#Account Aggregator Rbi

Text

There are differences between UPI and Account Aggregator

Imagine having a central platform to look up your financial assets information for all of your account savings, fixed deposit and investment plans and pension savings, insurance premiums and more, all at the same time. There is no need to log and downloading financial information from different platforms, simple access, and a single view of your financial situation,

Because of the Bank Account Aggregator framework this framework is no longer restricted to the realms of imagination

The idea for Account Aggregator was conceived through the Reserve Bank of India to make it easier to access and share of financial information. In simpler terms, it acts as a "data bridge" between different participants in the financial industry.

The Account Aggregator framework is changing the method by which financial data is distributed. According to experts, it is likely to be a replica of the enormous UPI's success. UPI.

There is plenty of common ground among UPI as well as Account Aggregator it's important to understand what the distinction is since these differing concepts solve distinct issues.

This blog is designed to assist you to understand the differences between Account Aggregator and UPI.

What exactly is UPI and what are the problems UPI address?

Unified Payment Interface (UPI) is a mobile-based electronic payments system that allows you to transfer funds from bank accounts using a your mobile phones.

One of the most important benefits that comes with UPI payment is that it allows immediate real-time transactions without disclosing the bank's details. This creates a safe swift, simple and easy payment method. You don't have for carrying cash debit card or credit card. This makes it easier to make transactions while on the move.

The benefits of UPI isn't limited to transferring money between accounts. Through UPI the ability to seamlessly pay for your utilities or recharge your mobile phone. You can also perform quick and secure transactions via e-commerce platforms and pay for insurance premiums make investments in mutual funds as well as facilitate transactions using barcodes. There are numerous possibilities and this makes UPI an incredibly flexible and well-loved payment option for a wide range of applications.

What is Account Aggregator? how does it help solve problems?

Account Aggregator was created through the Reserve Bank of India (RBI) in order to make it easier for information exchange across Financial Information Providers (FIPs) as well as Financial Information Users (FIUs) with the consent of the customer.

Account Aggregator lets you easily access and examine the financial data from various sources like account balances, stocks and tax information, insurance policies specific to investments and many more in one screen. This comprehensive view of financial assets makes it easier to manage of financial assets and allows better-informed decision making.

Account aggregation also allows the secure exchange of financial data with financial institutions. This makes it simpler to join and transact with, as well as combine a variety of financial services. Use cases for Account Aggregator are vast ranging from getting loan or collaborating with wealth management professionals to organize and improve investment portfolios, and detecting potential fraud risks and reducing risk

The difference between UPI and Account Aggregator are stark.

Integration with financial institutions from other countries

UPI is a quick payment method that allows money transfers between two accounts. This means that its infrastructure is only connected to banks. However Account Aggregator provides an even greater scope since its use and impact can be extended to all financial institutions as well as all four regulatory bodies.

The focus area

Both UPI as well as Account Aggregator are both digital public infrastructures, this is the point where simjlarity ceases.. UPI is primarily concerned with the 'transfer of funds', whereas Account Aggregator is specifically focused on the transfer of financial information'.

The UPI infrastructure connects only to banks. AA connects every financial institution, including Banks as well as NBFCs, insurance companies, broking businesses, CRAs and more which makes it much more broad in terms of application and scope.

Authority to govern

National Payments Corporation of India (NPCI) is a not-for-profit organization established through the Government of India regulates UPI transactions. It also sets the standards and guidelines that govern how the system is used. NPCI assures the security as well as security for UPI transactions in addition to promoting the expansion and use of electronic payments across India. In contrast, Account Aggregator is an authorized by the RBI, and is expected to conform to various rules and rules which the RBI established to encourage responsible and fair behavior. Regulations of the RBI ensure the privacy and security of the customers is protected, and ensure that banks are committed to ethical lending policies. Sahamati additionally plays an important function in strengthening and promoting the ecosystem of Account Aggregators. Sahamati is an alliance of industry that functions as a self-organized organization in order to help facilitate coordination between all the players of the Account Aggregator community. The alliance establishes the fundamental rules and an ethical code to the entire community.

#Sahamati Account Aggregator#Account Aggregator Rbi#Account Aggregation Apps#Account Aggregator Nbfc#Rbi Account Aggregator#Account Aggregation Service#Account Aggregator Vendors#Yodlee Account Aggregation#Financial Account Aggregators#Mint Account Aggregation#Plaid Account Aggregation#Nbfc Account Aggregators#Best Account Aggregation App#Bank Account Aggregator App#Tink Account Aggregation

1 note

·

View note

Text

Decoding India's DPDPA: Navigating Data Protection and Account Aggregator Compliance

Explore India's Digital Personal Data Protection Act (DPDPA) with insights on data protection, account aggregator compliance, and actionable steps for businesses. Build a data-centric culture, ensure compliance, and discover Anumati, a regulated solution for seamless data management

0 notes

Link

What's the role that NBFCs play in the Indian financial system? Are they even that significant? And, what’s the procedure of NBFC registration in India? If all these questions trouble your mind, then reading this article is probably the best thing you be doing now. NBFCs, which stands for Non-Banking Financial Corporations, are entities that offer many financial instruments and services to the general public but do not possess a full banking license. Registered under the Companies Act of 2013 as companies, the principal business of NBFCs is financial activity.

#account aggregator nbfc#nbfc account aggregator#nbfc license rbi#rbi nbfc registration#nbfc registration in india#nbfc certificate#rbi nbfc license#nbfc company registration#nbfc registration

0 notes

Text

#account aggregator#finserve#aa#api integration#technology service provider'#fintech#rbi#digital platforms#financial institutions#digital signature

0 notes

Text

RBI's Draft Guidelines: Enhancing Transparency in Loan Aggregation

The Reserve Bank of India (RBI) has introduced draft guidelines aimed at fostering transparency in the aggregation of loan products by lending service providers (LSPs). The proposed framework seeks to empower borrowers with comprehensive information about available loan offers, thereby enabling informed decision-making.

Under the draft guidelines, banks and non-banking finance companies (NBFCs) are required to ensure that their loan service providers furnish a digital view of all loan offers accessible to borrowers from willing lenders with whom the LSPs have arrangements. This digital view encompasses essential details such as the lender's identity, loan amount, tenor, annual percentage rate, and key terms and conditions, facilitating a fair comparison of various offers.

To uphold transparency, the RBI mandates that the content displayed by LSPs remain unbiased and refrain from promoting specific lenders' products through deceptive practices. Additionally, LSPs must adopt a consistent approach in assessing lenders' willingness to offer loans, with full disclosure of their methodology.

Furthermore, the guidelines stipulate the provision of a link to the key facts statement (KFS) for each regulated entity, ensuring borrowers have access to essential information about the lenders.

LSPs, acting as agents of regulated entities, are entrusted with various functions related to customer acquisition, underwriting support, pricing support, and servicing, among others. However, the RBI emphasizes the need for adherence to outsourcing guidelines to maintain operational integrity.

The proliferation of LSPs offering loan aggregation services underscores the importance of ensuring transparency in the borrower-lender relationship. Particularly in cases where LSPs have arrangements with multiple lenders, borrowers may not have upfront visibility into the potential lender. The draft guidelines aim to address this issue, promoting fairness and accountability in the digital lending ecosystem.

By setting forth clear norms for loan aggregation, the RBI seeks to enhance consumer protection and foster a more transparent and competitive lending landscape. As stakeholders provide feedback on the draft guidelines, the regulatory framework is poised to evolve, further bolstering trust and confidence in the digital lending space.

0 notes

Text

EXPORT OF SERVICES AND INVOICE FORMAT – OVERVIEW OF EXPORT OF SERVICES

The Goods and Services Tax (GST) literature provides detailed guidelines about the content of an invoice in its various notes. The ‘Export Invoice’ related to Service is also a document containing a description of the services provided by an exporter, and the amount due from the importer. Export invoicing is governed by various laws and regulations including GST regime as well as the guidelines of RBI. Export invoices are used by the governmental authorities in the assessment and calculation of taxes.

There are three types of transactions that are related to export in GST: Export under IGST, Under Bond/LUT, and Zero- rated supply.

Under the GST Law, the export of goods or services has been treated as follows.

inter-State supply and covered under the IGST Act.

‘zero rated supply’ i.e., the goods or services exported shall be relieved of GST levied upon them either at the input stage or at the final product stage.

Zero- rated supply means that the entire value chain of the supply is exempt from tax. This means that in case of zero rating, not only is the output exempt from payment of tax, but there is also no bar on taking/availing credit of taxes paid on the input side for making/providing the output supply.

The export transaction can be completed on payment of IGST that can be claimed as refund after the goods have been exported, as per the defined procedure. In the case of goods and services exported under bond or LUT, the exporter can claim a refund of accumulated ITC on account of export. The export goods are to be made under self-sealing and self-certification without any intervention of the departmental officer.

Export invoices fall under electronic invoicing system for taxpayers with aggregate Annual Turnover of more than 10 Cr from 01st October, 2022. This ceiling will be modified on a periodical basis. All supplies to SEZs (with/without payment), exports (with/without payment), deemed exports, are also currently covered under e-invoicing except those fall under exempt list with the turnover limit.

Generating the right export invoice is an important part of export services. Business needs to ensure that it complies with all regulations while issuing an export invoice to avoid any legal or financial penalties. There are no specific guidelines mentioned for the format of invoice while exporting services. Generally, export invoices for services need to contain the following details based on the available info.

Name, address, contact details and GSTIN of exporter and similar details of recipient

Invoice number and date

Details of Shipping

Type of export and total value of invoice and currency

Conversion rate from INR to applicable currency and Total Value of the Document

Taxable Value, Tax rate and Tax as applicable, if the refund is claimed and type of export is Export with Tax

HSN Code

Signature of authorized person

Shipping bill number, date and Port are not needed for Invoice related to Export of Services as per the Annexure documentation of GST.

Exporters need to submit various forms and documents to report on their export transactions to RBI pe the type of exports and need to follow RBI guidelines. If the exporter is claiming any benefits under export promotional schemes, the relevant details should be included in the invoice. DGFT is responsible for administering various export schemes.

SMART ADMIN is a cloud-based software for Office Automation. Smart Admin Tools are designed for Payroll management, Timesheet, and Project Tracking – visit SMART ADMIN for FREE Trial and Registration.

For more information visit https://www.smartadmin.co.in/

0 notes

Text

How Signzy Empowers Payment Aggregators in a Licensed Landscape

Before we start, let’s know, what are Payment Aggregators. – Payment aggregators are financial entities that facilitate the processing of transactions between merchants and customers without the need for multiple direct merchant accounts.

Well, the Indian digital payments scene just got a shot in the arm!

The Reserve Bank of India (RBI) has finally granted Payment Aggregator (PA) licenses to key players like Razorpay and Cashfree, paving the way for a vibrant and regulated ecosystem. This move signifies a significant leap forward for the industry, bringing much-needed clarity and stability.

But with great power comes great responsibility. Obtaining a PA license isn’t just about a celebratory press release. It’s about meeting stringent compliance requirements and ensuring robust merchant onboarding, monitoring, and underwriting practices. This is where the real challenge lies, and this is where Signzy steps in as your trusted partner.

Understanding the Power of a Payment Aggregator License

Remember the days of uncertainty around merchant onboarding and compliance? The PA license puts those concerns to rest. It sets the gold standard for digital payment acceptance, ensuring consumer protection and fostering trust in the system. This is a game-changer for payment aggregators, opening doors to new markets and partnerships, and ultimately, fueling growth.

The Thorny Side of the Rose: Challenges in the New Landscape

While the PA license unlocks opportunities, it also presents its own set of challenges. Let’s face it, the current ecosystem faces hurdles in:

Merchant Onboarding: Streamlining the process while ensuring thorough KYC and AML checks.

Merchant Monitoring: Keeping a watchful eye on suspicious activity and preventing fraud.

Underwriting: Accurately assessing risk and extending credit responsibly.

These challenges can be daunting, but they don’t have to be insurmountable.

Signzy: Your Digital Shield in the Payment Aggregators Arena

Signzy offers a comprehensive suite of solutions specifically designed to address the challenges faced by payment aggregators in the new PA landscape. We empower you with:

Automated Onboarding: Say goodbye to manual paperwork and embrace seamless digital verification with AI-powered KYC and AML tools.

Real-time Monitoring: Gain unparalleled visibility into your merchant activity with advanced fraud detection and risk management systems.

Data-driven Underwriting: Leverage the power of data and AI to make accurate risk assessments and extend credit with confidence.

Harmony with Regulations and Networks

Signzy’s solutions are meticulously aligned with the latest RBI regulations and payment network standards. We understand the importance of compliance and work closely with regulatory bodies and financial institutions to ensure your operations remain seamless and secure.

Conclusion

The PA license is a watershed moment for the Indian digital payments industry. It unlocks immense potential, but it also demands robust solutions to navigate the challenges. Signzy stands as your trusted partner, empowering you to thrive in this new landscape with cutting-edge technology and a commitment to compliance.

Ready to embrace the future of digital payments? Contact Signzy today and discover how we can help you navigate the PA landscape with confidence and ease. Visit www.signzy.com for more information about us.

1 note

·

View note

Text

The Convenience of UPI: How It's Reshaping India's Payment Landscape

In recent times, one of the most notable innovations from India that has gained international recognition is the Unified Payments Interface (UPI) system. This digital payment method now accounts for over 40% of all payments in India, with its usage spanning across 30 crore individuals and over five crore merchants.

UPI's presence is ubiquitous in India, from local street vendors to upscale shopping centers. As of 2022, India leads the global chart in digital transactions, holding nearly 46% of the world's share, surpassing Brazil, China, Thailand, and South Korea. UPI transactions have skyrocketed from one million in 2016 to an astounding 10 billion (1,000 crores).

The introduction of UPI has revolutionized the way transactions are conducted in India. Global Data research indicates a significant shift from cash transactions, which dropped from 90% in 2017 to under 60%. The demonetization of Rs 500 and Rs 1000 notes in 2016 was pivotal, as UPI transactions surged from 2.9 million to 72 million within six months.

By the end of 2017, there was a 900% increase in UPI transactions compared to the previous year, and the growth has been relentless since.UPI's user-friendly design is a critical factor in its widespread adoption. It allows seamless transactions through a Virtual Payment Address (VPA), bypassing the need to exchange sensitive banking information. This simplicity, akin to sending a text message, extends beyond convenience to foster financial inclusion, transparency, and a reduction in the informal economy.

In FY23, the UPI platform processed a total of 8,376 crore transactions aggregating to ₹139-lakh crore, compared with 4,597 crore transactions worth ₹84-lakh crore in FY22. This remarkable growth underscores UPI's ever-increasing significance in the realm of digital payments.

The rise of UPI has not only diminished the reliance on cash but also overshadowed other digital payment methods. For example, the use of debit cards for merchant payments has seen a decline, and the way prepaid wallets are used has been transformed by UPI. As UPI continues to innovate, its influence on India's digital landscape is expected to grow even further.

The success of this digital payment system is rooted not only in its robust infrastructure but also in the behavioral shift it has encouraged, moving people from cash to digital transactions. Building trust and accessibility through innovative features has been crucial. Innovations like voice notifications in payment apps, announcing the amount received instantly via QR code, have helped build trust among small merchants and vendors accustomed to cash dealings.

A significant aspect of UPI's design is the freedom it offers customers to choose their service provider, regardless of their bank. This choice empowers users to select their preferred payment apps for UPI transactions.

Integrating RuPay credit cards with UPI is a groundbreaking development in the digital payment arena. This integration allows cardholders to use their credit lines for UPI transactions, offering the combined benefits of credit cards and UPI.

India's digital payment ecosystem is drawing global interest. Following UPI's domestic success, the National Payments Corporation of India (NPCI) established NIPL (NPCI International Payments Limited) in 2020 to promote UPI internationally. Since then, NIPL and the Reserve Bank of India (RBI) have forged partnerships with financial institutions in over 30 countries to extend UPI-based transactions globally.

Recent additions include France, UAE, and Sri Lanka, with UPI's entry into France marking a significant step into the European market. Prime Minister Modi has advocated for UPI's expansion into the BRICS group, which has recently welcomed six new members.

UPI is currently the preferred choice for digital payments among end-users in India, thanks to its accessible, secure, quick, seamless, adaptable, and user-friendly attributes. As technology advances and consumer preferences evolve, the UPI payment ecosystem constantly adapts, becoming more accessible, efficient, and secure.

In this ever-changing landscape, let's explore five key trends that are shaping the future of UPI payments:

Global Expansion of UPI Payments

UPI's homegrown solution is rapidly gaining traction on the international stage, poised to broaden its acceptance in overseas markets and boost cross-border transactions. In response to the needs of Indian travelers and NRIs, the Indian Government has expanded UPI services to numerous countries, simplifying transactions and reducing costs for fund transfers and remittances. Countries like France, Bhutan, Nepal, Oman, UAE, Vietnam, Singapore, Cambodia, Hong Kong, Taiwan, the United Kingdom, and Europe are now embracing UPI payments.

India's digital solid payment ecosystem draws global interest, as evidenced by MOUs signed with 13 countries, including Malaysia, Thailand, Philippines, South Korea, and Japan, to integrate UPI into their digital payment systems. Nepal has led the way by becoming the first foreign nation to adopt UPI, enabling diverse payment options for its operations.

The surge in transaction volumes is expected to enhance UPI's global presence further. As UPI becomes accessible to more customers worldwide, the scale of its transactions is set to grow significantly. This success story of India's Make-in-India payment solution is a testament to its global impact, contributing to the Digital India initiative and offering travellers the ease of UPI transactions globally.

RuPay Credit Cards Integrated with UPI

The fusion of RuPay credit cards with UPI represents a groundbreaking move in the digital payment arena, merging the benefits of credit cards and UPI for consumers. With millions in India already using UPI apps for transactions, this integration elevates convenience, allowing users to link their credit cards to UPI, thereby reducing the need to carry physical cards. This initiative is expected to further boost digital payment adoption, especially in areas lacking POS terminals.

Initially implemented for RuPay credit cards, the goal is to extend this feature to other cards, widening the user base and enhancing security by safeguarding card data. This integration allows cardholders to use their credit lines for UPI transactions, promoting cashless transactions and added convenience.

Moreover, this integration reduces risks associated with skimming at POS terminals and losing physical cards, bolstering transaction security. The RBI's approval to link RuPay credit cards with UPI merges the best of both worlds, offering consumers enhanced payment options and security and propelling India towards a more digitised and inclusive economy.

UPI 123Pay for Offline Payments

Last year, a significant milestone in digital payments was the launch of UPI 123Pay, which targets feature phone users and provides access to the digital world. Despite the prevalence of smartphones, a significant number of Indians still rely on feature phones. Recognizing this, the RBI's UPI 2.0 extension introduced UPI 123Pay, independent of phone type or internet connectivity.

UPI 123Pay enables feature phone users to conduct digital transactions through four methods: IVR system, a feature phone-based app, missed calls, or proximity sound payment. Additionally, the service supports multiple regional languages, expanding its reach to non-Hindi and English-speaking regions, particularly in rural areas.

As UPI 123Pay gains popularity, a significant shift towards digital payments in India is anticipated. This innovation marks a pivotal moment in India's digital payment landscape, promoting financial inclusion and empowerment for feature phone users and paving the way for a more digitally-driven economy.

UPI Autopay for Recurring Payments

UPI Autopay revolutionises recurring payments by offering a streamlined solution for authorising and managing automatic debits from bank accounts. Users can set up one-time authentication for recurring payments, linking their bank accounts to charge debits at specified intervals, daily, weekly, monthly, or annually. Once set, the specified amounts are automatically debited on the scheduled dates, offering users a hassle-free payment experience.

This feature caters to recurring payments, including utility bills, online subscriptions, loan EMIs, and insurance premiums, simplifying the payment process and ensuring timely transactions without manual intervention. UPI Autopay enhances user convenience and reliability, significantly adding to the digital payment ecosystem.

UPI One World for International Travellers

The RBI's UPI One World initiative opens new avenues for international travellers in India. They can now load PPI wallets linked to UPI, facilitating smooth payments at all QR-based UPI-accepting merchant outlets. Initially available to tourists from G-20 countries, these wallets will be accessible at select Indian airports. The RBI has authorised two banks and two non-bank PPI issuers to offer this facility to foreign nationals outside airports.

The Beginning for UPI

Unified Payments Interface (UPI), a groundbreaking real-time payment system, has transformed the landscape of financial transactions in India. Launched in April 2016 by the National Payments Corporation of India (NPCI) under the auspices of the Reserve Bank of India (RBI), UPI emerged as a pivotal element of the Indian government's 2015 Digital India initiative.

This initiative aimed to evolve India into a digitally empowered society and knowledge-based economy, with a significant focus on fostering digital payments and minimising cash-based transactions. UPI was conceived and developed as an integral part of this vision, offering a secure and user-friendly platform for digital financial transactions.

The surge in smartphone penetration in India played a vital role in UPI's inception. With the increasing accessibility to affordable smartphones and mobile data, there was a notable increase in mobile internet users nationwide. This surge provided the perfect opportunity to utilize mobile phones as a conduit for digital financial transactions, paving the way for the creation of UPI.

Before the advent of UPI, India's digital payment ecosystem needed to be more cohesive, characterized by many mobile wallets, various net banking methods, and numerous proprietary payment applications; this fragmentation posed significant challenges for seamless money transfers across different platforms. UPI was introduced as a unifying solution to streamline the digital payment landscape, offering a singular platform that could integrate multiple banks and payment service providers.

UPI aimed to simplify the transaction process by introducing a uniform interface accessible across different banks and payment applications. It effectively eliminated the need to input extensive bank account details for each transaction and streamlined the authentication process using unique identifiers such as Virtual Payment Addresses (VPAs) and Mobile Personal Identification Numbers (MPINs).

A key feature of UPI was its interoperability, allowing users to link several bank accounts to a single UPI ID. This feature ensured that users could send and receive funds across any UPI-compatible app or service, irrespective of their bank affiliations. This level of interoperability promoted financial inclusion and made digital payments more accessible to a broader segment of the population.

The establishment and success of UPI were significantly supported by the Reserve Bank of India and the National Payments Corporation of India. These regulatory bodies provided the guidance, infrastructure, and security framework necessary for UPI's widespread adoption and success. They also played a critical role in formulating rules and guidelines to secure user transactions and safeguard against potential fraud, ensuring a safe and reliable digital payment environment.

How UPI is a Game-Changer for India's Digital Payment Landscape?

Unified Payments Interface, commonly known as UPI, has been a transformative force in India's digital payment landscape, offering unparalleled ease and transaction efficiency. Here's a breakdown of why UPI stands out as a revolutionary tool:

Rapid Transactions: UPI enables swift and seamless money transfers between various bank accounts. Whether reimbursing a friend, settling a bill, or completing a purchase, UPI transactions are executed promptly, ensuring no time is lost.

Intuitive User Experience: UPI has simplified the payment process, eliminating the need for lengthy banking details or complex procedures. Users can set up a Virtual Payment Address (VPA), a unique identifier linked to their bank account, making it incredibly easy to send or receive money without remembering or disclosing bank account numbers or IFSC codes.

Accessibility Around the Clock: Operating 24/7, UPI allows transactions at any hour, breaking free from the constraints of traditional banking hours. This round-the-clock availability means payments can be made over weekends and holidays, offering convenience whenever needed.

Versatile Applications: UPI's utility extends beyond personal money transfers. It's an effective tool for bill payments, online shopping, and in-store purchases. With the widespread acceptance of UPI payments via QR codes, transactions are convenient and contactless.

Flexibility Across Platforms: UPI's design ensures compatibility with various apps and banks. Users can link their bank accounts to any UPI-supported app, allowing them to choose and switch between apps without hassle, based on personal preference, while maintaining access to their funds.

Promoting Digital Access: UPI has significantly expanded the reach of banking and digital payment services to a broader audience, including those previously underserved by these facilities. Compatible with smartphones and basic feature phones, UPI ensures inclusive participation in the digital economy, irrespective of users' digital literacy levels.

Innovative Features and Services: The advent of UPI has spurred the creation of novel features and services in the digital payment sector. From splitting bills among friends to enjoying cashback on transactions and even exploring options like loans and investments through UPI-based platforms, the system continues to evolve, enhancing user convenience and offering many choices.

What’s Driving UPI Success?

The story of UPI's success is fascinating and rooted in its ever-expanding versatility and reach. As UPI began to weave its way into the fabric of rural India, its growth wasn't just about broader adoption. It was also about how UPI started embracing a variety of account types. We're talking about everything from savings and current accounts to wallets, prepaid cards, and now even RuPay Credit Card accounts and credit lines hosted by banks.

Interestingly, this expansion has opened up many new use cases for UPI. It's not just about sending money to friends or family anymore. UPI is becoming a go-to for all sorts of transactions, and the best part is that it's mostly free for the end customer for most of these transactions. That's a huge draw. Who would prefer a more convenient, cost-effective way to handle their finances?

Let's take a little trip down memory lane. Remember when digital wallets were all the rage? They were everywhere, but then came more stringent regulations. Things like know-your-customer norms, top-ups, and payment restrictions started to tighten around these wallets. That was a turning point. Many payment apps shifted their focus to UPI as their preferred payment method. It was a smart move, considering the ease and flexibility UPI offered.

Now, think about the big players in the game. These apps have massive user bases, and they've been instrumental in propelling UPI's growth. It's like they caught this wave of opportunity with UPI, and they've been riding it ever since. Their expansion and the growing trust in their services have played a crucial role in making UPI what it is today – a cornerstone of digital payments in India.

Why is Everyone Using UPI for Most of the Transactions?

Have you noticed how everyone with a bank account talks about UPI? If you're still wondering what all the fuss is about, let us break it down for you.

First off, UPI payments are swift. We're talking about completing transactions in just a few seconds. It's like sending a text message – quick and straightforward. And the best part? Almost every bank supports UPI transactions through their mobile apps. It's like having a bank in your pocket.

Let's talk about safety because that's crucial. UPI payments are super secure. To make a payment, you need the SIM card linked to your account in your phone, and you have to enter your secret MPIN each time. It's like having a personal security guard for your transactions.

But here's a cool feature – you can request money from someone else with UPI. Think about how handy that is when splitting bills or getting reimbursed. You don't usually get it with other payment methods like IMPS or NEFT.

And there's more. These mobile payment apps are about more than just transferring money. They're like your personal finance assistant. You can set up reminders for all your bill payments and pay them off with just a click. No more late fees or forgotten bills!

Have you ever run into trouble with your account or noticed something fishy? With UPI apps, you can easily file a complaint from the app. It's like having a direct line to the bank's helpdesk.

Another great thing? UPI doesn't sleep. It's available 24/7. So, UPI is always at your service, whether it's a late-night online shopping spree or an early morning bill payment.

And the cherry on top – it's completely free! There are no hidden charges or fees for your transactions. It's like having a free financial tool that's fast, safe, and convenient.

So, that's the lowdown on why UPI is all the rage right now. It's not just a payment method; it's a lifestyle change, making financial transactions more accessible, safer, and more convenient than ever before.

The Origin Story of Mobile Banking: Tracing the Journey from Traditional Banking to on-the-go Financial Management

You know, the journey of mobile banking is quite a story. It all started back in 2002 with something as simple as SMS banking. That was our first natural step away from cash transactions and into the digital finance world. Back then, mobile banking was pretty basic – you could check your account balance or make simple transfers, but it was groundbreaking.

Fast forward to 2010, and the landscape changed dramatically with the rise of smartphones. Suddenly, mobile banking wasn't just a handy tool but an integral part of our daily lives. With the advent of Android and iOS operating systems, downloading banking apps became a breeze. These apps opened up a whole new world of online financial transactions right from the palm of our hand.

But, as with any technology, mobile banking had its share of challenges. For starters, in the early days, only a few high-end mobile devices supported these banking apps. It was something only some could access.

Then there were the extra charges. Banks would often charge for their mobile banking services, meaning you might incur a fee every time you use the app. It was different from the free-for-all we're used to today.

Security was another big concern. The risk of fraud and scams was higher. You could easily fall prey to some clever scammer if you weren't careful. And if you lost your phone? Well, that was a nightmare. It was like handing over your wallet and banking details to whoever found or stole it.

And let's remember the limitations. There was a cap on how much money you could transfer through mobile banking and sometimes even restrictions on when you could make transactions. It wasn't as flexible as it is now.

So, while mobile banking has come a long way since its SMS days, it's been a journey with its fair share of bumps and learning curves. But look at where we are now – it's hard to imagine life without it!

Unveiling the Magic of UPI: Is This the New Era of Mobile Banking?

The way we handle money has been evolving constantly, right? Think about how we moved from SMS banking to mobile banking around 2010. It was a giant leap forward. But then, as technology kept advancing and we all wanted more from our banking services, something even better came. Enter UPI in 2016, stepping up as the new champ in the digital payment arena.

Let me throw some numbers at you to paint the picture. Between February 2021 and January 2022, the NPCI recorded a staggering Rs. 75.6 lakh crore in annual transactions through UPI. And in that same period, transactions worth Rs. 4,106 crore were made. These aren't just numbers; they're a testament to UPI's growing popularity and trust. It's not hard to see why.

The thing about UPI is there are other ways to transfer money. It's about the simplicity and speed it brings to the table. And when you pair it with popular apps, it's like having a magic wand for your finances. You're sitting at home, sipping coffee, and with just a few taps on your favourite app, you can send money to anyone in no time. It's that easy and quick. It's like having a financial superpower in your pocket!

Transforming the Terrain of Digital Transactions

The journey of UPI's success in India is quite a tale, and now it's stepping onto the global stage, especially in places with a strong Indian connection. Let's chat about this in two parts.

Firstly, there's this exciting movement where countries with significant Indian populations, like Singapore, the UAE, Mauritius, Oman, and Indonesia, are opening up to UPI. They're either setting up or planning systems to accept UPI payments. This is huge for the Indian diaspora and travelers. Imagine the ease and familiarity of using UPI while abroad. It's not just about the convenience; it's also about the economic boost these countries could see from Indian travelers and residents using UPI.

Now, the second part is equally fascinating. Some countries are looking at UPI as a payment method and a model to develop their own instant payment systems. Take Nepal and Bhutan, for instance. They're collaborating with India to roll out UPI-inspired payment systems. It's like UPI is becoming a blueprint for modernizing payments globally.

Of course, different countries have their own success stories with instant payments. The world of digital payments is diverse, and there's room for many systems to coexist and work together. But UPI's success story is pretty compelling for countries still exploring real-time payment solutions. It's scalable, it's proven, and it's adaptable.

India and the NPCI aren't just sitting back and watching. They're reaching out, sharing insights, and helping shape the future of digital payments in other countries. It's a proactive move that could change the game for global digital transactions.

Unveiling the Future: Can UPI Revolutionise 90% of Retail Transactions in the Next Half-Decade?

The story of UPI's rise to potentially dominate 90% of retail transactions in just five years is quite something. It's like watching a new star rise in the digital payment sky, and there are several reasons why it's shining so brightly.

First up, the government's role has been pivotal. With initiatives aimed at creating a cashless economy, like demonetization and various incentives for digital transactions, there's been a real push for businesses and individuals to hop on the UPI bandwagon.

But what makes UPI stand out is its user experience. It's incredibly user-friendly. Imagine transferring money or making a payment with just a few taps on your phone. This simplicity draws millions, even from rural areas where smartphones are becoming more common.

Then there's the widespread acceptance of UPI. It's integrated into many payment gateways, e-commerce platforms, and merchant apps, making it easy for businesses to jump in. This broad acceptance is a big part of its growing popularity.

And let's talk about convenience and interoperability. With UPI, you can link multiple bank accounts to just one UPI ID. No need for a bunch of different banking apps. This kind of inclusivity and ease of use is a game-changer, especially across India.

Speed is another factor. UPI transactions are instant and real-time. In a world where we're used to everything happening at the click of a button, this immediacy is a massive draw for consumers and businesses.

Security is vital, too. UPI's two-factor authentication adds a layer of protection that gives users peace of mind. And with the addition of biometric authentication, like fingerprints or facial recognition, trust in the platform has soared.

Remember the incentives. Cashback offers and rewards for using UPI-based apps have been a clever way to encourage people to switch from cash to digital payments.

Then, there's the role UPI plays in financial inclusion. It's about more than just the urban tech-savvy user. UPI is bringing people who might have different bank accounts into the fold of digital transactions through mobile-based apps.

The surge in smartphone ownership, especially in rural India, has also been a catalyst. Affordable smartphones have brought UPI within reach of a much larger population segment.

Lastly, UPI's growing global footprint, thanks to collaborations with countries like Bhutan, Oman, the UAE, Southeast Asia, the UK, and Nepal, sets the stage for an international presence.

In a nutshell, UPI's journey is a mix of government support, user-friendly technology, security, incentives, and global outreach. It's like a perfect storm for a digital payment revolution.

Future of Unified Payment Interface

When we talk about UPI, it's like discussing a revolution in the making. The future of Unified Payments Interface (UPI) is not just bright; it's dazzling. Let's walk through what's on the horizon for UPI and how it's reshaping India's digital payment landscape.

First, UPI's growth is something out of a tech fairy tale. Since its launch, it's been on this incredible upward trajectory, and it doesn't look like it's slowing down anytime soon. More and more people and businesses are going digital, and UPI is becoming the go-to way to transact for an ever-growing audience.

Then there's this whole movement of UPI getting cozy with offline merchants. You've seen those QR codes at stores, right? That's just the beginning. Even the smallest shops are starting to see UPI as this super convenient and cost-effective way to handle payments.

Security is a big deal, especially with digital payments. UPI is gearing up to beef up its security game. We're talking about advanced authentication, top-notch encryption – the works. It's all about keeping those transactions safe and sound.

Now, let's get a bit techy. UPI and new technologies – it's like a match made in heaven. Imagine UPI transactions getting even smoother with AI, voice assistants, and biometric authentication. It's not just about making payments; it's about making them more intelligent and secure.

Going global is also on UPI's agenda. While it's been a game-changer domestically, there's a whole world out there. Collaborating with international payment networks embracing global standards – UPI could soon make sending money across borders as easy as sending a text.

Fintech companies have been UPI's buddies from the start. This partnership will only strengthen, leading to more astounding payment solutions, nifty value-added services, and innovative financial products.

Of course, with great power comes great responsibility. The regulatory landscape is evolving to keep up with all these digital payment innovations. We're talking consumer protection, data privacy, anti-fraud measures – all that good stuff to keep the digital payment world spinning safely.

From its humble beginnings seven years ago, UPI's journey has been nothing short of extraordinary. It's changed how we, the consumers, the merchants, and the banking world, think about and handle money. With smartphones becoming more common even in rural areas, UPI's reach is expanding.

NPCI, the brains behind UPI, has shown severe entrepreneurial chops in making this happen. It's not just a success story; it's a testament to innovation and collaboration. UPI isn't just a feather in the cap of the current administration; it's a shining jewel in India's digital crown.

0 notes

Text

Navigating the NBFC Account Aggregator (AA) Landscape: A Comprehensive Guide to Licensing and Operations

In the ever-evolving Indian financial ecosystem, Account Aggregators (AAs) have emerged as key players, facilitating the secure and consent-based sharing of financial data between individuals and regulated financial institutions. To operate as an AA, entities must obtain an NBFC-AA license from the Reserve Bank of India (RBI). This guide delves into the nuances of the NBFC-AA license, providing a comprehensive overview of the licensing process, eligibility criteria, and operational considerations.

Demystifying the NBFC-AA License

The NBFC-AA license serves as a regulatory authorization granted by the RBI to entities that provide account aggregation services. These services empower individuals to digitally access and share their financial information, such as bank statements, credit history, and investment details, with other regulated entities, paving the way for seamless financial transactions.

Objectives of the NBFC-AA License Framework

The introduction of the NBFC-AA license framework aims to achieve several critical objectives:

Empowering Individuals with Financial Data Control: AAs enable individuals to exercise granular control over the sharing of their financial data, fostering transparency and safeguarding privacy.

Enhancing Financial Inclusion and Accessibility: By simplifying the data-sharing process, AAs facilitate access to financial services, particularly for individuals from underserved segments of the population.

Promoting Competition and Innovation: The entry of AAs fosters competition and drives innovation in the financial sector, leading to a wider range of products and services tailored to diverse customer needs.

Eligibility Criteria for NBFC-AA License Acquisition

To be eligible for an NBFC-AA license, an entity must meet specific criteria:

Promoter Eligibility: The promoters of the entity must possess a proven track record in financial services or related industries.

Financial Strength: The entity must demonstrate financial soundness, meeting minimum net worth and capital adequacy requirements.

Technology Infrastructure: The entity must establish robust technology infrastructure and implement stringent security measures to protect customer data.

Regulatory Compliance: The entity must adhere to all applicable regulatory guidelines and data privacy laws.

Navigating the NBFC-AA Licensing Process

The application process for an NBFC-AA license involves several key steps:

RBI Registration: The entity must submit a registration application along with prescribed documents to the RBI.

In-Principle Approval: Upon satisfactory review, the RBI may grant in-principle approval for the NBFC-AA license.

Compliance with Stipulations: The entity must comply with the RBI's stipulated conditions, including establishing a robust technology infrastructure and obtaining necessary security certifications.

Operating License: Once all conditions are met, the entity can apply for an operating license to commence business operations.

Reaping the Benefits of an NBFC-AA License

Obtaining an NBFC-AA license offers several advantages:

Expanding Market Access: The account aggregation market in India is poised for significant growth, providing ample opportunities for AAs to expand their reach and customer base.

Revenue Generation Potential: AAs can generate revenue through various channels, including charging fees for data access and providing value-added services.

Brand Recognition and Reputation: Securing an NBFC-AA license enhances the brand image and reputation of an entity, instill

0 notes

Text

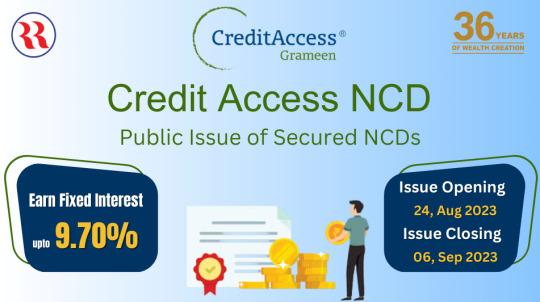

Credit Access NCDs: An Attractive Investment Opportunity

Before diving into the specifics of the NCDs, it's crucial to acquaint ourselves with the issuer. Credit Access Grameen Limited is a prominent Indian micro-finance institution headquartered in Bengaluru. Its core mission revolves around providing joint liability group loans and micro-loans, with a primary focus on empowering women in rural India. As of March 2022, CA Grameen is recognized as India's largest NBFC-MFI based on its impressive gross loan portfolio figures, endorsed by the MicroFinance Institutions Network in India.

Issuer's Focus and Opportunity:

Credit Access Grameen Limited primarily serves women customers in rural India, offering crucial financial support. Their target demographic comprises women with an annual household income of up to Rs 300,000, in alignment with the new microfinance regulations introduced by the RBI in March 2022. The company specializes in providing income generation loans, family welfare loans, home improvement loans, and emergency loans to its customer base.

CA Grameen's promoter, Credit Access India N.V., is a multinational firm specializing in micro and small enterprise financing. The promoter has a history of injecting capital into CA Grameen and facilitating access to potential fundraising avenues within the debt capital markets.

Why Consider Credit Access NCDs in Your Investment Portfolio:

Solid Credit Rating: The NCDs boast a "IND AA-/Stable" credit rating from India Ratings & Research Private Limited, signifying a robust credit profile.

Attractive Returns: Offering coupon rates ranging from 9.10% to 9.70% and effective yields from 9.48% to 10.13%, these NCDs provide competitive returns compared to traditional fixed-income investments.

Diverse Tenors: Investors can select from various tenors, ranging from 24 to 60 months, aligning their investments with their financial goals.

Flexible Interest Payment: Credit Access NCDs accommodate both monthly interest payments and cumulative interest options.

Listed on BSE: These NCDs will be listed on BSE, ensuring liquidity and ease of trading.

Credit Access NCD Investment Opportunity:

Let's delve deeper into the investment opportunity presented by Credit Access Grameen Limited through its NCD issue.

NCD Issue Details:

Issuer: Credit Access Grameen Limited

Base Issue Size: Rs. 400 Crores

Green Shoe Option: Rs. 600 Crores

Total Aggregated Issue: Rs. 1000 Crores

Issue Opening Date: August 24, 2023

Issue Closing Date: September 06, 2023

Face Value: Rs. 1,000 per NCD

Minimum Application: Rs. 10,000 (10 NCDs), collectively across all Options

Listing: The NCDs will be listed on BSE within 6 working days from the respective Tranche Issue Closing Date.

Issuance Mode: Dematerialized form

Credit Rating: IND AA-/Stable by India Ratings & Research Private Limited

Basis of Allotment: First come, first serve

Understanding the Series:

Series I, III, V, and VII provide monthly interest payments, ensuring regular income streams.

Investors have the flexibility to choose the series that best aligns with their financial goals and preferences.

Investment Benefits:

Attractive Yields: The NCDs offer competitive coupon rates, with effective yields ranging from 9.48% to 10.13% per annum, depending on the chosen series.

Diversity of Options: With eight series to choose from, investors can tailor their investments to suit their financial objectives.

Monthly Income: Series I, III, V, and VII provide monthly interest payments, ideal for those seeking regular income.

Safety and Credibility: CA Grameen holds a credit rating of "IND AA-/Stable" by India Ratings & Research Private Limited, indicating a strong level of creditworthiness.

How to Invest in Credit Access NCDs:

To invest in Credit Access NCDs, follow these steps:

Check Eligibility: Ensure you meet the eligibility criteria, including the minimum application amount.

Demat Account: If you don't already have one, open a demat account to hold your NCDs electronically.

Apply: Submit your application during the specified period between August 24, 2023, and September 6, 2023.

Allotment: Wait for the basis of allotment to be announced; allotment is on a first-come-first-served basis.

Trading: Once allotted, you can trade these NCDs on the BSE after listing.

Conclusion:

The Credit Access NCD issue presents an enticing investment opportunity for diversifying portfolios and earning attractive returns. Backed by a robust credit rating and offering a variety of series, these NCDs cater to a wide range of investor preferences. Whether you seek monthly income or cumulative growth of your investment, Credit Access NCDs offer both security and potential for substantial returns.

Investors are advised to assess their investment goals and risk tolerance carefully before making a decision. Remember that NCDs, like all investments, carry some level of risk, and it's essential to consult with a financial advisor or expert for personalized guidance.

Don't miss out on this opportunity to invest in the promising Credit Access NCD issue. Begin securing your financial future today.

Disclaimer:

All investments carry inherent risks. Investors should thoroughly review the offer-related documents and seek professional advice before making investment decisions.

Source :- https://realistic-magnolia-w8t3gc.mystrikingly.com

0 notes

Text

EXPORT OF SERVICES AND INVOICE FORMAT – OVERVIEW OF EXPORT OF SERVICES

The Goods and Services Tax (GST) literature provides detailed guidelines about the content of an invoice in its various notes. The ‘Export Invoice’ related to Service is also a document containing a description of the services provided by an exporter, and the amount due from the importer. Export invoicing is governed by various laws and regulations including GST regime as well as the guidelines of RBI. Export invoices are used by the governmental authorities in the assessment and calculation of taxes.

There are three types of transactions that are related to export in GST: Export under IGST, Under Bond/LUT, and Zero- rated supply.

Under the GST Law, the export of goods or services has been treated as follows.

inter-State supply and covered under the IGST Act.

‘zero rated supply’ i.e., the goods or services exported shall be relieved of GST levied upon them either at the input stage or at the final product stage.

Zero- rated supply means that the entire value chain of the supply is exempt from tax. This means that in case of zero rating, not only is the output exempt from payment of tax, but there is also no bar on taking/availing credit of taxes paid on the input side for making/providing the output supply.

The export transaction can be completed on payment of IGST that can be claimed as refund after the goods have been exported, as per the defined procedure. In the case of goods and services exported under bond or LUT, the exporter can claim a refund of accumulated ITC on account of export. The export goods are to be made under self-sealing and self-certification without any intervention of the departmental officer.

Export invoices fall under electronic invoicing system for taxpayers with aggregate Annual Turnover of more than 10 Cr from 01st October, 2022. This ceiling will be modified on a periodical basis. All supplies to SEZs (with/without payment), exports (with/without payment), deemed exports, are also currently covered under e-invoicing except those fall under exempt list with the turnover limit.

Generating the right export invoice is an important part of export services. Business needs to ensure that it complies with all regulations while issuing an export invoice to avoid any legal or financial penalties. There are no specific guidelines mentioned for the format of invoice while exporting services. Generally, export invoices for services need to contain the following details based on the available info.

Name, address, contact details and GSTIN of exporter and similar details of recipient

Invoice number and date

Details of Shipping

Type of export and total value of invoice and currency

Conversion rate from INR to applicable currency and Total Value of the Document

Taxable Value, Tax rate and Tax as applicable, if the refund is claimed and type of export is Export with Tax

HSN Code

Signature of authorized person

Shipping bill number, date and Port are not needed for Invoice related to Export of Services as per the Annexure documentation of GST.

Exporters need to submit various forms and documents to report on their export transactions to RBI pe the type of exports and need to follow RBI guidelines. If the exporter is claiming any benefits under export promotional schemes, the relevant details should be included in the invoice. DGFT is responsible for administering various export schemes.

SMART ADMIN is a cloud-based software for Office Automation. Smart Admin Tools are designed for Payroll management, Timesheet, and Project Tracking – visit SMART ADMIN for FREE Trial and Registration. For more information visit https://www.smartadmin.co.in/

0 notes

Link

0 notes

Text

Master Your Money in Minutes: Try Anumati's Account Aggregator Today!

Businesses & Individuals, say goodbye to finance chaos! Connect all accounts, track spending, make smarter decisions. Unleash your financial power with Anumati!

0 notes

Link

If you have a company and want to make it an NBFC company or you want to incorporate a new NBFC company or you have an NBFC company and want to get it registered under RBI regulations then this article is for you. Read it till the end and all your doubts and questions will be answered. We will let you know all the procedures to be followed, the authorities to be addressed, the documents to be submitted, and the details to be shared to get your NBFC Registration done.

#nbfc registration#nbfc company registration#how to start nbfc#how to start a nbfc in india#rbi nbfc license#nbfc certificate#nbfc registration in india#rbi nbfc registration#nbfc license rbi#nbfc account aggregator#account aggregator nbfc

0 notes

Text

#account aggregator#api integration#framework#aa#financial information#banks#nbfc#rbi#artificial intelligence#machine learning#data transfer

0 notes

Text

The circular cites that new investors from F. A. T. F. non-compliant jurisdictions in both, existing NBFCs and/or in companies seeking Certification of Registration (COR), would not be allowed to directly or indirectly acquire ‘significant influence’ in the investee, which, by accounting standards, translates to an aggregate of not more than 20% of the total voting rights of the investee.

0 notes