#debt relief

Text

I’m not one to share content from other platforms, but this one just feels right today.

Credit: @animalwolfsux on TikTok.

2K notes

·

View notes

Text

Democratic Governor Katie Hobbs uses 30 million dollars in funds given to the state by President Biden's American Rescue Plan Act to cancel medical debt for a million Arizonans.

Since medical debt is often sold for pennies on the dollar $30 million can be used to buy and cancel 1.5 to 2 billion dollars worth of debt.

Link

145 notes

·

View notes

Text

Space Coyotes Sticker 10-Pack:

• $15 / free shipping

• available at HiddenStashArt.Etsy.com (or just DM me)

• 3.5”-5” black & blue ink on multicolored vinyl

• comes with extras

Additional reading:

• $2581 left on the loan we took out to pay for my mother’s cremation in January (needs to be paid within 6 months or it starts accruing 24% interest)

• interesting fact: did you that in the state of Montana, if you can’t pay for burial or cremation within 1 week of the funeral home collecting it, they’ll keep your loved one’s body and refuse to tell you what they’re gonna do with it??

• I’m still a sad bitch and want to order some dumb stickers just for fun to cheer me up a little (my birthday is February 28th. It was also my mom’s birthday, so this one is going to suck emotionally)

• any shares of this post would be helpful

• that’s it. If you read this far, thanks for sticking around. Thanks either way, really, but I guess you wouldn’t see this thanks unless you read this far so

#space coyote#get weird#signal boost#debt relief#as if it’s anything but a drop in a huge fucking bucket#but still#thank you#stickers#sellers on etsy#artists on tumblr

122 notes

·

View notes

Text

Toledo City Council just approved a plan to turn $1.6 million in public dollars into as much as $240 million in economic stimulus, targeted at some of the Ohio metro’s most vulnerable residents.

“It’s really going to help people put food on the table, help them pay their rent, help them pay their utilities,” says Toledo City Council Member Michele Grim, who led the way for the measure. “Hopefully we can prevent some evictions.”

The strategy couldn’t be simpler: It works by canceling millions in medical debt.

Working with the New York City-based nonprofit RIP Medical Debt, the City of Toledo and the surrounding Lucas County are chipping in $800,000 each out of their federal COVID-19 recovery funds from the American Rescue Plan Act.

The combined $1.6 million in funding is enough for RIP Medical Debt to acquire and cancel up to $240 million in medical debt owed by Lucas County households that earn up to 400% of the federal poverty line.

“It could be more than a one-to-100 return on investment of government dollars,” Grim says. “I really can’t think of a more simple program for economic recovery or a better way of using American Rescue Plan dollars, because it’s supposed to rescue Americans.”

How It Works

Under the RIP Medical Debt model, there is no application process to cancel medical debt. The nonprofit negotiates directly with local hospitals or hospital systems one-by-one, purchasing portfolios of debt owed by eligible households and canceling the entire portfolio en masse.

“One day someone will get a letter saying your debt’s been canceled,” Grim says. It’s a simple strategy for economic welfare and recovery.

RIP Medical Debt was founded in 2014 by a pair of former debt collection agents, and since inception it has acquired and canceled more than $7.3 billion in medical debt owed by 4.2 million households — an average of $1,737 per household...

Local Governments Get Involved

The partnership with Toledo and Lucas County is the third instance of the public sector funding RIP Medical Debt to cancel debt portfolios.

Earlier this year, in the largest such example yet, the Cook County Board of Commissioners approved a plan to provide $12 million in ARPA funds for RIP Medical Debt to purchase and cancel an estimated $1 billion in medical debt held by hospitals across Cook County, which includes Chicago.

“Governments contract with nonprofits all the time for various social interventions,” Sesso says.

“This isn’t really that far-fetched or different from that. I would say between five and 10 other local governments have reached out just since the Toledo story came out.”

What's the Deal with Medical Debt?

An estimated one in five households across the U.S. have some amount of medical debt, and they are disproportionately Black and Latino, according to the U.S. Census Bureau...

Acquiring medical debt is relatively cheap: hospitals that sell medical debt portfolios do so for just pennies on the dollar, usually to investors on the secondary market.

The purchase price is so low because hospitals and debt buyers alike know that medical debt is the hardest form to collect...

The amount of debt canceled for any given household has ranged from $25 all the way up to six-figure amounts. Under IRS regulations, debts canceled under RIP Medical Debt’s model do not count as taxable income for households...

Massive Expansion Coming Up

After not one but two donations from philanthropist MacKenzie Scott, totaling $80 million, RIP Medical Debt is planning for expansion.

It’s using a portion of those dollars to create an internal revolving line of credit to expand to places where it can find willing sellers before it has found willing funders.

The internal line of credit means the nonprofit now has new, albeit still limited, flexibility to acquire debt portfolios from hospitals first, then begin raising private or public dollars locally to replenish the line of credit later and make those funds available for other locations.

“People often ask, do you only work with nonprofit hospitals, or do you work with for-profit hospitals? And I’m like, I just want to get the debt, regardless of who created the debt. If it’s out there, I want it,” Sesso says.

Fundamentally, they are not solving the issue of medical debt, but easing its pressure from as many lives as possible — while also upping the pressure on lawmakers and the healthcare industry.

“We’re intentionally taking the stories of the individuals whose debt we have resolved, and putting their stories out into the world with intention in a way that tries to push and create more of that pressure to fundamentally solve the problem,” she says.

-via GoodGoodGood, 4/6/23

#toledo#ohio#chicago#cook county#new york#medical debt#healthcare#healthcare access#united states#us politics#debt crisis#debt relief#hospital#nonprofit#good news#hope

300 notes

·

View notes

Text

Fuck it! US Private Student Loans Guide!

DISCLAIMER: while I have worked in private loans specifically for five+ years, this isn't ‘financial’ advice and is just a heavily summarized guide on how to navigate them. Yes, these loans suck, but complain to your legislators not me. I’m just trying to help you know what you’re doing. Additional info for each section is under the cut!

1) Who are you and who are all the companies constantly running around with my money?

I work in loan SERVICING, which is basically the billing department. If you’ve got a new company asking you for money, it's probably a new servicer and your debt is still owned by the bank. We enforce the terms in the promissory note, the document you sign telling the bank “yeah I'll play by your rules if you give me the money.” If your loan defaults, you’ll get contacted by a third (fourth?) party, but how that works is beyond my wheelhouse. The bank or your servicer should be able to confirm what happens in case of default.

2) What am I looking for in a ‘good’ loan?

Generally, you’re going to want SIMPLE instead of compound interest, a FIXED RATE opposed to a variable one, and you’ll want to go for FULL DEFERMENT while in school and make manual payments when you can. Also ask up front about stuff like if disability forgiveness or co-signer release (getting your parents off it) is offered.

3) This loan sucks! How do I make it better?

Student loans are NOTORIOUSLY hard to get out of, unfortunately. If the interest rate/payment relief options suck, you can try to REFINANCE where you take out a new loan to pay off the old one. This gives you a new promissory note, interest rate, and terms/conditions. If you’re trying to erase the debt entirely, ask for the promissory note (if they can't provide a copy, we have to forgive the debt. I've only seen this happen ONCE.) or try to go through social security disability.

DO NOT USE FREEDOM DEBT RELIEF OR OTHER SERVICES. DO NOT. THEY ARE SCAMS.

More in depth information for each point!

1) Lenders and Servicers

The lender is the person who provides the funds in the debt - the bank who pays the school or the hospital or the home contractor fixing your sink. The servicer is the company that is your point of contact when you need to make payments, ask for payment relief, or otherwise manage the loan that exists. Think of us as the mechanic (we keep the car running) where the bank is the manufacturer (they make the car). Some different servicers are SoFi, Zuntafi, Great Lakes, Nelnet and Firstmark Services; their names will be on the billing statements. Some different banks are Citizens, US Bank, NorthStar; their names will be on the promissory note and the disclosures.

Sometimes banks do sell the debt, however! A couple years ago Wells Fargo sold an enormous chunk of their loans off somewhere (an investment group, maybe?) but! The promissory note will still be the EXACT same if your debt gets sold. You’ll only get a new promissory note if you refinance the loan yourself.

2a) Interest Accrual and Rates

Interest is how banks profit off the loans they give out and/or ‘ensure they don't end up with a loss if the loan defaults’. (It's profit.) Most, but not all, loans calculate interest with the simple daily interest formula, shown below:

[(Current loan balance) x (interest rate)] divided by 365

If your loan’s balance is $10,000 and your interest rate is 6% you’ll be charged $1.64 each day. SIMPLE INTEREST means that this interest just kind of floats around on the account until a payment comes in and pays it off, where COMPOUND adds that interest to the balance at the end of the month/day/whatever. Compound charges you more over the life of the loan.

FIXED INTEREST is a set percent that doesn't change, where VARIABLE will change usually based on whatever the economy is doing. There’s a minimum and maximum value to the variable interest rates, so if you’re doing a variable ASK WHAT THE MINS AND MAXES ARE. A fixed rate might be 8% and a variable might be 3.25% the day you take it out, but that variable could have a maximum interest rate of 25% so be VERY, VERY CAREFUL. If you get stuck in a real bad variable interest rate, your best solution is probably a refinance.

2b) Deferment and Payment Allocation

So interest is gonna be accruing on your loan from the day the money leaves the bank. Sucks. And you may not be able to make payments while you're in school, so opting to DEFER your payments will stop them from billing you so you can skip a month or whatever without penalty. At the END of that deferment, though, whatever interest that accrued will be added to your current balance. If we use the example from above (10k loan with 1.64 daily interest) four years of school will add $2,400 to your balance and then your daily interest will jump up to $2.03 a day.

Solution? Make payments of what you can while you’re in school to chip away at that floating interest. Usually when you make a payment, it’s gonna go towards the interest first and then the rest drops the balance. (E.g. if you make a $20.00 payment ten days after your loan is disbursed, $16.40 will go towards interest and $3.60 towards your 10k balance). There is NO PENALTY for making extra payments or making early payments, but it might make your bills look a little weird if you’re being billed each month for just the interest.

3) Why are these loans so horrible? Can’t I find anything to help me?

Blame Reagan and the republicans who enabled him.

No, but really. The problem with these loans is that those promissory notes are VERY legally binding and have lots of fine print in there designed to make it as hard as possible for someone to skimp out on their debt without having their credit score decimated. Some lenders might even dip into your paychecks if you're crazy behind or default; again, that's not my wheelhouse and I've only maybe seen that once. Your best bet is just to pay it off as fast as possible (again, no penalty for paying the loan off early) or refinance into better terms.

And I get it. I really do. I hate how we’ve made so many incredibly important things in our society locked behind a paywall that charges poor people more to climb than the rich. But if you’ve made it this far, please don't turn your anger at me for not giving you the answers you want. The best I can do is vote for people who are willing to crack down on predatory lending, keep fighting for student loan forgiveness… and at my own job, make sure that my coworkers aren't making mistakes.

If you have a more specific question, I can try to answer as best I can without breaking any information privacy laws. And take care, okay? You are never fighting alone.

#private loans#student loans#school loans#loan forgiveness#long post#credit score#credit services#debt relief#debt consolidation#I spent like two weeks off and on with this PLEASE REBLOG but also PLEASE BE NICE

184 notes

·

View notes

Text

USAmericans with federal student loan debt, the application for up to $20,000 in debt relief is live (in beta). The application is super easy and only takes a couple of minutes to fill out.

Tell your friends.

Tell your enemies.

Tell everyone.

https://studentaid.gov/debt-relief/application

#student loans#debt relief#student debt#student loan debt#student debt relief#student loan debt relief#student aid#signal boost

683 notes

·

View notes

Text

queer latina desperately needs help. ($495/999)

i'm drowning and i don't know how much more of this i can take. the last few months have been the worst of my life.

i've lost two close friends. i've been learning about my abuse as a child and later SA on top of my already existing mental illnesses and other diagnosis. as if i needed more trauma, my cats, my babies, have been terribly sick.

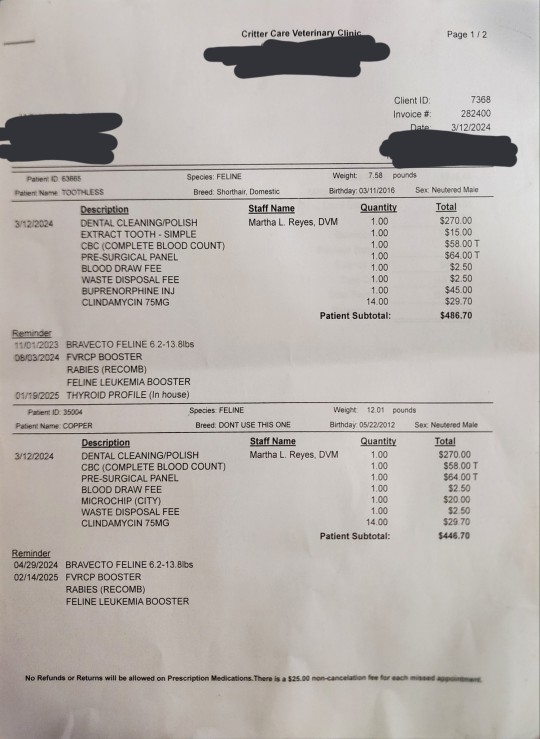

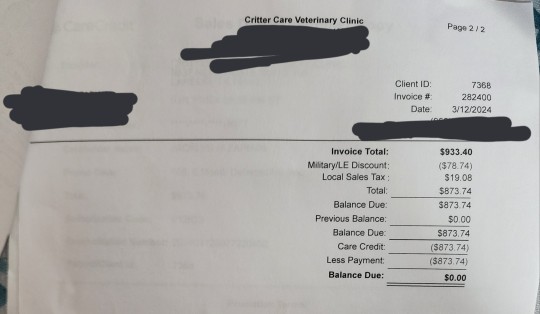

i've already lost one (chompy, bottom right) to kidney disease. toothless and copper (right side) needed emergency dentals and we nearly lost toothless. then chachi (top left), my light, got a tumor and i got the worst news of my life. her breast cancer is back and it's aggressive. idk what i'm going to do without her.

everything has amounted to $999 and that's only so far. i'm a struggling, queer latina who is the breadwinner of my family of 5 (two of which are my parents who were/are my abusers and i cannot afford to leave) and i make below the average salary.

i know this is a writing blog but i'm desperate. thank you for reading. love and light your way.

GoFundMe

Cashapp $jacklynzapiain

Paypal @ jacklyng95

Venmo @ jacklynzapiain

#signal boost#tw pet death#tw pet loss#tw pet illness#debt relief#fundraising#fundraiser#queer community#queer#crowdfunding#crowd funding#queer crowdfund#signalboost#mutual aid#financial aid#mutual aid request

49 notes

·

View notes

Text

THE STUDENT LOAN FORGIVENESS APPLICATION... IS LIVE!!!

IT’S HAPPENINGGGGGGG

Ok that’s too much capslock. Go here to fill out the application, babies:

Student loan forgiveness application

It takes about 30 seconds to fill out with your basic info. And while the site is in beta mode (or so it says) it seems... extremely well-designed and user friendly for a government site? Where was this level of web design when the ACA was passed?

If you have student loans we IMPLORE YOU to fill it out and see if you qualify. If you have questions (and who don't?), see our FAQ on student loan forgiveness here:

The 2022 Student Loan Forgiveness FAQ You've Been Waiting For

#student loan forgiveness#student loans#student debt#debt relief#federal student loans#Joe Biden#student loan debt relief#debt forgiveness#student loan forgiveness application#government

356 notes

·

View notes

Text

#us politics#republicans#conservatives#tyt#the young turks#john iadarola#workers unite#worker's rights#working class#working class solidarity#debt relief#cancel student debt#student debt#student debt forgiveness#2023#us supreme court#scotus#biden v. Nebraska

137 notes

·

View notes

Text

The Student Loan Debt Relief Application is available early!

https://studentaid.gov/debt-relief/application

***IF IT DOESN’T LET YOU APPLY RIGHT NOW DO CHECK BACK ON THERE SOON. IT’S THE BETA LAUNCH AND WILL BE AVAILABLE ON AND ON OFF DURING THIS TIME***

#let’s chat#sip tea#talk student loans#talk applications#talk debt relief#links to apply#student loans#applications#debt relief

266 notes

·

View notes

Text

Wow! I found the article link about the “30 proud, self-described gutter-pagan, mostly queer dirtbags” who erased 1.6 million in medical debt. It’s possible. And it proves how crooked our pay-for medical system really is. AMAZING. (I also Re-posted the tumblr I saw it on first—check out their comments, which help explain how it was done in laymen’s terms).

#social justice#medicine#debt#medication#queer#pagans of tumblr#philadelphia#debt relief#medical corruption#grass roots#lgbtqia

38 notes

·

View notes

Text

Stop thinking only about yourself. The self-interest and lonersim bullshit is poison.

559 notes

·

View notes

Text

President Joe Biden on Wednesday will announce $1.2 billion of student debt relief for nearly 153,000 borrowers

The administration’s latest tranche of loan forgiveness covers borrowers who are enrolled in Biden’s new loan repayment program, initially borrowed $12,000 or less and have been repaying their debt for at least 10 years.

The administration says that it has now approved loan discharges totaling nearly $138 billion for nearly 3.9 million borrowers through dozens of administrative actions since coming into office.

#student loans#student loan debt#Thanks Biden#Joe Biden#politics#us politics#good news#debt relief#student loans canceled

23 notes

·

View notes

Text

PSA: The application for student loan relief is live: https://studentaid.gov/debt-relief/application

The link says it's in beta, but if you submit your application now, you won't have to re-submit when the regular launch date happens. More info is here (link).

I checked it out, thinking it was going to be really long and complicated (like the times I have had to apply for forbearance), but it's so short. It took me 2 minutes!

Sharing this in case anyone needs this info!

Edited to add: This post was made 15 Oct. 2022.

221 notes

·

View notes

Text

Gabon's debts will be reduced by $450 million thanks to an innovative debt-for-nature mechanism. Piloted on Gabon's behalf by Bank of America (BofA), the debt-for-nature mechanism enables developing countries to reduce their external debt in return for funding for their biodiversity. In return, Gabon is protecting part of its marine ecosystem. This is the second case in Africa after the Seychelles.

...Gabon is paying for its biodiversity through the debt-for-nature mechanism. The operation, for which tenders were launched on the London Stock Exchange on 25 July 2023, will enable Gabon to reduce its external debt by up to 450 million dollars (267.1 billion CFA francs). In return, the country is committed to protecting its marine environment, with the support of the US-based non-governmental organisation (NGO) The Nature Conservancy.

Financially, the operation is being led by Bank of America (BofA), the second largest US bank in terms of deposits. A debt-for-nature swap is a debt relief technique for developing countries. It involves extending payment terms, reducing interest rates, granting new loans at low rates and writing off debts. This technique, invented by the American biologist Thomas Lovejoy, considered to be the godfather of biodiversity, involves exchanging part of the foreign debt for local investment in environmental protection measures.

The largest network of marine reserves in Africa

As part of Gabon’s debt-for-nature operation, the choice to protect marine biodiversity is not an insignificant one. Over the years, the Central African country has built up the largest network of rich and diverse marine reserves in Africa. Stretching over 53,000 km2, or 26% of the country’s territorial waters, this environment comprises 20 marine parks and aquatic reserves. It is home to countless threatened marine species, including the largest breeding populations of leatherback and olive ridley turtles, as well as 20 species of dolphins and whales.

Gabon thus becomes the second African country, after the Seychelles, to benefit from the debt-for-nature swap. It’s a swap that should spread throughout Africa... explains Hamouda Chekir, a member of Lazard’s Government Advisory team.

The French bank has just assisted Ecuador with a financial package that benefits both nature and the country’s economy. In concrete terms, Ecuador has swapped its current debt of $1.63 billion for a debt of $656 million, a transaction corresponding to 3% of the South American country’s total external debt, i.e. $48.129 billion in February 2023."

-via Afrik21 (via FutureCrunch), August 1, 2023

#conservation#biodiversity#debt for nature#debt relief#debt#gabon#africa#ecuador#seychelles#marine life#marine park#good news#hope#united states#france#bank of america

85 notes

·

View notes

Text

Haven’t seen this on tumblr yet so here it is— the Debt Collective is starting a movement to petition the Department of Education to cancel student debt on an individual basis. You fill out the form with your info and reasoning, and the Debt Collective generates and submits a letter on your behalf to the Secretary of Education.

Do I particularly think anything will come of this? No. But I filled it out because my voice matters. My reasons matter. If I’m going to be forced to pay this debt, the people responsible for collecting it will be forced to listen to be bitch about it. Have at it, folks. Took me less than 15 minutes to complete.

24 notes

·

View notes