#overtime laws

Text

SCOTUS Takes a Pass on “Gap Time” Dispute

SCOTUS Takes a Pass on “Gap Time” Dispute

It’s two months into argument season at the Supreme Court, and we’re always keeping our fingers crossed that the justices will take up a wage and hour issue and clear up some ambiguities in the law or a circuit split.

Top billing this SCOTUS term goes to Helix Energy Solutions Group, Inc. v. Hewitt, in which the Court will address whether a supervisor who earned more than $200,000 a year but was…

View On WordPress

#employment litigation#Fair Labor Standards Act#FLSA#Gap Time#labor and employment#minimum wage#overtime laws#SCOTUS#straight-time pay#U.S. Supreme Court#wage law

0 notes

Text

I'm sorry but they have identical wanted posters TT-TT only Luffy has Usopp and Law has Bepo

#and he is smiling#the photographs working for the marines must be working overtime#or was it a selfie??#uncanny#one piece#op#luffy#trafalgar law#lawlu

306 notes

·

View notes

Text

Taking over a planet? Sounds boring think I’ll flirt with my Pearl instead 🤩

#one piece#monkey d luffy#trafalgar law#lulaw#Lawlu#Crystal gems AU#this was self indulgent I can admit that lol#feel free to ask questions about it!#one piece au#cutiecandychopper art#sorry I haven’t uploaded in awhile!#overtime at work is kicking my ass

62 notes

·

View notes

Text

Jesus Christ.

#'WORK OVERTIME SO YOU HAVE THE RIGHT TO SEE YOUR CHILD. WHO WE NEED YOU TO HAVE SO HE CAN WORK FOR US TOO.'#cosas mias#march 2023 by the way#there have been laws pushing for even longer workdays

33 notes

·

View notes

Photo

I mean, while I’ve got you here- (P1 | P2 | P3) (Patreon)

#Doodles#Law Abiding Citizen#LAC#Doug Peterson#LAC Russ#Roug#If you're not otherwise busy I mean I guess we could-#Lol#Looking like all that kiss-doodling practice has finally started to show results >:3c Quite pleased!#Looks like his gamble paid off! It'd take some doing but Doug could absolutely acquisition some overtime of the seduction variety lol#His -lust is usually more of the wander- variety but who is he to turn down a bit more time with his favourite human? :3#For the first encounter it'd probably have to be limited to their usual amount of time so what like two minutes lol but it's enough to kiss!#Or it could be longer if you'd prefer to imagine that lol it's not like I can stop you ♪#What a bureaucratic nightmare it'd be to either change or add being in a relationship with a client lol HR will hear about this Doug!#He's used to it he's been skirting that edge for way too long already this will just make it recognized pfft#Immediately bringing feelings into it! Aren't you a demon! Well that's why he changes his tune so quickly as well#For the record Russ did mean but he's feeling pretty guilty for that and having an ulterior motive and having human needs and all that lol#He does actually need contact to stay sane (enough) but asking for things is hard! Especially if they're to do with his crush!#All sorts of awkward uncomfortable feelings :) This is not how he envisioned his confession playing out!#I haven't drawn Doug with fully dark eyes in a while ah <3 It was fun :D Him hiding his eyes but literally hehe#Yet more of me ignoring the timeline lol - call him your Everything right now do it make him feel loved I dare you#A little possessive ♪ It's allowed he's being backed up by being the only person with access to him! This all works out!#I really am rather pleased with the last smooches :D Shapes! And Russ holding his horns while Doug initiates hehe ♪#I dunno how clear it is but Doug also has his tail wrapped around Russ' arm to pull him in ♥#Sometimes being obvious about it pays off

11 notes

·

View notes

Text

very very stressed out over work and how badly i’m handling my life

#there’s a lot of shady stuff happening at work with paychecks and overtime on top of them listening into us on the cameras#which is illegal in PA and after trying to talk to the owner who i thought was a resonable human being#and getting a talking in circles ‘i know the laws but i don’t want to follow them’ conversation#i decided to report them to the department of labor and to the attorney general#but i’m disheartened that ive worked here since before they opened and theyre really fucking with everyones money#changing clock in times randomly not paying overtime messing up payroll like every other week#it really sucks because i dont want to leave this job but ive truly never seen anything like this anywhere ive worked#and then the girl ive been working the most shifts with really stresses me out she’s not a nice person and living back at home#everything is just like crushing me dude

6 notes

·

View notes

Text

Kicking and screaming and throwing a tantrum as I drag myself out of bed at 4:45 on this bitch of a Saturday </3

#I feel like a 4yo#jobs that REQUIRE overtime should be illegal#like I’m v happy there’s a federal law that animals used in research must be live-checked every day no matter what#but the face that I just gotta give up one of my weekends every month instead of them hiring part timers that solely work weekends…#anyways I’m cranky and whining#<- as is my right. but. I understand it’s annoying

2 notes

·

View notes

Text

my boss just put out a new week and im fucking furious, im scheduled for 8 consecutive days totaling 49 hours and im not gonna see a fucking dime of overtime for it bc it's technically the last 5 days in one "workweek" and the first 3 days in the next AND the last shift is fucking 2:30-8pm the day before my vacation starts so i get to go on this trip ive been planning for months strung out and exhausted, likely in serious pain from overexertion and burnt out to the point of being on the edge of a fucking emotional breakdown

#the fact that a company can be penalized (in the form of overtime) for scheduling someone sunday-sunday or monday-monday#but tuesday-tuesday etc is business as usual is so fucking asinine and just fucking insulting#like thank you so much govt for protecting my rights and dignity two days of the week#im so grateful i dont even mind being screwed over for the other 5 uwu#and now its fucking my responsibility to go around begging ppl to take my shifts or trade for my days off the week before#its just fucking disrespectful is what it is#AND THERE'S A FUCKING CLOPEN IN THERE#so im working 2:30-10pm and then 9hrs later i get to go back in for 7-2:30 aka working 15 out of 24 hours in a day#without even the dignity of being able to attempt a full night's sleep#also the fact that when i google 'consecutive days worked labor laws' or 'clopening' ITS ALL ADVICE FOR EMPLOYERS#like. here's how much ur legally allowed to run ur employees into the ground:)#u should try to avoid clopening bc it can cause health issues and that would lower job performance/profits (aka what really matters)#personal

3 notes

·

View notes

Text

So the place I work at part-time to get some extra cash has recently been bought up and they're changing their entire system - the scheduling app, the internal email that my boss sends mass emails to etc etc. You can only activate your new account on this one specific laptop at work that's connected to their intranet or w/e. They told us like 10 days ago. Well, I only work evenings and weekends and didn't get any shifts last week, due to no fault of my own, and when I tried to log in the computer wasn't connected to the correct intranet apparently. I've never even heard of this intranet previously so I'm not about to try and fix it on my own, right, and you can only call tech support like 8-14 Mon-Fri. Great, huh. Still, I did what I could given the circumstances, no fucking way am I paying for a bus ticket (and wasting my own, unpaid time) to go to work just to spend five minutes logging into a laptop.

My boss just texted me saying "if you want to keep working here starting tomorrow, you need to come in TODAY and activate your new login." I guess to get me to come and do it lol.

The thing is, I don't need the money.

This is not gonna go how she thinks it's gonna go.

#I am responding with#“Hi thanks for the termination notice!”#“I'm assuming this is effective immediately so please note I won't be in for my scheduled shifts this Saturday and Sunday”#“Also here's a list of all the overtime hours you haven't paid me for. Please make sure they're included on my next pay slip”#“otherwise i'll forward the information to the national collection agency”#(which you can use as a private person for free over here it's great)#I also have proof of them breaking both labour laws and the collective agreement :))#herr's personal post

0 notes

Text

Tbh california should just pave the way for a shorter work week by requiring lunch breaks to be paid.

#tag#like it’s only 2.5 hours per week if you work full time#but it’s a start ya know?#turn the 8 hour day into an actual 8 hour day instead of 8.5#then maybe step 2 is turn the 2 already required-and-paid 15min breaks into 30mins as well#and then that’s another 2.5 hours#suddenly the paid work week is 5 hours shorter but you’re still getting paid#and with CAs laws on how long a shift has to be vs how many breaks you get by law#it’ll be inconvenient at best for employers to fuck with trying to come in under the line for scheduling on that front#step 3 is perhaps a little counterintuitive and maybe has to be done as part of step 2#give an option for overtime that’s NOT paid at time-and-a-half as long as that employee 1) works full time that week#and 2) works for only 4 days of the week#(or as long as they have at least 3 days where they work no more than 4 hours? something like that?)#this essentially creates a slightly-less-than-ideal option for a 3 day weekend#one I would gladly take‚ personally

1 note

·

View note

Text

After watching Quiet on Set I'm reminded of when things like riverdale were big on tumblr and the outrage some ppl had about teenagers being played by adults in their 20s and the "unrealistic standards" that supposedly set

But good gods children need to be kept safe. Idgaf about the unrealistic standards and I hope every show is like that. I was pissed about it then and I'm more so now. That is not an environment children need to be in. I hope child actors become a thing of the past

#idc about 'baby 3' on law and order or whatever#i mean the kinds of environments where kids are forced to work overtime and parental neglect and greed is taken advantage of#any bad environment is way worse when its children suffering

1 note

·

View note

Text

Common FAQs Related to Exempt Employees' Work Hours in California

1 note

·

View note

Text

i get a feeling i'm terribly annoying the hr lady. ah well

#emailed her about my one vacation day from last year that didn't transfer to 2024 and it turns out. i used all my vacation days#last year i harassed her bc i worked overtime on saturday and instead of getting a day off as is the law it was automatically set to payment#and she said it's too late to change it now but then my supervisor changed it without telling me and then i emailed her like where tf#is my money#i got that day but not when i wanted it

0 notes

Text

What is Overtime Pay in California?

In the state of California, nonexempt employees are entitled to overtime pay of:

5 times their normal rate of pay for each extra hour worked over 8 hours in a day or more than 40 hours in a week.

2 times their normal rate of pay for hours worked over 12 hours in a day or if they work seven days straight and work more than 8 hours on the seventh day.

Sometimes, workers who are nonexempt may be paid differently than an hourly wage and their overtime pay is calculated accordingly. Exempt workers are those to whom the overtime laws do not apply. There are also some special exceptions that have their own guidelines.

What is the Regular Rate of Pay?

An employee’s regular rate of pay is the way their compensation for their work is calculated. This could be by the hour, per year, by piecework, or on commission. Regardless of how the rate of pay is calculated, it can never be lower than the minimum wage. It can also never exceed an 8 hour workday or a 40 hour workweek. There is however a standard under Industrial Welfare Commission Wage Orders that allows for alternative workweek schedules consisting of either 4 days of 10 hour shifts or 3 days of 12 hour shifts. For these schedules, the rate of pay is based on the 40 hour workweek.

Some agreed upon schedules come out to less than 40 hours per workweek. Although a set agreed upon work week may total under 40 hours, the employer is not obligated to pay overtime until the employee works more than 8 hours in a workday or 40 hours within that workweek.

How Much is Overtime Pay in California?

In order to qualify for overtime, the following parameters must be met:

Hours paid time and a half:

Over 8 and up to 12 hours per workday

Over 40 regular hours per workweek

The first 8 hours of the 7th day worked in a row per workweek

Hours paid double time:

Over 12 hours per workweek

Over 8 hours on the 7th day worked in a row per workweek

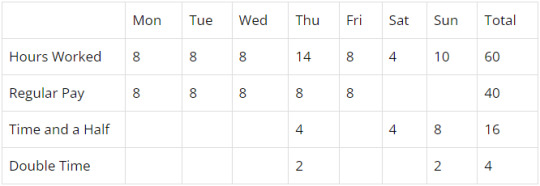

How to Calculate Overtime Pay in California

Step 1: Determine Workweek vs Workday

Workday – The default workday begins at 12:01 in the morning. However, employers are able to set their workday to be any block of 24 hours that begins at the same time every calendar day. If an employee works more than 8 hours in a workday, they are entitled to overtime pay for the extra hours worked. Employers are not permitted to average out hours across multiple days. If an employee works 6 hours one day and 10 hours the next, they receive 2 hours of overtime pay.

Workweek – A workweek is a set period of seven days that begins the same calendar day every week. While employees within the same company may have different workweek schedules, a workweek is set for each individual employee and can not be changed unless it is being permanently altered. If an employee works more than 40 hours within a workweek, they are entitled to overtime pay.

Step 2: Calculate Hours Worked

Employees must document the times that they punch in for work, out for break, back in from break, and out for the day. Most employers have a system for all employees to do this, so that the employer can then calculate the hours worked for each person.

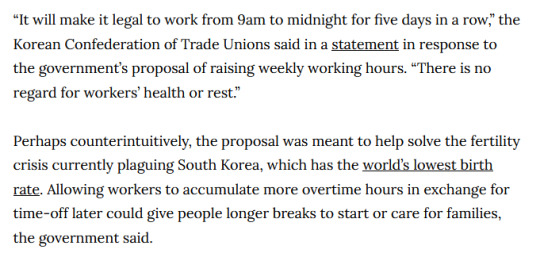

Step 3: Determine Amount of Daily Overtime Hours

When calculating daily overtime for nonexempt employees, employers must pay

Time and a half for hours worked over 8 and up to 12

Time and a half for the first 8 hours of the seventh day worked in a row

Double time for hours worked over 12

Double time for hours worked over 8 on the seventh day worked in a row

Step 4: Determine Amount of Weekly Overtime Hours

When calculating weekly overtime for nonexempt employees, employers must pay

Time and a half for hours worked over 40

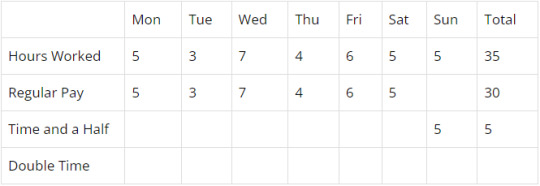

Step 5: Calculate Daily vs Weekly Overtime Hours

According to California state law, both daily and weekly overtime hours must be taken into account. The overtime hours themselves are only counted once, but they also do not negate each other. This is to protect workers in situations such as if someone works more than 8 hours a day, but they worked less than 40 hours that week. Determining overtime on both a daily and weekly basis ensures that employee gets paid properly. The way this works is:

When an employee’s daily overtime is the same or more than the employee’s weekly overtime, then they must be paid in accordance with daily overtime. In these cases, the weekly overtime is already included in the daily overtime.

When the employee’s daily overtime hours are less than the number of weekly overtime hours, then the remaining time must be accounted and compensated for.

Employers must also ensure that daily double time rules are being followed when calculating weekly overtime as well.

Employers can keep track of these hours by accounting for the hours worked and separating the regular rate of pay from the overtime. This ensures that all hours are accounted for and paid correctly.

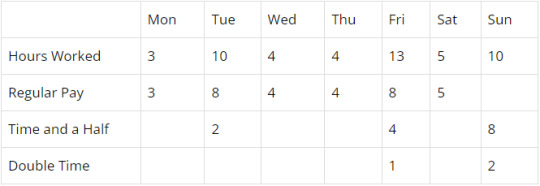

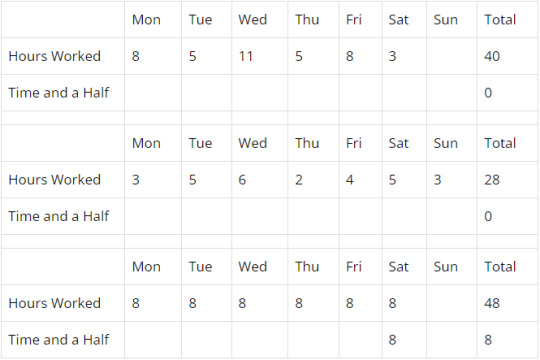

No weekly overtime, but time and a half daily overtime for the seventh day in a row worked:

No daily overtime, but time and a half weekly overtime paid for hours worked over 40 in the workweek:

Both daily and weekly overtime:

Time and a half for daily hours worked over 8 up to 12

Time and a half for the first 8 hours of seventh day worked in a row

Double time for hours worked over 12

Double time for hours over 8 on seventh day worked in a row

Time and a half for weekly overtime hours over 40

Step 6: Determine Base Rate of Hourly Pay

Since overtime is 1.5 or 2 times the employee’s regular rate of pay, it is important to figure out what that is. An employee’s regular rate of pay is generally the amount of money earned by the employee each hour generally calculated by dividing the total compensation for the workweek by the hours worked. There are many different ways in which employers pay out their employees’ compensation, and so different ways for the regular rate of pay to be calculated.

Hourly Non-Exempt Employees

The regular rate of pay for hourly employees is the amount of money they earn each hour. If they also receive bonuses or commissions, those are divided by the number of hours worked.

So, if an employee makes $20 an hour, then their overtime pay would be $30 an hour or $40 an hour for double time.

Sometimes, employees are paid different rates within the same workweek. In these cases, the regular rate of pay is calculated by dividing all earnings throughout the week by all of the hours worked. The overtime premiums are then added to the applicable overtime hours afterwards. So, if an employee works 20 hours at $10 an hour and 30 hours at $15 an hour, their total earnings would be $650 which would be divided by 50 for a regular rate of $13. $6.5 would be added to every overtime hour that earned time and a half, and $13 would be added to every overtime hour that earned double time.

Sometimes, employees also earn flat-sum bonuses on top of their hourly rates. When this happens, the bonus is divided by the amount of non-overtime hours they worked, and then that amount is added to the hourly rate. The final sum is the number used to determine the overtime rate of pay. So, if an employee works 45 hours in a workweek at $10 with a weekly bonus of $100, the $100 would be divided by 40 making $2.5 which would make the regular rate of pay $12.5 which would be used to calculate the applicable overtime.

Piece Rate or Commission Employees

There are several different methods that can be used to calculate regular rate of pay for employees who are compensated by piece or commission:

The rate that the employee is paid by piece or commission is considered the regular rate, and that number is multiplied by 1.5 for hours worked over 8 up to 12 in a workday and multiplied by 2 for hours worked over 12 per workday.

The total amount of money earned for the workweek is divided by the total hours worked for the workweek. The overtime premium of that number is then added to the applicable overtime hours.

For group rates, the amount of pieces the group produced during the workweek is divided by the amount of people in the group. Each member of the group is paid accordingly, and that amount is then divided by the hours worked.

Salaried Non-Exempt Employees

When a salaried employee is nonexempt, their salary only covers regular hours worked. In these situations, those employees are entitled to overtime pay. To determine the regular rate of pay for a full time employee, the weekly salary is divided by 40. If the employee is paid monthly, the monthly rate is multiplied by 12 months in a year, then that number is divided by 52 weeks in year, then that number is divided by 40 hours in a week.

Are Salaried Employees Entitled to Overtime?

Some salaried employees may be exempt from overtime pay for many reasons:

Federal law

State Law

California Labor Code Provision

Industrial Welfare Commission Wage Orders

If the salaried employe does not meet the requirements for exemption status, then the employer must pay them overtime rates when overtime hours are worked.

Employees That Are Paid Different Rates Within the Same Job

When employees are paid two or more different rates at the same job within the same workweek, the weighted average is found by dividing the total amount of money earned by the total number of hours worked. So, if an employee worked 20 hours at $10 an hour, 20 hours at $12 an hour, and 10 hours at $14, the weighted average would be $580 divided by 50 hours, totaling $11.6 an hour.

Employees that Receive Bonuses

Nondiscretionary bonuses are included when calculating an employee’s regular rate of pay for the sake of overtime if that bonus is for how many hours they worked, a reward for high performance, or an incentive to stay with the employer.

When calculating regular rate of pay on a flat sum bonus for the sake of overtime, the amount of the bonus is divided by the number of regular hours the employee worked. That amount is then used to calculate the time and a half or double time to be used for any additional overtime hours.

When calculating regular rate of pay on a production bonus, the amount of the bonus is divided by the number of hours the employee worked during the bonus period. That amount is then used to calculate the time and a half or double time to be used for any additional overtime hours in the bonus period.

Bonuses that are not factored into overtime pay are discretionary bonuses such as holiday gifts or special rewards.

Who Is Exempt from California Overtime Laws?

The most notable exempt workers are those who earn a fixed salary that is equal to or greater than double the minimum wage.

There are specific salaried job categories that are generally exempt such as:

Normally Exempt Roles

These requirements reduce the likelihood that high salaried professionals are not able to enjoy the benefits of overtime pay. However, these roles are often rewarded in amounts of compensation that far exceed the need for overtime pay.

Executives

Administration

Professional Employees

Outside Salespeople

The requirements for being classified as an exempt outside salesperson are:

18 years old or older

51% or more of their work is conducted away from the business

They sell products, contracts, the performance of services, and/or the use of facilities

Unionized Employees

Not all union workers are exempt. Exemption for unionized workers requires:

That the collective bargaining agreement explicitly provides for wages and working hours and conditions

That the collective bargaining agreement explicitly provides for regular rate of pay and premium overtime rates that are 30% or higher than state minimum wage

Job Specific Exceptions

The California Industrial Welfare Commission outlines certain job specific exceptions to overtime laws such as:

Agricultural workers

Ambulance workers

Camp Counselors

Live-in household workers

Retirement home managers

Personal attendants

Some 24-hour residential childcare providers

The parents, spouse, and children of the employer

Independent Contractors

The requirements for being an independent contractor are:

Someone who is contracted to perform a specific service for a specific amount of pay

Someone who has complete control over when and how the service is completed

Alternative Schedules

Sometimes, employees may agree to alternative schedules such as working a 40 hour workweek as 4 days of 10 hour shifts. These schedules are not bound by overtime laws. A valid alternative workweek schedule must be:

Voted on via secret ballot by the affected employees

Approved by a two-thirds majority

Reported within 30 days by the employer to the Division of Labor Standards Enforcement

Employers are not permitted to retaliate against any employees for their stance on alternative schedules. Employees working an alternative schedule are still entitled to overtime pay when:

They work more than the daily agreed upon hours

They work more than 40 hours in a workweek

Nonresidents

In the state of California, all nonexempt workers are protected by the state’s overtime laws, including those who are not residents of the state or citizens of the country. There is some back and forth about whether workers who work in the state for less than a day at a time should also be protected by those same laws.

Step 7: Calculate Total Overtime and Pay Balance

According to Labor Code Section 204, overtime in California must be paid by the payday for the next payroll period. The regular hours for that pay period must be paid on time, only the overtime pay may be paid the following payday.

Are Any Amounts Excluded from Overtime Pay?

There are some types of payments and compensation that may not be included when calculating overtime in California such as:

Discretionary Bonuses

Expenses

Gifts

Holiday Pay

Paid Time Off

Can Overtime Be Waived?

In the state of California, all nonexempt employees must be compensated for any overtime worked. If an employer has an employee sign an agreement waiving their right to overtime pay, that waiver is unenforceable, and the employee is still entitled to their overtime pay.

Can an Employer Require Overtime?

In most cases, employers in California are allowed to require their employees to work overtime. One big exception is that employers are not permitted to require employees to work seven consecutive days in a row with no day off for rest. Employees are however able to waive their rest day provided they are aware of their right to take it if they choose.

Are Employers Responsible for Paying Unapproved Overtime?

In the state of California, all nonexempt employees must be paid overtime pay for all overtime hours worked regardless of managerial approval. While employers are permitted to discipline employees who work unapproved overtime, they can not refuse to pay them. In accordance with California law, employees must be paid for whatever time they were suffered or permitted to work. This means that the employer is responsible for any compensation owed for hours worked that they knew about or should have known about.

What Can an Individual Do if Overtime Isn’t Paid?

If an employee was not paid properly for overtime hour worked, they can contact the Department of Labor, file a claim with the Division of Labor Standards Enforcement, or file a lawsuit to sue for the money. When suing a former employer, they can also file a claim for a waiting time penalty in accordance with Labor Code Section 203.

What is the Wage Claim Filing Process?

After an employe files a claim with the Division of Labor Standards Enforcement, that claim is then assigned to a Deputy Labor Commissioner. They will then decide whether to:

Refer the matter to a conference – The parties involved are brought together to meet and attempt to resolve the issue out of court.

Refer the matter to a hearing – The parties involved will testify under oath during a recorded hearing. Afterwards, the Labor Commissioner will serve an Order, Decision, or Award (ODA) to the parties.

Dismiss the matter

The ODA may be appealed by either party. The matter will then be sent to trial where the parties involved will present their cases again, without the initial hearing bearing primary weight on the court’s final decision. IF the employer is the one appealing the ODA and the employee can not afford legal representation, the DLSE may opt to represent them.

What Do I Do If I Win an Overtime Pay Claim But the Employer Fails to Pay?

Sometimes, an Order, Decision, or Award will be in the employee’s favor and the employer will not appeal but will refuse to pay. In this instance, the Division of Labor Standards Enforcement will request that the ODA be entered as a court judgement.

Contact Mesriani Law Group if You Are Owed Overtime Pay

In the state of California, employers are legally required to pay all nonexempt employees 1.5 times their regular rate of pay for hours worked over 8 and up to 12 in a work day, hours over 40 in a work week, and the first 8 hours of the seventh day worked in a row in a workweek. They are also legally required to pay 2 times their regular rate of pay for hours worked over 12 in a workday, and hours over 8 on the seventh day worked in a row. Unfortunately, not all employers properly pay their employees. If you believe your employer has not paid you properly, call Mesriani Law Group today.

Overtime Pay FAQs

How does overtime work?

In the state of California, if an employee works more than 8 hours and up to 12 hours in a workday, those hours are compensated at 1.5 times their normal rate of pay. Also compensated at time and a half are hours worked over 40 in a workweek and the first 8 hours worked on the seventh consecutive day in a row. Hours over 12 on a workday and hours over 8 on the seventh day in a row are compensated at 2 times the normal rate of pay.

Do overtime hours count towards 40 hours in California?

All hours count towards total hours worked. Hours worked over 8 in a workday are daily overtime. Hours worked over 40 in a workweek are weekly overtime. If hours count as both daily and weekly overtime, they are only counted once.

Is 7th day double time in California?

According to California state labor laws, the first 8 hours worked on the seventh consecutive day in a row worked in a workweek are paid at time and a half. Any hours worked after those first 8 hours are paid at double time.

#California Employment Laws#Overtime#Overtime Pay#Wage and Hour Violations#Employment Law#Employment Lawyers#California Attorneys#Workplace Discrimination#Workplace Retaliation

0 notes