Text

Moonlighting in Modern India: The Dual Employment Dilemma

In the dynamic context of Indian employee-employer relations, “Moonlighting in India” has been successful in capturing the essence of a shifting work culture. Earlier, a single job was often enough to sustain an individual or even a family. However, as the world evolved, so did the nature of employment. The modern work environment, characterized by its fluidity and adaptability, has seen a significant rise in moonlighting. This phenomenon isn’t just about earning an extra rupee; it’s a reflection of the changing aspirations and capabilities of the workforce.

The term moonlighting, once associated with secretive night jobs, has now expanded to encompass a range of secondary employment opportunities. With the dawn of the digital age, geographical boundaries have blurred, enabling professionals to work for global clients from the comfort of their homes. This has been further pushed by the recent pandemic, which introduced the world to the potential of remote working on an unprecedented scale.

Furthermore, the evolution of work culture has played a pivotal role in this shift. The traditional 9-to-5 job is no longer the only viable employment model. Flexible employment options, freelance opportunities, and gig-based roles have gained prominence. For many, moonlighting is not just about financial necessity but also about pursuing passion projects, diversifying skills, or simply seeking new challenges.

What Does Moonlighting Mean in India

Moonlighting, at its core, refers to the practice of holding a secondary job in addition to one’s primary employment. The term finds its roots in the imagery of working under the moon’s light, often after regular working hours. Earlier, moonlighting was a means to make ends meet, especially during economic downturns or personal financial crises.

The concept of moonlighting is not new. In earlier times, individuals often took up additional tasks or roles to supplement their income. With the Industrial Revolution and the establishment of structured work hours, the term began to signify after-hours work. As economies evolved, so did the reasons for moonlighting. From mere survival, it transitioned to opportunities for skill enhancement, passion projects, and financial growth.

On a global scale, moonlighting has been prevalent in various forms. In developed nations, it often emerges from the desire to pursue varied interests or to achieve specific financial goals. The gig economy, characterized by short-term contracts and freelance work, has further fueled this trend. Platforms like Uber, Airbnb, and Upwork have made it easier for individuals to take up secondary roles that fit their schedules.

In contrast, the Indian context presents a unique blend of factors. While financial necessity remains a driving force for many, the IT boom and the rise of startups have introduced new dimensions to moonlighting in India. The recent surge in remote working opportunities has also played a role, allowing professionals to collaborate with global clients while maintaining their primary roles. However, cultural and corporate perceptions of moonlighting vary, leading to diverse practices and policies across companies.

The Legal and Ethical Implications of Moonlighting

Moonlighting, while prevalent, brings forth a wide range of legal and ethical considerations. From an employer’s perspective, the primary concern often revolves around potential conflicts of interest, confidentiality breaches, and divided employee loyalty.

Legally, the stance on moonlighting varies across jurisdictions. In India, there isn’t a comprehensive legal framework addressing moonlighting for all sectors. Specific industries, like the IT sector, fall outside the umbrella of traditional labour laws that might prohibit dual employment. Instead, the legalities are often governed by employment contracts.

Many companies explicitly mention moonlighting policies in their offer letters, prohibiting employees from taking up secondary employment. Such clauses aim to protect business interests, and intellectual property, and ensure undivided attention to the primary job. This is especially crucial in sectors like fintech where proprietary technology and data are at stake.

However, the enforceability of no-moonlighting clauses can be complex. While companies can set terms of employment, they must also ensure that these terms are fair and not overly restrictive. If challenged, the enforceability might depend on the nature of the secondary job, its impact on the primary role, and any real conflicts or damages caused.

Ethically, the debate around moonlighting is complicated. On one hand, employees have the right to personal time and the pursuit of additional income or interests. On the other hand, moonlighting can raise questions about an employee’s commitment, potential fatigue, and the risk of compromising proprietary information. In sectors like IT, where project-based work is common, moonlighting might be viewed as a breach of trust, especially if the secondary role is with a competitor.

While moonlighting in India is not outright illegal, its acceptance varies across companies. Both employers and employees must navigate this space with clarity, understanding their rights, obligations, and the broader implications of dual employment.

The Prevalence of Moonlighting in the Indian Corporate Space

The Indian corporate landscape presents a diverse view on moonlighting, influenced by factors such as industry type, company size, and organizational culture. While some companies adopt a lenient approach, recognizing the benefits of skill diversification, others maintain strict policies to safeguard business interests.

Indian IT giants, for instance, have been in the spotlight for their stance on moonlighting. With project-based work and client confidentiality at the core, many IT firms prohibit employees from engaging in secondary employment. Such policies aim to prevent potential conflicts of interest, protect intellectual property, and ensure dedicated employee focus. Recent news highlighted instances where IT professionals faced repercussions for undisclosed moonlighting activities, underscoring the seriousness with which some companies view this issue.

However, not all sectors share this rigid view. Startups and newer enterprises, often driven by innovation and agility, maybe more open to employees pursuing side gigs, especially if they align with the company’s vision or contribute to skill enhancement. The rise of the gig economy in India, with platforms like Freelancer, Upwork, and UrbanClap, has also made moonlighting more accessible and prevalent.

The status of moonlighting acceptance in the Indian corporate world is, thus, highly variable. While some companies see it as a potential threat, others view it as an opportunity for employees to grow and bring diverse experiences to the table. The key lies in striking a balance, ensuring that while employees have the freedom to explore, business interests and ethics are not compromised.

Moonlighting Jobs and Their Detection

Read the full article at: https://dsb.edu.in/moonlighting-in-india/?utm_source=tumblr&utm_medium=tumblr&utm_campaign=tumblr+moonlighting

#ai#jobs#banking#education#chatgpt#gpt 4#google#india#blockchain#fintech#moonlighting#job search#jobsearch#jobseekers#jobposting#employment#employees#working#career#work

0 notes

Text

Ethical Hacking: White Hats Making The Digital World Secure

In today’s digital age, the term ‘Ethical Hacking’ is like a safety check. It is a crucial line of defence in our interconnected world. Simply put, ethical hacking is when hackers test computer systems to find and fix weak spots. This has a critical role because we hear about online fraud and phishing attacks all the time.

Ethical hacking is the good side of the hacking world. It’s about diving into systems, not to exploit, but to protect. It’s about wearing the white hat in a realm where not everyone plays by the rules.

Now, let’s break it down a bit. On one side, we have our heroes, the White Hats. These are the ethical hackers, the tech-savvy experts who use their skills to find and fix security gaps. They’re the digital guardians, ensuring our data stays safe and sound.

On the other side, there are the Black Hats. These are the experts with similar skills but different intentions. They’re out to find system loopholes, not to fix them, but to exploit them. It could be for money, fame, or just the thrill, their actions cause real damage.

But somewhere in between, we find the Grey Hats. These hackers might not always ask for permission but they do not necessarily have harmful intentions. They might spot a weakness, sneak in, but then give a heads-up to the organization about the gap they found.

Understanding these different hats is essential. It reminds us of the importance of ethical hacking and the role it plays in keeping our online world a safe place to work.

The Ethical Framework: A Moral Compass

Ethical hacking, by its very name, carries a sense of responsibility. It’s not just about skills, but also about the ethics and principles that guide it. At its core, ethical hacking is about doing the right thing and ensuring that digital spaces are safe for everyone.

Consent is Everything. Ethical hackers don’t just dive into systems on impulse. They seek and have permission. They’re invited to test and explore, ensuring that systems are strong and secure. This separates them from malicious hackers who operate without any permission.

Boundaries are crucial too. Even with permission, there are limits. Ethical hackers respect them, ensuring they don’t overstep or cause unintended harm. They understand the importance of staying within the agreed-upon scope of their work and legalities can’t be ignored.

Ethical hacking might sound like a grey area, but it’s not. There are clear legal frameworks that define what’s acceptable and what’s not. Stepping outside these can lead to serious repercussions.

Ethical hackers work with integrity and report vulnerabilities. They respect client confidentiality and they do not misuse their access. They do not disclose vulnerabilities publicly without consent. And they certainly do not harm the system they’re testing.

The world of ethical hacking is guided by a strong moral compass. It’s a domain where skills meet responsibility, ensuring the digital world remains a safe space for all.

The Ethical Hack: A Step-by-Step Guide

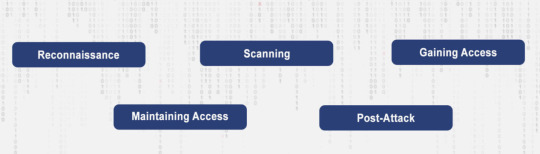

An Ethical Hack is like a detective starting an investigation in a systematic and methodical manner. Let’s follow through this process.

Reconnaissance: This is the initial phase, often linked to a burglar stalking out a house before a heist. Ethical hackers gather as much information as possible about the target system. They look for domain names or IP addresses linked to a company in order to understand the target but from a distance.

Scanning: Now, the hacker gets a bit closer. Think of it as the detective using a magnifying glass to find fingerprints. In this phase, ethical hackers identify open ports or services running on servers. Tools like Nmap or Nessus might be used here. They help in detecting potential vulnerabilities in the system.

Gaining Access: This is the action phase. The hacker tries to exploit the vulnerabilities they’ve found. It’s like the detective finding an unlocked back door. They might use tools like Metasploit to find a way in. It is important to understand ethical hackers have permission and they are testing the locks and not stealing anything.

Maintaining Access: Here, the hacker acts like a spy, trying to create a backdoor for themselves. It’s about seeing if they can remain undetected in the system, highlighting potential risks. Can they stay without the system’s knowledge? If yes, then there’s a problem.

Post-Attack: Once the testing is done, ethical hackers must report their findings. It’s like a detective presenting evidence in court. They detail vulnerabilities found, data accessed, and how long they remained undetected. This information is crucial for strengthening the system further.

Tools and Techniques for Ethical Hacking

In the tech world, tools and techniques are essential. They are what make the process efficient and effective. Similarly, many are used in various stages of hacking.

Scanning Tools: As mentioned, tools like Nmap help hackers scan systems. It’s like a radar, detecting what’s out there. Nessus, on the other hand, is more about vulnerability assessment. Think of it as a health check-up for systems, spotting potential weak points.

Exploitation Tools: Metasploit is a big name here. It’s an application designed to find and exploit vulnerabilities. It’s like a locksmith’s set, helping hackers test every lock.

Password Cracking Tools: Sometimes, hackers need to crack passwords. Tools like John the Ripper or Hydra come into play. They test the strength of passwords, ensuring they are robust enough to keep intruders out.

Wireless Hacking Tools: In our wireless age, tools like Aircrack-ng are vital. They test the security of wireless networks. It’s about ensuring that Wi-Fi networks are as secure as their wired counterparts.

Forensic Tools: Post-attack, tools like Wireshark help in analyzing what happened. They dissect the hack, helping organizations understand and learn from it.

Ethical Hacking is a thorough process. It’s about understanding, testing, and strengthening digital defences. With the right tools and a systematic approach, ethical hackers ensure that the digital world remains a bit safer for all of us.

Why Ethical Hackers Are Essential

For some years, cyber threats have been escalating at an alarming rate. From data breaches to ransomware attacks, the online world faces constant threats. Despite this chaos, ethical hackers emerge as heroes. They’re the first line of defence, proactively identifying vulnerabilities before malicious hackers can exploit them. Their role is not just about finding weak spots but also recommending robust solutions to fortify these digital fortresses.

In 1995, Kevin Mitnick became “the world’s most famous hacker” after hacking codes from tech companies like Nokia, IBM, Microsoft and Motorola. He was once a notorious black hat hacker, who transformed into a white hat, using his skills to help organizations bolster their defenses.

Another instance is the “Heartbleed” vulnerability in OpenSSL. Ethical hackers were instrumental in identifying and mitigating this critical bug, preventing potential chaos.

The Learning Roadmap: Becoming an Ethical Hacker

Thinking about becoming an ethical hacker is similar to setting out on an academic adventure. There is an oversupply of resources available for aspiring hackers. Platforms like Udemy, Coursera, and edX offer courses tailored for beginners and experts alike. For those seeking a structured learning path, certifications like CEH (Certified Ethical Hacker) or OSCP (Offensive Security Certified Professional) provide comprehensive curriculums.

Starting as a beginner, the world of hacking might seem overwhelming. But remember, every expert was once a beginner. The initial steps involve understanding basic cybersecurity concepts, networking, and operating systems and advanced steps include penetration testing, vulnerability assessment, and intrusion detection.

In the hacking community, certifications aren’t just pieces of paper; they’re badges of honour. The CEH certification equips learners with hands-on hacking techniques. GPEN (GIAC Penetration Tester) is another esteemed certification, focusing on penetration testing methodologies. For those seeking a challenge, OSCP is known for its rigorous 24-hour hacking exam. Lastly, CREST provides recognized accreditations in the penetration testing field. These certifications not only enhance knowledge but also open doors to lucrative career opportunities in cybersecurity.

In essence, becoming an ethical hacker is a journey of continuous learning. With the right resources, dedication, and certifications, one can master the art and science of ethical hacking, ensuring the digital world remains a safer place for all.

Is Ethical Hacking Legal?

Read the full article at: https://dsb.edu.in/ethical-hacking/?utm_source=tumblr&utm_medium=tumblr&utm_campaign=tumblr+ethical+hacking

#ai#india#education#chatgpt#google#gpt 4#banking#blockchain#fintech#jobs#ethical hacking#hacking#security#cyber security#technology#infosec#phishing

0 notes

Text

AI in Education: Medium For Learning or Teacher’s Replacement

We stand on the brink of a revolution by Introducing “AI in Education”. The transformative potential of artificial intelligence is not just reshaping industries but is also redefining the way how we educate and learn. From healthcare to finance and from analytics to marketing, AI’s footprint is evident, but its most profound impact might very well be in the classrooms of tomorrow.

The world has witnessed rapid technological advancements in the field of AI in the past few years. Industries have evolved, businesses have transformed, and our daily lives have become intertwined with digital innovations. Among these, AI stands out as a beacon of change, indicating a new era of possibilities. And as it saturates every sector, education emerges as a prime candidate for AI’s transformative touch.

A future where every student gets a personalized learning experience, where educators are empowered with tools of unprecedented precision, and where the boundaries of traditional classrooms are expanded beyond physical walls.

This journey into the world of AI in education is not just about technology. It’s about harnessing its power to create more inclusive, engaging, and effective learning environments. It’s about understanding the vast potential and the challenges, ensuring that as we step into the future, we do so with vision, purpose, and a commitment to excellence.

The Multiple Benefits of AI in Education

The integration of “AI in Education” is not just a technological shift, it’s a revolutionary change that offers a wide range of benefits.

What are the advantages that AI brings to the educational table?

Personalized Learning: One of the most significant breakthroughs AI offers is the ability to tailor educational content to individual student needs. The one-size-fits-all approach days are gone. With AI-driven platforms, students can now receive customized lessons, ensuring that learning is aligned with their pace and style. This personal touch ensures that no student is left behind, and each one gets the optimal learning experience tailored just for them.

Efficiency and Automation: For educators, AI is nothing short of a boon. Routine administrative tasks, which once consumed a significant chunk of their time, can now be automated. From grading assignments to tracking student attendance and performance, AI streamlines these processes, allowing educators to focus on what they do best — teaching.

Enhanced Engagement: The digital-age student is tech-savvy and often seeks interactive and engaging learning experiences. AI offers gamification, virtual reality (VR), and immersive learning experiences. These tools not only make learning fun but also enhance retention and understanding, making education a truly interactive experience.

Support for Diverse Needs: Every student is unique, and so are their learning needs. AI recognizes this diversity and offers tools specifically designed for students with disabilities and different learning styles. Be it speech recognition tools for the differently-abled or adaptive learning platforms for those with learning challenges,

Data-Driven Insights: In the age of information, data is king. AI harnesses the power of data analytics to provide insights into student performance. Educators can now get real-time feedback, identify areas of improvement, and strategize teaching methods to ensure every student achieves their full potential.

The benefits of integrating AI into education are manifold. It’s not just about making processes efficient. It’s about redefining the learning experience, making it more personalized, inclusive, and impactful.

AI’s Role in Rural and Underserved Areas

AI in Education extends beyond the state-of-the-art classrooms in urban centres. Its true potential will shine when it’ll reach the corners of the world where traditional education systems have often stuttered.

How AI is making waves in rural and underserved areas.

Bridging the Educational Divide: For decades, rural areas have fought with challenges like limited resources, fewer qualified teachers, and outdated teaching methods.

AI will emerge as a source of hope in such scenarios. With AI-driven educational platforms, students in remote areas can access high-quality content, interactive lessons, and even virtual tutors. It’s not just about providing education, it’s about ensuring that the quality of education is on par with urban centres.

This democratization of learning is pivotal in levelling the playing field and ensuring that every student, irrespective of their geographical location, has a fair shot at a quality education.

Virtual Classrooms and Remote Learning Opportunities: The concept of a classroom is being redefined. No longer confined to four walls, AI-powered platforms are creating virtual classrooms where students from different parts of the world can come together to learn. These virtual spaces offer interactive lessons, real-time feedback, and even opportunities for collaborative projects. For students in rural areas, this means they can access courses that might not be available in their local schools.

The Teacher and AI: A Collaborative Approach

The Education industry often raises a fundamental question: Will AI replace teachers?

At the heart of every educational journey is the teacher, a guiding force whose impact goes beyond academics. AI, with all its advancements, cannot replicate the human touch, empathy, understanding, and mentorship that teachers provide.

Instead, AI serves as a powerful tool in the hands of educators. It amplifies their capabilities, provides them with resources, and ensures that they can cater to the diverse needs of their students more effectively. The essence of teaching remains human; AI merely provides the tools to make this process more efficient and impactful.

AI Enhances Teacher Capabilities and Reduces Burnout. It is a noble profession, but it’s also one that comes with its set of challenges. Administrative tasks, grading assignments, and managing large classrooms can lead to burnout. This is where AI steps in as a saviour. By automating routine tasks, AI allows teachers to focus on what truly matters which is interacting with students, providing mentorship, and crafting impactful lessons.

Likewise, with AI-driven insights, teachers can identify areas where students might be struggling and tailor their teaching methods accordingly. This not only enhances the quality of education but also ensures that teachers find their roles more fulfilling and less exhausting.

In the grand scheme of education, teachers remain the artists, crafting the future of their students with dedication and passion.

AI, in this scenario, is the brush, the tool that allows them to paint more vividly, ensuring that every student gets a masterpiece of education tailored just for them.

Ethical and Legal Implications of AI in Education

The integration of AI in Education is not without its challenges. As we use the infinite benefits, it’s crucial to address the ethical and legal implications that arise.

Data Privacy Concerns: With AI systems collecting vast amounts of data to provide personalized learning experiences, data privacy emerges as a paramount concern. Schools, institutions, and ed-tech companies must ensure that the data collected is stored securely, and any potential breaches could compromise the personal information of students. It’s not just about securing data; it’s about building trust. Parents, educators, and students need the assurance that their data is used solely for educational purposes and is protected from any misuse.

Unbiased Algorithms: AI systems are only as good as the data they’re trained on. If this data carries biases, AI algorithms can retain and even amplify these biases. In an educational context, this could lead to unfair assessments, misguided learning recommendations, or even discrimination. AI systems in education must be trained on diverse and representative datasets, ensuring that the outcomes are fair and unbiased.

Legal Considerations and the Role of Policy: As AI becomes more integrated into the education system, there’s a pressing need for clear legal frameworks. These frameworks should address issues like data ownership, accountability in case of AI errors, and the rights of students and educators.

Moreover, policies should be in place to guide the ethical use of AI, ensuring that its integration aligns with the core values of education.

Potential Drawbacks and Challenges of AI in Education

Alongside the numerous benefits, there are potential pitfalls and challenges that educators, policymakers, and stakeholders must address.

Dependence on Technology: As classrooms become more tech-centric, there’s a growing concern about over-reliance on technology. While AI-driven tools can enhance learning, they shouldn’t overshadow the fundamental human aspects of education. There’s a risk that students might become too dependent on AI for answers, potentially stifling critical thinking and problem-solving skills. It’s crucial to strike a balance, ensuring that technology complements, rather than replaces, traditional learning methods.

The Risk of Depersonalized Education: One of AI’s strengths is its ability to provide personalized learning experiences. However, if not implemented thoughtfully, there’s a risk of education becoming too mechanized and losing its personal touch. The human connection between teachers and students is irreplaceable and AI should aid this connection, not diminish it. While the lessons might be AI-driven, the human essence of mentorship, guidance, and support remains intact.

Infrastructure and Training Requirements:

Read the full article at: https://dsb.edu.in/ai-in-education-medium-for-learning-or-teachers-replacement/?utm_source=tumblr&utm_medium=tumblr&utm_campaign=tumblr+ai+in+education

#ai#india#fintech#jobs#blockchain#education#banking#chatgpt#gpt 4#google#students#learning#teaching#learn#higher education#educators

0 notes

Text

The Web 3.0 Evolution: The Future Of Decentralized Internet

As we stand on the brink of a new era, the term “Web 3.0” is buzzing everywhere for some years now, promising a transformative shift in how we interact with the digital world.

In the early days, the internet was a static network of read-only content, a digital library of sorts. This was Web 1.0, where users were mere consumers of information. Then came Web 2.0, a more dynamic and interactive phase, introducing us to social media, blogs, and user-generated content. It was a significant leap, transforming users into active contributors.

Now, we are transitioning to Web 3.0, often referred to as the semantic or decentralized web. It’s not just an upgrade; it’s a paradigm shift. Web 3.0 aims to create an internet that’s intelligent, context-aware, and tailored to individual user experiences. It’s an internet where users own their data, where information is decentralized, and where digital interactions mirror the complexity and richness of human interactions.

Web 3.0 is characterized by several key features. It leverages artificial intelligence and machine learning to understand and interpret data, making the web more intuitive and personalized. It’s built on blockchain technology, ensuring transparency, security, and user control over personal data. It’s also interoperable, allowing diverse systems and applications to work together seamlessly.

The Technology Behind Web 3.0

The magic lies in its underlying technology. It’s a blend of advanced tech that works together to create a more intelligent, secure, and user-centric web.

At the heart of 3.0 is blockchain technology. Known as the backbone of cryptocurrencies. Blockchain brings decentralization to the web. It’s a distributed ledger that records transactions across multiple computers, ensuring transparency and security. In the new Web, blockchain enables users to have control over their data, eliminating the need for intermediaries.

Cryptocurrencies serve as the native currency of the Web 3.0 ecosystem. They facilitate transactions, incentivize network participation, and can even represent ownership of digital assets. This integration of blockchain and cryptocurrencies in 3.0 paves the way for a more democratic and equitable digital economy.

Web 3.0 is often referred to as the semantic web. It’s an extension of the current web, designed to enable computers to understand and interpret information just like humans do. The semantic web uses metadata and ontologies to give meaning to data, making it easier for machines to process and analyze information.

Artificial intelligence (AI) plays a crucial role in this context as AI and machine learning algorithms can analyze and learn from the vast amount of data on the web, providing personalized content and experiences. They can understand user behaviour, preferences, and needs, making Web 3.0 a more intuitive and user-friendly space.

One of the defining characteristics of Web 3.0 is decentralization. Unlike the current web, where data is controlled by a few tech giants, Web 3.0 aims to distribute data across the network. This decentralization gives users control over their data, enhancing privacy and security.

In Web 3.0, users can decide who can access their data and for what purpose. They can also monetize their data if they choose to. This shift towards user control is a significant step towards a more democratic and user-centric web.

Understanding Decentralization in Web 3.0

In a decentralized system, there is no central authority that controls or manages the operations. Instead, control is distributed among multiple participants or nodes in the network. Compared to the centralized model of Web 2.0, where a few tech giants control most of the web’s data and services.

Decentralization is achieved through blockchain technology ensuring transparency and security. Each node in the network has a copy of the entire blockchain, making it nearly impossible to alter or forge data.

Benefits and Challenges of a Decentralized Web

A decentralized web offers several benefits, Including:

It enhances privacy and security. Since users control their data, there’s less risk of data breaches and misuse.

It promotes transparency. With blockchain, all transactions are recorded and visible to all participants, making the web more trustworthy.

It enables peer-to-peer interactions. Users can interact directly with each other, without the need for intermediaries.

Despite its benefits, a decentralized web also poses challenges, including:

Scalability is a major issue. As the number of transactions increases, the blockchain network can become slower and less efficient.

The adoption barrier. For many people, concepts like blockchain and cryptocurrencies are complex and difficult to understand. This can hinder the widespread adoption of Web 3.0.

Web 2.0 vs. Web 3.0: A Comparative Look

The transition from Web 2.0 to Web 3.0 is not merely about advanced technology; it’s about a fundamental shift in how we interact with the Web.

User Experience

In Web 2.0, the user experience is largely dictated by the platform. Websites and applications provide a one-size-fits-all experience, with limited personalization. On the other hand, 3.0 aims to deliver a highly personalized user experience. Leveraging AI and semantic technologies, Web 3.0 can understand user preferences and deliver content that’s tailored to every individual user’s needs.

Data Control and Privacy

Web 2.0 is characterized by centralized data control. Tech giants like Google and Facebook store and control user data, often leading to concerns about privacy and data misuse. Whereas, Web 3.0 emphasizes user control over data. Users can decide who can access their data and for what purpose, enhancing privacy and security.

Applications

Web 2.0 introduced us to social media, blogs, and user-generated content. However, these applications are owned and controlled by centralized entities. 3.0 takes it a step further with decentralized applications (dApps). These are applications that run on a peer-to-peer network, rather than a centralized server. dApps are open-source, transparent, and operate with tokens, offering a whole new range of possibilities for digital interaction.

The Shift from Centralized to Decentralized Web

The most significant difference between a centralized to a decentralized web. In Web 2.0, a few entities control the Internet, leading to issues like data monopolies, privacy breaches, and a lack of transparency. Web 3.0 aims to address these issues envisioning an internet where users are in control, data is decentralized, and digital interactions are transparent and secure.

Web 3.0 Applications and Examples

Web 3.0 is not just a theoretical concept, it’s already shaping our digital world in exciting ways.

Real-World Examples of Web 3.0 Applications:

Decentralized Finance (DeFi): They leverage blockchain technology to offer financial services like lending, borrowing, and trading without the need for traditional financial intermediaries. Platforms like Uniswap and Compound are leading examples of DeFi applications.

Decentralized Social Media: Web 3.0 is also transforming social media. Platforms like Minds and Mastodon are decentralized alternatives to traditional social media, giving users control over their data and content.

Decentralized Marketplaces: Web 3.0 has given rise to decentralized marketplaces like OpenSea, where users can trade digital assets and NFTs (Non-Fungible Tokens). These platforms operate on blockchain, ensuring transparency and security.

Emerging Web 3.0 Startups:

Filecoin: A decentralized storage network that allows users to rent out their storage space or buy storage space from others. It’s a promising example of how Web 3.0 can disrupt traditional cloud storage services.

Orchid: A decentralized VPN service that leverages blockchain to ensure privacy and security. Users can buy bandwidth from a global pool of service providers, making the internet more accessible and private.

Aragon: A platform for creating and managing decentralized organizations. It’s a powerful example of how Web 3.0 can transform governance and organizational structures.

Impact of Web 3.0 on Various Sectors

The transformative potential of Web 3.0 extends far beyond the realm of the Internet. It has the potential to disrupt a wide range of industries, from finance and healthcare to education and beyond.

Financial Sector

DeFi applications are enabling peer-to-peer financial services, eliminating the need for intermediaries like banks. For instance, platforms like Compound allow users to lend and borrow cryptocurrencies directly, offering a more transparent and accessible financial system.

Education Industry

AI can analyze a student’s learning style and adapt content accordingly, while blockchain can secure and verify educational credentials. Platforms like ODEM are using Web 3.0 technologies to create a decentralized education marketplace, where students can directly connect with educators.

Marketing Sector

With its emphasis on data privacy and user control, marketers need to adapt to a landscape where meaningful, consent-based interactions are paramount. Decentralization opens avenues for direct, peer-to-peer marketing, bypassing traditional intermediaries. Blockchain can enhance transparency in digital advertising, preventing ad fraud and ensuring fair compensation. An example is Brave, a privacy-focused browser that offers opt-in ads and rewards users with its native cryptocurrency, Basic Attention Token (BAT), embodying a new, Web 3.0-aligned advertising model.

Healthcare Sector

Web 3.0 can enhance data security, privacy, and interoperability. Patients can have control over their health data, deciding who can access it and for what purpose. This can facilitate better data sharing and collaboration among healthcare providers, leading to improved patient care. Companies like MedRec are leveraging blockchain, a key technology of Web 3.0, to secure patient data and enable better data sharing.

Businesses and Individuals

For businesses, It can offer new ways to engage with customers, enhance transparency, and streamline operations. Companies that leverage 3.0 technologies can gain a competitive edge, offering services that are more secure, personalized, and user-centric.

For individuals, It can transform the way we interact with the digital world. It promises a more democratic internet, where users control their data and digital interactions are more secure and personalized. From finance and healthcare to education and entertainment, 3.0 can enhance various aspects of our digital lives.

Web 3.0 and the Metaverse

Read the full article at: https://dsb.edu.in/the-web-3-0-evolution-the-future-of-decentralized-internet/?utm_source=Tumblr&utm_medium=Tumblr&utm_campaign=Tumblr+web+3.0

#tech#web 3.0#decentralized internet#internet#blockchain#india#ai#jobs#fintech#chatgpt#education#gpt 4#google#banking#metaverse

0 notes

Text

Understanding the Challenges of Moving from LIBOR: Navigating the Tides

In the vast ocean of global finance, the London Interbank Offered Rate (LIBOR) stands out. It has long served as a crucial navigational beacon. Established in the mid-1980s, LIBOR quickly became the world’s most widely used benchmark for short-term interest rates. It’s similar to the financial world’s heartbeat. It underpins an estimated $350 trillion worth of financial contracts worldwide. These range from complex derivatives to simple home mortgages.

LIBOR represents the average interest rate for major global banks. They can borrow from one another in the international interbank market for short-term loans. LIBOR is published in five currencies: U.S. dollar, Euro, British pound, Japanese yen, and Swiss franc. It comes in seven different maturities ranging from overnight to one year. This provides a consistent, reliable gauge of the cost of unsecured borrowing in the London interbank market.

The importance of LIBOR in the financial system cannot be overstated. It serves as a reference rate for many financial products. These include syndicated loans, adjustable-rate mortgages, student loans, credit cards, and various types of derivatives. It’s the foundation of the global financial system. It influences borrowing costs throughout the economy. Moreover, it affects the finances of corporations, governments, and consumers alike.

However, LIBOR is the backbone of the financial world. Yet, it doesn’t come without its flaws. The financial world is preparing to navigate a future without it.

The Need for Transition from LIBOR

The journey towards a post-LIBOR world began with a series of unfortunate events. These events shook the financial world to its core. The LIBOR crisis erupted in 2012. It revealed that some banks had been manipulating the rate to their advantage. This led to a crisis of confidence in the benchmark. The scandal tarnished the reputation of LIBOR. It also highlighted its inherent vulnerabilities. One primary concern was that it was based on estimates and not actual transactions. This made it easier to manipulate.

The implications of the crisis were far-reaching. It led to billions of dollars in fines for the banks involved. Additionally, it casts a long shadow over the integrity of the global financial system. In response, it sparked a global conversation. The discussion centred around the need for a more robust and transparent alternative. This alternative needed to withstand the tests of market integrity and reliability.

How Everything Led to LIBOR’s End

In response to the crisis, regulatory bodies worldwide began pushing for a transition away from LIBOR. In the UK, the Financial Conduct Authority (FCA) made an announcement in 2017. It stated it would no longer ask or persuade banks to submit rates for LIBOR’s calculation after 2021. This announcement effectively set the clock ticking for the end of LIBOR.

The final nail in the coffin was in March 2021. The administrator of LIBOR, ICE Benchmark Administration, confirmed the termination dates for most LIBOR settings. It was announced that several LIBOR settings would cease after December 31, 2021. This included all the British pound, euro, Swiss franc, and Japanese yen settings. Additionally, the “one-week and two-month U.S. dollar settings” were included. The remaining U.S. dollar settings would cease immediately after June 30, 2023.

The announcement marked the beginning of the end for LIBOR. It set in motion a significant transition in global finance history. The transition from LIBOR is more than just a regulatory requirement. It’s a crucial step towards a stable and trustworthy financial system.

Challenges in the Transition from LIBOR

Navigating away from LIBOR is no small feat. The transition presents a multitude of challenges that financial institutions and market participants must overcome.

One of the most significant challenges is the complexity of replacing LIBOR in existing contracts, often referred to as “legacy contracts”. These contracts, which can extend beyond 2023, were drafted with LIBOR as the reference rate and often lack adequate provisions for the permanent removal of the benchmark. Modifying these contracts to replace LIBOR with a new rate is an enormous task, both legally and operationally, and raises the potential for legal disputes and market disruption.

The transition also involves the adoption of new risk-free rates (RFRs) that are fundamentally different from LIBOR. Unlike LIBOR, which reflects the credit risk of unsecured interbank lending, RFRs such as the Secured Overnight Financing Rate (SOFR) in the U.S. and the Sterling Overnight Index Average (SONIA) in the UK are nearly risk-free, as they are based on actual transaction data from secure lending markets. This shift from a credit-sensitive rate to a risk-free rate could have significant implications for the pricing and risk management of financial products.

Adding to the complexity is the absence of term structures in the new RFRs. While LIBOR is quoted for different maturities, most RFRs are overnight rates. The development of term rates based on RFRs is still in progress, and until these are widely available and accepted, the transition will remain a challenge.

The impact of the transition extends to various financial sectors and products. From securities, where LIBOR is deeply embedded, to syndicated loans and adjustable-rate mortgages that reference LIBOR, the transition will require significant adjustments. Market participants will need to adapt to new pricing mechanisms, risk management tools, and system changes, all while ensuring minimal disruption to financial markets.

Potential Solutions and Strategies for the Transition

Despite the challenges, the financial world is not walking without a light in this dark transition. Several solutions and strategies are being developed and implemented to navigate the shift from LIBOR. A key part of the solution lies in the development of alternative RFRs.

In the U.S., the Federal Reserve has endorsed the Secured Overnight Financing Rate (SOFR) as the replacement for U.S. dollar LIBOR. SOFR is based on actual transactions in the Treasury repurchase market, making it a more robust and reliable benchmark.

In the UK, the Bank of England has identified the Sterling Overnight Index Average (SONIA) as the preferred alternative to the sterling LIBOR.

These RFRs, along with others being developed around the world, are set to play a pivotal role in the post-LIBOR era.

Another crucial strategy for the transition is the incorporation of robust fallback language in financial contracts. Fallback provisions outline the steps to be taken and the replacement rate to be used if LIBOR ceases to exist. The International Swaps and Derivatives Association (ISDA) has developed a standard fallback protocol, which many market participants have agreed to, providing a clear path for the transition in derivative contracts.

Technology and data also hold the key to managing the transition effectively. Financial institutions are leveraging technology solutions to identify and analyze LIBOR exposure in their contract portfolios. Advanced analytics, fintech solutions and AI are being used to extract and review contractual terms at scale, enabling institutions to manage the transition in a more efficient and risk-controlled manner.

The transition from LIBOR is undoubtedly a complex and challenging process. However, with the right strategies and solutions in place, the financial world can successfully navigate the shift and emerge with a more transparent and robust benchmarking system.

The Impact of the Transition on Global Financial Markets

The ripples of the transition from LIBOR are being felt across global financial markets. This is leading to significant changes and potential disruptions.

One of the most profound impacts is the change in market risk profiles. The shift from LIBOR, a credit-sensitive rate, to nearly risk-free rates changes the dynamics of interest rate risk.

Financial institutions will need to review their risk management strategies. This is because the new rates do not reflect bank credit risk. These rates could also behave differently from LIBOR under various market conditions.

The transition also has a significant effect on interest-rate products and securities. LIBOR is deeply embedded in these markets. Its replacement will require adjustments in pricing, valuation, and risk management of these products. For instance, the shift to SOFR in the U.S. will have effects. It could affect the pricing of interest rate swaps. This is because SOFR tends to be lower than LIBOR due to its nearly risk-free nature.

Moreover, the transition carries the potential for market disruption and legal disputes. The modification of legacy contracts to replace LIBOR could be problematic. It could lead to disagreements over the choice of replacement rate. The adjustment spread might also be a point of contention. This could potentially result in lawsuits. There’s also the risk of market fragmentation. Different jurisdictions or market segments might choose different replacement rates.

The Role of Regulatory Bodies and Financial Institutions in the Transition

Read the full article at: https://dsb.edu.in/understanding-the-challenges-of-moving-from-libor-navigating-the-tides/?utm_source=Tumblr&utm_medium=Tumblr&utm_campaign=Tumblr+LIBOR

#libor#benchmark#uk finance#loans#tech#fintech#india#blockchain#jobs#banking#chatgpt#education#gpt 4#ai#google#investment#altcoin#crypto#defi

0 notes

Text

The Rise of Battery Recycling in India: From Waste to Wealth

In the age of technology, where batteries power everything from our smartphones to our cars, the importance of battery recycling cannot be overstated. As India stands on the verge of an energy revolution, recycling has emerged as a critical component of the country’s sustainable future.

Recycling batteries is the process of converting used batteries into reusable materials, thereby reducing the need for new raw materials and the environmental impact of waste disposal. It’s a practice that not only conserves resources but also prevents old batteries, which can be toxic and made economically useful, instead of ending them in landfill sites.

India, with its huge population and rapidly growing economy, generates a significant amount of battery waste. The rise of electric vehicles and renewable energy storage solutions has further amplified the need for effective battery recycling. Recognizing this, the Indian government has implemented policies and regulations to encourage the proper disposal and recycling of batteries.

The Need for Recycling Batteries

Recycling Batteries is not just a matter of environmental responsibility; it’s a necessity. The improper disposal of batteries can have severe environmental and economic implications.

Environmental Impact of Improper Battery Disposal

Batteries contain a variety of heavy metals and toxic chemicals, including lead, mercury, cadmium, and lithium. When disposed of improperly, these substances can leak into the soil and water, causing significant environmental harm. This contamination can disrupt ecosystems, harm wildlife, and even pose risks to human health through the contamination of food and water supplies.

Moreover, the improper disposal of batteries contributes to the growing problem of electronic waste, or e-waste. E-waste is one of the fastest-growing waste streams globally, posing a significant challenge for waste management and leading to the loss of valuable resources that could be recovered and reused.

Economic Benefits of Battery Recycling

On the other side, recycling batteries offers substantial economic benefits. The process of recycling recovers valuable materials like lead, nickel, and lithium, which can be reused to manufacture new batteries or other products. This reduces the demand for new and unused materials, leading to cost savings and a lower environmental footprint.

In addition, the battery recycling industry can create jobs and stimulate economic growth. As the demand for batteries continues to rise, particularly with the growth of electric vehicles and renewable energy storage, so does the potential for a thriving battery recycling industry.

In India, the battery recycling sector is still in its infant stages, but it holds immense potential. With the right policies and infrastructure, battery recycling can become a significant industry, contributing to India’s economy while helping to address environmental challenges.

The journey of recycling batteries in India can be a fascinating tale of turning waste into wealth. It can build a story of how a country can leverage policy, technology, and entrepreneurship to transform a challenge into an opportunity.

Indian Government’s Policy on Battery Recycling

Recognizing the importance of recycling batteries, the Indian government has implemented a series of policies and regulations aimed at promoting responsible battery disposal and recycling.

Overview of the Battery Waste Management Rules 2022

Battery Waste Management Rules 2022 replaces the earlier Battery Management and Handling Rules 2001, providing a unified structure for the management of battery waste in India. They cover all types of batteries and apply to manufacturers, importers, assemblers, re-conditioners, consumers, and recyclers.

The 2022 rules introduce several significant changes, including stricter Extended Producer Responsibility (EPR) obligations, a focus on environmentally sound management of battery waste, and provisions for the formalization of the informal battery recycling sector.

Role of Extended Producer Responsibility (EPR)

Extended Producer Responsibility (EPR) is a policy approach under which producers are given significant responsibility for the treatment or disposal of post-consumer products.

Under the Battery Waste Management Rules 2022, producers are required to ensure that used batteries are collected and sent for recycling in an environmentally sound manner. They are also required to create awareness among consumers about the importance of proper battery disposal.

Government’s Initiatives to Promote Battery Recycling

The Indian government has launched several awareness campaigns, incentives for battery recycling businesses, and research and development programs to improve battery recycling technologies.

Furthermore, the government is also working to strengthen the infrastructure for battery collection and recycling and to formalize the informal battery recycling sector, which currently handles a significant portion of battery waste in India.

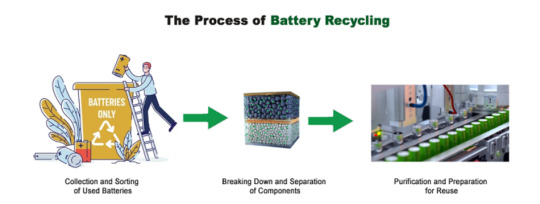

The Process of Recycling Batteries

Recycling Batteries is a complex process that involves several stages, each of which plays a crucial role in transforming used batteries into reusable materials. Here’s a closer look at how it works:

Collection and Sorting of Used Batteries

The first step in the recycling process is the collection of used batteries. This can be done through various means, including collection boxes at retail stores, community recycling events, and dedicated battery recycling facilities.

Once the batteries are collected, they are sorted based on their chemistry. Different types of batteries such as lead-acid, nickel-cadmium, and lithium-ion require different recycling processes, so accurate sorting is crucial.

Breaking Down and Separation of Components

After sorting, the batteries are broken down, often through a process called mechanical treatment. This involves crushing the batteries into small pieces, which makes it easier to separate the different components.

The crushed batteries are then separated into different streams. For example, in the case of lead-acid batteries, the lead and plastic components are separated from the electrolyte.

Purification and Preparation for Reuse

The separated materials then undergo further treatment to purify them and prepare them for reuse. This can involve a variety of processes, depending on the type of material.

For example, lead from lead-acid batteries is often smelted and refined to remove impurities, after which it can be used to manufacture new batteries. Similarly, plastic components can be cleaned and converted into pellets for use in new plastic products.

The recycling process not only recovers valuable materials from used batteries but also ensures that potentially harmful substances are managed in an environmentally sound manner.

The Business of Battery Recycling in India

Current State of Battery Recycling Industry in India

As the demand for batteries continues to grow, so does the potential for a thriving battery recycling industry. The Industry of recycling batteries in India is still in its infancy stages, but it’s growing rapidly.

Currently, the industry is dominated by the unorganized sector, which handles a significant portion of battery waste. However, as the market grows, more and more companies will enter the market and invest in advanced recycling technologies.

Major Companies Involved in Recycling Batteries

Several companies are leading the way in recycling batteries in India. These include Gravita India Ltd., a leading lead recycling company, and Attero Recycling, which specialises in e-waste management and recycles various types of batteries. Other players include Ecoreco, which offers solutions for e-waste and battery waste management, and Exigo Recycling, which provides recycling services for electronic waste, including batteries.

Opportunities and Challenges in the Battery Recycling Business

Read the full article at: https://dsb.edu.in/the-rise-of-battery-recycling-in-india-from-waste-to-wealth/?utm_source=tumblr&utm_medium=tumblr&utm_campaign=tumblr+battery+recycling

#waste management#battery#recycling#battery recycling market trend#battery recycling#ai#india#blockchain#fintech#jobs#education#google

0 notes

Text

Decentralized Finance (DeFi): The Future of Fintech

Imagine a world where financial transactions are not governed by centralized banks or intermediaries but are instead managed by a network of individuals. This is the world of Decentralized Finance, or DeFi, a revolutionary concept that is poised to reshape the fintech industry. By leveraging blockchain technology and cryptocurrencies, DeFi offers a new way of conducting financial transactions, from loans to insurance, all transacted directly between individuals.

Understanding DeFi: The New Way of Finance

At its core, DeFi is built on blockchain technology, a decentralized, distributed public ledger where financial transactions are recorded in computer code. This technology enables peer-to-peer transactions, effectively eliminating the need for middlemen such as banks or brokers.

In the DeFi landscape, individuals can lend, borrow, trade, and invest directly with each other.

For instance, instead of depositing savings in a bank that lends it out at a higher interest rate, individuals can lend their savings directly to others, earning the full interest return. This democratization of finance is one of the key advantages of DeFi over traditional finance.

Moreover, DeFi applications, often referred to as “dApps” or protocols, are already being used in a variety of ways. From facilitating traditional financial transactions like payments, trading securities, and insurance, to more complex operations like yield harvesting and flash loans, DeFi is making its mark in the financial world.

DeFi vs Banks: A New Financial Landscape

The rise of DeFi naturally raises questions about the future of traditional banks. Will DeFi replace banks? The answer is complex.

DeFi has the potential to offer many services currently provided by banks but in a more transparent and accessible way. However, it’s unlikely to completely replace traditional banking, especially in the short term, due to regulatory, security, and adoption challenges.

Likewise, DeFi is undoubtedly shaping the future of fintech. By offering a more inclusive financial system, it’s paving the way for a new financial landscape where anyone with internet access can participate in financial services, regardless of their location.

The Risks and Challenges of Decentralized Finance (DeFi)

Despite its potential, DeFi is not without risks and challenges. One of the main concerns is regulation. As a relatively new field, DeFi operates in a regulatory grey area. Will it be banned or regulated? This remains to be seen, but it’s clear that regulatory bodies are taking a closer look at DeFi.

Another concern is the risk of scams and hacks. While blockchain technology is secure, other aspects of DeFi, such as smart contracts, are vulnerable to attacks. Furthermore, the high collateral requirements for DeFi loans can limit accessibility, contradicting one of DeFi’s main advantages.

The Potential Impact of Decentralized Finance (DeFi)

Despite these challenges, the potential impact of DeFi is significant. By democratizing access to financial services, DeFi could change the world. It’s not just about financial inclusion, it’s also about empowering individuals and institutions.

For institutions, DeFi can offer a new way to manage financial transactions, reducing costs and increasing efficiency. For individuals, DeFi can provide access to financial services that were previously out of reach, especially for those in unbanked or underbanked regions.

Read the full article at: https://dsb.edu.in/decentralized-finance-defi-the-future-of-fintech/?utm_source=tumblr&utm_medium=tumblr&utm_campaign=tumblr+defi

#defi#decentralized finance#ai#india#blockchain#fintech#jobs#banking#chatgpt#education#google#gpt 4#crypto

0 notes

Text

The U.S. Debt Ceiling and Its Global Implications

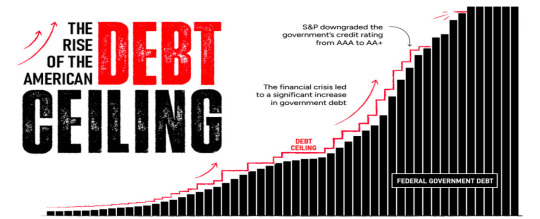

Every country’s financial structure houses various integral concepts that dictate its economic narrative. One such pivotal yet complex concept is the ‘debt ceiling.’ Frequently appearing in U.S. financial news, the term ‘debt ceiling’ refers to the maximum limit set by Congress on the amount of national debt that the U.S. government can accrue to meet its financial obligations. The term ‘ceiling’ signifies a limit beyond which the national debt cannot extend.

What is the Debt Ceiling

The debt ceiling functions as a regulatory limit on the amount of national debt the U.S. Treasury can accrue to pay for the expenditures that Congress has already approved. It acts as a checkpoint to monitor and control government spending.

Over the past century, the debt ceiling has been raised or suspended multiple times, each change reflecting the evolving realities and necessities of government spending and borrowing. It’s an interesting dance between policy, spending, and repayment, and an essential cog in the wheel of U.S. financial mechanisms.

Why is the U.S. in Debt and Unable to Repay It?

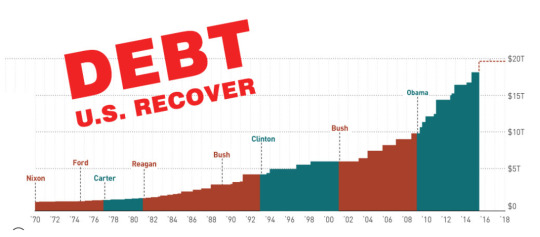

Over the years, the U.S. has built up a colossal national debt, a daunting figure that’s largely the outcome of varied factors such as heavy government spending, enduring economic crises like the 2008 financial meltdown, the COVID-19 pandemic, and certain tax policies that have influenced the debt scenario.

The complex challenge of repaying this debt is deeply intertwined with the global economic structure’s complexities. While it’s easy to assume that the trade deficit, characterized by a higher import volume than export, contributes to the debt, it doesn’t directly add to the national debt. However, it does play a role in influencing the overall economic health of the nation and indirectly impacts the debt situation.

But, what are the reasons that the U.S. has hit the debt ceiling and is not able to overcome it?

Government Spending: The U.S. government spends substantially on various programs such as defence, healthcare, social security, and interest payments on the national debt. This spending often exceeds the government’s revenues, resulting in a deficit that adds to the national debt.

Economic Crises: Economic downturns often necessitate increased government spending to stimulate the economy and provide relief.

Tax Policies: Tax policies also play a role in the debt scenario. Tax cuts, while potentially stimulating economic growth, can decrease government revenue, thus increasing the deficit if not accompanied by corresponding reductions in government spending.

Interest Payments: As the national debt grows, so does the interest the government must pay on that debt. These interest payments can become a significant part of the budget, leaving less room for other spending priorities and creating a cycle that can cause the debt to grow even further.

Managing and repaying the U.S. debt is a complex issue that involves a careful balance of government spending and revenue, fiscal policy decisions, and managing the country’s economy in the context of a global economic system.

The Size and Scope of U.S. Debt

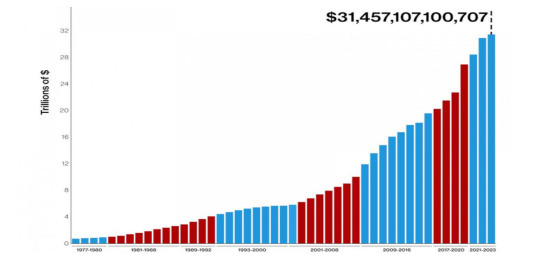

As of 2023, the U.S. national debt stands at a staggering $31.4 trillion, earning the country the status of being the world’s largest debtor.

Where Does the U.S. Borrow From?

The United States acquires debt by issuing Treasury securities like Treasury bonds, notes, and bills. These financial instruments are bought by a wide array of investors, including individuals, corporations, and foreign governments.

Who Are Its Biggest Lenders?

The U.S.’s most substantial debt holders on the international front are Japan and China. Other countries, including the United Kingdom, Brazil, and Ireland, also hold significant portions of U.S. debt. The United States owes Japan approximately $1.28 trillion, while China holds around $1.06 trillion of U.S. debt. The amounts owed to other lenders vary, typically falling into the range of billions of dollars.

Consequences of Hitting the Debt Ceiling

The U.S. hitting its debt ceiling can have significant global implications due to the interconnectedness of today’s global economy.

Here are some potential global consequences:

Impact on Global Markets: The U.S. Treasury market is the largest and most liquid bond market in the world. If the U.S. defaults on its debt obligations, it could cause widespread volatility in global markets. Investors, both domestic and foreign, might start doubting the creditworthiness of the U.S., causing a sell-off of U.S. Treasury securities that could disrupt financial markets worldwide.

Currency Fluctuations: The U.S. dollar is the world’s primary reserve currency, meaning many countries hold it in large quantities to carry out international trade. A U.S. debt default could weaken the dollar, leading to currency fluctuations and economic instability globally.

Global Economic Slowdown: The U.S. economy plays a vital role in driving global growth. Any economic disruption in the U.S., like a recession triggered by a debt default, could have a domino effect on the world economy, potentially leading to a global economic slowdown or recession.

Impact on Foreign Debt Holders: Countries like China and Japan, which hold significant amounts of U.S. debt, could face losses if the U.S. were to default. This could impact their economic stability.

Reduced Confidence in Global Financial System: The U.S. is seen as a global economic leader, and its debt is considered one of the safest investments. A debt default could shake confidence in the global financial system, leading to economic uncertainty and reduced investment.

Potential for Increased Borrowing Costs: If a U.S. default leads to a downgrade in its credit rating, borrowing costs for the U.S. could increase, which could then impact borrowing costs globally. This could make it more expensive for governments, businesses, and individuals worldwide to borrow money.

Here are some potential individual consequences:

In short, the U.S. hitting its debt ceiling and potentially defaulting on its debt repayments could have serious, far-reaching consequences for the global economy. It highlights the need for prudent fiscal policy not only for the U.S. but for economies around the globe. But, what will the citizens of the U.S. face because of hitting its debt ceiling?

The wrangling over the debt ceiling can create economic uncertainty, negatively impacting consumer and business confidence. This can lead to reduced business investments, job cuts, and slower economic growth.

The government might have to make tough choices about which bills to pay. This could put programs like Social Security, Medicare, and military pensions at risk, directly affecting the citizens dependent on these programs.

The uncertainty and the potential for increased government borrowing costs can trickle down to the public in the form of higher interest rates for mortgages, auto loans, student loans, and credit cards.

The debate and uncertainty surrounding the debt ceiling often lead to stock market volatility. This can affect the retirement savings and investment portfolios of everyday Americans.

The Domino Effect: Recession and Layoffs

The repercussions of the U.S. hitting its debt ceiling can go far beyond its own borders, owing to the country’s significant role in the global economy. A notable concern is the potential for a worldwide economic recession and the dreaded consequence – mass layoffs.

As the keystone of global markets, the U.S. economy’s health directly influences financial currents worldwide.

Imagine this: the U.S., unable to lift its debt ceiling, defaults on its debt. This scenario would unsettle financial markets and could seriously undermine investors’ confidence. The ensuing decline in investments can ripple through economies, leading businesses to scale back or shut down, manifesting the dire reality of layoffs.

A U.S. default could also send shockwaves through economies heavily reliant on exporting to the U.S. A debt default could trigger a contraction in the U.S. economy, causing a slump in demand for imports. As a result, these export-dependent economies may see their growth slow down, potentially leading to job cuts in various sectors.

A U.S. debt default could create a ripple effect in global interest rates. As investors’ confidence shakes, they may demand higher returns to compensate for the increased risk, causing a surge in global interest rates. This increase in borrowing costs can hurt businesses and households, leading to a decline in spending, further slowing economic growth, and potentially driving more layoffs.

How Will the U.S. Recover from This Debt?

Recovering from such an overwhelming amount of debt is a long-term and complex process. It requires the implementation of severe cost-cutting measures, comprehensive tax reforms, and strategies to stimulate economic growth.

An integral part of this process is maintaining fiscal discipline to prevent uncontrolled debt accumulation. However, these measures must be carefully balanced to ensure that they don’t hinder economic growth or place an unfair burden on the nation’s citizens.

Read more at: https://dsb.edu.in/the-us-debt-ceiling-and-its-global-implications/?utm_source=tumblr&utm_medium=tumblr&utm_campaign=tumblr+us+debt

#USDebtCeiling#GlobalImplications#EconomicImpact#FinancialMarkets#USFiscalPolicy#DebtCrisis#EconomicOutlook#FinancialStability#GovernmentShutdown#GlobalEconomy#USDollar#TradeTensions#MonetaryPolicy#BudgetDeficit#EconomicForecast#india#fintech#jobs#banking#education#google#ai#blockchain

0 notes

Text

Data Protection Bill: Safeguarding Your Digital Identity

In the digital age, data has become the new currency. Every click, every scroll, every search, every online purchase, and every social media post contributes to the vast ocean of data that defines our digital identity. Data Protection Bill safeguards this identity of yours as with the growth of these digital platforms and services, we are sharing more personal data online than ever before. This data can be a gold mine for businesses, offering insights into consumer behaviour and preferences. However, it can also be a source of vulnerability if not appropriately protected, leading to data breaches that can have devastating consequences. This is where the data protection bill comes into the picture.

Data protection refers to the practices, safeguards, and rules put in place to protect your personal information. It’s about respecting an individual’s rights to privacy and ensuring that data is collected, stored, used, and shared in ways that comply with the law and ethical standards. It’s about giving individuals control over their personal information and ensuring that organizations are transparent about how they use this data.

The Evolution of Data Protection Laws in India

India’s journey towards data protection laws has been a dynamic one, marked by significant developments and shifts.

The Introduction of the Bill, 2019

The Data Protection Bill 2019 was a landmark proposal that aimed to set up a unified system for data protection in India. It was designed to address the growing concerns around data privacy and security in the digital age. The bill proposed strict rules for the collection, storage, and processing of personal data, and laid out penalties for violations.

However, the bill also sparked considerable debate. Critics argued that it will give excessive powers to the government, potentially undermining the very rights it sought to protect.

The Withdrawal of the Bill, 2021

In response to the concerns, the bill was withdrawn. This decision was driven by the need to strike a balance between protecting individual privacy, fostering innovation, and ensuring national security. The withdrawal provided an opportunity for further deliberation and consultation, allowing for a more nuanced approach to the complex issue of data protection.

The Data Protection Bill, 2022

The Data Protection Bill 2022 marked a significant step forward in India’s data protection journey. The new bill addressed many of the concerns raised about the 2019 proposal, offering a more balanced approach to data protection.

Key features of the 2022 bill include:

Consent-based data processing: The bill emphasizes the need for explicit consent for data processing, empowering individuals to have greater control over their personal data.

Data localization: The bill mandates that certain types of data must be stored within India while allowing for the transfer of other data under specific conditions.

Data Protection Authority: The bill proposes the establishment of a Data Protection Authority to enforce and regulate data protection laws.

Penalties for violations: The bill includes provisions for hefty fines and penalties for violations, acting as a deterrent for misuse of personal data.

The Impact of the Bill on Various Sectors

The Data Protection Bill’s impact will be felt across various sectors, from small businesses to multinational corporations, and even from traditional industries to digital platforms.

For businesses, especially those that handle large volumes of personal data will need to ensure that their data-handling practices align with the new regulations, which could involve revamping existing systems and processes.

Social media giants and data-holding companies will be the most impacted as they rely heavily on user data for their operations, and will need to implement robust data protection measures. They’d also need to be transparent about their data practices and ensure that they obtain explicit consent from users before collecting and processing their data.

The bill also introduces stiff penalties for non-compliance, which adds an additional layer of accountability. Businesses will need to take data protection seriously or risk facing hefty fines and damage to their reputation.

The Data Protection Bill is not just for tech companies or businesses in the digital space. It applies to all industries and practices that handle personal data, from healthcare and finance to education and retail. This means that all organizations, regardless of their size or sector, will need to comply with the Bill.

Micro and Macro Perspectives on the Bill

The Data Protection Bill operates on both micro and macro scales, providing a dynamic framework for data protection that caters to individual privacy rights and broader societal needs.

Micro-Level Safeguards

The Data Protection Bill empowers individuals by giving them control over their personal data. It mandates that organizations must obtain explicit consent before collecting and processing personal data.

Individuals will have the right to know why their data is being collected, how it will be used, and who it will be shared with. This bill also provides individuals with the right to access their data, correct inaccuracies, and even request deletion in certain circumstances.

These provisions ensure that individuals are not just passive subjects in the data economy, but active participants with rights and agency.

Macro-Level Safeguards

The Data Protection Bill protects society by setting standards for data handling practices and holding organizations accountable for non-compliance.

It mandates that organizations must implement appropriate safeguards to protect personal data from unauthorized access, disclosure, alteration, and destruction.

The Bill also establishes a Data Protection Authority to oversee and enforce data protection laws. This independent body will have the power to investigate violations, impose penalties, and issue guidelines to promote compliance.

Furthermore, the Act includes provisions for data localization, which require certain types of data to be stored within India. This not only enhances data security but also supports law enforcement and national security efforts.

Data Protection Bill vs. Personal Data Protection Bill

While the terms “Data Protection Bill” and “Personal Data Protection Bill” might seem interchangeable, they represent distinct legislative proposals.

The Data Protection Bill is a comprehensive piece of legislation aimed at safeguarding personal data and regulating its processing. It covers a broad spectrum of data, from personal to sensitive and critical information, and applies to both government and private entities.

On the other hand, the Personal Data Protection Bill is a specific proposal that focuses on the protection of personal data. It emphasizes individual consent, data privacy, and the rights of data subjects. It also proposes the establishment of a Data Protection Authority to oversee and enforce data protection laws.

Embracing the Future of Data Protection

It’s clear that this bill represents a significant milestone in India’s digital journey. The Bill is not just about safeguarding personal data; it’s about fostering trust, promoting transparency, and ensuring that the digital economy is built on a foundation of respect for individual privacy.

The importance of the Data Protection Bill cannot be overstated. In an era where data has become the new currency, protecting personal data

Read more at: https://dsb.edu.in/data-protection-bill-safeguarding-your-digital-identity/?utm_source=tumblr&utm_medium=tumblr&utm_campaign=tumblr+data+protection

#ai#india#blockchain#fintech#chatgpt#jobs#banking#education#google#gpt 4#edtech#data protection#data curation

0 notes

Text

The Role of Vostro Accounts in Facilitating Rupee Trade

In the world of international finance, certain terms and concepts stand out for their significance and impact. Vostro Account is one such term. Originating from the Latin words for ‘yours’, this term refers to accounts held by one bank with another, facilitating international trade and financial transactions. But how does it facilitate the Rupee trade?

Understanding Vostro Accounts

A Vostro account is an account held by a domestic bank on behalf of a foreign bank in the domestic bank’s currency. It enables the foreign bank to access local banking services and conduct transactions in the domestic currency without the need for a physical presence outside its home country. For example, when Bank A from the United States opens an account with Bank B in India, it’s called a Vostro account. Bank A can utilize this account to conduct business and transactions in Indian Rupees, the local currency of Bank B.