#it mergers

Text

Strategic Due Diligence: Key Steps in Preparing for Mergers and Acquisitions

Mergers and acquisitions (M&A) are transformative events that can reshape the trajectory of companies, unlocking new opportunities for growth and expansion. However, the road to a successful M&A deal is fraught with challenges and uncertainties. Strategic due diligence plays a crucial role in mitigating risks, identifying synergies, and ensuring that the deal delivers the intended value to all stakeholders involved. In this blog post, we’ll explore the key steps in strategic due diligence and how they contribute to the success of M&A transactions.

1. Define Objectives and Criteria

Before embarking on an M&A journey, it’s essential for companies to define their objectives and criteria for potential targets. This involves clarifying strategic goals, identifying target markets or industries, and setting specific criteria for evaluating potential acquisitions. By clearly defining objectives and criteria upfront, companies can focus their efforts on opportunities that align with their strategic vision and offer the greatest potential for value creation.

2. Conduct Preliminary Research

Once objectives and criteria are established, companies can begin conducting preliminary research to identify potential acquisition targets. This may involve market analysis, competitor benchmarking, and industry trends analysis to identify opportunities and assess market dynamics. Additionally, companies should leverage their networks and industry contacts to gather intelligence and identify potential targets that may not be publicly known.

3. Perform Financial Analysis

Financial analysis is a critical component of strategic due diligence, helping companies assess the financial health and performance of potential acquisition targets. This involves reviewing financial statements, cash flow projections, and historical performance metrics to evaluate the target’s revenue, profitability, and growth prospects. Financial analysis also helps identify any potential red flags or areas of concern that may impact the valuation or viability of the deal.

4. Assess Operational and Technological Compatibility

In addition to financial analysis, companies should assess the operational and technological compatibility of potential acquisition targets. This involves evaluating factors such as organizational structure, operational processes, and technological infrastructure to determine compatibility with the acquiring company’s systems and processes. Assessing operational and technological compatibility early in the due diligence process can help identify integration challenges and inform post-merger integration planning.

5. Evaluate Legal and Regulatory Compliance

Legal and regulatory compliance is another critical aspect of strategic due diligence. Companies must assess the legal and regulatory landscape in which the target operates and identify any potential risks or liabilities that may arise from non-compliance. This involves reviewing contracts, licenses, permits, and regulatory filings to ensure compliance with applicable laws and regulations. Additionally, companies should assess potential legal risks, such as pending litigation or regulatory investigations, that may impact the deal.

6. Conduct Cultural Assessment

Finally, companies should conduct a cultural assessment to evaluate the compatibility of organizational cultures between the acquiring company and the target. Cultural alignment is essential for successful integration and can significantly impact employee morale, productivity, and retention post-merger. By assessing cultural fit early in the due diligence process, companies can identify potential cultural barriers and develop strategies to address them during the integration phase.

Conclusion

Strategic due diligence is a critical component of the M&A process, enabling companies to assess potential risks and opportunities and make informed decisions about potential acquisitions. By following these key steps in strategic due diligence, companies can minimize risks, identify synergies, and ensure that M&A transactions deliver the intended value to all stakeholders involved.

0 notes

Text

In the early 70s Sesame Street was created with an eye towards educating poor, inner-city children for free, and became a massive hit with all children. In 2016, faced with going off the air forever after facing conservative efforts to destroy public broadcasting since basically its beginning, new episodes became a timed exclusive for premium cable network HBO. In 2022 HBO Max, newly merged with and taken over by reality TV channel Discovery, removed Sesame Street episodes and spin-offs from streaming as a tax write-off and scheme to avoid paying residuals.

135K notes

·

View notes

Text

Why they're smearing Lina Khan

My god, they sure hate Lina Khan. This once-in-a-generation, groundbreaking, brilliant legal scholar and fighter for the public interest, the slayer of Reaganomics, has attracted more vitriol, mockery, and dismissal than any of her predecessors in living memory.

She sure must be doing something right, huh?

A quick refresher. In 2017, Khan — then a law student — published Amazon’s Antitrust Paradox in the Yale Law Journal. It was a brilliant, blistering analysis showing how the Reagan-era theory of antitrust (which celebrates monopolies as “efficient”) had failed on its own terms, using Amazon as Exhibit A of the ways in which post-Reagan antitrust had left Americans vulnerable to corporate abuse:

https://www.yalelawjournal.org/note/amazons-antitrust-paradox

The paper sent seismic shocks through both legal and economic circles, and goosed the neo-Brandeisian movement (sneeringly dismissed as “hipster antitrust”). This movement is a rebuke to Reaganomics, with its celebration of monopolies, trickle-down, offshoring, corporate dark money, revolving-door regulatory capture, and companies that are simultaneously too big to fail and too big to jail.

This movement has many proponents, of course — not just Khan — but Khan’s careful scholarship, combined with her encyclopedic knowledge of the long-dormant statutory powers that federal agencies had to make change, and a strategy for reviving those powers to protect Americans from corporate predators made her a powerful, inspirational figure.

When Joe Biden won the 2020 presidential election, he surprised everyone by appointing Khan to the FTC. It wasn’t just that she had such a radical vision — it was also that she lacked the usual corporate law experience that such an appointee would normally require (experience that would ensure that the FTC was helmed by people whose default view of the world is that it should be structured and regulated by powerful, wealthy people in corporate boardrooms).

Even more surprising was that Khan was made chair of the FTC, something that was only possible because a few Republican Senators broke with their party to support her candidacy:

https://www.senate.gov/legislative/LIS/roll_call_votes/vote1171/vote_117_1_00233.htm

These Republicans saw in Khan an ally in their fight against “woke” Big Tech. For these senators, the problem wasn’t that tech had got too big and powerful — it was that there were a few limited instances in which tech leaders failed to wield that power in the ways they preferred.

The Republican project is a matter of getting turkeys to vote for Christmas by doing a lot of culture war bullshit, cruelly abusing disfavored sexual and racial minorities. This wins support from low-information voters who’ll vote against their class interests and support more monopolies, more tax cuts for the rich, and more cuts to the services they rely on.

But while tech leaders are 100% committed to the project of permanent oligarchic takeover of every sphere of American life, they are less full-throated in their support for hateful, cruel discrimination against disfavored minorities (in this regard, tech leaders resemble the corporate wing of the Democrats, which is where we get the “Silicon Valley is a Democratic Party stronghold” narrative).

This failure to unquestioningly and unstintingly back culture war bullshit put tech leaders in the GOP’s crosshairs. Some GOP politicians actually believe in the culture war bullshit, and are grossly offended that tech is “woke.” Others are smart enough not to get high on their own supply, but worry that any tech obstruction in the bullshit culture wars will make it harder to get sufficient turkey votes for a big fat Christmas surprise.

Biden’s ceding of antitrust policy to the left wing of the party, combined with disaffected GOP senators viewing Khan as their enemy’s enemy, led to Khan’s historic appointment as FTC Chair. In that position, she was joined by a slate of Biden trustbusters, including Jonathan Kanter at the DoJ Antitrust Division, Tim Wu at the White House, and other important, skilled and principled fighters like Alvaro Bedoya (FTC), Rebecca Slaughter (FTC), Rohit Chopra (CFPB), and many others.

Crucially, these new appointees weren’t just principled, they were good at their jobs. In 2021, Tim Wu wrote an executive order for Biden that laid out 72 concrete ways in which the administration could act — with no further Congressional authorization — to blunt corporate power and insulate the American people from oligarchs’ abusive and extractive practices:

https://pluralistic.net/2021/08/13/post-bork-era/#manne-down

Since then, the antitrust arm of the Biden administration have been fuckin’ ninjas, Getting Shit Done in ways large and small, working — for the first time since Reagan — to protect Americans from predatory businesses:

https://pluralistic.net/2022/10/18/administrative-competence/#i-know-stuff

This is in marked contrast to the corporate Dems’ champions in the administration. People like Pete Buttigieg are heralded as competent

technocrats, “realists” who are too principled to peddle hopium to the base, writing checks they can’t cash. All this is cover for a King Log performance, in which Buttigieg’s far-reaching regulatory authority sits unused on a shelf while a million Americans are stranded over Christmas and whole towns are endangered by greedy, reckless rail barons straight out of the Gilded Age:

https://pluralistic.net/2023/01/10/the-courage-to-govern/#whos-in-charge

The contrast between the Biden trustbusters and their counterparts from the corporate wing is stark. While the corporate wing insists that every pitch is outside of the zone, Khan and her allies are swinging for the stands. They’re trying to make life better for you and me, by declaring commercial surveillance to be an unfair business practice and thus illegal:

https://pluralistic.net/2022/08/12/regulatory-uncapture/#conscious-uncoupling

And by declaring noncompete “agreements” that shackle good workers to shitty jobs to be illegal:

https://pluralistic.net/2022/02/02/its-the-economy-stupid/#neofeudal

And naturally, this has really pissed off all the right people: America’s billionaires and their cheerleaders in the press, government, and the hive of scum and villainy that is the Big Law/thinktank industrial-complex.

Take the WSJ: since Khan took office, they have published 67 vicious editorials attacking her and her policies. Khan is living rent-free in Rupert Murdoch’s head. Not only that, he’s given her the presidential suite! You love to see it.

These attacks are worth reading, if only to see how flimsy and frivolous they are. One major subgenre is that Khan shouldn’t be bringing any action against Amazon, because her groundbreaking scholarship about the company means she has a conflict of interest. Holy moly is this a stupid thing to say. The idea that the chair of an expert agency should recuse herself because she is an expert is what the physicists call not even wrong.

But these attacks are even more laughable due to who they’re coming from: people who have the most outrageous conflicts of interest imaginable, and who were conspicuously silent for years as the FTC’s revolving door admitted the a bestiary of swamp-creatures so conflicted it’s a wonder they managed to dress themselves in the morning.

Writing in The American Prospect, David Dayen runs the numbers:

Since the late 1990s, 31 out of 41 top FTC officials worked directly for a company that has business before the agency, with 26 of them related to the technology industry.

https://prospect.org/economy/2023-06-23-attacks-lina-khans-ethics-reveal-projection/

Take Christine Wilson, a GOP-appointed FTC Commissioner who quit the agency in a huff because Khan wanted to do things for the American people, and not their self-appointed oligarchic princelings. Wilson wrote an angry break-up letter to Khan that the WSJ published, presaging their concierge service for Samuel Alito:

https://www.wsj.com/articles/why-im-resigning-from-the-ftc-commissioner-ftc-lina-khan-regulation-rule-violation-antitrust-339f115d

For Wilson to question Khan’s ethics took galactic-scale chutzpah. Wilson, after all, is a commissioner who took cash money from Bristol-Myers Squibb, then voted to approve their merger with Celgene:

https://www.documentcloud.org/documents/4365601-Wilson-Christine-Smith-final278.html

Or take Wilson’s GOP FTC predecessor Josh Wright, whose incestuous relationship with the companies he oversaw at the Commission are so intimate he’s practically got a Habsburg jaw. Wright went from Google to the US government and back again four times. He also lobbied the FTC on behalf of Qualcomm (a major donor to Wright’s employer, George Mason’s Antonin Scalia Law School) after working “personally and substantially” while serving at the FTC.

George Mason’s Scalia center practically owns the revolving door, counting fourteen FTC officials among its affliates:

https://campaignforaccountability.org/ttp-investigation-big-techs-backdoor-to-the-ftc/

Since the 1990s, 31 out of 41 top FTC officials — both GOP appointed and appointees backed by corporate Dems — “worked directly for a company that has business before the agency”:

https://www.citizen.org/article/ftc-big-tech-revolving-door-problem-report/

The majority of FTC and DoJ antitrust lawyers who served between 2014–21 left government service and went straight to work for a Big Law firm, serving the companies they’d regulated just a few months before:

https://therevolvingdoorproject.org/wp-content/uploads/2022/06/The-Revolving-Door-In-Federal-Antitrust-Enforcement.pdf

Take Deborah Feinstein, formerly the head of the FTC’s Bureau of Competition, now a partner at Arnold & Porter, where she’s represented General Electric, NBCUniversal, Unilever, and Pepsi and a whole medicine chest’s worth of pharma giants before her former subordinates at the FTC. Michael Moiseyev who was assistant manager of FTC Competition is now in charge of mergers at Weil Gotshal & Manges, working for Microsoft, Meta, and Eli Lilly.

There’s a whole bunch more, but Dayen reserves special notice for Andrew Smith, Trump’s FTC Consumer Protection boss. Before he was put on the public payroll, Smith represented 120 clients that had business before the Commission, including “nearly every major bank in America, drug industry lobbyist PhRMA, Uber, Equifax, Amazon, Facebook, Verizon, and a variety of payday lenders”:

https://www.citizen.org/sites/default/files/andrew_smith_foia_appeal_response_11_30.pdf

Before Khan, in other words, the FTC was a “conflict-of-interest assembly line, moving through corporate lawyers and industry hangers-on without resistance for decades.”

Khan is the first FTC head with no conflicts. This leaves her opponents in the sweaty, desperate position of inventing conflicts out of thin air.

For these corporate lickspittles, Khan’s “conflict” is that she has a point of view. Specifically, she thinks that the FTC should do its job.

This makes grifters like Jim Jordan furious. Yesterday, Jordan grilled Khan in a hearing where he accused her of violating an ethics official’s advice that she should recuse herself from Big Tech cases. This is a talking point that was created and promoted by Bloomberg:

https://www.bloomberg.com/news/articles/2023-06-16/ftc-rejected-ethics-advice-for-khan-recusal-on-meta-case

That ethics official, Lorielle Pankey, did not, in fact, make this recommendation. It’s simply untrue (she did say that Khan presiding over cases that she has made public statements about could be used as ammo against her, but did not say that it violated any ethical standard).

But there’s more to this story. Pankey herself has a gigantic conflict of interest in this case, including a stock portfolio with $15,001 and $50,000 in Meta stock (Meta is another company that has whined in print and in its briefs that it is a poor defenseless lamb being picked on by big, mean ole Lina Khan):

https://www.wsj.com/articles/ethics-official-owned-meta-stock-while-recommending-ftc-chair-recuse-herself-from-meta-case-8582a83b

Jordan called his hearing on the back of this fake scandal, and then proceeded to show his whole damned ass, even as his GOP colleagues got into a substantive and even informative dialog with Khan:

https://prospect.org/power/2023-07-14-jim-jordan-misfires-attacks-lina-khan/

Mostly what came out of that hearing was news about how Khan is doing her job, working on behalf of the American people. For example, she confirmed that she’s investigating OpenAI for nonconsensually harvesting a mountain of Americans’ personal information:

https://www.ft.com/content/8ce04d67-069b-4c9d-91bf-11649f5adc74

Other Republicans, including confirmed swamp creatures like Matt Gaetz, ended up agreeing with Khan that Amazon Ring is a privacy dumpster-fire. Nobodies like Rep TomM assie gave Khan an opening to discuss how her agency is protecting mom-and-pop grocers from giant, price-gouging, greedflation-drunk national chains. Jeff Van Drew gave her a chance to talk about the FTC’s war on robocalls. Lance Gooden let her talk about her fight against horse doping.

But Khan’s opponents did manage to repeat a lot of the smears against her, and not just the bogus conflict-of-interest story. They also accused her of being 0–4 in her actions to block mergers, ignoring the huge number of mergers that have been called off or not initiated because M&A professionals now understand they can no longer expect these mergers to be waved through. Indeed, just last night I spoke with a friend who owns a medium-sized tech company that Meta tried to buy out, only to withdraw from the deal because their lawyers told them it would get challenged at the FTC, with an uncertain outcome.

These talking points got picked up by people commenting on Judge Jacqueline Scott Corley’s ruling against the FTC in the Microsoft-Activision merger. The FTC was seeking an injunction against the merger, and Corley turned them down flat. The ruling was objectively very bad. Start with the fact that Corley’s son is a Microsoft employee who stands reap massive gains in his stock options if the merger goes through.

But beyond this (real, non-imaginary, not manufactured conflict of interest), Corley’s judgment and her remarks in court were inexcusably bad, as Matt Stoller writes:

https://www.thebignewsletter.com/p/judge-rules-for-microsoft-mergers

In her ruling, Corley explained that she didn’t think Microsoft would abuse the market dominance they’d gain by merging their giant videogame platform and studio with one of its largest competitors. Why not? Because Microsoft’s execs pinky-swore that they wouldn’t abuse that power.

Corely’s deference to Microsoft’s corporate priorities goes deeper than trusting its execs, though. In denying the FTC’s motion, she stated that it would be unfair to put the merger on hold in order to have a full investigation into its competition implications because Microsoft and Activision had set a deadline of July 18 to conclude things, and Microsoft would have to pay a penalty if that deadline passed.

This is surreal: a judge ruled that a corporation’s radical, massive merger shouldn’t be subject to full investigation because that corporation itself set an arbitrary deadline to conclude the deal before such an investigation could be concluded. That’s pretty convenient for future mega-mergers — just set a short deadline and Judge Corely will tell regulators that the merger can’t be investigated because the deadline is looming.

And this is all about the future. As Stoller writes, Microsoft isn’t exactly subtle about why it wants this merger. Its own execs said that the reason they were spending “dump trucks” of money buying games studios was to “spend Sony out of business.”

Now, maybe you hate Sony. Maybe you hate Activision. There’s plenty of good reason to hate both — they’re run by creeps who do shitty things to gamers and to their employees. But if you think that Microsoft will be better once it eliminates its competition, then you have the attention span of a goldfish on Adderall.

Microsoft made exactly the same promises it made on Activision when it bought out another games studio, Zenimax — and it broke every one of those promises.

Microsoft has a long, long, long history of being a brutal, abusive monopolist. It is a convicted monopolist. And its bad conduct didn’t end with the browser wars. You remember how the lockdown turned all our homes into rent-free branch offices for our employers? Microsoft seized on that moment to offer our bosses keystroke-and-click level surveillance of our use of our own computers in our own homes, via its Office365 bossware product:

https://pluralistic.net/2020/11/25/the-peoples-amazon/#clippys-revenge

If you think a company that gave your boss a tool to spy on their employees and rank them by “productivity” as a prelude to firing them or cutting their pay is going to treat gamers or game makers well once they have “spent the competition out of business,” you’re a credulous sucker and you are gonna be so disappointed.

The enshittification play is obvious: use investor cash to make things temporarily nice for customers and suppliers, lock both of them in — in this case, it’s with a subscription-based service similar to Netflix’s — and then claw all that value back until all that’s left is a big pile of shit.

The Microsoft case is about the future. Judge Corely doesn’t take the future seriously: as she said during the trial, “All of this is for a shooter videogame.” The reason Corely greenlit this merger isn’t because it won’t be harmful — it’s because she doesn’t think those harms matter.

But it does, and not just because games are an art form that generate billions of dollars, employ a vast workforce, and bring pleasure to millions. It also matters because this is yet another one of the Reaganomic precedents that tacitly endorses monopolies as efficient forces for good. As Stoller writes, Corley’s ruling means that “deal bankers are sharpening pencils and saying ‘Great, the government lost! We can get mergers through everywhere else.’ Basically, if you like your high medical prices, you should be cheering on Microsoft’s win today.”

Ronald Reagan’s antitrust has colonized our brains so thoroughly that commentators were surprised when, immediately after the ruling, the FTC filed an appeal. Don’t they know they’ve lost? the commentators said:

https://gizmodo.com/ftc-files-appeal-of-microsoft-activision-deal-ruling-1850640159

They echoed the smug words of insufferable Activision boss Mike Ybarra: “Your tax dollars at work.”

https://twitter.com/Qwik/status/1679277251337277440

But of course Khan is appealing. The only reason that’s surprising is that Khan is working for us, the American people, not the giant corporations the FTC is supposed to be defending us from. Sure, I get that this is a major change! But she needs our backing, not our cheap cynicism.

The business lobby and their pathetic Renfields have hoarded all the nice things and they don’t want us to have any. Khan and her trustbuster colleagues want the opposite. There is no measure so small that the corporate world won’t have a conniption over it. Take click to cancel, the FTC’s perfectly reasonable proposal that if you sign up for a recurring payment subscription with a single click, you should be able to cancel it with a single click.

The tooth-gnashing and garment-rending and scenery-chewing over this is wild. America’s biggest companies have wheeled out their biggest guns, claiming that if they make it too easy to unsubscribe, they will lose money. In other words, they are currently making money not because people want their products, but because it’s too hard to stop paying for them!

https://www.theregister.com/2023/07/12/ftc_cancel_subscriptions/

We shouldn’t have to tolerate this sleaze. And if we back Khan and her team, they’ll protect us from these scams. Don’t let them convince you to give up hope. This is the start of the fight, not the end. We’re trying to reverse 40 years’ worth of Reagonmics here. It won’t happen overnight. There will be setbacks. But keep your eyes on the prize — this is the most exciting moment for countering corporate power and giving it back to the people in my lifetime. We owe it to ourselves, our kids and our planet to fight one.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/07/14/making-good-trouble/#the-peoples-champion

[Image ID: A line drawing of pilgrims ducking a witch tied to a ducking stool. The pilgrims' clothes have been emblazoned with the logos for the WSJ, Microsoft, Activision and Blizzard. The witch's face has been replaced with that of FTC chair Lina M Khan.]

#pluralistic#amazon's antitrust paradox#lina khan#business lobby#lina m khan#ftc#federal trade commission#david dayen#microsoft#activision#blizzard#wsj#wall street journal#reaganomics#trustbusting#antitrust#mergers#merger to monopoly#gaming#xbox#matt stoller#the american prospect#jim jordan#click to cancel#robert bork#Judge Jacqueline Scott Corley#microsoft activision#fuckin' ninjas

6K notes

·

View notes

Text

trying to figure out how to say this delicately. i do think that the pwhl is going to make some progress, and already the support for the league is showing how much of a market there is for women's sports even from a few years ago. but it's kind of been irking me to see so many posts that act like there has never been any arena for women's pro hockey before. like do you understand how many people — how many leagues!! — came before this to even make the pwhl a possibility. do you know how many people have fought tooth and nail for women's pro hockey for DECADES. i'm not saying don't support the league, but don't act like it's the perfect solution to a brand new issue

#idk i'm just thinking#how quickly people forget the outrage and devastation of the entirety of the phf being blindsided by the acquisition/merger#contracts erased. careers ended. lives uprooted.#yes women players are getting more money and more visibility! that's great!#but i can't support it wholeheartedly#i will support it because they've ensured it's the only option there is but it still feels kind of bad man#saw a post earlier that was like 'starting today. young girls will realize there's a future for them in pro hockey'#that's great! but it's not starting today!#it started with all the groundwork that's been happening for years and years and years#hockey#pwhl#phf

744 notes

·

View notes

Text

"It's just some stupid animated kids shows. Who cares?"

The way I like to think about the HBO Max situation is:

Imagine you're an artist, and one day, a museum tells you it wants to have an exhibit with all of your work. You're excited, so you take some of your favorite pieces out of storage to give them to them. You make new pieces too, working months and years for this exhibit. Then your works are proudly presented in the museum, and everything runs smoothly for awhile. You even start making some new pieces to later be displayed. But one day, you're walking in the street and a fan comes up to you, telling you how sad it is that your exhibit is closing. What? You weren't told this was going to happen. So you look it up. And you find other posts about how your art exhibit closed yesterday. Then you call the museum, and they tell you that in the middle of night, they decided to close your exhibit and threw all your pieces in the dumpster which had already been emptied. And no they won't be exhibiting any of the work you had just finished for the museum. Now no one is able to see your art in person, not even you. All that's left of your hard and passionate work is photos.

Would you not be mad too?

7K notes

·

View notes

Link

This is a big deal.

4K notes

·

View notes

Text

Oh. So it's just the fucking Wild West now, huh?

3K notes

·

View notes

Text

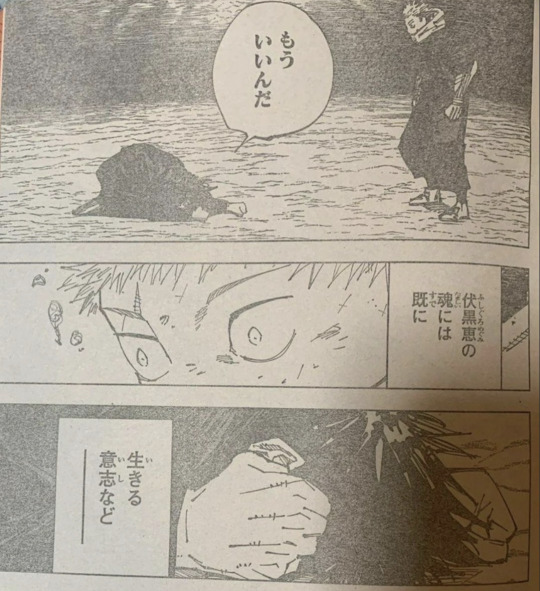

THIS HURTS THIS HURTS SO MUCH EVERY TIME I LOOK AT IT BC MEGUMI HAS BEEN ON HIS OWN THIS WHOLE TIME DROWNING IN THE ABYSS, UNABLE TO DO ANYTHING BUT WATCH AS HE'S FORCED TO HURT THE PEOPLE HE LOVES, THE VERY PEOPLE HES DOING EVERYTHING FOR IN THE FIRST PLACE, HIS SISTER, HIS FRIENDS, HIS PARENTAL FIGURE- SO OF COURSE HE CANT TAKE IT ANYMORE OF COURSE HE'S LOST ALL HOPE IM THINKING ABT HOW ALONE HES BEEN FEELING THIS WHOLE TIME AND HOW HELPLESS AND I WANT TO THROW UP PLEASE YUJI PLEASE SAVE HIM BRING HIM INTO THE LIGHT!!!

#jjk 251#jjk spoilers#jjk manga spoilers#megumi fushiguro#yuji itadori#itafushi#please#PLEASE hang in there son 😭😭😭#SO START BY SAVING ME BELIEVERS OUR TIME IS SOON!!!#BUT ALSO THE WHOLE THING WITH THE MERGER IS HAUNTING ME#NOT THAT I WOULD HOLD IT AGAINST HIM AT ALL I SUPPORT MY SON#definitely feeling the satosugu parallels but yuji wont pull a gojo#someone pls scream abt them with me im losing my mind today

191 notes

·

View notes

Text

what was super even doing in EXIT. how did he get there. what's his problem. some ideas...

#exit sonic#fleetway super sonic#stc#sonic the comic#fleetway sonic#fleetway knuckles#sonic the hedgehog#sth#porker lewis#TECHNICALLY.. HE'S HERE...#fanart#comics#merger au#id in alt text#the first one is the funniest in my mind. he just decided to be evil again. for fun#but the second one makes more sense SORT OF..#bc they were siphoning his chaos energy ANYWAY. the first thing to go WOULD be super...#he hates character regression. thats his motivation for that one. i guesssss#or hes just FREAKING TWISTEEDDDDD again#anyway :) feebay beepo who ages TERRIBLY but hes living a good life. hes good!#a shiny penny to whoever correctly guesses where i got that phone ref from

198 notes

·

View notes

Text

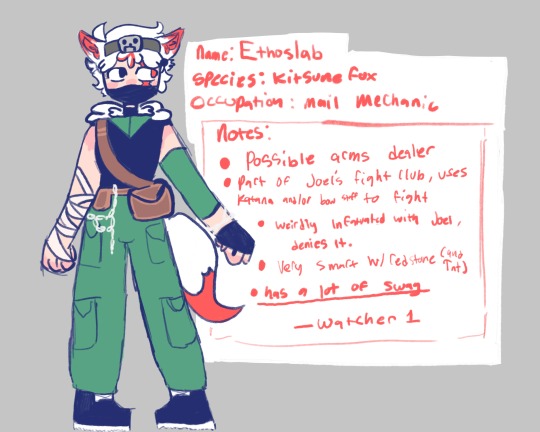

Navigating Cultural Integration in Company Mergers and Acquisitions

Mergers and acquisitions (M&A) are complex processes that involve more than just financial transactions. One critical aspect that often determines the success or failure of an M&A deal is cultural integration. When two companies come together, they bring with them unique cultures, values, and ways of working. Navigating this cultural integration requires careful planning, clear communication, and a deep understanding of the human elements involved.

Understanding Cultural Differences

Cultural differences can arise from various factors, including organizational structure, communication styles, leadership approaches, and even national or regional backgrounds. Before embarking on an M&A journey, it’s essential for both parties to conduct a thorough cultural assessment to identify potential areas of alignment and divergence. This assessment should go beyond surface-level observations and delve into the underlying values, norms, and behaviors that shape each organization’s culture.

Establishing Common Ground

Once cultural differences have been identified, the next step is to establish common ground and shared goals. This requires open dialogue and active engagement from both sides. Leaders should facilitate conversations that allow employees to express their concerns, share their perspectives, and find commonalities. By focusing on shared values and objectives, organizations can create a sense of unity and purpose that transcends cultural boundaries.

Clear Communication and Transparency

Effective communication is key to successful cultural integration. Leaders must be transparent about the M&A process, including its objectives, timeline, and potential impact on employees. They should provide regular updates and opportunities for feedback to ensure that employees feel informed and involved throughout the transition. Additionally, clear communication helps dispel rumors and address any misconceptions or fears that may arise during the integration process.

Fostering Collaboration and Inclusion

Cultural integration is not just about assimilating one company into another; it’s about creating a new, unified culture that values diversity and inclusion. Organizations should actively promote collaboration across teams and departments, encourage knowledge sharing, and celebrate the contributions of employees from all backgrounds. By fostering a culture of inclusivity, organizations can harness the collective talents and perspectives of their workforce to drive innovation and growth.

Respecting and Preserving Heritage

While cultural integration is essential for alignment and synergy, it’s also important to respect and preserve the heritage of each organization involved in the M&A. This means acknowledging and honoring the unique history, traditions, and achievements of both companies. Leaders should strive to create an environment where employees feel proud of their heritage and are encouraged to embrace elements of their cultural identity within the new organizational context.

Conclusion

Navigating cultural integration in company mergers and acquisitions is a complex but critical endeavor. By understanding cultural differences, establishing common ground, prioritizing clear communication and transparency, fostering collaboration and inclusion, and respecting heritage, organizations can effectively navigate the challenges of cultural integration and lay the foundation for long-term success in their M&A endeavors.

0 notes

Text

Takaba making Kenjaku laugh the same way as when they imagined the merger curse face, just by doing a comedy show with them (no gore or suffering needed) is gonna make me punch a wall. He fulfilled his promise of making them laugh and gave them something just as good as the merger: companionship. Kenjaku doesn't actually need any crazy eldritch experiments to be entertained, their obsession just led them to believe there was no other option and they previously had no one to connect with who could've pointed them in another way. Except Tengen, but she only seemed to make things worse or might even be the cause of all this (maybe not her personally, but definitely the troubled relationship between the two).

#why are they so perfect for each other?!#but well thanks to Yuuta we will never find out if Kenjaku would have actually reconsidered their merger plans#or at least done the merger differently with less civilian casualties#or done something completely different with Tengen#jjk spoilers#jjk 243#takaba fumihiko#kenjaku#takaken

127 notes

·

View notes

Text

Big Tech disrupted disruption

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2024/02/08/permanent-overlords/#republicans-want-to-defund-the-police

Before "disruption" turned into a punchline, it was a genuinely exciting idea. Using technology, we could connect people to one another and allow them to collaborate, share, and cooperate to make great things happen.

It's easy (and valid) to dismiss the "disruption" of Uber, which "disrupted" taxis and transit by losing $31b worth of Saudi royal money in a bid to collapse the world's rival transportation system, while quietly promising its investors that it would someday have pricing power as a monopoly, and would attain profit through price-gouging and wage-theft.

Uber's disruption story was wreathed in bullshit: lies about the "independence" of its drivers, about the imminence of self-driving taxis, about the impact that replacing buses and subways with millions of circling, empty cars would have on traffic congestion. There were and are plenty of problems with traditional taxis and transit, but Uber magnified these problems, under cover of "disrupting" them away.

But there are other feats of high-tech disruption that were and are genuinely transformative – Wikipedia, GNU/Linux, RSS, and more. These disruptive technologies altered the balance of power between powerful institutions and the businesses, communities and individuals they dominated, in ways that have proven both beneficial and durable.

When we speak of commercial disruption today, we usually mean a tech company disrupting a non-tech company. Tinder disrupts singles bars. Netflix disrupts Blockbuster. Airbnb disrupts Marriott.

But the history of "disruption" features far more examples of tech companies disrupting other tech companies: DEC disrupts IBM. Netscape disrupts Microsoft. Google disrupts Yahoo. Nokia disrupts Kodak, sure – but then Apple disrupts Nokia. It's only natural that the businesses most vulnerable to digital disruption are other digital businesses.

And yet…disruption is nowhere to be seen when it comes to the tech sector itself. Five giant companies have been running the show for more than a decade. A couple of these companies (Apple, Microsoft) are Gen-Xers, having been born in the 70s, then there's a couple of Millennials (Amazon, Google), and that one Gen-Z kid (Facebook). Big Tech shows no sign of being disrupted, despite the continuous enshittification of their core products and services. How can this be? Has Big Tech disrupted disruption itself?

That's the contention of "Coopting Disruption," a new paper from two law profs: Mark Lemley (Stanford) and Matthew Wansley (Yeshiva U):

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4713845

The paper opens with a review of the literature on disruption. Big companies have some major advantages: they've got people and infrastructure they can leverage to bring new products to market more cheaply than startups. They've got existing relationships with suppliers, distributors and customers. People trust them.

Diversified, monopolistic companies are also able to capture "involuntary spillovers": when Google spends money on AI for image recognition, it can improve Google Photos, YouTube, Android, Search, Maps and many other products. A startup with just one product can't capitalize on these spillovers in the same way, so it doesn't have the same incentives to spend big on R&D.

Finally, big companies have access to cheap money. They get better credit terms from lenders, they can float bonds, they can tap the public markets, or just spend their own profits on R&D. They can also afford to take a long view, because they're not tied to VCs whose funds turn over every 5-10 years. Big companies get cheap money, play a long game, pay less to innovate and get more out of innovation.

But those advantages are swamped by the disadvantages of incumbency, all the various curses of bigness. Take Arrow's "replacement effect": new companies that compete with incumbents drive down the incumbents' prices and tempt their customers away. But an incumbent that buys a disruptive new company can just shut it down, and whittle down its ideas to "sustaining innovation" (small improvements to existing products), killing "disruptive innovation" (major changes that make the existing products obsolete).

Arrow's Replacement Effect also comes into play before a new product even exists. An incumbent that allows a rival to do R&D that would eventually disrupt its product is at risk; but if the incumbent buys this pre-product, R&D-heavy startup, it can turn the research to sustaining innovation and defund any disruptive innovation.

Arrow asks us to look at the innovation question from the point of view of the company as a whole. Clayton Christensen's "Innovator's Dilemma" looks at the motivations of individual decision-makers in large, successful companies. These individuals don't want to disrupt their own business, because that will render some part of their own company obsolete (perhaps their own division!). They also don't want to radically change their customers' businesses, because those customers would also face negative effects from disruption.

A startup, by contrast, has no existing successful divisions and no giant customers to safeguard. They have nothing to lose and everything to gain from disruption. Where a large company has no way for individual employees to initiate major changes in corporate strategy, a startup has fewer hops between employees and management. What's more, a startup that rewards an employee's good idea with a stock-grant ties that employee's future finances to the outcome of that idea – while a giant corporation's stock bonuses are only incidentally tied to the ideas of any individual worker.

Big companies are where good ideas go to die. If a big company passes on its employees' cool, disruptive ideas, that's the end of the story for that idea. But even if 100 VCs pass on a startup's cool idea and only one VC funds it, the startup still gets to pursue that idea. In startup land, a good idea gets lots of chances – in a big company, it only gets one.

Given how innately disruptable tech companies are, given how hard it is for big companies to innovate, and given how little innovation we've gotten from Big Tech, how is it that the tech giants haven't been disrupted?

The authors propose a four-step program for the would-be Tech Baron hoping to defend their turf from disruption.

First, gather information about startups that might develop disruptive technologies and steer them away from competing with you, by investing in them or partnering with them.

Second, cut off any would-be competitor's supply of resources they need to develop a disruptive product that challenges your own.

Third, convince the government to pass regulations that big, established companies can comply with but that are business-killing challenges for small competitors.

Finally, buy up any company that resists your steering, succeeds despite your resource war, and escapes the compliance moats of regulation that favors incumbents.

Then: kill those companies.

The authors proceed to show that all four tactics are in play today. Big Tech companies operate their own VC funds, which means they get a look at every promising company in the field, even if they don't want to invest in them. Big Tech companies are also awash in money and their "rival" VCs know it, and so financial VCs and Big Tech collude to fund potential disruptors and then sell them to Big Tech companies as "aqui-hires" that see the disruption neutralized.

On resources, the authors focus on data, and how companies like Facebook have explicit policies of only permitting companies they don't see as potential disruptors to access Facebook data. They reproduce internal Facebook strategy memos that divide potential platform users into "existing competitors, possible future competitors, [or] developers that we have alignment with on business models." These categories allow Facebook to decide which companies are capable of developing disruptive products and which ones aren't. For example, Amazon – which doesn't compete with Facebook – is allowed to access FB data to target shoppers. But Messageme, a startup, was cut off from Facebook as soon as management perceived them as a future rival. Ironically – but unsurprisingly – Facebook spins these policies as pro-privacy, not anti-competitive.

These data policies cast a long shadow. They don't just block existing companies from accessing the data they need to pursue disruptive offerings – they also "send a message" to would-be founders and investors, letting them know that if they try to disrupt a tech giant, they will have their market oxygen cut off before they can draw breath. The only way to build a product that challenges Facebook is as Facebook's partner, under Facebook's direction, with Facebook's veto.

Next, regulation. Starting in 2019, Facebook started publishing full-page newspaper ads calling for regulation. Someone ghost-wrote a Washington Post op-ed under Zuckerberg's byline, arguing the case for more tech regulation. Google, Apple, OpenAI other tech giants have all (selectively) lobbied in favor of many regulations. These rules covered a lot of ground, but they all share a characteristic: complying with them requires huge amounts of money – money that giant tech companies can spare, but potential disruptors lack.

Finally, there's predatory acquisitions. Mark Zuckerberg, working without the benefit of a ghost writer (or in-house counsel to review his statements for actionable intent) has repeatedly confessed to buying companies like Instagram to ensure that they never grow to be competitors. As he told one colleague, "I remember your internal post about how Instagram was our threat and not Google+. You were basically right. The thing about startups though is you can often acquire them.”

All the tech giants are acquisition factories. Every successful Google product, almost without exception, is a product they bought from someone else. By contrast, Google's own internal products typically crash and burn, from G+ to Reader to Google Videos. Apple, meanwhile, buys 90 companies per year – Tim Apple brings home a new company for his shareholders more often than you bring home a bag of groceries for your family. All the Big Tech companies' AI offerings are acquisitions, and Apple has bought more AI companies than any of them.

Big Tech claims to be innovating, but it's really just operationalizing. Any company that threatens to disrupt a tech giant is bought, its products stripped of any really innovative features, and the residue is added to existing products as a "sustaining innovation" – a dot-release feature that has all the innovative disruption of rounding the corners on a new mobile phone.

The authors present three case-studies of tech companies using this four-point strategy to forestall disruption in AI, VR and self-driving cars. I'm not excited about any of these three categories, but it's clear that the tech giants are worried about them, and the authors make a devastating case for these disruptions being disrupted by Big Tech.

What do to about it? If we like (some) disruption, and if Big Tech is enshittifying at speed without facing dethroning-by-disruption, how do we get the dynamism and innovation that gave us the best of tech?

The authors make four suggestions.

First, revive the authorities under existing antitrust law to ban executives from Big Tech companies from serving on the boards of startups. More broadly, kill interlocking boards altogether. Remember, these powers already exist in the lawbooks, so accomplishing this goal means a change in enforcement priorities, not a new act of Congress or rulemaking. What's more, interlocking boards between competing companies are illegal per se, meaning there's no expensive, difficult fact-finding needed to demonstrate that two companies are breaking the law by sharing directors.

Next: create a nondiscrimination policy that requires the largest tech companies that share data with some unaffiliated companies to offer data on the same terms to other companies, except when they are direct competitors. They argue that this rule will keep tech giants from choking off disruptive technologies that make them obsolete (rather than competing with them).

On the subject of regulation and compliance moats, they have less concrete advice. They counsel lawmakers to greet tech giants' demands to be regulated with suspicion, to proceed with caution when they do regulate, and to shape regulation so that it doesn't limit market entry, by keeping in mind the disproportionate burdens regulations put on established giants and small new companies. This is all good advice, but it's more a set of principles than any kind of specific practice, test or procedure.

Finally, they call for increased scrutiny of mergers, including mergers between very large companies and small startups. They argue that existing law (Sec 2 of the Sherman Act and Sec 7 of the Clayton Act) both empower enforcers to block these acquisitions. They admit that the case-law on this is poor, but that just means that enforcers need to start making new case-law.

I like all of these suggestions! We're certainly enjoying a more activist set of regulators, who are more interested in Big Tech, than we've seen in generations.

But they are grossly under-resourced even without giving them additional duties. As Matt Stoller points out, "the DOJ's Antitrust Division has fewer people enforcing anti-monopoly laws in a $24 trillion economy than the Smithsonian Museum has security guards."

https://www.thebignewsletter.com/p/congressional-republicans-to-defund

What's more, Republicans are trying to slash their budgets even further. The American conservative movement has finally located a police force they're eager to defund: the corporate police who defend us all from predatory monopolies.

Image:

Cryteria (modified)

https://commons.wikimedia.org/wiki/File:HAL9000.svg

CC BY 3.0

https://creativecommons.org/licenses/by/3.0/deed.en

#pluralistic#coopting disruption#law and political economy#law#economics#competition#big tech#tech#innovation#acquihires#predatory acquisitions#mergers and acquisitions#disruption#schumpeter#the curse of bigness#clay christensen#josef schumpeter#christensen#enshittiification#business#regulation#scholarship

285 notes

·

View notes

Text

I’m just saying it’s kinda suspicious that HBO max deleted a bunch of loved shows of their platform with no warning to the hardworking creators, cast and crew right before launching the GoT spine off and last of us trailer :/

#hbo max#game of thrones#house of dragons#last of us#obviously no hate to the creators actors crew of those shows#infinity train#ok ko#summer camp island#uncle grandpa#warner bros#warner discovery#warner brothers#warner brother merger#discovery merger#discovery plus#discovery +#animation#house of the dragon#GoT

2K notes

·

View notes

Text

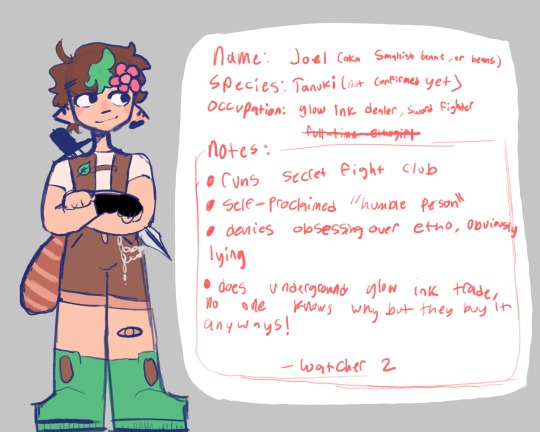

here is part 1 of the designs for the hermitcraft fic i am writing, starting with the watchers, etho, and joel!

as for the lore: these profiles were written by the watchers, containing semi-useful info on each hermit. likewise, the hermits made a profile on the watchers themselves which can be seen below:

now for joel and etho:

*spelt tanooki wrong on joel's profile, my bad!

59 notes

·

View notes

Text

cute thing I have learned during this conference: a couple different players are working in the quantum computing space, and specifically working on encryption protection algorithms to defend against attacks---these algorithms are called "kyber" and "dilithium" respectively.

nerds.

#this is like a previous conference I attended where they discussed different merger&acquisition concepts#in terms of different courses of food. so there was the amuse-bouche the main course etc.#I remember that so well! a triumph of messaging really#.....also I know a lot more about technology than I thought I did. kind of impressed by myself#that I can at least keep up with discussions of encryption standards and interoperability/data cleansing etc.#no wonder the company has to secretly manipulate you

58 notes

·

View notes