Text

A Comprehensive Analysis of Senco Gold Ltd.: Share Price Today, Market Cap, Price Chart, and Balance Sheet

Introduction:

When navigating the complexities of stock market investing, access to critical financial data is essential. In this exploration of Senco Gold Ltd., the focus will be on understanding key metrics such as share price today, market capitalization, price chart, and balance sheet analysis, utilizing the unbiased insights available on the Finology Ticker website.

Insights into Share Price Today:

The share price today of Senco Gold Ltd. serves as a real-time indicator of market sentiment towards the company's stock. It is imperative to recognize that share prices are susceptible to fluctuations influenced by market conditions, investor sentiment, and company-specific developments. Monitoring daily share prices can offer valuable short-term market trend insights.

Understanding Market Capitalization:

Market capitalization offers a window into the perceived value of a company by the market. By multiplying the share price by the outstanding shares, market capitalization helps gauge the company's size and significance within its industry. This metric facilitates comparisons with industry peers and is pivotal in assessing Senco Gold Ltd.'s market positioning.

Leveraging Price Chart Analysis:

Price charts visually depict a stock's price movements over a specified period, aiding investors in identifying patterns, trends, and support or resistance levels. Tools such as Finology Ticker can empower investors to analyze Senco Gold Ltd.'s price charts, enabling the identification of potential entry or exit points and informed investment decisions based on historical performance.

Gaining Insights from Balance Sheet Analysis:

A critical aspect of evaluating a company's financial health is that the balance sheet provides a snapshot of its assets, liabilities, and shareholders' equity. Analyzing Senco Gold Ltd.'s balance sheet is instrumental in assessing its solvency, liquidity, and overall stability. From this analysis, key financial ratios can be derived, offering insights into the company's performance compared to industry benchmarks.

Conclusion:

By leveraging resources like Finology Ticker, investors gain access to valuable data concerning Senco Gold Ltd.'s share price, market capitalization, price chart, and balance sheet analysis. However, it is essential for investors to demonstrate diligence in conducting thorough research, considering multiple data points and factors, and maintaining a discerning approach. By melding these insights with a deep understanding of the company and its industry, investors can make more informed evaluations of the potential risks and rewards associated with investing in Senco Gold Ltd.

0 notes

Text

Decoding Buffetology: Exploring the Investment Strategy of Warren Buffett

When it comes to investing, Warren Buffett is a name that commands respect and admiration. His unique investment style and remarkable track record have made him a legendary figure in the world of finance. If you've ever wondered about the secrets behind his success, a valuable resource awaits you - the "Buffetology: Warren Buffett Investment Strategy" course, available on Finology Quest.

This course goes beyond mere speculation and delves into the heart of Buffett's investment philosophy. It offers a comprehensive understanding of his strategies, principles, and techniques. By studying Buffetology, participants can gain valuable insights into how Buffett evaluates companies, identifies moats, and values stocks.

Finology Quest has developed this course as part of its commitment to providing knowledge and educational resources for aspiring investors. It has meticulously curated content, combining videos, quizzes, and interactive material to create an engaging and immersive learning experience. With its user-friendly approach, Finology Quest ensures that participants grasp the essence of Buffetology, regardless of their familiarity with investing.

The Buffetology course is highly recommended for both amateur and seasoned investors. Beginners can rely on it to establish a strong foundation in value investing, while experienced investors can deep dive into Buffett's strategies and refine their own approach. By understanding Buffetology, participants will be equipped with the tools and techniques to make informed investment decisions.

It's important to note that by mentioning Finology Quest and their Buffetology course, we are not promoting their services per se. Rather, we are acknowledging them as a reputable platform that offers valuable educational resources for those interested in learning about Buffett's investment strategy.

In conclusion, the "Buffetology: Warren Buffett Investment Strategy" course by Finology Quest provides a comprehensive and reliable resource for understanding Warren Buffett's investment philosophy. By taking this course, investors can gain insights into the principles that have guided one of the greatest investors of our time. Remember, investing is a journey, and learning from successful individuals like Buffett can undoubtedly enhance our chances of success.

0 notes

Text

Navigating the World of Mutual Funds: Exploring the Value of Finology Recipe's Mutual Fund Reports

Introduction:

Mutual funds have become a popular choice for investors seeking diversification and professional management. As investors navigate the world of mutual funds, reliable and comprehensive information becomes crucial in making informed decisions. In this article, we explore the significance of mutual fund reports and how Finology Recipe serves as a valuable resource for investors seeking insightful analysis and detailed information on mutual funds.

Understanding the Importance of Mutual Fund Reports:

Mutual fund reports play a vital role in evaluating mutual fund performance, risks, and characteristics. These reports provide in-depth information about a fund's investment strategy, holdings, historical performance, fees, and other critical data necessary for investors to assess its potential. By understanding and analyzing this information, investors can make well-informed decisions aligned with their investment goals.

Exploring Finology Recipe's Mutual Fund Reports:

Finology Recipe stands out as a trusted platform that provides investors with valuable mutual fund reports. Let's delve into how Finology Recipe's mutual fund reports bring significant value to investors:

Unbiased and Objective Analysis:

Finology Recipe's mutual fund reports are designed to be unbiased, providing investors with objective analysis free from promotional biases. By relying on these reports, investors can access impartial information and insights into mutual funds, enabling them to make informed decisions based on reliable data.

Detailed Information:

Finology Recipe's mutual fund reports offer a wealth of information on various aspects of mutual funds. Investors can access comprehensive details about a fund's investment objectives, portfolio composition, fund managers, historical returns, fees, and much more. This comprehensive information allows investors to gain a deeper understanding of a fund's performance and investment strategy.

Comparative Analysis:

Finology Recipe facilitates comparative analysis of multiple mutual funds. This feature allows investors to compare funds side by side, evaluating important metrics such as performance, expenses, risk measures, and asset allocation. By having access to comparative analysis, investors can pinpoint funds that closely align with their investment preferences and objectives.

Risk Assessment and Fund Ratings:

Finology Recipe's mutual fund reports provide crucial risk assessment metrics and fund ratings. These metrics help investors evaluate a fund's risk profile and potential volatility, enabling them to select funds that align with their risk tolerance. Additionally, fund ratings from reputable agencies offer further guidance on a fund's quality and long-term performance, providing valuable insights for investors.

Educational Resources:

Finology Recipe recognizes the importance of investor education. Alongside mutual fund reports, the platform offers a range of educational resources aimed at enhancing investors' understanding of mutual funds, investment strategies, and risk management. This commitment to education empowers investors to make well-rounded and informed investment decisions.

Conclusion:

Mutual fund reports serve as invaluable tools for investors seeking meaningful insights into mutual funds. Finology Recipe's mutual fund reports go beyond providing comprehensive and unbiased analysis, offering investors access to detailed information, comparative analysis, risk metrics, fund ratings, and educational resources. By leveraging these resources, investors can navigate the world of mutual funds with confidence, making informed decisions aligned with their investment objectives. However, it's important for investors to remember that mutual fund reports are just one piece of the puzzle, and due diligence and consideration of other factors are crucial in making sound investment choices.

0 notes

Text

Exploring Wipro Ltd.: Share Price, Market Cap, Price Chart, and Balance Sheet Analysis

Wipro Ltd., a globally recognized provider of information technology services and consulting, holds a significant position in the business landscape. For those delving into Wipro's specifics, factors such as share price, market capitalization, price charts, and balance sheet analysis play a pivotal role. Platforms like Finology Ticker offer valuable insights into these aspects, serving as a tool for a comprehensive assessment of the company's performance without appearing as promotional content.

One integral element to consider is Wipro Ltd.'s current share price, which acts as a gauge of the company's valuation and investor sentiment. Tracking changes in share price provides valuable insights into market trends and shifts in demand for the company's shares. With real-time updates on Wipro Ltd.'s share price, Finology Ticker empowers investors to stay informed and make well-timed investment decisions.

Market capitalization is another critical metric that illuminates Wipro Ltd.'s overall market value. Computed by multiplying the current share price by the total number of outstanding shares, market capitalization offers a snapshot of the company's size and relative position within the industry. Monitoring Wipro Ltd.'s market cap helps investors assess its standing among competitors and evaluate its long-term growth potential.

Price charts offer a visual representation of Wipro Ltd.'s historical share performance, enabling investors to identify trends, patterns, and potential support and resistance levels. Analyzing these charts can offer insights into the stock's volatility, aiding in the identification of strategic buying and selling opportunities. Leveraging Finology Ticker's price charts can assist in examining Wipro Ltd.'s stock performance and identifying historical patterns.

Furthermore, a comprehensive evaluation of Wipro Ltd.'s financial health entails a thorough analysis of the company's balance sheet. From depicting assets, liabilities, to shareholders' equity, the balance sheet is instrumental in assessing Wipro Ltd.'s liquidity, solvency, and overall stability. Scrutinizing elements such as revenue growth, debt levels, and cash flow offers valuable insights into the company's financial well-being. Access to these balance sheet details via platforms like Finology Ticker aids investors in making informed decisions.

While Finology Ticker provides comprehensive information on Wipro Ltd.'s share price, market cap, price charts, and balance sheet, it is imperative to complement this data with further research and analysis. Comparative analysis against industry peers, examination of industry trends, staying abreast of news updates, and considering expert opinions contribute to a more holistic understanding of the company's potential.

In summary, platforms like Finology Ticker offer investors comprehensive information on Wipro Ltd.'s share price, market cap, price charts, and balance sheet, aiding in gaining valuable insights into the company's financial performance without appearing as promotional content. However, it is essential to approach this data critically, conducting additional research and analysis to make well-rounded investment decisions aligned with individual financial objectives and risk tolerance.

0 notes

Text

An Informative Guide to Real Estate Investment in India

Introduction:

Real estate investment in India holds significant potential for diversifying portfolios and building long-term wealth. Thanks to the accessibility of online resources, beginners can now educate themselves on real estate investment strategies. This article serves as a guide to investing in real estate in India by providing valuable insights without any promotional content related to specific platforms.

Understanding the Indian Real Estate Market:

Before venturing into real estate investment, it is crucial to gain familiarity with the Indian real estate market. It is influenced by factors such as location, demand and supply dynamics, infrastructure development, regulatory frameworks, and economic conditions. The foundation of successful investment lies in thorough research and analysis of these factors to make informed decisions.

Investing Education:

The first step towards real estate investment is to acquire knowledge and understanding of fundamental concepts, strategies, and associated risks. Online platforms offer comprehensive educational resources for beginners interested in learning about real estate investment. These platforms provide courses on property valuation, legal considerations, financing options, risk management, and property market analysis. Utilizing these resources can help investors develop a strong understanding of real estate investment principles.

Establishing Investment Goals:

Having clear investment goals is essential for any real estate investor. Determine whether the objective is long-term capital appreciation, rental income, or a combination of both. Additionally, consider factors like the investment timeline, risk tolerance, and financial capacity when setting these goals. By defining objectives, investors can align their investment strategies and make informed decisions.

Researching Property Markets:

The subsequent step involves researching potential property markets. Different cities and regions in India offer diverse opportunities for real estate investment. Factors such as population growth, infrastructure development, employment opportunities, and rental demand should be evaluated. Government reports, industry publications, and expert opinions serve as reliable sources offering valuable insights into these markets. It is essential to conduct thorough due diligence and analyze market trends before making investment decisions.

Analyzing Investment Options:

Real estate investment in India provides various options, including residential properties, commercial buildings, retail spaces, and land. Each option comes with different risks, returns, and holding periods. Investors should analyze these options based on their investment goals, budget, and market research. Understanding potential risks, rental yields, appreciation potential, and future development plans before making a final decision is crucial.

Securing Financing and Legal Considerations:

Once a property is identified, investors need to arrange financing if required. Several financing options are available, including bank loans, private lenders, and partnerships. Assess the financial implications and select an option that aligns with the investment goals. Additionally, ensure proper legal due diligence, including title verification, land-use restrictions, ownership disputes, and necessary documentation, to safeguard the investment.

Continuous Learning and Adaptation:

Real estate investing is a dynamic field, and market conditions can change rapidly. It is crucial for investors to continuously educate themselves and stay updated with market trends, regulatory changes, and emerging investment strategies. Online platforms offer ongoing educational resources, enabling investors to enhance their knowledge and adapt their strategies accordingly.

Conclusion:

Investing in real estate in India presents an enticing opportunity for diversifying portfolios and building long-term wealth. By understanding the nuances of the Indian real estate market, acquiring investing education, setting investment goals, conducting extensive research, analyzing investment options, addressing legal considerations, and continuously learning, investors can position themselves for success. Online resources serve as valuable educational tools for beginners looking to embark on their real estate investment journey, enabling them to make informed decisions and navigate the complexities of the market.

0 notes

Text

Navigating Investment Decisions: Exploring the Value of Stock Research Reports on Finology Recipe

Introduction:

In the realm of investment decisions, the significance of stock research reports cannot be overstated. These reports provide investors with essential insights into the performance, potential, and risks associated with specific stocks, aiding in informed decision-making. One reputable platform known for its robust stock research reports is Finology Recipe. In this article, we delve into the significance of stock research reports and how Finology Recipe serves as a valuable resource for investors seeking to navigate the complexities of the stock market.

Unpacking the Essence of Stock Research Reports:

Stock research reports serve as in-depth analyses that delve into the financial metrics, management competency, competitive positioning, and growth prospects of individual companies. Conducted by experienced financial analysts or research teams, these reports offer a comprehensive examination of various factors impacting a company's stock performance, enabling investors to make well-informed decisions based on thorough insights.

Leveraging Finology Recipe’s Stock Research Reports:

Finology Recipe emerges as a trusted platform offering a diverse array of stock research reports designed to empower investors in their decision-making process. Let's explore how Finology Recipe's stock research reports stand out as invaluable resources for investors:

Impartial and Comprehensive Analysis:

At the core of Finology Recipe’s stock research reports lies a commitment to impartiality and comprehensiveness. By presenting unbiased analyses devoid of promotional influences, investors can rely on the accuracy and reliability of the insights provided, allowing for informed decision-making based on factual information.

Expertise-Driven Insights:

Finology Recipe's stock research reports benefit from the expertise of seasoned financial analysts specializing in various industries and sectors. These experts leverage their knowledge and market acumen to deliver insightful analyses of company data, industry trends, and competitive landscapes, equipping investors with nuanced perspectives essential for sound decision-making.

Extensive Coverage:

One of the key strengths of Finology Recipe’s stock research reports is their extensive coverage of companies across diverse industries and sectors. This breadth allows investors to access reports on companies of varying sizes and niches, facilitating the building of a well-diversified investment portfolio and enabling informed decision-making across a spectrum of investment opportunities.

Detailed Financial Data Access:

Investors leveraging Finology Recipe’s stock research reports gain access to detailed financial data crucial for evaluating a company's financial stability and performance. From income statements to key financial ratios, this comprehensive data empowers investors to make informed investment decisions grounded in a thorough understanding of underlying financial metrics.

Education-Centric Approach:

Beyond offering stock research reports, Finology Recipe prioritizes investor education by providing supplementary resources aimed at enhancing financial literacy and market understanding. By incorporating educational materials alongside research reports, investors can deepen their knowledge of investment strategies, risk management practices, and market dynamics, fostering a well-rounded approach to decision-making.

Conclusion:

Stock research reports from Finology Recipe serve as invaluable tools for investors seeking to navigate the intricate landscape of investment decisions with confidence and clarity. By leveraging the impartiality, expertise, extensive coverage, and educational resources offered through these reports, investors can gain a holistic understanding of investment opportunities, assess risks effectively, and make well-informed decisions aligned with their financial goals. While stock research reports are essential resources, investors must complement this information with their due diligence and a diversified approach to investment decision-making in the dynamic world of finance.

0 notes

Text

Explore the Cable Sector: Unraveling Industry Classification and Resource Options

The cable sector continues to play a significant role in media consumption and entertainment, intertwined with telecommunications and technology. For investors delving into cable sector stocks and their industry classification, a wealth of resources is available, including platforms like Finology Ticker that offer insights into this complex market.

When delving into the list of cable sector stocks with industry classification, it is paramount to approach the data with a discerning eye. At the core, there is a need to comprehend how cable stocks are categorized within the broader industry landscape, where connections between cable providers, content creators, and streaming services form a complex ecosystem. Finology Ticker can serve as a valuable tool in depicting the classification and categorization of cable sector stocks, aiding investors in understanding the industry context in which these companies operate.

Furthermore, combining data from such platforms with in-depth research and analysis is vital. Given the dynamic nature of the media landscape, a thorough grasp of trends, challenges, and prospects within the cable sector is critical to assessing the investment potential of these stocks. This involves analyzing cord-cutting patterns, industry shifts, technological advancements, and regulatory changes to gauge the long-term viability of investments in the cable sector.

Maximizing available resources, such as Finology Ticker's compilation of cable sector stocks, is just one aspect of extensive due diligence. Investors are advised to corroborate this information with market insights, industry reports, and expert perspectives to cultivate a nuanced understanding of the sector. By integrating diverse information sources, investors can make more informed choices when contemplating investments within the cable industry.

Moreover, recognizing the macroeconomic and societal influences that could impact the cable sector is crucial. Demographic changes, tech innovations, and shifts in consumer behavior all shape the trajectory of cable companies. Therefore, a thorough examination that considers both broader trends and industry-specific data is essential for prudent investment decision-making.

In summary, while platforms like Finology Ticker offer valuable insights into cable sector stocks and industry classification, investors must approach this data with a holistic and critical mindset. Rigorous research, a deep understanding of industry dynamics, and acknowledgement of overarching trends in technology and consumer behaviour are key components in making well-informed investment decisions in the ever-evolving cable sector.

0 notes

Text

Navigating Online Certification Courses for Finance, Investing, and the Stock Market in India

Introduction:

In the current ever-evolving financial realm, it has become imperative for individuals to arm themselves with knowledge and skills in finance, investing, and the stock market. Online learning platforms offer an accessible and flexible option for pursuing online certification courses to gain valuable insights and expertise. A notable platform that offers a variety of courses tailored to the Indian market is Finology Quest. This article aims to examine the advantages of online certification courses and showcase some of the options available through Finology Quest, avoiding any promotional language.

Strengthening Financial Acumen:

A strong foundational knowledge of finance is crucial for making well-informed decisions, managing personal finances, and reaching long-term financial objectives. Online certification courses provide individuals with a structured learning experience, covering essential topics such as financial planning, budgeting, risk management, and investment strategies. The courses presented on Finology Quest are designed to provide practical knowledge from industry experts, assisting individuals in developing a comprehensive understanding of financial concepts.

Mastery of Investing:

Investing requires expertise and understanding in order to generate wealth and attain financial security. Online certification courses in investing equip learners with the knowledge necessary to make wise investment decisions. Finology Quest's courses encompass various aspects of investing, including fundamental and technical analysis, portfolio management, and strategies for selecting stocks, bonds, and other investment instruments. These courses provide individuals with the tools to evaluate investment opportunities and manage risks with confidence.

Grasping the Dynamics of the Stock Market:

For those intrigued by the dynamic world of stock markets, it is vital to comprehend market mechanics, trading strategies, and the factors influencing stock performance. Online certification courses focusing on the stock market offered by platforms such as Finology Quest explore topics such as market analysis, stock valuation techniques, and the impact of economic trends and geopolitical factors on stock prices. These courses provide learners with a comprehensive understanding of the stock market, empowering them to make informed investment decisions.

Advantages of Online Certification Courses:

Online certification courses in finance, investing, and the stock market offer several benefits. They provide flexible learning options, allowing individuals to study at their own pace and convenience. This aspect is particularly advantageous for working professionals or individuals with other commitments. Additionally, online courses often offer interactive learning materials, quizzes, and case studies, facilitating a practical understanding of the subject matter. The ability to access course materials and resources even after completion ensures that learners can revisit and reinforce their knowledge whenever needed.

Courses Offered on Finology Quest:

Finology Quest stands out as a prominent online learning platform offering a range of online certification courses in finance, investing, and the stock market in India. The platform features courses designed by industry experts to cater to different skill levels, from beginners to advanced learners. The courses cover various topics, including financial planning, equity analysis, technical analysis, derivatives, and more. Finology Quest's emphasis on practical knowledge and its user-friendly interface have garnered positive feedback from learners seeking to enhance their financial expertise.

Conclusion:

The availability of online certification courses has revolutionized the way individuals learn and acquire expertise in finance, investing, and the stock market. Platforms like Finology Quest provide an essential opportunity for individuals in India to access high-quality courses and gain practical knowledge from industry experts. Enrollment in these courses offers the chance to enhance financial literacy, master the art of investing, and develop a thorough understanding of the stock market. Investing in one's financial education is an investment in long-term success, and online certification courses serve as essential stepping stones towards financial expertise.

#financial courses#stock market courses online free#certified financial planner course#stock market training

0 notes

Text

Taking Control of Your Retirement: Navigating the Future with the Investment Calculator from Finology Recipe

Introduction:

As individuals navigate the complex landscape of retirement planning, it's essential to leverage tools that can simplify this crucial process. One such tool is the "Retirement Planning- Plan Your Future with Investment Calculator" available on Finology Recipe. In this article, we will delve into how this calculator can empower individuals to take charge of their financial future and support informed decision-making during retirement planning.

Unpacking Retirement Planning:

Retirement planning entails a comprehensive assessment of an individual's financial needs, goals, and investment options to secure a comfortable retirement. It involves examining income sources, expenses, savings, and potential investment returns, all of which are critical components in ensuring a financially sound post-retirement life.

Exploring the Investment Calculator on Finology Recipe:

Finology Recipe, a trusted platform for financial planning tools, offers an Investment Calculator designed to assist individuals in their retirement planning journey. Let's explore how this calculator can be a valuable resource in mapping out a secure and prosperous retirement:

Holistic Financial Evaluation:

The Investment Calculator on Recipe enables users to input various financial details, including current savings, anticipated contributions, inflation rates, expected investment returns, and retirement age. By analyzing these factors, the calculator provides a comprehensive assessment of an individual's financial situation and projected retirement funds.

Goal-Centric Projections:

This calculator allows users to establish specific retirement goals by determining the desired income during retirement. It then projects the required retirement savings to achieve those goals, factoring in inflation and potential investment returns. Such tailored projections help individuals align their financial aspirations with a strategic plan.

Tailored Investment Strategies:

With the Investment Calculator, users can explore different investment strategies based on their risk tolerance and time horizon. By adjusting investment allocation and considering the impact of varying returns, users can evaluate the potential growth of their retirement funds, customizing their investment plan to suit their preferences and goals.

Flexibility and Adaptability:

Retirement planning is an evolving process that demands regular evaluation and adjustment. The Investment Calculator allows users to review and modify their inputs as needed, enabling them to fine-tune their strategies in response to changing circumstances or as they approach retirement age.

Building Knowledge and Confidence:

In addition to providing calculations, the Investment Calculator on Recipe equips users with valuable educational resources and insights. Users can access information on retirement planning, investment options, and risk management, supporting them in making well-informed decisions and enhancing financial literacy.

Conclusion:

The Investment Calculator on Finology Recipe serves as a user-friendly and effective tool that facilitates comprehensive financial assessment and customized investment strategies for retirement planning. By utilizing this calculator, individuals can gain a clearer understanding of their retirement goals, project their future financial situation, and make informed decisions to maximize their retirement savings. While tools like the Investment Calculator are invaluable, seeking professional advice tailored to individual circumstances remains a critical aspect of successful retirement planning.

#retirement planning#retirement planning guide#retirement planning tool#retirement planning calculator#retirement planner

0 notes

Text

Understanding GG Engineering Ltd Share Price: Insights and Considerations

GG Engineering Ltd is a prominent player in the engineering industry and is known for its innovative solutions and strong market presence. For investors and shareholders interested in tracking the performance of GG Engineering Ltd shares, accessing accurate information about share prices, market capitalization, price charts, and balance sheets is essential. Fortunately, there are reliable resources available, such as Finology Ticker, which provides comprehensive data on GG Engineering Ltd's share price today, market cap, price chart, and balance sheet.

Importance of Share Price Analysis

The share price of a company reflects the current valuation of its stock in the market. It is a critical metric that provides insights into investor sentiment, market trends, and the financial performance of the company. Understanding the dynamics of GG Engineering Ltd's share price can be pivotal for investors looking to make well-informed decisions regarding their investments.

Leveraging Finology Ticker for Comprehensive Insights

Finology Ticker is a respected financial website that offers a wealth of information regarding GG Engineering Ltd's share price. Through the platform, investors can access real-time data on share prices, enabling them to stay updated on market movements and make strategic decisions related to buying or selling GG Engineering Ltd shares.

Market Capitalization Analysis

In addition to share price, market capitalization is another crucial metric that provides an understanding of the overall value and size of a company. By accessing data on GG Engineering Ltd's market capitalization, investors can gauge the company's standing in the industry and compare it with its peers. This can aid in assessing the company's performance and potential growth prospects.

Insights from Price Charts and Balance Sheets

Price charts and historical data offer valuable insights into the stock's performance over time, helping investors identify trends and patterns. Additionally, a thorough analysis of GG Engineering Ltd's balance sheet can provide insights into the company's financial health, asset management, and debt obligations.

Considerations and Risk Mitigation

While the data provided by platforms like Finology Ticker can offer valuable insights, it is important to approach investment decisions with caution. Share prices are influenced by a myriad of factors, including market conditions, industry trends, and macroeconomic events. Therefore, investors should conduct thorough research, diversify their portfolios, and seek professional guidance to mitigate potential risks associated with stock trading.

Conclusion

Analyzing GG Engineering Ltd's share price is an essential aspect of monitoring the company's performance and making informed investment decisions. Platforms like Finology Ticker offer comprehensive data on GG Engineering Ltd's share price today, market cap, price chart, and balance sheet empowering investors to make well-informed choices. However, it is crucial for investors to exercise diligence, conduct thorough research, and remain aware of the inherent risks associated with stock investments. By leveraging available data and seeking professional advice, investors can navigate the complexities of the stock market and make strategic decisions regarding GG Engineering Ltd shares.

#GG Engineering Ltd. Share Price#NSE GG Engineering Ltd.#GG Engineering Ltd. Stock Price#GG Engineering Ltd. Price Chart

0 notes

Text

A Guide to Filtering High-Growth Stocks: Insights from Finology Quest

Identifying high-growth stocks is a sought-after skill among investors looking to maximize their returns. However, understanding how to filter and select these promising stocks requires a keen understanding of market dynamics. Platforms like Finology Quest provide valuable resources to help investors navigate this process effectively.

The "How to Filter High-Growth Stocks with Mr Gautam Baid" course offered by Finology Quest is an invaluable resource for those seeking to enhance their stock selection skills. This course, presented by renowned expert Mr Gautam Baid, offers insights and strategies for identifying high-growth stocks amidst a sea of investment options.

Understanding the Characteristics of High-Growth Stocks:

The course begins by delving into the crucial characteristics of high-growth stocks. Participants gain an understanding of metrics such as revenue growth rates, earnings per share (EPS) growth, and return on equity (ROE). By learning to analyze these indicators, investors can filter out potential high-growth stocks from the broader market.

Quantitative and Qualitative Analysis Tools:

Furthermore, the course explores various quantitative and qualitative analysis tools that aid in the identification of high-growth stocks. Participants learn about techniques like ratio analysis, trend analysis, and industry comparisons. This multi-faceted approach allows investors to develop a comprehensive understanding of a company's growth potential.

Risk Assessment and Management:

While the focus is on identifying high-growth stocks, the course also emphasizes the importance of risk assessment and management. Investors learn to evaluate the potential risks associated with high-growth stocks, including market volatility and industry-specific risks. Understanding these risks helps investors make informed decisions and allocate their resources accordingly.

Real-World Examples and Case Studies:

One of the highlights of the course is the inclusion of real-world examples and case studies. Through the analysis of past and current high-growth stocks, participants gain insights into the practical application of the filtering techniques taught in the course. This hands-on approach provides a deeper understanding of the subject matter and enhances the learning experience.

Continuous Learning and Adaptation:

The course concludes by emphasizing the importance of continuous learning and adaptation in the ever-changing world of high-growth stocks. Participants are encouraged to stay updated with market trends, explore new investment strategies, and remain open to refining their filtering techniques as needed.

In conclusion, the "How to Filter High-Growth Stocks with Mr Gautam Baid" course offered by Finology Quest equips investors with valuable insights into the process of identifying and selecting high-growth stocks. By understanding the characteristics of high-growth stocks, employing quantitative and qualitative analysis tools, assessing and managing risks effectively, and continually adapting to market dynamics, participants can enhance their chances of finding promising investment opportunities. With Finology Quest as a trusted educational resource, investors can confidently navigate the intricacies of filtering high-growth stocks and work towards maximizing their investment returns.

#high growth stocks#how to find high growth stocks#how to identify high growth stocks#how to pick high growth stocks

0 notes

Text

Unleashing the Power of Financial Planning: Leveraging Free Tools for Informed Investing with Finology Recipe

Introduction:

In today's dynamic financial landscape, the role of financial planning in shaping a secure future cannot be overstated. With the emergence of free tools like Finology Recipe, individuals have unprecedented access to resources that can significantly impact their investment decisions. This article aims to explore the pivotal role of financial planning and shed light on the advantages of utilizing free tools such as Recipe for Informed and Empowered Investing.

Unpacking the Essence of Financial Planning and its Relevance:

Financial planning serves as a compass that guides individuals towards their monetary aspirations. It encompasses a strategic approach to comprehensively manage finances, strategize achievable goals, and chart a roadmap towards their realization. These are some key reasons why financial planning is paramount:

Goal Articulation and Precision:

Financial planning enables individuals to articulate and specify their financial ambitions, ensuring a focused trajectory for their investments. Whether it involves saving for retirement, purchasing a property, or funding education, defining goals forms the cornerstone of prudent financial planning.

Fiscal Budgeting and Expenditure Governance:

A fundamental aspect of financial planning involves formulating a budget that harmonizes income and outlays. By diligently monitoring finances, individuals can optimize savings and investment potential, thereby reinforcing control over their financial resources.

Wealth Aggregation and Preservation:

Through financial planning, individuals gain insights into their present financial standing and opportunities for wealth accumulation. Analyzing income, expenses, and risk tolerance facilitates informed investment decisions that resonate with their envisioned financial milestones.

Introducing Finology Recipe's Free Tools and Features:

Finology Recipe provides an array of free financial planning tools, empowering individuals to navigate their investments effectively. These tools encompass various features that can revolutionize financial planning:

Goal-Driven Planning:

Recipe's tools facilitate users in establishing tailored investment strategies aligned with their unique financial objectives. By inputting requisite details, individuals can gain valuable insights into the actualization of their financial goals over time.

Investment Portfolio Evaluation:

Through Recipe's free tools, users can meticulously scrutinize their investment portfolios. Performance tracking, asset allocation assessments, and diversification reviews equip individuals to make well-informed decisions pertaining to their investment approach.

Risk Profiling and Assessment:

Assessing risk tolerance is pivotal in financial planning. Recipe's tools empower individuals to evaluate their risk appetite, utilizing risk assessment calculators to expedite investment decisions congruent with their risk preferences.

Retirement Strategizing:

Planning for retirement is a pivotal facet of financial planning. Recipe's tools offer assistance in calculating retirement funding needs, forecasting future income, and scrutinizing investment avenues, ensuring a financially secure post-retirement phase.

Conclusion:

Financial planning is indispensable in safeguarding financial stability and realizing long-term aspirations. Free tools like those offered by Finology Recipe empower individuals to proactively manage finances and make informed investment decisions. By leveraging these tools, individuals can delineate precise financial objectives, chart feasible strategies, and navigate the labyrinth of investment intricacies with enhanced efficacy. While these tools offer invaluable assistance, it is imperative to underscore the importance of seeking professional counsel and tailoring financial plans to individual circumstances for a holistic and successful financial planning journey.

0 notes

Text

Understanding Senco Gold Ltd. Share Price: Key Insights and Factors to Consider

Introduction:

With its recent listing on the Indian stock market, Senco Gold Ltd. has caught the attention of investors and shareholders in the jewellery industry. In order to stay abreast of the company's performance, it is crucial to have access to accurate information about its share price, market capitalization, price charts, and balance sheets. Finology Ticker is a renowned financial website that offers these resources to assist investors in making informed decisions. This article aims to provide an overview of the significance of analyzing Senco Gold Ltd.'s share price and the essential considerations to keep in mind.

Exploring Share Price:

Share price represents the value at which a company's shares are traded on the stock market. The share price fluctuates based on multiple factors, such as the company's financial performance, market trends, and investor sentiment. The website Finology Ticker provides reliable information on Senco Gold Ltd.'s current share price to help investors stay up-to-date with accurate data.

Significance of Market Capitalization:

Market capitalization is the total value of a company's outstanding shares in the market. It is an essential metric that indicates the size and valuation of the company. Through the provision of information on Senco Gold Ltd.'s market capitalization, Finology Ticker helps investors compare the company's standing against its peers in the industry.

Utilizing Price Charts and Historical Data:

Price charts and historical data are valuable tools for analyzing a company's stock performance over time. Finology Ticker offers comprehensive price charts that depict Senco Gold Ltd.'s price movements over an extended period. It enables investors to identify trends, patterns, and potential support and resistance levels, facilitating informed investment decisions.

Insights from Balance Sheet Analysis:

Assessing a company's balance sheet is crucial for analyzing its financial position, including the management of assets, liabilities, and equity. Finology Ticker offers access to Senco Gold Ltd.'s balance sheet, giving investors valuable insights into the company's operational efficiency, debt management policies, and profitability.

Considerations and Risks:

It is important to note that share prices are influenced by multiple factors beyond a company's control, such as macroeconomic conditions, environmental factors, or political events. Therefore, it is essential to conduct comprehensive research, diversify portfolios, and seek advice from financial experts to mitigate potential risks when trading.

Conclusion:

Analyzing share prices is a crucial step in tracking the performance of companies like Senco Gold Ltd. Finology Ticker provides a reliable platform for accessing accurate information about share prices, market capitalization, price charts, and balance sheets that assist investors in making informed decisions. However, trading is an inherently risky proposition that can be influenced by various factors beyond the control of investors. Therefore, it is crucial to exercise caution, stay informed, and seek professional advice when making investment decisions in Senco Gold Ltd. stock.

0 notes

Text

Exploring the World of Stock Market Investing: A Guide for Beginners

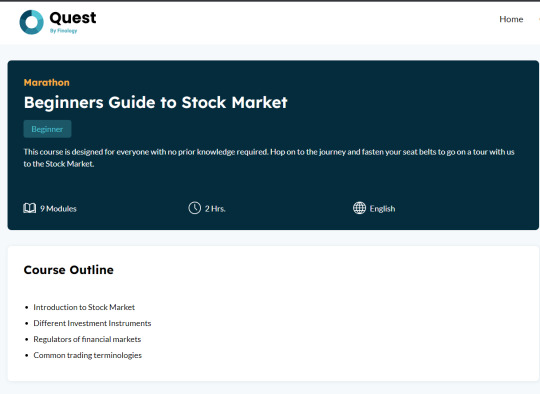

For newcomers to the world of stock market investing, the sheer volume of information and jargon can be overwhelming. Fortunately, platforms like Finology Quest offer educational resources tailored for beginners seeking to navigate the complexities of the stock market.

The "Beginners Guide to Stock Market" course on Finology Quest provides a structured and informative introduction to the fundamentals of stock market investing. From understanding basic terminology to evaluating investment opportunities, the course serves as a roadmap for those embarking on their investment journey.

One of the key takeaways from the course is the emphasis on understanding the risks associated with investing in the stock market. By familiarizing themselves with concepts like risk management and diversification, beginners can make informed decisions about where and how to allocate their funds.

Moreover, the course emphasizes the importance of developing a sound investment strategy that aligns with individual financial goals and risk tolerance levels. By learning how to create a diversified portfolio and monitor market trends, beginners can work towards building a robust investment plan.

Continuous learning is also highlighted as a crucial aspect of successful stock market investing. The dynamic nature of the market requires investors to stay informed and adapt their strategies as needed. The course encourages beginners to engage in ongoing research and education to stay ahead in the ever-evolving world of investing.

In conclusion, the "Beginners Guide to Stock Market" course offered by Finology Quest provides a valuable resource for individuals taking their first steps into the world of stock market investing. By establishing a solid foundation of knowledge, understanding risk management principles, developing a thoughtful investment strategy, and committing to continual learning, beginners can set themselves up for long-term success in the stock market.

#how to buy shares#how to start investing#best stocks for beginners with little money#how to make money in stocks

0 notes

Text

The Role of Stock Reports and Mutual Fund Analysis in Informed Investing

Introduction:

In the world of investing, access to reliable information is crucial for making sound decisions. Platforms like Finology Recipe provide valuable insights through their stock reports and mutual fund analysis. This article will explore the significance of these resources and how they can empower investors to make informed choices.

Understanding Stock Reports and Mutual Fund Analysis:

Stock Reports:

Stock reports offer detailed analysis of individual stocks, including financials, performance indicators, industry comparisons, and price trends. They provide investors with a comprehensive understanding of a company's fundamentals, growth prospects, and potential risks. By analyzing robust data and conducting research, stock reports help investors make informed decisions based on solid information.

Mutual Fund Analysis:

Mutual fund analysis involves evaluating aspects such as historical performance, portfolio composition, expense ratios, investment objectives, and risk profiles. It helps investors determine the potential returns and risks associated with a mutual fund, ensuring alignment with their goals and risk tolerance. Mutual fund analysis assists investors in selecting funds that suit their investment preferences and objectives.

The Significance of Finology Recipe:

Finology Recipe is an online platform that offers a range of resources, including stock reports and mutual fund analysis. By providing unbiased information, Recipe aims to support investors in their decision-making process.

Stock Report and Mutual Fund Analysis on Recipe:

Recipe's stock report section presents users with comprehensive information, analyzing financial metrics, industry trends, and risks associated with individual stocks. It equips investors with objective analysis and research, enabling them to make informed decisions based on factual information rather than subjective opinions.

Similarly, Recipe's mutual fund analysis section evaluates various parameters of mutual funds, such as performance history, risk assessment, expense ratios, and investment objectives. This resource helps investors make well-informed decisions when selecting funds that align with their investment goals and risk appetite.

Empowering Investors with Unbiased Insights:

One key advantage of platforms like Finology Recipe is their commitment to providing unbiased insights. Recipe's stock reports and mutual fund analysis focus on delivering objective information, devoid of any promotional content or vested interests. This empowers investors to evaluate investment opportunities based on reliable analysis, enhancing their ability to make informed choices.

Conclusion:

Stock reports and mutual fund analysis play a crucial role in guiding investment decisions. Platforms like Finology Recipe provide investors with valuable resources, ensuring access to reliable information. However, it's important to remember that these reports are just one component of a comprehensive investment strategy. Investors should consider their financial goals and risk tolerance and seek advice from financial professionals before making any investment decisions. By combining diligent research with pertinent analysis, investors can enhance their chances of achieving long-term investment success.

0 notes

Text

Examining Campus Activewear Ltd. Share Price and Financials through Ticker by Finology

Investors and shareholders recognize the importance of staying up-to-date with the latest share prices and financials of companies they follow, and Campus Activewear Ltd. is no exception. Ticker by Finology provides an invaluable tool for gaining insights into Campus Activewear Ltd.'s current share price, market capitalization, price chart, and balance sheet.

An in-depth analysis of a company's share price gives valuable insights into its financial performance and market perception. Campus Activewear Ltd., a leading activewear industry player, has piqued the interest of investors exploring potential opportunities. By tracking the company's share price, investors can make informed decisions and evaluate the market's response to Campus Activewear Ltd.'s performance.

Furthermore, Campus Activewear Ltd.'s market capitalization can indicate the company's relative size and value compared to similar industry peers. This data serves as an effective benchmark for investors to reflect and evaluate the company's performance among its competitors.

A price chart is an exceptional tool to monitor a company's share price over an extended period. For Campus Activewear Ltd., its price chart provides a visual representation of movement, direction, and potential purchase/sale opportunities. Analyzing historical price movements allows investors to assess past market behavior and make more informed investment decisions.

Consequently, evaluating Campus Activewear Ltd.'s balance sheets assists investors in understanding the company's financial health. In this evaluation, investors study the company's equity, liabilities, and assets. This information provides insights into Campus Activewear Ltd.'s financial solvency, stability, and overall financial well-being.

Despite the usefulness of Ticker by Finology, investors must approach analysis with caution. A share price is influenced by several factors, such as industry trends, regulatory measures, and economic conditions. Investors must conduct extensive research and consult multiple sources before making any investment decisions.

Therefore, in conclusion, Ticker by Finology is a vital tool in evaluating Campus Activewear Ltd.'s share price, market capitalization, price chart, and balance sheet. While this information is value-added, investors must supplement their analysis with careful research and financial advice before investing in any financial instruments.

0 notes

Text

A Comprehensive Guide to Real Estate Investment in India

Introduction:

Real estate investment in India has captured the attention of many individuals looking to build their fortune and establish financial stability. However, the complex nature of the market demands deep insights and knowledge. Fortunately, Quest by Finology provides valuable resources and courses to guide individuals through the intricacies of real estate investment in India.

Understanding the Indian Real Estate Market:

It is essential to comprehend the dynamics and nuances of the Indian real estate sector for successful investment. The industry offers diverse investment options, including residential, commercial, and industrial properties - each shaped by market trends, regulations, and economic factors.

Navigating the Online Real Estate Investment Space:

Thanks to technological advances, individuals can also invest in real estate through online platforms that offer access to a wide range of properties. Quest by Finology's course titled "How to Invest in Real Estate in India?" aids in gaining essential knowledge and tools to conduct online real estate investment in India effectively.

Important Considerations for Real Estate Investment:

Location: The location of a property is a critical factor in determining its potential return on investment. Proximity to transport, amenities, educational institutions, and employment hubs significantly affect a property's desirability and value appreciation.

Legal and Regulatory Framework: Understanding the legal and regulatory framework governing Indian real estate investments is critical. Familiarity with property laws, taxation, and compliance requirements is essential for informed decision-making.

Market Research and Due Diligence: Conducting thorough market research is crucial while making real estate investment decisions. This includes factors like property valuation, rental yields, and demand analysis. Due diligence while studying title deeds, land ownership, and property history helps mitigate risks.

Leveraging Quest by Finology's "How to Invest in Real Estate in India?" Course:

Quest by Finology offers a comprehensive course that provides insights into virtual real estate investment in India. The course covers necessary topics, including investment strategies, market analysis, legal considerations, and risk management. Enrolling in such courses equips individuals with valuable knowledge, empowering them to make informed investment decisions.

Conclusion:

Realizing the potential of real estate investment in India requires sound knowledge and understanding. With guidance from resources like Quest by Finology's platform and course offerings, individuals can navigate the Indian real estate market wisely. Conducting thorough research, due diligence, and continuous learning enables informed decision-making, positioning individuals for long-term financial growth through Indian real estate investment.

0 notes