#iasb

Photo

#quotefortheday #ThomasDrummond #CivilEngineer

.

.

.

“Property has its duties as well as its rights. – Thomas Drummond, Civil Engineer

.

.

.

#Springbord#commercialrealestate#fasb#iasb#abstraction#administration#management#cam#lease#Reconciliation#audit#property#accounting#services#outsourcing

2 notes

·

View notes

Text

Shasat Introduces the 2023 Edition of the IFRS Update Program

In the dynamic landscape of financial reporting, staying informed and updated with the latest developments is essential for financial professionals worldwide. The International Financial Reporting Standards (IFRS) continue to evolve, with over 140 countries adopting these globally recognized accounting standards. To thrive in this ever-changing environment, professionals must invest in their knowledge and expertise.

Shasat has launched its 2023 edition of the IFRS Update Programs in selected cities. These IFRS Update Programs serve as a gateway to staying ahead of the curve. Designed to provide comprehensive insights and practical training, the program equips financial experts with the latest updates in the International Financial Reporting Standards (IFRS)

Central to this program is an in-depth exploration of the latest accounting standards. The program delves into the intricacies of newly issued standards, closely examines comments and concerns raised by the Financial Reporting Council (FRC), and dissects discussion papers and exposure drafts issued by the International Accounting Standards Board (IASB). The goal is to ensure participants are fully up to date with the ever-evolving IFRS landscape. Shasat recognizes that staying informed is not limited to just new standards. The program extends its coverage to include IFRIC updates and their impact on current accounting practices. Additionally, it sheds light on annual improvement projects and changes that could potentially influence upcoming annual reports.

Beyond the realm of accounting standards, the program’s instructors will discuss key topics under consideration at the IASB, providing insights into the ongoing research initiatives by the IASB and their current status. This comprehensive approach ensures participants receive an all-encompassing education on IFRS.

In today’s interconnected world, industry bodies significantly influence financial reporting practices. The program addresses concerns voiced by these prominent entities, offering invaluable perspectives on how these matters might affect future annual reports.

Grasping the IASB’s project timeline is crucial for anticipating changes in the near future. The program offers clarity on what to expect in the ensuing 12 months, preparing participants for any potential shifts in the financial reporting landscape.

Details on the upcoming programs are as follows:

IFRS Update Training Program | GID 210001 | London: October 6-7, 2023

IFRS Update Training Program | GID 210003 | Sydney: November 20-21, 2023

IFRS Update Training Program | GID 210004 | Zurich: November 23-24, 2023

IFRS Update Training Program | GID 210005 | Toronto: December 14-15, 2023

IFRS Update Training Program | GID 210006 | Cape Town: November 14-15, 2023

IFRS Update Training Program | GID 210009 | Singapore: October 18-19, 2023

IFRS Update Training Program | GID 210010 | Dubai: December 27-28, 2023

IFRS Update Training Program | GID 210012 | San Francisco: October 11-12, 2023

IFRS Update Training Program | GID 210013 | Miami: December 7-8, 2023

IFRS Update Training Program | GID 210011 | New York City: December 18–19, 2023

IFRS Update Training Program | GID 210000 | Online (Live Webinar): Available on request, four 90-minute sessions

1 note

·

View note

Text

it's a scream, baby!

pairing: skz hyunjin and felix (hyunlix) x fem!reader

au: slasher movie, based on the film scream (1996)

genre: angst, horror, smut, very slight hints at fluff (18+ only)

summary: you lived in such a small, quiet town. everyone got along, and life was peaceful. so why, in your senior year, were students at your college dropping down dead practically each day? and who was the masked killer hiding behind the name of ghostface? surely, none of your friends had anything to do with it, right?

warnings: attached to each chapter -- violence, graphic character death, use of guns and knives

status: completed - 14/09/2023 !

character intros ☆ playlist

OFFICIAL GHOSTFACE KILL COUNT: 013

chapter one: do you like scary movies?

chapter two: who's there?

chapter three: i wanna know who i'm looking at

chapter four: movies don't create psychos...

chapter five: movies make psychos more creative

chapter six: basic instinct

chapter seven: subtlety, you should look it up

chapter eight: push the laws and end up dead

chapter nine: i'll be right back!

chapter ten: everybody's a suspect

chapter eleven: we all go a little mad sometimes

chapter twelve: what do you want?

chapter thirteen: ...to see what your insides look like

chapter fourteen: you look like you've seen a ghost

chapter fifteen: what's your favourite scary movie?

BONUS CHAPTERS:

the date is set - hyunlix centric

the decision is made - hyunjin and reader centric

#mixtape racha#mixtape-racha fic#iasb-fic#hyunjin x reader#felix x reader#hyunlix x reader#scream au

479 notes

·

View notes

Text

Atlassian US Financial Reporting Requirements: A Comprehensive Overview

Atlassian, a global software company that helps teams collaborate and build together, is now officially an American company. As a result, the company is subject to the financial reporting requirements of the US Securities and Exchange Commission (SEC). Atlassian's financial reporting practices are critical to the company's operations and the interests of its stakeholders.

Atlassian's financial reporting overview includes revenue recognition policies, compliance and controls, and public disclosure practices. The company's revenue recognition policies are consistent with generally accepted accounting principles (GAAP) and are designed to reflect the economic substance of the transactions. Atlassian's compliance and controls are designed to ensure that the company's financial statements are accurate, complete, and reliable. The company's public disclosure practices are designed to provide timely and accurate information to investors and the public.

Key Takeaways

Atlassian, a global software company, is now officially an American company and subject to the financial reporting requirements of the SEC.

Atlassian's financial reporting overview includes revenue recognition policies, compliance and controls, and public disclosure practices.

The company's financial reporting practices are critical to its operations and the interests of its stakeholders.

Atlassian's Financial Reporting Overview

youtube

Atlassian Corporation Plc is a global software company that specializes in developing tools that help teams collaborate, build, and create together. As a publicly traded company in the United States, Atlassian is required to comply with the financial reporting requirements set forth by the Securities and Exchange Commission (SEC).

Regulatory Framework

The SEC is the primary regulatory body responsible for overseeing the financial reporting of publicly traded companies in the United States. The SEC requires companies to file periodic reports that disclose important information about their financial performance, operations, and management. These reports are made available to the public and are used by investors to make informed investment decisions.

Atlassian is required to comply with a number of SEC regulations, including Regulation S-K, which sets forth the requirements for the content and format of disclosure documents, and Regulation S-X, which sets forth the requirements for financial statements and other financial information.

Filing Requirements

Atlassian is required to file a number of reports with the SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K. These reports are filed electronically through the SEC's Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system.

In addition to these periodic reports, Atlassian is also required to file certain other reports and forms with the SEC, including proxy statements, registration statements, and beneficial ownership reports.

Overall, Atlassian is committed to maintaining high standards of financial reporting and transparency in accordance with SEC regulations. By providing accurate and timely financial information to investors, Atlassian aims to build trust and confidence in its business and drive long-term value for its shareholders.

Revenue Recognition Policies

youtube

Atlassian follows the Financial Accounting Standards Board (FASB) and International Accounting Standards Board (IASB) guidelines for revenue recognition. The company recognizes revenue when it is earned and realizable. Revenue is earned when the company has delivered the product or service to the customer, and the customer has accepted it. Revenue is realizable when the company has received payment or has a reasonable expectation of receiving payment.

Subscription Model

Atlassian offers a subscription-based model for its software products. Under this model, customers pay a fixed fee for access to the software for a specified period. Revenue from subscription fees is recognized ratably over the subscription period. Atlassian recognizes revenue from subscription fees when the subscription period begins, and the software is made available to the customer.

Licensing and Support

Atlassian also generates revenue through licensing and support services. Licensing revenue is recognized when the license is delivered to the customer and the customer has accepted it. Support revenue is recognized ratably over the support period. Atlassian recognizes revenue from licensing and support services when the product or service is delivered to the customer and the customer has accepted it.

In summary, Atlassian's revenue recognition policies adhere to the FASB and IASB guidelines. The company recognizes revenue when it is earned and realizable. Revenue from subscription fees is recognized ratably over the subscription period, and revenue from licensing and support services is recognized when the product or service is delivered to the customer and the customer has accepted it.

Compliance and Controls

youtube

Atlassian, as a public company, is subject to various financial reporting requirements in the United States. The company adheres to these requirements to ensure transparency and accuracy in its financial reporting.

Sarbanes-Oxley Act

One of the most significant financial reporting requirements in the United States is the Sarbanes-Oxley Act (SOX). Atlassian is compliant with SOX regulations and has implemented internal controls to ensure compliance. These controls are designed to prevent financial fraud, ensure accurate financial reporting, and protect investors.

Internal Audits

Atlassian also conducts regular internal audits to ensure compliance with financial reporting requirements. These audits are performed by an independent team of auditors who evaluate the company's financial statements, internal controls, and compliance with financial reporting regulations. The results of these audits are reported to the company's Audit Committee, which oversees the company's financial reporting and compliance efforts.

Overall, Atlassian is committed to maintaining compliance with financial reporting requirements in the United States. The company's internal controls and regular audits help ensure accurate financial reporting and protect the interests of investors.

Public Disclosure Practices

Atlassian Corporation Plc is a public company that is required to comply with the US Securities and Exchange Commission (SEC) regulations regarding public disclosure practices. The company is committed to maintaining transparency and providing timely and accurate information to its stakeholders. This section will discuss Atlassian's public disclosure practices, including earnings releases and investor communications.

Earnings Releases

Atlassian issues quarterly earnings releases to provide financial information to its shareholders and the public. These releases include consolidated statements of income, balance sheets, and cash flow statements. They also provide information on revenue, gross profit, net income, and earnings per share. Atlassian's earnings releases are available on the company's website and through various financial news services.

Investor Communications

Atlassian communicates with its investors through various channels, including its website, investor relations department, and quarterly earnings calls. The company's investor relations department provides information on the company's financial performance, corporate strategy, and other relevant information. Atlassian's quarterly earnings calls are webcast live and provide an opportunity for investors to ask questions about the company's financial results and operations.

In summary, Atlassian is committed to maintaining transparency and providing timely and accurate information to its stakeholders. The company's public disclosure practices include quarterly earnings releases and investor communications through various channels.

Frequently Asked Questions

How does Atlassian disclose its financial performance to investors?

Atlassian is required to disclose its financial performance to investors in accordance with U.S. Securities and Exchange Commission (SEC) regulations. The company publishes its financial statements, including balance sheets, income statements, and cash flow statements, in its annual report. Additionally, Atlassian files quarterly reports with the SEC on Form 10-Q and current reports on Form 8-K as necessary.

What are the key highlights from Atlassian's most recent earnings report?

Atlassian's most recent earnings report was for the third quarter of fiscal year 2022. The report showed that the company's total revenue was $740.5 million, up 30% from the same quarter in the previous year. The report also showed that Atlassian's gross margin was approximately 82% on an IFRS basis and approximately 85% on a non-IFRS basis.

What sustainability practices are included in Atlassian's corporate reporting?

Atlassian is committed to sustainability and includes information about its sustainability practices in its corporate reporting. The company's most recent annual report includes a sustainability section, which outlines its sustainability goals and progress towards those goals. Atlassian also publishes an annual sustainability report, which provides more detailed information about the company's sustainability initiatives.

Where can I find the transcript for Atlassian's latest earnings call?

The transcript for Atlassian's latest earnings call can be found on the company's investor relations website. The website also provides access to recordings of past earnings calls.

What information is provided in Atlassian's proxy statement?

Atlassian's proxy statement provides information about the company's annual meeting of shareholders, including information about the proposals to be voted on and the nominees for election to the board of directors. The proxy statement also includes information about executive compensation and other matters related to corporate governance.

How can shareholders access Atlassian's annual financial statements?

Shareholders can access Atlassian's annual financial statements on the company's investor relations website. The website includes links to the most recent annual report, as well as archived annual reports from previous years.

#Atlassian us benefit#Youtube#Atlassian us benefit Atlassian us careers#Atlassian us careers#Atlassian Financial

42 notes

·

View notes

Text

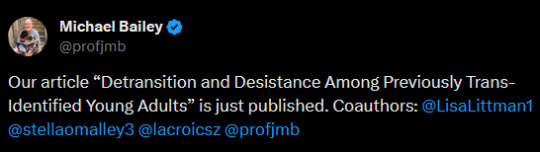

read this shit article and

> sub 100 people sample size

>71 afab, 7 amab; 90% afab sample

>32% didn't even medically transition

>the majority of the participants were recruited from fucking r/detrans

>also turns out michael bailey is on the editorial board of iasb and has published research with them before using data gained without institutional ethical approval

12 notes

·

View notes

Text

Climate research in space

ESA's decision to further pursue the CAIRT (changing-atmosphere infrared tomography) satellite mission as one of two projects was confirmed by the ESA Programme Board for Earth Observation on Tuesday (21.11.2023). "For us, this means that the mission is now entering Phase A - which makes our plans much more concrete," explains Professor Björn-Martin Sinnhuber from the Institute of Meteorology and Climate Research at KIT, who is coordinating the scientific work. "If ESA ultimately selects our proposal, we should be able to get data in the early 2030s." By then, CAIRT could be launched into orbit as the ESA Earth Explorer 11 satellite. The purpose of the mission is to obtain urgently needed data on changes in the Earth's atmosphere. These data are expected to improve understanding of the links between atmospheric circulation, the exact composition of the atmosphere and regional climate changes.

Space tomograph for the atmosphere

The centerpiece of CAIRT is an imaging infrared spectrometer to measure a large number of trace gases, aerosols and atmospheric waves with unprecedented spatial resolution. "We are familiar with tomography as a tool for medical diagnostics," says Sinnhuber. "Basically, the same thing happens here, just a bit bigger. It's a kind of space tomograph for the entire Earth's atmosphere." CAIRT will regularly measure the atmosphere at an altitude of five to 115 kilometers in the infrared range with a horizontal resolution of around 50 by 50 kilometers and a vertical resolution of one kilometer.

The planned mission builds on many years of experience in atmospheric remote sensing at KIT. In recent years, KIT researchers have already carried out pioneering work with remote sensing from balloons and airplanes. "Together with Forschungszentrum Jülich, we have developed the scientific instrument GLORIA, which can be seen as a kind of prototype for CAIRT," explains Dr. Michael Höpfner, who heads the research with GLORIA at KIT and is also involved in CAIRT. GLORIA has already made some great scientific observations, most recently new findings on the transport of aerosols after extensive forest fires in Canada during the PHILEAS measurement campaign with the HALO research aircraft, but on high-altitude balloons as well. "With the CAIRT satellite mission, we can take this to a new level because we will then receive global measurements on a daily basis," says Höpfner.

About CAIRT

KIT coordinated the proposal for the satellite concept for the CAIRT mission, building on a longstanding joint initiative with the Forschungszentrum Jülich. The scientific objectives are defined and consolidated in close cooperation by an international panel of experts from the European Centre for Medium-Range Weather Forecasts (ECMWF), the Institute of Applied Physics "Nello Carrara" (IFAC) of the Italian Research Council, the Institute of Astrophysics of Andalusia (IAA-CSIC), the National Center for Scientific Research (CNRS) in France, the Royal Belgian Institute of Space Aeronomy (BIRA-IASB), the University of Leeds and the University of Oxford in the United Kingdom, the University of Oulu in Finland and the Finnish Meteorological Institute as well as the University of Toronto in Canada.

8 notes

·

View notes

Note

hai<3 seeing as iasb is almost finished, 1, how do you feel about fanart for the fic, and two what scene/ characters would you most want fanart of?? no reason of course 🙃

dreamy i love u and i ADORE any and all fanart !!

my favorite scenes are 1. literally anything from chap 1 literally any scene i don't know what came over me when i was writing that. 2. nicos big reveal in his apt <3 3. when [redacted for spoilers but like. you know. at the end of the latest chapter when [???] saves [???] and its very dramatic??? that scene]

also the mixtape. also the kissing corner? i understand this wasn't helpful in the least the more important question is what scene do YOU want fanart the most of !!!!!

to answer your other question my favorite characters are nico will connor mitchell piper leo katie jason silena drew thalia reyna travis<3 hope that clears it up <3

2 notes

·

View notes

Text

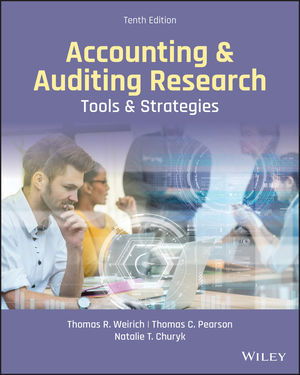

Solution Manuals For Accounting and Auditing Research: Tools and Strategies, 10th Edition Thomas R. Weirich

TABLE OF CONTENTS

Preface ix

About the Authors xiii

1 Introduction to Applied Professional Research 1

What is Research? 2

Research Questions 3

Nature of Professional Research 5

Critical Thinking and Effective Communication 6

Economic Consequences of Standards Setting 7

Role of Research in the Accounting Firm 7

Skills Needed for the CPA Exam and Practice 9

Overview of the Research Process 11

Step One: Identify the Relevant Facts and Issues 11

Step Two: Collect the Evidence 12

Step Three: Analyze the Results and Identify the Alternatives 13

Step Four: Develop a Conclusion 14

Step Five: Communicate the Results 14

Data Analytics/Emerging Technologies in Accounting and Auditing Research 14

Summary 16

Discussion Questions 16

Exercises 17

Appendix: Research Focus on the CPA Exam 18

2 Critical Thinking and Effective Writing Skills for the Professional Accountant 22

Critical Thinking Skills 22

Levels of Thinking 24

Universal Elements of Reasoning 27

An Example of Using Critical Thinking Skills 28

Effective Writing Skills 29

Writing as a Process 30

Punctuation Primer 31

Improved Writing Skills Required 34

Active Voice 34

Short Sentences 34

Definite, Concrete, Everyday Language 35

Tabular Presentation 35

Limited Jargon and Technical Terms 35

No Multiple Negatives 36

Elements of Plain English 36

Writing Effective Texts, e-mails, and Letters 37

Writing Memos to the File 38

Summary 39

Discussion Questions 39

Exercises 40

3 The Environment of Accounting Research 43

The Accounting Environment 43

The SEC and the Standard-Setting Environment 44

Rules-Based vs. Principles-Based Accounting Standards 46

Financial Accounting Standards Board 46

FASB Strives to Simplify Standards 48

Content of Authorities 48

FASB Due Process 49

FASB Conceptual Framework Project 51

Statements of Financial Accounting Concepts Nos. 1–8 52

American Institute of Certified Public Accountants (AICPA) 52

Governmental Accounting Standards Board 53

Other Organizations Influencing Standard Setting 55

U.S. Generally Accepted Accounting Principles (U.S. GAAP) 57

The FASB Accounting Standards CodificationTM 58

Using Authoritative Support 59

Reading an Authoritative Pronouncement 60

Accounting Choices Have Economic Consequences 62

Summary 62

Discussion Questions 63

Exercises 63

4 Financial Accounting Research Tools 65

Accounting Research Online 66

Database Research Strategies 66

Step One: Define the Information Needed 66

Step Two: Determine the Sources to Search 66

Step Three: Use Appropriate Search Methods 67

Step Four: View the Results and Manage the Information 67

Step Five: Communicate the Search Results 67

FASB Accounting Standards CodificationTM Research System 67

The Research Process 68

Locating U.S. GAAP Using the Codification 72

Examples Using the Codification 72

SEC Accounting for Public Companies 73

SEC Regulations and Sources 74

The SEC’s Published Views and Interpretations 74

SEC Staff Policy/Interpretations 75

Accessing SEC Filings and Regulations 77

Cases to Practice Accounting Research 78

Data Analytics for the Accounting Researcher 79

Summary 80

Discussion Questions 80

Exercises 81

Knowledge Busters: The Codification 84

Appendix: CPA Exam—Financial Accounting Simulations 89

Document Review Simulation 93

5 The Environment of International Research 95

International Accounting Environment 95

International Accounting Standards Board (IASB) 97

IASB Authorities 99

IASB Due Process 100

Interpretations Committee Due Process 101

IASB’s Conceptual Framework 102

Principles-Based Accounting Standards 102

IFRS Funding Regulation, and Enforcement 103

International Financial Reporting Standards (IFRS) Research 105

IFRS Hierarchy 105

Electronic International Financial Reporting Standards (eIFRS) 105

Summary 107

Discussion Questions 107

Exercises 108

Knowledge Busters 109

6 Other Research Databases and Tools 111

Other Database Research Strategies 111

Step One: Define the Information Needed 112

Step Two: Determine the Sources to Search 112

Step Three: Use Search Techniques and Tools 113

Step Four: View the Results and Manage the Information 114

Leading Publishers of Global Financial Information 115

Commercial Accounting Databases and Tools 115

U.S. Accounting Research Tools 117

U.S. Government Accounting Databases 118

Financial Research Databases 120

S&P Capital IQ 121

Mergent Online 122

Other Financial Databases and Sources 123

Research Challenges for Business Research 124

Business Research Databases and Tools 124

Article Index Sources 125

Other Specialized Research 125

Massive Legal Research Databases 126

LexisNexis Database Products 127

Westlaw Database Products 128

Recent Legal Database Competitors 129

Summary 129

Discussion Questions 130

Exercises 130

Knowledge Busters 132

Appendix 6A-1: Website Addresses 132

7 Tax Research for Compliance and Tax Planning 135

Tax Planning Concepts and Tax Research Goals 135

Tax Research Goals 136

Tax Research Challenges 137

Specialized Tax Research Databases 138

Thomson Reuters Checkpoint 139

Primary Tax Authorities 139

The Code 140

Treasury Regulations 142

Revenue Rulings and Revenue Procedures 144

Lesser Administrative Sources (Nonprecedential) 145

U.S. Tax Court 146

Other Judicial Sources of Authority 147

Steps in Conducting Tax Research 148

Step One: Investigate the Facts and Identify the Issues 148

Step Two: Collect the Appropriate Authorities 148

Step Three: Analyze the Research 151

Step Four: Develop the Reasoning and Conclusion 154

Step Five: Communicate the Results 154

Evolving Professional Concerns and Changes 156

Professional Standards for Tax Services 158

Data Analytics in Tax Research 159

Summary 160

Discussion Questions 160

Exercises 161

Knowledge Busters 164

Appendix 7A-1: Website Addresses 165

8 Assurance Services and Auditing Research 166

Assurance Services 167

Consulting Services and Standards 167

Attestation Services and Standards 169

Auditing Standard-Setting Environment 171

Auditing Standard-Setting Process 171

Public Company Accounting Oversight Board (PCAOB) 172

Auditing Standards Board (ASB) 173

International Auditing and Assurance Standards Board (IAASB) 177

AICPA Online Professional Library 177

AICPA Code of Professional Conduct 178

Auditing Standards in the Public Sector 182

Thomson Reuters Checkpoint 182

Compilation and Review Services 184

Role of Judgment and Professional Skepticism in Accounting and Auditing 186

Economic Consequences 187

Data Analytics/Emerging Technologies in Auditing Research 187

Summary 188

Discussion Questions 188

Exercises 189

Knowledge Busters 190

Appendix: CPA Exam Audit Simulation 191

9 Refining the Research Process 193

Method for Conducting Research 193

Step One: Identify the Issues or Problems 195

Step Two: Collect the Evidence 197

Step Three: Analyze the Results and Identify Alternatives 201

Step Four: Develop a Conclusion 202

Step Five: Communicate the Results 203

Remain Current in Knowledge and Skills 204

Complexities in Practice 205

Developing Professional Skills Needed for Practice 206

Summary 207

Discussion Questions 207

Exercises 208

Knowledge Busters 209

Appendix 9A-1: Certifications and Associations for Accounting, Auditing, and Tax 210

Appendix 9A-2: Research Sources from AICPA, FASB, PCAOB, and Others 211

Appendix 9A-3: Abbreviations for International, Canadian, and U.K. Standards 213

10 Forensic Accounting Research 216

Forensic Accounting Standards 217

Definition of Fraud 218

Types of Fraud 218

The Fraud Triangle 219

Overview of a Financial Statement Fraud Examination 222

Step One: Identify the Issue and Plan the Investigation 223

Step Two: Gather the Evidence and Complete the Investigation Phase 223

Step Three: Evaluate the Evidence 224

Step Four: Report Findings to Management or Legal Counsel 224

Business Investigations 225

Computer Technology in Fraud Investigations 225

Data-Mining Software 226

Data Analytics 227

MindBridge Ai Auditor 228

Public Databases 230

Courthouse Records 230

Company Records 231

Online Databases 232

The Internet 232

Instant Checkmate (www.instantcheckmate.com) 232

Zoominfo.com (www.zoominfo.com) 233

Other Websites 233

Fraud Investigation Regulations 233

Summary 233

Discussion Questions 233

Exercises 234

Knowledge Busters 234

Index I-1

Read the full article

0 notes

Photo

#fridayquotes #quotefortheday #AdamContos

.

.

.

“If you’re committed to it, you’ll find a way. If not, you’ll find an excuse.” – Adam Contos

.

.

.

#Springbord#CommercialRealEstate#FASB#IASB#Lease#Abstraction#Administration#Management#CAM#Reconciliation#Audit#Property#Accounting#Services#Outsourcing

2 notes

·

View notes

Text

Belém retoma vacinação pós-carnaval: Diversos imunizantes disponíveis

A partir desta quinta-feira, 15 de fevereiro, o serviço de vacinação em Belém será retomado, operando em horário normal, das 8h às 17h, nas unidades básicas de saúde (UBS) da capital e distritos. Essa retomada ocorre após o período de carnaval, no qual o atendimento foi interrompido devido aos pontos facultativos e ao feriado.

A Prefeitura de Belém, através da Secretaria Municipal de Saúde (Sesma), destaca a disponibilidade de diversas vacinas, incluindo a Pfizer Bivalente, Coronavac Monovalente, Pfizer Baby e Influenza, além de outros imunizantes que compõem o calendário vacinal para crianças, adolescentes, adultos e idosos.

Nas UBSs, grupos prioritários a partir dos 12 anos de idade podem receber a dose de reforço com a vacina Pfizer Bivalente contra a COVID-19. Para idosos, imunocomprometidos, gestantes e puérperas, a dose de reforço é especialmente importante, devendo ser administrada com um intervalo de seis meses entre as doses. Para outros grupos prioritários, como trabalhadores da saúde, pessoas com comorbidades, indígenas, quilombolas, entre outros, o intervalo recomendado entre as doses é de um ano.

Além disso, a vacina Coronavac Monovalente está sendo oferecida a pessoas de 5 a 59 anos que não pertencem aos grupos prioritários e precisam iniciar ou completar seu esquema vacinal. Esta vacina também é indicada para crianças de três e quatro anos. Para crianças de seis meses a menores de cinco anos, a Prefeitura disponibiliza o imunizante Pfizer Baby.

A vacina contra a gripe está liberada para toda a população a partir dos 6 meses de idade. Adicionalmente, imunizantes como Varicela, HPV, DTP (contra difteria, tétano e coqueluche) e Tríplice Viral (contra sarampo, caxumba e rubéola), que enfrentaram desabastecimento nacional, já estão disponíveis nas UBSs.

Para receber a vacinação, é importante apresentar a carteirinha de vacinação e um documento oficial com foto.

Durante o período de fevereiro de 2023 a 9 de fevereiro de 2024, cerca de 270 mil pessoas receberam o reforço com o imunizante bivalente contra a COVID-19, representando uma cobertura vacinal de 24,23%. A meta é vacinar 1.114.892 pessoas dos grupos prioritários. Quanto à vacina contra a Influenza, a campanha visa imunizar aproximadamente 530 mil pessoas. Até o momento, cerca de 117 mil pessoas foram vacinadas, atingindo 17,57% da cobertura vacinal planejada.

Confira onde encontrar as vacinas contra a Covid-19, Influenza e as demais do calendário do Programa Nacional de Imunização do Ministério da Saúde:

Pfizer Bivalente, a Pfizer Baby e a Coronavac Monovalente:UBS Fátima - Rua Domingos Marreiros, Nº 1664;IASB – Tv. Enéas Pinheiro – em frente ao Bosque Rodrigues Alves;CSE Marco – Av. Rômulo Maiorana, 2558;Uremia – Av. Alcindo Cacela, 1421;UBS Bengui II - Pass. Maciel, S/N – Ao lado da Escola Marilda Nunes;UBS Cabanagem - Rua São Paulo, S/N – Entre Rua São Pedro e Rua Olímpia;UBS Satélite - Conj. Satélite, WE 8;UBS Sideral - Rua Sideral – Esquina com Av. Brasil;UBS Tapanã - Rua São Clemente;UBS Pratinha - Rod. Arthur Bernardes – Base Naval;UBS Castanheira - Pass. Sol Nascente - Castanheira;UBS Curió - Pass. Eng. Alberto Engelhard – Estrada da Ceasa;UBS Águas Lindas - Conj. Verdejantes I, 2ª Rua, S/N;UBS Marambaia - Av. Augusto Montenegro;UBS Tavares Bastos – Av. Rodolfo Chermont, 170;ESF Souza – Av. Almirante Barroso – Passagem Getúlio Vargas (dentro da Setrans);UBS Combu – Furo do Combu, s/nUBS Portal da Amazônia - Rua Osvaldo de Caldas Brito - 30 B - Jurunas;UBS Condor - Pass. Lauro Malcher, Nº 285;UBS Guamá - Rua Barão de Igarapé-Miri, Nº 479;UBS Terra Firme - Pass. São João, Nº 170;UBS Icoaraci - Rua Manoel Barata, Nº 840;UBS Maguari – Conj. Maguari, alameda 15;UBS Tenoné II - Rua 6ª Linha - s/n, ao lado da Fund. Paula Frassinete;UBS Fidélis - Rua Pantanal - S/N - Outeiro;UBS Cotijuba - Rua Manoel Barata, s/n- Outeiro;UBS Outeiro - Rua Manoel Barata, s/n- Outeiro;ESF Fama – Rua Tucumaeira – Estrada do Fama, 72- Outeiro;UBS Pedreira – Av. Pedro Miranda, esquina da Tv. Mauriti;UBS Paraíso dos Pássaros - Rua dos Tucanos;UBS Providência - Av. Norte;UBS Sacramenta - Av. Senador Lemos, esquina com Dr. Freitas;UBS Telégrafo - Rua do Fio – entre Pass. São João e Pass. São Pedro;UBS Vila da Barca – Rua Cel. Luiz Bentes, próximo à Pedro Álvares Cabral;UBS Aeroporto – Rua do Pouco s/n- Mosqueiro;UBS Baía do Sol - Av. Beira Mar, s/n- Mosqueiro;UBS Carananduba – Praça de Carananduba-Mosqueiro;UBS Furo das Marinhas – Rod. Augusto Meira Filho s/n- Mosqueiro;UBS Maracajá - Tv. Siqueira Mendes, s/n- Mosqueiro;UBS Sucurijuquara – Estrada da Baía do Sol- Mosqueiro.

Pfizer bivalente e a Coronavac Monovalente: Hospital Naval – Rua do Arsenal, 200;Hospital da Aeronáutica – Av. Almirante Barroso, 3492;Hospital do Exército – Tv. Marquês de Pombal, 850;UBS Mangueirão – Rua São João-1;USF Panorama XXI – Conj. Panorama XXI, Qd. 24, casa 11-B;USF Carmelândia – Rua Tancredo Neves, 02;UBS Eduardo Angelim – Conj. Eduardo Angelim – Av. 17 de abril s/nUBS Paracuri I - Pass. Maura, 218, entre a 3ª e a 4ª Rua;UBS Quinta dos Paricás – Estrada do Maracacuera, 2477;UBS Barreiro I – Passagem Mirandinha, 367;UBS Canal da Pirajá – Tv. Barão do Triunfo, 1015, esquina com a Rua Nova.

As vacinas Varicela, HPV e DTP estão disponíveis nos seguintes locais:UBS Fátima - Rua Domingos Marreiros, nº 1664;IASB – Tv. Enéas Pinheiro – em frente ao Bosque Rodrigues Alves;Hospital Naval – Rua do Arsenal, 200;Hospital da Aeronáutica – Av. Almirante Barroso, 3492;Hospital do Exército – Tv. Marquês de Pombal, 850.UBS Bengui II - Pass. Maciel, S/N – Ao lado da Escola Marilda Nunes;UBS Cabanagem - Rua São Paulo, S/N – Entre Rua São Pedro e Rua Olímpia;UBS Mangueirão – Rua São João-1;UBS Satélite - Conj. Satélite, WE- 8;UBS Sideral - Rua Sideral – Esquina com Av. Brasil;UBS Tapanã - Rua São Clemente;UBS Pratinha - Rod. Arthur Bernardes – Base Naval;USF Carmelândia – Rua Tancredo Neves, 02;USF Panorama XXI – Conj. Panorama XXI, Qd. 24, casa 11-B;USF Parque Verde - Av. Padre Bruno Sechi, 1111.ESF Souza – Av. Almirante Barroso – Passagem Getúlio Vargas (dentro da Setrans);UBS Águas Lindas - Conj. Verdejantes I, 2ª Rua, S/N;UBS Castanheira - Pass. Sol Nascente - Castanheira;UBS Curió - Pass. Eng. Alberto Engelhard – Estrada da Ceasa;UBS Marambaia - Av. Augusto Montenegro;ESF Radional - Passagem Radional II- Condor;UBS Condor - Pass. Lauro Malcher, Nº 285;UBS Guamá - Rua Barão de Igarapé-Miri, Nº 479;UBS Portal da Amazônia - Rua Osvaldo de Caldas Brito - 30 B - Jurunas;UBS Terra Firme - Pass. São João, Nº 170;UBS Cremação- Rua dos pariquis,2906 – Cremação.UBS Eduardo Angelim – Conj. Eduardo Angelim – Av. 17 de Abril s/n;UBS Icoaraci - Rua Manoel Barata, Nº 840;UBS Paracuri I - Pass. Maura, 218, entre a 3ª e a 4ª Rua;UBS Quinta dos Paricás – Estrada do Maracacuera, 2477;UBS Tenoné II - Rua 6ª Linha - s/n, ao lado da Fund. Paula Frassinete.ESF Fama – Rua Tucumaeira – Estrada do Fama, 72.UBS Cotijuba - Rua Manoel Barata, s/n;UBS Fidélis - Rua Pantanal - S/N - Outeiro;UBS Outeiro - Rua Manoel Barata, s/n;UBS Barreiro I – Passagem Mirandinha, 367;UBS Canal da Pirajá – Tv. Barão do Triunfo, 1015, esquina com a Rua Nova.UBS Paraíso dos Pássaros - Rua dos Tucanos;UBS Providência - Av. Norte;UBS Sacramenta - Av. Senador Lemos, esquina com Dr. Freitas;UBS Telégrafo - Rua do Fio – entre Pass. São João e Pass. São Pedro;UBS Vila da Barca – Rua Cel. Luiz Bentes, próximo à av. Pedro Álvares Cabral.UBS Aeroporto – Rua do Pouco s/n- Mosqueiro;UBS Baía do Sol - Av. Beira Mar, s/n- Mosqueiro;UBS Carananduba – Praça de Carananduba- Mosqueiro;UBS Furo das Marinhas – Rod. Augusto Meira Filho s/n- Mosqueiro;UBS Maracajá - Tv. Siqueira Mendes, s/n- Mosqueiro;

Locais que disponibilizam a vacina Tríplice Viral:IASB – Tv. Enéas Pinheiro – em frente ao Bosque Rodrigues Alves.UBS Fátima - Rua Domingos Marreiros, Nº 1664;UBS Bengui II - Pass. Maciel, S/N – Ao lado da Escola Marilda Nunes;UBS Satélite - Conj. Satélite, WE-8;UBS Tapanã - Rua São Clemente;UBS Pratinha - Rod. Arthur Bernardes – Base Naval;UBS Cabanagem - Rua São Paulo, S/N – Entre Rua São Pedro e Rua Olímpia.UBS Águas Lindas - Conj. Verdejantes I, 2ª Rua, S/N;UBS Curió - Pass. Eng. Alberto Engelhard – Estrada da Ceasa;UBS Marambaia - Av. Augusto Montenegro.UBS Guamá - Rua Barão de Igarapé-Miri, nº 479;UBS Portal da Amazônia - Rua Osvaldo de Caldas Brito - 30 B - Jurunas;UBS Terra Firme - Pass. São João, nº 170.UBS Icoaraci - Rua Manoel Barata, nº 840;UBS Tenoné II - Rua 6ª Linha - s/n, ao lado da Fund. Paula Frassinete.UBS Cotijuba - Rua Manoel Barata, s/n;UBS Outeiro - Rua Manoel Barata, s/n.UBS Providência - Av. Norte;UBS Sacramenta - Av. Senador Lemos, esquina com Dr. Freitas;UBS Telégrafo - Rua do Fio – entre Pass. São João e Pass. São Pedro.UBS Carananduba – Praça de Carananduba- Mosqueiro.

Com informações da Agência Belém.

Read the full article

0 notes

Text

it's a scream, baby! | hyunlix

chapter one: do you like scary movies?

words: 1.51k // warnings: minor character death, cursing

OFFICIAL GHOSTFACE KILL COUNT: 000

heejin jumped as the monster in the movie claimed another victim with its knife-like fingers. why did she even choose to watch this again? nightmare on something? beech road? no, that wasn’t right… elm street! stupid fucking elm street and stupid fucking freddy kreuger with his stupid fucking hands. she wasn’t even supposed to be watching it alone, let alone throwing her popcorn around the living room every time something scared her, but her dumbass boyfriend never turned up for date night. it was his choice of movie too!

when the phone rang, she rolled her eyes and paused the movie. if that wasn’t suho calling her with a good explanation, she was going to be pissed. he’d sworn he wouldn’t be late tonight, and further sworn that he wasn’t going to flake again like he did everytime their date night coincided with a lacrosse-team party.

“goddammit, suho, you promised you’d be on time tonight, i–”

but the voice at the end of the phone was not that of her boyfriend. in fact, it wasn’t a voice she recognized at all, so how did they have her number? and why were they calling her at 10:30 on a wednesday night?

“all alone tonight, heejin? what a shame. seems like a waste for a pretty girl like you to be by herself.” the voice almost sounded distorted, like someone was using a voice-changer on the end of the line.

“listen, if this is some sort of stupid prank, its not funny. who is this?”

between the stress of upcoming finals, and a flaky boyfriend who seemed to enjoy the company of a football more than he did his girlfriend, heejin wasn’t in the mood for jokes.

the voice chuckled, in a way that sent a shiver up heejin’s spine. “i think the better question is; where am i? you should really learn to lock your doors when you’re home alone, kid.”

“this isn’t funny. fuck off.” heejin hissed, slamming the phone down and heading back towards the comfort of her couch. kid. she wasn’t a kid. who the fuck where they to talk to her all patronizing like that? but just as she attempted to take her seat, the phone rang again.

huffing, she picked up the handset. “what?”

“now, thats not nice. i just wanna talk.” the voice laughed, something eerie about their tone putting heejin on edge.

“yeah, they’ve got 900 numbers for that. bye, now.”

tossing the phone on the counter, heejin headed into the kitchen to make herself a glass of water. what kind of weirdo called up girls on a wednesday night to scare them? men were weird. but she barely managed to cross the threshold of the kitchen when the ringing of the phone pierced the silence again.

heejin was beginning to get upset at this point. why wouldn’t they get the hint? if it was suho or his friends pulling a prank, she was truly going to get mad. but, she’d give them one last chance to piss off and grow up.

“listen here, asshole-!” she shouted, but was quickly cut off.

“no, you listen here you little bitch! hang up on me again and i’ll gut you like a fish!” the voice growled, catching her off guard. “yeah, thats right. wanna play a game, blondie? it’s called ‘guess how i’m gonna die’.”

trying to stop her voice from shaking, heejin ran across the lower expanse of the house, locking all the doors and windows she could see. what the fuck kind of joke was this?

“what do you want? please- don’t fuck with me.” backing into the living room to draw the blinds and grab the first weapon she could see - a letter cutter - she hid herself behind the tv display. she’d quickly realized this wasn’t suho or his friends - even they knew when a joke went too far.

“well, then. if you wanna see your pretty, little boyfriend again, you better be smart about this.” was the only reply she received as the voice laughed. the house was quiet - too quiet - heejin thought as she curled herself further into a corner. and what did suho have to do with this? holding back tears, she prayed her parents would come home soon.

“round one of the game, blondie. its no fun if you hide. why don’t you come out where i can see ya? if you don’t, i’m afraid its an automatic win for me.”

taking a deep breath to calm herself, heejin pulled herself out of the ball she was curled in and took a few cautious steps into the middle of the room. maybe the voice was bluffing? as long as she stayed inside the house, not going outside to “investigate a noise” like the dumb bitches in horror films, she’d be okay.

“good,” the voice on the other end of the phone drawled, the tone making heejin’s skin crawl. “now, round two. did you lock me out of the house, or did you lock me in?”

the call dropped, making heejin’s breath catch in her throat. the silence surrounding her was ridiculously loud, and she was scared to make a step or turn, even slightly. surely, this was just a prank. the guys had obviously just taken it too far, and were probably laughing at her wherever they were hidden. the minute she found them, she’d give them a piece of her mind.

it had to be a prank, didn’t it? stuff like this didn’t happen in woodsboro, it was the safest town she’d ever known.

any slight whistle of the wind outside sounded like an ever-growing closer breath, every tick of the clock like a creaky footstep reverberating throughout the house. clutching the letter cutter to her body, heejin tiptoed towards the hallway, hoping that she could get to her bedroom and hide in there until her parents returned home.

but that never came.

instead, she turned the corner to hear loud, clomping footsteps approaching her. a tall figure was inching closer to her, a father-death costume donned, and a large kitchen knife in their hand - her own kitchen knife. she feared she was about to die by her own utensil, unless whichever jock was pranking her took the mask off now.

holding onto hope that this was just a joke gone too far, although deep down she knew that wasn’t the case, she held out the letter cutter, swinging it.

“suho, i swear to fuck. if you don’t take that mask off right now and apologise, i won’t be held responsible for my actions.” her voice trembled as the faux-confidence slipped from her aura.

surprisingly, the figure did take the mask off, but much to heejin’s horror, it wasn't her loving boyfriend, or any of his stupid friends, and he continued to approach her, knife clutched tightly in his fist and a sadistic smile on his face.

“please, don’t do this- please, i’ll do anything!” heejin pleaded, tears falling freely down her face as the man grabbed a fistful of her hair and traced the edge of the knife against her throat.

the last words she ever heard were a simple, yet arrogantly cocky “i win.” before the knife was plunged into her stomach.

–

(y/n) climbed out of her car in confusion, wondering why so many people were around campus today. did she miss the memo for an event? it was only 8:20am, why were the emergency services on site?

barely anyone seemed to be walking alone, people grasping each other tightly. she spotted at least 6 girls crying, 4 boys pale and sickly in apparent shock. she couldn’t even begin to count the amount of students and staff talking to news reporters or journalists. what the hell was going on?

spotting jisung climbing off his bus, she jogged over to him, her confusion ever-growing and ever-present on her features. being her best friend and the biggest social butterfly she knew, surely jisung would have an answer to the gossip swirling around her in hushed voices.

“ji! what’s going on?” she called, grasping his attention, confused further as he ran over and picked her up in a hug, the relief clear in his aura.

“thank fuck, you’re okay. everyone’s been trying to get hold of you all morning. did you lose your phone or something? don’t ever fucking scare us like that again!”

(y/n) was slightly shocked, jisung had never raised his voice at her like that. none of the boys did. what the hell did she miss last night? everyone was acting so… weird. she didn’t know what she’d missed during her study night with yeji, but clearly it was something major. something bad.

“did something happen on campus? why are the news here? was there a fire or something?” she questioned, arm slung around her friend’s shoulders, but her expression soon dropped as the boy turned to face her - a look of what could only be described as sheer terror on his face.

“did you not hear? kang heejin was murdered last night.”

taglist: join taglist here @pretty-racha @chubbyanarkiss @downtherabbithole01 @amara-mars @queen-klarissa @demetrisscarf @velv3y @KarmaGolden @queenfelix @taeriffic

(red means it wouldn't let me tag you)

#mixtape-racha#mixtape-racha fic#iasb-fic#hyunjin x reader#felix x reader#hyunlix x reader#scream au#hyunlix fic#hyunlix smut#hyunjin smut#felix smut#hyunjin x reader fic#hyunjin x reader smut#felix x reader smut#felix x reader fic#stray kids smut#stray kids x reader#stray kids x reader fic#it's a scream baby-fic#stray kids au#stray kids horror au#stray kids horror

347 notes

·

View notes

Text

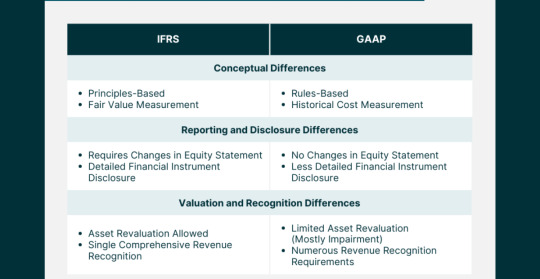

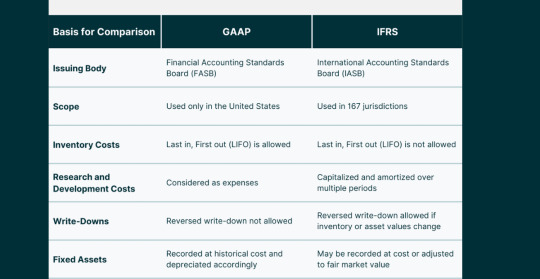

GAAP vs IFRS

Decoding US Accounting Rules: GAAP vs IFRS | Expert Insights in 2024

Navigate the GAAP vs IFRS debate in US Accounting effortlessly. Gain expert insights, make sense of regulations. Your guide to financial clarity.

The evolving landscape of accounting standards unfolds a nuanced debate between the Generally Accepted Accounting Principles and the International Financial Reporting Standards. These two frameworks, while sharing a common goal of transparent financial reporting, diverge in their approaches, giving rise to a multifaceted discourse with far-reaching implications for the financial world.

1. Introduction

The evolution of accounting standards has witnessed the crystallization of two dominant frameworks – General Accounting Accepted Principles and International Financial Reporting Standards. In the labyrinth of financial reporting, companies grapple with choosing between these standards, each with its unique history, principles, and global relevance. The debate surrounding GAAP vs IFRS is not a mere academic exercise but a pivotal consideration with implications for investment decisions, legal compliance, and the global financial landscape.

1.1. Evolution of Accounting Standards

The journey of accounting standards traces back to the aftermath of the 1929 stock market crash when the need for standardized, transparent financial reporting became glaringly apparent. What emerged were the General Accounting Accepted Principles, designed to restore investor confidence by providing a reliable framework for financial statements. Over time, GAAP has become deeply embedded in the U.S. financial system, shaping the way companies communicate their financial health.

On the global stage, the International Financial Reporting Standards evolved as a response to the growing interconnectedness of economies. The International Accounting Standards Board (IASB) took the reins in developing IFRS, aiming for a standardized global language of financial reporting. This set the stage for a two-pronged approach to financial reporting standards – General Accounting Accepted Principles dominating in the U.S. and International Financial Reporting Standards gaining traction internationally.

1.2. The Crucial Role of GAAP and IFRS

GAAP stands as the bedrock of accounting standards in the United States, overseen by the Financial Accounting Standards Board (FASB). Its principles, rooted in historical cost, revenue recognition, and matching, provide stability and a familiar structure for U.S. businesses. On the other hand, IFRS, under the stewardship of the IASB, operates as a global player, emphasizing fair value, substance over form, and materiality.

The significance of General Accounting Accepted Principles lies in its historical context and its alignment with the unique needs of the U.S. business environment. Its principles have served as a guiding light for American companies, offering a consistent framework for financial reporting. International Financial Reporting Standards, with its global perspective, caters to the interconnectedness of today’s businesses, providing a common language for multinational corporations.

1.3. Navigating the GAAP vs IFRS Dilemma

The choice between General Accounting Accepted Principles and International Financial Reporting Standards is not a one-size-fits-all decision. Companies grapple with a complex decision-making process, considering factors such as their geographical reach, industry nuances, and investor preferences. This debate is not isolated to boardrooms; it resonates in financial markets, legal proceedings, and regulatory landscapes, shaping the very fabric of financial reporting practices.

2. Understanding GAAP

2.1. The Foundation of GAAP

a. Historical Roots and Evolution

GAAP’s roots delve deep into the need for a standardized accounting framework post the 1929 stock market crash. FASB emerged as a response to the chaos that ensued, charged with the responsibility of establishing and improving financial accounting and reporting standards. The journey of GAAP has been one of continuous evolution, adapting to the changing business landscape and regulatory requirements.

b. FASB’s Ongoing Influence

The Financial Accounting Standards Board (FASB) stands as the guardian of GAAP, playing a pivotal role in setting and refining accounting standards. FASB’s mission goes beyond rule-making; it seeks to improve financial reporting, providing transparency and relevance in financial statements. The ongoing influence of FASB ensures that GAAP remains adaptive and responsive to the dynamic nature of business transactions.

2.2. Core Principles Anchoring GAAP

a. Embracing the Historical Cost Principle

One of the cornerstones of GAAP is the historical cost principle, dictating that assets should be recorded at their original cost. This principle provides stability and reliability in financial statements, allowing users to assess the financial health of a company based on the actual cost of its assets at the time of acquisition. While critics argue that this approach may not reflect current market values, proponents emphasize the prudence and consistency it offers.

b. Revenue Recognition as a Cornerstone

GAAP’s approach to revenue recognition centers on the realization and earned criteria. Revenue is recognized when it is realized or realizable and earned. This conservative approach ensures that revenue is not prematurely recognized, aligning with the matching principle. While this method may defer recognizing revenue until later stages in the sales cycle, it safeguards against potential overstatement and presents a cautious picture to investors.

c. The Significance of the Matching Principle

The matching principle is a guiding force in GAAP, emphasizing the alignment of expenses with the revenue they generate. This principle ensures that the costs associated with generating revenue are recognized in the same period as the revenue itself, presenting a more accurate portrayal of a company’s profitability. While adhering to the matching principle might result in lower reported profits during high-revenue periods, it provides a more realistic long-term view.

2.3. Scrutinizing Criticisms and Recognizing Limitations

a. Rigidity vs. Stability

One common criticism leveled against GAAP is its perceived rigidity, particularly regarding the historical cost principle. Critics argue that this approach may not capture the true economic value of assets, especially in industries with rapidly changing market conditions. However, proponents assert that this rigidity provides stability and consistency, allowing for easier comparison across periods and industries.

b. The Balancing Act of Revenue Recognition

The conservative approach to revenue recognition in GAAP has faced scrutiny for potentially understating a company’s immediate financial performance. Critics argue that this caution may not be reflective of a company’s true economic position, especially in industries where revenue realization is instantaneous. However, the balancing act lies in mitigating the risk of premature revenue recognition, ensuring financial statements maintain integrity and accuracy.

c. Challenges in Adhering to the Matching Principle

While the matching principle aligns expenses with revenue, critics contend that it introduces complexities in determining the direct association between costs and specific revenue streams. This challenge becomes more pronounced in industries with diverse revenue sources. Despite these challenges, adhering to the matching principle remains integral in presenting a holistic view of a company’s financial health, helping investors make informed decisions.

3. Embracing IFRS

3.1. IFRS: A Global Framework

a. The Rise of International Financial Reporting Standards

The emergence of IFRS marks a significant shift towards a globalized approach to financial reporting. As businesses expanded internationally, the need for a common accounting language became evident. IFRS, under the stewardship of the International Accounting Standards Board (IASB), rose to prominence as a framework that transcends borders, providing a standardized set of principles for companies operating on the world stage.

b. IASB’s Pivotal Role in Shaping IFRS

The International Accounting Standards Board (IASB) shoulders the responsibility of developing and maintaining IFRS. Unlike GAAP, IFRS operates under a principles-based approach, focusing on broad principles rather than detailed rules. This flexibility allows for easier adaptation to diverse business environments, making IFRS an attractive choice for multinational corporations seeking a harmonized approach to financial reporting.

3.2. Unpacking Core Principles of IFRS

a. Fair Value Measurement: A Paradigm Shift

One of the fundamental differences between GAAP and IFRS lies in the approach to asset valuation. While GAAP predominantly adheres to the historical cost principle, IFRS leans towards fair value measurement. Fair value reflects the current market value of assets, providing a more dynamic and responsive perspective. Critics argue that fair value introduces volatility, but proponents emphasize its relevance in capturing real-time economic conditions.

b. Substance Over Form: Emphasizing Economic Reality

In IFRS, the substance of transactions takes precedence over their legal form. This principle ensures that financial statements reflect the economic reality of transactions, promoting transparency and accuracy. While this approach aligns with the overarching goal of providing relevant information to users, it requires careful judgment and interpretation, potentially introducing subjectivity in financial reporting.

c. Materiality’s Role in Flexibility

IFRS introduces greater flexibility in materiality judgments compared to GAAP. Materiality refers to the threshold at which information becomes relevant to users. The more flexible stance in IFRS allows entities to exercise judgment in determining what information is material, considering both quantitative and qualitative factors. This flexibility, while enhancing the adaptability of IFRS, also raises concerns about potential inconsistencies in financial reporting.

3.3. Weighing Advantages and Drawbacks

a. IFRS Flexibility: A Double-Edged Sword

The flexibility embedded in IFRS is both its strength and weakness. Proponents argue that this adaptability makes IFRS suitable for diverse business environments, allowing for easier integration with various industries and legal systems. However, critics contend that this very flexibility can lead to inconsistencies and a lack of comparability, challenging the reliability of financial statements for investors and stakeholders.

b. Global Appeal vs. Application Challenges

The global nature of IFRS makes it an attractive choice for multinational companies aiming for consistency in financial reporting across borders. The common language of IFRS facilitates international transactions and fosters a seamless global financial landscape. However, the application of IFRS can pose challenges in jurisdictions with varying legal and regulatory frameworks, potentially leading to complexities in implementation and interpretation.

4. Key Differences Between GAAP and IFRS

4.1. Delving into Variances

a. Revenue Recognition: The GAAP-IFRS Divergence

One of the pivotal differences between GAAP and IFRS lies in the recognition of revenue. While both frameworks aim to depict the economic reality of transactions, their approaches diverge in certain key aspects. GAAP tends to be more prescriptive, providing specific guidelines for various industries, whereas IFRS adopts a broader principles-based approach, allowing entities more room for interpretation.

b. Inventory Valuation: Differing Approaches

The treatment of inventory valuation varies significantly between GAAP and IFRS. GAAP typically follows a specific set of rules for valuing inventory, such as the Last In, First Out (LIFO) or First In, First Out (FIFO) methods. In contrast, IFRS permits the use of various methods, including FIFO and weighted average, offering companies more flexibility in choosing an approach that aligns with their specific business dynamics

c. Consolidation Methods: Navigating Complexity

Consolidation methods, particularly in the context of subsidiaries and investments, showcase differences between GAAP and IFRS. GAAP often employs a more rule-based approach, specifying conditions for consolidation. In contrast, IFRS focuses on a principles-based approach, considering the substance of relationships rather than relying on rigid criteria. This variance introduces nuances in financial reporting, influencing how companies present their financial position and performance.

4.2. The Impact on Financial Statements

a. Shaping Investor Perception

The differences in revenue recognition, inventory valuation, and consolidation methods contribute to variations in financial statements produced under GAAP and IFRS. Investors, as key stakeholders, must navigate these differences to gain an accurate understanding of a company’s financial health. The choice between GAAP and IFRS significantly shapes investor perception, influencing investment decisions and risk assessments.

b. Decision-Making Dynamics

Companies, in choosing between GAAP and IFRS, must consider the implications on decision-making dynamics. The framework adopted affects how financial information is presented, potentially influencing strategic decisions, mergers and acquisitions, and capital-raising activities. Understanding the impact of these frameworks on decision-making is crucial for entities operating in dynamic and competitive business environments.

4.3. Global Adoption Trends: A Comparative Analysis

The adoption trends of GAAP and IFRS provide insights into the global dynamics of financial reporting standards. While GAAP maintains dominance within the United States, IFRS has gained traction in numerous jurisdictions worldwide. Understanding the factors influencing these trends, such as regulatory requirements, investor preferences, and global market integration, sheds light on the evolving landscape of accounting standards.

“Accounting isn’t just about profits and losses; it’s about sculpting the financial soul of a company.” Michael Johnson

5. The Evolution of Accounting Standards

5.1. GAAP’s Historical Odyssey

a. Post-1929: A Catalyst for Change

The stock market crash of 1929 served as a catalyst for rethinking the approach to financial reporting. The chaos that ensued prompted the establishment of standardized accounting principles, laying the foundation for what would later become GAAP. The primary goal was to restore investor confidence by providing a reliable framework for financial statements, reducing uncertainty and fostering stability in financial markets.

b. Amendments and Updates: Shaping GAAP’s Trajectory

GAAP’s journey has not been static; it has evolved through amendments and updates to address emerging challenges and align with changing business dynamics. The Financial Accounting Standards Board (FASB) plays a pivotal role in shaping GAAP, ensuring that it remains relevant, transparent, and responsive to the needs of companies and investors. The ongoing commitment to refinement reflects a dedication to maintaining the integrity of financial reporting.

5.2. Internationalization Efforts

a. Pioneering Attempts at Global Standardization

As globalization gained momentum, so did the recognition of the need for global accounting standards. Efforts were made to align U.S. GAAP with international standards, but achieving a universal standard proved challenging. The push for global standardization gained traction with the rise of IFRS, offering a framework that transcends national boundaries and facilitates consistency in financial reporting for multinational corporations.

b. The Challenge of Aligning U.S. Standards Globally

While the concept of global accounting standards gained support, aligning U.S. GAAP with international standards presented formidable challenges. The unique legal, regulatory, and cultural landscape in the United States posed hurdles to seamless integration. Despite these challenges, the pursuit of convergence and harmonization continued, reflecting the recognition of the interconnectedness of global economies.

5.3. Convergence Initiatives

a. The Ongoing Pursuit of Harmonization

Convergence initiatives aimed at harmonizing GAAP and IFRS gained prominence in the early 21st century. The objective was to reduce disparities between the two frameworks, fostering a more standardized global approach to financial reporting. While full convergence remained elusive, progress was made in aligning specific standards, reflecting a commitment to minimizing inconsistencies and facilitating ease of comparison for investors and stakeholders.

b. Prospects and Hurdles in a Unified Global Standard

The prospects of a unified global accounting standard remain a tantalizing goal, promising enhanced comparability and consistency in financial reporting. However, hurdles such as divergent national interests, legal complexities, and varying levels of standard-setting infrastructure continue to challenge the realization of this vision. Navigating these obstacles requires ongoing collaboration and a commitment to the overarching goal of global financial transparency.

6. Regulatory Bodies Influencing GAAP

6.1. FASB’s Pivotal Role

a. GAAP’s Guardian: The FASB Mandate

The Financial Accounting Standards Board (FASB) stands as the guardian of GAAP, wielding influence over the development and refinement of accounting standards. FASB’s mandate goes beyond rule-making; it encompasses a commitment to improving financial reporting, ensuring that standards are not only relevant but also responsive to the evolving needs of businesses and investors.

b. FASB’s Mission in Financial Reporting Improvement

FASB’s mission revolves around the improvement of financial reporting through the development of high-quality accounting standards. The board operates under a due process system, seeking input from various stakeholders, including investors, auditors, and preparers of financial statements. This collaborative approach ensures that GAAP remains a robust and adaptive framework that reflects the intricacies of modern business transactions.

6.2. SEC’s Watchful Eye

a. SEC’s Authority in Recognizing GAAP Standards

The Securities and Exchange Commission (SEC) plays a crucial role in the oversight of financial reporting in the United States. While the FASB sets accounting standards, the SEC has the authority to recognize and prescribe the principles used in the preparation of financial statements for publicly traded companies. This dual-layered system ensures a balance between industry expertise and regulatory oversight in shaping GAAP.

b. SEC’s Contributions to Financial Transparency

The SEC’s contributions to financial transparency extend beyond its recognition of GAAP standards. The commission actively engages in rule-making and enforcement to ensure that companies adhere to accounting principles and provide accurate and timely financial information to investors. The synergy between the SEC and FASB reinforces the integrity of financial reporting in the U.S. capital markets.

6.3. AICPA’s Industry Impact

a. AICPA: Nurturing Professional Standards

The American Institute of Certified Public Accountants (AICPA) plays a vital role in shaping professional standards within the accounting industry. While not directly involved in setting GAAP, the AICPA contributes to the development of ethical and professional standards that guide the conduct of accountants. This commitment to excellence enhances the credibility of financial reporting, reinforcing the trust that stakeholders place in GAAP.

b. Industry-Wide Compliance through AICPA Guidance

The AICPA’s influence extends beyond standards development to encompass industry-wide compliance. The organization provides guidance on best practices, ethical considerations, and emerging issues within the accounting profession. This guidance ensures a cohesive and ethical approach to financial reporting, aligning with the principles embedded in GAAP and contributing to the overall reliability of financial statements.

7. International Bodies Shaping IFRS

7.1. IASB’s Global Mandate

a. IASB’s Significance in IFRS Development

The International Accounting Standards Board (IASB) holds a central role in the development and maintenance of IFRS. Unlike the FASB’s role in the U.S., the IASB operates on a global scale, aiming to set accounting standards that are applicable and relevant to entities worldwide. The IASB’s commitment to a principles-based approach reflects its recognition of the diverse needs of global businesses.

b. A Global Perspective in Standard Setting

The IASB’s global perspective is intrinsic to its standard-setting process. The board considers input from various regions, industries, and stakeholders, ensuring that IFRS reflects the nuances of international business. The principles-based approach allows for adaptability, catering to the diverse legal, economic, and cultural landscapes in which entities operate globally.

7.2. IFRIC’s Interpretative Role

a. Navigating Grey Areas: IFRIC’s Guidance

The International Financial Reporting Interpretations Committee (IFRIC) plays a crucial role in navigating interpretative challenges within IFRS. Given the principles-based nature of IFRS, grey areas may arise, requiring clarification and guidance. IFRIC addresses these challenges by providing interpretations and guidance, ensuring consistent application of IFRS standards across diverse industries and jurisdictions.

b. Consistent Application of IFRS Standards

Consistency in the application of IFRS standards is paramount to ensuring comparability and reliability in financial reporting. IFRIC’s interpretative role contributes to this objective by offering guidance on ambiguous or complex issues. This commitment to clarity and consistency aligns with the overarching goal of IFRS – to provide a common language for financial reporting that transcends geographical and industry-specific boundaries.

7.3. Monitoring Board’s Oversight

a. Ensuring Independence in Standard Setting

The Monitoring Board plays a crucial oversight role in ensuring the independence and effectiveness of the IFRS Foundation, which houses the IASB. Independence is a cornerstone of credible standard-setting, and the Monitoring Board’s role is to safeguard the integrity of the standard-setting process. This commitment to independence reinforces the trust that global stakeholders place in IFRS as a reliable and unbiased framework.

b. The Role of the Monitoring Board in IFRS Integrity

The Monitoring Board’s vigilance extends beyond independence to the broader integrity of the IFRS framework. By overseeing the activities of the IFRS Foundation and IASB, the Monitoring Board contributes to the credibility of IFRS as a global accounting standard. This oversight ensures that IFRS continues to meet the evolving needs of global financial markets and remains a trusted framework for transparent financial reporting.

8. Impact on Financial Reporting

8.1. Side-by-Side Comparison

a. Financial Statement Variances: GAAP vs IFRS

A side-by-side comparison of financial statements prepared under GAAP and IFRS reveals variances arising from differences in principles, approaches, and interpretations. These variances extend to revenue recognition, asset valuation, and consolidation methods, influencing the reported financial position and performance of entities. Investors and analysts must navigate these differences to glean accurate insights into a company’s financial health.

b. Interpretation Challenges for Investors

Investors face interpretation challenges when analyzing financial statements prepared under different frameworks. Understanding the nuances of GAAP and IFRS differences is crucial for making informed investment decisions. The ability to discern how specific accounting choices impact financial metrics empowers investors to evaluate risks, assess potential returns, and navigate the complexities of the global investment landscape.

8.2. Revenue Recognition Dynamics

a. The Nuances of Revenue Recognition

The nuances of revenue recognition under GAAP and IFRS reflect the underlying philosophies of each framework. GAAP, with its prescriptive guidelines, provides specific criteria for recognizing revenue in various industries. In contrast, IFRS adopts a broader approach, emphasizing the substance of transactions over rigid rules. Navigating these nuances requires a deep understanding of industry dynamics and the specific requirements of each framework.

b. Implications for Investor Decision-Making

The implications of revenue recognition dynamics extend to investor decision-making. Differences in when and how revenue is recognized can influence perceptions of a company’s immediate financial performance. Investors must factor in these nuances to make informed decisions, considering the impact on key financial metrics such as earnings per share, profit margins, and return on investment.

8.3. Asset Valuation Approaches

a. Valuation Philosophies: Fair Value vs. Historical Cost

The variance in asset valuation philosophies between GAAP and IFRS introduces complexities in financial reporting. GAAP’s adherence to historical cost provides stability and consistency, albeit potentially understating the current market value of assets. In contrast, IFRS’s emphasis on fair value introduces a more dynamic and responsive approach to asset valuation. Companies must navigate the trade-offs between stability and accuracy in presenting their financial position.

b. Balancing Accuracy and Stability in Asset Reporting

Balancing accuracy and stability in asset reporting requires careful consideration of the trade-offs between fair value and historical cost. Companies must weigh the benefits of presenting current market values against the potential volatility introduced by fair value measurements. Striking the right balance ensures that financial statements accurately reflect the economic reality of a company’s assets while providing stakeholders with a stable and reliable foundation for decision-making.

9. Challenges in Adoption

9.1. Corporate Resistance Factors

a. Unpacking Corporate Hesitations

The decision to adopt new accounting standards, whether transitioning from GAAP to IFRS or vice versa, is met with corporate hesitations. Companies fear the potential disruptions, costs, and uncertainties associated with the transition. Understanding these resistance factors is essential for regulatory bodies, standard-setters, and industry stakeholders to develop strategies that facilitate smoother adoptions and ensure widespread compliance.

b. Overcoming Corporate Resistance Challenges

Overcoming corporate resistance challenges requires a multi-faceted approach. Clear communication on the benefits of the new standards, comprehensive training programs, and support mechanisms can alleviate concerns. Regulators and standard-setters must collaborate with industry representatives to address specific challenges faced by different sectors, fostering a cooperative environment conducive to successful adoptions.

9.2. Implementation Costs

a. Financial and Operational Impacts

The implementation of new accounting standards incurs financial and operational impacts for companies. Costs associated with staff training, system upgrades, and adjustments to internal processes contribute to the overall financial burden. Companies must carefully assess these costs and develop comprehensive implementation plans to mitigate disruptions and ensure a seamless transition to the new standards.

b. Strategies for Mitigating Implementation Costs

Strategies for mitigating implementation costs involve proactive planning, phased adoption approaches, and leveraging technology. Companies can benefit from engaging with industry peers that have successfully navigated similar transitions, learning from best practices and challenges. Collaboration between standard-setters, regulatory bodies, and industry associations plays a crucial role in developing strategies that balance the need for improved standards with the practicalities of implementation.

9.3. Training and Skill Gaps

a. The Need for Specialized Training

The adoption of new accounting standards introduces the need for specialized training to ensure that professionals possess the skills required for compliance. Training programs must address the nuances of the new standards, focusing on changes in accounting principles, reporting requirements, and the application of new methodologies. Bridging skill gaps is crucial for maintaining the integrity and accuracy of financial reporting.

b. Collaborative Approaches to Skill Development