#foreign companies registration in india

Text

Streamlining Success: Formation and Incorporation of Company with Mas LLP

In the vibrant landscape of business, laying the groundwork for your company's success begins with a strategic approach to formation and incorporation. At Mas LLP, we understand the intricacies involved in this pivotal process, and we offer comprehensive solutions tailored to simplify the Formation and incorporation of company of your company. Let's explore why Mas LLP stands out as your premier choice for company formation and incorporation services.

Expert Guidance: With Mas LLP, you're not just navigating the formation and incorporation process alone. Our team of seasoned professionals brings years of experience and expertise to the table. From choosing the right business structure to navigating legal requirements, we provide expert guidance and support every step of the way.

Comprehensive Solutions: Mas LLP offers a comprehensive suite of services designed to streamline the formation and incorporation process. Whether you're starting a new venture or expanding your existing business, we handle every aspect of company formation and incorporation, ensuring compliance with regulatory requirements and minimizing administrative burdens.

Tailored Approach: We understand that every business is unique, with its own goals, objectives, and challenges. That's why we take a personalized approach to company formation and incorporation, offering tailored solutions that align with your specific needs and aspirations. Whether you're a small startup or a large corporation, we have the expertise and resources to support you on your journey.

Transparency and Efficiency: Transparency and efficiency are at the core of everything we do at Mas LLP. We believe in keeping our clients informed and empowered throughout the formation and incorporation process, providing regular updates, clear communication, and transparent pricing. Our streamlined approach minimizes bureaucratic hurdles and accelerates the process, allowing you to focus on building and growing your business.

Compliance Assurance: Staying compliant with regulatory requirements is essential for maintaining the legal and financial integrity of your company. Mas LLP helps clients navigate the complexities of company formation and incorporation, ensuring adherence to all applicable laws, rules, and regulations. With our proactive approach to compliance, you can minimize potential liabilities and focus on achieving your business goals.

Dedicated Support: At Mas LLP, we're committed to providing exceptional service and support to our clients. Our dedicated team of professionals is here to answer your questions, address your concerns, and provide expert guidance every step of the way. With personalized attention and responsive support, you can trust Mas LLP to be your reliable partner in company formation and incorporation.

In the competitive business landscape, the Formation and incorporation of company of your company are critical steps towards achieving your entrepreneurial dreams. With Mas LLP as your trusted partner, you can navigate these processes with confidence and clarity.

Contact us today to learn more about our Formation and incorporation of company services and take the first step towards building a successful and sustainable business.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services

2 notes

·

View notes

Text

Exploring Investment in India: Meaning, Significance, and Opportunities

Investment in India embodies the allocation of financial resources with the aim of generating returns, fostering growth, and contributing to the economic development of the country. It encompasses various forms, including foreign direct investment (FDI), domestic investments in sectors like infrastructure, manufacturing, technology, and financial markets, among others. The significance of investment in India extends beyond mere financial transactions; it serves as a catalyst for economic progress, job creation, innovation, and the overall enhancement of living standards.

One of the primary reasons investment in India holds immense importance is its role in driving economic growth. Foreign investors recognize India's vast market potential, growing middle-class population, and skilled workforce as lucrative opportunities. FDI, in particular, contributes to job creation, facilitates technology transfer, and enhances infrastructure development, thereby bolstering the economy.

Moreover, investments in India spur innovation and technological advancements. Various sectors, especially technology and startups, have witnessed substantial inflows of investments, fostering an entrepreneurial ecosystem. This influx of capital often leads to the development of new technologies, services, and products, positioning India as a hub for innovation and fostering global competitiveness.

The significance of investment in India also lies in its contribution to infrastructure development. Investments in sectors like transportation, energy, telecommunications, and urban development play a crucial role in building a robust infrastructure backbone. Improved infrastructure not only attracts further investments but also enhances the ease of doing business, facilitating smoother operations for both domestic and foreign companies.

Investment in India acts as a catalyst for job creation, addressing the pressing issue of unemployment. With substantial investments pouring into various sectors, job opportunities arise, providing employment to a significant portion of the population. This not only improves livelihoods but also contributes to social and economic stability.

Furthermore, the investment climate in India has been continually evolving, with the government introducing various reforms and initiatives to ease regulations, simplify processes, and attract more investments. Initiatives like Make in India, Digital India, and Atmanirbhar Bharat have been instrumental in showcasing India as an attractive destination for investors.

In conclusion, investment in India holds multifaceted significance in fostering economic growth, driving innovation, creating job opportunities, and enhancing infrastructure. The inflow of investments, both domestic and foreign, plays a pivotal role in shaping India's economic trajectory, enabling the country to emerge as a global economic powerhouse. As India continues to showcase its potential across diverse sectors, investing in the country remains a strategic decision for individuals and entities looking to participate in and benefit from its dynamic growth story.

This post was originally published on: Foxnangel

#foreign direct investment#fdi investment#fdi in india#foreign invest in india#investment in india#investing in india#company registration in india#investment options in india#foxnangel

0 notes

Text

Navigating the Indian Business Landscape: Tips for a Smooth Business Setup

Creating a company in India is a lucrative but complex process that requires thoughtful preparation and calculated execution, particularly when utilizing Bandraz’s services as your reliable business solutions partner.

Without further ado, let’s check out some acing tips that can help you in navigating the Indian Business Landscape through Bandraz!

Thorough Market Research: Start your Indian business adventure by collaborating with Bandraz for in-depth market research. Gain from their understanding of target demographics, competitive landscape research, and your product or service demand. Your business plan will be guided by Bandraz’s data-driven approach to ensure it meets the target market’s demands.

Regulatory Compliance: With Bandraz, you can easily navigate India’s regulatory landscape. Please use their knowledge to comprehend compliance guidelines, legal requirements, and the subtleties of labor and tax legislation. To guarantee that your company runs in compliance with Indian laws, Bandraz can help with the licensing procedure.

Local Partnerships: With Bandraz’s assistance, build solid local alliances. Work with regional companies or develop joint ventures, using Bandraz’s network to build credibility and learn about the Indian industry. With so many contacts, Bandraz can help create valuable alliances that will pay off in the long run.

Cultural Sensitivity: Follow Bandraz’s advice to ensure cultural sensitivity in your commercial dealings. Their understanding of Indian culture will guide you through the country’s terrain and promote successful relationship- and communication-building. The favorable brand image of Bandraz in the culturally diverse Indian market results from their comprehension of local customs and traditions.

Technological Integration: With Bandraz’s help, smoothly embrace technology. Utilize their knowledge to combine technology for efficient corporate procedures, web presence creation, and successful digital marketing tactics. With Bandraz, your company may be more visible in the Indian market and remain at the forefront of the digital revolution.

Talent Acquisition: Use Bandraz’s resources to acquire talent. Please take advantage of their understanding of the Indian talent market and, with Bandraz’s help, establish a welcoming workplace environment. Developing a trained and driven team with the help of Bandraz is crucial to reaching your company goals in India.

Scalability Planning: Bandraz helps you with your first scalability planning. Count on their experience to create a thorough strategy that considers infrastructure, supply chain management, and logistics to support your company’s expansion in the fast-paced Indian market.

With the help of Bandraz’s extensive business solutions, you may set up your Indian business with confidence and success. Navigating the Indian business scene becomes collaborative and fulfilling when you have Bandraz as your trusted partner.

For a hassle free approach to open a Business in India, contact Bandraz today!

#Business in India for Foreigners#Start a new Business in India#Registration of foreign companies in India#Business Setup Services#Business Setup Consultants

0 notes

Text

Simple Steps Incorporation of Foreign Subsidiary in India at VenturEasy

Thanks to VenturEasy's knowledge, you may go on your Indian business journey with confidence. We provide end-to-end solutions for a successful introduction into the Indian market, from simple Incorporation of Foreign Subsidiary in India to overcoming compliance complexities.

More Info: https://ventureasy.com/blog/incorporation-foreign-subsidiary-india/

#Incorporation of Foreign Subsidiary in India#Foreign Subsidiary in India#Subsidiary in India#Company registration in India

1 note

·

View note

Text

A guide to choose the right destination for global expansion

Whether providing B2B services or exporting products, setting up a business or a shared service center or setting up a remote team in a different country for international growth is not easy. But if successful, the benefits go beyond just profitability and brand popularity. International expansion is the business strategy to achieve global success. Needless to say, with numerous growth opportunities across various sectors it is tempting for any SME, startup, or business enthusiast to dive straight toward building remote teams and growing their business footprint.

Growing your business internationally offers various benefits to your company. Your remote teams at cross-border locations, function towards achieving company objectives and goals. This reduces the risk of relying on a single market for profitability. International expansion helps you tap the skilled and diverse workforce into a new competitive market. Also, strategically capturing international markets fosters collaboration with local businesses, and increases partnerships with local service providers such as Employer of Record (EOR) or Professional Employer Organizations (PEO). These service providers prove to be instrumental in simplifying your business expansion journey in the location of your business.

Steps to selecting your target location for global success

A step-by-step, strategic international business expansion process that considers the time, cost, and resource constraints can help you explore potential opportunities a new market can offer. The cultural aspects, operational capacity, market scenario, and legalities of the target countries need to be critically examined. It also helps you understand if your organization is ready to establish its teams in the new market.

Through this article, we go beyond cultural differences, GDP growth, competition level, and communication and focus on all the important factors to consider while choosing your destination. These key factors will help you determine the best-suited destination for growing your business and making your international expansion successful.

Availability of talent

When you start your search for the perfect destination for building remote teams, understand its talent pool and resources. A country may be particularly suitable due to its technology and infrastructure but may be short on skilled resources and expertise.

A strategic approach toward recruiting and hiring remote employees can help you acquire a larger and more diverse talent pool. In addition, the location of your choice should suffice the needs of your remote employees to work efficiently. For instance, half of India’s current population is under the age of 26 and can seize global job opportunities. India offers numerous employee benefits and perks, diverse company culture, and flexible work schedules.

Several policies, business initiatives, and competitive compensation packages are additional factors that make India a promising destination for expanding business and building remote teams. An in-house team of HR professionals in the country of choice can manage hiring and all other HR activities. Moreover, outsourcing human resources or bringing a professional in the house (for example PEO or EOR company) can provide guidance and a network for accessing talent in the desired location and handle all the complexities around hiring.

Calculate the costs

At the offset, it is imperative to know that managing remote teams internationally, is like managing a startup in the global market. Hence, make sure you consider the cost factor while fixing an international location for your business expansion. Apart from operating costs in a foreign country, other monetary aspects to be considered include taxation for employees as well as corporations, production costs, government incentives, and other overhead social costs that affect remote operations.

Research the legalities and estimate the monetary investments required for your business expansion. For instance, Ireland ranks number 11 on Forbes’s best countries for Business list. Ireland’s low corporate taxes, access to other European markets, and high-tech talent pools make it an interesting choice for business expansion. Prioritizing destination based on operational costs, prospective profitability and return on investment (ROI) can give a realistic image of the costs while taking your business into an international location.

The economic and political environment

Growth opportunities in the world are vast. The economic and political environment of a country can help you decipher whether your business capacity aligns with the destination of your choice. Understand the country’s GDP, CPI, and exchange rates, market size. Ideally, a country with stable economic growth is suitable for building remote teams.

The desired destination should encourage your business growth, and market reach, and should pose a little political risk. Forecasting business accessibility, market performance, and general regulatory changes can help you shortlist the most viable business destination for your remote teams.

Go through the taxes and regulations

Before selecting your location for international expansion, research its local laws and regulations. Any foreign business has to pay regional and municipal taxes. The local regulations differ based on the type of services industry and even state and country. Research employment tax laws, income tax breaks, government regulations, grants, land discounts, and other financial benefits. Many countries offer economic and trade benefits in specific locations and zones. Mexico for example, offers free trade agreements with many countries including the US.

Evaluating IP protection permits, trade regulations and laws of a destination can help you determine how business-friendly a destination is for your services. Understanding these laws can mitigate any legal risks and help you determine the bests suitable destination for your remote teams. Going through all these regulations and tax affairs can be challenging at times. In such cases, speaking to trade experts or commissioner offices from desired destinations can help you gather data and analyze your best route to international business expansion.

Logistics and infrastructure

IT-related software and AI have become an integral part of any business and help to streamline online business operations. As per the latest forecast by Gartner, Inc., the worldwide IT expenditure is expected to reach a total of 4.6 trillion dollars in 2023, showing a 5.1% rise from the year 2022. This exponential growth of technology, digital Internet connectivity, and software availability is pushing various SMEs and startups toward global expansion. Hence, when taking your business to a foreign location, considering the country’s logistical capabilities, technological development, and infrastructure becomes essential.

Does the destination of your choice have the resources to scale and enhance your business efficiently? Does it support the business vision of developing your remote teams? Is the country equipped to provide you with the high-end software and technology your business needs? Not all destinations answer these queries and offer everything your business needs.

The best solution is to find a destination offering all the resources and experience at a reasonable cost. For instance, a software company wishing to take its business overseas can prioritize Germany or Japan which have large software markets. Providing the necessary IT support and handling the back-office processes in a foreign location can be taxing. Consequently, reaching out to International PEO or EOR services to overcome these challenges becomes a strategic move.

Choose PEO or EOR services as your local expert

Expanding your business to a new destination is a milestone for any organization wishing to go global. Once you evaluate which country to target and how to manage your services, then business expansion in an international location proves to be fruitful.

However, if you are unsure of moving forward alone, then approaching external support is a good idea. An external vendor can fill the gaps and mitigate potential risks. Also, PEO or EOR services can support you through all your legal hurdles, saving you time and investment in a foreign country. Moreover, you can test the new market by building remote teams in the desired location. Testing the business culture and analyzing the market reaction can help you develop an effective international business expansion strategy before making any permanent commitment such as subsidiary formation.

Conclusion

Global expansion plays a pivotal role in creating brand awareness and enhancing your balance sheet by positively impacting the top and bottom lines. Expanding markets in new locations, helps you reach a larger consumer base by transcending geographical boundaries. At often times, going forward after choosing a destination an organization can face obstacles such as challenges of remote working, managing remote teams, providing technology and infrastructure support, and so on. In such cases, an experienced partner like EOR can streamline your business expansion journey.

Since the Employer of Record services already has a strong foothold in the destination of your choice, they can be your local business guide and take over all your non-core business responsibilities. An EOR with its network and customized solutions, will reduce your legal hurdles and significantly enhance your overall business experience. If building your subsidiary is the right step for your business, then an EOR can guide you in the process. With EOR services, you can hire internationally, manage remote teams and be compliant in the destination you choose for your global success.

You can look at our case studies to gather insights on how EOR plays an important role when you think of building remote teams and expanding your business footprint in the destination of your choice.

#foreign company incorporation in India#setting up a subsidiary company in India#foreign company registration in India#business setup services in India#setting up business in india

0 notes

Text

Find the top accounting firm in Pune.

In Pune, as in some other significant city, you can track down an assortment of bookkeeping administrations to take care of various requirements. These administrations might include:

Monetary Bookkeeping: This includes keeping up with and planning fiscal summaries, for example, the pay proclamation, accounting report, and income explanation.

Accounting: Clerks record monetary exchanges, keep up with general records, and handle everyday monetary tasks.

Charge Readiness and Arranging: Bookkeepers can assist people and organizations with charge arranging, documenting assessment forms, and guaranteeing consistence with charge regulations.

Review Administrations: A bookkeeping firms might give examining administrations to survey monetary records and give a free assessment on the precision and dependability of fiscal summaries.

Finance Handling: This includes computing representative compensations, expenses, and derivations for organizations.

Monetary Counseling: Bookkeepers might offer monetary exhortation, planning, and anticipating administrations to assist people and organizations with settling on informed monetary choices.

While looking for a bookkeeping administration in Pune, think about the accompanying elements:

Notoriety and Experience: Search for deeply grounded firms or experts with a decent standing and a history of offering quality types of assistance.

Administrations Advertised: Guarantee the firm or expert offers the particular bookkeeping administration in Pune you require.

Accreditations: Actually look at the capabilities and certificates of the bookkeepers to guarantee they are able to deal with your monetary issues.

References and Surveys: Look for proposals from companions, partners, or read internet based audits to measure the fulfillment level of their past clients.

Cost: Look at the expenses charged by various bookkeeping firms and experts to track down a help that accommodates your spending plan.

It's generally smart to connect with a couple of bookkeeping specialist organizations, examine your necessities, and request statements prior to settling on a choice.

For more info :-

company registration in mumbai

company registration in Pune

Stock Audit Services in India

payroll services in india

0 notes

Text

Tips to expand foreign business in India

Introduction

There are numerous methods to benefit from starting a business in India. One of the best nations for global company growth is India. Plans for a foreign company’s expansion in India must be supported by detailed market analysis and a sound business strategy. Before beginning any form of business, it is important to be aware of the benefits of your enterprise, including the market, workplace, and location. It’s critical to comprehend the ideal business development approach. The comprehensive information in this article will assist you in learning more about the suggestions for growing foreign business in India.

With the help of our in-depth guide on foreign company registration in India, you can unleash the potential for international business growth. Investigate the advantages of entering the booming Indian market, supported by careful market study and a solid business plan. Learn about the essential elements for effective business development, such as market insights, workplace concerns, and strategic location selections. Arm yourself with the knowledge you need to make wise choices and advance your international business in India’s thriving marketplace.

What are the advantages of establishing a foreign company in India?

1. Comprehensive Tax System: The network of tax treaties in India is extensive. The Direct Taxes Code and the Goods and Service Tax (GST) have also recently changed the Indian tax structure to make doing business simpler.

2. large population: One of the main benefits of beginning a business in India is that it has a vast population, a sizable market without boundaries, and well-established logistics. For many years to come, global businesses are likely to be drawn to India because of its young population and expanding economy.

3. Low Operational Cost: Everything needed to start a firm, including infrastructure, phones, the internet, labor, and salaries, may be operated at a noticeably low cost. Additionally, individuals are willing to work for little pay.

4. Business-friendly Laws: In recent years, the Indian Parliament has approved many significant measures that are advantageous for the majority of industrial sectors. The efficiency of moving goods around India has grown because of, the Goods and Services Tax Bill. There are new tax laws in the Direct Taxes Code Bill.

5. Indian Financial System: India has a well-regulated financial system with access to developed markets worldwide and the ability to be financed from a variety of sources subject to certain RBI rules and regulations, etc.

6. Large Trade Network: Backed by regional and bilateral free trade agreements, India has a sizable network of technical and management institutions that meet the highest international standards. There are also a lot of additional trading partners out there.

7. Indian Work Ethics and the Working Class: Indians are renowned worldwide for having strong work ethics. Indians are distinct from South Asians in that they mix a strong work ethic with an openness to learning and a “never say no” mentality. In addition, the large proportion of Indians who are working age (18 to 65) extends the period of time during which services are available in the Indian market. The young people are now seeking possibilities after coming out of the closet. Businesses can take advantage of this chance by creating jobs and raising production.

8. Significant English-speaking population: For business purposes, India boasts a sizable English-speaking population. Due to their extensive ties to the UK, Indians are fluent in English. Even though Indian English has a somewhat different accent and vocabulary from British or American English, international organizations will substantially benefit from graduates’ fluency in English and their knowledge of the several regional Indian languages.

9. Startup India Movement: As part of the “Startup India Movement,” the government is enacting a number of changes to open doors for attracting foreign direct investment (FDI) and promoting corporate alliances. To reduce the burden of outmoded policies and regulations on the business environment, certain efforts have already been made. In order to raise India’s standing on the World Bank’s “Ease of Doing Business” index, this reform is also in line with its criteria.

10. Government programs: The Indian government has launched numerous programs to draw foreign capital into the country’s numerous industries. To entice investors, it periodically announces many alluring policies and plans. The specific ministries of each business have worked hard to relax the laws and standards governing foreign investment in that area.

What are the top 3 strategies for expanding foreign business in India?

There are several suggestions for growing a foreign company in India, but the key three are as follows:

Appoint a country manager: A country manager is in charge of the company’s expansion into a new country or territory. He or she is responsible for directing the market’s introduction, growth, and offerings from manufacturing to commercialization via the market’s distribution channels. According to their knowledge of the market, the area, and the language, they are ideally suited to design the proper plan and assure the successful foundation of the company on the ground through constant study of the competition. For foreigners, India frequently offers significant cultural contrasts in terms of social, personal, or professional life. You will find it simpler to implement your management style and have greater professional success if you hire a country manager.

Select the proper region: India is a difficult country. It would be incorrect to assume that every region is the same. India has 29 states with various characteristics and 23 official languages, with the north and the south clearly dividing culture and language. Because of this, it’s crucial to concentrate on the Indian region you’ve chosen before attempting to launch a firm.

You can establish yourself with the help of your industry. For instance, Hyderabad is good for the sciences, Bombay is ideal for consulting, and New Delhi is ideal for sensitive businesses. Bangalore is finest for the IT sector. Pune is a heavily industrialized city, Chennai is a hub for many enterprises in the IT and automotive industries, and Tirupur is a center for the textile industry. There are other disadvantages to consider, so make sure you continually search for offices in key locations and hire personnel with the necessary credentials.

A skilled workforce: India has the benefit of a talented workforce that is both affordable and highly qualified. It ranks among the top 10 economic superpowers in the world and has a populace that is increasingly younger and more active. India is still evolving and becoming a more appealing prospect because of its growing middle class. But doing business in India is still a complicated undertaking. Wait until your project has been thoroughly investigated before starting. Not all businesses are fit for this Asian nation.

Conclusion

India’s economy is among the fastest-growing in the world, and it has a sizable market of more than 1.2 billion people. Since India is known for its diversity, it is essential to seek out expert advice and do research in order to comprehend the market’s structure, consumer preferences, and execution. Foreign Direct Investment (FDI) has attracted a sizable amount to India due to its opportunities, and as more foreign companies are registered each year, FDI inflow grows.

0 notes

Text

#register company in singapore#company incorporation in singapore#company formation in singapore#company registration in singapore#register company in singapore from india#business registration singapore#company incorporation services singapore#company registration in singapore for foreigners#register a company in singapore from india#singapore company registration cost

0 notes

Text

Foreign Company Registration | Foreign Company Registration In India

Foreign Company Registration in India - We help in Foreign Company Registration in form of Subsidiary company, ranch, LLP, Liaison office.

Foreign Company Registration in India

https://ezybizindia.in/foreign-company-registrations/

0 notes

Text

Digital India and its UPI payment linkage with Singapore

#PEO#employer of record services in india#professional employer organization#peo vs eor#peo companies#Professional Employment Organization#foreign company incorporation in india#employer of record india#setting up a subsidiary company in india#foreign company registration in india#peo providers#business setup services in india#list of peo companies#employer of record

0 notes

Text

Unlocking GST Success: Your Guide to Finding the Right GST Expert in India from Mas LLP

In the dynamic world of Indian taxation, Goods and Services Tax (GST) has revolutionized the way businesses operate and comply with tax regulations. Navigating the complexities of GST requires expert guidance and support from seasoned professionals who understand the intricacies of the tax system. At Mas LLP, we pride ourselves on being leading GST expert in India, offering comprehensive solutions tailored to meet the diverse needs of businesses across the country. Let's delve into why Mas LLP is your go-to partner for GST success.

Unparalleled Expertise: With extensive experience and a team of seasoned professionals, Mas LLP brings unparalleled expertise to the table. Our GST expert in India have in-depth knowledge of GST laws, rules, and compliance requirements, enabling us to provide expert guidance and support across a wide range of GST-related matters.

Comprehensive Solutions: Mas LLP offers a comprehensive suite of GST services designed to address the diverse needs of businesses in India. Whether you're a small startup, a mid-sized enterprise, or a multinational corporation, we have the expertise and resources to support you at every stage of your GST journey. From GST registration and compliance to filing returns and managing audits, we handle every aspect of GST with precision and professionalism.

Tailored Approach: We understand that every business is unique, with its own set of goals, objectives, and challenges. That's why we take a tailored approach to GST consulting, offering customized solutions that align with your specific needs and aspirations. Whether you're looking to optimize your GST strategy, mitigate risks, or resolve compliance issues, we work closely with you to develop tailored solutions that deliver results.

Transparency and Trust: At Mas LLP, transparency and trust are at the core of everything we do. We believe in building long-term relationships with our clients based on honesty, integrity, and reliability. Our transparent pricing, clear communication, and ethical business practices ensure that you always know where you stand and can trust us to act in your best interests.

Client-Centric Focus: We're committed to providing exceptional service and support to our clients. Our dedicated team of GST expert in India is here to answer your questions, address your concerns, and provide expert guidance every step of the way. Whether you need assistance with GST planning, compliance, or dispute resolution, we're here to help you achieve your GST goals.

In the competitive landscape of Indian business, having the right GST expert in India by your side can make all the difference. With Mas LLP as your trusted partner, you can navigate the complexities of GST with confidence and clarity. Contact us today to learn more about our GST services in India and take the first step towards GST success.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services

2 notes

·

View notes

Text

10 Important Facts You Need to Know About FDI in India

FDI stands for Foreign Direct Investment. It refers to an investment made by a company or individual from one country into a business or entity in another country. Unlike portfolio investment, which involves buying stocks or bonds, FDI involves acquiring a lasting interest in an enterprise in another country. This lasting interest implies a significant degree of influence by the investor in the management, operations, and decision-making processes of the foreign business. FDI is considered a critical driver of economic growth, facilitating the transfer of capital, technology, skills, and fostering international trade and economic integration between countries.

Foreign Direct Investment (FDI) holds immense importance for both the investing country and the recipient country due to several reasons:

1. Economic Growth: FDI serves as a catalyst for economic growth in the recipient country by injecting capital, expertise, and technology. It helps in boosting productivity, creating job opportunities, and enhancing overall economic development.

2. Transfer of Technology and Skills: Multinational corporations investing through FDI bring advanced technologies, innovative practices, and managerial skills to the recipient country. This transfer of knowledge contributes to the upgrading of local industries and enhances their competitiveness on a global scale.

3. Infrastructural Development: FDI often leads to the development of infrastructure in the recipient country. Investments in sectors like telecommunications, energy, transportation, and manufacturing contribute to the improvement of infrastructure, benefiting the overall economy.

4. Boost in Exports and Foreign Exchange Reserves: FDI can lead to an increase in exports from the recipient country. When foreign companies set up manufacturing facilities or invest in local industries, it often results in increased exports, which subsequently enhances the country's foreign exchange reserves.

5. Job Creation: FDI generates employment opportunities in various sectors. The establishment of new businesses or expansion of existing ones creates jobs, thereby reducing unemployment rates and improving living standards.

6. Global Integration: FDI fosters economic ties between countries, encouraging international trade and fostering globalization. It promotes cross-border collaboration, joint ventures, and partnerships, leading to greater economic interdependence between nations.

7. Stability and Sustainability: Long-term FDI commitments provide stability to the recipient country's economy. These investments, unlike volatile portfolio flows, indicate a certain level of confidence in the country's economic prospects, contributing to long-term sustainability.

8. Spillover Effects: FDI can lead to positive spillover effects, benefiting not only the specific sectors where investments are made but also other related industries and the overall economy. This includes technology diffusion, managerial expertise, and best practices that may spread across various sectors.

In the vast panorama of global economics, where nations vie for supremacy in attracting investments and fostering economic prosperity, Foreign Direct Investment (FDI) emerges as a pivotal force shaping the destinies of countries. In this intricate tapestry of economic interdependence, India stands as a beacon, beckoning global investors with its vast market potential and promising growth prospects.

The saga of FDI in India is a tale woven through the fabric of time, marked by transformative milestones and strategic shifts. Historically, India's tryst with FDI took a decisive turn during the 1990s, a watershed era characterized by bold economic reforms that laid the groundwork for a liberalized economy. This phase witnessed the dismantling of stringent regulations and the inception of policies aimed at wooing foreign investors, signaling India's intent to embrace globalization and chart a new trajectory towards economic resurgence.

Since then, FDI has traversed a diverse landscape of sectors within India's economy. While industries like telecommunications, automobiles, and pharmaceuticals have welcomed significant foreign investments, the road for FDI in retail remains contentious, with debates revolving around the delicate balance between inviting global giants and safeguarding the interests of local players.

The ebbs and flows of FDI inflows into India narrate a compelling story of economic evolution. Over the years, the country has witnessed a steady rise in FDI, a testament to the growing confidence of foreign investors in India's potential. Countries like Singapore, the United States, and Mauritius have emerged as key contributors to India's FDI inflows, weaving intricate webs of economic collaboration and bilateral ties.

The impact of FDI transcends mere statistical figures; it paints a canvas of transformation across various facets of India's economic landscape. It has been a catalyst for economic growth, injecting much-needed capital, fostering technological advancements, and infusing managerial expertise that propelled India's industries onto the global stage. Moreover, FDI's role in job creation, infrastructure development, and augmenting productivity stands as a testament to its profound impact on India's economic journey.

Yet, within this tale of growth and progress, lie challenges that require adept navigation. Bureaucratic complexities, regulatory hurdles, and occasional policy uncertainties have been impediments, hindering the seamless flow of FDI into the country.

Against this backdrop, the Indian government has proactively introduced various initiatives, from the ambitious Make in India campaign to streamlined foreign investment norms, aimed at creating a more hospitable and investor-friendly environment. These initiatives seek to streamline processes, boost investor confidence, and position India as an attractive FDI destination on the global map.

As we delve deeper into the realm of FDI in India, exploring its intricacies, opportunities, and challenges, it becomes evident that beyond economic metrics, FDI holds the potential to shape India's socio-economic fabric. It contributes to skill development, knowledge transfer, and often uplifts communities by raising living standards in regions touched by these investments.

However, the pursuit of economic growth through FDI necessitates a delicate balance. Addressing environmental concerns, ensuring sustainable development, and safeguarding local interests amidst global integration emerge as crucial considerations for India's sustainable growth trajectory.

In the grand tapestry of India's economic narrative, FDI emerges as a thread intricately woven, influencing the fabric of the nation's growth, innovation, and global integration. As India charts its course in the 21st century, the dynamics of FDI will undoubtedly continue to shape its economic landscape, playing an ever-more pivotal role in sculpting its destiny on the global stage.

1. FDI Policies and Liberalization

The genesis of India's FDI journey can be traced back to the landmark economic reforms of the early 1990s. These reforms, often termed as the New Economic Policy, heralded a departure from the restrictive, license-based economy towards a more liberalized and open market. Initiatives like the abolition of industrial licensing, reduction of trade barriers, and relaxation of FDI restrictions marked India's resolve to embrace globalization and invite foreign investors.

2. Sectors Open to FDI

While FDI regulations have evolved, certain sectors remain key magnets for foreign investments. The telecommunications sector witnessed significant FDI inflows, driving technological advancements and revolutionizing communication networks. Similarly, the automobile industry, buoyed by FDI, witnessed collaborations between global giants and Indian manufacturers, elevating the sector's competitiveness. However, the retail sector remains a contentious territory due to concerns over its impact on local businesses, leading to nuanced policies that balance interests.

3. FDI Inflow Trends

The trajectory of FDI inflows into India paints a picture of evolving trends and changing investor preferences. Over the years, India has emerged as a favored destination, witnessing a consistent rise in FDI inflows. Countries like Singapore, Mauritius, and the United States have consistently featured among the top contributors, fostering robust bilateral relations and economic partnerships.

4. Impact on Economic Growth

FDI's impact transcends mere monetary figures; it's a catalyst that ignites multifaceted growth engines within India's economy. The infusion of capital, infusion of advanced technologies, and managerial expertise through FDI have propelled various industries, leading to enhanced productivity, increased job opportunities, and an overall improvement in India's economic indices.

5. Challenges and Regulatory Hurdles

Despite the allure of India's burgeoning market, challenges persist on the FDI front. Bureaucratic hurdles, complex regulatory frameworks, and occasional policy ambiguities have posed impediments, deterring potential investors and stalling the seamless flow of FDI. Achieving a balance between investor-friendly policies and safeguarding national interests remains a delicate tightrope walk for policymakers.

6. Government Initiatives to Attract FDI

Recognizing the significance of FDI, the Indian government has embarked on numerous initiatives aimed at easing entry barriers and fostering a conducive environment for foreign investors. The Make in India campaign, launched to promote domestic manufacturing and attract global investments, stands as a testament to India's commitment to positioning itself as a manufacturing hub on the global stage.

7. Role in Start-up Ecosystem

FDI's impact extends beyond traditional industries; it has been instrumental in nurturing India's vibrant start-up ecosystem. Foreign investors, apart from injecting financial capital, bring invaluable expertise and access to global markets, nurturing innovation and entrepreneurship within the country.

8. Socio-economic Impact

Beyond its economic ramifications, FDI influences India's socio-economic landscape. It plays a pivotal role in skill development, knowledge transfer, and often leads to the upliftment of communities by improving standards of living in regions touched by these investments.

9. Environmental Implications

The pursuit of economic growth through FDI brings forth environmental concerns. Balancing industrial progress with environmental sustainability remains a critical challenge. Encouraging environmentally conscious investments and enforcing stringent regulations to mitigate ecological impact stand as imperative tasks for sustainable development.

10. Future Prospects

The narrative of FDI in India is an unfolding saga, intricately woven with successes, challenges, and aspirations. Its impact reverberates across the fabric of India's economic landscape, shaping industries, fostering innovation, and connecting India to the global economic echelons. As India steers its course towards becoming a global economic powerhouse, navigating the complexities surrounding FDI, addressing challenges, and harnessing its potential for inclusive and sustainable growth will remain pivotal in scripting India's economic odyssey in the 21st century.

This post was originally published on: Foxnangel

#fdi in india#foreign direct investment in india#fdi investment in india#foreign investment in india#invest in india#company registration in india#franchise in india#foxnangel

0 notes

Text

#company registration#foreign companies#indians#foreign company registration#law firm in india#ksandk#lawyer

0 notes

Text

Foreign company registration in Malaysia

Foreign businessmen and companies who want to start a company in Malaysia should know details about foreign company registration in Malaysia this 2022 and business entities that permit foreign ownership. Here we will look at the available company registration options for foreign businessmen and companies in Malaysia, and will also talk about the process and requirements.

Get a RM20,000 tax rebate per year for the next 3 years when you register your company this 2022 in Malaysia.FOREIGN COMPANY REGISTRATION OPTIONS IN MALAYSIA

Foreign investors can obtain ownership of a company by setting up one of the following foreign company registration options in Malaysia:

Branch office

Representative office

Private limited company

Branch office

A branch office is not a separate legal entity and is an extension of the foreign parent company. The foreign parent company is liable and responsible for all the debts and operations of the branch in Malaysia. The activities of a branch office must be the same as the foreign parent company, and a branch is suitable for foreign companies that want to expand their business to Malaysia for a short-term basis. There must be at least one Malaysian resident nominee director or agent to set up the branch in Malaysia.

100% owned by the head office

Must file branch office’s as well as parent company’s audit reports

Taxed as non-resident entity, local tax benefits not available

Tax at 25% on profits attributable to the branch (subject to tax adjustments).

Withholding tax of 10% + 3% is applicable on payments made to the branch for services performed in Malaysia (as branch is a non-resident for tax purposes)

Generally tax incentives are not available to branch.

Representative office

Foreign companies that want to increase their market and understanding of the Malaysian business environment can set up a representative office. A representative office does not have an independent legal standing in Malaysia. Therefore, the parent company is responsible for the debts and liabilities.

Name must be the same as parent company

For Foreign Companies that wish to set up temporary vehicle in Malaysia to conduct research and act as liaison office and other activities which will not result directly in actual commercial transactions.

The proposed operational expenditure of the RE must be at least RM300,000 per annum.

A Representative office/Regional office will be given expatriate post and the number allowed depends on the functions and activities of the Regional Office/Representative Office. Expatriates will only be considered for managerial and technical posts. The proposed expatriate must be currently employed by the applicant company or its subsidiary or within the group.

Private limited company

The private limited company or SDN BHD is the most common type of entity for foreign investors. Foreigners are permitted to own 100% of the company. However, for some industries, they will need 50% to 60% Malaysian ownership. These industries include agriculture, banking, education, oil and gas. A private limited company or SDN BHD is a separate legal entity from its owners, meaning that it can buy or sell property, enter legal contracts and sue or get sued in courts.

Can use parent company name also or different name also.

Can conduct different or multiple business activities too.

Suitable for local or foreign companies that wish to expand their operations in Malaysia.

Min one shareholders or can be solely owned by a corporate body (either 100% local or 100% foreign-owned*) allowed.

One resident director are required, who need not be Malaysians but must have a principal residential address within Malaysia.

Taxed as Malaysia resident entity, local tax benefits available.

Tax incentives may be available depending on the type of activity undertaken and subject to meeting eligibility conditions.

No restrictions on hiring local or foreign staff.

But for taxation intensive, staff recruitment, business visa for directors, family dependent facilities, business licenses, and many other purposes mostly foreigners chose private limited companies and we also suggest for Private limited or SDH BHD company.

Post-registration requirements and compliance

Once you have successfully registered the company in Malaysia, you must fulfil post-registration requirements and obligations.

These requirements are:

Opening a corporate bank account.

Obtaining business licenses & permits (export-import licenses, CIDB, DBKL, Food licenses, etc).

Registering as a taxpayer.

Registering with the provident fund.

Appointing auditors.

Apply for WRT and ESD .

Process business visa through ESD (under Malaysian immigration).

Email us for more details: [email protected]

Why Lim & Ani Associates Sdn Bhd

We are providing one of the best business & company setup consultancy services in Malaysia, with experienced & licensed company secretaries, professional accountants, auditors, tax & SST experts, business advisors - a one-stop business solution in Malaysia.

As one of the best leading corporate advisors, we are offering services below as per business act 2016 & Malaysian Government policy;

Company registration consultancy.

Business setup advisory.

Accounting advisory.

Business licenses advisory.

Professional global business advisory.

Marketing & planning.

Legal business policy & HR management.

Business survival & transformation advisory.

Call, Email or text us.

LIM & ANI ASSOCIATES SDN BHD

Call: +60108242527 (whatsap & viber)

Call: +60172041317 (whatsapp)

Call: +601121189303

Call: +603-84081680 (office landline)

Email: [email protected]

www.mbbusinessjoint.com

#Malaysia business advisory#company registration in Malaysia#register company in Malaysia#business setup in Malaysia#invest in Malaysia#business migration malaysia#foreign investment Malaysia#Malaysia business specialist#entrepreneur#business#Malaysia#India#UAE#Dubai#bangladesh#Pakistan#india#Norway#australia#KualaLumpur Business Setup

0 notes

Text

#subsidiary company in India#subsidiary company formation in India#foreign company subsidiary in india#company registration in india

0 notes

Text

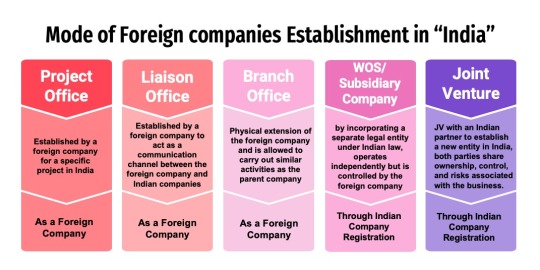

How do Foreign Companies Start a Business in India?

How do Foreign Companies Start a Business in India?

If you're looking to enter in the Indian market, the company can be registered in two ways

1. Indian Entity

2. Foreign Company

Indian Entity can be registered in the following ways:

I. Limited Liability Company,

II. Limited Liability Partnership

III. Joint Ventures

Foreign Company can be registered in the following ways:

I. Liaison Office

II. Branch Office

III. Project Office.

For more details, log on to www.manishanilgupta.com/Foreign-Company-Setup-in-India now.

#how foreign companies start a business in India#private limited company#company registration#registration#foreign registration#registration inindia

0 notes