#stockstobuy

Text

US stock trading sharing

As long as you have any investment questions, you can ask me and I can help you solve any investment problems. My confidence comes from the recognition of my abilities

#donald trump#finance#investing#nyc#stock market#ask#answered#ask game#stock trading#shares#stock tips#stockstowatch#stockstobuy#stockholm#investment#investors#real estate investing#investing stocks#savings#options#opportunities

3 notes

·

View notes

Text

Value vs. Growth Stocks: What’s the Difference and Which One Should You Invest ??

When it comes to investing in stocks, there are various strategies and approaches that investors can employ. Two popular investment styles are value investing and growth investing. Understanding the difference between these two approaches is essential for making informed investment decisions. In this blog, we will delve into the characteristics of value and growth stocks, explore their differences, and help you determine which one aligns with your investment goals.

Value Stocks: Uncovering Hidden Gems

Value stocks are companies that are considered undervalued by the market, trading at prices lower than their intrinsic value. These stocks often have stable earnings, pay dividends, and possess solid fundamentals. Value investors typically focus on identifying stocks with low price-to-earnings (P/E) ratios, low price-to-book (P/B) ratios, or other valuation metrics that suggest the stock is priced lower than its actual worth. Value stocks may include mature companies in established industries that may have experienced temporary setbacks or are overlooked by the market.

Top of Form

Bottom of Form

Key Characteristics of Value Stocks:

Low valuation metrics: Value stocks often have low P/E ratios, P/B ratios, or other valuation metrics compared to their industry peers.

Dividend payments: Many value stocks are known for their consistent dividend payments, making them attractive to income-focused investors.

Established companies: Value stocks are typically found in well-established industries, where companies have a long history and solid track records.

Potential for turnaround: Value investing involves identifying companies with potential for a turnaround or market correction, where their true value may be unlocked over time.

Growth Stocks: Investing in the Future

Growth stocks, on the other hand, are companies that exhibit strong growth potential, often characterized by above-average revenue and earnings growth rates. These companies typically reinvest their earnings back into the business to fuel expansion, rather than paying dividends. Growth investors seek companies that are at the forefront of innovation, disruptive technologies, or emerging industries, with the expectation that their earnings and stock prices will rise substantially in the future.

Key Characteristics of Growth Stocks:

High revenue and earnings growth: Growth stocks typically demonstrate above-average revenue and earnings growth rates compared to their peers and the overall market.

Limited or no dividends: Instead of distributing profits as dividends, growth companies reinvest earnings into research, development, and expansion.

Technological or industry disruptors: Growth stocks are often associated with companies leading the charge in innovative sectors or disrupting traditional industries.

High valuations: Due to their growth potential, growth stocks may trade at higher P/E ratios and valuation multiples compared to their current earnings.

Which Should You Invest In: Value or Growth?

Deciding whether to invest in value or growth stocks depends on your investment objectives, risk tolerance, and investment horizon. Both approaches have their merits:

Value stocks can offer stability, income potential, and the opportunity to buy companies at a discount. They are favored by conservative investors seeking established companies with solid fundamentals and attractive dividend yields.

Growth stocks, on the other hand, offer the potential for significant capital appreciation. They are suitable for investors with a higher risk appetite, a long-term investment horizon, and an interest in innovative industries and emerging trends.

Some investors choose to maintain a balanced portfolio that includes both value and growth stocks, diversifying their risk and capitalizing on opportunities across different market segments.

Ultimately, the decision between value and growth investing comes down to your personal financial goals, investment strategy, and risk tolerance. It is advisable to consult with a financial advisor or conduct thorough research before making any investment decisions.

Conclusion:

Value and growth investing represent distinct approaches to stock selection, each with its own set of characteristics and potential rewards. Value investing focuses on finding undervalued companies with solid fundamentals and stable earnings, while growth investing targets companies with high growth potential and innovation. The choice between value and growth stocks ultimately depends on your investment objectives, risk tolerance, and time horizon.

I hope you have received all of the necessary information, for additional information, please see our blog area

#investment shares StockPicks#stockmarket#Strategy#Stockstobuy#BestStockstobuy#investment#stock market#stockpicks#best stocks for swing trading#crypto#stock market news#stockxpo#stocks#stock

2 notes

·

View notes

Text

#StocksToBuy#stocks#StockMarket#finance#stock#krishafinance#broker#bestdemataccount#freedemataccount#India#stockbroker#StockMarketindia#Nifty#update#news#sensex#evening

3 notes

·

View notes

Text

Analyzing Adani Energy Solutions' Fourth Quarter Performance

Adani Energy Solutions, formerly known as Adani Transmission Ltd, and Adani Total Gas Ltd are set to announce their quarterly results on April 30.

In the fourth quarter of FY24, Adani Energy Solutions sold 2,226 million units, marking a notable increase from the previous year's 2,100 million units.

In the latest report for the fourth quarter, Adani Energy Solutions received a Letter of Award (LOA) for an additional order quantity of 1.7 million meters from MSEDCL, with a revenue potential of Rs 2,100 crore.

With a vision to supply 60% renewable power to Mumbai by FY27, Adani Energy Solutions has already achieved 35% by March 31, 2024

Foreign Portfolio Investors (FPIs) maintained their stake in Adani Total Gas at 13.13% in Q4, reflecting confidence in the company's performance.

Analysts remain bullish on the growth prospects of both Adani Energy Solutions and Adani Total Gas.

Ventura Securities recommends a BUY rating for Adani Energy Solutions, citing substantial revenue growth opportunities.

Similarly, for Adani Total Gas, Ventura Securities re-initiated its BUY rating, foreseeing growth in revenue, EBITDA, and PAT over the coming years.

To know more about the stock updates, click here: thebusinesscorridor

0 notes

Text

#investing stocks#stock trading#stock#stockstobuy#stock market#stock tips#nseindia#ai stocks#artificial intelligence

0 notes

Text

📈 Today's Stock Market Update! 🚀

Meta's shares fell 10% despite beating earnings, disappointing investors with future revenue forecasts.

Meanwhile, Alphabet exceeded expectations with a 26% earnings increase and announced their first dividend, causing shares to surge over 10%.

Snapchat saw a remarkable 30% increase in stock value, surpassing EPS predictions by 150%, thanks to significant upgrades in their ad platform.

Stay tuned for more updates tomorrow on ExxonMobil and Chevron!

0 notes

Text

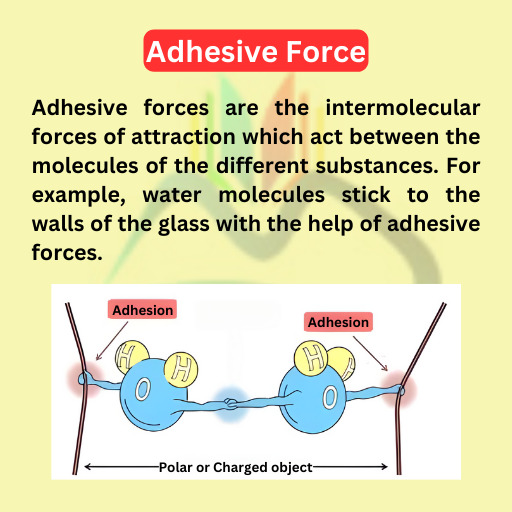

Adhesive Force

.

INDIA's FIRST E- MAGAZINE WITH LIVE TESTING

.

LINK IN BIO... .

#sciencenews#jeemain2024#Pushpa2FirstSingle#Ghaziabad#SupremeCourtOfIndia#StocksToBuy#Besharm_Rohini#Iran#Israel#efastforward#jee#neetpreparation

0 notes

Text

Bajaj Finance Share Price Target 2030

Bajaj Finance Share Price Target 2030 तक बढ़ोतरी ने पूरे देश भर में कस्टमर बेस पर नजर डाले तो काफी मजबूत देखने को मिलता है और हर साल देखा जाए तो काफी अच्छी तेजी से कंपनी के साथ नए कस्टमर जुड़ने हुए देखने को मिल रहा है अभी तक कंपनी ने लगभग 6.29 करोड़ से भी ज्यादा कस्टमर कस्टमर को फाइनेंसिंग का सुविधा प्रदान किया है और जो भी नए कस्टमर आते हैं उनमें से लगभग 57% कस्टमर दूसरी बार भी बजाज फाइनेंस से ही लोन लेते हुए देखने को मिलते हैं।

कंपनी के साथ जैसे-जैसे नए कस्टमर जुड़ते जाएंगे बजाज फाइनेंस शेयर प्राइस टारगेट द्वारा 26 में देखा जाए तो आपको बहुत ही बेहतरीन रिटर्न कमाई करके देने के साथ ही पहला टारगेट आपको ₹12000 दिखाते हुए जरूर नजर आ सकता है उसके बाद आप जरूर दूसरा टारगेट ₹12500 रुपए के लिए होल्ड करने की सोच सकते हैं।

Bajaj Finance Share Price Target 2030 हर साल देखा जाए तो Bajaj Finance Share Price में जिस तरह की ग्रोथ लगातार Increase होते हुए नजर आ रही है रेवेन्यू और प्रॉफिट (Revenue and Profit ) के साथ आगे बढ़ रही है इसकी वजह से कंपनी के शेयर प्राइस में भी उसी अनुसार बढ़त होते हुए नजर आया है मैनेजमेंट की माने तो मार्केट में जिस तरह से कंपनी का ब्रांड वैल्यू मजबूत होते देखना को मिल रहा है इसकी वजह से आने वाली दिनों में कंपनी के फाइनेंशियल प्रदर्शन और भी बेहतर होने की पुरी उम्मीद नजर आ रही है।

इसके साथ ही बजाज फाइनेंस ने धीरे-धीरे टू व्हीलर की फाइनेंस के साथ-साथ और भी नए नए कैटेगरी के अंदर भी अपने रिटेल्स कस्टमर को फाइनेंसिंग सुविधा ऑफर करने की योजना पर काम कर रही है आने वाले समय में जैसे-जैसे बजाज फाइनेंस नए-नए कैटेगरी के अंदर अपने कस्टमर को फाइनेंसिंग सुविधा ऑफर करते हुए नजर आएंगी इसके चलते जरूर कंपनी के बिजनेस में अच्छी बढ़त होते हुए नजर आने वाली है।

Bajaj Finance Share Price Target । 2030 आने वाले सालो�� मे Bajaj Finance रिटर्न्स की भरमार देखने को मिलेगी

Bajaj Finance Share Price Target 2030 कंपनी आने वाले कुछ सालों में मैनेजमेंट पूरी प्लान कर रही है कि अपने ब्रांच नेटवर्क देश के हर कोने-कोने तक फैलाएं जिसके लिए कंपनी हर ग्रामीण और शहरी क्षेत्र में जहां पर कंपनी के ब्रांच नेटवर्क मौजूद नहीं है उन सभी जगह पर अपने ब्रांच नेटवर्क को फैलाने की पूरी प्लेन के तहत काम करता हुआ देखने को मिल रहा है जैसे-जैसे वायर फाइनेंस का ब्रांच नेटवर्क मजबूत होता जाएगा उसी अनुसार कंपनी के बिजनेस में भी बढ़त देखने को मिलेगी

कंपनी का नेटवर्क जैसे-जैसे मजबूत होते जाएंगे Bajaj Finance Share Price Target2030 तक आपको बहुत ही बेहतरीन रिटर्न कमाई करके देने के साथ ही पहला टारगेट 17500 के आसपास दिखाते हुए नजर आ सकता है और फिर जरूर दूसरा टारगेट ₹18000 हिट होने के लिए रख सकते हो

Bajaj Finance Share Price Target 2030 बजाज फाइनेंस अपने कस्टमर को बेहतर से बेहतर फाइनेंसिंग सुविधा प्रदान करने के लिए लगातार दूसरी कंपनियों के साथ पार्टनरशिप के तहत भी काम करता हुआ देखने को मिल रहा है दूसरे कंपनियों के साथ पार्टनरशिप बढ़ाने के चलते धीरे-धीरे अपने कस्टमर को बहुत सारे अलग-अलग फाइनेंस से जुड़े प्रोडक्ट सेगमेंट में कंपनी अच्छी ऑफर देने में कामयाबी हासिल करते हुए देखने को मिल रही है जिससे कंपनी के। बिजनेस को बहुत ही ज्यादा फायदा मिलते हुए नजर आ रहा है।

Read More

#Bajaj Finance#trends#shares#stockstowatch#stock trading#stock market#investing stocks#stock tips#stockstobuy

0 notes

Text

Stock Market Today: On Tuesday, April 9, the Indian stock market saw a mixed session. The Sensex and Nifty 50 opened the day higher, setting new records, but they ended the day lower due to weak global cues. This volatility was indicative of the general mood of the market, which was impacted by both local and foreign variables.

India’s benchmark index, the Sensex, started the day at 75,124.28, breaking through its previous close of 74,742.50 and setting a new session high of 75,124.28. It did, however, later retreat from these peaks and close at 74,683.70, down 59 points, or 0.08 percent. In a similar vein, the Nifty 50 began trading at 22,765.10, starting at 22,666.30, and reached a new high of 22,768.40 before closing the day 24 points, or 0.10 percent, lower at 22,642.75.

0 notes

Text

Revolutionize your online presence with Patna's web innovation.

"Experience a digital transformation with Hexile Services Pvt. Ltd.'s innovative website designing in Patna. Revolutionize your online presence and captivate your audience with cutting-edge web solutions tailored to your needs. From sleek designs to seamless functionality, we're here to elevate your brand to new heights in the digital sphere. Let's embark on this journey together!"

Call Us:- +91 9319934449 / +91 9334044680

Visit:- https://www.hexileservices.com

✰―――――◆―――――✰✰―――――◆―――――✰

#hexileservices#websitedesigning#WebInnovation#DigitalTransformation#webdevelopment#OnlinePresence#TheGirlfriend#dhoni#neet2024#pushpa2#stockstobuy#Paypal#RameshwaramCafe#Facebooking#FacebookPage#instareel#like4likes#LikeAndShare#PatnaSahib#callnow

0 notes

Text

LKP Research recommends a buy rating on the Axis Bank Stocks!

LKP Research is optimistic about Axis Bank and suggests buying its stock. In their report dated April 25, 2024, they set a target price of Rs 1322 for the stock.

In the last quarter of the financial year 2024, Axis Bank achieved its target of having a return on equity (ROE) of more than 18%.

Additionally, the bank experienced a good increase in credit, with a growth of 14.2% compared to last year and 3.5% compared to the previous quarter.

According to LKP research, “Based on our evaluation of the bank's standalone performance and future prospects, we predict that the price-to-book value ratio (PBV) will be 2.2 times the adjusted book value per share (BVPS) by the year 2026.”

For Trade Insights: thebusinesscorridor

1 note

·

View note