#bond funds

Text

Looking for an investment option that will make you money? There are many different types of investments, and each one has its own pros and cons. In this post, we’ll discuss different types of investment options.

Common Interest Ownership Account

Individual Retirement Account (IRA)

Savings accounts

Bond funds

Mutual funds

There are many different types of investment options. You may be interested in investing money for your retirement, or you may want to invest some money that you have earned on a part-time job or freelance project. With so many different choices, it can be hard to know which option is right for you.

Investment options come in many forms: stocks, bonds, and cash-flow-based investments like mutual funds. These are just three examples of how investors can manage their risk while saving for specific purposes.

#different investments#mutual fund#bond funds#savings#ira#investment#investments#investmentproperty#investmentbanking#investmentproperties#InvestmentBanker#investmentopportunity#investmentrealestate#investmentph#investmentart#investmentgold#investmentadvisor#investmentbank#investmentmanagement#investmentclub#investmentadvice#investmentdeals#investmentgroup#investmentcars#investmentplans#InvestmentResearch#investmentplanning#investmentloans#investmentopportunities#InvestmentTips

0 notes

Text

Ko-Fi prompt from Isabelo:

Hi! I'm new to the workforce and now that I have some money I'm worried it's losing its value to inflation just sitting in my bank. I wanted to ask if you have ideas on how to counteract inflation, maybe through investing?

I've been putting this off for a long time because...

I am not a finance person. I am not an investments person. I actually kinda turned and ran from that whole sector of the business world, at first because I didn't understand it, and then once I did understand it, because I disagreed with much of it on a fundamental level.

But... I can describe some factors and options, and hope to get you started.

I AM NOT LEGALLY QUALIFIED TO GIVE FINANCIAL ADVICE. THIS IS NOT FINANCIAL ADVICE.

What is inflation, and what impacts it?

Inflation is the rate at which money loses value over time. It's the reason something that cost 50 cents in the 1840s costs $50 now.

A lot of things do impact inflation, like housing costs and wage increases and supply chains, but the big one that is relevant here is federal interest rates. The short version: if you borrow money from the government, you have to pay it back. The higher the interest rates on those loans, the lower inflation is. This is for... a lot of reasons that are complicated. The reason I bring it up is less so:

The government offers investments:

So yeah, the feds can impact inflation, but they also offer investment opportunities. There are three common types available to the average person: Bonds, Bills, and Notes. I'll link to an article on Investopedia again, but the summary is as follows: You buy a bill, bond, or note from the government. You have loaned them money, as if you are the bank. Then, they give it back, with interest.

Treasury Bills: shortest timeframe (four weeks to a year), and lowest return on investment. You buy it at a discount (let's say $475), and then the government returns the "full value" that the bond is, nominally (let's say $500). You don't earn twice-yearly interest, but you did earn $25 on the basis of Loaning The Government Some Cash.

Treasury Notes: 2-10 year timeframe. Very popular, very stable. Banks watch it to see how they should plan the interest rates for mortgages and other large loans. Also pretty high liquidity, which means you can sell it to someone else if you suddenly need the cash before your ten-year waiting period is up. You get interest payments twice a year.

Treasury Bonds: 20-30 years. This is like... the inverse of a house mortgage. It takes forever, but it does have the highest yield. You get interest payments twice a year.

Why invest money into the US Treasury department, whether through the above or a different government paper? (Savings bonds aren't on sold the set schedule that treasury bonds are, but they only come in 30-year terms.)

It is very, very low risk. It is pretty much the lowest risk investment a person can make, at least in the US. (I'm afraid I don't know if you're American, but if you're not, your country probably has something similar.)

Interest rates do change, often in reaction or in relation to inflation. If your primary concern is inflation, not getting a high return on investment, I would look into government papers as a way to ensure your money is not losing value on you.

This is the website that tells you the government's own data for current yield and sales, etc. You can find a schedule for upcoming auctions, as well.

High-yield bank accounts:

Savings accounts can come with a pretty unremarkable but steady return on investment; you just need to make sure you find one that suits you. Some of the higher-yield accounts require a minimum balance or a yearly fee... but if you've got a good enough chunk of cash to start with, that might be worth it for you.

They are almost as reliable as government bonds, and are insured by the government up to $250,000. Right now, they come with a lower ROI than most bonds/bills/notes (federal interest rates are pretty high at the moment, to combat inflation). Unlike government papers, though, you can deposit and withdraw money from a savings account pretty much any time.

Certificates of Deposit:

Okay, imagine you are loaning money to your bank, with the fixed term of "I will get this money back with interest, but only in ten years when the contract is up" like the Treasury Notes.

That's what this is.

Also, Investopedia updates near-daily with the highest rates of the moment, which is pretty cool.

Property:

Honestly, if you're coming to me for advice, you almost definitely cannot afford to treat real estate as an investment thing. You would be going to an actual financial professional. As such... IDK, people definitely do it, and it's a standby for a reason, but it's not... you don't want to be a victim of the housing bubble, you know? And me giving advice would probably make you one. So. Talk to a professional if this is the route you want to take.

Retirement accounts:

Pension accounts are a kind of savings account. You've heard of a 401(k)? It's that. Basically, you put your money in a savings account with a company that specializes in pensions, and they invest it in a variety of different fields and markets (you can generally choose some of this) in order to ensure that the money grows enough that you can hopefully retire on it in fifty years. The ROI is usually higher than inflation.

These kinds of accounts have a higher potential for returns than bonds or treasury notes, buuuuut they're less reliable and more sensitive to market fluctuations.

However, your employer may pay into it, matching your contribution. If they agree to match up to 4%, and you pay 4% of your paycheck into an pension fund, then they will pay that same amount and you are functionally getting 8% of your paycheck put into retirement while only paying for half of it yourself.

Mutual Funds:

I've definitely linked this article before, but the short version is:

An investment company buys 100 shares of stock: 10 shares each in 10 different "general" companies. You, who cannot afford a share of each of these companies, buy 1 singular share of that investment company. That share is then treated as one-tenth of a share of each of those 10 "general" companies. You are one of 100 people who has each bought "one stock" that is actually one tenth of ten different stocks.

Most retirement funds are actually a form of mutual fund that includes employer contributions.

Pros: It's more stable than investing directly in the stock market, because you can diversify without having to pay the full price of a share in each company you invest in.

Cons: The investment company does get a cut, and they are... often not great influences on the economy at large. Mutual funds are technically supposed to be more regulated than hedge funds (which are, you know, often venture capital/private equity), but a lot of mutual funds like insurance companies and pension funds will invest a portion of their own money into hedge funds, which is... technically their job. But, you know, capitalism.

Directly investing in the stock market:

Follow people who actually know what they're doing and are not Evil Finance Bros who only care about the bottom line. I haven't watched more than a few videos yet, but The Financial Diet has had good energy on this topic from what I've seen so far, and I enjoy the very general trends I hear about on Morning Brew.

That said, we are not talking about speculative capital gains. We are talking about making sure inflation doesn't screw with you.

DIVIDENDS are profit that the company shares to investors every quarter. Did the company make $2 billion after paying its mortgages, employees, energy bill, etc? Great, that $2 billion will be shared out among the hundreds of thousands of stocks. You'll probably only get a few cents back per stock (e.g. Walmart has been trading at $50-$60 for the past six months, and their dividends have been 57 cents and then 20.75 cents), but it adds up... sort of. The Walmart example is listed as having dividends that are lower than inflation, so you're actually losing money. It's part of why people rely on capital gains so much, rather than dividends, when it comes to building wealth.

Blue Chip Stocks: These are old, stable companies that you can expect to return on your investment at a steady rate. You probably aren't going to see your share jump from $5 to $50 in a year, but you also probably won't see it do the reverse. You will most likely get reliable, if not amazing, dividends.

Preferred Stocks: These are stock shares that have more reliable dividends, but no voting rights. Since you are, presumably, not a billionaire that can theoretically gain a controlling share, I can't imagine the voting rights in a given company are all that important anyway.

Anyway, hope this much-delayed Intro To Investing was, if not worth the wait, at least, a bit longer than you expected.

Hey! You got interest on the word count! It's topical! Ish.

#economics#capitalism#phoenix talks#ko fi#ko fi prompts#research#business#investment#finance#treasury bonds#savings bonds#certificate of deposit#united states treasury#stocks#stock market#mutual funds#pension funds

63 notes

·

View notes

Text

They sure help plenty... National War Fund - 1943.

#vintage advertising#vintage illustration#ww2#wwii#life during wartime#the home front#national war fund#usda#world war ii#vintage posters#propaganda posters#war bonds#war savings bonds#uso#the 40s#the 1940s#war department#united service organizations#united states armed forces

15 notes

·

View notes

Text

you ever think about how by yakuza 8 haruto will be 8 years old and won’t remember kiryu at all, and if/when he shows back up kiryu will be a total stranger to him. haha

#:) suffer with me#rambling#y6#realistically the closest person to him in what would’ve been kiryu’s role in haruto’s life would be nagumo#especially considering he’s got so god damn many parallels to kiryu despite his personality being so different#I also think he’d know uncle akiyama because akiyama’s the closest other protag to haruka and is a civilian so he doesn’t have like a Ton#of risk visiting her- at least not nearly as much as other characters who Aren’t civilians#he’s also got the Money to travel so there’s that prjscjdjsjc#no but for real? i feel like he’d visit but Also he’d fund the orphanage. for kiryu’s sake haruka’s sake even mirei’s sake in a way#ahh……anyway it’s killing me to think about 8 year old haruto finally actually meeting kiryu and knowing not to be scared of him or anything#cause of everything haruka’s said about him and all that- but having absolutely no emotional connection to him at all. so he’s still just…#a stranger to him. like that’s just the cruel truth#kiryu missed his most important developmental years and isn’t a part of haruto’s life and even if he were to show back up and be around for#good it’d take years until their bond feels like a true deep familial one#it’s very very very bittersweet to think about kiryu trying to bond with him. ohhh man yeah that hurts to think about. oh boy#haruto#kiryu

23 notes

·

View notes

Text

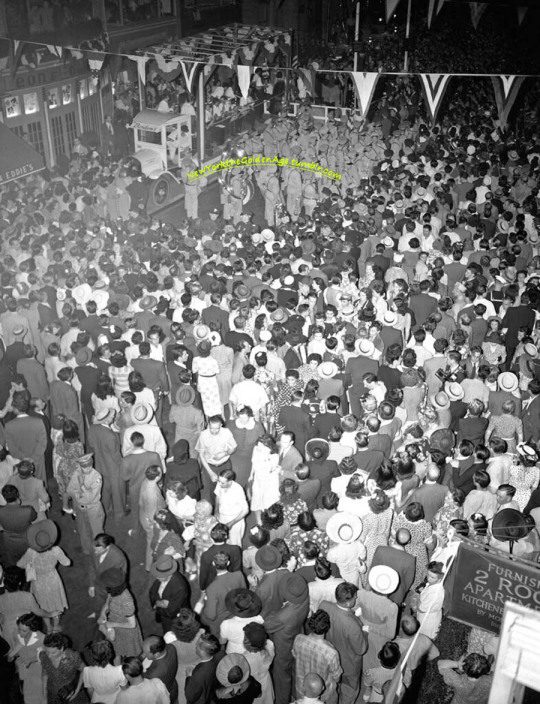

A throng surrounds the speaker’s platform and music stand on Swing Street, 52nd Street between Fifth and Sixth Avenues, July 23, 1942. The street, packed with night clubs, staged a war bond rally and invited everyone who had at least a dime to buy a war stamp. Well-known bands and Army music outfits supplied the background for dancing.

Photo: Kenneth Lucas for the AP

#vintage New York#1940s#Kenneth Lucas#World War II#home front#war bonds#war stamps#July 23#23 July#rallies#Swing Street#crowd#fund-raising

47 notes

·

View notes

Text

the REAL real "who gets custody over Hunter" battle is going to be Camila Noceda vs Perry Porter, who's homes and hearts already have room made for him by that point and who's children have both called younger sibling dibs

#the owl house#hunter toh#camila noceda#luz noceda#gus porter#perry porter#luz has seniority but gus has a special secret handshake#and Vee is as literally his little sister as it gets for them#eda has no stake in this#and as far as camila and perry are concerned all darius is good for is funds#Darius is NOT only good for funds but Perry knew him back in school he knows stuff#lilith sneaks in there partly out of guilt#mostly because i would kill for lilith and hunter to bond#lina rambles#toh#hunter wittebane

197 notes

·

View notes

Text

The Republican congressman and serial fabulist George Santos has until Friday to appeal an order to reveal the identities of three people who guaranteed his $500,000 bond on fraud charges, a New York judge said on Tuesday.

A lawyer for Santos had said identification of the guarantors would imperil their “health, safety and wellbeing”, and claimed the New York congressman would rather go to prison than reveal the names.

“My client would rather surrender to pre-trial detainment than subject these suretors to what will inevitably come,” the lawyer, Joseph Murray, wrote to the judge on Monday.

At his arraignment in Long Island last month, Santos, 34, pleaded not guilty to multiple charges of fraud, money laundering, theft of public funds and making false statements.

After entering his plea, Santos told reporters: “It’s a witch-hunt. I’m going to fight my battle, I’m going to fight the witch-hunt, I’m going to take care of clearing my name.”

The New York Times sought the identification of Santos’s bail guarantors, arguing they should be identified as they had a chance to exert political influence over a congressman. Other news outlets joined the Times in its effort.

On Tuesday, Santos did not immediately comment.

Last month, House Republicans deflected a Democratic motion to expel Santos from Congress, referring his case to the ethics committee.

Only five members of Congress have ever been expelled from the House: three for fighting against the Union in the civil war and two over convictions for fraud.

Santos has admitted “embellishing” a résumé that was ripped apart after he won his seat in Congress last November, even his real name being brought into question.

He has denied accusations of wrongdoing including alleged schemes involving stolen cheques and puppies and allegations of sexual harassment from a former aide.

After winning a New York district previously held by a Democrat, Santos became a key figure in Republicans’ slim House majority. In January, he backed the House speaker, Kevin McCarthy, through 15 rounds of voting to secure the position.

Santos has repeatedly said he will not resign, and is running for re-election next year.

#us politics#news#the guardian#2023#rep. george santos#george santos#george santos should resign#anthony devolder#new york#bail bonds#Joseph Murray#fraud#money laundering#theft of public funds#making false statements#The New York Times#us house of representatives#republicans#conservatives#gop

18 notes

·

View notes

Text

I think it’d be incredible to see the C2 wizards visit Avalir. Ultimate destination couple’s trip for Caleb and Essek, they’d get so much research done and maybe even take a break long enough to stroll around the city, taking in the sights and having nerdy debates about the magic behind everything. The Hall of Eyes recruits Veth almost instantly, and when she isn’t testing out their reflexes with random crossbow bolts, she’s having the time of her life crafting bigger and bigger Fluffernutters.

Astrid and Eadwulf rediscover the joy of magic, not just as power or as a tool but as something to explore and experiment and have fun with. Ikithon's plans for a “subtle” takeover are foiled at every turn because there are at least a dozen archmages of his calibre in the city and all of them have better networking skills, which is what you really need to distinguish yourself when you’re not the only one with 9th level spells anymore. On the other hand, Allura puts on a sundress (blue, of course) and has the most relaxed vacation of her life, where she doesn’t have to be the expert archmage in the room all the time, she can just chill and enjoy herself.

Yussa gets lost in the Meridian Labyrinth while investigating the arcane machinery. When they finally rescue him, he just gets handed a piece of parchment and some ink so that he can draw a map as he goes next time.

#critical role#exu calamity#critical role spoilers#exu spoilers#caleb widogast#essek thelyss#veth brenatto#astrid becke#eadwulf grieve#trent ikithon#allura vysoren#yussa errenis#i should also add that eadwulf and purvan definitely fuck at some point while bonding over the lack of respect for their matron#meanwhile astrid and patia have such an intense rivalry for positions of influence that everyone assumes they're enemies-and-lovers#as per aabria and liam's tweets; laerryn immediately adopts caleb who doubles down on his spell components HARD#essek and laerryn also have several long conversations about writing effective proposals for grant funding#allura sitting back and sipping a cocktail: after i finish this book on arcane wards; i should check if they have a carpet store here

166 notes

·

View notes

Text

The Importance of Diversification in Your Investment Portfolio

Diversification is a critical concept in investment that can help you balance risk and reward. By diversifying your investments, you can mitigate potential losses without significantly impacting potential gains. This article explores the importance of diversification in an investment portfolio and provides some strategies to help you diversify effectively.

What Is…

View On WordPress

#Asset Allocation#Bonds#Diversification#Financial Planning#Investing Strategy#Investment Portfolio#Mutual Funds#Real Estate#Risk Management#Stocks

5 notes

·

View notes

Text

Tagged by the lovely @missanniewhimsy for last lines of a WIP, but this whole conversation only makes sense together. Thank you babe :)

It wasn’t the Brucie Wayne voice- the Bat voice- no, just that soft spoken secret between Jasons innumerable siblings, and apparently, this one woman.

“Eleanor,” Bruce said, gloom abated only by the smallest uptick of a smile at the baseball bat in her hand, corona of broken glass gleaming crunched beneath her steel-toed boots, “Should I open the garage?”

She had to tilt back her head to look at him, and the action made Bruce slump, shoulders low.

Muffled by Dick’s sweater, Tim wrestled free enough to to ask, because he was a little fucking shit, “Did B adopt your soulmate?”

The bat disappeared. Elle crossed her arms and glared up, backburn sear of anger reaching Jason, even here and now, fucking soul mark empathy filling him with something so much warmer than all the whiskey in the world.

“What the fuck were you thinking? Sending Dick to my house. You know- you knew what he’d”-

Terrible, Bruce gently interrupted. “You stopped coming home.”

#Migration Patterns of Turdidae#DRUNK BAT BOY BONDING#the one with magic!#and soulmarks!#and the pure devastation of Jasons's mark being a ROBIN#Battison Bruce doing B- parenting in every direction#meeting a teenage girl in an alley who hits him over the head with a bottle of vodka and then yells at him about his failures#hi would you like a college fund? a donut? 35 million dollars?#Ten years later when that girl is a) a grown woman and b) a scary scary witch#Want to take a magical unbreakable baseball bat to a maserati?#feat. the fact that every future and present robin sees Elle's mark and has to for at least a second WONDER#(Dick does this most dramatically. it's Dick)#WE ARE BREAKING THE MEMORIAL CASE AS AN ACT OF LOVE AND IMPORTANT TIPSY VANDALISM#thank you for the tag!!

18 notes

·

View notes

Text

#capitalist system#capitalism kills#life under capitalism#ftp#acab#defund the police#defundthepolice#police brutality#blm#abolishtheprisonindustrialcomplex#this is amerikkka#true crime#us politics#defund the police fund our communities#all cops are bastards even the ones you know#tyre nichols#bail bonds

11 notes

·

View notes

Text

Exploring Different Investment Vehicles: Stocks, Bonds, Mutual Funds, and More

Navigate the various options available for those looking to invest

In this blog post, we will explore different investment vehicles, including stocks, bonds, mutual funds, and more, to help you gain a clearer understanding of their characteristics, benefits, and considerations.

Stocks

Bonds

Mutual Funds

Exchange-Traded Funds (ETFs)

Real Estate Investment Trusts (REITs)

Read the full blog here https://www.phindia.com/blogs/2023/08/10/exploring-different-investment-vehicles-stocks-bonds-mutual-funds-and-more/

#investments#stock investments#financial markets#bonds#mutual funds#stocks#phiblog#philearning#books#finance books#securities#portfolios#phibooks#phibookclub#ebook#education#undergraduate

4 notes

·

View notes

Text

10 Small Investment Ideas: Building Wealth Through Low-Risk Options

Discover 10 small investment ideas that offer low-risk options to kickstart your journey towards building wealth and securing a brighter financial future. Learn about mutual funds, index funds, robo-advisors, stocks, bonds, real estate, precious metals, cryptocurrency, small businesses, and investing in yourself. Get insights on risk factors, positive factors, and FAQs to make informed investment decisions.

Many people mistakenly believe that significant wealth is a prerequisite for investment opportunities. However, this notion is unfounded. Small investments, made consistently over time, can accumulate and pave the way to financial growth. In this article, we will explore ten small investment ideas for beginners that offer low-risk options to kickstart your journey towards building wealth and securing a brighter financial future.

We will also provide insights on how to manage these investments effectively based on facts and proven strategies:

Mutual Funds: Embracing Diversification Mutual funds are an accessible entry point for beginners in the investment realm. These funds pool money from multiple investors to purchase a diversified range of assets, including stocks, bonds, and securities. Diversification spreads investments across different assets, reducing the risk of significant losses. With modest initial investments, mutual funds are an excellent choice for beginners.

Index Funds: Simplicity and Affordability Combined Index funds, a type of mutual fund, track specific market indices such as the S&P 500. They provide a straightforward and cost-effective way to invest in a broad range of stocks. For beginners lacking the time and expertise to select individual stocks, index funds offer diversification, lower expense ratios, and the potential for steady long-term growth.

Robo-Advisors: Simplifying the Investment Process Robo-advisors are online investment platforms that automate portfolio management and offer personalized advice. They are ideal for beginners seeking convenience and requiring minimal initial investment. These platforms provide automated diversification, real-time recommendations, and low-cost portfolio management, allowing gradual wealth accumulation.

Read More

Other Topic:

How to Safeguard your Investments During a Market Decline?

How to create your own trading setup?

Relative Strength Index (RSI)

South Korea Retains Position in MSCI Emerging Markets

#InvestmentIdeas #WealthBuilding #FinancialGrowth #LowRiskInvestments #BeginnerInvesting

#small investment ideas#low-risk options#building wealth#financial growth#beginner investing#mutual funds#index funds#robo-advisors#stocks#bonds#real estate#precious metals#cryptocurrency#small businesses#investing in yourself#risk factors#positive factors

5 notes

·

View notes

Text

Devoted to Peace, Devoted to you, Day 7

[What is this?] [Day 1] [Prev] [Next]

The next morning, Dream brings Fundy breakfast but as he's handing it over, he says they won't be able to spend time together today. As the leader, he needs to help his people with checking how many supplies they have and he just can't have the hostage wandering around while all of their weapons and such are in view.

Fundy asks if that means he's supposed to just sit in his "house" for the entire day and Dream pauses before telling him that actually, if he'd prefer, there's one more person not allowed to poke around while they work. That would be Eret. So, Fundy can spend the day under their watch or alone.

Fundy still has some very conflicting feelings about Eret, but they've seemed helpful so far, so he decides to go with that option. Dream walks him there and after a very brief talk with Eret, he leaves to fulfill his duties. Being alone with Eret is... tense.

Fundy feels like somehow, they can tell what his plan here truly is. They don't flat-out ask him if he's trying to do something, but they do say that Dream approaches them whenever he learns they've seen him and asks if they think Fundy's acting suspiciously. They also assure him they always say "No" but ask him to be careful. That's it, they don't push any further. That's for the best, probably.

The two of them have lunch together and things get more and more comfortable. It's almost as though the betrayal never happened. It'd probably be better if they actually talked about it but this is good enough.

Later that day, Eret offers to give Fundy a dagger for protection, if he thinks that'd be wise. Fundy's very tempted, but he doubts he'd be able to sneak it past Dream, so he refuses it. The fact that they offered by itself does tell him that while he's not fully ready to trust them (and they still need to talk a lot, probably), Eret's probably the closest thing to an ally he has.

Dream picks him up from Eret's care/watch/whatever in the evening, and since Fundy's had a lot of time to think of new ways to flirt with/fluster Dream, he does not hold back while the man walks him in the direction of his "house."

When he does finally pause to catch his breath, Dream says he has something for him. That... could be very good or very bad! It could mean Dream's growing... fond? Of him? Or it could mean he's about to get stabbed. One way to find out, so he just hums an "oh?"

Dream hands him a book and quill. Oh God, he remembered Fundy mentioning that 1) his thoughts were getting all jumbled up and 2) writing things down usually helped. He listened. That's probably the best outcome he could've gotten.

He commits to his plan and hugs Dream as a thank you. He still doesn't get stabbed (and Dream's heart probably skips a few beats, which it shouldn't, this was meant as a part of his new plan!!! Totally not because he saw the book while counting supplies and it made him think of Fundy!!)!

Once he's left alone for the night, he's a bit tempted to write out his plan. He quickly realizes that that'd be very stupid, someone will most likely take a look at that book sooner or later, but that gives him a new idea. He writes an entire essay gushing about how nice Dream's been to him, and how cute he is, and how Fundy expected hell but every second around Dream feels like heaven but he's not sure what to do now and--

Basically, The Butcher Army's/L'Manburg's hit list, page 5, but no accusations, just pure "Dream is amazing and I think I love him".

#fundywastaken#fwt#devoted to peace devoted to you#Would it be my fic/wip/whatever if I didn't have funds bonding with ert??? No it wouldn't be I need them to support each other#Also if you forgot about that book you're welcome <3 So had I; until I read my own notes for this#and one last thing. why the hell are these getting so long????? I swear I'm only rewording the notes but somehow they keep expanding

5 notes

·

View notes

Text

I'm trying to fucking relax here after 6 hours straight of playing Stardew Valley and NOW my brain decides to think about Eddie and Noah. NOW it decides that we have to think about them as Victorian gentlemen who "never married" and "remained bachelors for life" and "lived together in a totally platonic way" and "slept in the same bed because it was convenient".

#grits My teeth . noah being a poor man from an immigrant household who is struggling to get by nd maybe is an entrepreneur#who meets this affluent yet reclusive timid man who happily funds his efforts and seems to appreciate his companionship#and the SOCIETAL PRESSURES of HIM BEING TOLD TO NOT MARRY BELOW HIS CLASS and that he MUST PROVIDE AN HEIR TO THE FAMILY WEALTH#maybe they even meet because he gets SICK and noah is a doctor-in-trainibg who shadows the man taking care of him and eventually takes over#forming an extremely strong bond with this odd man who seems to deliberately injure himself just to see him and.#FUCK. GOD!!!!!!!

6 notes

·

View notes

Text

Fernando Alonso on Instagram: "I would like to be featured on a James Bond movie, now that I signed for Aston Martin"

credit to papabear55 on reddit

#he's also busy advertising for sunreef again#eco villian?#eco friendly villain?#based in monaco#waging war with bond using the earnings from his eco friendly hedge fund and bitcoin exchange#he speaks 5 languages and has a#chef/gardener/bicycle repairman#that he occasionally sleeps with#and provides pole dance entertainment on the yacht#charles leclerc to be cast as the young bond#in an attempt to be incognito all ss agents now have french accen#seb loeb is the spymaster#and ocon provides the tech and decryption services#when he's not playing with his pet falcon

12 notes

·

View notes