#incometax

Text

#accountant#accounting#incometax#business#rajajinagar#nammabengaluru#smallbusiness#finance#taxes#tax

2 notes

·

View notes

Text

Call: +91-8860632015 For UDYAM / MSME Registration

#smallbusiness#businessowner#startup#gst#incometax#tax#explore#like#india#indian#gurgaon#faridabad#business#delhi#noidacity#mumbai

8 notes

·

View notes

Video

Guide to successful financial audit!

If you want to know more please click here

#accounting#accounting software#business#accountant#finance#tax#bookkeeping#smallbusiness#taxes#entrepreneur#payroll#accountingservices#cpa#taxseason#businessowner#money#incometax#accountants#audit#bookkeeper#accountingsoftware#gst

8 notes

·

View notes

Text

Trust in our solutions at MFiling.com to make tax season a breeze. Contact us today!

#TaxSolutions#ConsultingExperts#MFiling#TaxAdvice#TaxServices#TaxSeason#FinancialConsulting#Taxation#FinancialSolutions#TaxProfessionals#AuditServices#CorporateTaxation#TaxPreparation#TaxCompliance#FinanceExperts#IncomeTax#SmallBusinessTax#AccountingServices#TaxPlanning#TaxStrategies#TaxHelp#TaxationLaw#BusinessFinance#FinancialFreedom#BusinessStrategy#MoneyMatters#InvestingTips#FinancialGoals#TaxTips#SmallBusiness

2 notes

·

View notes

Text

2 notes

·

View notes

Text

Inventory Audit Services in Kochi

Inventory auditing is a key part of collecting evidence, particularly for manufacturing and retail organizations. Our dedicated auditing team provides you excellent Inventory Audit Services in Kochi, Kerala. Inventory audits on a regular basis improve your understanding of your stock flow, assist you in accurately calculating earnings and losses, and keep your firm operating efficiently.

Our auditing procedure involves the following:

Audit of inventory and damaged products

Stock inspection and reporting on a regular basis

Maintenance of Fixed Assets records and stock verification

Accounting records are checked on a regular basis for accuracy and completeness.

#audit#accounting#tax#accountant#finance#business#bookkeeping#taxes#incometax#iso#accountants#taxseason#cpa#smallbusiness#payroll#entrepreneur#accountingservices#auditor#taxconsultant#gst#money#taxplanning#bookkeeper#ca#businessowner#taxreturn#taxation#management#charteredaccountant#taxprofessional

4 notes

·

View notes

Photo

Sending Money Abroad Will Burn a Bigger Hole in your Pocket Soon - @lawyer2ca ✅ Whether you're investing in a home or stock market abroad, or sending money to your family or friends, money transfers, no matter how much or how little, are about to get more expensive as the blanket application of 20% TCS for all remittances, other than travel and medical will be applicable. ✅ In the case of educational expenses, like university fees, the tax collection at source (TCS) norms remain unchanged. ✅ The rate of TCS for international remittance under LRS for education purposes continues to remain the same at 5% on transfers above Rs 7 lakh and 0.5% if the source of funds is through a loan from a financial institution. ✅ The tax collection for overseas remittances will surely cause hindrance to travelers, especially students who would be going abroad for higher education. #Lawyer2CA #incometax #UnionBudget2023 #NirmalaSitharaman #finance #Global #india #Budget2023 #TCS (at Lawyer2CA) https://www.instagram.com/p/Co6sWUPSLOy/?igshid=NGJjMDIxMWI=

2 notes

·

View notes

Text

#gstupdates#gst#gstindia#gstr#incometax#tax#gstreturns#gstregistration#gstcouncil#india#taxes#business#incometaxindia#gstnews#accountant#charteredaccountant#taxation#incometaxreturn#accounting#finance#gstfiling#startup#gstreturn

2 notes

·

View notes

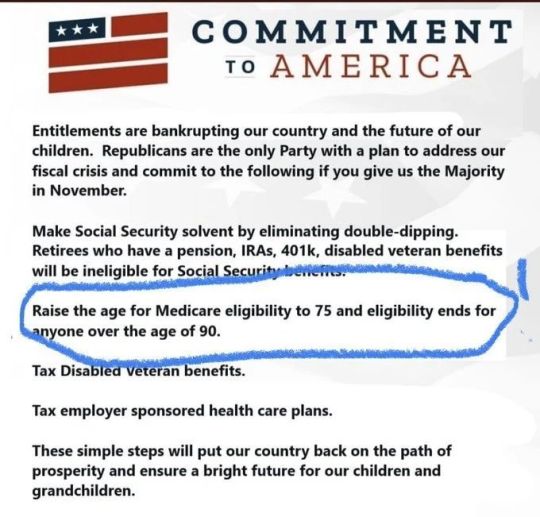

Photo

This cannot be stressed enough. Once again, this is the #Republican plan to HURT people, not help people. Do you know someone who even gets a pension? Perhaps a pension and #SocialSecurity? Your grandparents, parents, siblings? You? How much of their current #fixedincome is pension and how much is Social Security? In our case, they're nearly equal. Imagine the Republicans cutting your income by half. But you still have to pay for a place to live, electricity, phone, food ... And this doesn't take into account #incometax. Yes, you get taxed on your Social Security income even though you already paid income tax on that money. How much do they pay for their Medicare? Oh, yes. You sign up for #Medicare and you pay for it. Even though you were paying for it the whole time you were working. A vote for #Republicans is a vote to hurt people. People you know. People like you, or even yourself. #VoteBlueToSaveAmerica #VoteBlue https://www.instagram.com/p/CkD82LArk5o/?igshid=NGJjMDIxMWI=

#republican#socialsecurity#fixedincome#incometax#medicare#republicans#votebluetosaveamerica#voteblue

2 notes

·

View notes

Text

hrsoftwarebd

Accounting Software Development

#hrsoftbd#incometax#quickbooks#account#cpa#tax#accountant#cma#audit#taxreturn#payroll#cga#bookkeeping#charteredaccountant#auditor#accountantsalary#accountspayable#accountingsoftware#financialaccounting#corporationtax#cpas#theacountant#whatisaccounting#managementaccounting#costaccounting#taxpreparation

2 notes

·

View notes

Text

Stratking Accounting and Tax Professional Corporation is a full service CPA accounting firm, serving professionals and professional services firms throughout the state of Ontario. If you have any questions about our services or would like to schedule a consultation, please feel free to contact us today!

3 notes

·

View notes

Text

#ddhan#tax#taxes#taxconsultant#taxation#taxaccountant#taxcompliance#taxadvice#taxcredits#taxhelp#professionals#taxprofessional#taxprofessionals#gst#gstreturns#gstfiling#incometax#incometaxreturn#incometaxindia#taxfiling#gstcompliance#incometaxreturnfiling#tds#directtax#indirecttax#taxmanagement

3 notes

·

View notes

Text

Call: +91-8860632015 for All Types of CA, CS & Lawyer Services 😊😊

#business#success#money#smallbusiness#businessowner#startup#investment#love#goals#incometax#tax#taxes#taxseason#gst#accountant#taxpreparer#taxrefund#taxprofessional#trending#viral#explorepage#explore#india#indian#like#photography#trend#instadaily

2 notes

·

View notes

Text

Filing Income Tax Returns in India: A Comprehensive Guide with Ensurekar

Introduction

Filing your income tax return (ITR) in India can seem daunting, but with the right information and guidance, it can be a smooth and efficient process. This guide provides a comprehensive overview of e-filing income tax returns in India, including registration, types of returns, filing procedures, and crucial details for the Assessment Year (AY) 2023-24.

What is eFiling Income Tax Return?

The Income Tax Department of India offers a convenient online platform for electronically filing your ITR. This e-filing portal eliminates the need for physical visits to tax offices and streamlines the entire process.

Why File Your ITR?

Individuals falling under specific tax slabs are mandated to file their returns. Here are some reasons why filing your ITR is important:

Fulfilling Tax Obligations: It ensures compliance with tax regulations and avoids potential penalties for non-filing.

Claiming Refunds: If you've paid excess taxes through TDS (Tax Deducted at Source), filing your ITR is necessary to claim a refund.

Loan and Visa Applications: Many financial institutions and embassies require a clean tax filing history for loan approvals and visa processing.

Carrying Forward Losses: If you've incurred losses under a specific income head, filing your return allows you to carry them forward and offset future income.

Building a Credit History: A consistent record of timely ITR filing can positively impact your creditworthiness.

Types of eFiling Income Tax Returns

There are two main ways to file your ITR electronically:

Self-e-Filing: This involves filing your return directly through the Income Tax Department's e-filing portal. You'll need to fill out the ITR form with all necessary information, attach required documents, and submit it online.

Assisted ITR Filing: You can opt for assistance from authorized professionals like tax consultants, chartered accountants, or online tax-filing platforms. These intermediaries will handle the entire filing process, from collecting information to submitting your return online.

Benefits of eFiling Income Tax Return (ITR):

Convenience: Eliminates the need for physical visits and saves time and effort.

Security: The online process protects sensitive information with secure protocols.

Timely Processing: E-filing leads to faster processing and quicker refunds compared to paper returns.

Accuracy: The online platform helps with accurate tax calculations and reduces the chances of errors.

Environmentally Friendly: E-filing reduces paper usage and contributes to a greener environment.

How to File an eFiling Income Tax Return

Step 1: Registration

New users need to register on the Income Tax Department's e-filing portal using their PAN card details.

Step 2: Gather Documents

Collect all relevant documents like PAN card, Aadhaar card, Form 16 (salary certificate), TDS certificates, bank statements, investment proofs, and any other income or deduction-related documents.

Step 3: Choose the Right ITR Form

The appropriate ITR form depends on your income sources and category. Common forms include ITR-1 (for income up to ₹50 lakhs) and ITR-2 (for income with capital gains or foreign assets). For AY 2023-24, ensure you use the most recent versions of the forms.

Step 4: Fill and Verify the ITR Form

Fill out the chosen ITR form with accurate details about your income, deductions, and exemptions. Carefully review the entries to avoid errors. You can verify the return electronically using Aadhaar OTP or EVC (Electronic Verification Code), or by sending a signed physical copy of ITR-V to the Centralized Processing Center (CPC) within 120 days of filing.

Step 5: File the Return Online

Log in to the e-filing portal, navigate to the 'e-File' section and select 'Income Tax Return.' Upload the prepared ITR form or XML file and submit it.

Step 6: Keep Records for Reference

Maintain copies of the filed return, acknowledgment receipt, and supporting documents for future reference.

How Ensurekar Can Help

At Ensurekar, we understand the complexities of tax filing. We offer a comprehensive range of services to ensure a smooth and efficient ITR filing experience:

Expert Guidance: Our experienced tax professionals can guide you through the entire process, from choosing the right ITR form to maximizing deductions and claiming refunds.

Accurate Calculations: We ensure accurate tax calculations to minimize any tax liabilities or penalties.

Timely Filing: We help you meet all deadlines and avoid late filing penalties.

Stress-Free Experience: We take the stress out of tax filing, allowing you to focus on other important matters.

Additional Information:

Penalty for Late Filing of ITR: Filing your ITR after the due date can attract penalties and interest charges on the tax payable.

Steps to File ITR without Form 16: If you don't have Form 16, you can still file your ITR by gathering income proofs from various sources, calculating your TDS using Form 26AS, and claiming eligible deductions.

Conclusion:

Filing your income tax return is a crucial responsibility. By leveraging the benefits of e-filing and potentially seeking professional assistance from Ensurekar, you can ensure a smooth, accurate, and timely filing process.

0 notes

Text

Maximize Profits with Professional Business Consulting Services

Are you an experienced professional looking to leverage your skills and expertise for additional income?

Join our dynamic community of consultants on the Biz Consultancy app and start monetizing your knowledge today. Tailor your consultation schedule to fit your lifestyle, offering advice and sharing your expertise with those in need.

Earn financial rewards for your consulting services and expand your reach to clients worldwide, broadening your professional network.

Download the Biz Consultancy app from the App Store or Google Play Store and seize the opportunity to turn your expertise into income while making a positive impact on others' lives.

Join Biz Consultancy today!

#taxpreparation#taxseason#taxes#taxpreparer#tax#taxprofessional#taxrefund#taxreturn#taxplanning#taxprep#incometax#taxtips#accounting#bookkeeping#accountant#entrepreneur#smallbusiness#taxtime#business#payroll#finance#money#taxation#businesstaxes#businessowner#taxservices#taxpro#Business consultants#Business consulting services#Business advisor

0 notes

Text

आज ही फाइल करें अपनी Income Tax Return और पाएं TDS रिफंड का लाभ!

Maximize your tax savings! Don't miss out on the opportunity to file your Income Tax Return today and unlock the potential of receiving a TDS refund. Act now to secure your financial future and enjoy the benefits of timely tax planning. Let's make every rupee count!

#IncomeTax#TaxSeason#TaxRefund#TDSRefund#TaxFiling#DeadlineAlert#FinancialPlanning#TaxSavings#ITR#TaxBenefits#FilingDeadline#FinancialFreedom#MoneyMatters#TaxPreparation#FinancialWellness

0 notes