#andy showing junior all the care his father never gave him

Note

Andy celebrating Junior's birthday while living in the middle of the woods

The sun had been up for a while now, maybe an hour. Andy was never sure about times anymore. All he knew was that he had a red velvet cupcake in hand, with a candle sticking out from the top, and a gift in the pocket of his flannel.

All that mattered was that today was September 26th.

Junior’s fifteenth birthday.

Now, Andy knew he couldn’t do much to celebrate his kid’s birthday. They were living in the middle of the woods and he only went on supply runs once a week. No matter how hard he tried to persuade Junior to go back to “civilization”, he refused. So they both stayed still, feeling content in only each other’s company.

But just because he couldn’t go all out for Junior’s birthday, doesn’t mean he still wasn’t going to make it special for him.

Andy quietly went up to Junior’s room, gently knocking on the door with his free hand. “Jun? You awake?” He asked and the only response he got was a groan, signaling that Andy was the one to wake him up. But he still opened the door, entering with a big smile.

“Happy birthday to you…” He began singing, resulting in Junior groaning louder.

“Oh my gods…”

“Happy birthday to you…” Junior put his pillow over his head but when Andy got closer, he snatched the pillow away and tossed it to the side, “Happy birthday, dear Junbug…”

“That’s not my nam—”

“Happy birthday to you!” Andy sang the last part a little louder and sat down at the edge of Junior’s cot, pulling his lighter out of one of his pockets and lighting the candle on top of the cupcake.

Junior stared up at him, his hair a wild mess from sleep and eyes tired but an eyebrow raised in annoyance. “It’s so early, Andy, what the hell…?”

“It’s your birthday, Junior. You can wake up early on one day, you sleep in all the time.”

“Yeah, it’s my birthday, I’m not supposed to wake up early on my birthday. And you wake me up early too when we go hunt.” The birthday boy whined, dropping his head back down to where his pillow used to be.

“You enjoy hunting, so don’t give me that.” Andy chuckled before gently shaking Junior’s shoulders. “C’mon, Junbug. You gotta make a wish.”

Junior’s eyebrow raised higher. “I’m fourteen, Andy, not four. I don’t need to make a wish.”

“Fifteen,” The man corrected, “you’re fifteen today, Junior.”

“Whatever…” Junior rolled his eyes before rolling over onto his back and slowly sitting up, “I’m still one year closer to reaching Death’s inevitable cold, clammy hands.”

“Jesus, kid…” Andy wanted to retort that he wasn’t this morbid at fifteen but even he knew that was a lie, “just…just blow out the candle. Come on, do this for your old man.”

This got a giggle out of Junior for Andy “accepting” that he was old, closing his eyes for a few seconds and then blowing out the candle.

Andy pulled out the candle and then handed the cupcake to the kid. “Here, breakfast.”

Junior’s eyes widened. “Sugar for breakfast?” His voice was small when he asked this and it made the grown man’s heart clench.

Now, Andy didn’t condone murder…but if Logan Wheeler ever came back to life, he would treat him the same way he treated that decapitated Chucky head that he kept for four years, but keep Logan alive even longer.

“Yes, kid. It’s your birthday, you can have a cupcake for breakfast. I’ll even make you pancakes too if you’re still hungry.” Andy said with a soft smile, pushing down his poisonous thoughts about Logan, and ruffles Junior’s hair.

The teenager rolled his eyes again and lightheartedly smacked Andy’s hand away before taking the cupcake from him and taking a bite, humming in delight. “Thank you, Andy.” He said with a small smile, now not seeming to mind being woken up this early.

“Well, don’t thank me just yet…” Andy started before pulling out Junior’s present from his pocket and handing it to him.

Junior’s eyes lit up from realization and he quickly grabbed it while holding onto the cupcake with his other hand. “Is this…?”

“Your very own switchblade!” Andy proudly announced and Junior began grinning. “You always talked about how cool switchblades were so I figured that’d be a nice gift. But I still want you to be careful with it, okay?”

“Yeah, I will.” Junior giggled as he switched it open, his eyes lighting up more at the sight of the blade to the point where it was almost concerning to Andy. “Thank you! Thank you so much!”

“You’re welcome, kiddo.” He ruffled Junior’s hair again but this time, the teenager let him. “Oh! I almost forgot…there’s still two Chuckys alive for you to play with.”

“Can I use the blowtorch?” Junior asked, a maniacal look in his eyes.

Maybe Andy shouldn’t have introduced the concept of fire being a main torture method for Chucky, the kid was getting far too fascinated with fire.

He accidentally created a pyromaniac.

“…okay, but you need to be—”

“—be careful, I know,” Junior interrupted with a little smirk, “Gods, you’re such a mother hen!”

“I am not!” Andy denied but even he knew that it was getting a lot harder to deny that, so he decided to change the subject. “Just finish up the first part of your breakfast and we can keep celebrating, alright?”

Junior giggled but nodded, taking another bite out of his cupcake and then resting his cheek against the man’s shoulder. “Thanks, Andy…”

Andy smiled and leaned down to kiss the top of Junior’s head. “No problem…happy birthday, Junbug.”

OH MY GOD THIS IS SO INCREDIBLY SWEET 💕💕💕💕

This becomes even more significant considering Andy hates birthdays. Like, he may hate his but he tried his best to give the boy a good one.

I love how cute the use of the nickname Junbug sounds, its adorable. The father and son energy this has despite neither of the characters acknowledges it's perfect.

They are so fucked up yet so adorable, little murderous thing and the dad he found in the wild having fun slaughtering all those dolls hehe

#asks#messages#submitted fic#andy barclay#junior wheeler#AU#andy celebrating junior's birthday#this fic is a caress to my soul#completely ignoring canon this totally happened#andy showing junior all the care his father never gave him#in the most misserable of contexts#totally hits my sentimental fiber#this kid is happier as a hermit in the woods that he ever was in his wealthy home

4 notes

·

View notes

Photo

i wanna hide the truth, i wanna shelter you

a love letter to luxor’s zander driskell

I want to start off with a disclaimer that there’s a bunch more pre-Luxor content on this one compared to the girls’, but with Zander it felt extremely important to explore that aspect. There’s a note on the section where I’m finally playing him in the roleplay due to that, but anything before that point is before I started playing him in the group. Anyway, I’m proud to present a 3 hour Zander playlist, come help me judge him for the amount of references to his dad and Ches throughout this entire playlist.

Yet again I’d like to thank Lex for help throughout this process, and warn everyone that the usual Zander trigger warnings are all over this playlist (mental health, violence, abuse / child abuse, etc etc). Anything additional is noted on the sections.

‘cause i had a fire, passion and desire. now all i require are circuits and wires | pre-luxor:

zander before attending luxor

additional tws: potential self harm (breathe me)

iRobot (Jon Bellion) [ I was a human, before you killed me and ripped my heart out. ] // Breathe Me - Acoustic (Jonathan Roy) [ I think that I might break and lost myself again and I feel so unsafe. ] // Tell Me Why (Taylor Swift) [ Why do you have to make me feel small so you can feel whole inside? Why do you have to put down my dreams so you're the only thing on my mind? ] // Weight Of Living, Pt. II (Bastille) [ All that you desired when you were a child was to be old. Now that you are here, suddenly you fear you've lost control. ]

happiness is beautiful to see, won't you box it up for me? | sophomore year:

zander’s sophomore year at luxor, and the introduction to one ches elswood.

additional tws: bleed out can be extremely uncomfortable to listen to with the whole, bleeding out theme. please skip that song if you feel you need to

Cop Car (Keith Urban) [ You were thinking that running for it would make a good story; I was thinking you were crazy as hell. ] // Don't Trust Me (Phillip Phillips) [ So when I say I'm okay, don't trust me. ] // Burn Out (Imagine Dragons) [ Oh, give me strength, and give me peace. Does anyone out there want to hear me? ] // Crawling (Linkin Park) [ This lack of self-control I fear is never-ending. Controlling, I can't seem. ] // Bleed Out (Blue October) [ Will I bleed out? I gave it all, but you can't stop taking from me. And way down, I know you know where to cut me with your eyes closed. ] // Don't Sing the Blues (Bohnes) [ I was ridiculous, young Icarus. I flew too close to the sun. ]

do you remember all the plans we made? | helena:

a section dedicated to zander’s relationship with helena

additional tws: sex (carry your throne), alcohol (tonight I wanna cry)

Carry Your Throne (Jon Bellion) [ If you're lost in this darkness I'll carry your throne. No, I won't let it swallow you whole. ] // Snake Eyes (Mumford & Sons) [ It's in the eyes. I can tell, you will always be danger. ] // Halfway Gone (Lifehouse) [ You were always hard to hold, so letting go ain't easy. I'm hanging on but growing cold. ] // The Promise (Andy Black) [ Tell me what ever happened to the love we gave, the promise that we both betrayed. ] // Tonight I Wanna Cry (Keith Urban) [ And I thought that bein' strong meant never losin' your self-control, but I'm just drunk enough to let go of my pain. To hell with my pride, let it fall like rain from my eyes, tonight I want to cry. ]

i say one day the valley is gonna swallow me whole, i feel like a photo that's been overexposed | junior year (‘18-‘19):

junior year of high school, fairly self explanatory

additional tws: smoking (antisocial)

Flaws (Bastille) [ You have always worn your flaws upon your sleeve and I have always buried them deep beneath the ground. Dig them up. Let's finish what we've started. ] // Battle Cry (Imagine Dragons) [ Just one more time before I go, I'll let you know that all this time I've been afraid, wouldn't let it show. Nobody can save me now, no. ] // 12 Rounds (Bohnes) [ I'm coming home, I've got some things to say. My gloves are on and my shoes are almost laced. ] // Novocaine (Fall Out Boy) [ Don’t mind me, I’m just the son of a gun. So don’t stop, don't stop 'till your heart goes numb. Now I’m just numb, I don’t feel a thing for you. ] // Machine (Imagine Dragons) [ 'Cause I've been wondering when you gonna see I'm not for sale. I've been questioning when you gonna see I'm not a part of your machine. ] // Antisocial (Ed Sheeran feat. Travis Scott) [ So antisocial, but I don't care. Don't give a damn, I'm gonna smoke here. ] // Stay Frosty Royal Milk Tea (Fall Out Boy) [ Seems like the whole damn world went and lost its mind and all my childhood heroes have fallen off or died. ] // Never Going Back (The Score) [ I'm never gonna follow just because they say so. ]

consign me not to darkness | summer 2019:

the summer after the merge, where zander is stuck at home working for lance

additional tws: alcohol (if you’re going through hell)

Two Evils (Bastille) [ I'm the lesser of two evils or am I tricking myself nice? ] // Man or a Monster (Sam Tinnesz feat. Zayde Wølf) [ When you look at yourself, are you a man or a monster? ] // DNA (Lia Marie Johnson) [ Are the pieces of you in the pieces of me? I'm just so scared you're who I'll be. When I erupt just like you do, they look at me like I look at you. ] // Broken Crown (Mumford & Sons) [ So crawl on my belly 'til the sun goes down I'll never wear your broken crown. I can take the road and I can fuck it all away, but in this twilight, our choices seal our fate. ] // If You're Going Through Hell {Before The Devil Even Knows} (Rodney Atkins) [ I've been deep down in that darkness, I've been down to my last match. Felt a hundred different demons breathin' fire down my back. ] // Mud On the Tires (Brad Paisley) [ 'Cause it's a good night to be out there soakin' up the moonlight. ] // Pray For You (Jaron And The Long Road To Love) [ I pray your brakes go out runnin' down a hill, I pray a flower pot falls from a window sill and knocks you in the head like I'd like to. ]

but all the scars they prove that i fought my way through so, i always keep 'em showing | senior year of hs (‘19-‘20)

finally, the point in the timeline where zander is actually getting roleplayed by me. includes summer camp fun too

The Silence (Bastille) [ Tell me a piece of your history that you've never said out loud. Pull the rug beneath my feet, and shake me to the ground. ] // Stand Up (The Cab) [ Yeah, all of my demons are kicking and screaming but I'll never leave them behind. Yeah, maybe I'm crazy but don't try to save me, 'cause I've never felt so alive. ] // Only One (The Score) [ Tell me how it feels to know I'm not a puppet under control. I cut the strings a long time ago. ]

running from the devil, but the devil takes hold | fall & winter 2020:

a new school year, increased disdain for his father, a certain set of posters, and the start of realizing there may be something wrong with him.

Gold (Imagine Dragons) [ But now you can't tell the false from the real. Who can you trust? When everything you touch turns to gold. ] // Just Like You (Three Days Grace) [ You thought you were standing beside me, you were only in my way. You're wrong if you think that I'll be just like you. ] // Bad Blood (Bastille) [ All this bad blood here, won't you let it dry? It's been cold for years, won't you let it lie? ] // Middle Finger (Bohnes) [ But I refuse to let you make me feel like I can't fly. Not only will I soar again, I'll own the fucking sky. ] // American Beauty/American Psycho (Fall Out Boy) [ You take the full, full truth, then you pour some out, and you can kill me, kill me or let God sort 'em out. ] // Homecoming King (Andy Black) [ You're standing there with the homecoming king; turn the silver spoon into a diamond ring. Can he make you disappear without anyone noticing? Yeah, fuck the homecoming king ] // Monster (Imagine Dragons) [ I'm only a man with a candle to guide me, I'm taking a stand to escape what's inside me. A monster, a monster, I've turned into a monster. ] // Animal I Have Become (Three Days Grace) [ Somebody help me through this nightmare I can't control myself. Somebody wake me from this nightmare, I can't escape this hell. ] // Gallows (The Score feat. Jamie N Commons) [ Been turning my back on the sun these days, trying to walk the line but I'm losing my way. ]

i'm sifting through the sand, looking for pieces of broken hourglass trying to get it all back but it back together | spring 2021:

continuing to take a good look at his mental health, a desire to improve, and an appreciation for his support circle.

additional tws: sex/masturbation mention (All Time Low)

All Time Low (Jon Bellion) [ I've been trying to fix my pride but that shit's broken, that shit's broken. ] // Bishops Knife Trick (Fall Out Boy) [ These are the last blues we're ever gonna have, let's see how deep we get. The glow of the cities below lead us back to the places that we never should have left. ] // Demons (Imagine Dragons) [ They say it's what you make, I say it's up to fate; it's woven in my soul, I need to let you go. Your eyes, they shine so bright, I wanna save that light, I can't escape this now, unless you show me how. ] // I'll Be Good (Jaymes Young) [ I never meant to start a fire, I never meant to make you bleed. I'll be a better man today. ] // The Anchor (Bastille) [ You were the light that is blinding me. You're the anchor that I tie to my brain. 'Cause when it feels when I'm lost at sea, you're the song that I sing again and again. ] // Ungrateful Eyes (Jon Bellion) [ Still lost, still feel depressed like I'm try to find a way in. I'm trying to figure this out, but my God I'm so human. And so I turned to my sister and smiled and asked this question, “all we wanna know is where the stars came from, but do we ever stop to watch them shine?” ] // Rise Up (Imagine Dragons) [ The darkness right in front of me, oh, it's calling out, and I won't walk away. ] // Bless The Broken Road (Rascal Flatts) [ Every long lost dream led me to where you are, others who broke my heart, they were like Northern stars, pointing me on my way into your loving arms. This much I know is true, that God blessed the broken road that led me straight to you. ]

#musing ( playlists )#no chains won't hold me down ( musings )#violence tw#Smoking tw#alcohol tw#abuse tw#child abuse tw#self harm tw#blood tw#stabbing tw#bc implied

3 notes

·

View notes

Text

Imprisoned - Chapter II

Chapter II

Story Rating: 14+

Warnings: Violence, Murder, Mentions of Murder, Language, Gore

Summary: Y/N is Andy and Laurie Barber’s 14-year-old daughter who is a high-grade student in Archer Middle School. Her best friend, Alice Miller had been gone for a while. They search for the lost student and find out that Alice Miller’s body has the prints of Andy and Laurie Barber’s daughter, Y/N.

DEFENDING JACOB SPOILER FREE FOR THIS CHAPTER!

(If my story is somewhat accurate for the series I DID NOT know! This is my story with my ideas based off the trailer I’ve seen)

Chapter I Chapter II Chapter III Chapter IV Chapter V Chapter VI Chapter VII Chapter VIII Chapter IX Chapter X Chapter XI Chapter XII Chapter XIII

Author’s Notes: I’m kind of liking this series.

Song Inspired: Painted Staircase by Active Child (Defending Jacob Trailer)

~~~

The sun was just setting on that night, the lights going off in the huge house. “Thanks, dad,” Alice leans over and hugs her dad. Eric was his name, he was a gentle guy and he worked in a warehouse just a few miles out of the town of Newton. Her parents were really nice but her dad just seemed very intimidating sometimes.

“All right, you girls have fun okay? I’ll be back around 9 and we’ll drop off Y/N afterwards, okay?”

“Okay, dad,” Alice says, Eric grins, “Keep your phone on you!” Alice gives him a thumbs up and she grabs Y/N’s hand to drag her up to the house. Who knows if Emily had drinks at the house. Her family was rich. She was a ninth grader but their friend Henry was known to Emily and he asked if she could invite them.

Which she did. She didn’t mind them. Or so they thought. They knocked on the door and they saw someone walk up to the door behind the colored glass before the door unlocks to Henry. “You made it!” He says. Alice walks in and hugs him, “We did!” Y/N then comes up and hugs Henry next before he takes them inside.

The party was crowded. A mixture of all the grades. Y/N turns to the dining room where the shouts and laughter came from. They were playing beer pong. Don’t drink. Don’t let someone urge you to drink. Her father’s words came into her head and she turns away from it.

“What’s going on?” Alice asked. Henry looks around, “Everyone here is drinking, some juniors from the high school brought in some drinks. Would you like to try some?” Henry asked. What the hell is wrong with them?

Alice paused for a moment.

Y/N turned her head to see the kids staring at her. Her hands twists into each other anxiously. Henry took Alice’s hand and guided them to the kitchen. Be careful, Y/N.

.

Andy was in the bathroom, scrubbing the dirt off Milo’s back after it just rained for an hour. Milo tends to be happy about rain and play in the mud. Andy pours water onto Milo, “You gotta stop with this playing in the mud, buddy.” Andy sees Milo plant his feet, knowing what had to come next, Andy pulls back when Mile shakes the water off of him.

“Bud, hey...” Andy gently takes Milo’s face into his hands and stroked his cheek, he smiled. Milo tries to lick Andy’s face who pulls away with a smile. “You’re a good boy.” Andy reaches for the cup in the tub and pours the water on the dog again, getting the soap off. His sleeves were rolled up but they were still soaked. His shirt was completely wet, he noted to himself a shower after this tub drains.

He unplugs the tub and reached for the towel on sink before heading over to Milo. “Out,” He says, Milo jumps out and shakes once again, getting water on the walls and mirror.

“Okay, that’s enough, bud,” Andy kneels down and rubs the dog’s fur down. He had short fur so he wasn’t dripping much water. Andy grabs his paw and sees them, “You need your nails clipped, buddy.” Andy finishes drying off the dog before Milo is set off running.

Andy takes the towel and drops it into the laundry basket, walking out. He steps into the living room and sees Laurie sitting down on the couch, searching for a show to watch. “What time is it?” She asked, Andy glanced at the clock and sighs, sitting down next to her.

“It’s 8 and a half,” He says. Y/N left around six and they hope she’d be tired by now.

“We can text her right now. See how she’s doing.” Andy takes out his phone and goes to his messages, finding his daughter’s name and clicks on the bar. How’s it going? He sends it and closes his phone afterwards. Laurie leans over, resting her head on his shoulder as she clicks on the show to watch. He brings his arm around her and sighs.

“She’s okay. I’m sure she’s having fun.”

Andy shuffles a bit while Milo jumps next to him and lays beside him. Andy puts his hand on the dog’s back and rubs it. “It’s just something I did in high school. I just hope she’s not doing something she’s not suppose to.”

“She knows. When she was little, she spitted your beer out on the carpet and dumped it into the sink.” Andy chuckles at the memory. “What did she say after that?” He completely forgot how she said it after she dumped the beer.

No, daddy. That’s bad for you!

“She said, ‘No, daddy. That’s bad for you!’ Then she gave you a water bottle,” Laurie smiles at the memory with a laugh. Andy’s smile never left his lips as he watched the show. He remembers having her on his shoulders as they skip rocks into the water.

Go to the park she goes with Alice now, he’d find her in the forest collecting sticks. The smile that never left her face. He can’t seem to get his off at the moment.

.

An hour had past. Andy was calling Y/N’s cell for 15 minutes and she never picked it up. “Is she answering?” Laurie asked. Andy doesn’t answer her and picks his phone up again, calling. That made Laurie put her hand to her forehead in fear.

The two stood in the kitchen. After two episodes that were 45 minutes long, they didn’t realize Y/N’s curfew was passed.

“Hey, you’ve reached Y/N Barber. I can’t get to the phone right now.” Andy drops his phone from his ear and sighs, he rubs his forehead with his hand. “We shouldn’t have let her gone out.”

“An, I’m sure her phone died.”

“She said it was 100%. She couldn’t have been playing on it through the whole time there because I’m sure there were a lot of things to do there-” The couple turn to the door opening and closing. Andy looks out to see the dark car drive off and the two rush to the front door.

“Y/N,” Laurie comes up and hugs Y/N, “Hun, why did it take you so long?” Laurie asks. Y/N looked up at her mother, “I’m sorry. I tried to call you but my phone died.”

“Bullshit,” Andy spats.

Laurie looks at him, “Andy.” Y/N looks up at her father who was completely angry but she knew it was out of fear. Her eyes look down at the ground, “I’m sorry. I tried to call...” She says. Laurie sighs and strokes Y/N’s hair, “Are you hungry?”

Y/N nods and Laurie turns away, “Okay. I made some dinner. You can sit at the dining table I’ll bring you a plate.” Y/N nods and walks over to the dining table as Laurie walks into the kitchen.

Andy follows his wife. “You don’t think that’s a little strange?”

Laurie pulls out a plate and grabs the food from the fridge. “Andy, she’s a teen. You know those kids get bored at some moment to go on their phones. Her phone is three years old, anyway.”

“She would’ve gotten my text then, right?” Andy asked. Laurie sighs once again, “Just relax. She’s home, she’s safe.” Andy couldn’t believe what came out of their daughter’s mouth. Yes, their daughter had a 3-year-old phone but she would’ve done everything else but on her phone.

That’s the reason she went out. Unless she didn’t expect it to be that boring once she got there. He’s gonna let this slide. He looks towards the dining room table to see Y/N playing with her fingers at the table. He walks away and heads into their bedroom, closing the door afterwards.

Laurie turns to look and walks over to the dining table. “Here you go, hun,” She says, Y/N gives her a small thank you. “How was the party?”

“It’s was good,” She says, putting food into her mouth. Laurie managed to grin, “I’m sorry about your dad. He just was...”Laurie gently shook her head.

“Scared?” Y/N asks, her eyes divert to her mother, who gazed at her. “Yeah... He was,” Laurie said. Y/N looks back at her plate and picks at it, now. Laurie looks at her hands and sighs.

“Why don’t you get some rest? I’m sure that party took the energy out.” Y/N takes her plate and takes it to the counter, putting it in the sink before walking past her mom. “Goodnight.”

“Goodnight, baby,” She says.

The sound of Y/N’s door closing, Laurie gets up and walks over to her bedroom. Andy sat at his desk with the one light on. “You should get some sleep as well.” He never turns to face her as he kept his eyes in front of him. “I will,” He replied.

Laurie doesn’t say anything else and goes into the closet to pull clothes out for a shower.

Leaving Andy at his desk.

.

Y/N woke up around 10 in the morning. Her head pounds as she lifts her head up to the light shining through her thin curtains. Y/N feels Milo leave her bed and goes straight for the door.

Y/N hears Andy and Laurie chatting outside in the dining room is sounded like. Milo gently scratches the door and Y/N stands up. She opens the door and Milo runs out into the dining room, meeting the couple who sat at the table.

Y/N comes out and sees them at the table in a bad position. She got the feeling they were waiting for her to come out soon enough to talk to her. Laurie and Andy look at her, her father seemed more upset than Laurie.

“Y/N, can you sit down for a minute?” Laurie asks, Y/N slowly walks over to the table and sits down in front of them. Andy didn’t even look at her, Laurie did. Y/N looks at them in fear as Laurie sighs.

“Y/N. How did you get home?” She asked.

Y/N froze in place. “Alice’s dad dropped me off-”

“Eric called us this morning saying Alice didn’t make it home last night. He didn’t see you there.”

Y/N was stuck. She waited for another question but it never came. She slightly flinched when Andy finally faced her, “Y/N, how did you get here?”

“I walked,” She spoke.

Andy and Laurie looked at each other at her response. “You walked home? You walked 3 miles from Emily’s house to ours? Where was Alice?”

“I left...” Y/N grips her hands, in fear she didn’t want to be yelled at. “You left Alice? Where did you see her last?”

“She was in the kitchen... I-... and then I just left,” Y/N closed her legs and felt the tears burn her eyes. Laurie looks at her, “Honey, what’s wrong?” Y/N diverts her eyes away from them, she shakes her head. “I’m sorry...” Was all she says.

Andy looks at her softly now, he looks at his wife who was torn as well. They hated to see their daughter like this. Andy reaches over the table, “Hey...” He says.

Y/N looks up, her red glistening eyes shining in the dining light. “It’s okay. We just needed to know where Alice was seen last. But you didn’t have to walk 3 miles to our home. You could’ve called us.”

“My phone... was dead...” She says, Andy looks at her and nods. Knowing they should’ve gotten it fixed a long time ago. “We’ll get that fixed. I’m sure I can take it in in a few days.”

Y/N gently nods and wipes the tears off her cheeks. Laurie looks at Andy, “Did he say he was gonna call the cops?” She asked.

Andy shook his head, “He’s not suppose to call them till 9. You’re to call a missing person after 24 hours,” Andy turns his head a little bit, realizing something. Laurie looks at him confusingly.

He looks at Y/N, “Hey, do you know where Emily’s house is?”

Y/N looks up, “I mean... she lives by the forest. You know by the park and stuff.” Andy diverts his eyes to his wife. “We can have a search team in the Cold Spring Park.”

“How will we get people to help-?”

“There are always people who search for missing kids. I can call Eric back and tell him about a search team,” Andy stands up and pulls his phone out again. “I’ll go out with the search team and you just stay with Y/N.” Laurie nods.

“How long will you be out there?”She asked.

Andy clicks on Eric’s contact and pulls it up to his ear. “As much as we need.”

.

A day went by and after that call, Andy got a search team for the look of Alice. He stood at the end of trail. There was a sign he read. Cold Spring Park. Him and his daughter would go down this trail sometimes. It’s the trail that leads to the school and to their home if Y/N would’ve taken herself.

He looked down the trail, knowing this trail goes on for miles. He turns to see Eric and his wife. “Hey, An,” Eric said, the two shook hands. “Eric.”

“I want to thank you for doing this,” Eric says, Andy nods, “My daughter is best friend’s with yours. She’s a good kid, she makes Y/N happy.” Eric smiles softly. The two look at the people who were in yellow and orange vests with the word search team.

Andy thought about the search team. If they don’t find her today. He could probably grab Milo for this search next time. He’s sure Milo can find her. Milo knew her.

Andy sighs. “Okay, let’s start. Would you like to explain to them about her?” He asked. Eric looks at him and nods. “Um...” He sees the people gather up, “Thank you all for coming to help us. My name is Eric Miller. I’m Alice’s father. She had bee missing for over 24 hours. Police had been notified and we gathered you to help us find our daughter.”

Andy nods and they started the search. People calling out to others, their eyes scanning through the woods. Eric and his wife were holding hands, hoping that their daughter would soon be found.

.

Hours had went by, Andy knew they went down for miles. It was starting to get late and so they had to end the search there. People wished and prayed the couple a good luck as they went on their ways.

Andy was left with the Miller Family. Eric spoke softly to his wife as Andy turned to them. “I’m sorry we didn’t find her today. I’m sure she’ll be found soon.”

Eric looks up from his wife. “We just hope she’s alive. We can’t live without her.” Andy nods reassuringly, he holds his hand out. Eric takes it and shakes it. “Thank you so much again for that.”

“We’ll be sure to check the park again.” Eric nods and they head back home. Andy enters his car and leaves the park, going back home to his family. It was messed up more than ever. Who knows what the Miller’s thought. What if they wished it was Y/N instead?

Hoped that Andy’s kid could get the same medicine.

They’re too nice to even think that. Andy gave them his prayers and hoped that they find Alice alive.

.

Seven days later.

Seven days. And they still didn’t find Alice. After their last one, Police took the stand and went on the search. K9′s and policemen all searching the area for the missing girl.

Eric and his wife stayed home.

They couldn’t bare to see if they’re daughter was more likely to be gone for three days. Andy was at work on the gloomy day. He had his daughter at home, watching their dog Milo with Laurie. He needed to get work done so he could be able to see his daughter’s show.

He was reading over the cases before his phone began to ring. He looked over and picked it up, “This is Andy Barber?”

“Mr. Barber, this is Officer Collins.”

Amber Collins is Henry’s mother. Andy stood straight, “Is there a problem?” He asked. It seemed to sound like dogs were going wild on the line with chatter. “We found her,” She says.

Andy felt relieved, “This call should be for the Miller’s, not me-”

“Mr. Barber, we found her body.”

He froze. That’s not what the Miller’s wouldn’t like to hear. After four days of missing, they find her dead. He inhales softly, “Where?”

“We’re in the park, on a trail that leads to the school. There’s a small pond.”

“I’ll be there in a minute,” He says. He puts the phone down and gets in his car, driving off. He grips the top of the wheel. No wonder Y/N walked home. She couldn’t find Alice. Unless she told her she was leaving early and that gave an advantage for someone to take her.

He reached the trail to the park, seeing Officer Collins waiting at the entrance. Andy parks his car on the side and gets out. Amber smiles, “Mr. Barber, haven’t seen you in a while.”

Andy had his grey coat, he looks down the trail to see the people down there. Cop cars with their lights on and a few civilians looking. Andy looks over to Amber, “It has.”

The two walk down the trail towards the pond. The more he got closer, the more he would’ve gotten sick there. “One of our K9s picked her up at the last minute we were gonna leave the area for people to have their park back.” The smell was metallic and muddy like. Earthly and the mixture of blood, he knew this was bad.

They stop right at the small dip to the old pond that was below, people in hazmat suits taking pictures or looking down for remains. The air was taken out of Andy’s lungs as he saw it.

“Is that her?” Collins asked.

Andy saw the dress, torn apart from pieces. The blood seeped through the fabric by her chest. That dress she always wore to Y/N’s birthday parties. Amber didn’t need an answer when she could see his state right now. She turns away from him. “It’s nothing worst than a kid,” Amber spoke.

Andy hears someone come in view beside him and sees the detective. “Hey, Paula.”

“Good afternoon,” She says, Pam Duffy is a detective Andy would see sometimes during these types of things. It was rare though. “How you doing?” He asked. Pam inhales deeply before sighing, “You know, I just got a coffee from the Diner. Then I get called up for this,” She looks down at the body.

“How long before they get the prints?”

Amber sighs, “Well, there were no weapons around the area, but we might find some on the body. May take two days,” She says. Andy looks down at the body once again. The flashes around her made him feel sick in the stomach again.

How would his daughter think?

He doesn’t want to come home and say her best friend died. Murdered nearby their favorite park.

“Give me the papers after they are filed,” Andy says, Pam nods, “I’ll call you if anything comes up.”

“I’m sorry. I just... I have to go,” He said to them, they nod, knowing this was his daughter’s friend. The body was not yet to be proven it was her just yet. Her face was turned away from them, but he knew by the dress she wore. He heads out of the park trail and hopped into his car.

He closed the door and grabs the wheel. He leans forward into his wheel. He’s taking the case of his daughter’s best friend. He’d have to investigate the students someday.

.

Andy reaches back home, leaving his car in the garage. He walks into his home and sees Milo run up to him. “Hey, bud...” He says lowly, petting the dog nonchalantly. He hears heavy steps upstairs as they come down. “Hey, dad,” Y/N says, she stops to see his face. “What’s wrong?” She asked.

He stared up at her but then managed to smile, “Nothing I just... I planned on going on for dinner tonight.”

“Really? Where?” She asked. He sees her come down the stairs, “The diner. I just thought we would like some family time, you know?” He says. She smiles and hugs him, “That’ll be nice... Thank you.”

He reaches up to caress her head, he stared at the wooden floor. The thoughts of Alice and her body in that pond. He wraps his other arm around her back.

“You’re welcome.”

~~~

Oh, man...

I gotta work on that part two for that Chris Evans imagine

Hope you guys are doing well!

TAGS:

@joannaliceevans-fanficblog @jtargaryen18 @princess-evans-addict @chrisevans-imagines @elliee1497 @ifuseekamyevans @rororo06

Want a tag? Just ask!

#chris evans x reader#chris evans#andy barber#andy barber x reader#defending jacob#apple tv series#crime drama#cevans#jacob barber#avengers#captain america#laurie barber#daughter of the barbers#murder#crime murder#crime#tv drama#tv crime

82 notes

·

View notes

Text

-- && guests may mistake me as ( andy biersack ), but really i am ( liam sullivan + cis male + he/him ) and my DOB is ( 12/28/93 ). i am applying for the ( banquet manager ) position as part of the EHP and would like to live in suite ( #203 ). i should be hired because i am ( + loyal, charismatic, driven ), but i can also be ( - distracted, opinionated, pushy ) at times. personally, i like to ( watch documentaries, play poker, get tattoos ) when off the clock, but that won’t interfere with work. thank you for your consideration!

ooc;; it’s ya girl kay again, i’m so so sorry adfjlaksfj. this is liam, he’s a brain baby of mine that i played a little while ago and he’s been haunting me since i stopped playing him so here he is to be a part of y’all’s lives. hopefully you dig him, if not......... well that’s fine, too. can’t make you do anything, i’m not your mom unless you’re card; go to your room, card.

TW’s: Mentions of prostitution. Abortion. Drug use, drug addiction, drug overdose, & drug related death.

fast facts / personality details;;

( i put these first this time because the background is A Lot on this one okay )

has a rather protective and care-giving nature mixed in with his excellent work ethic and drive.

loves when guests ask for the manager and he gets to come out and see how much they didn’t expect the manager to be a 6′4″ beanpole with neck tattoos.

lives by the ideal “put your money where your mouth is” ; also just like, be genuine and up front with him in general, like he’s not an asshole, but also he knows how to deal with assholes, so let that be said

has a five year old german shepherd named Roxy that he rescued from shelter overflow when she was only a six month old puppy; Roxy still thinks that she is a small lap dog despite being a Big Girl

still wears the ring that his mom gave him for his eighteenth birthday every day, despite the issues that they had, and despite her being gone now.

has his nose pierced and his lip pierced, though the lip ring he takes out for stretches of time; the nose ring is always in, though.

absolutely covered in tattoos, in case that wasn’t already painfully obvious. he loves getting them and yes, still has room for more, will continue to get them probably forever.

prefers brown liquor over pretty much any other alcohol, though he’s not opposed to a good draft every once in a while

listens to more classical music than anyone would ever probably expect of him; that being said he also listens to a lot of classic rock and, naturally, a dose of pop punk, too, for fun.

he likes listening to true crime podcasts and watching various true crime / serial killer documentaries; criminal minds is also his favorite show. so like don’t piss him off, i guess ajdkfljasdklf

smokes cigarettes like he’s a motherfucking chimney; says he’s working on quitting, has yet to actually start that process.

generally just a supportive person; if Liam cares about you in any capacity - even if it’s just because you work together - you’ll know it. he likes to help the people around him, try to steer them in the right direction, offer them advice.

he’s not a shy person, in fact he’s rather social, and while there’s a dry humored joke or a sarcastic toy here and there, he’s a pretty genuinely nice dude. despite the things that he’s seen and been through in his life, he’s worked really hard to stay optimistic, and driven throughout and so far he’s been very successful at that.

dresses rather nice / got that business casual look down with the short-sleeved button ups or the long-sleeved ones with the sleeves rolled for work purposes. however, outside of work it's like a cat and his wardrobe were in a trash bag together. lots of black, and dark earthy colors, too. the duality of man.

background / life story;;

Liam Travis Sullivan was born and raised in Las Vegas, Nevada, where his mother, Stephanie Sullivan, was an escort / call girl on The Strip.

Stephanie getting pregnant was a tremendous ‘oops,’ but she kept the baby anyway. The baby’s father was a client who had a wife and kids already, so he paid Stephanie a whole lot of money to stay quiet and out of contact with him. This money allowed for her to take time off from working to be able to have Liam and take care of him for a bit.

Liam really was Stephanie’s whole world once he was born; the best thing that she ever did, as she so often told him through the years.

Liam never knew his father, but he put two and two together once he was old enough to understand what it was that his mom did.

Liam was three years old when Stephanie finally returned to working on The Strip. He was left in the care of some of Steph’s other ‘working girl’ friends on the nights she happened to be working.

He got very accustomed to spending his time around females, having a heavy female influence in his life as he grew up -whether that particular female influence was always the best or not. It led to his respect for women, though, and his ability to feel very comfortable around them, even from a young age.

When Liam was six years old, Stephanie ended up pregnant again. However, this time she ended up actually having an abortion. Liam only knew about it because his mother rambled about it to him in an overemotional drunken state. She told him that “he was her good boy and all that she needed.”

Working The Strip -as notorious a place as it was- and making the money that she did left Steph open to a lot of drinking and drug use.

At eight years old, Liam found a stash of his mother’s cocaine in their bathroom. This earned a distressed meltdown from Steph about him staying away from that sort of stuff because it was bad. Though, as a developing child gaining understanding of the world around him, that proved to confuse Liam because he didn’t understand why his mommy had it and was doing it if it were so bad.

Liam was ten years old the first time that his mom overdosed. This instance just involved going to the hospital to get her stomach pumped and spend the night on a fluid IV, but it was still terrifying for the boy at the time.

Stephanie struggled with drug abuse for most of Liam’s life. Living where they did facilitated it so easily and also made any getting caught up in the law with it rare -it was Vegas, after all, not to mention Stephanie was in sex work, so the law wasn't always looking out for her anyway.

Right before Liam was about to start high school, the young teenager -already having had to do so much growing up so early and so fast- took it upon himself to give his mother an intervention of sorts. He told her that if she was going to keep taking time with her away from him that he was going to run away, figure life, out himself, even if he did end up in the foster system or something. He pleaded with her that he didn’t want to lose her, that he wanted her there for all the things his life could still have in store for him. Ultimately, after many tears and a lot of convincing, Steph let her fourteen year old son flush her drug stash and they made a very rushed plan to finally get out of Vegas.

Moving to California was really good for the both of them for a while. Being in a new place meant starting fresh, moving forward. Stephanie didn’t know anyone she could get drugs from; between that, the support of her son, and finding help at local NA meetings, she managed through the withdrawal and the struggling. She got a stable, more normal job, working at a sports bar -bartending and waiting tables.

Liam easily adjusted to the change of environment. He practically thrived in Los Angeles. Before he knew it, he had friends, got into playing football at his high school, was losing his virginity. Fast-paced and unconventional were ways that Liam was used to living his life, so getting into things like physical relationships with girls, despite how young he was in reality, felt normal to him in all his adjusting.

Things stayed going really well for pretty much the whole first year they were in LA. Liam did well in school, got a part time job to help his mom out. Steph ended up picking up a second job to stay busy and keep money coming in. They were good, they were better than they had been, and they had each other.

The summer before Liam’s junior year of high school, he caught his mom using again. Evidently it had been going on for a few months already at that point, and because of how busy he was with school, friends, and work, he had caught on late. Stephanie argued with him on the matter, told him that it wasn’t his business to worry about, among other unexpectedly harsh things. It was the first real, legitimate fight he ever really had with his mom, at least the first one that really mattered.

With too much riding on his focus on school and football -given he had since come up with the goal to go to a good college, to make something of himself and do good things- Liam shut himself off from his mom for a little while. They lived together, came and went about their lives, but they spoke minimally, Liam didn’t fight more with her despite knowing that she was still using at the time. It was very odd for him, to have any sort of bad energy between him and his mom -it was so rare, it had always been just the two of them. He decided, though, that he had to focus on himself and his future.

Senior year came with the promise of scholarships, multiple college scouts having their eyes on him, more than one girl interested in dating him, a wide friend circle, a basic car he had been able to buy for himself, and a growing savings account. Liam was doing great, he was on the right track, focused. Stephanie, however, had downward spiraled. Her using had gotten out of hand to the point of losing both of her jobs, having to get a new one in a setting that was dangerously close to the things she had been doing in Vegas -a strip club.

It wasn’t until Liam’s Winter Formal that year -Stephanie deep into her continued cocaine addiction- that something changed. He was in his suit, getting ready to leave to go pick up his date when his path crossed with Stephanie’s. Upon finding out where her son was heading, who he was going with, the friends he was meeting -details she hadn’t been knowledgeable on for some time at this point- the woman burst into tears. She sobbed apologies to her son, begged him to forgive her for missing out on his life, made promises to him that she would get better for him -promises Liam tried not to take to heart; he had learned.

They did get Stephanie into a rehabilitation clinic shortly after the holidays. She had to sober up a little bit and once again Liam shouldered the responsibility of getting rid of the drugs that she had in their apartment. He spent two months alone in their apartment while his mom worked through her issues, sobered up fully, came back to him. It was an exhausting couple of months for him, trying to be a self sufficient adult in an apartment that had to have things paid for in it, while also juggling school and football, but he managed.

Stephanie came home a different woman than she left, and upon getting a more functional version of his mother back, Liam had the tiniest glint of hope that maybe things would be okay again. Graduation was looming, and he had a few different schools that were more than willing to offer him full ride football scholarships to their universities. Notre Dame, Duke, UCLA, among other state-based colleges all had eyes on him. It was something he could finally talk to his mom about.

While Stephanie encouraged him to follow his heart, follow wherever his dreams were gonna take him, Liam couldn’t shake the idea of being far from home -or, in particular, being far from where she was. Things were so fragile with her and her addiction, it was so much more possible for something bad to happen and him to have absolutely no idea about it if he went far away. So despite the incredible opportunities he could have had elsewhere, he chose to accept to scholarship from UCLA out of all the schools who chose him.

Going to college, let alone such a prestigious and well known state school like UCLA was like something out of a fairytale for Liam. Looking back on what his life had been up to the point of graduating high school and moving on to bigger things, he was amazed at what he had accomplished. Given the healthy and sober way that his mother still was at the time of his high school graduation, she, too, made it a point to make sure he knew how amazed and proud she was of him.

College wasn’t quite as easy for him as high school was, but that just drove Liam to work even harder. He wasn’t going to waste the opportunity he was given. He was double majoring in business and marketing; even though he had little idea what sort of business he wanted to be a part of, he knew that he wanted something for himself, something that could do good, give back in some way shape or form. Those subjects would do a lot to help him get there, he knew that much.

Stephanie stayed sober for most of Liam’s college experience, after the help of going to rehab, and the continued going to NA meetings. He popped back to the apartment every now and again -having moved into campus living during the semesters- and that helped her, too. Things seemed really good for quite some time, but having the other shoe drop once again unfortunately didn’t come as too terribly much of a shock to Liam. She had been getting involved with some guy she knew from work, they’d been sleeping together, and what Liam didn’t know is that they frequently went out for drinks. Drinking slowly but surely progressed into getting high together; something easy for Stephanie to fall into, particularly because of her habit, but also because of the familiarity of the circumstances -it was awfully similar to when she was working on The Strip and would get wasted with clients.

Liam was in his last semester of college, just about three months shy of graduating with his bachelor’s degree. It was a huge deal for him, it was something that he wasn’t going to give up for anything in the world. Still, he made it a point to help his mother after she called him absolutely high out of her mind and apologizing to him while he was pulling an all-nighter on an assignment one night. He didn’t ask many questions, just the basics, and he looked into a place himself -a rehab center that was further away, lengthier and more in depth with their programs. Before, they had gone with what was convenient, facility-wise, but he wasn’t going to make that mistake twice. If his mother needed more special attention, he was going to get her to that.

Getting his degree was a gift, a blessing he in reality never thought would be his. While his mom was still in rehab at the time of his graduation -Liam insisted that she not leave treatment just to come to the ceremony- she still wrote to him consistently, sent him a congratulations card right around the day of the ceremony. Liam was in a position in his life that awed him in a way, ready to take on the world.

Pursuing the concept of his own business sort of took a back seat; having just gotten his degree, it wasn't like Liam could immediately leap into much, not to mention he didn't have the funds. He had been working and saving all through college - served, cooked, and bartended at a grand total of six different restaurants in Los Angeles by the time he graduated - but on top of any business itself being expensive, school itself was expensive, too.

By the time Liam was twenty-four years old, he was managing two bars, and co-managing a restaurant out in Los Angeles. He was living on his own, keeping tabs on his mother sporadically, but mostly working toward a goal for a business of his own. He was teetering between a pub of sorts, or a burlesque club - two wildly different ideas, but both with the same idea in mind; somewhere entertaining but somewhere that also provided a sense of community, somewhere he could give jobs to people that needed them - perhaps that was inclined to women, from his subconscious protection of his mother, but that was beside the point.

A coworker of his at one of the bars he was the bar manager of ended up being who presented a move out of Los Angeles to him. There was potentially more business opportunity somewhere out of that location, out of the state of California, even. Chicago was brought to the table, this friend having heard of a program that offered employee housing at a luxury hotel. Liam was apprehensive about the Malnati at first, given he didn't want to have to start on a bottom rung in terms of his job once again. As it turned out, however, there was a management position that was generally up his alley. Seeking opportunity and further growth wherever he could find it, Liam made the move to Chicago.

Things between him and his mom had been more distant over the year since he graduated college, and in his move to Chicago, he couldn't say he was surprised to end up hearing about things getting bad again for his mom. It was a moment of true growing up for Liam, realizing that he had to be responsible for himself, he had to do what he needed to do, he couldn't carry his mom anymore. If she didn't want to get better and stay better, he couldn't be the one derailing his life to continue to try to make her do so.

That first year of him living in Chicago, working as the banquet manager at the Malnati, his mom overdosed for the last time. It was unexpected in the same way that it wasn't; Liam went through a brief period of a numb sort of grieving - he was of course sad to have lost his mom, to have to come to terms with the fact that he'd never get to see or speak to her again. He also, though, had to face the fact that as dark and upsetting as the circumstances were, they were out of his hand, they were not his responsibility. He mourned his mother as she deserved, and he went on with his life; because deep down he knew that she would want that for him, anyway.

Liam has been living in Chicago and working as the Malnati's banquet manager for the last nearly-three years now. He oversees more than just a restaurant and a bar now, and it's expanded his career experience in ways that he is very thankful for. It's a little bit on the backburner once again, but definitely not forgotten, that he intends to have his own business some day. Perhaps more than one, even. He loves the organization and the hard work and dedication that go into leading - whether that be a kitchen or a bar or an event. He likes to be supportive as much as a leader - Liam wants to see his team succeed; if there's slack that needs to be picked up and he can help, he will. He's not going to bark orders and call it a day, that's not what he's about, that's not what he considers his job. He's got a good head on his shoulders, and a good work ethic, and he likes doing what he does.

wanted connections;;

IT’S TIME ONCE AGAIN FOR ME TO FAIL AT THESE LMFAO

Liam in his job oversees chefs, bartenders, servers, room service runners, and musicians, so like we got a whooooole lineup of connections to be had there; he’s their boss yeah, but as I’ve said like a million times now he’s really active in trying to help his team succeed. he’ll help out on the bar and running food and covering breaks or callouts or whatever, so like there’s a lot of good potential relationships to be had there.

other managers bc we love seniority adfjlkasdfjk no i’m just kidding, but still we love some manager pals why not

idk i think it’d be really funny to have someone who’s like intimidated by him simply because of the way that he looks and he’s like look i’m really not that bad i just like tattoos a lot okay lmAO

a casual hookup here or there is chill; he’s not super into the fwb thing? like he’ll stay friends after a hookup if the other person is cool with it, but as an ongoing thing it just gets too complicated for his liking.

pet parent friends; his girl Roxy is a friendly giant baby and he adores her, bring him some parent friends and her some dog friends

tattoo pals of some variety?? even if it’s just him constantly encouraging people to go get tattoos, or talking them through processes? going with them for moral support because he barely even feels it when he gets tattoos now?? who knows

honestly we been knew i’m up to just talking shit out and winging it a lot of the time too so just hit me up if you wanna figure some stuff out with this inked up beanpole okay? okay ily.

#liam. | about#liam. | headcanons#this is EXCEPTIONALLY LONG LMAO I'M SO SORRY#there's a lot to take in#if you made it through the whole thing you may be entitled to emotional compensation

9 notes

·

View notes

Text

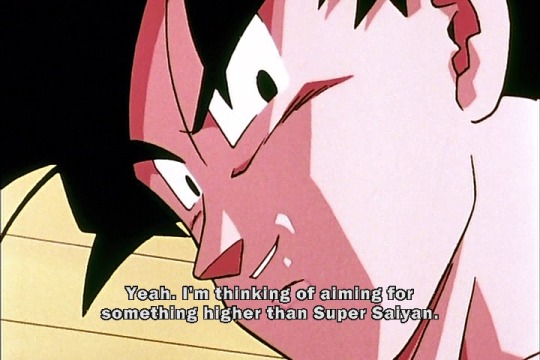

Dragon Ball Z 147

So Goku’s healthy again, but he knows he’s no match for the androids or Cell. So before he tackles them, he’s planning to train himself to surpass the Super Saiyan form. He doesn’t know if it’s possible, though, so he figures that if he can’t pull it off in one year, he’ll give up.

Of course, the situation right now is pretty desperate, and the world may not have that much time, but Goku’s got that angle covered.

He asks Chi-Chi if he can bring Gohan in on his plan, and Chi-Chi agrees, since she knows there’s no point in arguing with him on this. She only asks that he get the job done right, because she wants him to study hard when he gets back. Also, she wants Goku to get a job when this is all over. Ha ha, the joke’s on her, he’ll be dead by then.

Then Goku kisses her goodbye. The Funimation dub uses a pretty distinct sound effect for this. The Japanese version, less so, although you can hear something. Honestly, the lack of a sound effect makes it more apparent just how long this lasts. It’s like a Big Red commercial. The gum, not the soda.

Does anyone remember Big Red soda? I always thought it was weird how there was a gum and a soda with the same name. I’ve never tried the soda because it looked nasty.

I looked it up and apparently the soda is still around. They also make Big Pineapple, which I think I’ve seen at the store before. Also, they used to make Big Orange, which explains this Andy Griffith bit my dad used to listen to, where Andy portrays a hillbilly who sees a football game for the first time, and the only thing he understands is the Big Orange he gets at the concession stand.

Apopros of nothing, “Big Orange” is the name I gave to the big goldfish that swims at the edge of the lake outside my apartment. There’s more than one, but whatever. They call all be Big Orange.

So then Goku teleports to the other Z-Fighters, just as Krillin is wishing that he were back. Yamcha’s plan to pursue Cell in an aircraft isn’t panning out, because it’s too slow to get them where they need to go before Cell leaves. Goku could teleport them, but he’s been laid up all this time, until now.

Krillin jumps on Goku like my mom’s dog jumps on me. This is nice and all, but it begs the question: Why doesn’t Goku just use instant transmission to help Piccolo hunt down Cell? It never gets answered, although I suspect at this point Cell’s already become too strong for Piccolo to beat, and right now he’s the strongest good guy.

Goku addresses Piccolo as “Kamiccolo” because he already knows that Kami and Piccolo have merged, but Piccolo hates that name, so he tells him to just call him Piccolo. Seriously, did he just now realize that this was going to be an issue? This is probably the most Piccolo thing ever. Telling everyone you’re not Piccolo anymore, and that you no longer have a name, but then realizing days later that people will need to call you something, so it might as well be Piccolo.

Goku’s planning to use the “Room of Spirit and Time”, which he used once before while training on Kami’s Lookout to fight Piccolo at the 23rd Budokai. The dub calls this the Hyperbolic Time Chamber, which I’m going to be using from here on, because it’s a much cooler name. The gimmick here is that one year passes inside the Hyperbolic Time Chamber, while only a single day passes in the outside world. So Goku could get a year’s worth of training while Cell only gets one day to hunt for the androids.

Like Dr. Gero, the Time Chamber is a retcon. I remember watching the original Dragon Ball hoping to catch either one of these being mentioned, but it just never happened. There were those filler episodes that showed Goku using a special room that seemed to send him back in time. But we never saw him use a room where time moves slower. So that’s why he has to talk to Kami about using it again, and since Kami is now part of Piccolo, we need Piccolo to recall the time Goku used it as a boy.

Of course, according to Piccolo, Goku couldn’t stand to use the Time Chamber for more than a month, which would be about two hours to the outside world, so maybe it’s just as well that the 23rd Budokai arc never covered this.

Of course, Goku’s a lot stronger today, so he ought to be able to handle a full year inside the Chamber. He collects Gohan, and prepares to teleport them away, but Krillin asks him a question before he leaves. With this new crisis, is Goku scared, or is he happy to face such a terrible foe. Goku replies: “Both”.

Goku’s next stop is to find Vegeta. Trunks is there with him, though he complains that he isn’t getting anywhere. Vegeta refuses to work with him, and as far as Trunks can see, Vegeta isn’t actually doing anything.

He’s just been staring out into the distance like this for three days. Yeah, Vegeta’ll do that.

But Goku takes one look and immediately understands what Vegeta is really doing. He’s beginning to grasp the concept of ascending beyond the Super Saiyan form. He can’t pursue the goal until he first understands what it is. I’m not sure I get why it takes three days of contemplation to do that, but I like that Goku gets it and validates Vegeta’s behavior.

This is an important part of Vegeta and Trunks’ relationship. It’s easy to side with Trunks, since Vegeta is very clearly a dick, but there are times when he knows best, and in situations like these, Trunks isn’t always able to appreciate his father’s wisdom. It’s also kind of a lonely thing for Vegeta, because the only person in the universe who seems to understand him is Goku, whom he considers his worst enemy.

So Goku invites him to spend a day in the Hyperbolic Time Chamber. Vegeta is too intrigued by the opportunity to pass this up, although there are some terms. The Chamber is designed to accommodate two people at a time, and since they don’t have much time to work with, it’s important that they double up. So Vegeta won’t have to train with Goku, but he will have to share the chamber with Trunks. Vegeta agrees, but only so long as he gets to have his turn in the HBC first.

Meanwhile, the androids have finally arrived at Goku’s house. They apparently trashed the place when they didn’t find anyone, and 18 is helping herself to Chi-Chi’s wardrobe, thought she can’t find anything she likes. However, she’s wearing a new outfit, which I always assumed belonged to Chi-Chi as well, but the anime doesn’t make that clear. Did they stop in some other town on their way here? I have a hard time seeing that, considering how remote the location of Goku’s house is. And yet, this doesn’t look much like something Chi-Chi would ever wear. Then again, we never saw Goku in his Fred Flintstone outfit before or after the Driver’s Ed episode. I like to think he and Chi-Chi run around in those clothes every once in a while.

18 to Goku: Damn, bitch, you live like this?

They ask 16 if he knows where Goku is, which seems like something they should have asked a long time ago, but whatever. Doesn’t matter, because 16 doesn’t know where Goku is at this moment, but he does know that if he’s not home, then he’s probably at Capsule Corp. or Master Roshi’s island. Kame House is closer, so they decide to check that one out first. This time, they just fly, so I guess everyone got sick of the frozen food delivery van.

Meanwhile, Cell’s still at it, and the Z-fighters still can’t catch up to him.

The Saiyans all go to the Lookout. You notice how the Nyoibo is sticking out of the bottom? I’m not entirely sure when that came back, but I’ve been halfway paying attention to this, because I never understood when/if Goku recoverd the Nyoibo after his first trip to the Lookout. He had it with him when he arrived at the 23rd Budokai, and I’m pretty sure it wasn’t attached to the Lookout during the Saiyans Saga or the Garlic Junior Saga. But here lately, it’s back.

Popo leads the group to the Hyperbolic Time Chamber, which has been stocked with food. It also has plumbing, however that works.

Vegeta asks why Goku would let him in on this secret, since he’s made no secret of his ultimate goal to surpas and kill him. Goku explains that their current enemies may be too much for either of them to handle alone, so it just makes sense for them both to get as strong as they can. The unspoken message here is that Goku doesn’t sweat Vegeta. If they both use the Time Chamber, then they’ll both get the same amount of time to improve, and Goku thinks he’ll come out ahead, or at least stay even with Vegeta.

As agreed, Vegeta and Trunks take their turn first. From the outside, the HBC just looks like a big wooden door.

But once you step through the door, you end up in some other dimension. The only feature here is a small structure that serves as living space for the occupants.

Beyond that, there’s just nothing but empty white space. There’s some sort of ground here, but it’s not really clear what it’s made of. I wonder what it feels like to touch it. Also, as Trunks observes, the air is thinner, and the temperature is hot. The gravity is also higher.

Trunks is beginning to wonder what he signed up for here...

Vegeta’s more optimistic about the harsh conditions. This isn’t a spa, after all. It’s supposed to be a harsh environment for the sake of better training. Even so, you can see the sweat running down the side of his face. Even he’s a little unnerved by this.

About a day later, Picccolo and the humans haven’t made any progress in chasing down Cell. We find them here, sleeping on the floor of Kame House. Pretty sure Piccolo doesn’t sleep, which is why he’s watching TV instead. Whose coffee is that?

Then the androids drop in.

Piccolo refuses to tell them where Goku is, so that means they gotta fight it out. So Piccolo leads them to a larger island where they can get it on. He tells the others to stay behind, since they wouldn’t be strong enough to help.

Cute shot of 18 here. 17 plans to fight Piccolo himself, since 16 never wants to fight anyone but Goku, and 18 took care of Vegeta last time. 17 tells Piccolo that he really will kill him this time unless he talks, but he doesn’t know that Piccolo’s gotten stronger since their last encounter.

Then Piccolo turns a bright mauve color. Well, not really, but I have no idea what they palette swapped him like this.

#dragon ball#2019dbliveblog#imperfect cell saga#imperfect cell#cell#goku#chi chi#master roshi#piccolo#vegeta#trunks#gohan#tien#krillin#yamcha#android 16#android 17#android 18#mr popo

21 notes

·

View notes

Text

Wildfire Records: Breaking America - Chapter Three

Word count: 1813

“For God's sake Patricia, it shouldn’t be so difficult to find a vein in a junkie surely?” The harsh sound of who he assumed was the matron berating a more junior nurse was what brought him back to the world. His eyes flickered and he immediately squinted as fluorescence attacked his corneas, flinching slightly as the nurse apparently found a vein.

Andy blinked as he looked at those at his bedside, trying to swallow in a mouth dryer than the Sahara.

“Here..” the younger nurse spoke and handed him a cup of water with a straw once she had finished ensuring that the drip was properly attached to him, “you shouldn’t be awake yet, you’ll probably fall back to sleep soon..”

“Wh—“ he tried to speak but his throat wouldn’t allow him, so he sipped more water with a wince. Why did his throat feel like it had been ripped to pieces? “Where am I?” He managed a whisper, and the nurse took the cup back from him once he had finished.

“You’re at University College Hospital sir, your—one of the girls you were with called an ambulance when you overdosed in your hotel room.”

Well shit. Now he wished he’d bothered to remember their names. One of them had saved his life.

“I’m going to need to take a few details from you before you got back to sleep Andy” The nurse spoke, and he could feel the drugs working to lull him back into that dreamless sleep.

“Mm..” he responded, nodding.

“I need your last name and your emergency contact. One of the girls gave us your phone but we couldn’t get hold of your dad.” Typical. Andy had been on the brink of death and his dad hadn’t even bothered to answer the phone. Maybe he wouldn’t be disappointed after all, maybe he wouldn’t care. It was both a comforting and traumatising thought.

“My last name is deMaine.” He spoke, sipping water from the mug the nurse had filled but passing it back to her as he felt the drowsiness kicking in even more. “And uh I don’t really have anyone.”

What a horrible truth that was. He used to be able to count on Danny and Josh, used to introduce them to others as his brothers and now he had pushed them away along with everyone else in his life. Scared, and properly sober for the first time in years, he wrote down a number and a name for the nurse to call, hoping to God that they would show.

He awoke to the soft sound of a guitar, the room still bright but he somehow felt better. Azure hues moved to an uncomfortable feeling in his arm where the drip was still attached to him, and when his eyes scanned the room he could have sworn he was hallucinating.

Josh sat on a chair with one foot resting against the bed, his soft guitar tones tinkling through the room as Danny turned a page in the book he was reading. Neither of them seemed to have noticed he was awake, and this was so strange that he was starting to think that he wasn’t.

He moved only to push himself up on the bed slightly and the two men looked up immediately, the relief in their eyes something he had never seen before. He had never known people to be concerned for him, at least not to the point where they would actually come and wait by his hospital bed.

“Oh thank God..” Danny sighed, his entire body relaxing. He hadn’t even realised that he was so tense until he saw his friends eyes open, and he glanced at Josh who had stood and placed his guitar in his chair.

“How are you feeling, man?” Josh spoke, worry in his eyes. He had given Danny’s name to the nurse in the hope that he would come, but he had never expected Josh to come too. He had forced himself on his girlfriend only hours ago. Wait.. how long had he been asleep?

“I..” Andy tried to speak but his throat was dry again, and Danny offered him a cup with a straw. When the cool water had soothed his throat a little, the redhead pushed himself further up. “I feel like I’m on the world's worst come down, but I’m alright..”

He glanced at Josh who was watching, and although Andy could see now that there was a flash of anger in his friends' eyes, he didn’t blame him.

“Well yeah..” The blonde spoke, “The nurse told us you had almost 5 grams of coke in your system, and like 120mgs of MDMA.” Josh shook his head, and Andy's eyes widened at the numbers. He hadn’t realised he had taken so much, didn’t look or ask as to the doses of the pills that were given to him. “You were partying for like three days straight, I don’t know how you’re alive..” His tone was jovial, a small laugh accompanying his words, but the redhead could tell that he was being serious.

“Wait, what day is it?” Andy spoke, eyes darting to the clock on the bedside table, guilt wracking through him as he realised how much studio time he must have missed.

“It’s Wednesday… you’ve been asleep for almost two days.” Danny spoke, moving the straw back to the redhead's lips and he gratefully sipped as the seriousness of the situation settled in.

He had lost almost a week of his life, and what for? Sure it had been fun to have an orgy with four girls but had it been worth almost dying? Those girls didn’t even stick around to see if he would live.

“I’m—“ he choked up, shaking his head in disbelief, “I’m sorry for that night at the gig..”

He glanced up at Josh and saw the blonde's jaw clench. Obviously being called to see Andy on his deathbed hadn’t helped him deal with the situation and he redhead didn’t blame him. He had full on kissed his best friends girlfriend, and in front of him.

“Listen, I’m not saying I forgive you because I don’t. Not yet. It’s too soon after the incident. But I know that..” he sighed and licked his lips, “I know that it’s not entirely your fault.”

“I really did think she wanted me to kiss her..” he spoke although he wished he hadn’t. Josh brought his hand to his face and pinched the top of his nose as he struggled to maintain composure.

“Now is not the time to talk about this..” Danny spoke before either of the men could make it worse, “we came because we want to make sure you’re alright..”

“You didn’t have to..” The redhead spoke once more although he was so glad they were here. He had expected Danny to be the only one to show, the only one who cared, but it was Josh that shook his head and furrowed his brow in disbelief.

“Yeah we did..” he uttered, clenching his fists against the bar of the bed once more before seeming to calm himself, “it doesn’t matter what you did, you’re still our friend.”

Andy had never felt affection like this before. In his 26 years on earth, he had come to terms with the fact that no-one gave a shit, not really. And yet here were his friends, men he had treated so badly, standing by his hospital bed and proving otherwise.

The redhead cleared his throat as he fought back tears, moving to sit even straighter and taking the cup from Danny.

“I uh... I’ve been thinking you might be right.” The redhead directed at the brunette. “I think I might need some help.”

Danny and Josh let out a small laugh at the understatement, and Andy couldn’t help but chuckle too. It was stupid, this whole thing. He should have listened to his friends months ago when they had tried to get him to at least cut-down. At least they were still here.

“I’ll get the nurse and we can talk about some options hm?” Danny spoke, and Andy nodded. “There are some others who want to see you too..”

The drummer opened the door and called the others in, and Josh pursed his lips as Andy’s ECG spiked as Victoria walked into the room.

“Oh thank God, I thought you were going to die..” she spoke, moving over to him and wrapping her arms around him, the ECG bleeping faster as he ran his fingers through her hair for a moment. She pulled back only to punch him in the arm, “don’t you dare fucking do that again, you hear me? We were so scared!”

She stepped back, her hand absentmindedly reaching for Josh’s and Andy swallowed a knot which formed in his throat. For a second he had thought that Victoria felt something again, he had remembered his dying thoughts of how much he loved her. This beautiful woman had been his only thought, apart from a stupid image of his father, as he descended to Hell. He knew then what love really was. He no longer prioritised having her, holding her, kissing her. He just needed for her to be happy. The world would be right if she was happy.

Juliet’s arms were next to wrap around Andy, and he held her close for a moment before she pulled back with a sad smile. “We’re gonna get you a nurse and some information on facilities… you know you might have to go into a residential place, right?”

Andy sighed and nodded, “I'll do whatever is best, I.. it sounds stupid but I just didn’t realise something like this could happen.”

“It doesn’t sound stupid,” Victoria spoke, and he realised that she was probably the only person in the room qualified to agree with him. She had been doing drugs with him for months when they were together. God what hell he had forced upon her. “You always hear about it, you just don’t think it will happen to you..”

He nodded, glad that someone could relate even though he was the reason she could do so.

“Well it did, and it’s done,” Juliet spoke, her logical tone shining through and Andy was glad for it. “Now we just have to make sure it doesn’t happen again.”

The redhead nodded, looking toward the door where the nurse from before came in with a sympathetic smile. He hated when people looked at him like that, hated false sympathy but he supposed it went hand in hand with being hospitalised for an overdose.

She sat on the end of the bed and the others moved to sit on the side of the room, Danny’s hand squeezing Andys shoulder slightly before he retreated.

“So Andy,” the nurse began, “let’s talk about how to get you clean.”

2 notes

·

View notes

Text

Friday Night Lights {ACOTAR}

Chapter 11

Summary: Inspired by the series Friday Night Lights. In a town that is obsessed with football, a group of teenagers are glorified for what they bring to the field. But what the people of Velaris don’t realize is that there is a lot more to life than football, and it’s not always pretty.