#shareholder

Text

#mark zukerburg#elon musk#lgbtq#lgbtq community#lesbian#queer#nonbinary#nonbinary lesbian#lgbt pride#lgbtqia#sapphic#gay girls#elon mask#elon twitter#buyout#twitters#shareholder#jeff bezos#jeff besos#jeff bejos#amazon#labor#firstpost#unionize#labor unions#facebook#social networks#metaverse

881 notes

·

View notes

Photo

. We could go purchase some #shares or just make it a #coffeedate Either way, it always nice to see that a company you own shares in expanding in #business #newspotforthehighwaytraffic #Starbucks #Starbuckstt #newlocation #brentwood #phl #stockmarket #stockmarkettrinbago #shareholder #tickersymbol #tickersymbolphl #smallinvestors #investor #investing #investingtt #dividends #dividendstocks #passiveincome #kinda #buyingincome #buymoreshares #thisisnotinvestingadvice https://www.instagram.com/p/CoEDTvxOwTx/?igshid=NGJjMDIxMWI=

#shares#coffeedate#business#newspotforthehighwaytraffic#starbucks#starbuckstt#newlocation#brentwood#phl#stockmarket#stockmarkettrinbago#shareholder#tickersymbol#tickersymbolphl#smallinvestors#investor#investing#investingtt#dividends#dividendstocks#passiveincome#kinda#buyingincome#buymoreshares#thisisnotinvestingadvice

7 notes

·

View notes

Text

Deutsche Telekom Stock Review

Deutsche Telekom is a Germany-based company that provides integrated telecommunication services. It operates through five segments: Germany, United States, Europe, Systems Solutions, and Group Development. The Germany segment provides fixed-network and mobile telecommunications services to consumers and business customers. The United States segment provides telecommunications services in the United States market; and the Europe segment offers fixed-network and mobile operations of the national companies in Greece, Romania, Hungary, Poland, the Czech Republic, Croatia, Slovakia, and Austria.

IPO

A major turning point in the world of telecommunications took place in November 1996, when Deutsche Telekom went public. It was the largest IPO in history and the capstone of years of intense effort by Goldman Sachs to establish a presence in the German market.

The company's offering marked a significant step in the development of an Anglo-Saxon shareholder culture. It was also the first telecommunications company to be listed on the Frankfurt and New York stock exchanges, as well as the Tokyo Stock Exchange.

It was the largest ever IPO and it was oversubscribed five times. Shares traded at nearly 20 percent above the issue price on their first day of trading.

In addition to its traditional services in Germany, the company provides telecommunications services throughout the rest of Europe and the United States. Its businesses include fixed network and broadband, mobile telephony, and information technology services.

Today, the company is one of the world's leading telecommunications companies with operations in more than 50 countries and a broad range of products and services. It has a worldwide network of around 248 million wireless and 26 million wireline customers.

The company has been in the forefront of telecommunications innovation, investing extensively in digital technologies to develop innovative new products and services for its customers. Examples include the Internet of Things, 5G technology, video conferencing, and artificial intelligence.

For a company like Deutsche Telekom, it is important to have a diverse product portfolio that appeals to different kinds of users. The company is also known for acquiring and selling companies to generate growth and streamline operations.

Despite its success, the company has faced several challenges in the past few years. It has lost customers to larger rivals, including AT&T and Verizon Communications Inc VZ.N, and it has also experienced a drop in revenue and profits.

However, the company's management has made efforts to turn its fortunes around, launching new business models and making strategic acquisitions. It is a leader in the telecommunications industry and it continues to seek ways to grow its business and create value for shareholders.

Mergers and Acquisitions

Deutsche Telekom is a diversified telecommunications company with a strong position in Europe and a booming US business. It operates in a number of different sectors, such as payments and commercial real estate tech.

In the US, the company is primarily focused on mobile services. Its subsidiary T-Mobile USA has an excellent record of growth and is a significant competitor to AT&T and Verizon. In addition, it owns Sprint (NYSE:S), which is set to become a major player in the U.S. telecom industry once the merger is complete in 2019.

The company has not made many major acquisitions, but it has done a few small ones over time. These smaller deals, such as the purchase of a Romanian carrier, the sale of T-Mobile Netherlands and its acquisition of Austria’s Telecom Austria, have improved its market position and scale.

Its US telco operations, T-Mobile USA and T-Mobile International, have been growing at very strong rates. These companies have a large customer base and are expected to continue expanding.

T-Mobile US is the second largest wireless service provider in the United States with a customer base of 120 million, behind Verizon. It has a very competitive pricing model and a great reputation in the industry.

However, the stock has not performed well in recent months. This is largely due to the fact that many investors are not aware of the fact that the German government owns 57 percent of the company. It has been criticized by a few legislators who think that the government should reduce its holding before the deal can be completed.

As a result, the stock has been down with other European stocks. If the Euro continues to weaken, this would likely help the stock and also its U.S. assets, which have been irrationally punished by European investors because they are included in a European stock.

To counter this, the company has been increasing its dividend and repurchasing some of its own shares, which are now trading at about a 50% discount to their value. These dividend increases and the repurchases should allow for further growth.

Shareholders

One of the largest shareholders in deutsche telekom stock is the German government and its agency, Kreditanstalt fuer Wiederaufbau (KfW). KfW owns 17.3 percent of the company's shares. It has been buying more shares and reducing its stake in a series of transactions.

Another large shareholder is the United States investment group Blackstone. It purchased 4.5 percent of deutsche telekom stock for $3.3 billion. It is hoping that the purchase will help the company achieve its long-term financial goals and boost shareholder value, according to the company's announcement.

It also plans to use the money to fund future dividend increases. The dividends are a key part of the company's plan to reinvest in new technologies and networks.

The company also recently rolled out an overhaul of its corporate strategy to focus on digitalization and adapting its business models to the changing needs of customers. The changes will make it a software company that sells telecommunication services, rather than just a hardware manufacturer.

This is a big shift from the days when telecommunications networks were made up of monolithic blocks of network elements. Today, companies like DT are disaggregating their technology and moving it into the cloud. This allows them to connect with third-party networks and use their infrastructure to provide telecommunications services.

In the case of telecommunications, this involves billing-software and other backend systems. These backend systems are responsible for collecting and analyzing customer data to make pricing decisions.

If these systems are not able to comply with GDPR, will they be subjected to enforcement action or sanctions by U.S., EU, or German authorities? If not, will they be the target of new private actions for fraud and/or breach of contract?

To protect its data, deutsche telekom stock has "binding corporate rules" that it has promised to abide by. These rules are "binding" on all of the company's subsidiaries and any of its other companies that can be required to comply with them or have already adopted them on a voluntary basis.

But what if deutsche telekom stock's subsidiary T-Mobile USA doesn't subscribe to these "binding" corporate privacy rules? Does it still have to comply with the "binding" rules, or is there something in the corporate law that prevents it from doing so?

Dividends

One of the coolest perks of being a shareholder of this German company is the opportunity to participate in its annual dividend payout. The company pays out an impressively large sum each year, and it has a long and distinguished history of making its shareholders happy. Despite its size, the company manages to stay on top of its game thanks to some innovative corporate strategies and a healthy dose of luck. In a nutshell, there's a reason why this stock has been a KfW staple for so long. The company is also one of the few surviving German telecoms. If you're on the hunt for a good value telecommunications stock, deutsche telekom should be at the top of your list. You'll be rewarded with top-notch service and competitive paycheques, not to mention a hefty chunk of the local economy.

After all, it's not every day that you get a free piece of the country's largest phone company, let alone one of the most innovative and coveted German telecommunications companies in the business.

2 notes

·

View notes

Text

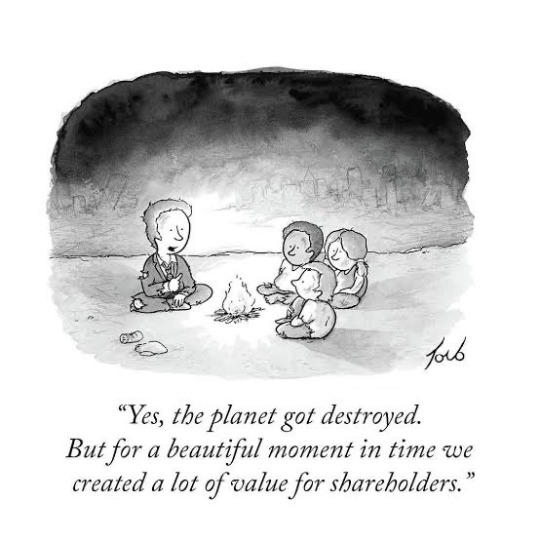

#existential risk#x risk#x-risk#ai#biotech#natural disaster#disasters#shareholder#shareholders#value#corporation#corporations#planet got destroyed#rubikon reminded me of this#megacorp#megacorporation

2 notes

·

View notes

Text

youtube

15 Stocks That Have Destroyed the Most Wealth Over the Last Decade

Over the previous ten years, the combined loss of shareholder value caused bythese stocks was projected to be $281 billion.

0 notes

Text

instagram

1 note

·

View note

Text

Southwest Gas Increases Dividend: Good News for Shareholders!

#Arizona #California #capitalallocation #cashflowfromoperations #CEO #customerservice #Dividend #dividendincrease #financialperformance #firstquarter2024 #JohnHester #longtermgrowth #loyalshareholders #naturalgasutilitycompany #nevada #NewYorkStockExchange #operatingresults #passiveincome #profitability #shareholder #SouthwestGasHoldings #stakeholders #stock #sustainability #tickersymbolSWX

#Business#Arizona#California#capitalallocation#cashflowfromoperations#CEO#customerservice#Dividend#dividendincrease#financialperformance#firstquarter2024#JohnHester#longtermgrowth#loyalshareholders#naturalgasutilitycompany#nevada#NewYorkStockExchange#operatingresults#passiveincome#profitability#shareholder#SouthwestGasHoldings#stakeholders#stock#sustainability#tickersymbolSWX

0 notes

Text

Shareholder Rights: What You Can Do as an Owner of a Company

If you are a shareholder, you must know all the rights you have since they allow you to have an impact on your company and enable you to enjoy the full benefits of being a shareholder. In this article, we will discuss both the rights and duties which you have as a shareholder of a company.

0 notes

Text

disney news alert

so the proxy war has some news.... just so you guys know.... nelson peltz is the biggest individual shareholder in disney, and he is unhappy with disney like a lot of us are. he wants to replace two people on the board of directors, which bob iger does not like(bob iger sucks hes running disney into the ground). imma be honest with yall, walt disney always paid his writers a lot and incorporated diversity all throughout his studio. anyways. this proxy war has been going on for like a month or two... blackcell also wants to replace some people on the board, but they're less family first. nelson peltz wants to make the parks the way they were pre-iger(more like during the reign of michael eisner and frank wells). now, elon musk is hinting at acquiring disney. now people don't like elon. but i think he could be good in the fact that he just wants to make money? and the best way to do that is to please people. disney is standing on the back of the parks and the back is about to break. there's two ways elon can go about this to yk change disney for the better. he can either buy a bunch of shares and assist nelson peltz, or he can just buy disney altogether. there will be backlash no matter what happens, but disney needs to change or its gonna go away. no one wants that

#disney#nelson peltz#proxy war#elon musk#x#michael eisner#frank wells#shareholder#blackcell#bob iger#sag aftra#strike#walt disney#just being positive#nelson peltz would be a way to finally get the parks back to being amazing again#id love that and the better the parks do#the better the movies and tv shows and then more pjo shows yk?

1 note

·

View note

Text

Disney Reports Lower Streaming Losses and Higher Earnings Ahead of Q1 Earnings Call

Ahead of Disney’s 2023/2024 Q1 earnings call, Disney is reporting a 23% earnings share at $1.22, which was significantly above the Wall Street expectation of .99. Streaming losses were about one-third of the estimated amounts this quarter, coming in at a $138 million loss instead of the $400 million that was expected.

Even though Disney needs to hit subscriber numbers by the end of the fiscal…

View On WordPress

0 notes

Text

Working on a shareholder resolution to Caterpillar regarding their involvement in the Palestinian Genocide.

While I work on that I wanted to ask if anyone might have experience:

Submitting Resolutions (I have also contacted Caterpillar about this)

Writing them up properly

Any advice is greatly appreciated.

Want to put it up for a vote while I can before I dump my investment.

And yes I know it's been happening for a while and yes I know it's not just limited to the Palestinian situation and yes I know I was (possibly and probably intentionally) ignorant of that and yes I know that's no excuse.

That's why I'm doing it now.

#caterpillar#shareholders#shareholder#shareholder resolutions#shareholder resolution#palestine#free palestine#gaza#free gaza#genocide#gaza strip

0 notes

Text

Shareholder Disputes in the Netherlands

What Are Shareholder Disputes in the Netherlands?

Shareholder disputes in the Netherlands and in Dutch companies can significantly disrupt business operations. These disputes arise when there is a disagreement among shareholders, often leading to legal confrontations and operational challenges. Understanding the dynamics of these disputes is crucial for any shareholder in a Dutch company.

How Does Dutch Law Manage Shareholder Disputes?

Dutch law provides a structured approach to handle shareholder disputes. The legal framework, including the Dutch Civil Code, outlines the rights and obligations of shareholders. Key decisions are made in the general meeting, where disagreements can escalate into legal issues. Shareholders agreements play a pivotal role in preventing disputes, ensuring a clear understanding of each party's rights and responsibilities.

The Role of the Netherlands Enterprise Court

The Netherlands Enterprise Court is a key player in resolving shareholder disputes. This specialized court has the authority to investigate company policies and take measures to resolve deadlocks, ensuring the smooth operation of businesses amidst conflicts.

What Triggers Shareholder Disputes in the Netherlands?

Common causes of shareholder disputes include disagreements in general meetings, conflicts between majority and minority shareholders, deadlocks in decision-making, and issues surrounding buyout arrangements. Each of these causes requires careful legal navigation to resolve effectively.

Navigating Shareholder Agreements and Buyouts

Understanding the terms of shareholder agreements and navigating buyout processes are essential for shareholders. These agreements outline important aspects like profit distribution and share issuance. In buyouts, legaladvice is crucial to ensure fair valuation and protect the interests of all parties involved.

Why is Legal Expertise Essential in Shareholder Disputes?

Dutch law firms specialize in providing legal advice and strategies for handling shareholder disputes. Their expertise in drafting shareholders agreements and representing clients in court is invaluable in effectively resolving conflicts and protecting shareholder interests.

Choosing the Right Dutch Corporate Lawyer

Selecting a Dutch corporate lawyer with experience in shareholder disputes is critical. They should have a thorough understanding of Dutch law, a successful track record in similar cases, and the ability to represent your interests effectively in court.

How Do Deadlocks Affect Shareholder Disputes?

A deadlock in a shareholder dispute can halt company operations and decision-making. Such situations require urgent legal intervention to protect the interests of all parties involved and ensure the continuity of the business.

What Legal Services Are Available in Amsterdam?

Amsterdam offers a range of legal services to address shareholder disputes. These services include advice on establishing shareholders agreements, court representation, and guidance on buyout arrangements, ensuring that shareholder interests are well-protected and disputes are resolved efficiently.

Understanding Power Dynamics in Dutch Companies

The power dynamics within Dutch companies can greatly influence the outcome of shareholder disputes. The role of majority and minority shareholders, the importance of shareholders’ meetings, and the right to legal recourse play a significant role in resolving these conflicts.

Frequently Asked Questions

What options are available for resolving shareholder disputes?

Inquiry proceedings, forced exit and buy-out proceedings, or establishing a comprehensive shareholders agreement.

What happens when shareholders disagree?

Disagreements can lead to decision-making deadlocks and operational issues, requiring prompt resolution.

How can shareholder conflict be resolved?

Through dialogue, mediation, arbitration, or legal action, with a focus on preventing disputes through well-drafted shareholder agreements.

Need Legal Assistance with Shareholder Disputes in the Netherlands?

MAAK Attorneys specializes in handling shareholder disputes under Dutch law. Our team of experienced Dutch lawyers provides strategic advice, legal representation, and proactive solutions to protect your interests in shareholder disputes. Contact us for expert legal guidance and personalized assistance in resolving your legal challenges in the Netherlands.

Remko Roosjen, an experienced commercial law attorney, leads our team at MAAK Attorneys. His expertise in commercial disputes, contracts, and effective legal strategies ensures our clients receive the best possible outcomes in their legal matters.

For more information, visit MAAK Attorneys or contact Remko Roosjen at [email protected] or +31 (0)20 – 210 31 38.

0 notes

Text

#work#business#lifestyle#luxury#shareholder#hustle#money#cash#satire#commentary#comedy#sarcasm#military family#soldier#veteran#armed forces#navy#air force

0 notes

Photo

During a recent Konami shareholder meeti... https://www.xtremeservers.com/blog/yu-gi-oh-is-faltering-but-fans-feel-konamis-ignoring-them/?feed_id=82282&_unique_id=64b1d83dac4c0&Yu-Gi-Oh%21%20Is%20Faltering%2C%20But%20Fans%20Feel%20Konami%27s%20Ignoring%20Them

0 notes

Link

#Aktionär#BlackRock#BlackRockInc.#censorship#Google#JamesO'Keefe#O’KeefeMediaGroup#OMG#shareholder#Zensur

0 notes

Text

Shareholder payout as spending cut

Shell (LON: SHEL) will increase its dividend per share by 15% in the second quarter of the year and reduce spending elsewhere as part of CEO Wael Sawan’s Capital Markets Day pitch in New York.

London-listed Shell said total shareholder distributions are being increased to 30-40% of its cash flow from operations (CFFO), up from 20-30% previously.

It will also deliver buybacks of at least $5bn for…

View On WordPress

0 notes