#December 2020 to March 2021 Calendar

Text

Tolkien Fandom Event Calendar

Recently I’ve received some asks about events/weeks in the Tolkien fandom, so I thought I’d compile a list of those that I know about. This is not exhaustive, and dates are subject to change by the organizers of these events!

Other blogs you can check out are @tolkieneventsblog and @tolkienfandomevents, though I’m not sure how active those are. The @silmarillionwritersguild Discord also has a channel dedicated to signal boosts for all sorts of Tolkien-related & general fandom happenings, which is another excellent way to keep up with fandom goings-on.

Want to run your own event? Here’s some of my tips!

If your event is not on here and you’d like it to be, let me know and I can add it :) Note: I will only add events that have announced dates!

~

JANUARY

Screw Yule

My Slashy Valentine @myslashyvalentine — work time

Lord of the Rings Secret Santa @lotr-sesa — reveals

Thorin’s Spring Forge @thorinsspringforge — signups

Second Age Week @secondageweek

FEBRUARY

Hidden Paths

My Slashy Valentine — reveals

Thorin’s Spring Forge — claims

Maedhros and Maglor Week @maedhrosmaglorweek

MARCH

Back to Middle-earth Month @spring-into-arda

Thorin’s Spring Forge — work time

Fëanorian Week

Fun with Fanon Fest Round 1 @funwithfanon

APRIL

Tolkien Reverse Summer Bang @tolkienrsb — signups

Silm Remix @tolkienremix — signups & assignments

Thorin’s Spring Forge — reveals

Aralas Week @aralas-week

Barduil Month @bi-widower-dads

All of Arda is Autistic @all-of-arda-is-autistic

F3: Focus on Friendship & Family, Phase I @spring-into-arda

MAY

Tolkien Reverse Summer Bang — claims

Silm Remix — reveals

Aspec Arda Week @aspecardaweek

Angbang Week @angbangweek

Gondolin Week @gondolinweek

F3: Focus on Friendship & Family, Phase II

JUNE

Tolkien Reverse Summer Bang — work time

Scribbles and Drabbles @fall-for-tolkien — signups

Tolkien Ekphrasis Week @tolkienekphrasisweek

F3: Focus on Friendship & Family, Phase III

JULY

Tolkien Reverse Summer Bang — work time

Scribbles and Drabbles — claims

Tolkien Gen Week @tolkiengenweek

LotR Ladies Week @lotrladiessource

Tolkien Appreciation Week @tolkienweek

Tolkien Latin American & Caribbean Week @tolkienlatamandcaribbeanweek

AUGUST

Tolkien Reverse Summer Bang — deadlines

Scribbles and Drabbles — art reveals

Innumerable Stars Exchange @innumerable-stars — nominations & signups

Tolkien of Colour Week @tolkienofcolourweek

Silvergifting Week @silvergiftingweek

Tolkien OC Week @tolkienocweek

SEPTEMBER

Tolkien Reverse Summer Bang — reveals

Scribbles and Drabbles — work time

Innumerable Stars Exchange — signups & assignments

Sindar Week @sindarweek

Dor Cúarthol Week @dorcuartholweek

Finwëan Ladies Week @finweanladiesweek

OCTOBER

Innumerable Stars Exchange — reveals

Scribbles and Drabbles — work time

Half-elven Week @halfelvenweek

NOVEMBER

Tolkien Secret Santa @officialtolkiensecretsanta — signups & assignments

Scribbles and Drabbles — fic reveals

Nolofinwean Week @nolofinweanweek

DECEMBER

Tolkien Secret Santa — advent calendar & reveals

My Slashy Valentine @myslashyvalentine — signups & assignments

Lord of the Rings Secret Santa — claims

Khazad Week @khazadweek

MONTHLY EVENTS: These events have prompts/challenges occurring every month.

Teitho Contest

Tolkien Short Fanworks

Silmarillion Writers’ Guild @silmarillionwritersguild

(this list was last updated 5/4/23)

LEGACY EVENTS: These events used to occur, but have not happened within the last year.

Arda Needs More Pride @ardaneedsmorepride (bimonthly; last run 2020)

Kiliel Week @kilielweek (timing variable; last run 2021)

@oneringnet monthly events (last run 2021)

Atani Week @ataniweek (January; last run 2021)

Legendarium Ladies April @legendariumladiesapril (April; last run 2020)

Gates of Summer Exchange @gatesofsummerexchange (May-June, last run 2022)

Tolkien South Asian Week, run by @arwenindomiel (June; last run 2022)

Arafinwëan Week @arafinweanweek (July; last run 2019)

Fëanturi Week (August; last run 2019; no official blog and the creator has deactivated)

Imladrim Week @imladrimweek (November; last run 2019)

Doriath Week @doriathweek (November; last run 2020)

Tolkien Family Week @tolkienfamilyweek (November; last run 2021)

#tolkien#tolkien fandom#the silm#the silmarillion#silm fandom#silmarillion#silm#lotr#lord of the rings#lotr fandom#the hobbit#hobbit fandom#tefain nin#tolkien fandom event calendar#tolkien fandom events#save

353 notes

·

View notes

Text

List of Speak Now TV-related Easter eggs Taylor has dropped recently (just drop it already ffs)

NB: I'm only including hints that are obvious and don't require mental gymnastics. Your mileage might vary, of course.

27 February 2020: The Man music video is released, with the iconic graffitied wall showing Speak Now coming after Red.

26 October 2020: Taylor posts this TikTok.

I really think this is a really obvious hint, but nobody ever seems to talk about it... anyways notice how the colours of the garments she points at go purple > blue > green > black?

9 November 2021: Red (Taylor's Version) signed CDs go on sale. On her website, the price $20.10 is written in purple.

12 November 2021: "Red is about to be mine again, but it has always been ours."

13 December 2021: Taylor turns 32. Her AMA award for Speak Now can be seen in this photo she posts.

20 January 2021: Taylor is named 2022 Record Store Day Ambassador. The logo uses purple text and we lose our minds.

5 May 2022: Taylor Nation drops Speak Now (and 1989) merch for some reason.

Apparently, this was to show the Speak Now trademark was still being used, but I'm still putting it here.

21 October 2022: Anti-Hero music video released.

The koi fish guitar from the Speak Now World Tour makes an appearance.

Also, in the official YouTube video for the TSAntiHeroChallenge thing, she wears the purple dress from the Speak Now tour.

25 October 2022: Bejeweled music video released.

This day is the 12th anniversary of Speak Now.

Enchanted plays at the beginning.

Laura Dern says "Speak not".

Taylor presses the 3 button in the elevator, which is coloured purple.

The 13 button and the 13th indicator light (representing the album after Midnights) are also purple.

Taylor's hairpin says "SN".

Koi fish appears in the windows of the castle.

Long Live plays at the end.

1 November 2022: "I'm enchanted to announce my next tour..."

27 January 2023: Lavender Haze music video released.

The koi fish appears again.

29 January 2023: The official Taylor Swift 2024 calendar is shown on the publisher's website. It features photos from the Speak Now tour.

The cover picture is the same one used in the Eras Tour to represent the Speak Now era.

It will be available for purchase on July 20th.

17 March 2023: Taylor drops If This Was A Movie (TV), which was a deluxe track on Speak Now, and Safe & Sound and Eyes Open (TV), which were first performed live on the Speak Now tour.

9 April 2023: Photos from the set of a music video being filmed in Liverpool are leaked. The Speak Now tour flying balcony and piano can be seen.

13 April 2023: Taylor says that "recently one of my albums has been on my mind a lot" before performing Speak Now.

1 May 2023: Taylor posts this. The purple heart speaks for itself.

5 May 2023: WE WON. WE FINALLY WON.

205 notes

·

View notes

Photo

Czech Calendar Customs Master Post

I’m an American who has always been fascinated with family history. The most recent arrivals in my family from the old world were my Great-Grandparents who emigrated from Běhařovice, a small village in Southern Moravia, Perhaps it is because they are my most recent connection to Europe that I’m pulled so strongly toward their traditions. In this post I’ll provide links to my posts documenting my attempts to integrate Czech calendar customs into my practice, as well as other resources. In 2023 I plan on doing more detailed articles and will add them to this article. I am in no way an expert on the customs of Czechia, just a descendant attempting to connect with my ancestors.

From Groundhog Day to the Three Kings: Customs and Traditions of Villages in Znojmo (Southern Moravian district in Czechia that my great-grandparents were from) Machine translated by google

February/March/April 2023 Devotional Schedule

Hromnice

Hromnice is the holiday that takes place at Candlemas/Groundhog Day/Brigid’s Day (February 2nd)

Bearers of Folklore: One More Hour on Hromnice

Background

My 2022 Hromnice candle

2023 Hromnice candle

Blessing my Hromnice candle

Waking Up Perun

Drowning Morana/Smrtka (Around Vernal Equinox)

Background

Drowning Morana 2023

Drowning Morana 2022

Drowning Morana 2021

Drowning Morana 2020

Drowning Smrtka in my Great-Grandparent’s Village

Morana embroidery

Masopust (Carnival)

Background

Fat Thursday Dinner 2022

Kupala Night (Midsummer)

Midsummer 2022

Dozinky (Autumn Equinox)

Background

2022 Dozinky wreathe 1

2022 Dozinky wreath 2

Dušičky (All Soul’s Day)

Dusicky 2022

Koleda (Winter Solstice)

Background

St. Thomas’ Day

Koleda dinner 2022

Christmas and Advent

My St. Andrew’s Eve 2022 (November 30)

St. Andrew’s Eve (November 30)

My St. Barbara’s Day (December 4)

St. Barbara’s Day (December 4)

St. Nicholas’ Eve (December 5)

St. Ambrose Day (December 7)

Feast of the Immaculate Conception (December 8)

St. Lucy’s Day (December 13)

Christmas Eve Dinner Plans for 2022

Christmas Eve Dinner 2022/2023?

St. Stephen’s Day (December 26)

Vanilla crescents/ Vanilkové rohlíčky recipe

Walnut boat fortune telling 2022

Apple fortune telling 2022

Free paper cut out ethnographic nativity scene by painter Maria Fischerová-Kvěchová

My version of the cut out ethnographic nativity scene

Czech and Moravian Christmas Carols

2022 Czech inspired Christmas embroidery

Foods for the New Year

New Year’s Sweepers

New Year’s Lunch

Feast of the Three Kings

87 notes

·

View notes

Note

Hi! I’m getting into Thunderbirds fics and was thinking about writing some myself. I saw that you ran a challenge at one point and was wondering if there was any event calendar the fandom is using. Or are there any events at all? I wasn’t sure where to find any.

Hi and welcome to the Thunderfam! :D

There is no strict calendar, but a few events do recur at will.

At the moment we are in the middle of Fanart Appreciation Month, which has occurred in January the previous two years as well. The idea being to reblog lots of artworks to give our artists some recognition.

February has been Fab Five Feb in 2019 and 2020, but was missed last year. I haven't done the call out as to whether the Thunderfam want that one this year yet. It is usually a six week challenge with a focus on the five brothers plus another character which changes each year.

Some time in March/April there might be a Easter gift fic event.

Somewhere between April and August there is sometimes a random challenge event. There was nothing last year, but in previous years there has been Sensory Sunday , Earth & Sky Week and an Olympics challenge.

We also celebrate each of the Tracy boys' birthdays - Gordon 14 Feb, Alan 12 March, Scott 4 July (?), Virgil 15 August (always a big one for me :D ) and John in October. Other cast members also get birthday celebrations at various times of the year.

September and October are usually taken up by external challenges like Sicktember and Whumptober.

We did have a Thunderfam November event - Fluffember - but last year an external event was picked up so Fluffember didn't run, but it did run 2019, 2020 and 2021.

December is left to Tag Team Secret Santa.

There have also been random other events over the past few years and I have no doubt there were others before I joined the fandom in 2018. Due to the sudden rise of Covid in 2020 we started International Rescue & Relief, a fluff prompt challenge which is technically still going, but I haven't mentioned it for ages.

Plus there are always writing prompts or question lists flying around that get picked up by whoever wants to play.

Thunderfam, if I have forgotten anything, please chime in. It is late here and my brain is usually pretty unreliable.

Anyways, welcome, thank you for asking. I hope you have fun in thunderfam :D

Nutty

(so do you have a favourite Tracy brother? :D )

18 notes

·

View notes

Note

Oh damn I'm also due Jan 1, I don't want my kid to share a birthday with a Duggar. How many days are left in the calendar that are not yet Duggar birthdays or anniversaries?

Info, Please!: How Many Calendar Days Don't Have A Duggar / Bates Birthday or Anniversary?

I'm pretty sure I've done a Post on this before, but not for a very long time! Anon, I know you only asked about the Duggars, but I'm going to include the Bateses too, since I know I'll get follow–up Asks!

There are quite a few "free" days, without a Duggar / Bates Birthday or Anniversary. (More than I would've expected!) Here is the full list of "Free" Days, as of November 17, 2022—

January 2—6, 8—11, 13—17, 19, 21, 22, 24, 25, 27, 29, 30

February 2, 4, 5, 7, 8, 11—15, 18, 20—22, 24, 25, 28, 29

March 1, 2, 4—7, 10—24, 29, 31

April 1, 2, 4, 5, 7—9, 12—15, 17, 19, 20, 23—27, 29, 30

May 1, 3—11, 13, 15, 16, 20—22, 27—31

June 1, 3—6, 9—13, 16—19, 22, 25—29

July 1—3, 5, 6, 9—15, 17, 20, 22—26, 28, 30, 31

August 1, 3, 5, 7—10, 12—14, 16—20, 22, 23, 25—27, 30, 31

September 1—4, 6, 7, 9—11, 14, 16—20, 22—25, 27—30

October 2—4, 6, 7, 9, 10, 12, 13, 15, 18—21, 24, 25, 27, 30

November 6, 10—14, 16—20, 23—25, 28—30

December 1, 2, 4—6, 9, 12, 13, 15, 17, 22—29

The Longest Period w/ No Birthday or Anniversary is March 10th—24th (15 Days), and the Longest "Streak" of Birthday / Anniversary Days is November 1st—6th (6 Days).

Birthdays / Anniversaries fall on the following Fixed–Date Holidays—New Year's Day, Earth Day, Independence Day. Fixed–Date Holidays without a Birthday / Anniversary include Groundhog Day, Valentine's Day, Leap Day, April Fool's Day, Juneteenth, Halloween, Veterans' Day, Christmas Eve, Christmas Day, and New Year's Eve.

All of the following days have Multiple Event On The Same Day—

3 Birthdays August 2; December 30

1 Anniversary, 2 Birthdays May 26

1 Anniversary, 1 Birthday October 5; November 2 and 5

2 Anniversaries May 24

2 Birthdays January 12; February 1, 10, 17, and 19; April 11; May 2 and 19; June 23; July 4, 7, 18, and 19; September 15; November 9 and 21

The Full Calendar of Birthdays / Anniversaries... After the jump.

January—

1 New Year's Day. Birthday—William Gilvin ("Gil") Bates Jr. (1965).

7 Birthday—Grace Annette ("Gracie") Duggar–Burnett (2020).

12 Birthdays—Jana Marie Duggar (1990) and John David ("J.D.") Duggar (1990).

18 Birthday—Finley Marie Paine–Bates (2022).

20 Birthday—Joseph Garrett ("Joe") Duggar (1995).

23 Birthday—Michaela Christan (Bates) Keilen (1990).

26 Birthday—Lexi Mae Webster–Bates (2017).

28 Birthday—Linda Jane ("Jane") (Hartsell) Bates [Gil's Mother] (1940).

31 Birthday—Layla Rae Stewart–Bates (2020).

February—

1 Birthdays—Trace Whitfield Bates (1997) and Jeb Colton Bates (2012).

2 Groundhog Day.

3 Birthday—James Lee ("J.L.") Duggar [Jim Bob's Father] (1936).

6 Birthday—Henry Wilberforce Seewald–Duggar (2017).

9 Birthday—Maci Jo Webster–Bates (2021).

10 Birthdays—Tiffany Lian (Espensen) Bates (1999) and Tyler Wayne Hutchins [Duggar] (2008).

14 Valentine's Day

16 Birthday—Robert Ellis ("Bobby") Smith III (1995).

17 Birthdays—Jackson Ezekiel Bates (2002) and Addallee Hope Bates (2006).

19 Birthdays—Ethel Mary (Hardin) Ruark [Michelle's Mother] (1927) and Brooklyn Praise Duggar–Caldwell (2021).

23 Birthday—Gideon Martyn Forsyth–Duggar (2018).

26 Anniversary—Justin + Claire (Spivey) Duggar (2021).

27 Birthday—Claire Yvonne (Spivey) Duggar (2001).

29 Leap Day.

Hailey James Clark–Bates's Projected DOB is February 23, 2023.

March—

3 Birthday—Joshua James Duggar (1988).

8 Birthday—Travis James Clark (2001).

9 Birthday—Derick Michael Dillard (1989).

25 Birthday—Kolter Gray Smith–Bates (2020).

26 Anniversary—Jer + Hannah (Wissmann) Duggar (2022).

27 Birthday—Zade Patrick Stewart–Bates (2022).

28 Birthday—Zoey Joy Webster–Bates (2018).

30 Birthday—Everly Hope Paine–Bates (2018).

Webster–Bates #5's Projected DOB is March 31, 2023. Baby C's Estimated DOB is in March 2022.

April—

1 April Fool's Day.

3 Anniversary—Jed + Katey (Nakatsu) Duggar (2021).

6 Birthday—Israel David Dillard–Duggar (2015).

10 Birthday—Lydia Johanna (Romeike) Bates (1998).

11 Birthdays—Carlin Brianne (Bates) Stewart (1998) and Allie Jane Webster–Bates (2015).

16 Birthday—Abbie Grace (Burnett) Duggar (1992).

18 Birthday—Charles Stephen ("Chad") Pain III (1987).

21 Birthday—Jason Michael Duggar (2000).

22 Earth Day. Birthday—Emerson Hope ("Emy") Wells (2003).

28 Birthday—Ellie Bridget Bates (2007).

May—

2 Birthdays—Erin Elise (Bates) Paine (1991) and Truett Oliver Duggar–Nakatsu (2022).

12 Anniversary—Lawson + Tiffany (Espensen) Bates (2022).

14 Birthday—Charles Stephen ("Carson") Paine–Bates IV (2015).

17 Birthday—Jill Michelle (Duggar) Dillard (1991).

18 Birthday—Lauren Milagro (Swanson) Duggar (1999).

19 Birthdays—Benjamin Michael Seewald (1995) and Warden Justice Bates (2003).

23 Birthday—Jackson Levi Duggar (2004).

24 Anniversarys—Bill + Jane (Hartsell) Bates (1964) [Gil's Parents] and Alyssa (Bates) + John Webster (2014).

25 Anniversary—Carlin (Bates) + Evan Stewart (2019).

26 Anniversary—Joy (Duggar) + Austin Forsyth (2017). Birthdays—Mary Leona (Lester) Duggar [Jim Bob's Mother] (1941) and Ivy Jane Seewald–Duggar (2019).

Forsyth–Duggar #3's Projected DOB is May 25, 2023. Duggar–Caldwell #4's Estimated DOB is in May 2022.

June—

2 Birthday—Marcus Anthony Duggar–Keller (2013).

7 Birthday—Jadon Carl Bates–Perkins (2021).

8 Birthday—Garrett David Duggar–Caldwell (2018).

14 Birthday—Hazel Sloane Balka–Bates (2021).

15 Birthday—Michael James Duggar–Keller (2011).

19 Juneteenth.

20 Birthday—Kaci Lynn Bates–Perkins (2016).

21 Anniversary—Jill (Duggar) + Derick Dillard (2014).

23 Birthdays—Anna Renee (Keller) Duggar (1988) and Hannah Marlys (Wissmann) Duggar (1995).

24 Birthday—Charlotte Raine Smith–Bates (2021).

30 Anniversary—Josiah + Lauren (Swanson) Duggar (2018).

July—

4 American Independence Day. Birthdays—William Gilvin ("Bill") Bates Sr. [Gil's Father] (1938) and Kelton Edward Balka (1995).

7 Birthday—James Andrew Duggar (2001) and Frederick Michael ("Freddy") Dillard–Duggar (2022).

8 Birthday—Samuel Scott Dillard–Duggar (2017).

16 Birthday—Meredith Grace Duggar–Keller (2015).

18 Birthdays—James Robert ("Jim Bob") Duggar (1965) and Fern Elliana Seewald–Duggar (2021).

19 Birthdays—Felicity Nicole Vuolo–Duggar (2018) and Willow Kristy Balka–Bates (2019).

21 Anniversary—Jim Bob + Michelle (Ruark) Duggar (1984).

27 Birthday—William Lawson ("Lawson") Bates (1992).

29 Birthday—Katelyn Koryn ("Katey") (Nakatsu) Duggar (1998).

August—

2 Birthdays—Jennifer Danielle Duggar (2007), Callie–Anna Rose Bates (2009), and Cambree Layne Smith–Bates (2022).

4 Birthday—Josie Kellyn (Bates) Balka (1999).

6 Birthday—Brooklyn Elise Paine–Bates (2016).

11 Birthday—Kendra Renee (Caldwell) Duggar (1998).

15 Anniversary—Michaela (Bates) + Brandon Keilen (2015).

21 Birthday—Evelyn Mae Forsyth–Duggar (2020).

24 Birthday—Evan Patrick Stewart (1995).

28 Birthday—Josiah Matthew ("Si") Duggar (1996).

29 Birthday—Kenneth Nathaniel ("Nathan") Bates (1993)

September—

5 Birthday—Jeremy Joseph Vuolo (1987).

8 Anniversary—Joe + Kendra (Caldwell) Duggar (2017).

12 Birthday—Mason Garrett Duggar–Keller (2017).

13 Birthday—Michelle Annette (Ruark) Duggar (1966).

15 Birthdays—Brandon Timothy Keilen (1989) and Judson Wyatt Bates (2010).

21 Birthday—Whitney Eileen (Perkins) Bates (1993).

26 Anniversary—Josh + Anna (Keller) Duggar (2008).

Charlie Duggar–Burnett was born in September 2022, but his Exact DOB is Unknown.

October—

1 Anniversary—Trace + Lydia (Romeike) Bates (2022).

5 Anniversary—Josie (Bates) + Kelton Balka (2018). Birthday—Katie Grace (Bates) Clark (2000).

8 Birthday—Mackynzie Renee Duggar–Keller (2009).

11 Birthday—Johannah Faith Duggar (2005).

14 Birthday—Esther Joy (Keyes) Bates (1997).

16 Birthday—Isaiah Courage Bates (2004).

17 Birthday—Kenna Joy Bates–Keyes (2022).

22 Anniversary—Nathan + Esther (Keyes) Bates (2021).

23 Birthday—Madyson Lily Duggar–Keller (2021).

26 Birthday—Kelly Jo (Callaham) Bates (1966).

28 Birthday—Joy–Anna (Duggar) Forsyth (1997).

29 Birthday—Bradley Gilvin Bates–Perkins (2014).

31 Halloween.

November—

1 Anniversary—Jessa (Duggar) + Ben Seewald (2014).

2 Anniversary—Erin (Bates) + Chad Paine (2013). Birthday—Addison Renee Duggar–Caldwell (2019).

3 Anniversary—John + Abbie (Burnett) Duggar (2018).

4 Birthday—Jessa Lauren (Duggar) Seewald (1992).

5 Anniversary—Jinger (Duggar) + Jeremy Vuolo (2016). Birthday—Spurgeon Elliot Seewald–Duggar (2015).

7 Birthday—Khloé Eileen Bates–Perkins (2019).

8 Birthday—Bella Milagro Duggar–Swanson (2019).

9 Birthdays—Alyssa Joy (Bates) Webster (1994) and Robert Ellis ("Kade") Smith–Bates IV (2018).

11 Veteran's Day.

15 Birthday—Justin Samuel Duggar (2002).

21 Birthdays—Kenneth Hubbard Callaham Sr. [Kelly Jo's Father] (1934) and John Elliott Webster (1989).

22 Birthday—Evangeline Jo Vuolo–Duggar (2020).

26 Birthday—Holland Grace Paine–Bates (2019).

27 Birthday—Maryella Hope Duggar–Keller (2019)

December—

3 Anniversary—Katie (Bates) + Travis Clark (2021).

7 Birthday—Garrett Floyde Ruark Sr. [Michelle's Father] (1924).

8 Birthday—Betty Jo (Smith) Callaham, etc. [Kelly Jo's Mother] (1938).

10 Birthday—Josie Brooklyn Duggar (2009).

11 Birthday—Austin Martyn Forsyth (1993)

14 Anniversary—Zach + Whitney (Perkins) Bates (2013).

16 Anniversary—Tori (Bates) + Bobby Smith (2017).

18 Birthday—Jordyn–Grace Makiya Duggar (2008).

19 Anniversary—Gil + Kelly Jo (Callaham) Bates (1987).

20 Birthday—Tori Layne (Bates) Smith (1995).

21 Birthday—Jinger Nicole (Duggar) Vuolo (1993).

24 Christmas Eve.

25 Christmas Day.

30 Birthday—Zachary Gilvin Bates (1988), Jedidiah Robert ("Jed") Duggar (1998), and Jeremiah Robert ("Jer") Duggar (1998).

31 New Year's Eve.

Unknown Anniversaries—Betty Jo (Smith) + Ken Callaham [Kelly Jo's Parents], Jimmy + Mary (Lester) Duggar [Jim Bob's Parents], and Garrett + Ethel (Hardin) Ruark [Michelle's Parents]

Unknown Birthdays—Baby C (AKA Duggar–Swanson #2), Duggar–Caldwell #4, and Charlie Duggar–Burnett

30 notes

·

View notes

Note

I just wanted to say thank you for running this event for the past few years. It was what got me into this fandom and once I started writing one of my favourite events to participate in.

Thank you so much <3333

Thank you for your kind words 🥺

And to think this event was what got you into Maribat! 🥺 Very honored to know that this event got you to write for the fandom QuQ

When I first thought of wanting to start this event, I think I was just getting into Maribat myself, having a few fics out on A03 and seeing new tropes emerge in the fandom. And out of the tropes, I started to love the bio!dad trope, becoming a sucker for the damn trope and noticed there wasn't enough!

And I thought, oh, maybe I should write for it! And I did! But then I thought, should I start an event for it?

At this time, Maribat March, Angst April (or I think that was what it was called) and Daminette December were the major events and when I thought about those events... I became skeptical of myself.

Because I didn't have a large following like those blogs...I wasn't well known as other writers/artists in the fandom..

I remember asking the Maribat Insanity server if I should even do an event because...did anyone else like the trope?? After all, there were so little works...

And my god...the amount of support I got and the amount of people who encouraged me to give it a try...

So I gave it a shot.

I made an interest form May 2020 and by June 2020, the first calendar of the event was post and on September 2020, the event launched.

And so many people participated, writing fics on Tumblr, linking their works from A03, making art...

In 2021, people still participated and even extended the trope from Bruce being Mari's bio dad to other characters like Luka and Kagami.

In 2022 and 2023, not many people participated but I still hosted it because people were excited to create works for the fandom.

And I think...I think that is why I still hosted the event for the past four years...

The Maribat community was the first crossover community I dared to join after a friend introduced me to it and honestly was one of the most welcoming, most creative communities I've been a part of and a community I will always hold dearly to my heart.

They inspired me to write, to grow as a writer, as a person and knowing this event introduced you to this community and helped you start your journey as a fellow writer... it really means a lot and once again shows how the community just continues to inspire...

So again...thank you, from the bottom of my heart <3 and I'm happy you enjoyed writing for this event <3

Thank you.

4 notes

·

View notes

Text

FAQs About The California Employee Retention Credit

California employers are encouraged to take advantage of the California Employee Retention Credit before it expires. But what is this tax credit? Who qualifies? Is ERC taxable in California? In this article, Dominion Enterprise Services’ CPA Skyler Kressin breaks down the ERC and how it can benefit your business.

Like many business owners, California employers were subjected to extreme challenges during 2020 and 2021 and even extending into 2022. Business operations often were fully or partially suspended due to state or local health orders, revenue swings occurred unexpectedly, labor shortages abounded, and the unknowns related to global economic conditions created a difficult environment for businesses of all stripes due to COVID-19.

In the midst of these difficult times, various federal programs were created to mitigate these challenges, including the CARES Act and the American Rescue Plan Act. Each of these had provisions for relief, such as advance payment programs or forgivable business loans such as the Payment Protection Program (PPP loan).

While many businesses took advantage of these relief provisions, the sheer volume of legislation signed into law in the last several years has resulted in some of the key relief provisions for employers to be overlooked in the effort to keep the lights on and business flowing.

One such relief provision that consistently has been overlooked was created specifically for employers who continued to pay wages and federal employment taxes throughout the official “pandemic period” (March 12, 2020, through the third quarter of 2021) in the form of an employer tax credit, officially called the Employee Retention Credit (ERC).

The good news is, for California employers specifically, this federal tax credit may be much easier to obtain than for those who own and operate businesses in other states, due to how eligibility works.

High-level Features of the ERC for California Employers:

• The credit is up to $26,000 per employee for a fully eligible employer.

• The credit is a federal refundable tax credit, meaning you can claim a refund directly in the form of a check from the IRS, and the ERC is NOT a loan or grant through a bank like the PPP.

• That said, the other relief programs, (such as the PPP) do interact with the ERC but importantly, do NOT make you ineligible for the ERC as was previously widely believed – even those who received both rounds of PPP funding are still potentially eligible for the ERC.

• The claim is made through federal payroll tax filings and entails tax calculations customarily performed by tax professionals.

• The eligible filing period for the ERC begins to expire in April 2023 as the statute of limitations for refunds begins to sunset.

Who is Eligible for the ERC?

Eligibility for the ERC is determined on a calendar quarter basis (corresponding to each federal filing period) and can be achieved in one of two ways:

1. Gross Receipts Test

Employers must show a specified percentage decline in gross receipts, quarter-over-quarter when comparing a given quarter in 2019 to the same quarter in 2020 or 2021. For example, the quarter ending December 31, 2019, compared to the quarter ending December 31, 2020, must show a specific percentage decline. Specifically, 2020 needs to show a decline of 50% in at least one quarter, and 2021 needs to show a decline of 20% in at least one quarter – BOTH compared to the equivalent quarters in 2019.

2. Trade or Business Operations Disruption Test

This test is where there may be advantages for the California Employee Retention Credit as opposed to the relative eligibility in other states. Eligibility under this test all hinges on whether direct state or local government orders restricted business operations for employers during the pandemic period. California was one of the more restrictive jurisdictions as compared to other U.S. states and localities, so ERC eligibility is more likely to be achieved for California employers than in other jurisdictions.

As with all federal legislation and tax law, there are nuances and fine print to the above eligibility tests that go beyond the scope of this article and edge cases that require parsing through grey areas. This is where working with a qualified and licensed tax professional who specializes in tax credits comes into play. Many who are otherwise eligible for the ERC may be leaving money on the table, or otherwise working off an incomplete assessment of the full scope of their eligibility.

Is ERC Taxable in California?

Another benefit of the ERC is that, in general, it is not taxable on your California income tax return, as per FTB Publication 1001. That said, given it is a federal credit, it does directly impact your federal income tax filing and may result in the need to modify your federal income tax filing.

Dominion Can Help

Dominion Enterprise Services, PLLC is a full-service licensed CPA firm, with broad experience in helping California employers with various tax credits and consulting and has broad familiarity with the Employee Retention Credit specifically for the state and local legislative and regulatory environment in California during the pandemic period.

Our model is based on a transparent assessment of the facts and circumstances of each business we work with and working with existing tax preparers and payroll providers in ensuring the maximum claim for the ERC in California is pursued under the law.

Given the unique regulatory landscape of California, don’t miss out on this opportunity to claim the California Employee Retention Tax Credit before the eligible filing period ends in April 2023. If you would like us to help with this process, please click on the button below and fill out our quick, one-minute questionnaire.

#dominion enterprise services in usa#employee retention credit for business in usa#employee retention tax credit in usa#tax consulting services in usa#new employee retention credit rules in usa

0 notes

Text

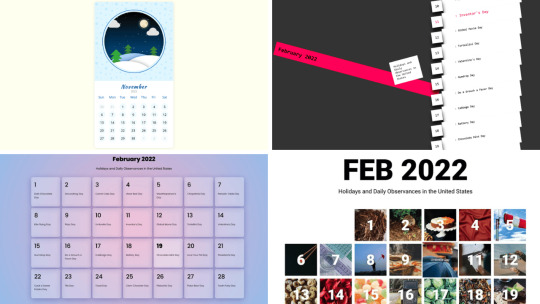

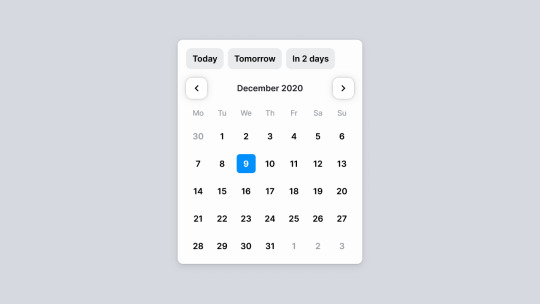

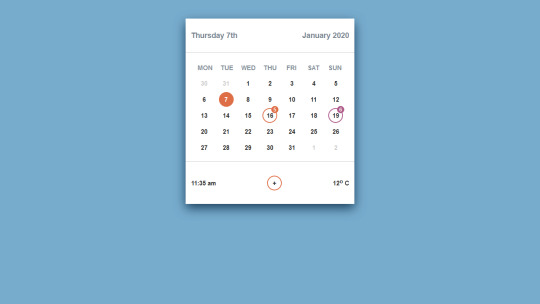

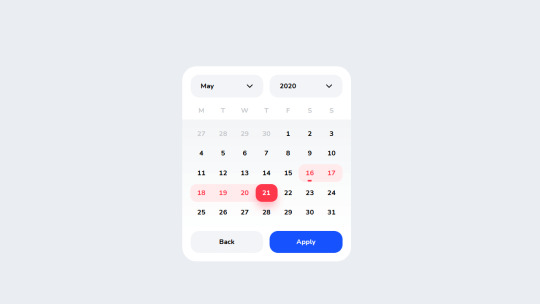

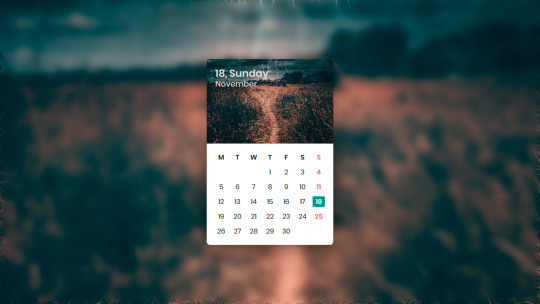

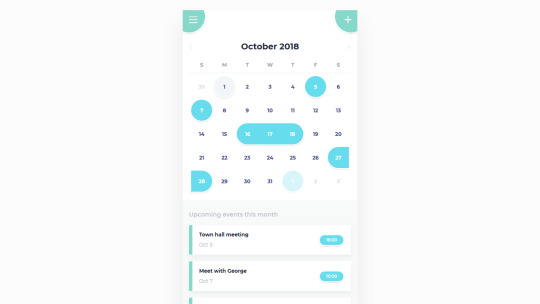

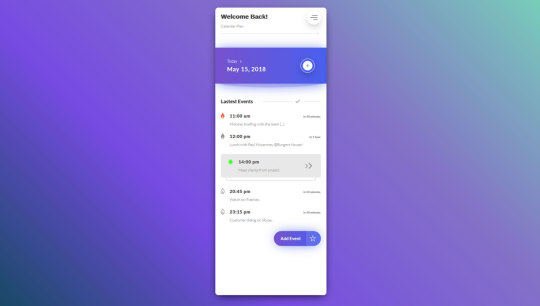

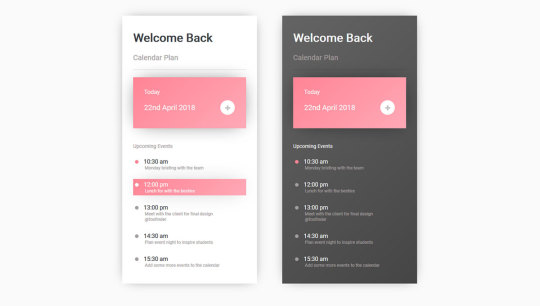

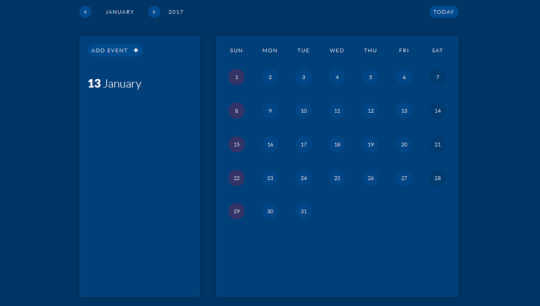

Explore 40+ CSS Calendars

Welcome to CSS Monster, your go-to destination for exploring our latest collection of CSS calendars, thoughtfully curated for July 2023. This collection showcases the creativity and innovation of HTML and CSS with six new items hand-picked from various reputable resources like CodePen and GitHub. Each calendar code example in this collection is not only visually appealing but also functional, providing a powerful demonstration of what can be achieved with HTML and CSS.

CSS calendars stand as indispensable tools for web developers and designers alike. They offer an elegant solution for tracking events, appointments, or deadlines within a website or application. The true beauty of CSS calendars lies in their adaptability; with the prowess of CSS, these calendars can be seamlessly styled to complement any aesthetic or theme, making them a versatile addition to any project.

We invite you to delve into our collection of CSS calendars, where inspiration meets education. Whether you're a seasoned developer or just embarking on your coding journey, these code examples are crafted to be both inspiring and instructive. It's worth noting that all items in our collection are freely available for use. Feel empowered to incorporate them into your projects or leverage them as a starting point for crafting your own unique creations.

Happy coding, and may your projects flourish with the dynamic functionality and aesthetic appeal of CSS calendars!

Author

Shraddha

October 19, 2022

Links

Just Get The Demo Link

How To Download - Article

How To Download - Video

Made with

HTML (Pug) / CSS (SCSS)

About a code

CSS WINTER ANIMATION CALENDAR

Compatible browsers:Chrome, Edge, Firefox, Opera, Safari

Responsive:no

Dependencies:-

Author

Pepita K.

February 17, 2022

Links

Just Get The Demo Link

How To Download - Article

How To Download - Video

Made with

HTML / CSS (SCSS)

About a code

CALENDAR

Compatible browsers:Chrome, Edge, Firefox, Opera, Safari

Responsive:no

Dependencies:-

Author

Cătălin George Feștilă

February 15, 2022

Links

Just Get The Demo Link

How To Download - Article

How To Download - Video

Made with

HTML / CSS

About a code

DAYS

Compatible browsers:Chrome, Edge, Firefox, Opera, Safari

Responsive:yes

Dependencies:-

Author

Josiah Thomas

February 14, 2022

Links

Just Get The Demo Link

How To Download - Article

How To Download - Video

Made with

HTML / CSS

About a code

CALENDAR

Compatible browsers:Chrome, Edge, Firefox, Opera, Safari

Responsive:yes

Dependencies:-

Author

Una Kravets

March 15, 2021

Links

Just Get The Demo Link

How To Download - Article

How To Download - Video

Made with

HTML / CSS (SCSS)

About a code

CSS-ONLY CALENDAR LAYOUT

Compatible browsers:Chrome, Edge, Firefox, Opera, Safari

Responsive:no

Dependencies:-

Author

Håvard Brynjulfsen

January 16, 2021

Links

Just Get The Demo Link

How To Download - Article

How To Download - Video

Made with

HTML / CSS (SCSS)

About a code

DATEPICKER

Compatible browsers:Chrome, Edge, Firefox, Opera, Safari

Responsive:no

Dependencies:-

Author

Tutul

July 4, 2020

Links

Just Get The Demo Link

How To Download - Article

How To Download - Video

Made with

HTML / CSS (SCSS)

About a code

CALENDAR UI

Compatible browsers:Chrome, Edge, Firefox, Opera, Safari

Responsive:no

Dependencies:-

Author

Mark Eriksson

June 3, 2020

Links

Just Get The Demo Link

How To Download - Article

How To Download - Video

Made with

HTML / CSS (SCSS)

About a code

CALENDAR

Compatible browsers:Chrome, Edge, Firefox, Opera, Safari

Responsive:no

Dependencies:-

Author

mrnobody

November 18, 2018

Links

Just Get The Demo Link

How To Download - Article

How To Download - Video

Made with

HTML / CSS (SCSS)

About a code

CSS CALENDAR UI DESIGN

Compatible browsers:Chrome, Edge, Firefox, Opera, Safari

Responsive:yes

Dependencies:-

Author

Eliza Rajbhandari

December 10, 2018

Links

Just Get The Demo Link

How To Download - Article

How To Download - Video

Made with

HTML / CSS (SCSS)

About a code

CALENDAR MOBILE APP UI

Compatible browsers:Chrome, Edge, Firefox, Opera, Safari

Responsive:yes

Dependencies:ionicons.css

Author

Ahmed Nasr

May 25, 2018

Links

Just Get The Demo Link

How To Download - Article

How To Download - Video

Made with

HTML / CSS (SCSS)

About a code

CALENDAR PLAN - TASKS EVENTS APP

Author

BradleyPJ

April 22, 2018

Links

Just Get The Demo Link

How To Download - Article

How To Download - Video

Made with

HTML / CSS (SCSS)

About a code

LIGHT & DARK CALENDAR

Author

jpag

October 25, 2017

Links

Just Get The Demo Link

How To Download - Article

How To Download - Video

Made with

HTML

About a code

SIMPLE CALENDAR

Author

yumeeeei

August 6, 2017

Links

Just Get The Demo Link

How To Download - Article

How To Download - Video

Made with

HTML

About a code

DUOTONE CALENDAR

Author

Antoinette Janus

June 12, 2017

Links

Just Get The Demo Link

How To Download - Article

How To Download - Video

Made with

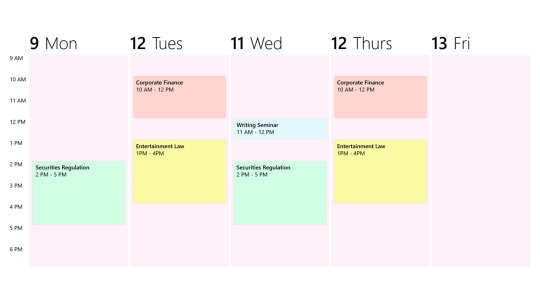

HTML (Pug) / CSS (SCSS) / JavaScript

About a code

FLUENT DESIGN: CALENDAR

Author

Alex Cramer

June 8, 2017

Links

Just Get The Demo Link

How To Download - Article

How To Download - Video

Made with

HTML

About a code

CALENDAR UI

Author

Tom

May 15, 2017

Links

Just Get The Demo Link

How To Download - Article

How To Download - Video

Made with

HTML

About a code

WINDOWS FLUENT DESIGN CALENDAR

Author

Davide Francesco Merico

May 11, 2017

Links

Just Get The Demo Link

How To Download - Article

How To Download - Video

Made with

HTML/Pug

About a code

CALENDAR UI

Author

Jocelyn

April 11, 2017

Links

Just Get The Demo Link

How To Download - Article

How To Download - Video

Made with

HTML

About a code

CALENDAR

Read the full article

0 notes

Text

Worker Retention Credit Internal Income Service

They use the funding to discover the innovation potential of the findings they have made in the midst of their Starting, Consolidator, Advanced or Synergy grant tasks. Today’s announcement considerations the first of three deadlines in the 2023 call, with a complete annual finances of €30 million. Wage skills for the ERTC additionally range relying on the size of the group and the number of full-time staff who work 30 hours per week or 130 hours a month. Learn tips on how to shift from specializing in tactical administrative work to putting your employees first. It’s essential to note that having experienced a lockdown just isn't a marker of ERC eligibility.

Wages reported as payroll costs for PPP mortgage forgiveness or sure different tax credit cannot be claimed for the ERC in any tax period. This is commonly referred to has the “gross receipts test” and it’s critical for determining your ERC eligibility. erc program deadline of the 1st 2020 calendar quarter is marked as the start of the decline in gross receipts, which there are 50% lower than in the identical interval throughout 2019. The decline then ends in the following calendar quarter, and right here the receipts needed to be greater than 80% of the earlier calendar quarter in 2019. For businesses that started in 2019, the quarter the business started is used as the bottom for figuring out the quarterly decline, till the enterprise reaches a yr of operations. For instance, a new business that began in Quarter 2 of 2019 would use that quarter as the bottom to determine income decline for either Quarter 1 of 2020 or Quarter 2 of 2020.

Real Deadline To Apply For The Erc

Even more, there are a bunch of misconceptions surrounding the credit score. For instance, even when an employer made more money during the pandemic than stated employer did in prior years, they might nonetheless qualify for the ERC. The final dates for eligible businesses to claim the ERTC is with their quarterly Form 941 tax filings, due July 31, Oct. 31 and Dec. 31, 2021.

youtube

Some companies, particularly people who acquired a Paycheck Protection Program loan in 2020, mistakenly believed they didn’t qualify for the ERC. If you’ve already filed your tax returns and now notice you may be eligible for the ERC, you'll find a way to retroactively apply by filling out the Adjusted Employer’s Quarterly Federal Tax Return (941-X). Originally out there from March 13, 2020, through December 31, 2020, the ERC is a refundable payroll tax credit score created as part of the CAR AR ES Act.

The Way To Get An Employee Retention Tax Credit In 2022

The employee retention credit score requires cash from gross sales collected from 2019 to 2020. Remember that your web earnings, loss, and the number of everlasting staff determine the amount of credit score computation. It is still potential for you to claim the ERC because the original program allowed businesses to say this credit score for three years. This means you can claim 2020 bills till April 15, 2024 and 2021 expenses by April 15, 2025. Michael focuses on offering tax, monetary assertion and advisory companies to multi-generational family owned companies across Oregon.

The information supplied here isn't funding, tax or financial recommendation.

Most businesses now have roughly returned to regular operations, and required business closures and restrictions for COVID-19 abatement have been lifted in most areas.

When the economic system is unstable, employers are confronted with difficult decisions around staffing, pay and advantages.

She reached out to Jones & Roth about creating a FlexPath that may permit her to proceed to advance professionally whereas working decreased hours.

This credit score of as much as $28,000 per employee for 2021 is on the market to small companies who have seen their revenues decline, or even been quickly shuttered, because of COVID. For each worker, wages up to $10,000 for 2020 could be counted to find out the quantity of the 50% credit score. For 2021, the Federal Government boosted the credit score to 70% against the primary $10,000 in wages per quarter . Each worker is value up to $5,000 for 2020 and $21,000 for 2021. Because this credit can apply to wages paid after March 12, 2020, many employers who are/were struggling can get entry to mentioned credit and gain much-needed relief. If a reduction in the employment tax deposits doesn't cover the credit, the employer may receive an advance payment from the IRS.

Worker Retention Credit

Most employers file these tax returns quarterly, so they need to use Form 941-X (Adjusted Employer’s Quarterly Tax Return). Employers who file yearly should use Form 944-X (Adjusted Employer’s Annual Tax Return). Consolidated Appropriations Act – The Consolidated Appropriations Act extended the ERC for the period of January 1, 2021, via June 30, 2021. In this time interval, qualifying employers could receive a credit score towards 70% of certified wages, with a maximum credit of $10,000 per quarter for each qualifying worker.

#ERC Deadline#Is It Too Late To Apply For Employee Retention Credit#ERTC Assist#erc credit deadline#erc tax credit deadline#erc application deadline#erc credit deadline 2022#erc filing deadline#erc deadline 2022#erc program deadline#deadline for erc credit#deadline for erc#erc deadlines 2023#erc grant deadline#when is the erc deadline

1 note

·

View note

Text

Small Enterprise Tax Credit Packages U S Division Of The Treasury

Whether or not you qualify for the ERC is dependent upon the time interval you’re applying for. To be eligible for 2020, you want to have run a business or tax-exempt group that was partially or fully shut down due to Covid-19. You additionally need to show that you just experienced a major decline in sales—less than 50% of comparable gross receipts in comparability with 2019. The American Rescue Plan extends the availability of the Employee Retention Credit for small companies through December 2021 and permits businesses to offset their current payroll tax liabilities by up to $7,000 per worker per quarter. This credit score of up to $28,000 per employee for 2021 is out there to small businesses who've seen their revenues decline, and even been briefly shuttered, due to COVID. You may be eligible for up to $26,000 per worker in tax credit.

As there is a lot uncertainty in regards to the long and short-term impacts of the pandemic, you probably can assist your staff into the longer term with security by making use of right now. The short answer to this question is “Yes.” Regardless of the dimensions of your business, you can apply for worker retention credit score. Whether you run a “trade” or “business” entity, each are seen as the identical kind of enterprise by the IRS.

youtube

The Coronavirus Aid, Relief, and Economic Security Act of 2020 provided a refundable employment tax credit score for eligible employers paying certified wages and health plan bills. Even although this system resulted in 2021, companies still have time to assert the ERC. When you file your federal tax returns, you’ll declare this tax credit score by filling out Form 941. However, this steerage was launched on January 22, and the Form 941 for the 4th quarter is due by January 31.

Finance Choices For Businesses

It ended at the beginning of the first calendar quarter after the first quarter by which gross receipts had been greater than 80% of gross receipts for that quarter in 2019. For 2021, the brink was raised to 500 full-time employees, that means that should you employed more than 500 individuals, you would solely declare the ERC for those not providing companies. If you had 500 or fewer workers, you could declare the ERC for all of them, working or not. The ERC repeal date of Sept. 30, 2021, affected any enterprise that anticipated to receive the credit score in the course of the fourth quarter of 2021. As a end result, they could have lowered their tax deposits or accounted for the anticipated credits of their budgets for the quarter.

To be eligible, an employer should have skilled a lower in gross receipts of more than 50% when in comparison with the same quarter within the previous yr in 2020 and 2021. The credit score is on the market for wages paid from March 13, 2020 by way of December 31, 2020. For the 2021 program, the credit is elevated to 70%, and the restrict is $10,000 per quarter.

My Firm Was An "Essential Business" And Doesn’t Qualify

Calculating the ERC tax credit score and filling our your ERC utility isn’t inconceivable but can be troublesome when you select to do the process alone. There are ERC corporations that you can hire to handle your ERC utility for you, however there would require a small payment. If your small business meets the ERC skills, you presumably can obtain hundreds of dollars in your ERC tax credit refund.

Start how to apply for erc , orcontact uswith questions. ERC Today is here to assist with whatever questions or issues you have concerning the Employee Retention Credit. We provide fast, straightforward, and versatile tax consulting providers and speedy filing choices, together with devoted consumer assist. Our staff might help you determine when you can apply for the credit score along with your PPP mortgage.

This blog does not present authorized, financial, accounting, or tax recommendation. ADP doesn't warrant or guarantee the accuracy, reliability, and completeness of the content material on this blog. ADP is a better method to give you the outcomes you want and your workers, so everybody can attain their full potential. Our unbiased evaluations and content material are supported partially by affiliate partnerships, and we adhere to strict tips to preserve editorial integrity.

For 2020, if you had greater than 100 full-time employees in 2019, you can only declare the wages of employees you retained however weren't working.

Any commercial merchandise and producers mentioned in these recordings are presented for informational functions solely and don't represent product approval or endorsement by the U.S.

Failure to take action would result in an IRS advance cost AND application of the same credit by ADP, which would end in underpayments of tax, and significant IRS penalties and interest.

Once you’ve applied for the employee retention tax credit yourself or via a specialist like Omega Accounting, discover methods to examine the standing of your ERC refund and claim the ERC on your taxes.

Recovery startup companies can file for the period March 2020 by way of December 2021.

BJA intends to support intensive TA that relies on a strategic planning and implementation approach or process. Applicants should therefore additionally explain how they'll deliver intensive PREA TA that's concern specific. The Infrastructure Investment and Jobs Act amended Section 3134 of the Internal Revenue Code. The amendment limited the availability of the worker retention credit in the fourth quarter of 2021 to restoration startup companies, as defined in section 3134.

Both Employee Retention Tax Credits and Employee Retention Credits are refundable tax credit. And BJA's Byrne JAG formula grant program is considered one of these impacted packages and BJA administers each the Byrne JAG program and the PREA reallocation awards underneath this program. And the solicitation also requires the delivery of PREA TA to different state, native, and tribal confinement amenities and companies that need and request it.

#How to Apply for ERC#ERTC Assist#apply for erc#applying for erc#how to apply for erc tax credit#how to apply for erc credit#apply for erc grant#apply for erc credit#how to apply for ertc#apply for ertc

1 note

·

View note

Text

You May Qualify For The Irs Employee Retention Tax Credit Refund For Each W-2 Employee

Are you an employer who is struggling to keep your employees on the payroll during this difficult time?

If so, you may qualify for the Employee Retention Tax Credit (ERTC) refund.

The ERTC is a federal tax credit created by the Coronavirus Aid, Relief, and Economic Security (CARES) Act to help employers retain their W-2 employees.

This tax credit allows employers to receive up to $5,000 per employee in refundable credits.

Overview of the Employee Retention Tax Credit

With the Employee Retention Tax Credit, employers can get up to a 50% refund on wages paid to employees between March 12, 2020 and January 1, 2021!

Eligible Employers are able to claim this credit for qualified wages (including allocable qualified health plan expenses) they pay their employees. The amount of qualified wages taken into account per employee is capped at $10,000, so the maximum credit available for each employee is $5,000.

This tax credit is fully refundable too, meaning that employers will be able to receive the full amount regardless of how much tax they owe.

This could provide a huge relief for businesses during these turbulent economic times.

Eligibility Requirements

To be eligible for the Employee Retention Credit, your business must have been affected by COVID-19 restrictions or a significant decrease in gross receipts during 2020.

If your business has fully or partially suspended its operations due to orders from an appropriate governmental authority limiting commerce, travel, or group meetings because of COVID-19, you may qualify for the tax credit.

If your business experienced a significant decline in gross receipts during any calendar quarter compared to the same quarter in 2019—at least a 50 percent decline—you may also be qualified to receive this credit.

Eligible employers include both taxable and tax-exempt businesses carrying on a trade or business during 2020 that meet these requirements.

By claiming the Employee Retention Credit, businesses can receive up to $5,000 per employee who is kept on their payroll throughout 2020. To claim your credit, go to

http://2023employeeretentioncredit.com.

Calculating the Credit Amount

If your business was affected by COVID-19, you could get up to $5,000 back for keeping employees on the payroll throughout 2020. The Employee Retention Credit equals 50% of the qualified wages (including qualified health plan expenses) that an Eligible Employer pays in a calendar quarter.

Qualified wages are wages and compensation paid after March 12, 2020 and before January 1, 2021. The maximum amount of qualified wages taken into account with respect to each employee for all calendar quarters is $10,000 so that the maximum credit for qualified wages paid to any employee is $5,000.

Qualified health plan expenses are amounts paid or incurred by an Eligible Employer that are properly allocable to employees’ qualified wages to provide and maintain a group health plan. Depending on the size of your organization and how it was affected by COVID-19, here are some key points to consider when calculating the credit amount:

Determine if the average number of full-time employees exceeds 100.

Calculate qualified wages based on economic hardship due to governmental orders or significant decline in gross receipts.

Include the employer's qualified health plan expenses properly allocated to employee's qualified wages.

Claiming the Credit

Depending on when qualified wages were paid, different IRS notices and revenue procedures may apply. From March 12, 2020, through December 31, 2020, Notice 2021-20 and Revenue Procedure 2021-33 should be consulted; from January 1, 2021 through June 30, 2021, Notice 2021-23 and Revenue Procedure 2021-33 should be referred to; from July 1st through September 30th of 2021, Notice 2021-49 and Revenue Procedure 2021-33 should be referenced; finally after September 30th of this year up until January 1st of 2022 Notice 2021-49 as well as Notice 2021-65 must both be consulted.

To claim the credit all you have to do is fill out Form 941 for each quarter that you are claiming the credit for and include it with your quarterly tax return. The form will provide instructions on how to calculate the amount that can be claimed. After filing you will receive a refund within 90 days!

Forms Required

Gather the right forms to ensure you get the most out of your Employee Retention Credit--from Form 941-X to CT-1-X Instructions, let's make sure you have everything you need!

To qualify for this credit, several forms are required:

IRS Forms:

Form 941-X (April 2022 Revision)

Form 941 (December 2021 Revision)

Form 943

Form 944

State Forms:

Form CT-1 (2020 Revisions)

Form CT-1-X Instructions

If these forms are not filled out and submitted correctly, then your business may not receive the full amount of Employee Retention Tax Credit.

Make sure to double check that all information is correct before submitting the forms. This will help make sure that your business receives the refund it deserves.

How are Gross Receipts calculated?

To calculate your gross receipts, you'll need to compare the quarterly figure for 2020 to the same period in 2019 and determine if there has been a significant decline.

If your 2020 gross receipts are less than 50% of what they were in 2019 in any calendar quarter, this is considered a significant decline.

You must then check if any later quarters show an increase of more than 80% of 2019's figures.

If so, the significant decline ends with that quarter or the first quarter of 2021.

Otherwise, it will continue until such an increase is seen.

It's important to accurately calculate your gross receipts as it affects whether or not you may be eligible for employee retention tax credit refunds from the IRS.

Conclusion

You should now be familiar with the Employee Retention Tax Credit and how it could benefit your business.

It's important to review all the eligibility requirements, calculate the credit amount, claim the credit, and submit the required forms.

Keep in mind that gross receipts are an important factor in determining if you qualify for this tax break.

If you think you may qualify, don't wait - take advantage of this opportunity today!

Doing so could save you money and help keep your business running smoothly.

1 note

·

View note

Text

Methods for Calculating the Employee Retention Credit

In order to help businesses recover from the effects of the COVID-19 epidemic, the government has created a tax credit known as the Employee Retention Credit (ERC). In order to survive and recover from the economic depression caused by the epidemic, the ERC provides considerable subsidies to qualifying enterprises that retain employment. This piece will describe how Employee Retention Credit works, along with its prerequisites and advantages.

What is the Employee Retention Credit?

The Employee Retention Credit is a tax credit that allows eligible businesses to offset a portion of their payroll taxes against their tax liability. The ERC helps businesses retain employees during the COVID-19 pandemic by providing them with a financial incentive to keep their staff on the payroll. Cares Act, in March 2020, introduced the ERC.

Who is eligible for the Employee Retention Credit?

Businesses impacted by the COVID-19 pandemic may be eligible for the Employee Retention Credit. Eligible businesses include those that:

Had to fully or partially suspend their operations due to a government order related to COVID-19, OR

Have experienced a significant decline in gross receipts (at least 20%) compared to the same calendar quarter in 2019.

How much is the Employee Retention Credit worth?

The Employee Retention Credit is worth up to 70% of eligible wages paid to each employee, up to a maximum of $10,000 per employee per quarter. Besides, you can also claim the credit for wages paid between March 13, 2020, and December 31, 2021.

How to claim the Employee Retention Credit?

Businesses can claim the Employee Retention Credit by filing Form 941, Employer's Quarterly Federal Tax Return. Employers can apply for the credit against their Social Security taxes. Alternatively, businesses can request an advance credit payment by filing Form 7200, Advance Payment of Employer Credits Due to COVID-19.

What are the requirements for claiming the Employee Retention Credit?

To claim the Employee Retention Credit, businesses must meet certain ERC requirements, including:

The business must have operated for all or part of the calendar year 2020 or 2021.

They must have experienced a full or partial suspension of operations due to a government order related to COVID-19 OR a significant decline in gross receipts.

The business must have paid eligible wages to eligible employees during the covered period.

The business must not have received a Paycheck Protection Program (PPP) loan, or if it did receive a PPP loan, it must have used the loan proceeds for expenses other than those that qualify for PPP loan forgiveness.

Can businesses claim both the PPP and the ERC?

Yes, businesses can claim both the PPP and the ERC, but they cannot use the same wages for both programs. This means businesses can use the PPP loan funds for certain expenses and claim the ERC for other eligible wages. However, businesses must ensure they do not double-dip and use the same wages for both programs. It is important to consult with a tax professional to determine the best strategy for maximizing the benefits of both programs.

What are the benefits of the Employee Retention Credit?

The Employee Retention Credit (ERC) is a tax credit that significantly benefits eligible businesses. Some of the ERC benefits include:

Cash refund

The ERC is refundable, meaning eligible businesses can receive a cash refund for any credit amount that exceeds their payroll tax liability.

Tax credit

The ERC is a tax credit that can be applied against payroll taxes, including Social Security and Medicare taxes.

Retention of employees

The ERC incentivizes businesses to retain their employees by providing a credit for eligible wages paid during the pandemic.

Up to $33,000 per employee

Eligible businesses can claim a credit of up to $7,000 per employee per quarter, for a total credit of up to $33,000 per employee for wages paid between March 13, 2020, and December 31, 2021.

Expanded eligibility

The American Rescue Plan Act expanded the ERC eligibility to include businesses that received PPP loans as long as they met certain ERC requirements.

How Does the Employee Retention Credit Work?

The Employee Retention Credit (ERC) is a tax credit that provides financial assistance to eligible businesses affected by the COVID-19 pandemic. The ERC is designed to encourage businesses to retain employees and continue paying wages during the pandemic. Here's how it works:

Eligibility

To be eligible for the ERC, a business must have experienced a significant decline in gross receipts or have been partially or fully suspended due to a government order during the pandemic.

Calculation of credit

The ERC is calculated based on the wages paid to eligible employees during the qualifying period. For wages paid between March 13, 2020, and December 31, 2020, the credit is 50% of eligible wages, up to a maximum of $5,000 per employee. For wages paid between January 1, 2021, and December 31, 2021, the credit is increased to 70% of eligible wages.

Qualified wages

Eligible wages for the ERC include wages paid to employees during the qualifying period, including health benefits.

Claiming the credit

Businesses can claim the ERC on their quarterly employment tax returns, including Form 941. You can use a payroll tax credit to offset payroll taxes or to get a refund if the credit exceeds payroll taxes.

Interaction with PPP

As of March 2021, businesses that received a PPP loan can also claim the ERC. But not for the same wages used to calculate PPP loan forgiveness. This means businesses can receive both the PPP loan and the ERC for different wages.

0 notes

Text

A Comprehensive Guide to Employee Retention Tax Credit

In this article, we'll check out the Employee Retention Credit (ERC), a refundable tax credit report made to urge organizations to preserve their staff members during uncertain economic times. We'll break down what the ERC is, who certifies, just how to calculate competent salaries, exactly how to claim the credit scores, and the function of Type 941-X while doing so. Furthermore, we'll address whether family members of local business owner can be included in the ERC.

What Is the Employee Retention Credit?

The Employee Retention Credit is an arrangement of the Coronavirus Help, Relief, as well as Economic Safety And Security (CARES) Act presented in March 2020. It was later on expanded under the Consolidated Appropriations Act of December 2020 as well as the American Rescue Strategy Act (ARPA) of March 2021. The ERC aims to assist services impacted by the COVID-19 pandemic maintain their staff members on pay-roll, maintain procedures, and also inevitably recoup from the crisis.

This credit history is refundable for a certain portion of qualified salaries that qualified employers pay to their workers. It is asserted on the company's government work tax return, minimizing the overall amount of taxes owed to the Irs (INTERNAL REVENUE SERVICE).

Apply for the employee retention credit

Exactly how Does the Employee Retention Credit Job?

The Employee Retention Credit is readily available to qualified employers that have experienced a considerable decrease in gross invoices or were compelled to fully or partly put on hold operations due to COVID-19. The debt amounts to 50% of certified wages paid to employees, up to a maximum of $10,000 per worker per calendar quarter. This indicates that the maximum credit history per worker is $5,000 per schedule quarter.

Qualified salaries include wages and compensation paid to staff members, as well as certified health insurance costs. Nevertheless, the credit scores can not be asserted on incomes that are paid making use of Income Security Program (PPP) car loan proceeds that have been forgiven.

Companies can assert the credit scores for incomes paid between March 13, 2020, and December 31, 2021. The debt is asserted on the company's federal work tax return, Type 941. If the credit score surpasses the employer's overall government work tax obligation liability, the excess credit is refundable to the employer.

That Is Eligible for the Employee Retention Credit?

Eligible employers consist of those who experienced a significant decline in gross receipts or were forced to totally or partly suspend procedures due to COVID-19. Companies who had approximately 500 or fewer permanent employees in 2019 can assert the credit history on all earnings paid to workers during the eligibility period. Companies who had an average of greater than 500 full-time employees in 2019 can only declare the credit on salaries paid to employees that were not supplying solutions as a result of the COVID-19-related conditions.

Self-employed people are also qualified for the credit score if they satisfy specific standards. They need to have experienced a significant decrease in gross invoices or be unable to carry out solutions as a result of COVID-19-related scenarios. They have to also have several certifying organizations that were either partly or fully suspended due to COVID-19.

How To Calculate Professional Earnings for Employee Retention Credit

That Qualifies for the Employee Retention Credit?

In order to receive the Employee Retention Credit (ERC), an employer must meet one of the complying with requirements:

Have fully or partially put on hold operations as a result of federal government orders connected to the COVID-19 pandemic.

Experienced a considerable decrease in gross invoices, defined as a decline of a minimum of 50% in 2020, or 20% in 2021 when compared to the same quarter in the previous calendar year.

Eligibility for the ERC Credit scores likewise includes tax-exempt organizations, with details regulations that relate to governmental employers and also tribal entities. Independent individuals may not claim the ERC for their own wages but can do so for the earnings they paid to their employees.

If you're wondering whether your service gets the ERC, you're not alone. The IRS has actually provided support to aid companies identify their eligibility. If you're still not sure, it's best to consult with a tax expert who can assist you navigate the guidelines and also policies bordering the credit scores.

youtube

What are certified wages?

Certified earnings are defined as salaries paid to an employee during the period when the company is eligible for the ERC. This consists of wages, ideas, and particular health insurance plan costs. The meaning of qualified salaries varies depending upon the size of the company:

For employers with 100 or less permanent workers in 2020, or 500 or fewer in 2021, all wages paid to staff members throughout the qualified period are thought about certified earnings.

For employers with more than 100 full-time staff members in 2020, or more than 500 in 2021, certified wages are those paid to employees who are not supplying solutions due to the suspension of operations or the decrease in gross receipts discussed over.

The maximum quantity of qualified earnings that can be taken into consideration for the credit is $10,000 per employee in 2020 and also $10,000 per staff member per quarter in 2021.

It is essential to note that not all earnings paid during the qualified period will receive the credit rating. For instance, wages paid to family members of the employer might not be qualified. Furthermore, wages paid to employees who relate to the company or that have a substantial section of business might be subject to additional analysis by the IRS.

Companies must keep in-depth documents of all certified salaries paid throughout the eligible period, consisting of paperwork of the reasons specific workers were not providing services throughout that time.

If you're taking into consideration asserting the ERC, it's important to act promptly. The credit score is set to expire at the end of 2021, so qualified employers will certainly need to act quickly to benefit from this beneficial tax break.

Just how To Claim the Employee Retention Credit

Are you an employer wanting to declare the Employee Retention Credit (ERC)? The ERC is a refundable tax credit rating created to urge businesses to maintain workers on their payroll throughout the COVID-19 pandemic. Right here's a detailed guide on just how to assert the ERC:

Action 1: Determine Your Eligibility

Prior to you can assert the ERC, it is very important to establish whether you're eligible. Usually, companies that experienced a substantial decline in gross receipts or were required to suspend operations because of federal government orders are qualified for the credit history. Nonetheless, there are specific restrictions and constraints that use, so it's important to assess the internal revenue service guidelines meticulously.

Step 2: Calculate Your Debt Quantity

The ERC amounts to 50% of qualified wages paid to staff members in between March 12, 2020, and December 31, 2021. The maximum credit scores quantity per staff member is $5,000. To compute your credit quantity, you'll need to establish the number of certified workers as well as the complete quantity of qualified salaries paid during the qualified period.

Step 3: Send Kind 941

Employers assert the ERC on their federal employment income tax return, typically by submitting Kind 941, Company's Quarterly Federal Tax Return. In addition to supplying details regarding your pay-roll taxes, you'll require to consist of details about your ERC calculations and also any other appropriate credit scores or adjustments.

Tip 4: Wait On Reimbursement or Carryforward

The credit scores is applied against the employer's share of Social Security tax obligations, with any excess credit scores reimbursed or carried forward to balance out future work tax obligation liabilities. If you're qualified for a refund, you should get it within a couple of weeks of sending your income tax return. If you're lugging the credit rating forward, ensure to maintain accurate documents of your computations and also any carryforward amounts.

On the whole, asserting the ERC can be an intricate process, yet it can provide considerable monetary alleviation to eligible companies. If you have questions or require support, consider seeking advice from a tax obligation professional or calling the IRS straight.

What is Form 941-X as it relates to the Employee Retention Credit?

Form 941-X is a Modified Employer's Quarterly Federal Tax Return or Insurance Claim for Reimbursement, made use of to proper errors on previously filed Types 941. Employers that discover mistakes in their work tax returns after submitting them can utilize Form 941-X to make necessary corrections or claim reimbursements.

In the context of the Employee Retention Credit (ERC), companies who have actually identified extra certified incomes as well as are qualified for a greater credit history quantity can submit Form 941-X to ask for a change or refund of paid too much tax obligations pertaining to the ERC. This is especially pertinent for companies who were influenced by the COVID-19 pandemic and needed to shut their services or experienced a significant decline in gross receipts.

The ERC is a refundable tax credit rating that was introduced as part of the Coronavirus Help, Relief, as well as Economic Safety (CARES) Act in 2020. The credit is developed to motivate companies to keep their workers on payroll throughout the pandemic as well as amounts to 50% of qualified wages paid to staff members, approximately a maximum of $10,000 per staff member per quarter.

Certified salaries consist of incomes and payment paid to workers between March 13, 2020, as well as December 31, 2021. Qualified companies include those who experienced a complete or partial suspension of operations as a result of government orders related to COVID-19 or had a substantial decrease in gross receipts compared to the same quarter in the previous year.

Employers that declared the ERC on their quarterly Type 941 yet later on determined added qualified incomes can file Kind 941-X to declare the added credit history. The form has to be filed within 3 years of the initial Kind 941 filing day. It is very important for companies to maintain accurate records of their qualified earnings and talk to a tax obligation professional to guarantee they are declaring the right quantity of the ERC.

In recap, Kind 941-X is a valuable tool for employers that need to appropriate errors or insurance claim refunds associated with their employment tax returns. In the context of the ERC, employers can use Kind 941-X to claim added credit histories and recoup overpaid tax obligations. As the pandemic continues to effect companies, it is important for companies to remain notified concerning the most recent tax obligation credits as well as rewards available to them.

Can family members of business owners be included in the ERC Credit history?

According to the IRS, particular relative of entrepreneur are not qualified to have their wages considered as qualified incomes for the Employee Retention Credit (ERC). This is due to the fact that the objective of the ERC is to incentivize employers to maintain their staff members on the payroll, as opposed to incentivizing companies to pay their family members.

The ineligible member of the family consist of children or an offspring of a kid, bros, sisters, stepbrothers, or relatives, daddies, moms, or forefathers of moms and dads, stepfathers or stepmothers, nieces or nephews, aunties or uncles, and sons-in-law, daughters-in-law, fathers-in-law, mothers-in-law, brothers-in-law, or sisters-in-law.

It's important to keep in mind that while member of the family might not be eligible for the ERC, various other staff members might still qualify. Eligible workers must have been utilized by the company during the suitable amount of time as well as must have experienced a decrease in hrs or salaries because of the COVID-19 pandemic.

In addition to comprehending the eligibility requirements for the ERC, it's likewise essential for employers to understand the process of computing as well as claiming the credit. The quantity of the credit rating is based upon a portion of certified incomes paid to eligible staff members throughout the relevant time period. Companies can claim the credit history on their quarterly work tax returns or can ask for a development settlement of the credit report from the internal revenue service.

To conclude, comprehending the Employee Retention Credit and the procedure of determining and asserting it can substantially benefit companies impacted by the COVID-19 pandemic. Employers should meticulously review the qualification criteria, qualified wages, and also compliant techniques for asserting the ERC to guarantee they get the proper credit to help preserve their workforce as well as maintain operations during these difficult times. By doing so, organizations can not only make it through but grow in the face of misfortune.

1 note

·

View note

Text

A Comprehensive Guide to Employee Retention Tax Credit

In this write-up, we'll discover the Employee Retention Credit (ERC), a refundable tax credit history created to urge businesses to retain their staff members throughout uncertain economic times. We'll break down what the ERC is, who certifies, exactly how to calculate qualified salaries, how to declare the credit history, and also the role of Form 941-X while doing so. Additionally, we'll deal with whether family members of business owners can be consisted of in the ERC.

What Is the Employee Retention Credit?

The Employee Retention Credit is a provision of the Coronavirus Help, Alleviation, and Economic Safety And Security (CARES) Act introduced in March 2020. It was later broadened under the Consolidated Appropriations Act of December 2020 and also the American Rescue Plan Act (ARPA) of March 2021. The ERC intends to assist businesses affected by the COVID-19 pandemic keep their staff members on pay-roll, maintain operations, and also inevitably recuperate from the situation.