#Business CPA

Text

August 2nd:

I decided to push this exam back. I was so stressed out and never meeting my study goal each day and just falling further and further behind. My mom finally pulled me aside and told me to move my exam that this stress isn't worth it when it might cause me to make a worse score. It cost $35 to move the exam but now I'll take it September 6th instead of August 25th. I redid my study schedule leading up to the exam and now my daily goal is two modules a day which is much easier than the three I was trying to do and never got to. It's also easier to convince myself to start the work when my to-do list is shorter. Today I studied for three hours and forty minuets and finished up module three and got half way through module four. I'm very happy with this as I got a slow start to my day with having to switch everything around. I'm so much more relaxed now that I have more time!

Today's accounting topic: The economic order quantity inventory model attempts to minimize total ordering and carrying costs and can be applied to the management of any exchangeable good. Just-In-Time inventory model was developed to reduce the lag time between inventory arrival and inventory use.

Other activity: I finally finished a full crochet clothing item! I finished a blue shirt and I love it so much. I've weaved in all the ends and blocked it and got to wear it to dinner with my mom.

#CPA exam review#CPA#cpa exam#business#BEC#Business CPA#studyblr#study inspiration#study hard#study motivation#study blog#study space#studying#student#study#studyspo#heydilli#astudentslifebuoy#heyzainab#juliistudies#inky studies#lookrylie#problematicprocrastinator#mittonstudies#heystardust#notetaeker#mine#now i have time to do hobbies without feeling guilty#like crocheting :)#and knitting possibly? 👀

178 notes

·

View notes

Text

Empowering Nonprofits: Velu's Commitment to Strategic Financial Leadership

Welcome to Velu, where accounting expertise meets community empowerment. We are dedicated to supporting nonprofits with tailored CFO services that amplify their impact. Led by CEO Tyler Wilcox, CPA, Velu is more than a financial services provider; we are your strategic partner in driving growth and maximizing community benefit.

Our Specialized Approach

At Velu.us, we understand the unique challenges nonprofits face in managing finances while striving to achieve their mission. Our outsourced accounting solutions are designed to alleviate the burden of financial management, allowing nonprofits to focus on their core activities and community initiatives. With a foundation of comprehensive expertise in accounting, tax, consulting, and auditing, we offer a holistic approach to financial management.

Tailored CFO Services

Our CFO services are customized to meet the specific needs and goals of each nonprofit organization we serve. From budgeting and financial forecasting to grant management and compliance.

Remote Accounting & Bookkeeping- Grow your nonprofit or small business with the support of a Velu CPA.

Tax Strategy & Compliance- We’ll take care of the legal matters so you can focus on growing your nonprofit or small business.

Fractional CFO Services - Partner with Velu and grow your organization confidently.

Quickbooks Cleanup- From Messy to Mastered, Clean up your Quickbooks with the help of a Velu CPA.

Meet Our CEO: Tyler Wilcox, CPA

Tyler Wilcox leads Velu with a passion for community empowerment and financial excellence. As a Certified Public Accountant (CPA) with extensive experience in accounting and consulting, Tyler brings a wealth of knowledge to the nonprofit sector. His vision is to equip nonprofits with the financial tools and insights they need to thrive and make a lasting impact in their communities.

Driving Greater Community Impact

At Velu, we believe that strong financial management is key to maximizing a nonprofit's potential for community impact. By providing strategic financial planning and CFO services, we enable nonprofits to allocate resources efficiently, pursue growth opportunities, and achieve sustainable outcomes. Our goal is to empower nonprofits to reach more beneficiaries and create positive change on a larger scale.

Comprehensive Expertise

Our team at Velu combines technical expertise with a deep understanding of nonprofit operations. Whether you are a small startup or a large established entity, we offer scalable solutions tailored to your organization's size and complexity. From day-to-day accounting tasks to complex financial analysis and reporting, Velu is committed to delivering reliable and accurate support.

Commitment to Community Empowerment

Community empowerment is at the core of everything we do at Velu. We believe that strong nonprofits are essential for building resilient and thriving communities. By supporting nonprofits with strategic financial leadership, we contribute to the overall well-being and sustainability of the social sector.

Why Choose Velu?

Choosing Velu means partnering with a team of dedicated professionals who are passionate about your organization's success. We go beyond traditional accounting services to become trusted advisors and advocates for your mission. Our commitment to transparency, integrity, and innovation sets us apart in the field of nonprofit financial management.

Join Us in Making a Difference

If you're a nonprofit organization seeking to enhance your financial capabilities and drive greater community impact, Velu is here to support you every step of the way. Let's work together to create a brighter future for those we serve.

Get in Touch

Ready to take your nonprofit's financial management to the next level? Contact Velu today to schedule a consultation with our team. Together, we can unlock new opportunities and accelerate your organization's growth.

Experience the Velu Difference

Visit our website at velu.us to learn more about our services and discover how Velu can empower your nonprofit to thrive. We look forward to partnering with you on your journey towards greater impact and sustainability. This blog captures the essence of Velu's mission and commitment to empowering nonprofits through strategic financial leadership. By highlighting our expertise, personalized approach, and dedication to community empowerment, we invite nonprofits to explore the transformative possibilities of partnering with Velu.

0 notes

Text

2.18.2024

What I did today instead of studying… bad news is now im behind on my study plan, but good news is my desk looks great!

Planning to catch up over tomorrow and the next day, shouldn’t be too bad. Fingers crossed!

31 notes

·

View notes

Text

y’all i will write ok, but im dropping my hoes, i just graduated with my bachelors, im starting my summer internship, im entering my masters program, im going to start gaining research experience bc while i do have a job that will directly help me gain said research experience, i want to be the most competitive candidate bc in three years time, i hope to start applying to phd programs in the northeast bc i decided i just can’t get enough of academia 🫨

#oh#and im studying for the cpa exam#will most likely also be going back to school directly after im done w my masters to obtain a degree in mathematics & econ#busy busy busy

33 notes

·

View notes

Video

Guide to successful financial audit!

If you want to know more please click here

#accounting#accounting software#business#accountant#finance#tax#bookkeeping#smallbusiness#taxes#entrepreneur#payroll#accountingservices#cpa#taxseason#businessowner#money#incometax#accountants#audit#bookkeeper#accountingsoftware#gst

8 notes

·

View notes

Text

Unlocking Business Scalability: The Role of #Technology in #Future-Proofing your Firm.

Introduction: In the rapidly evolving world of accounting and #financialmanagement, scalability is the name of the game. Every accounting firm aspires to grow, thrive, and adapt to the ever-changing market demands. Scalability is not just expansion: it's about adaptability, resilience, and seizing opportunities while managing challenges effectively. To achieve this, technology emerges as a pivotal ally. In this #Blog, we will explore your accounting firm. From embracing cloud-based solutions to integrating scalable systems and processes, we will provide actionable insights to help your firm meet the evolving needs of your clients and the market.

The Power of Scalability:

Meet Client Needs

Stay Competitive

Operational Efficiency

#Revenue_Growth

Leveraging Technology for Scalability:

#Cloud_Based_Solutions

Integrated Systems

Scalable Processes

#Data_Analytics

#Security and Compliance

Actionable Insights for Your Firm:

Evaluate Current Systems

Embrace the Cloud

Training and Skill Development

Data-Driven Decision-Making

Cybersecurity and Compliance

read more: (https://www.caofficeautomation.com/unlocking-business.../)

Powered By : #Accountants_Practice_Management_Software

Our website: https://www.caofficeautomation.com/

Follow us on...

Instagram: https://www.instagram.com/ca_office_automation/

Twitter (X): https://twitter.com/caofficeauto

LinkedIn: https://www.linkedin.com/company/ca-office-automation/

YouTube: https://www.youtube.com/channel/UC2iMV5-pkrQ6Pdh6q6m1I0A

5 notes

·

View notes

Text

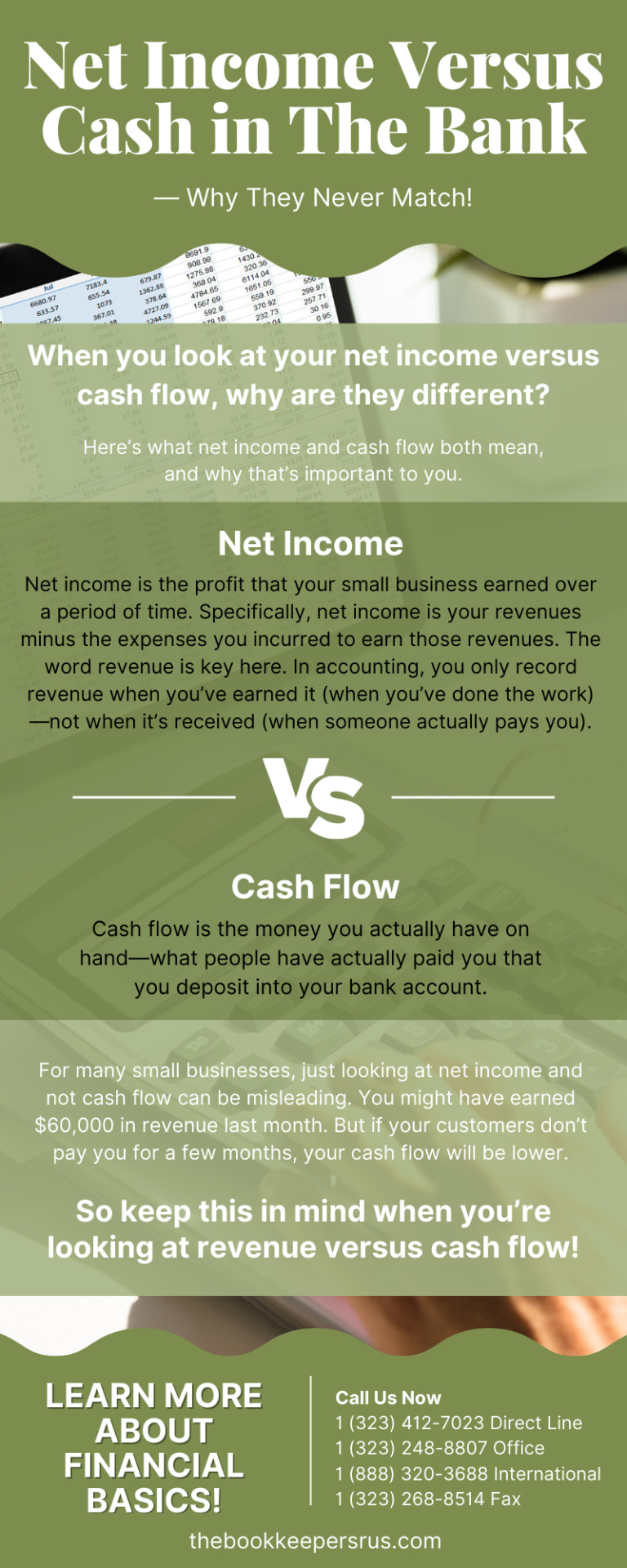

Do you understand the essentials of small business success? Read on our business tips!

#affordablebookkeeping#topbookkeepers#reliable bookkeeping#recordkeepers#los angeles cpas#thebookkeepersrus will provide you end to end#healthcarebookkeepers#small business tips

2 notes

·

View notes

Text

Let The Bookkeepers R Us guide your #business to success! With expert financial advice and years of experience, our #experts can help your business reach new heights.

#hirebookkeepersla#recordkeeping services#losangeles#cpa california#smallbusinesstips#startup business tips#business tips#thebookkeepersrus

3 notes

·

View notes

Note

Well, I was *supposed* to get my Kraken calendar today, but the box was torn up and it must have slid out (the rest of my order is there). So far though, the customer service team has been awesome.). *crosses fingers*

i have had nothing but incredibly positive experiences with kraken customer service. my calendar got sent to the wrong address and i hadn't bothered to follow up yet but they called me to fix it. in a completely separate incident i was also recently contacted by my kraken ticket representative (?! i have a kraken ticket representative?!) who just wanted to check in and encourage me to call him about any ticketing issue i have, even though i assured him i have no intention of buying season tickets???? also i lost my CPA water bottle at the oilers game and when i went to the lost and found (me, drunk and semi-distraught: "it's a CPA water bottle but it's got a sticker of matty beniers and brendan brisson on it so you'll know it's mine...") the guest services lady reached into the back room and gave me two new ones. anyway, this is all to say that i am sure the kraken's ace customer service team will reunite you with your calendar in no time.

#for anyone who is not local please know that the CPA water bottles from opening night were extremely coveted items#and i did not know there were even any more of them in existence but she just GAVE ME TWO#i suppose it was a sound investment on their part bc i will now defend the entire kraken customer service operation to the death#anon i hope the anon about getting your new calendar tomorrow is also you and that you have received it as scheduled!#sorry i'm catching up on the inbox after a busy week

11 notes

·

View notes

Text

August 8th:

Got over three hours of studying in today! I finished up module 8 and did module 9 so I'm finally done with section two. Tomorrow I'll review section two and take a practice exam and then review sections one and two and take the first mini exam. I felt more confidant with the last two modules of section two than I did with any other module but I'm hoping reviewing will give me confidence in the other modules too.

Today's accounting topic: The internal rate of return is the expected rate of return of a project and focuses the decision maker on the discount rate at which the present value of the cash inflows is equal to the present value of the cash outflows (usually the initial investment).

Other activity: I went to the gym at nine am today and took my dog on a mile long walk after it poured rain for three hours and was nice and cool!

#CPA exam review#CPA#cpa exam#business#BEC#Business CPA#studyblr#study inspiration#study hard#study motivation#study blog#study space#studying#student#study#studyspo#heydilli#astudentslifebuoy#heyzainab#juliistudies#inky studies#lookrylie#problematicprocrastinator#mittonstudies#heystardust#notetaeker#mine#headed back up to the big city tomorrow to meet with friends for lunch :)#we'll see how much work actually gets done rip

131 notes

·

View notes

Text

youtube

Get Paid +$2.06 Every 5 Minutes With This EVIL Strategy! | CPA Marketing For Beginners 2023

#cpa#cpagrip#cpamarketing#cpa marketing#youtube#make money online#marketing#youtube video#online business#Youtube

2 notes

·

View notes

Text

Why Use A CPA?

CPAs offer multiple financial services, which include: personal financial planning, retirement and estate planning, college funding, investing, risk management, and business succession planning. CPAs can also offer guidance on investment options or assist with estate planning needs to ensure beneficiaries receive the maximum benefits. CPA Services in Marlboro, NJ can suggest advice on how to decrease tax liability and help a client to complete financial goals.

2 notes

·

View notes

Text

3.10.2024

90% section complete!!!

This weekend has been so productive for me. I would’ve gotten further today but my mom stopped by and we chatted about her upcoming wedding for a few hours.

I’m feeling pretty encouraged. I definitely need to do a heavy review of all the calculations I need to know, and I have a ton of multiple choice questions I need to do for practice.

Goal is: finish the rest (!!!) of the modules tomorrow, I have 4 left. Tuesday heavy review of Units 5 and 6, and then take the mini exam over them. Wednesday I have a study session planned, I’d like to get like… 60 MCQs and 6 sims done as practice? I need to set a more solid schedule of number of review questions per day, maybe I’ll sort that out Wednesday too. I’d like to take a simulated exam Wednesday, but I don’t know if it’s feasible with the study session (too distracting). If not, Thursday for sure. Then starting Friday, im going to start heavily focusing unit by unit on getting formulas and calculations down.

I’m already thinking about the next certification I want to get… is that crazy?

21 notes

·

View notes

Text

Get Offshore Accounting And Tax Services For Accounting Firms

Are you looking for offshore services for your accounting firm? Visit Credfino.com. Their aim is to assist accounting firms, tax firms in attaining stable and reliable revenue growth, enhancing profitability, and optimizing operations via staffing solutions and business consulting. Visit their website to learn more.

#Accounting Firms#Offshore Staffing#Business Consulting#Tax firms#staffing solutions#Tax Services#Accounting Services#CPA firm#Offshore services

6 notes

·

View notes

Text

What is an enrolled agent, and what are their responsibilities?

An enrolled agent (EA) is a tax professional authorized by the US government to represent taxpayers before the Internal Revenue Service (IRS) in matters related to tax issues, such as audits, collections, and appeals. EAs are licensed by the IRS after passing a rigorous exam covering individual and business tax returns, and ethical standards. They also need to complete 72 hours of continuing education within a three-year period to keep their license valid.

Enrolled agents provide a range of tax services, including tax planning, preparing and filing tax returns, responding to IRS inquiries, and negotiating payment plans with the IRS. They can work independently, as part of a tax firm or as an employee in a company's accounting or finance department. EAs are knowledgeable about tax laws and regulations, and they can help taxpayers navigate the complexities of the tax code to minimize tax liability and maximize refunds.

We have a detailed blog on "UNLOCKING THE BENEFITS OF ONLINE CONTINUING EDUCATION PLATFORMS FOR EA'S", do have a look.

Read Time: 12 mins only

#cpa training#cpa#cpa firm#cpa marketing#accounting#entrepreneur#quickbooks#online business#businessgrowth#businessowner#continuing education#us cpa

2 notes

·

View notes