#and tax evasion....

Text

Obsession? I don't have an obsession! Who said I have an obsession?!

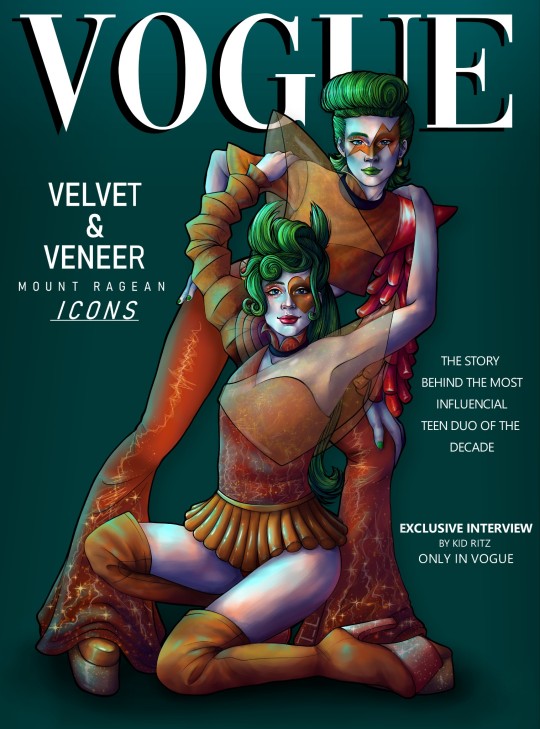

Anyways, here's more Velvet and Veneer fanart. (They deserve to be on a vogue cover. Who are we kidding. They are literally ICONS)

(Click for better quality)

Their outfits are based on this silly little concept art that i love very much:

#velvet trolls#be gay do crimes#their only crime was slaying too hard#and torturing trolls#but we dont talk about that part#and tax evasion....#trolls 3#trolls fanart#dreamworks trolls#veneer trolls#velvet and veneer fanart#velvet and veneer#trolls band together#gay rights but also gay wrongs#this is prime wlw mlm solidarity#velvet and veneer trolls

1K notes

·

View notes

Text

imprisoned for his crimes

#his crimes are arson larceny murder tax fraud tax evasion serveral counts of aggravated assault and so many more#really glad this was in my drafts#digimon#tokomon#digimon adventure

6K notes

·

View notes

Text

#kirby#splatoon#bugsnax#turnip boy commits tax evasion#nintendo#funny#lol#humor#meme#gaming#video games#ps4#ps5#switch#nintendo switch#splatoon 3#lore#kirby and the forgotten land#retro#retrogaming

2K notes

·

View notes

Text

Pukicho was in a plan of some sorts with a lawmaker to evade taxes and disappear. They said goodbye over Tumblr, along with revealing almost the entire plot, yet somehow it wasn't discovered by the police/news.

487 notes

·

View notes

Text

Arthur: What are you talking about?! You’re the most important person in my life!!! I love you more than anything- I’d marry you if I could!

Merlin: why don’t you?

Arthur: BECAUSE EVERY TIME I ASK YOU, YOU CALL ME AN IDIOT!!!

Merlin: That’s because it’s a stupid idea.

Arthur: SEE!!!

#merthur#merlin bbc#merlin emrys#arthur pendragon#merlin x arthur#merlin incorrect quotes#they probably got married on accident tbh#like some Vegas incident or something#but like- if Vegas had a medival version#probably did it for tax evasion reasons too#it was definitely fake at first and then it just kind of… evolved

505 notes

·

View notes

Text

All animals instinctively understand how to commit tax evasion. Most never have the opportunity to put that understanding into practice, but together we can change that.

4K notes

·

View notes

Text

They have seen your crimes against the government

#submas#submas ingo#submas emmet#Pokémon#they saw you commit tax evasion and are disappointed#I’m making a new comic yipeeee#they might also be looking at your search history#plz spare their innocent eyes

370 notes

·

View notes

Text

Microsoft put their tax-evasion in writing and now they owe $29 billion

I'm coming to Minneapolis! Oct 15: Presenting The Internet Con at Moon Palace Books. Oct 16: Keynoting the 26th ACM Conference On Computer-Supported Cooperative Work and Social Computing.

If there's one thing I took away from Propublica's explosive IRS Files, it's that "tax avoidance" (which is legal) isn't a separate phenomenon from "tax evasion" (which is not), but rather a thinly veiled euphemism for it:

https://www.propublica.org/series/the-secret-irs-files

That realization sits behind my series of noir novels about the two-fisted forensic accountant Martin Hench, which started with last April's Red Team Blues and continues with The Bezzle, this coming February:

https://us.macmillan.com/books/9781250865847/red-team-blues

A typical noir hero is an unlicensed cop, who goes places the cops can't go and asks questions the cops can't ask. The noir part comes in at the end, when the hero is forced to admit that he's being going places the cops didn't want to go and asking questions the cops didn't want to ask. Marty Hench is a noir hero, but he's not an unlicensed cop, he's an unlicensed IRS inspector, and like other noir heroes, his capers are forever resulting in his realization that the questions and places the IRS won't investigate are down to their choice not to investigate, not an inability to investigate.

The IRS Files are a testimony to this proposition: that Leona Hemsley wasn't wrong when she said, "Taxes are for the little people." Helmsley's crime wasn't believing that proposition – it was stating it aloud, repeatedly, to the press. The tax-avoidance strategies revealed in the IRS Files are obviously tax evasion, and the IRS simply let it slide, focusing their auditing firepower on working people who couldn't afford to defend themselves, looking for things like minor compliance errors committed by people receiving public benefits.

Or at least, that's how it used to be. But the Biden administration poured billions into the IRS, greenlighting 30,000 new employees whose mission would be to investigate the kinds of 0.1%ers and giant multinational corporations who'd Helmsleyed their way into tax-free fortunes. The fact that these elite monsters paid no tax was hardly a secret, and the impunity with which they functioned was a constant, corrosive force that delegitimized American society as a place where the rules only applied to everyday people and not the rich and powerful who preyed on them.

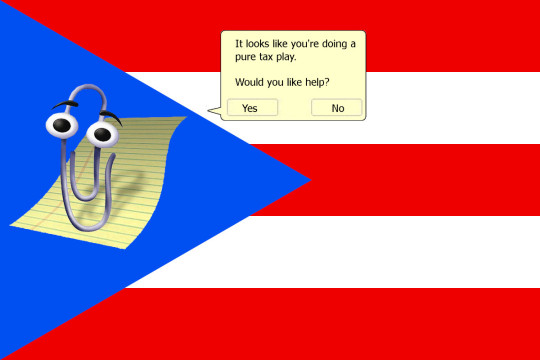

The poster-child for the IRS's new anti-impunity campaign is Microsoft, who, decades ago, "sold its IP to to an 85-person factory it owned in a small Puerto Rican city," brokered a deal with the corporate friendly Puerto Rican government to pay almost no taxes, and channeled all its profits through the tiny facility:

https://www.propublica.org/article/the-irs-decided-to-get-tough-against-microsoft-microsoft-got-tougher

That was in 2005. Now, the IRS has come after Microsoft for all the taxes it evaded through the gambit, demanding that the company pay it $29 billion. What's more, the courts are taking the IRS's side in this case, consistently ruling against Microsoft as it seeks to keep its ill-gotten billions:

https://www.propublica.org/article/irs-microsoft-audit-back-taxes-puerto-rico-billions

Now, no one expects that Microsoft is going to write a check to the IRS tomorrow. The company's made it clear that they intend to tie this up in the courts for a decade if they can, claiming, for example, that Trump's amnesty for corporate tax-cheats means the company doesn't have to give up a dime.

This gambit has worked for Microsoft before. After seven years in antitrust hell in the 1990s, the company was eventually convicted of violating the Sherman Act, America's bedrock competition law. But they kept the case in court until 2001, running out the clock until GW Bush was elected and let them go free. Bush had a very selective version of being "tough on crime."

But for all that Microsoft escaped being broken up, the seven years of depositions, investigations, subpoenas and negative publicity took a toll on the company. Bill Gates was personally humiliated when he became the star of the first viral video, as grainy VHS tapes of his disastrous and belligerent deposition spread far and wide:

https://pluralistic.net/2020/09/12/whats-a-murder/#miros-tilde-1

If you really want to know who Bill Gates is beneath that sweater-vested savior persona, check out the antitrust deposition – it's still a banger, 25 years on:

https://arstechnica.com/tech-policy/2020/09/revisiting-the-spectacular-failure-that-was-the-bill-gates-deposition/

In cases like these, the process is the punishment: Microsoft's dirty laundry was aired far and wide, its swaggering founder was brought low, and the company's conduct changed for years afterwards. Gates once told Kara Swisher that Microsoft missed its chance to buy Android because they were "distracted by the antitrust trial." But the Android acquisition came four years after the antitrust case ended. What Gates meant was that four years after he wriggled off the DoJ's hook, he was still so wounded and gunshy that he lacked the nerve to risk the regulatory scrutiny that such an anticompetitive merger would entail.

What's more, other companies got the message too. Large companies watched what happened to Microsoft and traded their reckless disregard for antitrust law for a timid respect. The effect eventually wore off, but the Microsoft antitrust case created a brief window where real competition was possible without the constant threat of being crushed by lawless monopolists. Sometimes you have to execute an admiral to encourage the others.

A decade in IRS hell will be even more painful for Microsoft than the antitrust years were. For one thing, the Puerto Rico scam was mainly a product of ex-CEO Steve Ballmer, a man possessed of so little executive function that it's a supreme irony that he was ever a corporate executive. Ballmer is a refreshingly plain-spoken corporate criminal who is so florid in his blatant admissions of guilt and shouted torrents of self-incriminating abuse that the exhibits in the Microsoft-IRS cases to come are sure to be viral sensations beyond even the Gates deposition's high-water mark.

It's not just Ballmer, either. In theory, corporate crime should be hard to prosecute because it's so hard to prove criminal intent. But tech executives can't help telling on themselves, and are very prone indeed to putting all their nefarious plans in writing (think of the FTC conspirators who hung out in a group-chat called "Wirefraud"):

https://pluralistic.net/2023/09/03/big-tech-cant-stop-telling-on-itself/

Ballmer's colleagues at Microsoft were far from circumspect on the illegitimacy of the Puerto Rico gambit. One Microsoft executive gloated – in writing – that it was a "pure tax play." That is, it was untainted by any legitimate corporate purpose other than to create a nonsensical gambit that effectively relocated Microsoft's corporate headquarters to a tiny CD-pressing plant in the Caribbean.

But if other Microsoft execs were calling this a "pure tax play," one can only imagine what Ballmer called it. Ballmer, after all, is a serial tax-cheat, the star of multiple editions of the IRS Files. For example, there's the wheeze whereby he has turned his NBA team into a bottomless sinkhole for the taxes on his vast fortune:

https://pluralistic.net/2021/07/08/tuyul-apps/#economic-substance-doctrine

Or his "tax-loss harvesting" – a ploy whereby rich people do a "wash trade," buying and selling the same asset at the same time, not so much circumventing the IRS rules against this as violating those rules while expecting the IRS to turn a blind eye:

https://pluralistic.net/2023/04/24/tax-loss-harvesting/#mego

Ballmer needs all those scams. After all, he was one of the pandemic's most successful profiteers. He was one of eight billionaires who added at least a billion more to his net worth during lockdown:

https://inequality.org/great-divide/billionaire-bonanza-2020/

Like all forms of rot, corruption spreads. Microsoft turned Washington State into a corporate tax-haven and starved the state of funds, paving the way for other tax-cheats like Amazon to establish themselves in the area. But the same anti-corruption movement that revitalized the IRS has also taken root in Washington, where reformers instituted a new capital gains tax aimed at the ultra-wealthy that has funded a renaissance in infrastructure and social spending:

https://pluralistic.net/2023/06/03/when-the-tide-goes-out/#passive-income

If the IRS does manage to drag Microsoft through the courts for the next decade, it's going to do more than air the company's dirty laundry. It'll expose more of Ballmer's habitual sleaze, and the ways that Microsoft dragged a whole state into a pit of austerity. And even more importantly, it'll expose the Puertopia conspiracy, a neocolonial project that transformed Puerto Rico into an onshore-offshore tax-haven that saw the island strip-mined and then placed under corporate management:

https://pluralistic.net/2022/07/27/boricua/#que-viva-albizu

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/10/13/pour-encoragez-les-autres/#micros-tilde-one

My next novel is The Lost Cause, a hopeful novel of the climate emergency. Amazon won't sell the audiobook, so I made my own and I'm pre-selling it on Kickstarter!

#pluralistic#irs#puerto rico#puertopia#microsoft#micros~1#tax avoidance#tax evasion#pure tax play#big tech can't stop telling on itself#corporate crime#rough ride#the procedure is the punishment#steve ballmer#pour encouragez les autres

889 notes

·

View notes

Text

if you are an American,

🙂 are you good?

it’s officially tax season crunch-time folks!

You know what that means: sweaty searches for your W2 and paralyzing fear over whether you owe or not! 🙂

Will it be a return for you this year or will you be looking for a third job to cover that amount due? 🙃

I’m right there with you friends.

Let my humble contribution below, bring you some laughs as you languish to help combat the Sunday Scaries. 🐀❤️

youtube

#taxes#tax services#taxation#tax preparation#tax planning#tax professional#tax policy#tax payers#tax payment#tax filing#tax forms#tax free#tax liability#tax evasion#tax season#tax savings#tax strategies#tax software#mental health#mental illness#mental heath awareness#mental health matters#Youtube

226 notes

·

View notes

Text

My life would improve greatly if instead of having to talk to people I could just either " !!! " or " ??? " Like Turnip Boy

#That vegetable is so relatable#Turnip posting 🍃#turnip boy#turnip boy commits tax evasion#turnip boy robs a bank#tbcte#tbrab

258 notes

·

View notes

Text

They are little creachures!! They dont know about the "economy"!!!

#sth#sonic the hedgehog#miles tails prower#sonic fanart#and then they commited tax evasion#i did my taxes have a finished phone doodle i did in the waiting room#also i got a phone stylus!! fun#my art

2K notes

·

View notes

Text

Ghosts Are Dragons Designs: Dan

PREV | NEXT

#my art#ghosts are dragons#Sun core dan#danny phantom#dark danny#dan fenton#dan phantom#dcxdp#dpxdc#dragons#jordan phantom#dante fenton#he has so many names#Dante is what he goes by for tax evasion

181 notes

·

View notes

Text

Ok several things to talk about here ,,,

1. Turnip boy is Enorme

2. Their GOVERNMENT NAMES are their HEXADECIMAL CODES?????????

3. IT’S THE FUCKING BARBIE MEME?!?!?! (you know the one.)

4. Heights .

Ok so . Neither of them are standing in the right position (feet together, standing straight) BUT ima going to estimate that they are both about 155cm. That is almost exactly 5’1. ALL OF THE STICK FIGURES ARE CANONICALLY 5’1. CONFIRMED!!!!

man I love overanalyzing things <333333

#animation vs minecraft#avm#avm blue#animator vs animation#ava#red avm#Ava red#Ava blue#Barbie meme#turnip boy#turnip boy commits tax evasion#animators vs games#avg

367 notes

·

View notes

Text

thinking about the way psychics both are and are not a known factor in the world of mp100. the worldbuilding is light, allegorical, and comedic, but even meeting it where it's coming from, it paints a delightful picture of how the rest of the world relates to the supernatural shit.

like, clearly most people don't believe in psychic power, or at least they don't assume it to be real. but when confronted with it, the more common reaction seems to be along the lines of "ah shit, huh, makes sense i guess." inukawa knew mob is a psychic, and brought it up without hesitation, like oh yeah, this is a known thing, but was then surprised among the others to see how much mob can do. the talk show is difficult to interpret, because it was a trap set up for reigen specifically, but how things play out, it feels like being a legitimate psychic isn't quite as outlandish an idea as it would be in our world. actual psychics don't seem to be putting much effort into hiding (if they're even trying to hide), there's unions, the goverment can put together a psychic suicide squad, the news can show a giant broccoli flying, there's books with instructions to meet aliens that actually have some truth to them, and yet people aren't that aware. and yet again, people like mitsuura and amakusa exist.

it feels like the supernatural is... kinda boring? weird stuff just happens occasionally, and it doesn't have much bearing on people's lives. the rest of it works like how essential oils do actually have certain effects and uses (for example, insect repellent), but then there's just a mountain of bullshit and people selling you things, so you don't really bother with any of it. cases like mob feel like ball lightning, as in i remember reading about it right next to absolutely fake shit as a kid and being told it's not real, but it is real, but fucked if anyone knows what exactly it is and some of the reports and theories are suspicious as hell. just. weird shit in the world that's ultimately irrelevant and uninteresting to most people.

the delightful part is that this all reinforces the idea that psychic power is just one quality among many that people can have.

but also.

when reigen founded spirits and such. i do not know how exactly it works where i live, let alone in japan. but registering a business. don't you usually need to put down what type of business you're running? did he have to figure out a close enough option, or is there a standard one to pick for psychic business, something they're considered to fall under, or even a psychic specific one?

delighted by the thought that spirits and such is officially a spa or something instead of what the industry standard is. reigen either didn't know which one people usually pick, or chose against the standard because it was less of a hassle. or tax reasons. imagine.

#mp100#i love the casual vibe of the worldbuilding#but tbh mostly thinking about like#oops seri you can't become a full partner in the company#the govt knows you're a psychic so we'd be hit with the psychic tax#this is the only form of tax evasion i can think of reigen actually committing dfgdsfgdf

241 notes

·

View notes

Photo

Agent Peña. And I’m done...

#javier peña#javier pena#pedro pascal#javier pena edit#narcos#narcosedit#ppascal#ppascal edit#pedro pascal edit#agent peña#netflixedit#ppascaledit#he was like they got al capone for tax evasion i'm trying to get the narcos for a dead cat#sure#why not

865 notes

·

View notes

Text

I have no doubt these 2 could get up to some absolute nonsense 🖤💜

#neither of these fuckers have ever paid a tax in their life 😌#critical role#laudmoore#cr3#cr c3#critrole#critrole memes#bells hells#bell's hells#ashton greymoore#laudna#ashna#cr tombstone#cr gravestone#text post meme#money laundering#tax evasion#ashton x laudna#laudna x ashton#cr memes#cr shitpost#courtesy of me#cr campaign three#crit role#critrole meme#everything everywhere all at once

172 notes

·

View notes