#CPA exam review

Text

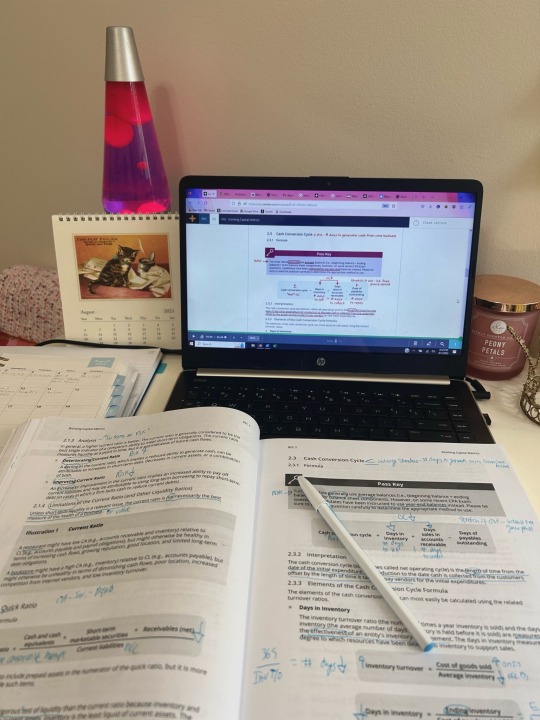

August 2nd:

I decided to push this exam back. I was so stressed out and never meeting my study goal each day and just falling further and further behind. My mom finally pulled me aside and told me to move my exam that this stress isn't worth it when it might cause me to make a worse score. It cost $35 to move the exam but now I'll take it September 6th instead of August 25th. I redid my study schedule leading up to the exam and now my daily goal is two modules a day which is much easier than the three I was trying to do and never got to. It's also easier to convince myself to start the work when my to-do list is shorter. Today I studied for three hours and forty minuets and finished up module three and got half way through module four. I'm very happy with this as I got a slow start to my day with having to switch everything around. I'm so much more relaxed now that I have more time!

Today's accounting topic: The economic order quantity inventory model attempts to minimize total ordering and carrying costs and can be applied to the management of any exchangeable good. Just-In-Time inventory model was developed to reduce the lag time between inventory arrival and inventory use.

Other activity: I finally finished a full crochet clothing item! I finished a blue shirt and I love it so much. I've weaved in all the ends and blocked it and got to wear it to dinner with my mom.

#CPA exam review#CPA#cpa exam#business#BEC#Business CPA#studyblr#study inspiration#study hard#study motivation#study blog#study space#studying#student#study#studyspo#heydilli#astudentslifebuoy#heyzainab#juliistudies#inky studies#lookrylie#problematicprocrastinator#mittonstudies#heystardust#notetaeker#mine#now i have time to do hobbies without feeling guilty#like crocheting :)#and knitting possibly? 👀

178 notes

·

View notes

Text

My FAR Study Approach: How I Passed with a 95

Throughout my 8 weeks of studying for far, i spent 2.5 hours studying each day monday–friday and 5 hours each day saturday–sunday, totaling around 22 study hours a week. So i studied a total of around 180 hours for far.what’s the difference between the monday–friday study routine versus the saturday.

Visit Us -

0 notes

Text

What Is the Hardest Section of CPA Exam Review?

If you are totally determined to achieve your goal, then there is nothing impossible. On this planet which exists manmade, that is easy to be done. You must keep in mind If you have chosen your goal, then you must be committed to it. However, moving to the CPA exam consists of four sections; Business Environment and Concepts (BEC), Auditing and Attestation (AUD), Regulation (REG), and Financial Accounting and Reporting (FACR). While all applicants must take the CPA Exam, additional criteria vary by jurisdiction.

Do many CPA aspirants want to know What is the hardest section of CPA Exam Review? Your accounting background will determine which CPA Exam Review topic is the most challenging for you. While many candidates believe the FAR component to be the toughest, if you've never done an audit, you may find AUD, with its concentration on tax law, to be more difficult.

So from all four sections, as per our study and what we have seen, most of the students found Financial Accounting and Reporting (FACR) to be the hardest part of the CPA Exam Review, why Financial Accounting and reporting the hardest, so we will explain it further along with solutions.

Why The Financial Accounting And Reporting Is Hardest Section Of CPA Exam?

The FAR portion begins with two multiple-choice tests, each with 33 MCQs. You are then permitted to begin two tests, each of which has eight task-based simulations. So bear in mind that you must prepare for all questions; do not assume, "I can earn passing grades," but rather set a high goal, and you will achieve it. Around 30-40% would be a financial statement accounting concept, 25-30% would be a conceptual framework and financial reporting, 5-15% would be state and local government accounting, and 20-30% would be transactions. Here are some study tips which need to keep in mind;

First and foremost, maintain an intense focus on concepts.

Clear your concepts in your mind

Cover all of the topics, and do not leave anything out.

Allow ample time for studying.

Consistency is always important, so practice regularly for the greatest results.

The CPA-FAR test encompasses a significant amount of information, and it is critical to go through the CPA review material and cover all subjects. And always find the best CPA Exam Tutor who will guide you more and give more clarity on topics.

Vishal CPA Prep is one of the most reputed institutions for CPA Exam Preparation in USA and offers classes at very reasonable prices. We are dedicatedly working to achieve our aspirant’s desirable scores. So get in touch with us and get proper CPA Exam Advice.

1 note

·

View note

Text

3/9/2024

Just over 6 hours today!! Super good day. I got really motivated to keep going, and just kept on until my brain stopped being able to process things (it’s 1am 😵💫).

The software says im only 45% through unit 5, but they weight the different categories (lectures, MCQs, simulations) really weirdly, I think im closer to 75% through it. Tomorrow I’ll finish it, do review questions, and move on to F6!

Test is in 11 days, and i don’t know if ill be fully ready but i know im gonna give it my all, and im way more prepared than the last time!!!

#I miss the final review thing they used to have 😭 gonna have to ‘final review’ on my own and idk how to be super effective like that#cpa exam#studyblr#cpa#study blog#studyspo#studying#business student#taycpa#study#gradblr

13 notes

·

View notes

Text

The Average CPA Salary Landscape in the US

Elevate your career in accounting and secure a competitive CPA salary in the US with training from Miles Education. Our curriculum focuses on the essential skills of financial management, tax, and auditing, preparing you for diverse sectors and global opportunities. To know more visit : https://bit.ly/4aEUOJz

#us cpa course#cpa review#cpa course#cpa classes#cpa#certified public accountant#us cpa exam#us cpa#cpa training

0 notes

Text

The Best CPA Exam Review Courses for Financial Accounting and Reporting

Choosing the right review course is crucial for success. With numerous options available, selecting the best CPA exam review course for FAR can be daunting. In this guide, we'll explore the top CPA exam review courses tailored specifically for mastering FAR. These courses are meticulously designed to help you understand complex financial accounting concepts, prepare effectively, and pass the FAR section with flying colors. Whether you're a seasoned accountant or new to the field, these courses offer comprehensive study materials, expert instruction, and practice questions to ensure you're fully prepared for exam day. From in-depth video lectures to interactive quizzes and simulations, each course is uniquely structured to cater to different learning styles. We delve into the features, pros, and cons of the best CPA exam review courses for financial accounting and reporting, empowering you to make an informed decision and excel in your CPA exam journey.

Understanding the CPA Exam Review Course

The CPA exam review course is a comprehensive program designed to prepare candidates for the rigorous CPA exam. This course covers all four sections of the exam. Auditing and attestation (AUD), business environment and concepts (BEC), financial accounting and reporting (FAR), and regulation (REG).

Benefits of Enrolling in a CPA Exam Review Course

Enrolling in a CPA exam review course offers several advantages. It provides structured study materials, expert instruction, and practice exams that mimic the actual CPA exam format, helping candidates become familiar with the exam's content and format. These courses are specifically designed to prepare candidates for the challenging CPA exam.

Features of a High-Quality CPA Exam Review Course

A high-quality CPA exam review course should include comprehensive study materials, such as textbooks, practice questions, and video lectures. It should also offer adaptive learning technology to tailor the study plan to each candidate's needs. A top-notch review course will offer comprehensive study materials, including textbooks, practice questions, and lectures, all designed to cover the exam's content thoroughly.

How to Choose the Right CPA Exam Review Course?

Choosing the right CPA exam review course is crucial for success. Candidates should consider factors such as course format, instructor expertise, pass rates, and student support services when making their decision. With a myriad of options available, it can be overwhelming to determine which course is best suited to your learning style, schedule, and budget.

Tips for Success in a CPA Exam Review Course

Success in a CPA exam review course requires dedication and strategic study habits. Candidates should create a study schedule, focus on weak areas, and take advantage of practice exams to assess their progress.

Overview of the CPA Exam Sections

The CPA exam is divided into four sections, each focusing on different aspects of accounting and business. Candidates must pass all four sections within an 18-month period to become a certified public accountant. The AUD section focuses on auditing procedures and techniques, ensuring candidates understand how to assess financial statements for accuracy and compliance.

Success Stories from CPA Exam Review Course Graduates

Many CPA exam review course graduates have shared their success stories of passing the CPA exam after completing the course. These stories highlight the effectiveness of the course in preparing students for the rigors of the CPA exam and achieving their career goals.

Conclusion

In conclusion, selecting the best CPA exam review course for financial accounting and Reporting is a critical decision for aspiring CPAs. Each course offers unique features and benefits, tailored to suit various learning styles and preferences. Whether you prefer self-paced study, interactive lectures, or comprehensive practice exams, there is a course that can help you succeed. By evaluating your individual needs and considering factors such as content quality, instructor expertise, student support, and affordability.

0 notes

Text

Unleashing the Power of CPA Exam Review Course

The dynamic realm of accounting and finance. The certified public accountant (CPA) designation is not merely a credential; it symbolizes a commitment to excellence, expertise, and ethical standards in the complex world of financial management. A comprehensive CPA exam review course serves as the linchpin in this transformative journey, providing aspiring accountants with the tools, knowledge, and strategic insights needed to conquer the rigorous CPA examination. The power of a CPA exam review course lies in its ability to distill vast and intricate accounting principles into manageable, digestible modules. These courses are meticulously designed to cover the four key sections of the CPA exam. Auditing and attestation business environment and concepts.Financial accounting and reporting and Regulation. Through a combination of interactive lectures, practice exams, and real-world case studies, candidates gain a profound understanding of the diverse subjects tested, ensuring a holistic preparation that goes beyond mere memorization.

Core Concepts and Principles for CPA Exam Review Course

Certified public accountant exam review course is designed to equip aspiring professionals with the knowledge and skills necessary to excel in the demanding field of accounting and finance. The core concepts and principles covered in such a course encompass a broad spectrum of accounting disciplines, ensuring a well-rounded understanding of financial reporting, auditing, regulation, and business environment concepts.

World Applications and Case Studies in CPA Exam Review Course

One notable application of the CPA exam review course lies in its role as a catalyst for career advancement in the field of accounting and finance. Aspiring accountants and finance professionals engage with the course to deepen their understanding of accounting concepts, financial reporting, auditing, and taxation. The comprehensive nature of the curriculum ensures that candidates are well-versed in the latest industry trends and regulatory changes, enhancing their ability to provide accurate financial information and insights within their respective organizations.

Time Management Strategies for CPA Exam Review Course

Successfully managing your time is crucial when undertaking a CPA exam review course, as the comprehensive nature of the material demands a disciplined and organized approach. First and foremost, create a detailed study schedule that encompasses all sections of the CPA exam auditing and Attestation. Business environment and concepts. Financial accounting and reporting and regulation.

Strategies and Confidence-Boosting Tips for CPA Exam Review Course

Effective time management is another critical aspect of CPA Exam preparation. Allocating sufficient time for each section, understanding one's peak productivity hours, and incorporating breaks to avoid burnout are essential components of a successful study routine. Developing a balance between active study sessions and passive learning through activities like note-taking, flashcards, and mnemonic devices can reinforce key concepts.

A Holistic CPA Exam Review Course

This type of course goes beyond mere content coverage and aims to equip candidates with a well-rounded skill set that encompasses not only the technical knowledge required for the CPA exam but also the critical thinking, problem-solving, and communication skills essential for success in the accounting profession.

Cracking the Comprehensive CPA Exam Review Course

One of the standout features of this review course is its emphasis on practical application. Real-world scenarios and case studies are integrated into the curriculum, allowing candidates to develop critical thinking skills and the ability to apply theoretical knowledge to complex, practical situations. This not only enhances their problem-solving capabilities but also prepares them for the challenges they may encounter in their future roles as CPAs.

Strive for CPA Exam Review Course

Ensuring a well-rounded preparation. Furthermore, the course should stay updated with the latest changes in the CPA exam format and content, enabling candidates to align their studies with the most current industry standards. Adaptive learning technology, personalized study plans, and real-time progress tracking are additional.

Conclusion

In conclusion, the journey through the CPA exam review course has proven to be a transformative experience, unlocking the full potential of aspiring accountants and setting the stage for professional success. The course not only equipped candidates with a comprehensive understanding of the complex and ever-evolving world of accounting but also honed their analytical skills, critical thinking abilities, and ethical decision-making processes.

1 note

·

View note

Text

How REG CPA Review Courses Prepare You for Success?

This comprehensive guide delves into the strategic approaches and indispensable insights that top-notch REG CPA review courses offer for conquering the challenges of the Regulation (REG) section of the CPA exam. Discover meticulously crafted study plans, interactive learning modules, and real-world simulations designed to equip candidates with the knowledge and confidence needed to excel. From mastering intricate tax regulations to navigating the nuances of business law, this blog unveils the transformative impact of REG CPA review courses in not only preparing candidates for the exam but also shaping their expertise for a successful career in accounting. Explore tailored strategies, cutting-edge resources, and the roadmap to REG CPA exam excellence as you set out on the path to enduring success in the field of accounting.

Strategic Study Plans: Tailoring Your Path to Success

Uncover the art of strategic study plans in reg cpa exam review course, tailoring your path to success. This section explores how these courses go beyond one-size-fits-all approaches, assessing your strengths, weaknesses, and learning style to craft a personalized study plan. From tax regulations to business law, understand how strategic planning optimizes your preparation, ensuring that you focus on areas that require the most attention. Dive into the transformative impact of a study plan designed with precision, fostering efficient learning and instilling confidence as you approach the comprehensive challenges of the REG CPA exam.

Interactive Learning Modules: Immersive Exploration of Regulatory Concepts

Delve into the world of interactive learning modules that propel you toward success in the REG CPA exam. This section explores how these courses leverage technology to create immersive, engaging modules that go beyond traditional study materials. From taxation concepts to legal frameworks, understand how interactive modules break down complex topics, allowing you to explore, practice, and solidify your understanding. Experience the dynamic shift from passive learning to active engagement, enhancing comprehension and retention as you navigate the intricacies of regulatory concepts crucial for exam success.

Real-World Simulations: Bridging Theory with Practical Application

Explore the transformative role of real-world simulations in REG CPA review courses, bridging theoretical knowledge with practical application. This section delves into how these simulations replicate actual scenarios, allowing you to apply regulatory concepts in a simulated professional environment. From tax calculations to legal case analyses, understand how real-world simulations enhance problem-solving skills and prepare you to confidently tackle the diverse challenges of the REG CPA exam and your future career in accounting.

Comprehensive Taxation Mastery: Navigating Regulatory Complexity

Navigate the complex landscape of taxation with a focus on how REG CPA review courses comprehensively prepare you for success. This section explores how these courses break down intricate tax regulations, providing in-depth insights and practice opportunities. From individual taxation to business entities, understand how comprehensive taxation mastery becomes a cornerstone of your exam preparation. Uncover the strategic approach these courses employ to ensure you not only understand the regulations but can apply them effectively in exam scenarios and real-world accounting practices.

Nuances of Business Law: In-Depth Exploration and Application

Dive into an in-depth exploration of business law as REG CPA review courses unravel its nuances. This section delves into how these courses break down legal frameworks, statutes, and regulations, offering a detailed examination of business law concepts relevant to the exam. From contracts to agency relationships, understand how the courses guide you through the complexities of business law, providing not only theoretical knowledge but also practical application scenarios. Experience the transformative impact of mastering business law intricacies, a crucial aspect of your success in the REG CPA exam and future accounting endeavors.

Mock Exams and Practice Tests: Exam Simulation for Peak Performance

Explore the significance of mock exams and practice tests in simulating the exam environment for peak performance. This section delves into how REG CPA review courses incorporate these simulations to assess your readiness and familiarize you with the exam structure. From time management to question strategies, understand how mock exams become a pivotal component of your preparation, offering a realistic preview of the challenges you'll face. Experience the confidence boost that comes with successfully navigating simulated exam scenarios, ensuring you enter the actual REG CPA exam fully equipped for success.

Expert Guidance and Support: Mentorship on Your Journey to Success

Uncover the invaluable mentorship provided by expert instructors in REG CPA review courses. This section explores how seasoned professionals guide you through the complexities of regulatory concepts, offering insights, clarification, and personalized support. From clarifying doubts to providing strategic advice, understand how expert guidance becomes a cornerstone of your success. Experience the transformative impact of mentorship as it propels you toward exam excellence, fostering not only knowledge acquisition but also the confidence and assurance needed to navigate the intricate regulatory landscape successfully.

Conclusion

In conclusion, the journey through REG CPA review courses is an immersive and strategic preparation, tailored to ensure your success in the challenging Regulation section of the CPA exam. From personalized study plans that focus on your strengths and weaknesses to interactive modules, real-world simulations, and comprehensive taxation mastery, these courses offer a multifaceted approach to exam readiness. Navigating the nuances of business law and experiencing exam simulations further fortifies your capabilities. Mock exams, practice tests, and expert guidance provide a holistic preparation, instilling the confidence and skills needed for success. As you embark on this transformative learning journey, the preparation offered by REG CPA review courses becomes not just an educational experience but a comprehensive roadmap leading to confidence, competence, and triumph in the regulatory realm of the CPA exam.

0 notes

Text

CPA Exam Review Course Tips and Strategies for Exam Success

Embarking on the journey to become a certified public accountant is a significant step in one's professional career. However, the path to achieving this prestigious designation is often laden with challenges, chief among them being the formidable CPA exam. To conquer this crucial milestone and attain exam success, candidates need more than just book knowledge; they need a comprehensive CPA exam review course that equips them with the right tips and strategies. The CPA exam is renowned for its rigour, encompassing four challenging sections: auditing and attestation, business environment, concepts of financial accounting and reporting, and regulation. With a vast body of knowledge to cover, navigating this examination necessitates a well-structured plan and an arsenal of effective study strategies. In this context, a CPA exam review course serves as a beacon of hope, offering candidates valuable insights, expert guidance, and proven techniques to maximize their exam performance.

Understanding the CPA Exam Format and Sections

The Certified public accountant exam is a rigorous and comprehensive examination that individuals must pass to become licensed CPAs in the United States. To succeed in this exam, it is crucial to have a clear understanding of its format and the sections it consists of here's a detailed description of the CPA exam format and its sections.

Crafting a Customized Study Plan

One size does not fit all when it comes to preparing for the CPA exam review course crafting a customized study plan tailored to your unique strengths and weaknesses is essential for success. In this section, we will explore the crucial elements of creating a study plan, including setting realistic goals, managing your time efficiently, and choosing the right study materials. Whether you are a recent graduate or a working professional, designing a personalized study plan is the cornerstone of your exam preparation journey.

Effective Study Techniques and Strategies

Studying for the CPA exam requires more than just reading textbooks and taking notes. To maximize your learning and retention, you need to employ effective study techniques and strategies. We will delve into proven methods such as active learning, spaced repetition, and mnemonics to help you grasp complex concepts and remember them on exam day. Discover how to break down daunting topics into manageable chunks and gain the confidence you need to tackle any question that comes your way.

Navigating Exam Content with Precision

The CPA exam covers a vast array of topics, and knowing how to navigate this content with precision is crucial for success. In this section, we will provide strategies for identifying high-priority topics, focusing your study efforts on areas with the highest potential for scoring, and tackling different question types effectively. From financial statement analysis to tax regulations, learn how to dissect and conquer the exam content with confidence.

Mock Exams and Practice Tests Your Secret Weapons

Simulating exam conditions through mock exams and practice tests is a game-changer in your CPA exam preparation. This section will guide you through the benefits of mock exams, including assessing your readiness, building endurance, and fine-tuning your time management skills. Discover how to use practice tests strategically to identify weak areas and refine your study plan, ultimately boosting your confidence as you approach exam day.

Managing Stress and Maintaining a Healthy Work-Life-Study Balance

CPA exam preparation can be stressful, but it's essential to maintain a healthy work-life-study balance to stay on track. In this section, we will explore stress management techniques, including mindfulness, time management, and self-care. Discover how to maintain your well-being while preparing for the exam, ensuring that you remain focused, motivated, and resilient throughout your journey.

Exam Day Strategies for Success

The big day has arrived, and it's time to put all your preparation to the test. In this final section, we will provide you with essential strategies for exam day success, from a pre-exam checklist to managing your time during the test and dealing with test anxiety. Learn how to approach different question formats, pace yourself, and maintain a positive mindset to maximize your chances of passing the CPA exam with flying colors.

Conclusion

In conclusion, successfully preparing for the CPA exam requires a combination of dedication, effective study strategies, and a well-structured review course. This challenging examination demands a high level of commitment, as it tests not only your knowledge but also your ability to apply accounting principles in real-world scenarios. To excel on the CPA exam, it's essential to follow a few key tips and strategies.

0 notes

Text

The CPA Exam Review Course: A Comprehensive Guide

Introduction:

The CPA Exam Review Course is the perfect guide for those who are looking to pass their CPA Exam. This comprehensive guide will teach you everything you need to know about the CPA Exam and help you achieve success. You’ll learn about the history of the CPA Exam, how to prepare for the exam, what kind of study materials are best for you, and more. Plus, this course has been designed specifically for podcast listeners so that you can stay up-to-date on all of the latest changes in the accounting profession.

What is the CPA Exam?

The CPA Exam is a graduation requirement for many law firms and other professional organizations. It is also used as an entrance exam into many accounting, finance, and other business schools. The CPA Exam is a test of your knowledge of financial statement analysis, economic planning, and financial reporting.

The CPA Exam measures your ability to analyze financial statements, make economic decisions, and prepare reports. The CPA Exam is not just about passing the test; it’s about becoming a high-quality accountant. To get the best chance at passing the CPA Exam, practice as much as possible and study for the exam in advance.

Section 2: What You Will Need to Pass The CPA ExamSection 2. What You Will Need to Pass The CPA Exam

To pass the CPA exam you will need to have a strong understanding of financial statement analysis, economic planning, and financial reporting. You will also need good math skills and be able to read complex financial statements quickly and accurately.

What is the CPA Exam Test?

The CPA Exam Test is a test that is given to candidates who are looking to become CPAs. It is used for the certification of CPAs in many different countries around the world. The exam is divided into three parts, with each part having a different focus.

The first part of the CPA Exam Test is focused on financial statements. This part covers how to analyze financial statements and make informed decisions about financial investments. The second part of the CPA Exam Test focuses on accounting principles. This part covers how to report financial information and make informed decisions about business operations. Finally, the third and final part of the CPA Exam Test is focused on ethics and public accounting practices. This part covers how to behave ethically while practicing public accounting and how to comply with government regulations.

What are the CPA Exam Contents?

The CPA Exam is a required exam for many positions in the U.S. government and business world. The exam covers various financial concepts, including public accounting and financial statement analysis. In addition, the CPA Exam covers ethics considerations, which are important for professional members of organizations.

How to pass the CPA Exam

To pass the CPA Exam, you first need to prepare for it. This means studying for both the theory and practice exams. In addition to this, you should also ensure that you have a strong understanding of accounting and financial reporting. To help you in your preparation, we provide a comprehensive guide that will teach you everything you need to know about the CPA Exam.

How to Pass the CPA Exam

If you are successful in passing the CPA Exam, there are a few things that you can do to maintain your certification and keep up with changes in the field of accounting. One of these measures is to attend continuing education courses, which can give you new insights and techniques on how to pass the exam. Additionally, maintain good personal hygiene and diet so that your body is prepared for simulated questions on accounting material.

Tips for Successfully Investing in the Stock Market

The best way to make money in the stock market is to have a long-term investment strategy. A good strategy involves investing in different stocks and sectors over time, diversifying your investments, and staying up-to-date on financial news.

Diversify Your Investments

Diversifying your investments allows you to avoid losing money if one stock falls below its price point. You can also invest in a variety of different securities, such as bonds and mutual funds, to increase your chances of making money.

Stay Up-to-Date on Financial News

Keep track of financial news so that you can stay informed about changes in the stock market and what might be affecting your investment portfolio. This will help you make sound decisions about which stocks to buy and how much money to save for the future.

Be Prepared for Volatility

If there’s a chance that prices for certain securities could go down, you must have an emergency fund set aside in case of unexpected fluctuations. As well, be prepared for volatility – know what risks you’re taking on by investing in the stock market!

Conclusion

The CPA Exam is an important certification that can help you in your career. By studying and passing the CPA Exam, you will be able to provide excellent services to clients. However, it is important to have a long-term investment strategy and be up-to-date on financial news to maintain a successful career in the stock market. Always stay prepared for volatility and take preventative measures to minimize losses.

0 notes

Text

August 8th:

Got over three hours of studying in today! I finished up module 8 and did module 9 so I'm finally done with section two. Tomorrow I'll review section two and take a practice exam and then review sections one and two and take the first mini exam. I felt more confidant with the last two modules of section two than I did with any other module but I'm hoping reviewing will give me confidence in the other modules too.

Today's accounting topic: The internal rate of return is the expected rate of return of a project and focuses the decision maker on the discount rate at which the present value of the cash inflows is equal to the present value of the cash outflows (usually the initial investment).

Other activity: I went to the gym at nine am today and took my dog on a mile long walk after it poured rain for three hours and was nice and cool!

#CPA exam review#CPA#cpa exam#business#BEC#Business CPA#studyblr#study inspiration#study hard#study motivation#study blog#study space#studying#student#study#studyspo#heydilli#astudentslifebuoy#heyzainab#juliistudies#inky studies#lookrylie#problematicprocrastinator#mittonstudies#heystardust#notetaeker#mine#headed back up to the big city tomorrow to meet with friends for lunch :)#we'll see how much work actually gets done rip

131 notes

·

View notes

Text

My Study Approach for AUD - How I Scored a 90

Back in 2019, i passed the aud exam with a score of 90. I also scored a 98 on bec, 95 on far, and 91 on reg. So i decided to launch my company maxwell cpa review to help students pass the cpa exams. With the aud exam, students often rush into specific concepts before understanding the overarching elements of audits.

Visit Us -

0 notes

Link

A CPA Exam Review is a course that prepares you for the CPA Exam. A Certified Public Accountant (CPA) is a worldwide recognized certification representing the highest level of proficiency in accounting. The CPA course test is administered by the American Institute of Certified Public Accountants (AICPA), the world’s largest accounting organization. A CPA Review course will assist you in completing all four parts of the CPA Exam as soon as feasible.

0 notes

Note

I am rereading short one shots of yours like eating a piece candy as a reward for each chapter of review I do for my CPA exam, and its delightful. I snickered outloud while rereading Cheers to Pour Decisions. Thank you for an archive full of treats to help keep me sane in this trying time.

Good luck with your studying!! You can totally do it! 💕

15 notes

·

View notes

Text

Introducing myself! Been a fan of #studyblr since I was in senior high school but it is only now that I've created one. This is due to my procrastination tendencies and my overall laziness. I have to create this account as a way of being accountable in my integrated review.

About me:

In my 20s

From the Philippines

She/her

Education:

Studying in one of the state universities in the Ph

BS Accountancy

Hoping to graduate this year

Short-term Goals:

To graduate on time

Get a civil service exam this year

Read at least 5 books before the year ends

Enroll in a review center (if I graduate - manifesting!)

Long-term Goals:

Pass the CPA licensure exam next year

Hobbies:

Reading books

Cleaning the house

Interests:

Tear-jerker novels

50s and 60s love songs, 70s and 80s disco songs

That's it for now! I will try to post my progress everyday as a way of accountability.

19 notes

·

View notes

Text

Future of Business Analytics in Accounting

Unlock the future of accounting with Business Analytics. Harness the power of data for strategic decisions, predictive analysis, and cost reduction. Embrace trends like automation, big data, and cloud computing. Overcome challenges in data security, skills gap, and integration complexity. Transform into a strategic advisor with analytics. Enroll now at Miles Education for a successful journey in mastering these essential skills. visit: https://bit.ly/43aTvQa

1 note

·

View note