#InvestmentRisk

Text

Abstract:Uncover the alarming concerns surrounding Alfa Capital Invest, from its regulatory evasion to its elusive website, signaling high risks for investors. This analysis serves as a stark warning to conduct thorough checks with tools like WikiFX, safeguarding against deceitful brokerage practices.

0 notes

Video

youtube

Manta Network (MANTA) Coin Will Be Listed on BingX Spot

📈 #MantaNetwork #MantaListing #CryptocurrencyTrading #BingXSpot #MANTAUSDT #CryptoExchange #InvestmentRisk #HighVolatility #MarketUncertainty #RegisterNow

#youtube#MantaNetwork#MantaListing#cryptocurrencytrading#bingx#BingXSpot#MANTAUSDT#cryptoexchange#investmentrisk#investment risks#highvolatility#marketuncertainty#registernow

0 notes

Text

Mastering Risk Management: A Guide for Smart Investing

Investing can be exhilarating, but it’s not without its share of risks. Smart investors know that managing these risks is the key to long-term success. In this article, we’ll explore the art of risk management in investing and provide you with strategies to make more informed and secure investment decisions.

Understanding Investment Risks

Before we dive into risk management strategies, it’s…

View On WordPress

0 notes

Text

Evaluating the Risk in Your Investment Portfolio

Do you ever find yourself wondering how much risk is in your investment portfolio and how to effectively manage it? It’s a common concern among investors, regardless of their experience level. Understanding and assessing the risk associated with your investment portfolio is crucial for achieving your financial goals. So, how can you evaluate the risk in your investment portfolio? Let’s dive…

View On WordPress

0 notes

Text

Banks are disappearing

Cryptocurrency lending is a form of lending that frees you from the constraints of the traditional financial system, without the need for complicated paperwork or strict lending terms. It's called decentralized finance (DeFi), and it gives you the opportunity to earn higher interest rates than banks. You can also customize your interest rate based on the length of the loan, the amount you borrow, the type of cryptocurrency, the amount of collateral, and more. However, like investing, crypto lending is risky and requires careful consideration💰💡

0 notes

Text

While investing, one comes across many myths that are intuitive, intriguing, at times scary, and often promising. Through this unit of Myth vs Fact, we aim at spreading substantial facts and thus making our investors wise and informed.

https://web-link.co/5g19u

#mutualfunds#udyaminvestments#investment#udyamitsallaboutmutualfunds#investmentawareness#mutualfundssahihai#assetallocation#investmentrisk

0 notes

Text

Uncover the Best P2P Lending Platform in India To Earn Interest

I've recently immersed myself in the world of Peer-to-Peer (P2P) lending and boy, it's a game changer! Experts say it's a disruptive innovation in the finance sector, and I couldn't agree more. It's like a bridge connecting lenders and borrowers without the usual banking red tape. Talk about convenience! Plus, for those of us who like to venture into new investment avenues, P2P lending offers an opportunity to diversify our portfolios, spreading investments across multiple loans to balance out risks.

What's more? The returns are pretty attractive, often beating traditional savings accounts. I mean, who doesn't want their money to work harder? But, like everything else, it's not without its risks. If a borrower defaults, you might not get your money back. Yet, I believe the key is to be informed and cautious. Learn from others' experiences, monitor those Non-Performing Assets, and diversify, diversify, diversify!

With P2P lending, even people with limited credit history or lower credit scores have an alternative source of credit. That's financial inclusion right there! I've only scratched the surface here, but I'm excited to learn more about this financial frontier. If you're on a similar journey, let's connect and exchange notes!

#P2PLending#InvestmentDiversification#AttractiveReturns#InvestmentRisks#FinancialInclusion#P2PLendingCommunity#students#fresherblog#college#college life#desiblr

0 notes

Text

Don't be fooled by the hype surrounding IPOs - remember that there are risks involved in investing in early-stage companies. #InvestmentRisk

Reach out to one of our advisors today and take control of your financial future!

Phone: +(852) 3002 2737

Email: [email protected]

0 notes

Text

Retail investors can potentially benefit from the growth of a successful IPO, but it's important to remember that there are risks involved. Make sure to carefully evaluate the company's financials and market position before investing. #InvestmentRisk

Speak to a Canox professional today 📞

+852 3521 6737

0 notes

Text

Abstract:CFTC charges Technical Trading Team, LLC and top executives for a $5 million forex scheme. Accused of fraud, misleading investors, and unregistered operations, TTT's case highlights the risks in forex investments and the importance of regulatory oversight.

0 notes

Text

Building a Diversified Investment Portfolio

Achieve Your Financial Goals with a Well-Structured Diversified Investment Portfolio

By Amir Shayan

Investing is a journey, and like any journey, the path you take can greatly influence your destination. Whether you're planning for retirement, looking to grow your wealth, or saving for a major life goal, building a diversified investment portfolio is a strategy that can help you achieve your financial objectives with greater confidence and lower risk.

In this comprehensive guide, we will explore the concept of portfolio diversification, why it's essential, and how to go about constructing a diversified investment portfolio that aligns with your financial goals and risk tolerance.

Understanding Portfolio Diversification

Diversification Defined

Diversification is a risk management strategy that involves spreading your investments across various asset classes, industries, geographic regions, and individual securities. The primary goal is to reduce the overall risk of your portfolio by not putting all your eggs in one basket.

The Rationale Behind Diversification

The rationale for diversification is rooted in the principle that different assets behave differently under various market conditions. By holding a mix of assets with non-correlated or negatively correlated returns, the hope is that when some investments are underperforming, others will offset those losses, thereby creating a more stable overall portfolio.

Types of Assets for Diversification

- Stocks: Shares in companies that represent ownership. They are known for their potential for high returns but also come with higher risk.

- Bonds: Debt securities issued by governments, municipalities, or corporations. Bonds offer income in the form of interest payments and are generally considered lower risk than stocks.

- Real Estate: Physical properties or real estate investment trusts (REITs) that provide exposure to the real estate market.

- Cash and Cash Equivalents: Highly liquid assets such as money market funds and Treasury bills, often used as a safe haven.

- Commodities: Physical goods such as gold, oil, and agricultural products. These can act as hedges against inflation and provide portfolio diversification.

- Alternative Investments: These include hedge funds, private equity, and venture capital. They are less conventional than traditional assets and often have low correlations with stocks and bonds.

The Benefits of Portfolio Diversification

Risk Reduction

The primary benefit of diversification is risk reduction. When one asset class experiences a downturn, others may remain stable or even appreciate in value. This helps cushion the impact of losses and lowers the overall risk of your portfolio.

Enhanced Consistency

Diversified portfolios tend to exhibit more consistent performance over time. While they may not achieve the highest returns during bull markets, they are better positioned to weather market downturns and provide more predictable outcomes.

Improved Risk-Return Profile

Diversification allows you to pursue a target rate of return while taking on less risk. By balancing assets with different risk profiles, you can seek to optimize the risk-return trade-off that aligns with your investment goals.

Reduced Emotional Stress

Investors often experience anxiety and make impulsive decisions during market turbulence. Diversification can help reduce emotional stress by providing a sense of stability during market fluctuations.

Potential for Long-Term Growth

A well-diversified portfolio has the potential for long-term growth. Over time, it can generate compounding returns that accumulate and work in your favor.

Constructing a Diversified Investment Portfolio

Assess Your Financial Goals and Risk Tolerance

Before constructing your portfolio, it's crucial to define your financial goals and assess your risk tolerance. Are you investing for retirement, a major purchase, or wealth preservation? Understanding your objectives will guide your asset allocation decisions.

Risk tolerance refers to your ability and willingness to endure fluctuations in the value of your investments. It's influenced by factors such as your age, investment time horizon, financial capacity, and emotional temperament.

Determine Your Asset Allocation

Asset allocation is the process of deciding how to distribute your investments among various asset classes. It's a critical step in building a diversified portfolio. Common asset classes include stocks, bonds, real estate, cash, commodities, and alternatives.

The right asset allocation for you depends on your financial goals and risk tolerance. Generally, a more extended investment horizon and a higher risk tolerance may lead to a higher allocation to stocks, which historically offer higher returns but also greater volatility.

Choose Investments Within Each Asset Class

Once you've determined your asset allocation, the next step is to select specific investments within each asset class. For example, within the stock portion of your portfolio, you can choose individual stocks or opt for mutual funds and exchange-traded funds (ETFs) that provide exposure to various stocks.

Diversify Within Asset Classes

Diversification doesn't stop at the asset class level. It extends to diversifying within each asset class. For stocks, this can mean investing in different industries, geographic regions, and market capitalizations. For bonds, it can involve varying maturities and credit qualities.

Consider Tax Efficiency

Tax efficiency is an often overlooked aspect of portfolio construction. Different types of accounts, such as traditional IRAs, Roth IRAs, and taxable brokerage accounts, have varying tax implications. It's essential to consider tax-efficient placement of your investments to minimize the tax impact on your returns.

For example, tax-inefficient investments, like bonds with regular interest payments, may be better placed in tax-advantaged accounts. Meanwhile, tax-efficient investments, like stocks held for the long term, may be more suitable for taxable accounts.

Monitor and Rebalance Your Portfolio

Building a diversified portfolio is not a one-time task; it requires ongoing maintenance. As market conditions change, your asset allocation may drift away from your target. Periodic monitoring and rebalancing ensure that your portfolio stays aligned with your goals and risk tolerance.

Rebalancing involves selling investments that have exceeded their target allocation and reinvesting the proceeds into assets that have fallen below their target. This process helps you maintain your desired level of diversification.

Stay Informed and Seek Professional Advice

The investment landscape is dynamic, and staying informed is essential. Economic conditions, market trends, and individual investments can change over time. Consider keeping up with financial news, reading investment literature, and seeking advice from financial professionals when needed.

Pitfalls to Avoid

While diversification is a powerful strategy, there are common pitfalls to be aware of:

Over-Diversification

While diversification is beneficial, over-diversification can dilute the potential for meaningful returns. Having too many investments can lead to complexity, increased trading costs, and difficulty in monitoring your portfolio.

Neglecting Individual Investment Quality

Diversification should not come at the expense of individual investment quality. Be selective when choosing investments, and focus on those with strong fundamentals and growth potential.

Emotional Decision-Making

Even with a diversified portfolio, emotional decision-making can lead to impulsive actions during market volatility. Stick to your long-term plan and avoid making decisions based on fear or greed.

Failing to Rebalance

Neglecting to rebalance your portfolio can lead to unintended drifts in your asset allocation. Regularly assess your portfolio and make necessary adjustments.

Conclusion

Building a diversified investment portfolio is a foundational step in achieving your financial goals. By spreading your investments across different asset classes and within those classes, you can reduce risk, enhance consistency, and improve your overall risk-return profile. Remember to align your portfolio with your financial objectives, regularly monitor and rebalance it, and stay informed about market developments. While diversification can't eliminate all investment risks, it remains one of the most effective tools for managing them, helping you navigate the path to financial success with confidence.

Read the full article

#assetallocation#bonds#Diversifiedportfolio#financialgoals#Investmentplanning#investmentrisk#investmentstrategies#portfoliodiversification#realestate#Riskmanagement#Stockmarket

0 notes

Video

youtube

dogwifhat (WIF) Coin Will Be Listed on BingX Spot: An Exciting Addition to the Cryptocurrency Market

#cryptocurrency #BingXSpot #WIFcoin #tradingpair #investmentrisks #marketvolatility #cryptotrends #risktolerance #officialchannels #complianceandregulations

#youtube#cryptocurrency#bingxspot#WIFcoin#tradingpair#investmentrisks#investment risks#marketvolatility#cryptotrends#crypto trends#risktolerance#risk tolerance#officialchannels#complianceandregulations

0 notes

Link

0 notes

Photo

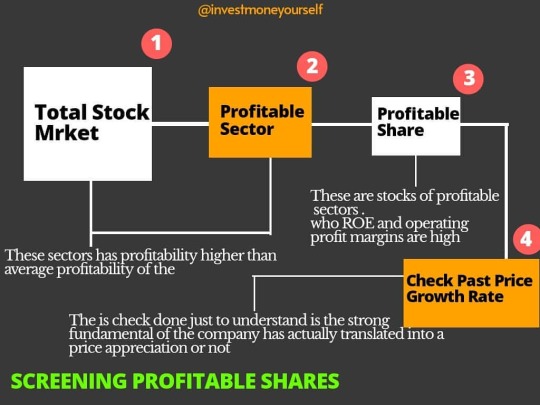

To identify profitable shares, we will use the below steps: Profitability of Stock Market: In this step we will try to estimate the average profitability of the whole Indian stock market. How to do it? We’ll pick all stocks listed in S&P BSE-500 Index. Average ROE and Operating profit margin of all these stocks will give us an approximate idea of the profitability of Indian stock market. Read more about what is share market. Profitability of Sectors: In this step we will pick those sectors, whose average profitability is more than the average profitability of the total market. These will be our ‘most profitable sectors’. Know about stock’s having high weightage in Sensex Nifty. Profitable Shares: Among the profitable sectors, we will individually check all their stocks. The stocks which will display high operating profit margin, and high ROE will be those stocks which we will tag as ‘inherently profitable shares’. How to use RoCE and ROE to identify profitability. Price Growth: This is the final step. The list of stocks which we will tag as inherently profitable, on these stocks we will do one more check. We will check their past price growth rates. This will be done just to understand if the strong fundamentals of the company has actually translated into price appreciation or not. Read more about highest return stocks in last 10 years. I’ve implemented the above 4 steps and identified few Indian stocks which looks inherently profitable. Hashtag: #enterpreneurlife #enterpreneurlifesyle #sharemarket #enterpreneurlifesyle #gravveyy #investmentrisk #invest101 #invest #accounting (at New Delhi, India) https://www.instagram.com/p/CCGDcdpnsUu/?igshid=7wkgebm3oaj5

#enterpreneurlife#enterpreneurlifesyle#sharemarket#gravveyy#investmentrisk#invest101#invest#accounting

0 notes

Photo

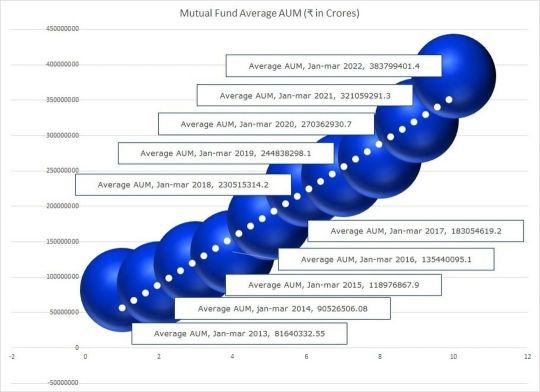

म्युच्युअल फंडांची वाढ ही वेगाने होत आहे. गेल्या १० वर्षात ही वाढ पाच पट झाली आहे. याच काळात आपल्या सहकार्याने उद्यमची वाढ देखील १० पटीने झाली आहे. याचा अर्थ असा की म्युच्युअल फंडातील गुंतवणुकीचा गुंतवणूकदारांना चांगला परतावा मिळत आहे. नुकतीच गुंतवणुक केलेल्या गुंतवणूकदारांना मात्र गुंतवणुकीत काहीशी घट दिसू शकते. परंतु घातलेले पैसे पूर्णपणे बुडाले असे मात्र कोणत्याच म्युच्युअल फंड गुंतवणूकदारा बाबत झालेले नाही. सध्या गुंतवणूकदारांचा कल सिप (sip) करण्याकडे वाढलेला आहे. अर्थात त्याला कारण म्हणजे अनेक गुंतवणूकदार आजकाल आर्थिक उद्दिष्टे ठरवितात. ही उद्दिष्टे सध्या करण्यासाठी सिपचा खुप उपयोग होतो. या काळात असेही दिसून आले की नियोजित रीतीने पैसे काढणे (swp) ही गुंतवणुकदारासाठी अत्यंत उपयोगी सुविधा आहे. ही सुविधा वापरल्याने करदायित्व देखील कमी होते. सेबी (SEBI) ऍ्मफी (AMFI) आदि संस्थांचे म्युच्युअल फंडांवर लक्ष असते. त्यांनी केलेल्या सुधारणांमुळे म्युच्युअल फंड गुंतवणुकदाराची सुरक्षितता खूपच वाढली आहे. आजकाल म्युच्युअल फंड योजना या वेगवेगळ्या वर्गात विभागल्या गेल्या आहेत. या मुळे आर्थिक उद्दिष्टा साठी योग्य योजना निवडणे सोपे झाले आहे. आपल्या म्युच्युअल फंड गुंतवणुक प्रवासात वाटचालीसाठी आपण आमची सहाय्यक म्हणून निवड केलीत त्यासाठी धन्यवाद. आपली गुंतवणुक वाटचाल सुखादायी व्हावी हा आमचा कायम प्रयत्न असतो. कृपया खालील फॉर्म भरून द्यावा. https://forms.office.com/r/Z5gFwxZx1A म्युचुअल फंडात केलेली गुंतवणूक ही बाजाराच्या अधीन असते. मागील कामगिरी तशीच राहील अथवा राहणार नाही. गुंतवणूक करण्यापूर्वी संबधित योजनेचे माहिती पत्रक वाचून व समजून घेऊन गुंतवणूक करा. #wisedecisions #udyaminvestments #investment #mutualfunds #MutualFundsSahiHai #stockmarket #investmentrisk #investment #MutualFundsSahiHai #mutualfunds #udyaminvestments #assetallocation #udyamitsallaboutmutualfunds https://www.instagram.com/p/Cer_9TNKa2O/?igshid=NGJjMDIxMWI=

#wisedecisions#udyaminvestments#investment#mutualfunds#mutualfundssahihai#stockmarket#investmentrisk#assetallocation#udyamitsallaboutmutualfunds

0 notes