#Spirit Airlines

Text

Book that flight bookie 🫶🏽

#black girl aesthetic#black girl blogger#black girls of tumblr#black girl joy#pinterest#black girl magic#soft life#black girl beauty#luxury#flight#vacation#night flight#solo travel#black girl travel#travel#soft girl era#black luxury#good vibes#pintrest girl#positivity#delta#southwest#spirit airlines#black boy travel#black girl femininity#hyper feminine#feminine traits#feminine divine#that girl#it girl

266 notes

·

View notes

Text

Animated by @cgkpluie

6K notes

·

View notes

Text

Boeing, Spirit and Jetblue, a monopoly horror-story

Catch me in Miami! I'll be at Books and Books in Coral Gables TONIGHT (Jan 22) at 8PM. Berliners: Otherland has added a second date (Jan 28) for my book-talk after the first one sold out - book now!

Last week, William Young, an 82 year old federal judge appointed by Ronald Reagan, blocked the merger of Spirit Airlines and Jetblue. It was a seismic event:

https://storage.courtlistener.com/recap/gov.uscourts.mad.254267/gov.uscourts.mad.254267.461.0_6.pdf

Seismic because the judge's opinion is full of rhetoric associated with the surging antitrust revival, sneeringly dismissed by corporate apologists as "hipster antitrust." Young called America's airlines and "oligopoly," a situation he blamed on out-of-control mergers. As Matt Stoller writes, this is the first airline merger to be blocked by the DOJ and DOT since deregulation in 1978:

https://www.thebignewsletter.com/p/antitrust-enforcers-block-the-jetblue

The judge wasn't shy about why he was reviving a pre-Jimmy Carter theory of antitrust: "[the merger] does violence to the core principle of antitrust law, 'to protect] markets –- and its market participants — from anticompetitive harm."

The legal arguments the judge advances are fascinating and worthy of study:

https://twitter.com/johnmarknewman/status/1747343447227519122

But what really caught my eye was David Dayen's American Prospect article about the judge's commentary on the state of the aviation industry:

https://prospect.org/infrastructure/transportation/01-19-2024-how-boeing-ruined-the-jetblue-spirit-merger/

Why, after all, have Spirit and Jetblue been so ardent in pursuing mergers? Jetblue has had two failed merger attempts with Virgin, and this is the third time they've failed in an attempt to merge with Spirit. Spirit, meanwhile, just lost a bid to merge with Frontier. Why are these two airlines so obsessed with combining with each other or any other airline that will have them?

As Dayen explains, it's because US aviation has been consumed by monopoly, hollowed out to the point of near collapse, thanks to neoliberal policies at every part of the aviation supply-chain. For one thing, there's just not enough pilots, nor enough air-traffic controllers (recall that Reagan's first major act in office was to destroy the air traffic controller's union).

But even more importantly, there are no more planes. Boeing's waitlist for airplane delivery stretches to 2029. And Boeing is about to deliver a lot fewer planes, thanks to its disastrous corner-cutting, which grounded a vast global fleet of 737 Max aircraft (again):

https://prospect.org/infrastructure/transportation/2024-01-09-boeing-737-max-financial-mindset/

The 737 disaster(s) epitomize the problems of inbred, merger-obsessed capitalism. As Luke Goldstein wrote, the rampant defects in Boeing's products can be traced to the decision to approve Boeing's 1997 merger with McDonnell-Douglas, a company helmed by Jack Welch proteges, notorious for cost-cutting at the expense of reliability:

https://prospect.org/infrastructure/transportation/2024-01-09-boeing-737-max-financial-mindset/

Boeing veterans describe the merger as the victory of the bean-counters, which led to a company that chases short-term profits over safety and even the viability of its business:

https://www.airliners.net/forum/viewtopic.php?t=213075

After all, the merger turned Boeing into the single largest exporter in America, a company far too big to fail, teeing up tens of billions from Uncle Sucker, who also account for 40% of Boeing's income:

https://www.thebignewsletter.com/p/its-time-to-nationalize-and-then

The US government is full of ex-Boeing execs, just as Boeing's executive row is full of ex-US federal aviation regulators. Bill Clinton's administration oversaw the creation of Boeing's monopoly in the 1990s, but it was the GOP that rescued Boeing the first time the 737 Maxes started dropping out of the sky.

Boeing's biggest competitor is the state-owned Airbus, a joint venture whose major partners are the governments of France, Spain and Germany – governments that are at least theoretically capable of thinking about the public good, not short-term profits. Boeing's largest equity stakes are held by the Vanguard Group, Vanguard Group subfiler, Newport Trust Company, and State Street Corporation:

https://prospect.org/blogs-and-newsletters/tap/2024-01-18-airbus-advantage/

As Matt Stoller says, America has an airline that the public bails out, protects, and subsidizes but has no say over. Boeing has all the costs of public ownership and none of the advantages. It's the epitome of privatized gains and socialized losses.

This is Reagan's other legacy, besides the disastrous shortage of air-traffic controllers. The religious belief in deregulation – especially deregulation of antitrust enforcement – leads to a deregulated market. It leads to a market that is regulated by monopolists who secretly deliberate, behind closed board-room doors, and are accountable only to their shareholders. These private regulators are unlike government regulators, who are at least nominally bound by obligations to transparency and public accountability. But they share on thing in common with those public regulators: when they fuck up, the public has to pay for their mistakes.

It's a good thing Boeing's executives are too big to fail, because they fail constantly. Boeing execs who are warned by subcontractors of dangerous defects in their planes order those subcontractors to lie, or lose their contracts:

https://www.levernews.com/boeing-supplier-ignored-warnings-of-excessive-amount-of-defects-former-employees-allege/

As a result of Boeing's mismanagement, America's only aircraft supplier steadily has lost ground to Airbus, which today enjoys a 2:1 advantage over Boeing. But it's not just Boeing that's the weak link aviation. US aviation is a chain entirely composed of weak links.

Take jet engines: Pratt & Whitney are Spirit's major engine supplier, but these engines suck as much as Boeing's fuselages. Much of Spirit's fleet is chronically grounded because the engines don't run. The reason Spirit buys its engines from those loveable goofballs at Pratt & Whitney? The Big Four airlines have bought all the engines for sale from other suppliers, leaving smaller airlines to buy their engines from fat-fingered incompetents.

This is why – as Dayen notes – smaller US airlines are so horny for intermarriage. They can't grow by adding routes, because there are no pilots. Even if they could get pilots, there'd be no slots because there are no air traffic controllers. But even if they could get pilots and slots, there are no planes, because Boeing sucks and Airbus can't make planes fast enough to supply the airlines that don't trust Boeing. And even if they could get aircraft, there are no engines because the Big Four aviation cartel cornered the market on working jet engines.

Part of Jetblue and Spirit's pitch was that they hand off the routes that they'd cut after their merger to other small airlines, like Frontier and Allegiant. But Frontier and Allegiant can't service those routes: they don't have pilots, slots, planes or engines.

Spirit hasn't been profitable since 2019 and is sitting on $4b in debt. Jetblue was proposing to finance its acquisition with another $3.5b in debt. The resulting airline could only be profitable by sharply cutting routes and massively raising prices, cutting 6.1m seats/year. With a debt:capital ratio of 111%, the company would have no slack and would need a bailout any time anything went wrong. Not coincidentally, the Big Four airlines also have debt:capital ratios of about 100-120%, and they do get bailouts ever time anything goes wrong.

As William McGee reminds us, it's been 14 years since anyone's started a new US airline:

https://twitter.com/WilliamJMcGee/status/1747363491445375072

US aviation is deeply cursed. But Boeing's self-disassembling aircraft show us why we can't fix it by allowing mergers: private monopolies, shorn of the discipline of competition and regulation, are extraction machines that turn viable businesses into debt-wracked zombies.

This is a subject that's beautifully illustrated in Dayen's 2020 book Monopolized, in the chapter on health care:

https://pluralistic.net/2021/01/29/fractal-bullshit/#dayenu

The US health care system has been in trouble for a long time, but the current nightmare starts with the deregulation of pharma. Pharma companies interbred with one another in a string of incestuous marriages that produced these dysfunctional behemoths that were far better at shifting research costs to governments and squeezing customers than they were at making drugs. The pharma giants gouged hospitals for their products, and in response, hospitals underwent their own cousin-fucking merger orgy, producing regional monopolies that were powerful enough to resist pharma's price-hikes. But in growing large enough to resist pharma profiteering, the hospitals also became powerful enough to screw over insurers. Insurers then drained their own gene pool by combining with one another until most of us have three or fewer insurers we can sign up with – companies that are both big enough to refuse hospital price-hikes, and to hike premiums on us.

Thus monopoly begets monopoly: with health sewn up by monopolies in medical tech, drugs, pharmacy benefit managers, insurance, and hospitals, the only easy targets for goosing profits are people:

https://pluralistic.net/2022/01/05/hillrom/#baxter-international

This is how you get a US medical system that costs more than any other rich nation's system to operate, delivers worse outcomes than those other systems, and treats medical workers worse than any other wealthy country.

Now, rich people can still buy their way out of this mess, but you have to be very rich indeed to buy your way out of the commercial aviation system. There's a lot of 1%ers who fly commercial, and they're feeling the squeeze – and there's no way they're leasing their own jets.

Stein's Law holds that "anything that can't go on forever will eventually stop." America's aviation mergers – in airlines, aircraft and engines – have hollowed out the system. The powerful, brittle companies that control aviation have so much power over their workforce that they've turned air traffic controller and pilot into jobs that no one wants – and they used their bailout money to buy out the most senior staff's contracts, sending them to early retirement.

Now, I'm with the people who say that most of US aviation should be replaced with high-speed rail, but that's not why our technocrats and finance barons have gutted aviation. They did it to make a quick buck. A lot of quick bucks. Now the system is literally falling to pieces in midair. Now the system is literally on fire:

https://www.nytimes.com/2024/01/19/us/miami-boeing-plane-engine-fire.html

Which is how you get a Reagan appointed federal judge issuing an opinion that has me punching the air and shouting, "Yes, comrade! To the barricades!" Anything that can't go on forever will eventually stop. When the system is falling to pieces around you, ideology disintegrates like a 737 Max.

I'm Kickstarting the audiobook for The Bezzle, the sequel to Red Team Blues, narrated by @wilwheaton! You can pre-order the audiobook and ebook, DRM free, as well as the hardcover, signed or unsigned. There's also bundles with Red Team Blues in ebook, audio or paperback.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/01/21/anything-that-cant-go-on-forever/#will-eventually-stop

Image:

Vitaly Druchenok (modified)

https://commons.wikimedia.org/wiki/File:ECAir_Boeing_737-306_at_Brazzaville_Airport_by_Vitaly_Druchenok.jpg

CC BY-SA 4.0

https://creativecommons.org/licenses/by-sa/4.0/deed.en

--

Joe Ravi (modified)

https://commons.wikimedia.org/wiki/File:Panorama_of_United_States_Supreme_Court_Building_at_Dusk.jpg

CC BY-SA 3.0

https://creativecommons.org/licenses/by-sa/3.0/deed.en

#pluralistic#aviation#antitrust#monopoly#boeing#jetblue#spirit airlines#oligopoly#air traffic controllers#airbus#steins law

248 notes

·

View notes

Text

🍌✈️

#airbus a319#spirit airlines#i guess. like obviously who else makes their planes this colour#whatever. banana plane.#plane beef

154 notes

·

View notes

Text

78 notes

·

View notes

Text

My Geography teacher was interviewing me for a position at Spirit Airlines.

426 notes

·

View notes

Text

rainbow

#off-duty#there you go. spirit plane lurking in the back of the breeze picture#I feel like there MUST be an orange airline out there but I can't actually recall it so suggestions appreciated#play#wow air#spirit airlines#breeze airways#s7 airlines

40 notes

·

View notes

Text

Getting pressed at 35k feet is crazy.

16 notes

·

View notes

Text

Perks of living on a flight path ✈️

#orlando#aircraft#airplane#american airlines#delta air lines#spirit airlines#photography#plane spotting#planespotting#original photography#photographers on tumblr#justgoshoot#mkexplore#kei teay

43 notes

·

View notes

Text

A federal judge Tuesday blocked JetBlue Airways’ purchase of Spirit Airlines after the Justice Department sued to stop the merger, saying the deal would drive up fares for price-sensitive consumers by taking the discount carrier out of the market.

JetBlue’s proposed $3.8 billion purchase of discounter Spirit would have produced the country’s fifth-largest airline, a deal the carriers had said would help them better grow and compete against larger rivals like Delta and United.

“JetBlue plans to convert Spirit’s planes to the JetBlue layout and charge JetBlue’s higher average fares to its customers,” U.S. District Court Judge William Young wrote in his decision. “The elimination of Spirit would harm cost-conscious travelers who rely on Spirit’s low fares.”

The decision, handed down Tuesday, marks a victory for a Justice Department that has aggressively sought to block deals it views as anti-competitive.

“Today’s ruling is a victory for tens of millions of travelers who would have faced higher fares and fewer choices had the proposed merger between JetBlue and Spirit been allowed to move forward,” Attorney General Merrick Garland said in a statement. “The Justice Department will continue to vigorously enforce the nation’s antitrust laws to protect American consumers.”

8 notes

·

View notes

Note

Setting this as the autopilot disconnect

3 notes

·

View notes

Text

Spirit only operates Airbuses so I'm starting a fundraiser to gift them a 737 MAX that instantly explodes from it's own vile aura the minute you step inside.

#Shitpost#Commercial Aviation#Spirit Airlines#Boeing#Boeing 737 MAX#Budget Airlines#Airplanes#Avgeek

6 notes

·

View notes

Video

Spirit Airlines shareholders voted Tuesday on whether to approve a merger with JetBlue Airways. The company said results of the vote will be announced Wednesday.

#video#tiktok#tiktoks#funny#lmao#wtf#news#spirit airlines#jetblue#jetblue airways#airplane#airplanes#washingtonpost

25 notes

·

View notes

Text

Spirit warned investors that merging with Jetblue would be illegal

++++

Jetblue is trying to buy Spirit Airlines. It’s a terrible idea. Consolidation in the US aviation industry has resulted in higher fares, less reliable planes, spiraling junk-fees, and brutal conditions for flight- and ground-crews. The four remaining US major airlines, who gobbled their rivals, are three times more profitable than their European counterparts:

https://www.economist.com/leaders/2017/04/22/a-lack-of-competition-explains-the-flaws-in-american-aviation

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/03/12/they-put-it-in-writing/#that-was-then

That’s great news if you’re an airline shareholder. It’s terrible news if you’re hunting for your lost bags, or if you’re a flight attendant or pilot being squeezed, or if you’re being hit for billions in covid bailouts — or if you’re one of one million Americans who were stranded during Christmas week by the failure of Southwest Airlines’ IT systems, which use duct-tape and wishful thinking to hold together the IT systems of all the airlines SWA bought:

https://pluralistic.net/2023/01/16/for-petes-sake/#unfair-and-deceptive

The collapse of competition in the US airline industry is the result of a deliberate policy, the “consumer welfare” theory of antitrust, which says that monopolies are “efficient” and good for the public. It’s a theory that took root under Reagan, and was reaffirmed and expanded by every president, R or D, since.

Until now. For the first time in two generations, the Biden administration has taken up the neglected, noble art of trustbusting, blocking mergers and promising to break up the mergers we’ve already seen, through enforcers like Jonathan Kanter at the DoJ Antitrust Division and Lina Khan at the FTC:

https://www.eff.org/deeplinks/2021/08/party-its-1979-og-antitrust-back-baby

Which is bad news for the proposed Jetblue/Spirit merger. Last week, the DoJ filed suit to block the merger, joined by the AGs from NY, MA and DC.

https://storage.courtlistener.com/recap/gov.uscourts.mad.254267/gov.uscourts.mad.254267.1.0.pdf

Notably, Pete Buttigieg — who has been historically shy of using his prodigious powers as the boss of a large agency — will also block the merger:

https://www.transportation.gov/briefing-room/usdot-statement-justice-departments-lawsuit-block-proposed-jetblue-spirit-merger

Spirit’s shares are in the toilet. Writing in his BIG newsletter, Matt Stoller explains why shareholders are bolting for the doors: the case against the Jetblue/Spirit merger is incredibly strong. A slam-dunk, even:

https://mattstoller.substack.com/p/an-end-to-airline-consolidation

Spirit, after all, is America’s most famous budget airline. That means that it attracts fliers by undercutting the Big Four. That puts downward pressure on the Big Four, who are faced with the choice of taking lower profits to retain fliers’ business, or losing all the profit when those fliers take Spirit. Remove Spirit from play and that downward pressure on fares disappears. You don’t need newfangled “neo-Brandeisian” antitrust to see why this is bad — even under “consumer welfare” antitrust, anything that will obviously make prices go up is prohibited (indeed, this is the only thing consumer welfare antitrust cares about).

How do we know that a Jetblue/Spirit merger is a price-increasing, illegal antitrust violation? Spirit says so.

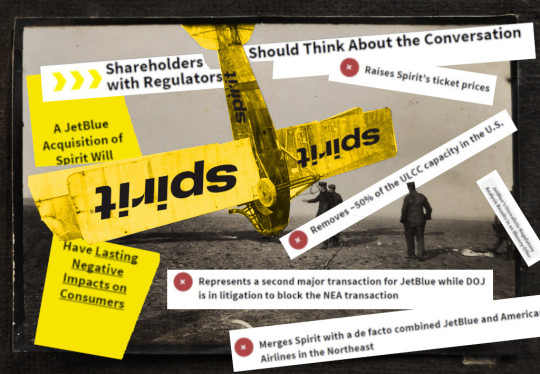

[Image ID: A slide prepared for Spirit Airlines’ board, titled ‘Shareholders should think about the conversation with regulators,’ and laying out the case that a Jetblue/Spirit merger is illegal.]

This is truly delicious! You see, last year, there was a bidding war for Spirit and Jetblue was the outside bidder. Spirit’s board wanted to convince their shareholders to reject Jetblue’s bid, so they commissioned some aviation economists to do a study on the matter, which Spirit then circulated to its investors.

That report is unequivocal: it estimates that a Jetblue/Spirit merger will be a disaster. Spirit’s participation in a route lowers fares by 17%. When Spirit stops competing on a route, fares go up by 30%. Spirit CEO Ted Christie called the proposed merger “unlawful” and “unethical”:

https://simpleflying.com/spirit-ceo-shareholder-rejection-jetblue-cynical-disruptive-offer/

Spirit is a major competitor to Jetblue. As Stoller notes, they compete on hundreds of routes, and are adding more all the time. Jetblue clearly understands that removing Spirit as a competitor would let it raise fares. As one Jetblue manager — quoted by the DoJ — explained: “I don’t think we should be selling the [Spirit] fare if [Spirit] is not serving the market.” Jetblue’s internal memos on the merger include an executive stating that the merger will allow the airline to realize “efficiencies” by reducing service and increasing fares. This isn’t the kind of “efficiency” we want.

Stoller notes that even with this damning evidence, there are still some spoilers. Florida governor Ron DeSantis has cut a deal to back the merger, even though Florida stands to suffer the most of any state from this merger due to the number of Spirit flights taking off from its airports. And, Stoller notes, the judge presiding over the case is an 82 year old Reagan appointee — a ideology-addled dotard named William Young.

But, Stoller notes, with Buttigieg and the DOT on the case, it’s hard to see how this merger can go through — the DOT has very broad powers to block mergers that reduce routes and don’t have to meet the same evidentiary standards as the DoJ would in court.

Stoller thinks Buttigieg has had a “moment of truth” — that outside pressure from activists and critics convinced the secretary that his future political fortunes would be better served, on balance, by boldly using his powers (and pleasing the public), rather than sitting on his hands (and pleasing future industry donors):

https://mattstoller.substack.com/p/pete-buttigiegs-moment-of-truth

If that’s so, it’s welcome news. While I would prefer that our political leaders acted boldly in the public interest out of a sense of duty, I will happily settle for bold action motivated by fear of the voters’ wrath.

[Image ID: A crashed WWI biplane, redecorated in Spirit airlines livery. The scene is decorated with text-snippets cut out of a Spirit Airlines internal investor presentation slide advising that merging with Jetblue is ill-advised and possibly illegal.]

#pluralistic#matt stoller#spirit airlines#jetblue#aviation#monopoly#mergers#petard#antitrust#southwest#swords

125 notes

·

View notes

Text

I got on a Spirit air flight and everything was made of plywood, including the seats and plane.

331 notes

·

View notes

Note

The first two pictures are from the Boeing Dreamliner plant. I’m sorry you can’t see much. There wasn’t a plane parked at the spot closest to the road. Also, I missed my chance to grab a photo of the Dreamliner cargo plane (which is freaking huge and weirdly shaped and I kinda love it? You should add it to the review list) the last photo is just the view from inside the airport I’m at because you seem like you would appreciate a good airport photo

YES YES YES thank you for these images...just seeing the little tailfins all lined up in the distance is lovely :) though there are also some really fantastically colorful planes in that last picture. A pair of blue and yellow highlighter markers...

As for the Dreamlifter, I have plans to talk about her soon. Very very soon.

#off-duty#transmissions#I have to say I do much prefer the Breeze livery in low light. explodes my eyes way less#polairoids#breeze airways#spirit airlines#not going to bother tagging the bits of united/air europa/eva air/latam planes you can see. but I see and acknowledge them

8 notes

·

View notes