Text

📢Attention Michigan CPAs!

🎉Complete your CPE credit needs hassle-free with our exclusive 40 CPE package for Michigan CPAs.📚💼

Here's what's included in the Michigan CPA CPE Package: 📌Accounting: 8 Credits 📌 Auditing: 8 Credits 📌Taxes: 16 Credits 📌Finance: 1 Credit 📌 Ethics (Regulatory): 2 Credits 📌Computer Software and Applications: 3 Credits 📌Business Management and Organization: 2 Credits

⚖️ As per the Michigan State Board of Accountancy, things that Michigan CPAs should keep in mind:

➡️A minimum of 50% of CPE hours must be completed through interactive live webinars.

➡️ No more than 20% of CPE can be in Personal Development, Computer, Software, Application, Marketing, Communication, or Management.

➡️ 8 hours of CPE should be completed in the subject areas of accounting and/or auditing.

➡️ CPE Reporting Cycle of Michigan CPAs ends on June 30 (biennially).

➡️ Michigan CPAs can earn CPE Credits from NASBA Approved CPE Providers as long as it directly relates to their professional competence. Don't miss out on this opportunity to conveniently fulfill your CPE credit needs.

Enhance your professional competence with our comprehensive Michigan 40 CPE package. Subscribe to my CPE today! To verify the detailed requirements, please visit the Michigan CPE Requirement Page or the Board Website. Feel free to ask any questions or DM us. #MichiganCPA #CPEcredits #ContinuingEducation #ProfessionalDevelopment #myCPE

0 notes

Text

📢📢Attention Tennessee CPAs! 📢📢

➡️Your search for the most convenient way to complete your CPE compliance is over. Try the 60 CPE Package by my CPE, approved and tailored specifically for CPAs in Tennessee just like you!

➡️Why choose our 60 CPE Package for Tennessee CPAs from my CPE?

➡️Here's why: Approved by NASBA: myCPE is authorized by NASBA (Sponsor id: 143597) to provide CPE credits to CPAs. You can trust our courses to meet the highest standards of quality and relevance.

➡️Complete Compliance: This package includes 60 hours of self-study webinars that align perfectly with the Tennessee State Board of Public Accountancy's requirements. Stay on track and fulfill your obligations hassle-free.

➡️Diverse Course Offerings: Our 60 CPE Package covers a wide range of subjects to enhance your professional knowledge. With 23 hours in Accounting and Auditing, 25 hours in Taxation, 7 hours in Finance, 1 hour in Business Management and Organization, and 2 hours in Computer Software and Application, you'll gain valuable insights across various domains.

➡️Technical Expertise: Fulfill your technical subject area requirements with 57 CPE hours included in this package. Along with 3 hours of ethics. Stay up to date with the latest developments and maintain your professional edge.

➡️Accounting and Auditing Focus: If you provide attest services (including compilations), our package offers 23 hours of content in Accounting and Auditing, surpassing the minimum requirement of 20 hours. Stay on top of your game in this critical area.

➡️Convenient Subscription: Gain access to this fantastic package by subscribing to myCPE Unlimited Access Prime for just $199. Enjoy the flexibility of learning at your own pace and in the comfort of your own space.

➡️Explore our online CPE Package and unlock a world of knowledge through popular webinars covering Accountancy & Auditing, Taxation, Finance, Business Management and Organization, and Computer Software and Application.

➡️Wait, there's more! If you're interested in a smaller package, we also offer a 40 CPE Package for Tennessee CPAs (Incl. 2 Hours Ethics).

➡️Remember, our 60 CPE package is 100% compliant with the Tennessee Board of Accountancy regulations, and we stand behind our commitment to your satisfaction. If you believe the package doesn't meet compliance standards, simply reach out to our support team at [email protected], and we'll gladly provide a full refund.

Don't miss out on this fantastic opportunity to fulfill your CPE requirements with ease. Subscribe today and empower your professional growth! For more detailed information, visit our website or the Tennessee CPE Requirement Page. Stay compliant, stay ahead!See less

0 notes

Text

Calling all Rhode Island CPAs!

Need to fulfill your CPE requirements? Look no further! Introducing our exclusive 40 CPE Package tailored just for you.

➡️Includes 6 hours of Ethics training to meet RI CPA standards.

➡️ Get 12 credits in Accounting and Auditing, 14 credits in Taxes, 2 credits in Business

➡️Dive into the world of Computer Software and Application with 4 credits.

➡️All courses are self-study, approved by NASBA, and compliant with the Rhode Island State Board of Accountancy.

Don't miss this opportunity to advance your professional competence conveniently and flexibly.

Hurry! Limited availability.

1 note

·

View note

Text

🔊Ethics and Conducts for Kansas CPAs

➡️myCPE presents an enlightening Ethics CPE course that delves into the ethical standards that every CPA in Kansas should uphold. Regardless of whether you work in public, governmental, or private accounting practices, this course is designed to equip you with the necessary knowledge to navigate the complex landscape of ethical decision-making.

➡️Our course is rooted in the AICPA Code of Professional Conduct, which sets the gold standard for CPAs.

➡️This ethics course, sheds light on some of the most critical points, including: Integrity: The backbone of ethical conduct. Objectivity and Independence: Crucial elements for maintaining trust. The SEC's Auditor Independence Requirements: Understanding the expectations. Alternative Practice Structures (APS): Expanding horizons and exploring new possibilities. Professional due care: Elevating your commitment to excellence. Applicability of AICPA Code of Ethics: Understanding how it impacts your daily work.

➡️Stay up to date with the latest developments, tackle ethical dilemmas, and enhance your decision-making skills.

➡️Subscribe today to myCPE for the comprehensive packages and unlock the full potential of CPE packages for Kansas CPAs and complete your requirements in one go. Embrace ethics as the guiding force for a successful and trusted CPA career. Enroll in our Ethics and Conducts for Kansas CPAs course today! #CPAethics #KansasAccountants #EthicsMatters #ProfessionalExcellenceSee less

0 notes

Text

Calling all Kansas CPAs! 🎉

Are you tired of searching for countless courses to fulfill your CPE requirements? Look no further! Introducing our exclusive 40 CPE package for Kansas CPAs, designed to meet all your Kansas CPE requirements in one go! 🌟

🔒 Approved and Compliant:

✅ Our 40 CPE package is fully approved by NASBA (Sponsor ID: 143597) for providing continuing education to CPAs.

✅ It includes 2 hours of ethics, ensuring you stay up-to-date with the latest ethical standards.

✅ This package is specifically tailored to meet the requirements set by the Kansas Board of Accountancy.

💼 What's Included:

📚 40 hours of self-study webinars: Get comprehensive knowledge through our engaging and informative webinars.

🔢 8 hours of CPE courses in accounting and/or auditing: Enhance your technical expertise.

💰 16 CPE hours in taxes: Stay updated with the ever-evolving tax landscape.

💼 2 hours in finance: Learn key financial concepts and strategies.

🌐 4 CPE hours in non-technical subject areas: Expand your knowledge in areas like communication, marketing, and business management.

💯 Guaranteed Satisfaction:

✅ Our 40 CPE package is 100% compliant with the regulations of the Kansas Board of Accountancy.

✅ We offer a 100% satisfaction guarantee. If you believe the package is non-compliant, simply email our support team at [email protected], explain the issue, and we will gladly refund your full payment.

🔥 Special Offer:

🎁 Subscribe to myCPE Unlimited Access Prime for just $199 and gain access to this exclusive package. Don't miss this incredible opportunity to fulfill your CPE requirements hassle-free!

🖱️ Discover the convenience of our online CPE package, which includes popular webinars covering a wide range of topics, such as Accountancy & Auditing, Taxation, Finance, Communication & Marketing, Business Management and Organization, and Computer Software and Applications.

⚖️ Remember, as a Kansas CPA, you have specific requirements to fulfill. Trust myCPE to provide you with the highest quality CPE courses, approved and compliant for your state.

🔗 For detailed requirements and to learn more about the Kansas CPE Board, visit the Kansas CPE Requirement Page or their official website.

Don't let CPE stress you out – choose the comprehensive and convenient 40 CPE package from myCPE and invest in your professional growth today! 🎓💼

1 note

·

View note

Text

Attention Connecticut (CT) CPAs!

Are you aware of the latest Continuing Professional Education (CPE) requirements for maintaining your CPA license in Connecticut?

➡️Here's a quick overview:

👉CPE Requirements: Complete 40 hours of CPE annually.

📅Reporting Cycle: July 1st to June 30th.

⏰License Renewal Period: Don't forget to renew your license by December 31st each year.

👉Ethics Requirement: Connecticut CPAs must take a 4-hour ethics course every 3 years. The course should cover ethical behavior and understanding of the Connecticut Rules of Professional Conduct or the AICPA Code of Professional Conduct for CPAs.

Subject Area Restriction: Earn your CPE credits from NASBA Approved CPE Providers. Any topic directly related to your professional competence is acceptable. However, subjects like spirituality, personal health/fitness, sports/recreation, foreign languages, and production will not contribute directly.

For further reference on CPE regulations specific to Connecticut CPA, click here

0 notes

Text

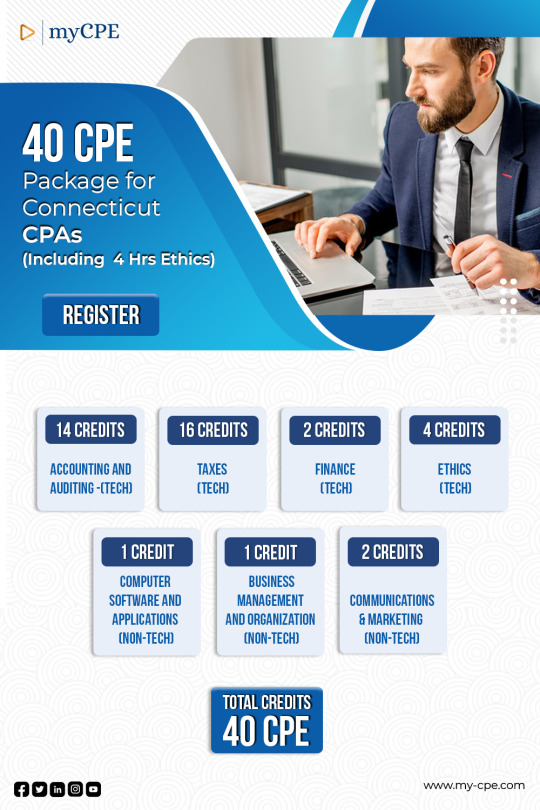

Attention Connecticut CPAs!

CPE deadline is approaching, so don't miss to fulfill your CPE requirements with the 40 CPE Package on myCPE!

This package is customized especially for Connecticut CPAs and includes courses in accounting and auditing, taxes, finance, ethics, computer software and applications, business management, and communication & marketing - totaling 40 credits!

myCPE is NASBA approved and the courses are compliant with the Connecticut Board of Accountancy regulations so that you can cover all your CPE requirements in one go. We offer 100% satisfaction This package is included with my CPE Unlimited Access subscription so you can keep viewing more content even after your CPE has been fulfilled.

Learn more about the package and purchase it here 40 CPE Package for Connecticut CPAs

0 notes

Text

Google Fi Breach: A Deep Dive into SIM Swapping Attacks

Are you a Google Fi user?

Your data may have been stolen due to a recent cyberattack related to a T-Mobile breach. Hackers may have accessed user information, including phone numbers, SIM card serial numbers, account status, and mobile service plan information.

In this blog post, we provide a deep dive into the Google Fi Breach and SIM Swapping Attacks. Learn how you can protect yourself from these attacks and keep your personal information private.

Don't let hackers steal your personal information. Stay informed and take action now! Read our latest blog post and learn how to protect yourself from SIM Swapping Attacks.

0 notes

Text

BECOMING AN ENROLLED AGENT: 6 REASONS YOU’LL WANT TO BE AN EA

Looking for a career that's always in demand, offers flexibility, and has a high earning potential?

Look no further than becoming an Enrolled Agent! 🔍💼 Check out our latest article to discover six reasons why you'll want to be an EA, including comprehensive tax knowledge and a fulfilling career.

Read the full article now and start your journey towards a rewarding career in tax preparation! 📚💰 #EnrolledAgent #TaxPreparation #CareerGoals

0 notes

Text

When the IRS says it, we've got to pay attention to it. They have a number of notices that is of high importance to every taxpayer, however, not everyone is well-versed in the traits of tax codes. Also, even though they are routine processes of the tax, notices from the IRS can be scary. Here's an article that discusses how to respond to IRS notices and IRS Taxpayer Advocate Service. Read Now for details.

#IRStaxupdate #taxadvocate #CPETaxCourse #taxexperts #taxnews #taxexperts, #taxpros, #taxlawyers, and #taxaccountants

0 notes

Text

2023’S TOP FP & A TRENDS - FINANCIAL PLANNING

What are the top trends in financial planning and analysis (FP&A) in 2023, and how are they impacting the future of the field?

Emphasis on data-driven decision making: FP&A is becoming more reliant on data sources, including non-financial information, such as customer information, social media information, and supply chain information, to make strategic decisions.

Financial planning and analysis (FP&A)

Increased use of automation and artificial intelligence: AI and machine learning are transforming the field of FP&A by analyzing vast amounts of data, identifying patterns and trends, and predicting financial performance.

The rise of "RegTech" (regulation technology): RegTech provides companies with customizable solutions for simplifying compliance processes, reducing costs, and improving operational efficiency.

Shift towards rolling forecasts: Rolling forecasts are becoming more popular due to the rapidly changing business environment, enabling organizations to respond more quickly to market changes.

Increased focus on scenario planning: Scenario planning involves creating multiple forecasts to make more informed decisions in a growing portion of the FP&A function due to increased business uncertainty.

Adoption of cloud-based solutions: Cloud-based FP&A solutions are growing in popularity, offering more flexibility, scalability, and cost-effectiveness than on-premise solutions.

The importance of data visualization: FP&A is increasingly relying on data visualization to identify trends and patterns in data and make informed decisions.

Integration with other business functions: FP&A is increasingly integrated with marketing, sales, and operations to become more data-driven and make more informed decisions.

Environmental, social, and governance (ESG) reporting: ESG reporting is becoming increasingly important for businesses to provide transparency and accountability by detailing the impact of their activities on the environment, society, and governance.

Overall, these trends highlight the importance of FP&A for driving business performance, and organizations are investing in these areas to stay ahead in a rapidly changing business environment.

You can read our full blog on 2023’S TOP FP & A TRENDS - FINANCIAL PLANNING

0 notes

Text

Updates to IIA CIA CPE Requirements Policy for 2023

👉There is no limit to the number of CPE hours that can be carried over from one reporting cycle to another if there is a surplus of CPE acquired during the calendar year.

👉The grace period has increased from 1 year to 2 years.

Individuals who go three years without reporting CPE will have their certification revoked.

👉The reinstatement of an expired certification is possible before 31 December 2023 if the individual completes the CPE requirements for one year, submits an application for reinstatement, and pays an application fee.

👉CIA certified professionals must report the required number of hours of CPE annually by 31 December.

👉The IIA has expanded the list of eligible CPE activities to include traditional activities, such as attending conferences and workshops, as well as innovative ones, such as taking online courses, participating in webinars, and setting up a self-study program. It also includes activities that develop professional skills, such as leadership development and communication workshop classes.

👉The IIA has introduced new measures to ensure the quality of CPE activities, including pre-approval of all CPE activities, strict criteria for evaluating the quality and relevance of CPE activities, and a system for verifying the completion of CPE activities.

👉It is essential for CIA candidates and certified individuals to be aware of these changes and comply with the CPE requirements to maintain their certification. They should report their hours annually and take advantage of the opportunities to further their professional development

Get in-depth knowledge on CERTIFIED INTERNAL AUDITOR: CIA CPE REQUIREMENT POLICY CHANGES 2023 today!

1 note

·

View note

Text

MYCPE DECLARES THE WINNERS OF EXCELLENCE AWARDS 2021-22

myCPE proudly announces the winners of the Excellence awards 2021-22 for firms in Accounting in different categories.

myCPE - Best Firms to Work for Award 2021-22 and myCPE - Top Emerging Accounting Firms 2021-22 are the two types of awards that we are awarding this year.

These prestigious award recognize firms that have created a positive work environment, have strong company cultures, competitive compensation and benefits, and have been progressively working at taking the profession forward with forward thinking mindset.

Read on to discover the top firms that have earned this coveted recognition!

0 notes

Text

Failing to meet Enrolled Agent continuing education requirements can result in revoking your Enrolled Agent status and penalties.

You may even face disciplinary action by the IRS as well. After one missed renewal cycle, inactive enrollment is placed by the IRS, means you are not eligible to practice before the IRS and cannot represent taxpayers.

Things becomes harsher with the number of missed cycles where the IRS may terminate your enrollment, requiring you to retake the EA Exam for re-enrollment.

However, if you are unable to fulfill the requirements due to extenuating circumstances, you may be able to request a waiver of the IRS EA CE requirements.

This is an article that explains how and what requires to be done when you are running short of your EA CE credits. Read more to know.

1 note

·

View note

Text

What is an enrolled agent, and what are their responsibilities?

An enrolled agent (EA) is a tax professional authorized by the US government to represent taxpayers before the Internal Revenue Service (IRS) in matters related to tax issues, such as audits, collections, and appeals. EAs are licensed by the IRS after passing a rigorous exam covering individual and business tax returns, and ethical standards. They also need to complete 72 hours of continuing education within a three-year period to keep their license valid.

Enrolled agents provide a range of tax services, including tax planning, preparing and filing tax returns, responding to IRS inquiries, and negotiating payment plans with the IRS. They can work independently, as part of a tax firm or as an employee in a company's accounting or finance department. EAs are knowledgeable about tax laws and regulations, and they can help taxpayers navigate the complexities of the tax code to minimize tax liability and maximize refunds.

We have a detailed blog on "UNLOCKING THE BENEFITS OF ONLINE CONTINUING EDUCATION PLATFORMS FOR EA'S", do have a look.

Read Time: 12 mins only

#cpa training#cpa#cpa firm#cpa marketing#accounting#entrepreneur#quickbooks#online business#businessgrowth#businessowner#continuing education#us cpa

2 notes

·

View notes

Text

10 Things to consider while taking continuing education courses in 2023

Continuing Professional Education (CPE) courses are essential for professionals to enhance their skills and knowledge, upgrade their qualifications, and advance their careers.

Here are some tips to consider while taking CPE courses in 2023:

Choose a course relevant to your career and skills.

Ensure that the course is accredited by a reputable organization and approved by the respective governing body.

Look for courses that offer flexible scheduling options so that you can balance your work and personal commitments.

Research about the course, including its description, learning objectives, recommended course credit, and any fees. Read reviews and testimonials from previous attendees to assess the course's quality.

Seek out additional resources like online tutorials, articles, and podcasts, and choose a platform that provides these resources.

Check the instructor/speaker's credentials and reputation to ensure that they have the necessary expertise and experience in the subject matter.

Consider taking ethics courses as they are critical components of continuing education for professionals.

Ensure that the course materials are updated, accurate, and relevant to your needs and interests.

Look for courses that provide practical knowledge and skills that you can apply to your job.

Choose a platform that provides a user-friendly interface and a variety of courses to meet your professional development needs.

Is your CPE/CE deadlines are about to come and you are looking to refill your credits by the perfect CPE/CE course then explore now. To read the entire blog on “10 Things to consider while taking continuing education courses in 2023” click on blog title.

1 note

·

View note

Text

10 WAYS TO CLAIM ERC FOR YOUR CLIENTS

The Employee Retention Credit (ERC) is a program created in response to the COVID-19 pandemic and economic shutdown. It provides a refundable tax credit to businesses for maintaining payroll during 2020 and 2021. The credit is available from March 13, 2020, through September 30, 2021, and in some cases through December 31, 2021.

The ERC is unique in that neither employees nor employers are required to repay it. It is a payment in the form of employer credits, so it is money owed to businesses by the government. The credit has made a significant difference for organizations struggling to keep employees on payroll and their doors open.

There are many details about the ERC that tax professionals(EA) should know to help their clients make the most of it. For instance, businesses can qualify for the ERC even if they have claimed the Paycheck Protection Program (PPP), and a 20% reduction in business (not just a 50% reduction) also qualifies for the ERC. In addition, a partial suspension or shutdown due to government orders or even an essential business that was affected by the pandemic may qualify for the credit. Clients who have grown during the pandemic may still qualify if they experienced a partial suspension, and eligible small businesses can claim up to $26,000 per employee in credits for tax years 2020 and 2021. Refundable credits are also available for startups that opened their doors during the pandemic.

If you loved the blog do read the full 10 WAYS TO CLAIM ERC FOR YOUR CLIENTS.

Content and summary for :10 WAYS TO CLAIM ERC FOR YOUR CLIENTS. Kindly review so that I can go ahead with promotions

0 notes