Text

Unveiling the Triumphs of Siddhartha Lal: Architect of Royal Enfield’s Resurgence

If motorcycles are poetry on wheels, Siddhartha Lal, the owner of Royal Enfield, is the poet behind the resurgence of this iconic brand. In a mesmerizing journey of passion, innovation, and leadership, Lal’s success story is etched into the history of the motorcycle industry. Let’s delve into the narrative that reshaped Royal Enfield, exploring the detailed account in this captivating article: Royal Enfield Owner: Siddhartha lal Success Story

1. From Enthusiast to Visionary Leader:

Siddhartha Lal’s journey didn’t start with boardrooms; it began with a genuine love for motorcycles. Uncover the transition from an enthusiast to a visionary leader who breathed new life into Royal Enfield.

2. Reviving an Iconic Brand:

Royal Enfield, a brand steeped in history, found a renaissance under Lal’s leadership. Explore the strategic decisions and innovative approaches that revitalized this timeless symbol of motorcycling.

3. Global Recognition:

Lal’s ambitions transcended borders, propelling Royal Enfield to a global stage. Dive into the expansion strategies that turned Royal Enfield into a recognizable force beyond the Indian subcontinent.

4. Navigating Industry Dynamics:

The motorcycle industry is dynamic, with its fair share of challenges. Learn how Siddhartha Lal navigated through industry shifts, economic fluctuations, and the evolving demands of motorcycle enthusiasts.

5. Legacy Beyond Machinery:

Beyond the roar of engines, Lal’s legacy extends into the culture of motorcycling. Discover how his influence shaped not just motorcycles but also the lifestyle and community around Royal Enfield.

Embark on a Journey of Inspiration:

For a nuanced exploration of Siddhartha Lal’s success story and the transformation of Royal Enfield, immerse yourself in the complete article here. It’s a narrative that resonates with enthusiasts, industry observers, and aspiring leaders.

0 notes

Text

IDFC FIRST WOW! Credit Card Review

Choosing a credit card is like finding the perfect match for your financial journey, and the IDFC FIRST WOW! Credit Card stands out with its unique offerings. Let's delve into what sets this card apart from the rest. For a comprehensive review, explore this insightful article: IDFC FIRST WOW! Credit Card Review

IDFC FIRST WOW! Credit Card: A Cut Above the Rest

Welcome Benefits Beyond the Ordinary:The IDFC FIRST WOW! Credit Card extends a warm welcome with benefits that go beyond the ordinary. Discover the exclusive perks that greet you as a cardholder.

Milestone Rewards That Excite:Milestone rewards can make or break a credit card experience. Uncover how the IDFC FIRST WOW! Credit Card redefines these rewards, making every spending milestone an exciting achievement.

Zero Foreign Currency Markup:For those with a global lifestyle, the absence of foreign currency markup is a game-changer. Learn how this feature sets the IDFC FIRST WOW! Credit Card apart, saving you on international transactions.

Personalized Lifestyle Benefits:Your lifestyle deserves personalized perks, and that's precisely what the IDFC FIRST WOW! Credit Card offers. From dining delights to entertainment privileges, explore how this card aligns with your unique preferences.

Comprehensive Insurance Coverage:Beyond the usual offerings, the IDFC FIRST WOW! Credit Card provides comprehensive insurance coverage. Dive into the layers of protection that accompany your card membership.

Unlock the Full Review:

For an in-depth exploration of the IDFC FIRST WOW! Credit Card, covering fees, charges, and real-world user experiences, delve into this article It's your compass in navigating the credit card landscape and making an informed choice.

0 notes

Text

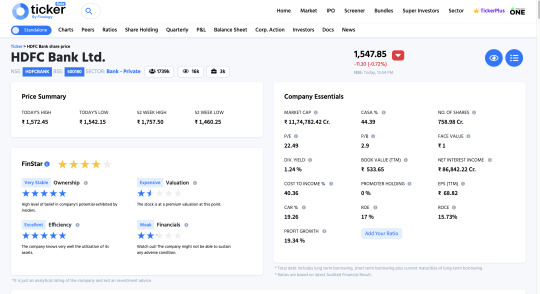

Decoding HDFC Bank: A Comprehensive Stock Review

In the dynamic landscape of the financial market, HDFC Bank emerges as a stalwart, shaping the contours of the banking sector. This article aims to unravel the intricacies of HDFC Bank’s stock, providing readers with a detailed review and real-time insights. For those seeking in-depth analysis, the go-to resource is Ticker by finology HDFC bank.

Introduction: A Banking Powerhouse

HDFC Bank, a name synonymous with financial excellence, has carved its niche as a reliable and innovative player in the banking industry. As we delve into the various facets of HDFC Bank’s stock, the aim is to offer investors a nuanced perspective and equip them with the tools needed for informed decision-making.

1. Financial Fortitude:

At the core of HDFC Bank’s success lies its unwavering financial stability. This section delves into the bank’s consistent performance, showcasing its ability to weather market fluctuations and maintain a robust financial position.

2. Market Leadership and Trust:

The discussion expands to HDFC Bank’s market leadership and the trust it has garnered among investors. The article explores the bank’s extensive network, customer-centric approach, and the resulting reputation as a reliable and customer-friendly institution.

3. Innovation in Banking Solutions:

A crucial aspect of HDFC Bank’s stock review is its commitment to innovation. From pioneering digital solutions to a diverse range of financial products, the article sheds light on how the bank continues to evolve to meet the dynamic needs of its customers.

4. Risk Management Prowess:

An examination of HDFC Bank’s risk management practices is imperative for a holistic understanding. This section outlines how the bank’s proactive risk management contributes to a resilient and secure financial environment.

5. Investor-Focused Policies:

Investors value transparency and policies that prioritize shareholder value. The article navigates through HDFC Bank’s investor-friendly approach, ensuring stakeholders stay well-informed about the bank’s performance and future trajectory.

Unlock Real-Time Data and Insights:

For those craving real-time updates, financial indicators, and a comprehensive review of HDFC Bank’s stock, the article directs readers to this Ticker by finology HDFC bank. It serves as a hub for detailed insights, empowering investors with the information needed for strategic decision-making.

Conclusion: Navigating the Future with HDFC Bank

As we conclude this exploration, the article emphasizes the significance of staying informed in the ever-changing financial landscape. HDFC Bank’s stock review provides readers with a roadmap to navigate the intricacies of the banking sector and make informed investment decisions.

0 notes

Text

A Comprehensive Brokerage Comparison Guide

In the world of investing, the right brokerage account can make all the difference. As investors, we seek a platform that aligns with our needs, offers competitive features, and minimizes costs. Enter the era of informed decision-making through a thorough Brokerage Comparison.

Understanding the Significance of Brokerage Comparison:

Brokerage Charges Decoded:

The cornerstone of any brokerage comparison is the evaluation of brokerage charges. A transparent understanding of fees ensures that your returns aren’t eroded by unnecessary costs.

User-Friendly Account Opening:

The ease of opening an account can significantly impact your overall experience. A user-friendly process streamlines the onboarding journey, reducing friction for new investors.

Trading Platforms Unveiled:

The heart of your trading experience lies in the trading platform. Robust and intuitive platforms offer a seamless interface for executing trades and accessing market information.

Research and Analysis Tools Empowerment:

Quality research is a game-changer for investors. Platforms providing advanced research and analysis tools empower users to make informed decisions, elevating the overall investing experience.

Responsive Customer Support:

In the dynamic world of finance, responsive customer support is invaluable. Efficient support services ensure that your queries are addressed promptly, especially during critical trading moments.

Exploring Additional Features:

Beyond the basics, exploring additional features such as educational resources, market insights, and integration with financial tools can enhance the overall utility of a brokerage platform.

Discover Your Ideal Brokerage Platform:

For those embarking on the journey of brokerage selection, a visit to Select Brokerage Comparison is a must. The platform offers a meticulous brokerage comparison, breaking down the complexities to empower investors with the knowledge needed to make informed decisions.

Conclusion: Empowering Investors Through Information

Navigating the multitude of brokerage options requires a keen eye and access to reliable information. A comprehensive brokerage comparison serves as a beacon, guiding investors towards platforms that align with their unique preferences and goals.

0 notes

Text

A Guide to Healthy Financial Practices and Resources for Early Adults

In your early 20s, the choices you make about money can set the stage for your financial well-being in the years to come. Here’s a comprehensive guide on cultivating healthy financial habits and a valuable resource to navigate your financial journey.

1. Budgeting Brilliance: The Cornerstone of Financial Success

Establishing a budget is crucial. Understand your income, track your spending, and allocate funds wisely. It’s the foundation for effective financial management.

2. Emergency Fund Building: Your Financial Safety Net

Start building an emergency fund. Having a financial cushion for unexpected expenses provides peace of mind and prevents the need to dip into savings or rely on credit.

3. Investing for Tomorrow: The Power of Early Investing

Don’t underestimate the power of compounding. Even small investments made consistently in your early 20s can grow significantly over time. Explore different investment options and consider seeking professional advice.

4. Credit Score Consciousness: Navigating the Credit Landscape

Understand the impact of your credit score. Maintain good credit habits, pay bills on time, and manage credit responsibly to secure favorable terms on loans and credit cards.

5. Debt Management: Balancing the Scale

While some debt may be unavoidable, manage it wisely. Prioritize paying off high-interest debt, and be mindful of your overall debt-to-income ratio.

6. Financial Education: Empowering Yourself with Knowledge

Invest time in financial education. Learn about personal finance, investments, and the implications of financial decisions. Resources like books, online courses, and reputable websites can be invaluable.

Explore the Recipe for Financial Success:

For a comprehensive guide on cultivating healthy financial habits and gaining insights into managing your finances effectively, explore Recipe By finology. It’s a valuable resource offering practical tips and tools to navigate the intricacies of personal finance.

Conclusion: Paving the Way to Financial Success

Mastering money matters in your early 20s is a journey that requires intention and discipline. By embracing these healthy financial habits and utilizing resources like the recommended website, you can pave the way for a financially secure and fulfilling future.

0 notes

Text

Decoding the Oracle: Investment Lessons from Warren Buffett

Warren Buffett, the iconic investor and CEO of Berkshire Hathaway, has been a beacon of wisdom for generations of investors. His annual letters to shareholders are not just reports; they are rich sources of investment philosophy and insights into successful wealth creation. Now, enthusiasts can delve even deeper into the Oracle of Omaha’s mindset.

Understanding the Significance of Buffett’s Annual Letters:

Long-Term Perspective:

One of the core tenets of Buffett’s approach is his unwavering focus on the long term. The course dissects how he identifies businesses with enduring qualities, emphasizing the importance of sustained growth over time.

Economic Moats:

Buffett coined the term “economic moats” to describe a company’s competitive advantages. “Buffettology” breaks down this concept, helping participants recognize and evaluate businesses with strong and defensible market positions.

Future Plans and Growth:

The annual letters provide a roadmap to Berkshire Hathaway’s future plans and growth trajectory. Understanding how Buffett assesses a company’s potential can be a game-changer for investors, and the course unravels these nuances.

Why “Buffettology” Matters for Indian Investors:

Adaptability to the Indian Context:

The course doesn’t merely replicate Buffett’s principles; it translates them into actionable strategies for the Indian market. It bridges the gap between global investment philosophies and the specific dynamics of the Indian economy.

Navigating the Indian Investment Landscape:

Investing in India requires a nuanced understanding of local challenges and opportunities. “Buffettology” equips participants with the tools to navigate the Indian investment landscape effectively.

Practical Application of Buffett’s Wisdom:

It’s not just about theory; the course focuses on practical applications. Participants gain insights into how Buffett’s principles can be practically applied to identify and evaluate potential investment opportunities.

Promoting Financial Literacy and Informed Investing:

“Buffettology” isn’t just a course; it’s an initiative to promote financial literacy and empower investors to make informed decisions. The course acts as a bridge, connecting Buffett’s legendary wisdom with the aspirations of Indian investors.

Explore “Buffettology” and Unleash the Power of Knowledge: For those eager to unlock the secrets of Warren Buffett’s success, the “Buffettology” course is a journey into the mind of a master investor. Explore the course here and embark on a transformative learning experience.

0 notes

Text

Unraveling the Intricacies of Section 34 IPC: Understanding Collective Liability in Criminal Acts

The Indian Penal Code (IPC) stands as a cornerstone of India's legal framework, and within its pages, Section 34 holds a distinctive place. This provision deals with the collective liability of individuals acting in concert with a shared intention to commit a criminal act. In this article, we unravel the intricacies of Section 34 IPC, shedding light on its nuances and the profound impact it has on the dispensation of justice.

Understanding Section 34 IPC:

1. Common Intention Defined: Section 34 hinges on the concept of "common intention." It's essential to comprehend how this common intention is formed among individuals, each playing a distinct role in the execution of a criminal act.

2. Collective Liability: The essence of Section 34 lies in establishing collective liability. Even if the actions of each individual differ, the section holds all participants responsible for the culmination of their combined efforts.

3. Distinguishing Acts: Unlike other provisions, Section 34 doesn't necessitate that each individual performs the same act. It is the collective intent and the shared objective that bind them together in legal culpability.

Real-world Implications:

1. Application in Criminal Cases: Section 34 is frequently invoked in cases where a group of individuals collaborates to achieve a common criminal goal. Understanding its application is crucial for legal practitioners, investigators, and scholars.

2. Legal Precedents: The article explores notable legal precedents where Section 34 IPC played a pivotal role in shaping the outcomes of criminal cases. These case studies offer practical insights into the functioning of this legal provision.

Promoting Legal Literacy:

1. Importance of Legal Education: Enhancing legal literacy is paramount for a society governed by the rule of law. This article aims to contribute to the understanding of Section 34 IPC, fostering informed discussions around collective liability.

2. Read More on Finology Legal Blog: For an in-depth exploration of Section 34 IPC, delve into this detailed analysis: Understanding Section 34 IPC. The Finology blog serves as a valuable resource for legal enthusiasts, providing comprehensive insights into various legal aspects.

0 notes

Text

The Best Demat Account for Beginners: 5paisa

Why 5paisa?

User-Friendly Interface:

5paisa is known for its intuitive platform, making it easy for beginners to navigate and execute trades seamlessly.

Low Brokerage Charges:

With competitive brokerage charges, 5paisa ensures that beginners can trade without burning a hole in their pockets.

Educational Resources:

5paisa offers educational resources, including tutorials and guides, to help beginners understand the dynamics of the stock market.

Research Tools and Reports:

The platform provides research tools and reports, empowering beginners with the information needed to make well-informed investment decisions.

Diversified Investment Options:

5paisa allows beginners to diversify their investments across various asset classes, providing a comprehensive trading experience.

0 notes

Text

Investing in the stock market can be a rewarding journey, especially when approached with careful consideration. Here's a step-by-step guide to help you get started:

1. Educate Yourself:

Before diving in, take the time to understand the basics of the stock market. Learn about key concepts like stocks, bonds, dividends, and market trends.

2. Set Financial Goals:

Define your financial objectives. Are you investing for retirement, a down payment on a house, or wealth accumulation? Clear goals will guide your investment strategy.

3. Create a Budget:

Assess your financial situation and determine how much you can comfortably invest. It's crucial not to invest more than you can afford to lose.

4. Open a Brokerage Account:

Choose a reputable brokerage platform to open an investment account. Consider factors like fees, user interface, and available research tools.

5. Diversify Your Portfolio:

Spread your investments across different assets to minimize risk. Diversification can include a mix of stocks, bonds, and other securities.

6. Research Before Investing:

Thoroughly research the companies or funds you're interested in. Analyze financial statements, performance history, and future growth potential.

7. Monitor Your Investments:

Stay informed about your investments. Regularly check your portfolio, review market trends, and adjust your strategy as needed.

Now, for a valuable resource to enhance your investment journey, check out Recipe by Finology: Stocks and mutual fund reports. It's a fantastic platform that provides comprehensive stock and mutual funds reports, offering insights to help you make well-informed investment decisions.

Remember, investing involves risks, and there are no guarantees. Consider consulting with a financial advisor to tailor your strategy to your specific financial situation.

Happy investing! 🚀💡

Disclaimer: This is not financial advice. Always do your research or consult with a financial advisor before making investment decisions.

0 notes

Text

Identifying high-growth stocks involves a combination of financial analysis, industry understanding, and a keen eye for emerging trends. Here are some strategies to filter high-growth stocks:

Revenue and Earnings Growth:Look for companies with a history of consistent revenue and earnings growth. Analyze their financial reports over the past few years to ensure a positive and upward trajectory.

Industry Potential:Assess the growth potential of the industry the company operates in. High-growth stocks are often found in sectors with expanding markets, driven by technological advancements, changing consumer behaviors, or other positive trends.

Innovative Products or Services:Companies with innovative and unique products or services often experience rapid growth. Look for businesses that are at the forefront of technological advancements or are disrupting traditional markets.

Competitive Positioning:Evaluate the company's competitive positioning within its industry. A sustainable competitive advantage, whether through technology, branding, or cost leadership, can contribute to sustained high growth.

Financial Health:Examine the company's financial health. Check for low debt levels, positive cash flow, and strong profitability. A healthy balance sheet is crucial for weathering economic downturns and fueling expansion.

Management Quality:Assess the quality of the management team. A capable and visionary leadership team is vital for navigating challenges and executing growth strategies effectively.

Market Size:Consider the total addressable market (TAM) of the company. High-growth stocks often come from companies operating in large markets with significant growth potential.

Analyst Recommendations:While not the sole factor, analyst recommendations can provide insights into market sentiment. Positive recommendations may indicate potential for growth, but always conduct your research.

Technological Advancements:Embrace companies that leverage cutting-edge technologies. In today's dynamic business environment, technological advancements can be a key driver of growth.

Social and Environmental Responsibility:Increasingly, investors are looking for companies with a commitment to social and environmental responsibility. Businesses with sustainable practices often attract long-term investors and positively impact their brand image.

Remember, investing carries inherent risks, and there's no one-size-fits-all approach. Diversify your portfolio, stay informed about market trends, and consider seeking advice from financial professionals based on your specific financial goals.

Disclaimer: This information is for educational purposes only and should not be considered as financial advice. Always conduct thorough research or consult with a financial advisor before making investment decisions.

To know:

What are the strategies to find a Multibagger stock?

How to find tailwinds/headwinds in an Industry

Should you invest in Value Trap Stocks?

Filtering stocks in Mr Gautam Baid Style

Which sectors will perform well in the next 5 years?

How important is the Behavioural Aspect in Investing?

Visit this course: How to filter High-Growth Stocks

0 notes

Text

Defamation Law in India

What is Defamation? Defamation refers to the act of making false statements about an individual or entity that harm their reputation. It can take various forms, including spoken words (slander) and written words or images (libel). In India, defamation is both a civil wrong and a criminal offense.

IPC Section 499: Defamation Defined Section 499 of the IPC defines defamation. According to this section, whoever, by words either spoken or intended to be read, or by signs or visible representations, makes or publishes any imputation concerning any person intending to harm, or knowing or having reason to believe that such imputation will harm, the reputation of such person is said to defame that person.

Elements of Defamation under Section 499:

Publication: The statement must be published to a third party.

Imputation: The statement must contain an imputation that harms the reputation of the person.

Intent or Knowledge: The person making the statement must either intend to harm the reputation or have reason to believe that such imputation will cause harm.

IPC Section 500: Punishment for Defamation Section 500 prescribes the punishment for defamation. A person found guilty of defamation can be punished with simple imprisonment for a term that may extend to two years or with a fine or both.

Recent Trends and Impact on Social Media

With the rise of social media, the dynamics of defamation have evolved. Posts on platforms like Twitter, Facebook, and Instagram can reach a vast audience instantly. This has led to an increase in defamation cases related to online content.

Key Considerations in Defamation Cases:

Truth as a Defense: Truth is a valid defense against defamation charges. If the statement is proven to be true, it may not be considered defamatory.

Public Figures: Defaming public figures requires a higher threshold. They often need to prove malicious intent along with the falseness of the statement.

Civil vs. Criminal Defamation: Defamation can be both a civil offense, where damages are sought, and a criminal offense, where fines or imprisonment may be imposed.

0 notes

Text

What are Green Energy Stocks?

To better understand the need for green energy, we must first understand its counterpart. Fossil fuels are made from dead organic matter found in the earth’s crust. This organic matter is rich in carbon and hydrogen and releases energy when burned.

Fossil fuels are comprised of coal, oil and natural gas. They are the most prevalent fossil fuels due to their abundance, efficiency, and relatively cleaner burning. But these benefits come at a cost. Although natural gas is the cleanest fossil fuel, when burned at massive rates like the present, the cumulative release of pollutants mitigates this benefit. Coal and oil already have the “unclean” tag on them, which means they release the most contaminants among all fossil fuels.

Fossil fuels are also non-renewable, which means that although they occur naturally in the planet’s crust, the rate at which they are replenished is less than the rate at which they are consumed.

Thus, to serve as a solution on these two troubled fronts, green energy was discovered or, rather, popularised; to shift the world’s need from the current sources of energy. Green energy is an umbrella term that comprises all the sources of energy that have little-to-negligible emissions and are renewable. Solar, wind, hydroelectric and geothermal are the most common sources of green energy.

Future Prospects of Green Energy Stocks in 2023

According to the Central Electricity Authority, India’s power requirement is projected to reach 817 GW by the year 2030. To put this in perspective, India’s highest power demand for 2022 was recorded on 9th June at 210 GW. The Government of India also aims to achieve a target of fulfilling 50% of this demand through renewable energy sources.

The Indian Government has also planned to increase the renewable energy production capacity to 500 GW by 2030 to fulfil the above-mentioned demand. For reference, the renewable energy production capacity was around 10 GW in 2005, which was increased to around 100 GW by December 2021. That’s growth by a whopping 16.6% CAGR in 16 years.

This opens up a huge opportunity for organisations to capitalise on. Various companies have been created anew or as subsidiaries of existing corporations to profit from this rising need for alternative energy.

Not only is profit the incentive for this switch, but owing to the ill effects of fossil fuels, various governments are also pushing for the switch from non-renewable to renewable energy sources.

For instance, the Indian Government allocated ₹19,500 crore for a Production Linked Incentive scheme in order to boost the production of high-efficiency solar modules.

“Go Green” is not just a domestic movement anymore, either. The alternate/non-conventional energy sector has received an inflow of $11.62 billion from April 2000 to March 2022. India is still seen as a potential player in the renewable energy market as the rulers of UAE committed to invest $75 billion to establish a partnership in clean energy.

Well, enough Environmental Studies and Geopolitics; it’s time we get financial and look at the top 5 green energy stocks in India.

Read Top 5 Green Energy Stocks in India 2023

0 notes

Text

Reliance Industries Ltd (RIL):RIL is a diversified conglomerate with a significant presence in the petrochemical sector. It operates one of the largest petrochemical complexes globally.

BASF India Ltd:BASF is a leading chemical company globally, and its Indian arm operates in segments such as agricultural solutions, performance products, and functional materials.

Pidilite Industries Ltd:Pidilite is known for its adhesives and sealants products. It has a strong presence in the chemicals and coatings industry.

Vinati Organics Ltd:Vinati Organics focuses on specialty chemicals and has a reputation for innovation. It operates in segments such as performance chemicals, aromatics, and polymer additives.

Aarti Industries Ltd:Aarti Industries is a leading player in the specialty chemicals segment. It manufactures a diverse range of chemicals used in various industries.

Navin Fluorine International Ltd:Navin Fluorine is engaged in the business of specialty fluorochemicals and has a strong presence in the global market.

SRF Ltd:SRF operates in various business segments, including chemicals. It is known for its specialty chemicals, packaging films, and technical textiles.

Deepak Nitrite Ltd:Deepak Nitrite is involved in the manufacturing of basic chemicals and intermediates. It has a diversified product portfolio.

Remember that investing in stocks involves risks, and past performance is not indicative of future results. It's crucial to conduct thorough research, consider your investment goals and risk tolerance, and stay updated on market conditions before making any investment decisions. Additionally, stock prices can be influenced by various factors, including market dynamics, economic conditions, and company-specific news.

Get the latest information about 170 companies present in Chemicals sector on Ticker.

0 notes

Text

Choosing the best demat account in India involves considering factors such as charges, services, and facilities, and one name that stands out prominently is Zerodha. Here's a closer look at why Zerodha is often regarded as the top choice in the Indian brokerage landscape:

1. Low Transaction Costs:

Zerodha is renowned for its transparent fee structure. With a flat brokerage fee and no percentage-based charges, it offers cost-effective trading that benefits both beginners and seasoned investors.

2. User-Friendly Trading Platform:

Zerodha's trading platform, Kite, is a standout feature. It provides an intuitive and user-friendly interface, real-time market data, advanced charting tools, and seamless access across devices. The platform is designed to cater to the needs of both beginners and experienced traders.

3. Paperless Account Opening:

Zerodha simplifies the account opening process by offering a seamless, paperless experience. Users can complete the KYC (Know Your Customer) requirements online, ensuring a quick and hassle-free onboarding process.

4. Diverse Investment Products:

Beyond traditional equity trading, Zerodha offers a range of investment products, including direct mutual funds, bonds, and commodities. This diversity allows investors to explore various avenues and build a well-rounded portfolio.

5. Educational Resources:

Zerodha places a strong emphasis on financial literacy. Through its "Varsity" platform, it provides comprehensive educational resources and tutorials, helping users enhance their understanding of markets, trading strategies, and financial concepts.

6. Security and Compliance:

Security is a top priority for Zerodha. The platform adheres to stringent security measures and regulatory standards, ensuring a safe and secure environment for users to conduct their trading and investment activities.

7. Innovation in Trading:

Zerodha has been a pioneer in introducing innovative features and technologies to the Indian brokerage industry. This includes tools for algorithmic trading, advanced charting, and a host of other features that empower users with sophisticated trading capabilities.

8. Customer Support:

Zerodha is known for its responsive and client-centric customer support. Trained professionals are available to assist users with any queries or concerns they may have, enhancing the overall user experience.

In conclusion, when evaluating demat accounts in India based on charges, services, and facilities, Zerodha consistently emerges as a top contender. Its commitment to transparency, innovation, and user education makes it a preferred choice for individuals looking to embark on a seamless and rewarding journey in the world of online trading and investing.

0 notes

Text

Crafting Your Personal Finance Blueprint: A Step-by-Step Guide

Developing a personal finance plan is a crucial step towards achieving your financial goals and securing your future. Here's a step-by-step guide to help you create an effective personal finance plan:

1. Assess Your Current Financial Situation:

Take stock of your income, expenses, debts, and savings. Understand where your money is coming from and where it's going.

2. Define Your Financial Goals:

Clearly articulate short-term and long-term financial goals. Whether it's buying a home, saving for education, or planning for retirement, having well-defined goals will guide your financial decisions.

3. Create a Budget:

Develop a realistic budget that aligns with your goals. Categorize your expenses, prioritize necessities, and allocate funds for savings and investments.

4. Emergency Fund:

Build an emergency fund to cover unexpected expenses. Aim for three to six months' worth of living expenses in a liquid and easily accessible account.

5. Manage Debt:

Evaluate and prioritize your debts. Create a plan to pay off high-interest debts while making minimum payments on others.

6. Save and Invest:

Develop a disciplined savings habit. Consider investment options based on your risk tolerance and goals. Diversify your portfolio for a balanced approach.

7. Insurance Coverage:

Assess your insurance needs, including health, life, and property insurance. Adequate coverage protects you and your loved ones from unforeseen events.

8. Retirement Planning:

Start early with retirement planning. Contribute to retirement accounts like 401(k) or IRA, taking advantage of employer contributions and tax benefits.

9. Review and Adjust:

Regularly review your financial plan. Life circumstances and goals may change, requiring adjustments to your budget, savings, and investments.

10. Seek Professional Advice:

Consider consulting a financial advisor for personalized guidance. A professional can provide insights, help you navigate complex financial decisions, and optimize your plan for success.

Remember, personal finance is a dynamic process. Tailor your plan to your unique circumstances, and be flexible as your life evolves. If you're seeking comprehensive financial planning tools and resources, check out Recipe for Financial Planning for a wealth of insights and practical solutions.

Start your journey to financial well-being today!

1 note

·

View note

Text

The question of whether it is acceptable to ban beef in a secular country like India on religious grounds is a complex and debated issue. India, as a secular nation, upholds the principle of separating state affairs from religious influence, as enshrined in its Constitution. However, the matter of beef consumption intersects with cultural, religious, and ethical considerations, leading to diverse opinions.

Secularism in India: India's commitment to secularism implies that the state does not favor any particular religion and respects the freedom of individuals to practice their beliefs. It aims to ensure equal treatment of all religions under the law.

The Beef Ban Debate: The beef ban in some Indian states is often rooted in cultural and religious sentiments, particularly concerning the sacred status of cows in Hinduism. For many Hindus, the cow is revered, and its slaughter is considered offensive. States that have implemented beef bans often cite these cultural and religious sentiments as a basis for their legislation.

Arguments in Favor:

Respect for Religious Sentiments: Supporters of the beef ban argue that it aligns with the cultural and religious sentiments of a significant section of the population, particularly Hindus.

Preservation of Cows: Proponents contend that banning cow slaughter contributes to the preservation of cows, which are considered sacred by many.

Arguments Against:

Religious Pluralism: Critics argue that imposing a beef ban based on religious grounds contradicts the principle of religious pluralism and freedom of choice.

Economic Impact: Some critics highlight the economic impact on communities involved in the cattle trade, as well as the potential loss of livelihoods.

Balancing Secularism and Religious Sentiments: The challenge lies in finding a balance between respecting religious sentiments and upholding the principles of secularism. Striking this balance involves crafting policies that respect diverse beliefs while safeguarding individual freedoms.

Legal Landscape: The legality of beef bans has been challenged in various courts, with judgments often emphasizing the need for a nuanced approach that respects religious sentiments without infringing on individual rights.

The question of whether it is acceptable to ban beef in a secular country like India on religious grounds reflects the ongoing dialogue between cultural, religious, and legal considerations. Achieving a harmonious balance that respects diverse beliefs while upholding secular principles remains a complex challenge for policymakers and society at large

0 notes

Text

G20 Summit

Chairing the G20 summit in 2023 offers several potential benefits for India, both on the domestic and international fronts. Some of the key benefits include:

Enhanced International Influence: Chairing the G20 summit elevates India's international standing and provides an opportunity to shape the global agenda. India can leverage this position to influence discussions on important global issues, particularly those relevant to developing nations.

Economic Advancements: Hosting the G20 summit allows India to showcase its economic progress and potential. It can attract foreign investments, foster economic partnerships, and promote itself as an attractive destination for trade and commerce.

Trade and Investment: India can use the summit to advocate for open and inclusive global trade. This can benefit Indian businesses and help expand export markets, fostering economic growth.

Global Health: Given the ongoing global health challenges, India can prioritize discussions on pandemic preparedness, equitable access to vaccines, and strengthening healthcare systems. This can position India as a leader in global health governance.

Sustainable Development: India can promote sustainable development goals, environmental conservation, and climate change mitigation. These efforts can align with India's commitment to green and sustainable practices.

Geopolitical Relations: As the summit's host, India can engage in diplomatic efforts to improve relations with G20 member nations and address regional and global geopolitical issues.

Bilateral and Multilateral Partnerships: Hosting the G20 summit provides India with a platform to establish bilateral and multilateral partnerships with participating countries, fostering cooperation on various fronts, including trade, technology, and security.

Foreign Direct Investment (FDI): India can attract FDI by highlighting its economic potential, regulatory reforms, and investment-friendly environment during the summit.

International Collaboration: India can strengthen its collaborations with G20 member nations, which can have positive ripple effects in areas such as science and technology, innovation, education, and healthcare.

Diplomatic Skills: Chairing the G20 summit enhances India's diplomatic skills and experience, which can be applied to other international forums and negotiations.

Global Responsibility: As a G20 host, India has the opportunity to demonstrate its commitment to global responsibilities and showcase its approach to resolving global challenges.

Crisis Management: The G20 host has a central role in managing and coordinating responses to global crises. India can demonstrate its crisis management capabilities and commitment to global stability.

In conclusion, chairing the G20 summit in 2023 is a significant opportunity for India to strengthen its international presence, promote its economic interests, and play a crucial role in shaping global policies. It offers a platform to address a range of global challenges and foster international cooperation, ultimately benefiting India's development and its position on the world stage.

Know more about G20 Summit: Objectives, Achievements and 2023 India Presidency

0 notes