#& if you want to report someone for. say. harassment. like asking for your location repeatedly. you have to report the specific comment.

Text

redditors are so fucking weird, sometimes they don't even know what hill they're dying on all they know is that they're gonna die on it for sure

#told a dude on reddit who was asking how much violence is allowed in YA books that you can put as much as you'd like#& he was like ''books sure have changed since i was an adolescent'' & i was like. no. they've always been that way. read them & see#(literally gave Watership Down as an example. it was published in the 70's)#& he started ranting & raving about how actually i'm wrong because liberals & kids these days don't understand#what it's like to be an adolescent (kept using that word) in a time where all books were banned for even the most minor of implied violence#& i was like ''what the fuck are you talking about'' & he was like ''where do you live & how old are you'' about a hundred times#i wish i was exaggerating. it really escalated that fast#oh also they were assuming i'm a guy & using he/him pronouns which is like. fuck off lol yeah you're obviously an old white guy from Americ#literally i should just leave reddit forever but i can't stand by watching people say ''quit forever'' when newbies ask simple questions#like redditors are insane. batshit#i want to be the ''do whatever you want forever'' person in a sea of ''you're 12 & only have a 12yo's reading level? die''#also the blocking on there is bullshit. you can't reply to comments if one of the people in the convo is blocked#& you can't block someone twice in 24 hours#& if you want to report someone for. say. harassment. like asking for your location repeatedly. you have to report the specific comment.#which you now can't see because you blocked them#more & more i become astonished that people use every other social media EXCEPT tumblr#couldn't imagine living like that. it must be horrible

2 notes

·

View notes

Text

The problematic behavior of Tomdaya stans; a thread

Some of you might not be aware of the stalkerish problematic stuff tomdaya stans have done with Tom and Zendaya’s life but it’s gotten to the point where Tom’s own brothers protect with big scrutiny every single female in Tom’s life because they fear they’re going to get bullied or harassed. This is not OK and this has to stop so we’re exposing their toxic behavior.

This is only to bring awareness and we do not condom any hate or death threats, don’t send hate to tomdaya accounts, either block them or report them but don’t bully them. Many of them might need professional help dealing with the fact that Tom and Z are not together due to the fact that they created an illusion in their heads for a long time but that doesn’t mean some of them aren’t plenty manipulative and love to get away with bullying and harassment.

If you don’t know, Tom was recently seen with another woman on his instagram, not going to say the name and please don’t try to find out about her, the relevant information is in this post and all of the private information regarding her is being protected for the same reasons. Many stans decided to apply the same treatment to her as they did to Olivia. If you don’t know what happened last year, all information is here. The fact that this kind of bullying and harassment got overlooked is horrifying.

This specific behavior doesn’t apply to all of the stans but the vast majority is on the same page.

A big thanks to all the blogs who contributed with information and their writing in this post.

STALKING

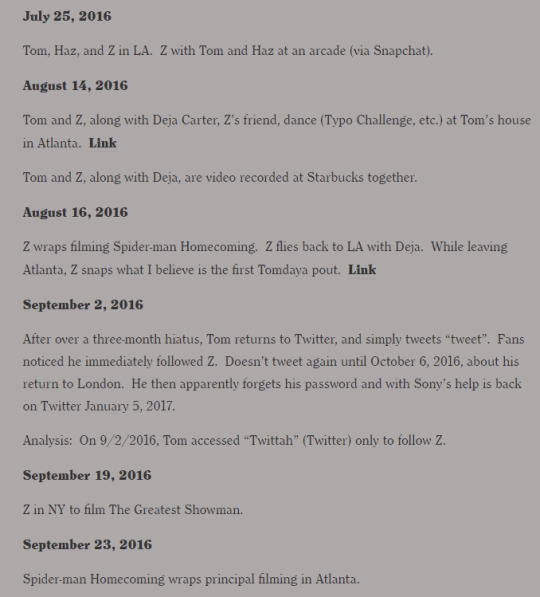

1. Tomdaya stans have made an entire thread/timeline of events in Tom and Zendaya's life that they manipulated so it can be seen as proof of them dating. They stalk every single part of their lives, from paying stalkerish apps to review their instagram activities daily to having a constant GPS to know their exact locations everyday. They ask twitter accs, owners of restaurants/stores, people close to them information about their whereabouts/the things they buy or eat/who they were with, etc.

They order their ‘’interactions’’ with specific dates and they even know information you shouldn’t know about them.

They pay for apps that helps them stalk their every move. That’s right, they take every like as proof of them being together.

They hide behind the pretext that they're celebrities and this is what they've signed up for but neither Tom nor Zendaya have signed up for constant daily harassment of their partners in life.

HARASSMENT OF PARTNERS

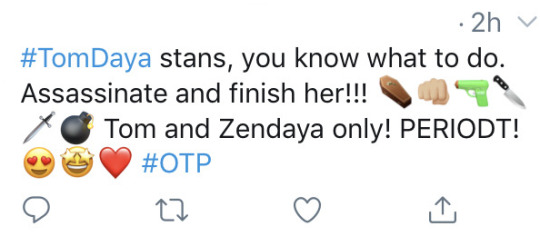

Tom was seen last year with a blonde girl called Olivia, everyone speculated that was his girlfriend and that was something everyone should’ve respected since it’s Tom’s life and he’s in control of it, instead, many fans including Tom H. crazy fans and tomdaya stans, decided to stalk and harass Olivia to the point she had to make her account private. They started bullying her by publicly calling her names like ‘’Olive Oil’’, ‘’Ugly old woman’’, ‘’Ugly fake bitch’’ among other names. They continuously compare her with Zendaya and write on her friends and family members’ social media and ask them to tell Olivia nasty things. You really think this is ok?

Same is happening with the girl Tom was seen with. Tom’s own brothers asked several people to take down and delete the video because they were disrupting her privacy. Many stans didn’t care and started all over again harassing the girl. (I’m not posting images or the identity of this new girl in hopes that this helps maintain a little big of privacy for her.)

However here are some examples of them harassing Olivia:

’’I saw a troubling post on twitter about this fan dming another fan saying that they’d kill her (Olivia). That they’d find a way. So that “the fans can have him all to ourselves” - source

MANIPULATING THE NARRATIVE

Tomdaya stans and some Tom Holland crazy stans love to harass Tom Holland to the point that they tag family members and friends only because he decided to go out in public with Olivia. They call him cheater, manipulator, a dumbass, made fun of him because Tom is dyslexic calling him an illiterate, mocked him and tried to cancel him in every opportunity given by manipulating everyone into thinking some of these ‘’facts’’ are true.

Many fans don’t know better and go to social media to frame Tom as a scumbag because many tomdaya stans have convinced the public of this.

This same issue occurs with Zendaya. Her known boyfriend; Jacob Elordi, is frequently called a cheater and is being investigated every five seconds on every social media, candid, interaction ever. Many fans are already calling him cheater, telling everyone Zendaya’s changed her behavior thanks to Jacob and that she needs help.

Source

BULLYING

The definition of cyberbullying according to Stopbullying.gov:

“Cyberbullying is bullying that takes place over digital devices like cell phones, computers, and tablets. Cyberbullying can occur through SMS, Text, and apps, or online in social media, forums, or gaming where people can view, participate in, or share content. Cyberbullying includes sending, posting, or sharing negative, harmful, false, or mean content about someone else. It can include sharing personal or private information about someone else causing embarrassment or humiliation. Some cyberbullying crosses the line into unlawful or criminal behavior. “

Examples of cyberbullying on Tumblr from good ole Toutdesuite360:

https://toutdesuite360.tumblr.com/post/190572803098/faces-haha-ive-heard-this-has-been-memed-when

Making fun of Jacob Elordi’s wealth… but that isn’t that only thing that the Tomdaya stans have done.

She basically implied that Olivia looked like an elderly lady, and she permitted her followers to humiliate her.

Funny, that a middle aged woman who has never revealed her face on her blog is bullying a young woman.

(She may have deleted the link to save her a** on the post with the Cher pictures, but thankfully @crazypeopleonfandom took screenshots of this post; I got most of my photos from them)

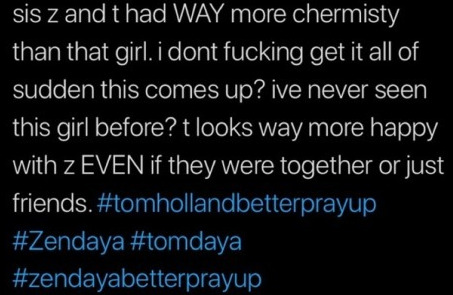

The next aren’t pertaining to the ‘innocent’ Toutdesuite360, just some random jerks from Twitter/Instagram. If you have the time, you can read through them.

See the pictures above and below for reference.

Labelling Zendya, Jacob E., Tom, and Olivia as cheaters, when there was no confirmed relationship between Tom and Z, and Jacob broke up with Cari already is plain disrespectful. These are type of claims are considered slander, and I’m surprised that the people who own these accounts haven’t been rightfully sued.

And remember when I talked about the repetition of people tagging Tom and Z’s family for their ‘thoughts’? Why are you tagging Nikki in your post?

Calling Olivia, once again, a vulgar word that shouldn’t be used for any woman.

This person and many other tomdayas are harassing Zendaya and Tom by tagging them repeatedly. Now we know why Tom stopped using Twitter, and why he may be taking breaks from social media.

And, as pointed out in another point on the thread: Tom has dyslexia! I easily ignore the posts that tease him about his lips, but when it comes to his disability, that crosses the line. It is unacceptable to bully someone just because your fantasy relationship doesn’t seem so real now.

Before I finish this point, I just want to remind people that celebrities are humans too. Everyone has feelings, and even if they haven’t seen these posts, it is still harmful to post this kind of information on your account. Fans who are young (or naive) may see these posts, thus making them believe that Tom actually cheated on Z, and that Z is really with Jacob as ‘payback’ to Tom. Bullying is still an ongoing issue, and maybe you should stop harassing/humiliating people on your platform.

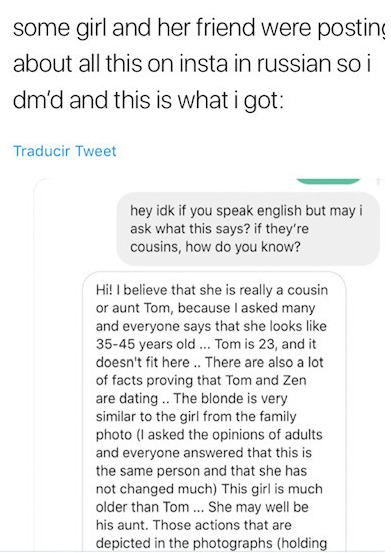

DEATH THREATS

Olivia, Tom and his family, friends, Zendaya, Jacob Elordi, etc. They were sent death threats as a result of a fictional ship. This is truly upsetting and we’ve shown some proof of that above and it’s truly sickening how many of them really want to attack Olivia in public only because of a few photographs.

DEBUNKING EVIDENCE

While we don’t know anything for sure, we need to trust and respect what Tom and Zendaya have said several times: they were never together and they were just friends. This is a topic that makes them feel uncomfortable and tomdaya stans decide to twist their words every time they want to clarify the situation, saying they’re hiding their relationship and that they’ve been hiding it for over 3 years.

Stop believing everything SpideyParker on YouTube says, that person desperately wants them together so they’ll do anything in their power to make it seem like that they’re ’’still together’’. All of their evidence is also nothing but scraps. I can also make a video cropping out certain individuals from the frame to make it look like Tom is with someone or I can also investigate every tiny detail to a borderline degree to make it seem like Zendaya is dating someone. It’s really easy to manipulate the truth, so don’t fall for these things so easily. Check with the real sources, Tom and Zendaya. Trust and respect what they say it’s not your job to investigate and figure their lives out.

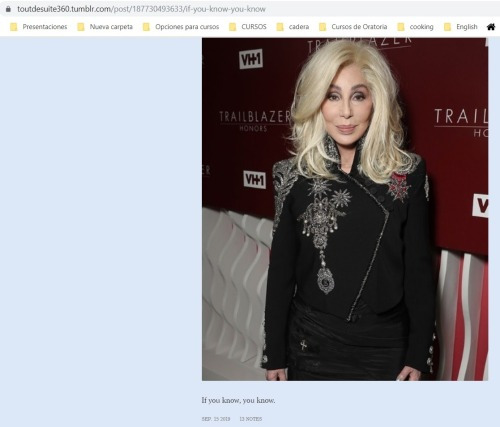

Their evidence of the relationship is ridiculous, stuff like them wearing the same clothes,

because obviously there’s no way this jacket is in any random store in the world...This is a unique jacket, made by Tom and Z specifically...And it’s not even the same jacket. If we’re going by their logic, then

More, more, more and more.

Source

Robert Downey Jr. and Tom have been in a relationship for a long time...

Angourie, Remy and Tom wearing the same jacket.

I have no idea what’s going on with the freaking necklace you swear with blood that Zendaya gave him but that’s hardly something special:

Matching necklace with Olivia.

Avengers necklace.

He likes necklaces, nothing special here.

'’Tom only goes to Zendaya’s home, and only goes out with her!’’

Tom Holland went to RDJ's house to watch Black Panther with him.

Tom and RDJ facetime daily.

Obviously, his only friend is Zendaya...

Look at him and Zendaya there, wow.

‘‘Tom looks at her with heart eyes and in a very special way!’‘

Excuse me, what is he supposed to do? Ignore Zendaya and look somewhere else every time she talks?

MORE

He literally looks at everyone the same way.

‘‘He only does Spider-Man because he wants to be the Peter Parker to his Mary Jane, one of the most romantic comic book couples!’‘

I can’t believe I once read this as proof but I haven’t forgotten about it.

Interview with Tom and Laura:

“Is Zendaya’s character Mary Jane Watson?’’

Tom Holland: “No, no! This is one of those rumours, that like, we’ve all said it’s not true.

Laura Harrier: It’s not true!

Tom Holland: Like, we keep on… You guys keep building yourselves up for disappointment.

Laura Harrier: Unless we don’t know how this started? Because you guys are gonna see this movie and be like “…Ugh.” She’s Michelle!

Tom Holland: She’s a character called Michelle.

Laura Harrier: She’s playing Michelle.

Tom Holland: 100%. Hands down. Her character’s called Michelle. And she’s sort of this weird, quirky one in the friendship group that Peter has. She’s funny, but she’s super strange.

Laura Harrier: Yeah, super dry humour.

Tom Holland: She’s 100% not Mary Jane. It’s funny, everyone’s like “Is she Mary Jane?” and I’m like NO, I’M TELLING YOU! SHE’S NOT MARY JANE!

Source

‘‘He did the Will Smith thing with her, he loves her!’‘

‘’He only ever talks about her! He only praises her!’’

Angourie Rice.

Robert Downey Jr, 2, 3

Laura Harrier, 2

Elizabeth Olsen.

Jacob Batalon.

Chris Hemsworth.

Jake Gyllenhaal.

And the list goes on and on.

‘‘He always goes to her special events only! He only goes to her parties! He only goes to hospitals with her! He was on the set of Euphoria with her!’‘

How about, he goes out with her and everyone else in group and individually? He goes out with Harrison alone, with Jacob alone, with Laura alone, etc. I love how many of them love to leave out certain people to make everyone believe it’s only the two of them. And he doesn’t only goes to hospitals with her, he’s gone with many other people and he does it because he’s a good person, not because he’s on a date with Zendaya.

Tom AND Jacob visit Zendaya on the set of the Greatest Showman.

Tom and friends celebrating Harrison’s birthday party.

Tom on a double date.

Tom going to Joe Russo’s restaurant to get an exclusive cooking lesson from Jessica Largey.

Tom on birthday parties.

Tom, Laura, Harrison and Harry out for dinner in Brazil.

Tom, Brie Larson, Tessa Thompson, and Zachary Levi in a club in Brazil.

Tom, Laura, Jacob, Harrison in a pool party.

RDJ & Tom Holland visit Jon’s restaurant and participate on his show.

Tom Holland visits Doctor Strange’s set.

Tom Holland, Ciara Bravo, Joe Russo visit haunted attraction.

He’s a good person and loves supporting his friends.

‘‘He only has chemistry with her!’‘

Tom and RDJ’s extraordinary chemistry.

Tom and Jake’s chemistry.

Tom and Jacob’s chemistry.

Tom and Laura’s chemistry.

Tom and Daisy’s chemistry.

Tom and Chris Pratt’s chemistry.

Also Will Smith, Chris Hemsworth, etc.

Look below for Ciara and Tom’s chemistry.

Like I said before, maybe he’s a good actor and that’s it?

‘‘Their FFH kiss was too real and magical!’‘

Spoiler alert for Cherry

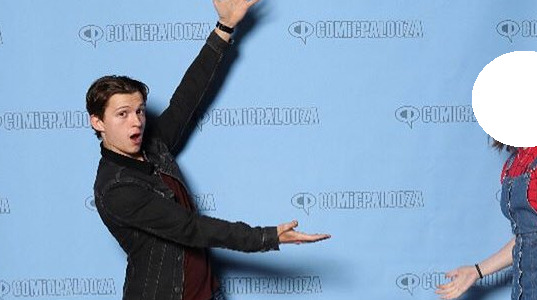

Fan about witnessing Tom’s kiss with Ciara Bravo:

His reaction about kissing Laura Harrier:

‘‘He LOVES touching her’‘

I’m sorry, is he supposed to be scared of touching people?

This is it. This is the big touch they always talk about and the only times they’ve ever held hands is in manips or in FFH, but that doesn’t count, those are fictional characters. Well...

Maybe he’s a touchy person. Consider that.

’’She’s the only one that knows him well!’’

How well do Zendaya, Jacob, & Laura know Tom?

I’m sure Harrison, RDJ, his friends and others know him pretty well too.

And only because he knows she likes ice cream doesn't mean she’s his ultimate soulmate or something blown out of proportion.

‘‘He’s only a gentleman with her!’‘

Tom saves Gina Rodriguez

Tom rescues fan

Karen Gillan

‘‘He looked way too in love with MJ to be fake’‘

Nope.

Nope 2

Nope 3

It’s called acting, pretty sure you guys know by now he’s good.

‘’They’re inseparable!’‘

Jacob, Tom and Harrison

Also, why is it that every female in his life is his cousin, aunt, close childhood friend or ‘’he probably hates her’’ for you?

They’ve said this multiple times but:

In an interview with Elle, Tom said he is not involved with anyone at the moment but is "definitely a relationship person." And when addressing the rumors, he says it’s uncomfortable and annoying when people ship him and Zendaya together.

Zendaya also denied the claims, telling Variety Magazine that she and Tom were simply ‘just friends’.

You can ship them if you want, as a bromance or cute chemistry, but not at the expense of someone else. Not when you violate their privacy, their lives and specially not when you bully, harass and stalk every detail of their lives.

Zendaya is clearly very happy with Jacob Elordi:

Let her have that. No, she doesn’t look miserable with him, no, he didn’t change her style or her personality. No, she doesn’t dress differently because of him. She is the same as always, she looks even happier. Let her be. This is good for her. She has every right to go out in public with her boyfriend. And for the love of god, stop commenting on her instagram posts ‘’warning’’ her that Jacob is going to cheat on her. Hopefully that won’t happen ever.

And no, they’re not going to magically ’’get back together’’ when Spider-Man 3 starts filming, stop wishing bad luck on Zendaya and Jacob’s relationship. Tom is not going to magically realize how ‘’wrong’’ he was for ‘’leaving’’ Zendaya. He never left her, he’s her friend.

All of this have gotten to the point where Tom can’t have a friendship with a female and he has to ‘’protect’’ them every time he wants to interact with them. Do you guys seriously think this is ok? Are you really a fan of his if this is how you want him to live? Controlling him all the time?

Do you realize how wrong and unfair it is for the other partner every time you comment in every single picture on instagram, twitter, etc about how ‘’cute’’ Tom and Zendaya are? About how ‘’ugly’’ Olivia is? How about when you compare Zendaya and Olivia, or every single female in Tom’s life? Or when you comment on Zendaya’s instagram telling her she is different now and that you don’t like her now because she’s changed for Jacob? Telling her that Jacob is going to cheat on her? Stop sending death threats to the partners, stop tagging their families in your ‘’evidence/proof’’ posts/tweets. Just because they don’t voice these things doesn’t mean they don’t read them.

Being sincere, if you all, as a collective; really, genuinely cared about Tom, this is the last thing you would wanna pull. In your endless obsession with thinking you have a right to dictate the life of a man simply because he's famous; actually stopped once to consider how this is possibly making Tom and Zendaya feel?? You are basically sending the message that nobody is enough, that him being happy isn't enough, that he won't ever be allowed to be happy until he gets with the person YOU think is best for him. Fucking abhorrent, how they don't have a choice on who they choose to fucking love. This is how you make a celebrity jaded. THIS is how you make a celebrity hate you. And he will, unless you stop your bullshit, and treat him; and whoever he decides to be with, like human beings.

When you focus only on two people it’s easy to believe anything, try and see the bigger picture. Allow Zendaya and Tom to enjoy their lives without harassing them and their partners.

#zendaya#tom holland#tomdaya#jacdaya#zendaya coleman#jacobdaya#jacob elordi#robert downey jr#anti tomdaya#jake gyllenhaal#tom holland x reader#tom x reader#marvel#mcu#far from home#spideychelle#michelle jones#peter parker#harassment#bullying#harrison osterfeild x reader#harrison osterfield#harry holland#sam holland#ffh#spiderman

251 notes

·

View notes

Link

Aziz? redemption ?

AZIZ DIDN’T FUCKING DO ANY GOD DAMN THING WRONG!!!!!!

God, I love being white,” said Louis C.K.

“Here’s how great it is to be white,” the comedian went on: “I could get in a time machine, and go to any time, and it would be fucking awesome when I get there. That is exclusively a white privilege.”

The bit, part of his 2008 special Chewed Up, was emblematic of C.K.’s approach: poking fun at the inequalities of American society, while simultaneously acknowledging the ways they benefited him.

Contrast that with a set he performed in December 2018, a little over a year after he admitted to masturbating in front of women without their consent. During the December appearance, apparently at a comedy club on Long Island, C.K. joked that Asian men are “all women” and poked fun at school shooting survivors and gender-nonconforming teenagers, according to BuzzFeed News.

“They tell you what to call them,” he complained of teens who use the pronouns they/them. “Oh, OK. You should address me as ‘there’ because I identify as a location. And the location is your mother’s cunt.”

Imagine thinking the best way to resurrect your career after admitting to sexual misconduct is to mock trans people and Parkland gun violence survivors.

2018, during which his standup special and the wide release of his film I Love You, Daddy were canceled, seems to have wrought a change in C.K. Where once his comedy offered a fresh look at established power structures, he now seems set on ranting about kids today and their pronoun choices.

Fellow comedian Aziz Ansari has followed a similar trajectory. He once decried sexual harassment in his act — and addressed the issue in a nuanced way on his show Master of None. But in 2017, a woman told the website Babe.net that he had pressured her for sex — Ansari said he had believed everything that happened between them was “completely consensual,” and that he was “surprised and concerned” by her account.

After the incident, his comedy took on a different tone: In a fall 2018 appearance, he made fun of online debates about cultural appropriation and complained that nowadays, “everyone weighs in on everything,” according to the New Yorker.

The bigotry in C.K.’s set is disturbing, especially coming from someone who seemed at one time to have a relatively clear understanding of how power works in America. But what is also striking about C.K. and Ansari’s post-#MeToo material is its banality. Before they were publicly accused, these men wrestled with thorny questions of identity and power in ways that, while not always satisfying, were usually thought-provoking. After the allegations, they began parroting tired complaints about political correctness.

Of the many people accused of sexual misconduct as part of the #MeToo movement, C.K. and Ansari seemed like they might be uniquely equipped to reckon with the allegations against them, perhaps even adding something to the public conversation around #MeToo. Instead, they have retreated into boring and offensive stereotypes, perhaps playing to those who never thought they did anything wrong.

We’re all worse off for their decision, missing out on the art C.K. and Ansari might have created if they’d been willing to really face their accusations, and robbed of the opportunity to see two intelligent and thoughtful men really wrestle with the implications of #MeToo. In a time when more and more of the accused mull their comebacks, it’s natural to wonder what real redemption — complete with an acknowledgment of harm and a commitment to atonement — might look like. Apparently, Louis C.K. and Aziz Ansari will not be the ones to show us.

Louis C.K. used to talk about violence against women. Now he makes fun of genderqueer teens.

Before #MeToo, Louis C.K. was beloved by many for his often self-lacerating comedy. In his standup and on the autobiographical FX show Louie, he portrayed himself as a sad-sack weirdo disturbed by his own sexual urges — he once called himself a “prisoner” of “sexual perversion.”

C.K.’s work could be offensive, as when he complained that he missed being able to use a homophobic slur (and claimed, unconvincingly, that the way he used it had nothing to do with homophobia). But some hailed his comedy as feminist, and he showed a remarkable ability to mine humor from the dangers and biases women face — a difficult feat for a male comic.

“How do women still go out with guys when you consider that there is no greater threat to women than men?” he asked in a 2013 special. “We’re the number one threat to women! Globally and historically, we’re the number one cause of injury and mayhem to women.”

But C.K. was also the subject of long-simmering sexual misconduct rumors — and in November 2017, four women told the New York Times that he had masturbated in front of them or asked them to watch him masturbate (a fifth said that he masturbated while on a phone call with her).

In a move that remains unusual among men accused as part of #MeToo, C.K. admitted to the allegations against him. “These stories are true,” he said in a statement to the New York Times.

“I have spent my long and lucky career talking and saying anything I want,” he added. “I will now step back and take a long time to listen.”

But as many have pointed out, the listening didn’t last very long. C.K. was back onstage in September 2018, less than a year after his pledge to step back. In an October appearance at the West Side Comedy Club in New York, he addressed the fallout from his sexual misconduct revelations, saying he’d been to “hell and back” and that he’d “lost $35 million in an hour.”

While many were critical of C.K.’s comeback attempt, West Side Comedy Club host AMarie Castillo told the comedy website LaughSpin that the comic “was so genuine and reflected on how weird his year was” in his October appearance. “Sounds to me he is owning up, acknowledging, and trying to figure it out,” she said.

But in a December set, he didn’t sound much like someone trying to figure anything out. In audio posted on YouTube, apparently from an appearance at the Governor’s Comedy Club on Long Island on December 16, C.K. poked fun at gender-nonconforming youth, Parkland school shooting survivors, and Asian men, among other groups. (The club was unable to confirm to BuzzFeed that C.K. was there that night, though multiple people posted on Instagram that they had seen him perform there.)

“You know why Asian guys have small dicks,” he said at one point, according to Patrick Smith and Amber Jamieson of BuzzFeed. “’Cause they’re women. They’re not dudes. They’re all women. All Asians are women.”

C.K. also said he thought it was ridiculous that the term “retarded” was now viewed as inappropriate, Smith and Jamieson reported. When some listeners appeared shocked, he responded, “Fuck it, what are you going to take away, my birthday? My life is over, I don’t give a shit.”

C.K. has not responded to a request for comment from Vox.

Aziz Ansari once included a sexual harassment storyline on his show. Now he’s complaining about Twitter outrage.

Ansari’s comedy has always been more lighthearted than C.K.’s, but he hasn’t shied away from difficult topics. In a 2015 Netflix special filmed at New York’s Madison Square Garden, he asked women in the audience to raise their hands if they’d ever been followed by a “creepy dude,” according to Eren Orbey at the New Yorker.

“Yeah, that’s way too many people,” he said when hands went up. “That should not be happening.”

The second season of his Netflix show, Master of None, also included a storyline about sexual misconduct. Ansari’s character, Dev, teams up with celebrity chef Jeff Pastore (Bobby Cannavale) for a show called Best Food Friends. But Dev is forced to make a choice when a female crew member reveals that Chef Jeff repeatedly harassed her. The episode, which aired before #MeToo gained steam in fall 2017, felt true to life, as Isha Aran pointed out at Splinter, “from the fears victims face in going public to the misogynist skepticism they’re met with when they share their stories.”

But in January 2018, a woman going by the name Grace told the website Babe.net that Ansari had repeatedly pressured her for sex while the two were on a date. She called it “by far the worst experience with a man I’ve ever had.”

“We went out to dinner, and afterwards we ended up engaging in sexual activity, which by all indications was completely consensual,” Ansari said in a statement on the allegations last January. “The next day, I got a text from her saying that although ‘it may have seemed okay,’ upon further reflection, she felt uncomfortable. It was true that everything did seem okay to me, so when I heard that it was not the case for her, I was surprised and concerned.”

“I continue to support the movement that is happening in our culture,” Ansari concluded, presumably referring to #MeToo. “It is necessary and long overdue.”

By fall 2018, however, his tone sounded different. In a Connecticut stop on his “Working Out New Material” comeback tour, he complained about Twitter users debating whether a teenager’s prom dress constituted cultural appropriation, according to Orbey.

“Everyone weighs in on everything,” he said. “They don’t know anything. People don’t wanna just say, ‘I don’t know.’”

He also decried “the destructive performativity of Internet activism and the fickle, ever-changing standards of political correctness,” according to Orbey. He compared left-wing Twitter users to Trump supporters (“at least with the Trump people,” he said, “I kinda know where they stand”) and accused them of competing with one another in a game of “Progressive Candy Crush.”

“One might have hoped that, nearly a year later, [Ansari] could find a way to reckon with one of the movement’s messiest lessons: that even men who wish to serve as allies of women can, intentionally or not, hurt them in private,” Orbey wrote. “Instead, like other men who have reëmerged in recent months, he seems to have channelled his experience into a diffuse bitterness.”

Ansari has not responded to Vox’s request for comment.

If C.K. and Ansari can’t reckon with the allegations against them, can anyone?

Allegations of sexual misconduct against C.K. and Ansari hit fans hard in part because of the thoughtful nature of their comedy — these were supposed to be the good guys.

The accusations prompted fans and critics to reevaluate both men’s work. At Splinter, Aran notes that despite its sexual harassment storyline, Master of None’s second season displays some underlying misogyny. Dev’s relationship with love interest Francesca, in particular, sends the message “that a woman’s initial reluctance can be chipped away at, that indifference is a wall to be torn down.”

C.K., meanwhile, had been telling masturbation jokes for years. As Melena Ryzik, Cara Buckley, and Jodi Kantor reported at the New York Times, “he rose to fame in part by appearing to be candid about his flaws and sexual hang-ups, discussing and miming masturbation extensively in his act — an exaggerated riff that some of the women feel may have served as a cover for real misconduct.” His film I Love You, Daddy, which was initially scheduled for release in November 2017, dealt with a relationship between a famous filmmaker and a 17-year-old girl.

And C.K.’s December set does recall some of his earlier work — the man who complained about teens today and their pronouns is clearly the same one, for instance, who expressed nostalgia for a time when he could use homophobic slurs without being criticized.

Still, C.K. and Ansari were somewhat unusual as male entertainers willing to delve into issues of power and privilege and talk about the ways men hurt women.

That’s what makes their current material so surprising. Ansari and C.K. aren’t just avoiding the subject of #MeToo — they’re going in the opposite direction, complaining about political correctness and outrage culture when their comedy once sent the message that women were absolutely right to be outraged.

Their new work is reactionary — crude jokes about Asian men wouldn’t be out of place at a Trump rally — and it’s dated. C.K.’s complaints about they/them pronouns aren’t just offensive; they’re also tired, well-worn platitudes parroted by everyone from psychologist Jordan Peterson to TV host Piers Morgan. C.K. may think his new material is edgy, but his rant about young people today sounds like it could come from Grandpa Simpson.

Some have speculated that C.K. is consciously courting a more right-leaning audience with his new material after losing the trust of his previous fans, and it’s certainly possible that he and Ansari are pivoting to please the people who were eager to explain away the allegations against them — those who think sexual misconduct only matters if it rises to the level of the allegations against Harvey Weinstein, or who believe that men who are accused deserve swift and unconditional forgiveness.

Whatever the case, the trajectories of C.K. and Ansari are doubly disappointing — first, because men whose work had a feminist bent were accused of hurting women, and second, because they let those accusations destroy the nuanced social awareness their earlier work displayed. Apparently, C.K. and Ansari were only interested in challenging the status quo when they remained unchallenged — once women spoke out against them, they performed the comedic equivalent of packing up their toys and going home.

That’s sad for all of us. We don’t get to see the comedy these men could have created if they’d wanted to face, rather than flee from, our current moment in history. And we don’t get to see two thoughtful entertainers bring their talents to bear on a project that matters to all of us — figuring out what it should look like for men accused as part of #MeToo to apologize, atone, and move forward.

Ever since the #MeToo movement gained mainstream attention in 2017, there’s been a lot of talk about what accused men can do to redeem themselves. Now, more than a year in, it’s certainly possible to imagine some of the accused truly reckoning with their pasts — Dan Harmon’s apology for sexually harassing a writer on his show offers a view of what that might look like. But it’s hard to hold out much hope for such a reckoning on a large scale when two men who seemed like they, of all people, might be able to look deeply at their own behavior have instead chosen to pander to those who would excuse them.

______________________

AZIZ DIDN’T FUCKING DO ANY GOD DAMN THING WRONG!!!!!!

24 notes

·

View notes

Text

Standing up to my boss.

It bothers me when people tell those who are getting seriously mistreated at their work place not to stand up for themselves because “Well what if this screws up your chance at getting a new job?”

I had explained to one of my friends today that I had written a very detailed letter to my old boss of why I as well as many others were so angry at him leading to three of us putting in our two weeks notice at the same time. This letter lead to us sitting down and talking, and that conversation lead to him personally attacking my coworkers and I which ended with me telling him face to face exactly just how screwed up everything he as well as the other owner and the manager he sent to “help” our store did was.

the response I received from this was “What you did was REALLY stupid.” followed up with a list of ways I should have handled it, all stemming around “Well what if this affects you getting jobs in the future?” Here is my problem with this. If everyone just quietly walks away from an abusive job, especially one at this level, nothing ever changes. The owners just continue on with their bullshit assuming they got away with it because no one said anything.

Just to clarify, there were countless things that lead to me telling off my boss, and they weren’t just little things that added up, they were big things and caused huge issues in the work place taking a serious toll on the workers. The situations that lead to fellow workers and I reaching the point we did were as follows:

Left without a manager or supervisor for ten months and were told they “couldn’t afford” promotions so no one within the store could be promoted.

Refused to hire people when we were in serious need of stock guys and sales associates leaving us very short staffed on a constant basis, sometimes only one person running the entire store for hours.

Were told multiple times that they had people ready to hire for management and supervisor positions and just never hired them forcing the keyholders to do the work of management and supervisor for months without the title or the pay.

Repeatedly forced us to fix corporate fuck ups causing us to deal with countless very angry customers because they didn’t want to deal with them, which lead to one of the workers being harassed by a customer to the point where we had to ban them from calling the store, so I personally was getting yelled at by him for telling him he could no longer call the store and talk to her, then she ended up getting on the phone and telling him herself. That’s right, WE, the workers at the store where he was harassing someone had to tell him he could no longer call, NOT corporate.

Had to deal with multiple people from other locations being sent to “help” us because they refused to just promote someone to keyholder so they could close, even though we only had one key holder who could work Wednesdays, which meant we were literally training people from other stores on how to do things in our store so they could do exactly what people who already worked there were perfectly capable of doing.

Were told we were being trained for Manager and keyholder positions that we would FINALLY be getting promoted to, only to find out other people who weren’t even training or qualified were offered the jobs behind our back and then told “You are qualified, it’s just not the right time.” as if we hadn’t been doing the jobs for months already.

Had a manager sent from the other store who was suppose to train us but literally did nothing but talk about her store and fuck up the displays, snap at people repeatedly, steal things from our stock room for her store, and go against our store policies causing us to have countless customer issues that she refused to fix because it was our store not hers.

Were personally verbally attacked on the regular because we spoke up about issues in the store and how we NEEDED things to change, these attacks included the manager from the other store as well as the owners constantly yelling at the keyholders, and the manager personally talking shit about me to my coworkers because I reported her for majorly fucking shit up at the store, causing me to spend an entire shift fixing all her fuck ups. As well as talking shit about my coworker for not finding the time to talk to her in the middle of us fixing all her fuck ups.

Were told that it was totally acceptable for the manager to treat the employees like total shit and do and say whatever the fuck she wanted because “She was a manager” and was told that those who were going to stay for their two weeks needed to shut up and not cause any issue aka not stand up for themselves while being disrespected.

Hired a manager that after three of us put in our two weeks had hired five new people instantly, then proceeded to threaten every one of the sales associates and stock from the old crew telling them they had people there ready to replace them if they didn’t “hold their weight” aka reach a ridiculous sales goal EVERY shift they worked (it was a furniture store, so many days were completely dead)

Within a matter of two days from being hired the new manager left the doors unlocks overnight (the store also had a starbucks inside meaning someone could have robbed both the furniture store and the starbucks,) had three citations from the mall, and multiple of her customers calling in with complaints, yet somehow the girl was not fired or disciplined, and continued to treat the employees like shit.

Workers at other stores were being told that the company was “Cleaning house” basically implying that the three of us that had quit were actually fired, using us as a way to make people think that they could be next.

Promoted one of the new hires to key holder who in no way or form was qualified (She has the attention span of a gnat and showed up to work in a crop top for training.) And the girl ended up kicking an employee out of the store because the employee told her that she filled out a form wrong and was trying to help her do it properly so she wouldn’t get in trouble. The new manager agreed with what she did, and when the girl who was kicked out put in her two weeks notice, she was given zero hours for those weeks, even though everyone else who put in their two weeks was given hours for both weeks.

The new manager showed up to work hung over smelling of alcohol and threw up in the bathroom then proceeded to pretend to have a cold claiming that was why she was throwing up, forcing a key holder to come in on her day off and cover her shift. This was an evening shift that she was working. The same manager will constantly refuse shift changes or days off to people, but then ask them to cover her shifts trying to guilt trip them into doing it, and even gave herself a holiday (New Years Day) off without even asking if the other keyholders had plans that night. She also told one of the new girls that she could not call out due to an emergency with her child telling her that if she did she would be written up. Once again, she did not get fired or disciplined in any way and continues treating the employees like shit, including lying about one of the starbucks workers (They have their own managers that are completely separate from the furniture store, but are under the same owner) claiming he was giving old employees free drinks, even though those employees had paid.

Since the new manager was hired they have had 7 people quit within less than a month, two new hires included due to employee severe mistreatment in the workplace.

Now this is just the bigger stuff, there is a ton of smaller stuff that over time also lead to serious issues. So combining those with all of the above, no, I was not just going to quietly leave and not stand up for my coworkers (now friends) and I, because honestly that is total bullshit. Why the hell should I have to feel that I have to stay silent and hope that karma gets them in the long run when they have done nothing but be abusive time and time again to us? WHy are we being made to feel that we can’t have a voice?

Can speaking up to my boss like i did affect who hires me in the future? Yeah. Do I regret standing up for what is right? Hell no! As far as I’m concerned, if someone doesn’t hire me without giving me the chance to explain why i stood up to my boss, those are not the type of people I want to be working for.

1 note

·

View note

Link

Federal customs officials said Friday that their agents had detained a demonstrator in Portland, Ore., in a widely seen video circulating online that showed two men in apparent military garb taking a young man wearing all black into custody, defending the apprehension by describing the man as being suspected of attacking federal agents and property.

This defense came as federal authorities were under criticism for their tactics from elected officials, civil rights activists and demonstrators, including one in Portland who described being “terrified” during a similar encounter.

In a statement on Friday, U.S. Customs and Border Protection said that its agents had taken the action in the video and that they “had information indicating the person in the video was suspected of assaults against federal agents or destruction of federal property.”

When the agents approached him, CBP said, “a large and violent mob moved towards their location. For everyone’s safety, CBP agents quickly moved the suspect to a safer location for further questioning.”

The agency also disputed suggestions that they were operating only as unidentified federal agents.

“The CBP agents identified themselves and were wearing CBP insignia during the encounter,” CBP said in its statement. “The names of the agents were not displayed due to recent doxing incidents against law enforcement personnel who serve and protect our country.”

A similar encounter left Mark Pettibone, a 29-year-old demonstrator, shaken, he told The Washington Post in an interview.

Pettibone said he was scared when men in green military fatigues and generic “police” patches jumped out of an unmarked minivan early Wednesday. Pettibone said that when several men in fatigues approached him, his first instinct was to run.

He did not know whether the men were police or far-right extremists, who frequently don military-like outfits and harass left-leaning protesters in Portland. In his account, the 29-year-old said he made it about a half-block before he realized there would be no escape.

Then, he sank to his knees, hands in the air.

“I was terrified,” Pettibone said. “It seemed like it was out of a horror/sci-fi, like a Philip K. Dick novel. It was like being preyed upon.”

He was detained and searched. One man asked him if he had any weapons; he did not. They drove him to the federal courthouse and placed him in a holding cell, he said. Two officers eventually returned to read his Miranda rights and ask if he would waive those rights to answer a few questions; he did not.

Almost as suddenly as they had grabbed him off the street, the men let him go. The federal officers who snatched him off the street as he was walking home from a peaceful protest did not tell him why he had been detained or provide him any record of an arrest, he told The Post. As far as he knows, he has not been charged with any crimes. And, Pettibone said, he did not know who detained him.

“Arrests require probable cause that a federal crime had been committed, that is, specific information indicating that the person likely committed a federal offense, or a fair probability that the person committed a federal offense,” Orin Kerr, a professor at University of California at Berkeley Law School, told The Post. “If the agents are grabbing people because they may have been involved in protests, that’s not probable cause.”

During a video news conference Friday, Portland Mayor Ted Wheeler twice called the federal police in his city President Trump’s “personal army” and said that he is joining a chorus of Oregon’s elected officials in sending a clear message to Washington: “Take your troops out of Portland.”

“This is part of a coordinated strategy out of Trump’s White House to use federal troops to bolster his sagging polling data, and it is an absolute abuse of federal law enforcement officials,” Wheeler said. “As we were starting to see things de-escalate, their actions last Saturday and every night since have actually ratcheted up the tension on our streets.”

Federal officers from the U.S. Marshals Service and Department of Homeland Security have stormed Portland’s streets as part of Trump’s promised strong response to ongoing protests. Local leaders expressed alarm at news of Pettibone’s detention and echoed calls for the feds to leave that have grown stronger since Marshals Service officers severely wounded a peaceful protester on Saturday.

“A peaceful protester in Portland was shot in the head by one of Donald Trump’s secret police,” Sen. Ron Wyden (D-Ore.) wrote in a Thursday tweet that also called out acting DHS secretary Chad Wolf. “Now Trump and Chad Wolf are weaponizing the DHS as their own occupying army to provoke violence on the streets of my hometown because they think it plays well with right-wing media.”

Civil rights advocates suggested the Trump administration is testing the limits of its executive power.

“I think Portland is a test case,” Zakir Khan, a spokesman for the Oregon chapter of the Council on American-Islamic Relations, told The Post. “They want to see what they can get away with before launching into other parts of the country.”

Jann Carson, interim executive director of the American Civil Liberties Union of Oregon, called the recent arrests “flat-out unconstitutional” in a statement shared with The Post.

“Usually when we see people in unmarked cars forcibly grab someone off the street, we call it kidnapping,” Carson said. “Protesters in Portland have been shot in the head, swept away in unmarked cars, and repeatedly tear-gassed by uninvited and unwelcome federal agents. We won’t rest until they are gone.”

Nightly protests have seized Portland’s downtown streets since George Floyd’s death in Minneapolis in late May. For more than six weeks, Portland police have clashed with left-leaning protesters speaking out against racism and police brutality. Tear gas has choked hundreds in the city, both protesters and other residents caught in the crossfire. Protesters have spray-painted anti-police messages on the Mark O. Hatfield federal courthouse and Multnomah County Justice Center, which serves as the local jail and a police headquarters.

After Trump sent federal officers to the city, allegedly to quell violence, tensions escalated. The feds have repeatedly deployed tear gas to scuttle protests, despite a newly passed state law that bans local police from using the chemical irritant except to quash riots. On Saturday, federal agents shot a man in the face with a less-than-lethal munition, fracturing his skull. Local officials, from the mayor to the governor, have asked the president to pull the federal officers out of the city.

“I am proud to be among the loud chorus of elected officials calling for the federal troops in Portland’s streets to go home,” Portland Commissioner Jo Ann Hardesty said in a statement shared with The Post on Sunday. “Their presence here has escalated tensions and put countless Portlanders exercising their First Amendment rights in greater danger.”

Pettibone says he was simply exercising his free speech rights on Wednesday when he was detained. He and a friend were walking to a car to drive home after a relatively calm demonstration in a nearby park. He said he did not do anything to instigate police that night, or at any of the other protests he had attended over the past six weeks.

“I have a pretty strong philosophical conviction that I will not engage in any violent activity,” he told The Post. “I keep it mellow and try to document police brutality and try to show up for solidarity.”

DHS did not immediately respond to a request for comment Thursday night, and likewise did not answer questions from Oregon Public Broadcasting. The Marshals Service told the radio station its officers had not arrested Pettibone and said the agency always keeps records of its arrests.

“We’ve done a great job in Portland,” Trump said at a news conference on Monday. “Portland was totally out of control, and they went in, and I guess we have many people right now in jail. We very much quelled it, and if it starts again, we’ll quell it again very easily. It’s not hard to do, if you know what you’re doing.”

Yet the scene on Portland’s streets late Thursday reflected a different reality.

Protesters once again filled the streets in downtown, defiantly moving fencing meant to keep the crowd away from the Multnomah County Justice Center. And once again, federal officers launched tear gas into the protest.

As police, both local and federal, have responded to demonstrators with increasing force, the protests have grown more unwieldy and determined. Neither side appears ready to surrender.

“Once you’re out on the street and you’ve been tear-gassed and you see that there’s no reason — the police will claim that there’s a riot just so they can use tear gas — it makes you want to go out there even more to see if there can be any kind of justice,” Pettibone told The Post.

Emily Gillespie in Portland contributed to this report.

Correction: A previous version of this story stated incorrectly that a video circulating online showed Customs and Border Protection personnel detaining Mark Pettibone. The identity of the protester in that footage remains unclear.

‘It was like being preyed upon’: Portland protesters say federal officers in unmarked vans are detaining them

0 notes

Text

Who Are We Reopening For added to Google Docs

Who Are We Reopening For

Reopening restaurant dining rooms still puts customers and employees at risk. So why is it happening?

I dream of eating in restaurants. Literally, I have woken up and burst into tears because a few sweet moments earlier I was in public with no mask on, shaking the hand of a familiar waiter, hugging friends as we meet at a new place one of us wanted to try, or just waiting for my partner at the bar with a book. As the weeks of isolation march on, the gravitational pull of public life feels ever stronger. And as more states either reopen or flirt with reopening, it’s tempting to think these fantasies are just around the corner.

Many states are advertising that fantasy as the truth. In all but a handful of states, it is now legal or will soon be legal to once again operate dine-in services at restaurants. Of states that have allowed that, many require restaurants to operate at a limited capacity or only allow outdoor dining, but by the end of May, it is likely that eating at a restaurant will once again be available to much of the country. And what’s more, that official encouragement has led to a general “fuck it” attitude. The Washington Post reports that in Avalon, a wealthy development of restaurants and stores in Georgia, people are thrilled to be dining out again without masks. “The wineries are opening this weekend for indoor service and we’re going there tomorrow,” crowed one retiree a few weeks ago. “I can’t wait!”

These reopenings are based on the acceptance of unnecessary sickness and death. An internal report from the Trump administration, which is pressuring states to “reopen” businesses, projects a steady rise in the death toll from COVID-19, resulting in 3,000 deaths a day by June 1. In a leaked phone call, Texas Gov. Greg Abbott, who recently allowed restaurants to reopen their dining rooms, admitted “the fact of the matter is pretty much every scientific and medical report shows that when you have a reopening... it actually will lead to an increase and spread” of the new coronavirus.

Abbott was correct. Cases are climbing in most states that have allowed for reopening. In Georgia, Gov. Brian Kemp has come under fire for releasing misleading data, and we ultimately won’t know for weeks about spread. Countless studies and reports from medical institutes and experts say it’s too soon, that reopened business and a rise in mobility will undo the already meager progress we’ve made in flattening the curve of the pandemic. Dr. Anthony Fauci warns of “needless suffering and death.” And yet, the government on both the local and federal levels insist this is the only way; people need to work, they say, the economy needs to keep moving, and everyone needs to feel a sense of normalcy.

Even more cautious states are gearing up to reopen soon. Yet there’s no vaccine; the curve, while breaking, has not been flattened; and there is no cure. While white-collar workers in many places will work from home until the end of the year, everyone else, nearly 70 percent of all workers, is on the front line. But this potential for suffering is needless. Our governments and the general desire to get “back to normal” has created an environment in which service workers must make the choice between their health and their safety, and where an individual’s choice to forego a mask at a cafe could affect dozens. Food service workers are being asked to repeatedly expose themselves to harm, and for what? So the rest of us can eat food in a dining room again?

Some restaurants have been making things work under regulations that limit service to takeout and delivery, whether or not they have received Paycheck Protection Program loans. Loosened alcohol sale laws provide an extra source of revenue, and many have begun selling produce and meat along with prepared food. Some restaurants are trying to adapt their businesses to a “new normal” in which they are allowed to (or compelled to) reopen, but cannot safely resume operations as they were before, and some are refusing to reopen until it is safe. Some are even trying to close, which comes with its own exorbitant costs. But many restaurants are weighing the risk of reopening dining rooms and the reality that their business models just wouldn’t work in the long run with takeout as their only source of income.

Tony Harper, a bartender at the Fairmont Hotel in Austin, says he feels lucky his company has decided to stay closed until June 1. “We all know May 1 [was] too early,” he says. “I can’t be truly thrilled until we have this contained and don’t have to work our way around the virus for employment.” He also speculates there may not be much work for him anyway. Though Texas has allowed restaurants to reopen their dining rooms at limited capacity and their patios at full capacity, many diners are trepidatious about eating out. Texas’s first open weekend was quiet, with just 16 percent of people in Austin saying they’d be willing to immediately return to restaurants. And despite economic hardship, a poll shows 71 percent of Americans think it’s a bad idea to reopen restaurants and bars. “I don’t really feel the pressure [to go back to work] because honestly the service industry is going to be down for a minute,” says Harper, “so there’s no point in diving back into what, at this point, is still a dangerous situation.”

Starbucks also announced that it would reopen 90 percent of its locations by early June, with select stores allowing customers inside. Though the company said it will emphasize “entryway hand-off” and cashless payments, employees are saying it’s too early. In March, thousands of Starbucks workers signed a petition to close all locations, writing that continuing to stay open would put both customers and employees at risk. Now, more employees are signing the petition in protest of the recent reopenings. In the comment section, some write that they live with health care workers and are at risk of spreading the virus, or aren’t able to find child care.

Hermia* was concerned when, on May 7, she arrived at her Starbucks location in Atlanta to prepare for reopening the next day. “Most people didn’t come in with their own masks,” she said, “and the ones provided by Starbucks are I think literally T-shirts that someone cut out.” She says the store’s layout makes it impossible to keep six feet apart from her coworkers at all times, and that if she can’t guarantee everyone will be taking the new sanitation measures seriously, she’ll be exposing herself. Even if every employee follows protocol, there are still customers to deal with. “Starbucks is a little bit more expensive than our competitors, and I feel like at that price point people get a little pushy,” she said. “People are never on their best behavior at Starbucks.” There have already been reports of customers harassing workers when they’ve been asked to wear masks, and in general, reopening puts workers in the position of having to enforce public health practices.

Rebecca, another Starbucks worker in Tennessee, wasn’t comfortable going into work back in March, before Starbucks made the decision to close. So she chose to take the company’s catastrophe pay and wait it out. But now, she says she’s still not safe, and is declining to return to work at Starbucks. “I don’t feel comfortable returning to work because I’ve been seeing a lot of statistics about how the United States is not where it needs to be in terms of testing,” she said. “I think the purpose of reopening the economy… that should be to help people. If people are willing to sacrifice human lives to make human lives better, that just seems like nonsense to me.”

Rebecca’s husband still has full-time employment, so she can afford, at least for now, to say no to work. But for others, the ability to make money is the primary determinant of returning to work, regardless of fears about health, something which activists and labor experts have been critical of. Damon A. Silvers, the director of policy and special counsel for the AFL-CIO, called states reopening (and sometimes setting up ways to report people who choose not to return to work) “the choice to endanger your life or starve.”

“I would not be there if it weren’t for the money,” says Hermia. In April, unemployment reached 14.7 percent, over 20 million people, the highest postwar number ever recorded, with 5.5 million of those jobs coming from food and drinking services. “I can’t really afford to go on a leave of absence. I keep thinking about how many people have lost their jobs... I’m fine now, but then when I’m not fine, will I be able to find a job?” Harper also says that, while he doesn’t feel the need to return to work yet, the clock is ticking. “With quarantine you are limited, so I’m not spending much. With that being said, [my finances are] only coming close to balancing due to the additional $600” a week he is receiving from the CARES Act, which runs out on July 31.

For many, unemployment insurance has been nearly impossible to obtain in the first place. “The Florida unemployment was an absolute nightmare,” said Paul Pecor, who recently returned to work at Marker 88 in Islamorada in the Florida Keys. The unemployment website kept crashing, and due to a glitch in the system, he was told he was ineligible for insurance and had to reapply. After seven weeks, he still has not received a check. “That’s why I made the decision to return to work and depend on me and not the state,” he said. But he recognizes that if the unemployment option were there, things might be different. “That’s the other issue a lot of businesses are facing: the difficulties of finding employees that want to return to work versus making more money collecting unemployment, and in the same respect staying safe.”

Some have argued that despite the worry and the uncertainty, reopening business is an “acceptable risk” in some places. And it’s true that there are places where reopening looks more feasible. Pecor says he does feel safe at work, because Islamorada has a specific setup. The two roads that lead to the island chain have been blocked, so only those who live or work on the islands can get through. The restaurant seating is outdoors, six feet apart, and he trusts his coworkers to keep things clean. However, that doesn’t mean he thinks it’s the best idea. “We are far from out of the woods,” he says, and acknowledges it could be a whole different story when the state decides to open those roads back up on June 1. “I understand people’s frustrations and wanting to get back to some norm, to get back to work so they can feed their family… But if this virus happens to spike again, then it was all for nothing, and it will be twice as hard to reopen again.”

There’s no guarantee that, say, Harper will be able to walk into his bar next week and feel fine. Viruses don’t adhere to human calendars, and for your average person doomscrolling through the news, it is nearly impossible to intuit what “safe” will feel like, especially as the government goes to great lengths to keep information about the pandemic from getting out. Experts tell the New York Times that benchmarks like quality of hospital care, widespread testing, and a sustained reduction of cases must be met before things will be safer.

Some states have implemented these measurements to determine when businesses can reopen, as well as phases of that process so hundreds of people don’t rush into a crowded music venue on day one. The U.S. is still woefully behind when it comes to testing, and the jury is still out as to whether having COVID-19 antibodies means one can’t become infected again or pass the virus to others. If we had adequate testing, more knowledge of how COVID-19 antibodies work, and the proper resources given to hospitals, the path to reopening would be clearer. But even then, experts say the metrics we have been relying on are faulty, and that there is no “magic number” that will tell us when it is safe to resume life as it was. “The numbers don’t tell you what the system really looks like,” Bruce Y. Lee, a professor of health policy and management at the City University of New York School of Public Health, told HuffPo. “I don’t know of a single state that’s ready to reopen.”

The problem is the question is being presented not as “when will the pandemic be under control?” but rather “when can we start making money again?” That framing puts the wellbeing of business over the wellbeing of people, to already confounding results. It’s pretty clear that where dining rooms have reopened, safety measures often exist in direct opposition to how a restaurant is supposed to operate. I mean, how is one supposed to eat with a mask on? Either you have situations like the one at C&C Coffee and Kitchen in Colorado, which opened its doors for Mother’s Day in defiance of the governor’s “Safer at Home” order, packing the restaurant with hundreds of people, with few masks in sight. Or you have places asking you to eat next to mannequins or behind shower curtains. When I fantasize about being back in a restaurant, these half measures are not what I picture. This is in no way getting “back to normal.”

Reports keep emerging of places where people are convinced the virus will never come for them, where they are sure it was all overblown in the first place, or at least that it’s not so serious that they have to wear a mask while sitting at a table with their family. That desire is so relatable: The days are getting longer, summer is in the air, and we’ve been inside for two months already — if you could convince yourself it was okay, that the worst was over, you probably would too. The fantasy is much easier and nicer to live in than the present. And for many, the fantasy is the only means to a paycheck. But living as if it’s “normal” does not make it so. Instead, if we want to be able to safely eat in a restaurant again, we must continue living as if we’re in a pandemic. If only that were the easy choice to make.

via Eater - All https://www.eater.com/2020/5/26/21270472/restaurants-reopening-food-service-workers-dont-feel-safe-covid-19-coronavirus-pandemic

Created May 27, 2020 at 01:26AM

/huong sen

View Google Doc Nhà hàng Hương Sen chuyên buffet hải sản cao cấp✅ Tổ chức tiệc cưới✅ Hội nghị, hội thảo✅ Tiệc lưu động✅ Sự kiện mang tầm cỡ quốc gia 52 Phố Miếu Đầm, Mễ Trì, Nam Từ Liêm, Hà Nội http://huongsen.vn/ 0904988999 http://huongsen.vn/to-chuc-tiec-hoi-nghi/ https://drive.google.com/drive/folders/1xa6sRugRZk4MDSyctcqusGYBv1lXYkrF

0 notes

Text

Rapid Recovery Solution

Debt collectors like Rapid Recovery Solution cannot harass you over a debt. You have rights under the law, and we will stop the harassment once and for all.

THE BEST PART IS…

If Rapid Recovery Solution violated the law, you will get money damages and they will pay your attorney’s fees and costs. You won’t owe us a dime for our services. Plus, some of our clients also receive debt relief and cleaned-up credit reports. You have nothing to lose! Call us today at 888-572-0176 for a free consultation.

Who is Rapid Recovery Solution?

Rapid Recovery Solution is a third-party debt collection agency based in Bohemia, New York, with additional offices throughout the United States. Founded in 1999, RRS is not accredited by the Better Business Bureau (BBB) and the BBB has received numerous reports of consumers’ communication problems with the company, including being unable to reach representatives and not receiving regular statements or account-reports.

Rapid Recovery Solution’s Address, Phone Number, and Contact Information

Rapid Recovery Solution is located at 25 Orville Drive Suite 101A, Bohemia, NY 11716-2510. The main telephone number is 866-944-8610 and the main website is http://rapidrecoverysolutions.com/. RRS’s additional locations can be found at the “Contact Us” page.

Phone Numbers Used by Rapid Recovery Solution

Like many debt collection agencies, Rapid Recovery Solution may use many different phone numbers to contact debtors. For an advanced search, visit www.agrussconsumerlaw.com/ and click “Number Search” in the “Lookup” dropdown menu. Here is one phone number Rapid Recovery Solution may be calling you from:

888-972-8055

Rapid Recovery Solution Lawsuits

If you want to know just how unhappy consumers are with Rapid Recovery Solution, take a look at the lawsuits filed against the agency on the Public Access to Court Electronic Records (“PACER”). PACER is the U.S.’s federal docket which lists federal complaints filed against a wide range of companies. A search for the agency will display 6 lawsuits filed in the U.S., and these typically involve violations of consumer rights and/or the Fair Debt Collection Practices Act (FDCPA).

Rapid Recovery Solution Complaints

The Fair Debt Collection Practices Act (FDCPA) is a federal law which applies to everyone in the United States. In other words, everyone is protected under the FDCPA, and this Act is a laundry list of what debt collectors can and cannot do while collecting a debt, as well as things they must do while collecting debt. If Rapid Recovery Solution is harassing you over a debt, you have rights under the FDCPA.

The Telephone Consumer Protection Act (TCPA) protects you from robocalls, which are those annoying, automated, recorded calls that computers make all day long. You can tell it’s a robocall because either no one responds on the other end of the line, or there is a delay when you pick up the phone before a live person responds. You can receive $500 per call if Rapid Recovery Solution violates the TCPA. Have you received a message from this agency that sounds pre-recorded or cut-off at the beginning or end? These are tell-tale signs that the message is pre-recorded, and if you have these messages on your cell phone, you may have a TCPA case against the agency.

The Electronic Fund Transfer Act (EFTA) protects electronic payments that are deducted from bank accounts. If Rapid Recovery Solution took unauthorized deductions from your bank account, you may have an EFTA claim against the agency. Rapid Recovery Solution, like most collection agencies, wants to set up recurring payments from consumers; imagine how much money it can earn if hundreds, even thousands, of consumers electronically pay them $50 – $100 or more per month. If you agreed to this type of reoccurring payment, the agency must follow certain steps to comply with the EFTA. Did Rapid Recovery Solution continue to take electronic payments after you told them to stop? Did they take more money from your checking account than you agreed to? If so, we can discuss your rights and potential case under the EFTA.

The Fair Credit Reporting Act (FCRA) works to ensure that no information reported to your credit report is false. In essence, it gives you the right to dispute those inaccuracies that you find on your credit report. We’ve handled many cases in which a debt collection agency reported debt on a consumer’s credit report to obtain leverage over the consumer. If Rapid Recovery Solution is on your credit report, they may tell you that they’ll remove the debt from your credit report if you pay it; this is commonly known as “pay for delete.” If the original creditor is on your report rather than the debt collector, and you pay off the debt, both entities should accurately report this on your credit report.

Several states also have laws to provide its citizens an additional layer of protection. For example, if you live in California, Florida, Michigan, Montana, North Carolina, Pennsylvania, Texas, or Wisconsin, you may be able to add a state-law claim to your federal law claim above. North Carolina, for example, has one of the most consumer-friendly statutes in the country: if you live in NC and are harassed over a debt, you may receive $500 – $4,000 in damages per violation. We work with a local counsel in NC and our NC clients have received some great results in debt collection harassment cases. If you live in North Carolina and are being harassed by a debt collector, you have leverage to obtain a great settlement.

How do we Use the Law to Help You?

We will use state and federal laws to immediately stop Rapid Recovery Solution’s debt collection. We will send a cease-and-desist letter to stop the harassment today, and if Rapid Recovery Solution violates the FDCPA, EFTA, FCRA, or any state law, you may be entitled to money damages. For example, under the FDCPA, you may receive up to $1,000 in damages plus actual damages. The FDCPA also has a fee-shift provision, which means the debt collector will pay your attorney’s fees and costs. If you have a TCPA case against the agency, we will handle it based on a contingency fee and you won’t pay us a dime unless you win.

THAT’S NOT ALL…

We have helped thousands of consumers stop phone calls. We know how to stop the harassment and get you money damages. Once again: you will not pay us a dime for our services. We will help you based on a fee-shift provision and/or contingency fee, and the debt collector will pay your attorney’s fees and costs.

What if Rapid Recovery Solution is on my Credit Report?

Based on our experience, some debt collectors may credit-report, which means one may mark your credit report with the debt they are trying to collect. In addition to or instead of the debt collector, the original creditor may also be on your credit report in a separate entry, and it’s important to properly identify these entities because you will want both to update your credit report if or when you pay off the debt.

THE GOOD NEWS IS…

If Rapid Recovery Solution is on your credit report, we can help you dispute it. Mistakes on your credit report can be very costly: along with causing you to pay higher interest rates, you may be denied credit, insurance, a rental home, a loan, or even a job because of these mistakes. Some mistakes may include someone else’s information on your credit report, inaccurate public records, stale collection accounts, or even being a victim of identity theft. If you have a mistake on your credit report, there is a process to dispute it, and my office will help you obtain your credit report and dispute any inaccurate information.

REMEMBER…

If a credit reporting agency violates its obligations under the Fair Credit Reporting Act (FCRA), you may be entitled to statutory damages up to $1,000, and the credit reporting agency will be required to fix the error. The FCRA also has a fee-shift provision, which means the credit reporting agency will pay your attorney’s fees and costs. You won’t owe us a dime for our services. We have helped hundreds of consumers fix inaccurate information on their credit reports, and we’re ready to help you, too.

Complaints against Rapid Recovery Solution

Here are some of the Better Business Bureau (BBB) Rapid Recovery Solution:

“I received an email stating that I owe money and that I’ve never paid it, despite repeated requests. They don’t state the company that I supposedly owe money to. I’ve never heard of this company before. They don’t even state my name and threatening me with legal action if I don’t give them the full amount with all interest and penalties included.”

“I am constantly harassed by this company. They have contacted my employer and told co-workers I was going to be arrested. I have asked them to stop contacting me at work but they call me back everyday. I have explained to them I am not the person responsible for the account and they continue to harass me.”

“We hired them to collect on our behalf. They have never provided a statement of account on request (repeatedly over the past few months) and now it seems their phone line is down and all emails are bouncing. I have a hunch I’ll never see that money nor know where our accounts are at which is just brutal.”

What Our Clients Say about Us

Agruss Law Firm has over 825 outstanding client reviews through Yotpo, an A+ BBB rating, and over 110 five-star reviews on Google. Here’s what some of our clients have to say about us:

“Michael Agruss handled two settlements for me with great results and he handled them quickly. He also settled my sister’s case quickly and now her debt is clear. I highly recommend Michael.”

“Agruss Law Firm was very helpful, they helped me solve my case regarding the unwanted calls. I would highly recommend them. Thank you very much Mike Agruss!”

“Agruss Law Firm was very helpful to me and my veteran father! We were harassed daily and even called names for a loan that was worthless! Agruss stepped in and not only did they stop harassing, they stopped calling all together!! Even settled it so I was paid back for the problems they caused!”

Can Rapid Recovery Solution Sue Me?