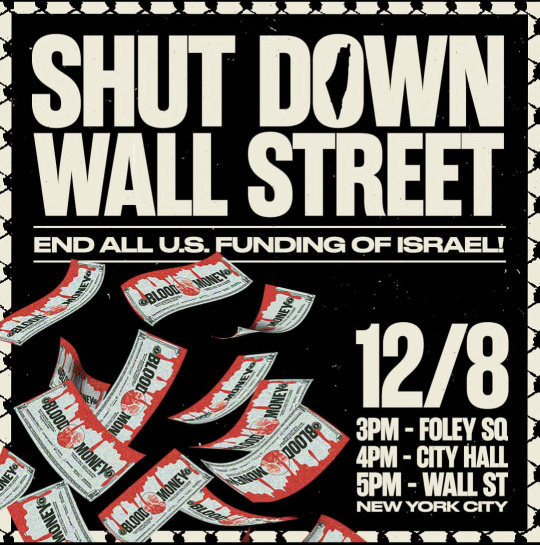

#Wall Street

Text

#american airlines#capitalism#democrats#republicans#politics#corporate/industrial news#the simpsons#lol#twitter#wall street

23K notes

·

View notes

Text

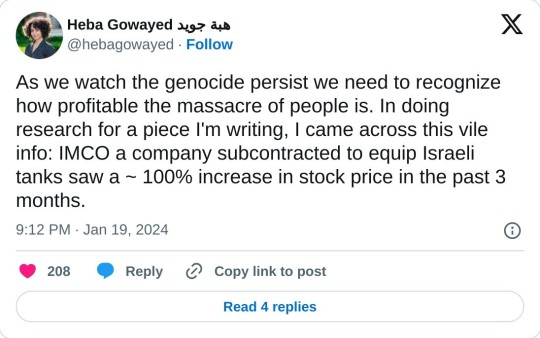

It's not profitable in Israel only

#yemen#jerusalem#tel aviv#current events#palestine#free palestine#gaza#free gaza#news on gaza#palestine news#news update#war news#war on gaza#military industrial complex#wall street#imperialism#war for profit#genocide

2K notes

·

View notes

Text

Looking south down Broad Street, in the heart of the financial district, with the New York Stock Exchange at the right, January 16, 1924.

Photo: Underwood Archives via Fine Art America

#vintage New York#1920s#Wall St.#Broad St.#Jan. 16#16 Jan.#NY financial district#Wall Street#old New York

126 notes

·

View notes

Text

#funny#lol#humor#humour#lmao#awesome#funny pics#wall street#anti capitalism#eat the rich#revolution#cute#interview#left wing#leftist#equality#meme

2K notes

·

View notes

Text

“The greatest asset, indeed the only asset, of modern finance is debt, the thing that makes men commit suicide. The whole structure of finance collapses unless somebody owes something to somebody else. It is a gigantic heap of debt, like a heap of dirt. It is a heap of debts hoarded until they have gone bad. It is now a heap of bad debts which a little more bad debt will send toppling into the mire.”

— G.K.’s Weekly (08/01/1931)

183 notes

·

View notes

Video

youtube

How the Corporate Takeover of American Politics Began

The corporate takeover of American politics started with a man and a memo you've probably never heard of.

In 1971, the U.S. Chamber of Commerce asked Lewis Powell, a corporate attorney who would go on to become a Supreme Court justice, to draft a memo on the state of the country.

Powell’s memo argued that the American economic system was “under broad attack” from consumer, labor, and environmental groups.

In reality, these groups were doing nothing more than enforcing the implicit social contract that had emerged at the end of the Second World War. They wanted to ensure corporations were responsive to all their stakeholders — workers, consumers, and the environment — not just their shareholders.

But Powell and the Chamber saw it differently. In his memo, Powell urged businesses to mobilize for political combat, and stressed that the critical ingredients for success were joint organizing and funding.

The Chamber distributed the memo to leading CEOs, large businesses, and trade associations — hoping to persuade them that Big Business could dominate American politics in ways not seen since the Gilded Age.

It worked.

The Chamber’s call for a business crusade birthed a new corporate-political industry practically overnight. Tens of thousands of corporate lobbyists and political operatives descended on Washington and state capitals across the country.

I should know — I saw it happen with my own eyes.

In 1976, I worked at the Federal Trade Commission. Jimmy Carter had appointed consumer advocates to battle big corporations that for years had been deluding or injuring consumers.

Yet almost everything we initiated at the FTC was met by unexpectedly fierce political resistance from Congress. At one point, when we began examining advertising directed at children, Congress stopped funding the agency altogether, shutting it down for weeks.

I was dumbfounded. What had happened?

In three words, The Powell Memo.

Lobbyists and their allies in Congress, and eventually the Reagan administration, worked to defang agencies like the FTC — and to staff them with officials who would overlook corporate misbehavior.

Their influence led the FTC to stop seriously enforcing antitrust laws — among other things — allowing massive corporations to merge and concentrate their power even further.

Washington was transformed from a sleepy government town into a glittering center of corporate America — replete with elegant office buildings, fancy restaurants, and five-star hotels.

Meanwhile, Justice Lewis Powell used the Court to chip away at restrictions on corporate power in politics. His opinions in the 1970s and 80s laid the foundation for corporations to claim free speech rights in the form of financial contributions to political campaigns.

Put another way — without Lewis Powell, there would probably be no Citizens United — the case that threw out limits on corporate campaign spending as a violation of the “free speech” of corporations.

These actions have transformed our political system. Corporate money supports platoons of lawyers, often outgunning any state or federal attorneys who dare to stand in their way. Lobbying has become a $3.7 billion dollar industry.

Corporations regularly outspend labor unions and public interest groups during election years. And too many politicians in Washington represent the interests of corporations — not their constituents. As a result, corporate taxes have been cut, loopholes widened, and regulations gutted.

Corporate consolidation has also given companies unprecedented market power, allowing them to raise prices on everything from baby formula to gasoline. Their profits have jumped into the stratosphere — the highest in 70 years.

But despite the success of the Powell Memo, Big Business has not yet won. The people are beginning to fight back.

First, antitrust is making a comeback. Both at the Federal Trade Commission and the Justice Department we’re seeing a new willingness to take on corporate power.

Second, working people are standing up. Across the country workers are unionizing at a faster rate than we’ve seen in decades — including at some of the biggest corporations in the world — and they’re winning.

Third, campaign finance reform is within reach. Millions of Americans are intent on limiting corporate money in politics – and politicians are starting to listen.

All of these tell me that now is our best opportunity in decades to take on corporate power — at the ballot box, in the workplace, and in Washington.

Let’s get it done.

#youtube#videos#video#powell memo#corporations#wall street#finance#corruption#politics#lobbying#government

1K notes

·

View notes

Text

Never trust corporations to solve the climate crisis

#climate change#climate justice#current events#important#Wall Street#capitalism#environment#news#global climate crisis

845 notes

·

View notes

Text

Three, four years ago I could have told you, and did tell people, that inflation would start steadily going up, and I said even then that it would likely be stubborn, meaning it wasn't going to be an easy fix.

I knew this back then because it was obvious, even years ago, that the BRICS countries, along with many African and South Asian countries and elsewhere were looking for ways to get around using the US Dollar for trade.

They were making moves to expand trade relations outside US dollar transactions and were for many years planning and building the infrastructure for a future Multipolar world.

And that process began rapidly picking up pace three or four years ago.

I began to say then, what I'm still saying now, as that process goes on and trade outside the US Dollar system grows exponentially year-on-year, that's going to begin to have an effect on inflation.

Why? Well, Imperialism really. Because the US for decades has depended on the steady demand for US Dollars to hold down inflation, allowing the US to use debt spending to finance wars, military bases and imperialistic ventures like Syria.

Remember, it was the US in its massively dominant position after WWII that built the Bretton Woods System that made the US Dollar the world reserve currency pegged to gold, and it was the US that unilaterally abandoned Bretton Woods 1 and took the dollar off Gold, allowing for the US to finance wars through debt spending, and created the Petro-Dollar with Saudi Arabia in the 1970's.

This debt spending is essentially the surplus value from the Global South and other poorer countries that must buy US Dollars to fund infrastructure projects, energy consumption, food and medicine imports, etc since it's the world reserve currency and if you wish to use the US Financial System at all, such as the World Bank, or SWIFT messaging system, well you have to use US Dollars.

Basically, it's the sucking of the wealth out of poorer countries to finance their own economic oppression.

But as these countries catch on and with new rising global powers like Russia, China and Iran building the infrastructure for an alternative system, the US Dollar is being abandoned faster than ever.

In 2000, more than 70% of Foreign Exchange Reserves were held in US Dollars. By 2020, that figure had dropped considerably to 59%. And the rate at which it's dropping is only increasing.

Knowing this, I said back in 2019 and 2020 that inflation was likely to become a problem. And if it did become a problem, then we knew exactly what the Fed would do as a result: dramatically increase benchmark Interest rates.

This didn't take any particularly specialized or secretive sources to figure out. It's been obvious for years to anyone seriously interested in economics and geopolitics.

And what happens when interest rates go up? The value of the bonds bought under lower interest rates suddenly go way down, while debts become more expensive. It's like gravity in economics.

So with all that being said, why then did all these banks (Signature Bank, First Republic Bank, and Silicon Valley Bank) continue buying troubled assets and Treasury bonds if they're so smart and educated and knew all this?

I mean, these guys are supposed to be the best of the best corporate bankers, right? On the cutting edge of investment banking, right? That's what everyone said even just months before Silicon Valley Bank failed. (CNBC host and moron of the year Jim Cramer literally praised Silicon Valley Bank less than a month before its failure)

So one of two things must be true here and neither one is good for YOU the average worker.

Either these bankers are idiots; complete morons who have little to no understanding of basic economics, geopolitics, and monetary policy, something that should be of concern to all of us.

I mean, I'm just a dude working for a small retailer in New Orleans and even I knew this inflation and higher interest rates were coming.

So why exactly are these people paid such exorbitant salaries? If I can understand the basics of their job better than they can, why am I a retailer, and he, a millionaire banker???

So that's one possibility, one I'm virtually certain is actually true, that our ruling Elite isn't particularly smart or well educated in reality, anymore than ordinary people I meet everyday, and any one of us could easily do their jobs just as well or better than they do given the opportunities afforded to them.

But even if in this case, that's not what happened. That these weren't idiots. Well then the alternative is something that should also be deeply disturbing to you: that these bankers knew they would be facing this situation, that they were well aware of the coming inflationary pressures and equally aware what the Feds response would be, interest rate hikes.

And instead of using the last couple of years to shed possibly dangerous assets and shore up the money the banks kept on hand, they continued to do what was personally making them so much profit, at the expense of tax payers, because they were absolutely certain that the government these bankers spend so much money on campaigns for, would swoop in regardless of the recklessness of their behavior, and bail them out no matter what.

These are not the signs of a healthy political, economic or banking system.

#bailout#bank bailout#bank bailouts#us corruption#economic corruption#political corruption#us imperialism#us hegemony#wall street#bankers and bailouts#fuck capitalism#neoliberal capitalism#neoliberalism#fuck neoliberalism#socialism#communism#marxism leninism#socialist politics#socialist worker#socialist news#socialist#communist#marxism#marxist leninist#progressive politics#politics#us banking crisis#us banking system#recession#economics

188 notes

·

View notes

Text

Adriana Lima attending Diana Krall and Elvis Costello performance for the 2006 Cipriani-Deutsche Bank Concert Series for amfAR, Cipriani Wall Street, NYC, 17/05/06.

107 notes

·

View notes

Text

#cottagecore#naturecore#grunge#gallery#walls#wall street#photography#drawing#free palestine#free gaza#bethlehem#ao3

32 notes

·

View notes

Text

1K notes

·

View notes

Text

58 notes

·

View notes

Text

This is what ticker tape really looked like, March 26, 1942. The stuff pouring out of the machine for a clerk at Merrill, Lynch, Pierce, Fenner, and Beane is like something out of a cartoon—I can see it going and going until it fills up the room.

Photo: Robert Wands for the AP via Money Review

#vintage New York#1940s#Robert Wands#Bob Wands#ticker tape#Merrill Lynch#Wall Street#vintage Wall St.#brokerage house

46 notes

·

View notes

Text

Curitiba City - Brazil 🇧🇷

❤️❤️❤️

#brazil#brasil#curitiba#curitiba city#bus turist#street food#street 24 hours#streetphotography#street fashion#streetwear#wall street#flowers street#flowers

228 notes

·

View notes

Text

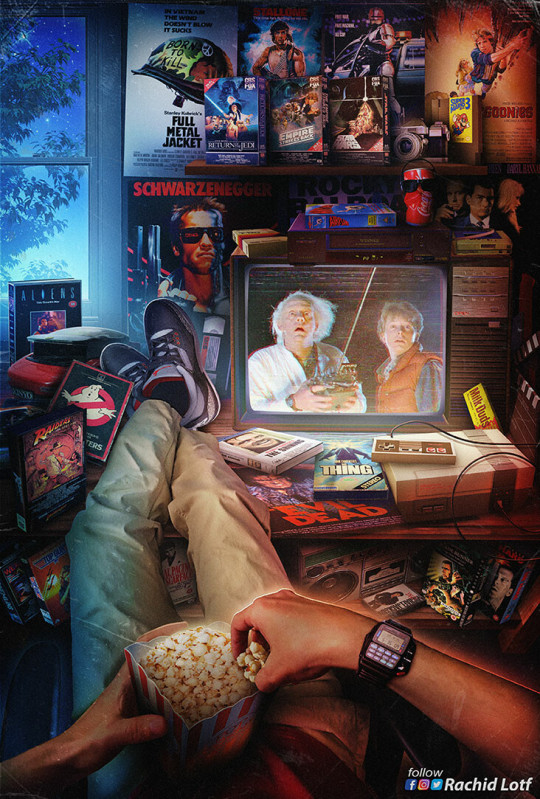

80's Movies. Arte por Rachid Lotf.

#1980s#Illustration#VHS#Rachid Lotf#Casio#Back to the Future#Blade Runner#Die Hard#Top Gun#Michael Jackson's Bad#Raiders of the Lost Ark#Ghostbusters#Aliens#Terminator#Wall Street#Full Metal Jacket#Robocop#The Goonies#Star Wars#Evil Dead#The Thing#The Shining#Nintendo#John Rambo

488 notes

·

View notes

Photo

621 notes

·

View notes