#under $250k

Text

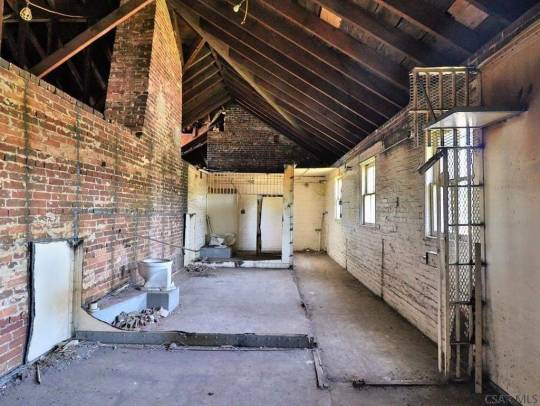

Bedford, PA c.1895.

https://bit.ly/ZillowGoneWILD

Listing via Gary Green / Century 21

Wow! I'm not sure if this was some sort of jail or sanitarium but I dig it. It would make a great movie set. (1/3)

#weird architecture#historic architecture#zillow gone wild#unique#architecture#jail#institution#movie set#oh the possibilities#under $250k#victorian era#1895#pennsylvania#for sale#turret

16 notes

·

View notes

Text

I deserve a TROPHYYYYY for not speaking BLISTERING Reagan slander at every possible moment on this planet, I'm god's strongest soldier and the burden I carry is immense

#only slightly sarcastic lmao#daily reminder that if you're american and under 45#and not making like 250k a year or more#ronald fucking reagan is directly responsible for getting the snowball rolling on like 90% of the things that make ur life fucking miserabl#tbh his policies are far reaching enough that even non Americans continue to feel the effects#god i was SO BRAINWASHEDDDDDD growing up bc my dad was rich and white and benefited from regan era policies#and then i grew up and got out and i was normal and poor and was like wait a goddamn second here#rray.txt

5 notes

·

View notes

Text

Fire in the Water (Chapter 26)

Story Notes:

Focal ship: Lucas/Maya (slow burn)

Rating: Mature/Teen & Up

26: Why All These Fires, Why All These Gliding Ghosts

(Maya POV)

Maya followed her heart that night, and it got her in trouble.

There was no denying anything after that. Not to herself.

To everyone else, yes; because not doing so would require far too much analysis and it was so much easier to just push the feelings down and try to forget about them.

She'd had enough practice.

Or, read from the very beginning…

This story is restricted to AO3 accounts now. You'll need to register/log in to read it. [reason]

#Girl Meets World#lucaya#Maya Hart#Maya x Lucas#GMW fic#beholdmysparkle#starlightsweetheart#userbriana#5*p writes sometimes#WIP: FitW#just under 250K now peeps.... and... there's still 8 days to cover.#COMMENTS (at AO3 preferably) please and thank you

4 notes

·

View notes

Text

still baffled at how "these people weren't preyed upon" apparently got read as "I am laughing at these idiots dying". esp when i have repeatedly said how horrific this whole situation is. so lemme overexplain I fucking guess.

they weren't "preyed upon", since they had plenty of money and opportunity for lawyers to also look over the waivers and for private investigation of the company, and were made aware of every hazard and caveat before the trip.

the CEO literally went as crew to replace an attorney who cancelled due to work at the last minute; you gonna tell me the CEO's own company misled him into the deathtrap he jerry-rigged himself? you gonna tell me someone whos job it is to suss out bullshit and read legal documents definitely got taken advantage of? how about the dude who had already done the trip before?

come the fuck on.

literally all I'm saying is that none of these people were in a position to be taken advantage of/exploited/"preyed upon". most had an intimate understanding of the risks from prior trips, and all were given warning after warning about possible horrible deaths, and they went anyway for ~adventure~. "oh woe poor stupid helpless billionaires getting twisted around a malicious corporation's finger" please think about this critically for two entire seconds

#stirring up trouble#the ONE person you can MAYBE say didnt have a full grasp of the scenario is the 19yo but since he's listed as an investor#and his brother didnt go on the trip i have to assume it was something he chose#despite multiple warnings of the risks and a million red flags. alas.#anyway i dont think it's fucking funny and i hate it when people put words in my mouth#i have too many there already. ffs.#$250k under the sea#i can think it's horrific and ALSO believe the lot of them getting fucked over by their own disdain for regulations is basically karmic.#i don't really feel bad for any of them but i'm not fucking gloating either. it's just wild to see such clear hubris in action.

5 notes

·

View notes

Text

Any time no new houses under $300k show up in the specific towns I'm considering moving to for a couple days I get extremely anxious and start redrawing my life plan since I will never own a home

#realistically under $250k bc i'm allergic to spending over $1.5k/month on housing.#i increase it to $300k bc i would go that high for something turnkey and with perfect refinished hardwoods throughout and like no mold and#a new roof within the past 5 years

2 notes

·

View notes

Text

.

#its missing my first car hours#acura tl with 250k miles and a dozen problems under the hood but she was fast#which is why she's totaled and probably parted out now

0 notes

Text

thinking about how, in an ideal world, hlh is ~halfway or more done

1 note

·

View note

Text

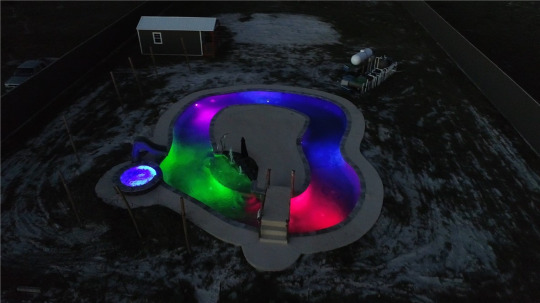

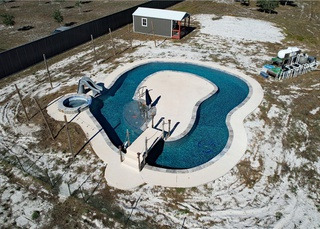

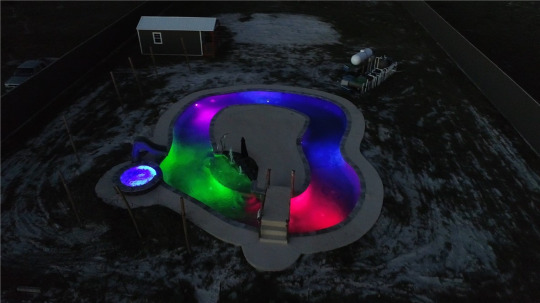

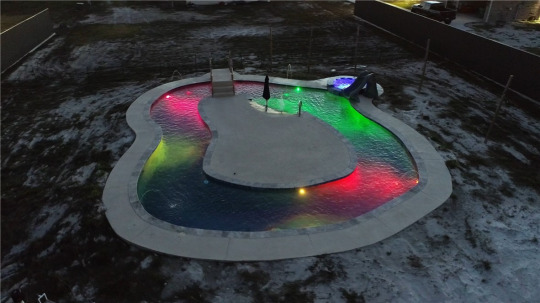

Oh my, all there is on this property in Aransas Pass, Texas is a heated "lazy river" pool with water fountain/sprayers, colorful lighting, a hot tub with a waterfall, a bridge to the center island, sidewalk and deck water jet sprayers, and a waterfall under the bridge. $250K.

Google Streetview shows no house as of 2011, so pictures of the area in general suggest that it wasn’t “leveled” at any point in the last 10 years.

So, this would be about where the house would go.

There's a small building back here and while the town doesn't allow permanent RVs or mobile homes, you can apply for a temporary permit while the house is being built.

I don't know why they built the pool first, then decided to sell it, but there it is.

https://www.redfin.com/TX/Aransas-Pass/1520-W-McClung-Ave-78336/home/184120607

159 notes

·

View notes

Photo

Need some Help. I have been posting for over 9 years to this blog/archive of everything motorcycle. There are now over 165k posts containing over 250k photos... I will continued to post, on a daily basis, motorcycle related photos for as long as i can.

I now need some help with medical and other expenses. I am in the fight of my life. I was recently diagnosed, the end of September, with stage 4 Lung cancer which has spread to lymph-nodes, my liver & my pelvic bone. The photos, above are a before my Chemo and Radiation treatments along with an actual photo of my getting a radiation treatment!

Update: The Chemo put me in the hospital for a full week! I had a very adverse reaction to the infusion Chemo, so bad that the oncologist stopped the infusion chemo until the radiation treatments were completed. Well, on December 9th, I had my very last radiation treatment to my hip and to the tumor in my lung. Now sometime this coming week I will be restarting the Chemo! This time however, they are going to give me an oral Chemo drug and hope for the best!

I am asking anyone who follows my blog to please lend a brother a hand... either with the built in “Tip” feature that is under every photo in every post or by helping me through my go fund me page: https://gofund.me/70d5f221

If you can help it will be greatly appreciated.

2K notes

·

View notes

Text

I strongly appreciated that Matt Yglesias a bit ago put some focus on the long tail of the educational reform movement in America, because in the Trump/Woke era its got tossed aside as a salient issue in exchange for new fronts. But history never works quite like that, and its still the grounding for a lot of modern issues that is just opaque, but still powerful.

And he completed my thought for me when it came to this ridiculous story of a consulting company called, inexplicably, "Woke Kindergarten" that was paid 250K to give antiracism training to a San Francisco elementary school's staff. Obviously it did nothing because DEI trainings don't work even for their own goals and sensitivity training for SF teachers is not the vector any issues with student achievement is riding on, but we all know that.

Instead its notable that up until the early 2010's, there was a strong, bipartisan initiative to use test scores to hold schools accountable for their results. Which schools hated! For the classic reason of all institutions hate scrutiny, but also for the somewhat fair reason that schools don't have that much agency of their student's learning to begin with, so that accountability could often be arbitrary. So one of the ways to outflank that initiative - at the time led by the Obama administration - from the left was to critique it from the angle of racism. Both accurately pointing to structural inequalities outside of the system (which proponents thought they could account for etc etc, its a whole debate) and using far more dubious critiques like saying standardized testing is inherently racist. This was always an idea "in the water" but in ~2000 you didn't find school principals with this idea - but by 2012, you did, as they had picked it up as ammo to fight the Reformers.

And then when Trump got elected and the culture war exploded, this was a ready-made faction to jump into the fray and piggy-back off the agenda. Its a real showcase of the "long roots" of ideological shifts - they are almost always composed of shifting factions under the surface bringing their own baggage into the system. Since we memory-holed the 2000's education wars, we often miss this side of it.

120 notes

·

View notes

Text

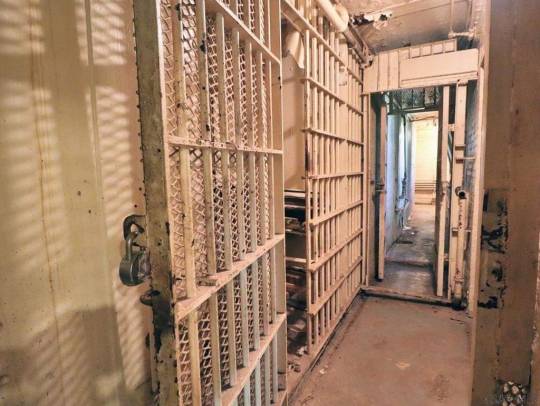

Bedford, PA c.1895.

https://bit.ly/ZillowGoneWILD

Listing via Gary Green / Century 21

Wow! I'm not sure if this was some sort of jail or sanitarium but I dig it. It would make a great movie set. (2/3)

#weird architecture#unique#jail#sanitarium#movie set#jail cells#toilets#turret#toilets and turrets#historic architecture#1895#victorian era#zillow gone wild#i like it#under $250k#pennsylvania#dungeon#murals#oven#crematorium#what was this#i want it

16 notes

·

View notes

Text

How I Built an Emergency Fund, inspiration I deeply hope is helpful

As the blog URL says, this is not financial advice. This is how I did this thing, and I am posting it here, publicly, in hopes that it helps you should you need this information.

In short: Remix this advice to what fits your life + do not sue me if this goes poorly for you. This is for Americans, if you do not live in America and/or your money is not in America, I hope this is a useful base.

None of these links are affiliate links.

I write these things as a mental shift. I like to ramble and I wish I had someone tell me this stuff 20+ years ago. I'm hoping this helps you.

This is an incredibly long post so I'm putting it under a KEEP READING.

This post goes over two stages: "short term + not life-or-death" and "long term + actual life or death"

Part 01: SHORT TERM + NOT LIFE-OR-DEATH FUND

You need to find a high yield savings account that is FDIC insured. Ally is a popular bank for this.

Functionally, the only difference between a "high yield savings account" and "savings account" from the giant conglomerate bank down the street is the interest rate.

I do not know why non-high-yield savings accounts exist. I'm guessing because legally they can, and I hate it.

Moving away from my personal socioeconomic views to return to advice.

"FDIC insured" is not something you pay for. It is nearly universal on savings accounts. If a savings account, or a checking account, does NOT have it, then you should not put your money there. Something is wrong with that bank.

FDIC means if your bank goes out of business, your account is insured up to $250,000, per account, by the government. So if your bank goes out of business, the government makes sure you still have your cash (up to $250k).

A high-yield savings account means your cash is available whenever you need it.

Other products, like CDs, exist, but this ramble is designed to be as simple and starter as possible. Begin with a high yield savings account, build up from there as you do your own research + compare this to your needs.

Do not accept an account that has minimum balances. Do not open an account with monthly fees.

Touch this account as little as possible.

For every $1 you put in, every month, a few pennies will materialize. It's not much, but the main point is at every level, your money works for you.

Rich people do this. You can too.

Touch this account as little as possible.

You can have multiple savings accounts.

I personally have a savings account in the above structure designed for "oh hell I am kinda screwed, but will be okay, just need a buffer."

"How much should I have in there?" you might ask. Common advice says "3-6 months expenses" which is a lot. I say "start with literally $1 and continue as you can until comfortable with what is possible, for you, at this time."

Will $1 make you rich? No.

Will it save your life in a bad situation? Probably not.

Does this $1 essentially become a tiny robot that is making you money for as long as it is docked into its cargo bay? ...weird metaphor but we'll go with it, sure.

Ultimately is it a start? Yes.

You can have multiple savings accounts. You can have a savings account "this is for short term emergencies" and "this is for... slightly less short term" etc.

It costs you nothing to have multiple. They all operate in the same way. It's handy to have them all at the same bank because it can make transferring cash easier.

Part 02: LONG TERM + ACTUAL LIFE-OR-DEATH FUND WITH RISK SO BE CAREFUL

Once you have your savings account set up, and it's being funded on a regular basis (every week, every paycheck, every month, every quarter -- whatever works for you), look into creating a second, bigger, more dangerous-term cash reserve.

I like my Roth IRA. This is a link to a proper finance blog that has a lot of details. I am trying to make this handy/simple to get started.

401ks and (non-Roth) IRAs are funded with pre-tax dollars, frequently in conjunction with your job.

Normally, cash goes from job -> government takes a slice -> you.

Pre-tax retirement accounts, cash goes from job -> retirement takes the percentage you decide -> government takes a slice of what is left -> you

Roth IRAs, job -> government takes a slice -> you -> Roth IRA

The benefit to pre-tax retirement accounts being, because the cash going in is pre-tax, there is more of it.

It can grow faster in the stock market or other places your particular fund allows you to put cash into.

The taxes come out when you withdraw -- usually retirement -- because if you withdraw before you retire, you are heavily penalized with extra fees.

That's why Part 02 is a ROTH IRA. Your money has already been taxed -- job -> government's slice -> you -> Roth IRA.

This means the money is yours, already taxed. If you withdraw the gains, those get taxed, but the base, that's yours.

If you invest $100 and it grows to $105, you can withdraw $100 without paying fees or taxes. If you withdraw that extra $5, that is when taxes start to come into play. If you withdraw $100, and leave the $5, the $5 continues to grow, and that extra growth is taxed if withdrawn. So try not to touch it (ideally you leave all of it until retirement).

This is why this is an emergency, life-or-death only, account. You tap it only when you need to when all other choices are wretched and ruinous.

There is an annual limit as to how much money you can put into a Roth IRA (several thousand bucks).

You can start them very small. Like $20 or maybe less.

Look for a bank or institution that does not charge fees to open and maintain one.

AT EVERY STEP YOU SHOULD BE AVOIDING FEES

Here are smart people talking about ideas on how to get started.

Okay, so, what do we do now with this fancy roth thing.

Here is where things get... uncomfortable.

A Roth IRA is an account type.

You need to do something with your money.

The reason you have this in addition to, and secondary to, your high-yield savings account is because this is an investment vehicle, the balance is going to go up and down, and may reach $0.00.

For my Roth IRA, I like "exchange traded funds" -- ETFs.

There are a lot of options -- you can invest in most anything

Because my Roth IRA is built for "help me I'm dying" emergencies, I invest in a mix of S&P 500 index funds and small-cap funds.

SO MANY WORDS.

Let's break this down what this means.

S&P 500 index funds: This is an index fund of giant, giant, giant companies.

An index fund is like a stock. But instead of a single company, it tracks (owns shares of) an index -- like the DOW or Nasdaq. Or countries. Or... the entire market for oil. Etc.

The metaphor isn't completely accurate, but I like to think of it as "an index fund is a company that owns tiny bits of other companies."

Like, okay, say you have SlimeIndexFund and a share price is $40.

In this example, SlimeIndexFund owns $10 worth of "BardCo" and $10 of "ThiefCo" and $10 of "MermaidCo" and $10 of "EvilCo".

Let's say EvilCo does a lot of evil and is now worth $15, and MermaidCo does a lot of mermaid stuff and is now worth $15, and BardCo sings out of tune so is now worth $5. ThiefCo is oddly at the same $10 but we're scared so we're leaving ThiefCo to stay at $10.

A share in SlimeIndexFund is now worth $45. ($5 BardCo + $10 ThiefCo + $15 EvilCo + $15 MermaidCo)

This is diversification

Because I bought an index fund, instead of just buying BardCo, my risk is less.

Had I bought all MermaidCo, my return would be higher -- but this is a much bigger risk.

The entire purpose of this set up of a Roth IRA is TO MINIMIZE RISK.

Your Roth IRA should allow you to buy "fractional shares" and if it doesn't fuck that bank, go somewhere that does.

In the above example, SlimeIndexFund is $40/share and at that price you are getting the full benefit of 1 share.

Let's say you have $10.

You buy a fractional share of SlimeIndexFund for $10, which is 25% of 1 share.

So when SlimeIndexFund shares raise from $40 -> $45, your fractional share goes from $10 -> $12.50.

Not all funds and stock shares (etc) have fractional shares, most do.

It's a great way to start and build.

Small-cap funds: These operate in literally the same way. The difference is the companies are (in comparison) much smaller. They tend to be more nimble.

So I am diversifying between "here is a fund, it has a lot of large companies" and "here is a fund, it has a lot of small companies."

Let's say Big Office Building real estate goes down, but the sale of Small Company Making waffles goes up. This mixes together and I'm less in danger of losing money, or losing much money.

You can pick individual stocks.

The reason it is not recommended, by nearly everyone, is because the market has incredible tools and power over individual stocks.

By using any kind of fund that bundles things together, you are thereby automatically using these tools by proxy

It is critical to understand this is the stock market. Your account will go up and down. It may go down A LOT, like 25%, and take years to recover. Maybe it goes down 100% to literally $0.00.

That's why this is the LAST RESORT EMERGENCY FUND.

So why are we doing this.

This feels... wrong?

The potential for growth is significantly higher than a savings account. Adjusted for inflation, somewhere in between 6-7%.

At this rate, if you can leave your initial deposit alone for somewhere between 10 - 13 years, it has doubled.

This equation recalculates every time you make a deposit. So if you can deposit $20 every pay check, it has the potential to grow very quickly.

As above, this is the stock market, so it can also get wiped out.

But given the stock market has historically always recovered, though it may take several years, the risk is worth it to me + a lot of other people.

The reason this is built as a last-resort cash bucket is because of this risk. Before moving into this arena, you should have other cash buckets as a buffer.

Your RISK is it goes down. Which it will frequently.

Your REWARD is if it goes up. Which historically it has far more than it went down.

The PURPOSE of using funds as described above is so you don't have try to guess who the next Amazon is and wind up picking the next Pets.com (which went out of business, like, a long... long time ago).

The people making the funds figure out who is Amazon and who is Pets.com and work, day and night, to make your money grow and/or protect it when outside influences are hurting the market.

They are incredibly equipped to do this and their literal livelihood is on the line when they do it poorly.

Which is a polite way of saying, they are continuously incentivized above all else to work for the fund you're investing in.

The reason you're doing this in a Roth IRA specifically is you're hoping to keep as much of it intact, as possible, until you retire, at which point -- if you've followed fairly simple rules -- you withdraw the base and gains tax-free.

Whereas money in a normal stock account? Those gains are taxable every year.

"I have literally $20 I can save per pay check! Can I put in $15 into a high-yield savings account and $5 into a Roth IRA to get started?!"

Yes!

Also, congrats! You're diversifying already!

Your Roth IRA broker should allow you to invest a minimum of $1 at a time, and buy fractional shares. If they don't, don't sign up with them!

Lean heavily into your high-yield savings account until that is very comfortable and thick, then push money into the Roth IRA.

Your goal is to build a system that works for you -- both literally (money working for you) and emotionally ("this is comfortable")

"Should I pay off debt before proceeding? A lot of people say to pay off excess debt first."

This is up to you.

Most financial blogs etc. do say "focus on paying off debt first" -- it's good advice, your returns are risk-free and permanent, since the lower your debt is, the less you have to pay over time.

Interest -- working for you or against you -- is continuous and eternal.

Personally, I like to diversify everything, so I not-financial-advice ramble "do all three -- pay down debt, throw a little cash into a high-yield savings, throw a little cash into a Roth IRA"

The problem with "pay off debt first" is that it misses out any occasional giant gains the stock market makes (Roth IRA) and introduces the risk of "I have paid this credit card on time for 5 years, I'm short on change for 3 months due to a situation that gets resolved quickly, and now I have a late payment fee, and a higher interest rate."

Look at your life, finances, and potential future and make decisions!

And also:

Always be on the look out for deals with banks. Sign up bonuses, referral links from friends, etc. Think of it as a money sale.

If you are not comfortable with the idea of a Roth IRA hitting $0.00 potentially, do not do step 02. These are ideas, not directives.

All financial tools can be used for different purposes. All of them. Thus -- these are ideas, not directives.

I am listing a few examples of banks, funds, etc. These are not recommendations nor are they affiliate links. They are listed because I want to maximize your start on this path, but caution, in strongest possible terms, you must do your own research and figure out what makes sense for you.

There are a lot of nuances I am paving over for the sake of simplicity, which is why I am continually saying...

...c'mon say it with me...

...you must do your own research before continuing

Smart, free sites that cover this + a lot of other stuff:

NerdWallet

Bank Rate

One final note about Roth IRAs:

Robinhood currently is offering a 1% match on an IRA. Considering the strict limits of how much an IRA can intake per year, it's not much, but it doesn't cost you anything. Money on sale!

As a final note -- always feel comfortable asking people handling your money for help. They are working for you. Your money works FOR YOU.

If you are uncomfortable, leave, immediately, without concern.

At the retail level, there are hundreds of banks and financial institutions clamoring for your business. If someone makes you uncomfortable for not knowing something, or getting a term wrong, or asking "too many" questions -- go somewhere else.

It doesn't matter if your account is literally worth $20.

They are working for you.

This is a business transaction, and if they make you feel like your time isn't worth their business, I promise you there is someone else who will gladly take care of you.

I end with -- whenever someone is giving you financial advice, always ask why. It helps ensure they aren't scamming you, it's just a good business practice.

I like to ramble, it helps me mentally

I like to be useful, I want the world to be significantly more balanced in terms of who is doing okay

I like to write, this is all good practice for me in doing Various Other Things I do

I fucking hate predatory financial practices. I was gatekept out of financial literacy for decades and so every time I help someone else figure out how to set up their own life and protect themselves it is a giant "fuck you" to the systems and directly to the people who stood in my way.

562 notes

·

View notes

Text

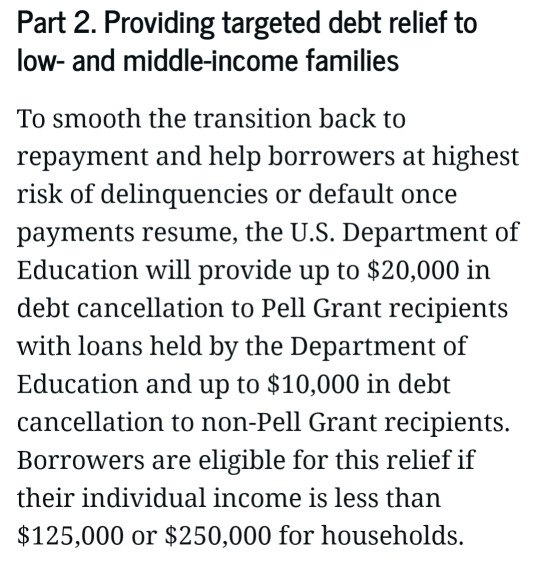

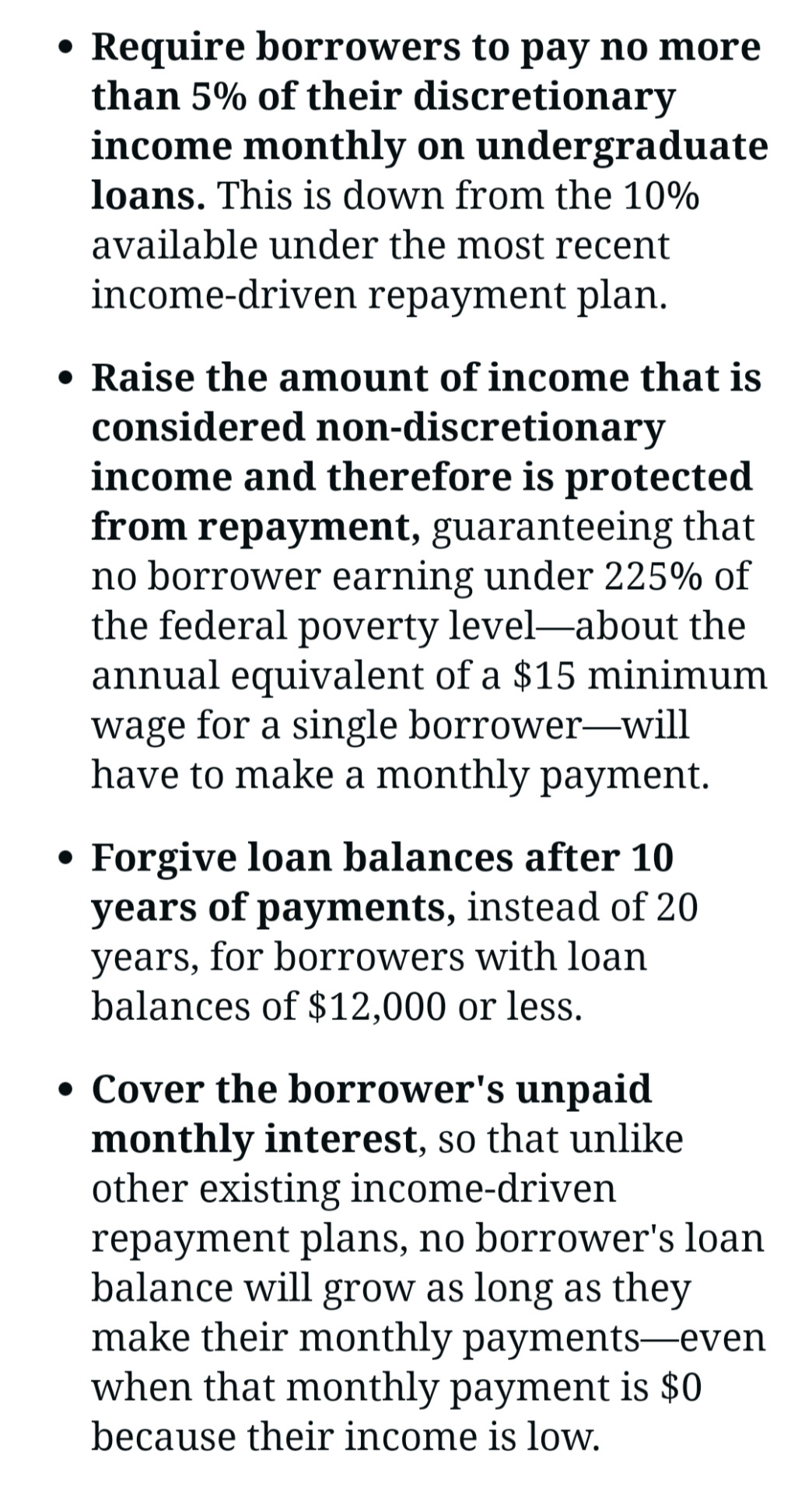

Biden is canceling between 10 to 20k in student loans for any borrower with individual income under 125k or married 250k.

And he is fully restructuring how loan processing works.

There's more at the link but

I think

My student loans might be about to disappear bc I was a Pell grant recipient and my total is under 20k.

I'm gonna cry at my fucking desk.

ALSO THAT LAST BULLET POINT, THAT THE INTEREST WILL BE COVERED EVEN IF YOU CAN ONLY PAY 10$ A MONTH

yep yep yep I'm crying

THE DEBT FORGIVENESS PERIOD BEING SHORTENED BY TEN FUCKING YEARS

gonna just sit at my desk and sob

1K notes

·

View notes

Text

Happy Birthday, Addams Family! ROTTMNT TMNT AU!!!! 🎉🎉🎉🎉

This animatic covers three main parts of the Miyamoto family lore. The way back past, regular past, and present day of the AU. Not every scene is linear, good luck lol. You get to meet a mysterious new character, though :)))

This is like. My second ever 'full' animatic, the longest I've ever done, and the first animatic I've ever done to a song. I'm proud of myself for actually committing and allowing myself the leeway to let it not be perfect. To let some frames be weird and to let it be just so slightly off beat (it'll tear me up inside shhhh)

Sappiness under the cut ⬇️⬇️⬇️⬇️ and some of my favorite frames

When I started this AU last year, I never knew it would get to the place it is today.

With almost 800 art pieces from me alone, and at minimum 250k words written, it has become a project me and my friends have poured our hearts into, and I love it to death. This year has been rough, I've fucked up, I've learned, I've improved, and I'm still improving.

I've met amazing people, gotten amazing mutuals, and created great things for this AU. It's changed my life in a really positive way, and I can't imagine where I'd be without it, or without the friends I've made through it.

Funny how such an edgy, nerdy AU can make such an impact, but it has. And I'm excited for what the next year brings, for me, and for my AU. Even if I'm still too nervous to interact with people half the time, or get a bit too wrapped up in pointless things, I'm getting better, and I'm excited to see where I can take this, and where I can go with it.

I'm happy this AU exists, and im happy my friends exist along with it.

With that, my top 3 frames.

Have a good day, if you've made it this far :] here's to another one, fuckers 🎉🎉🍾🍾🍾

#addams! tmnt au#rottmnt au#addams! leo#addams! usagi#rottmnt#tmnt au#rottmnt art#rottmnt oc#rise of the tmnt oc#rise of the tmnt#rise of the tmnt art#rise of the tmnt fanart#rise of the tmnt au#rottmnt usagi#tmnt usagi#tmnt oc#tmnt fanart#tmnt art#animatic#addams! miyamotos#addams! ishida#addams! kenichi#addams! chizu#blaze's faves#tmnt original character#rottmnt original character#rise of the teenage mutant ninja turtles au#rise of the teenage mutant ninja turtles#tmnt 2018#save rottmnt

169 notes

·

View notes

Note

There is one (1) window.

oh damn so there is. had to look through a lot of pics and diagrams but yep, there's a porthole in the door, which is why I never noticed it; reports also said they were using sonar and cameras to actually look at the titanic wreck because it would be impossible to see otherwise, so I guess I got my wires crossed there and assumed there were no windows? my bad, will amend that info in the big post shortly

that said. look at this "typical" seating configuration. they are not sleeping comfortably if at all.

oof

3 notes

·

View notes

Text

Open blinds (Pedri × Spanish streamer! reader)

Warnings: kind of suggestive, fluff, lots of Spanish, mentions of Spanish streamers

Masterlist

You will have to convince Pedri to stop being so cute while sleeping so you can get mad at him.

You love being with him in Barcelona, waking up next to him and all, but he really needs to start closing the blinds before going to bed, because you are not sure you will keep on living if you have to wake at 5 am every morning as the sun hits you on the face.

Pedri has his arms slung over your waist as he is in a deep slumber, and you can't help but stare at his relaxed expression. He is so lucky he is free today, while you will spend all day running around because of La Velada del Año 2, luckily, you still have a few hours before having to meet everyone for breakfast, then preparing, then presenting the event alongside Cristinini, all rewarded by the afterparty.

You cursed the moment you accepted Ibai's proposal to present the event. It wasn't like you needed the hype, 250k viewers minimum per stream was what every streamer dreamed about, and you could have comfortably watched the event from Pedri's coach, or even your own if he had the energy to go to Madrid.

You started squirming under Pedri's grip, trying to turn away from the sun as he stirs awake.

"¿Qué haces?" he groans, eyes fluttering open as he pulls you closer to him. (what are you doing?)

"Dejaste las cortinas abiertas otra vez, Pedri" (you left the blinds open again, Pedri)

"Mmmm, lo siento amor, pero es muy temprano para tener esta discusión" he says while cuddling closer to you, an strategy to get into your heart (sorry love, but it's still too early for this discussion)

"Igual dudo me pueda volver a dormir" (still I doubt I can go back to sleep)

His brown eyes finally stay open as he looks down at you, he gives you a suggestive smile "Yo sé de algo que te cansará" (I know of something that will tire you out)

You gasp mockingly "Pedro González López, ¿te me estás insinuando tan temprano?" (are you trying to seduce me so early)

He pulls off a innocent look "No me atrevería, " he smirks "pero tampoco lo niego" (I wouldn't dare, but I don't deny it)

He spins you both, you lying against the bed as he stares down at you. He leans down, places a kiss on your forehead, cheek, lips and neck, then scoots lower, and buries his head in between your legs, you for surely have a long morning ahead of you. You try your best to fake innocence when all your friends give you weird looks at your late arrival, flushed cheeks and messy hair.

He for sure will tease you when that faraway look still hasn't gone away by the time you are on live.

You guess you will have to do the very same to him so you are at the same level.

#Pedri#pedri imagine#pedri headcanon#pedri x reader#Pedri×reader#spanish nt#barca#fc barca#fc barcelona#football#football player#football imagine#spain nt

319 notes

·

View notes