#improvecreditscore

Text

Credit Card Piggybacking: Strategy to Improve Your Credit Score

The Concept of Credit Card Piggybacking

Credit card piggybacking is an innovative strategy that can help individuals build or improve their credit scores. This concept involves becoming an authorized user on someone else's credit card account, thereby gaining access to their credit history and positive payment behavior.

By leveraging the established credit of a responsible cardholder, those with limited or poor credit can benefit from the increased likelihood of being approved for loans, mortgages, and other financial opportunities.

To begin credit card piggybacking, one must find a willing participant who has good credit standing and is willing to add them as an authorized user. It is crucial to choose someone who has maintained a low utilization rate (the percentage of available credit they regularly use) and consistently pays their bills on time.

Becoming an Authorized User

As authorized users, individuals can tap into the primary cardholder's positive credit history. The credit card issuer may report the account activity to the credit bureaus in the authorized user's name, which can potentially boost their credit score.

Responsible credit habits, such as timely payments, low credit utilization, and long credit history, contribute to this positive effect.

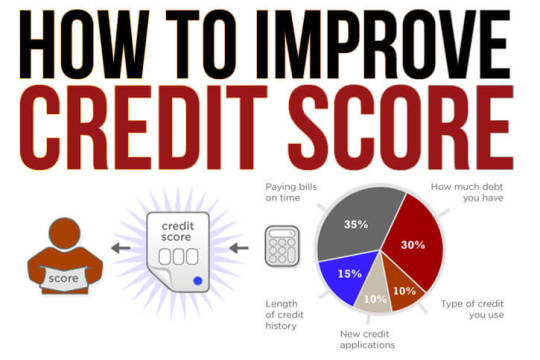

Impact on Credit Score

Credit card piggybacking can have a positive impact on an authorized user's credit score if the primary cardholder has a strong credit profile.

Factors such as the account's age, payment history, and credit utilization ratio can contribute to improving the authorized user's credit score, particularly if they have a limited credit history or negative marks on their credit report.

Risks and Considerations

While credit card piggybacking offers benefits, it's essential to be aware of the risks involved. As an authorized user, your actions can impact both your credit score and the primary cardholder's credit. Irresponsible purchases or late payments can have adverse effects.

Additionally, being a cosigner on someone else's credit card account carries the risk of fraud or misuse, emphasizing the importance of trust and open communication.

The Perspective of the Primary Cardholder

Primary cardholders should carefully consider the impact of adding an authorized user to their account. While it can potentially benefit the authorized user's credit score, closely monitoring their activity is crucial to avoid any negative consequences.

Responsible credit habits and maintaining the account in good standing are essential to protect both parties' credit.

The Importance of Individual Credit Building

While credit card piggybacking can boost your credit score, it's vital to continue building your own credit history independently. Establishing good credit habits, such as timely bill payments and maintaining a low credit utilization ratio, is key to long-term financial stability.

Balancing Benefits and Responsibility

Credit card piggybacking can be a valuable strategy to improve your credit score. By leveraging someone else's positive credit history, you can enhance your creditworthiness.

However, both authorized users and primary cardholders must be aware of the potential risks and responsibilities involved. Building your own credit history independently remains crucial for long-term financial success.

Conclusion

In conclusion, credit piggybacking is a beneficial strategy to improve your credit score in 2023. By becoming an authorized user of someone else's credit card, you can leverage their positive credit history. However, it's important to consider the risks involved and maintain responsible credit habits.

While credit piggybacking provides a valuable boost, it should complement building your own credit history. Establishing good credit habits, making timely payments, and maintaining a low credit utilization is crucial for long-term financial stability.

Combining credit piggybacking with individual credit-building efforts is key. By doing so, you can establish a solid credit foundation and open up greater financial opportunities. Remember, responsible financial practices are essential in your credit-building journey.

Sources: THX News & Harrison Pierce.

Read the full article

#Authorizeduser#Boostcreditworthiness#Buildingcreditindependently#Creditcardpiggybacking#Creditutilizationratio#Financialstability#Improvecreditscore#Positivecredithistory#Responsiblecredithabits#Risksofpiggybacking

0 notes

Text

What is The Good and Average Credit Score in The UK/Britain 2023?

#blogstory#blogger#bloginuk#blog#blogs#bloglikestory#storylikeblog#blogforbusiness#ukcreditscore#creditscoresuk#goodcredit#averagecreditscore#financeuk#creditrating#credithistory#creditmanagement#financialwellbeing#credittips#improvecreditscore#credithealth#CreditScoreGoals#financialfreedom#crediteducation#creditbuilding#CreditScoreFactors#creditscoreknowledge#creditscoresolutions#manageyourcredit#lowcreditscore

1 note

·

View note

Text

How do I check a credit card history?

In today's world, credit cards are vital in day-to-day life. A long time back, credit cards were considered things to be used only by the rich, as the middle-class people were unaware of their use.

But as the world flourished, people came to know about its use.

Credit cards are a payment method in which you can buy a thing and pay for it afterward. You will receive the report of your use at the end of the month.

It is good to check the report as anything unauthorized can be reported.

You can check your credit card report via online banking, or you will get a monthly detail of your credit card transaction. This report will contain your,

1.List of transactions domestic or international.

2.Transaction dates.

3.Dues pending on card to avoid late payment fee.

4.The credit limit of how much can you use and how much of it is left on the card.

5.How many reward points are present on the account.

6.Summary of how much you have paid to the bank, and how much due is pending.

7.The list of items bought through credit card.

It is necessary to check your credit card bill, as this will save you from bad debt. Credit card bills if repaid on time will help you in the long run. And seeing any unusual activity on the credit card like a purchase should be directly reported to the bank. A card report also helps you understand if you are overspending more than usual.

0 notes

Link

Improve Your Credit Score For Better Deals On Loans & Mortgages. It is one of the best credit repair organization which will help you to enhance your credit score.

1 note

·

View note

Text

Improve Your Credit Score

If you want to improve your credit score then you contact Zoom Boom Credit. We help your credit score rating has been improving. visit for more information on our site.

1 note

·

View note

Link

0 notes

Text

Shop Simplio | Increase Personal Credit Line

Raise your personal credit line, buy awesome gadgets, and build your personal credit score at the same time. With Shop Simplio building your credit is fun and cheap.

0 notes

Photo

Learn how to fix your credit.

With the right approach, you can build your credit score and apply for credit, loans and even a mortgage. Learn how a foreclosure affects your credit score and what you can do right now to start repairing your credit.

0 notes

Text

Should You Build Your Credit Or Pay Off Your Debt First?

Whenever you come across a bonus or any other lump sum payout, there comes the sweet dilemma. ‘Do I save money or pay off some debt?’. Both options are important and require some consideration before making a decision.

#creditscore#checkyourscore#improvecreditscore#fixcreditscore#NBFC#banks#lending#investment#savings#credit#debt#money#credithistory#finance#CreditMantri

0 notes

Video

COMMENT "INFO" BELOW OR CALL 424-328-0405 AND SAVE UP TO 50% WITH PROMO CODE "BARB2017" #creditrepair #bestresults #inquiryremoval #improvecreditscore #ficoboost #creditfix #creditboost

1 note

·

View note

Text

What You Need To Do To Repair Credit And Increase Credit Score?

The credit rating of each person is such a thing, which often determines the quality of his life, giving the opportunity to receive more financial support or vice versa. A high credit rating helps to get the best offers from lenders and the financing of large purchases; a low credit score, on the contrary, does not make it possible to rely on good interest rates and terms of loans, as well as on approval of large amounts of loans. If you need to finance the purchase of a house, a new car, or an initial business investment, then you will need a good credit. That is why, like many other people you are worried about how to repair your credit score.

As is often the case, people remember their credit rating only when they need money, despite the fact that it will not work out quickly to correct the situation. Depending on the condition of your credit, you may need more than one month to repair your credit score. Therefore it is worth doing this now, not postponing until later, when you may not have time left for it, but how to do it and where to start?

We have compiled and analyzed information to compile this manual to repair credit and increase credit score, where there are clear steps that you can follow. Read on to find out how.

First of all, find out what happens to your credit

Every year, once you have the opportunity to get your credit report from every credit bureau in the USA for free. You should definitely take advantage of this opportunity by requesting your credit report. In addition, many credit cards offer weekly or monthly credit reports, as well as some online services.

To use one of the online services to view your credit report, you will first need to register, after which information about your credit score will become available to you. Now that you are aware of the current state of affairs, you can assess your situation and proceed with your credit score.

Do not be surprised when you see different numbers of credit points in credit reports from different sources, they will almost always differ, albeit slightly. This is due to various errors that you most often can remove.

Correct, discuss or dispute invalid entries in your credit report

Errors in credit reports are a very common phenomenon. Your lender may not promptly enter information about your loan payment, which you made in a timely manner, for example, and thus the wrong information was received by the credit bureau. This is fairly common, but you can fix it if you know about it and make a little effort.

To correct an error in a credit report, you just need to contact your lender or credit bureau. Now it can also be done online and correct the error with one click. This is definitely worth doing to repair your credit and increase credit score. You will be able to correct or dispute late payments that you consider to be erroneous. It is possible to do this both with current accounts and with already closed ones. This is important to do because your credit history will also be carefully considered by lenders when you apply for a loan.

It is worth making the effort to correct all errors, because such mistakes lower your credit rating. You can also dispute some adverse credit events that may have occurred, but those that occurred through no fault of yours or circumstances beyond your control. Using one of the online services, you can dispute such events with one click of the "Dispute" button. Often, lenders accept your position and agree to relieve you of responsibility for such events.

At the same time, credit bureaus will be required by law to remove such an unfavorable record, if there is no evidence that you made a late payment or other action that harmed your credit. Not all disputes are resolved quickly, some may take several weeks, but the main thing is that any credit bureau, also under the law, is obliged to investigate any case that you dispute.

You can also dispute the incidents that occurred. Some people manage to dispute even such cases when their debt was transferred to a company collecting debts. Of course, this is not always the case and in most cases such events remain in the credit report, but successful cases tell us that this is possible in principle.

Each dispute causes a precedent that the credit bureau is required to verify. The bureau addresses the creditor to confirm or deny the information. Collection companies, as well as small local creditors, in most cases ignore such requests due to the fact that it is troublesome for them. This means that the information will not be confirmed and the credit bureau will have to remove such unverified information.

Some people use this dispute strategy, hoping that a small lender or a collection company will not respond to a credit bureau request, but we do not recommend doing so, because it can cause great harm to your credit if something goes wrong. Of course, if this has already happened, then try to use all the available opportunities to repair your credit score, but you should not count on it initially.

Be polite

If you have failed to dispute your debt or an overdue payment, or any other adverse credit event, then you can give up, or you can simply and politely ask your lender to delete the record about it. Often the lender will be ready to meet you in order to keep you as a client and increase your loyalty, especially if you have been a client for a long time.

Lenders have the opportunity to change the records in your credit report at any time by sending the necessary information to the credit bureau. Try to negotiate with your lender that he instructed the credit bureau to remove the record of a harmful credit event. Ask a human being, as if asking your friend to go to meet you. You may sometimes be surprised at how effective such an appeal to the lender may be.

Pay every bill on time

To prevent a decrease in your credit score and the deterioration of your credit history, try to always make loan payments and pay your bills on time. Even one late payment reduces your credit score, and with it your credibility for your creditors.

Perhaps some lenders will give you some time to pay your debt before you send a negative record of your late payment to a credit bureau. Sometimes this period can reach 90 days, but this does not happen often, only a few lenders are willing to do that. Therefore, always count so that you always pay on time.

Increase credit limits

The ratio of the use of credit to your total credit limit significantly affects your credit rating. The less you use the credit available to you, the higher your credit rating will be. Try not to use more than 30% of the credit limit available to you on a credit card. When you use more funds, your credit score becomes smaller.

If there is such an urgent need to use the entire credit limit, then try as quickly as possible to pay off your debt. To repair credit and increase credit score, try to let the lender increase your credit limit. If the lender does this, then using the same amount of credit funds, you will reduce your balance. This will positively affect your credit rating, and instantly.

Apply for an increase in your credit limit. If this need to be done by phone, then again in a polite conversation, ask your credit agent. If you have a good payment history without delinquency and for quite a long time, then you probably will not be denied. Lenders are interested in you to spend more, because they earn from it.

Just do not forget then why you asked for an increase in the credit line and do not start spending more money. So you only worsen your position with the same utilization rate and with increased debt. Do not go beyond your previous spending.

First-repay-the-credit-accounts-with-higher-interest-rates

Open another credit card

You can register another credit card to increase your total credit limit and reduce its utilization rate. To do this, it should not be used to reduce your balance and then again instantly repair your credit score.

To do this, you should choose credit card options without an annual fee and with no penalty for low activity of use. Let the interest rate of such a credit card be higher, but you are not going to use it too much? If you have problems with this, then you should not open a new account. If you are resistant to low price tags and sales, then this option will suit you.

Redeem the maximum possible of your outstanding balances

If you, using the previous tips, increase your credit limit and reduce the utilization rate of the credit, then try a little more and the result you get may pleasantly surprise you. You will have to make an effort to pay the outstanding balances on your credit cards, but believe me, it's worth it. If your balance drops to zero, then your credit rating will instantly increase. You will immediately increase your credit score and your financial opportunities will increase significantly.

You can count on financing your large purchases when your balance decreases so much. Of course, this is easier said than done, but still, it is within your power. In the long run, this step will significantly affect your credit in a positive way.

First repay the credit accounts with higher interest rates

First and foremost, focus on repaying loans and credit cards with higher interest rates as quickly as possible. This will allow you to reduce your debt and simplify the further management of your finances. Then switch your attention to newer credit accounts so that your credit history does not decrease. The longer your credit history is, the greater your credit rating will be, if other things being equal. The system is not complicated - first we extinguish high interest rates, then those credit cards that have a smaller age.

Become an authorized user of a credit card of a person you trust

To repair credit and increase credit score you can use another method. To do this, you need to become an authorized user of a credit card with a low balance or without it at all of one of your family members or another person whom you can trust and who will also trust you.

If you find a person who agrees to this, he will give his permission for you to become such an authorized user and at the same time the credit limit of this person will be added to yours. This, again, will increase your ratio of available credit to used and quickly. But you should remember that if this person makes a delay in payment, this will also affect your credit history and the credit report as a whole.

Do not close old credit cards

As already mentioned, the duration of your credit history has a significant impact on your credit, although not the greatest of all factors. In case you close one of your old credit cards, the average duration of your credit immediately decreases, which negatively affects your credit score.

When you want to repair credit and increase credit score, then perhaps you should close one of your credit cards to reduce the number of credits. For this purpose, it is better to use a new credit card so as not to reduce the length of your credit history. You should also pay attention to the presence or absence of annual payment for each of your credit cards. It is desirable that the credit card you intend to leave, that is, the older one, does not have an annual fee, if possible.

Bottom line

As you can see, repair credit and increase credit score is something that can be done and in some cases quite quickly. After you use all the steps that we have listed here, start working very hard to further build your credit and increase your credit score and you will get excellent financial opportunities.

Read our financial blog to learn how to manage your personal finances.

Read the full article

0 notes

Photo

Quick fix your credit score with tried and tested hacks used from decades to Improve Score. To know more about it click on Improve Credit Score.

0 notes

Photo

0 notes

Video

How to discharge student loans in bankruptcy? https://3wayfunding.com/optin

#Vimeo#bestplaceforstudentloans#badcreditstudentloans#studentloanswithoutcosigner#studentloansforgiveness#score#studentloanpayment#fico#privatestudentloans#raise#improve#clean#repair#perfect#easy#clear#fast#quick#improvecreditscore#experian#ciarahoneydip

0 notes