#modern monetary theory

Text

Social Security is class war, not intergenerational conflict

Today, Tor.com published my latest short story, "The Canadian Miracle," set in the world of my forthcoming (Nov 14) novel, The Lost Cause. I am serializing this one on my podcast! Here's part one.

The very instant the Social Security Act was passed in 1935, American conservatives (in both parties) began lobbying to destroy it. After all, a reserve army of forelock-tugging plebs and family retainers won't voluntarily assemble themselves – they need to be goaded into it by the threat of slowly starving to death in their dotage.

They're at it again (again). The oligarch-thinktank industrial complex has unleashed a torrent of scare stories about Social Security's imminent insolvency, rehearsing the same shopworn doom predictions that they've been repeating since the Nixonite billionaire cabinet member Peter G Peterson created a "foundation" to peddle his disinformation in 2008:

https://en.wikipedia.org/wiki/I.O.U.S.A.

Peterson's go-to tactic is convincing young people that all the Social Security money they're paying into the system will be gobbled up by already-wealthy old people, leaving nothing behind for them. Conservatives have been peddling this ditty since the 1930s, and they're still at it – in the pages of the New York Times, no less:

https://www.nytimes.com/2023/10/26/opinion/social-security-medicare-aging.html

The Times has become a veritable mouthpiece for this nonsense, publishing misleading and nonsensical charts and data to support the idea that millennials are losing a generational war to boomers, who will leave the cupboard bare:

https://www.nytimes.com/2023/10/27/opinion/aging-medicare-social-security.html

As Robert Kuttner writes for The American Prospect, this latest rhetorical assault on Social Security is timed to coincide with the ascension of the GOP House's new Speaker, Mike Johnson, who makes no secret of his intention to destroy Social Security:

https://prospect.org/economy/2023-10-31-debunking-latest-attack-social-security/

The GOP says it wants to destroy Social Security for two reasons: first, to promote "choice" by letting us provide for our own retirement by flushing even more of our savings into the rigged casino that is the stock market; and second, because America doesn't have enough dollars to feed and house the elderly.

But for the New York Times' audience, they've figured out how to launder this far-right nonsense through the language of social justice. Rather than condemning the impecunious olds for their moral failing to lay the correct bets in the stock market, Social Security's opponents paint the elderly as a gerontocratic elite, flush with cash that rightfully belongs to the young.

To support this conclusion, they throw around statistics about how house-rich the Boomers are, and how much consumption they can afford. But as Kuttner points out, the Boomers' real-estate wealth comes not from aggressive house-flipping, but from merely owning a place to live. America's housing bubble means that younger people can't afford this basic human necessity, but the answer to that isn't making old people homeless – it's providing a lot more housing, and banning housing speculation:

https://pluralistic.net/2021/06/06/the-rents-too-damned-high/

It's true that older people are doing a lot of consumption spending – but the bulk of that spending isn't on cruises to Alaska to see the melting glaciers, it's on health care. Old people aren't luxuriating in their joint replacements and coronary bypasses. Calling this "consumption" is deliberately misleading.

But as Kuttner points out, there's another, more important point to be made about inequality in America – the most significant wealth gap in America is between workers and owners, not young people and old people. The "average" Boomer's net worth factors in the wealth of Warren Buffett and Donald Trump. Older renters are more rent-burdened and precarious than younger renters, and most older Americans have little to no retirement savings:

https://www.forbes.com/sites/teresaghilarducci/2023/10/28/the-new-york-times-greedy-geezer-myth/

Less than one percent of Social Security benefits go to millionaires – that's because the one percent constitute one percent of the population. It's right there in the name. The one percent are politically and economically important, but that's because they are low in numbers. Giving Social Security benefits to everyone over 65 will not result in a significant outlay to the ultra-wealthy, because there aren't many ultra-wealthy people in America. The problem of inequality isn't the expanding pool of rich people, it's the explosion of wealth for a contracting pool of rich people.

If conservatives were serious about limiting the grip of these "undeserving" Social Security recipients on our economy and its politics, they'd advocate for interitance taxes (which effectively don't exist in America), not the abolition of Social Security. The problem of wealth in America is that it is establishing permanent dynasties which are incompatible with social mobility. In other words, we have created a new hereditary aristocracy – and its corollary, a new hereditary peasantry:

https://pluralistic.net/2021/06/19/dynastic-wealth/#caste

Hereditary aristocracies are poisonous for lots of reasons, but one of the most pressing problems they present is political destabilization. American belief in democracy, the rule of law, and a national identity is q function of Americans' perception of fairness. If you think that your kids can't ever have a better life than you, if you think that the cops will lock you up for a crime for which a rich person would escape justice, then why obey the law? Why vote? Why not cheat and steal? Why not burn it all down?

The wealthy put a lot of energy into distracting us from this question. Just lately, they've cooked up a gigantic panic over a nonexistent wave of retail theft:

https://www.techdirt.com/2023/10/31/the-retail-theft-surge-that-isnt-report-says-crime-is-being-exaggerated-to-cover-up-other-retail-issues/

Meanwhile, the very real, non-imaginary, accelerating, multi-billion-dollar plague of wage theft is conspicuously missing from the public discourse, despite a total that dwarfs all retail theft in America by an order of magnitude:

https://fair.org/home/wage-theft-is-built-into-the-business-models-of-many-industries/

America does have a property crime crisis, but it's a crisis of wage-theft, not shoplifting. Likewise, America does have a retirement crisis: it's a crisis of inequality, not intergenerational conflict.

Social Security has been under sustained assault since its inception, and that's in large part due to a massive blunder on the part of FDR. Roosevelt believed that people would be more protective of Social Security if they thought it was funded by their taxes: "we bought it, it's ours." But – as FDR well knew – that's not how government spending works.

The US government can't run out of US dollars. The US government doesn't get its dollars for spending from your taxes. The US government spends money into existence and taxes it out of existence:

https://pluralistic.net/2020/12/14/situation-normal/#mmt

A moment's thought will reveal that it has to be this way. The US government (and its fiscal agents, chartered banks) are the only source of dollars. How can the US tax dollars away from earners unless it has first spent those dollars into the economy?

The point of taxation isn't to fund programs, it's to reduce the private sector's spending power so that there are things for sale to the public sector. If we only spent money into the economy but didn't take any out of the economy, the private sector would have so many dollars to spend that any time the government tried to buy something, there'd be a bidding war that would result in massive price spikes.

When a government runs a "balanced budget," that means that it has taxed as much out of the economy as it put into the economy at the start of the year. When a government runs a "surplus," that means it's left less money in the economy at the end of the year than there was at the beginning of the year. This is fine if the economy has contracted overall, but if the economy stayed constant or grew, that means there are fewer dollars chasing more goods and services, which leads to deflation and all kinds of toxic outcomes, like borrowing more bank-created money, which makes the finance sector richer and the real economy poorer.

Of course, most governments run "deficits" – which is another way of saying that they leave more dollars in the economy at the end of the year than there was at the start of the year, or, put another way, a deficit probably means that your economy got bigger, so it needed more dollars.

None of this means that governments can spend without limit. But it does mean that governments can buy anything that's for sale in their own currency. There are a lot of goods for sale in US dollars, both goods that are produced domestically and goods from abroad (this is why it's such a big deal that most of the world's oil is priced in dollars).

Governments do have to worry about getting into bidding wars with the private sector. To do that, governments come up with ways of reducing the private sector's spending power. One way to do that is taxes – just taking money away from us at the end of the year and annihilating it. Another way is to ration goods – think of WWII, or the direct economic interventions during the covid lockdowns. A third way is to sell bonds, which is just a roundabout way of getting us to promise not to spend some of our dollars for a while, in return for a smaller number of dollars in interest payments:

https://pluralistic.net/2021/04/08/howard-dino/#payfors

FDR knew all of this, but he still told the American people that their taxes were funding Social Security, thinking that this would protect the program. This backfired terribly. Today, Democrats have embraced the myth that taxes fund spending and join with their Republican counterparts in insisting that all spending must be accompanied by either taxes or cuts (AKA "payfors").

These Democrats voluntarily put their own policymaking powers in chains, refusing to take any action on behalf of the American people unless they can sell a tax increase or a budget cut. They insist that we can't have nice things until we make billionaires poor – which is the same as saying that we can't have nice things, period.

There are damned good reasons to make billionaires poor. The legitimacy of the American system is incompatible with the perception that wealth and power are fixed by birth, and that the rich and powerful don't have to play by the rules.

The capture of America's institutions – legislatures, courts, regulators – by the rich and powerful is a ghastly situation, and to reverse it, we'll need all the help we can get. Every hour that Americans spend worrying about their how they'll pay their rent, their medical bills, or their student loans is an hour lost to the fight against oligarchy and corruption.

In other words, it's not true that we can't have nice things until we get rid of billionaires – rather, we can't get rid of billionaires until we have nice things.

This is the premise of my next novel, The Lost Cause, which comes out on November 14; it's set in a world where care and solidarity have unleashed millions of people on the project of maintaining the habitability of our planet amidst the polycrisis:

https://us.macmillan.com/books/9781250865939/the-lost-cause

It's a fundamentally hopeful book, and it's already won praise from Naomi Klein, Rebecca Solnit, Bill McKibben and Kim Stanley Robinson. I wrote it while thinking through and researching these issues. Conservatives want us to think that we can't do better than this, that – to quote Margaret Thatcher – "there is no alternative." Replacing that narrative is critical to the kinds of mass mobilizations that our very survival depends on.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/11/intergenerational-warfare/#five-pound-blocks-of-cheese

This Saturday (Nov 4), I'm keynoting the Hackaday Supercon in Pasadena, CA.

#pluralistic#class war#inheritance tax#death tax#mmt#modern monetary theory#intergenerational war#intergenerational wealth transfers#social security#ss

352 notes

·

View notes

Text

For most of the time, politicians have ostensibly retreated into the pre-Keynesian view that governments should run like households and seek to ‘balance their books.’ And most of the media has tended to endorse this fallacy.

But when it was obviously necessary to act to save the economy, for example after the Global Financial Crisis or during the height of the pandemic when much of the economy had to be shut down, governments suddenly remembered that they have the extraordinary power to create money.

After the Global Financial Crisis, the government – via the Bank of England’s Quantitative Easing programme – created around £445 billion of new money to prevent a collapse in the banking system.

During COVID, the government created around £450 billion more to prevent a collapse in household finances when people would otherwise have had no income.

In total, during the 21st century, the government has created £895 billion of new money – when it had the will to do so.

And the view from economists is supportive. The argument for government spending to pay for healthcare, save businesses from bankruptcy, create new jobs and prevent a climate apocalypse has been made by the proponents of Modern Monetary Theory, for example Stephanie Kelton in her book The Deficit Myth. This book explains in detail how money is created and shows that the idea that governments should – or even responsibly could – budget in the same way as a normal household is no more than (admittedly compelling) rhetoric.

But politicians and the media have – by and large – reverted to the notion that the government finances constitute a brake on what can be done for the public good. And our government continues to rein-in public spending even though it is clear that most public services are struggling badly.

110 notes

·

View notes

Text

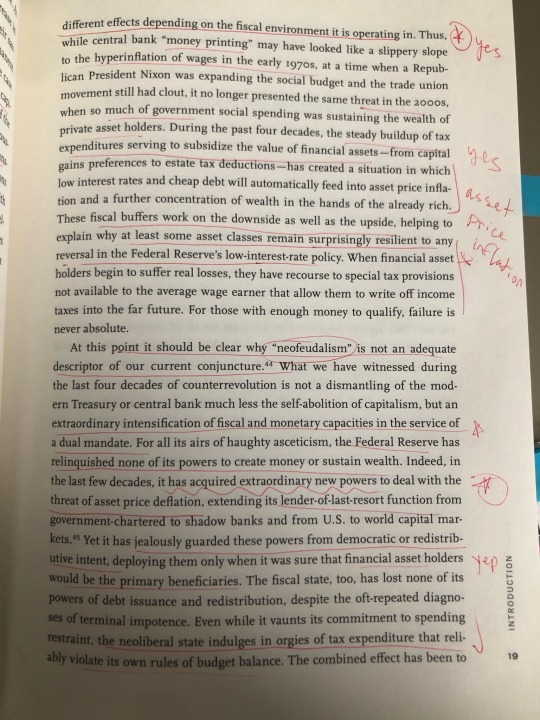

If you’ve been in one of my seminars you’d know that Melinda Cooper is one of my favorite thinkers… and the most underrated scholar working in Capitalism Studies and political economy today. Her new book, Counterrevolution: Extravagance and Austerity in Public Finance, is a deep intellectual history of the modern fiscal state that looks at the influence of the Virginia School of economics on shaping monetary and fiscal policy in the US from the 1970s onward. It’s super technical and wonky but admittedly, I love reading technical and wonky works of political economy (it bothers me when Marxists don’t know how the economy actually works). Someone had to write this book… I believe Melinda Cooper was the right woman for the job. Who else can explain how tax policy is class war, or toggle between levels of abstraction as seamlessly as Cooper does? My former New School student (now doing a PhD at Yale) is disappointed it’s not sexy Marxist theory but I think it’s great that Melinda Cooper is in the ring with the political economy bros. I don’t agree with some of the politics of this book (it’s somewhat MMT in flavor) but find it impressive nonetheless.

11 notes

·

View notes

Text

📣 Featuring Stephanie Kelton, FINDING THE MONEY screens in competition at the Bend Film Festival on Oct 13, 14 & 15. Director Maren Poitras will be in attendance with subjects and experts L. Randall Wray and Rohan Grey.

Tickets: 👉 https://bit.ly/FTMatBENDFF2023

Stay close, we're coming to a city near you!

#MMT#Modern Monetary Theory#maren poitras#documentary#film#marc smolowitz#finding the money#stephanie kelton

2 notes

·

View notes

Text

youtube

8 notes

·

View notes

Text

Bitches on tumblr stop accidentally reinventing Modern Monetary Theory challenge (impossible)

0 notes

Text

i had an idea a while back for something called infinity coin which is an infinite currency. its basically just a jpeg and you can copy it as many times as you want to make more money. the infinity economy is founded on the principle that money has no meaningful relationship to the underlying material conditions anyways so we might as well just make infinite money and give it out to everyone on earth so they can solve real problems by spending infinite money on them. one infinity coin = infinite USD. pretty good exchange rate if you ask me

#economics#economy#society#money#free money#money printing#modern monetary theory#philosophy#ecommerce#life#thoughts#my thoughts#bookworm thoughts#research#mathematics#algorithm#science

0 notes

Text

Utang Luar Negeri

Juan Perón, Presiden Argentina (1946-1955 dan 1973-1974), membuat banyak pinjaman dari Amerika Serikat dan negara-negara lain untuk membiayai pembangunan ekonomi dan sosial. Namun, pinjaman tersebut justru digunakan untuk memperkuat kekuasaannya dan meningkatkan pengeluaran militer. Setelah Perón digulingkan (1955), pemerintahan baru langsung menyelidiki korupsi dan penyalahgunaan kekuasaan…

View On WordPress

#BUNGA UTANG#IMF#JUAN PERON#MODERN MONETARY THEORY#POKOK UTANG#RENT SEEKING#SANI ABACHA#UTANG LUAR NEGERI#UTANG NAJIS

0 notes

Text

It's not your tax money going to fund Israel. It's just not. I'm pissed about all the money being sent to fund genocide, but that is simply not how taxes or fiat currency work. Leftist need to do a better job of understanding this.

0 notes

Text

"We see thus: In the first case, it is not the diminished rate either of the absolute, or of the proportional, increase in labour power, or labouring population, which causes capital to be in excess, but conversely the excess of capital that makes exploitable labour power insufficient. In the second case, it is not the increased rate either of the absolute, or of the proportional, increase in labour power, or labouring population, that makes capital insufficient; but, conversely, the relative diminution of capital that causes the exploitable labour power, or rather its price, to be in excess. It is these absolute movements of the accumulation of capital which are reflected as relative movements of the mass of exploitable labour power, and therefore seem produced by the latter’s own independent movement. To put it mathematically: the rate of accumulation is the independent, not the dependent, variable; the rate of wages, the dependent, not the independent, variable. Thus, when the industrial cycle is in the phase of crisis, a general fall in the price of commodities is expressed as a rise in the value of money, and, in the phase of prosperity, a general rise in the price of commodities, as a fall in the value of money. The so-called currency school concludes from this that with high prices too much, with low prices too little money is in circulation. Their ignorance and complete misunderstanding of facts are worthily paralleled by the economists, who interpret the above phenomena of accumulation by saying that there are now too few, now too many wage labourers."

– Karl Marx, Capital Vol. I Ch. 25

#marxism#socialism#capitalism#modern monetary theory#imagine posing next to your own bust LMFAO#milton friedman

0 notes

Text

New York Post tells it like it isn't -- ticking time bomb version

Readers of this blog are familiar with the “ticking time bomb” series; examples are here, here, here and elsewhere.

The point of this endless series is that since 1939, the media, politicians, and economists have been wringing their hands about the so-called federal debt, explicitly claiming it is a “ticking time bomb.”

That’s 84 years of “the-world-is-about-to-end” predictions that demonstrably…

View On WordPress

1 note

·

View note

Text

Taking a deep dive into a revolutionary new theory called Modern Monetary Theory or #MMT, our documentary FINDING THE MONEY has found much success this fall, including packed houses and memorable Q&As at our World Premiere at the Woodstock Film Festival, Boston GlobeDocs, and the Bend Film Festival in Oregon.

We also won the audience award at the San Francisco Green Film Festival, where the film was the festival's closing night selection and even made it onto the front page of the San Francisco Chronicle Datebook!

Huge congratulations to Maren Poitras, our amazing director, and our entire filmmaking team.

Next up: We’re participating in the IDFA Docs For Sale market this week, and we are actively confirming the film for many more festivals as we gear up for the film's wide release in May 2024.

Follow the film's adventures at findingmoneyfilm.com and for more of 13th Gen's fall news, check out our latest newsletter: 👉 https://bit.ly/4779wYE

#documentary#filmmaker#Finding The Money#Modern Monetary Theory#Marc Smolowitz#Stephanie Kelton#economics#film#Maren Poitras#Woodstock Film Festival#green film festival#climate#San Francisco

0 notes

Link

free online MMT course that started just two days ago. Applications are still open! I’m in on it!

0 notes

Text

This month, we speak with Larry Johnson, associate professor in the Social Foundations of Education Program at the University of South Florida, Saint Petersburg. In his pedagogy, Johnson focuses on the complex relationship between education, culture, and society with the goal of exploring policies and practices from historical and contemporary perspectives that address structural inequality, and transforming educational institutions into sites for social justice. Johnson is notably a long-time proponent of Modern Monetary Theory (MMT) and variously mobilizes MMT’s insights when training our teachers-to-be. In our conversation with Johnson, we discover just how constrained the US system of public education is by wrong economic thinking and what it would mean to think otherwise. Together, we ask: How do federal interest rates shape US education policy? What do standardized tests have to tell us about neoclassical economics and the nature of money? Why is the rhetoric of education in the United States so narrowly focused on preparing students for careers? How do classist and racist myths of taxpayer financing create unequal schooling? And how could we ever reasonably hope for the political economy of education in the United States to ever be otherwise? Pondering such questions, Johnson opens a window onto his longstanding advocacy for radically rethinking US public education through the lens of endogenous public money theory.

2 November 2023

1 note

·

View note