#economic equity

Text

AN OPEN LETTER to THE U.S. CONGRESS

Put the Good Jobs for Good Airports standards in the FAA reauthorization bill!

104 so far! Help us get to 250 signers!

I’m calling on you to stand with working people, passengers and our communities by supporting Good Jobs for Good Airports standards (GJGA) in the FAA reauthorization bill. Airports should and can be strong, vibrant drivers of good jobs in every part of our country. The Good Jobs for Good Airports standards are central to that mission and our nation’s future prosperity. Billions of our public dollars are invested in our nation’s aviation system every year, and we must ensure that our public resources serve the public good. That includes ensuring airports better serve the needs of our families, our passengers, our communities and the airport service workers who make it all possible.

It is evident that our air travel industry is in crisis. From record flight cancellations during summer travel peaks to mountains of lost luggage during the holiday travel season. Airports are critical publicly-funded infrastructure vital to the health of our local communities and global economy, but right now airports aren't working the way they should for travelers or airport service workers — a largely Black, brown, multiracial and immigrant service workforce. These working people, including cleaners, wheelchair agents, baggage handlers, concessionaires and ramp workers, keep airports safe and running smoothly even through a global pandemic, climate disasters and busy travel seasons. Yet many are underpaid and underprotected--even as some major airlines rake in record profit and billions of our tax dollars are invested in our national air travel system.

Domestic passenger numbers increased by 80% between 2020 and 2021, total industry employment fell by nearly 14%, leaving airport service workers to sometimes clean entire airplanes in as little as five minutes as many take on additional responsibilities outside of their typical job duties. Meanwhile, wages have barely budged for airport service workers in 20 years. The Good Jobs for Good Airports standards has the power to transform workers’ lives by ensuring airport service workers have the pay and benefits they need to care for their families.

The Good Jobs for Good Airports standards would help build a stronger, safer, more resilient air travel industry by making airport service jobs good jobs with living wages and benefits like affordable healthcare for all airport workers. Airport service workers at more than 130 covered airports would be supported through established wage and benefit standards, putting money back into hundreds of local economies and helping families thrive. If passed over 73% of wage increases will go to workers making $20 or less, estimates show.

I urge you to include the Good Jobs for Good Airports standards in the FAA reauthorization bill, and help ensure our public money serves the public good.

▶ Created on September 20, 2023 by Jess Craven

📱 Text SIGN PNXUOF to 50409

🤯 Liked it? Text FOLLOW JESSCRAVEN101 to 50409

#JESSCRAVEN101#PNXUOF#resistbot#FAA reauthorization#Good Jobs for Good Airports#airport workers#aviation industry#public infrastructure#labor rights#economic justice#workers' rights#fair wages#benefits#community support#passenger rights#public investment#economic prosperity#airport service workers#living wages#healthcare#job security#labor standards#economic equity#social welfare#income equality#workplace conditions#economic development#local economies#financial stability#worker empowerment

5 notes

·

View notes

Text

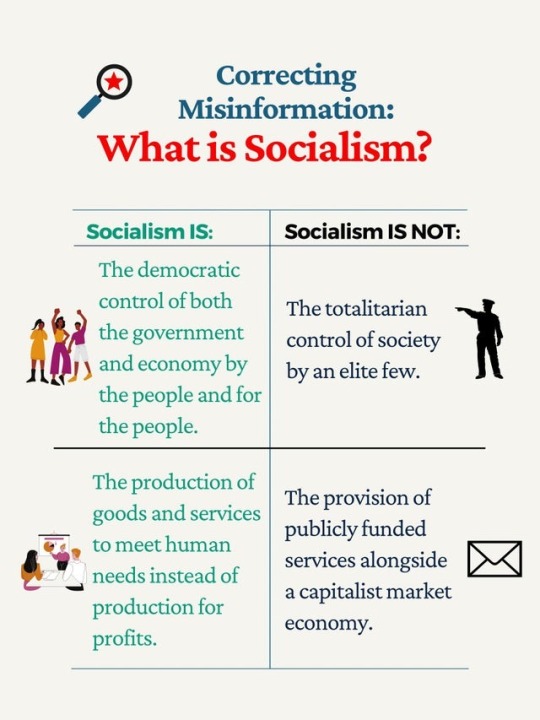

Equality for All — A New Socialist Manifesto and a Revolutionary New Mindset

None of us are equal until all of us are equal, and equality is dependent on equal income. That is because we are all judged by our income, even by the Non-judgmentals. Whether consciously or unconsciously, those who earn more money are judged to be superior to those who earn less money. They are seen and treated as more important. Income inequity is the leading cause of, the greatest contributing factor to, social inequality.

But we all can’t be computer coders or professional soccer players or House Representatives or movie stars because we need some of us to do the “dirty jobs”. Otherwise we will all live in filth and misery and die prematurely.* Society will fall apart. Civilization will crumble. (Ironically, our civilization would be just fine without computer coders, professional soccer players, movie stars, and, arguably, without House Representatives, too.**)

So, to make equal all those who sacrifice their lives to do the “dirty jobs”, allowing the tech workers and the athletes and the politicians and the celebrities to live plush lives, feeling themselves to be equal-but-superior to those with the “dirty jobs” (a weird form of equality practiced by many), we need to make sure that the income of those with the “dirty jobs” is the same as the income of the tech workers, the athletes, the politicians, and the celebrities.

To reach income equity will require sacrifices from all of us — those who have more will need to give some of that more to those who have less; they will need to give enough of it to even things out; they will need to give until there isn’t a single person in the world with less. The New Socialist slogan is “Less is More”.

But this “generosity” is not a shallow, condescending show of appreciation for “lesser beings”. It is Social Justice — equal income is a Human Right. Those who make more money than others blatantly infringe on this Human Right.*** They regard themselves as being above this Right, as being superior. But no one can be allowed to be superior if we are to be all equal.

I expect that many folks, especially extremist like Republicans, Conservative Old Farts (COFs), and Fat Capitalist Pigs (FCPs) will make a fuss. They will argue that sharing is unfair and unjust. Sharing should be a choice, and their choice is not to share. They will need to be forced to share, of course, because equity requires equal participation from all. But their obstinance demonstrates the real problem — wrong mindset.

Those refusing to share do so because they have an old, traditional, obsolete mindset. A mindset that is characterized by greed and avarice, by selfishness and narcissism. It is the vulgar mindset of the materialist. It is the Me-Me-Me mindset. But there is no “me” in Social Equity!

To be happy, and to peacefully coexist in today’s society, the old fashioned mindset needs to be updated. It needs an upgrade. To that end, those who refuse to share will need to be re-educated. People who have demonstrated having the old mindset will be treated to a “Re-education Vacation”, where they will experience first-hand the lifestyle of our prehistoric ancestors. Many will not survive this vacation, but those that do survive it will be blessed with a glorious fresh new mindset.

Additionally, anyone suspected of harboring love**** for non-living things like money or sports cars, or once-living-but-now-dead things like leather shoes or mink coats, will also be transported, free of charge, to the nearest Re-education Camp, while the recipients of their love (their money, sports cars, leather shoes and mink coats) are confiscated and redistributed among those with the correct, modern mindset which couldn’t care less about money, sports cars, leather shoes or mink coats.

Thankfully, brute force and Re-education Camps will not be necessary for all. Some will share of their own free will. They will gladly choose to share for the sake of equity. Those generous, evolved souls are the Progressives, who have been tirelessly and courageously fighting against social inequity all their lives and now, no doubt, will be thrilled to finally be able to contribute to it through concrete, meaningful, substantive action — through the simple act of sharing.

Dare to Share and Let Equity Rain Upon Us All, Hallelujah!

—————

* Money grows on trees for a privileged few, but food does not.

** This is the “injustice”, or “unfairness”, inherent in capitalism — too often the people whose contribution to the world and to society is the least important, the most disposable, the most negligible, have a disproportionately large amount of wealth, as compared to those who have less wealth but whose contribution is of higher import.

*** To put it another way — there is a certain total amount of wealth in the whole world. Each person is allotted to have a portion of that wealth. Each person’s portion is the same as, i.e. equal to, every other person’s portion. That equal allotment is a Human Right. Those with more wealth have exceeded their rightful portion. Those with more have, in essence, stolen from those with less. They need to give it back!

To find the exact portion allotted to each of us is easy — you divide the total wealth of the world by the total population of the world. The result is how much we each deservedly get. Inevitably, the total amount of wealth, as well as the total population, changes over time, and so each person’s portion changes with it.

Not surprisingly, many people will find this way of thinking shocking and absurd. That is because they are still stuck with the old, obsolete mindset and need to be re-educated.

**** Love is love is not. The sophisticated, modern mind can distinguish the subtle differences that exist between various kinds of love. All love is not equal. Some love has a greater inherent value than some other love. For example, a person with the right mindset can easily see that the love for a BMW 5 Series is not equal in worth to the love for a baby. Even though the owner of a BMW 5 Series may treat her BMW like a baby, the love for a BMW is worth less, and the modern mind does not bother with worth-less love.

#socialism#satire#political satire#economic equity#new socialism#social commentary#mindset#new mindset#cartoon#equal pay

0 notes

Text

Power to the Workers!

Capitalism served its purpose bringing us out of feudalism. Now it’s become nothing more than a generalized Ponzi scheme and an industrialized version/analogy of legacy admissions. It’s high time we socialized the value we, the workers create. #SupportWorkers

View On WordPress

#America#Capitalism#economic equity#Economics#economy#Ponzi scheme#Socialism#socialized value#USA#workers

1 note

·

View note

Text

South LA Cafe: Fighting Inequity Through Coffee, Community and Connection in Historically Black Community

South LA Cafe, founded by Joe and Celia Ward-Wallace, is on a mission to fight racial, social, economic and food inequity through coffee, community and connection.

The cafe was created to provide fresh, affordable and healthy food options for the South LA community, which has been a food desert for decades. The cafe has become a central hub in the community, with a focus on preserving the…

View On WordPress

#Celia Ward-Wallace#coffee#community#community hub#COVID-19 testing#cultural erasure#culture preservation#economic equity#food desert#food equity#fresh food#gentrification.#healthy food#Joe Ward-Wallace#racial equity#social impact#South Central LA#South LA Cafe#vaccines

0 notes

Text

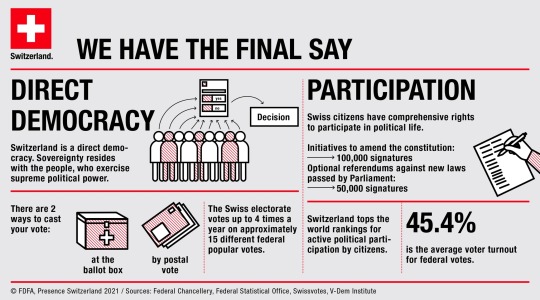

I am a Socialist and I favour Direct Democracy.

1 note

·

View note

Text

Text: When someone asks my political views

Picture of a book titled "Everybody has a house and everybody eats"

#leftism#leftist#hope for humanity#hopepunk#hope punk#hope#economic policy#government policy#ubiforward#ubiquiti#ubi#equity#futurism#solar punk#solarpunk#hopeposting#imagine#activism#antiwork

2K notes

·

View notes

Text

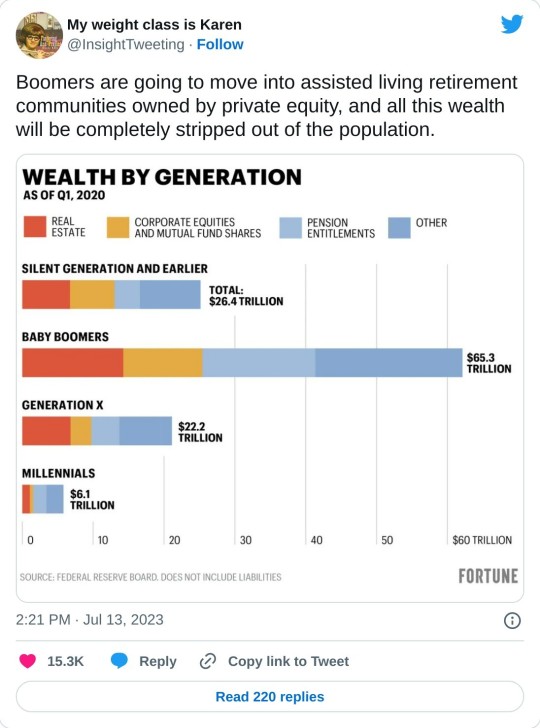

Private Equity is bonkers because it's the cartoonishly evil imagined version of capitalism people talk about on the internet but made real. What if a bunch of guys with too much money went around destroying value and making pretty much everything worse so that they could make more money and do it all over again.

385 notes

·

View notes

Text

Ko-Fi prompt from @dirigibird:

I've been looking at investment options but I don't want to be messing around too much with the stock market, and a co-worker suggested exchange traded funds. Would love to know your opinions!

LEGALLY NECESSARY DISCLAIMER: I am not a licensed financial advisor, and it is illegal for me to advise anyone on investment in securities like stocks. My commentary here is merely opinion, not financial advice, and I urge you to not make any decisions with regards to securities investments based on my opinions, or without consulting a licensed advisor. I am also going to be talking this all over from an American POV, which means some of these things may not apply elsewhere.

So instead of letting you know what to pick or how to organize your securities, I'm going to go through the definitions of what various investment funds are, how they compare functionally, and maybe rant about how I disagree with the stock market on a fundamental ethical level if I have word count left over.

If you want more information, and are okay with jargon, I'd suggest hitting up investopedia. That is where I will be double-checking most of my information for this one.

I also encourage folks who know more about the stock market specifically to jump in! I like to think I'm good at research and explaining things, but I'm still liable to make mistakes.

Mutual Funds: A mutual fund is a pool of money and resources from multiple individuals (often vast numbers of people, actually) being put together and managed as a group by investment specialists. The primary appeal of these is that the money is professionally managed, but not personally so; it gives smaller investors access to professional money managers that they would not have access to on their own, at cheaper rates than if they tried to hire one for just their own assets. The secondary appeal is that, due to the sheer number of people, and thus capital, that is being invested at once, the money can be invested in a wide variety of industries, and is generally more stable than investing in just one company or industry. Low risk, low reward, but overall at least mostly reliable. Retirement plans are often invested in mutual funds by employer choice, through companies like Fidelity or John Hancock.

Hedge Funds: A hedge fund is a high risk, high reward mutual fund. Investors are generally wealthy, and have the room and safety to lose large amounts of money on an investment that has no promise of success, especially since money cannot be withdrawn at will, but must remain in the fund for a period of time following investment. It gets its name from "hedging your bets," as part of the strategy is to invest in the opposition of the fund's focus in order to ensure that there is a backup plan to salvage at least some money if the main plan backfires. Other strategies are also on the riskier side, often planning to take advantage of ongoing events like buyouts, mergers, incumbent bankruptcy, and shorting stocks (that's the one that caused the gamestop incident).

Private Equity: Private equity is... a nightmare that got its own incredibly good Hasan Minhaj episode of Patriot Act, so if you've got 20 minutes, an interest in comedically-delivered, easily-digestible, Real Information, and an internet connection, take a watch of that one. (If it's not available on YouTube in your country, it's originally from Netflix, or you can probably access it by VPN.) Private equity companies are effectively hedge funds that purchase entire companies, rebuild them in one way or another, and then sell them at (hopefully) a profit. Very often, the companies purchased by private equity are very negatively impacted, especially if the private equity group is a Vulture Fund. Sometimes, it's by taking it apart to sell off; sometimes it's by just bleeding it for cash until there's nothing left. Sometimes, it's taking over a hospital and overcharging the patients while also abusing the staff! (Glaucomflecken has a lot of videos on the topic of private equity in the medical industry, check him out.)

Venture Capital: In contrast to private equity, which purchases more mature companies, venture capital is focused on startups, or small businesses that have growth potential. These are the kinds of hedge funds that are like a whole group that you'd see some random tv character calling an Angel Investor (they're not actually the same thing, but they overlap by a lot). I'd hesitantly call these less ethically dubious than private equity, but I'm still suspicious.

And finally, to answer your question on what ETFs are and how they fit into the above.

Exchange Traded Funds: ETFs are... sort of like a mutual fund. Sort of. You are, to some extent, pooling your money... ish.

An ETF is like a stock that is made out of partial stocks. So instead of paying $100 for stock A, and not getting stocks B/C/D that all cost the same, you buy $100 of the ETF, which is $25 each of stocks A/B/C/D. You are getting a quarter of a unit of stock, which isn't normally an option, but because you are purchasing through an ETF that officially already bought those Whole stocks, you can now purchase the partial stocks through them.

They buy the whole stocks, then they resell you mixes of those stocks. They still officially own the whole stocks themselves, but you now own parts of the stocks. Basically, you own "stock" in a company that owns stock in other companies, and in that process you own partial stocks in those other companies.

I'm going to re-explain this using fruit.

Imagine you can buy apples, oranges, melons, grapes, etc. You can also buy fruit cups. You can only buy the individual fruits in big batches or you can pool your money with a few other people, hand it to a chef. The chef will decide which fruits look like they'll taste the best by lunch time, buy a bunch of those fruit pallets with your combined money, and plan out the best possible fruit salad for you to share with a bunch of people once lunch rolls around.

You could also buy a fruit cup. You don't have a lot of control over what's already in the fruit cup, but there are a few different mixes available--that one has strawberries, but that one over there uses kiwi, and the other one that way has pineapple--and you can pick which mix you want. It's a pretty small fruit cup, and it's predesigned, but you can choose the one you want without having to pool money with everyone else. You just first have to let someone else design the fruit cups you choose from, and you don't know which ones are probably going to survive the best to lunch time unless you ask a chef (which defeats the purpose of buying a fruit cup instead of pooling your money, and asking the chef costs money).

That's the ETF. The ETF is the fruit cup.

The upside is that you can now just track the prices of your fruit cup, instead of tracking the prices of four different fruits, and so if the price of one fruit drops, you can just... let the other three buoy it.

Of course, in the real world, there are more than just four stocks involved in an ETF. This part of the Investopedia article lists a few examples, and they're usually themed and involve anywhere from 30 (DOW Jones) to thousands (Russell) of shares by stock type, or by commodity/industry. So with the ETF, you can invest in an entire industry, like technology, and just keep track of that single "stock" in the industry game.

They do cost less in brokerage/management fees than regular mutual funds, and they have a slightly lower liquidity (slower to cash out). There also exist actively managed ETFs, which are basically mutual funds for ETFs. You are paying the chef to buy you premade fruit cups.

(Prompt me on ko-fi!)

#economics#stock market#etfs#etf#mutual funds#hedge funds#venture capital#private equity#capitalism#phoenix talks#ko fi#ko fi prompts#economics prompts

51 notes

·

View notes

Text

65 notes

·

View notes

Text

“Maintaining income and educational inequality is key to #necrocapitalism: there is more profit to be made from the weak, the desperate and the uninformed, than from those who have the option to collude with this self-destructive system”

#Equality #economics #ClimateJustice #writing

10 notes

·

View notes

Text

The antitrust Twilight Zone

Funeral homes were once dominated by local, family owned businesses. Today, odds are, your neighborhood funeral home is owned by Service Corporation International, which has bought hundreds of funeral homes (keeping the proprietor’s name over the door), jacking up prices and reaping vast profits.

Funeral homes are now one of America’s most predatory, vicious industries, and SCI uses the profits it gouges out of bereaved, reeling families to fuel more acquisitions — 121 more in 2021. SCI gets some economies of scale out of this consolidation, but that’s passed onto shareholders, not consumers. SCI charges 42% more than independent funeral homes.

https://pluralistic.net/2022/09/09/high-cost-of-dying/#memento-mori

SCI boasts about its pricing power to its investors, how it exploits people’s unwillingness to venture far from home to buy funeral services. If you buy all the funeral homes in a neighborhood, you have near-total control over the market. Despite these obvious problems, none of SCI’s acquisitions face any merger scrutiny, thanks to loopholes in antitrust law.

These loopholes have allowed the entire US productive economy to undergo mass consolidation, flying under regulatory radar. This affects industries as diverse as “hospital beds, magic mushrooms, youth addiction treatment centers, mobile home parks, nursing homes, physicians’ practices, local newspapers, or e-commerce sellers,” but it’s at its worst when it comes to services associated with trauma, where you don’t shop around.

Think of how Envision, a healthcare rollup, used the capital reserves of KKR, its private equity owner, to buy emergency rooms and ambulance services, elevating surprise billing to a grotesque art form. Their depravity knows no bounds: an unconscious, intubated woman with covid was needlessly flown 20 miles to another hospital, generating a $52k bill.

https://pluralistic.net/2022/03/14/unhealthy-finances/#steins-law

This is “the health equivalent of a carjacking,” and rollups spread surprise billing beyond emergency rooms to

anesthesiologists, radiologists, family practice, dermatology and others. In the late 80s, 70% of MDs owned their practices. Today, 70% of docs work for a hospital or corporation.

How the actual fuck did this happen? Rollups take place in “antitrust’s Twilight Zone,” where a perfect storm of regulatory blindspots, demographic factors, macroeconomics, and remorseless cheating by the ultra-wealthy has laid waste to the American economy, torching much of the US’s productive capacity in an orgy of predatory, extractive, enshittifying mergers.

The processes that underpin this transformation aren’t actually very complicated, but they are closely interwoven and can be hard to wrap your head around. “The Roll-Up Economy: The Business of Consolidating Industries with Serial Acquisitions,” a new paper from The American Economic Liberties Project by Denise Hearn, Krista Brown, Taylor Sekhon and Erik Peinert does a superb job of breaking it down:

http://www.economicliberties.us/wp-content/uploads/2022/12/Serial-Acquisitions-Working-Paper-R4-2.pdf

The most obvious problem here is with the MergerScrutiny process, which is when competition regulators must be notified of proposed mergers and must give their approval before they can proceed. Under the Hart-Scott-Rodino Act (HSR) merger scrutiny kicks in for mergers when the purchase price is $101m or more. A company that builds up a monopoly by acquiring hundreds of small businesses need never face merger scrutiny.

The high merger scrutiny threshold means that only a very few mergers are regulated: in 2021, out of 21,994 mergers, only 4,130 (<20%) were reported to the FTC. 2020 saw 16,723 mergers, with only 1.637 (>10%) being reported to the FTC.

Serial acquirers claim that the massive profits they extract by buying up and merging hundreds of businesses are the result of “efficiency” but a closer look at their marketplace conduct shows that most of those profits come from market power. Where efficiences are realized, they benefit shareholders, and are not shared with customers, who face higher prices as competition dwindles.

The serial acquisition bonanza is bad news for supply chains, wages, the small business ecosystem, inequality, and competition itself. Wherever we find concentrated industires, we find these under-the-radar rollups: out of 616 Big Tech acquisitions from 2010 to 2019, 94 (15%) of them came in for merger scrutiny.

The report’s authors quote FTC Commissioner Rebecca Slaughter: “I think of serial acquisitions as a Pac-Man strategy. Each individual merger viewed independently may not seem to have significant impact. But the collective impact of hundreds of smaller acquisitions, can lead to a monopolistic behavior.”

It’s not just the FTC that recognizes the risks from rollups. Jonathan Kanter, the DoJ’s top antitrust enforcer has raised alarms about private equity strategies that are “designed to hollow out or roll-up an industry and essentially cash out. That business model is often very much at odds with the law and very much at odds with the competition we’re trying to protect.”

The DoJ’s interest is important. As with so many antitrust failures, the problem isn’t in the law, but in its enforcement. Section 7 of the Clayton Act prohibits serial acquisitions under its “incipient monopolization” standard. Acquisitions are banned “where the effect of such acquisition may be to substantially lessen competition between the corporation whose stock is so acquired and the corporation making the acquisition.” This incipiency standard was strengthened by the 1950 Celler-Kefauver Amendment.

The lawmakers who passed both acts were clear about their legislative intention — to block this kind of stealth monopoly formation. For decades, that’s how the law was enforced. For example, in 1966, the DoJ blocked Von’s from acquiring another grocer because the resulting merger would give Von’s 7.5% of the regional market. While Von’s is cited by pro-monopoly extremists as an example of how the old antitrust system was broken and petty, the DoJ’s logic was impeccable and sorely missed today: they were trying to prevent a rollup of the sort that plagues our modern economy.

As the Supremes wrote in 1963: “A fundamental purpose of [stronger incipiency standards was] to arrest the trend toward concentration, the tendency of monopoly, before the consumer’s alternatives disappeared through merger, and that purpose would be ill-served if the law stayed its hand until 10, or 20, or 30 [more firms were absorbed].”

But even though the incipiency standard remains on the books, its enforcement dwindled away to nothing, starting in the Reagan era, thanks to the Chicago School’s influence. The neoliberal economists of Chicago, led by the Nixonite criminal Robert Bork, counseled that most monopolies were “efficient” and the inefficient ones would self-correct when new businesses challenged them, and demanded a halt to antitrust enforcement.

In 1982, the DoJ’s merger guidelines were gutted, made toothless through the addition of a “safe harbor” rule. So long as a merger stayed below a certain threshold of market concentration, the DoJ promised not to look into it. In 2000, Clinton signed an amendment to the HSR Act that exempted transactions below $50m. In 2010, Obama’s DoJ expanded the safe harbor to exclude “[mergers that] are unlikely to have adverse competitive effects and ordinarily require no further analysis.”

These constitute a “blank check” for serial acquirers. Any investor who found a profitable strategy for serial acquisition could now operate with impunity, free from government interference, no matter how devastating these acquisitions were to the real economy.

Unfortunately for us, serial acquisitions are profitable. As an EY study put it: “the more acquisitive the company… the greater the value created…there is a strong pattern of shareholder value growth, correlating with frequent acquisitions.” Where does this value come from? “Efficiencies” are part of the story, but it’s a sideshow. The real action is in the power that consolidation gives over workers, suppliers and customers, as well as vast, irresistable gains from financial engineering.

In all, the authors identify five ways that rollups enrich investors:

I. low-risk expansion;

II. efficiencies of scale;

III. pricing power;

IV. buyer power;

V. valuation arbitrage.

The efficiency gains that rolled up firms enjoy often come at the expense of workers — these companies shed jobs and depress wages, and the savings aren’t passed on to customers, but rather returned to the business, which reinvests it in gobbling up more companies, firing more workers, and slashing survivors’ wages. Anything left over is passed on to the investors.

Consolidated sectors are hotbeds of fraud: take Heartland, which has rolled up small dental practices across America. Heartland promised dentists that it would free them from the drudgery of billing and administration but instead embarked on a campaign of phony Medicare billing, wage theft, and forcing unnecessary, painful procedures on children.

Heartland is no anomaly: dental rollups have actually killed children by subjecting them to multiple, unnecessary root-canals. These predatory businesses rely on Medicaid paying for these procedures, meaning that it’s only the poorest children who face these abuses:

https://pluralistic.net/2022/11/17/the-doctor-will-fleece-you-now/#pe-in-full-effect

A consolidated sector has lots of ways to rip off the public: they can “directly raise prices, bundle different products or services together, or attach new fees to existing products.” The epidemic of junk fees can be traced to consolidation.

Consolidators aren’t shy about this, either. The pitch-decks they send to investors and board members openly brag about “pricing power, gained through acquisitions and high switching costs, as a key strategy.”

Unsurprisingly, investors love consolidators. Not only can they gouge customers and cheat workers, but they also enjoy an incredible, obscure benefit in the form of “valuation arbitrage.”

When a business goes up for sale, its valuation (price) is calculated by multiplying its annual cashflow. For small businesses, the usual multiplier is 3–5x. For large businesses, it’s 10–20x or more. That means that the mere act of merging a small business with a large business can increase its valuation sevenfold or more!

Let’s break that down. A dental practice that grosses $1m/year is generally sold for $3–5m. But if Heartland buys the practice and merges it with its chain of baby-torturing, Medicaid-defrauding dental practices, the chain’s valuation goes up by $10–20m. That higher valuation means that Heartland can borrow more money at more favorable rates, and it means that when it flips the husks of these dental practices, it expects a 700% return.

This is why your local veterinarian has been enshittified. “A typical vet practice sells for 5–8x cashflow…American Veterinary Group [is] valued at as much as 21x cashflow…When a large consolidator buys a $1M cashflow clinic, it may cost them as little as $5M, while increasing the value of the consolidator by $21M. This has created a goldrush for veterinary consolidators.”

This free money for large consolidators means that even when there are better buyers — investors who want to maintain the quality and service the business offers — they can’t outbid the consolidators. The consolidators, expecting a 700% profit triggered by the mere act of changing the business’s ownership papers, can always afford to pay more than someone who merely wants to provide a good business at a fair price to their community.

To make this worse, an unprecedented number of small businesses are all up for sale at once. Half of US businesses are owned by Boomers who are ready to retire and exhausted by two major financial crises within a decade. 60% of Boomer-owned businesses — 2.9m businesses of 11 or so employees each, employing 32m people in all — are expected to sell in the coming decade.

If nothing changes, these businesses are likely to end up in the hands of consolidators. Since the Great Financial Crisis of 2008, private equity firms and other looters have been awash in free money, courtesy of the Federal Reserve and Congress, who chose to bail out irresponsible and deceptive lenders, not the borrowers they preyed upon.

A decade of zero interest rate policy (ZIRP) helped PE grow to “staggering” size. Over that period, America’s 2,000 private equity firms raised buyout warchests totaling $2t. Today, private equity owned companies outnumber publicly traded firms by more than two to one.

Private equity is patient zero in the serial acquisition epidemic. The list of private equity rollup plays includes “comedy clubs, ad agencies, water bottles, local newspapers, and healthcare providers like hospitals, ERs, and nursing homes.”

Meanwhile, ZIRP left the nation’s pension funds desperate for returns on their investments, and these funds handed $480b to the private equity sector. If you have a pension, your retirement is being funded by investments that are destroying your industry, raising your rent, and turning the nursing home you’re doomed to into a charnel house.

The good news is that enforcers like Kanter have called time on the longstanding, bipartisan failure to use antitrust laws to block consolidation. Kanter told the NY Bar Association: “We have an obligation to enforce the antitrust laws as written by Congress, and we will challenge any merger where the effect ‘may be substantially to lessen competition, or to tend to create a monopoly.’”

The FTC and the DOJ already have many tools they can use to end this epidemic.

They can revive the incipiency standard from Sec 7 of the Clayton Act, which bans mergers where “the effect of such acquisition may be substantially to lessen competition, or to tend to create a monopoly.”

This allows regulators to “consider a broad range of price and non-price effects relevant to serial acquisitions, including the long-term business strategy of the acquirer, the current trend or prevalence of concentration or acquisitions in the industry, and the investment structure of the transactions”;

The FTC and DOJ can strengthen this by revising their merger guidelines to “incorporate a new section for industries or markets where there is a trend towards concentration.” They can get rid of Reagan’s 1982 safe harbor, and tear up the blank check for merger approval;

The FTC could institute a policy of immediately publishing merger filings, “the moment they are filed.”

Beyond this, the authors identify some key areas for legislative reform:

Exempt the FTC from the Paperwork Reduction Act (PRA) of 1995, which currently blocks the FTC from requesting documents from “10 or more people” when it investigates a merger;

Subject any company “making more than 6 acquisitions per year valued at $70 million total or more” to “extra scrutiny under revised merger guidelines, regardless of the total size of the firm or the individual acquisitions”;

Treat all the companies owned by a PE fund as having the same owner, rather than allowing the fiction that a holding company is the owner of a business;

Force businesses seeking merger approval to provide “any investment materials, such as Private Placement Memorandums, Management or Lender Presentations, or any documents prepared for the purposes of soliciting investment. Such documents often plainly describe the anticompetitive roll-up or consolidation strategy of the acquiring firm”;

Also force them to provide “loan documentation to understand the acquisition plans of a company and its financing strategy;”

When companies are found to have violated antitrust, ban them from acquiring any other company for 3–5 years, and/or force them to get FTC pre-approval for all future acquisitions;

Reinvigorate enforcement of rules requiring that some categories of business (especially healthcare) be owned by licensed professionals;

Lower the threshold for notification of mergers;

Add a new notification requirement based on the number of transactions;

Fed agencies should automatically share merger documents with state attorneys general;

Extend civil and criminal antitrust penalties to “investment bankers, attorneys, consultants who usher through anticompetitive mergers.”

#pluralistic#american economic liberties project#jonathan kantor#doj#clayton act#hart-scott-rodino act#zirp#financial engineering#monopoly#consolidation#rollups#debt financing#private equity#hedge funds#serial acquirers#antitrust#incipiency standard#Celler-Kefauver Act#vons#brown shoe#boomers#silver wave#labor#monopsony#pricing power#kkr#envision#funeral homes#surprise billing#sci

103 notes

·

View notes

Text

AN OPEN LETTER to THE U.S. SENATE

Women deserve equal pay! Pass S. 728, the Paycheck Fairness Act now!

393 so far! Help us get to 500 signers!

Women—especially women of color—are the backbone of our nation’s economy. But they are consistently underpaid and their work is undervalued. Action on equal pay is sorely needed to address these inequities, but Republican Senators have blocked vital legislation, S. 728, the Paycheck Fairness Act, that would achieve critical progress. The median annual earnings for women working full time, year-round in 2022 was $52,360, or just 84 cents for each dollar earned by men, with much wider gaps for most women of color compared with white, non-Hispanic men. All women—regardless of the number of hours worked during the year—typically made $41,320, or 78 cents for each dollar earned by all men. Discrimination is one of the factors contributing to this gap, leading to thousands of dollars in lost wages for women over the course of their careers. That’s why we need the Paycheck Fairness Act. The Paycheck Fairness Act would strengthen existing equal pay protections, prohibit retaliation against workers who discuss their pay or challenge pay discrimination, limit employers’ reliance on salary history, and much more. These robust measures would bring us one step closer to equal pay. Women and families cannot afford to wait for equal pay. We need to pass the Paycheck Fairness Act now.

▶ Created on April 3 by Jess Craven · 393 signers in the past 7 days

📱 Text SIGN PWBBDA to 50409

🤯 Liked it? Text FOLLOW JESSCRAVEN101 to 50409

#activate your activism#AN OPEN LETTER to THE U.S. SENATE#Women deserve equal pay! Pass S. 728 the Paycheck Fairness Act now!#393 so far! Help us get to 500 signers!#Women#women of color#WOC#S. 728#the Paycheck Fairness Act#84 cents to 1 dollar#wage gap#intersectional feminism 101#▶ Created on April 3 by Jess Craven#393 signers in the past 7 days#📱 Text SIGN PKEOQT to 50409#🤯 Liked it? Text FOLLOW JESSCRAVEN101 to 50409#JESSCRAVEN101#PWBBDA#resistbot#equal pay#paycheck fairness act#women's rights#gender equality#women in the workforce#pay equity#economic justice#discrimination#salary history#workplace fairness#workplace equality

6 notes

·

View notes

Text

Stone me to death if I’m wrong I guess but I really feel like any privilege comes with the responsibility to distribute that privilege downward any way you can and not hoard it exclusively for your own benefit. but idk who am I to say

#intersectional social justice#social responsibility#accountability#intersectionality#privilege#economic justice#wealth inequality#wealth redistribution#systemic violence#systemic injustice#systemic oppression#social equity#racial justice#christian privilege#male privilege#straight privilege#white privelage#grassroots activism#intersectional activism#equitability

7 notes

·

View notes

Text

Claudia Goldin wins the Nobel Prize in Economics

Listen to Claudia Goldin, Nobel Prize winner and Economic Historian share how her ground breaking research traces women’s journey to close the gender wage gap and sheds new light on the continued struggle to achieve equity between couples at home.

#nobel prize#nobel#Economics#Claudia Goldin#Princeton University Press#Career#Family#Gender equity#Equity#Wage gap

17 notes

·

View notes

Text

Apple Adds $25 Million to Racial Equity and Justice Initiative, Increasing Financial Commitment to over $200M since 2020

This week, Apple announced its Racial Equity and Justice Initiative (REJI), a long-term global effort to advance equity and expand opportunities for Black, Hispanic/Latinx, and Indigenous communities, has more than doubled its initial financial commitment to total more than $200 million over the last three years.

Since launching REJI in June 2020, Apple has supported education, economic…

View On WordPress

#Ahmaud Arbery#and criminal justice reform#Anti-Recidivism Coalition#Apple#Breonna Taylor#Defy Ventures#Delgado Community College#economic empowerment#Education#George Floyd#HBCUS#Hispanic-Serving Institutions#Houston Community College#HSIs#Los Angeles Community College District#My Brother’s Keeper Alliance (MBKA)#Obama Foundation#Racial Equity and Justice Initiative (REJI)#The Last Mile#Tim Cook#Vera Institute of Justice

16 notes

·

View notes

Text

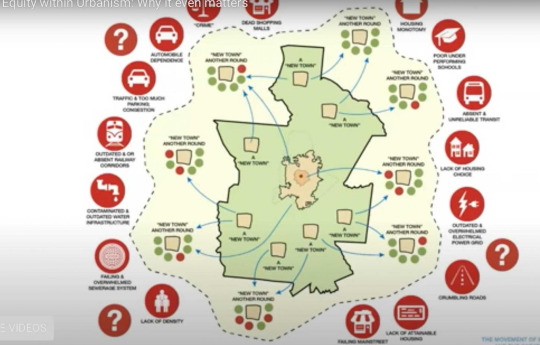

Why we need to address equity within urbanism

Architect, urban designer, and small-scale developer Marques King reviewed the legacies and precedents of racism within American land use and how this history shows us a way forward. King covered 300 years of American urbanism through an equity lens in a On the Park Bench webinar, beginning with a little-known quote from Martin Luther King, Jr.

“At the same time that the US government refused to give the negro any land, through an act of Congress, our government was giving away millions of acres of land in the West and the Midwest, which meant it was willing to undergird its peasants from Europe with an economic floor. Not only did they give the land, they built land grant colleges with government money to teach them how to farm, and they provided county agents to further their expertise in farming, not only that, they provided low interest rates in order that they could mechanize their farms, not only that, many people are receiving millions of dollars in federal subsidies not to farm, and they are the very people telling black man he ought to lift himself by his own bootstraps.”

Read more.

#new urbanism#urbanism#urban design#cities#urban planning#history#american history#equity#mlk jr#economics#government#racisim

4 notes

·

View notes