#Investment Management Course

Text

Empower Your Financial Decision-Making: Executive Program in Investment Management | ATLAS Edge

Introduction:

Financial literacy is not just a skill; it's a necessity for executives and business leaders navigating the complexities of today's financial landscape. From capital allocation to risk management, informed decision-making is crucial for driving business success. However, the ever-changing nature of the financial market and the abundance of information can pose challenges for executives seeking to make sound investment decisions. That's where the ATLAS Edge Executive Program in Investment Management comes in, offering a solution to empower executives with the knowledge and skills needed to navigate the world of investment management effectively.

Why is Financial Literacy Important for Executives?

Financial literacy is the cornerstone of effective decision-making for executives. It enables them to understand the financial health of their organizations, interpret financial data, and identify opportunities for growth and optimization. Executives who are financially literate are better equipped to allocate resources strategically, manage risks effectively, and drive sustainable business growth. In today's competitive business environment, financial literacy is not just a valuable asset; it's a prerequisite for success.

Challenges Faced by Executives in Investment Management:

Executives often face numerous challenges when it comes to investment management. The financial market is dynamic and complex, with trends and regulations constantly evolving. Executives must navigate through vast amounts of information from various sources, making it challenging to discern reliable insights from noise. Additionally, time constraints pose a significant challenge, as executives must balance their investment management responsibilities with other duties and priorities within the organization.

How the ATLAS Edge Executive Program in Investment Management Can Help:

The ATLAS Edge Executive Program in Investment Management is designed to equip executives with the knowledge and skills needed to overcome these challenges effectively. The program's comprehensive curriculum covers a wide range of topics, including investment principles, portfolio management, risk assessment, and financial analysis. Led by industry experts with years of experience in investment management, the program provides practical insights and real-world examples to help executives enhance their decision-making capabilities.

Participants will also have the opportunity to engage with peers and industry professionals, fostering collaboration and networking opportunities. Whether delivered online or in-person, the program is designed to accommodate the busy schedules of executives, providing flexibility without compromising on quality or depth of learning.

Key Benefits of Taking the Program:

By enrolling in the ATLAS Edge Executive Program in Investment Management, executives can expect to gain numerous benefits, including:

Improved Understanding of Investment Principles and Strategies: Participants will develop a solid foundation in investment theory and practice, enabling them to evaluate investment opportunities effectively and make informed decisions.

Enhanced Ability to Evaluate and Select Investment Opportunities: Through case studies, simulations, and hands-on exercises, executives will learn how to analyze investment options, assess risks, and identify opportunities for maximizing returns.

Increased Confidence in Making Financial Decisions: Armed with a deeper understanding of investment management principles, executives will gain the confidence to make sound financial decisions that align with their organization's strategic objectives.

Stronger Foundation for Leading and Managing Investment Teams: For executives responsible for leading investment teams, the program provides valuable insights into team dynamics, leadership strategies, and best practices for managing investment portfolios.

In conclusion, the ATLAS Edge Investment Management Course offers a valuable opportunity for executives to enhance their financial literacy and decision-making skills. By equipping themselves with the knowledge and tools needed to navigate the complexities of investment management, executives can position themselves and their organizations for long-term success in today's dynamic business environment.

0 notes

Text

"Though I don't know exactly what you are or what you're up to... My bullets will find you — until then, you best find a casket store in Penacony, and ask the owner to reserve a good quality casket for you, imposter!"

Hardly could get more Western film than this

#That one scene in A Fistful of Dollars#The casket maker doesn't appear that way in Yojimbo if I recall#I love those films so much#Boothill has such a... soft youthful voice? I didn't recognise him at first. His voice is beautiful though#I talk too much#Boothill#The way he awkwardly laughs a little and asks almost shy 'Did I make a mistake?' lmao#I was wondering how he got her number and she gave it to him but gave him Black Swan's?#Or was Black Swan talking about Constance when she mentioned that 'she' who gave Boothill her whereabouts? Or someone else altogether?#He was kind of cute with that 'Did I make a mistake?' haha#'get that forehead clean and wait for me' this man is hilarious and has watched far too many movies xD#'are you asking me to write your will? Sure‚ go ahead' omg stop hahahahaha#'Not quite' responds Black Swan. Truly an elegant lady. I would have mocked him to no end#Hilarious too the idea or possibility of her apparently clocking him by the way he talks#'She's clearly not a Pathstrider of The Hunt. But you are‚ aren't you?'#Of course it could be context but it'd be funny if simplistic perhaps to think it's his manner of speaking lol#'go buy a bottle of Asdana's White Oak and warm it up‚ and I'll raise a glass to you' this man is hilarious and would be unbearable irl xD#I love the idea of an Emanator of Nihility existing despite the impossible. It seems very fitting#Also‚ unrelated‚ but I love Aventurine's little whimpers before his 'Didn't think you'd have the nerve to show yourself'#When Ratio claims he 'is the manager of this task' does he mean as undertaker or something real in the mission?#When he says Aventurine won't be seeing the Strategic Investment Department because he's the manager#did Ratio mean he will be the one dealing with the funeral or that there won't be a funeral at all because he's in charge?#I found this confusing

8 notes

·

View notes

Text

the only reason im able to handle helen and dale being like This with each other is bc i feel so strongly in my waters that season 3 them will figure it out but note it down that if season 3 doesn't fix them im gonna get in a fist fight with michael lucas just fyi

#i was gonna do work ahead of tomorrow while watching the ep but lol its ep 5 of COURSE im not managing work#especially bc i avoided a rewatch recently so the live watch would feel as fresh as possible so now im invested obviously#my post tag#nia watches the newsreader#the newsreader spoilers

14 notes

·

View notes

Note

Heyyy, I've deleted Tumblr for over year so I just gonna ask now, you still making saiouma content? :>

helloe!!

yeah im still very much invested in saiouma content is just comin at a snails pace bc my motivation is still in the trenches 🥀🥀🥀 the gays will come back from the war soon guys trust........

#ask#breezy answers#the phenomenal timing of this ask i actually managed to get a bit of doodling done last night#BUT OF COURSE AS FATE WOULD HAVE IT MY STYLUS FFFFUUCCKINGGGG DIIIIEEESSSS#this happens so much i will actually explode#its charged NOW tho we're so back#also been cookie running for my life a lot more recently#never been this invested in a story till now. war criminal jester when i get you

5 notes

·

View notes

Text

I love how vastly different June and Levi are and how their relationships with Enver differ in so many ways.

If Levi is a guy believing he is equal to gods, then June is, at his core, a prodigal follower.

It's a pattern he doesn't break out of even as he betrays his father for Selune. Gortash didn't manage to shake this part of him, only created a push, allowing June chose a god other than Bhaal (i.e. June didn't want Enver to die, realized he didn't want to die himself and entered a pact-like relationship with the Lady of Silver to prevent these two things from happening.)

The hardest thing for him is to go back on his word/dismantle the existing alliance. His mortal flaw is loyalty, blind loyalty.

So at some point his story comes to a crossroads.

He can either reaffirm his alliance with Gortash, unknowingly dooming him a Gortash himself, not to mention death of Duke Ravengard and many other casualities.

In this scenario Gortash dies from the psyonic command of the Nether Brain and June becomes the hero of Baldur's Gate and the new archduke.

Which sounds fun and games until you realize it also includes him becoming a new Chosen of Bane, because June might have learned how to break out of his father's chains, but he doesn't know what to do with himself and, after his and Selune's ways part, is an easy prey for gods with less than honorable plans.

The other road comes with stabbing Gortash in the back, metaphorically speaking. It includes the wicked choice of putting a tadpole into his head and making him cooperate because "oh, but I can just relinquish the protection astral prism bestows on you. I am sure you'll love being Elder Brain's thrall".

It's a choice what leaves absolutely everyone (well, not EVERYONE) horrified because not only they did not expect that from June, but also looking how pleased June is with himself by walking Gortash into the corner opens their eyes to the fact what he is not, in fact, a hero. He was a villain in the past and some of this past still lingers, even more after Selune's cold soothing light has left.

And, ridiculously, it's the choice what saves everyone; gondians, Ravengard, Karlach, Gortash himself.

#bg3 spoilers#bg3#dark urge: june#june's main theme is servitude and wherever he breaks out of it#if he does it's his good ending if he doesn't - the bad one where he is bane's new favorite tyrant#all gortash managed to do is to show june he has a choice who to follow#and june breaking out of this badly fitting loyalty is a result of the bond he builds with companions#also to clarify of course june and enver were A THING#surprisingly the whole tadpoling business actually makes it better bc before that Gortash kind of looked down at june#but after that june gains new respect in the man's eyes. Enver didn't know his favorite assassin could be cunning and wicked#in a way beyond bland murder that's it#me: *invests in more than one durge and makes them whole ass people*#me: i am very normal about this game#what are they doing after the end of the game? Gortash kind of manages to pull the 'i was enthralled as you all' card#Probably doesn't manage to keep his title as archduke but weasels out of any reprecussions#is he still Bane's Chosen? I doubt it. At this point Bane has probably deemed him a failure.#there's a big chance he tags along with June and Astarion to Underdark because hey all these unliberated ppl in there!#Astarion: so let's make it clear...You're planning to conquer Underdark?#Gortash: Conquer? Such a crude world. I am planning to liberate them. save them from themselves!#June laughing: sure you do love. i bet that's what tyranny is al about: liberation. freedom of wills and artistic expression.#Gortash: laugh all you like my dear partner in crime but don't you see them suffer?#Gortash: don't you hear them choke on a breath under suppressing rule of the Spider Queen?#June: so you deem yourself a savior now?#gortash: yes. The question is: will you save these people with me?#June:...a...compelling argument. I doubt we can do worse than the existing conditions under the Lloth are#Astarion: another world' saving but also inevitably self-centered quest? Another one? We JUST survived the last one.#June: I don't know. We live here now. isn't it natural to make this place more... lived in? I like the dangerous nature here#June: but I doubt drow will be very welcoming. And Menzoberranzan seems like a good place for the spawns to settle#June: ...if we restructure some things that's it#Astarion painfully aware he travels with two fools with delusions of word domination/salvation: fiiine.

3 notes

·

View notes

Text

I am once again sad that a person I bonded with in a dream is not real

#ALEX. where are you and who are youuuu#okay so the dream was crazy. like.. coherent by my usual standards but still ridiculous#i was back at high school but was the age i am now & i was attending a class in ‘business and employment’ which was supposed to help us all#get jobs and learn skills. but in reality the vast majority of the people in the class (including myself) were in mlm schemes#(multi-level marketing before anyone gets confused with the acronym)#myself and the entirety of my high school friend group (about 8 or 9 people) formed the largest faction and we were selling fragrances#for exactly the sort of company you would expect. anyway. i’d been elected manager even though someone else in the group (who actually sells#this shit irl lol) had recruited me & another person’s mom had invested money into it so that none of us had to actually buy inventory#and i was so uncomfortable and ashamed. i was like ‘okay i’ll just do this for a month and then bounce so i can at least get work/management#experience’. so i was very much checked out when everyone was brainstorming ideas for how to come up with a brand & sell it#the only thing i did notice is that there was this guy named alex who was pretty much reporting us whenever we breathed. an example would be#we wanted to call ourselves ‘lions’ but apparently that was the name of an lgbt society in the area that was important to him#so he complained to the teacher/facilitator about us and we couldn’t use lions. and our whole group was complaining about him#but i was thinking ‘fuck i hope he gets us shut down’. he seemed like a nice guy and the stuff people started saying was borderline#homophobic so i had to be the one to shut them down like ‘hey i’m bi as well and i’m your fucking manager. any more of that and you can find#yourself a new job’#so anyway. next thing that happened was the facilitator was like ‘okay we seem to have pretty much been taken over by mlm schemes BUT here#is a list of people in the class who do not want to be recruited & their reasoning. just so you can take note’ and she does a presentation#of course it starts with alex and his ideological opposition to mlms; but there are other people like a girl who has a large academic#workload. but it becomes apparent that alex is the one who rallied them all together to spread dissent. so i went over to talk to him#(for some reason he was now hiding in a tent) and i was like ‘yes alex!!!! can i shake your hand?’ and he was puzzled but he let me#then i stood up and said ‘can i just say something. everyone has great reasons for not wanting to be recruited and as a manager; i want to#say that if i catch any of my employees trying to recruit anyone on the do not recruit list for any reason; you will be fired immediately’#of course this causes a schism. but it also causes me and alex to end up having a heart-to-heart where he’s like ‘why are you even part of#one of these things’ and i’m like ‘honestly i just want legitimate work experience’ and he’s like ‘i can think of so many more legitimate#jobs. including like. fly-tipping. i’d rather have that on my cv than scentsy’ and i was like ‘you’re so right’#and then i woke up thinking ‘god i’m going to have to go door to door selling this shit’ but then i realised i actually didn’t#and i was so happy#it has motivated me to go back to job-hunting though because my god.#that five minutes when i thought i was going to have to traverse the neighbourhood dressed like an idiot and selling wax melts? bleak.

1 note

·

View note

Text

How to support small islands’ resilience to external threats and chart new pathways to sustainable prosperity.

The fourth International Conference on Small Island Developing States (SIDS4) opened today in Antigua and Barbuda to deliver a bold new and transformative plan of action to help SIDS build resilience, tackle the world’s most pressing challenges and achieve the Sustainable Development Goals.

World leaders, together with representatives from the private sector, civil society, academia and youth, have gathered at the Conference to tackle critical issues impacting the future of SIDS. Under the theme “Charting the course toward resilient prosperity”, the four-day Conference (27-30 May) will showcase new innovations and develop practical solutions to address critical SIDS-specific challenges driven by the climate emergency, spiralling debt and health crises.

The Conference will adopt The Antigua and Barbuda Agenda for SIDS (ABAS) – a Renewed Declaration for Resilient Prosperity, which sets out the sustainable development aspirations of small islands over the next 10 years and the support required from the international community to achieve them.

“The new Antigua and Barbuda Agenda for Small Island Developing States outlines steps to achieve resilient prosperity in partnership with the international community,” said United Nations Secretary-General António Guterres. “I urge SIDS governments to back up these words with bold investments and sustained engagement across all sectors of sustainable development. But SIDS cannot do this alone. The international community has a duty to support Small Island Developing States – led by the countries that have greatest responsibility and capacity to deal with the challenges they face.”

Echoing this, Li Junhua, UN Under-Secretary-General for Economic and Social Affairs and Secretary-General of the SIDS4 Conference highlighted: “The Agenda tells the SIDS story, their journey, their hopes and challenges. But most importantly, the Agenda shows the global community the specific actions that Member States, development partners, financial institutions, the UN system and stakeholders must take to deliver and follow-up on SIDS’ aspiration for prosperity and a sustainable future for their people and our planet.

“Together, we will use this Conference as a catalyst for building and renewing partnerships, innovative financing mechanisms and concrete actions that will support these extraordinary island nations and their people to build a more resilient and sustainable future that leaves no island behind,” he added.

SIDS’ Resilience

The SIDS across the Pacific, Caribbean and Atlantic, Indian Ocean and South China Sea are home to approximately 65 million people. They manage 19.1 per cent of the world’s Exclusive Economic Zones and the resources they hold. Accounting for 14 per cent of the world’s coastlines, SIDS boast a high degree of biodiversity. The people of SIDS have pioneered renewable energy solutions, championed sustainable tourism while spearheading conservation efforts and making major strides in developing ocean-based economies.

Yet these small island nations remain a special case for sustainable development given their small size, remote location, narrow resource base and unique vulnerability to external shocks, including climate-induced disasters. With SIDS still reeling from the double shocks of the global financial crisis and the COVID-19 pandemic, amid the rapidly accelerating impacts of climate change, the SIDS4 Conference takes on even greater urgency.

At the Frontlines of Climate Change

SIDS are at the frontlines of the rapidly accelerating impacts of climate change despite only contributing to 1 per cent of global carbon dioxide emissions. Climate change is threatening around 75 per cent of SIDS’ coral reefs, which are some of the planet’s most biologically diverse and valuable ecosystems. And for low-lying SIDS like Tuvalu, Maldives and Kiribati, sea-level rise represents an existential threat. These islands may be uninhabitable by the end of the century which could cause mass population displacement. Despite this vulnerability, SIDS had access to only US $1.5 billion out of US $100 billion in climate finance pledged to developing countries in 2019.

Many SIDS also remain dependent on imported fossil fuels, curtailing both their environmental and economic efforts. According to the International Renewable Energy Agency (IRENA), some SIDS would need an investment of around US $5.9 billion annually to achieve their renewable energy targets by 2030 and reduce their fossil-fuel dependency.

A Crippling Debt Crisis

The COVID-19 pandemic deepened existing fragilities and triggered the most acute economic contraction across SIDS, increasing their debt burden and depleting resources. Over 40 per cent of SIDS are now on the edge of or are already grappling with unsustainable levels of debt. Between 2000 and 2019, the external debt of SIDS rose by 24 percentage points (of GDP). The total public debt for SIDS now stands at approximately US $82 billion dollars. Many SIDS continue to rely on Official Development Assistance (ODA). However, ODA to SIDS remains comparatively low, standing at just under US $3 billion in 2020 for all SIDS. Approximately two-thirds of ODA-eligible SIDS are currently classified as lower-middle or upper-middle-income economies and are at risk of becoming ineligible for concessional financing.

Plagued by gaps and inefficiencies, the current outdated global financial system has failed to serve as a safety net for these countries. SIDS are paying more to service debt than invest in healthcare and education. In response, SIDS are calling for increased access to concessional finance, through expanding multilateral lending. They also want representation of SIDS in international financial institutions and the incorporation of vulnerability into the allocation of concessional finance, accompanied by support to sustainably manage their debt levels.

Looking Ahead

As a critical moment to renew multilateralism and deliver on the promise to leave no one behind, the upcoming Summit of the Future, taking place at UN Headquarters in New York from 22 to 23 September 2024, will be an opportunity to further address the concerns of SIDS. The Summit will help to ensure the most vulnerable countries can access both the finance and technology they need to support their development goals – including climate mitigation and adaptation.

“Small Island Developing States face critical existential challenges. The overlapping crises of COVID-19, climate change, and conflicts in different parts of the world, have seriously jeopardized their journey toward sustainable development,” stated Rabab Fatima, the UN Under-Secretary-General and High Representative for

Small Island Developing States. “The adoption of the Antigua and Barbuda Agenda for SIDS (ABAS) ushers in a new era of hopes and aspiration for transformative changes in SIDS in the coming decade. I call on the international community to demonstrate strong commitment at SIDS4 to supporting SIDS on their journey toward sustainable and inclusive development to ensure full and effective implementation of the ABAS.”

About the Conference

In addition to eight plenary meetings and five interactive dialogues, the Conference features five high-level special events: the SIDS Children and Youth Action Summit (24-26 May), the SIDS Gender Equality Forum (25-26 May), the 2024 SIDS Global Business Network Forum (25-26 May), the SIDS4 Civil Society Forum (29 May) and the SIDS4 Private Sector Roundtable (28 May). The UN Secretary-General is convening a High-Level Meeting on Mobilization of Resources for SIDS on 28 May. There will also be more than 170 side events.

Key deliverables of The Antigua and Barbuda Agenda for SIDS (ABAS) will be launched at the Conference. These include the Centre of Excellence for SIDS, which has the potential to strengthen data collection, storage and analysis, mobilize investment in SIDS and promote technology innovation, and a Debt Sustainability Support Service to support sound debt management in SIDS.

SIDS4 SDG Media Zone

The SIDS4 SDG Media Zone on 27-30 May will highlight opportunities to accelerate progress toward sustainable development in the three SIDS regions and efforts towards a more resilient future. Conversations in the Zone will unpack some of the Conference themes, including financing for development, climate change, youth engagement and digital technologies.

All sessions will be live on UN WebTV. Programme details are available here:

Schedule of press briefings is available here.

Key SIDS4 Conference

Small islands on the frontlines of catastrophic climate crisis, crippling debt, exacting heavy toll on development gains

#small island developing states#the tropics#conferences#sids4#landlocked developing countries#antigua and barbuda#plenary sessions#tropical communities#tropical regions#development issues#charting the course for resilient prosperity#resilent prosperity#united nations#Debt Sustainability#technological innovation#sound debt management#mobilize investment

0 notes

Text

Nicki Minaj and Cardi B Carpool Karaoke

#Nicki #Minaj #Cardi #Carpool #Karaoke

0.38 [Music]

0.38 no

0.38 [Music]

0.38 you know what now you sound like you're

0.38 kind of taking it

0.38 um

0.38 well when i do private parties i'd be so

0.38 shy

0.38 like i did a bar mitzvah not so long ago

0.38 and i never performed in front of so

0.38 many kids oh

0.38 and then like my dj he didn't have the

0.38 clean version of the song…

View On WordPress

#$0 marketing#$7 affiliate marketing course#0 dollar marketing#0 investment affiliate marketing#0 investment digital marketing#0 to 1000 affiliate marketing#0 to 10000 affiliate marketing#0nline marketing#1 page marketing plan#1 page marketing plan audiobook#10 log marketing#10 minute school affiliate marketing#10 minute school digital marketing#10 minute school email marketing#12th commerce it digital marketing#12th commerce ocm chapter 8 importance of marketing#12th ocm marketing#15 psychological marketing triggers#2024 affiliate marketing#2024 digital marketing strategy#2024 digital marketing trends#2024 marketing#2024 marketing trends#2024 social media marketing#22 immutable laws of marketing#22 immutable laws of marketing audiobook#2nd puc business studies marketing chapter#2nd sem marketing management#3 cʼs of marketing#3.0 remote marketing agency

0 notes

Text

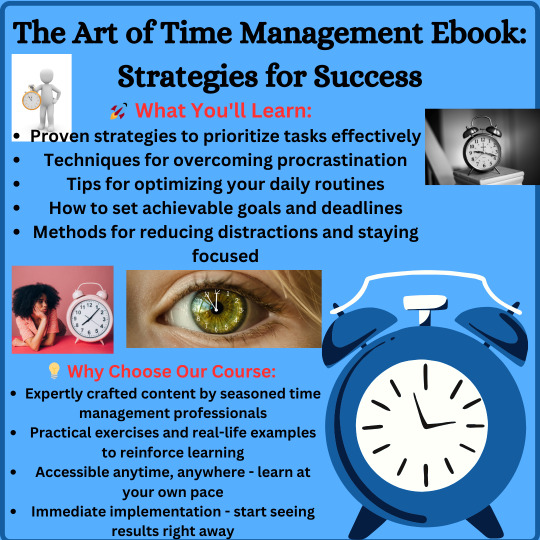

Mastering Time: A Comprehensive Ebook Course on Time Management

Feeling constantly overwhelmed and behind schedule? I used to be there. My to-do list overflowed, deadlines loomed, and the constant pressure left me feeling stressed and unproductive. Then, I stumbled upon the Time Management Ebook Course, and it became a game-changer.

Practical Strategies, Not Just Theory

This course wasn't filled with empty platitudes or theoretical frameworks. It provided practical, actionable strategies that I could implement immediately. From prioritizing tasks effectively to identifying and eliminating time-wasters, the course offered a clear roadmap to regain control of my schedule.

Tailored to My Needs

What impressed me most was the course's ability to cater to individual needs. It offered various techniques and tools, allowing me to choose the ones that best suited my work style and preferences. This personalized approach made the information truly valuable and applicable to my specific situation.

From Chaos to Clarity

Implementing the strategies from the course transformed my daily routine. My to-do list became manageable, and I started accomplishing more in less time. The constant feeling of being "behind" faded away, replaced by a sense of calm control and focus.

Sustainable Habits, Lasting Impact

The course wasn't just a quick fix. It equipped me with the tools and mindset to build sustainable time management habits. I learned to prioritize effectively, schedule realistically, and identify areas for improvement. This newfound awareness has had a lasting impact on my productivity and overall well-being.

Investing in Your Time

The Time Management Ebook Course wasn't just an investment in a course; it was an investment in my time and sanity. It empowered me to reclaim control of my schedule, reduce stress, and achieve more in all aspects of my life. If you're struggling with time management, I highly recommend this course. It's a practical, effective solution that can truly transform your relationship with time.

#time management#productivity#stress reduction#organization#focus#efficiency#to-do list management#time management strategies#work-life balance#personal development#self-improvement#ebook course#practical tips#actionable advice#personalized approach#sustainable habits#lasting impact#invest in your time#achieve more#British time management

0 notes

Text

Preparing MIT’s campus for cardiac emergencies

New Post has been published on https://thedigitalinsider.com/preparing-mits-campus-for-cardiac-emergencies/

Preparing MIT’s campus for cardiac emergencies

MIT has launched an initiative to install an automated external defibrillator (AED) in every building on MIT’s campus, including leased spaces and satellite locations. The effort will continue over the course of the upcoming year and is supported through funds from MIT’s central budget.

“Rapid access to an AED is a critical step in the survival of cardiac arrest victims,” says Suzanne Blake, director of MIT Emergency Management, which is spearheading the project. “We’re excited about the opportunity to implement this program at MIT and improve our lifesaving capabilities on campus.”

AEDs work by sending an electric charge to the heart of a person experiencing a cardiac emergency in order to restore their normal heart rhythm. But an AED is only effective if it is in close proximity to the cardiac emergency. While AEDs are not an uncommon sight around MIT — many buildings have them — their availability has been dependent on a department’s purchasing one through its own budget. With this new program, the funding is being provided centrally and the devices are being supplied to units free of charge.

“It was important for the Institute to make this investment to ensure that these devices are widely available to members of our community,” says Glen Shor, executive vice president and treasurer. “Suzanne and her team were critical to making this happen, and they will continue to oversee the program as a whole, including the procurement, administration, and maintenance of AEDs on our campus.”

Not only will the program install AEDs in buildings that weren’t previously equipped with them, it will also replace existing ones. For Senior Emergency Management Specialist David Barber, equipping every MIT building with an AED has long been a professional goal — and it’s one that derives from a personal experience.

“About 11 years ago. I became infinitely more interested in AEDs because I had a cardiac event on campus, and an AED saved my life,” Barber says. “I’m very lucky.” It’s a story he’s not shy about sharing with others. In fact, he often recounts his experience during CPR classes he teaches to underscore how use of the device, in combination with CPR, can be lifesaving.

Barber also enjoys describing how this particular type of AED made its way to MIT’s campus — or rather, made its return. “Being passionate about AEDs, I’m always on the lookout for the latest, greatest thing,” he says. Several years ago, MIT mechanical engineering students Rory Beyer ’17 and Moseley Andrews ’17 contacted Barber to find out if his office could provide them with used AEDs for a class 2.009 (Product Engineering Process) project. After graduating from MIT, the students continued to build upon the idea, and Barber heard from them again — this time to share information about their company, Avive, which they co-founded with a third partner, Sameer Jafri.

The energy-efficient Avive devices have built-in maintenance tracking. They also provide users with step-by-step instructions on a touch-screen display — a helpful feature for those without experience operating an AED and those who might find the prospect of doing so intimidating.

For Barber, the success of the new program has been incredibly rewarding. “It’s a triple win: One in every building, new technology, and departments don’t have to pay for them anymore. That the idea was born in an MIT classroom makes it even better.”

While training is not required to use an AED, MIT Emergency Management encourages all MIT community members to take first aid, CPR, and AED training to become more informed about how to respond to cardiac and other emergencies. MIT is a “HeartSafe Campus,” a certification granted by the National Collegiate Emergency Medical Services Foundation. Contact [email protected] with any questions about the AED program.

#Abdul Latif Jameel Poverty Action Lab (J-PAL)#Administration#Alumni/ae#Born#Building#buildings#Campus buildings and architecture#Campus emergency#cardiac arrest#certification#classes#Community#course#devices#display#energy#engineering#Foundation#Funding#Health#Health sciences and technology#heart#heart rhythm#how#how to#investment#it#life#management#Mechanical engineering

1 note

·

View note

Text

🚀 Start Trading Today with Bharti Share Market Institute! Open Your Free Demat Account Now!

Discover the world of trading with Bharti Share Market Institute! Get expert guidance, cutting-edge technology, and personalized support.

✨ Why Choose Us?

Expert Guidance

Comprehensive Education

Cutting-Edge Technology

Personalized Support

✨ How to Get Started:

Visit Our Website : www.bhartisharemarket.com

Fill in Your Details

Submit Required Documents

Start Trading…! Don't miss out…! Open your free demat account with Bharti Share Market Institute today and begin your journey to financial success!

For more information, visit Bharti Share Market Institute.

1 note

·

View note

Text

Blog Posting Date : 01 Jan 2024 Disclaimer- For Educational Purpose Only, Should not be considered as a Investment Advice “The Conviction Club” Knowledge Series Post For the past 2-2.5 years, FIIs have sold a lot. Even after that we did well because of strong DII flows, thanks to domestic flows.

#Peek into Investor’s Rights#leverage in financial management#joel greenblatt magic formula#combined leverage formula#what is ev ebitda#vix india index#Psychology of A Market Cycle#special situations examples#special situation stocks in india#vix index india#stock market courses in bangalore#stock market mentor in bangalore#financial alpha blog#super master class#psychology of stock market#special situation investing#bangalore stock market training#best stock market training in chennai

1 note

·

View note

Text

Teaching Teens Money Matters: Over Half of U.S. Students Now Guaranteed Personal Finance Courses

Money management skills are not often part of the core curriculum taught in America’s high schools. Yet handling personal finances wisely is an essential life skill. This week, however, Pennsylvania passed legislation requiring all high school students in the state to complete a personal finance course before they graduate. With the Keystone State on board, over half of U.S. high schoolers now…

View On WordPress

#graduation requirements#high school courses#investing#money management#personal finance#teen education

0 notes

Text

FinTech & IT MBA Course

FinTech, an emerging field, uses cutting-edge technologies to efficiently and successfully provide financial services by fusing finance and technology. It will make day-to-day issues easier for banks, insurance companies, non-banking financing companies (NBFC), payment banks, stock trading, and investment advisory firms to handle while offering more user-friendly solutions.

This two-year online MBA degree in IT and FinTech is open to students with an interest in information and finance technology. This degree offers students a competitive edge in the job market by combining two essential areas of the booming management market.

What is FinTech?

Any technology that supports financial services, such as online banking, mobile payment apps, and even cryptocurrencies, is referred to as fintech (financial technology). Although it's a large category with a wide range of technologies included, its main objectives are to compete with traditional financial institutions and help consumers and organisations manage their funds.

Over the past several years, FinTech has revolutionised nearly every aspect of the financial sector. A decade ago, one had to visit a bank or other financial institution to get a mortgage, small business loan, or even just to move money from one account to another.

FinTech has made it possible to invest, borrow, save, and transfer money via online and mobile services without ever having to walk inside a bank. Traditional institutions were hesitant to accept FinTech solutions, but both start-ups and well-established companies are betting on digital financial services.

What is the IT & FinTech MBA programme?

The two-year postgraduate MBA programme in IT and FinTech assists students in bridging the gap between the application of innovative financial technology in financial services and managerial excellence. Those who want to work in management roles in the financial or digital technology industries can take the online MBA degree financial course as an elective. It will provide students with the much-needed professional boost they need to raise their earning potential and enter this rapidly developing area.

Why should you enrol in a FinTech and IT MBA programme?

Fintech is a new industry that is growing quickly because of many different expectations and worries about the long-term effects on markets and commerce. The following arguments support your decision to pursue a career in this field:

Modern technology and innovation: The fintech and IT sectors are at the vanguard of innovation, continuously pushing the envelope and creating new technologies. Being involved in cutting-edge projects like blockchain, AI, machine learning, and data analytics is possible for those who work in these domains, and it can be both lucrative and intellectually interesting.

Growth and Demand: There is a strong need for qualified workers in the fintech and IT industries, which are expanding quickly. Technological developments and the growing digitalization of financial services have opened up a multitude of opportunities for those with the necessary knowledge in both fields.

Transferable talents: Working in fintech and IT can give you a lot of useful transferable skills. These abilities include the ability to solve problems, analyse data, manage projects, be technically proficient, think strategically, and be adaptable. These are in-demand abilities that may be used in a variety of industries, offering flexibility and upward career mobility.

High salary and compensation: Because IT and fintech positions are so specialised, workers in these domains frequently receive competitive pay and benefits packages. It is possible to get paid more because of the need for qualified personnel and the important role technology plays in the finance sector.

Ongoing education and career advancement: Since technology is always changing, it's important for those in the IT and fintech industries to stay abreast of the newest developments. By offering chances for ongoing education and career advancement, this guarantees that your abilities will be applicable and beneficial throughout the duration of your work.

Global Opportunities: Fintech and IT jobs frequently cross national borders, making them suitable for employment abroad. Professionals in these domains might investigate a variety of worldwide career choices due to the growing globalisation of financial services and technology.

Cooperation and cross-disciplinary work: Fintech and IT positions frequently call for cooperation and communication with experts in a variety of fields, such as operations, marketing, finance, and technology. Because of the cross-disciplinary nature of this work, there are opportunities to learn from specialists in a variety of subjects in a dynamic and diverse work environment.

Security and stability of employment: As technology becomes more and more integrated into the financial sector, there will likely be a high demand for IT and fintech specialists. This provides a certain amount of work security and stability along with lots of chances for professional development.

If you are looking for the best online MBA Degree visit here

Opportunities for employment following an MBA in FinTech and IT

EmploymentThe online MBA degree programme in IT and FinTech offers a vast array of job choices due to the swift progress of technology and the increasing inclination towards fintech. Through the use of innovative technology and the prompt delivery of customised, value-added services, emerging FinTech companies have put the traditional financial services industry to the test in recent years. opportunities for an MBA programme in FinTech and IT

Information Analysis

Robo Advisors and Wealth Tech

Hazard and Adherence

Online safety

Artificial Intelligence, Machine Learning, and Data Science

Cryptocurrencies and Blockchain

Development of Mobile Apps

Online Lending

Using crowdsourcing

Leading Fintech and IT career paths following an MBA

Fintech Product Manager: Developing, creating, and introducing cutting-edge financial technology goods and services is the responsibility of fintech product managers. They manage the product development lifecycle, design product strategy, carry out market research, and collect consumer feedback in close collaboration with cross-functional teams.

Data Scientist/Analyst: By examining enormous volumes of financial and customer data to extract insightful knowledge, data scientists and analysts are essential to the fintech sector. To find trends, create predictive models, evaluate risk, and enhance corporate procedures, they employ statistical modelling, machine learning, and data visualisation approaches.Best careers opportunities in IT and Fintech following an MBA

If you are looking for the best online MBA Degree visit here

Blockchain Developer: As blockchain technology carries on transforming the financial sector, there is an increasing need for blockchain developers. These experts create, develop, and put into practise smart contracts, decentralised applications (DApps), and blockchain solutions to improve the efficiency, security, and transparency of financial transactions.

Cybersecurity Specialist: Cybersecurity is crucial in the fintech sector because of the sensitive nature of financial data and transactions. Organisations may safeguard their networks, systems, and consumer data against cyber threats with the assistance of cybersecurity specialists. They put security measures into place, evaluate risks, carry out audits, and handle security issues.

Compliance Officer: Strict regulatory frameworks and compliance standards must be followed by fintech organisations. Compliance officers make sure that businesses abide by all relevant laws, rules, and industry standards. They create and carry out compliance programmes, carry out audits, and offer advice on regulatory and risk management issues.

UX/UI Designer: The primary goal of user experience (UX) and user interface (UI) designers is to provide user-friendly, intuitive interfaces for fintech platforms and applications. To guarantee a smooth and interesting user experience, they work with development teams, perform user research, and create wireframes and prototypes.

Financial Analyst: In fintech organisations, financial analysts carry out market research, financial modelling, evaluation of investment opportunities, and offering of strategic decision-making insights. They participate in the processes of financial planning, budgeting, and forecasting in addition to analysing financial data and assessing financial performance.

Payment Systems Specialist: Within fintech companies, payment platforms and infrastructure are designed, implemented, and managed by payment systems specialists. They collaborate with banking partners, keep up with the most recent advancements in payment technology, and guarantee safe and easy payment procedures for clients.

Expert Robo-Advisor: Robo-advisors manage portfolios and offer individualised investment advice through the use of automation and algorithms. Experts in this field create and construct robo-advisory systems, enhance algorithmic models, and guarantee automated investment services comply with regulations.

Qualifications required for a FinTech profession

Fintech offers chances to people with a variety of skill sets, so even if you are not a digital wiz, it's a fascinating new field to follow. If this is a field you're interested in, you'll need the following essential skills to gain a job:

Comprehensive Knowledge of Blockchain

Undoubtedly, blockchain technology has disrupted a number of well-established industries, including banking. Businesses continue to battle intensely to hire the top crypto talent since the pool of people possessing expertise in blockchain technology and application development is very narrow. There are many different career opportunities available to you if you meet this description.

Outstanding coding skills

Those that can improvise while creating apps, websites, and platforms are typically employed by the greatest financial and tech companies. The need for skilled individuals who can spearhead these new technological advancements will increase as fintech companies continue to produce ever more digital innovations. If you're familiar with computer science or information technology, you can explore the realm of fintech.

Enthusiasm for Figures

Because fintech relies so largely on data, it will be very beneficial to have a basic understanding of finance-based maths as well as the ability to interpret charts and graphs and identify trends. A degree in mathematics may make it easier for you to break into the fintech industry.

Proficiency in Cyberspace Defence

Fintech businesses are actively looking for cybersecurity specialists that can help shield their clients from expensive breaches. If you can help design cutting-edge security solutions that can foil fraudsters and swiftly put an end to online crimes, fintech is where you belong.

If you are looking for the best online MBA Degree visit here

#online studies#online mba#online learning#management courses#mba#fintech#investment#bitcoin#crypto#blockchain#digital marketing#cybersecurity#executive mba

0 notes

Text

Unlocking the Secrets: Mastering the Stock Market Course for Financial Success

Dive into the world of stocks and investments with our comprehensive Stock Market Course. Gain practical insights, learn strategies, and explore global market trends to make informed financial decisions. Elevate your knowledge and secure your financial future today!

#stock market course#stock market courses#stock market course in Delhi#Stock Market Education#Investment Training#Trading Strategies#Financial Market Courses#Stock Analysis Techniques#Portfolio Management Classes#Equity Market Learning#Risk Management Training#Fundamental Analysis Skills#Technical Analysis Courses#Day Trading Education#Options and Derivatives Learning#Wealth Creation Seminars#Market Trends Analysis#Long-term Investing Education#Stock Market Fundamentals#Online Stock Trading Courses#Investor Education Programs#Financial Literacy Workshops#Profiting from Stocks Training#Diversification Strategies#Economic Indicators Understanding#Retirement Planning through Investments#Behavioral Finance Workshops#Trading Psychology Mastery

0 notes

Text

Master Your Finances with our Comprehensive Personal Finance Course

Take control of your financial future with our Personal Finance Course. Learn how to budget, save, invest, and effectively manage your money. Start your journey towards financial freedom today!

0 notes