#Audit Management

Text

Elevating Auditing Excellence: BCT Digital's Audit Management Solutions

In today’s dynamic business landscape, regulatory compliance, risk management, and operational efficiency are paramount for organizations seeking to maintain trust, integrity, and accountability. Enter BCT Digital’s Audit Management Solutions — a comprehensive suite of offerings designed to streamline audit processes, enhance transparency, and drive operational excellence.

The Importance of Audit Management

Effective audit management is essential for businesses looking to ensure compliance with regulatory requirements, mitigate risks, and optimize performance. However, traditional audit processes often suffer from inefficiencies, redundancies, and manual errors, leading to delays, inaccuracies, and compliance gaps.

BCT Digital’s Audit Management Solutions are engineered to address these challenges head-on, providing businesses with the tools, insights, and automation capabilities they need to conduct audits more efficiently, effectively, and accurately. By leveraging advanced technologies such as AI, machine learning, and data analytics, BCT Digital enables organizations to streamline audit workflows, identify patterns and trends, and make data-driven decisions that drive continuous improvement.

Streamlined Audit Workflows, Enhanced Collaboration

At the core of BCT Digital’s Audit Management Solutions lies a commitment to streamlining audit workflows and enhancing collaboration across the organization. BCT Digital’s solutions automate routine audit tasks, such as planning, scheduling, and data collection, freeing up auditors to focus on more value-added activities, such as analysis, risk assessment, and decision-making.

Moreover, BCT Digital’s Audit Management Solutions provide a centralized platform for collaboration, communication, and knowledge sharing among auditors, stakeholders, and subject matter experts. By facilitating real-time collaboration, document sharing, and issue tracking, BCT Digital empowers organizations to work more efficiently and effectively together, driving greater transparency, accountability, and alignment across the audit process.

Real-Time Insights, Actionable Intelligence

In today’s fast-paced business environment, timely insights and actionable intelligence are essential for driving informed decision-making and continuous improvement. BCT Digital’s Audit Management Solutions provide organizations with real-time visibility into audit processes, enabling them to track progress, monitor performance, and identify opportunities for optimization in real-time.

By leveraging advanced analytics and reporting capabilities, BCT Digital enables organizations to gain deeper insights into audit findings, trends, and patterns, empowering them to make data-driven decisions that drive operational excellence and regulatory compliance. Whether it’s identifying areas of risk, uncovering process inefficiencies, or optimizing resource allocation, BCT Digital’s Audit Management Solutions provide organizations with the tools they need to stay ahead of the curve and achieve audit excellence.

Partnering for Audit Excellence

In an era defined by regulatory complexity, operational risk, and digital transformation, effective audit management is essential for businesses looking to thrive and grow. With BCT Digital’s Audit Management Solutions, organizations can streamline audit processes, enhance transparency, and drive continuous improvement, empowering them to achieve audit excellence and maintain trust, integrity, and accountability in today’s dynamic business landscape.

Partner with BCT Digital today and experience the difference that our Audit Management Solutions can make for your organization. With streamlined workflows, enhanced collaboration, real-time insights, and actionable intelligence, BCT Digital enables organizations to elevate audit excellence and achieve their business objectives with confidence and certainty.

0 notes

Text

Is Your Audit Management Software Ready for the Evolving ISO 9001 Landscape

The world of quality management is abuzz with the potential revision of the ISO 9001 standard, the cornerstone for Quality Management Systems (QMS). While an updated version is on the way, the current ISO 9001:2015 remains the go-to standard for organizations seeking to demonstrate their commitment to quality.

But here's the thing: to truly thrive under ISO 9001, robust Audit Management Software (AMS) is an essential companion to your QMS.

Why is Robust Audit Management Software Crucial

Regular audits are the lifeblood of any effective QMS. They ensure adherence to ISO 9001 requirements, identify areas for improvement, and ultimately contribute to continuous improvement.

The Future of ISO 9001 and Your QMS

The upcoming revision of ISO 9001 is a signal that the standard needs to adapt to evolving business practices. Potential changes could focus on the following:

• Greater emphasis on risk management and adaptability.

• Integration with emerging technologies like artificial intelligence.

• A stronger focus on sustainability and environmental responsibility.

Staying Ahead of the Curve

Regardless of the revisions, organizations committed to quality can prepare for the future by:

• Maintaining a robust QMS based on ISO 9001:2015.

• Implementing an Audit Management Software to streamline audits, ensure compliance, and drive continuous improvement.

• Staying informed about the revision process and potential changes.

• Identifying areas for improvement within their existing QMS.

By proactively combining a strong Quality Management Software with a powerful AMS, organizations can ensure their quality management systems remain effective and ready to adapt to the evolving ISO 9001 landscape. This will guarantee compliance and empower them to achieve true operational excellence.

0 notes

Text

BCT Digital: One Stop Solution for Credit Risk, EWS, Expected Credit Loss,Audit Management,ERM,

GRC,Audit Management, Compliance Management, Model Risk Management,Asset Liability Management,Raroc Calculator.

BCTDigital is a leading technology firm that provides cutting-edge solutions for financial institutions and businesses in the area of credit risk, enterprise risk management, audit management, compliance management, model risk management, and asset liability management. The company's goal is to help its clients effectively manage risk and comply with regulatory requirements, ultimately leading to improved financial stability and growth.

Credit Risk Management: BCTDigital's credit risk management solution enables financial institutions to monitor and manage their credit risk exposure in real-time. It provides an in-depth view of credit portfolios, early warning systems (EWS) and stress testing capabilities to assess the impact of various economic scenarios on the credit portfolio. This helps institutions make informed decisions regarding loan origination and portfolio management, reducing the risk of credit losses.

Enterprise Risk Management: BCTDigital's enterprise risk management solution provides a comprehensive view of all risks facing an organization, including operational, financial, and strategic risks. It enables organizations to identify, assess, and prioritize risks, and to design and implement appropriate risk mitigation strategies. This helps organizations make informed decisions and manage risks more effectively, leading to improved financial stability and performance.

Audit Management: BCTDigital's audit management solution streamlines the audit process, making it more efficient and effective. It provides a centralized platform for managing audit plans, schedules, and results, as well as for tracking and reporting on audit findings. This helps organizations ensure that audits are conducted in a consistent and efficient manner, and that any issues are identified and addressed in a timely manner.

Compliance Management: BCTDigital's compliance management solution helps organizations ensure compliance with relevant regulations and laws. It provides a centralized platform for managing compliance policies, procedures, and processes, as well as for tracking and reporting on compliance activities. This helps organizations reduce the risk of non-compliance, ensuring that they are able to meet their obligations and maintain their reputation.

Model Risk Management: BCTDigital's model risk management solution helps organizations manage the risks associated with the use of mathematical models in their operations. It provides a centralized platform for managing and testing models, as well as for tracking and reporting on model performance. This helps organizations ensure that their models are accurate and reliable, reducing the risk of incorrect decisions based on inaccurate model outputs.

Asset Liability Management: BCTDigital's asset liability management solution helps organizations manage the risks associated with their balance sheet. It provides a comprehensive view of an organization's assets and liabilities, as well as the potential impact of changes in interest rates, market conditions, and other factors on their balance sheet. This helps organizations make informed decisions regarding their balance sheet, reducing the risk of financial losses.

In conclusion, BCTDigital's solutions provide financial institutions and businesses with the tools they need to effectively manage risk and comply with regulatory requirements. By providing a centralized platform for managing risk and compliance, organizations can make informed decisions, improve financial stability and performance, and ultimately achieve their goals. Whether you are a financial institution looking to manage credit risk or a business looking to ensure

compliance with regulations, BCTDigital has the expertise and technology to help you succeed

#Credit Risk#EWS#Expected Credit Loss#Audit Management#ERM#GRC#Compliance Management#Model Risk Management#Asset Liability Management#Raroc Calculator.#audit management system

1 note

·

View note

Text

WovVIA - Best software for audit & inspection | Internal inspection software - WovVIA

Use our internal inspection software across the organization and functions to capture responses and improve processes. Create easy checklists to ensure compliance from over 200+ industry wise survey questionnaire templates.WovVIA is best software for audit & inspection. To get started for our FREE-FOREVER Plan ( Absolutely FREE) visit : https://wovvtech.com/index.php/wovvia-inspection-audit/ Or contact us at: [email protected]

0 notes

Audio

MedQPro offers several JCI and NABH Compliance and Accreditation Tools for your benefit. With the self-assessment audits we provide with our NABH Compliance Tools, you can now conduct all the audits with great accuracy and in virtually no time. This in-depth audit report helps management better understand the hospital's state.

#JCI and NABH Compliant Software#MedQPro Solutions#QMS Software Solution#India’s first NABH Compliant Software#hospital quality management software#healthcare quality management software#NABH compliance software#healthcare standards compliance#hospital compliance#NABH compliance#software for JCI compliance#audit management

0 notes

Text

Brinkwhump Linkdump

I'm on tour with my new, nationally bestselling novel The Bezzle! Catch me in TUCSON (Mar 9-10), then San Francisco (Mar 13), Anaheim, and more!

Once again, I find myself arriving at the weekend with a giant backlog of links, triggering a linkump, the 15th such dumpage, a variety-pack of miscellany for your weekend. Here's the previous editions:

https://pluralistic.net/tag/linkdump/

Let's start with the latest incredible news from KPMG, the accounting and auditing giant that is relied upon as a source of ground truth for a truly terrifying share of the world's economy. KPMG has a well-deserved reputation for incompetence and corruption. They first came on my radar in 2001 when they sent a legal threat to a blogger for linking to their website without permission:

https://memex.craphound.com/2001/12/05/reason-4332442-not-to-ask/

The actual link was to KPMG's corporate anthem, which remains, to this day, a banger:

https://web.archive.org/web/20040428063826/http://chkpt.zdnet.com/chkpt/uknewsita/http://anthems.zdnet.co.uk/anthems/kpmg.mp3

Don't miss the DJ remixes (and the Nokia ringtone!) that the internet thoughtfully provided when KPMG decided that it didn't want the world to know about "Our Vision of Global Strategy":

https://web.archive.org/web/20011128153057/http://corporateanthems.raettig.org/

Now all this is objectively very funny, a relic of the old, good internet from one of its moments of glory, but KPMG? They were already enshittifying, even in 2001, and the enshittification only intensified thereafter. Nearly every accounting scandal of the past quarter-century has KPMG in it somewhere, from con-artists selling exhausted oil fields to rubes:

https://www.desmog.com/2021/06/03/miller-energy-kpmg-auditors-oil-fraud/

To killer nursing homes that hire KPMG to audit its books – and to advise it on how to defeat safety audits and murder your grandma:

https://pluralistic.net/2023/05/09/dingo-babysitter/#maybe-the-dingos-ate-your-nan

They're the architects of Microsoft's tax-evasion plot:

https://www.propublica.org/article/the-irs-decided-to-get-tough-against-microsoft-microsoft-got-tougher

And they were behind Canada's dysfunctional covid contact-tracing app, which never worked, but generated tens of millions in billings to the government of Canada, who used KPMG to hire programmers at $1,500/day, plus KPMG's 30% commission:

https://pluralistic.net/2023/01/31/mckinsey-and-canada/#comment-dit-beltway-bandits-en-canadien

KPMG's most bizarre scandal is literally stranger than fiction. The company bribed SEC personnel help its own accountants cheat on ethics exams. The corrupt officials were then given high-paid jobs at KPMG:

https://www.nysscpa.org/news/publications/the-trusted-professional/article/sec-probe-finds-kpmg-auditors-cheating-on-training-exams-061819

I mean it when I say this is stranger than fiction. I included it as a plot-point in my new finance crime novel The Bezzle (now a national bestseller!), and multiple readers have written to me since the book came out a couple weeks ago to say that they thought I was straining their credulity by making up such an outrageous scandal:

https://us.macmillan.com/books/9781250865878/thebezzle

But all of that is just scene-setting (and a gratuitous plug for my book) for the latest KPMG scandal, which is, possibly, the most KPMG scandal of all KPMG scandals. The Australian government hired KPMG to audit Paladin, a security contractor that oversees the asylum seekers the country locks up on one of its island gulags (yes, gulags, plural).

Ever since, Paladin has been the subject of a string of ghastly human rights scandals – the worst stuff imaginable, rape and torture and murder of adults and children. Paladin made AU423 million on this contract.

And here's the scandal: KPMG audited the wrong company. The Paladin that the Australia government paid KPMG to audit was based in Singapore. The Paladin that KPMG audited was a totally different company, based in Papua New Guinea, who already had a commercial relationship with KPMG. It was this colossal fuckup that led to the manifestly unfit Singaporean company getting nearly half a billion dollars in public funds:

https://www.theguardian.com/business/2024/feb/24/incredible-failure-kpmg-rejects-claims-it-assessed-the-wrong-company-before-423m-payment-to-paladin

KPMG denies this. KPMG denies everything, always. Like, they denied creating "power maps" of decision-makers in the Australian government to target with influence campaigns in order to win contracts like this one. Who knows, maybe, this one time, they're telling the truth? After all, the company whose employees gather to sing lyrics like these can't be all bad, right?

The time is now to lead the way,

We share the same the idea

That may win by the end of the day.

Our strength is here to stay.

Identity, one energy,

One strategy, with sympathy.

These are the words that will lead us into a new world.

https://everything2.com/title/KPMG+corporate+anthem

You may find it strange that I'm still carrying around the factoid that KPMG once threatened to crush a blogger for linking to its terrible corporate anthem, but that's just my "Memex Method," which helps me keep track of literally everything that seemed important to me through most of my adult life:

https://pluralistic.net/2021/05/09/the-memex-method/

One of my favorite quips from the very quotable Riley Quinn is that "leftists are cursed with object-permanence" – that is, we actually remember what just happened and use it to think about what's happening now. The Memex Method is object permanence for 20+ years worth of stuff. A lot of those deep archives never see use, but there's a surprising number of leading indicators buried in the stuff that happened in years gone by.

Take James Boyle's 2014, XKCD-style comic about the experience of driving a notional Apple car:

https://www.thepublicdomain.org/2014/11/07/apple-updates-a-comic/

Apple, it turns out, spent the next decade working on just such a car, and while that car has now been canceled, Boyle's comic correctly anticipates so much about the trajectory Apple's products took. It's uncannily accurate – real "don't invent the torment nexus"/"cyberpunk was a warning, not a suggestion" stuff:

https://knowyourmeme.com/memes/torment-nexus

But no matter how many times we insist that the torment nexus shouldn't be created, the boardrooms of end-stage capitalism continue to invent them. Take HP, the poster-child for enshittification, edging out even KPMG in the race to turn everything into a pile of shit. After years of tormenting people to punish them for wanting to print things, HP has announced a new service that so mustache-twirlingly evil that it lacks verisimilitude:

https://arstechnica.com/gadgets/2024/02/hp-wants-you-to-pay-up-to-36-month-to-rent-a-printer-that-it-monitors/

Here's the pitch: HP will sell you a printer that you don't own. In addition to paying a monthly fee for your ink – which you pay no matter whether you print or not – you will also pay a monthly fee just for having HP's printer on your premises. You are absolutely, positively forbidden from using third-party ink in this printer, and must use HP's own ink, which sells for about $10,000/gallon.

But while you aren't allowed to use this printer in ways that are bad for HP's shareholders, HP is absolutely free to use the printer in ways that are bad for you. When you click through the signup agreement, you grand HP permission to surveil every document you print – and your home wifi network more generally – and to sell that data to anyone and everyone.

What's more, HP reserves the right to discipline you with punitive credit-card charges if you disconnect this printer from the internet, on the basis that doing so makes it harder for them to spy on your printer.

I'm sorry, this is just more torment nexus shit, the kind of thing you'd expect to drop on Apr 1, not Feb 29, but I guess this is where we are. I can only conjecture as to whether HP's businesses strategists are directly taking direction from my novella "Unauthorized Bread," or whether they're learning about it second-hand from a KPMG consultant who converted it to Powerpoint form and charged $1,500/day for the work:

https://arstechnica.com/gaming/2020/01/unauthorized-bread-a-near-future-tale-of-refugees-and-sinister-iot-appliances/

All of this cartoonish villainry is the totally foreseeable consequence of a culture of impunity, in which companies like HP and KPMG can rob, cheat, steal (and sometimes even kill) without consequence. This impunity is so pervasive that the exceptions – where a rich criminal faces real consequences – become touchstones: Enron, Arthur Anderson, Theranos, and, of course, FTX.

FTX was arguably the largest-scale corporate crime in world history, stealing more than $10 billion dollars, mostly from rubes sucked in by hype and Superbowl ads. When news that FTX founder and owner Sam Bankman-Fried was convicted of fraud and was in for a lengthy prison sentence made a huge stir, because criminals like SBF usually walk away from the wreckage with their hands in their pockets, whistling a jaunty tune.

One of the very best commentators on cryptocurrency scams generally and FTX/SBF in particular is Molly White, whose Web3 is Going Just Great feed is utterly indispensable. White's newsletter, "Citation Needed," dives deep into the wrangle of SBF's sentencing:

https://www.citationneeded.news/issue-52/

Bankman-Fried's parents – prominent law professors at top law schools – helped brief the court this week on their son's punishment. According to them, SBF faces 100 years in prison, but should be sentenced to 5.5-6.5 years at the most. Why? Because he is a vegan, who is not greedy, and feels remorse, and cares for individuals (recall that SBF presented himself as the avatar of the batshit "effective altruism" philosophy while privately admitting that he used this as a smokescreen).

The most bizarre note in the 100-page filing is SBF's mother declaring that her son is an "angel of mercy," apparently unaware of the grisly meaning of that term:

https://en.wikipedia.org/wiki/Angel_of_mercy_(criminology)

America's prisons are a travesty and I wouldn't wish them on anyone, but that's not the argument SBF's parents are making; rather, they're arguing that their special boy doesn't deserve the treatment America metes out to poorer, less white people who merely steal hundreds or thousands of dollars. A crook who steals ten billion should be handled the way a casino handles a whale – with concierge service.

The problem is, there are so many of these remorseless, relentless crooks that there's no way we could scale up that white-glove treatment when we finally round 'em all up and make them pay. Writing for The American Prospect, Maureen Tkacik tells us about the ransomware attack that shut down America's pharmacy system last month:

https://prospect.org/health/2024-03-01-zoomer-hackers-shut-down-unitedhealthcare/

The attack brought down Change Healthcare, part of the monopolist Unitedhealth, which serves as the "pharmacy benefit manager" to a vast swathe of American pharmacies. PBM is one of those all-American finance scams, a middleman garlanded with performative complexity put there to make you feel stupid for asking why independent pharmacies all have to pay rent to this malicious, unaccountable – and now, manifestly incompetent – gang of crooks.

Tkacik's breakdown of this scam – and how it rendered Americans' ability to get the drugs they depend on to go on breathing – is characteristically brilliant. Tcacik is fast emerging as my favorite Explainer of Scams, a print version of John Oliver or Adam Conover. You may recall her work from my post last week on how private equity has taken a wrecking ball to America's hospitals:

https://pluralistic.net/2024/02/28/5000-bats/#charnel-house

I always try to finish these linkdumps with some upbeat news to carry you through the weekend, and this week brought two genuinely wonderful – and totally underreported – pieces of amazing news.

The first is that Starbucks has sued for peace in the war against its workers' unions. Hundreds of Starbucks stores have unionized in recent years, but not one of them had a contract. Instead, Starbucks had waged dirty war on their own workers, from denying gender-affirming care to unionized employees to simply shutting down whole stores after they voted to unionize:

https://www.cnbc.com/2022/06/14/starbucks-union-company-threatens-that-unionizing-could-jeopardize-gender-affirming-health-care.html

But the workers held fast and after years of this, Starbucks has caved, promising contracts for all unionized stores and an end to its campaign of terror against workers seeking to unionize more of its stores. In a postmortem for Jacobin, Eric Blanc rounds up "seven lessons from Starbucks workers' historic victory":

https://jacobin.com/2024/02/starbucks-sbwu-contract-bargaining/

This is the kind of listicle I can get behind. According to Blanc, the Starbucks unions won by deploying worker-to-worker organizing, a tactic that many of the new unions that are shaking up formerly impossible-to-organize jobsites are using (Blanc has a book about this coming from UC Press called "We Are the Union: How Worker-to-Worker Unionism Can Transform America," so he should know).

Other tactics that made the difference for Starbucks unions: new digital training and support tools and partnering with established unions for support and infrastructure. Blanc also calls out the success of "salting" – the venerable but largely disused tactic of union organizers applying for a job at a non-union shop in order to organize it.

Blanc also mentions government policy, including the outstanding work of NLRB general counsel Jennifer Abruzzo, a shrewd and committed tactician whose understanding of the technicalities of labor law have let her push for bold measures. For example, in Thrive Pet Care, Abruzzo is arguing that when a company refuses to bargain in good faith for a contract with its union, she can step in and order them to honor the terms of a contract at comparable unionized competitors until they produce a contract of their own:

https://pluralistic.net/2023/09/06/goons-ginks-and-company-finks/#if-blood-be-the-price-of-your-cursed-wealth

Abruzzo is one of several smart, competent tacticians in the Biden administration who are working to kneecap corporate power. Another is Rohit Chopra, chair of the Consumer Finance Protection Bureau, who just announced another bold, important initiative that will help Americans fight corporate corruption and get a fair deal:

https://prospect.org/economy/2024-03-01-public-option-credit-card-shopping/

Chopra is taking aim at credit-card comparison sites that purport to show you where you can get the best deal. If you're an affluent person who doesn't carry a balance, this might not matter to you, but if you're an average working stiff, high interest rates can gobble up a massive share of your paycheck. What's more, credit card margins are higher than they have ever been:

https://www.consumerfinance.gov/about-us/blog/credit-card-interest-rate-margins-at-all-time-high/

The most expensive credit cards come from the big, monopolistic banks, but you wouldn't know it from the leaderboards produced by Credit Karma, NerdWallet, LendingTree, and Bankrate. All of these sites take bribes from the big banks to list their credit cards above those offered by credit unions – who are typically 10% cheaper than the big banks' cards.

The new CFPB rule prohibits this fraudulent ranking, but the Bureau is going even further. They're using their administrative powers to force banks to report their rates to the Bureau, which will publish them on a publicly funded, neutral website – what David Dayen calls "a public option" for shopping for credit cards.

This policy makes a perfect bookend to the last CFPB initiative I wrote about here: a rule that forces banks to allow you to transfer your account to a rival with a couple of simple clicks, importing all your history, payees, and everything else you need to switch to a better bank:

https://pluralistic.net/2023/10/21/let-my-dollars-go/#personal-financial-data-rights

Combine that ease of switching with reliable information on which banks will give you the best deal and you get something that will directly transfer millions and millions of dollars from giant, wildly profitable banks to low-income people who've been tricked into paying them punitive interest rates.

So that's it, this week's linkdump. I promised you I'd end on a high note, and I did it. The world may be full of all kinds of terrible things, but workers and regulators are scoring big, muscular victories in battles where the stakes are real and important. Have a great weekend – we've earned it.

And remember!

The time is now to lead the way,

We share the same the idea

That may win by the end of the day.

Our strength is here to stay.

Identity, one energy,

One strategy, with sympathy.

These are the words that will lead us into a new world.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/03/02/macedoine/#the-public-option

Image:

Stacy (modified)

https://www.flickr.com/photos/notahipster/4402860361/

CC BY 2.0

https://creativecommons.org/licenses/by/2.0/

#pluralistic#paladin#kpmg#audits#incompetence#molly white#sam bankman-fried#ftx#crypto#cryptocurrency#fraud#maureen tcacik#ransomware#pharma#pharmacy benefit managers#intermediaries#middlemen#starbucks#labor#unions#cfpb#bribery#corruption#finance#hp#printers#enshittification#iot#unauthorized bread#james boyle

75 notes

·

View notes

Text

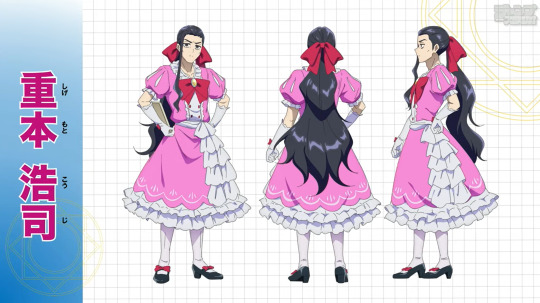

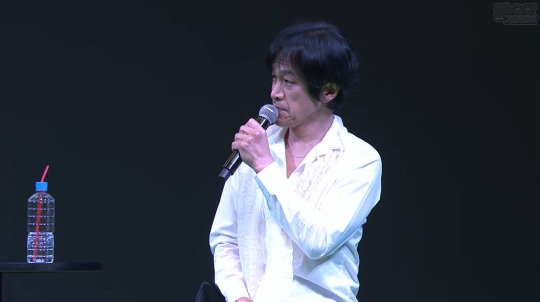

Magilumiere at Jump Festa time!

Koyama Rikiya as Shigemoto, now we're cooking.

Honestly I'm pretty satisfied with the casting for the rest of the key Magilumiere staff! Yamashita Daiki playing Nikoyama who looks uncannily like Deku is A+ no notes. Oosaka Ryouta I hadn't pictured as Midorikawa but I now that I think about it... that casting kind of rules.

Unfortunately only Fairouz, Hanamori and Koyama could be there in person but everyone seems pretty pumped.

Edit: Oh and here are the other newly revealed anime designs:

Kana and Hitomi only had existing designs shown so I haven't shared them. No date for the anime was revealed beyond “Fall 2024."

Edit 2: New character designs and cast comments are now available on the official anime website.

#magilumiere co. ltd.#magilumiere magical girls inc.#magilumiere#magi lumiere#kabushiki gaisha magilumiere#株式会社マジルミエ#shigemoto kouji#koyama rikiya#nikoyama kazuo#midorikawa kaede#i always forget that's how dark midorikawa's hair is#i'm going to have to rewatch the stream later#they were talking about their auditions when i was throwing this together and missed half of what they were saying ;o;#lol i managed to beat the official website tho so it was worth it#sorry i had to update this a million times (i was doing it live via phone)

72 notes

·

View notes

Text

sorry to everyone else i’m currently obsessed with ‘the night manager’ cause i’m entering tom hiddleston’s james bond campaign

why is this fandom on tumblr literally a hairpin and a blade of grass? WAKE UP WE’RE GETTING SEASON 2

#the night manager#tom hiddleston#okay but can tom hiddleston be james bond now?#james bond#my thoughts#loki#that show is his entire audition reel#please i beg#craigbond found dead in ohio#completely serious right now#i will keep this fandom alive no matter what i do

32 notes

·

View notes

Text

Watching this latest trailer has got me going "I wish they'd have Shane as the guest one of these days, even if it was some kind of special :(" because the Professor is constantly making me forget Shane has technically been in every episode of Puppet History.

#puppet history#watcher entertainment#the professor#shane madej#they bring out their producer for an episode and while he's on screen there's editing magic going on like that audition flashback scene#but there's also the gag of Shane getting frequently called offscreen#(and yet the guy still manages to be named History Master)

21 notes

·

View notes

Text

Streamline Audits with Precision: BCT Digital's Audit Management System

In the intricate realm of governance, risk, and compliance, audits play a pivotal role in ensuring transparency, accountability, and adherence to regulatory standards. However, managing audits efficiently and effectively can be a daunting task, requiring meticulous planning, coordination, and documentation. BCT Digital, a frontrunner in fintech solutions, offers a cutting-edge Audit Management System designed to streamline audit processes, enhance collaboration, and drive compliance excellence for businesses across industries.

Holistic Audit Planning and Scheduling

BCT Digital’s Audit Management System provides businesses with a comprehensive platform for audit planning and scheduling. With intuitive dashboards and customizable workflows, businesses can easily define audit scopes, assign responsibilities, and set timelines for audit activities. Our system enables seamless collaboration between audit teams, stakeholders, and external auditors, facilitating effective communication and coordination throughout the audit lifecycle.

Centralized Document Management and Compliance Tracking

Document management is a critical aspect of audit management, requiring businesses to maintain accurate records, evidence, and documentation to support audit findings and conclusions. BCT Digital’s Audit Management System offers centralized document management capabilities that enable businesses to store, organize, and track audit-related documents and artifacts in a secure and compliant manner. With version control, access controls, and audit trails, businesses can ensure data integrity, confidentiality, and availability throughout the audit process.

Automated Audit Workpapers and Reporting

Creating audit workpapers and generating audit reports can be time-consuming and labor-intensive tasks, often requiring manual data entry and compilation. BCT Digital’s Audit Management System automates the creation of audit workpapers and reports, enabling businesses to streamline audit documentation and reporting processes. Our system generates standardized templates, populates data from audit findings and observations, and produces comprehensive audit reports with minimal effort, saving time and resources while ensuring consistency and accuracy.

Real-time Monitoring and Audit Analytics

Monitoring audit progress and analyzing audit data in real-time is essential for identifying trends, patterns, and areas for improvement. BCT Digital’s Audit Management System offers real-time monitoring and audit analytics capabilities that enable businesses to track audit progress, monitor key performance indicators, and gain actionable insights into audit performance. With customizable dashboards, reports, and visualizations, businesses can analyze audit data, identify emerging risks, and make data-driven decisions to drive continuous improvement and compliance excellence.

Regulatory Compliance and Audit Readiness

Compliance with regulatory requirements is a top priority for businesses undergoing audits, and BCT Digital’s Audit Management System ensures adherence to regulatory standards and best practices. Our system offers built-in compliance checks, audit trails, and reporting capabilities that help businesses demonstrate compliance with regulatory requirements such as SOX, GDPR, and PCI DSS. By implementing robust compliance controls and audit readiness measures, businesses can mitigate regulatory risks, avoid penalties, and maintain trust with regulators and stakeholders.

BCT Digital’s Audit Management System empowers businesses to streamline audits, enhance collaboration, and drive compliance excellence with confidence and precision. With holistic audit planning and scheduling, centralized document management, automated workpapers and reporting, real-time monitoring and audit analytics, and regulatory compliance and audit readiness capabilities, our system offers a comprehensive solution for audit management that enables businesses to achieve their governance, risk, and compliance objectives efficiently and effectively. Experience the power of BCT Digital’s Audit Management System and unlock new possibilities for audit management today.

0 notes

Text

.

#have been attempting to make a self-tape for this audition for DAYS#after a whole helluva lotta bullshit having to do with hunting down a time+space+camera to film with i Finally managed to get some takes#then some weird bullshit with the camera's sd card happened where i wasnt able to pull the files off onto my laptop#FINALLY able to copy the files to my laptop. FINALLY able to access playback (the video camera i borrowed wouldnt let me access its gallery#FINALLY watching them... they all kinda suck so far but thats Fine at least i Have Them yk#get to take 7 and its actually not nearly as terrible as the previous 6!! feelin pretty good abt this one!! dont get hopes too high ofc but#i mean hey this ones acceptable if the last few arent any good either & just in case i cant go thru with my plans for tmrw to do a reshoot#so yk i start to rename the file so i can tell which clip it is!#Whole Laptop Crashes#WAHOO#typed this up to avoid freakin out while carefully rebooting her. bbg dont do this to me#luckily i already saved multiple contingency copies just in case (bc ive already had so many issues i was feelin Extra Cautious)#so i at least dont have to worry about dealing with the sd card bullshit Again. ugh#EDITING TO SAY: SHE LIVES!! laptop is fine after powering back up & files are unscathed!! was able to retitle & keep on truckin no problem#god i hate dealing with video as a medium#*this* is why im a stage performer not a screen actor lmao#fuck this shit. juust gimme a floor and an audience and ill make it worrk#cameras are fickle creatures on-par with printer machines#im rly excitednervous abt this audition tho; only submitted my resume+headshot on a whim & didnt rly think anything would come of it#but they contacted me and asked for a tape!! so im like !!!!! okayy sure id love to send that !!! i just have to face The Horrors first#if i dont get it then thats not the end of the world or anyth; but itd be SO FUCKING COOL if my v first submission landed me my first gig!!#so uhh. pls put out a good thought to the universe for my self-tape landing me the chance to perform in this queer play festival !!#bee speaks#🤞🤞🤞

4 notes

·

View notes

Note

NPD culture is shaking internally whenever you fail/feel like you did and having trouble with speaking/moving comfortably afterwards (also if it was a group work believing everyone hates you now and being deadly afraid of meeting them)

.

#cluster b culture is#NPD culture is#cluster b#npd#Mod Reef#anonymous#MOOD#i remember in high school#i didn't audition for varsity choir because i was so fucking terrified of screwing it up and everyone knowing i was actually a failure lmao#i still managed to get in because the choir director actually WANTED me as part of varsity (and what an ego boost that was!)#but yeah

44 notes

·

View notes

Link

Use our internal inspection software across the organization and functions to capture responses and improve processes. Create easy checklists to ensure compliance from over 200+ industry wise survey questionnaire templates.WovVIA is best software for audit & inspection.

To get started for our FREE-FOREVER Plan ( Absolutely FREE) visit : https://wovvtech.com/index.php/wovvia-inspection-audit/ Or contact us at: [email protected]

0 notes

Text

Tom: *tries to bully Carlos into singing something for the fans*

Carlos: *suggests Danielle sing something instead to draw attention away from himself*

Danielle: No one wants me to sing LESS than you do, Los!

Carlos: *dies laughing*

(from 17:55 of this video)

#Tom Cavanagh#Carlos Valdes#Danielle Panabaker#these three is2g 😂#it's so different seeing them all in such a casual setting getting goofy as hell#Tom's Broadway audition story#Carlos's rant about people losing stuff because they put it in stupid places#Danielle talking about everyone dancing at her wedding#and Tom's ensuing Victor Garber impression#talking about Harry Potter because it's a book series so they found a loophole#“MUSICAL THEATRE FANS MY ASS!” “well you didn't know it either” “weeeelllllllll.......”#the rapid fire question round and them just answering like “yes. next question!”#all the shouts of “VOLDEMORT!” when someone tried to mention The Flash or any other struck work#Danielle leaping off the stage to hear a fan's question while Tom and Carlos are cutting up and making noise#it's amazing they managed to get any work done while they were all on the same show together

11 notes

·

View notes

Text

The long sleep of capitalism’s watchdogs

There are only five more days left in my Kickstarter for the audiobook of The Bezzle, the sequel to Red Team Blues, narrated by @wilwheaton! You can pre-order the audiobook and ebook, DRM free, as well as the hardcover, signed or unsigned. There's also bundles with Red Team Blues in ebook, audio or paperback.

One of the weirdest aspect of end-stage capitalism is the collapse of auditing, the lynchpin of investing. Auditors – independent professionals who sign off on a company's finances – are the only way that investors can be sure they're not handing their money over to failing businesses run by crooks.

It's just not feasible for investors to talk to supply-chain partners and retailers and verify that a company's orders and costs are real. Investors can't walk into a company's bank and demand to see their account histories. Auditors – who are paid by companies, but work for themselves – are how investors avoid shoveling money into Ponzi-pits.

Attentive readers will have noticed that there is an intrinsic tension in an arrangement where someone is paid by a company to certify its honesty. The company gets to decide who its auditors are, and those auditors are dependent on the company for future business. To manage this conflict of interest, auditors swear fealty to a professional code of ethics, and are themselves overseen by professional boards with the power to issue fines and ban cheaters.

Enter monopolization. Over the past 40 years, the US government conducted a failed experiment in allowing companies to form monopolies on the theory that these would be "efficient." From Boeing to Facebook, Cigna to InBev, Warner to Microsoft, it has been a catastrophe. The American corporate landscape is dominated by vast, crumbling, ghastly companies whose bad products and worse corporate conduct are locked in a race to see who can attain the most depraved enshittification quickest.

The accounting profession is no exception. A decades-long incestuous orgy of mergers and acquisitions yielded up an accounting sector dominated by just four firms: EY, KPMG, PWC and Deloitte (the last holdout from the alphabetsoupification of corporate identity). Virtually every major company relies on one of these companies for auditing, but that's only a small part of corporate America's relationship with these tottering behemoths. The real action comes from "consulting."

Each of the Big Four accounting firms is also a corporate consultancy. Some of those consulting services are the normal work of corporate consultants – cookie cutter advice to fire workers and reduce product quality, as well as supplying dangerously defecting enterprise software. But you can get that from the overpaid enablers at McKinsey or BCG. The advantage of contracting with a Big Four accounting firm for consulting is that they can help you commit finance fraud.

Remember: if you're an executive greenlighting fraud, you mostly just want to be sure it's not discovered until after you've pocketed your bonus and moved on. After all, the pro-monopoly experiment was also an experiment in tolerating corporate crime. Executives who cheat their investors, workers and suppliers typically generate fines for their companies, while escaping any personal liability.

By buying your cheating advice from the same company that is paid to certify that you're not cheating, you greatly improve your chances of avoiding detection until you've blown town.

Which brings me to the idea of the "bezzle." This is John Kenneth Galbraith's term for "the weeks, months, or years that elapse between the commission of the crime and its discovery." This is the period in which both the criminal and the victim feel like they're better off. The crook has the victim's money, and the victim doesn't know it. The Bezzle is that interval when you're still assuming that FTX isn't lying to you about the crazy returns they're generating for your crypto. It's the period between you getting the shrinkwrapped box with a 90% discounted PS5 in it from a guy in an alley, and getting home and discovering that it's full of bricks and styrofoam.

Big Accounting is a factory for producing bezzles at scale. The game is rigged, and they are the riggers. When banks fail and need a public bailout, chances are those banks were recently certified as healthy by one of the Big Four, whose audited bank financials failed 800 re-audits between 2009-17:

https://pluralistic.net/2020/09/28/cyberwar-tactics/#aligned-incentives

The Big Four dispute this, of course. They claim to be models of probity, adhering to the strictest possible ethical standards. This would be a lot easier to believe if KPMG hadn't been caught bribing its regulators to help its staff cheat on ethics exams:

https://www.nysscpa.org/news/publications/the-trusted-professional/article/sec-probe-finds-kpmg-auditors-cheating-on-training-exams-061819

Likewise, it would be easier to believe if their consulting arms didn't keep getting caught advising their clients on how to cheat their auditing arms:

https://pluralistic.net/2023/05/09/dingo-babysitter/#maybe-the-dingos-ate-your-nan

Big Accounting is a very weird phenomenon, even by the standards of End-Stage Capitalism. It's an organized system of millionaire-on-billionaire violence, a rare instance of the very richest people getting scammed the hardest:

https://pluralistic.net/2021/06/04/aaronsw/#crooked-ref

The collapse of accounting is such an ominous and fractally weird phenomenon, it inspired me to write a series of hard-boiled forensic accountancy novels about a two-fisted auditor named Martin Hench, starting with last year's Red Team Blues (out in paperback next week!):

https://us.macmillan.com/books/9781250865854/redteamblues

The sequel to Red Team Blues is called (what else?) The Bezzle, and part of its ice-cold revenge plot involves a disillusioned EY auditor who can't bear to be part of the scam any longer:

https://www.kickstarter.com/projects/doctorow/the-bezzle-a-martin-hench-audiobook-amazon-wont-sell

The Hench stories span a 40-year period, and are a chronicle of decades of corporate decay. Accountancy is the perfect lens for understanding our modern fraud economy. After all, it was crooked accountants who gave us the S&L crisis:

https://scholarworks.umt.edu/cgi/viewcontent.cgi?article=10130&context=etd

Crooked auditors were at the center of the Great Financial Crisis, too:

https://francinemckenna.com/2009/12/07/they-werent-there-auditors-and-the-financial-crisis/

And of course, crooked auditors were behind the Enron fraud, a rare instance in which a fraud triggered a serious attempt to prevent future crimes, including the destruction of accounting giant Arthur Andersen. After Enron, Congress passed Sarbanes-Oxley (SOX), which created a new oversight board called the Public Company Accounting Oversight Board (PCAOB).

The PCAOB is a watchdog for watchdogs, charged with auditing the auditors and punishing the incompetent and corrupt among them. Writing for The American Prospect and the Revolving Door Project, Timi Iwayemi describes the long-running failure of the PCAOB to do its job:

https://prospect.org/power/2024-01-26-corporate-self-oversight/

For example: from 2003-2019, the PCAOB undertook only 18 enforcement cases – even though the PCAOB also detected more than 800 "seriously defective audits" by the Big Four. And those 18 cases were purely ornamental: the PCAOB issued a mere $6.5m in fines for all 18, even though they could have fined the accounting companies $1.6 billion:

https://www.pogo.org/investigations/how-an-agency-youve-never-heard-of-is-leaving-the-economy-at-risk

Few people are better on this subject than the investigative journalist Francine McKenna, who has just co-authored a major paper on the PCAOB:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4227295

The paper uses a new data set – documents disclosed in a 2019 criminal trial – to identify the structural forces that cause the PCAOB to be such a weak watchdog whose employees didn't merely fail to do their jobs, but actually criminally abetted the misdeeds of the companies they were supposed to be keeping honest.

They put the blame – indirectly – on the SEC. The PCAOB has three missions: protecting investors, keeping markets running smoothly, and ensuring that businesses can raise capital. These missions come into conflict. For example, declaring one of the Big Four auditors ineligible would throw markets into chaos, removing a quarter of the auditing capacity that all public firms rely on. The Big Four are the auditors for 99.7% of the S&P 500, and certify the books for the majority of all listed companies:

https://blog.auditanalytics.com/audit-fee-trends-of-sp-500/

For the first two decades of the PCAOB's existence, the SEC insisted that conflicts be resolved in ways that let the auditing firms commit fraud, because the alternative would be bad for the market.

So: rather than cultivating an adversarial relationship to the Big Four, the PCAOB effectively merged with them. Two of its board seats are reserved for accountants, and those two seats have been occupied by Big Four veterans almost without exception:

https://www.pogo.org/investigations/captured-financial-regulator-at-risk

It was no better on the SEC side. The Office of the Chief Accountant is the SEC's overseer for the PCAOB, and it, too, has operated with a revolving door between the Big Four and their watchdog (indeed, the Chief Accountant is the watchdog for the watchdog for the watchdogs!). Meanwhile, staffers from the Office of the Chief Accountant routinely rotated out of government service and into the Big Four.

This corrupt arrangement reached a crescendo in 2019, with the appointment of William Duhnke – formerly of Senator Richard Shelby's [R-AL] staff – took over as Chief Accountant. Under Duhnke's leadership, the already-toothless watchdog was first neutered, then euthanized. Duhnke fired all four heads of the PCAOB's main division and then left their seats vacant for 18 months. He slashed the agency's budget, "weakened inspection requirements and auditor independence policies, and disregarded obligations to hold Board meetings and publicize its agenda."

All that ended in 2021, when SEC chair Gary Gensler fired Duhnke and replaced him with Erica Williams, at the insistence of Bernie Sanders and Elizabeth Warren. Within a year, Williams had issued 42 enforcement actions, the largest number since 2017, levying over $11m in sanctions:

https://www.dlapiper.com/en/insights/publications/2023/01/pcaob-sets-aggressive-agenda-for-2023-what-to-expect-as-agency-enforcement-expands

She was just getting warmed up: last year, PCAOB collected $20m in fines, with five cases seeing fines in excess of $2m each, a record:

https://www.dlapiper.com/en/insights/publications/2024/01/pcaobs-enforcement-and-standard-setting-rev-up-what-to-expect-in-2024

Williams isn't shy about condemning the Big Four, publicly sounding the alarm that 40% of the 2022 audits the PCAOB reviewed were deficient, up from 34% in 2021 and 29% in 2020:

https://www.wsj.com/articles/we-audit-the-auditors-and-we-found-trouble-accountability-capital-markets-c5587f05

Under Williams, the PCAOB has enacted new, muscular rules on lead auditors' duties, and they're now consulting on a rule that will make audit inspections much faster, shortening the documentation period from 45 days to 14:

https://tax.thomsonreuters.com/news/pcaob-rulemaking-could-lead-to-more-timely-issuance-of-audit-inspection-reports/

Williams is no fire-breathing leftist. She's an alum of the SEC and a BigLaw firm, creating modest, obvious technical improvements to a key system that capitalism requires for its orderly functioning. Moreover, she is competent, able to craft regulations that are effective and enforceable. This has been a motif within the Biden administration:

https://pluralistic.net/2022/10/18/administrative-competence/#i-know-stuff

But though these improvements are decidedly moderate, they are grounded in a truly radical break from business-as-usual in the age of monopoly auditors. It's a transition from self-regulation to regulation. As @40_Years on Twitter so aptly put it: "Self regulation is to regulation as self-importance is to importance":

https://twitter.com/40_Years/status/1750025605465178260

Berliners: Otherland has added a second date (Jan 28 - THIS SUNDAY!) for my book-talk after the first one sold out - book now!

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/01/26/noclar-war/#millionaire-on-billionaire-violence

Back the Kickstarter for the audiobook of The Bezzle here!

Image:

Sam Valadi (modified)

https://www.flickr.com/photos/132084522@N05/17086570218/

Disco Dan (modified)

https://www.flickr.com/photos/danhogbenspics/8318883471/

CC BY 2.0:

https://creativecommons.org/licenses/by/2.0/

#pluralistic#big accounting#auditing#marty hench#martin hench#big four accountants#management consultants#corruption#millionaire on billionaire violence#long cons#the bezzle#conflicts of interest#revolving door#self-regulation#gaap#sox#sarbanes-oxley#too big to fail#too big to jail#audits#defective audits#Public Company Accounting Oversight Board#pcaob#sec#scholarship#Francine McKenna#William Duhnke#administrative competence#photocopier kickers#NOCLARs

67 notes

·

View notes

Text

Unlocking GST Success: Your Guide to Finding the Right GST Expert in India from Mas LLP

In the dynamic world of Indian taxation, Goods and Services Tax (GST) has revolutionized the way businesses operate and comply with tax regulations. Navigating the complexities of GST requires expert guidance and support from seasoned professionals who understand the intricacies of the tax system. At Mas LLP, we pride ourselves on being leading GST expert in India, offering comprehensive solutions tailored to meet the diverse needs of businesses across the country. Let's delve into why Mas LLP is your go-to partner for GST success.

Unparalleled Expertise: With extensive experience and a team of seasoned professionals, Mas LLP brings unparalleled expertise to the table. Our GST expert in India have in-depth knowledge of GST laws, rules, and compliance requirements, enabling us to provide expert guidance and support across a wide range of GST-related matters.

Comprehensive Solutions: Mas LLP offers a comprehensive suite of GST services designed to address the diverse needs of businesses in India. Whether you're a small startup, a mid-sized enterprise, or a multinational corporation, we have the expertise and resources to support you at every stage of your GST journey. From GST registration and compliance to filing returns and managing audits, we handle every aspect of GST with precision and professionalism.

Tailored Approach: We understand that every business is unique, with its own set of goals, objectives, and challenges. That's why we take a tailored approach to GST consulting, offering customized solutions that align with your specific needs and aspirations. Whether you're looking to optimize your GST strategy, mitigate risks, or resolve compliance issues, we work closely with you to develop tailored solutions that deliver results.

Transparency and Trust: At Mas LLP, transparency and trust are at the core of everything we do. We believe in building long-term relationships with our clients based on honesty, integrity, and reliability. Our transparent pricing, clear communication, and ethical business practices ensure that you always know where you stand and can trust us to act in your best interests.

Client-Centric Focus: We're committed to providing exceptional service and support to our clients. Our dedicated team of GST expert in India is here to answer your questions, address your concerns, and provide expert guidance every step of the way. Whether you need assistance with GST planning, compliance, or dispute resolution, we're here to help you achieve your GST goals.

In the competitive landscape of Indian business, having the right GST expert in India by your side can make all the difference. With Mas LLP as your trusted partner, you can navigate the complexities of GST with confidence and clarity. Contact us today to learn more about our GST services in India and take the first step towards GST success.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services

2 notes

·

View notes