#Personal investing

Text

Personal Investments for May

College classes - my mentor mentioned to me how important “JUST GETTING STARTED” is and I am starting, doing, and loving everything I’m learning. I am currently enrolled in 9 credits for 10 weeks, but I’ll be okay I schedule self care. Like my 80 minute massage tomorrow.

I bought a beach body membership - I am tired of guessing what to eat and how to workout and I’m taking kickboxing right now and learning portion control. So far I like it because I don’t feel boxed in and it’s helping me get to where I want to go.

I am buying a membership to Code Academy! - I am a programmer and cloud architect in the making, so I am taking advantage of this platform and a few others!

I’m buying a seat at the table! - I don’t have much money, but in tech (and most field TBH) it’s not as much what you know as who you know. This month I am purchasing a few memberships to local tech spaces. I am doing this to network and meet people.

I am buying a museum membership -A good place to meet people and learn new things is the museum. I love going to the museum and they have events that I’ve been to in the past so I can’t wait!

I am buying a XEBEC - XEBEC is a screen extender for your laptop. I am so excited because this is going to make coding in multiple windows so much easier.

I am investing some money - I am investing in a new startup that I found that I believe in and I will start contributing to a ROTH IRA this month as well. I also buy a couple of stocks weekly through CashApp.

I am going to buy some new skincare - As an esthetician I absolutely love Image Skincare. So I will be buying some of it this month.

I am buying a ticket for a tech conference out of state.

I am using my new insurance to GO TO THERAPY!!! I am so excited to get someone who can help me through my issues

I am buying some more supplies for my business ideas.

#reinventmyself#personal investing#Level Up#Next Level#leveling up#levelup#blackwoman#black beauty#black women#black luxury#black femininity#black women in femininity#femininity#feminine#feminine black women#self esteem#self love#self care#self improvement#money in the bank#more money#money

390 notes

·

View notes

Text

“If opportunity doesn't knock, build a door.”

#youhao#invest in crypto#breaking news: investing#crypto#investment#multi level marketing#cryptocurrency#blockchain#btc#eth#cryptocurrencies#personal investing#investing#multilevelmarketing#binance#network marketing#investasi crypto di indonesia#earn money online#earnings#money online#moneyonmymind

9 notes

·

View notes

Text

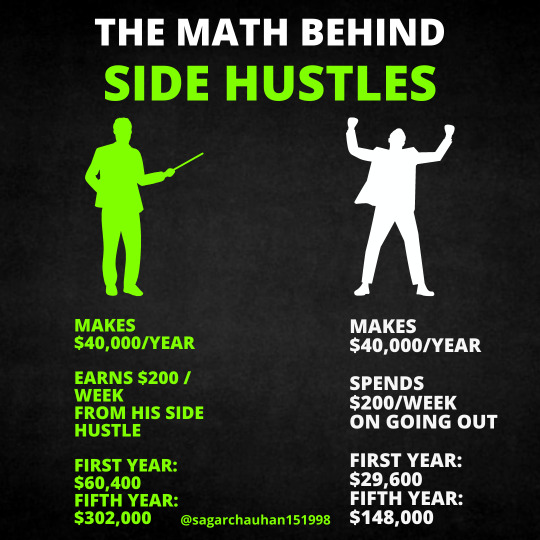

🧐THE MATH BEHIND - SIDE HUSTLES😇

MAKES - $40,OOO/YEAR

EARNS $200 / WEEK FROM HIS SIDE HUSTLE

FIRST YEAR: $60,400 FIFTH YEAR: $302,000

MAKES - $40,000/YEAR

SPENDS - $200/WEEK ON GOING OUT

FIRST YEAR - $29,600

FIFTH YEAR - $148,000

Official website - www.mahalpur.com

Follow me - @sagarchauhan151998

#business#businesstips#personal investing#investing#blogging#sagar singh chauhan#seo#mahalpur.com#digital marketing#seo hindi#online business#online marketing#seo tips in hindi#socialmediamarketing

5 notes

·

View notes

Text

Here are the most important tips to start investing

Be aware of how markets operate

Understanding how markets operate is the first step in investing. Markets aren’t always just, and they don’t always favor sound ideas. You must comprehend how something functions if you wish to invest in it to generate money. You must be familiar with how markets operate and how to interpret financial statements.

2. Information resources

Online, there are many resources available for learning about investment. There are websites dedicated to providing information about the stock market. There are websites that offer details on various investment types. Even websites exist that instruct visitors on how to invest. Learn as much as you can about the market and how to use your available instruments before you begin investing.

3. Learn how to analyze companies

Once you have learned how to read financial statements, you should look at companies’ balance sheets, income statements, cash flow statements, and any other financial documents that are provided. Analyze these numbers to determine whether the company is making enough profit to cover its expenses and pay back its debt. Once you understand how a company works, you can decide if it’s a good investment.

4. Determine the company’s ownership.

You could believe that purchasing stock in a firm entitles you to a portion of it. In truth, unless someone purchases your shares, you don’t actually own anything. You become a shareholder when you purchase shares. When profits are distributed, dividends are paid to shareholders. Depending on their proportion of ownership, shareholders receive dividend payments.

5. Invest in stocks that you understand

If you are going to invest in a company, you need to understand how the company operates. You need to know what products it sells, how much it costs to produce those products, and how profitable it is. You need to know the competition, the industry, and the economy. If you don’t understand a company, you won’t be able to make smart decisions about buying or selling its stock.

6. Don’t try to time the market

Timing the market is difficult because no one knows exactly when the market will move. Even professional traders cannot predict the future. Trying to guess when the market will go up or down is a fool’s game. Instead, focus on finding great companies and then let them run their course.

7. Be patient

It takes years to build a business. It takes years to turn a small idea into a successful product. It takes years to develop a brand name. It takes years to create a loyal customer base. Do not expect overnight success.

8. Have fun!

Investing is supposed to be fun. Make sure that you enjoy yourself while you’re learning about the market. You’ll learn a lot faster if you’re having fun.

For beginner investors.. Here are the best options to start

3 notes

·

View notes

Text

What is Hotspot Token (HPT)?

There also are three types of tokens, DeFi tokens, NFTs, and asset-backed tokens.

Hotspot Token is an asset-backed token that will be used to transact between connected devices in the IoT ecosystem.

After development stage, HPT will be earned by providing and validating wireless coverage (proof of coverage) and when devices on the network connect to the Internet.

The team is already in contact with companies like Cisco, IBM, PTC, Nebra, and RakWireless for partnership.

This will make HPT a common utility and payment token soonest. We all know what this means.

We urge every member to support, promote, and invite members and there is a special reward for that (referral system).

Thank you for your time and I hope this explains the concept of hotspot token.

#crypto#cryptocurrency#investing#investing stocks#marketing#personal investing#real estate investing#viral news#finance#entrepreneur#business#beauty#blockchain#elon musk#themooncarl#nft#cryptocurrencies#sri lanka#made in usa#dogecoin

3 notes

·

View notes

Text

Supermarkets are the new retail powerhouses

Supermarkets are changing how we shop for food. They’re also changing the way we live. Here are 10 things you need to know about supermarkets.

The Grocery Store Is Now A Destination.

Supermarkets are now more than places where people go to buy groceries. They’re destinations. And they’re becoming increasingly popular as a place to eat out. In fact, according to Nielsen, nearly half (47%) of U.S. adults say they plan to dine at a supermarket within the next year.

The Grocery Store Has Become an Entertainment Center.

Departmental stores in Nepal are also becoming entertainment centers. They’ve added movie theaters, bowling alleys, ice skating rinks, and even roller coasters.

The Grocery Store Can Be Used as a Social Hub.

If you haven’t noticed yet, supermarkets are becoming more social hubs than grocery stores. In fact, some of them are turning into mini malls with restaurants, bars, and other amenities.

The Grocery Store Offers More Than Food.

There’s no doubt that supermarkets are changing how we shop. And while they’ve been doing so for years, they’re now taking things one step further by offering services such as banking, insurance, and even pet care.

The Grocery Store Provides Value Beyond Price.

In addition to providing value through price, supermarkets are also helping us save money by making shopping easier. For instance, they make it easy to compare prices across stores, and they offer coupons and discounts that help us save money.

2 notes

·

View notes

Text

Investing for teens

If you're under 18 and want to get into investing or learn the basics of it then I recommend checking out Bumper investing or https://www.joinbumper.com/. It's an app/website that's specifically designed for teens who want to invest. Bumper bites or https://www.joinbumper.com/bumper-bites also has some nice foundational information for those who are just starting. If you want to get into finance or just have passive income as a teen then you should definitely take a look at the website

2 notes

·

View notes

Text

BlackRock CEO Larry Fink says 65 retirement age is too low. Here's what experts say

BlackRock CEO Larry Fink speaks during the New York Times DealBook Summit Nov. 30, 2022 in New York City.

Michael M. Santiago | Getty Images News | Getty Images

“But I do think it’s a bit crazy that our anchor idea for the right retirement age — 65 years old — originates from the time of the Ottoman Empire,” wrote Fink, who is 71.

Republicans have touted raising the retirement age.

Former…

View On WordPress

#401k plans#business news#Elder care#Government pensions and social security#Health Care Costs#Medicare Health Plans#personal finance#Personal income#Personal investing#Personal saving#Personal spending#Retiree finances#Retirees#Retirement Planning#Social Security#U.S. Social Security Administration

0 notes

Text

A 30s Wake Up Call

30 hit me hard, but not in an identity or mid-life crisis kind of way. You know that old saying, "too much month at the end of the money"? Yea, that happened. It's easy to laugh it off as a fluke the first time, but you really come to hate it when it happens month after month.

What would you do if you came down to the last week in the month, payday 7 days away, and you were in the hole 37 bucks? How do you get by? How do you full up your car to get to work? How do you eat? What bills are going to be late this time?

If you've struggled with those questions, you're not alone. Welcome to Matt's Money Mayhem, where I share my journey to sort out my money mess.

1 note

·

View note

Text

6 High Income Skills

youtube

#skills#youtube#skillsdevelopment#skillsupgrade#learning#personal investing#personal development#Youtube

0 notes

Text

Personal Investments for August

- My cap and gown for graduation!

- Business ingredients -

- 401k -

- Roth IRA with a local bank!

- Courses - one for certifications in tech, a course for business

- personal help for preparing my finances

- student loan debt!

#leveling up#NextLevel#Next Level#leveluponabuck#level up on a buck#personal investing#august#fallyall#fall#autumn#black beauty#black women#black luxury#black women in femininity#feminine black women#soft girl#soft aesthetic

32 notes

·

View notes

Text

#youhao#invest in crypto#breaking news: investing#crypto#investment#multi level marketing#cryptocurrency#blockchain#btc#eth#cryptocurrencies#personal investing#investing#multilevelmarketing#binance#network marketing#investasi crypto di indonesia#earn money online#earnings#money online#moneyonmymind

9 notes

·

View notes

Text

🔥INVESTING RULES 👨💼 - YOU SHOULD NEVER BREAK 👍

1. NEVER BORROW TO INVEST

2. THE BEST TIME TO INVEST IS NOW

3. AVOID EMOTIONAL INVESTING

4. RESEARCH BEFORE INVESTING

5. STOP TRYING TO GET RICH QUICK

6. ALWAYS FOLLOW A PROVEN STRATEGY

Follow me for more - @sagarchauhan151998

Official Website - www.mahalpur.com

#blogging#business#online business#business idea#investors#personal investing#investing#makemoney#enterpreneur#sagar singh chauhan#seo#mahalpur.com#digital marketing#seo hindi#online marketing#seo tips in hindi#socialmediamarketing

3 notes

·

View notes

Text

The Importance of Insurance in Personal Finance and Investing ?

Insurance is an important aspect of personal finance and investing. It provides a safety net to protect individuals and their families against financial loss from unexpected events. Insurance products come in many forms, such as life, health, home, and auto insurance, and each offers unique benefits and coverage options.

IMPORTANCE OF INSURANCE

One of the most important reasons to have insurance…

View On WordPress

0 notes

Note

I feel like for Dorian and Astarion to become parents it would have to be an accident. Like, dorian finding it in the trash or some magical nonsense they find making one pop out of thin air. both of which I imagined seeing your funny comic XD (your art is precious by the way)

oh 100%, i was thinking today that they probably wouldn’t try and have one on purpose but maybe after several decades of therapy it wouldn’t be a nightmare if it happened unintentionally

anyway i pulled this out of somewhere and i hate it

#ramble#bg3#baldur's gate 3#astarion#tavstarion#the idea of them accidentally conjuring a person somehow is very funny#i regret starting this as a joke because now i’m invested#although iirc neil newbon said he thinks he’d have children and i feel like i trust him#also before you say this is too mean. did you play the game

2K notes

·

View notes