#Ethereum technology

Text

Cardano will soon be offered on the world’s first digital asset bank

Read the original article HERE.

On August 2, Team Sygnum announced in a press release that the digital asset bank will integrate Cardano into its “bank-grade staking offering.” Valued at over $800 million, Sygnum’s integration of Cardano (alongside similar moves made by Ledger Live) foreshadows more adoption in the future for the Crypto world’s eighth largest coin by market cap.

The bank initially only supported staking for Ethereum, Internet Computer, and Tezos. Although earning profits from staking is already possible, Sygnum allows users to earn staking profits through their “institutional-grade” banking platform (customers still have control of their ADA and can withdraw them anytime without charges or penalties). Sygnum empowers clients and large-scale investors (banks and other financial institutions) to delve into the crypto market with the “complete trust” of a regulated banking platform.

This comes as Cardano prepares to implement the VASIL Hard Fork — a change that will significantly improve the scalability and reduce transaction fees on the network.

If you enjoyed reading this, consider following. It helps a lot!

ADA Crunch

4 notes

·

View notes

Text

𝐓𝐇𝐄 𝐄𝐕𝐎𝐋𝐔𝐓𝐈𝐎𝐍 𝐎𝐅 𝐖𝐄𝐁𝟑

The Web3 is an evolution of the world wide web and it might interest you to know how technically sound the features of Web3 are.

Web3 is technically carved of many features and this has made it better than web1 and web2 whose feature is not as powerful as web3.

The Web3 is.

. Decentralized

. Trustless and permissionless

. Artificial Intelligence

. Connectivity and ubiquity

The features of Web3 is very interesting and will make alot of things easy for users on the world wide web (www). and one of this is that the Intelligent Search Engine can collate informations and generate tailored recommendations based on profile and preference, saving you hours of work and stress.

This is just a tip of things among the evolution of Web3 you should know.

Stay connected to learn about Web3.

____________________________________

Please leave comments, subscribe and follow my news on my official social media pages: Telegram, LinkedIn, Facebook, Twitter, Gettr, Reddit, and Tumblr.

🤝 Reinis TUMOVS.

#tumovs#wkwgroup#тумовс#banking#bank#crypto#digitalcurrency#fintech#blockchain#defi#reinis tumovs#blockchain technology#bankers#bts#bitcoin#solana#ethereum#web3#crypto market#technology#finance

63 notes

·

View notes

Text

New Blog:

#crypto#cryptocurrency#ethereum#technology#bitcoin#btc#education#technological advancements#life#tech

2 notes

·

View notes

Text

#Bitcoin#crypto#cryptocurrency#tendance#beautiful#ethereum#teeshirt#fun#cool#clothes#nft#shiba#style#tenuedujour#blockchain#technology#art#design#hodl#look#fashion#streetwear#insta#cryptoart#altcoin#tumblr#tumblrlife#tumblrphoto#envywear#tumblrphotos

28 notes

·

View notes

Text

From Amateur Hour to Organized Crime: The Growing Sophistication of Sandwich Bot Networks

Remember the early days of DeFi, when sandwich bots were clumsy scripts written by hobbyists, easily detectable and swatted away? Those days are gone. The landscape of MEV (Miner Extractable Value) exploitation has evolved into a sophisticated ecosystem, with well-organized networks employing cutting-edge tools and coordinated strategies to fleece unsuspecting users.

From Solo Players to Syndicates

Gone are the days of lone bots lurking in the mempool. Today, MEV teams operate like criminal enterprises, pooling resources, expertise, and infrastructure to maximize their gains. These teams leverage:

Advanced bots: Employing AI and machine learning, these bots can predict market movements, identify profitable opportunities, and execute complex arbitrage strategies in milliseconds.

Flash loan manipulation: Borrowing vast sums instantly, these teams manipulate markets, trigger liquidations, and extract hefty profits before disappearing.

Front-running bots: These bots predict user actions and place transactions ahead, denying them the intended price and reaping the difference.

Distributed networks: Operating across multiple nodes and blockchains, these networks are harder to detect and disrupt.

The Stakes are High

The impact of these organized attacks extends far beyond individual losses:

Market manipulation: By manipulating prices, these bots distort markets, creating unfair advantages and undermining trust in DeFi.

Exacerbated volatility: Their rapid arbitrage activity fuels market volatility, discouraging participation and hindering adoption.

Centralization concerns: Large, well-resourced teams gain an unfair edge, raising concerns about centralization within DeFi.

Fighting Back

The good news is, that the fight against organized MEV exploitation is not one-sided. Here are some promising developments:

MEV-resistant protocols: Projects like Flashbots and MEV Boost offer infrastructure to mitigate certain MEV exploits.

Layer 2 scaling: Solutions like Optimism and Arbitrum aim to reduce MEV by processing transactions off-chain.

Collaboration and research: Ongoing research and collaboration between developers, users, and researchers aim to develop fairer and more efficient mechanisms for distributing MEV rewards.

The Future of MEV

The battle against organized MEV networks is an ongoing one, requiring constant vigilance and adaptation. By staying informed, supporting responsible projects, and advocating for fair and transparent DeFi, we can ensure that this revolutionary technology benefits everyone, not just the digital robber barons of the mempool.

#artificial intelligence#machine learning#deep learning#technology#robotics#autonomous vehicles#robots#collaborative robots#cryptocurreny trading#crypto trading#crypto currency#crypto#sandwich attack#sandwich bot#sandwich#ethereum#binance#polygon

1 note

·

View note

Text

NEW NFT ITEM I CREATED JUST FOR YOU GUYS!!! ***THE NFT PRIZE BOX*** Unlock 3 unique rare NFT art pieces instantly! joshuabruceNFTart.com

#cryptocurrency#blockchain#bitcoin#technology#art#artwork#joshua bruce#crypto#eth#ethereum#NFTprizebox#nft art#NFT#nftcollectibles#nftdrop

2 notes

·

View notes

Text

Join us on a fascinating exploration of the evolving landscape of digital money as we compare Central Bank Digital Currencies (CBDCs) with cryptocurrencies. Delve into the key differences, advantages, and challenges associated with both CBDCs and cryptocurrencies, shedding light on their potential impact on our financial systems and everyday lives. Discover the potential benefits of CBDCs, such as increased financial inclusion and improved transaction efficiency, while also exploring the decentralized nature and privacy aspects of cryptocurrencies. Whether you're a cryptocurrency enthusiast or simply intrigued by the future of money, this journey will provide valuable insights and inspire engaging discussions. Buckle up for an intriguing exploration of CBDCs vs cryptocurrencies - the future of digital money awaits!

#blockchain#cryptocurrency#crypto#green technology#technology#blockchain technology#bitcoin#metaverse#defi#nftnews#cbdc#digital currency#btc#ethereum#cryptocurrency news

2 notes

·

View notes

Text

Jan Gregory named The Most Powerful Person in the Crypto Networking Industry leading the Globe with a 50,000+ Bitcoin Army

Jan Gregory, currently CEO and CMO of the world’s best brands in passive AI driven income. As you may already know, Jan Gregory has recently been recognized as the “Most Powerful Person” in the world of network marketing!His leadership and vision have led his companies to great success, and many of the world’s top leaders in the industry are joining his Diversity 2030 Vision to achieve their…

View On WordPress

#BitCoin#blockchain#Business#crypto#crypto mining#cryptocurrency#Education#entrepreneurs#ethereum#jan cerato#jancerato#marketing#Technology

6 notes

·

View notes

Text

Earning Money Online: How to Get Started with Cryptocurrency Trading

Cryptocurrency trading has become a popular way to earn money online. With the rise of digital currencies like Bitcoin, Ethereum, and Litecoin, more people are exploring the potential of trading cryptocurrencies for profit. If you're interested in getting started with cryptocurrency trading, here's what you need to know. Read more

#cryptocurreny trading#cryptocurrency#blockchain#Cryptocurrency investment advice#cryptocurrency trading#Bitcoin#Ethereum#Litecoin#decentralized currencies#trading strategy#cryptocurrency exchange#market trends#investment#cryptocurrency news#market movements#online income#digital currencies#blockchain technology.

2 notes

·

View notes

Link

9 notes

·

View notes

Text

The Ridiculousness Continues: Retik Finance Fails CertiK Audit

Read the original article HERE.

As I covered in my last article, Retik Finance is obviously a scam. But that didn’t stop them from rushing to reassure the public that their scammy token isn’t actually a scam by informing us all that their CertiK audit is complete (spoiler: it’s still a scam).

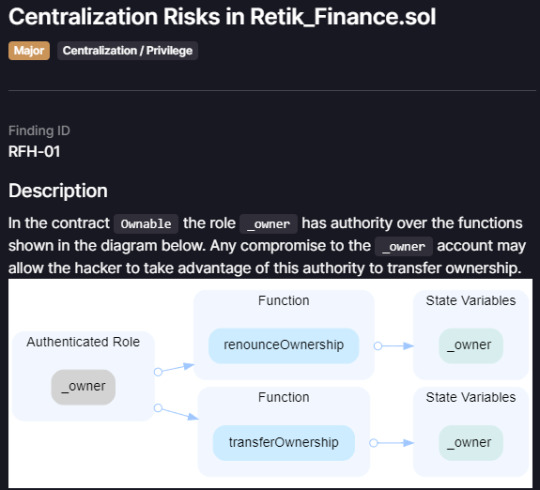

A quick look at the audit report reveals that Retik Finance still did horribly on the audit. Take a look at this detail in the contract code found by CertiK:

The owner of the Retik Finance contract has the ability to take Retik tokens from users (renounceOwnership) and send them to his own account (transferOwnership). This alone should scare away any users. Retik Finance is entirely centralized.

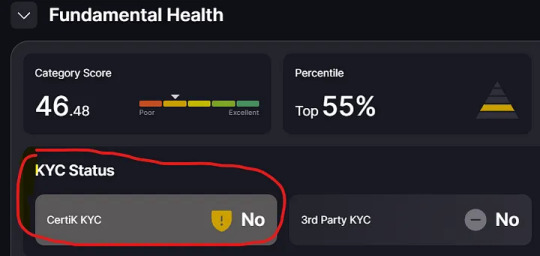

But it doesn’t stop there. CertiK also reports a very low Fundamental Health score for Retik Finance. Largely because Retik Finance hasn’t verified their identity. Probably because scammers don’t want to reveal who they are, making it more difficult to hold them accountable.

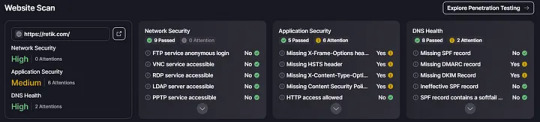

To top it all off, CertiK reports that their website has vulnerabilities as well:

So Retik Finance is a centralized mess with dangerous code and unverified owner(s). The only good thing on their audit report is that they have thousands of followers on Twitter/X and a lot of telegram users, which is a sad sight to witness. Hopefully people don’t keep falling for this obvious scam.

This also brings up another point: why is CertiK not immediately warning users that Retik Finance is a scam? Any body with any sense can figure out for themselves that Retik Finance is a malicious project in less than a minute (I highlighted the reasons why in my previous article). CertiK is supposed to be a professional crypto audit company; auditors at CertiK should be more than capable to see behind Retik Finance’s lies and point them out as a scam. CertiK needs to do a better job of exposing scummy projects.

If you enjoyed reading this, consider following/clapping. It helps a lot!

Need help with crypto gas fees? I have a subreddit for that: https://www.reddit.com/r/CryptoGasFees/

ADA Crunch

2 notes

·

View notes

Text

مایکل سیلور: بیت کوین بهمرور زمان اعتبار طلا را از بین

میبرد

#Ethereum#Cryptocurency#Metaverse#exchange#learning#Tidafy#iran#LeagueOfTheirOwn#بيتكوين#اتریوم#کریپتو#متاورس#صرافی#تیدافای#رمزارز#ارزدیجیتال#token#technology#youtube#metaverse#business#news#developers & startups#entrepreneur#finance#btc latest news#crypto latest news#coinbase#bitcoin latest news#forex

13 notes

·

View notes

Text

Doxy Finance is an NFT and sports fantasy project that is now changing the way people consume sports and games.

✅Join Us Today👉www.doxyfinance.com

#blockchain technology#crypto#defi#cryptocurrencies#eth#ethereum#ps4#soccer#advertising#marketing#hockey#fantasy world#fantasy#nftmarketplace#nftworld#nft update#nft news#nft crypto#metaverse#opensea#tezos

2 notes

·

View notes

Text

#gaming#crypto#anime#blockchain#bitcoin#defi#ethereum#bitcoin latest news#web series#technology#news

4 notes

·

View notes

Link

#vitalik buterin#facebook#meta#Mark Zuckerberg#Science and Technology#metaverse#ethereum#facebook as a business#delete facebook#delete instagram#delete social media#forsakebook#suckerberg

2 notes

·

View notes

Text

This Is a Elactronics Bazaar.

#elactronics#technology#television#home & lifestyle#makeup#student#home decor#health & fitness#street style#education#edayfm#economy#ethereum#interiors#autos#england#escritos

2 notes

·

View notes