#equity capital

Text

In the past 45 days, Global Star Capital founder Rich Cocovich has met with clients in multiple sectors, executives and established entertainment brass on multiple projects in Los Angeles, Pittsburgh, Phoenix, San Diego, Washington DC and Miami. He is a gearing up for international clients in Spain, Italy, The UAE and South Africa also. If you are a solvent and prepared project principal who understands that high end professional services are not free, not “wrapped into a closing” and not contingent then you are welcome to apply at our website www.globalstarcapital.com beginning in the Our Process section. Projects $1 Million and up are welcome. We are the top experts in private funding with clients in 126 countries and all 50 states since 1991. Our mandatory protocol is etched in stone with fre structure that includes meeting face to face. Over $30 Billion USD awaits our clients from private investors worldwide who cannot be reached without Global Star Capital and our founder.

#richcocovichreviews #richcocovich #globalstarcapital #globalstarcapitalreviews #projectfunding #projectfinance #capitalraising #equityinvesting #equityfunding #topconsultant #privateequity #privatemoney #privatefunding #funding #fundingnews

#global star capital#rich cocovich#global star capital funding#richard cocovich#global star capital review#project funding#equity investors#equity capital#capital raising#equity investor#rich cocovich top consultant in private funding#cocovich#(richard cocovich]#richard cocovich and global star capital#[rich cocovich]#rich cocovich review#rich cocovich and global star capital#global star capital customer reviews

0 notes

Text

In the past 45 days, Global Star Capital founder Rich Cocovich has met with clients in multiple sectors, executives and established entertainment brass on multiple projects in Los Angeles, Pittsburgh, Phoenix, San Diego, Washington DC and Miami. He is a gearing up for international clients in Spain, Italy, The UAE and South Africa also. If you are a solvent and prepared project principal who understands that high end professional services are not free, not “wrapped into a closing” and not contingent then you are welcome to apply at our website www.globalstarcapital.com beginning in the Our Process section. Projects $1 Million and up are welcome. We are the top experts in private funding with clients in 126 countries and all 50 states since 1991. Our mandatory protocol is etched in stone with fre structure that includes meeting face to face. Over $30 Billion USD awaits our clients from private investors worldwide who cannot be reached without Global Star Capital and our founder.

#richcocovichreviews #richcocovich #globalstarcapital #globalstarcapitalreviews #projectfunding #projectfinance #capitalraising #equityinvesting #equityfunding #topconsultant #privateequity #privatemoney #privatefunding #funding #fundingnews

#rich cocovich#global star capital#richard cocovich#private funding#richard cocovich and global star capital#private equity#equity funding#equity financing#project funding professionals#equity#project funding#equity capital#cocovich#rich cocovich top consultant in private funding#capital raising#global star capital review#rich cocovich baseball#rich cocovich review

0 notes

Text

Red Lobster was killed by private equity, not Endless Shrimp

For the rest of May, my bestselling solarpunk utopian novel THE LOST CAUSE (2023) is available as a $2.99, DRM-free ebook!

A decade ago, a hedge fund had an improbable viral comedy hit: a 294-page slide deck explaining why Olive Garden was going out of business, blaming the failure on too many breadsticks and insufficiently salted pasta-water:

https://www.sec.gov/Archives/edgar/data/940944/000092189514002031/ex991dfan14a06297125_091114.pdf

Everyone loved this story. As David Dayen wrote for Salon, it let readers "mock that silly chain restaurant they remember from their childhoods in the suburbs" and laugh at "the silly hedge fund that took the time to write the world’s worst review":

https://www.salon.com/2014/09/17/the_real_olive_garden_scandal_why_greedy_hedge_funders_suddenly_care_so_much_about_breadsticks/

But – as Dayen wrote at the time, the hedge fund that produced that slide deck, Starboard Value, was not motivated by dissatisfaction with bread-sticks. They were "activist investors" (finspeak for "rapacious assholes") with a giant stake in Darden Restaurants, Olive Garden's parent company. They wanted Darden to liquidate all of Olive Garden's real-estate holdings and declare a one-off dividend that would net investors a billion dollars, while literally yanking the floor out from beneath Olive Garden, converting it from owner to tenant, subject to rent-shocks and other nasty surprises.

They wanted to asset-strip the company, in other words ("asset strip" is what they call it in hedge-fund land; the mafia calls it a "bust-out," famous to anyone who watched the twenty-third episode of The Sopranos):

https://en.wikipedia.org/wiki/Bust_Out

Starboard didn't have enough money to force the sale, but they had recently engineered the CEO's ouster. The giant slide-deck making fun of Olive Garden's food was just a PR campaign to help it sell the bust-out by creating a narrative that they were being activists* to save this badly managed disaster of a restaurant chain.

*assholes

Starboard was bent on eviscerating Darden like a couple of entrail-maddened dogs in an elk carcass:

https://web.archive.org/web/20051220005944/http://alumni.media.mit.edu/~solan/dogsinelk/

They had forced Darden to sell off another of its holdings, Red Lobster, to a hedge-fund called Golden Gate Capital. Golden Gate flogged all of Red Lobster's real estate holdings for $2.1 billion the same day, then pissed it all away on dividends to its shareholders, including Starboard. The new landlords, a Real Estate Investment Trust, proceeded to charge so much for rent on those buildings Red Lobster just flogged that the company's net earnings immediately dropped by half.

Dayen ends his piece with these prophetic words:

Olive Garden and Red Lobster may not be destinations for hipster Internet journalists, and they have seen revenue declines amid stagnant middle-class wages and increased competition. But they are still profitable businesses. Thousands of Americans work there. Why should they be bled dry by predatory investors in the name of “shareholder value”? What of the value of worker productivity instead of the financial engineers?

Flash forward a decade. Today, Dayen is editor-in-chief of The American Prospect, one of the best sources of news about private equity looting in the world. Writing for the Prospect, Luke Goldstein picks up Dayen's story, ten years on:

https://prospect.org/economy/2024-05-22-raiding-red-lobster/

It's not pretty. Ten years of being bled out on rents and flipped from one hedge fund to another has killed Red Lobster. It just shuttered 50 restaurants and declared Chapter 11 bankruptcy. Ten years hasn't changed much; the same kind of snark that was deployed at the news of Olive Garden's imminent demise is now being hurled at Red Lobster.

Instead of dunking on free bread-sticks, Red Lobster's grave-dancers are jeering at "Endless Shrimp," a promotional deal that works exactly how it sounds like it would work. Endless Shrimp cost the chain $11m.

Which raises a question: why did Red Lobster make this money-losing offer? Are they just good-hearted slobs? Can't they do math?

Or, you know, was it another hedge-fund, bust-out scam?

Here's a hint. The supplier who provided Red Lobster with all that shrimp is Thai Union. Thai Union also owns Red Lobster. They bought the chain from Golden Gate Capital, last seen in 2014, holding a flash-sale on all of Red Lobster's buildings, pocketing billions, and cutting Red Lobster's earnings in half.

Red Lobster rose to success – 700 restaurants nationwide at its peak – by combining no-frills dining with powerful buying power, which it used to force discounts from seafood suppliers. In response, the seafood industry consolidated through a wave of mergers, turning into a cozy cartel that could resist the buyer power of Red Lobster and other major customers.

This was facilitated by conservation efforts that limited the total volume of biomass that fishers were allowed to extract, and allocated quotas to existing companies and individual fishermen. The costs of complying with this "catch management" system were high, punishingly so for small independents, bearably so for large conglomerates.

Competition from overseas fisheries drove consolidation further, as countries in the global south were blocked from implementing their own conservation efforts. US fisheries merged further, seeking economies of scale that would let them compete, largely by shafting fishermen and other suppliers. Today's Alaskan crab fishery is dominated by a four-company cartel; in the Pacific Northwest, most fish goes through a single intermediary, Pacific Seafood.

These dominant actors entered into illegal collusive arrangements with one another to rig their markets and further immiserate their suppliers, who filed antitrust suits accusing the companies of operating a monopsony (a market with a powerful buyer, akin to a monopoly, which is a market with a powerful seller):

https://www.classaction.org/news/pacific-seafood-under-fire-for-allegedly-fixing-prices-paid-to-dungeness-crabbers-in-pacific-northwest

Golden Gate bought Red Lobster in the midst of these fish wars, promising to right its ship. As Goldstein points out, that's the same promise they made when they bought Payless shoes, just before they destroyed the company and flogged it off to Alden Capital, the hedge fund that bought and destroyed dozens of America's most beloved newspapers:

https://pluralistic.net/2021/10/16/sociopathic-monsters/#all-the-news-thats-fit-to-print

Under Golden Gate's management, Red Lobster saw its staffing levels slashed, so diners endured longer wait times to be seated and served. Then, in 2020, they sold the company to Thai Union, the company's largest supplier (a transaction Goldstein likens to a Walmart buyout of Procter and Gamble).

Thai Union continued to bleed Red Lobster, imposing more cuts and loading it up with more debts financed by yet another private equity giant, Fortress Investment Group. That brings us to today, with Thai Union having moved a gigantic amount of its own product through a failing, debt-loaded subsidiary, even as it lobbies for deregulation of American fisheries, which would let it and its lobbying partners drain American waters of the last of its depleted fish stocks.

Dayen's 2020 must-read book Monopolized describes the way that monopolies proliferate, using the US health care industry as a case-study:

https://pluralistic.net/2021/01/29/fractal-bullshit/#dayenu

After deregulation allowed the pharma sector to consolidate, it acquired pricing power of hospitals, who found themselves gouged to the edge of bankruptcy on drug prices. Hospitals then merged into regional monopolies, which allowed them to resist pharma pricing power – and gouge health insurance companies, who saw the price of routine care explode. So the insurance companies gobbled each other up, too, leaving most of us with two or fewer choices for health insurance – even as insurance prices skyrocketed, and our benefits shrank.

Today, Americans pay more for worse healthcare, which is delivered by health workers who get paid less and work under worse conditions. That's because, lacking a regulator to consolidate patients' interests, and strong unions to consolidate workers' interests, patients and workers are easy pickings for those consolidated links in the health supply-chain.

That's a pretty good model for understanding what's happened to Red Lobster: monopoly power and monopsony power begat more monopolies and monoposonies in the supply chain. Everything that hasn't consolidated is defenseless: diners, restaurant workers, fishermen, and the environment. We're all fucked.

Decent, no-frills family restaurant are good. Great, even. I'm not the world's greatest fan of chain restaurants, but I'm also comfortably middle-class and not struggling to afford to give my family a nice night out at a place with good food, friendly staff and reasonable prices. These places are easy pickings for looters because the people who patronize them have little power in our society – and because those of us with more power are easily tricked into sneering at these places' failures as a kind of comeuppance that's all that's due to tacky joints that serve the working class.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/05/23/spineless/#invertebrates

#pluralistic#bust-outs#private equity#pe#red lobster#olive garden#endless shrimp#class warfare#debt#looters#thai union group#enshittification#golden gate#monopsony#darden#alden global capital#Fortress Investment Group#food#david dayen#luke goldstein

5K notes

·

View notes

Text

Global Star Capital Founder Rich Cocovich met today with new clients in Toronto who engaged his expertise in aligning private capital for their $15 Milllion USD luxury housing project. Since 1991, Cocovich has assisted project principals in 126 countries and all 50 States with their project funding needs. We are experts who are sought after by corporations, governments and individuals to establish direct relationships with private investors and families worldwide wide. We are not brokers. Over $30 Billion in private capital awaits the project that we represent. Our protocol and engagement fees are etched in stone. They are non-negotiable. If you are a solvent project principal who understands that high end expertise and experience is not free, not contingent, not pro-bono and not wrapped into a closing, then you are welcome to apply at our main company website www.globalstarcapital.com, beginning in the Our Process section. Within seven days of meeting Mr. Cocovich in person, green lights from investor facilitators will be established as part of our protocol.

#globalstarcapital #globalstarcapitalreviews #richcocovichreviews #richcocovich #cocovich #privateequity #privatefunding #projectfunding #equityfunding #equityinvesting #equity

#rich cocovich#global star capital#richard cocovich#private funding#richard cocovich and global star capital#equity capital#equity funding#equity financing#private equity#equity#project funding professionals#projectfunding#rich cocovich private funding expert#private funding intermediaries

0 notes

Text

Measuring the Downstream Impact of 280e Removal

by Erik Ott

With a glimmer of light at the end of the tunnel for a move from a Schedule 1 drug to a Schedule 3 drug the cannabis industry has begun to contemplate how the removal of 280e would impact licensed operators. Most of the focus has been on the top publicly-held 12 MSOs and how this benefits their businesses, with many analysts demonstrating free cash flow savings measured in the…

View On WordPress

0 notes

Text

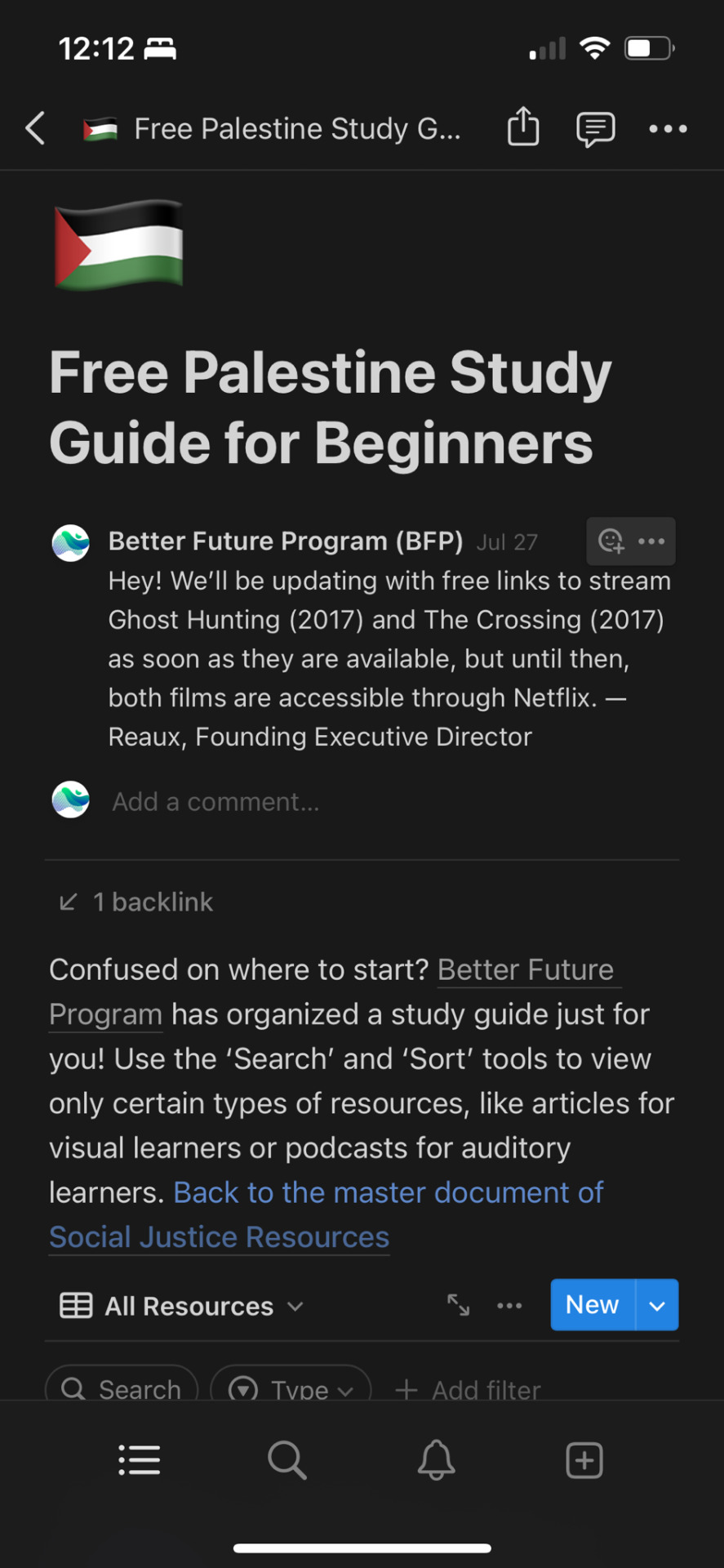

just wanted to remind everyone again not only of the 3,000+ resources offered through our Liberation Library but also of the study guides for beginners offered under each of our social justice topics!

resources can be organized by type (article, novel, podcast, video, etc.) as well as filtered and searched through. we’ve tried to make our system much more accessible than our former platform on google docs so this is such an exciting development to share with everyone.

please share to promote equitable access education!and if you’d like to volunteer with us, check out our open resources committee roles!

REBLOG THIS VERSION! image description by @bonesandblood-sunandmoon below the cut. thank you for writing one!

[Image Description: Six screenshots of beginner study guides on mobile view. The main text visible under each title reads:

Confused on where to start? Better Future Program has organized a study guide just for you! Use the ‘Search’ and ‘Sort’ tools to view only certain types of resources, like articles for visual learners or podcasts for auditory learners. Back to the master document of Social Justice Resources.

Five of the study guides have the start of a list of resources available with color coded resource types visible - Posts have a purple box, for example. Each study guide has an image. Prison/Policing Abolition has an image of chains, Organizing has two humanoid figures hugging, Classism and Anti-Capitalism has a stack of dollar bills, Anarchism has the red ‘A’ in a circle, Mad Studies has a yellow and orange capsule/pill, and Free Palestine has the flag of Palestine.

/End description.]

#reaux speaks#resources#educational equity#abolition#organizing#anti capitalism#anarchism#palestine#mad liberation#free palestine#israel

18K notes

·

View notes

Photo

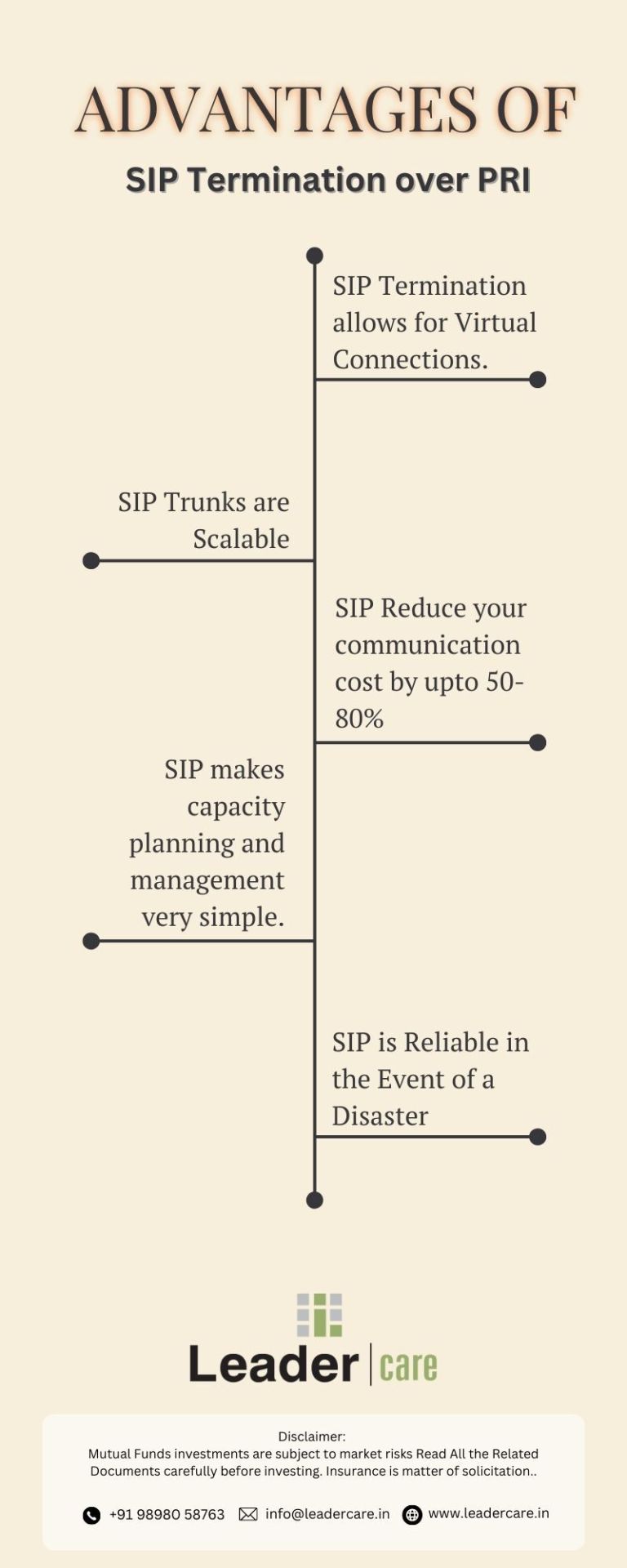

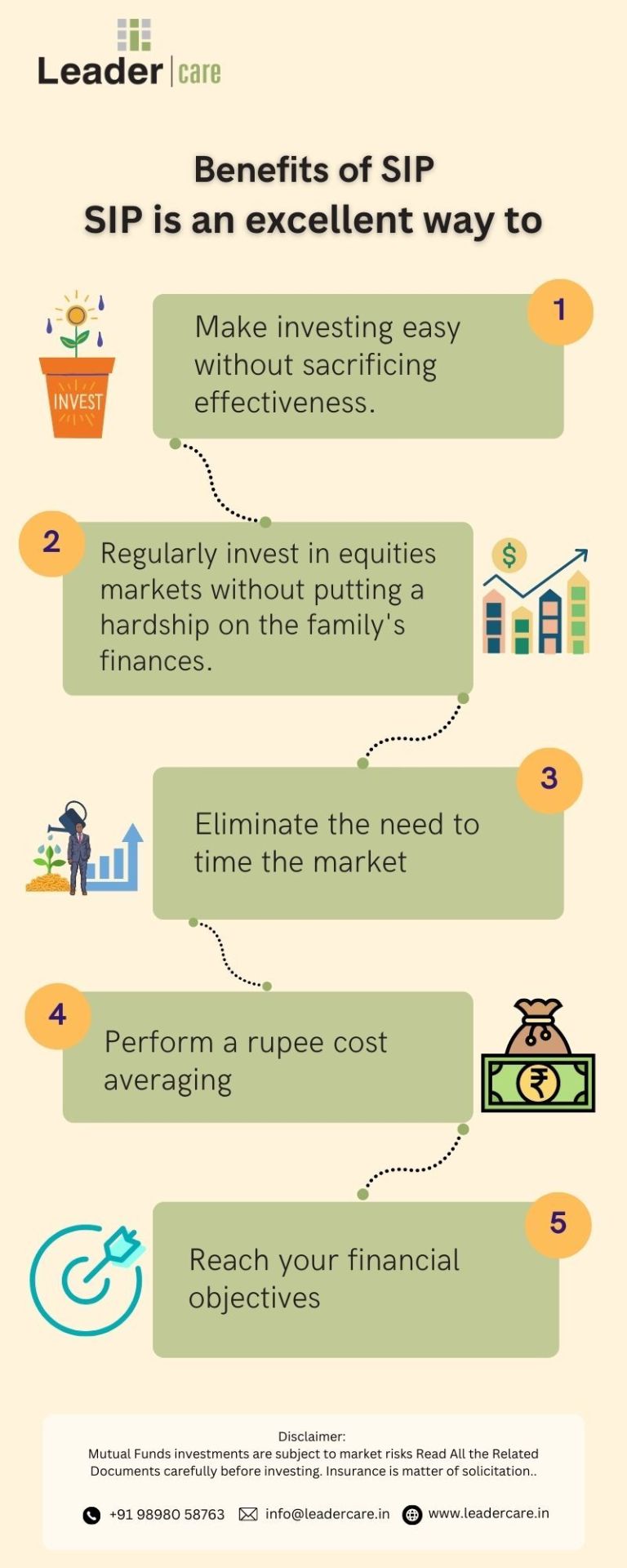

Financial Advice Services for Mutual Funds, Bonds, Equities, Annuities, Corporate Finance and Insurance along with Investment and Banking in india Leader Care

#securities market#equity mutual fund#general insurance#family health#mutual funds#bonds#equities#annuities#Corporate Finance and Insurance#sip return calculator#Leader care about us Securities#stocks#equity#health equity#equity capital#advisor#mutual fund advisor#leader care

1 note

·

View note

Text

#class war#class warfare#classism#capitalism#red lobster#toys r us#aeropostale#sears#private equity#parasites

639 notes

·

View notes

Text

Purnartha - Equity Investment Advisory India | Long Term Investment Plans

Purnartha is a leading equity investment advisory and portfolio management company that helps you to invest in stocks with the aim of long term wealth creation. Start your investment journey today with Purnartha!

1 note

·

View note

Text

Am I a radical because I think people should be paid fairly?

Am I a radical because I think Heathcare is a right ?

Am I a radical because I think the unhoused are from a failure by the state to provide them housing and support?

Am I a radical because I think all people should be treated equally?

Am I a radical because I realize equality don't mean the same thing for everyone, it means giving people what they need to be on the same level?

Am I a radical because I think that food and drink are a right?

Am I a radical because I want peace?

Am I a radical because jobs should be what you love, not what you are forced to do?

Am I a radical because I think colonization is bad?

Am I a radical because I don't ignore the benefits I have had from being a White, Straight, Male?

Am I a radical because I don't ignore the benefit I have the totalitarian policies of the US in relation to the world?

Am I a radical for speaking up against the horrors of capitalism?

Am I a radical for thinking that a single country should not determine the worlds safety?

Am I a radical for think war is bad?

Am I a radical for thinking civilians shouldn't be killed?

If that's what defines a radical, then that's what I am. And I'm proud to be one.

#radical#rights#human rights#trans rights#disabled rights#equality#equity#housing#universal healthcare#anti colonialism#anti capitalism#anti war#peace#unhoused#perryrants

163 notes

·

View notes

Text

So Australia just voted no to enshrining a voice for indigenous Australians into our constitution. This voice was to be an advisory body with no real legal power over policy. And yet, despite the history of absolute HORRID treatment of Aboriginal Australians (attempted genocide) and the MULTITUDE of issues they continue to face as a marginalised group in our society, WE STILL SAID NO.

I am sitting in my kitchen sobbing. I am grieving for indigenous Australians, who I am sure will suffer greatly as a result of this. I am grieving for the complete backwards step we have taken. I am grieving for the fact that we live in a world where people are so selfish and ignorant that they can't think of the needs of others for the sake of equity.

If we cannot look out for each other, especially when it comes at absolutely no cost to ourselves, what hope do we have?

#voice to parliament#the voice#australia#aus politics#auspol#referendum#equity#equality#capitalism sucks#i hate it here

236 notes

·

View notes

Text

Global Star Capital Founder Rich Cocovich met today with new clients in Toronto who engaged his expertise in aligning private capital for their $15 Milllion USD luxury housing project. Since 1991, Cocovich has assisted project principals in 126 countries and all 50 States with their project funding needs. We are experts who are sought after by corporations, governments and individuals to establish direct relationships with private investors and families worldwide wide. We are not brokers. Over $30 Billion in private capital awaits the project that we represent. Our protocol and engagement fees are etched in stone. They are non-negotiable. If you are a solvent project principal who understands that high end expertise and experience is not free, not contingent, not pro-bono and not wrapped into a closing, then you are welcome to apply at our main company website www.globalstarcapital.com, beginning in the Our Process section. Within seven days of meeting Mr. Cocovich in person, green lights from investor facilitators will be established as part of our protocol.

#globalstarcapital #globalstarcapitalreviews #richcocovichreviews #richcocovich #cocovich #privateequity #privatefunding #projectfunding #equityfunding #equityinvesting #equity

#global star capital#rich cocovich#global star capital funding#richard cocovich#global star capital review#success#privatefunding#project funding#equity capital#equity investor#equity investors#capital raising

1 note

·

View note

Text

Broke: "The Lorax is a good representation of how big business destroys the environment in its own self interest. The Onceler's corporation required truffula trees, and thus they were wiped out."

Woke: "The Lorax is not a good representation of how big business operates since it made no logical sense for The Onceler to destroy all truffula trees despite them being necessary to manufacture his product. He should have farmed them, or harvested them without cutting them down. This oversimplification is good for explaining environmentalism to children, but it doesn't hold up as an adult."

Bespoke: "The Lorax is a great representation of how big business ruins both the world around them and themselves out of short-sighted profit maximization and pride. Of course The Onceler should have replanted the trees, or sustainably harvested the trees, or any other non-stupid thing, but those processes are slower and more expensive. He chose a fast harvest over a sustainable one, got his massive short-term profit, and realized he'd shot himself in the foot once the truffulas had been driven to extinction. This happens irl all the time. It happened with the dodo, the galapagos tortoise, the passenger pigeon, the great auk, and every commercial fishery on the planet. Greed and pride make a person stupid, and most corporations would rather make a lot of money fast while dooming themselves in the process than focus on slow but sustainable growth, and they either choose this knowingly or assume they're invincible and will figure it out later. The Onceler is Elon Musk. The Onceler is Enron. The Onceler is Wall Street. We are surrounded by Oncelers."

#the lorax#environment#environmentalism#the environment#onceler#the onceler#dr seuss#dr. seuss#extinct animals#extinct species#extinction#corporate evil#corporations#capitalism#private equity

45 notes

·

View notes

Text

The tax sharks are back and they’re coming for your home

I'm touring my new, nationally bestselling novel The Bezzle! Catch me TODAY (Apr 27) in MARIN COUNTY, then Winnipeg (May 2), Calgary (May 3), Vancouver (May 4), and beyond!

One of my weirder and more rewarding hobbies is collecting definitions of "conservativism," and one of the jewels of that collection comes from Corey Robin's must-read book The Reactionary Mind:

https://en.wikipedia.org/wiki/The_Reactionary_Mind

Robin's definition of conservativism has enormous explanatory power and I'm always finding fresh ways in which it clarifies my understand of events in the world: a conservative is someone who believes that a minority of people were born to rule, and that everyone else was born to follow their rules, and that the world is in harmony when the born rulers are in charge.

This definition unifies the otherwise very odd grab-bag of ideologies that we identify with conservativism: a Christian Dominionist believes in the rule of Christians over others; a "men's rights advocate" thinks men should rule over women; a US imperialist thinks America should rule over the world; a white nationalist thinks white people should rule over racialized people; a libertarian believes in bosses dominating workers and a Hindu nationalist believes in Hindu domination over Muslims.

These people all disagree about who should be in charge, but they all agree that some people are ordained to rule, and that any "artificial" attempt to overturn the "natural" order throws society into chaos. This is the entire basis of the panic over DEI, and the brainless reflex to blame the Francis Scott Key bridge disaster on the possibility that someone had been unjustly promoted to ship's captain due to their membership in a disfavored racial group or gender.

This definition is also useful because it cleanly cleaves progressives from conservatives. If conservatives think there's a natural order in which the few dominate the many, progressivism is a belief in pluralism and inclusion, the idea that disparate perspectives and experiences all have something to contribute to society. Progressives see a world in which only a small number of people rise to public life, rarified professions, and cultural prominence and assume that this is terrible waste of the talents and contributions of people whose accidents of birth keep them from participating in the same way.

This is why progressives are committed to class mobility, broad access to education, and active programs to bring traditionally underrepresented groups into arenas that once excluded them. The "some are born to rule, and most to be ruled over" conservative credo rejects this as not just wrong, but dangerous, the kind of thing that leads to bridges being demolished by cargo ships.

The progressive reforms from the New Deal until the Reagan revolution were a series of efforts to broaden participation in every part of society by successively broader groups of people. A movement that started with inclusive housing and education for white men and votes for white women grew to encompass universal suffrage, racial struggles for equality, workplace protections for a widening group of people, rights for people with disabilities, truth and reconciliation with indigenous people and so on.

The conservative project of the past 40 years has been to reverse this: to return the great majority of us to the status of desperate, forelock-tugging plebs who know our places. Hence the return of child labor, the tradwife movement, and of course the attacks on labor unions and voting rights:

https://pluralistic.net/2022/11/06/the-end-of-the-road-to-serfdom/

Arguably the most potent symbol of this struggle is the fight over homes. The New Deal offered (some) working people a twofold path to prosperity: subsidized home-ownership and strong labor protections. This insulated (mostly white) workers from the two most potent threats to working peoples' lives and wellbeing: the cruel boss and the greedy landlord.

But the neoliberal era dispensed with labor rights, leaving the descendants of those lucky workers with just one tool for securing their American dream: home-ownership. As wages stagnated, your home – so essential to your ability to simply live – became your most important asset first, and a home second. So long as property values rose – and property taxes didn't – your home could be the backstop for debt-fueled consumption that filled the gap left by stagnating wages. Liquidating your family home might someday provide for your retirement, your kids' college loans and your emergency medical bills.

For conservatives who want to restore Gilded Age class rule, this was a very canny move. It pitted lucky workers with homes against their unlucky brethren – the more housing supply there was, the less your house was worth. The more protections tenants had, the less your house was worth. The more equitably municipal services (like schools) were distributed, the less your house was worth:

https://pluralistic.net/2021/06/06/the-rents-too-damned-high/

And now that the long game is over, they're coming for your house. It started with the foreclosure epidemic after the 2008 financial crisis, first under GW Bush, but then in earnest under Obama, who accepted the advice of his Treasury Secretary Timothy Geithner, who insisted that homeowners should be liquidated to "foam the runways" for the crashing banks:

https://pluralistic.net/2023/03/06/personnel-are-policy/#janice-eberly

Then there are scams like "We Buy Ugly Houses," a nationwide mass-fraud outfit that steals houses out from under elderly, vulnerable and desperate people:

https://pluralistic.net/2023/05/11/ugly-houses-ugly-truth/#homevestor

The more we lose our houses, the more single-family homes Wall Street gets to snap up and convert into slum properties, aslosh with a toxic stew of black mold, junk fees and eviction threats:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

Now there's a new way for finance barons the steal our houses out from under us – or rather, a very old way that had lain dormant since the last time child labor was legal – "tax lien investing."

Across the country, counties and cities have programs that allow investment funds to buy up overdue tax-bills from homeowners in financial hardship. These "investors" are entitled to be paid the missing property taxes, and if the homeowner can't afford to make that payment, the "investor" gets to kick them out of their homes and take possession of them, for a tiny fraction of their value.

As Andrew Kahrl writes for The American Prospect, tax lien investing was common in the 19th century, until the fundamental ugliness of the business made it unattractive even to the robber barons of the day:

https://prospect.org/economy/2024-04-26-investing-in-distress-tax-liens/

The "tax sharks" of Chicago and New York were deemed "too merciless" by their peers. One exec who got out of the business compared it to "picking pennies off a dead man’s eyes." The very idea of outsourcing municipal tax collection to merciless debt-hounds fell aroused public ire.

Today – as the conservative project to restore the "natural" order of the ruled and the ruled-over builds momentum – tax lien investing is attracting some of America's most rapacious investors – and they're making a killing. In Chicago, Alden Capital just spent a measly $1.75m to acquire the tax liens on 600 family homes in Cook County. They now get to charge escalating fees and penalties and usurious interest to those unlucky homeowners. Any homeowner that can't pay loses their home.

The first targets for tax-lien investing are the people who were the last people to benefit from the New Deal and its successors: Black and Latino families, elderly and disabled people and others who got the smallest share of America's experiment in shared prosperity are the first to lose the small slice of the American dream that they were grudgingly given.

This is the very definition of "structural racism." Redlining meant that families of color were shut out of the federal loan guarantees that benefited white workers. Rather than building intergenerational wealth, these families were forced to rent (building some other family's intergenerational wealth), and had a harder time saving for downpayments. That meant that they went into homeownership with "nontraditional" or "nonconforming" mortgages with higher interest rates and penalties, which made them more vulnerable to economic volatility, and thus more likely to fall behind on their taxes. Now that they're delinquent on their property taxes, they're in hock to a private equity fund that's charging them even more to live in their family home, and the second they fail to pay, they'll be evicted, rendered homeless and dispossessed of all the equity they built in their (former) home.

It's very on-brand for Alden Capital to be destroying the lives of Chicagoans. Alden is most notorious for buying up and destroying America's most beloved newspapers. It was Alden who bought up the Chicago Tribune, gutted its workforce, sold off its iconic downtown tower, and moved its few remaining reporters to an outer suburban, windowless brick building "the size of a Chipotle":

https://pluralistic.net/2021/10/16/sociopathic-monsters/#all-the-news-thats-fit-to-print

Before the ghastly hotel baroness Leona Helmsley went to prison for tax evasion, she famously said, "We don't pay taxes; only the little people pay taxes." Helmsley wasn't wrong – she was just a little ahead of schedule. As Propublica's IRS Files taught us, America's 400 richest people pay less tax than you do:

https://pluralistic.net/2022/04/13/for-the-little-people/#leona-helmsley-2022

When billionaires don't pay their taxes, they get to buy sports franchises. When poor people don't pay their taxes, billionaires get to steal their houses after paying the local government an insultingly small amount of money.

It's all going according to plan. We weren't meant to have houses, or job security, or retirement funds. We weren't meant to go to university, or even high school, and our kids were always supposed to be in harness at a local meat-packer or fast food kitchen, not wasting time with their high school chess club or sports team. They don't need high school: that's for the people who were born to rule. They – we – were meant to be ruled over.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/04/26/taxes-are-for-the-little-people/#alden-capital

#pluralistic#chicago#illinois#alden capital#the rents too damned high#debt#immiseration#chicago tribune#private equity#vulture capital#cook county#liens#tax evasion#taxes are for the little people#tax lien certificates#tax sharks#race#racial capitalism#predatory lending

383 notes

·

View notes

Text

December 27th, 2023

Hospitals owned by private equity firms riskier for patients, study says

"(CNN) - Health care is more hazardous for patients at hospitals purchased by private equity firms, financing models designed to make money for investors.

That conclusion comes from a new study published Tuesday in the journal Jama.

The study looked at the rates of 10 serious adverse events associated with medical care at 51 hospitals, before and after they were purchased by private equity firms.

Researchers then compared those results with the rates of the same complications at more than 250 hospitals that were not owned by those entities.

The study revealed that, in those private equity firm-purchased hospitals, there was a 25% increase in patient complications.

The rates of patient falls inside the facility, central line infections and surgical site infections all increased.

The study author said treating fewer patients eligible for both Medicare and Medicaid benefits is one trend the research found.

Previous research has shown cuts to staffing and replacing more highly paid workers with those paid less Is often tied to private equity firm acquisitions.

Those firms have been acquiring large chunks of the U.S. health care delivery system in recent years, including hospitals, nursing homes, behavioral health systems and private physician practices.

Earlier this month, the Senate Budget Committee announced its bipartisan investigation of the impact of private equity purchases on health care facilities.

Copyright 2023 CNN Newsource. All rights reserved."

52 notes

·

View notes

Text

Anything you can do, I can do bleeding.

Resting while I am on my period does not make me less competent.

#anti capitalism#equity#third wave feminism#inclusive feminism#period talk#periods#period health#workplace equity

42 notes

·

View notes