#Creditmanagement

Text

AR Akermon Rossenfeld Co: 7 Proven Strategies for Successful Debt Collection

Debt collection can be a challenging and often frustrating process for businesses. However, with the right strategies in place, it can also be a highly successful endeavor. AR Akermon Rossenfeld Co is a leading expert in debt collection, offering a range of services designed to help businesses recover outstanding debts quickly and effectively. In this blog post, we will explore seven proven strategies for successful debt collection that AR Akermon Rossenfeld Co recommends.

Establish Clear Terms and Conditions

One of the most important aspects of successful debt collection is establishing clear terms and conditions from the outset. This includes clearly outlining payment terms, deadlines, and consequences for late or non-payment. By ensuring that your customers understand these terms upfront, you can minimize the risk of disputes later on.

Maintain Regular Communication

Effective communication is key to successful debt collection. AR Akermon Rossenfeld Co recommends maintaining regular communication with debtors to keep them informed of their outstanding debts and payment deadlines. This can help to build trust and encourage debtors to make payments promptly.

Offer Flexible Payment Options

To make it easier for debtors to repay their debts, AR Akermon Rossenfeld Co suggests offering flexible payment options. This could include installment plans, deferred payments, or discounts for early repayment. By accommodating the needs of your debtors, you can increase the likelihood of successful debt collection.

Use Automated Reminders

Automated reminders can be an effective way to prompt debtors to make payments. AR Akermon Rossenfeld Co recommends using automated reminders via email, SMS, or phone calls to remind debtors of upcoming payment deadlines. This can help to reduce the risk of late or non-payment.

Offer Incentives for Early Payment

To encourage debtors to make payments promptly, AR Akermon Rossenfeld Co suggests offering incentives for early payment. This could include discounts, rewards, or entry into a prize draw. By offering incentives, you can motivate debtors to settle their debts quickly.

Use Professional Debt Collection Services

For businesses struggling to collect outstanding debts, AR Akermon Rossenfeld Co recommends using professional debt collection services. These services can help to recover debts quickly and efficiently, reducing the burden on businesses and improving cash flow.

Review and Improve

Finally, AR Akermon Rossenfeld Co advises businesses to regularly review their debt collection strategies and identify areas for improvement. By continuously refining your approach, you can increase the effectiveness of your debt collection efforts over time.

Conclusion

Successful debt collection requires a strategic and proactive approach. By following these seven proven strategies from AR Akermon Rossenfeld Co, businesses can improve their chances of recovering outstanding debts quickly and efficiently.

#DebtCollection#FinancialAdvice#BusinessTips#CashFlow#CreditManagement#DebtRecovery#PaymentReminder#FinancialPlanning#DebtFreeGoals#SmallBusinessFinance

0 notes

Text

6 Ways to Boost Your Credit Score Quickly and Take Charge of Your Credit Management

Your credit score is a vital number in today's financial world. It impacts everything from loan approvals and interest rates to rental applications and even job opportunities. So, if you're looking to improve your credit score quickly and take control of your credit management, here are 5 effective strategies to get you started:

1. Tame Your Credit Utilization

Credit utilization refers to the amount of credit you're using compared to your total credit limit. Ideally, you want to keep your credit utilization ratio below 30%. A good first step is to review your credit reports (you can get a free one from each bureau annually) and identify any credit cards with high balances. Focus on paying down these cards to lower your overall utilization. Consider transferring balances to a card with a lower interest rate to free up available credit and improve your score.

2. Make Consistent On-Time Payments

Payment history is the single most significant factor impacting your credit score. Even a single late payment can significantly ding your score, and the impact can linger for up to seven years. Set up automatic payments for your minimum balances to avoid missed payments altogether. Consider enrolling in programs that round up your purchases to the nearest dollar and apply the difference towards your credit card bill, accelerating your debt repayment and demonstrating consistent payment behavior to credit bureaus.

3. Leverage the Power of Credit Reporting Errors

Credit reports aren't perfect, and errors can drag down your score by hundreds of points. Obtain your free credit reports from all three major bureaus (Equifax, Experian, and TransUnion) and meticulously review them for any inaccuracies. Look for mistakes like incorrect account information, late payments that you didn't make, or accounts that don't belong to you. If you find errors, dispute them directly with the credit bureau and the creditor who reported the information using the online dispute process or by mail. Persistence is key in getting these errors corrected, and resolving them can significantly improve your credit score.

4. Become a Credit Card Authorised User

Being added as an authorized user on someone else's credit card with a good payment history can positively impact your score. This strategy works best if the primary cardholder has a long history of on-time payments and low credit utilization. However, ensure you understand the potential risks before becoming an authorized user, as you'll be legally responsible for any charges made on the account. This can be a great way to build credit if done responsibly but choose an authorized user relationship carefully to avoid inheriting someone else's credit baggage.

5. Consider a Secured Credit Card

If you have limited credit history or a poor credit score, a secured credit card can be a valuable tool. Secured cards require a refundable security deposit that serves as your credit limit. By using the card responsibly and making on-time payments, you can build a positive credit history and improve your score over time. Remember, responsible credit management is key. Use your secured credit card wisely and pay your balance in full each month to maximize its positive impact. Look for secured credit cards with rewards programs or graduation paths to traditional credit cards as an incentive for responsible use.

6. Be Mindful of New Credit Inquiries

While applying for new lines of credit can be tempting, especially if you're looking for lower interest rates on existing loans, too many inquiries in a short period (typically considered around six months) can negatively affect your score. Limit applying for new credit cards or loans unless necessary. Space out any credit applications you do make to minimize the impact on your score.

Taking Charge of Your Credit Management

These strategies can give your credit score a quick boost. However, true credit management is an ongoing process. By implementing these tips and maintaining healthy credit habits like monitoring your credit reports regularly (you can stagger your requests throughout the year to monitor activity more frequently), setting up alerts for changes to your credit report, and using credit responsibly, you can build a strong credit score and unlock a world of financial opportunities. Remember, a good credit score is an investment in your financial future, and taking control of your credit management is the first step toward achieving your financial goals.

0 notes

Text

The Impact of Non-Payment on Credit Scores in California: A Closer Look

Explore the consequences of non-payment on credit scores in California with our in-depth analysis. Learn about the intricacies and potential repercussions, gaining valuable insights into how financial decisions can influence your credit standing. Stay informed for a healthier financial future.

#CreditScores #CaliforniaFinance #FinancialEducation #CreditManagement #DebtImpact #CreditHealth #PersonalFinance #CaliforniaCredit #FinancialAwareness #CedarFinancial

#CedarFinancial#CreditScores#CaliforniaFinance#FinancialEducation#CreditManagement#FinancialAwareness#CaliforniaCredit#CreditHealth#PersonalFinance

0 notes

Text

www.GrowMyBusiness.Credit provides the resources to help entrepreneurs and small business owners understand and improve their business credit to get funding. We cover various aspects of business credit, such as how to establish and maintain good credit, understanding credit scores, and strategies to improve creditworthiness. We also offer guidance on how to build a strong business credit profile from scratch. This typically involves registering your business with the appropriate authorities, obtaining an Employer Identification Number (EIN), and creating a separate business credit profile. Grow My Business Credit assist clients in accessing unsecured business funding and revolving credit accounts that allows businesses to access funds as needed. We provide information on how to qualify for small business loans, which can be used for various purposes such as expansion, equipment purchase, or working capital. We also offer guidance on obtaining financing for real estate investments or commercial properties, which can be a significant aspect of building business wealth. Website: www.GrowMyBusiness.Credit The Book: www.amazon.com/dp/B0CM1Y5YW8

#BusinessCredit#CreditProfile#CreditScore#SmallBusiness#FinancialSuccess#CreditManagement#Entrepreneurship#FinancialHealth#SmallBizTips#FinancialPlanning#CreditWorthiness#CreditBuilding#BusinessGrowth#FinancialStability#CreditEducation#BusinessSuccess#MoneyMatters#Creditworthiness#BusinessOwners#BusinessFinances

0 notes

Text

Financial Literacy: A Foundation for Success

Introduction

Welcome to our in-depth guide on financial literacy. In today's fast-paced world, understanding financial matters is more critical than ever. Whether you're a young adult just starting or someone looking to improve their financial knowledge, this article will provide you with valuable insights and actionable advice.

Financial Literacy: A Foundation for Success

Financial literacy is not just a buzzword; it's a crucial life skill. It empowers individuals to make informed decisions about money, investments, and financial planning. In this guide, we'll cover a wide range of topics related to financial literacy, ensuring that you have the knowledge needed to navigate your financial journey successfully.

The Importance of Financial Literacy

Financial literacy plays a pivotal role in our lives. It's not just about balancing your checkbook; it encompasses a broad spectrum of knowledge and skills that can have a significant impact on your financial well-being.

Understanding Financial Literacy

Financial literacy encompasses various aspects, including:

Budgeting and Money Management

Saving and Investing

Debt Management

Retirement Planning

Financial Goal Setting

Building Strong Foundations

Before delving into specific aspects of financial literacy, it's essential to establish a strong foundation. Let's start with some fundamental principles.

Budgeting: The Key to Financial Success

Effective budgeting is the cornerstone of financial stability. It involves tracking your income and expenses to ensure that you're living within your means.

Saving for a Rainy Day

Financial experts often stress the importance of having an emergency fund. Learn how to save for unexpected expenses and emergencies.

The Power of Compound Interest

Discover how compound interest can work for you and help your savings grow over time. We'll explore the magic of compound interest in detail.

Financial Literacy in Practice

Now that we've laid the groundwork, let's delve into practical strategies for improving your financial literacy.

Investing Wisely

Learn about different investment options, such as stocks, bonds, and mutual funds. Understand the risks and rewards associated with each.

Managing Debt Effectively

Debt can be a double-edged sword. We'll discuss strategies for managing and reducing debt, so it doesn't become a financial burden.

Retirement Planning

It's never too early to start planning for retirement. We'll guide you through creating a retirement savings plan and understanding retirement accounts.

Achieving Financial Goals

Setting financial goals is crucial for success. Discover how to set SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals and work towards them.

FAQs (Frequently Asked Questions)

What is financial literacy?

Financial literacy refers to the knowledge and skills necessary to make informed financial decisions. It encompasses budgeting, saving, investing, and managing debt effectively.

How can I improve my financial literacy?

To improve your financial literacy, start by creating a budget, saving regularly, and educating yourself about various financial topics. Consider seeking advice from financial experts or attending workshops.

Why is budgeting important?

Budgeting is essential because it helps you track your income and expenses, avoid overspending, and achieve your financial goals.

Is investing a good way to grow my wealth?

Investing can be a powerful way to grow your wealth over time. However, it comes with risks, so it's essential to educate yourself and make informed investment choices.

When should I start planning for retirement?

It's best to start planning for retirement as early as possible. The earlier you begin saving and investing for retirement, the more financially secure you'll be in your golden years.

How can I reduce my debt?

To reduce debt, start by creating a debt repayment plan, focusing on high-interest debts first. Cut unnecessary expenses and consider debt consolidation if it makes financial sense.

Conclusion

In conclusion, financial literacy is a vital skill that can significantly impact your financial well-being. By mastering budgeting, saving, investing, and debt management, you can achieve financial success and secure your future. Take the first step today towards a financially savvy and prosperous life.

#FinancialLiteracy#MoneyManagement#InvestingTips#Budgeting101#DebtFree#RetirementPlanning#SmartSaving#FinancialEducation#PersonalFinance#FinancialGoals#FinancialEmpowerment#WealthBuilding#FinancialSuccess#FinancialWellness#FinancialFreedom#MoneySkills#FinancialPlanning#InvestmentStrategies#SavingsGoals#CreditManagement

0 notes

Text

Impact of Credit Utilization on Salaried Personal Loans

When it comes to obtaining a personal loan as a salaried individual, your credit score plays a pivotal role. One of the critical factors that affect your credit score is your credit utilization ratio. Understanding how credit utilization influences your eligibility and loan terms is crucial for securing the best personal loan offers. In this article, we will demystify the impact of credit utilization on salaried personal loans.

What Is Credit Utilization?

Credit utilization, also known as the credit utilization ratio, is the percentage of your available credit that you are currently using. It's calculated by dividing your credit card balances by your credit limits. For example, if you have a credit card with a limit of ₹50,000 and a balance of ₹10,000, your credit utilization ratio is 20% (10,000 / 50,000 * 100).

The Significance of Credit Utilization in Personal Loans

Maintaining a healthy credit utilization ratio is essential for several reasons:

Creditworthiness: Lenders consider your credit utilization when evaluating your creditworthiness. A lower ratio indicates responsible credit management, making you a more attractive borrower.

Impact on Credit Score: Your credit utilization directly affects your credit score. High utilization can negatively impact your score, while lower utilization can have a positive effect.

Loan Eligibility: Lenders often set criteria for credit utilization. Having a high ratio may disqualify you from certain loan offers, while a low ratio can increase your eligibility.

Interest Rates: A good credit utilization ratio can help you secure personal loans at lower interest rates. Lenders view individuals with lower utilization as lower-risk borrowers.

How to Maintain a Healthy Credit Utilization Ratio

To improve your chances of securing favorable personal loan terms as a salaried individual, follow these tips to maintain a healthy credit utilization ratio:

Keep Credit Card Balances Low: Try to keep your credit card balances well below your credit limits. Pay off outstanding balances in full whenever possible.

Use Credit Wisely: Avoid opening too many new credit accounts simultaneously, as this can negatively impact your credit utilization.

Regularly Monitor Your Credit: Check your credit report regularly to ensure accuracy and identify any discrepancies. Dispute any errors promptly.

Pay Bills on Time: Timely payment of credit card bills and other debts is crucial for maintaining a positive credit utilization ratio.

Consider Credit Limit Increases: Requesting a credit limit increase on your existing credit cards can help lower your utilization ratio.

Conclusion

Your credit utilization ratio is a key factor in determining your creditworthiness and, consequently, your eligibility and terms for personal loans as a salaried individual. Maintaining a healthy ratio by managing your credit responsibly is essential. By doing so, you not only improve your chances of loan approval but also gain access to better loan offers with lower interest rates.

When seeking personal loans tailored for salaried employees, you can explore the options available at Privo. Their expertise in catering to the unique financial needs of salaried individuals can help you secure a personal loan that suits your requirements while taking your credit utilization into account.

#CreditUtilization#PersonalLoans#SalariedEmployees#CreditScore#LoanImpact#FinancialAdvice#CreditManagement#LoanEligibility#FinancialEducation#CreditUtilizationRatio#DebtManagement#LoanApproval#FinancialWellness#CreditFactors#LoanInterestRates

0 notes

Text

How To Manage A Personal Loan $100,000!

In the realm of personal finance, managing a substantial loan like $100,000 requires careful planning, a clear understanding of interest calculations, and strategic repayment techniques.

Whether you're seeking financial assistance for a significant life event or an investment opportunity, a personal loan can be a valuable tool when used wisely.Are you a Tax Lawyer in USA?

In this comprehensive guide, we'll explore the nuances of managing a personal loan of $100,000 and leveraging interest calculators to your advantage.

Understanding Personal Loans

What Is A Personal Loan?

At its core, a personal loan is a financial arrangement where a lending institution provides a borrower with a fixed sum of money, which is to be repaid over a specified period with interest.

The flexibility of personal loans allows individuals to cover various expenses, from consolidating debts to funding educational pursuits or home renovations.

However, managing a substantial personal loan necessitates strategic planning and a solid understanding of how interest impacts the overall repayment process.

Interest Calculation In Personal Loans

The cornerstone of personal loan management lies in comprehending the concept of interest.

When you borrow money, the lender charges interest—a percentage of the principal amount—over the repayment period.

The interest rate is typically determined based on factors like credit score, loan term, and the lender's policies.

This interest adds to the total amount you'll need to repay, making it crucial to grasp how it's calculated.

Benefits Of Using Personal Loan Interest Calculators

Accurate Loan Estimations

One of the primary advantages of using a personal loan interest calculator is the ability to obtain accurate estimations of your monthly payments.

By inputting your loan amount, interest rate, and loan tenure, these calculators provide a breakdown of your repayment plan.

This information empowers you to plan your finances more effectively and anticipate the exact amount you'll be allocating for loan payments each month.

Comparison Of Interest Rates

Personal loan interest calculators also offer a unique advantage by allowing you to compare different interest rates offered by various lenders.

This functionality is especially valuable when aiming to secure the best possible interest rate.

By inputting different interest rates into the calculator, you can evaluate how they impact your monthly payments and the total amount repaid over time.

Steps To Use A Personal Loan Interest Calculator

Finding A Reliable Calculator

To effectively utilize a personal loan interest calculator, it's crucial to choose a reliable and accurate tool.

Consider factors like user reviews, website credibility, and ease of use when selecting a calculator.

Reputable online financial platforms often provide trustworthy calculators that simplify complex interest calculations.

Entering Loan Details

Using a personal loan interest calculator begins with inputting specific loan details.

You'll need to provide the loan amount, interest rate, loan term, and any additional fees associated with the loan.

This information serves as the foundation for the calculator's estimations, ensuring that the results accurately reflect your loan terms.

Analyzing The Results

Once you've entered the necessary details, the calculator generates a comprehensive breakdown of your repayment plan.

This breakdown includes the monthly installment amount, the total interest paid over the loan's duration, and the final amount repaid.

This data empowers you to make informed decisions about loan management and budgeting.

In the next section, we'll delve into effective strategies for managing a substantial personal loan and explore refinancing options as a means of securing better interest rates.

Strategies For Managing A $100,000 Personal Loan

Creating A Repayment Plan

Managing a $100,000 personal loan requires a well-thought-out repayment plan.

Without a structured approach, the sheer size of the loan can be overwhelming.

To effectively navigate this financial commitment, consider the following steps:

⇒ Assess Your Financial Situation: Take stock of your current income, expenses, and other financial obligations. This evaluation will help you determine how much you can comfortably allocate towards loan repayments.

⇒ Set a Realistic Budget: Craft a budget that accommodates your monthly loan payments while also covering essential expenses. Strive to strike a balance between loan repayment and maintaining a reasonable quality of life.

⇒ Prioritize Loan Payments: Make loan payments a top priority within your budget. Allocate funds specifically for the loan to ensure that you're consistently making progress on repayment.

Exploring Refinancing Options

Refinancing, the process of replacing an existing loan with a new one, can be a valuable tool in managing a $100,000 personal loan effectively.

Refinancing aims to secure better terms, which often include lower interest rates. Here's what you should know:

⇒ When to Consider Refinancing: Refinancing becomes particularly advantageous when market interest rates have decreased since you initially acquired the loan. Lower interest rates translate to reduced monthly payments and potentially significant savings over the loan's lifetime.

⇒ The Benefits of Lower Rates: By securing a lower interest rate through refinancing, you can potentially save money in the long run. This is especially crucial for substantial loans, as even a slight reduction in the interest rate can lead to substantial overall savings.

⇒ Factors to Consider: Before opting for refinancing, assess any associated costs, such as application fees or prepayment penalties. Compare the total costs of the new loan against the potential savings to ensure that refinancing makes financial sense.

Getting The Best Interest Rate On A Personal Loan

Maintaining A Good Credit Score

Your credit score plays a pivotal role in determining the interest rate you'll be offered for your $100,000 personal loan.

A higher credit score often translates to more favorable interest rates. Here's how to boost and maintain a healthy credit score:

⇒ Check Your Credit Report: Regularly monitor your credit report for errors and inaccuracies. Dispute any discrepancies to ensure that your credit score accurately reflects your financial behavior.

⇒ Timely Payments: Consistently make on-time payments for all your credit obligations, including credit cards and existing loans. Late payments can have a detrimental impact on your credit score.

⇒ Manage Credit Utilization: Keep your credit utilization—the ratio of your credit card balances to their limits—below 30%. High credit utilization can signal financial distress and negatively affect your credit score.

Shopping Around For Lenders

Securing the best interest rate on a personal loan involves exploring multiple lenders and their offerings.

Here's how to effectively shop for the most favorable terms:

⇒ Research Lender Options: Research and compile a list of reputable lenders that offer personal loans. Look for lenders known for transparency, good customer service, and competitive rates.

⇒ Compare Interest Rates: Request loan quotes from several lenders and compare the interest rates they offer. Keep in mind that rates can vary based on your creditworthiness and other factors.

⇒ Evaluate Loan Terms: In addition to interest rates, consider other terms such as loan origination fees, prepayment penalties, and repayment terms. The overall package should align with your financial goals and circumstances.

Frequently Asked Questions

Q1: How can I effectively use a personal loan interest calculator?

A1: Using a personal loan interest calculator involves inputting your loan details to obtain accurate estimates of monthly payments, total interest, and repayment breakdowns.

Q2: What benefits does refinancing offer for a $100,000 personal loan?

A2: Refinancing can lower interest rates, leading to reduced monthly payments and potential long-term savings on a substantial loan.

Q3: Can I improve my credit score to secure a better interest rate?

A3: Yes, maintaining a good credit score by making timely payments and managing credit utilization can positively impact the interest rate you're offered.

Conclusion

Managing a personal loan of $100,000 requires strategic planning, financial awareness, and the right tools.

By understanding interest calculations, utilizing personal loan interest calculators, and employing effective management strategies, you can navigate this financial commitment with confidence.

Remember that securing the best interest rate and crafting a solid repayment plan are key components of successful personal loan management.

Empower yourself with knowledge, and make informed decisions to achieve your financial goals while managing your substantial personal loan responsibly.

#PersonalFinance#LoanManagement#FinancialPlanning#MoneyManagement#SmartBorrowing#DebtManagement#BudgetingTips#FinancialGoals#CreditManagement#FinancialWisdom

0 notes

Text

Appreciating vs. Depreciating Assets: Making Informed Financial Choices

Hello Finance Enthusiasts! 👋

When it comes to managing your finances, understanding the difference between appreciating and depreciating assets is crucial. Let’s dive into these concepts to help you make informed decisions about your investments.

Appreciating Assets: Building Wealth Over Time

Appreciating assets are investments that tend to increase in value as time goes on. These assets can…

View On WordPress

#BusinessStrategies#CanadianRisk#CharteredInsurance#ConsultantExpertise#CreditManagement#DivorcePlanning#FinancialJourney#FinancialMastery#FinancialPartner#FinancialSpecialist#HardshipSolutions#InsurancePro#InvestmentStrategies#JobLossInsights#LLQP#NewcomerGuidance#RelationshipBuilding#RiskExpert#RiskManagement#StrategicPlanning#TradesFinance#UnderwritingSkills#WealthPlanning

1 note

·

View note

Text

What is The Good and Average Credit Score in The UK/Britain 2023?

#blogstory#blogger#bloginuk#blog#blogs#bloglikestory#storylikeblog#blogforbusiness#ukcreditscore#creditscoresuk#goodcredit#averagecreditscore#financeuk#creditrating#credithistory#creditmanagement#financialwellbeing#credittips#improvecreditscore#credithealth#CreditScoreGoals#financialfreedom#crediteducation#creditbuilding#CreditScoreFactors#creditscoreknowledge#creditscoresolutions#manageyourcredit#lowcreditscore

1 note

·

View note

Link

Acuiti Labs can help streamline credit management processes and enhance the customer experience by integrating BRIM with other SAP modules. They can help you identify the best solutions for your business needs and implement them effectively.

0 notes

Text

In today's fast-paced and dynamic world, managing debt and securing financial health is more crucial than ever. Akermon Rossenfeld, a seasoned financial expert, has graciously shared seven invaluable tips to guide you on the path to financial stability. Let's delve into these practical suggestions and empower ourselves to take control of our financial well-being.

#Moneymanagementtips#Financialwellness#Debtmanagement#Personalfinance#Budgetingtips#Financialfreedom#Creditmanagement

0 notes

Photo

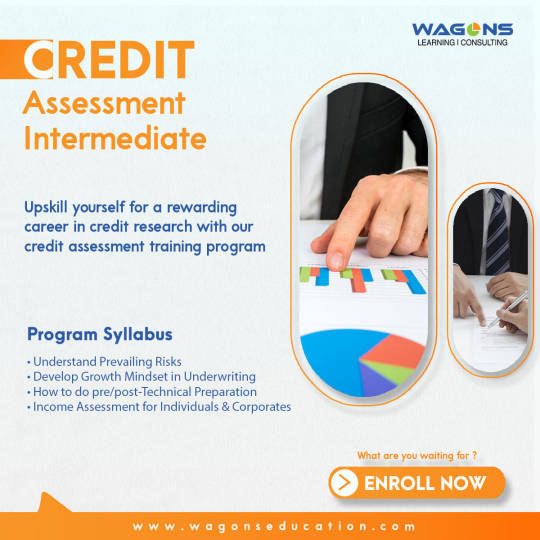

Credit assessment helps in calculating the financial soundness of a business or organization. All in all, it is the assessment of the capacity of an organization to respect its monetary commitments. To avoid credit risks banks and financial institutions, work on the viability of the credit evaluation process and credit corresponding costs.

Our Credit Assessment Training Program gives you an in-depth understanding of the lending landscape, credit underwriting, credit administration, and regulatory requirements.

Batch Timings

05th Nov | 4 hours |10am -2 pm

13th Nov | 4 hours |10am -2 pm

19th Nov | 4 hours |10am -2 pm

27th Nov | 4 hours |10am -2 pm

Click on the link below to register

https://wagonseducation.com/home/course/credit-assessment-intermediate/109

For more information visit:

https://www.wagonslearning.com/

#creditanalysis#creditmodeling#creditmanagement#creditrisk#creditportfolio#creditderivatives#creditassessment#creditreport#debtfree#wagonslearning#wagonseducation#learning#training#blockchain#fintech

1 note

·

View note

Video

youtube

What is the 15 3 rule? | Credit Card Hack Tricks

The Promise of the 15/3 Strategy | (877) 870-0717

Advocates' Perspective https://greenlightsdebtrelief.com

Supporters of the 15/3 credit card hack argue that it's a smart way to manage credit. By making two payments each billing cycle - one halfway through and another just before the due date - they believe it showcases financial responsibility. The key benefit, as touted by enthusiasts, is the potential reduction in credit utilization ratio, which can positively affect credit scores.

Skeptics' Standpoint

Critics, however, are quick to point out flaws in this approach. They highlight that credit card companies typically report to bureaus once a month, making the frequency of payments irrelevant to credit history. According to them, the supposed benefits of the 15/3 method are, at best, exaggerated.

Diving Deeper: The Real Impact on Credit Scores

A Closer Look at Credit Utilization

Proponents argue that by reducing the balance reported at the end of the billing cycle, the 15/3 hack can indeed lower the credit utilization ratio. In their view, this is a direct pathway to a better credit score.

Counterargument: The Illusion of Impact

On the flip side, critics assert that the improvement in credit utilization is merely superficial. They argue that the same result can be achieved by simply paying the full balance once, just before the reporting date.

Beyond the 15/3 Method: Exploring Alternatives

Comprehensive Credit Management

While the 15/3 hack garners attention, experts suggest more holistic approaches to credit score improvement. These include diverse credit management techniques, such as maintaining a variety of credit types and ensuring timely payments across all accounts.

The Power of Full Balance Payments

A universally accepted strategy is paying the full balance before the due date. This method not only helps maintain a low credit utilization ratio but also avoids the accrual of interest, a point agreed upon by both supporters and critics of the 15/3 hack.

Regular Monitoring of Credit Reports

Another agreed-upon strategy is the regular monitoring of credit reports. Both sides concur that keeping an eye on credit activities and addressing discrepancies swiftly is vital for maintaining a healthy credit score.

Concluding Thoughts

The 15/3 credit card hack remains a divisive topic in personal finance circles. While it has its advocates, many argue that traditional methods of credit management are more effective and reliable. Ultimately, the choice of strategy depends on individual financial habits and goals.

#youtube#CreditCardHack 153CreditStrategy CreditScoreTips CreditUtilization CreditManagement PersonalFinance DebtManagement CreditReportMonitoring Fi

0 notes

Text

Quick tips to establish a healthy business credit profile. Understanding the benefits of good business credit is a must..

#BusinessCredit#CreditProfile#CreditScore#SmallBusiness#FinancialSuccess#CreditManagement#Entrepreneurship#FinancialHealth#SmallBizTips#FinancialPlanning#CreditWorthiness#CreditBuilding#BusinessGrowth#FinancialStability#CreditEducation#BusinessSuccess#MoneyMatters#Creditworthiness#BusinessOwners#BusinessFinances

0 notes

Text

𝐅𝐢𝐧𝐚𝐧𝐜𝐞 𝐌𝐚𝐧𝐚𝐠𝐞𝐫 𝐉𝐨𝐛 𝐕𝐚𝐜𝐚𝐧𝐜𝐢𝐞𝐬,𝐅𝐢𝐧𝐚𝐧𝐜𝐞 𝐌𝐚𝐧𝐚𝐠𝐞𝐫 𝐎𝐩𝐞𝐧𝐢𝐧𝐠𝐬 𝐢𝐧 𝐈𝐧𝐝𝐢𝐚 - https://www.placementindia.com/job-search/finance-manager-jobs.htm

👆

#financemanagerjobs#financemanager#financialanalyst#financialplanner#salesmanager#backofficemanager#branchhead#accountant#creditmanager#investmentadvisor#businessdevelopmentassociate#PlacementINDIA💼

0 notes

Text

Breaking Point How Overdrafts Pushed Me to the Edge

🚀 Unlock financial flexibility with our Salaried Overdraft offerings! Get the best rates on overdrafts, with a comfortable tenure of up to 8 years. Plus, our Balance Transfer, Personal Loan, and Credit Card options are tailored to support your financial freedom. Ready to learn more about how you can benefit? 🌟

👉 Tap 'Learn More' or contact us at 9743739944 today!

FinancialFreedom #OverdraftSolutions #PersonalLoans #CreditManagement #instantloanservices #bhsinstantloan

Visit our website

https://bhsinstantloans.in/contact/

1 note

·

View note