#tax cheats

Text

BREAKING: The IRS says Microsoft owes $29 BILLION in back taxes.

The announcement comes as the IRS has begun a historic effort to crack down on wealthy and corporate tax cheats.

This is what happens when you properly fund the IRS.

- Americans for Tax Fairness

297 notes

·

View notes

Text

Forty-four of 50 US states worsen inequality with ‘upside-down’ taxes | US income inequality | The Guardian

Forty-four of 50 US states worsen inequality with ‘upside-down’ taxes

New research found that poorest fifth pay a tax rate 60% higher, on average, than the top 1% of households

"A total of 44 of the 50 US states worsen inequality by making the wealthy pay a lesser share of their income in taxes than lower income people, a new analysis has found.

State and local tax regimes are “upside-down”, the new research finds, with weak or non-existent personal income taxes in many states allowing richer Americans to avoid tax. A reliance on sales and excise taxes, considered regressive because they disproportionately impact the poor, has helped fuel this inequality, according to the report.

CEOs of top 100 ‘low-wage’ US firms earn $601 for every $1 by worker, report finds

“When you ask people what they think a fair tax code looks like, almost nobody says we should have the richest pay the least,” said Carl Davis, research director of the Institute on Taxation and Economic Policy (ITEP), which conducted the analysis.

“And yet when we look around the country, the vast majority of states have tax systems that do just that. There’s an alarming gap here between what the public wants and what state lawmakers have delivered.”

Only six states, plus the District of Columbia, have tax systems that reduce inequality rather than worsen it, with the poorest fifth of people paying a tax rate 60% higher, on average, than the top 1% of households.

The super-wealthy are treated particularly lightly by the tax system, with the top 1% paying less than every other income group across 42 states. In most states, 36 in all, the poorest residents are taxed at a higher rate than any other group.

The most regressive states in terms of taxation are, in order, Florida, Washington, Tennessee, Pennsylvania and Nevada. The least regressive jurisdictions are DC, Minnesota, Vermont, New York and California.

Various state-level policies, such as cutting taxes on the wealthy to supposedly drive economic activity, has worsened this situation, the report found. Inequality in recent decades has been far starker in the US than in other comparable countries and while some pandemic-era interventions, such as a child tax credit, lessened the burden on the poorest in society, many of those measures have now lapsed.

“But we know it doesn’t have to be like this,” said Aidan Davis, ITEP’s state policy director.

“There is a clear path forward for flipping upside-down tax systems and we’ve seen a handful of states come pretty close to pulling it off. The regressive state tax laws we see today are a policy choice, and it’s clear there are better choices available to lawmakers.”

• This article was amended on 11 January 2024. Owing to incorrect information supplied to us, an earlier version listed New Jersey as the fifth least regressive tax jurisdiction, according to the ITEP report, rather than California."

#I see why people are pissed but this isn't Biden's fault#It's about who people vote for#GOP#Wall Street#Tax Cheats#Trump Tax Scam#Wirst Stars For Taxes Are Florida Washington Tennessee Nevada#Vote Blue

4 notes

·

View notes

Text

This. Is NOT. Changing!

The spin machines for the FILTHY rich elite continue to propagate lies that loud, hateful, non-intellectual, name-calling MTG-types keep repeating. All AGAINST their own best interests:

Remember those Trump-era conservative tax cuts from that better-quality first image? THAT was only the beginning...

Trillion-dollar Apple - as an example - was able to dodge approximately $40 BILLION in taxes by using a relatively paltry amount of its offshore $252 BILLION untaxed cash-on-hand (that's literally CASH, not asset equity) to "reinvest" in US ventures thanks to further sweetheart legislation that they, with Microsoft, Facebook and Alphabet, combined to spend more than $16 million JUST IN THE THIRD QUARTER OF 2017 to get passed through Congress! For reference:

Still reading? All-told, as of 2017, the FORTUNE 500 had approximately $2.6 TRILLION in untaxed offshore funds (CASH, not asset equity)! What was in YOUR wallet in 2017? And how about now?

If you're working class, the FILTHY RICH and YOUR GOVERNMENT owe you! They've been cheating YOU for a VERY long time!

#manly views#us politics#border security#eat the rich#the right can't meme#not free stuff#life#liberty#pursuit of happiness#we the people#gop zombie horde#maga#trump#shitler#tax cheats#apple has how much money offshore???#no god know peace#iykyk#vote

2 notes

·

View notes

Text

Operation Deimos: The Abyss of Behemoth

Operation Deimos keeps track of the Agents of Behemoth: The Backstabbing Parasites of Corporate Personhood.

The Righteous One knows what is going on in the homes of the wicked; he will bring disaster on them. Those who shut their ears to the cries of the poor will be ignored in their own time of need. Proverbs 21:12-13 (NLT)

Dear friend, do not imitate what is evil but what is good. Anyone who does what is good is from God. Anyone who does what is evil has not seen God. 3 John 1:11 (NIV)

The iniquities of a wicked man entrap him; the cords of his sin entangle him. Proverbs 5:22 (BSB)

What sorrow awaits those who try to hide their plans from the LORD, who do their evil deeds in the dark! “The LORD can’t see us,” they say. “He doesn’t know what’s going on!” Isaiah 29:15 (NLT)

Behemoth is the first of God's conquests. Its maker approaches it with his sword. Job 40:19 (GWT)

And I saw the dead, great and small, standing before the throne. And there were open books, and one of them was the Book of Life. And the dead were judged according to their deeds, as recorded in the books. Apocalypse 20:12 (BSB)

And if anyone was found whose name was not written in the Book of Life, he was thrown into the lake of fire. Apocalypse 20:15 (BSB)

0 notes

Text

I understand the inflating away of certain debt by differential rates, I see the shell games and am sick of the bailouts. I get it. I'm still digging but I really get it. The movement of ~~ 2 trillion all over the world is very curious. Like a worm or Ghost....

I get the, I only know what I don't know. I get you know more. I get it. Please just STFU.

If you had done ANYTHING right this decade. Would people like me, particularly women be soooo pissed?

0 notes

Note

A thing I asked got answered! That’s the first time! Wow!

Anyway what I’m asking this time is; can we just see flowey and frisk hanging out with clover and kanako? Just having a fun time playing like actual children

photo taken 5 minutes before disaster playing uno….. any game played with all of them will inevitably turn into disaster

#asked and answered#monster clover au#mcau art#also chara cant REALLY interact w anyone bc the only ones that can see them are frisk and clover#but damn if they dont try their best to cheat for frisk or be annoying and make everyone pay 10000 in property taxes in monopoly

200 notes

·

View notes

Text

146 notes

·

View notes

Text

“Judge Ana Reyes highlighted the gravity of the crime, saying multiple times that it amounted to an attack against the US and its legal foundation.

“What you did in attacking the sitting president of the United States was an attack on our constitutional democracy,” Reyes said. “We’re talking about someone who … pulled off the biggest heist in IRS history.”

The judge compared Littlejohn’s actions to those of the January 6, 2021, Capitol attack, noting that, “your actions were also a threat to our democracy.”

“It engenders the same fear that January 6 does,” Reyes added.”

😡

#republican assholes#traitor trump#crooked donald#Trump is a tax cheat#tax the rich#tax the oligarchs

55 notes

·

View notes

Text

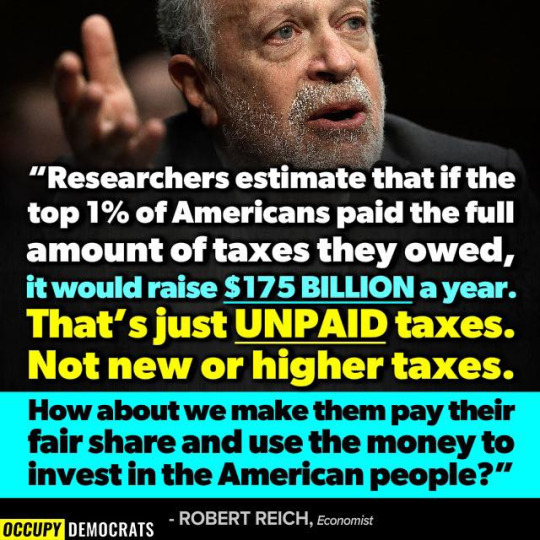

#Tax the rich#make the 1% pay their share#end corporate subsidies#end corporate welfare#billionaire tax#Republicans are owned by billionaires#oligarchs own GOP#corporate greed#republican party#never trump#republican assholes#traitor trump#crooked donald#republican hypocrisy#tax cheat Trump

21 notes

·

View notes

Text

Corporations pay their CEOs extravagantly while trying to cheat on taxes.

It would be one thing if, alongside the exorbitant executive pay, the quality of American CEO-ing was going up. But these executives are making off with bigger bags of boodle despite their persistent incompetence: Media executives keep running their businesses into the ground, tech firms are laying people off because of vibes, the planes keep nearly crashing, and examples of insane eye-popping greed—like Rite-Aid’s decision to claw back severance paid out to laid-off workers on the same day they handed their CEO a $20 million bonus—keep on coming.

So it may come as no surprise that there’s a robust connection between the overindulged CEOs and the firms that are most flagrantly dodging their fair share of taxes. For a report released Wednesday, the Institute for Policy Studies teamed up with Americans for Tax Fairness to spelunk into the balance sheets at some of America’s best-known tax scofflaws between 2018 and 2022. What they found was pretty consistent: The firms took home high profits and lavished their top executives with exorbitant pay, all while stiffing Uncle Sam.

The excess is stunning. “For over half (35) of these corporations,” the study reports, “their payouts to top corporate brass over that entire span exceeded their net tax payments.” An additional 29 firms managed this feat for “at least two of the five years in the study period.” Eighteen firms paid a grand total of zero dollars during that five-year span, 17 of which were given tax refunds. All in all, the 64 companies in the report “posted cumulative pre-tax domestic profits of $657 billion” during the study period, but “paid an average effective federal tax rate of just 2.8 percent (the statutory rate is 21 percent) while paying their executives over $15 billion.”

Which firms are the worst of the worst? You can probably guess the company that tops the list because it’s the one run by The New Republic’s 2023 Scoundrel of the Year. During the five years of the study, Tesla took home $4.4 billion in profits as CEO Elon Musk carted off $2.28 billion in stock options, which, since his 2018 payday, have ballooned to nearly $56 billion—a compensation plan so outlandish that the Delaware Court of Chancery canceled it. Tesla has, during that same period of time, paid an effective tax rate of zero percent through a combination of carrying forward losses from unprofitable years and good old-fashioned offshore tax dodging.

Elon Musk is either the world's richest or second richest person. But he still wants more. Give him credit for pathological greed.

In all fairness, Musk is not alone when it comes to enriching himself while screwing workers.

What sort of innovations have these CEOs wrought from this well-remunerated period? T-Mobile’s Mike Sievert presided over the Sprint merger that led to $23.6 million in stock buybacks and 5,000 layoffs. Netflix’s Reed Hastings poured $15 billion in profit into jacking up subscription rates. Nextera Energy has devoted $10 million in dark money in a “ghost candidate scheme” to thwart climate change candidates. Darden Restaurants has been fighting efforts to raise the minimum wage. Metlife has been diverting government money meant to fund low-cost housing into other, unrelated buckraking ventures. And some First Energy executives from the study period are embroiled in a corruption scandal that’s so massive that even Musk might find it to be beyond the pale.

These oligarchs are going to spend lavishly to elect Republicans who would give them even bigger tax breaks.

Fortunately, they can't literally buy votes. If we return to old school grassroots precinct work then we can thwart the MAGA Republican puppets of billionaire oligarchs.

One to one contact is a more important factor than TV or online ads in convincing people to vote your way. It takes more effort, but democracy was not built by slacktivism in the first place.

#corporate tax cheats#extravagant salaries for ceos#tax dodging#greed#oligarchs#tesla#elon musk#t-mobile#netflix#nextera energy#first energy#metlife#darden#maga#republicans#grassroots political work#election 2024#vote blue no matter who

11 notes

·

View notes

Photo

74 notes

·

View notes

Note

oh are we sharing attempted tax fraud stories? our office's favourite was the sovereign citizen that thought taxes were immoral, so she created a new federal company to sue her original company for the destruction of her husband's body because he did a physical job. she was sueing for more than the worth of the entire company. got that one my literal second day of bookkeeping.

it seems like you always get the really fun stuff right at the beginning when you're least equipped to handle it

#original#sometimes when doing free taxes in college#we would get someone right out of prison#which was fine#but we got one guy who JUST got out had no job no nothing#technically didn't even need to file because. no income.#so he got Jack Shit because there was nothing to refund#and he didn't qualify for any credits#we tried to console him by pointing out that having all this on file would make it easier to apply for benefits#and he was like 'but my friend got tons of money back'#and we were like 'either he has many children or he committed fraud'#later he called and threatened our professor#for cheating him out of his money he did not qualify for

100 notes

·

View notes