#stock investing for beginners

Text

10 Hidden Secrets (Stock Investing for Beginners)

youtube

#investing stocks#stock market#investing#investments#personal finance#stockmarket#stockmarkettips#personalfinance#how to invest in stocks for beginners#stock investing for beginners#stock market crash 2024#how to invest money as a teenager#investing for beginners 2024#passive income ideas 2024#personal finance tips#trading strategy for beginners#stock market news#warren buffett investment strategy 2024#personal finance tips for beginners#top 10 personal finance tips for beginners#top personal finance tips#day trading addict

1 note

·

View note

Text

7 Reasons to Create Cash Flow with the Stock Market

Seven reasons to use and create cash Flow with the stock market Have you ever thought about retiring and Not having to worry about money anymore Most people consider retirement as the Time when they no longer have to work However for some retirements may never Come due to a lack of savings or their Savings being too small due to inflation Using cash flow to retire is an Alternative that grows…

View On WordPress

#andy tanner#business ideas#cash flow#cashflow game#financial education#financial literacy#how to get rich#how to invest#how to make money#how to make passive income#investing for beginners#kiyosaki#make money#motivational speakers#network marketing#passive income#reasons to cash flow the stock market#rich dad poor dad#robert#Robert Kiyosaki#stock market cash flow#stock market cash flow andy tanner

8 notes

·

View notes

Text

Retirement planning is a crucial aspect of one's financial journey that often takes a backseat to immediate financial obligations. However, it's a fundamental and strategic step toward ensuring a comfortable and stress-free retirement.

If you want to plan your retirement in a better way, well, Recipe by Finology could please you :)

#finance#retirement planning calculator#financial planning#stock market#stock market for beginners#best investing strategies

2 notes

·

View notes

Text

#investment#options on futures#options trading#self investment#investing in yourself#reinvent yourself#invest in yourself#perfect investment strategy#investment for beginners#become the best version of yourself#real estate investment#options trading for beginners#property investment nz#nz property investment#guidance from educate yourself#tax free investments#stock investment#tax-free investments#investment planning#teaching yourself online

3 notes

·

View notes

Text

How To Invest In Stocks For Beginners With Little Money

Having little money should not stop you from reaching your financial goals and learning how to successfully invest in stocks. Investing in stocks can be a great way to grow your wealth and earn passive income, but it can be hard to overcome the fear of losing money if you don’t have a lot of cash on hand.

6 notes

·

View notes

Text

10 Small Investment Ideas: Building Wealth Through Low-Risk Options

Discover 10 small investment ideas that offer low-risk options to kickstart your journey towards building wealth and securing a brighter financial future. Learn about mutual funds, index funds, robo-advisors, stocks, bonds, real estate, precious metals, cryptocurrency, small businesses, and investing in yourself. Get insights on risk factors, positive factors, and FAQs to make informed investment decisions.

Many people mistakenly believe that significant wealth is a prerequisite for investment opportunities. However, this notion is unfounded. Small investments, made consistently over time, can accumulate and pave the way to financial growth. In this article, we will explore ten small investment ideas for beginners that offer low-risk options to kickstart your journey towards building wealth and securing a brighter financial future.

We will also provide insights on how to manage these investments effectively based on facts and proven strategies:

Mutual Funds: Embracing Diversification Mutual funds are an accessible entry point for beginners in the investment realm. These funds pool money from multiple investors to purchase a diversified range of assets, including stocks, bonds, and securities. Diversification spreads investments across different assets, reducing the risk of significant losses. With modest initial investments, mutual funds are an excellent choice for beginners.

Index Funds: Simplicity and Affordability Combined Index funds, a type of mutual fund, track specific market indices such as the S&P 500. They provide a straightforward and cost-effective way to invest in a broad range of stocks. For beginners lacking the time and expertise to select individual stocks, index funds offer diversification, lower expense ratios, and the potential for steady long-term growth.

Robo-Advisors: Simplifying the Investment Process Robo-advisors are online investment platforms that automate portfolio management and offer personalized advice. They are ideal for beginners seeking convenience and requiring minimal initial investment. These platforms provide automated diversification, real-time recommendations, and low-cost portfolio management, allowing gradual wealth accumulation.

Read More

Other Topic:

How to Safeguard your Investments During a Market Decline?

How to create your own trading setup?

Relative Strength Index (RSI)

South Korea Retains Position in MSCI Emerging Markets

#InvestmentIdeas #WealthBuilding #FinancialGrowth #LowRiskInvestments #BeginnerInvesting

#small investment ideas#low-risk options#building wealth#financial growth#beginner investing#mutual funds#index funds#robo-advisors#stocks#bonds#real estate#precious metals#cryptocurrency#small businesses#investing in yourself#risk factors#positive factors

5 notes

·

View notes

Text

A Beginner's Guide to the Stock Market: Demystifying the Basics

Introduction:

Welcome to the exciting world of the stock market! Investing in stocks can be a rewarding venture, but for beginners, it can also be overwhelming. This blog post aims to provide you with a solid foundation and demystify the basics of the stock market, so you can embark on your investment journey with confidence.

What is the Stock Market?

The stock market is a platform where individuals and institutions buy and sell shares of publicly traded companies. It serves as a marketplace for investors to trade stocks and other securities.

Understanding Stocks:

Stocks represent ownership in a company. When you purchase shares of a company's stock, you become a partial owner of that company and may have the right to vote on certain matters and receive dividends.

Types of Stocks:

There are different types of stocks, including common stocks and preferred stocks. Common stocks offer voting rights and the potential for capital appreciation, while preferred stocks provide fixed dividends but limited voting rights.

Setting Investment Goals:

Before diving into the stock market, it's crucial to establish your investment goals. Determine your risk tolerance, time horizon, and financial objectives. This will help shape your investment strategy.

Conducting Research:

Thorough research is essential before investing in stocks. Analyze company financials, industry trends, and market conditions. Utilize fundamental analysis to assess a company's performance and technical analysis to study price patterns.

Diversification:

Diversification is a key principle to mitigate risk. Spread your investments across various sectors, industries, and even geographic locations. This helps reduce the impact of individual stock volatility on your overall portfolio.

Investment Vehicles:

There are different ways to invest in stocks, such as individual stock picking, mutual funds, and exchange-traded funds (ETFs). Mutual funds pool money from multiple investors to invest in a diversified portfolio, while ETFs are passively managed funds that track specific indices.

Risk Management:

Understand that investing in the stock market involves risks. Educate yourself on risk management techniques such as setting stop-loss orders, understanding market volatility, and staying informed about your investments.

Long-Term Approach:

Stock market investing is best suited for the long term. Avoid making hasty decisions based on short-term market fluctuations. Adopt a patient approach and focus on the underlying fundamentals of the companies you invest in.

Learn from Mistakes:

Investing is a continuous learning process. Embrace the fact that mistakes may happen, but use them as opportunities to learn and refine your investment strategy. Seek knowledge from experienced investors and financial resources.

Conclusion:

As a beginner in the stock market, remember that education and patience are your allies. By understanding the fundamentals, conducting research, diversifying your portfolio, and managing risks, you can embark on a successful investment journey. Stay disciplined, stay informed, and enjoy the rewards of long-term investing in the dynamic world of the stock market.

#beginners#stock management#stockmarket#passiveseinkommen#income#financial markets and investing#investment#maximum#bitcoin news#bitcoin

2 notes

·

View notes

Text

Forex - Has no End?

Riddle: What has no end, yet always comes back around?

Forex trading and stock trading are both popular investment options, but many people are unsure which one is better. Both forex and stocks offer the potential for profitability, but they also bring their own unique risks. To help you decide which one is right for you, let’s take a look at the pros and cons of forex trading versus stock trading.

When it comes to forex trading, the primary benefit is that it is a 24-hour market. This means that you can trade any time of day or night, regardless of the stock market hours. This can be particularly advantageous for investors who have busy schedules or who trade from different parts of the world. Additionally, forex trading allows you to trade on multiple currency pairs, giving you the potential to diversify your portfolio.

The downside of forex trading is that it is a highly leveraged market. This means that you can leverage your investments to a greater degree than you can with stocks, which can result in greater potential losses. Additionally, the forex market can be extremely volatile, making it difficult to predict future movements.

When it comes to stock trading, the primary benefit is that it is a regulated market. This means that stocks are traded under set rules and regulations, making it easier to protect your investments. Additionally, stock trading allows you to invest in individual companies and funds, giving you the potential to diversify your portfolio more than you can with forex.

The downside of stock trading is that you have to pay fees to trade stocks. These fees can add up quickly, making it difficult to make a profit on small trades. Additionally, stock markets tend to be less liquid than forex markets, making it more difficult to buy and sell stocks quickly.

Overall, forex trading and stock trading both offer the potential for profitability, but they also bring their own unique risks. Forex trading allows you to trade on multiple currency pairs and offers the potential for 24-hour trading, but it is highly leveraged and can be extremely volatile. Stock trading offers the potential to invest in individual companies and funds and is regulated, but it also comes with fees and is less liquid. Ultimately, the best choice for you will depend on your own personal goals and risk tolerance.

Answer to Riddle: The Stock Market

#“forex vs stocks which is more profitable”#“which is best forex or stock market”#“forex vs stocks for beginners”#“is technical analysis the same for forex and stocks”#“pros and cons of forex vs stocks”#“forex market vs stock market size”#“forex vs stocks which is more profitable reddit”#“forex stock price”#stock market#investors#investment#invest

3 notes

·

View notes

Text

Unlocking the Power of Equity and Derivatives Investments: A Comprehensive Guide

Unlocking the Power of Equity and Derivatives Investments: A Comprehensive Guide" illuminates the intricacies of equity and derivatives markets, empowering investors with strategic insights. From understanding risk management to capitalizing on market volatility, this guide offers indispensable knowledge for navigating the complexities of financial markets and maximizing investment potential.

#stock market#stock market investment#stock market analysis#equity and derivative#stock market tip for beginners

0 notes

Text

#how to invest in stocks#investing for beginners#stock market#investing#the most important thing in investing in stocks#stock market investing#stock market for beginners#stocks#value investing#share market basics for beginners#stock market in india#the single most important metric for stock market investing#the most important things when buying stocks#how to begin investing in the share market#investing in your 20s#investing in international stocks

2 notes

·

View notes

Text

#Best Investing Books For Beginners#Best Books on the Indian Stock Market for Beginners#Best Stock Market Books for Beginners

0 notes

Text

Big Returns: Smart Ways to Start Investing in Stocks with Limited Funds

Investing in stocks can seem intimidating, especially when you're just starting out with limited funds. However, it's one of the best ways to grow your money over time and doesn't require as much capital as you may think. With some research, patience, and discipline, investing in the stock market can be an extremely effective strategy to build long-term wealth.

The goal of stock investing is to buy shares of public companies that you expect will increase in value over time. As the price of the stocks rise and you sell them for a profit, you make money. It's important to remember that stock prices fluctuate daily, so you need to take a long-term approach. With compound growth over decades, even small, regular investments can add up to substantial returns.

The key benefits of invest in stocks for beginners with little money include:

- Taking advantage of compound returns and growth potential over many years

- Developing good investing habits such as regular purchases and portfolio maintenance

- Leveraging fractional share investing to own pieces of expensive stocks

- Keeping costs low by using no-fee brokerages and index funds

- Strengthening your finances and net worth for the future

Know More: Stocks Blogs

This guide will walk through the investing basics, like identifying goals, assessing risk tolerance, opening a brokerage account, and placing your first trades. With the right strategy, investing in stocks can be an accessible way to grow your wealth over time, even starting with a small amount of money.

## Determine Your Investing Goals

Before investing any money in the stock market, it's important to determine your investing goals and time horizon. This will help guide your investment decisions.

### Short-Term vs Long-Term Goals

Short-term stock investment goals are things you want to achieve in the next 1-3 years, like saving for a down payment on a house or car. Long-term goals are further out, like retirement planning or saving for your child's college education.

When investing for short-term goals, focus on minimizing risk and preserving your capital. Avoid stocks and invest in safer options like savings accounts, money market funds, CDs, or short-term bonds. The stock market is too volatile for short-term investing.

For long-term goals, you can afford to take on more risk in search of higher returns. Stocks and stock mutual funds are appropriate for time horizons over 5 years. The longer your time frame, the more risk you can handle.

#best online stock trading courses for beginners#how to invest in stock market for beginners#how to know what stocks to buy for beginners#investing stocks#stock#stock market#Stock investment#stock blogs

0 notes

Text

Exploring the World of Stock Market Investing: A Guide for Beginners

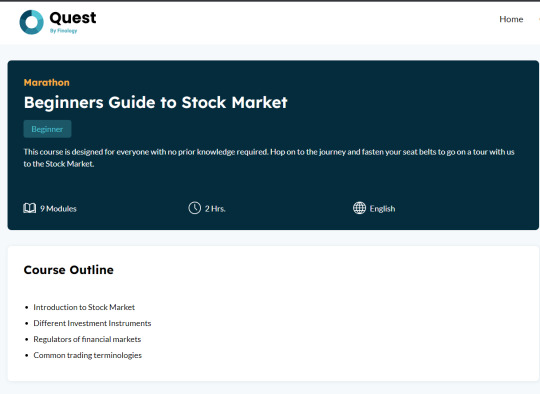

For newcomers to the world of stock market investing, the sheer volume of information and jargon can be overwhelming. Fortunately, platforms like Finology Quest offer educational resources tailored for beginners seeking to navigate the complexities of the stock market.

The "Beginners Guide to Stock Market" course on Finology Quest provides a structured and informative introduction to the fundamentals of stock market investing. From understanding basic terminology to evaluating investment opportunities, the course serves as a roadmap for those embarking on their investment journey.

One of the key takeaways from the course is the emphasis on understanding the risks associated with investing in the stock market. By familiarizing themselves with concepts like risk management and diversification, beginners can make informed decisions about where and how to allocate their funds.

Moreover, the course emphasizes the importance of developing a sound investment strategy that aligns with individual financial goals and risk tolerance levels. By learning how to create a diversified portfolio and monitor market trends, beginners can work towards building a robust investment plan.

Continuous learning is also highlighted as a crucial aspect of successful stock market investing. The dynamic nature of the market requires investors to stay informed and adapt their strategies as needed. The course encourages beginners to engage in ongoing research and education to stay ahead in the ever-evolving world of investing.

In conclusion, the "Beginners Guide to Stock Market" course offered by Finology Quest provides a valuable resource for individuals taking their first steps into the world of stock market investing. By establishing a solid foundation of knowledge, understanding risk management principles, developing a thoughtful investment strategy, and committing to continual learning, beginners can set themselves up for long-term success in the stock market.

#how to buy shares#how to start investing#best stocks for beginners with little money#how to make money in stocks

0 notes