#Disrupt Trading

Text

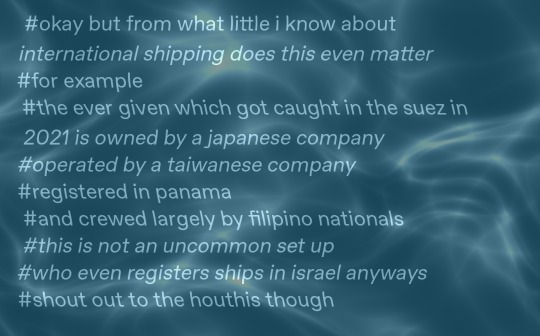

saw this tag re: malaysia banning israeli ships and i just want to note that the gov has not just banned israeli owned ships but ships registered in any country that is travelling to or from israel as well as any ship carrying cargo that is meant to end up in israel, and banning ships from picking up cargo in malaysian ports that they intend to sell to israel. whoever owns the ship is irrelevant in that situation, because it will be banned from docking in malaysia.

another thing to note is that malaysia controls the strait of malacca which is the primary shipping route through southeast asia, particularly when shipping routes cross from the south china sea to the indian ocean and onward (and vice versa) and if ships can't dock in the strait of malacca they have to take a much longer route through indonesia. this decision essentially disrupts most trade through asia that is meant for israel, which is significant.

177 notes

·

View notes

Text

Via seedingsovereignty

#cannot get over how the houthis have disrupted over 50% of global maritime trade#chefs kiss#palestine#gaza#yemen

59 notes

·

View notes

Note

you know the funny thing is that with the Trade federation the Hey this is actually an insane thing Nute is trying to get you to do, it will go really bad you should abandon ship before he drags you all down? Then just, get some people in the company to break faith and break the monopoly and splitting it into 20 different business, a bit of rather be the master of the hovel then servant in the mansion thing. So figuring out who owns what with the company might be good.

So, the tricky thing about this is is that the Trade Federation has contracts under that name. Just breaking off isn't enough. You'd need to invalidate the current contracts and have the infrastructure to establish new ones. And with the Trade Federation in the Senate, they'd make a Huge stink about contract violations and take people to court over it.

That's kind of part of the point of the Separatist movement, as explored in the story. Their government a) doesn't allow orgs like the Federation to having voting power as a protection for the consumers and b) doesn't have legal obligation to recognize or enforce Federation contracts. People did try to jump ship from the Trade Federation (probably internally too, although that hasn't come up). And Palpatine started a war over it.

#also there are *lots* of consequences to disrupting your trade routes#even as the producer and not the consumer#people do Not like having their supply chains interrupted

20 notes

·

View notes

Text

You feel such relief to know that Motaz evacuated Gaza but you’re conflicted because he’s saying bye to his friends and fellow journalists who are still stuck there and you can see it’s difficult for him because he doesn’t know when he’ll be back. So I am relieved but also extremely sad. And then there’s the entire population who are still there and can’t leave and are currently besieged in Khan Younis with tanks surrounding the area. There’s also the important fact that they don’t want to leave because it’s their home their country their land and that’s exactly what the Zionists want. It’s the same feeling when Plestia and Wael evacuated you just feel so happy for their safety but then remember that bisan is there and Wissam and hind and the many other journalists who aren’t as known because maybe they don’t report in English so they kind of get forgotten. Akh ya rab. I’m just rambling but basically seeing Motaz escape to safety evoked two very very strong contradicting feelings in me but first and foremost I’m angry which has been the most consistent one so far.

Anyways I can always count on Yemen to make the day better

#if I was a country I’d be yemen#being a little shit with a backbone the size of the universe#by being a little shit I mean disrupting the entire trade system and costing them billions of dollars

5 notes

·

View notes

Text

man i know i'm not the smartest person in the world but watching smosh do trivia makes me feel like a god

#i know they're all like. actors by trade. a lot of them were homeschooled or had disruptive schooling of some kind#but bitch so did i that's no excuse#they just released an episode about plants trivia and i'm like head in hands the whole way through like. y'all cannot be this dumb#like this isn't actual jeopardy-level trivia. this is pretty basic stuff#actually no i feel the same at trash taste trivia whenever they do that too but at least they're like just. some dudes who consume anime#man i would love to be quizzed more on random facts and trivia bc my brain has so much stuff in it that i never get to use or say#and apparently that isn't 100% universal. at least not when it comes to schooling topics like. plants#man 1. how do you not know mushrooms aren't plants and 2. how do you not know what carrion is#immediately second-guessing that gregor mendel did genetics studies with Peas as if that's not the quintessential thing to know#about genetics in grade school biology#like again i wasn't spectacular in school nor did i have a normal education but God Damn this is wild to me

2 notes

·

View notes

Text

the 4 bitches and 1 son of a bitch I'm sharing my bed with.

#Yorkshire Terriers#yorkies#From back to front:#Surprise (pronounced the French way)#Babbette#Esmerelda#Gracie#And Warrior (who is old and an ancestor of 3 of the others AND a champion in like 4 countries)#My wife has another 2 (the youngest two) in her bed#Warrior normally sleeps with her#But he can be quite disruptive to one's sleep#So we trade him off and tonight he's locked in my half of the house#As an anniversary present to my wife#Oh it's my wedding anniversary today!

6 notes

·

View notes

Quote

While class conflict may have grown in the Americas due to free trade, In the East however with America and Europe having many of their industries and imports being based from countries like China, India, Russia, and Saudi Arabia, Western free trade has given rise to these Eastern countries to become superpowers like in the case of China and Russia and Regional powers who also have major effects on the world economy nevertheless like Saudi Arabia. This of course is more in line with Oswald Spengler view of the destruction of Western capitalism than it is with Karl Marx. In 'Man and Technics,' Spengler warned that western technological capitalism was not only destroying everything that was natural, but was also moving many industries to East Asian countries for profit and that this would eventually give these East Asian countries the economic power to rival the West. This is especially true for China, which has the second largest economy in world partially due to Chinese state intervention and the outsourcing of western industries to China.

The importance of China and other eastern countries economies can be seen from the last two years alone. With China shutting down for Covid, which caused mass trade distributions and shortages in America and the world. To Russia, oil and natural gas being sanctioned by western countries due to the war in Ukraine which has caused a shortage of fossil fuels and the price of energy to increase. Not to mention, made inflation worse for many western countries. All this was also accelerated when Saudi Arabia and OPEC announced that they would decrease oil production by 2 million barrels causing more problems for western economies.

Albino Squirrel, “The American Protectionist Economy of The Past and The Protectionist Economy of The Future” (November 8th 2022).

#Globalization#Trade#Protectionism#National Economics#Supply Chains#supply chain disruption#Geopolitics#Current State of Affairs#Heterodox Economics

1 note

·

View note

Text

The Changing Nature of Global Supply Chains

The landscape of global trade and supply chains is perpetually evolving, more so under the weight of rising inflation experienced in recent times. In our recent podcast episode, we dissect the intricacies of inflation’s impact on supply chains and the subsequent ripple effects on consumer experiences and economic strategies. We analyze the U.S. inflation rate which reached 2.8% in March and the…

View On WordPress

#Air Quality#Automation#Automotive Industry#Chain Reaction Podcast Tony Hines#Global Supply Chains#Post Brexit Trade Disruptions#Resilience#Supply Chain Strategies#Warehousing

0 notes

Text

Discover the shocking tale of a miscarriage of justice against President Trump and its ripple effects: a trucker boycott of New York City. Delve into the controversial fallout, the socio-political implications, and the broader discourse surrounding this unprecedented event - or just listen to my snarky ranting!

#Truckers#Boycott#Transportation#NYC#Protests#Supply chain#Economic impact#Trucking industry#City regulations#Trade#Logistics#Urban policies#Economic justice#Trucking rights#Labor movement#Traffic congestion#Civic engagement#Business disruptions#Interstate commerce#Policy advocacy#Trump judgment

0 notes

Text

Information Technology

Information Technology

What is Information Technology?

Information Technology (IT) is a term that arouse during the 1970’s to describe the combination of two previously existing discipline, computing and telecommunication. Very many definitions of the term exist ranging from the narrow, that would encompass those traditional aspects of office data processing to the broad, that would involve the…

View On WordPress

#ai#android#apple#artificial-intelligence#black box#blockchain technology#chatgpt#computer#computing#disruption#disruptive technology#forex trading#gaming#hybrid#information system#information technology#innovation#invention#machine learning#microsoft#phone#quantum-computing#remote working#robots#smartphones#system#technologies#technology#telecommunication#web 3

0 notes

Text

this call was released anonymously (understandably) but my local Palestinian organizers who I literally trust with my life have endorsed it, and it seems to be gaining momentum in multiple cities, so I encourage you all to get involved:

"A proposal to coordinate a multi-city economic blockade on April 15th in solidarity with Palestine recently received overwhelming commitments to participate around the US and internationally.

The proposal states that in each city, we will identify and blockade major choke points in the economy, focusing on points of production and circulation with the aim of causing the most economic impact, as did the port shutdowns in recent months in Oakland, California and Melbourne, Australia, as just a few examples.

There is a sense in the streets in this recent and unprecedented movement for Palestine that escalation has become necessary: there is a need to shift from symbolic actions to those that cause pain to the economy.

As Yemen is bombed to secure global trade, and billions of dollars are sent to the Zionist war machine, we must recognize that the global economy is complicit in genocide and together we will coordinate to disrupt and blockade economic logistical hubs and the flow of capital."

ETA: since I posted, organizers in St. Louis, Seoul, Brussels, and the Netherlands have signed onto the agreement, so if you saw this before and your city wasn't listed look again. anyone with the capacity to do some outreach, and a few connections to start with, could take the initiative to bring their city or region on board. read the solidarity agreement and check out the resources, and if you know trustworthy people in your area who might be interested in this sort of thing, talk to them about it.

remember that this isn't a series of protests (although some cities are organizing protests in conjunction), it's a commitment to take mass direct action and to maintain a united front in the face of any state repression. many organizers are (and have already been) using an affinity group model to actually coordinate those direct actions. autonomous groups can take action on April 15th whether or not others in their city/region have committed to this agreement. just do your homework (look up know-your-rights info specific to where you live + general direct action safety tips) and take good care of each other

Blockades: a short guide to getting in the way

Basic blockading

Practical Protest Techniques: using your body

Blockading: a guide

ACT UP civil disobedience guide

tumblr

5K notes

·

View notes

Text

Jeremy Abelson: Pioneering the Path of Investment Excellence with Irving Investors

In the ever-evolving world of finance and investment, having a visionary leader who can navigate the complexities of the market is a game-changer. Jeremy Abelson, the founder of Irving Investors, is one such financial luminary. With a track record of success and a commitment to innovative investment strategies, Jeremy Abelson has made a significant impact on the investment landscape. In this…

View On WordPress

0 notes

Text

When Hollywood Strikes and AI Stumbles: A Tale of Two Industries

In a world that seems to be spinning faster with each passing day, two seemingly unrelated events have recently caught the public’s attention. On one hand, we have Hollywood actors joining writers on strike, demanding fair pay, and better working conditions. On the other hand, we have ChatGPT, the AI darling of OpenAI, coming under investigation by the Federal Trade Commission (FTC). At first…

youtube

View On WordPress

#accountability#advancement#ai#balance#better#call#challenges#circuits#common#complexities#creative#development#dignity#disruption#fairly#fairness#false#Federal-Trade-Commission#glamour#glitz#high#human#Industry#information#integrated#investigations#media#minds#models#modern

0 notes

Text

The intense need for digital trade finance is not hidden from anyone.

The present volatile market highlights a variety of challenges for trade finance banks and their corporate clients, including supply chain disruptions, increasing costs, prevailing compliance demands, risks of fraud, and emerging ESG examination.

But the initiative of eliminating paper-based trade finance procedures comes with many complexities, and financiers have to figure out whether they should purchase their solutions through a third party, or create their capabilities in-house.

Recently, Enno-Burghard Weitzel, SVP of Strategy, Digitization & Business Development at Surecomp spoke about digitization in trade finance in a webinar named “Taking trade finance digital — buy vs build.”

Incorporating Digital Solutions

In the present era, various banks and corporations are facing challenges in streamlining trade finance processes. Surecomp surveyed to determine digital solution incorporation and figure out issues.

Weitzel talked about discoveries, examining alternatives for banks to handle these complexities by determining whether to develop digital trade finance solutions in-house or outsource teams.

Trade finance has a long-term dependency on traditional techniques and relationships. But as the global economy becomes more digital, institutions need to transform their trade finance operations.

Digitization facilitates an opportunity to streamline processes, boost efficiency, and improve customer satisfaction. Other benefits include cost reduction, faster transactions, and improved risk management.

However, the pathway toward adopting digitization is quite daunting. Institutions must determine whether they want to invest in existing platforms from third-party providers or create custom digital solutions in-house. This “Buy or Build” dilemma has vital significance for long-term success and competitiveness in a quickly developing trade scene.

Surecomp’s Survey Discoveries — Discontent and Need For Improvement

To acquire a better understanding of the existing state of play, a survey is conducted by Surecomp on banks and corporates to evaluate their incorporation of digital trade finance tools and access complexities and development opportunities.

The results uncovered a critical degree of dissatisfaction among banks and corporates with their existing trade finance processes.

A notable 41% of banks highlighted their discontent with the overall duration of issuing financing approval to their clients, with 35% of them being completely depressed.

Similarly, 45% of corporates reported being unsatisfied with the time it takes to get approvals from their financiers.

Undoubtedly, both banks and corporates have a dire need for improvements in their trade finance processes. The top reactions in this regard were “more digital” ( 53% for banks, 52% for corporates), “more time-effective” ( 53% for banks, 52% for corporates), and “more optimized & easy” ( 41% for banks, 45% for corporates).

Surprisingly, despite this powerful urge for improvements, the survey results uncovered a noticeable gap concerning adoption.

While 71% of banks and 73% of corporates admitted that process automation is an intense requirement for internal stakeholders, a critical extent still can’t seem to carry out digital trade finance solutions to automate their processes.

A striking 59% of banks and 70% of corporates reported not utilizing a digital trade finance solution for automating the process.

Besides, 93% of banks keep on depending on email as the primary mode of negotiating with their trade finance customers, featuring the continuous utilization of time-consuming and error-prone manual processes.

“This gap highlights a significant chance for development and transformation, and by overcoming it, banks and corporates can leverage the full potential of digitization, organize their processes, and gain improved efficiency,” stated Weitzel. “The challenge, however, lies in determining the most appropriate sources of doing so.”

To Buy or To Build, That Is The Question

The trade finance industry has witnessed a huge surge in technological advancement in recent years, with a variety of solutions emerging to resolve several complexities and inefficiencies in the sector.

However, the landscape is described by fragmentations, with several fintechsolutions, and blockchain platforms in several phases of development.

Numerous arrangements have yet to enter into the stage of a live production from the mere proof-of-concept, and the events of recent months, where a few enormous initiatives have shut down subsequent failure to reach commercial viability, have yet to inspire confidence.

Weitzel stated, “Banks have invested huge amounts of money into digital transformations, but they are attracting development gradually.”

“Whether it is creating API connectivity for corporate clients into the backend, or investing money on integrations into platforms that don’t get scale, things aren’t moving as quick as they may have expected.”

Meanwhile, the expansion of new technologies in trade creates new complexities.

The stakeholders not only witness the risk of investing in technologies that may ultimately fail, but the requirement for standardization across various solutions develops huge integration obstacles, with banks and corporates finding themselves having to put up resources in multiple platforms to consider different aspects of their operations.

Looking at this scenario, creating a custom, in-house solution may sound satisfactory in terms of flexibility and control.

Building its digital solutions will help banks develop innovative features and capabilities that will distinguish them from their competitors, creating a tailored facility that fulfills the specific requirements of their clients.

This competitive distinction can be a valuable asset in an undeniably swarmed and competitive trade finance scenario, empowering institutions to stand out and cover a larger share of the market.

However, only a few financial institutions are capable of carrying out their digital service, while larger banks may have access to expert groups capable of designing & incorporating digital trade finance systems, smaller institutions might require more resources and skills.

Furthermore, the risks and limitations built-in to this approach often outweigh the potential benefits.

“Developing a custom trade finance solution demands dedicated amounts of time and human resources, “ stated Weitzel. “By choosing to purchase, banks will be capable of allocating their resources more effectively, focusing on things that bring competitive benefits and differentiation. We’ve seen this in the way that the relationship between banks and fintechs has improved from one of competition to one of strategic collaboration, where banks can use fintechs’ specialized knowledge and technological experience.”

Reactions received by Surecomp from the market highlighted a combined picture as to which side of the buy or create debate the industry is settling on.

Banks and corporates said they were already utilizing a digital trade finance solution, roughly half explained this was a third-party platform, while the remainder said they either used host-to-host integration between their enterprise resource planning (ERP) software and their banks’ servers, or a proprietary solution developed by the bank.

Bridging The Gap Between Buying And Building

To leverage huge economic and operational benefits, corporates and banks alike should begin incorporating digital trade strategies now — and this will mean filling the gap between buying & creating to get the benefits of both options while reducing the risks.

As stakeholders within the trade finance ecosystem strive to navigate the challenges of the buy or build dilemma, figuring out a hybrid approach that can empower them to make tangible processes now and expand their skills over time is a compelling alternative.

Surecomp’s RIVO platform, a digital hub that offers open API access to importers, exporters, banks, insurers, shipping companies, and solution providers, is one example of this concept in action.

With RIVO’s integration, organizations can easily connect their current in-house trade finance solutions with third-party platforms and services, empowering them to personalize their offerings and adjust emerging market needs without requiring huge in-house development or procurement efforts.

Embracing The Future Of Trade

The world of trade is currently struggling, with the continuous pressure of digitization compelling banks and corporations to reconsider their conventional processes & systems.

The advantages of incorporating digital transformation are clear, yet the complexities and decisions that institutions must navigate along this pathway are challenging and multifaceted.

Eventually, it will not be a one-size-fits-all initiative. Each organization must thoroughly assess its unique requirements, resources, and goals to figure out the most suitable path forward.

Originally published at https://www.emeriobanque.com.

#supply chain disruptions#Trade Finance#Digital Transformation#trade finance processes#global economy

0 notes

Text

Investment Optimization with AI: How Algorithms are Maximizing Returns

View On WordPress

#AI in finance#Automation#Disruptive technologies#Future of finance#Machine learning algorithms#Trading algorithms

0 notes

Text

I know I periodically ask people to look at Alice, but I would like to explain why.

That, above, is Alice when she was just ten days old. It was December 2008, and I had gone to Seattle to prepare to die. I was tired, I was dealing with a massive disruption in my social circle, and I was done. So I went to see friends, and to say my goodbyes before I went home and politely made my exit. I had a fully articulated plan, and no desire to tell people about it, which is not a good place to be.

Then we went to visit Betsy, who had recently ushered a litter of kittens into the world. And she put this little blue tabby potato in my hand and said "That's the girl."

And just like that, I decided to live. "Do you take checks?" I replied, and Alice entered my life.

(That makes it sound much easier than it was. Betsy was intending to keep Alice, who was without flaw by Maine Coon breed standards. Seriously, she was the kind of cat breeders work to produce for their entire careers. I spent two months wearing Betsy down before she agreed to let me have her.)

Alice was my first Maine Coon. Alice was my heart and soul somehow walking around outside of my body. She was without flaw. She was everything I wanted in this world, and she loved me as much as I loved her, and I would happily trade a year of my life for another hour with her in my arms.

In 2017, I went to Australia as a convention guest, and when I came home, Alice wasn't right. She was always food-motivated, and she was refusing to eat. I made a vet appointment immediately, and we started the necessary tests to find out what was wrong. Roughly a month later, while I was at another convention, my vet called me.

"I am so so sorry," she said, and the world ended.

Alice had large-cell feline lymphoma. It wasn't a surgically treatable cancer; we were going to have to go through chemo, and hope. So we did. And we did everything it was possible to do. Thanks to my Patreon, there was never a point where I had to decline treatment due to money, and I know what an incredible gift that was. Bit by bit, she faded, but she was still my Alice, and we were still fighting.

Then, on February 13th, 2018, I woke up and she was stretched out along my side from hip to knee, making the worst sound I have ever heard every time she took a breath. I didn't want to let her go. I could no longer make her stay. We left for the vet immediately, and my oncologist agreed that she was done; she was ready to go, and the last gift she gave me was staying by my side, not running and hiding like most cats would.

I held her. I sang "Beautiful Beast" for her. And she went ahead of me to the clearing at the end of the path, to the place she stopped me from going.

I miss her more than I knew I could miss anything in this world. She was my best friend and my favorite thing, and my mother told people I'd lost a child to explain why I would just wander around, dead-eyed and sobbing. Alice saved me when I didn't think it was possible, and I'm grateful; I have no such plans at this point.

But fuck my poor, broken heart, I just want her to come home. And in the absence of that as an option, I want everyone to look at Alice.

Please look at my poor girl.

#pet death#cat death#suicidal ideation#gnu alice#baby please come home#i don't care if you come back wrong#just come back#feline lymphoma

1K notes

·

View notes