#and then everything else is invested or in high yield.....

Text

i mean this in all seriousness.....

every bonus and raise i get at work is cuz i taught myself adobe automation tools and javascript for adobe (even though i took cs in hs like, i could not find a class in what i wanted so i just had to self teach it)

but the only reason i self taught that was cuz i was overly obsessed with kpop

so as long as all my savings accounts are where they should be (percentage of income-wise)... so like 401k, emergency fund, down-payment fund.......(which.....are all invested and/or in high yield 4.5% monthly compounding interest accts and are making their own money)

i can just dump all my disposable income into kpop because if i wasn't unhinged about kpop, i would not have this much disposable income lol

i feel like this is 100% an original meaning of girlmath moment tbh

#personal#i mean i also.....budget like a crazy person and save like....20-25% of my yearly gross income lol#and was doing that when i was broke too......bc im nuts and also bc the same reason my mom was nuts abt saving#(my mom was afraid shed have another stroke so she saved sooo much for retirement...and then did have to#retire early....but not bc of stroke but bc she also had CANCER what the actual fuck#like shes never done drugs and barely drinks and was a professional dancer which is like...a literal athlete..#thats NOT FAIR)#soooo she taught me how to save and invest super early lol.....like she....had me put my#bday money in an investment account every year and i was only allowed to spend interest#(explaining interest on a CD to a 8 year old by saying its a free GBA game lmao)#that was literally how she explained the $30 of interest the cd made i was like...ooo free!! i like free free is good!!#i have like.....enough to cover 2 months of basic bills (not including paychecks coming in) in checking#and then everything else is invested or in high yield.....#im so mad rn bc my 401k isnt doing that great tho....like my high yeild and my brokerage accounts are doing better#like the 401k is pretaxed and i get a very generous employer match of 5% instead of 3% so its worth#putting the money there instead of having it in my paycheck and putting it with the broker#buuuuut its annoying me#like im definitely getting more overall out of putting in 401k....but i wish it was making the same interest as my brokerage is

4 notes

·

View notes

Text

Losing dogs

pairing: young!coriolanussnow x fem!reader

summary: His golden prize, his future wife, was now bound to him by the ring on her finger. Of all of his investments, this one had the potential to yield the greatest return.

warnings: not really canon-compliant, mentions of minor violence, blood and shitty relationships

word count: 4k

Part 2 is here!

author's note: remember kids, manipulators and sick bastards are only hot in fiction - don't do them (and drugs) in real life!

The polished toes of his new shoes reflected everything in the grand hall—they caught glimmers of lamps adorned with gold, colourful drapes on the enormous windows, and the kaleidoscopic dresses of women around. The chatter filled the room, almost too loud to hear the music—not that he would enjoy it either. Some things require focus.

''Mister Fabius, Missis Fabius.''

Corialanus's face melts into a smile-like expression at the sight of the older couple.

They look like lice in the large building—rich lice, that is. The golden and platinum rings on Missis Fabius's fingers shine with every gemstone known to man, mirroring the bright lights. The jewels look ugly on the wrinkly hand, he notes. What a waste.

''Mister Snow, what a surprise! I was just telling Livia of your prodigious success in your new position. Incredible work, Mr. Snow; simply incredible! ''

The man's face radiated with excitement, getting closer in shade to his burgundy tie. The gold threats on it piqued more interest for Mister Snow than the words of the old man—after all, it's not every day you meet such luxury in person.

The man's wife, however, seemed less enthusiastic; her cold, bored gaze circled him up and down, stopping only after getting the satisfaction of an undoubtedly unpleasant conclusion.

Coriolanus mentally went over his outfit, hairstyle, and anything else she might have noticed. Nothing was out of place; the holes in his coat were a thing of the past. Still, it was something—that thought found its place in his brain, drilling a small hole in its way.

''When will we know of your decision, Mister Snow? We gave you time—a lot of time.''

''This evening, Mrs. Fabius. After the play, I promise to give you my answer tonight.''

He has to look first. What fool buys a horse blind? Sure, the horse came with immense fortunes and, most importantly, connections, but still. He couldn't afford to make a hasty decision, especially when the stakes were so high. After all, he was one of the most desirable bachelors; Fabiuses had to thank him for even considering the offer.

''There is no agreement until tomorrow, Mister Snow. We will have you for breakfast at nine o'clock sharp,'' Mr Fabius said, placing a hand on his wife's back and leading her towards the entrance. They could afford not to make one's adieu.

The opera was popular among the richest; all of the seats were taken. He would have lied if he said the golden rails and red velvet didn't make him feel a bit out of place. Nobody paid him any attention, although this time it didn't hurt him as much as usual. He could hide in the shadows of his box seat without being concerned about making an impression.

Not the stage, of course. It was the least of his worries, although he did pay a high price for a ticket. No, he looked at her.

The golden gown on her was a shimmering masterpiece. Layers and layers of the most expensive fabric covered her body like soft waves, crashing down at the round neckline with their gilded ends. She wore diamond earrings, just like her mother did, although they suited her better.

Coriolanus remembered her from the academy; she always sat near the window, gazing out at the world with a longing in her eyes. She wasn't a very bright student but rather a dutiful one. always on time, always prepared with her assignments, and always eager to please her teachers. The heiress to the jewellery empire. The flower of the elite social scene. Her presence attracted attention, yet she seamlessly blended into the background, never stealing the spotlight. YN Fabius was everything he needed her to be—a picture, but never a spectacle.

-

The manor was grand and opulent, showing the wealth and status of the Fabius family. Its sprawling gardens and delicate architecture were a testament to its esteemed position in society. Collums, paintings, and endless staircases stood as if frozen in time. It was as if there was no war just a decade ago.

''Mister Snow,'' the butler called out, his voice echoing through the grand foyer. ''Breakfast is served in the blue dining hall; if you would please follow me.''

Thousands and thousands of steps and passages lined the walls, leading to various wings and chambers of the mansion. It was warm, even during the cold autumn season. Only keeping the fireplaces always lit must cost a fortune.

When they finally reached the needed room, Coriolanus was slightly out of breath. The blue walls reached the high ceiling, painted with pictures of half-naked gods and goddesses frolicking in fields of flowers. It created the illusion of a smell wafting through the air as if the vibrant colours had come to life.

The table was served for four, not three, suggesting that someone else was expected to join them. The silverware gleamed under the soft rays of sunshine, casting a shimmering glow across the room—pure silver, nothing less.

The door behind him opened with a gentle creak, revealing Mr. Fabiuse's humble figure. His simple, at first glance, shirt was another of the perfectly constructed illusions—Coriolanus knew the fabrics like the back of his hand. The shirt, though seemingly plain, was made from the finest Egyptian cotton, woven with intricate patterns.

''Mister Snow, how good that you came on time. Excuse my ladies, the girls are such girls at every age. Take so long to get ready,'' he laughs. ''Please, take a seat," Mr. Fabius said, gesturing towards a plush chair covered in velvet.

''There is no point in all of those paints once you hit sixty,'' Mrs.Fabius said, appearing right behind her husband. She circled the table before taking a seat herself, her eyes glancing disapprovingly at the young man. "Let's begin before the food grows cold," she added with a sigh, her tone tinged with resignation.

''Of course,'' Mr. Fabius nodded, lifting the lid on the first dish. The aroma of it filled the room, and Coriolanus couldn't help but feel his hunger grow. He didn't have the habit of eating so much in the morning—another thing he needs to adjust about his routine.

When Mr.Fabius finally placed the fork down, Coriolanus knew it was time. ''Thank you for the invitation, Mr. Fabius. I must say, I thought a lot about your proposal, and after careful consideration, I have decided to accept it.''

''Good.'' Mrs. Fabius answered instead, her eyes sparkling with satisfaction. "I'm glad to hear that, Coriolanus. I believe this union will bring great delights to both of us."

Mr. Fabius seemed not to notice the interruption. ''I think a winter wedding would be absolutely perfect. Everybody seems to be getting married in the spring, but in the winter? Oh, it's definitely going to be a hit. Ah, and here's the lucky bride-to-be!''

She stood beside the just-opened door, her eyes following his expressions. Her hands, adorned just with one small pearl ring, were gently clasped together in front of her. She looked nervous, like a child standing in front of the full class on the first school day. Her dress, a delicate lace creation, clings to her figure like a second skin.

He smiled at her. YN looked like an antique statue, as if she just stepped out of the ruins of the Panem. Coriolanus wasn't even sure she was breathing—her stillness was so deep.

''Let's leave the lover birds to chirp,'' Mrs.Fabius said, standing up. She walked towards the couple, her heels clicking against the floor, and extended her hand towards YN. "Congratulations, my dear," she said with a warm smile before leaving, her husband following after her.

''It's time for a ring, isn't it?'' Coriolanus cleared his throat. Everything is to be done appropriately; there is no reason to avoid traditions. He reached into the pocket of his suit and pulled out a small box. White, of course—who is he, if not a romantic at heart?

''Mr. Snow,'' YN watched him stand up and come closer with the same expression she always bore—a mixture of melancholy and worship. ''Grant me something.''

He paused. Coriolanus didn't like to make promises. He would have to make it clear to her later, after the wedding—the fact that he took her for a bride was enough of a promise. Still, he needed this engagement to work, and he was not about to lose it to a crude lie. With a sigh, he softly replied, "What is it that you desire, Miss YN?"

''Promise me you will be kind to me. All of our marriage, promise to be kind to my heart.''

Coriolanus almost laughed in her face. Oh, what a lovely, clueless fool. "I will do my best to treat you with kindness, Miss YN."

''Good,'' she smiles. ''I think we will make a great couple then, Mister Snow.''

''Coriolanus, my dear. Please call me Coriolanus."

He couldn't help but feel a twinge of annoyance. It was sealed. His golden prize, his future wife, was now bound to him by the ring on her finger. Of all of his investments, this one had the potential to yield the greatest return.

-

Mr.Fabius didn't lie—his daughter was the perfect bride. She never spoke to him unless he did first; she never questioned him. She simply followed his lead, like a well-trained pet. A pretty, lovely YN. She knew what to do, how to dress, and what to say. He searched for one—at least a slight imperfection—and couldn't find one; it was as if she wasn't a human, which, to him, she wasn't.

''What are you going to do today?'' he asks, without bothering to look up from the newspaper. He doesn't wish to hear her answer, but he still asks out of courtesy. Coriolanus knows that her daily routine is made up of attending charity events, dinners with influential figures's wives, and shopping for designer clothes. It's a predictable pattern.

''Well, the trees I ordered came in today; I'll have to chat with the new gardener about them. Are you meeting with anyone important later?"

''As a matter of fact, I do. Larry Tremblay wants to include me in a business deal he's been working on."

It's partly true, but she doesn't need to know more. Just a familiar name was usually enough for his wife to hum in satisfaction and assume that he was still climbing the social ladder. Not this time, evidently.

''You shouldn't accept.''

He looked up from his cup, trying to guess if she had gone out of her mind. YN looked like usual, her eyes meeting his without a care in the world. Why today, of all days, she decided to question his decision was beyond him. He cleared his throat, attempting to maintain his composure. "And why should I decline such a good-looking opportunity?"

''He beats his wife. Just yesterday, I saw her with bruises. ''

Coriolanus fought hard to keep a smile from forming on his lips. Instead, he leaned back in his chair, feigning indifference. He knew his wife wasn't the brightest, but this? "Is that so?"

''Don't you understand what it means? The man only beats his wife for two reasons. If he has always enjoyed those types of things, which Larry did not, or if he loses power and control in other aspects of his life. The business isn't going as well as he wants it to,'' YN lowers her gaze, losing confidence in her voice. ''I thought you would want to know that.''

He would, very much. Her conclusion was the dumbest thing he ever heard, based on some black and blue marks and a twist of her imagination. Still, it was interesting—his wife's head wasn't always empty like he hoped. She thought enough to notice something, and she listened enough to remember his partners.

''I will keep that in mind,'' he replied, his tone tinged with a hint of annoyance. What harm could it do to entertain her thoughts? It was even slightly amusing to see her try to piece together a puzzle that didn't exist.

-

It wasn't so fun anymore when Larry Tremblay was fired exactly two weeks later. Surely, it could be a consequence, but Coriolanus Snow didn't believe in them. There had to be something, anything, to explain his wife's sudden knowledge—she couldn't have acquired it on her own, about that he was sure.

YN looked unfazed by his questioning gaze as she lay on the dark olive-coloured sofa in his office, continuing to play with a snow-white kitten on her stomach. It was his wedding gift, one of many—the pricy creature with a diamond collar. He thought it was rather symbolic—two caged animals who were once considered sacred.

''How did you understand that Tremblay was about to be fired?'' Coriolanus asked, his voice laced with suspicion. It could be that she overheard the woman talk about it, or even that she had some inside information from her connections. What bothered him more was what she could know from the same source about him.

YN paused, her fingers gently stroking the kitten's fur as she met his gaze. "I didn't know that. I simply knew he had trouble at work. Evidently, they were big enough for him to lose his position."

''Really?'' he chuckled. Maybe she was telling the truth. ''Then, what can you say about my work?''

YN's eyes narrowed slightly. "Your work doesn't matter; how you present yourself does. Can I give you some advice?'

"Sure.'' Coriolanus bit his tongue, fighting the urge to snap back at her. After all, it is what he married her for—to fit in. He took a deep breath.

''Buy a new car, but not the most expensive one; it will give off an impression of stability, like you know the job isn't going anywhere. Your shoes are always too polished; it's like you wore them right out of the box. And throw away that hideous tie you always wear—you look like a student."

''Something else?'' Coriolanus mustered a weak smile, trying to hide his frustration.

''I don't want to offend you, Coriolanus. But I want you to do well. After all, you are my husband now, and your success reflects on both of us. Why not help where I can? You know I love clothes.''

''Good, '' he replied, forcing a more genuine smile. "Now get away from that cat before it scratches you. I'll figure out the rest on my own."

''Of course you will. You are the smartest man I've ever met.''

-

He was. It was because of his intelligence that YN married him, because of his ambition. Well, that and something else.

From her earliest childhood, YN knew what she was destined to be. She was the child of late parents, the only child, and a girl; she would inherit everything the generations of her family worked so hard to achieve. And YN was no fool; she needed a man. Driven, proud, and cold-blooded. The one who was not afraid to get his hands dirty while she spent her time leisurely in his shadow. Oh, no—YN never minded her place, much like her mother did. She taught her to bet on the finest horses, and Coriolanus Snow was no exception.

From the time she saw him in his ridiculously tight shirt in the academy, she knew what she wanted. Him. The top of every class, the charmer with pretty eyes—a catch, really. Her mother said there was darkness inside her dear Coriolanus, but YN knew. That's why she now sits in the opulent living room, waiting for him to get home. Mr. Snow was a horrific, ruthless man. But he was still, at his core, a man.

And men never listen. That's how she got him and got him good—a silent, fawn-eyed creature that he thought he could control. An obedient wife and a lovely lap dog. It was funny to see his gaze twitch slightly when she said something she wasn't supposed to—how long would it take him to figure it out?

It's time—his tall figure appeared in the corridor leading to the living room. YN watches silently as he takes off his shoes and coat, placing them on the rack by the door. Home at seven p.m. sharp, just like any other day. Just like any other day, dinner is at the table.

He never said thank you. Instead, her closet grew bigger with countless dresses, bags, and shoes—sometimes even brand-new jewellery. YN didn't mind it; she loved it—the jealous whispers of other women at the events about how lucky she was. She didn't have to sleep with a big, fat old man to get the latest fur coat or the most exquisite diamond necklace.

At least a few times a month now, Coriolanus would wake up in the middle of the night, screaming. This night was one of those: YN woke up from the constant turning and tossing in the bed. She doesn't know how he didn't figure out why; it was easy to guess his food contained something to make his sleep far worse—YN made sure of that. Maybe he just didn't have the heart to admit his weaknesses, even to himself.

''Hey,'' she whispered, getting out of the warm covers. YN tiptoed over to Coriolanus' side of the bed, careful not to bump into anything in the dark. ''Hey, wake up. Are you okay?" she asked, gently shaking him awake.

Coriolanus jolted upright, his eyes wide with fear as he gasped for breath. He wasn't; of course, he wasn't. Yn would have lied if she said she didn't find it hot to see him like this—sweat glistening on his forehead, his chest heaving.

''You were having a nightmare again.''

He looked at her with the eyes of a lunatic, still not over his dream. ''What did I say this time?"

''You were mumbling something about birds and songs, I think? It didn't make much sense."

He doesn't recall that she mentored the 10th game too. Without much success, of course, but one thing she did remember was a girl from District 12 who liked to sing. Coriolanus remembered her too; it was evident from the fear that crossed his eyes.

''Excuse me,'' he said, his voice still shaky. ''I need a moment.''

YN watched as he stumbled towards the bathroom, his hands twitching. As much as her husband wanted to hide those parts of himself, he couldn't. Not from her.

There was nothing else to do but wait. YN climbed on the bed, turning her back to the bathroom door. Coriolanus would only come out when he thought she had fallen asleep. She learned to control her breath when she was just a little girl; it saved her life once, when a rebel pointed a gun at her small frame, meaning to shoot. He didn't—what use was it to waste a bullet on a non-breathing child?

Surely, after some time, the blonde man stepped out of the bathroom. For a few minutes, he listened to her steady breathing before sliding under the covers and pressing his body against hers, his large hand covering her shoulders. Coriolanus wasn't gentle; YN wasn't sure he knew what the word meant anyway, but he was careful. His arm around her chest wasn't tight—just enough for him to bring her closer.

As much as YN wanted to turn around and face him, she didn't. There was no point—like any other human, he hated the feeling of vulnerability. Instead, YN focused on the warmth of his body. Coriolanus Snow was a god more than a human, and real gods were never kind. The only currency they recognized was blood.

-

The annual party for the victor of this year's games. The first year Coriolanus Snow worked as a head gamemaker, his creation was a bloodbath, a spectacle of violence and despair. He did a good job—an excellent one, even—and one of the greatest stars of today's celebration was him.

They needed to dress the part in clothes that exuded power. And so they did. Coriolanus's suit was ample—purple velvet with gold embroidery—the colour of Roman emperors. The colour of the winners. The suit hugged his broad shoulders perfectly, suiting his white hair. Gold cufflinks, gold rings—he looked like a sovereign among men. It was risky to do so right in front of the current president, but who was Coriolanus Snow if he was not confident in his success?

YN wore the gown from the matching collection, a floor-length masterpiece. The deep purple colour was a stark contrast to her skin tone. And jewellery, of course—she came from the Fabius family for a reason. The lavender diamonds on her necklace and earrings. They were rare—the rarest—even. Only a few violet diamonds have been mined in the past seventy years.

It was all anyone talked about behind their backs. Whispers, rumours, and so much venom dripped from the mouths of Panem's elite—that's what they were hoping for, anyway. The Snows were just as shamelessly rich as they were powerful.

That's why they now sat at the President's table, just a few faces away from them. Coriolanus smiled to himself - not even the President's wife could compare to YN. Not in fashion, not in elegance. He had an impeccable taste - even a person far away from politics could see that.

''A toast!'' the President stood up with a glass in his hand, turning to face the Coriolanus. ''I am sure many of you know who was the mastermind behind the games this year - it's my pleasure to introduce Coriolanus Snow to those of you who don't. However, not many know his story of success. From a dirt-poor background, when his greatest possession was his family name, he worked hard to achieve the position he holds today. Let us raise our glasses and celebrate his remarkable journey to success and the country of Panem - the land of opportunity!''

YN cursed under her breath as she listened to the crowd cheer for her husband. He remained stoic - the only thing that gave away his fury was his eyes - they grew as dark as the sky outside. She didn't bother to calm him - this fire was impossible to put out. The President made a fatal mistake with his speech - she knows. But the true fear crept into her heart when she saw the President's wife pass Coriolanus the dish.

Cabbage.

Under a fancy sauce, it could be transformed into a delicacy fit for their circle. But tonight, it was his last straw. The colours changed on the face of Coriolanus, from white to all shades of red. His fists clenched, and veins pulsed on his temples. The room fell silent as they observed.

''Oh, I am so sorry,'' YN chipped in. Quick, something. ''I have a terrible allergy to cabbage.''

The President's wife looked concerned. ''Oh, I didn't know.''

YN made her eyes water, throwing a coughing feat for more dramatic effect. ''I think I need to step outside for some fresh air."

She felt a warm hand on her back. ''Let me accompany you, just to make sure you're alright." her husband announced, carefully leading her towards the exit.

-

The first thing he did when they reached the women's bathroom was break the mirrors in a fit of anger. Shards of glass scattered across the floor as he paced around the room like a caged animal. YN watched as shouted and hit the walls, sitting on the bathroom floor. Beautiful one - the tile was a lovely shade of pink, contrasting with the chaos unfolding before her.

After a good few minutes, he finally calmed down and sank to the floor beside her, his face buried in his hands. Her husband, her hauntingly beautiful, pathetic husband - oh, what a sight. He looked mad, maniac, even; his blonde hair was far from its usual perfectly styled form, falling on his tear-stained cheeks.

"What do you think of me?"

His voice is hoarse, a few notes down from a honey-like. She likes it better, YN thinks - nothing of the fasçade he was trying so hard to uphold. No, just a raw hunger with a mix of equally raw despair.

"I think you are an animal, Coriolanus."

She smiles, watching his expression change. He suspected it, of course - her husband was a smart man. Still, he can't believe it - his head twitches in her direction, his gorgeous bottomless eyes shining under the weak light of the only surviving floor lamp.

"What?" he asks with such a loss in his voice YN has to fight the urge to bring him close. Not now, she thinks. It's not the time.

"A hungry, desperate, sick, sick animal with nothing to lose."

Coriolanus gets closer abruptly, clearly angered - she can't let him leave now. His arm shouts to find its place on her neck, long, slim fingers forming a circle around her throat. "You think I am after money, don't you?"

"No, no," a yelp escapes her lips, bordering a hysterical laugh. "Only fools are after money, Coriolanus, and you are no fool."

YN watches as he loses his grip a little, calmed by her words. What a pitiful, fascinating creature was her husband - one word of reassurance and he is willing to let thousands of cursings slide.

"What is it, then? What did you fantasize about in your small dull head?"

He still doesn't believe her. YN is surprised at how quickly it becomes boring.

"You want power."

Clap - the grip on her neck is tight again.

"That's why you choose the fear. People forget the hand that feeds them, but the one who beats? Never."

The frown on his face falls a little, and through the gritted teeth escapes something like a curse. "You talk an awful lot about me," he notes. "What are you hungry for?"

"You."

He laughs. That was a deep, chest laugh - YN thinks she never heard him laugh so sincerely. "You want my love? Don't lie to me, YN," he taunts, pressing a little harder on her neck.

"Not love. Love is easily swayed, is it not? No, I want you."

Coriolanus looks at her as if he never done so before. Well, he looked thousands of times, but he didn't see. His eyes study every expression in hers, every part of her face. "A hungry dog is not a loyal dog," he finally masters.

There is a certain silence after his words. YN gulps, desperatly trying to help her dried throat - the blood from his hands ran down her neck onto her exposed chest, leaving sticky, dark trails behind.

"Feed me, then."

He kisses her. He puts a force behind it, watching her hands fall on his chest for some kind of support. Coriolanus kisses her until there is no air in YN's chest anymore, and she has to push him away to take a rushed breath.

They were going to be just fine.

After all, they both never bet on losing dogs.

#imagine#coriolanus snow#coriolanus x reader#coriolanus x you#tbosas#young!coriolanus snow#coryo snow#hunger games x reader#coriolanus snow x reader#coriolanus snow x you#coriolanus snow fanfiction#president snow#coriolanus snow imagine#the hunger games#the ballad of songbirds and snakes#young coriolanus snow#corio snow#character x reader#character x you#character x y/n#tbosas x reader#tbosas x you#fine as fuck

2K notes

·

View notes

Note

Hi!! I just wanted to say that I love the way you write Optimus in your AU’s❤️❤️❤️ And I specially love the concept of your \\Decepticon Optimus AU\\ PLEASE PART 2 PLEASE PART 2 PLEASE PART 2 PLEASE PART 2

I’ll start drawing fanarts :D

Congratulations. You have bought my services with the offer of fanart. Here you go mate, more Decepticon Optimus (~ ̄▽ ̄)~ I've actually been wanting to write this for a REALLY long time, but I just never thought anyone was interested. That said, take a bit of a Starscream POV in preparation for a proper continuation of this thing.

Previous part here.

━━━━━━ ⊙ ❖ ⊙ ━━━━━━━━━━━━ ⊙ ❖ ⊙

Starscream served Megatron because it was what was best for his people. There was indeed a lot of personal investment in the choice as well. After all, with how high he was in the ranks, if Megatron fell, he would have a solid chance to take control of the army so long as Tarn or Overlord didn't fight him too much for it. It was simply the best decision when the alternative was following the Autobots and having to deal with their roots in the Senate. While it was a difficult decision to join up with a rebel force, after Vos burned, it was only right.

War was a torment, one that Starscream only endured because he had his trinemates and fellow citizens of Vos by his side. Despite the comfort Skywarp and Thundercracker offered, there was always something missing for Starscream as the war dragged on. All his fellows were focused on the goal to the point of everything else being drowned out. They stopped seeing the point of it all for the most part and largely fell into the haze of conflict with no regard for the place where it all began. The common soldiers just wanted to survive, the officers wanted to rise through the ranks, and the rest were loyal to Megatron more so than what they fought for.

Admittedly Starscream fell amongst them when things got stressful and his place became threatened. However aside from those moments, he was contemplative, often trying to remember WHY they fought rather than focusing himself too much on the conflict itself. That was not to say he held no grudges, no he held them close to himself with a degree of glee. But he desired companionship from someone more... neutral in a sense. He wanted someone to understand where he was coming from and preferably be in a position that Starscream would still have influence over. He couldn't have his greatest fears and insecurities being held but just anyone after all.

Then as if answered by Primus himself, Starscream stumbled upon a fascinating mech who was quick to catch his attention. Right off the bat he looked the part of a Decepticon. Black plating with red tinted windows and optics, a huge axe and blaster as his weapons of choice, and a reputation for valuing logic over emotion. Even his designation matched the embodiment of Decepticon values. Nemesis was quite the name for a mech who hardly managed to rise above the rank of a private. However those traits were not what caught Starscream's attention. Rather it was the fact that Nemesis's behavior was so out of the ordinary and yet perfectly in line with Decepticon standards as to be concerning in a sense.

There were pages upon pages of reports detailing Nemesis's presence being crucial for morale. Never did the mech win any ground for the Decepticons, but he also never lost any. He was supposed to be a mid-ranked ground officer just there to keep the troops in line. And yet he was beloved by countless soldiers, as shown in their written reports. How did such a cold mech with such an intimidating frame and name get so popular amongst the troops? Mecha on opposite ends of the planet knew his designation, at least amongst Vehicons. It was strange, so strange in fact that Starscream found himself paying the mech a visit during a routine check of the area.

Visiting out of pure curiosity yielded increadible results as Starscream observed Nemesis in action. The mech forever wore his mask and seemed almost unsure how to reply when presented with a situation that required emotions. However he somehow managed to be a comfort to those he served with while battling with ferocity that Starscream found vaguely familiar but more so striking. Nemesis was fascinating, and more than that, he was kind. It was silly and a spur of the moment decision, but he stole Nemesis away from his division and had the mech placed under his direct supervision.

Nemesis for his part took the change with grace, but Starscream quickly noticed more and more oddities surrounding him as time passed by. Often the emotionally unstable mecha Nemesis took to comforting simply vanished a short while after his conversations with them. On records they were labeled as deserters, but Starscream saw that they were being aided by the far too kind Decepticon he'd taken under his wing. Nemesis was quiet, he didn't cause any trouble and largely kept to himself. And yet so many odd things happened around him that Starscream couldn't help but keep him around and not report him. Why would he turn in this great source of potential entertainment and comradery? Was it a risk? Yes. But he had his trine and he was sure he could blast one mech into oblivion if need be. Besides, the mecha who vanished were never of importance. If Nemesis had a thing for killing a few foot soldiers every now and then, he certainly wouldn't be the first of his kind.

One by one more oddities became clear and Starscream had a grand time watching them unfold. It was like his personal reality holodrama as he observed Nemesis wandering around befriending every last Vehicon and seemingly unknowingly earning their collective loyalty. He didn't seem to be aware of the fact that half of the Decepticon army regarded him fondly due to his association with the Vehicons, but if he did, he certainly never abused it. He learned the names of every Vehicon, treated them kindly, and in his gruff way even helped them get out of trouble. It was... a welcome relief from the cruelty Starscream saw regularly. The desire that led him to search out someone more neutral for companionship only grew as he continued to keep an optic on his little pet project.

Such an interesting mech he was. Eventually Starscream couldn't help but ask.

Starscream: Why do you bother with the Vehicons? They are clones, expendable soldiers.

Nemesis: No one is expendable. Every life is sacred. Is that not why we fight for freedom? So that all might enjoy their right to life?

Starscream: But why do you not try and rise through the ranks? You have the combat and strategic skills to do so, and yet you have never once tried to rise above the rank your service under me gave you.

Nemesis: I have personal reasons for wishing to not garner the attention of Megatron and his inner circle. But aside from that, I simply do not care.

Starscream: And why is that? You fight for us, you have bled for us. How can you say it does not matter?

Nemesis: My history is long and complicated my Lord. I have seen horrors and I have no desire to be the one giving the order to inflict more upon others. I am here to protect those I care about. That is all.

Starscream: And here I thought you were known for being cold and calculating.

Nemesis: There is a time and a place for all things.

After their conversation, Starscream only became more fascinated by the mech who embodied the Decepticons in frame and reputation and yet seemed more and more like an Autobot the more time passed. Nemesis was, in his own strange way, a bit like a stray cyber-feline. Starscream had to earn his trust, and he did so by simply not ratting Nemesis out when he finally caught the mech smuggling younglings across enemy lines. Whether Nemesis knew he was there or not was up for debate, but watching the cold and gruff mech run younglings into neutral territory and pass them off to mecha preparing to go off world had Starscream confirming that Nemesis was a good individual at spark.

For vorns Nemesis served under him, trying and largely failing to be stealthy when smuggling younglings out and creating distractions for Vehicons to escape punishment. Such a kind spark hidden behind layers of a grim persona. Starscream couldn't help but assist every now and then. He made sure not to make his intervention obvious, but Nemesis started to treat him with greater familiarity the longer they worked together.

By the time Thundercracker and Skywarp fell in battle, what began as a simple attempt to be amused and to search for someone to remind him of the purpose of their war turned into a proper friendship. Nemesis covered for him and did a great deal of planning and order issuing on his behalf while he grieved. And when he was too out of sorts to do anything more than lay on his berth uselessly, Nemesis came by with an energon cube and took care of everything. The kind Decepticon warrior was there for him throughout all of it, even dealing with his rages and outbursts. Starscream would never say so aloud, but he appreciated the patience shown to him more than anything else. Nemesis never yelled at him, never so much as grabbed him harshly, and even when Starscream was breaking things in his grief and rage, Nemesis was there to calm him down with soothing words.

It was never meant to end with Nemesis becoming his dear friend, but by the time Starscream was at last able to handle the loss of his trinemates, there was no going back. Nemesis was his friend, his companion, and his stable foundation amidst the storm of war. It was almost impossible to tell how Nemesis really felt about him, but considering the mech never tried to climb the ranks or leave, Starscream assumed the feeling was at least somewhat mutual. It certainly helped that Nemesis's distractions kept Megatron's wrath from falling on Starscream's helm.

Once Starscream could confidently call Nemesis a brother, he did not care for the increasingly suspicious behavior the warrior engaged in. He trusted that if it were important, Nemesis would talk to him about it. Thus whenever his friend vanished for extended periods of time, Starscream allowed it to be. He was horribly anxious whenever Nemesis up and dropped off the map for stellar cycles at a time, but much like a stray cyber-feline, he always came back and always with something or other as a gift. Part of Starscream feared that Nemesis was a traitor who merely wanted his trust for information gathering purposes, but without his trine, he refused to think about it. Until Nemesis proved himself a traitor, Starscream would continue to treat him as a brother.

He covered for Nemesis's vanishing act, he helped the Vehicons in his absence, and whenever his brother returned, Starscream relished in the attention offered. Nemesis was never a very touchy mech, but soft shoulder touches, tender aid in wing cleaning, and gentle words were more than enough for Starscream. He cherished it all and fought to keep Nemesis with him viciously when it came time for the Exodus to begin.

But that of course was when everything fell apart.

Starscream had a plan. He already filed the paperwork, prepared appropriate documents, and convinced Megatron to allow him to keep Nemesis with him as they took to the stars. He was ready and fully willing to jump through whatever hoops were needed to ensure that Nemesis remained by his side. Then, just like that, Nemesis was gone. One sentimental conversation under the stars later, Nemesis dropped off the map leaving only a collection of files and a note at his desk. The world itself seemed to shatter around Starscream as he read the note and flew faster than he ever had before. He couldn't lose Nemesis, not after he lost everyone else.

Starscream wished it was just a horrible nightmare when he finally found what remained of his brother in arms. He screamed and begged as he tried in vain to fix the damage done to the lifeless frame before him. However when all was said and done, he could only hold Nemesis's body in his arms and weep. The note said that Nemesis was simply tired and that it was no one's fault. Starscream believed him, Nemesis was not one to outright lie. And yet he couldn't help but lament the fact that his brother never told him of his woes. Starscream would have helped, he would have made things better if Nemesis had only asked it of him.

He would have made things right.

He buried Nemesis's body under the open sky and stayed for a whole cycle just so that he could pretend that he and his brother were merely admiring the stars above in silence. When he returned to the Decepticons, his spark ached with loss, but was also hardened in certainty. The war had taken everything from him. His people, his trine, and now the kindest Decepticon he'd ever known. He wasn't exactly sure why his anger over the event came to be pinned on Megatron, but it was. Nemesis, his trine, and so many of his kind were dead because of a foolish war Megatron had yet to win. The competitive desire to take control for personal gain warped into a desperate need to have absolute authority. He needed to make things right, to ensure that the foolishness came to an end.

It hurt still, so his arrogance increased to cover for it. His spark wept, so he pulled away from others. The only one he ever really tolerated was Knockout, and that was merely because he was a neutral deep down. There was no loyalty in his spark, and Starscream appreciated that amidst the sea of diehard Megatron followers. He needed control and he needed it desperately. But of course that need led to punishment, and Starscream could only flounder to stay alive without anyone there to back him up.

Then things changed again.

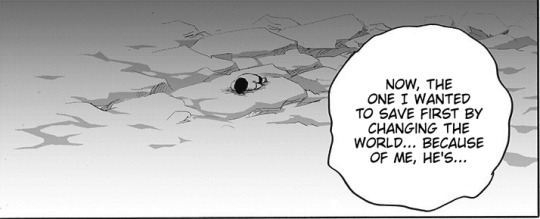

Vorns spent grieving those he lost came back to haunt him one the battlefield when Optimus Prime of all mecha stood in front of him and stopped a hit from Megatron from reaching him. The Prime looked livid. Why though? Why did the other big player in the ridiculous war they were embroiled in care for one lone seeker, one who had the energon of thousands on his servos? It did not make sense, but pieces began to fall into place as time wore on and Optimus kept defending him. Aggression and anger never before seen in the Prime always showcased itself whenever Megatron tried to touch Starscream or the Vehicons. Optimus would even wield an AXE when he fell into the strange cold rages that always ended with the Prime changing his fighting style completely.

Starscream did not wish to believe it. He couldn't believe it. And yet as he observed more and more, he couldn't help but see the similarities. A bulky frame that had the indicators of magnetic attachments to allow for more armor to be installed. A thick battlemask and heavy set pedes that offered protection from any and all hazards. Large black servos covered in scars carrying a familiar red axe that Starscream knew like his very own wings. It shouldn't have been possible, and yet every time the Prime stopped a hit from landing on him, Starscream couldn't help but see it.

Optimus Prime and Nemesis were related. Somehow they were tied together, and with every uttered word the Prime threw out on the battlefield when rushing to his defense, Starscream only became more certain. How? He did not know. But through whatever means, Optimus Prime had either acquired the attention of his brother while he still lived, or more likely WAS Nemesis in some form. It seemed so obvious looking back, but as Starscream fled the battlefield, he made a decision. In the quiet of his quarters, he opened a commlink to the one mech he thought he would have preferred to see eliminated in fire and smoke.

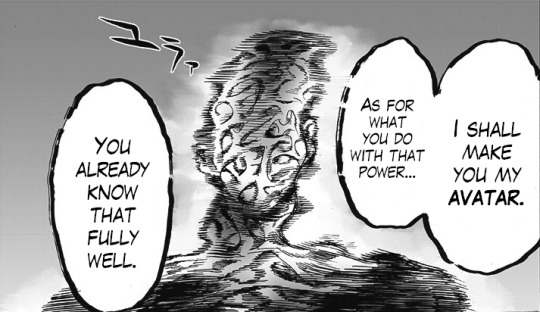

Starscream: I don't know how you did it or if it is even you... but if you knew Nemesis, or if he is in there somewhere... please let me hear him again.

Optimus: ...

Starscream: I stopped caring about this fragging war long ago. Just let me hear my brother's voice again. Let me know he's still there, if only as a memory.

Optimus: ...

Starscream: Please, just this once, let me hear him.

Optimus: ...

Optimus: I am here, and I am sorry I had to leave you for so long.

#transformers#maccadam#transformers prime#optimus prime#starscream#decepticons#decepticon optimus#nemesis prime#alternate universe#secret identity#undercover au#starscream and optimus friendship#I will live and die on that hill when its in the right scenario#I think its cute aight?#anyway here is the alternate POV of this au before I get on into the main meat of it I suppose

120 notes

·

View notes

Text

Coming of Age; The lessons in immortality and moral high grounding

The longest meta often starts with the tiniest thing.

One thing in Cosmic Garou's design is an interesting one to note.

Long ears.

It's not only demonic, but elvish as well.

It is by no means accidental, because elves who in popular culture posses such long ears, often denote long life, vitality and immortality.

I'd like to borrow something I found from quora, from Douglas Adam's Hitchiker's guide to galaxy. An answer to question:

Do the Elves in Tolkien’s mythos ever go insane from living too long? Do any of them resent being immortal?

I think this topic is covered very nicely in Douglas Adams' book “Life, the Universe and Everything - Wikipedia ”, the third book in his five book trilogy “The Hitchhiker's Guide to the Galaxy”:

Wowbagger the Infinitely Prolonged was-indeed, is - one of the Universe's very small number of immortal beings.

Those who are born immortal instinctively know how to cope with it, but Wowbagger was not one of them. Indeed he had come to hate them, the load of serene bastards.

He had had his immortality thrust upon him by an unfortunate accident with an irrational particle accelerator, a liquid lunch and a pair of rubber bands. The precise details of the accident are not important because no one has ever managed to duplicate the exact circumstances under which it happened, and many people have ended up looking very silly, or dead, or both, trying.

Wowbagger closed his eyes in a grim and weary expression, put some light jazz on the ship's stereo, and reflected that he could have made it if it hadn't been for Sunday afternoons, he really could have done.

To begin with it was fun, he had a ball, living dangerously, taking risks, cleaning up on high-yield long-term investments, and just generally outliving the hell out of everybody.

In the end, it was the Sunday afternoons he couldn't cope with, and that terrible listlessness which starts to set in at about 2.55, when you know that you've had all the baths you can usefully have that day, that however hard you stare at any given paragraph in the papers you will never actually read it, or use the revolutionary new pruning technique it describes, and that as you stare at the clock the hands will move relentlessly on to four o'clock, and you will enter the long dark teatime of the soul.

So things began to pall for him. The merry smiles he used to wear at other people's funerals began to fade. He began to despise the Universe in general, and everyone in it in particular.

"So, Elves, having been created immortal, would live happily in Valinor until the end of time. Humans, if they had been granted their wish of immortality, wouldn’t know how to cope with it."

Elves are naturally immortal; like the Ainur, they are bound to Arda until its End. Elves are immune to all diseases, and they can recover from wounds which would normally kill a mortal Man.[1]:218-9

Nonetheless, Elves can be physically slain or die of grief and weariness.

Saitama denotes all the signs of immortality as well, yet his body is still human, because he stubbornly clings to his humanity. And so his body is still capable of dying.

So in this, Garou's story and one of the themes in OPM is a coming-of-age, where Garou matures enough to realize the cost of attaining such power and takes responsibility for his actions.

Of growing and becoming an old and weary soul, of having your loved ones die before you.

That's why he chose to not remain so and chose to go out in his own terms and not linger around trying to find redemption. Otherwise he'd just become insane.

Humans, when immortality is thrust on them, would not know how to cope with it. There is one being that would know this fact better than anybody else. The one who imposed those limits on humankind.

Yet said being is actually already dead but stubbornly clinging to a human-resembling form and takes the identities and forms of other people because it has none of it's own. Or perhaps it resents itself and so hides behind a facade.

Makes you think who could have killed such a being and locked it away behind a dimensional barrier. If not himself.

So in the cruellest way possible, Future Garou learned an important lesson; not to dabble with powers he does not know to justify being moral police. The consequences are too severe.

That's why he only got a mere fraction of the power and why he was allowed to go out on his own terms. So the lesson will stick harder when it becomes apparent that he's not out of the woods yet. Because he's definitely not allowed to live a long life no or become immortal in the mortal world.

OPM God could have taken his life, yet he did not.

We're really making assumptions here that how long Garou spent touching God's hand is the reason why he got only a small portion of his powers imparted to him.

Instead of OPM God choosing to only impart him with a small fraction.

Or that the gesture itself is entirely meaningless in the grand scheme of things; that the true meaning of taking God's hand is accepting, wanting help and willingness to take that power and touching the hand makes the contract more binding when the person is manipulated to follow through with thinking of it as moral obligation.

It's not like he has to tell them what to do with the power, after all, their own moral code will make certain that they do exactly as he emotionally manipulates them to confidently act.

Like a puppet chessmaster, the space moral police lawyer. Also known as Advocate.

They'd still be a puppet, even if they have free will, when they get manipulated into thinking that they can justify their current actions. And why such manipulation is so hard to shake off by telling them they're being controlled, because their own hard convictions lead them on.

Being able to take the moral high ground, when one has so many problems with society's moral values and everyone else's values one deem bad, is a helluva drug indeed.

(Nice parallel btw)

If it's not apparent, Garou is not the only one who got taught an important lesson that will stick.

Don't take the moral high ground and flaunt that power imbalance. The consequences are too severe. The resulting ignorance and superiority complex are not worth it.

Being able to justify anything one does on the cognitive side is only fooling oneself into becoming a hypocrite.

Consider using heart and empathy instead.

--

So what did we learn about chasing and gaining power, attaining immortality and moral high grounding?

Fucking Don't. Don't fucking do it. Because at the end of the day, people still have to accept responsibility for their own actions if they're to be an actual mature person. Physically and mentally.

The higher moral ground one takes, the harder will be the fall when one slips off the edge.

Oh and the inner critic, Big Brother, is watching, with a magnifying glass in hand.

--

(Funny how your own metas make you sound like a bloody hypocrite huh? There is a lot of power in written and spoken words too. It certainly does make one consider. That's how you know ONE's writing is super-effective. Preach.)

Edit: You know it's kind of creepy when I write this shit for multiple hours, post and then I come back and see ONE has posted an omake in Mob Psycho about the same fucking thing.

Well, I fucking guess I'm on the right track with the theme he wants to tell ppfpfpf. Preaching without action or empathy is just being a dumbass hypocrite.

#opm#one punch man#opm meta#garou#opm god#saitama#fubuki#elves#immortality#coming of age#moral high ground#maturity#long

29 notes

·

View notes

Text

@triviallytrue, @headspace-hotel

Re: this: I can't reblog the post, but "pre-Columbian North American giant wild bison herds had a similar total biomass to modern North American grazing cattle herds and converted grass to animal tissue at a similar rate" doesn't seem obviously silly to me.

Biologically, cattle are basically just more docile bison. Human selective breeding has probably made some difference to how much metabolic resources domestic cattle invest in growth vs. everything else, but cattle and bison are physiologically and structurally very similar organisms and meat is already a large percentage of a bison's mass, so I doubt it's an orders of magnitude difference. It's not like fruit, where you can easily selectively breed the plant to grow orders of magnitude bigger fruit.

There is the factor that with domestic cattle you can feed them stuff that isn't wild grass. You can feed them irrigated farmed animal feed crops extensively selectively bred for high yields that grow in monoculture fields with no competition and have their own growth supercharged by commercial fertilizers full of mined phosphorus and Haber process nitrogen etc.. That might make an orders of magnitude difference. But I have the admittedly vague impression that while modern cattle-raising does involve a significant amount of stable feeding with animal feed crops or agricultural waste, it also still involves quite a bit of basically just letting the cattle walk around the landscape and eat grass.

It's worth noting that there is at least one major biome where basically industrialized hunting is still a major modern food source for humans: the ocean. It doesn't seem crazy to imagine the same approach might work in terrestrial contexts; the oceans and the land have similar total productivity and the land is significantly more productive per average square kilometer. On the flip side, it's also worth noting that modern fishing isn't exactly a glowing model of sustainability and even there we're seeing a switch to aquaculture.

Like, I doubt "return the land to the bison and then industrially harvest them the way we harvest ocean fish" would actually be a good idea (or what Headspace Hotel actually wants to do), but it actually isn't obvious to me that it would be orders of magnitude less land-efficient than modern cattle ranching, at least in terms of meat production (a major advantage of cattle over wild bison is you can milk cattle, but we're talking about meat, so that isn't very relevant).

Now I wonder to what degree modern San Franciscan office workers eating way more meat than tenth century Chinese peasants has more to do with improvements in transport (railroads, trucks, motorized ships), food preservation (canning and refrigeration), weapons (guns and railroads enable agriculturalist states to conquer semi-arid nomad country and turn it into export-oriented meat factories), and the efficiency of specifically chicken production than with a general increase in the land efficiency of meat production.

Aside: I have no idea how realistic it is, but "basically treat bison the way we treat fish" gives me a mental image of giant vehicles that drive around the Great Plains to run down herds of bison and pull them in for efficient industrial slaughter, dismemberment, and packaging; basically exactly how fishing boats work, but on land! Giant vehicles roaming steppes and gathering up big wild herbivores for on-site slaughter and processing might be a neat idea for speculative fiction!

29 notes

·

View notes

Text

72 seconds of non-data entry mode to ramble something

I am doing data entry and I need to take a break for a moment.

Here is your irregular reminder that you do not build wealth investing -- you grow wealth (or if you do not have wealth, then money) with investing.

This is an extremely overlooked and unfucking believably important difference.

You should only invest the cash you are comfortable saying good bye to for years, and possibly forever, should everything go to hell with your stock picks (or significantly preferably: your fund picks that track an index, industry, etc.)

If you do not have money like that, then you should invest in a high-yield savings account that is FDIC insured (study these terms at nerdwallet or similar)

If you do have money like that but are not comfortable, see above

I see so many goddamn fucking "you should invest if you want to retire someday"

(waves hi from 2008 financial crisis still affecting the world today)

It should be:

You should take care of your day-to-day

You should structure non-housing debt as much as possible so the highest interest rates (typically credit cards) are paid off as possible

You should keep an eye on who is charging you monthly fees and seek to minimize them as much as possible on all levels -- if you are charged a late fee continuously for XYZ bill, is there something you can do to alter this? -- even if it is a small fee

If you have a mortgage, as possible, you should factor in 1 extra payment per year (1 month of payment divided by 12 = the amount you add to your monthly payment explicitly and exclusively to the principle)

(-- if you cannot do this due to finances and/or your bank does not allow you to, then take this amount and put it into a high-yield savings account every month so it grows in parallel to your mortgage, and can be tapped someday to pay off the balance, when savings = said end balance)

etc.

and advice should always include regular reminders the system is rigged to benefit you when you have cash and break you when you do not

and so the times when you do not are extremely unlikely to be a moral or ethical failing

i.e.

any guilt you feel over this is very likely a result of various market and marketing forces to make you feel like shit in order to

drum roll please

make someone else money because

drum roll crescendo

the system is rigged to benefit those with cash

protect yourself financially + mentally

guilt is not profitable to your personal financial situation

okay back to work I've gotta data entry now

3 notes

·

View notes

Text

Best Sugarcane Juice Machine Manufacturer

When it comes to best sugarcane juice machine manufacturer, one name that stands out as a beacon of excellence is Bharani Engineering. With a legacy of innovation, quality, and reliability, Bharani Engineering has cemented its position as the best sugarcane juice machine manufacturer in the market. Whether you are looking to start your own business or upgrade your existing juice business, Bharani Engineering offers a wide range of sugarcane juice machines to suit your needs.

Choosing the Best Sugarcane Juice Machine Manufacturer?

And Why Thats Bharani Engineering!

At Bharani Engineering, we understand the importance of quality and efficiency in sugarcane juice extraction. That’s why we have developed a range of sugarcane juice machines that are not only easy to operate but also deliver high-quality juice with maximum yield. Here are some reasons why Bharani Engineering is the best choice for your sugarcane juice machine needs:

1. Wide Range of Options

We offer a variety of sugarcane juice machines to cater to different needs and preferences. Whether you need a highway model sugarcane juice machine for a large-scale operation or a compact table-top sugarcane juice machine for a small business, we have got you covered. Our machines are available in electric, petrol, and diesel-operated options, ensuring that you can choose the one that suits your requirements.

2. Superior Quality

At Bharani Engineering, we prioritize quality above everything else. Our sugarcane juice machines are built to last, using the finest materials and cutting-edge technology. We conduct rigorous quality checks at every stage of the manufacturing process to ensure that our machines meet the highest standards of performance and durability. When you choose Bharani Engineering, you can be confident that you are investing in a top-quality product.

3. High Efficiency

Efficiency is key when it comes to sugarcane juice extraction. Our machines are designed to extract juice from sugarcane with maximum yield, ensuring that you get the most out of your raw materials. With Bharani Engineering’s sugarcane juice machines, you can expect high productivity and cost-effectiveness for your business.

4. Excellent Customer Service

At Bharani Engineering, we believe in building long-term relationships with our customers. We provide excellent customer service, assisting you at every step of the buying process and beyond. Our knowledgeable and friendly team is always ready to address your queries and provide timely support whenever you need it. With Bharani Engineering, you can expect a hassle-free experience from start to finish.

Conclusion:

When it comes to finding the best sugarcane juice machine manufacturer, Bharani Engineering is the top choice. With a wide range of options, superior quality, high efficiency, and excellent customer service, Bharani Engineering has established itself as a leader in the industry. Don’t settle for anything less than the best – choose Bharani Engineering for all your sugarcane juice machine needs.

For Enquiry Contact: 094452 78623

Our Website: https://bharaniengineering.com

#sugarcanejuicemachine#sugarcanejuicemachines#sugarcanejuice#sugarcanejuicemachinemanufacturer#sugarcanejuicemachineshop#sugarcanejuicemachineprice#sugarcanejuicemachiness#sugarcanejuicemachinethingy#juicebusiness#juicebusinessideas#karumbumachine#karumbumachinemanufacturer#karumbujuicemachine

0 notes

Text

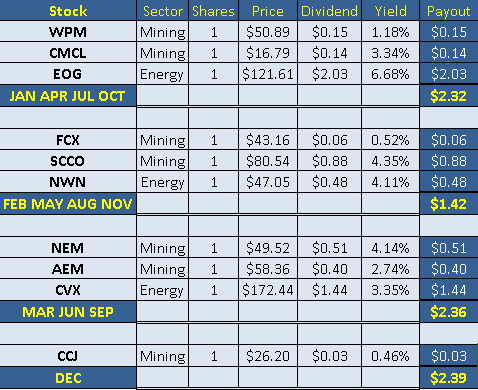

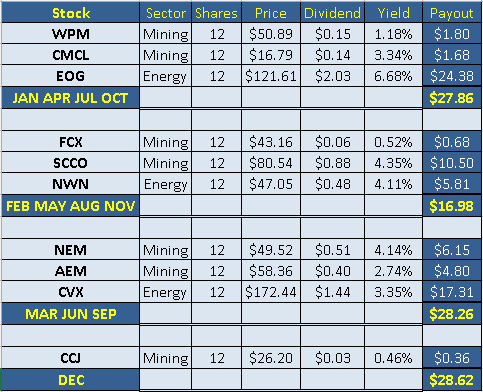

A Starter, Commodities heavy portfolio for 3.09% dividend yield income.

Just for fun, let's assume you had invested in some earlier dividend stock suggestions. You'd have a starter mining and energy portfolio that paid you every month. Let's take a deeper look at how such a portfolio might appear if you were to buy just one stock of each.

Note that I'm using current yields and prices as of the writing time for this. For reference, the date is April 16th.

Here's how our portfolio appears in a spreadsheet:

Right away we can see that this isn't a get rich quick scheme and that this isn't market trading or timing. It's patiently investing long haul for passive income. We get a safe 3.09% average dividend yield in an undervalued sector during uncertain times. You might even call this contrarian investing.

If you were to buy one of every stock at once the total cost to you would be $640.36. With dollar cost averaging and patience you could build this portfolio over time and the pay days would begin to add up. Suppose that's still too much to invest all at once. Well, let's break it down by quarter.

For January, April, July and October, the total cost to buy one of each stock at market price is $189.29.

February, May, August, November the total cost is $170.75.

March, June, September the total cost is $280.32 and December is just $26.20.

If expendable income is short and that's still too much, you could still do a few things because you want to buy your stocks as cheap as you can get them.

First, you could wait for the market drops. The saying "buy low, sell high" is true. However, it's easier said than done for many new investors as emotions fight against buying a stock going down in price. By researching the ex dividend date, the stocks tend to drop as the money for the payouts are set aside so planning to buy on that date might help because it's an expected dip.

The second thing you might consider, is making a plan to buy one or two targeted stocks at a time when they are affordable, spread out across your portfolio. Keep track of what you have and what you want. Then again, perhaps just buying using set price limits is easiest.

Also, we aren't chasing large dividend yields because when it comes to dividend yields, bigger isn't always better and it certainly isn't the only consideration.

The monthly payouts might look pretty meager and they are. At first. Let's assume you keep this up and buy one of each stock every month, and everything else remains about the same. At the end of that year you would have 12 of each stock and our portfolio might look like this...

Then, after 5 years and no portfolio rebalancing or selling...

As you can see, this passive income stream is starting to get better. Especially considering that gold, copper, uranium, oil and gas probably won't become utterly worthless in the foreseeable future.

I hope this concept is helpful. As a young man starting out, I was working multiple minimum wage jobs while going to school and trying to figure out how to get ahead. There were few resources to learn from about wealth management and wealth building at that time. It was pretty disheartening to spend that last $5 to have enough gas to get to work for the rest of the week. It also meant no eating for the last 2 or 3 days until payday and certainly no emergency fund. You do have an emergency fund don't you?

Admittedly, there were naïve mistakes with money until experience and self-discipline got the financial boat right side up. Still, you can't get back lost time.

I offer this as a concept to understand dividend investing in hard commodities. I make no outcome promises of any kind regarding investing or these stocks. Perform your own due diligence and speak to your licensed financial advisor before investing. Disclosure, I also own and plan to buy more of all the stocks listed as part of a larger and slightly more diversified portfolio.

0 notes

Text

FREE QUOTE, Better Future through Life Insurance

Right now, just paying bills and providing for your family are top of mind for everyone. Which is as it should be.

The question is, how will the bills be paid and your family’s current lifestyle remain uninterrupted should you no longer be there to provide for them?

Unthinkable scenarios aside, life insurance is a spectacular investment vehicle for long-term wealth building.

But who has the time to conduct a life insurance rates comparison on the best types of life insurance out there with everything else on your to do list?

Life Insurance Quotes, Free & Simple

When online buying disrupted every other industry, life insurance saw the opportunity to not only make purchasing easier but to eliminate what buyers disliked most. High-pressure sales.

Gone are the days of going into an insurance office to haggle with a high-pressure salesman showing you insurance policies you don’t need and can’t afford. We don’t like that any more than you do.

You can instantly access several life insurance companies and their costs from your computer in one place at one time. Your options appear side-by-side so you can easily compare the quotes and features of each carrier.

For free.

It’s only after you’ve looked at the best life insurance options for you and your family that you are offered the opportunity to speak with a non-commissioned agent trusted to act only as an advisor—not a salesperson.

Armed with facts, you drive the conversation. And if you don’t want to speak to an agent, you can bypass that step and buy an online life insurance policy on your own.

Building Wealth Through Life Insurance

Start with Term Life Insurance.

Right now, your budget may be pulled in all directions with day-to-day living expenses as you grow your career and raise your family. Most people are.

Get term life insurance and make a start toward long-term wealth with an affordable term life insurance quote. A small investment of $25 a month for a 30-year term life insurance policy can yield wealth-building dividends later.

Transition to Wealth-Building Whole Life.

Whole life insurance builds wealth for your family with less risk, interest-bearing dividends you can use to invest in your retirement, your children’s education, or real estate. It’s yours to spend however you wish. And it provides lifetime coverage.

But the term policy you buy today can be converted into an investment vehicle down the road. The conversion will require no medical exam or health questions. Just a seamless transition from one policy to another.

Life insurance is so much more than a policy. It’s an investment in your future. And it starts with a tap or two on a keyboard for online term insurance. For free.

0 notes

Text

The Road Ahead 2023 Lets Go

Seduction of pessimism is a common theme these days in market outlooks and commentary from the pundits... perhaps one appears wiser or sounds smarter when prognosticating on imminent or far-off disasters. Everything is veiled or covered in a view where nothing can ever get better, trouble lurks in every corner.

Remember markets are forward-looking discounting mechanisms typically operating on a 3 to 30-month time horizon. Anything longer than that they tend to either ignore or await further data.

So, what do the next 3 to 12 months hold for us...

First, we want to acknowledge that 2022 was a hard year for all of us and I'm proud of every one of our members. You did not panic and commit the cardinal sin of exiting holdings at the lows of the market and so we have seen asset value recoveries of our portfolios from the depths of the bear market of '22.

In 2022 we were off the charts wrong in the timing of the market direction due to geo-political events we did not forecast happening yet our portfolios continued to survive and did not get crushed like so many others who held concentrated holdings in Crypto/ new economy tech stocks / or in the meme stocks... your ability to not lose one's heads when everyone else is losing theirs and is chasing the next new shiny thing is key to the market upside that the future holds.

Every correction or bear market historically has been followed by higher highs. Bear markets are short-term events typically lasting no more than 6 to 18 months... on the other hand, the average investor has an investment time horizon of decades. Hence bears have minimal portfolio impact as long as we stay invested... that said, we at OneNorthStar are always on the lookout to avoid or at least partially sidestep bear markets because even if we sidestep/ avoid one bear market within your investment horizon it will significantly accelerate your return profile to state the obvious.

Onwards to 2023: Look for a 20-30% market return year.

The skepticism towards the market is alluring and many seem to have fallen for it believing we will never recover and even worse days lie ahead. Perhaps they do. However, consider the historic fact that markets have not seen a negative third year of a president's term except for 1938 (WW II) and 1931 (Great Depression). So, history is strongly on our side... even more important along with correlation we have causation on our side also... as the risk of legislation, regulations, and sky-high market expectations all look to have abated.

Legislation risk is minimal because there is perfect gridlock in the US... between the Senate at the hands of the Democrats and the House in control of the Republicans, it's unlikely any meaningful legislation is agreed upon and passed.

Market expectations are close to rock bottom/ quite subdued... hence any upside will lead to a consistent market rally as expectations will be exceeded. Hence in such a calm environment investors and businesses can plan and execute capital expenditures without the overhang of the above issues which in the medium term will lead to higher earnings per share as these capital projects come to fruition and accelerate GDP.

Furthermore, returns are likely to be front-loaded in 2023 in our view as the relief rally continues despite skepticism that this is a head fake or a bear rally, etc.

Let us explore some of the current topics in the news and our view on them:

Debt Ceiling:

In one word, ignore. The debt ceiling has been raised, extended, or revised 78 separate times since 1960. This is political shenanigans/ typical posturing on both sides of the aisle and is not relevant to the market otherwise Treasury yields would have shot up significantly if the market perceived a risk of default. Anytime the market does go down in response to this consider it a likely buying opportunity.

Economy/ GDP:

While they both are not the same, for our current purposes let us assume them to be similar. We do not need a roaring economy or high GDP numbers for markets to perform, just as long as expectations or sentiment are exceeded, the market rips up to price in the upside surprise and today many assume a recession or negative GDP as the base case.

Interest Rates and the Fed:

It feels like they have no idea how many rate hikes they have to do to cool down inflation as the commentary keeps changing in every press release from the Fed on the expected rate trajectory. In our view inflation has peaked... Prices, specifically input prices for finished products are on a downward spiral, be it for metals/ timber/ fuel/ shipping etcetera... And hence output prices should accordingly soften in the coming time window. It's likely the Fed overshoots on interest rate hikes and then starts to cut as it sees the economy soften is our base case expectation.

Job market/ layoffs:

While unfortunate for individuals impacted, we still see tightness in the labor market in many sectors (healthcare, leisure, etc.) so wages and hence earnings may be impacted by this and is a risk worth monitoring.

Dollar strength/weakness:

The recent trend of a strong dollar should reverse as worldwide economies show strength or are above market expectations coupled with the Fed slowing or stopping its rate hikes. This may allow non-US stocks to outperform relatively and is an allocation decision we will act on potentially.

So, what does all this English mean for your portfolios, and your financial objectives?

A recession seems to have been priced in by the market, so even if one occurs or does not, we expect the market to move upwards in a strong manner. We are conservative in our holdings, to which we will add aggression in the right places... with moderation to achieve your portfolio objectives.

We look to keep shining a light on an opportunity, together.

Warm Regards...

Team One North Star

This material is general in nature and intended for educational purposes only; it should not be considered tax, legal, or investment advice, or an investment recommendation. Consult your financial advisor for personalized advice that is tolerance.

#financial advisor in connecticut#financial advisor in Massachusetts#Expert financial advisor services for corporate executives#Top investment planning services for NJ corporate executives#Best wealth management consultant for corporate executives in CT#Financial advisor for Indian families in CT#Best investment planning services for Indian families in CT#Best financial planning services in CT for Indians#Experienced wealth management advisor specializing in Indian family finances in MA

0 notes

Text

How to manage finances

Introduction

A lot of time has been spent thinking about money. I’ve thought about it from the perspective of being a parent, an employee, and an entrepreneur. And after spending so much time thinking about these different financial situations, I’ve come up with a few tips that can help you manage your finances better than most people:

Having a budget is a good start

Budget are plans for spending your money. It helps you stay within a budget and meet your financial goals, whether that’s buying a car or paying off debt.

A budget can be created in several different ways:

By creating an Excel spreadsheet that matches up income with expenses;

Using an app on your phone (like Mint); or

Asking someone else—like an accountant who specializes in personal finance management—to help you create one!

Automate your payments

Automating your payments is a great way to save time and money. You can automate your bills and savings, as well as any regular expenses that you pay each month (like utility bills).

There are two main ways to automate payments: direct debit or automatic payment.

Get rid of credit card debt

If you have credit card debt, it’s important to get rid of it. Credit card companies are notorious for charging high interest rates and fees, so if you’re paying more than 10% interest on your balances each month (and this includes any additional charges like late fees or over-the-limit fees), then keeping that money in your pocket isn’t going to help at all.