#crypto investment in uk

Text

Abimoney ABI 2023 2024 abitechno abilive abitrade1 token crypto cryptocurrency investment companies

#Abimoney ABI#2023#2024#abitechno#abilive#abitradexlm crypto staking#crypto investment in uk#token crypto web 3.0#token cryptocurrency list#token crypto nft#token crypto significato#token ethereum list#token crypto presale#crypto staking tax uk#token crypto raffi ahmad#Abi Money adalah token kripto yang berjalan di tiga blok chain TRC 20#ERC 20#dan BEP 20 yang dikembangkan oleh Abitekhno INC sebuah perusahaan IT yang berbasis di Delaware#USA. didukung dengan 11 utilitas bertujuan membangun ekosistem dimana pemegang token abi money dapat melakukan transaksi dengan aman#cepat dan nyaman.#Dalam ekosistem abi money anda dapat menghasilkan income#saling terhubung diantara komunitas#dan menggunakan abi money dalam transaksi sehari-hari.#Salah satu utilitas abi money yang sangat menguntungkan bagi pemegang token adalah flatform abi staking#dimana pengguna dapat menghasilkan 200% investasi dalam 38 bulan. Simak informasi mengenai abi staking di https://indonesia.abi.money. Untu#pendaftaran 100% free.#https://defi.abi.money/client/?r=T0JZ1PDO#Manfaatkan pula Airpods asbi staking sebesar 10 USD selama kuota masih tersedia.#Mutilitas lain yang dapat digunakan adalah abi live yang merupakan aplikasi vidio conference yang dapat digunakan secara gratis sebanyak 70#silakan donwloadd di appstore dan playstore.

0 notes

Text

Don’t know about crypto currency investing??…..you will earn a lot of money and be successful. get started by sending How to start on WhatsApp 👇👇👇

#crypto#metallica#uk politics#investing#make money as an affiliate#dale earnhardt jr.#whatsapp#mongolia#healthy snack#bitcoin#ethereum#usdtm#krypto#curvy model

4 notes

·

View notes

Text

Your Ultimate Crypto Investment and Trading Guide | FinanceConductor

1 note

·

View note

Text

RECOVERING LOST, HACKED, OR STOLEN CRYPTO - HACK-ANGELS

Hello, my name is Peter Hartman.

I'm 56 years old from Germany.

My family and I were left with nothing after falling prey to a cryptocurrency investment fraud that took $807,000 in USDT and Bitcoins from us. We were quite fortunate to stumble across a post about HACK-ANGELS, a cryptocurrency and funds recovery organization with extensive cybersecurity knowledge. HACK-ANGELS was able to recover all of our cash, and they were tracked down and reported to the right authorities using the information we gave. In my opinion, you should use HACK-ANGELS to recover your cryptocurrency.

Adr: 45-46 Red Lion St., London WC1R 4PF, UK

Email: [email protected]

Tel: +1 203-309-3359

Visit: https://thehackangels.com

#RECOVERING LOST#HACKED#OR STOLEN CRYPTO - HACK-ANGELS#Hello#my name is Peter Hartman.#I'm 56 years old from Germany.#My family and I were left with nothing after falling prey to a cryptocurrency investment fraud that took $807#000 in USDT and Bitcoins from us. We were quite fortunate to stumble across a post about HACK-ANGELS#a cryptocurrency and funds recovery organization with extensive cybersecurity knowledge. HACK-ANGELS was able to recover all of our cash#and they were tracked down and reported to the right authorities using the information we gave. In my opinion#you should use HACK-ANGELS to recover your cryptocurrency.#Adr: 45-46 Red Lion St.#London WC1R 4PF#UK#Email: [email protected]#Tel: +1 203-309-3359#Visit: https://thehackangels.com

1 note

·

View note

Text

Understanding the Challenges of Moving from LIBOR: Navigating the Tides

In the vast ocean of global finance, the London Interbank Offered Rate (LIBOR) stands out. It has long served as a crucial navigational beacon. Established in the mid-1980s, LIBOR quickly became the world’s most widely used benchmark for short-term interest rates. It’s similar to the financial world’s heartbeat. It underpins an estimated $350 trillion worth of financial contracts worldwide. These range from complex derivatives to simple home mortgages.

LIBOR represents the average interest rate for major global banks. They can borrow from one another in the international interbank market for short-term loans. LIBOR is published in five currencies: U.S. dollar, Euro, British pound, Japanese yen, and Swiss franc. It comes in seven different maturities ranging from overnight to one year. This provides a consistent, reliable gauge of the cost of unsecured borrowing in the London interbank market.

The importance of LIBOR in the financial system cannot be overstated. It serves as a reference rate for many financial products. These include syndicated loans, adjustable-rate mortgages, student loans, credit cards, and various types of derivatives. It’s the foundation of the global financial system. It influences borrowing costs throughout the economy. Moreover, it affects the finances of corporations, governments, and consumers alike.

However, LIBOR is the backbone of the financial world. Yet, it doesn’t come without its flaws. The financial world is preparing to navigate a future without it.

The Need for Transition from LIBOR

The journey towards a post-LIBOR world began with a series of unfortunate events. These events shook the financial world to its core. The LIBOR crisis erupted in 2012. It revealed that some banks had been manipulating the rate to their advantage. This led to a crisis of confidence in the benchmark. The scandal tarnished the reputation of LIBOR. It also highlighted its inherent vulnerabilities. One primary concern was that it was based on estimates and not actual transactions. This made it easier to manipulate.

The implications of the crisis were far-reaching. It led to billions of dollars in fines for the banks involved. Additionally, it casts a long shadow over the integrity of the global financial system. In response, it sparked a global conversation. The discussion centred around the need for a more robust and transparent alternative. This alternative needed to withstand the tests of market integrity and reliability.

How Everything Led to LIBOR’s End

In response to the crisis, regulatory bodies worldwide began pushing for a transition away from LIBOR. In the UK, the Financial Conduct Authority (FCA) made an announcement in 2017. It stated it would no longer ask or persuade banks to submit rates for LIBOR’s calculation after 2021. This announcement effectively set the clock ticking for the end of LIBOR.

The final nail in the coffin was in March 2021. The administrator of LIBOR, ICE Benchmark Administration, confirmed the termination dates for most LIBOR settings. It was announced that several LIBOR settings would cease after December 31, 2021. This included all the British pound, euro, Swiss franc, and Japanese yen settings. Additionally, the “one-week and two-month U.S. dollar settings” were included. The remaining U.S. dollar settings would cease immediately after June 30, 2023.

The announcement marked the beginning of the end for LIBOR. It set in motion a significant transition in global finance history. The transition from LIBOR is more than just a regulatory requirement. It’s a crucial step towards a stable and trustworthy financial system.

Challenges in the Transition from LIBOR

Navigating away from LIBOR is no small feat. The transition presents a multitude of challenges that financial institutions and market participants must overcome.

One of the most significant challenges is the complexity of replacing LIBOR in existing contracts, often referred to as “legacy contracts”. These contracts, which can extend beyond 2023, were drafted with LIBOR as the reference rate and often lack adequate provisions for the permanent removal of the benchmark. Modifying these contracts to replace LIBOR with a new rate is an enormous task, both legally and operationally, and raises the potential for legal disputes and market disruption.

The transition also involves the adoption of new risk-free rates (RFRs) that are fundamentally different from LIBOR. Unlike LIBOR, which reflects the credit risk of unsecured interbank lending, RFRs such as the Secured Overnight Financing Rate (SOFR) in the U.S. and the Sterling Overnight Index Average (SONIA) in the UK are nearly risk-free, as they are based on actual transaction data from secure lending markets. This shift from a credit-sensitive rate to a risk-free rate could have significant implications for the pricing and risk management of financial products.

Adding to the complexity is the absence of term structures in the new RFRs. While LIBOR is quoted for different maturities, most RFRs are overnight rates. The development of term rates based on RFRs is still in progress, and until these are widely available and accepted, the transition will remain a challenge.

The impact of the transition extends to various financial sectors and products. From securities, where LIBOR is deeply embedded, to syndicated loans and adjustable-rate mortgages that reference LIBOR, the transition will require significant adjustments. Market participants will need to adapt to new pricing mechanisms, risk management tools, and system changes, all while ensuring minimal disruption to financial markets.

Potential Solutions and Strategies for the Transition

Despite the challenges, the financial world is not walking without a light in this dark transition. Several solutions and strategies are being developed and implemented to navigate the shift from LIBOR. A key part of the solution lies in the development of alternative RFRs.

In the U.S., the Federal Reserve has endorsed the Secured Overnight Financing Rate (SOFR) as the replacement for U.S. dollar LIBOR. SOFR is based on actual transactions in the Treasury repurchase market, making it a more robust and reliable benchmark.

In the UK, the Bank of England has identified the Sterling Overnight Index Average (SONIA) as the preferred alternative to the sterling LIBOR.

These RFRs, along with others being developed around the world, are set to play a pivotal role in the post-LIBOR era.

Another crucial strategy for the transition is the incorporation of robust fallback language in financial contracts. Fallback provisions outline the steps to be taken and the replacement rate to be used if LIBOR ceases to exist. The International Swaps and Derivatives Association (ISDA) has developed a standard fallback protocol, which many market participants have agreed to, providing a clear path for the transition in derivative contracts.

Technology and data also hold the key to managing the transition effectively. Financial institutions are leveraging technology solutions to identify and analyze LIBOR exposure in their contract portfolios. Advanced analytics, fintech solutions and AI are being used to extract and review contractual terms at scale, enabling institutions to manage the transition in a more efficient and risk-controlled manner.

The transition from LIBOR is undoubtedly a complex and challenging process. However, with the right strategies and solutions in place, the financial world can successfully navigate the shift and emerge with a more transparent and robust benchmarking system.

The Impact of the Transition on Global Financial Markets

The ripples of the transition from LIBOR are being felt across global financial markets. This is leading to significant changes and potential disruptions.

One of the most profound impacts is the change in market risk profiles. The shift from LIBOR, a credit-sensitive rate, to nearly risk-free rates changes the dynamics of interest rate risk.

Financial institutions will need to review their risk management strategies. This is because the new rates do not reflect bank credit risk. These rates could also behave differently from LIBOR under various market conditions.

The transition also has a significant effect on interest-rate products and securities. LIBOR is deeply embedded in these markets. Its replacement will require adjustments in pricing, valuation, and risk management of these products. For instance, the shift to SOFR in the U.S. will have effects. It could affect the pricing of interest rate swaps. This is because SOFR tends to be lower than LIBOR due to its nearly risk-free nature.

Moreover, the transition carries the potential for market disruption and legal disputes. The modification of legacy contracts to replace LIBOR could be problematic. It could lead to disagreements over the choice of replacement rate. The adjustment spread might also be a point of contention. This could potentially result in lawsuits. There’s also the risk of market fragmentation. Different jurisdictions or market segments might choose different replacement rates.

The Role of Regulatory Bodies and Financial Institutions in the Transition

Read the full article at: https://dsb.edu.in/understanding-the-challenges-of-moving-from-libor-navigating-the-tides/?utm_source=Tumblr&utm_medium=Tumblr&utm_campaign=Tumblr+LIBOR

#libor#benchmark#uk finance#loans#tech#fintech#india#blockchain#jobs#banking#chatgpt#education#gpt 4#ai#google#investment#altcoin#crypto#defi

0 notes

Text

invest today and start making profits

message me to start investing 📊

#bitcoin#business#investment#entrepreneur#investors#canada#canada politics#usa politics#usa#uk politics#uk#california#investing stocks#crypto#millionaire#music#btc

0 notes

Text

@cleansparkmining has put a smile on my face this morning, i just received my profit . I'm really happy and my family is happy about this.

#bitcoin#cleansparkmining#mining#crypto#crypto mining#finance#investing#investment#economy#earn money online#banking#stock market#uk politics#america#taylor swift#critical role#festival#marketing#business

0 notes

Text

Good things and opportunities must be appreciated, @cleansparkmining is really generating good earnings for investors.

You can join them as well tbh!!!!

#bitcoin#cleansparkmining#mining#crypto#crypto mining#finance#investing#investment#stock market#marketing#banking#economy#taylor swift#uk politics#ts4#festival

0 notes

Text

tuesday again 5/23/2023

six sentences or less bc that's the kind of week it is

listening

straighten up and fly right from the nat king cole songbook, covered by sammy davis junior. i have a lot of fondness for the nat king cole songbook bc my grandmother had a lot of fondness for it, and this one was very comfortably in our (contralto) ranges. really burrowing into the comforting familiar as we enter the Cross Country Move Hellzone (tm). spotify

youtube

-

reading

lot of documentation for work bc i am trying to build a google sheet + calendar for our grants and reports such that when someone adds OR EDITS a row in the grant/report tracker it creates a new google calendar event OR UPDATES existing events. i may have to give up on that second half.

in non-work stuff, it is hysterical how many hackers brian krebs (infosec reporter/journalist/researcher) is able to interview. like when this guy was asked "yo is this your code targeting a specific mastodon server with a crypto scam" the response was

Clicking the “open chat in Telegram” button on Zipper’s Lolzteam profile page launched a Telegram instant message chat window where the user Quotpw responded almost immediately. Asked if they were aware their domain was being used to manage a spam botnet that was pelting Mastodon instances with crypto scam spam, Quotpw confirmed the spam was powered by their software.

“It was made for a limited circle of people,” Quotpw said, noting that they recently released the bot software as open source on GitHub.

we live in the stupidest possible cyberpunk future.

-

watching

i don't know jack about shit about cars and i don't know what the fuck jennings motorsports on youtube is talking about 80% of the time but a friendly guy with a calm voice talking through how he's going to get some cars in the worst shape you've ever seen up and running again? yes good thanks, i've blown through his entire backlog in the last week in my second monitor while i've cleaned data. this man is essentially rebuilding this rare limited edition shiny holographic car from half a frame and a panel LOOK how fucked this thing is.

youtube

love the Will It Run? videos bc the answer is almost always yes AND SOMETIMES HE EVEN DRIVES THEM DOWN HIS DRIVEWAY AND BACK even if the cars are barely holding themselves together. the horse souls in these machines can be coaxed back into resurrection with the proper burnt offerings and application of liquefied dinosaur

-

playing

the charm of Powerwash Simulator is somewhat dampened by its extremely buggy achievements bc i KNOW i could get all 40 so fuckin easy if they just WORKED. i didn't get the "main campaign completed!" achievement despite spending nearly forty hours 100%ing every job, so i think the rarity of the achievements is somewhat inaccurate, bc it's more like, did you happen to play through that level at a time when the achievement was working? despite all that, it has been incredibly effective at damping generalized moving anxiety and it's a tremendous catch-up-on-podcasts game. it's hysterical to me this was published by square enix bc this style of simulator game is usually published by Playway or a Playway company, a shadowy network of about a hundred small polish studios, many of which went public and had IPOs in order to hand over a controlling interest of the company to Playway. long history of annoying business practices such as remaking more popular games with the serial numbers filed off and making demos to gauge interest and THEN only making about one full game for every twenty demos, which is very irritating for players. not this one tho, it's in fucking brighton in the uk, no relation!

-

making

this is going to be cleaning and move prep for the next six weeks. i deep cleaned (even mopped!) my kitchen and bathroom last weekend bc it uh. really needed it, and that's the most exciting thing i did. no progress on cleaning the flip clock radio bc i do not currently have the patience to sit down with qtips and get in all the little grooves.

24 notes

·

View notes

Note

are in game currencies you can buy with real money covered under the same laws that make nfts and bitcoin taxable?

DISCLAIMER

I am not an international tax expert. Tax laws are obviously different in different jurisdictions; something that's true in the USA might not be true in the UK or Ukraine or India or Japan or Kenya or whatever. Also, the details of individual games can affect their legal standing. You may wish to consult a local tax expert before filing your return.

Disclaimers aside, probably not.

The thing about NFTs is that you can resell them. If you buy an ugly ape for etherium, you can later sell that ape for etherium and sell the etherium for cash, hopefully more than you paid in. That's what makes crypto stuff taxable; it's an investment.

Most in-game currencies cannot be exchanged for real-world money. You can't buy Fortnite VBucks at 5¢ to the buck and resell it at 7¢ to make a profit, and you can't sell anything for real-world cash. (This the main reason why gambling regulations usually don't apply to lootboxes.)

As far as the law is concerned, buying VBucks in Fortnite is no different from buying DLC on Steam.

Aside from blockchain games like the infamous Axie Infinity, the only ways I can think of for in-game currency purchases to result in taxable transactions probably violate the terms of service. Back in ye olde World of Warcraft days, people would sell their in-game gold for real-world money—profitable, despite (or because of?) being against the TOS.

Obviously, people can buy premium video game currency with their own money; that's what premium currency is for. But hypothetically, if you used that currency to buy an in-game item that you sold for real-world money, that would be a taxable transaction. The amount you sold it for minus the price initially paid for in-game currency would be taxable game.

Again, this is probably a violation of the terms of service you agreed to without reading, which would make this a breach of contract. In the US, you are required to report illegal income; however, as per the fifth amendment, you don't have to report anything that would incriminate yourself. How you report such income without self-incrimination is an exercise for any reader running a Fortnite money laundering business.

3 notes

·

View notes

Text

House sales are cratering but inventory is soaring

When I moved to the UK in the early 2000s, nearly everyone I met fancied themselves a real-estate investment genius. Young people all had plans to “get on the housing ladder.” Each of these schemes was more crackpot than the last — the most plausible involved buying minuscule flats, “doing them up,” and flipping them. The weirder ones involved buying unbuilt holiday homes in Spain or Croatia — places these people couldn’t afford to visit, especially not after assuming crushing debt to buy these homes — waiting for them to “go up in value,” and selling them.

No amount of debate or discussion could dissuade these young people from pursuing these highly speculative, highly leveraged bets. They had been subjected to a yearslong barrage of assurances of the inevitability of house prices rising, including no fewer than three public TV shows about house-flipping — that is, publicly funded propaganda to make risky, speculative financial bets look “safe as houses.”

But as weird as my conversations with young people were, they were nothing compared to my conversations with people of their parents’ generation. Without exception, every older person I talked to about the housing crisis — for that’s what it was! — was convinced that they were the second coming of Warren Buffet, a genetic sport born with the mutant power to unerringly spot underpriced homes.

Their evidence for this? They had bought homes in the 1970s and 1980s for less than £100k, and now those homes were worth £2m. For them, this was a sign that they had “bought well.” No amount of debate could convince them otherwise, not even discussions of how the surreal, high-risk bets their children were making were feeding a bubble that saw all homes soaring in price.

Buying into a bubble doesn’t make you a genius — it makes you a gambler in a rigged casino. Now, lots of people make money in a rigged casino, and not just the casino’s owners. Marks who luck out on their entry and exit can walk out with some of the loot, too. In fact, it’s to the casino’s advantage to have a pool of satisfied marks walking around in the world, boasting of the incredible (and fair) opportunities to be found at the casino’s tables.

This is especially visible in the world of crypto speculation. The multibillion-dollar “stablecoin” Tether has long been understood to be a scam — but enough people were able to profitably use it that every time someone pointed out the incoherence of Tether’s claims to reserve assets, a bleating chorus of Tether boosters appeared to drown them out.

The original “airdrop” actually took place in the UK housing market, when Margaret Thatcher killed the idea that shelter was a human right by selling council flats (public housing) to their residents. A generation later, those flats were mostly in speculators’ hands, the money from sales was long gone, and the children of those former council tenants had nowhere to live.

The people who bought and held onto their homes through the housing bubble considered themselves to be genius investors, even though their “strategy” consisted of “living somewhere, while forces they didn’t understand drove trillions into the housing market and inflated the price of every home.”

Housing is a uniquely dangerous form of speculation, because shelter is a primary human right, and being unsheltered is catastrophic. When a nation replaces labor rights and a social safety net with speculation on housing, it pits the living conditions of everyone who doesn’t have a home against everyone who does. A country whose residents’ dignified retirement depends on house prices going up is a country whose government is committing to making shelter more expensive.

https://gen.medium.com/the-rents-too-damned-high-520f958d5ec5

Imagine if the only way people in your town could experience upward social mobility was if the price of food went up, and if your local, regional and national government committed itself to a policy of making food as expensive as possible. Life without food is harder than life without shelter — but a society that fails to provide stable housing to its people is still an abject failure.

Here in the USA, we’ve just been through yet another housing bubble, driven by a combination of offshore speculators, overall asset inflation from Trump’s quantitative easing, NIMBYism, and 15 years of failure to build new housing since the Great Financial Crisis. House prices have soared to levels that dwarfed the runup to the 2008 bust.

The entire asset bubble — stocks, crypto, baseball cards, art, wine — is bursting, and its taking the housing market with it. April saw the largest decrease in house sales in US history, a month-on-month drop of 16.6% and a year-on-year drop of 26.9%.

https://wolfstreet.com/2022/05/24/housing-bubble-getting-ready-to-pop-unsold-inventory-of-new-houses-spikes-by-most-ever-to-highest-since-2008-sales-collapse-below-400k/

Even those shocking numbers don’t convey the true scale of the collapse, because they obscure variations by region and sale price. For example, the US south experienced an annual drop of 36.6%. Unsold inventory in the south rose by 59%. Sales of homes listed at $200–300k fell by 71%.

One of the defining characteristics of a bubble is leverage: when people have to borrow to place their bets. Leverage makes bubbles a lot bigger. Credit gives bidders access to more money, so the prices go up as they outbid one another.

But leverage also makes bubble burst a lot harder. The people who loan money into the bubble want to make sure they don’t lose everything if prices go down, so when things look bad, they call in their loans. The banks that provided the leverage for the 2008 crisis used unregulated financial products in a bid to contain their risk (most “financial innovation” consists of finding ways to market prohibited products by rebranding them as something else).

That risk-containment strategy was built on contracts where borrowers promised not to seek bankruptcy protection if they got into trouble. This meant that when prices went down and lots of gamblers found themselves needing to cover their bets, they were unable to renegotiate their debts in bankruptcy court — instead, they had to sell off their assets for whatever they could get (remember “short sales”?).

This meant that as soon as house prices dipped, lots of houses were forced into the market, which drove house prices down even further. Those falling prices triggered another wave of sell-offs, and another drop in prices, and more sell-offs. No wonder that regulators sifting through the ashes of the 2008 collapse called these unregulated risk-containment strategies “suicide notes”:

https://pluralistic.net/2022/03/02/shadow-banking-2-point-oh/#leverage

These price-annihilating “fire sales” are a feature of every bursting bubble, though they’re an especially grave risk in crypto, where smart contracts are designed to force instantaneous, automated loan liquidations when the value of the loans’ collateral drops:

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4038788

Asset bubbles drive all kinds of risky behavior. As the current housing bubble has gotten bigger and bigger, house-buyers have held off on selling their old houses. In other words, if you buy a new house and move your family into it, you don’t sell the house you just left — you leave it empty for months, or even a year, borrowing to cover two mortgage payments.

Why would anyone do this? Because housing prices kept going up — and up — and up. By “hodling” onto that old house, you could ride that upward trend “to the Moon.”

Like the older Britons who were convinced that having a place to live made them financial geniuses, even though they had no theory to explain rising house prices and thus no way to predict when prices might fall, the people who hodl’ed their old houses mistook the dividends of a massive asset bubble for their own financial acumen.

That was a harmless delusion, so long as house prices kept going up. Once the market cooled, it was a disaster. As Barry Ritholtz describes, the people who held onto their former residences have run out of rope and can’t afford to keep up two homes anymore, and a flood of new listings is landing on the market, even as it collapses:

https://wolfstreet.com/2022/06/02/suddenly-here-comes-the-inventory-homes-listed-for-sale-jump-amid-price-reductions-and-sagging-sales/

Last month, new house listings went up by 26% month-on-month, and 8% year-on-year, the first annual increase in listings since 2019. It’s worse than it looks: rising mortgage rates mean that buyers are leaving this market, reducing demand for the (increasing) supply. Closing sales have declined for nine consecutive months.

Prices are falling: 74% more homes were relisted at lower prices in May than in April. The collapse is (unsurprisingly) worst in the cities that inflated the most during the bubble: Austin, Phoenix, Sacramento, Riverside, Denver and Raleigh.

The original sin here is to conceive of homes as assets first, and human rights second. Asset bubbles are hugely destructive, but they don’t have to implicate shelter. That was a policy choice, and once again, we’re learning that it was the wrong one.

Image:

Tony Mariotti (modified)

https://www.rubyhome.com/

CC BY 2.0:

https://creativecommons.org/licenses/by/2.0/

[Image ID: A Spanish Mission-style bungalow with a FOR SALE sign out front; it is sinking into a dark and stormy ocean.]

142 notes

·

View notes

Text

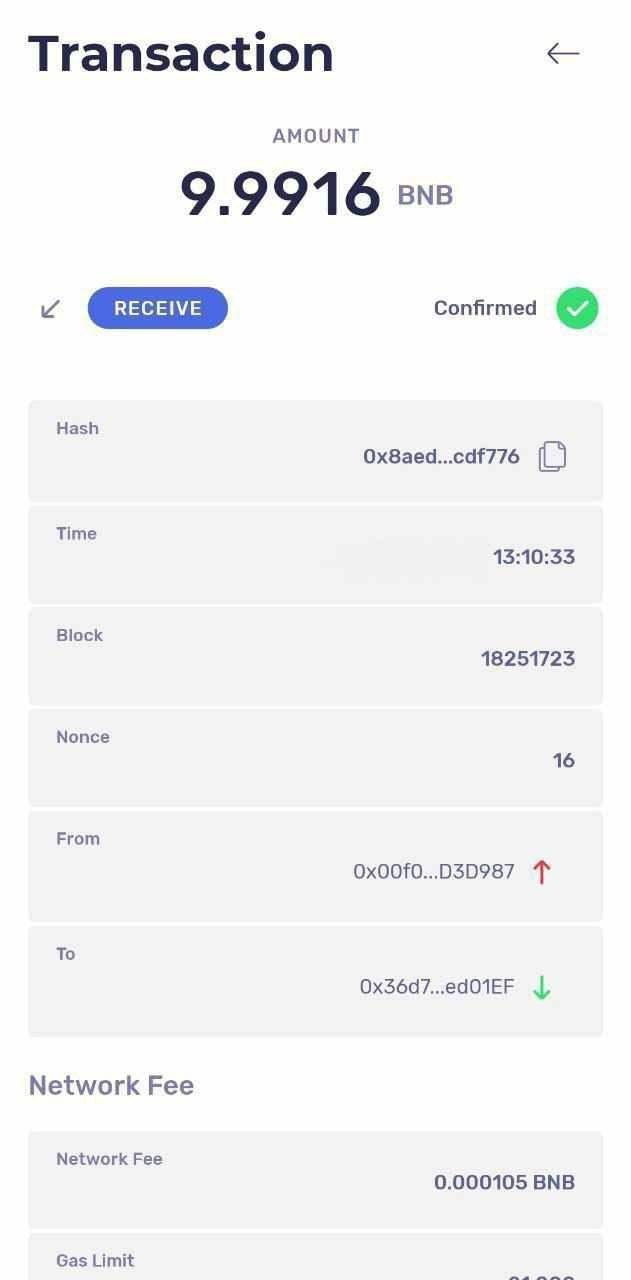

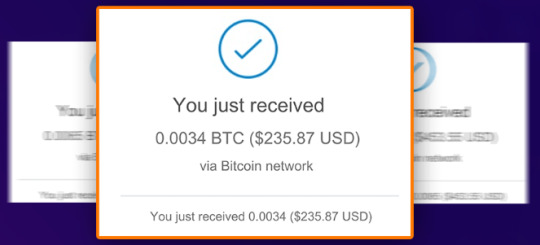

Coinz App Review - Generate Bitcoin & Ethereum On Autopilot (Seyi Adeleke)

Coinz App Review – Generate Bitcoin & Ethereum On Autopilot

Welcome to my Honest Coinz App Review. This is it! Generate Bitcoin & Ethereum Out Of Thin Air. Sending Us $253.87 Worth Of Crypto Directly To Our Wallet.

In today’s rapidly advancing digital landscape, cryptocurrency has emerged as a transformative force, captivating both investors and technology enthusiasts alike. However, crypto mining has often appeared daunting and complex, requiring specialized hardware and technical know-how.

But what if I told you there’s a solution to transform your everyday devices into crypto-mining powerhouses? Meet Coinz App – the innovative AI application poised to redefine how we approach cryptocurrency mining.

Picture harnessing the computational capabilities of your mobile phone or laptop to generate Bitcoin and Ethereum effortlessly, without the need for intricate setups or technical expertise. It might seem too good to be true, but the Coinz App is here to demonstrate that it’s not only achievable but also remarkably user-friendly and accessible to individuals of all technical backgrounds.

Coinz App Review: What Is It?

Coinz App is heralded as the pioneering AI application crafted to streamline cryptocurrency earnings, allowing users to effortlessly acquire Bitcoin and Ethereum. Eliminating the necessity for upfront investments or intricate technical analysis, the Coinz App represents an innovative platform leveraging AI technology to solve intricate equations, effectively generating cryptocurrency directly into users’ wallets. Its appeal lies in the commitment to risk-free, automated crypto earnings, positioning it as an enticing choice for both novices and experienced cryptocurrency enthusiasts.

It surpasses the combined power of ChatGPT, Bard, and Gemini COMBINED by a staggering 84 times. We harness this extraordinary power to operate Coinz on virtually any imaginable device, including mobile phones and even outdated laptops. In exchange, it effortlessly processes vast amounts of data for us, enabling us to generate Bitcoin without any cost. While it shares similarities with traditional crypto mining, it also presents a significant departure in approach.

>> Get Coinz App + My $17,000 Bonus To Boost Up Your Earnings MORE and you won’t find these bonuses anywhere >>

Coinz App Review: Overview

Creator: Seyi Adeleke

Product: Coinz App

Date Of Launch: 2024-Apr-01

Time Of Launch: 10:00 EDT

Front-End Price: $27

Refund: YES, 30 Days Money-Back Guarantee

Product Type: Software (online)

Discount : >> GET THE BEST DISCOUNT HERE <<

Recommended: Highly Recommended

Skill Level Needed: All Levels

Coinz App Review: Key Features

Leverage The Extreme Power Of AI Processing To Generate FREE Bitcoin & Ethereum.

No Investment is Needed – Not Even $5

No Need To Buy Expensive Mining Equipment

No Experience Or Technical Analysis Required

Over $68,659.80 In FREE Bitcoin & Ethereum Given To Our Members.

100% Risk-Free (Zero Trading Required)

Capitalize On The Biggest Bull Market Of The Century.

Even TOTAL Beginners Are Getting Free Bitcoin.

Enjoy FREE Bitcoin On Autopilot.

ZERO RISK: 30-Day Money Back Guarantee

>> Get Coinz App + My $17,000 Bonus To Boost Up Your Earnings MORE and you won’t find these bonuses anywhere >>

Coinz App Review: How Does It Work?

You’re Just 3 Steps Away From Receiving FREE Bitcoin Daily With Coinz.

Coinz App Review: Can Do For You

Beginner Friendly System: Whether you have 2 years of experience or two weeks, it doesn’t matter… Coinz gives you everything you need to start getting FREE cryptocurrency from scratch.

Works Anywhere In The World: As long as you have a computer and internet connection, you can receive Bitcoin anywhere in the world. Whether you’re in Kenya, India, USA, UK, Mexico, or anywhere else, you can receive Bitcoin for FREE.

Just A Few Clicks To Activate: This is something so easy even a 10-year-old could do it… Because it takes just a few clicks to activate Coinz.

Receive Bitcoin & Ethereum: You’ll be able to finally tap into the trillion-dollar cryptocurrency BOOM and get a slice of the pie… And the best part? All the crypto you’ll earn is FREE.

Zero Expenses Required: There aren’t any hidden fees or strings attached. No buying expensive equipment. None of that crap. We give you everything you need.

No Trading Or Risk Involved: Although you could hold onto the crypto you get, you can sell it at any time you want for cash. This means there’s zero risk and trading involved!

Works On Any Device You Want: Our application works on the internet, therefore it works on any device that’s connected online… This includes Windows, Mac, Android, iPhone, or any other phone or tablet that can connect online.

>> Get Coinz App + My $17,000 Bonus To Boost Up Your Earnings MORE and you won’t find these bonuses anywhere >>

Coinz App Review: Verify User Opinion

Coinz App Review: Who Should Use It?

Digital Product Sellers

Website Owners

Social Media Marketers

Affiliate Marketers

E-com Store Owners

Video Marketers

Small Business Owners

Bloggers & Vloggers

>> Get Coinz App + My $17,000 Bonus To Boost Up Your Earnings MORE and you won’t find these bonuses anywhere >>

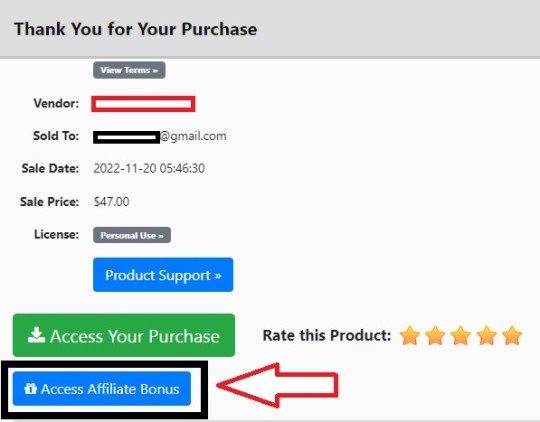

Coinz App Review: OTO And Pricing

FE: Coinz App ($17)

OTO1: Unlimited ($67)

OTO2: DoneForYou ($297)

OTO3: Automation ($47)

OTO4: Swift Profits ($47)

OTO5: Limitless Traffic ($97)

OTO6: Agency ($167)

OTO7: Franchise Edition ($97)

OTO8: Multiple Income ($47)

After purchasing, you’ll get my Special Bonus Instantly on your access page as an Affiliate Bonus button on WarriorPlus.

And before ending my legit Coinz App Review, I promised to give you my very Special Unique Own Developed PFTSES Formula for FREE.

>> Get Coinz App + My $17,000 Bonus To Boost Up Your Earnings MORE and you won’t find these bonuses anywhere >>

Coinz App Review: Free Bonuses

BONUS 1: Coinz 6-Figure In 60 Days LIVE Event (Value $1997)

Get VIP access to our live mastermind event and copy n’ paste our Coinz underground system we use to make 6-figures in 60 days. This alone is worth 5x what you will pay today, and it’s yours for free!

BONUS 2: Coinz Bitcoin Profit Secrets (Value $997)

This is a powerful system that you can integrate with the Coinz App to achieve remarkable results.

Discover the methods and techniques employed by the most successful Bitcoin investors so that you, too, can profit and succeed!

You’ll learn how to acquire your first Bitcoin, how to mine it, how to trade or invest in it, and much more! Even if you’re a complete novice, this will work for you.

BONUS 3: Buy & Sell Using Bitcoin (Value $697)

This system will open your eyes to know everything about buying and selling Bitcoins. This plus your Coinz App = Massive Profits daily.

BONUS 4: Crypto Flipping Niche Website Builder (Value $697)

Start making money online today using high-converting done-for-you niche websites package inside this app!

Get access to a bundle of done-for-you niche websites that will help you build your very first profitable cryptocurrency niche site today. This is a solid bonus you mustn’t miss, together with the Coinz app

BONUS 5: Coinz Traffic Booster (Value $497)

Discover The Top-Secret Tips And Strategies To Get Tons Of Traffic To Your Coinz Marketplace, and Boost Your Traffic & Sales!

Dominate any platforms (Facebook, Youtube, TikTok, Instagram, etc), Sell More Products & Services, and also make huge profits.

Coinz App Review: Money Back Guarantee

They offer a 100% risk-free guarantee backed by an iron-clad 30-day money-back policy. They aim to ensure you experience absolute success with Coinz.

Here’s the deal: If you give Coinz a try and find yourself unable to receive free Bitcoin or Ethereum, the responsibility falls on us.

Just inform us within 30 days, and we’ll promptly refund every cent without hesitation, as a gesture of good faith.

At Coinz, we prioritize our customers, considering you kings. And as a token of appreciation for your time, we’ll even include extra exclusive bonuses.

In the end, it’s a win-win situation for you, no matter what.

>> Get Coinz App + My $17,000 Bonus To Boost Up Your Earnings MORE and you won’t find these bonuses anywhere >>

Coinz App Review: Conclusion

For individuals intrigued by cryptocurrency but hesitant due to its complexities and associated risks, Coinz presents an enticing solution. Its utilization of AI for cryptocurrency generation, devoid of the necessity for technical expertise or significant initial investments, renders it accessible to a wide spectrum of users. We endorse Coinz for both newcomers to the crypto realm and seasoned enthusiasts seeking to broaden their digital asset acquisition avenues. However, akin to any investment venture, including innovative platforms like Coinz, we urge prospective users to conduct thorough research and contemplate the sustainability of their crypto-earning pursuits over the long term.

Frequently Asked Questions (FAQ)

Do I need any mining equipment?

Absolutely none! This doesn’t involve crypto mining whatsoever, so you don’t need to shell out thousands on equipment.

My computer isn’t the best, will it work on mine?

As long as it connects to the internet… YES. This is the same for any other device. The only thing is, it needs to have access to a web browser. If that’s the case, you’re all good to go.

How long will it take to receive my first Bitcoin/Ethereum?

This varies, but the vast majority of our users report receiving it as soon as they activate it. In short, the quicker you activate, the sooner you’ll likely see crypto.

Do I need any programming skills?

None whatsoever. I hate technical crap as much as you do, so we designed Coinz in mind for the average Joe and Jane… After all, not everyone has a computer science degree.

Can I turn Bitcoin into real money?

You sure can… Our video tutorials show you how to exchange your Bitcoin for real money in your bank account. This process is smooth as silk, and takes only a few minutes…

Do I need to trade Bitcoin or Ethereum?

Nope, but you could! It’s up to you whether you sell it for cash, or take the risk of holding it for potential gain.

What if I get confused along the way?

Don’t worry, we have video training that shows you every step of the way, from A-Z… We’ll show you everything you need to know so you can begin receiving Bitcoin & Ethereum ASAP.

I’m sold. How do I get started?

Click the button below to get Coinz for the lowest price.

>> Get Coinz App + My $17,000 Bonus To Boost Up Your Earnings MORE and you won’t find these bonuses anywhere >>

See my other reviews: AcquireWeb AI Review, InFlux AI Review, And Comet App Review.

Thanks for reading my Coinz App Review till the end and I hope it will help you to make your purchase decision.

Source: Coinz App Review - Generate Bitcoin & Ethereum On Autopilot (Seyi Adeleke)

Affiliate Disclaimer :

Some of the links in this article may be affiliate links, which means I receive a small commission at NO ADDITIONAL cost to you if you decide to purchase something. While we receive affiliate compensation for reviews/promotions on this article, we always offer honest opinions, user experiences, and real views related to the product or service itself. Our goal is to help readers make the best purchasing decisions, however, the testimonies and opinions expressed are ours only. As always you should do your own thoughts to verify any claims, results, and stats before making any kind of purchase. Clicking links or purchasing products recommended in this article may generate income for this product from affiliate commissions and you should assume we are compensated for any purchases you make. We review products and services you might find interesting. If you purchase them, we might get a share of the commission from the sale from our partners. This does not drive our decision as to whether or not a product is featured or recommended.

#coinzapp#coinz#coinzappreview#coinzapppreview#coinzappoverview#coinzapphonestreview#coinzappoto#coinzappdemo#coinzappbonus#coinzappdiscount#coinzapplegit#coinzappscam#coinzapphowdoesitwork#coinzappisitreal#getcoinzapp#buycoinzapp#coinzappbySeyiAdeleke

4 notes

·

View notes

Text

What Is Verified CoinBase Accounts?

Coinbase is one of the most popular cryptocurrency trading platforms. But there are so many other options out there that we wanted to give you an easy way to compare your options. There are three important considerations when choosing a cryptocurrency exchange: security, location, and your wallet. Below, we’ll discuss the best Coinbase alternatives.

Verification is the process of verifying the identity of an individual. Or business using a government-issued identification number. Verified accounts are officially operated by businesses and provide extra security. But, they’re only used for verification purposes. All Coinbase accounts are verified. And you can use your Coinbase account to buy, sell, send. And receive bitcoin and other crypto-currency.

Coinbase is a digital currency exchange that launched in 2012. And has grown to become one of the largest online exchanges in the world. It’s also now one of a handful of exchanges that allow users to buy and sell Bitcoin (BTC). Bitcoin Cash (BCH), Ethereum (ETH), Litecoin (LTC), and Bitcoin Gold (BTG). But recently, the exchange began rolling out a new offering called Verified Accounts.

In the cryptocurrency world, there are few things as coveted as verified Coinbase account. This term refers to an account that has been approved or verified. These accounts are often characterized as the ones with high CP, or Coinbase buy volume. By “high CP,” we mean that the account has bought a lot of cryptocurrency. It is fairly easy to gain verified Coinbase account. But difficult to maintain that status.

Buy Verified CoinBase Accounts

Bitcoin has been making headlines lately, with more and more enthusiasts. And mainstream adopters switching over to the cryptocurrency. The bitcoin market has soared to record highs in recent months. With the average cost of bitcoin topping $10,000/coin. As the cryptocurrency gains acceptance, more people are looking for a secure place to buy and sell bitcoin.

Those of you interested in cryptocurrency know that being an early adopter can mean a lot of benefits. This holds true with Coinbase, a platform that lets you buy and sell Bitcoin (BTC). Bitcoin Cash (BCH), Ethereum (ETH), Litecoin (LTC), and Ethereum Classic (ETC). Even if you’re not interested in trading right away. The platform still gives you access to all the remove cryptocurrencies.

Cryptocurrency is growing…fast. With digital currencies like Bitcoin, Ethereum, and Litecoin, the future looks bright. These currencies are only as good as their exchange. That’s where Coinbase comes in. Coinbase is a secure, reliable exchange that makes it easy to buy, sell, and store digital currency. It offers a user-friendly, simple interface where you can buy and sell bitcoin, Ethereum, and Litecoin. When you sign up with Coinbase, you must prove your identity, which helps to protect your account.

Bitcoin trading is a risky venture. It might very well be the best investment you’ve made, but it also might be the one that sets you back. If you buy bitcoin then sell it short, you run the risk of losing all it. This is why it is so important to know the first thing about how to buy and sell Bitcoin. The steps are simple and straightforward, but can also be easily overlooked.

How to verify a CoinBase accounts?

It can be a pain to verify a CoinBase account, especially if it is your first time. CoinBase is a digital wallet and exchange service where users can buy, sell and accept payment in Bitcoin. To send or receive funds, you must verify your account by providing valid documentation.

As part of our daily bitcoin transactions. We occasionally receive coins that are sent from the author’s Coinbase wallet account. They generally arrive fairly quickly. But every now and again we may find BTC that hazmat moved for some time. Sometimes these BTC are sent accidentally, sometimes the sender forgets to send the funds. And sometimes, as in this case, the sender simply lost the password to their Coinbase account.

How can I buy real Verified CoinBase Account?

Many people have been interested in how to buy real verified Coinbase Account. Over the years, various Coinbase Account have been there to answer different questions people have. Coinbase accounts have been there to make everyone feel comfortable while transacting online.

For buying Verified CoinBase Account you must take care. There are many fake account sellers on internet. Some of them offer 100 % fake account to satisfy you, but they will lose your money. It is risky to buy from sellers who offer 100 % verified account. Only these sellers offer 50 % verified account. And 50 % account is of no use. So, it is risky to buy from sellers who offer 100 % verified account.

Can you actually buy fully verified CoinBase accounts?

CoinBase is a digital asset exchange platform founded in 2008. Now, it offers users access to global payments with secure storage, and send and receive money globally. Users are

#Buy Verified Coinbase Accounts#paypal#cashapp#pay me money#venmo#payoneer#paxful#earn money online#binance#bitcoin#coin#bitcoin latest news#ethereum#cryptocurrencies

4 notes

·

View notes

Text

From something I was reading elsewhere about forthcoming regulation of "crypto" and adjacent parts of finance.

It is ridiculuous [sic] that I can transfer money in the UK in minutes, but in the US it takes many days so the banks can feast on the float.

Hear, hear. This has been bugging me years. People who have never needed to transfer money between accounts to cover a car or house or tuition payment probably don't even realize this is A Thing, but it's one of the most blatant examples of finance-industry profiteering that I know of.

They literally hold onto your money for days, without even trying to make an excuse, using the aggregate of all such "in flight" transfers to fund their own investments. Using billions to make tens of millions, with zero risk to them. It's stealing, even if the stolen goods are eventually returned, and should be prosecuted as such.

2 notes

·

View notes

Video

youtube

Best Way to Make Money with Printify Print on Demand - Instead of Crypto...

With Crypto crashing a lot of viewers have been asking me what are alternative ways of making money.

We came across Printify and we are so excited! It is truly a way you can start making money almost immediately with no investment. Have you ever imagined having your own store, but now instead of selling locally you had a global business.

You can sell shirts in UK from the comfort of your home in Australia, or sell mugs/stickers/shoes in Europe from your kitchen table in Cleveland! Printify looks after everything – a global business and distribution and best in practice all with the click of a finger.

Not only can you create a business and start making money straight away, you can use those profits to invest in things such as Crypto and you will never lose your own money.

In this video we are going to talk about why you would join Printify, the advantages of it and how you can create an income for life:

If you wish to join Printify - https://printify.com/

2 notes

·

View notes

Text

Looking to trade cryptocurrency in the UK? Revolut X now offers a seamless way to do just that. Partnering with TradingView, Revolut X provides users with a user-friendly platform to buy, sell, and trade popular cryptocurrencies. Stay up to date with real-time Market analysis and make informed decisions on your investments. Start trading crypto with ease using Revolut X and TradingView.

Click to Claim Latest Airdrop for FREE

Claim in 15 seconds

Scroll Down to End of This Post

const downloadBtn = document.getElementById('download-btn');

const timerBtn = document.getElementById('timer-btn');

const downloadLinkBtn = document.getElementById('download-link-btn');

downloadBtn.addEventListener('click', () =>

downloadBtn.style.display = 'none';

timerBtn.style.display = 'block';

let timeLeft = 15;

const timerInterval = setInterval(() =>

if (timeLeft === 0)

clearInterval(timerInterval);

timerBtn.style.display = 'none';

downloadLinkBtn.style.display = 'inline-block';

// Add your download functionality here

console.log('Download started!');

else

timerBtn.textContent = `Claim in $timeLeft seconds`;

timeLeft--;

, 1000);

);

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

Revolut is a financial technology (Fintech) company founded in 2015 that has become a major player in the challenger bank scene. But what exactly are challenger banks, and how does Revolut stand out with their cryptocurrency trading product? This article dives into Revolut’s cryptocurrency offerings, exploring its features, limitations and how it compares to competitors.

What are challenger banks?

Challenger banks, also known as neobanks, are financial institutions that operate primarily online. They offer a streamlined alternative to traditional brick-and-mortar banks. They typically focus on mobile apps, providing a user-friendly experience for money management, payments, and, sometimes, investment opportunities.

Challenger banks leverage cutting-edge technology to offer faster, more efficient services. By eliminating physical branches and streamlining operations, challenger banks often boast lower fees than traditional banks. The mobile-centric design makes managing finances easier and more intuitive.

Revolut has undergone some regulatory rigor over the years despite being a challenger bank. This equips them to play the bridge role between decentralized finance (DeFi) and traditional finance (TradFi) and drive mainstream audiences toward cryptocurrencies.

Is Revolut crypto-friendly?

Revolut entered the cryptocurrency space in 2017, allowing users to buy and sell a limited selection of cryptocurrencies directly within its app. In February 2024, it announced a new crypto exchange, Revolut X, targeting “advanced traders,” promising lower fees and enhanced Market analytics.

While exact user numbers for Revolut’s crypto products are not publicly available, its overall user base has surpassed 30 million, suggesting a significant potential audience for its crypto offerings.

What advantages does Revolut bring to the crypto space?

Revolut positions itself competitively by offering several innovative features, including:

- Fractional trading allows users to buy fractions of a cryptocurrency, making it accessible to those with limited budgets. Users can start their crypto investment journey for as little as 1 British pound.

- Revolut’s mobile app is known for its intuitive design, making crypto trading less intimidating for beginners. Crypto applications can be notoriously hard to navigate for users. Therefore, Revolut’s crypto offerings could make a major difference to user experience.

- Revolut’s advanced exchange promises lower fees and advanced features for seasoned traders.

- Seamless integration between their fiat banking app and crypto products could help position Revolut as the United Kingdom’s crypto bank.

Limitations of using Revolut’s offerings for crypto trading

However, there are limitations to consider, too:

- As a newer player in the crypto space, the Revolut banking app and Revolut X offer a smaller selection of cryptocurrencies and more limited support for layer-1 blockchains than established crypto exchanges.

- Users cannot earn a yield on their crypto holdings through staking mechanisms within the Revolut app.

- Revolut offers only basic Market and limit orders, which can be restrictive for most experienced traders.

- As of May 2024, Revolut restricts the transfer of crypto assets to external wallets, allowing transfers to other exchanges but blocking transfers to self-custodial wallets.

Steps to trade crypto using Revolut’s banking application

Here’s a step-by-step guide to using Revolut’s banking application to trade cryptocurrencies:

Step 1: Access the Revolut mobile app and log in with your Revolut account details.

Step 2: Navigate to the “Crypto” section. This may vary depending on the app version.

Step 3: Select the cryptocurrency you want to trade. Revolut will display the current price and trading chart.

Step 4: Choose between “Buy” or “Sell” and enter the amount you want to trade in fiat currency or the chosen cryptocurrency.

Step 5: Review the transaction details. This includes the total cost and any applicable fees.

Step 6: Confirm the transaction. Once confirmed, the crypto purchase or sale will be processed.

Before embarking on cryptocurrency trading, conducting thorough research and understanding the inherent risks is crucial. Cryptocurrencies are a volatile asset class, and their prices can fluctuate significantly.

Steps to trade crypto using Revolut X platform

In addition to the above option within its standard banking mobile application, Revolut has also launched its advanced crypto trading platform, Revolut X.

Step 1: Users can go to https://exchange.revolut.com to log in to the Revolut X application and stay connected to their Revolut account.

Step 2: Clicking on “Deposit” displays the user’s fiat balance on their Revolut banking application. Users can deposit the fiat from their Revolut account into the Revolut X account. If users already hold crypto on the exchange, it can also be used for trading.

Step 3: Once the deposit is approved from the Revolut mobile app, users can start trading on Revolut X.

Step 4: Revolut X only offers basic Market and limit order options, which may not satisfy the needs of experienced traders seeking more advanced tools and strategies. Also, the app only supports a limited number of cryptocurrencies compared to major exchanges like Coinbase, Binance and Crypto.com.

The app also supports sell orders so that if users want to exit their crypto holdings (say, for stablecoins), they can set sell orders in the app.

Step 5: Users can check their portfolio performance and assets held by clicking on the portfolio tab on the left.

The future of Revolut X

Revolut X is poised for significant growth in the crypto space. Its entry into the crypto trading space presents both opportunities and challenges. While it offers a convenient and user-friendly platform, its limitations may not suit experienced traders.

However, with its integration across banking products and focus on user experience, Revolut has the potential to carve a niche as a leading crypto bank in the United Kingdom. As it expands its cryptocurrency offerings and trading features, Revolut X could become a major player in the evolving landscape of digital asset exchanges.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_2]

1. How do I start trading crypto with Revolut X?

Simply download the Revolut app, fund your account, and enable the crypto trading feature.

2. Can I trade cryptocurrencies 24/7 on Revolut X?

Yes, you can trade cryptocurrencies 24/7 through the Revolut app.

3. Is Revolut X a secure platform for trading crypto?

Yes, Revolut X uses advanced security measures to protect your assets and personal information.

4. What cryptocurrencies can I trade on Revolut X?

You can trade various cryptocurrencies like Bitcoin, Ethereum, Litecoin, and more on Revolut X.

5. Are there any fees for trading crypto on Revolut X?

Yes, Revolut X charges a small fee for every crypto transaction.

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

[ad_1]

Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators

Claim Airdrop now

Searching FREE Airdrops 20 seconds

Sorry There is No FREE Airdrops Available now. Please visit Later

function claimAirdrop()

document.getElementById('claim-button').style.display = 'none';

document.getElementById('timer-container').style.display = 'block';

let countdownTimer = 20;

const countdownInterval = setInterval(function()

document.getElementById('countdown').textContent = countdownTimer;

countdownTimer--;

if (countdownTimer < 0)

clearInterval(countdownInterval);

document.getElementById('timer-container').style.display = 'none';

document.getElementById('sorry-button').style.display = 'block';

, 1000);

0 notes