#Account Aggregator Nbfc

Text

There are differences between UPI and Account Aggregator

Imagine having a central platform to look up your financial assets information for all of your account savings, fixed deposit and investment plans and pension savings, insurance premiums and more, all at the same time. There is no need to log and downloading financial information from different platforms, simple access, and a single view of your financial situation,

Because of the Bank Account Aggregator framework this framework is no longer restricted to the realms of imagination

The idea for Account Aggregator was conceived through the Reserve Bank of India to make it easier to access and share of financial information. In simpler terms, it acts as a "data bridge" between different participants in the financial industry.

The Account Aggregator framework is changing the method by which financial data is distributed. According to experts, it is likely to be a replica of the enormous UPI's success. UPI.

There is plenty of common ground among UPI as well as Account Aggregator it's important to understand what the distinction is since these differing concepts solve distinct issues.

This blog is designed to assist you to understand the differences between Account Aggregator and UPI.

What exactly is UPI and what are the problems UPI address?

Unified Payment Interface (UPI) is a mobile-based electronic payments system that allows you to transfer funds from bank accounts using a your mobile phones.

One of the most important benefits that comes with UPI payment is that it allows immediate real-time transactions without disclosing the bank's details. This creates a safe swift, simple and easy payment method. You don't have for carrying cash debit card or credit card. This makes it easier to make transactions while on the move.

The benefits of UPI isn't limited to transferring money between accounts. Through UPI the ability to seamlessly pay for your utilities or recharge your mobile phone. You can also perform quick and secure transactions via e-commerce platforms and pay for insurance premiums make investments in mutual funds as well as facilitate transactions using barcodes. There are numerous possibilities and this makes UPI an incredibly flexible and well-loved payment option for a wide range of applications.

What is Account Aggregator? how does it help solve problems?

Account Aggregator was created through the Reserve Bank of India (RBI) in order to make it easier for information exchange across Financial Information Providers (FIPs) as well as Financial Information Users (FIUs) with the consent of the customer.

Account Aggregator lets you easily access and examine the financial data from various sources like account balances, stocks and tax information, insurance policies specific to investments and many more in one screen. This comprehensive view of financial assets makes it easier to manage of financial assets and allows better-informed decision making.

Account aggregation also allows the secure exchange of financial data with financial institutions. This makes it simpler to join and transact with, as well as combine a variety of financial services. Use cases for Account Aggregator are vast ranging from getting loan or collaborating with wealth management professionals to organize and improve investment portfolios, and detecting potential fraud risks and reducing risk

The difference between UPI and Account Aggregator are stark.

Integration with financial institutions from other countries

UPI is a quick payment method that allows money transfers between two accounts. This means that its infrastructure is only connected to banks. However Account Aggregator provides an even greater scope since its use and impact can be extended to all financial institutions as well as all four regulatory bodies.

The focus area

Both UPI as well as Account Aggregator are both digital public infrastructures, this is the point where simjlarity ceases.. UPI is primarily concerned with the 'transfer of funds', whereas Account Aggregator is specifically focused on the transfer of financial information'.

The UPI infrastructure connects only to banks. AA connects every financial institution, including Banks as well as NBFCs, insurance companies, broking businesses, CRAs and more which makes it much more broad in terms of application and scope.

Authority to govern

National Payments Corporation of India (NPCI) is a not-for-profit organization established through the Government of India regulates UPI transactions. It also sets the standards and guidelines that govern how the system is used. NPCI assures the security as well as security for UPI transactions in addition to promoting the expansion and use of electronic payments across India. In contrast, Account Aggregator is an authorized by the RBI, and is expected to conform to various rules and rules which the RBI established to encourage responsible and fair behavior. Regulations of the RBI ensure the privacy and security of the customers is protected, and ensure that banks are committed to ethical lending policies. Sahamati additionally plays an important function in strengthening and promoting the ecosystem of Account Aggregators. Sahamati is an alliance of industry that functions as a self-organized organization in order to help facilitate coordination between all the players of the Account Aggregator community. The alliance establishes the fundamental rules and an ethical code to the entire community.

#Sahamati Account Aggregator#Account Aggregator Rbi#Account Aggregation Apps#Account Aggregator Nbfc#Rbi Account Aggregator#Account Aggregation Service#Account Aggregator Vendors#Yodlee Account Aggregation#Financial Account Aggregators#Mint Account Aggregation#Plaid Account Aggregation#Nbfc Account Aggregators#Best Account Aggregation App#Bank Account Aggregator App#Tink Account Aggregation

1 note

·

View note

Link

What's the role that NBFCs play in the Indian financial system? Are they even that significant? And, what’s the procedure of NBFC registration in India? If all these questions trouble your mind, then reading this article is probably the best thing you be doing now. NBFCs, which stands for Non-Banking Financial Corporations, are entities that offer many financial instruments and services to the general public but do not possess a full banking license. Registered under the Companies Act of 2013 as companies, the principal business of NBFCs is financial activity.

#account aggregator nbfc#nbfc account aggregator#nbfc license rbi#rbi nbfc registration#nbfc registration in india#nbfc certificate#rbi nbfc license#nbfc company registration#nbfc registration

0 notes

Text

Navigating the NBFC Account Aggregator (AA) Landscape: A Comprehensive Guide to Licensing and Operations

In the ever-evolving Indian financial ecosystem, Account Aggregators (AAs) have emerged as key players, facilitating the secure and consent-based sharing of financial data between individuals and regulated financial institutions. To operate as an AA, entities must obtain an NBFC-AA license from the Reserve Bank of India (RBI). This guide delves into the nuances of the NBFC-AA license, providing a comprehensive overview of the licensing process, eligibility criteria, and operational considerations.

Demystifying the NBFC-AA License

The NBFC-AA license serves as a regulatory authorization granted by the RBI to entities that provide account aggregation services. These services empower individuals to digitally access and share their financial information, such as bank statements, credit history, and investment details, with other regulated entities, paving the way for seamless financial transactions.

Objectives of the NBFC-AA License Framework

The introduction of the NBFC-AA license framework aims to achieve several critical objectives:

Empowering Individuals with Financial Data Control: AAs enable individuals to exercise granular control over the sharing of their financial data, fostering transparency and safeguarding privacy.

Enhancing Financial Inclusion and Accessibility: By simplifying the data-sharing process, AAs facilitate access to financial services, particularly for individuals from underserved segments of the population.

Promoting Competition and Innovation: The entry of AAs fosters competition and drives innovation in the financial sector, leading to a wider range of products and services tailored to diverse customer needs.

Eligibility Criteria for NBFC-AA License Acquisition

To be eligible for an NBFC-AA license, an entity must meet specific criteria:

Promoter Eligibility: The promoters of the entity must possess a proven track record in financial services or related industries.

Financial Strength: The entity must demonstrate financial soundness, meeting minimum net worth and capital adequacy requirements.

Technology Infrastructure: The entity must establish robust technology infrastructure and implement stringent security measures to protect customer data.

Regulatory Compliance: The entity must adhere to all applicable regulatory guidelines and data privacy laws.

Navigating the NBFC-AA Licensing Process

The application process for an NBFC-AA license involves several key steps:

RBI Registration: The entity must submit a registration application along with prescribed documents to the RBI.

In-Principle Approval: Upon satisfactory review, the RBI may grant in-principle approval for the NBFC-AA license.

Compliance with Stipulations: The entity must comply with the RBI's stipulated conditions, including establishing a robust technology infrastructure and obtaining necessary security certifications.

Operating License: Once all conditions are met, the entity can apply for an operating license to commence business operations.

Reaping the Benefits of an NBFC-AA License

Obtaining an NBFC-AA license offers several advantages:

Expanding Market Access: The account aggregation market in India is poised for significant growth, providing ample opportunities for AAs to expand their reach and customer base.

Revenue Generation Potential: AAs can generate revenue through various channels, including charging fees for data access and providing value-added services.

Brand Recognition and Reputation: Securing an NBFC-AA license enhances the brand image and reputation of an entity, instill

0 notes

Text

#account aggregator#api integration#framework#aa#financial information#banks#nbfc#rbi#artificial intelligence#machine learning#data transfer

0 notes

Text

RBI's Draft Guidelines: Enhancing Transparency in Loan Aggregation

The Reserve Bank of India (RBI) has introduced draft guidelines aimed at fostering transparency in the aggregation of loan products by lending service providers (LSPs). The proposed framework seeks to empower borrowers with comprehensive information about available loan offers, thereby enabling informed decision-making.

Under the draft guidelines, banks and non-banking finance companies (NBFCs) are required to ensure that their loan service providers furnish a digital view of all loan offers accessible to borrowers from willing lenders with whom the LSPs have arrangements. This digital view encompasses essential details such as the lender's identity, loan amount, tenor, annual percentage rate, and key terms and conditions, facilitating a fair comparison of various offers.

To uphold transparency, the RBI mandates that the content displayed by LSPs remain unbiased and refrain from promoting specific lenders' products through deceptive practices. Additionally, LSPs must adopt a consistent approach in assessing lenders' willingness to offer loans, with full disclosure of their methodology.

Furthermore, the guidelines stipulate the provision of a link to the key facts statement (KFS) for each regulated entity, ensuring borrowers have access to essential information about the lenders.

LSPs, acting as agents of regulated entities, are entrusted with various functions related to customer acquisition, underwriting support, pricing support, and servicing, among others. However, the RBI emphasizes the need for adherence to outsourcing guidelines to maintain operational integrity.

The proliferation of LSPs offering loan aggregation services underscores the importance of ensuring transparency in the borrower-lender relationship. Particularly in cases where LSPs have arrangements with multiple lenders, borrowers may not have upfront visibility into the potential lender. The draft guidelines aim to address this issue, promoting fairness and accountability in the digital lending ecosystem.

By setting forth clear norms for loan aggregation, the RBI seeks to enhance consumer protection and foster a more transparent and competitive lending landscape. As stakeholders provide feedback on the draft guidelines, the regulatory framework is poised to evolve, further bolstering trust and confidence in the digital lending space.

0 notes

Text

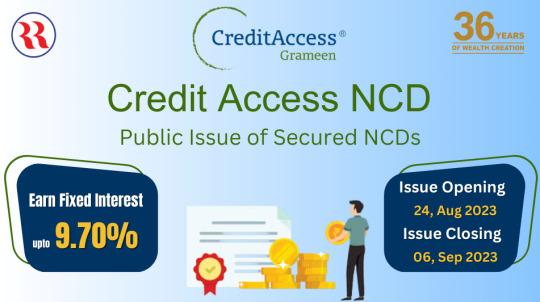

Credit Access NCDs: An Attractive Investment Opportunity

Before diving into the specifics of the NCDs, it's crucial to acquaint ourselves with the issuer. Credit Access Grameen Limited is a prominent Indian micro-finance institution headquartered in Bengaluru. Its core mission revolves around providing joint liability group loans and micro-loans, with a primary focus on empowering women in rural India. As of March 2022, CA Grameen is recognized as India's largest NBFC-MFI based on its impressive gross loan portfolio figures, endorsed by the MicroFinance Institutions Network in India.

Issuer's Focus and Opportunity:

Credit Access Grameen Limited primarily serves women customers in rural India, offering crucial financial support. Their target demographic comprises women with an annual household income of up to Rs 300,000, in alignment with the new microfinance regulations introduced by the RBI in March 2022. The company specializes in providing income generation loans, family welfare loans, home improvement loans, and emergency loans to its customer base.

CA Grameen's promoter, Credit Access India N.V., is a multinational firm specializing in micro and small enterprise financing. The promoter has a history of injecting capital into CA Grameen and facilitating access to potential fundraising avenues within the debt capital markets.

Why Consider Credit Access NCDs in Your Investment Portfolio:

Solid Credit Rating: The NCDs boast a "IND AA-/Stable" credit rating from India Ratings & Research Private Limited, signifying a robust credit profile.

Attractive Returns: Offering coupon rates ranging from 9.10% to 9.70% and effective yields from 9.48% to 10.13%, these NCDs provide competitive returns compared to traditional fixed-income investments.

Diverse Tenors: Investors can select from various tenors, ranging from 24 to 60 months, aligning their investments with their financial goals.

Flexible Interest Payment: Credit Access NCDs accommodate both monthly interest payments and cumulative interest options.

Listed on BSE: These NCDs will be listed on BSE, ensuring liquidity and ease of trading.

Credit Access NCD Investment Opportunity:

Let's delve deeper into the investment opportunity presented by Credit Access Grameen Limited through its NCD issue.

NCD Issue Details:

Issuer: Credit Access Grameen Limited

Base Issue Size: Rs. 400 Crores

Green Shoe Option: Rs. 600 Crores

Total Aggregated Issue: Rs. 1000 Crores

Issue Opening Date: August 24, 2023

Issue Closing Date: September 06, 2023

Face Value: Rs. 1,000 per NCD

Minimum Application: Rs. 10,000 (10 NCDs), collectively across all Options

Listing: The NCDs will be listed on BSE within 6 working days from the respective Tranche Issue Closing Date.

Issuance Mode: Dematerialized form

Credit Rating: IND AA-/Stable by India Ratings & Research Private Limited

Basis of Allotment: First come, first serve

Understanding the Series:

Series I, III, V, and VII provide monthly interest payments, ensuring regular income streams.

Investors have the flexibility to choose the series that best aligns with their financial goals and preferences.

Investment Benefits:

Attractive Yields: The NCDs offer competitive coupon rates, with effective yields ranging from 9.48% to 10.13% per annum, depending on the chosen series.

Diversity of Options: With eight series to choose from, investors can tailor their investments to suit their financial objectives.

Monthly Income: Series I, III, V, and VII provide monthly interest payments, ideal for those seeking regular income.

Safety and Credibility: CA Grameen holds a credit rating of "IND AA-/Stable" by India Ratings & Research Private Limited, indicating a strong level of creditworthiness.

How to Invest in Credit Access NCDs:

To invest in Credit Access NCDs, follow these steps:

Check Eligibility: Ensure you meet the eligibility criteria, including the minimum application amount.

Demat Account: If you don't already have one, open a demat account to hold your NCDs electronically.

Apply: Submit your application during the specified period between August 24, 2023, and September 6, 2023.

Allotment: Wait for the basis of allotment to be announced; allotment is on a first-come-first-served basis.

Trading: Once allotted, you can trade these NCDs on the BSE after listing.

Conclusion:

The Credit Access NCD issue presents an enticing investment opportunity for diversifying portfolios and earning attractive returns. Backed by a robust credit rating and offering a variety of series, these NCDs cater to a wide range of investor preferences. Whether you seek monthly income or cumulative growth of your investment, Credit Access NCDs offer both security and potential for substantial returns.

Investors are advised to assess their investment goals and risk tolerance carefully before making a decision. Remember that NCDs, like all investments, carry some level of risk, and it's essential to consult with a financial advisor or expert for personalized guidance.

Don't miss out on this opportunity to invest in the promising Credit Access NCD issue. Begin securing your financial future today.

Disclaimer:

All investments carry inherent risks. Investors should thoroughly review the offer-related documents and seek professional advice before making investment decisions.

Source :- https://realistic-magnolia-w8t3gc.mystrikingly.com

0 notes

Text

E-invoice Mandate: E-invoicing Changes, Exemptions, Documents Covered, Transactions and more

E-invoice mandate has been extended to companies with a turnover exceeding Rs. 5 crores from August 1, 2023. E-invoicing under GST is crucial for organizations now more than ever and the consequences of non-compliance with e-invoicing could lead to heavy penalties.

Changes in the E-invoicing Mandate over the years:

The e-invoice mandate began a phased implementation in October 2020, starting with companies earning over Rs. 500 crores. It was then extended in January 2021 to businesses turning over Rs. 100 crores. Eventually, organizations with an aggregate turnover of over Rs. 50 crores were also required to follow the mandate from April 2021. In a year’s time, in April 2022, it was extended for organizations earning over Rs. 20 crores. The latest change in the e-invoice mandate now requires companies with a revenue of over Rs. 10 crores to comply with the mandate.

What if the Turnover Limit in the E-Invoice Mandate is Crossed?

To help streamline the invoicing process of small and medium businesses, the latest extension of the e-invoice mandate included organizations with revenues over Rs. 10 crores.

If your business is crossing the e-invoicing turnover limit, then you must ensure that your systems and the accounts team is prepared. An e-invoice solutions provider is recommended to ease up your execution.

Read the detailed article to understand better: Crossed the e-invoicing turnover limit? Here are 5 things to do next!

What transactions are covered under E-invoicing?

B2B (Business to Business)

B2G (Business to Government)

SEZ developer transactions

Export transactions – Sales or services to customers outside India.

Deemed Supply (say to a Distinct person)

Deemed Exports

Credit notes

Debit notes

Note: B2C transactions, Import and Job work transactions are NOT covered under the current e-invoice mandate.

Are There Any Exemptions from E-invoice Mandate?

According to Rule 48(4), the following classes of people are exempt from the e-invoice mandate and need not generate an e-invoice under GST.

Banks, Insurance Companies, and Financial Institutions including but not limited to NBFCs.

Goods Transport Agency

Passenger Transport Services

Supplier of Services by way of admission to the exhibition of films.

Special Economic Zones (SEZ) Units. (Note: E-invoicing is applicable to Economic Zone Developers)

How Does E-Invoice Under GST Help a Business?

The e-invoice mandate is meant to ease up the legal and financial aspects of a business. Its core benefits are:

Reduced gap in GST Reconciliation and mismatch errors

Reduced data-entry error, since e-invoices can be read on several platforms

Real-time invoice tracking is possible

Faster Input Tax Credits (ITC) verification

Reduced fraudulent activities

How is an E-Invoice Under GST Generated?

The taxpayer's system itself generates an invoice, and the invoice data is subsequently sent to an Invoice Registration Portal like IRIS IRP for authorization. Once authorized, the invoice data is updated with an official digital signature and a QR Code along with Invoice Registration Number (IRN). We refer to this as an E-Invoice.

Read Full Article at :- E-invoice Mandate: E-invoicing Changes, Exemptions, Documents, Transactions Covered

0 notes

Text

Embracing Open Banking: Exploring Opportunities and Overcoming Challenges for Financial Institutions

Open banking has emerged as a transformative force in the financial industry, reshaping the way consumers interact with financial services. In this article, we delve into the potential benefits and hurdles that financial institutions face in the era of open banking.

Opportunities for Financial Institutions:

Enhanced Customer Experience

Open banking allows financial institutions to offer personalized and tailored services to customers. By leveraging customer data, institutions can provide targeted recommendations, improved account aggregation, and seamless integrations with third-party applications, elevating the overall customer experience.

Collaborative Partnerships

Open banking paves the way for strategic collaborations with fintech startups and other non-traditional players. Financial institutions can explore partnerships to develop innovative products and services, tapping into the agility and technological expertise of fintech firms.

Also Read: Best Banks And NBFCs For Small Business Loans In India

2. Challenges to Address:

Data Security and Privacy

As financial institutions share customer data with authorized third parties, ensuring robust data security and privacy becomes paramount. Institutions must adopt stringent measures to protect customer information, including strong authentication protocols and encryption techniques.

Regulatory Compliance

Financial institutions must navigate complex regulatory frameworks to ensure compliance with open banking standards. Adhering to regulations and guidelines requires significant investments in infrastructure, technology, and compliance procedures.

Technology Infrastructure and Integration

To fully embrace open banking, financial institutions must invest in advanced technology infrastructure and systems that enable seamless data sharing and integration with third-party providers. This requires robust API frameworks, scalable architectures, and data governance strategies.

Also Read: Importance Of Working Capital Management In Business

Conclusion:

Open banking presents a multitude of opportunities and challenges for financial institutions. By capitalizing on the opportunities and effectively managing the challenges, financial institutions can position themselves at the forefront of the evolving financial ecosystem, ultimately benefiting customers and driving industry-wide innovation in the era of open banking.

0 notes

Text

The circular cites that new investors from F. A. T. F. non-compliant jurisdictions in both, existing NBFCs and/or in companies seeking Certification of Registration (COR), would not be allowed to directly or indirectly acquire ‘significant influence’ in the investee, which, by accounting standards, translates to an aggregate of not more than 20% of the total voting rights of the investee.

0 notes

Text

Streamline Your NBFC Operations with Estabizz: A Comprehensive Guide

Introduction:

In today's rapidly evolving financial landscape, non-banking financial companies (NBFCs) play a crucial role in providing essential financial services to individuals and businesses. However, navigating the regulatory requirements and ensuring smooth operations can be a complex task for NBFCs. That's where Estabizz comes in. As a trusted platform, Estabizz offers a comprehensive range of services to support NBFCs, including registration, account aggregation, takeover assistance, and marketing solutions. In this article, we will delve into these key areas and explore how Estabizz can simplify your NBFC journey.

Registration of NBFCs:

Establishing an NBFC involves complying with various legal and regulatory norms. Estabizz understands the intricacies involved and provides end-to-end support for NBFC registration. With their expert guidance, you can navigate the registration process seamlessly, ensuring compliance with the necessary guidelines and accelerating your NBFC setup.

NBFC Account Aggregator License:

As an NBFC, managing financial data efficiently and securely is paramount. Estabizz assists in obtaining the NBFC Account Aggregator (NBFC-AA) license, which allows you to aggregate data from multiple financial institutions with customer consent. By availing Estabizz's services, you can streamline data aggregation, enhance customer experience, and gain valuable insights for making informed decisions.

NBFC Takeover Assistance:

The process of NBFC takeover requires meticulous planning and execution. Estabizz recognizes the complexities involved and provides expert assistance throughout the entire takeover journey. From due diligence to legal documentation and regulatory compliance, their team ensures a smooth and hassle-free transition, allowing you to expand your business efficiently.

NBFC Marketing Solutions:

In today's digital era, effective marketing is crucial for the success of any business, including NBFCs. Estabizz offers tailored marketing solutions to help NBFCs reach their target audience, enhance brand visibility, and drive customer acquisition. With their expertise in digital marketing strategies, Estabizz can assist you in implementing result-oriented campaigns, enabling you to stay ahead in a competitive market.

Why Choose Estabizz?

Estabizz is a one-stop solution provider for NBFCs, offering a wide array of services to streamline your operations. Here are some reasons why NBFCs prefer Estabizz:

Expert Guidance: Estabizz has a team of experienced professionals well-versed in the intricacies of the NBFC sector. Their expertise ensures accurate guidance throughout the registration, account aggregation, takeover, and marketing processes.

Comprehensive Solutions: From registration to marketing, Estabizz covers all aspects of NBFC operations. Their holistic approach saves you time, effort, and resources by providing integrated solutions under one roof.

Compliance Assurance: Regulatory compliance is a critical aspect of NBFC operations. Estabizz ensures that your organization meets all the necessary legal and regulatory requirements, minimizing compliance-related risks.

Personalized Approach: Estabizz understands that each NBFC is unique. They tailor their solutions to meet your specific requirements, ensuring a personalized experience that aligns with your business objectives.

Conclusion:

Embrace the benefits of simplified NBFC operations with Estabizz. Whether you require assistance with NBFC registration, account aggregation, takeover, or marketing, Estabizz is your trusted partner. With their expertise and comprehensive solutions, you can navigate the complexities of the NBFC landscape with confidence, driving growth and success for your organization. Streamline your NBFC journey today with Estabizz!

(Note: This article is a fictional piece created for demonstration purposes and does not represent actual information about Estabizz or its services. It should not be considered as professional advice for NBFC-related matters.)

1 note

·

View note

Text

An account aggregator is a non-banking financial company (NBFC), licensed by the RBI, the account aggregator RBI facilitates sharing of financial and other information on a real-time basis between different regulated entities. Anumati is a secure and fast account aggregation service that allows you to view all your bank accounts.

0 notes

Link

If you have a company and want to make it an NBFC company or you want to incorporate a new NBFC company or you have an NBFC company and want to get it registered under RBI regulations then this article is for you. Read it till the end and all your doubts and questions will be answered. We will let you know all the procedures to be followed, the authorities to be addressed, the documents to be submitted, and the details to be shared to get your NBFC Registration done.

#nbfc registration#nbfc company registration#how to start nbfc#how to start a nbfc in india#rbi nbfc license#nbfc certificate#nbfc registration in india#rbi nbfc registration#nbfc license rbi#nbfc account aggregator#account aggregator nbfc

0 notes

Text

Ensuring NBFC Account Aggregator Compliances

Discover the essential regulatory compliances that Non-Banking Financial Companies (NBFCs) must adhere to in the realm of Account Aggregation. Stay informed and compliant in the ever-evolving financial landscape.

0 notes

Text

Top 5 Benefits of Getting A Business Loan | Payor One

In this post, we will talk about the benefits of getting a business loan. So, without making any further delay, let us get started;

Flexibility For Usage

Dissimilar to value financial backers, moneylenders like banks and NBFCs don't impede how you maintain your business. They don't direct the way that you ought to utilize the business advance cash; they're simply worried about opportune reimbursements. Subsequently, a business loan is the most ideal choice to hold full command over how you spend reserves.

Convenient and Easy

Getting a business credit is basically as simple as reaching out to a moneylender and discussing the chance of getting financial support. Rather than searching for financial backers and having conversations that require a long time, in the end, getting a business loan is helpful and undeniably more clear.

Reasonable Interest Rates

Most moneylenders offer sensible financing costs on business credits, rather than different sorts of advances — the explanation being, merciless rivalry among loaning establishments for clients' consideration.

No Sharing of Profits

If you get a financial backer ready, they will expect a profit from the benefits your business makes. That is not the situation with a business loan. Here, you repay a decent aggregate to the moneylender, i.e., the head and the premium sums stay unaltered, regardless of how well your business does because of the monetary help.

If you have any desire to comprehend what your month-to-month reimbursements will resemble, utilize a straightforward web-based instrument, for example, the business credit EMI calculator.

Working Capital Support

You can utilize the business loan money to expand your functioning capital, which can be major assistance on the off chance that you have a liquidity crunch. You can run day-to-day tasks and cover momentary costs without dunking into the just-in-case account.

Final Words

We hope now you can understand the benefits of getting a business loan. Therefore, if you find it interesting and looking to Get a Business Loan, feel free to reach out to us at Payor One.

0 notes

Text

Account Aggregators - Will They Be the UPI-Equivalent of Lending in India?

On September 2nd 2021, eight Indian banks joined the Account Aggregator framework.

These are entities that share a customer's financial information with institutions who seek to use it.

The idea is to consolidate all personal financial data in one place and allow users to access financial services with just a few clicks from the comfort of their homes.

Head to the link below to know more.

https://transfin.in/account-aggregators-will-they-be-the-upi-equivalent-of-lending-in-india

0 notes

Link

NBFC Account Aggregator (NBFC-AA) License - LegalRaastaNBFC Account Aggregator are entities that facilitate the sharing of knowledge across various financial sector organizations.

0 notes