#collegeloan

Text

#uc san diego#undergraduate#undergrad student#financial aid#fafsa#university of california#ucsd#student loans

1 note

·

View note

Photo

Can I tap into my retirement savings to pay for my child's college education?

Are your kids need financial assistance beyond student loans to pay for their college education? If so, how you choose to save mustn't negatively impact their qualification for such assistance.

To this end, while you can use your retirement funds to pay for college expenses, this can affect your child's eligibility for various need-based financial aid programs.

Retirement funds withdrawn to pay college expenses are reported on the Free Application for Federal Student Aid (FAFSA) as additional income. Consequently, when using retirement funds, the expected family contribution from FAFSA will be higher, reducing your child's chances of qualifying for financial assistance.

Consult with your Personal Family Lawyer if you choose to tap into your retirement savings to fund college expenses, so you can ensure it's done right and will have the maximum benefit for everyone involved.

#collegeducation #collegeexpenses #retirementsavings #retirementsavingsplan #collegeloans #savings #retirement #college #lasvegasmoms #lasvegasfamilies #lasvegaslawyer #lasvegaslawfirm #lasvegasestateplanning #estateplanningattorney #greggordillo #gordillolawfirm

0 notes

Photo

Try using the debt snowball method as a great way to get out of debt and onto the road to financial freedom! It’s as simple as paying extra on the smallest debt first. When cleared move onto the next and keep repeating until debt free! #debtsnowball #debt #creditcard #studentloan #collegeloan #mortgage #loan #credit #getoutofdebt #finance #money #financialfreedom #carloan #infographic #entrvest #debtfreegoals #debtfreecommunityuk #financialindependence #debtavalanche #financialeducation https://www.instagram.com/p/CNvKLakn_hu/?igshid=17bxvtpgk2lqy

#debtsnowball#debt#creditcard#studentloan#collegeloan#mortgage#loan#credit#getoutofdebt#finance#money#financialfreedom#carloan#infographic#entrvest#debtfreegoals#debtfreecommunityuk#financialindependence#debtavalanche#financialeducation

0 notes

Photo

FACTUAL AF! Time to forgive student loans and restructure the educational system as a whole. Universities and institutions of higher education need to not accept students from schools who’s school boards ban CRT (Critical Race Theory). Unless they’re students of color. They definitely shouldn’t qualify for grants or scholarships (unless they’re students of color that are stuck in these racist school systems) Why would you want closed minded students attending your schools? They’re not bringing anything positive to the situation. If they’re willing to take 2 MANDATORY semesters of it in college then maybe you can accept them. MAAAAAAAAAYBE! Time for these places of higher learning to earn the money they steal from black student athletes and make a difference and help create a better society of the future. #collegeloans #crt #criticalracetheory #higherlearning #college #community #fuckmaga #fdt #fucktrump #fightthepower #fuckdonaldtrump #blackwallstreet #Whiteprivilege #nojusticenopeace #blm #saytheirnames #georgefloyd #blacklivesmatter #justiceforgeorgefloyd #justiceforbreonnataylor #liker #facts #truth #insurrection #Repost #politics #workingtogether #breakingnews #bestmemes #fact https://www.instagram.com/p/CQKST2YrVFf/?utm_medium=tumblr

#collegeloans#crt#criticalracetheory#higherlearning#college#community#fuckmaga#fdt#fucktrump#fightthepower#fuckdonaldtrump#blackwallstreet#whiteprivilege#nojusticenopeace#blm#saytheirnames#georgefloyd#blacklivesmatter#justiceforgeorgefloyd#justiceforbreonnataylor#liker#facts#truth#insurrection#repost#politics#workingtogether#breakingnews#bestmemes#fact

6 notes

·

View notes

Text

Going to college will always been the biggest regret of my life. A mistake I will pay for the rest of my life.

#college #education #school #Autism #ActuallyAutistic #Aspie #ASD #MBA #BFA #life #Rant #AutismAwareness

#Autistic#actuallyautistic#actually autistic#asd#aspie#aspergers#autismawareness#autism awareness#collegeloans#education#school#MBA#BFA#life#Rant

9 notes

·

View notes

Video

Who want to plan the next OCEAN’S 11 HEIST with me lol😫. #working9to5 #broke #billsbillsbills #tirebeingtire #INeedANewHustle #Insurance #mortgage #rent #collegeLoans #raisingafamily #loans #singleparents https://www.instagram.com/p/B3Ijt4LlNd6/?igshid=1vfj2r08d449q

#working9to5#broke#billsbillsbills#tirebeingtire#ineedanewhustle#insurance#mortgage#rent#collegeloans#raisingafamily#loans#singleparents

2 notes

·

View notes

Photo

“My Parents Had A Home At 18” #TooLargeToFail #PeopleWatching #Observe #EventPhotography #Noir #Manhattan #WallStreet #NYC #NewYorkCity #Noir #Protests #Signs #Journalism #MyParentsHadAhOmeAt18 #Monochromatic #Photography #Borrow #OccupyMovement #TooLargeTo #Economy #CollegeLoans #BailOuts #Portraits #StreetPhotography #StreetPhotographer #WhenAreThosePeopelGoingHome #GilbertKingElisa (at Wall Street) https://www.instagram.com/p/CW4jVcqDJ6M/?utm_medium=tumblr

#toolargetofail#peoplewatching#observe#eventphotography#noir#manhattan#wallstreet#nyc#newyorkcity#protests#signs#journalism#myparentshadahomeat18#monochromatic#photography#borrow#occupymovement#toolargeto#economy#collegeloans#bailouts#portraits#streetphotography#streetphotographer#whenarethosepeopelgoinghome#gilbertkingelisa

0 notes

Video

Students that take out debt for higher education are almost always underestimating how long it will take to repay the money they borrow. The result is college graduates that time and again must put their life on hold to climb out of a mountain in student loans.

How long does it take on average to repay student loans?

#studentloan studentloans college university collegeloans federalstudentloan collegedebt#Listen Now: https://www.youtube.com/watch?v=bUaTzwz-qdQ&t=23s

0 notes

Photo

One of the reasons college eduction costs are so high is due to the defunding of eduction, especially secondary/higher eduction. That leaves the burden on the student and leaving us in debt from already predatory student loans. Check out my latest post on mindmusicspirit.com on one of the systemic debt traps that is student loans... 😰😰 #studentloans #fundeducation #mindmusicspirit #collegeloans #debt #consciouscapitalism #blog #lifestyleblogs #debttrap https://www.instagram.com/p/CEz6y1qlZS3/?igshid=m7752eg8ahk0

#studentloans#fundeducation#mindmusicspirit#collegeloans#debt#consciouscapitalism#blog#lifestyleblogs#debttrap

0 notes

Photo

Nothing says Friday like payday! Here's a flashback from the archives of yours truly. In 1956, Dr. Norman Lazin, an LVC Alumnus, felt the need to financially help LVC students, so he placed money in envelopes that students could borrow with the promise to pay it back when they could. On average, 50% of the loans were repaid within a week. If only college loans were still that easy!

#lvc#lebanonvalleycollege#friday#flashbackfriday#archives#library#bishoplibrary#collegeloans#faculty#1956#1950s

9 notes

·

View notes

Photo

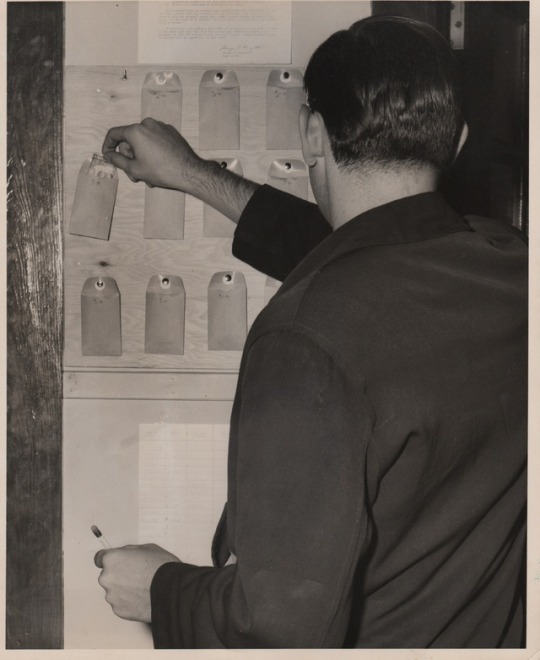

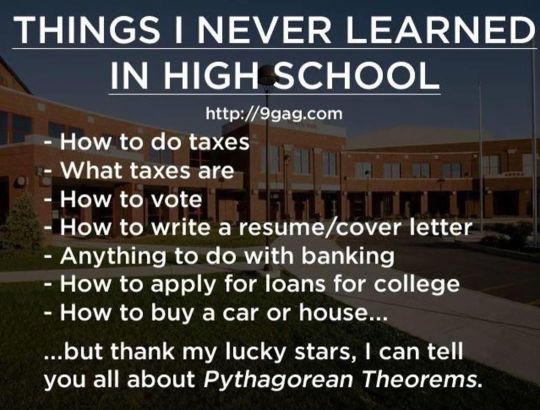

High school students in my Financial Literacy/Economics class learn about all of these topics. Business Education is a fundamental discipline and I am glad to be a part of it! #financialliteracy #economics #highschool #teacher #businesseducation #taxes #banking #collegeloans #buyahome #buyacar (at Columbus, Ohio) https://www.instagram.com/p/B_oOcqSA_CN/?igshid=vmemvoufw0hg

#financialliteracy#economics#highschool#teacher#businesseducation#taxes#banking#collegeloans#buyahome#buyacar

0 notes

Text

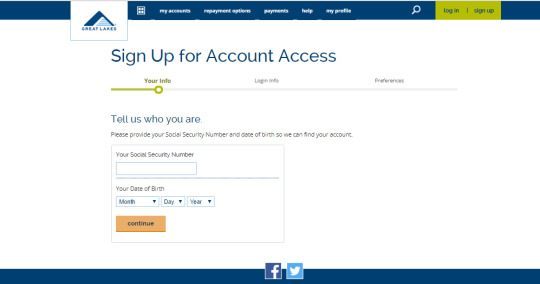

MygreatLakes Top 10 List of Student Loan Payment Application Criteria for College Students In 2020 (Review and Guide)

MygreatLakes Student Loan Review and Guide: What You Should Know

Mygreatlakes - Higher Education Corporation is one of the student loan providers in the United States. This guide is to help point you in the right direction when it comes to college funds. Mygreatlakes is a great option, however, we'll let you be the judge of that. Hence our list of the 12 things to watch out for before you embark on that college loan application.

It is already a known fact that paying student loans can be such a daunting task for any college student today, especially given the limited availability of student loans, and student opportunities to meet increasing expenses.

You may wonder, how exactly does student loans work? This is a great place to begin before we delve deeper into the financial intricacies of a funding college education. There is no gain-saying in the fact that this can be quite stressful for parents and students to navigate the complexities of the student loan world, and finding ways to understand how student loans work. Here's a list of important questions to ask before getting that loan:

Do you qualify for scholarships, grants or other free funds?What program are you pursuing?What special talent or skill do you possess?How can you leverage other options?What can you comfortably afford?

The Truth About My Great Lakes

1. My Great Lakes Background Information

My Great Lakes was founded in the United States, with its headquarters in Madison, WI. My Great Lakes is established within college funders in the United States, and as such, has earned a place in our review for college loan service providers for the 2020 school year.

The financial backing of the My Great Lakes has a strong foundation, with over 7 million customers, and over $75 billion in loans, grants, and other student fundings. An employer of over 2,000 employees within the midwest region of the United States.

My Great Lakes has made it quite easy to apply on their platform to get a student loan. Since 2011, The Great Lakes has sustained its position as a highly competitive college funding company in the United States. The confidence that comes with all of these accomplishments have made them the ideal candidate for our end of the year college funders review.

How Loans Work on MyGreatLakes

Signing up on My Great Lakes is easy. The loan application is very easy, and we have compiled a list of what to watch out for to enable you to process your application successfully.

You begin by entering your SSN and DOBThen your e-mail addressThe next page requires you choose a pinThen you set your identity image and catchphraseThen you fill out the rest of the information requested

t is important to note here that the website uses high SSL security to check your IP address to ensure that you are signing up from within the United States. If you are currently visiting friends and family, on a vacation, abroad or working abroad, or officially posted outside the United States, it is advisable that you wait until you return home before you start the application.

We know tuition, housing, food, books and other necessities that today's students need to be able to function at their best in school are increasingly rising. As such, parents and students alike are constantly on the lookout to find other options to help cover their college expenses.

2. Ideas to Consider Before Loans with MyGreatLakes

Some of these options range from volunteering opportunities to student jobs to looking outside the box, which could mean having to bring out those items that you have locked up in your garage for years and never bothered to take a second look at.

3. How to Approach Student Loans

After you have considered all of these other options, there is indeed a better way of approaching student loans would be to borrow the least amount as possible. For a lot of students, the idea of student loans can be quite promising, and a lot of people lose focus because of that.

You should approach loans with care. Knowing that though this loan is readily available to you, that is if you are a U.S. student, permanent resident and other special cases, however, learning to responsibly borrow will save you lots of troubles in the future.

4. Covering your Bases Before the Loans

Knowing that you have covered your bases is important, that way you are not overwhelmed after completion of your program, and the reality of college loan payment hits. By borrowing the least amount you can, your payment options are relatively flexible in terms of your purchasing power, and your mindset of knowing that you did not go on a spending spree.

5. Involve Family Members When You Can

This is another important area that you should know about, which is ensuring that you involve family members from your parents, to friends and siblings. This is because you may need them when that time comes.

Learning to build those vital relationships comes quite handy, as this can determine such factors as choosing to stay home or go out of state or farther for college, especially during your college days, and even after. So finding ways to stay in touch, and connect with family remains very important.

6. Focus on College and Your Purpose

One thing that students forget to do is to focus on their college program, and not give in to distractions. This is very important especially because it is easy to spend way too much on frivolities, and not actually get much done. The endless college parties, drinking and fun times can come with a huge price tag, but when you do not find yourself in such situations, you could as well save that money you would have spent on partying and investing it.

A lot of people are of the opinion that you cannot go through college without having to go through these other sides too, which is the parties, the drinking, and all of the fun stuff. However, just like everything else in life, this requires a high degree of moderation, not just because of finances, but also because of your goals and purpose for being in college.

7. You Still Should Have a Little Fun

If you choose to go the fun, party route, have a backup plan. Ensure that you put all the things you plan to do on a list, and then try to evaluate it using your budget for the semester. This will give you a good guide as to how to go about spending or not spending too much for the night.

This is not to say that you still should not have a little fun in college, however, the focus is on saving money using MyGreatLakes, therefore, the focus should be on how you can cut your spendings. Some other fun stuff you can consider that would not break the bank, are listed below:

Hang out with a friend in their roomCreate a fun playlist togetherMap out some nice after graduation plansRecount some memorable times in collegeInvite others to yours for a change

8. Borrow Books Instead of Buying

In most cases, you can borrow books for the semester. There are a ton of websites that provides the service. Amazon has a dedicated textbook system for students at any given semester. You can also extend the time needed if you need more time for your work or you decide to retake the class for any reason whatsoever for the term.

It is also quite possible that your school already has this service, where you would go borrow the assigned texts for the semester and return them at the end of the program, or however long you borrow them for. You can also use my MyGreatLakes loan to cover for books amongst other expenses.

9. Spending on Food, Clothing & Others

It is important to be smart with your spending as this will help you with saving up some more money, and not leaving yourself to chance for when that "need" that always do arise usually, from nowhere arises. It is also important to watch the cost of your grooming and other miscellaneous costs that tend to take out from the little you have.

You should look at finding tools that can help you save on things you already spend money on weekly-biweekly or monthly as the case may be. You can save money on hair expenses, for instance, by using tools that can help you find discounts, promos and more on hair salons near you for college students.

Other students may very much be into sports, soccer, basketball, badminton, running, hiking and the likes, that may not necessarily take money out of your pocket, but finding ways that can help you maximize your loan from MyGreatLakes would naturally mean a great win for your any time, any day.

10. Creating a Budget and Using It

College budgeting and saving money is very important. You can definitely make a huge difference in the way you plan your finances, and how you hope to keep at it. This is one area that many college students take for granted. However, if you are able to get this process going, it definitely will make that huge difference that you are hoping for in your finances.

Planning your money is a big part of the goal. You may not get first-hand money management, credit building or repair education in that program you are enrolled in. However, you can choose to learn about this essential information by going online and researching for yourself. This will keep you informed and in a better position to make an informed decision.

How Do You Proceed With The Information You Have

The information provided here is to serve as your guide on how to proceed with caution when it comes to getting student loans. It is important knowing that MyGreatLakes may have its many benefits, however, a loan is still a loan, and you are required to make payment when the time comes for the payment. So what you should bear in mind is to see ways to ensure that you do not get overwhelmed when the time for repayment comes.

Use the information provided as a guideCalculate and budget every dollar spentDo a weekly review of your spendingsLook for bargains and deals to take advantage ofHave a backup plan to make more money

The information we provide here would be very helpful if the tips are followed. Using this article as a guide, you would be able to stand the chance of creating a balance between your spendings, your income, and savings. You do not want to be stuck in college without funds, especially if you have things such as books, college supplies to take care of.

Finding options to ensure that you are not left all by yourself when the time comes to actually make money is very vital. For a lot of people, they try and reach out to their neighbors, friends and family members offering them some form of manual labor for money. Mowing, lifting, moving, and other different services that a student is able to provide is a great way to make money. for college students.

Taking Care of Your Health In College

It is important that you remember to "breathe" and unwind in college. There have been increasing cases of mental health challenges in colleges in recent years. However, the good thing is you can find ways to get the needed support that can help you scale through in hard times., and know that you are not alone.

Finding a network of support, and people who have been through the same things, who can share their story to encourage would do you lots of good. Therefore, ensure that you keep and maintain valuable friendships. These are people who are going to help you pull through when you need a shoulder to lean on, a hand to hold, or an ear to listen.

MyGreatLakes may pay your tuition, books, rent, and your other school expenses, however, some things are needed that are beyond financial matters. College grounds come with its many challenges, but finding ways to navigate these complexities can make the needed difference that you need to stay healthy and rejuvenated.

In Conclusion

With all being said, our conclusion remains: plan ahead and stick to it. If you plan ahead, you would be in the position of taking care of yourself, your academics, your expenses and even your fun times. However, if you decide to just go with the "flow" and not plan for what you need, it just may not work as you anticipate, and this can create its own unique challenges.

The many benefits of taking advantage of the loan provided by MyGreatLakes abound, but finding ways to ensure that you do not throw away the opportunity at will is where the work will show just how much you really want that college education. By and large, it all boils down to what you think is your reason for being in college. A lot of people go to college for many reasons, and the reasons are unique to each person, depending on what their driving force and motivation are.

To find better jobsTo have the flexibility of revenueTo be better educatedTo have bragging rightsTo set an example, or listen to the wish of parents and guardians

Your reasons may be outside of what has been provided, however, they still amount to your motivating factors. When the going gets tough, remember the reason you are in college in the first place, and let that reason drive you to accomplish great things in college and beyond. Keep an open mind, and take those opportunities as they come because you would look back and wish you did someday after all is said and done.

So now you know just what you need to be prepared. Do not let anyone or anything outside what you have agreed upon to define you. College can be fun and rewarding, but you have to do the work. Getting your loan approved from MyGreatLakes is just one of the many things that you would have to do to get on the path to paying for college.

Find balance in all of what you do is very important to your success. To find balance. As you go out to the class, with friends and family, have your eyes on the "prize", which is the reason you are in college in the first place anyways. So make sure you keep your purpose alive, ensure that you get sufficient rest, and above all stay motivated, stay driven, stay you.

Read the full article

0 notes

Text

My life sucks.

Sallie Mae is double garnishing me now. They have two arms coming at me. So now working at my par time minimum wage job. I am being garnished 30 percent of my income. Thanks to my inability to get anything better. I am even poorer now.

Tell me again why college was worth it? That is even with me having a MBA and BFA in animation. College is a scam. It is not worth it. All it gave me is low wage work. Made me even more unemployable then I was before college.

This debt has effected my mental health to no end. Of course they don't care about my issues. They don't care if they garnish all my wages. These ass***s are the worst. You know what? You can thank the US government. This would not happen in the private sector.

As not private sector loan provider would ever get subsidized by the government and mandated under regulations to provide loans. Then you can thank the FED for providing cheap money to the Gov to provide cheap loans to people.

You people wonder why I am depressed all the time. I can't a job that pays more then minimum wage and is full time and I am being garnished to the hilt.

I have every right to be depressed. No work, no money, no life

#Autistic#actuallyautistic#actually autistic#asd#aspie#aspergers#autismawareness#autism awareness#college#education#edu#school#student debt#studentdebt#studentloans#student loans#college loans#collegeloans#loans#debt#life#rant#depression#suicidal#government#college is a scam#collegeisascam#work#employment#jobs

40 notes

·

View notes

Video

"Umbreon, use strip attack!!!" #animenyc #blackspecter #animenycafterparty #slake #slakenyc #sonicboombox #cosplay #poccosplay #party #turnup #lit #umbreon #pokemon #eeveecosplay #eeveelution #stripperlife #collegeloans (at Slake)

#pokemon#slakenyc#eeveecosplay#slake#sonicboombox#umbreon#turnup#cosplay#poccosplay#party#stripperlife#collegeloans#animenycafterparty#blackspecter#lit#eeveelution#animenyc

1 note

·

View note

Photo

“My Parents Had A Home At 18” #TooLargeToFail #PeopleWatching #Observe #EventPhotography #Noir #Manhattan #WallStreet #NYC #NewYorkCity #Noir #Protests #Signs #Journalism #MyParentsHadAhOmeAt18 #Monochromatic #Photography #Borrow #OccupyMovement #TooLargeTo #Economy #CollegeLoans #BailOuts #Portraits #StreetPhotography #StreetPhotographer #WhenAreThosePeopelGoingHome #GilbertKingElisa (at New York City, N.Y.) https://www.instagram.com/p/CW4irQ4AJVA/?utm_medium=tumblr

#toolargetofail#peoplewatching#observe#eventphotography#noir#manhattan#wallstreet#nyc#newyorkcity#protests#signs#journalism#myparentshadahomeat18#monochromatic#photography#borrow#occupymovement#toolargeto#economy#collegeloans#bailouts#portraits#streetphotography#streetphotographer#whenarethosepeopelgoinghome#gilbertkingelisa

0 notes