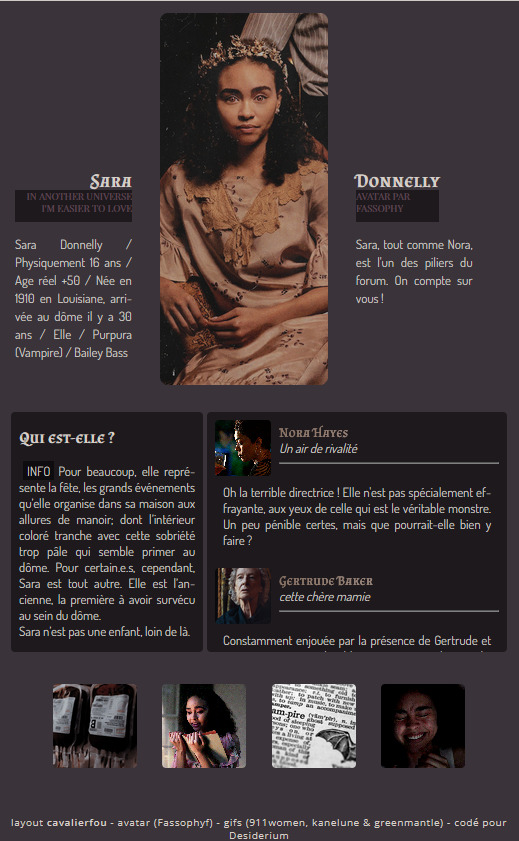

#lien layouts

Text

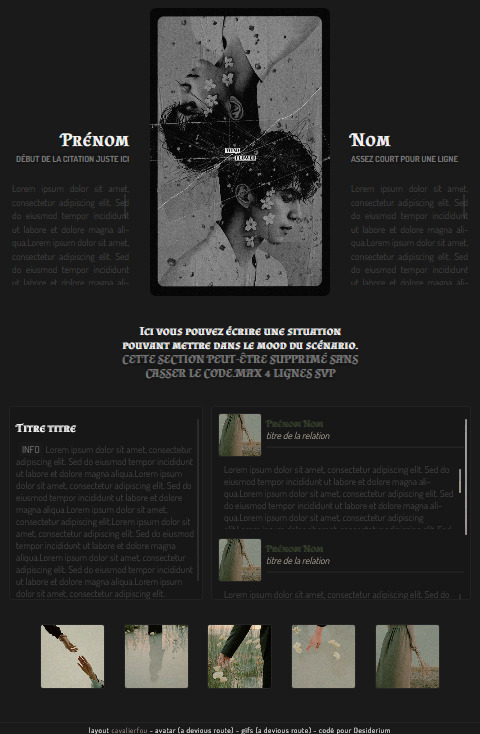

Fiche scénario - code libre service

Hello !

Vous retrouverez ici le code mise en libre service, qui est également utilisé sur le forum Desiderium (hésitez pas à rendre visite au forum).

La base de cette fiche est directement inspiré d'un layout de @cavalierfou , encore merci pour l'autorisation de rendre cette merveille en code ♥

Il y a deux versions, une assez large qui pourrait ne pas correspondre à tous les forums et une autre plus "étroite" qui normalement sera adapté pour tout les forums !

Le lien du code juste ici : https://pastebin.com/PzM33EZK

Les deux codes s'y trouve, séparé par une ligne de commentaire faites bien attention ! Si jamais vous n'avez pas accès au css et que vous voulez utiliser ce code il suffira de mettre la partie css dans des balises <style></style> et utiliser css minifer pour ne pas avoir de soucis avec FA et ces jnjdeijdziuned saut de ligne.

Enjoy !

/!\ ne pas enlever les crédits

Un petit aperçu ! La version sur la gauche est celle pour forum "étroit" et celle de la droite c'est la version large.

14 notes

·

View notes

Note

hi! first of all i'd like to say your theme looks gorgeous i love the mobile layout of the blog <3 second of all if it's not too bothersome could i please ask for first name and surname suggestions for sabrina zada/pasabist? i'm going for a floral/fairy/princess vibe if it helps with anything EDRFTGYU thank you so much and have a wonderful day!

* hey , thanks so much ! and yes , absolutely . sab is filipino and chinese ( my research says she’s also hispanic but it’s not stated specifically what she is - edit : anon said she is mexican so also consider this ! ) so i’ll list a combination of names that could fit your vibe 😇

chinese first names ↴

jiā : good , auspicious , beautiful .

qiàn : pretty , winsome .

bao : gem .

chao-xing : morning star .

mei lien : beautiful lotus .

eu-meh : gorgeous .

li jing : beautiful spirit .

níng : peaceful , to pacify .

genji : like god .

jia li : good and beautiful .

hee : lotus flower .

hua : flower .

li-mei : beautiful plum flower .

chinese surnames ↴

huang : yellow .

cai : firewood .

lai : to trust .

hu : whiskers or wild .

cheng : complete , journey , honesty .

li : the plum tree or logic .

gong : to give .

kang : well-being .

sun : a descendant .

xiao : quiet .

you can find more from these masterlists : x , x , x .

filipino first names ↴

bernila : blessed .

floribeth or lilibeth : flower , god is my promise .

dari : grace .

eleanor : shining one .

jaslene : flower , pretty .

dalisay : pure .

atarah : crown .

carmelita : beautiful garden .

mahalina : to be charmed .

analyn : gracious , beautiful .

althea : wholesome , to heal .

diwata : fairy .

marisol : sunflower .

filipino surnames ↴

adlawan : sun .

tanglao : illumination or light .

banaag : gleam , daybreak , reflection .

panganoron : sky .

valle : valley .

cruz : cross .

bulan : moon .

lualhati : glory .

guinto : gold .

divata : guardian .

you can find more from these masterlists : x , x .

— drea .

54 notes

·

View notes

Note

lmao sorry I’m kinda dumb but im working on a smau and I have no idea how to link one post to another?? I prob sound funny but if u could answer that’d be amazing!

Hi! I can totally show you, it's not an issue ^^ however I'm French so my layout will be in french, so bear with me-

1. To start, we have our post with the text we wanna add a link onto.

2. You select the part of the text you want-

3. Then you click on the chainlink icon-

4. Now this will pop up on your screen.

5. You paste your link on this, click "Add link" ("Ajouter un lien" in the image) and you'll be set!

Then you get something like this ;)

5 notes

·

View notes

Photo

The webcomic has been updated ! (Links in the linktree of my bio) Read on WEBTOON in a mobile friendly layout : https://www.webtoons.com/en/challenge/plumes/list?title_no=402050 Read on TAPAS : https://tapas.io/series/Plumes --------------- Le webcomic a été mis à jour! (Liens dans le linktree de ma bio) Lire sur Webtoon : https://www.webtoons.com/fr/challenge/plumes/list?title_no=585392 Lire sur AMILOVA :https://www.amilova.com/fr/BD-manga/3085/plumes.html . #comicart #traditionalpainting #Birdlovers #comicartist #Webcomic #webtoon #comic #bande-dessinée #Nature #Bird #oiseau #Fantasy #Sliceoflife #comicpage #fairy #birdspirit #watercolor #landscapepainting #aquarellepainting #leaves #tree #tinyworld #smallworld #tinypeople #smallpeople #birdpeople #Night #cute #hoopoe #Goldcrest https://www.instagram.com/p/ConYVT4Llsu/?igshid=NGJjMDIxMWI=

#comicart#traditionalpainting#birdlovers#comicartist#webcomic#webtoon#comic#bande#nature#bird#oiseau#fantasy#sliceoflife#comicpage#fairy#birdspirit#watercolor#landscapepainting#aquarellepainting#leaves#tree#tinyworld#smallworld#tinypeople#smallpeople#birdpeople#night#cute#hoopoe#goldcrest

11 notes

·

View notes

Text

DOCUMENTS TO BE CHECKED BEFORE BUYING A RESALE FLAT

Purchasing a resale flat is a profitable purchase from the perspective of a buyer. When you buy a flat in resale you save the money that you spend in paying the house rent.

You should acquire and verify all agreements and documents pertaining to the buying and selling of the flat till date. Here are a list of the documents that you need to check before purchasing a resale flat –

1. Title Report – You should ideally conduct a Title Search at the registrar’s office in order to retrieve the chain of documents that reflect the history of the flat. It will provide analysis of related to its tax rate, title holder’s name, joint encumbrances along with the details of property tax, liens and mortgages associated.

2. NOC from Bank – Also known as No Dues Certificate, the seller can get this from the concerned bank. This certificate assures that the bank has received all the dues from the seller and there are no more dues related to the flat and you can buy it without any worry.

3. Building Approval Certificate – An illegal construction can give you a trouble later. Hence, you should verify whether the flat is built following a building plan approved by the local municipal authority or not. This will reflect the blueprint of the flat, its layout, utilities and other equipment.

4. Encumbrance Certificate – Make sure you check the EC which ensures that the property has no dues, the title of the property is clear and marketable, and it is not partially sold to some other person.

5. Latest Tax receipts – You should check all the latest tax receipts before buying a resale flat. This will ensure that there are not outstanding dues attached to the property.

Written By

Property Channel Expert

Anurodh Jalan

Jalan Property Consultants

8801003684

2 notes

·

View notes

Text

Mastering the Online Application Process: A Step-by-Step Guide to Applying for a Car Title Loan

In today's digital age, the ability to apply for financial products online has revolutionized the borrowing process. Car title loans, once requiring in-person visits to brick-and-mortar establishments, can now be conveniently accessed from the comfort of your home through online platforms. If you're considering a car title loan and want to take advantage of the convenience of online applications, this step-by-step guide will walk you through the process, ensuring a smooth and hassle-free experience.

Research and Preparation

Before diving into the online application process, it's essential to conduct thorough research to understand the intricacies of car title loans and identify reputable lenders. Take the time to compare interest rates, fees, and repayment terms offered by different lenders to find the most favorable option for your financial situation. Additionally, gather all necessary documents, including your vehicle title, proof of income, identification, and vehicle registration, to streamline the application process.

Choose a Trusted Online Lender

Selecting a reputable online lender is crucial to ensuring a positive borrowing experience. Look for lenders with a proven track record of transparency, fair practices, and excellent customer service. Read reviews from past borrowers and check for any complaints or regulatory actions against the lender. Choosing a trusted lender will provide peace of mind throughout the borrowing process and minimize the risk of encountering predatory practices.

Navigate to the Lender's Website

Once you've chosen a lender, navigate to their website to begin the application process. Most lenders will have a dedicated section on their website for car title loans, where you can find information about their loan products and access the online application form. Take the time to familiarize yourself with the lender's website layout and navigation to https://viptitleloansinsanfrancisco.com/ ensure a seamless experience.

Complete the Online Application Form

Fill out the online application form accurately and completely, providing all requested information truthfully. You'll typically be asked to provide details about yourself, your vehicle, and your financial situation. Be prepared to upload copies of required documents, such as your driver's license, vehicle title, proof of income, and vehicle registration. Double-check your entries before submitting the application to avoid any errors or discrepancies.

Await Approval and Loan Offer

After submitting your online application, the lender will review your information and assess your eligibility for a car title loan. This process may take anywhere from a few minutes to a few hours, depending on the lender's review process and workload. Once your application is approved, the lender will present you with a loan offer detailing the loan amount, interest rate, fees, and repayment terms. Carefully review the offer to ensure it aligns with your needs and preferences.

Review and Sign the Loan Agreement

If you're satisfied with the loan offer, review the loan agreement in detail to understand the terms and conditions of the loan. Pay close attention to the interest rate, repayment schedule, fees, and consequences of default. If you have any questions or concerns, don't hesitate to reach out to the lender for clarification. Once you're comfortable with the terms, electronically sign the loan agreement to finalize the borrowing process.

Receive Funds and Repay the Loan

Upon signing the loan agreement, the lender will disburse the loan funds to your designated bank account, typically within one business day. Use the funds responsibly to address your financial needs or emergencies. Throughout the loan term, make timely payments according to the agreed-upon schedule to avoid late fees and penalties. Upon full repayment of the loan, the lender will release the lien on your vehicle title, returning it to you free and clear.

Conclusion

Embracing Convenience with Online Car Title Loan Applications

Online car title loan applications offer unmatched convenience and accessibility for borrowers in need of quick cash. By following this step-by-step guide, you can navigate the online application process with confidence, ensuring a seamless and efficient borrowing experience. Remember to research lenders, gather necessary documents, and carefully review loan terms to make informed decisions and secure the funds you need while safeguarding your financial well-being.

0 notes

Text

How to Go About Renovating a Bathroom

A bathroom renovation can be a fun and exciting project. However, it is important to do it correctly the first time. This will save you time and money in the long run.

The type of work that’s done significantly affects the cost. Structural changes like moving plumbing or knocking down walls will increase expenses. To know more about Renovating Bathroom, visit the Eastern Suburbs Bathroom Renovations website or call 0415902838.

Your bathroom is a space that’s essential to daily living. Whether you’re looking to upgrade fixtures or add a touch of luxury to your home, renovations are a great way to transform this space.

The first step is deciding the scope of your renovation. This will determine the budget and timeframe for your project. Consulting inspiration blogs, Pinterest and making your own mood board can help you define the style of your remodel.

It’s important to choose a team of specialised tradespeople for plumbing, electrical and waterproofing work. Using a contractor with the right credentials will ensure your renovation complies with regulations, and you avoid costly damages or health risks. It’s also important to consider if you require council approvals or, for apartment dwellers, strata rules.

Before starting the actual work on your bathroom, it is important to think about what you want to achieve. This will help you to decide what fixtures, materials, and colours you would like to use. You may also need to consider if you want to move or replace any items.

Bathroom designs can range from small makeovers to a complete overhaul, and the choices you make will affect your budget. Choose a style and design that suits you and your family’s tastes.

You will need council approval if you are changing the size or layout of your bathroom, or adding new sanitary fittings. A licensed electrician is required to install wirings and switches. They typically charge between $75 and $100 per hour. Similarly, a waterproofer is necessary to ensure the integrity of your bathroom.

The bathroom is one of the most used rooms in a home and a lot of money can be spent renovating it. It’s a great investment that can boost the value of your property and improve its appeal. However, it is important to know how much it costs before committing.

A complete renovation involves stripping the room down to the floor and walls and building a new bathroom from scratch. This is the most expensive option but can create a truly stunning and unique space.

You’ll need to hire licensed tradespeople for plumbing, tiling, plastering and painting. You’ll also want to get a quote from the best Sydney bathroom designers who can help you find smart solutions and make your vision a reality. Their service will save you time and hassle and prevent costly mistakes.

Renovating a bathroom is a large undertaking that requires expert knowledge to do it correctly. It’s also one of the most expensive rooms in a home, so it’s best left to licensed builders who can manage the entire project end to end. This is particularly important if structural or plumbing changes are involved.

If you’re having a difficult time choosing a builder, ask for recommendations from family and friends. You can also visit their showrooms and ask about their previous work.

If you like what you see, ask for a quote and an outline of the process. A good renovator will provide a clear quote with all the costs involved up front. They should also include a waiver of lien to prevent subcontractors and suppliers from placing a lien on your property.

A well-functioning bathroom requires the services of plumbers, who lay down pipes and install toilets, showers, faucets, bathtubs, and other plumbing fixtures. They’re responsible for the functionality of a bathroom, which is why it’s important to find one who is experienced and reliable.

If you’re planning to renovate your apartment bathroom, you may need to apply for a work permit and get approval from the building management. This is a requirement if you’re changing the layout of your bathroom or adding new appliances. To know more about Renovating Bathroom, visit the Eastern Suburbs Bathroom Renovations website or call 0415902838.

Located in Sydney, Decoris Bathrooms provides custom-made bathrooms for homeowners and property investors. They’re a boutique company that offers free online quotes or In-Home consultations for a minimum price. They also offer tips and tricks on bathroom renovations on their website.

#bathroom remodeling services#cost of bathroom renovation sydney#bathroom remodeling#bathroom renovation sydney#modern bathroom design#bathroom renovations#professional bathroom renovations#eastern suburbs bathroom renovations#bathroom renovators sydney#bathroom renovation#renovating bathroom#modern bathroom renovations#average bathroom renovation cost sydney

0 notes

Text

9 GÉNÉRATEURS de site Web AI : TOUT LE MONDE PEUT créer un site Web !

See on Scoop.it - Création de sites, référencement, ...

youtube

loadYouTubePlayer('yt_video_v_cBJTpvzBM_rdRaq3B3rV5K4zTT');

🚀 Aujourd'hui, je plonge dans le monde fascinant de l'intelligence artificielle avec un test complet des 9 outils IA les plus innovants pour la création de sites web. Si vous êtes passionné par le web design, l'IA, ou simplement curieux de voir comment ces technologies transforment notre manière de créer des sites, cette vidéo est faite pour vous !

Les outils:

01:01 https://webwave.me/ref/13305619587

02:58 https://www.pineapplebuilder.com/?via=richard

05:53 https://hocoos.com/

08:28 https://mixo.io/?via=ritch

11:00 https://codedesign.ai/?via=richard-houet

12:32 https://10web.io/?_from=richard81

14:56 https://durable.co/

16:53 https://www.hostinger.com/ai-website-builder

18:11 https://www.framer.com/features/design-layout/?via=ritch

Vous commencez avec webflow?

C'est par ici: https://webflow.grsm.io/ritch

(ceci est un lien affilié, cela m'aide à continuer à faire des vidéos de qualité sur webflow!)

👉 Lien vers la liste d'attente de ma formation:

https://rivia-academie.webflow.io/

Si vous appréciez le contenu que je crée et que vous trouvez mes tutoriels et conseils sur Webflow utiles, n'hésitez pas à me soutenir en m'offrant un café ou en faisant une petite donation. Merci à tous!

☕️ https://www.buymeacoffee.com/riviawebflow

Merci à tous d'avoir regarder cette vidéo et à bientôt !

👨💻 Vous avez besoins d'un site web? https://www.rivia.studio/

🚀 Rendez vous pour un appel d'introduction: https://calendly.com/riviastudio/introduction

🎥 Outils:

Camera: https://amzn.to/3LrInqD

Micro: https://amzn.to/3qT2p62

RGB: https://amzn.to/45uMsSB

Softbox: https://amzn.to/3sB8BQM

0 notes

Text

Car Title Loans Vernon To Open a Retail Store

Opening a retail store in Vernon is an exciting endeavor that holds the promise of both personal fulfillment and financial success. However, bringing this vision to life often requires a significant investment of capital, whether it's for inventory, location rental, or marketing. That is where Snap Car Cash comes into play as your trusted financial partner. With our streamlined and hassle-free car title loan Vernon services, we provide the financial support you need to turn your dream of a retail store into a reality. Our commitment to supporting local entrepreneurs and small businesses in Vernon is persistent, and we are here to empower you on your path to success.

Costs Associated With Opening a Retail Store

Location Rental: Securing a prime location for your retail store is crucial. Rental costs can vary significantly depending on the size and location of the space.

Inventory: Stocking your store with merchandise is a significant upfront cost. It's essential to have a well-curated inventory that meets the demands and preferences of your target market.

Store Design and Renovation: Creating an appealing and functional store layout may require some investment in interior design and renovation.

Licenses and Permits: You'll need to obtain the necessary licenses and permits to operate your retail store legally in Vernon.

Utilities and Overhead: Monthly expenses like electricity, water, and other utilities can add up. Factor in these ongoing costs into your budget.

Marketing and Advertising: Promoting your store and building brand awareness are essential. Allocate a budget for marketing strategies and advertising campaigns.

Employee Salaries: If you plan to hire staff, consider their salaries and benefits in your financial planning.

Point of Sale (POS) System: You'll need a reliable POS system for transactions and inventory management.

Insurance: Protecting your business with insurance, including liability and property insurance, is vital.

Miscellaneous Expenses: Don't forget to account for unforeseen or miscellaneous costs that may arise during the setup and operation of your retail store.

Qualification Criteria for a Car Title Loan Vernon

Auto Check, Lien Search, and Vehicle Inspection: To qualify for a car title loan Vernon with us, an Auto Check is conducted to assess the vehicle's accident history and origin. A Lien Search is performed to ensure the vehicle is free from all liens, indicating clear ownership. Additionally, a Vehicle Inspection and Evaluation are carried out as part of the qualification process.

Loan Fees:

Auto Check: This fee covers the cost of verifying the vehicle's accident history and origin, ensuring its credibility.

Lien Search: Ensures the vehicle is free and clear of any liens, indicating that it can be used as collateral for the loan.

Vehicle Inspection and Evaluation: A thorough assessment of the vehicle's condition and value is conducted to determine the loan amount.

Loan Rates:

We offer competitive title loans Vernon rates that are the best in the industry. These rates are designed to provide borrowers with a cost-effective financing solution for their retail store setup.

Repayment Terms and Fees:

Loan Term: We offer a flexible repayment period ranging from 2 to 5 years. Borrowers have the freedom to choose a repayment term that suits their financial situation and business needs.

No Early Payment Penalties: Borrowers are not penalized for making early payments. This flexibility allows entrepreneurs to repay the emergency car title loans ahead of schedule if their business experiences rapid growth or increased profitability without incurring additional fees.

Conclusion:

Opening a retail store in Vernon is an exciting opportunity. Still, it often requires a significant investment in various aspects such as location, inventory, design, licenses, utilities, marketing, employee salaries, and more. Snap Car Cash understands the challenges faced by local entrepreneurs and small businesses and offers a reliable solution through car title loans Vernon.

With us, you can obtain the necessary financial support to turn your retail store dream into reality. The qualification process involves thorough checks like an Auto Check, a Lien Search, and Vehicle Inspection, ensuring the vehicle's credibility and clear ownership. The car title loans Vernon fees cover these checks, and the competitive loan rates provided are among the best in the industry, offering a cost-effective financing solution for your retail store setup. For more information, call now at tel:1-888-886-7627.

0 notes

Text

Property Document Verification: The Smart Buyer's WayProperty Document Verification: The Smart Buyer's Way

Overview

Checking property documents before buying is a must to make sure you're not being swindled by a seller. It's especially important when it comes to the real estate market, where there's not always a lot of transparency. Fake sellers might try to sell you a property they don't own, or a property that's in legal trouble or has money owed to someone else.

When it comes to verifying property documents, there are a few different ways to go about it. One of the best ways to do this is to get all the info you need about the properties, which is really important for the buyers. You can do this by yourself, but if you want to make sure you have all the information you need, you can also reach out to the Sub-Registrar's Office. They keep track of all the property transactions in your area, and they can give you copies of titles, encumbrances, and other documents.

Another way to check property documents is to get advice from a lawyer. A lawyer will take a look at the documents and tell you about any potential risks or issues.

Some of the factors that is very important to understand and that needs to be verify first:

Title documents

Encumbrance certificate

Site plan

Property tax receipts

Sales deed

Power of attorney (if applicable)

Registered society documents (if applicable)

Other documents (relinquishment deed, partition deed, will, freehold, and mutation data)

What are property documents?

Property documents are legal documents that show that you own a property. These documents are important because they show that you have the right to live and use the property.

Why is it important to verify property documents before purchase?

It’s important to check property documents before you buy to avoid fraud and to make sure you’re receiving a legal title to your property. A legal title means the property is free of any legal issues, including liens or mortgages.

What property documents should you verify?

The following are some of the most important property documents to verify before purchase:

Title deed: This is the primary document that conveys ownership. It should contain details about the property, including its location, dimensions, and boundaries.

Encumbrance certificate: This certificate indicates whether there are any encumbrances on the property.

Site plan: This property diagram shows the property’s layout and dimensions.

Property tax receipts: These returns indicate that the property tax has been paid on time.

Sales deed: It’s the deed of sale between the seller and the buyer of the property.

How to verify property documents

You can verify property documents by contacting the following authorities:

Sub-registrar's office: This office keeps records of all real estate transactions in the county. You can get a copy of title deeds and other property documents through the sub registrar’s office.

Local Municipal Corporation: This office records property tax returns. You can get a copy of property tax returns from your local municipal corporation.

Here are some tips for verifying property documents:

Ensure that the documents are genuine and not counterfeit. You can verify the authenticity of these documents by cross-referencing them with other documents, including the seller’s ID.

Make sure that the documents are complete and that all of the information is correct. Pay attention to the details, such as the property address, the seller's name, and the buyer's name. And be satisfied & then invest.

If you have any doubts about the authenticity of the documents, you can consult with a lawyer. A lawyer can help you to review the documents and advise you on whether or not they are valid.

And furthermore you can take assistance of real estate agents like Shiimperial which is the best real estate company in Gurgaon and they will definitely help you in getting right and correct properties without any issues.

Shiimperial is an experienced real estate company in Gurgaon they have very good team of professionals who has great information about all kind news of real estate.

Conclusion Verifying property documents before purchase is an important step in ensuring a safe and hassle-free transaction. It protects you from fraud and ensures that you are getting a clear title to the property. There are a number of ways to verify property documents, including contacting the sub-registrar's office, hiring a lawyer, or using an online property verification service.

#hot properties in gurgaon#luxury apartments in gurgaon#upcoming projects in dwarka expressway#upcoming projects in delhi#affordable housing in delhi#luxury properties for sale#luxurypropertiesflats#posh area in delhi#property in delhi#apartments for sale in delhi

0 notes

Text

Essential Documents for Property Valuation

The process of establishing the monetary worth of a real estate property in Anna nagar, Chennai by taking into account criteria such as location, size, condition, and market circumstances is known as property valuation.During property valuation, certain documents are typically necessary to gather relevant information about the property and its surroundings. While the specific documents required may vary depending on the property's location and type, there are some commonly requested documents:

Property Deed: This document establishes ownership and provides information about the property's legal description, boundaries, and any encumbrances or liens.

Survey Reports: Survey reports offer detailed information about the property's boundaries, measurements, and any easements or right-of-ways that might impact its value.

Building Plans and Blueprints: These documents include architectural drawings, floor plans, and specifications that describe the layout, dimensions, and features of the property's structures.

Title Report: Obtained from the local land registry office, a title report confirms the property's ownership history, outstanding mortgages, liens, or legal claims that may affect its value.

Property Tax Records: These records indicate the property's assessed value for tax purposes. They provide insights into its historical value and tax liabilities.

Appraisal Reports: Previous appraisal reports, if available, can be useful in determining the property's value. These reports contain detailed assessments of the property's condition, features, and market comparables.

Maintenance and Repair Records: Documentation of any repairs, renovations, or upgrades done to the property helps assess its overall condition and value. This may include invoices, receipts, and permits obtained for the work.

Lease Agreements and Rental Income: For income-generating properties, lease agreements and rental income records provide insights into the property's revenue potential, influencing its valuation.

Environmental Reports: In certain cases, especially for commercial property in Chennai, or those in environmentally sensitive areas, environmental reports might be required. These reports evaluate potential environmental hazards or contamination that could affect the property's value.

Comparable Sales Data: Recent sales data of similar properties in the area, known as "comps," are vital for assessing market value. These records provide information on comparable properties' sale prices, size, location, and condition.

It's important to note that the specific documents required for property valuation can vary based on the valuation's purpose, local regulations, and the preferences of the valuer or appraisal company. Consulting with a professional appraiser or valuation expert will provide accurate guidance regarding the necessary documents for a particular property valuation.

What are the advantages of property valuation?

Property valuation serves various purposes, helping you make informed decisions about your land or building. It provides answers to questions such as: What is the current value of the property? Are there any enhancements or improvements that can boost its value?

Valuers play a crucial role in addressing these aspects and providing expert guidance. Additionally, through the valuation process, you receive a certificate that validates the worth of your property and other assets. This certificate holds legal significance and can be submitted as evidence in a court of law if needed.

How much does a property valuation cost?

The cost of a property valuation is not standardized and can vary based on several factors. These factors include the specific location, size, and type of property, as well as the type of certificate or document needed, such as a short-form or long-form valuation report. It's important to note that valuation services are often tax deductible. However, even if they are not, the expense is relatively low compared to the value gained from obtaining an accurate and fair assessment of the property's worth.

#residential land for sale in chennai#best real estate company in chennai#top real estate agents in chennai#flats for sale in chennai#house for rent in anna nagar#buy apartment in chennai#office space for rent in chennai#showroom for rent in chennai#apartment for sale in chennai#shop for rent in chennai

1 note

·

View note

Photo

Oopsie, I forgot to post the news here, but the webcomic has been updated on Monday, as usual ! (Links in the linktree of my bio) Read on WEBTOON in a mobile friendly layout : https://www.webtoons.com/en/challenge/plumes/list?title_no=402050 Read on TAPAS : https://tapas.io/series/Plumes --------------- Oups, j'ai oublié de le dire ici mais le webcomic a été mis à jour lundi, comme d'habitude ! (Liens dans le linktree de ma bio) Lire sur Webtoon : https://www.webtoons.com/fr/challenge/plumes/list?title_no=585392 Lire sur AMILOVA :https://www.amilova.com/fr/BD-manga/3085/plumes.html . #comicart #traditionalpainting #Birdlovers #Webcomic #webtoon #comic #bande-dessinée #Nature #Bird #oiseau #Fantasy #Sliceoflife #comicpage #fairy #birdspirit #watercolor #landscapepainting #aquarellepainting #mist #tinyworld #smallworld #tinypeople #smallpeople #birdpeople #dew #artstagram #artistoninstagram https://www.instagram.com/p/CpSDFwjKx28/?igshid=NGJjMDIxMWI=

#comicart#traditionalpainting#birdlovers#webcomic#webtoon#comic#bande#nature#bird#oiseau#fantasy#sliceoflife#comicpage#fairy#birdspirit#watercolor#landscapepainting#aquarellepainting#mist#tinyworld#smallworld#tinypeople#smallpeople#birdpeople#dew#artstagram#artistoninstagram

10 notes

·

View notes

Text

8 Essential Steps To Guide To Buy Properties In Montreal

With its vibrant culture, thriving economy, and diverse neighborhoods, Montreal offers an enticing real estate market for prospective buyers. However, navigating the purchasing process can take time and effort.

This blog will furnish a comprehensive guide to buy properties in Montreal, outlining eight essential steps to help you navigate the market, make informed decisions, and ensure a successful purchase.

Define Your Budget and Financing Options:

Before embarking on your property search, assessing your financial situation and determining a realistic budget is crucial. Consider your savings, income, and credit score to understand how much you can afford. Explore financing options, such as mortgages or loans, and get pre-approved to strengthen your buying position.

Research the Market and Neighborhoods:

When looking to buy properties in Montreal, it is essential to conduct thorough research on the real estate market and gain familiarity with the various neighborhoods. Consider amenities, transportation options, nearby schools, and your lifestyle preferences. This comprehensive research will enable you to narrow your choices and concentrate on areas that best suit your needs and preferences.

Engage a Real Estate Agent:

Working with a qualified real estate agent specializing in the Montreal market is invaluable. An agent can provide expert advice, access listings, and help negotiate the best deal. Choose an agent with extensive local knowledge, a strong track record, and excellent communication skills to guide you through buying.

View and Assess Properties:

Visit properties that match your criteria to understand their condition, layout, and potential. Take note of any repairs or renovations needed, and consider factors like natural light, storage space, and overall functionality. It is advisable to create a checklist to evaluate each property systematically.

Conduct Due Diligence:

Perform due diligence before making an offer on a property. This includes verifying the property's legal status, checking for liens or encumbrances, and reviewing the building's condition and history. Hire an inspector to evaluate the property's structural integrity, electrical and plumbing systems, and potential issues that may affect your investment.

Make an Offer and Negotiate:

Once you've identified a property you wish to purchase, work with your real estate agent to make a competitive offer. The offer should consider the market value, comparable sales, and additional terms or conditions. Be prepared for negotiations with the seller, as they may counter your offer or propose alternative terms. Your agent will guide you to secure the best possible deal.

Complete the Purchase Process:

Once your offer is accepted, you will need to complete several steps to finalize the purchase. Engage a notary or lawyer specializing in real estate transactions to review and prepare the necessary legal documents, including the purchase agreement. Conduct a title search to ensure everything runs smoothly. Arrange for property insurance and secure financing if needed. Your notary or lawyer will guide you to ensure a smooth transaction.

Close the Deal and Take Possession:

At the closing date, you will meet with your notary or lawyer to sign the final documents and transfer funds. The seller will provide the keys, and you will officially take possession of the property. Ensure all utilities are transferred to your name, and update your address with relevant authorities.

Conclusion:

If you wish to buy properties in Montreal it requires careful planning, research, and professional guidance. By following the eight steps outlined above, including defining your budget, conducting thorough research, engaging a real estate agent, assessing properties, performing due diligence, making an offer, completing the purchase process, and closing the deal, you can confidently navigate the Montreal real estate market.

Remember, each step is crucial for a successful purchase, and with the right approach, you can find your dream property in this vibrant and captivating city.

Luciano Messina Courtier Immobilier is one of the most trusted professionals for assistance. If you need support, contact the experts to discuss your requirements.

1 note

·

View note

Text

Importance Of Land Rights While Buying A New Home

Introduction

While everyone wishes to own a home at least once in their lives, many individuals choose to purchase or invest in land directly. The land is the most expensive part of any real estate investment and has a far greater rate of return than some other property kinds. It also allows the customer flexibility in terms of design, layout, floor plan, and so forth. However, while acquiring land, one must conduct an extensive due investigation.

Purchasing Land: Land Title Due Diligence

Before acquiring a property piece, it is critical to ensure that the title is sound and marketable. This means you must confirm whether the individual selling the property is the owner and has all the required powers to transfer the title to you. It is usually essential to consult with a lawyer/advocate to have title papers such as the sale deed and land tax receipts examined and to acquire a certificate confirming the vendor's title.

Generally, it is best to trace the title back 30 years, taking into account the intricacies of land papers and the constraints of claiming property rights.

Purchasing Land: Sub-Office Registrar's Searches

This search reflects transactions (changes in ownership via titles) and encumbrances (legal dues) about the land to be bought. Each state has its procedure for conducting searches at sub-registrar offices (deed-registering authority). In Bengaluru, for example, the sub-registrar gives the encumbrance certificate (search report), but in Maharashtra, the report is issued by an advocate or someone with expertise doing manual searches in sub-registrar offices. Before proceeding with the property transaction, one must verify with the relevant authorities for legal documentation.

Land Purchase: Public Notice for Land Purchase

It is generally customary to issue a public statement in local newspapers (ideally in English in addition to the local languages' daily newspapers) encouraging any claims over the land planned to be acquired before acquiring any property. This will assist determine whether there are any liens or third-party rights to the land.

Land Purchase: Power of Attorney

A person with a power of attorney (POA) on the owner's behalf is frequently used to sell land. (Read our guide to learn more about property power of attorney.) This POA should be carefully scrutinised to confirm that it corresponds to the property being sold.

There are occasions when you must sign specific paperwork in a limited amount of time, and procrastinating will typically cost you. To avoid such scenarios, you might authorise another person to sign on your behalf to make things easier.

Things To Consider When Acquiring Land

Below are the legal paperwork and criteria to consider when purchasing land:

Title deeds: You must check that the property's title deed is in the name of the individual from whom you are purchasing the land. You should also get the title deed checked by a real estate professional to ensure it meets all legal requirements.

Sales deed: You must obtain the sales deed for the property or land you are purchasing to guarantee that it is not owned by a developer, society, or others.

Tax receipts: Tax receipts are the most crucial item to look for when acquiring land to guarantee that all past taxes and payments have been paid.

Inspect for mortgaged land: It is critical to check that the land you purchase is not borrowed money by the seller or that the loan is cleared by the seller, even if the land was previously mortgaged.

Purchasing Land: Verification Of Original Land Purchase Paperwork

Before finalising the selling dealer, it is prudent to confirm that the original title documents for the land purchase are in place.

This is to guarantee that the vendor has not established any third-party rights or charges and has not parted with the original versions. During the selling transaction, these paper records should be obtained.

Purchasing Land: Land Purchase Approvals & Permissions

If the property/land being sold already contains structures or buildings, it is advisable to confirm that the authorised designs, appropriate licences, and NOCs are in place. Heritage restrictions and setbacks for road widening, that will apply to specific structures, should also be addressed.

Taxes And Khatha In The Purchase Of Land

Before acquiring land, the buyer should check that all property taxes have been paid up to the date of transfer and that authentic invoices for such payments are available for verification. It is also required to guarantee that the khatha (revenue documentation identifying the owner's name) is accessible in the vendor's name.

#real estate#Importance Of Land#Buying A New Home#Purchasing Land#Public Notice for Land Purchase#Power of Attorney#Land Purchase Paperwork#Land Purchase Approvals & Permissions

0 notes

Text

How to find the Best 2 BHK Apartments In Thanisandra?

If you are in the market for a 2 BHK apartment in Thanisandra, Bangalore, you are in luck. This area is a popular residential location due to its proximity to major commercial hubs, excellent transportation links, and abundance of amenities such as schools, hospitals, and shopping centers. However, with so many options available, it can be challenging to find the best 2 BHK apartment for your needs and budget. In this article, we will share some tips on how to find the best 2 BHK apartments in Thanisandra, says Coevolve Group, Top Builders In Bangalore.

Determine your budget

Before you start your search for a 3 BHK apartment in Thanisandra, determine your budget. This will help you narrow down your search and focus on apartments that fit your budget. Consider your monthly income, expenses, and other financial obligations when setting your budget. Keep in mind that in addition to the cost of the apartment, you will also have to pay maintenance fees, property taxes, and other charges, says Coevolve Group, Best Builders In Bangalore.

Look for the right location

Thanisandra is a large area, and different parts of it offer different amenities and advantages. Determine which location in Thanisandra is best for you based on your lifestyle and needs. For example, if you have kids, you may want to look for an apartment near a good school. If you work in a particular area, you may want to look for an apartment that is easily accessible by public transportation.

Decide on the size and layout

When looking for a 2 BHK apartment, consider the size and layout of the apartment. Do you need a spacious living room or a balcony? Do you need a separate dining area or a study room? These are important factors to consider when looking for an apartment. Make sure the apartment layout meets your needs and preferences, says Coevolve Group, Real Estate Developers In Bangalore.

Check the amenities

Thanisandra offers a wide range of amenities, and different apartment complexes may offer different facilities. Some apartments may have a swimming pool, gym, or clubhouse, while others may offer a children's play area or a jogging track. Determine which amenities are important to you and look for apartments that offer them.

Check the quality of construction

When buying an apartment, it's important to check the quality of construction. Look for apartments that are built by reputable builders and have a good track record of delivering quality projects. Check for any signs of poor construction such as cracks in the walls or floors, leaking pipes, or faulty electrical wiring, says Coevolve Group, Real Estate Builders In Bangalore.

Research the builder and developer

Before investing in an apartment, it's important to research the builder and developer. Look for builders who have a good reputation and are known for delivering quality projects on time. Check online reviews and ask for references from previous buyers. Research the developer's track record and financial stability to ensure that they will be able to complete the project on time.

Check the legal documents

Before buying an apartment, it's important to check the legal documents. Make sure that the developer has obtained all the necessary approvals from the local authorities and that the land is free from any disputes or litigation. Check for any encumbrances on the property such as mortgages, liens, or easements, says Coevolve Group, builders of best Luxury Apartments In Thanisandra

Visit the apartment complex

Finally, it's important to visit the apartment complex before making a decision. This will give you a better sense of the overall atmosphere, facilities, and quality of construction. Talk to the property manager or the builder's representative and ask any questions you may have. If possible, talk to current residents to get their feedback on the apartment complex.

In conclusion, finding the best 2 BHK apartment in Thanisandra requires some research and due diligence.

Visit for more information: https://coevolvegroup.com/

Address: 476, 2nd Floor, 80 Feet Rd, 6th Block, Koramangala, Bengaluru, Karnataka 560095

Call us: +91 9448694486

Mail: [email protected]

#2BHKapartmentsinThanisandra#TopBuildersInBangalore#3BHKapartmentinThanisandra#BestBuildersInBangalore

0 notes

Text

finding The Best Premium Apartments for sale near Hebbal |Sohan Exotica by Sohan Developers

Finding the best 3 BHK flats can be a challenging task, especially with the vast number of options available on the market. However, by considering the following tips, you can increase your chances of finding the perfect Premium Apartments for sale near Hebbal, like Sohan Exotica, for your needs.

Determine your budget: The first step in finding the Luxury Apartments near Hebbal is to determine your budget. Be realistic about what you can afford, and set a budget for your search. This will help you to narrow down your options and focus on flats that fit within your budget.

Location: The location of the flat is an important factor to consider when searching for a 3 BHK flat. Consider the proximity to your work, school, or other amenities that are important to you. Additionally, think about the safety and security of the area, as well as the noise level and traffic.

Size and layout: When looking for Luxury Apartments near Hebbal, pay attention to the size and layout of the flat. Consider the size of the bedrooms, living room, and kitchen, and think about whether the layout will work for your needs. Additionally, think about the number of bathrooms, balconies and terrace if any and the natural light in the flat.

Amenities: Look for flats that have amenities that are important to you. For example, if you have a car, look for a flat with a designated parking spot. If you have kids, look for a flat with a playground or a swimming pool. Additionally, consider the presence of a gym, security, intercom, and power backup.

Condition of the flat: When viewing Flats For Sale In Sahakara Nagar, pay attention to the condition of the flat. Look for signs of wear and tear, such as peeling paint, water damage, or cracks in the walls. Additionally, think about whether the flat needs any repairs or renovations and if it is move-in ready.

Builder reputation: Research the reputation of the builder before buying a flat. Look for reviews, ratings, and testimonials from previous buyers. Additionally, find out about the builder's track record for delivering projects on time and whether they have any pending legal disputes.

Resale value: If you're planning to sell the flat in the future, consider the resale value. Look for flats in popular and well-established areas, as they are more likely to hold their value over time. Additionally, consider the condition of the flat and the amenities offered, as these can also affect the resale value.

Legal documents: Before buying a flat, make sure to review all of the legal documents. This includes the sale agreement, the title deed, and the occupancy certificate. Additionally, it's important to check for any liens, mortgages, or other legal encumbrances on the property.

Professional help: If you're not familiar with the process of buying a flat, it may be beneficial to seek professional help. Consider hiring a real estate agent or a lawyer to help you navigate the process and ensure that your interests are protected.

Compare options: Don't rush into buying a flat. Take your time to compare different options and weigh the pros and cons of each one. Additionally, consider visiting the flat multiple times to get a sense of the neighborhood and the condition of the flat.

In conclusion, finding the Apartments in Sahakara Nagar can be a challenging task, but by considering your budget, location, size and layout, amenities, condition of the flat, builder's reputation, resale value, legal documents and professional help, you can increase your chances of finding a flat that meets your needs.

Project Location: Rajiv Gandhi Nagar Road, Sahakar Nagar, Kodigehalli, Bengaluru

560065

Area: 4.2 acres

Phone: +918884456808

Website:

Email: [email protected]

0 notes