#trading strategies stock

Text

#investment#options on futures#options trading#self investment#investing in yourself#reinvent yourself#invest in yourself#perfect investment strategy#investment for beginners#become the best version of yourself#real estate investment#options trading for beginners#property investment nz#nz property investment#guidance from educate yourself#tax free investments#stock investment#tax-free investments#investment planning#teaching yourself online

3 notes

·

View notes

Text

US STOCK TRADING

usstocktradings.blogspot.com "US Stock Trading is your go-to source for all things related to stock market. Keep on top of real-time stock quotes, market analysis, and expert insights for stocks, options. Our advanced tools and resources will help you track your portfolio and make informed trading decisions. Whether you're a seasoned investor or new to the market, US Stock Trading has everything you need to succeed in the fast-paced world of stocks and trading. Start trading today we helps you.

Website https://usstocktradings.blogspot.com/

2 notes

·

View notes

Text

Value vs. Growth Stocks: What’s the Difference and Which One Should You Invest ??

When it comes to investing in stocks, there are various strategies and approaches that investors can employ. Two popular investment styles are value investing and growth investing. Understanding the difference between these two approaches is essential for making informed investment decisions. In this blog, we will delve into the characteristics of value and growth stocks, explore their differences, and help you determine which one aligns with your investment goals.

Value Stocks: Uncovering Hidden Gems

Value stocks are companies that are considered undervalued by the market, trading at prices lower than their intrinsic value. These stocks often have stable earnings, pay dividends, and possess solid fundamentals. Value investors typically focus on identifying stocks with low price-to-earnings (P/E) ratios, low price-to-book (P/B) ratios, or other valuation metrics that suggest the stock is priced lower than its actual worth. Value stocks may include mature companies in established industries that may have experienced temporary setbacks or are overlooked by the market.

Top of Form

Bottom of Form

Key Characteristics of Value Stocks:

Low valuation metrics: Value stocks often have low P/E ratios, P/B ratios, or other valuation metrics compared to their industry peers.

Dividend payments: Many value stocks are known for their consistent dividend payments, making them attractive to income-focused investors.

Established companies: Value stocks are typically found in well-established industries, where companies have a long history and solid track records.

Potential for turnaround: Value investing involves identifying companies with potential for a turnaround or market correction, where their true value may be unlocked over time.

Growth Stocks: Investing in the Future

Growth stocks, on the other hand, are companies that exhibit strong growth potential, often characterized by above-average revenue and earnings growth rates. These companies typically reinvest their earnings back into the business to fuel expansion, rather than paying dividends. Growth investors seek companies that are at the forefront of innovation, disruptive technologies, or emerging industries, with the expectation that their earnings and stock prices will rise substantially in the future.

Key Characteristics of Growth Stocks:

High revenue and earnings growth: Growth stocks typically demonstrate above-average revenue and earnings growth rates compared to their peers and the overall market.

Limited or no dividends: Instead of distributing profits as dividends, growth companies reinvest earnings into research, development, and expansion.

Technological or industry disruptors: Growth stocks are often associated with companies leading the charge in innovative sectors or disrupting traditional industries.

High valuations: Due to their growth potential, growth stocks may trade at higher P/E ratios and valuation multiples compared to their current earnings.

Which Should You Invest In: Value or Growth?

Deciding whether to invest in value or growth stocks depends on your investment objectives, risk tolerance, and investment horizon. Both approaches have their merits:

Value stocks can offer stability, income potential, and the opportunity to buy companies at a discount. They are favored by conservative investors seeking established companies with solid fundamentals and attractive dividend yields.

Growth stocks, on the other hand, offer the potential for significant capital appreciation. They are suitable for investors with a higher risk appetite, a long-term investment horizon, and an interest in innovative industries and emerging trends.

Some investors choose to maintain a balanced portfolio that includes both value and growth stocks, diversifying their risk and capitalizing on opportunities across different market segments.

Ultimately, the decision between value and growth investing comes down to your personal financial goals, investment strategy, and risk tolerance. It is advisable to consult with a financial advisor or conduct thorough research before making any investment decisions.

Conclusion:

Value and growth investing represent distinct approaches to stock selection, each with its own set of characteristics and potential rewards. Value investing focuses on finding undervalued companies with solid fundamentals and stable earnings, while growth investing targets companies with high growth potential and innovation. The choice between value and growth stocks ultimately depends on your investment objectives, risk tolerance, and time horizon.

I hope you have received all of the necessary information, for additional information, please see our blog area

#investment shares StockPicks#stockmarket#Strategy#Stockstobuy#BestStockstobuy#investment#stock market#stockpicks#best stocks for swing trading#crypto#stock market news#stockxpo#stocks#stock

2 notes

·

View notes

Text

Tyllionaire: An Insight into Trading and Forex

Tylor K. Moore, popularly known as Tyllionaire or “TY,” is a successful trader, entrepreneur, and author. His interest in the stock market and forex started early in life, and he was inspired by Jay Z's business acumen. In this article, we delve into some of his responses to interview questions to learn more about his approach to trading.

Inspiration for Trading According to TY, he became interested in the stock market early on in life. He was inspired by Jay Z's hustle to sell drugs on the corners. While he looked up to Jay Z for his business moves, he never wanted to sell drugs like him. TY believed there was a faster way to make money and that trading offered that opportunity. He started looking into stocks using newspapers and the internet while in high school. After a few years, he discovered forex and hasn't looked back since.

Motivation to Write a Book on Forex TY has written a book on forex, which he believes will solidify his name in something bigger than himself. He thinks it's dope that people can go to Barnes and Noble, say his name at the desk, and order a copy of his book. Having a book is like a business card for him, which he uses to introduce himself to new people.

Factors to Consider in Trading Stocks and Forex TY believes that the most important factor to consider in trading is risk to reward. He emphasizes that trading is not gambling but using money wisely to make more money. Every little risk involves losing something, be it time, energy, or money. Therefore, having a concrete trading plan is essential. TY advises traders to think of trading like a business and treat it as such.

Risk Management To manage risk, TY uses a simple approach. Suppose you have $1000 in a micro account, and you're trading forex. In that case, you're only supposed to risk a maximum of 3% per trade professionally. That's about $30 per trade, and you're looking to make $60 to $100 from that $30 risk. While this may not seem like a lot, it can help you double your forex account if done five or ten times.

Trading Style TY is a scalper, which means he's a hunter on the 5-minute chart. He wakes up around 3 am every morning, smokes a blunt, plays some call of duty to get his mind right, and starts trading. Usually, he catches the late London session so he can scalp GBPUSD until the NY session a few hours later. If US30 or NAS100 starts moving earlier on, then he'll catch it before the United States stock market opens. He advises traders to exit once they've hit a lick, saying that once the money stacks up, it's time to go.

Understanding the Market TY believes he has a great understanding of the ebbs and flows of the market. He advises people to learn how to read charts, and they'll find it just like driving a car; they'll never forget. He recommends a video on his YouTube channel called "Understanding Japanese Candlesticks," which he believes will help anyone learn to read charts.

Emotions and Trading TY believes that treating trading like an investment helps remove the emotional attachment to money. He advises traders to think of trading as money invested, which could work or not work. This way, when the emotion is removed, it's easier to trade on a day-to-day basis.

Advice for New Traders TY advises new traders to do what works for them. Every person has their unique experience, and they should study every profitable moment and try to duplicate the situation. He believes that trading is similar to basketball, where the

You can find TY on YouTube by typing in “TY” or “Tyllionaire” or also by googling his name Tyler K. Moore

4 notes

·

View notes

Text

Indian Stock Market Hit by SVB Crisis and Global Market Volatility

The Indian stock market is facing turbulence due to the SVB crisis and global market volatility. #OptionTrading #BankNifty #Nifty50 #BankCrises #IndianStockMarket #GlobalMarketVolatility

Indian Stock Market Hit by SVB Crisis and Global Market Volatility

The Indian stock market is reeling from the recent failure of Silicon Valley Bank (SVB) in the United States and the ripple effect it is having on global equity markets. This comes on the heels of the Adani crisis, making it another blow to the market’s recovery efforts.

Investors have lost a whopping Rs 6.6 lakh crore in the…

View On WordPress

#bank stocks#bearish momentum#candlestick patterns#candlestick trading#global market volatility#rate hike#Silicon Valley Bank#SVB crisis#technical analysis#trading strategies

2 notes

·

View notes

Link

It’s important to review the investment strategy being used for your portfolio at each stage of your life to ensure that you are not taking too much risk. Doing this can help you avoid losing money and experiencing unnecessary stress. Based on our experience of talking to innumerable people, nearly all investors over 50 have their money invested in a much higher risk strategy than they realize.

#stocks#investing#retirement#sp500#money#daytrading#buy and hold#investors#trading strategy#growthstrategy

2 notes

·

View notes

Text

Read Business News Daily To Keep up with the Markets

The companies with net worth are referred to as Stock Market Quotes on the market. They are constantly in the news through Business News. Gillette, Microsoft, Wall Mart and Citigroup are a few that usually beat market's expectations.

The companies are evaluated for their marketing strategies, sales and product launches, as well as international investments, and profits and losses. Each one of these could create a rally, increase the market indices upwards and contribute to economic growth. Business News also provides the economic perspective of the government which aids the investor in weighing the risks based on market's sentiment.

Many people are unable to discern through the text of Finance News flashed or published in the media. It's an art. The ability to look past the words to understand what's really happening on the market or in the economy, or even with the stock is a matter of an analytical mindset. If you see a headline article about Facebook in its announcement of a new mobile phone in the midst of the Facebook IPO crisis A discerning reader needs to inquire if it is an unintentional tactic used by the clever PR company or is it actually a brand new innovation that could boost the value of the stock. These kinds of questions are not mentioned in the majority of the stories we read within Finance News.

What role will the most recent information on the market have in the lives of a typical investor? Does any significance to him when stocks fall? Does it matter if the market prices go up the charts?

The issue becomes more relevant in light of the stories in the press that claim investors have lost millions in the market as it fell 200 points- that show the massive impact of the fluctuation and rise of the markets for stocks.

An investor who is speculative gets directly affected by these changes However, a committed investor is able to record a nominal loss. The most current market information provide an estimate of our holdings and helps us assess our investment strategies in the future.

#Investors News#Stock Market Quotes#Financial News#Fx News#Commodities News#Cryptocurrency News#Fx Strategies#Stock Investors#Tips Stock#New Stocks Trading Today#Today's Market News#Financial Quotes#Shares Quotes

2 notes

·

View notes

Text

Best Intraday Trading Strategies| options buying strategy| Bank nifty

Did you know that the ROI of option buying is more than 80% a year but if you want to achieve this kind of ROI then you want a rule based system strategy. Don’t worry I am here to help you…

In this post you will learn a powerful bank nifty strategy which is back tested and I founded it effective provided that if you take it properly with stop loss and position sizing

3 notes

·

View notes

Text

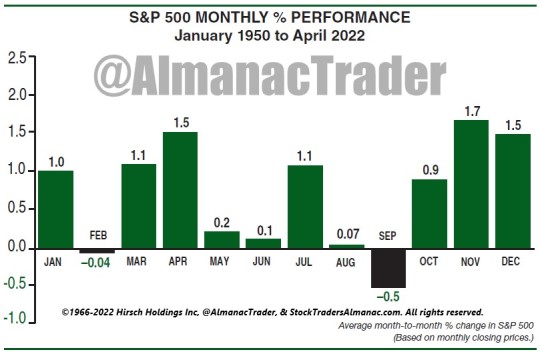

Setting the Record Straight: Best Six Months, Halloween Indicator, Sell in May

It’s that time of year again. The Best Six Months November-April begin next week, and they are even better when they begin in midterm years. But there are the naysayers so here’s the proof. This bar chart from the about to be released 2023 Stock Trader’s Almanac is led to Yale Hirsch’s discovery of this pattern and strategy.

Our Best Six Months Switching Strategy (aka “Halloween Indicator” or “Sell in May”) works. Any research to the contrary that goes back to 1900 on the DJIA (or even further back), is way too far back. Sell in May is an old British saw, soundly based on inherent behavioral finance patterns and the collective cultural behavior of the investment community, but it did not truly become a tradable investment strategy until after WWII.

The issue with starting way back then is the world is a much different place now than 100-plus years ago. Prior to about 1950, farming was a major portion of the U.S. economy and from 1901-1950, August was the best performing month of the year, up 36 times in 49 years (market closed in August 1914 due to World War I) with an average gain of 2.3%. July was the second-best month, up 31 of 50 with an average gain of 1.5%. June was fourth best, averaging 0.9%. Why, you may ask? Simply: planting, sowing, reaping, and harvesting. As crops were planted and then brought to market and sold, cash began to move and so did the stock market.

Agriculture’s share of GDP began to shrink post World War II as industrialization created a growing middle class that moved to the suburbs where hard-earned salaries would be spent filling new homes with all the modern conveniences we all take for granted now. Farming became more efficient and fewer and fewer people worked on the farm.

Suddenly, summer was less about the hard work of harvesting crops and more about vacations and relaxing. As the economy evolved and peoples’ lives changed, the market evolved. June and August went from being top performing months to bottom performing months. August went from #1 to #10 in 1950-2021 with an average DJIA gain of 0.1%. June went from #4 to #9 (0.1% average). The shift in DJIA’s seasonal pattern is clear in the following chart. “Sell in May” is a post WWII pattern, prior to then it would have been “Buy in May”.

While many market participants are hip to the saying “Sell in May and go away,” most forget to get back into the market in the fall. We like to say, “Buy in October and get yourself sober.” Before folks were keen on the Halloween Indicator which calls for getting long stocks on Halloween and the end of October, we created our Best Six Months Switching Strategy in 1986 and first featured it in the 1987 Stock Trader’s Almanac.

Back in 1986 we showed how most of the market’s gains were made in the “Best Six Months (BSM)” from November to April and that the market went sideways in the “Worst Six Months (WSM)” from May to October and is most susceptible to major declines during the Worst Six Months. From April 1950 to October, 21 2022 the S&P 500 has gained 2721.33 points versus 1013.35 points in the WSM. These six months combined have produced an average DJIA gain of 7.3% since 1950 compared to an average gain of just 0.8% during the months May to October.

We have improved the results of the strategy using the MACD technical indicator. Back in 1999 the late Sy Harding enhanced the BSM strategy by employing the late Gerry Appel’s MACD to improve entries and exits and dubbed it, “the best mechanical system ever.” Over the years we have refined the strategy further by corroborating more than one MACD, looking for confirmation across major market indices and taking MACD triggers earlier in the month.

We issued our Best Six Months Seasonal MACD Buy Signal to members on October 4 and have also issued baskets of seasonal sector ETF and undervalued, under-the-radar stock trades.

#october#stock market#seasonality#best six months#halloween strategy#Halloween Trade#Halloween#indicator#Sell in May#Midterm Elections#midterm year#Bear market#bull market

5 notes

·

View notes

Text

Bad News - Why The Financial News Media Can Cost You Money!

The communication innovations we have around us today like the internet, financial newspapers, and special interest television channels focused on investing like CNBC are a high speed pipeline of nonsensical chatter. All these sources of information mean that there is no shortage of media people trying to answer our questions about the stock market and specific stocks. You have to remember that the news media are constantly competing to survive against other stuff you can watch. If they don't always sound like they know exactly what is going on then you won't watch their presentations. If you don't tune into their show then their ratings go down. If their ratings go down they get fired and their show gets cancelled.

This means that financial journalists are in the business of finding great stories and sounding like authorities no matter what. The stock market is a great place for them to dig up news 'scoops' to feed to the public. They don't really check their facts very well and sometimes not at all. This means that if some insider wants to feed you a line of bull manure then all they have to do is maintain good connections with financial journalists, sponsor an investment show, or outright buy an investing TV channel like Jack Welch, the CEO of GE, did when he set up CNBC. What a great way for inside executives to control the flow of news information to the public then to actually own one of the only financial news channels…

But not so great for you!

These journalists also kick up the fire by bringing in so-called 'experts' to talk about each side of some topic that real experts would not consider important. This just makes it all the more confusing for the public to understand what is important when buying or selling a stock. Shows on CNBC like 'Closing Bell', 'Kudlow & Company', and 'Mad Money' do nothing but confuse and misdirect the attention of most individual investors in the public. Even worse this means that the Financial Quotes media allows overpriced stocks to be recommended through analysts in the inside web that inside executives are dumping on the public because they are trying to get out. This actually happened at the top of the bull market in 1999. For a great historical description of what happened read Maggie Mahar's book entitled "Bull."

The Exuberance of Lemmings

The famous Yale University Economist, Prof. Bob Shiller, Ph.D. is particularly harsh on the media in his book "Irrational Exuberance." Dr. Shiller is one the economists that Alan Greenspan respects most and where he got the term "Irrational Exuberance." He portrays the media as sound-bite-driven where superficial opinions are preferred over in-depth analyses. I agree whole heartedly with him and contend that it is also done just because the industry would rather have the retail investor confused and emotionally pliable to get you to buy and sell when they want.

Investors News tips - Stock Market Quotes & Financial News

Investors News Tips - offers free real time quotes, portfolio, streaming charts, financial news, live stock market data and more.

#Investors News#Stock Market Quotes#Financial News#Fx News#Commodities News#Cryptocurrency News#Fx Strategies#Stock Investors#Tips Stock#New Stocks Trading Today#Today's Market News#Financial Quotes#Shares Quotes

2 notes

·

View notes

Text

What is the best way to trade currencies?

Trading currencies, also known as forex trading, involves buying one currency while simultaneously selling another. Here are some steps and tips for effectively trading currencies:

1. Educate Yourself

Learn the Basics: Understand currency pairs, how the forex market operates, and basic trading terminology.

Study Market Influences: Know what affects currency prices, such as economic indicators, geopolitical events, and market sentiment.

2. Choose a Reliable Broker

Regulation: Select a broker that is regulated by a reputable financial authority.

Trading Platform: Ensure the broker offers a user-friendly and stable trading platform.

Fees and Spreads: Compare transaction costs, including spreads and commissions.

Customer Service: Choose a broker with reliable customer support.

3. Develop a Trading Plan

Define Goals: Set clear, realistic, and measurable trading goals.

Risk Management: Determine your risk tolerance and establish rules for risk management, such as stop-loss and take-profit levels.

Strategy: Choose a trading strategy that suits your style, whether it’s scalping, day trading, swing trading, or long-term trading.

4. Use Technical and Fundamental Analysis

Technical Analysis: Utilize charts and technical indicators (e.g., moving averages, RSI, MACD) to identify trading opportunities.

Fundamental Analysis: Analyze economic data, central bank policies, and geopolitical events to understand market trends and potential price movements.

5. Practice with a Demo Account

Simulated Trading: Use a demo account to practice trading without risking real money. This helps you get familiar with the trading platform and refine your strategy.

6. Start Small and Scale Up

Begin with a Small Capital: Start with a small amount of capital and gradually increase your investment as you gain experience and confidence.

Leverage: Use leverage cautiously, as it can amplify both gains and losses.

7. Keep a Trading Journal

Record Trades: Document all your trades, including entry and exit points, the rationale behind the trade, and the outcome.

Analyze Performance: Regularly review your trading journal to identify strengths, weaknesses, and areas for improvement.

8. Stay Informed and Adapt

Market News: Stay updated with the latest market news and economic reports.

Adaptability: Be prepared to adjust your trading strategy in response to changing market conditions.

9. Maintain Discipline and Emotional Control

Stick to Your Plan: Follow your trading plan and avoid making impulsive decisions based on emotions.

Avoid Overtrading: Don’t trade excessively. Quality over quantity is key.

10. Continuous Learning

Ongoing Education: Continue learning about the forex market, new trading strategies, and market analysis techniques.

Networking: Engage with other traders, join forums, and participate in webinars and trading communities.

Each strategy requires specific tools, market understanding, and disciplined risk management.

For more detailed guidance, visit Market Investopedia.

0 notes

Text

Mastering Trading with the Time Series Forecast Indicator: A Comprehensive Guide

In the complex and often unpredictable world of financial trading, having robust tools at your disposal can significantly improve your trading outcomes. One such powerful tool is the Time Series Forecast (TSF) indicator.

This post will delve deeply into what the TSF indicator is, how it works, and how you can effectively incorporate it into your trading strategy.

Understanding the Time Series…

View On WordPress

#Combining TSF with RSI#cryptocurrency trading#Cryptocurrency trading strategies#Divergence analysis#Forecasting in Trading#Forecasting price movements#forex trading#Forex trading strategies#Identifying trends#learn technical analysis#Linear Regression#Linear regression in trading#Moving averages and TSF#Predicting future prices#Risk management in trading#stock market#Stock market strategies#technical analysis#technical analysis tools#Time Series Forecast Indicator#Trading Strategies#trading tools#Trading with TSF#Trend Identification#TSF trading

0 notes

Text

OpenAI Praises Nvidia; Industrial Stock to Watch

The AI industry is experiencing remarkable advancements, particularly with the success of OpenAI’s ChatGPT. Recently, OpenAI gave a shoutout to Nvidia for its exceptional contributions to AI, a recognition that further cements Nvidia’s essential role in the sector. This acknowledgment comes as OpenAI continues to thrive, especially after a significant investment from Microsoft. Although Microsoft is often mentioned in discussions about AI breakthroughs, savvy investors should consider diversifying their portfolios to include other promising artificial intelligence stocks.

John McCarthy, often credited as the father of AI, defined it as the science and engineering of making intelligent machines. With ongoing technological leaps, achievements such as OpenAI’s triumph in DOTA 2 and the widespread acclaim of ChatGPT exemplify the sector’s potential. Projections show the global AI market could reach a staggering $733.7 billion by 2027, emphasizing the necessity for investors to recognize the overcrowded nature of some AI investments. Diversification remains critical in navigating the evolving sector, where companies like Nvidia are becoming central figures for their influential contributions.

Key Takeaways

OpenAI gives a shoutout to Nvidia for its significant contributions to AI.

Microsoft’s large investment in OpenAI highlights its AI dominance, yet Nvidia also appears as a key player.

John McCarthy’s definition of AI lays the foundational understanding for this evolving field.

The global AI market is expected to hit $733.7 billion by 2027, updating potential investment strategies.

Investors are advised to diversify their portfolios to include promising AI stocks like Nvidia.

To Read More >>> Click Here

Meet Our Sponsors:

#news#gold#silver#trendtracker360#tech news#tech#technology#technology news#economy#ai#openAI#chatgpt#ai technology#artificial intelligence#generativeai#ai tools#stocks to watch#stock trading#stock market#ai industry#tech industry#nvidia#investment strategy

0 notes

Text

Since the beginning of the stock market, new methods of opportunities have been introduced in each decade. There are indices like the Sensex and Nifty, which have become top indices to watch and observe in India. With the hike in online trading, retail investors seem to increase their interest in investing in the financial market. The index fund rebalancing is essential in order to update index funds over the rise or fall of nifty or other indices. Having a basic understanding of the function of an index fund will help investors invest in a smart way.

0 notes

Text

Stock Options Trading Strategies: Maximizing Your Investments

Discover effective stock options trading strategies with Trade Genie. Their expert insights and proven methods empower traders to maximize returns and minimize risks in the dynamic options market. Explore their strategies for successful trading today! For more information, visit Tradegenie.com

0 notes

Text

Index Option Tips | Nifty Option Tips | Bank Nifty Option Tips | HNI Trading Tips | BTST Tips For Today

Unlock the Secret to Explosive Profits with Our Index Option Tips, Nifty Option Tips, Bank Nifty Option Tips, HNI Trading Tips, and BTST Tips for Today. Looking to skyrocket your trading game? Look no further. Dive into our comprehensive guide packed with insider strategies and expert advice to dominate the market like never before. Whether you're a seasoned trader or a newbie, our tips cater to all levels, ensuring maximum returns on your investments. Discover the power of Index Option Tips, Nifty Option Tips, and Bank Nifty Option Tips to capitalize on market trends and secure massive profits.Elevate your trading portfolio with our exclusive HNI Trading Tips tailored for high-net-worth individuals, and stay ahead of the curve with our BTST Tips for Today, ensuring you never miss out on lucrative opportunities.Don't let FOMO control your trading decisions. Take charge of your financial future now and embark on a journey towards unparalleled success in the stock market. Click to revolutionize your trading game today.

#Index Option tips#top 5 advisories in india#stock option#option trading tips#options trading tips#nifty option tips#bank nifty option tips#nifty options tips#future and option tips#banknifty option tips provider#option trading tips free#option tips#option trading#options trading#option trading strategies#option trading strategy#option strategy#option strategies#option buying strategy#option trading for beginners#best option strategy#zero loss option strategy#what is option trading#option trading in hindi#best strategy for option trading#how to learn option trading#stock cash tips#stock future tips#hni trading tips#btst tips for today

0 notes