#Gnosis Safe Wallet

Text

This weekend’s episode of "Saturday Night Live" began with a skit poking fun at former President Donald Trump’s recently released, meme-worthy non-fungible token (NFT) collection.

“Seems like a scam and, in many ways, it is,” said James Austin Johnson, who played the 45th President in the show’s cold open.

While the mainstream media has eagerly picked up the story on the collection for its comedic value, the popularity of the Trump Digital Trading Cards has continued to climb since the collection dropped on Thursday, selling out within 24 hours.

According to data from OpenSea, the collection’s trading volume is 6,658 ether (ETH), or about $7.8 million at the time of publishing. Its floor price, which started at $99, has been hovering around 0.3 ETH, or $350.

The collection features 45,000 tokens in the style of baseball cards. In each collectible, Trump wears a different costume linked to rarity elements that allow users to enter a sweepstakes to win prizes like a zoom call with the former President or a cocktail hour at Mar-a-Lago.

In the wake of the project’s apparent success, internet sleuths have dug deep into the project and the parties behind the wallet addresses associated with Trump’s collectibles. Among the nuances and inconsistencies alleged on Twitter: the company that created the collectibles is hoarding a large amount of them; that the project poorly relies on stock imagery; and that most of the buyers opened new wallets without holding any cryptocurrency, sticking them with an NFT and no way to derive any future value from them.

THE STRANGE CASE OF 1,000 NFTS

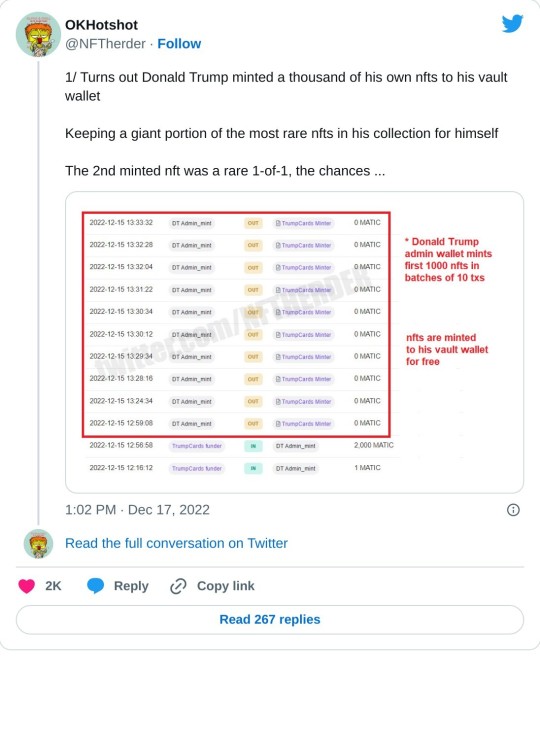

Over the weekend, Twitter user @NFTherder noticed something strange about a large number of the rarest NFTs in the collection. The user posted a thread explaining the nature of the transaction data of the contracts involved in the mint.

According to data from Polyscan, Polygon’s version of Etherscan, a “Donald Trump Admin” wallet minted 1,000 tokens to a Gnosis Safe Wallet, a multisignature smart contract wallet that requires a handful of users associated with the tokens to approve of any asset movement.

While the Collect Trump Cards site said that 44,000 of the 45,000 tokens created in the initial series would be available for users to mint, it did not specify what would happen to the remaining 1,000 tokens. Where another project might save those assets for a later date to revive demand, data suggests that the administrative wallet holds the remaining minted 1,000 tokens.

After the collapse of Three Arrows Capital, the crypto-hedge fund backed NFT collection “Starry Night” moved its tokens into a Gnosis Safe wallet, along with other valuable assets. It was likely done out of caution to hold the assets in one place to prevent any singular actor from moving these out of the wallet.

The Trump Trading Card site specified that there was a “strict limit of 100 Trump Digital Trading Cards per purchaser/household,” meaning that an individual or a group who did not have to abide by the rules for the general public was able to pick up a large swath of the NFT pool.

In addition, the mystery wallet isn’t full of second-rate NFTs. It minted 26% of the rarest 1-of-1 tokens and 28% of the autographed trading cards, according to NFTherder. These are the most valuable and expensive assets in the collection, respectively comprising 0.4% and 0.16% of the total tokens in the collection.

NFTherder told CoinDesk that not only do the wallet owners have the ability to inflate the price floor of the collection, but they also could have the ability to rig the sweepstakes and alter the competition.

“If this was a 10,000 unit collection about monkeys, the whole discord would be blowing up about how this is a rug and a scam and that the team is holding one fourth of the most rare supply,” said NFTHerder.

THE CURIOUS MARKS AND MAKER OF THE ART

While people have been digging into the wallet addresses and collection sweepstakes, other Twitter users were delving into pop culture digital artist Clark Mitchell and the artwork he created for the collection.

On-Chain TV founder Morgan Sarkissian tweeted an image of one of the collectibles featuring the 45th president in a space suit that seemed to still have a visible watermark from Shutterstock.

She also uncovered an Adobe watermark in another token listed in the collection.

Other Twitter users have found inconsistencies in the artwork, with some of the creative assets used to build the collection apparently taken from stock images or Amazon costumes.

While Mitchell has worked on other projects such as artwork for Disney, Hasbro and Marvel, this isn’t his first NFT project.

Web3 researcher and Twitter user @Valuemancer uncovered that Mitchell also did the artwork for Sylvester Stallone’s SlyGuy NFT collection that never launched, according to the digital collectibles website.

The collection included similar creative assets, such as drawings of the actor paired with exclusive access to events such as the Ultimate Stallone Experience, a dinner hosted by Stallone for token holders.

Mitchell, Sarkissian, @Valuemancer and the SlyGuy NFT collection did not respond to CoinDesk by press time.

THE SHINY NEW WALLETS WITH NO CRYPTO

While NFT collections often attract a wide range of buyers with various stake in the game, Trump’s NFT collection had a large number of buyers that appear to be new to digital collectibles.

According to data from Dune Analytics, of the nearly 12,900 users that minted Trump NFTs, about 9,300 did not hold any cryptocurrency in their wallet for gas fees – the fee all users pay for a transaction on the blockchain. If a holder has no balance of either MATIC or wETH, he is "No Gas" holder. That means he can't list his NFT for sale until he get some balance into his wallet, the Dune dashboard shows.

This means that 72% of buyers were likely purchasing NFTs for the first time.

The total number of tokens held by holders with no gas is 21,420, according to Dune Analytics, which one Twitter user pointed out may be stuck due to the more advanced nature of trading on Polygon.

“It's more like a 20,000 set than 45,000,” said Tyler Warner, staff writer at Lucky Trader on Twitter, citing the data as one of the reasons why the tokens skyrocketed in trading volume.

Warner did not respond to CoinDesk by press time.

In a harsh crypto winter where NFTs are already subject to market vulnerabilities, celebrities releasing successful NFT projects or funding Web3 ventures seems like a promising sign.

However, when the project is executed before fully working its kinks out, it does not serve as a vehicle for mass adoption. Instead, it can onboard a new user base that is not familiar with cryptocurrency or the steps needed to make a sound purchase, analyze blockchain data for irregularities and fund wallet transactions.

As projects like these continue to rise in popularity, it’s important to educate holders, dig into the details and look beyond the hype.

#us politics#news#coindesk#bitcoin#nfts#non fungible tokens#donald trump#Trump Digital Trading Cards#opensea#@NFTherder#twitter#Polyscan#Polygon#Etherscan#Gnosis Safe Wallet#Collect Trump Cards#Morgan Sarkissian#On-Chain TV#Clark Mitchell#copyright infringement#@Valuemancer#sylvester stallone#celebs#SlyGuy NFT#Dune Analytics#gas fees#Tyler Warner#blockchain#Lucky Trader#2022

30 notes

·

View notes

Text

anonymous &&. said... curious question what does ren carry in his gnosis hammer space currently? anything to note?

anon, can i just say how delighted i was to get this question? i will take every opportunity to ramble about the silly hat man ... thank you so very much for enabling me. 💖

i like to shitpost about the gnosis realm being some mystical hammerspace filled with miscellaneous garbage, but ren is actually an immensely frugal person. he doesn't like clutter, and he doesn't like keeping unnecessary things. ( if it does not spark joy or otherwise serve a purpose, he wants no part of it. ) everything he keeps hidden away can effectively be sorted into one of three categories — PRACTICAL, ENTERTAIMNENT and SENTIMENTAL VALUE.

practical items include the basic necessities he needs to maintain his wandering lifestyle. think — a sewing kit. a few rolls of bandages. ( not for him. ) his wallet. soap. materials to shine his catalyst. flint and steel to start a fire. various cooking implements — one pot, one pan. a dagger reserved solely for food preparation. a worn cutting board he made himself. chipped plates and bowls, with the utensils to eat from them. he doesn't need food, but he still finds the sensation of taste enjoyable enough that he'll sometimes cook even if he doesn't strictly have to. ( only when he's feeling motivated to, though; most of the time he doesn't bother. ) he'll also cook if he has company, though his reasons why range from maintaining the façade of being human to cooking simply being his weird little love language. if he likes you, he will make you food and nag about taking care of yourself. indirectly. in the most passive aggressive way possible.

i think it's only come up once before, but he also owns a very old, very sturdy iron kettle he uses to boil water for tea. ren has cups to go with it — though i imagine it's a patchwork selection from many different sets. ( he takes whatever he can get. ) he always has his favorite tea on hand, and yes, he does consider it a necessity.

entertainment is mainly reserved for books, because there really isn't much else he can get up to at night. he prefers to settle down somewhere when the sun sets, not out of concern for his safety, but because he thinks it's annoying trying to stomp around in the dark. he also keeps a journal; it's filled with shopping lists and irminsul paranoia induced poetry.

he is constantly accumulating new books and cycling out the old ones as he loses interest. he likes to bargain hunt; haggling is basically a socially acceptable form of arguing.

the final category encompasses items that don't serve a practical use, yet ren still carries them around regardless. depending on the object, he may not even take it out — he's content just knowing that it's there. think letters, gifts. unless stated otherwise, assume everything he was given for his birthday and over the holidays has been tucked away safely in the gnosis realm. his collection of interesting rocks and gemstones. ( notably, what he decides to keep depends more on texture than visual appeal. ) a few pressed flowers, native to various locations around teyvat. every little thing has some story behind it — will he actually share what that story is? unlikely. but they're the treasures he keeps tucked away in place of his literal heart.

#anonymous#𝟎𝟎𝟒 : 𝘵𝘩𝘦𝘺 𝘴𝘢𝘺 𝘺𝘰𝘶 𝘶𝘴𝘦𝘥 𝘵𝘰 𝘣𝘦 𝘴𝘰 𝘬𝘪𝘯𝘥. ◟ hc .◝#( it's funny bc collecting things has always been a character trait of his no matter which scrunkly you look at. )#( the kabukimono also collected rocks & seashells & flowers but he abandoned them as his love for the world crumbled to dust. )#( & scara hid the feather in his funky lil bag )#( he doesn't like clutter but he unconsciously accumulates Stuff )

5 notes

·

View notes

Photo

⚡️Новости криптомира

📎Команда BNB Chain развернет новый сервис - BNB Safe{Wallet}. Это кошелек с мультиподписью на базе протокола Gnosis Safe. Перед его использованием необходимо создать учетную запись Safe.

📎Сегодня состоится запуск мейннета Celestia, модульной сети консенсуса и передачи данных, предназначенной для запуска блокчейнов. Запуск основной сети произойдет вместе с листингом токена Celestia (TIA) на KuCoin и Bybit.

📎Банк России опубликовал Проект основных направлений развития финансового рынка. Авторы проекта определяют риски для развития российского финансового рынка, в качестве внешнего макроэкономического фактора упомянуты криптовалюты и стейблкоины.

📎Замминистра финансов России Алексей Моисеев заявил, что цифровой рубль способен в XXII веке заменить наличную валюту. Правительство и Минфин работают над доступностью цифрового рубля без интернета, благодаря чему он должен стать более удобным.

📎С 21 по 27 октября в криптоинвестиционные продукты вложено $326 млн - это самый большой приток средств с июля 2022. По мнению аналитиков, рост инвестиций связан с возрастающими ожиданиями одобрения SEC первого спотового биткоин-ETF.

#новости #биткоин #криптовалюта

0 notes

Text

In an effort to spice up safety, the BNB Chain has lately launched a safe multi-signature pockets service generally known as BNB ProtectedPockets.

This service is constructed upon the Gnosis Protected protocol and is now accessible on each the Binance Sensible Chain (BSC) and opBNB networks.

The Gnosis Protected Multisig Pockets

The BNB Chain has lately launched a multi-signature pockets service referred to as BNB ProtectedPockets, constructed on the Gnosis Protected protocol. The latter is a great contract pockets recognized for its high-level safety features, strong entry management, and complicated execution logic.

One among its standout options is the flexibility to permit a number of wallets to be managed by a number of homeowners, including an additional layer of safety.

As we speak, we’re launching the BNB ProtectedPockets 🔒

Our multi-sig pockets relies on the Gnosis Protected protocol and now dwell on BSC + opBNB. It affords a safe solution to handle digital belongings!

Create BNB Protected Account:https://t.co/7nJiV3vcqD

Documentation:https://t.co/yFzeupHeb2 pic.twitter.com/6h6gGyA2ZX

— BNB Chain (@BNBCHAIN) October 28, 2023

BNBChain’s Protected multi-signature pockets service affords digital asset storage with user-centric safety measures. Customers can customise their safety preferences, deciding on proprietor accounts and specifying the minimal variety of confirmations required for transactions.

To get began with the BNB Chain multi-signature wallet service, customers are required to create a Protected. Gnosis Protected is a protocol and platform that allows decentralized custody and administration of belongings throughout a number of networks, together with Ethereum (ETH), zkSync, Arbitrum, BNB Sensible Chain, EVM, and Ethereum Mainnet.

Its web3-enabled device, generally known as Protected Pockets, simplifies interplay with the DeFi and web3 ecosystem, thereby enhancing the security of belongings and selling cooperative asset administration.

Safety Breaches on the BNB Chain

Current years have witnessed quite a few safety breaches and assaults focusing on the BNBChain community, elevating considerations in regards to the security of customers’ belongings. Notable incidents embrace the July 2023 Vyper Copycat Exploit on BSC, the place vulnerabilities within the Vyper programming language resulted in cryptocurrency theft.

Moreover, a significant assault in October 2022 on Binance (BNB) noticed hackers exploiting weaknesses within the BNB community, resulting in substantial monetary losses.

In September 2023, hackers who beforehand focused the Stake on line casino for $41 million made off with roughly $328,000 million value of BNB (BNB) and Polygon (MATIC) tokens, additional highlighting the necessity for strong safety measures inside the ecosystem.

In response to a weblog post by BNB Chain, the introduction of the BNB ProtectedPockets, BNB Chain goals to offer customers with a safe and reliable answer for managing their digital belongings, providing peace of thoughts in an more and more complicated and difficult crypto panorama.

SPECIAL OFFER (Sponsored)

Binance Free $100 (Unique): Use this link to register and obtain $100 free and 10% off charges on Binance Futures first month (terms).PrimeXBT Particular Provide: Use this link to register & enter CRYPTOPOTATO50 code to obtain as much as $7,000 in your deposits.

0 notes

Text

BNBChain Introduces BNB SafeWallet

BNBChain has unveiled its secure multi-signature wallet service, BNB SafeWallet, which operates on the BSC network and opBNB, and is built upon the Gnosis Safe protocol. In a blog post, BNBChain highlighted the introduction of Gnosis Safe Multisig to the Binance Smart Chain as a significant advancement in fortifying the security of the BSC network and its surrounding ecosystem. Gnosis Safe is a smart contract-based wallet featuring essential multisig capabilities, which empower users with sophisticated execution logic, access control, and robust security. This protocol enables the support of various wallets, which can be managed by single or multiple entities to augment wallet security. BNBChain’s SafeWallet, leveraging the Gnosis Safe protocol, offers a secure storage solution for digital assets. Users are given the a

Read more on BNBChain Introduces BNB SafeWallet

0 notes

Text

OpenZeppelin eradicates the isContract function, fostering a shift towards greater adaptability and enhanced user experiences in the Ethereum ecosystem.

Smart contract development service OpenZeppelin recently removed a commonly used smart contract function called isContract to push the ecosystem forward toward greater flexibility and improved user experiences.

The isContract function returns true if an Ethereum (ETH) address belongs to a smart contract account rather than an externally owned account (EOA). Many decentralized application (dapp) developers have relied on it for security purposes, such as preventing bots from minting non-fungible tokens (NFTs).

However, as Ambire Wallet co-founder and CEO Ivo Georgiev pointed out rejoicing for removing the feature, relying on isContract breaks compatibility with account abstraction wallets like Ambire, Argent, and Safe. These wallets use smart contracts to manage users’ funds while abstracting some complexities away from the end user.

According to Georgiev, better ways to prevent issues like NFT minting abuse and security vulnerabilities exist. The presence of isContract has led to a harmful myth that smart contracts cannot function as user accounts.

In response, OpenZeppelin removed the function to push developers to reconsider assumptions about smart contracts and user accounts. This controversial move could accelerate the adoption of account abstraction and its associated benefits.

Safe — a decentralized custody protocol previously known as Gnosis Safe — developer Misha highlighted legitimate use cases of isContract, like ensuring that added Safe modules are valid contracts. However, Georgiev argued that there are better solutions that don’t preclude important account abstraction techniques.

The OpenZeppelin documentation warns that isContract should not be relied upon as the sole determiner of contract or EOA status. According to him, with clever programming, bots can return false positives or negatives.

This debate represents an important step forward as Ethereum builders rethink outdated assumptions and plant the seeds for the next generation of user-friendly decentralized applications. Removing isContract forces developers to find alternative solutions, ultimately benefiting end users by stopping discrimination against abstracted accounts.

0 notes

Text

Product Marketing Manager - Remote

Company: Gnosis

WHAT YOU WILL DO

Gnosis is building a Consumer Web3 wallet for Gnosis Chain and is looking for a Product Marketing Manager to join the team:

- Lead the Product Team to conduct user research to identify target users for adoption

- Lead Product Team to identify target user pain points and distill user stories and product requirements

- Work with Designers to develop, communicate and test design concepts, wireframes and prototypes

- Work with Product Team to develop product positioning, strategy, and roadmap

- Handle 0-to-1 go to market activities including PR, marketing and community building

WHO YOU ARE

- Experience with 0-to-1 product marketing

- Experience in Web3 and Ethereum, plus if prior experience with smart contract accounts

- Experience with Fintech or “Neobanks”

- Experience with Consumer Social

- Fluent in spoken English, reading, and writing in English

WHAT WE CAN OFFER YOU

- Do you need resources to pursue your professional goals? → We got you covered with a personal education and conference budgets;

- Is there something that you would like to try out within our projects? → You can use your Friday afternoons on research or on a side project in our ecosystem;

- Our hierarchy is flat, so there is no chance to get lost in vertical looking organizational structure;

- Not really an early bird? No worries! → Flexible working schedules and remote work policies are, for a long time, part of our culture;

- And do not worry about your equipment and subscriptions. We’ll equip you with the latest hardware and provide you all tools you need! But most important - grow with us! We're growing rapidly, the industry is expanding fast, and we have a lot to do. If you're someone who loves taking initiative and getting things done, there are a lot of opportunities for you at Gnosis. We’re enthusiastic about our shared mission and enjoy spending time together!

Please apply with your (English) resume. We look forward to your application!

At Gnosis, we strive to create an inclusive environment that empowers our employees. We believe that our products and services benefit from our diverse backgrounds and experiences and are proud to be an equal opportunity employer: all qualified applicants are considered for positions regardless of race, ethnic origin, age, religion or belief, marital status, gender identification, sexual orientation, or physical ability.

Apply for this position

ABOUT US

The Gnosis mission has always been centered on building decentralized infrastructure for the Ethereum ecosystem. When Gnosis was founded in 2015, it focused on building prediction markets to enable worldwide access to accurate information. While creating the prediction market platform, it became clear that Gnosis needed to build the infrastructure required to support it.As a DAO, Gnosis uses the products that it creates to transparently guide decisions on the development, support, and governance of its ecosystem.

Gnosis Safe (multisig and programmable account), Cow Protocol (formerly CowSwap and Gnosis Protocol), Conditional Tokens (prediction markets), Gnosis Auction, and Zodiac (standard and tooling for composable DAOs) are all products incubated by Gnosis. Their success is demonstrated by the recent spin-out of Cow Protocol and the formation of SafeDAO. By combining needs-driven development with deep technical expertise, Gnosis has built the decentralized infrastructure for the Ethereum ecosystem.

In November 2021, the xDai and GnosisDAO communities voted to combine their vibrant ecosystems to create the Gnosis Chain. Gnosis Chain uses the xDai token. It is the associated execution-layer EVM chain for stable transactions and includes a wide-ranging group of projects and users.Gnosis Chain is secured by a diverse set of validators. With over one hundred thousand validators and counting, we’re building a resilient and neutral network open to anyone without privilege or prejudice. Be a part of a team leading the web3 movement.

APPLY ON THE COMPANY WEBSITE

To get free remote job alerts, please join our telegram channel “Global Job Alerts” or follow us on Twitter for latest job updates.

Disclaimer:

- This job opening is available on the respective company website as of 4thJuly 2023. The job openings may get expired by the time you check the post.

- Candidates are requested to study and verify all the job details before applying and contact the respective company representative in case they have any queries.

- The owner of this site has provided all the available information regarding the location of the job i.e. work from anywhere, work from home, fully remote, remote, etc. However, if you would like to have any clarification regarding the location of the job or have any further queries or doubts; please contact the respective company representative. Viewers are advised to do full requisite enquiries regarding job location before applying for each job.

- Authentic companies never ask for payments for any job-related processes. Please carry out financial transactions (if any) at your own risk.

- All the information and logos are taken from the respective company website.

Read the full article

0 notes

Text

Making Ethereum Wallets Smarter Is the Next Challenge—and Visa Is Among Those Working on It - Decrypt

It’s no secret that crypto wallets need a makeover, and fast. But as the pieces and players leading this makeover emerge, so too is a fight over what to call the effort.

Some call it account abstraction, others call it EIP-4337.

“We call it a smart wallet,” Argent cofounder and CEO Itamar Lesuisse told Decrypt. “It’s as simple as that.”

Argent, along with Safe (formerly Gnosis Safe), is at the…

View On WordPress

0 notes

Text

Vitalik Buterin Explains How He Will Choose 'Guardians' for Recovery Wallets

Arman Shirinyan

Vitalik Buterin believes ‘guardians’ will become backbone of crypto safety

Multisig wallets, like Gnosis Safe, are a secure way to store funds without relying on a centralized entity. They offer the benefits of self-custody, meaning that your funds are not at risk if a seemingly trustworthy entity fails. Social recovery wallets are similar, allowing funds to be recovered using…

View On WordPress

0 notes

Text

CoW Swap DEX Suffers Major Exploit, Thief Makes Off With Over $180,000

A fresh DEX, CoW Swap, suffered an exploit resulting in the thief absconding with over $180,000. Cybercriminals are striking CoW Swap DEX, transferring funds worth $123,000 DAI, $50,000 BNB, and $7,400 ETH via two wallets.

Crypto firm PeckShield reports on a hacking incident and explains how it occurred.

It seems (1) @CoWSwap 's GPv2Settlement contract has been tricked 10 days ago to approve SwapGuard for DAI spending and (2) SwapGuard was just triggered to transfer out DAI from GPv2Settlement. Here are the two related txs: https://etherscan.io/tx/0x92f906bce94bab417cccc87ae046448d7fb8c2c0350b7ed911545577acb3bfc1… and https://etherscan.io/tx/0x90b468608fbcc7faef46502b198471311baca3baab49242a4a85b73d4924379b

The attacker appears to have approved SwapGuard for DAI eleven days ago via CoWSwap's GPv2Settlement contract. Then, DAI was removed from GPv2Settlement utilizing SwapGuard to be triggered. The SwapGuard function allows anyone to allegedly call arbitrary functions, and it's being exploited to the tune of over $180,000.

Exploiter is still active; some claim others are using the same exploit, fighting over remaining funds. CoW Swap has yet to comment.

Exploiter is still active: https://etherscan.io/tx/0x68da7ec7408c060460caf2346a2dd45b5066a65a7b83d7977b7cb0d7ee744bb5… Probably shouldn't use CoWSwap until situation has resolved.

Another incident has occurred in the DeFi area, a popular target for attackers. The DeFi industry suffered billions of losses in 2022, and thefts have continued in 2023.

CoW Swap is a relatively recent DEX that matches and executes orders in part using "Coincidence of Wants." For order execution, it blends off-chain and on-chain transactions.

COW Token Airdrop Boosts Gnosis Chain with 50% GNO Token Rise

Additionally, when the platform started the COW token airdrop last year, it garnered media attention. This helped the connected Gnosis chain or its token as well; following the announcement, the GNO token rose by almost 50%.

Furthermore, CoW Swap introduced Surplus-Capturing Limit Orders more recently. As a result, traders can decide the price at which they will buy or sell certain assets.

Related Reading | South Korean Authorities Traveled To Serbia To Find Terra’s, Do Kwon

Gnosis network updated with Gnosis Safe (Sep 2022 launch) to improve web3 ownership access, collaboration, and security and rebranded as Sage. Gnosis transitioned to proof-of-stake and has over 100,000 validators as part of its network.

Read the full article

0 notes

Text

Key Takeaways MetaMask appears to be approaching decentralization, which might recommend that an airdrop is on the horizon. Using MetaMask in various methods and connecting with ConsenSys-linked tasks might assist increase your opportunities of receiving the airdrop. Swapping tokens on MetaMask and utilizing the wallet's brand-new bridge are 2 activities that might result in an airdrop in the future. Crypto Briefing takes a look at the different actions MetaMask users can require to improve their possibilities of getting approved for the wallet's long-rumored token airdrop. MetaMask Token Incoming? MetaMask is the most popular Web3 wallet, and reports of a prospective token airdrop for active users have actually distributed in the crypto area for several years. ConsenSys creator and CEO Joe Lubin has actually hinted on numerous events that a token remains in the works, however the business has actually not yet shared complete information. Surprisingly, ConsenSys just recently released its MetaMask Grants DAO, an employee-led effort to grant financing to designers beyond ConsenSys dealing with broadening the MetaMask environment. The relocation might be a tip that the business is wanting to decentralize the task. ConsenSys struck a $7 billion appraisal with a $450 million Series D raise in March, which suggests it might possibly airdrop a good-looking amount to users. But because the wallet is broadly utilized by crypto locals of all stripes, receiving the airdrop might not be simple. Here are some actions MetaMask users can require to optimize their possibilities of getting the wallet's token once it's live. 1. Swap Tokens on MetaMask If you do not have a MetaMask wallet, you'll require to begin by producing one. To get going, download the internet browser extension or mobile app, develop a wallet, shop your seed expression in a safe location, and money your wallet with some ETH. Swapping tokens on MetaMask is simple. In the primary menu, simply click the blue Swap button beside the Buy and Send icons. Trade some ETH for any token of your picking, however ensure to keep adequate ETH in your wallet to pay deal costs. 2. Utilize the MetaMask Bridge MetaMask just recently introduced a bridge to let users move funds from one blockchain to another. Link your wallet to the MetaMask bridge, choose Ethereum as your very first network, pick another network to send out to (you can pick in between Polygon, Avalanche, and BNB Chain), then bridge over either ETH, MATIC, DAI, USDC, or USDT tokens. Again, ensure you currently have your 2nd network's native token in your location wallet to spend for gas costs. Otherwise, an easy option is to bridge MATIC from Ethereum to Polygon considering that MATIC is Polygon's native token. 3. Develop a Gnosis Safe Wallet ConsenSys and Gnosis Safe revealed a collaboration in February to increase wallet security, so MetaMask might reward Gnosis users. To begin utilizing the item, go to Gnosis Safe, link your wallet, and follow the actions to produce a multisig Safe wallet. You'll require to choose Ethereum as the network, call your brand-new wallet, supply a minimum of 2 addresses as the "owners" of the wallet (you can develop a brand-new MetaMask account and input that deal with together with the one you're currently utilizing), and pay a little deal charge. 4. Contribute through Gitcoin ConsenSys has close ties with Gitcoin, as it assisted the Ethereum-based contribution platform in its early days prior to it set out by itself in2021 Contributing to Gitcoin might for that reason increase the opportunities of getting approved for a MetaMask airdrop. To make a contribution, you'll require to produce a profile on GitHub, then go to the Gitcoin Grants page, link your MetaMask, choose a Grant job that you like, include it to your cart, go to take a look at, and select just how much you wish to contribute (and in which currency). We recommend contributing a minimum of $10 as any certification requirements might have a minimum contribution limitation to avoid airdrop farming.

5. Register for Infura ConsenSys obtained Infura in October2019 Infura is thought about among the world's leading blockchain facilities platforms and it likewise straight supports MetaMask. Infura is approaching decentralization and has actually introduced an early gain access to program for neighborhood members to assist. You can submit a kind on the business's site to register, though Infura is particularly searching for individuals with experience in blockchain facilities. You can likewise check out ConsenSys' Discord channel to find out about more methods to get included. Final Thoughts Airdrop searching is more art than science, and includes an aspect of luck. Even if you follow all of these actions, it is not ensured that you will have the ability to declare MetaMask tokens as soon as ConsenSys concerns them. Some airdrops like Bored Ape Yacht Club's APE token free gift were very rewarding. Others like Optimism's OP token circulation were questionable due to their stringent credentials requirements. Nevertheless, following the actions noted in this piece deserves the time and effort on the possibility they settle. Disclaimer: At the time of composing, the author of this piece owned BTC, ETH, and a number of other crypto properties. The details on or accessed through this site is acquired from independent sources our company believe to be precise and trustworthy, however Decentral Media, Inc. makes no representation or guarantee regarding the timeliness, efficiency, or precision of any details on or accessed through this site. Decentral Media, Inc. is not a financial investment consultant. We do not offer individualized financial investment guidance or other monetary suggestions. The info on this site goes through alter without notification. Some or all of the info on this site might end up being out-of-date, or it might be or end up being insufficient or unreliable. We may, however are not bound to, upgrade any out-of-date, insufficient, or incorrect info. You need to never ever make a financial investment choice on an ICO, IEO, or other financial investment based upon the details on this site, and you ought to never ever translate or otherwise depend on any of the info on this site as financial investment suggestions. We highly advise that you seek advice from a certified financial investment consultant or other competent monetary expert if you are looking for financial investment guidance on an ICO, IEO, or other financial investment. We do decline payment in any kind for examining or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or products. See complete conditions Aptos Airdrop Season Is Coming. Here's How You Can Profit In crypto, brand-new network launches are generally followed by airdrop seasons. These "seasons" are durations when all the brand-new jobs that have actually effectively developed applications on the network's testnet get ... Sei Network Unpacked: Testing the New Layer 1 Ahead of Its Token Airdr ... Sei Network is a DeFi-focused Layer 1 blockchain constructed on Cosmos. It will consist of fundamental primitives such as an order-matching engine and a merged liquidity design, making it possible for faster and much easier ... Which Ethereum Layer 2 Will Be Next to Airdrop a Token? Several Ethereum Layer 2 networks have actually hinted that they might introduce their own native tokens in the coming months, which would likely result in airdrops for early users. Sign Up With Crypto ... Read More

0 notes

Text

Asset Management With Decentralized Finance

In the DeFi space, you are your bank. Lending platforms like MakerDAO and Compound facilitate crypto lending by matching borrowers with lenders. The interest rates on these loans are determined by an autonomous ATOMIC auctions mechanism that runs on Ethereum smart contracts.

With DeFi protocols, you are the guardian of your crypto funds. Crypto wallets like MetaMask, Gnosis Safe, and Argent help you easily and securely interact with decentralized applications to do everything from buying, selling, and transferring crypto to earning interest on your digital assets.

However, Being a trusted Defi development company in India, we are extending decentralized finance development services to help entrepreneurs get started with Defi business easily.

0 notes

Photo

New Post has been published on https://primorcoin.com/cz-and-saylor-urge-for-crypto-self-custody-amid-increasing-uncertainty/

CZ and Saylor urge for crypto self-custody amid increasing uncertainty

Industry heavyweights have urged crypto investors and traders to self-custody their crypto assets amid the significant market uncertainty brought on by the collapse of FTX.

In a Nov. 13 tweet to his 7.6 million followers, Binance CEO Changpeng “CZ” Zhao pushed the crypto community to store their own crypto via self-custody crypto wallets.

“Self custody is a fundamental human right. You are free to do it anytime. Just make sure you do do it right,” he said, recommending investors to start with small amounts in order to learn the technology and tooling first:

Self custody is a fundamental human right.You are free to do it at any time.Just make sure you do do it right.Recommend start with small amounts to learn the tech/tools first.Mistakes here can be very costly.Stay #SAFU

— CZ Binance (@cz_binance) November 13, 2022

Speaking to Cointelegraph during the Pacific Bitcoin conference on Nov. 10-11, MicroStrategy executive chairman Michael Saylor also discussed the merits of self-custody given the current market environment.

Saylor suggested that self-custody not only provides investors with property rights, it also prevents powerful actors from corrupting the network and its participants:

“In systems where there is no self-custody, the custodians accumulate too much power and then they can abuse that power.”

“So self-custody is very valuable for this broad middle class, as it tends to create […] this power of checks and balances on every other actor in the system that causes them to be in continual competition to provide transparency and virtue,” he explained.

Backstage interview with the charming Michael @saylor ⚡️

✅ check @Cointelegraph to read his advice on how to handle the bear market

@pacificbitcoin

pic.twitter.com/yWZmEsgQar

— Joe Nakamoto (@JoeNakamoto) November 11, 2022

Saylor also made the argument that self-custody plays an important role in maintaining the integrity and security of blockchains because it increases decentralization:

“If you can’t self-custody your coin, there’s no way to establish a decentralized network.”

The recent events that transpired last week appear to have already pushed many investors and traders towards self-custody solutions.

Since the sudden collapse of FTX in early November, the number of Bitcoin (BTC) withdrawals on centralized exchanges reached a 17-month high, according to on-chain analytics firm Glassnode:

#Bitcoin $BTC Number of Exchange Withdrawals (7d MA) just reached a 17-month high of 3,424.315

View metric:https://t.co/QyB7zouWee pic.twitter.com/Su4biTEM7h

— glassnode alerts (@glassnodealerts) November 13, 2022

While at the same time, net inflows into self-custody wallets have soared.

Smart contract wallet Safe — previously Gnosis Safe — reported over $800 million in net inflows since last Tuesday when the FTX saga began to spiral out of control:

Over $800M net in-flows into @Safe since last Tuesday. $325M on Thursday alone. Looks like a flight to self-custody. pic.twitter.com/hiuij9dp7s

— lukasschor.eth | Safe (@SchorLukas) November 13, 2022

The outflow from centralized exchanges caused by the FTX meltdown also created problems for hardware-based cryptocurrency wallet provider Ledger — who were temporarily unable to process a mass influx of inflows due to scalability issues.

The token of the Binance-acquired self-custody wallet Trust Wallet (TWT) also increased 84% to $2.19 over the last 48 hours before cooling off to $1.83, according to CoinGecko.

The token allows token holders to participate in deciding how the wallet operates and what technical updates are to be made.

Related: Self-custody is key during extreme market conditions: Here’s what experts say

Investor confidence in centralized exchanges took another hit on Nov. 13 when Crypto.com accidentally sent 320,000 ETH to Gate.io.

Ethereum bull and host of The Daily Gwei Anthony Sassano on Nov. 13 called out the crypto exchange over its mistake and later stated that investors should not store assets on centralized exchanges “for longer than you need to.”

Meanwhile, Blockchain Association head of policy Jake Chervinsky said that self-custody education should be one of the first things newcomers learn, while Bitcoin proponent Dan Held told his 642,800 Twitter followers that self-custody is a crucial element to self-sovereignty:

Self custody your Bitcoin and run a full node.

That’s how you achieve self sovereignty.

Don’t trust, verify.

— Dan Held (@danheld) November 12, 2022

Source link

#Binance #BNB #CryptoExchange #DEFI #DEFINews #NFT #NFTNews

#Binance#BNB#CryptoExchange#DEFI#DEFINews#NFT#NFTNews#Crypto Exchange#Cryptocurrency Exchange#CryptoPress#decentralized exchange#NFT News

1 note

·

View note

Text

BitMEX has made a strategic resolution to boost the utilization of Bitcoin block house and reduce withdrawal charges for its customers.

In a major replace, efficient November 1, 2023, BitMEX will subject new Bitcoin deposit addresses to all its prospects.

BitMEX Reissues Bitcoin Deposit Addresses

BitMEX has just lately unveiled a major replace aimed toward optimizing the usage of Bitcoin block house and lowering withdrawal charges for its customers. In accordance with an October 30 announcement, BitMEX will reissue all buyer Bitcoin deposit addresses, transitioning to the extra environment friendly pay-to-witness publish key hash (P2WPKH) Bech32 format addresses.

The change eliminates the necessity for complicated multi-signature transactions, changing them with single on-chain signatures, leading to substantial block weight financial savings with out compromising safety.

The transition will happen in phases, with new customers receiving the up to date addresses from November 1, 2023, and current addresses being changed between November 1 and November 30, 2023. Customers are urged to cease utilizing outdated addresses, replace their handle books, and whitelist the brand new addresses to make sure a seamless transition.

A Shift from Multisignature to Bech32 Addresses

BitMEX’s resolution to reissue Bitcoin deposit addresses comes as a response to the evolving panorama of blockchain expertise. The brand new addresses will probably be within the pay-to-witness publish key hash (P2WPKH) Bech32 format, generally known as “bc1 addresses.” This variation will see the elimination of the historic “self-importance” handle prefix, together with “3BMEX” and “bc1qmex.”

BitMEX beforehand used deposit addresses based mostly on Bitcoin’s native on-chain 3 of 4 multisig system (P2WSH). This complicated course of required three signatures revealed to the blockchain for every spend from a deposit handle, even with the Segregated Witness (SegWit) witness low cost. Consequently, it consumed a major quantity of block house.

The brand new wallet addresses, then again, would require solely a single on-chain signature (P2WPKH) for every fund switch. This variation is facilitated by a multi-party computation (MPC-CMP) utilizing a community of extremely safe and geographically distributed non-public keys.

Notably, this up to date signature scheme is already employed for BitMEX’s scorching withdrawal processing, making certain the transition doesn't compromise the platform’s high-level pockets safety.

In the meantime, to boost safety, the BNB Chain has just lately unveiled a brand new safe multi-signature pockets answer known as BNB Protected, constructed on the Gnosis Protected protocol. It's at present accessible on each the Binance Sensible Chain (BSC) and the opBNB networks.

SPECIAL OFFER (Sponsored)

Binance Free $100 (Unique): Use this link to register and obtain $100 free and 10% off charges on Binance Futures first month (terms).PrimeXBT Particular Provide: Use this link to register & enter CRYPTOPOTATO50 code to obtain as much as $7,000 in your deposits.

0 notes

Text

DeFi 101:不可不知的新興的金融技術

相較傳統金融體系,去中心化金融脫離了傳統法規的監管,用戶掌握全權控制資產,並以點對點互動方式進行交易。這款新興的金融技術到底如何運作?有什麼優勢和風險?下文將為你一一介紹。

DeFi vs 中心化金融

去中心化金融(DeFi)是一種新興的金融技術,基於區塊鏈技術分散式記賬在每一個區塊上,這系統很大程度上擺脫傳統金融機構對貨幣、金融產品和金融服務的監管。相信大家都聽過FinTech,DeFi 與 FinTech 最大分別就在於信任機制,FinTech 是在現有的金融架構上使用區塊鏈技術,仍然存有中心化的機構,且所有操作基本上都是由人為控制,僅藉由第三方的信任機制取得用戶信任,而 DeFi 最大的特色就是去中心化,加上使用智能合約,且程式碼開源,核心邏輯都是在區塊鏈執行,無法更改、具有強制性,因此用戶可以直接信任DeFi系統。為了更好區分DeFi與中心化金融(CeFi)整理下面表格:

DeFi

CeFi

監管規則

沒有所謂的管理員,每個使用者都是平等的管理員且擁有相同的權限

所有權分散、不屬於任何人、不易被竄改

是由中央機構的封閉性系統監管

交易活動需要被第三方監管機關授權同意

資產保管

加密資產透過區塊鏈技術加上智能合約使用,去中心分散式記賬在每個區塊上,不再需要某個第三方機構保管

加密資產被政府授權的第三方金融機構保管,如銀行

使用者身份

使用者通常不需要提供任何關於真實身份的證明

使用者需要提供真實身份的證明,或簽署任何監管機關規定的文件(如KYC/AML)

符合DeFi的條件

以目前普遍的認定來說,一項金融服務是否可被視為 DeFi 必須符合4個條件:

建立於去中心化區塊鏈上

屬於金融產業

程式碼是開源

具有健全的開發者平台

DeFi需建基於區塊鏈上,關於區塊鏈的優勢同樣在 DeFi 上也可以找到,如透明性、抗審查、不可竄改等等,這些特性被普遍認為非常適合應用在金融相關領域。長久以來,銀行的管理及運作是高度中心化的,各項交易的資訊量龐大,且需要高度的正確性及不得容易被竄改,因此區塊鏈非常適合被套用在金融產業中,能有效降低其運作成本及增加管理效率。但要做到這幾點才可視為 DeFi,每個使用者不需要服務開發者、節點提供者或其他使用者的授權才可使用,即是否每個人都能藉由區塊鏈技術提供或獲取其金融服務,且使用者不需要透過層層中介 (如傳統金融服務)。

金融服務透明化、交易更有效率

DeFi 引起廣泛討論並不是沒有原因的,比起傳統金融,DeFi 更全球化、透明化、且易接觸,且在現今越來越注重自我掌控權加密資產是非常有吸引力的。以下是 DeFi 的一些好處:

透明度高,任何人的交易記錄都能公開查閱

交易與客户資產不受監管及審查

潛力大,越來越多人參與DeFi項目優化,進一步提升DeFi水準

更開放、更普及的金融服務

正常情況下,DeFi交易速度比起傳統銀行快很多

三大存在風險

雖然DeFi 是基於去中心化的區塊鏈所開發的應用,但這並不代表 DeFi 絕對安全。DeFi 中存在許多不同風險,但其中大多數都歸納下面3點。

在傳統金融機構發生一些金融糾紛,通常可以通過銀行、報警或法律來解決,但在去中心化金融中,如果出現金融糾紛,通常幾乎沒有追索權。

正常來說,DeFi系統都會加上智能合約,智能合約旨在減少或完全減輕交易風險,但一旦智能合約出錯,資金轉移到第三方基本上好難收回。

礦工就是將每次交易記錄並生成一個區塊上,每個節點連起來就是我們認識的區塊鏈。礦工可在看到還沒被確認的交易,他們能在確認前搶先交易。

如何應用在金融方面?

如果使用DeFi,我們的加密資產是掌握在自己手上。一些加密錢包可簡易且安全協助交易完成,如MetaMask、Gnosis Safe和Argent。

在傳統金融中,監管每個用戶個人資訊去反洗錢 (AML) 和打擊資助恐怖主義 (CFT) 的合規性,在DeFi領域,就會觀察加密錢包地址的交易行為,例如MetaMask 有助於實時評估風險並防止欺詐和金融犯罪。

由於 DeFi 的特性讓交易數據透明度大大增加,大量金融交易數據可應用於市場分析、商業決策和風險管理等。

去中心化交易所 (DEX) 是在沒有中央授權的情況下運作的加密貨幣交易所,允許用戶進行點對點交易並保持對其資金的控制。DEX 降低了價格操縱以及黑客攻擊和盜竊的風險,因為加密資產永遠不會由交易所本身保管。

比起傳統金融複雜手續的借貸服務,DeFi 有更加易於理解和操作的客戶端交互界面。而訪問的用戶可以通過這些界面與引導來選擇直接借入或借出任何平台支持的貨幣。而且實時向用戶提供他們在藉貸過程中的可收穫或須支付的可變利率。

不可不認識的DeFi 應用程式

目前市面上已經出推多款DeFi Apps,而下面8個是最值得留意。

在所有DeFi Apps中,DeFi Swap 在2022年整體表現最佳。因為它還提供了對一些最好的DEX 代幣的訪問。首先,DeFi Swap 是一個新推出的去中心化交易所,提供多種服務。這包括一個成熟的 DEX,它支持大量的 BSc 代幣選擇。

Aqru 是DeFi Apps 中賺取比特幣等多種加密貨幣最多利息,Aqru 允許將比特幣存入其加密儲蓄賬戶時賺取利息。當然以太坊也是可以。

Crypto.com DeFi 應用程序包含錢包、DeFi 交易所和加密抵押借貸等功能。從權限方面去看,Crypto.com 提供了一個非託管錢包,也就是說,只有自己才可登入自己錢包。簡而言之,這意味著您將是唯一可以訪問您的私鑰的人。

Binance 是世界上交易量最大的加密貨幣交易所,它的全球交易所(不包括美國)提供了 600 多種不同的加密資產。而在美國可以交易超過 100 多種代幣。除了可以將加密貨幣做儲蓄之外,還可以通過質押產生利息。

Coinbase 最適合剛剛接觸DeFi的新手們,因為它的介面設計非常有好,簡易操作。它還涵蓋了各種各樣的 ERC-721 兼容代幣。如果想買賣 DeFi 代幣,Coinbase 應用程序支持數百個市場。

Nexo 是一款抵押借貸功能強大的 DeFi 應用程式,因為無需進行信用檢查,貸款就會即將獲得批准。貸款利率也非常有競爭力,從而製定自己的還款計劃。

YouHodler 是另一個領先的 DeFi 應用程序,可讓加密代幣上賺取利息。而且 YouHodler 應用程序支持數十種不同收益率和風險級別的數字貨幣。例如,比特幣的年利率高達 6.8%,而萊特幣的年利率高達 7%。

最後一個 DeFi 應用程式是 Trust Wallet。這個廣受歡迎的 DeFi 應用程序提供的不僅僅是加密錢包服務。除了支持超過 56 種不同的區塊鏈,Trust Wallet 還可以直接訪問幣安智能鏈。這就是說只需單擊一個按鈕即可輕鬆購買領先的 BSc 代幣,例如 DeFi Coin。

0 notes

Text

Decentralized oracle network Chainlink has downplayed a recent change in the number of signers required on its multisig wallet — a move that garnered backlash on social media from vocal critics.Crypto researcher Chris Blec was among a number of users on X (formerly known as Twitter) who called out Chainlink for quietly reducing the number of signatures required on its multi-signature wallet from 4-of-9 to 4-of-8. The 4-of-8 multisig requirement is a security measure that requires four out of eight signatures to authorize a transaction.In a Sept. 25 X post, Blec drew attention to an original post from a pseudonymous user which showed that a wallet address had been removed from the multisig wallet without any announcement being made by Chainlink. Chainlink multisig has removed a signer and is now a 4-of-8 multisig.This multisig can change *any* Chainlink price feed to provide *any* price that it wants it to provide.Completely centralized under this multisig. https://t.co/GOAtJXShIV— Chris Blec (@ChrisBlec) September 24, 2023

While members of the crypto community were quick to raise their concerns with the move, a spokesperson for Chainlink told Cointelegraph that the update was part of a standard signer rotation process. “As part of a periodic signer rotation process, the multisignature Gnosis Safes used to help ensure the reliable operation of Chainlink services were updated. The rotation of signers was completed, with the Safes maintaining their regular threshold configuration.”Blec has long been an outspoken critic of Chainlink, going as far as saying that “the entire DeFi ecosystem can be intentionally destroyed in the blink of an eye,” if Chainlink’s signers were to ever “go rogue.”The entire DeFi industry - VCs, DAOs, devs, everyone - is colluding to hide the fact that if 5 people, chosen by @chainlink, ever decide (or are forced) to go rogue, the entire DeFi ecosystem can be intentionally destroyed in the blink of an eye.— Chris Blec (@ChrisBlec) February 7, 2023

According to Blec, the centralization risk inherent in Chainlink extends to a range of mainstay DeFi projects including Aave and MakerDAO, which rely on Chainlink’s oracles for price data.Chainlink is a decentralized oracle network that enables Ethereum-based smart contracts to communicate securely with real-world data and services outside the siloed world of blockchain networks.Notably, Chainlink’s native LINK (LINK) token has been one of the best performing crypto assets in recent weeks, having gained nearly 20% over the last month according to price data from Cointelegraph.

Source

0 notes