#repossession secured debt

Text

When you hear "fintech," think "unlicensed bank"

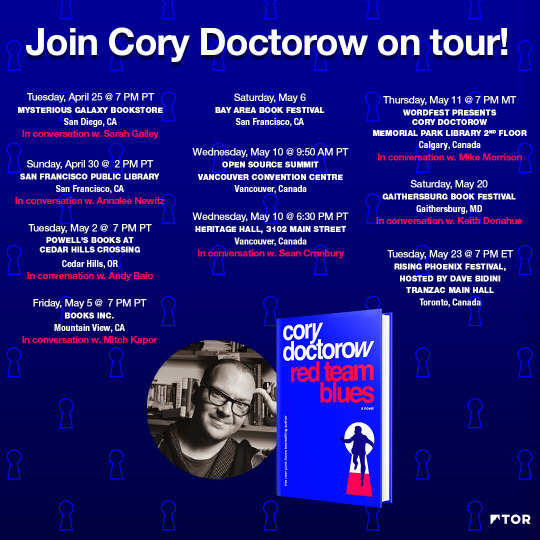

Tomorrow (May 2) I’ll be in Portland at the Cedar Hills Powell’s with Andy Baio for my new novel, Red Team Blues.

In theory, patents are for novel, useful inventions that aren’t obvious “to a skilled practitioner of the art.” But as computers ate our society, grifters began to receive patents for “doing something we’ve done for centuries…with a computer.” “With a computer”: those three words had the power to cloud patent examiners’ minds.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

Patent trolls — who secure “with a computer” patents and then extract ransoms from people doing normal things on threat of a lawsuit — are an underappreciated form of “tech exceptionalism.” Normally, “tech exceptionalism” refers to bros who wave away things like privacy invasions by arguing that “with a computer” makes it all different.

These tech exceptionalists are the legit face of tech exceptionalism, the Forbes 30 Under 30 set. They’re grifters, but they’re celebrated grifters. There’s a whole bottom-feeding sludge of tech exceptionalists that don’t get the same kind of attention, like patent trolls.

Oh, and the fintech industry.

As Riley Quinn says, “when you hear ‘fintech,’ think: ‘unlicensed bank.’” The majority of fintech “innovation” consists of adding “with a computer” to highly regulated activities and declaring them to be unregulated (and, in the case of crypto, unregulatable).

There are a lot of heavily regulated financial activities, like dealing in securities (something the crypto industry is definitely doing and claims it isn’t). Most people don’t buy or sell securities regularly — indeed, most Americans own little or no stocks.

But you know what regulated financial activity a lot of Americans participate in?

Going into debt.

As wages stagnate and the price of housing, medical care, childcare, transportation and education soar, Americans fund their consumption with debt. Trillions of dollars’ worth of debt. Many of us are privileged to borrow money by walking into a bank and asking for a loan, but millions of Americans are denied that genteel experience.

Instead, working Americans increasingly rely on payday lenders and other usurers who charge sky-high interest rates, on top of penalties and fees, trapping borrowers in an endless cycle of indebtedness. This is an historical sign of a civilization in decline: productive workers require loans to engage in useful activities. Normally, the activity pans out — the crop comes in, say — and the debt is repaid.

But eventually, you’ll get a bad beat. The crop fails, the workshop burns down, a pandemic shuts down production. Instead of paying off your debt, you have to roll it over. Now, you’re in an even worse situation, and the next time you catch a bad break, you go further into debt. Over time, all production comes under the control of creditors.

The historical answer to this is jubilee: a regular wiping-away of all debt. While this was often dressed up in moral language, there was an absolutely practical rationale for it. Without jubilee, eventually, all the farmers stop growing food so that they can grow ornamental flowers for their creditors’ tables. Then, as starvation sets in, civilization collapses:

https://pluralistic.net/2022/07/08/jubilant/#construire-des-passerelles

As the debt historian Michael Hudson says, “Debts that can’t be paid, won’t be paid.” Without jubilee, indebtedness becomes a chronic and inescapable condition. As more and more creditors attach their claims to debtors’ assets, they have to compete with one another to terrorize the debtor into paying them off, first. One creditor might threaten to garnish your paycheck. Another, to repossess your car. Another, to evict you from your home. Another, to break your arm. Debts that can’t be paid, won’t be paid — but when you have a choice between a broken arm and stealing from your kid’s college fund or the cash-register, maybe the debt can be paid…a little. Of course, digital tools offer all kinds of exciting new tools for arm-breakers — immobilizing your car, say, or deleting the apps on your phone, starting with the ones you use most often:

https://pluralistic.net/2021/04/02/innovation-unlocks-markets/#digital-arm-breakers

Under Trump, payday lenders romped through America. A lobbyist for the payday lenders became a top Trump lawyer:

https://theintercept.com/2017/11/27/white-house-memo-justifying-cfpb-takeover-was-written-by-payday-lender-attorney/

This lobbyist then oversaw Trump’s appointment of a Consumer Finance Protection Bureau boss who deregulated payday lenders, opening the door to triple digit interest rates:

https://www.latimes.com/business/lazarus/la-fi-lazarus-cfpb-payday-lenders-20180119-story.html

To justify this, the payday loan industry found corruptible academics and paid them to write papers defending payday loans as “inclusive.” These papers were secretly co-authored by payday loan industry lobbyists:

https://www.washingtonpost.com/business/2019/02/25/how-payday-lending-industry-insider-tilted-academic-research-its-favor/

Of course, Trump doesn’t read academic papers, so the payday lenders also moved their annual conference to a Trump resort, writing the President a check for $1m:

https://www.propublica.org/article/trump-inc-podcast-payday-lenders-spent-1-million-at-a-trump-resort-and-cashed-in

Biden plugged many of the cracks that Trump created in the firewalls that guard against predatory lenders. Most significantly, he moved Rohit Chopra from the FTC to the CFPB, where, as director, he has overseen a determined effort to rein in the sector. As the CFPB re-establishes regulation, the fintech industry has moved in to add “with a computer” to many regulated activities and so declare them beyond regulation.

One fintech “innovation” is the creation of a “direct to consumer Earned Wage Access” product. Earned Wage Access is just a fancy term for a program some employers offer whereby workers can get paid ahead of payday for the hours they’ve already worked. The direct-to-consumer EWA offers loans without verifying that the borrower has money coming in. Companies like Earnin claim that their faux EWA services are free, but in practice, everyone who uses the service pays for the “Lightning Speed” upsell.

Of course they do. Earnin charges sky-high interest rates and twists borrowers’ arms into leaving a “tip” for the service (yes, they expect you to tip your loan-shark!). Anyone desperate enough to pay triple-digit interest rates and tip the service for originating their loan is desperate and needs to the money now:

https://prospect.org/power/05-01-2023-fintech-ewa-payday-loan-scam/

EWA annual interest rates sit around 300%. The average EWA borrower uses the service two or three times every month. EWA CEOs and lobbyists claim that they’re banking the unbanked — but the reality is that they’re acting as sticky-fingered brokers between banks and young, poor workers, marking up traditional bank services.

This fact is rarely mentioned when EWA companies lobby state legislatures seeking to be exempted from usury rules that are supposed to curb predatory lenders. In Vermont, Earnin wants an exemption from the state’s 18% interest rate cap — remember, the true APR for EWA loans is about 300%.

In Texas, payday lenders are classed as loan brokers, not loan originators and are thus able to avoid the state’s usury caps. EWAs are lobbying the Texas legislature for further exemptions from state money-transmitter and usury limit laws, principally on the strength of the “it’s different: we do it with a computer” logic.

But as Jarod Facundo writes for The American Prospect, quoting Monica Burks from the Center for Responsible Lending, a loan is a loan even if it’s with a computer: “The industry is trying to create a new definition for what a loan is in order to exempt themselves from existing consumer protection laws… When you offer someone a portion of money on the promise that they will repay it, and often that repayment will be accompanied with fees or charges or interest, that’s what a loan is.”

Catch me on tour with Red Team Blues in Mountain View, Berkeley, Portland, Vancouver, Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

[Image ID: A stately, columnated bank building, bedecked in garish payday lender signs.]

Image:

Andre Carrotflower (modified)

https://commons.wikimedia.org/wiki/File:30_North_%28former_Pontiac_Commercial_%26_Savings_Bank_Building%29,_Pontiac,_Michigan_-_entrance_and_Chief_Pontiac_relief_sculpture_-_20201213.jpg

CC BY-SA 4.0

https://creativecommons.org/licenses/by-sa/4.0/deed.en

#pluralistic#cfpb#earned wage access#digital armbreakers#loansharks#payday lenders#tech exceptionalism#jubilee#debt#fintech#usury#michael hudson#graeber#debts that can't be paid wont be paid

670 notes

·

View notes

Text

‼️please help homeless filipino siblings afford a car for shelter and to make a living‼️

This is long, but i hope and pray you consider reading it all, please

hi, im Alex and im sure you've seen me on here the past few weeks, begging for my youngest brother's hospital fees

he's been released and we found our two other brothers on the street begging for food and in a bad condition

we recently lost both our parents so we're left orphans and homeless, we have no other family left

im the eldest and all three of my brothers are underage, i feel bad for not being abled enough to get a job to provide for them

i've been a grab (uber) driver before the bank had to repossess our own car so i had to stop and get different jobs but i dont last because im extremely anemic and i get so physically exhausted

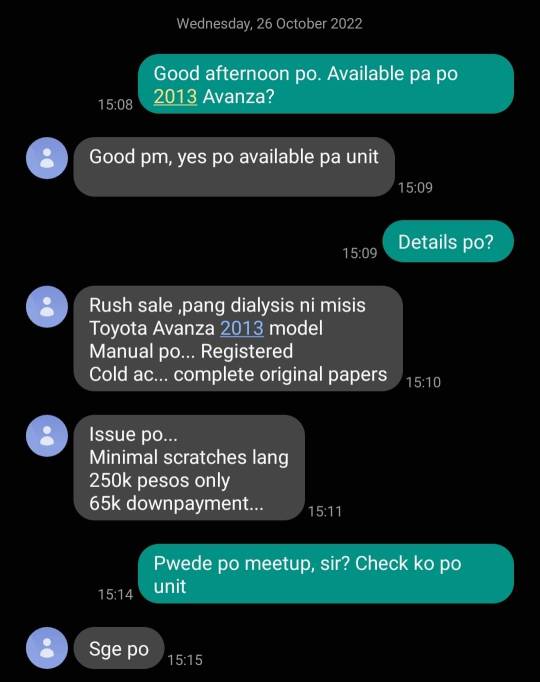

i found a secondhand suv for sale posted on a post, i texted them about it

we met up this afternoon to talk and to check the car. it's old but in a good condition, it's also the cheapest i could find that would fit all four of us comfortably and would stand as a temporary home for us. i was told that the owner has been trying to sell this car for two years for his wife's dialysis with no luck. the car is on sale for 250k PHP or 4,281.12 USD

i really would like to afford this car as it would help us:

have shelter now, we're homeless and have nowhere to go

make a living, i can drive for grab again and also for delivery (this is a job i can actually do fine)

save up to pay for our hospital debts (our dad's when he died, our mom's ambulance fee and my youngest brother's remaining hospital debt)

pay for our mom's ashes (1,275$)

i wouldn't have to be away from my brothers, i cannot leave them alone on their own. they can be with me all the time

save up to pay for a proper place

save up to send my brothers to public school

save up for my brother's asthma medications

save up to get back my two sons that i gave up to the orphanage last year

help the car owner with his own financial problem with his wife's dialysis

this car can change our lives, unfortunately i have 0 anything to afford it. the owner said i only have to give 65,000 PHP or 1,112.99 USD to drive off with it and i can pay the rest of the amount in installments whenever I can. he's very kind and i hope to help him and his family as well

if only 55 people can spare us 20$ to friday Oct 28th, we can drive off with this car for a new start. we haven't properly grieved for both our parents and i hope with this we can finally do it in peace

a reblog to reach a bigger audience would help us a lot as well, i know this seems impossible to reach by friday but i am praying for a miracle to happen to us, just once. thank you and i hope you would consider helping us a bit

364 notes

·

View notes

Note

Hey! I wanted to let those who may not know that the first story in today's episode had quite a few more updates they didn't get to. It wasn't attached to the one reposted, so they might not have seen it. A LOT went down.

I sent @winterxgardener a rundown summary of what else happened, but if those of you are curious, they are u/Scared-Weakness-6250. There are about seven or eight more updates.

It's a bit of a read, but also very interesting if you felt like you wanted more to the story.

I wished they had seen it as it would have been cool to hear their thoughts and reactions. Maybe they could do an episode called "Updates We Missed" or something like that going through previous stories and the updates that came after the episodes were taped?

Anyway, I hope all of you are having a great morning, noon, or night!

Kudos to @thisisatakenusername for updating us regarding the first story for the Reddit story. Whoa! Be prepared; it's a lot of information to handle. ⬇️

Basically the OP installed a lot of security measures and put in cameras and signs. They ended up cutting through the massive lock with an angle grinder and broke in. The police and the property manager came and caught them and they thankfully didn't resist arrest or no charges could have been dropped.

The damages were $5000. He planned on suing them for damages and especially the money they made off renting it illegally. The parents pretty much want nothing to do with the place now and OP understands but is sad because it was originally intended for them.

He ended up getting a sincere apology from the two brothers in law and it really meant a lot to OP. One of the brothers had to pay for both their bail and they were able to pay for the damages but not OP's legal fees. He assumes this only happened once they realized how f*cked they were

They basically were going to do anything and everything to make sure it goes away because they could lose their jobs as one of them has security clearance. They made an agreement for no contact and a lot of other legal stuff and things ended up working out ok. The actual break in event was a mess for OP as he was away with his wife’s family and didn’t have their phones on them for a bit.

One of the two families ended up having their truck repossessed and had to pay to break their lease on their SUV. They were $125k in debt on high interest credit cards, no home equity and two personal loans that were probably under false pretenses to begin with

The dad refused to help but the mom eventually caved. The parents had no house payments and lived off social security and pensions with a small emergency fund. That sister finally got to them, they ended up needing to borrow a car from them that could barely hold them and their three kids and the parents were paying for their groceries and the car insurance

They also filed for Class 7 bankruptcy and technically have nothing at stake if they break the agreement, so he is hoping they don't end up reaching out

The other brother-in-law also lives separately from his wife and kids because he is done with that family dynamic which I honestly don't blame. That sister was the one pressuring him to do everything and never wanted any part in it.

He is finally able to go there worry-free and his parents have also enjoyed it. It seems it is all behind him now

I tried the best I could to sum it up and left out some other details like meetings with his lawyer and the DA's office up at the house, but that is essentially what happened.

Me after reading it:

12 notes

·

View notes

Text

Speak with Our Long Island Bankruptcy Lawyer Today to Get a New Financial Start!

Speak with Our Long Island Bankruptcy Lawyer Today to Get a New Financial Start!

Are you struggling to make ends meet while facing overwhelming debt? A bankruptcy lawyer or attorney on Long Island could help you through the difficult process of declaring bankruptcy. Finding an experienced and competent lawyer who can guide you through the process and help you start over is essential, regardless of whether you are thinking about filing for Chapter 7 or Chapter 13 bankruptcy.

Bankruptcy: What is it?

A legal procedure called bankruptcy enables people or companies to get rid of or restructure their debt. Although there are many forms of bankruptcy, Chapter 7 and Chapter 13 bankruptcy are the most prevalent for people. While Chapter 13 bankruptcy is setting up a repayment plan that enables you to pay off your obligations over time, Chapter 7 bankruptcy involves selling assets to satisfy creditors.

Benefits of Bankruptcy Filing

Although declaring bankruptcy can be a challenging choice, there are several benefits to doing so. For instance, filing for bankruptcy can help you get rid of some debt, stop receiving harassment from creditors, and prevent foreclosure or repossession. Furthermore, filing for bankruptcy might give you a fresh start and the opportunity to reestablish your credit and financial security.

Locating a Lawyer or Attorney for Bankruptcy on Long Island

It's critical to locate a Long Island bankruptcy lawyer or attorney with extensive experience practicing bankruptcy law. This entails locating an individual who is knowledgeable about both the intricacies of New York State bankruptcy law and the bankruptcy court system. Additionally, you want to seek out a lawyer who is prepared to listen to you explain your particular financial circumstances and offer tailored counsel.

A Long Island Bankruptcy Lawyer's or Attorney's Benefits

Employing a bankruptcy lawyer or attorney on Long Island has several advantages. An attorney, for instance, can assist you in deciding which kind of bankruptcy is best for you, evaluating your eligibility for bankruptcy, and assisting you with the bankruptcy procedure. A lawyer can also help you with any legal difficulties that may come up during the bankruptcy procedure and represent you in court.

In summary

In the event that you are facing excessive debt and are thinking about declaring bankruptcy, a bankruptcy lawyer or attorney on Long Island can assist you in navigating the procedure and getting a fresh start. You may take charge of your finances and proceed with confidence by locating a skilled and experienced lawyer who is committed to offering individualized counsel and direction. A Long Island bankruptcy lawyer or attorney may assist you in achieving the necessary financial stability and peace of mind, regardless of whether you are thinking about filing for Chapter 7 or Chapter 13 bankruptcy.

Professionals at Pryor & Mandelup, LLP can be reached in two ways. To get a free service quotation and to complete out a simple questionnaire, you may visit their official website at https://pryormandelup.com/ or give them a call at (516) 997-0999.

#Long Island Bankruptcy Lawyer#Long Island Bankruptcy Attorney#Long Island Chapter 7 Attorney#Long Island Chapter 13 Lawyer

2 notes

·

View notes

Text

The Gambler (Short Story)

Yusuf reminisces on the loss of his family as a result of his gambling addiction after he secures his first $100k jackpot.

Like an unrecognizable lantern leading my way with no light, it's flame dimmed and deadened out, I walk into the room of shadows as they crowd the walls, the floor and ceilings in darkness. I plea that you consider your Gods, your faith, or your path because for me to be here in this empty room, means I've betrayed them all. I feel as though the deep red blood of my family dressed my sacrilegious hands. To be here, in this room, it felt as though I kneeled and laid my head on a cold chopping block, closing my eyes, waiting for the blade to fall in deliverance but it never comes. And so, I stew in these sour grapes for eternity with a gaping hole where my family had once been.

It wasn't cold but I still felt a shiver trickle down the bone of my spine. I expected things to go differently, and for that, I paid the price. These family taxes were beginning to take a toll on me, the late fee's began to add up, and today was collection. Repossession. This was a cruel reminder of my unpaid debts. I hadn't shown up to this house in two weeks and now it lied empty and bare. Quiet and desolate. The thriving family home, this once warm and comfortable corner of the world, has become nothing but an empty black box devoid of matter.

The couches and sofa, our desks and chairs. All the remaining furniture was covered in a grey and crinkly tarp as if to hide holy impurities from the eyes. As if what was once pure were now carrying an innocent deadliness to them, the tarp meant to suffocate the tears. The endless laughter that used to storm the room, the many nights we spent as a family sharing dinner in front of the TV re-watching the same shows our kids loved. Me and my wife, our skin becoming one. Our love rivaled that of a spiritual fascination with the moon or mysticism. I've changed since then, but I haven't died. Nirvana was a dream. A place I could never go.

My JanSport bag falls on the ground with a thud. My knees follow. To be here was to face the irony of a Shakespeare play, the mockery of any who gossiped infinitely. To be here was to fight the very cells within my body from swelling to the eyes and falling like rainwater, to swim against the floods. To be here was to relive every good memory I've ever had, then to recall the descent into entropy, the loss of my family, and ultimately the loss of identity I clung to before I stepped through that door. All my worst fears and paranoia danced with reality, to shame me, laugh at me, ridicule me, and tell me no balloon can dance amongst sharp objects. "Sooner or later, you must know, it will pop." And it did. Reality popped like corn in the oven and every individual kernel was me telling myself there was no way this could be real. But it was.

On the amber marble of the kitchen counter laid a note. It was from my wife. The night before I left she told me she wanted a divorce. Our life had been anything but a positive affirmation. It had been anything but a excitable increase of joy and laughter. Instead it was a stagnant and static cool jet grey but not the kind that makes you think "well, that looks very sharp and stylish." It was the bland and intrepid grey, the kind that screamed dangerously boring. Our love was nothing but cinders and ash, soot on the sand of any beach where water can extinguish it. But it was necessary. It had been a placeholder for our kids. They didn't have parents but they had a mom and they had a dad. We slept in the same bed, ate at the same table, and sat on the same sofa with Barney and Millie but it always felt we existed in separate rooms. I could see the absent look in her eyes pour hot iron into my soul. But then it cooled and became unrelenting metal. And now, she and the kids were gone. And here, I shall bear the weight of my inaction.

Underneath the note laid a long pile of unpaid bills she had left for me. It's the reason she left, it's the weight she had now no longer carried due to my whims and fancies. It had never been my intention to twist her legs or arms into submission for so long, never in a million lifetimes. But it became natural. Her tired body now running away carrying our clueless children on her broken back. A scar on our family they'll undoubtedly grow curious of as they contemplate their confusing origins. How I stood at the bottom of a well digging my grave attempting to coerce them down the hole. As I looked up at them, surrounded by the rocks of piling payments dipped in shadows. The closer I got to the jackpot, the more questions and uncertainties they were given. My gift to them. Until they turned away to disappear.

Evil collectors came to nestle into the home of my heart and mind as I dug, the heart of a once family man. A man of no solid confidence can hold his woman and children in earnest. No young child could understand the absence. No man who can dig this deep could promise his family stars in a black sky. The paper bill was an iron bar full of account numbers and dollar signs marked by absurd debts well into the many unaffordable thousands. As I look at these papers, cruel reminders that no other option could be as viable. I teemed in fury at how it still felt that way, even more now I had nothing left to lose. How much could I spend before I won my freedom?

A few years after Barney started middle school, his condition worsened. He required at-home

medical attention, nurse's came and went occasionally to check his condition, monotone monitors beeped, wheelchairs. The sad and expressionless face of my child laid peacefully paralyzed on a pillow in a forsaken slumber. In his own car-shaped twin-sized bed.

Me and my wife questioned reality and couldn't help but still find a bit of resentment for all the higher powers that be. They alone were the ones capable of inflicting a horrid fate onto an innocent child. But his life was a light, a burst of redemption and pleasure to us. A geyser of holistic vibrations from an otherwise rocky, hard ground. In a world that never truly wanted to comprehend him, enjoy him, relish him like we did, we would love every reincarnation of him for all of time. We would do anything for our young ALS warrior, my son Barney.

One night, after me and my wife got into an argument over his worsening condition I met with a friend of mine at a downtown bar called Inez's. Me and him ordered wine and sat as I told him my predicament over fruits and cheeses.

"Y'know what you need Yusuf? You need to come by the casino. Sure it'll get your mind off things and hey, maybe you'll make a killin' and solve all your problems eh?"

"Think that could help me?"

"Yusuf, man, I've seen a guy walk out damn near a millionaire."

"That's loaded, no way it could be one of us," I swirl the port around before throwing my head back killing the glass.

"That's your problem Yusuf, every one in that casino walks in knowing it's spend money to make money. Every single one of us believes we could walk out a millionaire. Solve our problems."

"Everyone is in debt? Sounds ironic"

"Some are finding their own way to get out of debt. Others are there to play smart." Mikhael says.

"Doesn't sound like a good idea to me."

"Trust me, it's better than people give it credit for. Just don't go too crazy."

That first night I went to the casino I walked out with almost $2,000. Me and my wife kissed when I walked through the door as I spun her in my arms, the tenderness of her love and warmth of her cheeks as our heads pushed into one another's. I didn't go back to the casino for months. Until we could see Barney had slowly started slurring his speech. As Barney became increasingly more paralyzed I could feel my heart slowly turn from flesh to glass, creating a fragile man that was stuck in time. The entropy that slowly creeped up into our walls like conscious vines with ill-intentions. A desire to invade our house and minds with a creeping reality. Eventually Barney would be completely paralyzed, completely silent. We managed to keep morale in the house high because we knew it's important. But behind closed doors, me and my wife began unraveling. The sky was falling into a stirring purple. The bright blues were the news of yesterday and days before. Today and tomorrow we fall into the oranges and then purples of our family woes. When we stood in the black, me and my wife stood alone. She in the car with the kids. Me in this kitchen, alone, leaning defeatedly onto the cold amber marble as my life was going off in flashes.

Me and my wife argued more and more everyday. I began to go to the casino after each one. Me and Mikhail would have the same conversations, play the same games, roulette, blackjack, slots. Then we sat at the same bar, Inez's, and drank our losses away or celebrated the small wins we claimed. It was much more balanced than one would think as we became better and better at the games and strategy. As I began to become a better gambler, my family began to grow increasingly isolated from my presence. Soon days turned into weeks and time melted, I'd find myself getting to go to the casino even on a good night. My wife began to stop questioning my absence and our arguments over Barney being paralyzed, me being an awful example of parenthood, our lack of money and my lack of willpower to go get another job became a daily ritual.

"You're just lazy Yusuf." My wife shakes her head.

"Marianna, look at this." I pull out more money from my hands, not as much as my first haul but an easy extra $200.

"How much did you lose?"

"I lost nothing," today.

"You're that good huh? Must be proud of yourself."

"Marianna, I just want to help. I'm not going in there and wasting money. I'm playing smart."

"That's how it starts Yusuf, you're going to the casino almost every other day. Barney needs you here."

"I'm doing this for Barney Marianna."

"You're doing it because you don't want to sit and talk to me and be with the kids anymore."

"I do. I love to sit and talk with you. I love being with the kids. But you're right, we need more money."

"The debts are getting paid, we can't afford this new wheelchair Yusuf. You can't spend all our money now on hopes and dreams. You have to pick up a second job."

"Marianna," I fold the money into her hands. "Take this. I promise I'll get him that chair."

"Yusuf, no."

"It'll be okay,"

"Please stop acting like this."

"Marianna, it's alright."

"It's not."

"I promise."

She sighs and stands up to tend to Millie's sudden outburst of crying. She believed me at first and as time passed by I realized I couldn't convince her anymore. I started betting more. Barney's conditioned worsened. Me and my wife's relationship began evanescing into invisibility. And through all the stress and responsibility, my impulse control began to deteriorate until the blood on me could be smelled as soon as I walked through the door. A long night of gambling and drinking.

My attention is brought back to the JanSport bag I dropped earlier. In it lied shy of $100k. Two weeks ago, when my wife told me she wanted a divorce, I flipped out. It was the first and last outburst of mine and it was the most violent. I didn't mean to say such shallow and empty words. They weren't me, or my tongue, it felt as though I had been possessed by a hungry spirit that simply wanted to eat. I just wanted to gamble.

To me, it was more then just a escape. It had become a game. An art form. To know when to hold back, to know when to go all in. It required a methodical science that could be as sensitive as a newborn's attachment to their caregiver. I made lots of money since taking it seriously. There were long intervals in which I made more then I loss, and then there were seasons where I lost more then I made. It never took less then a couple hundreds or so to get back to my spot though. And so the vicious cycle continued.

After our argument the next week me and Mikhail went to the MGM in Vegas. He paid for my trip and everything. I told my wife I was visiting distant relatives. I'm still not sure she was convinced. He said there was a group of people out there who were pro's that he'd been chatting with over the internet. People he said he knew pretty well. We all hung out and got drinks in the bars and hung out there. A man and three women. All single. I had gone out of anger, not at my wife, but a general unhappiness with my own life. They were pro's and with me and Mikhail together we had a pretty decent sized team. We made a pool of our money and split it even and bet it all together. When we came back together and met in the room we danced and partied and drank the night away. We were halfway to a million.

Mikhail wasn't wrong. There were people who spent their money to lose, for some idea, a false and phantom idea that they'd make it big with just one play and get lucky. They couldn't have been more wrong. To play smart was to know it'd take a loss to make a win. It's because the path to winning was no different then the path to losing. It's how you spend, at the end of the day, that truly makes a gambler and a fraud.

I had made much more money gambling and forgetting my life at home then I did working any job being a family man. The fact I'd come home to a violent silence, a subtle distrust, a ailing family separated me. I placed all my earnings in their hands. I thought me making this kind of money would've been a good thing. So while in Vegas, I allowed myself to completely forget. I allowed myself to forget my loving wife and all of our best times together. The beautiful sex we'd have and kisses we'd share, the children, the home we worked so hard to buy and inhabit together. Not just as another place to sleep, but a safe haven, a family castle for our kids to grow up and become kings and queens of one day. Even Barney. I allowed myself to completely forget, an invisible lot in my mind, and I played the game.

I pull back the tarp to the living room sofa and sit on the white soft couch. It was in pristine condition. The many nights me and my family spent on this sofa almost brings me to tears but I swallow them down. I'd already been sentenced to death by hanging. I grab the JanSport bag from the floor and open it to look at all the cash. Looking at it should've made me happy. All the things I've done to find my own happiness, and I lost sight of the most important things I could be doing to be happy. I forgot it wasn't just my happiness on the line. I felt they were attacking my happiness. But it was only because they missed me. It was how I used to make my wife happy. My kids happy. My home happy. How could I have been so selfish for this long? Now that I've finally lost them, I don't feel relief. I feel a dozen swords pierced through my back.

I still loved my wife and my kids. I would never stop loving my wife and kids. But her note was no different then the bills that lied next to them. The difference is now, my bills could be paid. The tolls I incurred on my family, they were far too high for any man to afford. I peel the blue envelop back, opening it to a white folded sheet of paper. It didn't fully fit, the note being small, and our wedding ring tucked in the corner. It was worn on her soft finger for nearly a decade. Just holding it in my hands, I could feel my knees return to jelly, the drunk warmth of my body threatening to kill itself on the spot.

I bring the note in my jacket pocket and grab a single stack of bills. Value $10,000. I had never spent any of my gambling money on myself save for the occasional drink of port wine with ritualistic fruits and cheeses with Mikhail. He was at home enjoying his win of the pot with his family. I can't say I'm sure if he was having a good time now or not. He never really talked about his family with me. Our conversation was never personal, always advising. Always planning the next jackpot, always in search of our next win. I stand from the couch and drag my feet towards the amber marble table. I grab my keys and decide I'll go for a drink and celebrate myself, alone, for the first time at Inez's.

#damn this book sexy#oxford who?#netflix and chill with my dictionary#spirituality#writeblr#poetry#creative writing#writers#writers and poets

5 notes

·

View notes

Text

Reclaiming Your Repossessed Car and Rebuilding Credit: A Comprehensive Guide

In the challenging landscape of financial setbacks, having your car repossessed can be a daunting experience. However, reclaiming your repossessed car is not only possible but also a pivotal step in rebuilding your credit. This comprehensive guide will walk you through the process, providing detailed insights and strategies to regain control of your vehicle and enhance your creditworthiness.

Understanding Repossession

What Leads to Repossession?

Before delving into the recovery process, it's crucial to understand why a car may be repossessed. Financial hardships, missed payments, or defaulting on a loan are common factors that can trigger the repossession process. Lenders typically take this step when other attempts to collect payments have failed.

Steps to Reclaim Your Repossessed Car

Contact Your Lender

Initiate communication with your lender as soon as possible. Open and honest dialogue can often lead to viable solutions. Discuss the reasons behind the missed payments and express your commitment to resolving the issue.

Negotiate Repayment Terms

Work with your lender to negotiate new repayment terms. This may involve restructuring your loan, extending the repayment period, or finding a middle ground that suits both parties. Be prepared to provide evidence of your ability to meet the revised terms.

Pay Outstanding Balances

Once an agreement is reached, promptly fulfill your financial commitments. This includes paying any outstanding balances, additional fees, or penalties. Timely payments demonstrate your dedication to rectifying the situation.

Retrieve Your Vehicle

Upon settling the outstanding amounts, inquire about the process of reclaiming your repossessed car. Ensure you are aware of any additional steps, documentation, or fees required. Prompt action is key to regaining possession.

Rebuilding Credit After Repossession

Check Your Credit Report

Start by obtaining a copy of your credit report. Thoroughly review it to understand the impact of the repossession on your credit score. Identify any inaccuracies and dispute them with the credit bureaus.

Create a Budget

Develop a comprehensive budget that prioritizes debt repayment and living expenses. Allocating funds responsibly will help prevent future financial challenges and improve your creditworthiness over time.

Consider Secured Credit Cards

Secured credit cards can be instrumental in rebuilding credit. These cards require a security deposit, mitigating the risk for lenders. Make regular, on-time payments to showcase responsible financial behavior.

Seek Professional Guidance

Consulting with a financial advisor or credit counseling service can provide valuable insights. Professionals can offer tailored advice, helping you navigate the complexities of credit rebuilding with expertise.

Conclusion

Reclaiming your repossessed car is not just about regaining a mode of transportation; it's a crucial step in rebuilding your financial standing. By following these detailed steps and adopting responsible financial practices, you can not only get back your car but also embark on a journey towards a healthier credit profile.

2 notes

·

View notes

Text

So, You (Un)Fortunately Work For Proton?

As mentioned in a previous headcanon post, Proton oversees the sub-markets and black markets that Rocket has direct influence and control over. People working under him are involved in assuring that these massive markets are ran smoothly, along with handling the logistics of deliveries and the movement of goods & services.

GRUNTS are responsible for the harder labor:

Driving/flying/sailing regional and inter regional trade routes with transport vehicles.

Loading and unloading cargo at ports and warehouses.

Transporting goods from the warehouses to Rocket owned businesses to be sold.

Smuggling goods when necessary. (Weapons, Pokémon, anything of dubious legality.)

Working as general staff in Rocket owned businesses.

OFFICERS & ELITE OFFICERS handle slightly more complicated affairs

Managing Rocket owned businesses.

Public relations with financial institutes.

Office work beneath heads & admins.

Overseeing grunt work.

Processing civilian loans.

Providing security when necessary.

HEADS & ADMINS have a more complicated workload

Negotiating regional and inter regional trade agreements.

Ownership/stock in Rocket owned businesses.

Establishing businesses in pre-established and new markets.

Tracking profits and creating budgets every quarter.

Keeping track of all business partners and active loans to assure that they are in good standing.

THE REPO SQUAD

If you have entered a financial agreement, taken out a loan, or have any sort of monetary relationship with the organization, you are expected to make all of your payments on time. 30 days delinquent, you get a written warning. 60 days you get a visit and a stern shaking down from an officer or elite officer (think of the scene in episode one of Squid Game where the main character was cornered by the loan shark). 90 days delinquent, and the repo squad comes out.

These are members hand picked by Proton, trained to move silently, efficiently, and with purpose, in order to retrieve the money or goods owed back by customers. The Repo Squad is permitted to cross regional borders— fleeing Kanto or Johto to avoid the debt is futile, you WILL be found. (They are trying to reach you about your car’s extended warranty lol.) The bigger the debt, the worse the punishment. It can range anywhere from vehicles and property being repossessed or Pokémon being taken, to physical harm to the person in delinquency of their payments, and even the disappearance of the person in question. Proton has no qualms whatsoever with how his repo man handle their job, as long as the job is done.

If Proton himself is sent out on a repo job, it’s going to be extremely messy and extremely violent— and it’s likely that the person is in debt to someone high ranked in Rocket. He also likes to take care of repos from people that he has a personal vendetta with, or a grudge.

#➤ 《 𝐀𝐝𝐝𝐢𝐜𝐭𝐞𝐝 𝐓𝐨 𝐓𝐡𝐞 𝐊𝐧𝐢𝐟𝐞 》 Headcanon#{ Shoutout to haematophiliac for the hierarchy headcanon post. I used the ranks as loose inspiration. }#{ wanted to throw this post together since I’ve had a few people ask how things work for my Proton#Hope this makes sense! }

13 notes

·

View notes

Text

VIOLA "VI" WOLF

Name: Viola “Vi” Wolf

Age: 45

Gender: Cis Woman

Pronouns: She/Her

Sexuality: Bisexual

Relationship Status: Single

Community Job: Mechanic/Handywoman

Reside in: Apartment in an apartment complex near the junkyard

How long have they been in Redwood?: 1 1/2 years

Faceclaim: Hilarie Burton

Headcanons & Biography

She has several tattoos which she got during her early twenties, mostly on her upper body and arms.

Her family’s repair shop and home were repossessed due to family debt. She considered trying to repurchase them but her life had different plans.

Her leg troubles her quite a lot. She still does her exercises, but it seems to be getting worse with the years. She refuses most help for it though.

She still wears the ring Judah gifted her and only takes it off when she’s working on fixing something.

She’s surprisingly good at shooting. While her family was never big on guns, she quickly took to them once she depended on them for survival. She came into Redwood with a pump-action shotgun and two sidearms, all of which she carefully maintained during her time after the outbreak.

While her big passion is cars, she has a general affinity for appliances or anything else electronic or mechanic, and she’s learned to fix a lot of things.

Born in a small town called Ithaca in New York State, it always seemed clear that Vi would become a part of the family business. Born as the only child to Christian and Margaret Wolf, Vi showed her interest in mechanics from a young age. Her father, owner of the multi-generational business “Wolf & Sons Auto Repairs”, encouraged his daughter's interest in the topic. When Vi wasn’t in school, she was often in her father’s shop, watching him work and learning the trade even from a young age. Her interest didn’t just stop at cars, however. Vi seemed to have a natural interest in anything technological or mechanical, taking apart devices, figuring out how they worked, and trying to put them back together. It seemed that her future career had been set for her.

Except that life had different plans. When Vi was 15, her parents passed away suddenly. A car accident with a drunk driver left the teenager an orphan. With no immediate family to take care of her, Vi was quickly shuffled into the foster system. Struggling with adjusting to her new environment, she quickly became “troubled” - drinking, partying, lashing out at others in the pain of her grief, with the people in her group foster home hardly having to capacity to properly care for the grieving teenager. Leaving the foster home at the age of 18 (or rather being kicked out), it seemed that Vi’s life was about to head down a rather troubled and disorganized past, with her hardly having any permanent home and often resulting to crash on people’s couches, holding herself above water with the occasional odd job.

There was no one specific thing that caused her to get her life back in order. It was a mix of realizing that her life was heading nowhere and the fact that she had started working as a handyman, fixing appliances for quick cash, that finally pushed her into getting her life back on track. Despite her lack of official education, she managed to secure a job at an auto repair shop as a mechanic in training. It seemed that her work provided solace for her.

Her life was largely uneventful for the following years - she worked, advancing in her career, saving up money, and doing volunteer work. However, a wedge was thrown into her life one day when she received a leg injury at work. It seemed that her life had been put to a sudden halt - her needing reconstructive surgery and extensive physical therapy in order to even have a chance to keep it and not have it amputated. It was during her time in the hospital that she met Judah. Initially, Judah was just one of the doctors working the floor she often stayed in, but soon enough the two got talking, and often ended up spending his lunch break together. Her stays in the hospital were rough on her, but her talks to Judah helped her through it. Soon enough, the two were spending time outside of the hospitals too, and sometime after, became a couple and eventually ended up married.

Her and Judah’s marriage had some hardships - including failed attempts to conceive children as well as her struggles with her physical limitations due to her leg, which always troubled her after the accident, but it was overall a very happy marriage. That was until the virus spread. Vi remembers her husband seeming rather troubled, remembers hearing the increasingly more concerning news - and the sound of her phone ringing when she was called to tell her that her husband had been bitten by one of the infected. She at least got to say goodbye to him, through one of the windows of the isolation room. Many others were not as lucky.

She stayed out in their shared apartment for as long as she could - but when the military began to forcibly evacuate people to quarantine camps, Vi knew that she needed to leave. Leaving in the middle of the night, Vi made her way out of the city, hoping to find someplace safe even as the world descended into chaos around her. Vi joined up with several groups as she went along, but often something happened - they disbanded, attacks by walkers or enemy raiders as the world descended into chaos. As a result, Vi often made her way through the world alone, even though it was hard. By the time she reached Redwood, she was utterly exhausted. Even though she was initially reluctant, she quickly realized that Redwood might be one of the few chances at safety she could get. So, eventually, she decided to stay, offering her services as a mechanic to the residents of the post-apocalyptic settlement.

2 notes

·

View notes

Text

The Man from Utah, Chapter 7, Draft 1, Part 21

It was unsurprisingly vacant. Amid the corpses, there were still weapons strewn around from that crowded fight, and there was plenty of debris to go around.

Fletcher wasted no time in picking up an assault rifle and running to back Dan up.

“Your idiot’s gonna get torn to pieces out there,” he said. “If you see another turret, get it now!”

Liam took the hint, searching for any security systems. While he was able to kick more guns over to Fletcher, this place was no military facility; it was more of a warehouse. There were crates on top of crates across all of the walls. With his luck, they’d be full of sewing buttons or something.

Still, he opened a crate to be sure. To his surprise, he found it was full of car batteries. No weapons or anything.

His head turned and really took a look at that vending machine. The cover was already off…

ObjectiveState==SURVIVE: 17100

Dan was taking a beating. Between his struggles to keep the MAG at bay and the mercenaries aiming at his now-exposed points, he felt more blood than air on him after this.

“You can be repossessed after,” the MAG said calmly. “Move so I may settle the debt properly.”

His fists of metal ground against Dan’s sword, sending sparks and shrapnel everywhere.

“I belong,” Dan said, spitting bloody bullets out of his mouth, “to no man.”

“A renegade, then? Oh, won’t that sweeten the pot!”

Dan started to buckle as gunfire continued to hit his side through the gash in his armor. He wasn’t sure how much more he could take, but if this was where he was going to die, he was going to go out fighting.

He stepped back, letting the MAG stumble for a bit before Dan turned to his other adversaries, charging forward. He was better able to deflect their shots from this angle, and he could swing his sword still. Grace no longer mattered; so long as he still had a wide arc, he’d be able to deal some serious damage.

2 notes

·

View notes

Text

Notes from Tokyo Vice: An American Reporter on the Police Beat in Japan by Jake Adelstein

note: take book with grain of salt as author is greatly self-aggrandizing, but provides some nice color on yakuza

many yakuza prefer to be called 'gokudo' (the ultimate path)

shobadai - slang for protection money paid to the yakuza

"Santa Fe was a book of nude photos of the popular actress Rie Miyazawa" that showed her pubic hair. When authorities didn't pursue the book for breaking obscenity laws based on the photos' "artistic qualities" it opened the floodgates to the relaxing of those policies enjoyed to this day

typical divisions of a police station: violent crime, white-collar, fraud, , traffic, juvenile crime, prevention, lifestyle/vice, plus an organized crime control division, which would pursue drugs, credit card fraud, and human trafficking

kind of neat - the idea of exotic animals being sold to yakuza to scare people. who would have a leashed tiger?

When someone leaves the yakuza, a letter is circulated to all members, either a hamonjo - this person is no longer in the organization, don't do business or associate with them; or a zetsuenjo - betrayer hunt this person down.

if a murdered body is found with the head facing North, that may indicate a killer feeling remorse as that's how dead bodies are laid out.

suicides remove their socks and shoes as it's rude to wear into the afterlife

There are two major types of yakuza: tekiya, low-level con artists and bakuto, the big leagues, who engage in predatory lending, human trafficking, the racket, and blackmailing corporations. They are over half Korean-Japanese and the dowa, formerly untouchable caste of Japan.

The major yakuza have lots of sub-groups that pay monthly dues. The Yamaguchi-gumi (biggest) takes in about $50M in private equity monthly and this is considered a conservative estimate.

The police don’t have the authority to wiretap, offer plea bargains, or witness protection in yakuza investigations, which limited their ability to effectively prosecute them. It’s also not illegal to be in a criminal organization.

As of 2006, the Tokyo Metropolitan Police compiled a list of ~1k front companies in greater Tokyo, 20% real estate with significant investment in securities, auditing, consulting, and other financiers.

Police sometimes call the yakuza “Realtors” lol

In 2008, a major Corporation was found to be paying over $100M USD to yakuza to remove tenants from properties they wanted to purchase (this is called jiage or land-sharking and is big because tenant laws are so protective.)

The bosses of some yakuza groups are minor celebrities and will be photographed and reported on having meetings/dinners with politicians, or will grant TV interviews!!!

Marubo cops – organized crime detectives

One business model: landsharking, moving yakuza into buildings before they can be repossessed and then buying them themselves or getting money from the original owner for the service, protection money from the sex trade, and the cash cow, extortion (specifically, shaking down business people with embarrassing secrets). They would do the same with companies in financial trouble. They would take out loans from midsize banks using the company’s real estate as collateral, but then when the company would go bankrupt, those loans would go unpaid. The Sumiyoshi-kain also ran staffing companies, loansharking, and an insurance company specializing in false claims to rip off real insurance companies. A collection agency for recovering bad debts for real loan companies. Pawnshops for trafficked goods. A talent agency for porn (paid well not coerced). Transportation and security for large events. Take construction contracts and then subcontract out, pocketing the difference. Set up a fake political org for the tax break and a way to launder money. Have your extortees pay to receive your newsletter.

kabukicho was the undisputed red light district of tokyo before it got partially cleaned up following the 2001 fire of the Myojo 56 building where 40+ people died. It is speculated that the yakuza burnt it down after not being paid its protection money by the mahjong parlor inside.

At least in 1999 during the time of this book, a reporter tells him: "Nine times out of ten, no matter how much it looks like a murder, the Shinjuku police will write it up as a case of assault resulting in death - manslaughter? Why? So they don't have to launch a full investigation." Murders of 'low-lifes' not deemed newsworthy. What WAS newsworthy was anything involving someone famous, a civilian, or a teenager. Maybe a brewing gang war.

The reason the anti prostitution law is on the books is to protect girls who were being sold into sexual slavery after the war. That's why they only go after the pimps and owners, not the girls.

one thing to track is i keep writing big clubs, when i should go smaller, seedier, and more participatory. one stage, men using vibrators on the fully naked dancer. also kinkier: more costumes, piss play, the works.

downtown there are typical haunts where the yakuza hang out near their offices, where they get coffee and shoot the shit. and it's not one organization, but all of them.

lots of young girls (high school to college) get addicted to the host clubs and run up a big tab at which point they get redirected into becoming hostesses or joining the sex trade themselves. these are usually unlicensed clubs that have no police protection and are therefore easy marks for the yakuza. a good host club makes about $300k a year in 1999; the legit hosts can make big money too, think $6-10k a month not including gifts. hosts and hostesses often frequent each other's places when they get off work, so they're often busiest at like 4am/late late hours.

Roppongi is known for its foreigners. The place to go if Japanese people and foreigners are looking to connect (/connect!) Before the bubble burst, Roppongi was known for its highbrow establishments, but it's gone sleazy with big clubs, drugs, and all the typical sex trade establishments. It's nicknamed "High-Touch Town"

Because yakuza bosses can be held liable (and sued) for the crimes of their subordinates, when someone gets collared, it's typical to throw them out of the org (at least on the surface) claiming they were just a bad egg to limit liability. Yakuza will also sue newspapers and other organizations that call their businesses fronts or old members yakuza. Very good lawyers.

money laundering - hostess clubs and sex parlors (have your employees act as regulars and pay there); donations to religious organizations you run from the profits, own restaurants, r&r spots, and more and have your employees go there with the profits.

there are legal limits on interest rates for consumer loans, but yakuza loan sharks obviously go way above that. keep database of all customers at one establishment to see when the loan is falling behind, and then reach out from one of your other loan offices to offer a loan with even higher interest rates to double prey upon your victims.

more swords as weapons since gun use penalties are so high!

not uncommon for yakuza to own the movie studios making yakuza films which has promise as a funny detail; also more chopped fingers, toes transplanted as fake fingers, etc.

Tokarev - Russian guns popular in the 90s with yakuza

"that's why we farm out the dirty work to the Chinese and the Iranians. If they get caught, they don't talk and they just get deproted."

control the media by running the top talent agencies and denying them access to top entertainment talent if they publish unfavorable reporting

2 notes

·

View notes

Text

To foretell the future, think like a banker

The banker's guide to owning it all

To foretell the future, think like a banker

Ishkabibble

To extort the maximum value from a population, when one has control of monetary system, leverage the laws of supply and demand. Use deflation, inflation, and hyperinflation all as tools to transfer wealth. All have a place and a purpose.

The banker's guide to owning it all

Become majority lender in an economy of people with assets you want.

Encourage indebtedness by loaning generously while securing on assets of interest.

Loosen lending standards until the assets you seek to capture are attached. (this makes the economy debt dependent)

Once debts are significant for the bulk of the population, sharply tighten lending standards. <-- Economic shock - Onset of deflation

Backstop losses with public guarantees if possible. This is gravy if one can get it. (Fannie and Freddie guarantees, for example)

Permit default 'without risk' on the assets you wish to sieze to maximize wealth transfer. (stall foreclosure, stay repossession orders etc)

Stall the economy to maximize default positions and deplete private liquidity. <-- We are here

Successively ratchet the economy downhill, while bettering secured positions.

In a series of large actions, sieze all security for default. Target the assets of greatest interest first. (This deals a heavy economic blow and can help cause the ratcheting required for step 8.)

Transfer asset ownership, but retain prior owners as renters where possible. (This reduces public lashback and helps maintain the asset for resale)

Once the bulk of assets of transferred, write them down to leverage the public financial backstop.

Buy up as many remaining assets on the cheap as possible. Hide this action.

Hyperinflate to destroy the external claims on wealth. <-- Onset of hyperinflation (This destroys treasuries, gov't bonds, currency. Ensures free title on new assets. May cause war.)

Stabilize the currency or devise a new one, resume lending at a reasonable pace. Sell the assets back, secured of course, at your chosen price in new currency.

Hyperinflation is only a risk to the wealthy if the population has the assets. Make note of that statement. It is key to timing the shift from deflation to hyperinflation.

I combined known events of the 1930s with those of other collapses and this is the model that results. Instead of positioning myself as a victim of the collapse, I positioned as the one that would profit.

The approach is reverse engineered, so it may not be entirely accurate. I expect it is close.

Ethics aside for the moment, one might consider the following in order of execution:

Eliminate secured debt.

Store preps to carry you through steps 8-13.

Secure precious metals for when the currency is collapsing. At that time, assets will become very cheap in terms of both gold and silver.

Exchange for assets while public stampedes into PMs in a panic.

If the gold price rises too high for your tastes, loan sums of cash against assets of much greater worth. Ensure you have a first on the security.

For those of limited means, directing capital can be very important. This model is deflationary while assets are transferred. It relies on limiting the panic in this period as well. From this, we can gather that accomodation is likely to remain available. Food will become a larger percentage of household spending (due to income reduction), and guns won't help against this enemy (protection will still matter though, as always). This can help prioritize where limited prep funds are spent.

For those with excess, items three and four may feel ethically questionable. Remember that private ownership of most of these assets will not survive this process with or without your involvement. Following in the footsteps of the banks directs some of their windfall to you... instead of them. I am personally comfortable with only the first three of the steps listed above. The fourth is a difficult one. I could only do that if I knew a bank was going to loan the money and complete the fleecing in my absence. But even then, I don't think I would take on the roll of aggressor.

I am bullish on both gold and silver from the point destruction of the dollar picks up momentum. For the immediate future, TPTB will jack the price all over the place to shake out the speculators. The choice to hold gold or silver must be based on market fundamentals, not the gamed valuation systems.

I am bullish on both gold and silver, but most bullish on silver. To an untrained eye, $1000 in silver looks like a LOT more than $1000 in gold. The market will soon become saturated with untrained buyers. They will be panicked and buying in haste. They won't know what to buy based on research or sound fundamentals, rather they will respond based on visual cues and heuristics. A suitcase of silver may buy a house because it looks like a lot, while the equal value in gold will not. As well, those little plastic sleeves will be big money makers. They will ensure a case filled with any PM looks more tangible. Less will become more when well packaged.

Emulating the actions of a banker would enable you to share in their spoils. It's hard to ensure you will have the dry powder to spend in step 12, and there's risk that a twist on this strategy could still come forth. But if it holds true, your suggestion would be effective.

h

1 note

·

View note

Text

Paperless Lending Service for Short Term Loans UK Direct Lender 100% Online

You occasionally need quick cash support prior to your payday to pay mid- or end-of-month expenses on schedule. Attempt to avoid owning a debit card! In that case, the short term loans UK alternative is always set up to help you in a helpful manner. These short-term loans are primarily prepared for members of the working class who frequently experience unplanned financial difficulties and want urgent financial assistance. The aid of these credits therefore enables you to plan the fast cash assistance that will be suitable to cover unforeseen budgetary demands on schedule.

You must possess a few certain prerequisites in order to obtain short term loans UK direct lender. These terms and conditions are simple and not at all challenging to abide with. These could include reaching the age of 18, having active bank records in your name, having a regular source of income with a monthly wage of at least £500, and United Kingdom citizenship.

After fulfilling all of the aforementioned requirements, you have full freedom to obtain short term loans UK in an amount ranging from 100 to 1000 without using your insurance as security throughout the period spent assurance. The credit amount needs to be paid back to the bank in less than two months, usually on the eve of your next salary.

Apply Now for Short Term Cash Loans to Have Money in Your Bank within 24 Hours

Our company loans are simple and uncomplicated, with fixed rates and adjustable loan durations ranging from one to twelve months. We can assist businesses where other lenders are unable to do so since we lend our own money, and we can have the funds in your bank within 24 hours.

Why not check your eligibility with a simple online application from Classic Quid since it won't affect your credit score?

So that you won't have to wait around, our rapid funding is made exclusively to cover an emergency.

Credit providers may charge these budgetary administrations with having relatively high short term cash loans fees because of how transient they are. All things considered, you should think about using the most popular and enticing online approach while applying for short term loans UK direct lender. The good news is that you may look at several credit reports provided by a few reputable online moneylenders, who enable you to select the finest loan deal at competitive loan fees. Also, the cost of the loan will be affordable for your budget.

As stated previously, salaried people are typically offered short term loans for bad credit in the period between their two consecutive paychecks. In this way, people who have poor credit histories, such as defaults, unpaid bills, repossession, late or missing payments, CCJs, IVAs, or debt, are nonetheless given full consideration for receiving these loans without any problems. Also, they can benefit from paying for your child's tuition or other educational costs, extraordinary bank overdrafts, unexpected medical or dental expenditures, Visa charges, unpaid rent, unexpected auto repairs, and even service costs.

4 notes

·

View notes

Text

have you ever heard of SOMETHING TO SOMEONE by Dermot Kennedy, well, it describes KILEAN RYAN to a tee! the thirty year old, and PERSONAL SECURITY TO THE IRISH MOB was spotted browsing through the stalls at portobello road market last sunday, do you know them? would you say HE is more aggressive or more OBEDIENT instead? anyway, they remind me of the smell of warm beer, the feeling of a freshly lit cigarette after a long day and the roar of the crowd on game day in the pub

Introduction

FULL NAME: Kilean Declan Ryan

NICKNAME(S): Ryan, Kils

AGE: Thirty

GENDER & PRONOUNS: Cis Male / He/Him

DATE OF BIRTH: August 1st 1992

ZODIAC SIGN: Leo

OCCUPATION: Security for the Irish Mob

SEXUALITY: Straight

Biography

Growing up Kilean's life was far from glamourous. He was raised by a single father, after his mum had passed away during childbirth. While he didn't think is father resented him, he knew he held him responsible. He was harder on Kilean than he was his older brother, and while it took some time, eventually he got used to it. It seemed like the price to pay for being the reason his father and brother lost someone they loved so much. From a young age, he took responsibility for what he did... even if it wasn't his fault.

When he was ten, his Dad had gotten a factory job in Park Royal. A neighbourhood near Nottinghill that was known to be the epicenter of industry and hard working jobs. When they left Ireland he thought this would be the start of a new beginning. But only three years after their big mom, the Guinness production plant shut down in Park Royal and moved to Dublin. While the irony of it all, had made the almost teen chuckle... their situation grew less funny with each passing day. Alcoholism consumed their small flat and it became clear that with the plant closed down, their father had no interest in trying again. He'd given up on that dream, and everything else that went along with it. Kilean and his older brother, knew it was their time to step up.

It wasn't long until a Kilean came across a local group of Irishmen in the area. In his mind, the Irish stood by one another and the naive boy thought they might have some work for him. Or even his father. He went into their businesses feeling like he was making big moves for his family. Ones that might finally make his father proud of him. Kilean had no idea that the pup he'd walked into was a front for a man name Bugsy O'Shea. Head of the Irish Mob in that part of London. Infamous to many, but not the thirty teen year old boy.

Bugsy promised to take Kilean under his wing, in exchange for a few odd jobs and cleaning up the bar on weekends. Like many con man and manipulators, he lulled the boy into a false sense of confidence by being the father figure he'd needed for so long. Throughout his teens, Bugsy didn't ask for much. The boy would work in the bar and run simple errand, until he turned eight teen and became an asset to the team.

It was around this time that he'd met a young girl named Poe. She was delicate like a flower, and he was so afraid to break her. She made him want to be a better man, and earn her love and affection. With her he felt like he could walk on water and when she kissed him, he swore he could see the stars. Their relationship was quick to build and before he knew it he was down on one knee, promising the world to his young love.

They would have a few good years together before Kilean's boss started making more and more requests. Ones that started to make him uneasy... and slowly exposed what kind of people he'd found himself working for. Debt collection, beatings, repossession for collateral and eventually torture. If he refused to do the job, Bugsy would tut tut tut, and shake his head slowly before asking him what his sweet Poe would think if she knew what he really did for work. Twisting the knife in his side until he couldn't deny Bugsy anymore. When that threat grew old, it turned to threats of Poe's safety. Scaring the living hell out of Kilean.

Not knowing how else to protect her, the Irishman did the only thing he knew would keep her safe. He left. He took a job protecting Bugsy's assets in Belfast and kept his distance from his ex wife in hopes the mob would leave her alone. The further he distanced himself, the better off she'd be. Or so he hoped.

Relationships

Poe Crane: DEATH OF ME - I would love you if I could but my unsteady heart's not ready and you would only get what’s left of me. I don't wanna walk away but it's not fair to let you stay // Poe is still the love of Kilean's life. He would do anything for her but he knows it's not safe to be in her life. He can't be the reason one more person he knows loses their life. No matter what it takes, he will keep her out of harms way. Even if it means she has to hate him to let him go.

4 notes

·

View notes

Text

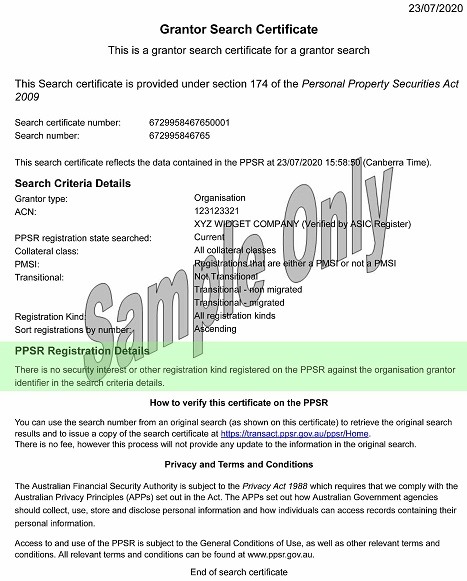

The Importance of Getting A PPSR Certificate

The PPSR (Personal Property Security Registration) system was launched by the Government of Australia on 30th January 2012. It is the official register of the Government, combining several state-based registers into one single-window entity. Some of the existing registers that were merged included the REVS and the ASIC Register of Company Charges. Anybody can access the online register round the clock and get PPSR Certificate.

The PPSR certificate is a document of a security interest in personal property that is mainly related to debts and other obligations whenever there is a lien on it. By definition for PPSR, personal property is limited to cars, company assets, boats, cars, used goods, and intellectual property. Land and fixtures fall outside the purview of this personal property.

Now, why should you get PPSR Certificate after registering a security interest on personal property? It is to let everybody know that you are the rightful owner of the personal property and that you have a security interest in it. Any transactions on that property without your knowledge are therefore illegal. This system is so popular today that on the PPSR, millions of searches take place every year in Australia.

What safeguards are you ensuring for your business or any form of personal property if you get PPSR Certificate? It becomes especially beneficial for those who are buying property or lending money against a lien on personal property. When you get PPSR Certificate, you get full particulars of the property, its ownership, lien, and in the case of movable property, whether it is genuine and not stolen. With these details and insights, you will at once know if you will be getting good returns on your investment.

It is very important to know whether the property you want to buy is free from debt and does not have any lien on it by a financial institution. Without a clear title, you cannot transfer the ownership to your name and there will always be a fear of repossession even if you have made full and final payment for it.

Take the example of buying a used car. Before selling it, the owner will ensure that it apparently looks in excellent condition but the true history of the vehicle will only be revealed if you get PPSR a Certificate after verification of the VIN (Vehicle Identification Number). Some of the particulars that you will get about your intended purchase are where the vehicle was built, the manufacturer, brand, engine size, and type of vehicle, the security code that denotes that it has been authorized by the manufacturer, the model, the year of the vehicle, and which plant manufactured the car. With a VIN check and a Certificate, you will at once know that you are getting value for your money.

The Registrar of Personal Properties Securities, appointed by the Attorney General’s Department, manages and controls the functioning of the PPSR.

2 notes

·

View notes

Text

Understanding Neighborhood Title Loans: A Comprehensive Guide

In today’s financial landscape, many individuals find themselves in need of quick cash to cover unexpected expenses. One option that often comes up is the title loan, a type of secured loan where borrowers use their vehicle title as collateral. This comprehensive guide will delve into the specifics of neighborhood title loans, how they work, their benefits and drawbacks, and considerations for potential borrowers.

What Are Neighborhood Title Loans?

Neighborhood title loans are a type of short-term, high-interest loan where the borrower uses their vehicle title as collateral. Unlike traditional loans from banks or credit unions, title loans are typically offered by specialized lenders and are known for their relatively lenient approval requirements.

How Do They Work?

To obtain a title loan, the borrower must own a vehicle outright or have significant equity in it. The process generally involves the following steps:

Application: The borrower applies for the loan by providing personal information and details about the vehicle.

Vehicle Appraisal: The lender assesses the vehicle’s value to determine the loan amount. Typically, loans are granted for 25-50% of the vehicle's value.

Loan Agreement: If approved, the borrower signs a loan agreement detailing the terms, including the interest rate and repayment schedule.

Title Surrender: The borrower hands over the vehicle title to the lender as collateral.

Funding: The borrower receives the loan amount, often within 24 hours.

The borrower retains possession of the vehicle during the loan period but risks repossession if they fail to repay the loan on time.

The Appeal of Title Loans

Title loans can be appealing for several reasons, especially for individuals who need quick access to cash and may not qualify for traditional loans.

Fast Access to Funds

One of the main advantages of title loans is the speed at which they can be obtained. Many lenders offer same-day funding, which can be crucial in emergency situations.

Lenient Credit Requirements

Title loans are often available to individuals with poor credit or no credit history. Since the loan is secured by the vehicle title, lenders are more willing to take the risk.

Simple Application Process

The application process for a title loan is usually straightforward and less cumbersome than applying for a traditional loan. This ease of access can be attractive to borrowers in urgent need of funds.

Risks and Drawbacks

While title loans offer certain advantages, they also come with significant risks and potential downsides.

High Interest Rates

Title loans typically come with very high interest rates, often in the range of 25% per month, which translates to an annual percentage rate (APR) of 300% or more. This can lead to a debt cycle that is difficult to escape.

Risk of Repossession

If the borrower is unable to repay the loan on time, the lender has the right to repossess the vehicle. This can be devastating, especially if the vehicle is the borrower’s primary means of transportation.

Short Repayment Periods

Title loans usually have short repayment periods, often 30 days. This can make it challenging for borrowers to gather the necessary funds to repay the loan, especially with the high interest rates.

Alternatives to Title Loans

Given the high costs and risks associated with title loans, it's important for potential borrowers to consider alternatives.

Personal Loans from Banks or Credit Unions

Traditional personal loans from banks or credit unions often come with lower interest rates and more favorable terms. While these may require better credit scores, they can be a more sustainable financial solution.

Credit Card Cash Advances

For those with credit cards, a cash advance might be a more affordable option compared to a title loan. However, it's important to note that cash advances can also come with high fees and interest rates.

Borrowing from Friends or Family

Borrowing from friends or family can be a way to avoid high-interest debt. This option requires clear communication and agreement on repayment terms to avoid straining relationships.

Key Considerations Before Taking a Title Loan