#high yield savings account online banks

Text

#invest money right now#ideas now#benefit of investing#high yield savings account online#savings account online#profitable companies#high yield savings account online banks#best place to invest money right now#suggestions and ideas#online banks#best place to invest your money#index mutual funds#ways to invest in real estate#own properties#date places#the best place to invest money right now#smaller amount#money right#different places#may be preferable#short term savings#term savings#many different places#places to invest your money#key benefit#profitable companies in the world#less overhead#invest your money right now#where you can invest your money#most secure places

0 notes

Text

High-Interest Online Savings Account

Getting the best interest rate for online savings accounts is possible online. Many online banks offer these accounts. They differ from traditional accounts. Traditional savings accounts need you to open an account in person.

The interest rate on most Internet savings banks is higher than traditional banks. The best APY at the moment ranges between 4.00% and 5.00%. The APY is more than the…

View On WordPress

#banks with high-interest savings accounts\#best interest-rate savings accounts online#best savings interest rates online banks#finance#high yield savings account#highest interest-rate savings accounts online#Investing#Most high-interest savings accounts#online high-rate savings accounts#personal finance#savings account#top online savings account rates#top online savings interest rates

0 notes

Text

it sucks that I’ve had to spend like 98% of my sinking funds for car maintenance but I’ve reminded myself that I just started putting money away and that’s what that account is there for lol. I’m actually really proud of myself for contributing $200 a month to that account and $166/mo to my emergency fund. It was really hard for me to save money for a long time. Not to be a wannabe financial guru but I also have bad spending habits and it was really hard to keep track of my spending but I really suggest ppl to start a high interest yield savings account through a bank that has no fees (plenty of online banks do this & they’re not scams). It works wonders for your life I promise.

2 notes

·

View notes

Text

For a guaranteed income of $100 a month from home with an initial investment of less than $2000, a highly accessible and low-risk option is to utilize a high-yield savings account or a certificate of deposit (CD) from a reputable bank.

**Step-by-Step Plan:**

1. **Research Banks:** Find banks offering the highest interest rates on savings accounts or CDs.

2. **Initial Investment:** Invest your $2000 in a high-yield savings account or CD.

3. **Interest Rate:** Look for an interest rate that can yield at least $100 per month. For example, to generate $100 in interest per month from $2000, you would need an annual interest rate of about 60%. This rate is unusually high for savings accounts or CDs, which typically offer rates between 0.5% to 3% per annum.

4. **Realistic Approach:** Given the typical interest rates, achieving $100 per month from a $2000 investment through traditional savings is unrealistic. Adjusting expectations, at a 3% annual interest rate, your yearly return would be $60 from a $2000 investment, or $5 per month.

**Alternative Approach:**

Since traditional savings methods won't yield $100 per month on a $2000 investment, consider combining a few different low-risk investments or income streams:

1. **Dividend Stocks:** Invest in stocks with high dividend yields. While this involves more risk than a savings account, choosing stable, well-performing companies can offer a more substantial return.

2. **Peer-to-Peer Lending:** Invest through platforms that allow you to lend money to individuals or small businesses online, earning interest as they repay loans.

3. **Microtasks or Online Surveys:** Supplement your investment income by completing microtasks or surveys online, which can easily be done from home.

**Conclusion:**

Generating a guaranteed $100 per month from a $2000 investment solely through passive income methods like savings or CDs is currently not feasible with typical bank offerings. Exploring a combination of slightly higher-risk investments such as dividend stocks or peer-to-peer lending, along with some active but minimal effort tasks like online surveys, could together more realistically reach your monthly income goal. Each method has its own risks and potential returns, so careful consideration and perhaps diversification are advisable.

0 notes

Text

Understanding How Time Frames Affect Passive Income: Three Examples

Passive income is often touted as the ideal way to earn money with minimal effort. However, the time frame over which one invests can significantly impact the potential returns. Here are three examples of how different time frames can affect passive income streams:

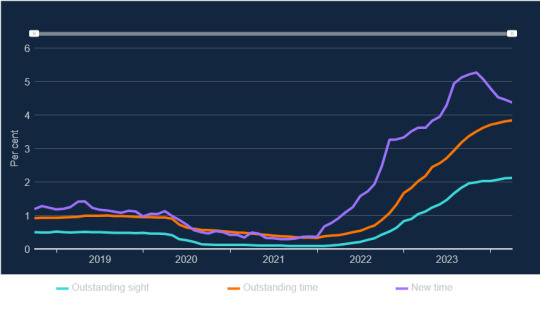

High-Interest Savings Accounts: In the short term, high-interest savings accounts can provide a reliable source of passive income. With interest rates having risen sharply since December 2021, savers can now enjoy more substantial returns on their deposits. For instance, moving your money to a high-interest account like the Post Office, which offers a 5.06% rate, can yield a decent income stream without much effort. However, it's crucial to monitor these rates regularly, as they can fluctuate.

Effective interest rates on individual deposits: source—Bank of England

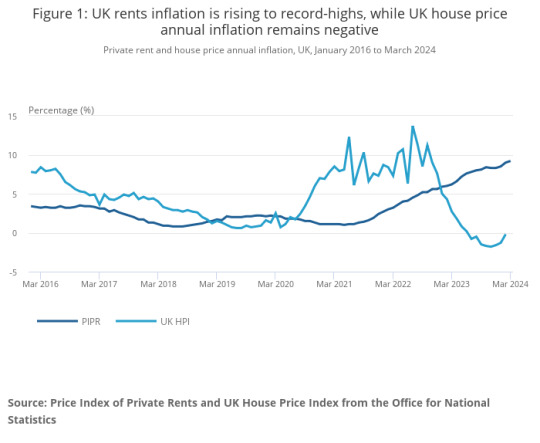

Renting Out Property: Medium-term passive income can be generated by renting out property. Whether it's a spare room through the government's Rent a Room Scheme or a parking space via platforms like JustPark, this method can provide a steady income stream. The key here is the balance between the initial investment and the ongoing passive returns. Over time, as the mortgage is paid down, the income can become more passive and potentially increase if property values rise.

Creating Online Courses: From a long-term perspective, creating and selling online courses can be a lucrative source of passive income. Once the initial work of recording and uploading the course is done, the creator can earn money each time someone enrols. Platforms like Skillshare or Udemy host such courses and handle the distribution, making it a potentially evergreen source of income as long as the content remains relevant and in demand.

Renting Out Property: Medium-term passive income can be generated by renting out property. Whether it's a spare room through the government's Rent a Room Scheme or a parking space via platforms like JustPark, this method can provide a steady income stream. The key here is the balance between the initial investment and the ongoing passive returns. Over time, as the mortgage is paid down, the income can become more passive and potentially increase if property values rise.

Creating Online Courses: From a long-term perspective, creating and selling online courses can be a lucrative source of passive income. Once the initial work of recording and uploading the course is done, the creator can earn money each time someone enrols. Platforms like Skillshare or Udemy host such courses and handle the distribution, making it a potentially evergreen source of income as long as the content remains relevant and in demand.

In conclusion, the impact of time frames on passive income can vary greatly depending on the type of investment and the effort involved. Short-term methods may require more frequent attention to rates and terms, while long-term strategies could yield higher returns with less ongoing effort. It's essential to consider your financial goals and the level of engagement you're willing to commit to when choosing the right passive income strategy for you.

0 notes

Text

Are money market accounts still a viable option for investors?

Money market accounts (MMAs) can still be a viable option for investors, depending on their financial goals, risk tolerance, and liquidity needs. MMAs are a type of savings account offered by banks and credit unions that typically offer higher interest rates compared to traditional savings accounts while providing easy access to funds. Here's a comprehensive explanation of the viability of money market accounts for investors:

Safety and Stability: Money market accounts are considered relatively safe and stable investment options. They are typically FDIC (Federal Deposit Insurance Corporation) insured up to certain limits, usually $250,000 per depositor per bank, providing a level of security against loss of principal.

Higher Interest Rates: While interest rates on money market accounts have generally been lower in recent years compared to historical averages, they still tend to offer higher yields compared to standard savings accounts. However, the interest rates on MMAs can vary based on market conditions and the policies of individual financial institutions.

Liquidity: One of the primary advantages of money market accounts is their liquidity. Investors can typically access their funds easily through checks, debit cards, or electronic transfers, making MMAs suitable for short-term savings goals or emergency funds.

Limited Risk Exposure: Money market accounts invest in short-term, low-risk securities such as Treasury bills, certificates of deposit (CDs), and commercial paper. While they offer higher returns than traditional savings accounts, they generally involve lower risk compared to other investment options such as stocks or bonds.

Regulatory Changes: It's essential for investors to stay informed about regulatory changes that may affect money market accounts. For example, during periods of financial instability, the government may implement temporary measures to support money market funds, as seen during the 2008 financial crisis. Changes in regulations can impact the yields, stability, and liquidity of MMAs.

Competition from Alternatives: With the rise of online banks and fintech companies, investors now have access to various high-yield savings accounts and other cash management tools that may offer competitive interest rates and features similar to MMAs. It's crucial for investors to compare rates, fees, and features across different options to find the best fit for their needs.

Inflation Risk: One potential downside of money market accounts, especially in periods of high inflation, is the risk of erosion of purchasing power. If the interest earned on an MMA does not outpace the rate of inflation, investors may experience a decrease in the real value of their savings over time.

In summary, money market accounts can still be a viable option for investors seeking safety, liquidity, and modest returns on their cash reserves. However, investors should carefully evaluate factors such as interest rates, fees, FDIC insurance coverage, and alternative options to determine whether MMAs align with their financial objectives and risk tolerance.

LTP Calculator Overview:

LTP Calculator is a comprehensive stock market trading tool that focuses on providing real-time data, particularly the last traded price of various stocks. Its functionality extends beyond a conventional calculator, offering insights and analytics crucial for traders navigating the complexities of the stock market.

Also Available on Play store - Get the App

Key Features:

Real-time Last Traded Price:

The core feature of LTP Calculator is its ability to provide users with the latest information on stock prices. This real-time data empowers traders to make timely decisions based on the most recent market movements.

User-Friendly Interface:

Designed with traders in mind, LTP Calculator boasts a user-friendly interface that simplifies complex market data. This accessibility ensures that both novice and experienced traders can leverage the tool effectively.

Analytical Tools:

Beyond basic price information, LTP Calculator incorporates analytical tools that help users assess market trends, volatility, and potential risks. This multifaceted approach enables traders to develop a comprehensive understanding of the stocks they are dealing with.

Customizable Alerts:

Recognizing the importance of staying informed, LTP Calculator allows users to set customizable alerts for specific stocks. This feature ensures that traders receive timely notifications about significant market movements affecting their portfolio.

Vinay Prakash Tiwari - The Visionary Founder:

At the helm of LTP Calculator is Vinay Prakash Tiwari, a renowned figure in the stock market training arena. With a moniker like "Investment Daddy," Tiwari has earned respect for his expertise and commitment to empowering individuals in the financial domain.

Professional Background:

Vinay Prakash Tiwari brings a wealth of experience to the table, having traversed the intricacies of the stock market for several decades. His journey as a stock market trainer has equipped him with insights into the challenges faced by traders, inspiring him to develop tools like LTP Calculator.

Philosophy and Approach:

Tiwari's approach to stock market training revolves around education, empowerment, and simplifying complexities. LTP Calculator reflects this philosophy, offering a tool that aligns with his vision of making stock market information accessible and understandable for all.

Educational Initiatives:

Apart from his contributions as a tool developer, Vinay Prakash Tiwari has actively engaged in educational initiatives. Through online courses, webinars, and seminars, he has shared his knowledge with aspiring traders, reinforcing his commitment to fostering financial literacy.

In conclusion, LTP Calculator stands as a testament to Vinay Prakash Tiwari's dedication to enhancing the trading experience. As the financial landscape continues to evolve, tools like LTP Calculator and visionaries like Tiwari sir play a pivotal role in shaping a more informed and empowered community of traders.

0 notes

Text

Elevate Your Space: Aesthetic Home Renovations for Your Bathroom on a Budget

Introduction:

Renovating your bathroom can be a transformative experience, turning a mundane space into a sanctuary of relaxation and rejuvenation. However, the prospect of renovating can often be daunting, especially when considering the associated costs. But fear not! With careful planning and strategic choices, achieving an aesthetic bathroom makeover on a budget is entirely feasible. In this blog post, we'll explore some savvy tips and tricks to elevate your bathroom on a budget.

Set a Realistic Budget:

Before diving into any renovation project, it's crucial to establish a realistic budget. Assess your finances and determine how much you're willing to allocate for the renovation. Remember to factor in both material costs and labor expenses. Setting a clear budget from the outset will guide your decision-making process and help you prioritize where to allocate your funds.

Focus on Essentials:

When working within a tight budget, it's essential to focus on the essentials. Identify the key elements that require attention in your bathroom renovation. This might include replacing worn-out fixtures, updating outdated tiles, or addressing any structural issues. By prioritizing essential upgrades, you can allocate your budget effectively and avoid unnecessary expenses.

Opt for Cost-Effective Materials:

You don't have to splurge on expensive materials to achieve a stylish bathroom aesthetic. Look for cost-effective alternatives that mimic the look of high-end materials. For example, ceramic tiles are a budget-friendly option for flooring and backsplashes, offering durability and versatility at a fraction of the cost of natural stone. Similarly, laminate countertops can provide a sleek and modern look without the hefty price tag of granite or quartz.

DIY Where Possible:

Save on labor costs by tackling some aspects of the renovation yourself. While certain tasks may require professional expertise, many aspects of bathroom renovation can be DIY-friendly, such as painting, installing new hardware, or even laying tiles. Just be sure to research proper techniques and safety precautions before diving into any DIY projects.

Explore Secondhand and Discount Options:

Don't overlook the potential treasures waiting to be found in secondhand stores, salvage yards, or online marketplaces. You'd be surprised at the quality and variety of gently used bathroom fixtures and materials available at a fraction of their retail price. Additionally, keep an eye out for clearance sales, promotions, and discount offers from home improvement stores to maximize savings on your renovation supplies.

Refresh Rather Than Replace:

In many cases, a simple refresh can breathe new life into your bathroom without the need for a full-scale renovation. Consider alternatives to replacing existing fixtures and surfaces, such as refinishing cabinets, reglazing bathtubs, or regrouting tiles. These budget-friendly options can yield impressive results and extend the lifespan of your bathroom components.

Conclusion:

Embarking on a bathroom renovation doesn't have to drain your bank account. By adopting a strategic approach and making savvy choices, you can achieve an aesthetic home makeover without overspending. Remember to set a realistic budget, prioritize essential upgrades, explore cost-effective materials, DIY where possible, seek out secondhand and discount options, and opt for refreshing existing fixtures where feasible. With these tips in mind, you'll be well on your way to creating a stylish and functional bathroom retreat that doesn't break the bank. Happy renovating!

0 notes

Text

Make 1K Every Day Fast And Simple Income Generating Proven Strategies for Success

To earn $1,000 every day, adopt proven income generating strategies that yield quick, significant returns. Seek out systems with a track record of financial success and user testimonials.

Making money quickly and consistently is a common goal for many, and reaching a target of $1,000 daily is an ambitious yet achievable objective. A multitude of online opportunities claim to offer the secret to financial prosperity, but discerning the legitimate from the too-good-to-be-true is crucial.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

Unlocking The Potential Of Daily Earnings

Unlocking the Potential of Daily Earnings is about turning each day into an opportunity. Imagine adding an extra $1,000 to your bank account daily. Such financial boosts can lead to a significant change in lifestyle and savings. Successful strategies exist. Follow them and you could see your income grow day by day.

Identifying High-profit Niches

Finding the right niche is critical for daily high-income potential. Look for industries with a huge demand but low competition. Do this by:

Researching market trends using tools like Google Trends.

Analyzing profitability through affiliate marketing platforms.

Spotting gaps in markets through customer reviews and forums.

Niches like health, wealth, and technology often promise better returns. Always ensure the niche aligns with your passion and expertise.

The Power Of Compound Earnings

Compound earnings can significantly increase your income over time. The key is to reinvest your earnings. See the power of compounding:

DayInitial Investment ($)Return Rate (%)Total Earnings ($)11,000101,100301,0001017,449

By consistently reinvesting your profits, small gains transform into large sums. Whether in stocks, savings accounts, or reinvestment in your business, compound earnings work.

Strategies That Deliver Results

Want to hit that 1K mark daily? Embrace strategies that work. Focus on tried-and-tested methods to generate income efficiently and effectively. The right strategies convert your efforts into steady earnings. Let’s dive into some powerful avenues for your financial breakthrough.

Leveraging Affiliate Marketing

Affiliate marketing offers a passive income stream. It’s simple: promote products and earn a commission for each sale. Start by choosing a niche you are passionate about. Next, find affiliate programs that fit your niche. These programs give you unique links to share. Share these links on your blog, social media, or email newsletters. When someone buys through your link, you get paid.

Join affiliate networks to find products to promote.

Understand your audience to offer relevant products.

Create high-quality content that adds value and includes your affiliate links.

Creating Digital Products

Digital products have high margins and unlimited potential. Think of ebooks, online courses, and software. They require upfront work but can earn money repeatedly without additional costs. Identify what you’re good at. Develop a product that solves problems or provides knowledge. Market your products online using social media, your website, and other platforms.

Type of Digital ProductDescriptionPotential IncomeEbooksWrite and sell your expertise.HighOnline CoursesTeach skills you’ve mastered.Very HighSoftwareCreate tools that help others.Scalable

Offering Freelance Services

Freelancing lets you capitalize on your skills. Millions outsource tasks and projects daily. Platforms like Upwork, Freelancer, and Fiverr connect freelancers with clients. Whether it’s writing, graphic design, or web development, you can offer services worldwide. Set competitive rates. Deliver top-notch work. Build a strong profile. Sustain a client base that trusts your expertise.

Set up profiles on freelancing platforms highlighting your skills.

Build a portfolio showcasing your best work.

Network to nurture client relationships and get repeat business.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

Strengthen Your Online Presence

Want to pocket an extra 1K daily? A powerful online presence is your secret weapon. Dive into strategies that catapult your success. Let’s explore!

Building A Persuasive Social Media Profile

Start with a smart profile picture. It’s your digital handshake. A professional headshot builds trust.

Write a bio that pops. In just a few words, tell your story. Make every word count.

Highlight your skills, what makes you unique.

Update regularly. Keep your achievements fresh.

Engage them. Post content they love. Respond to comments. Keep the conversation lively.

Effective Blogging Techniques

Create compelling headlines. Make them curious. They’ll want to read more.

Know your audience. Write what speaks to them. Solve their problems.

Use short paragraphs. Make it easy to read.

Include images. A picture says a thousand words.

Optimize with keywords. Get found on search engines. But keep it natural.

Call to action. Tell them what to do next. And make it stand out.

Maximizing Passive Income Streams

Earning $1K every day can seem like a dream, but it’s doable with passive income. Passive income streams require upfront effort or investment, but can pay off continuously. They are a key strategy for steady earnings without day-to-day work. Let’s explore some proven methods.

Investing In Dividend Stocks

One powerful revenue source is dividend stocks. Companies pay you just for holding their stock. Here’s how to get started:

Choose established, reliable companies.

Invest in diversified industries for safety.

Reinvest dividends for compounding interest.

Over time, the right portfolio might generate substantial daily income.

For clarity, here’s a simple comparison:

Stock TypeFrequency of PayPotential ReturnsHigh-yieldQuarterlyHigher risk, higher returnsBlue-chipAnnualStable, lower returns

Real Estate Income Opportunities

Real estate is another great way to earn passively. You can earn in two main ways:

Rental properties provide regular monthly income.

Real estate investment trusts (REITs) offer stock-like ease with dividends.

Both ways can help in hitting that $1K daily goal.

Here’s a snapshot of real estate income potential:

Property TypeExpected IncomeProperty ManagementSingle-family homeDepends on locationPossible self-managementMulti-family complexHigher potentialOften requires a manager

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

Automation And Scaling Up

Embracing the power of automation and scaling your businesses can transform the quest for making 1K every day from a dream into reality. It’s about working smarter, not harder. Leverage these strategies to multiply your revenue streams efficiently.

Incorporating Automation Tools

Time is money, and automation tools save you both. Automate mundane tasks. Discover tools that align with your business goals.

Email marketing software crafts and sends emails while you sleep.

Social media management platforms queue posts for optimal engagement.

Use accounting software for instant invoicing and expense tracking.

Simple integrations bring big impacts on efficiency. Select tools offering comprehensive analytics. This helps you understand what works for your audience.

Expanding Your Income Channels

Expand beyond one revenue stream. Diversify. More channels mean more opportunities to earn.

Start an e-commerce store. Sell goods related to your brand.

Create an online course. Share your expertise.

Explore affiliate marketing. Recommend products and earn commissions.

Each channel should fit your overall strategy. They must also resonate with your target audience. Observe market trends. Adapt and scale these channels as needed.

ChannelPotential EarningsEase of ScalingE-commerceHighMediumOnline CoursesVariesHighAffiliate MarketingLow to HighHigh

Review the performance of each channel. Reinvest profits for further growth. Success in scaling means careful planning and execution.

Adapting For Consistency And Growth

The journey to making 1K every day is an exciting challenge. The key to success lies in adapting for consistency and growth. You must navigate through changes and keep up the momentum. Let’s dive into strategies that can help you stay ahead of the game.

Adaptability In Market Trends

Staying ahead means knowing the market. Adaptability is about making quick changes. Here’s how:

Research — Keep an eye on market shifts.

Learn — Embrace new skills that the market demands.

Innovate — Try different methods to stand out.

Flexibility helps you use new trends to your advantage. It turns challenges into opportunities. Change is constant, and your strategy should be too.

Maintaining Growth Momentum

Growth is essential. Here’s how to maintain the momentum:

StrategyActionSet GoalsHave clear, measurable targets.Analyze DataReview your progress regularly.OptimizeAdjust strategies based on performance.

By setting goals and analyzing data, you make informed decisions. Optimization ensures your tactics stay effective. A strong foundation leads to sustainable earnings.

Frequently Asked Questions

Q. Can I Make $1000 Daily Online?

Yes, with the right strategies, such as affiliate marketing, freelancing, or e-commerce, earning $1000 daily is possible online.

Q. What Are Fast Income-generating Methods?

Quick income can be made through high-commission affiliate programs, dropshipping, or offering in-demand digital services like web design.

Q. Is Passive Income Achievable Quickly?

Building passive income streams like dividend stocks or rental properties typically takes time, but some digital products can yield faster results.

Q. Are There Proven Strategies To Make Money?

Absolutely, proven money-making strategies include investing in stocks, starting a blog with monetizable content, and creating online courses.

Q. How To Start Earning $1k From Home?

To earn $1K from home, look into remote jobs, begin freelance writing or graphic design, or set up a home-based business online.

Conclusion

Embracing these strategies can unlock the door to consistent financial growth. Forget long hours and complex methods; here’s a path to a simpler yet effective income boost. Start your journey towards earning $1k daily — your potential awaits. Take action, refine your approach, and watch success unfold.

Let’s make prosperity your new normal.

My Best Recommended & Proven Way to Make $100 Daily — Watch THIS FREE Training to START >>

Thanks for reading my article on How I Increase My New Website from 0 to 1000 of Daily Visitors Step-By-Step Guide

Affiliate Disclaimer :

This article Contain may be affiliate links, which means I receive a small commission at NO ADDITIONAL cost to you if you decide to purchase something. While we receive affiliate compensation for reviews / promotions on this article, we always offer honest opinions, users experiences and real views related to the product or service itself. Our goal is to help readers make the best purchasing decisions, however, the testimonies and opinions expressed are ours only. As always you should do your own thoughts to verify any claims, results and stats before making any kind of purchase. Clicking links or purchasing products recommended in this article may generate income for this product from affiliate commissions and you should assume we are compensated for any purchases you make. We review products and services you might find interesting. If you purchase them, we might get a share of the commission from the sale from our partners. This does not drive our decision as to whether or not a product is featured or recommended.

Source : Make 1K Every Day Fast And Simple Income Generating Proven Strategies for Success

#Fast income generation#Simple income strategies#Proven success methods#Making 1K daily#Quick income tactics#Easy money-making techniques#Rapid income growth#Efficient wealth building#Daily profit generation#Swift earnings approach#Streamlined wealth accumulation#Lucrative financial strategies#Speedy cash generation#Hassle-free income solutions#Reliable profit methods#Accelerated wealth creation#Instant revenue generation#Effortless income generation#Profitable success formulas#Rapid financial gains#Simplified wealth accumulation#Successful income blueprints#Swift profit generation#Efficient money-making plans#Quick success strategies

0 notes

Text

The Way To Switch Cash From One Bank To A Different

For a global switch, a third-party financial institution may facilitate the transaction. International wire transfers are additionally generally done using the Society for Worldwide Interbank Financial Telecommunication community. This just isn't an exhaustive listing, as many credit score unions and banks additionally offer related companies for free. As lengthy as you’ve confirmed the recipient, a financial institution wire switch is probably going the safest method to transfer money from one bank to another. An online switch by way of your bank’s website is another very secure option. To keep away from being scammed, concentrate on widespread schemes and solely transfer cash when you have a reliable cause for doing so and you know the recipient.

Debit card purchases, ATM withdrawals, checks and ACH transfers can all trigger overdrafts. Each financial institution has its personal fee construction for funds transfers with other establishments. Businesses additionally usually incur charges from their payment processor, just like they do with bank card funds. Because prospects usually initiate the transaction, it’s possible they may ship the wrong amount. There are methods to work around this—for instance, Stripe holds customers’ financial institution transfers and allows businesses to reconcile discrepancies for up to 90 days, in most cases. But you’ll nonetheless have to dedicate further time and resources to overpayment or underpayment points whenever you settle for financial institution transfers from clients.

youtube

Overdraft charges can put a dent in your wallet if you’re not careful. Here are a few methods to protect yourself against overdraft charges. Read on to study why we chose every financial institution, examine execs and cons and access particular person financial institution evaluations.

Tips On How To Get Overdraft Fees Refunded

This is to assist avoid sending cash to a scammer and reduce the chance of fraud. Before you make a bank switch you must at all times double-check that you've the required credit in your account. If you don't have the steadiness needed to satisfy the cost you might go overdrawn and be charged by your bank. If you're making a switch in person within the department and are unsure whether or not you manage to pay for, ask the financial institution teller to check before processing the transfer. Domestic wire transfers are processed in actual time and are often delivered within one business day.

Keep in thoughts that corporations might cost a payment for each sending and receiving wire transfers, and charges could improve if you’re sending the money to someone exterior the U.S.

Date of request On a business day - earlier than 1am Eastern time Date transfer shall be made Same day.

Depending on the circumstances of your switch, your funds might be received within minutes or up to a quantity of working days.

“Expert verified” signifies that our Financial Review Board completely evaluated the article for accuracy and readability.

You can also send wire transfers through money-transfer suppliers, which regularly have lower charges than conventional banks. Western Union, MoneyGram and Wise are examples of money switch suppliers. This method is best if both bank accounts are in your name. To transfer funds to somebody else, you may want to make use of a third-party payment provider or a wire switch.

Up to 4.60% APY on checking and savings account balances may be yours if you set up direct deposit or by depositing $5,000 or more each 30 days. Members with out direct deposit earn 1.20% APY on financial savings balances. Discover Bank provides a cash back checking account, a high-yield financial savings account, a money market account and CDs with terms from three months to 10 years. The cell app is extremely rated on the App Store and Google Play. For cell transactions funds will be paid to receiver’s mWallet account supplier for credit to account tied to receiver’s mobile number. Additional third-party expenses could apply, together with SMS and account over-limit and cash-out charges.

Select The Fastest Fee Possibility

Apply for a mortgage or refinance your mortgage with Chase. View today’s mortgage rates or calculate what you presumably can afford with our mortgage calculator. Open a savings account or open a Certificate of Deposit and start saving your cash. Learn more about what second chance banking is and the importance of a second probability bank account.

This digital account number automates reconciliation and prevents businesses from exposing their actual account details to prospects. Pay for your cash switch via credit/debit card1, or with your checking account. It’s straightforward to register and switch cash to another checking account via our mobile app or in individual today. To switch money to someone else’s checking account, you’ll have to have their details handy. Enter your recipient’s details to switch cash directly to their checking account. To enable non-Wells Fargo accounts for Transfers, extra security measures are required.

With bank to bank transfers, you can easily move money between your U.S. HSBC deposit accounts and your accounts at different U.S. financial institutions – together with banks and credit unions. There are some ways to do this, together with using your bank’s web site or mobile app, a personal examine, a cashier’s check, a wire switch or an ACH transaction. There are professionals and cons to each method, and a few come with switch fees. Check with your bank to see which method could be best for you based on these concerns.

ACH stands for Automated Clearing House, a network run by the National Automated Clearing House Association that enables banks and different monetary establishments to send and obtain cash. Nacha is an independent group owned by a big group of banks, credit score unions, and cost processing corporations. While bank-to-bank transfers are reliable, they aren’t the fastest approach to transfer money internationally. That’s why tens of millions of individuals worldwide select to switch money with Western Union.

While checks are getting much less and less frequent today, there are heaps of banks nonetheless accepting them. Once you’re all set up, you possibly can begin holding a steadiness in dozens of currencies — sending your cash all over the world. If your bank is in one other part of town, or you've a jam-packed schedule, this might be a difficulty. You and your recipient can be registered with the service and simply move the money between your accounts. You'll learn all about sending money inside the US and likewise tips on how to save when sending cash overseas with Wise.

Check your account for transfer charges deducted out of your account. Your financial institution may deduct a fee for sending the switch, and the receiving financial institution can also deduct a payment. The Wells Fargo Active Cash can be an excellent alternative on your balance transfer. Besides a generous intro supply, the cardboard offers ongoing worth through cash-back rewards. Still, make certain to do the maths to see if the offer is an effective match for you — and do not forget to consider other playing cards too. A steadiness switch frees up the credit score limit in your old card.

If you don’t have that info, get these numbers from a examine, from that account's online banking account, or from a representative at your bank. It also options its personal financial savings account and presents cryptocurrency investments. To decide which safe cost technique fits your wants, study concerning the six choices beneath, including how they work, how a lot they cost and which conditions they’re useful for. Money transfer apps are inexpensive and handy options for paying family and pals. Bankrate follows a strict editorial policy, so you'll have the ability to trust that we’re putting your interests first. Our award-winning editors and reporters create trustworthy and correct content material that will help you make the right monetary choices.

It is feasible that the money you might save is being made up through the change rate you may be supplied. A financial institution switch, also referred to as a wire switch, is a way to ship cash from one checking account to another anywhere in the world. Bank redirects are utilized in some online fee conditions.

Send money on the go, at the grocery store, the health club, or from wherever you might be with the Western Union® app. Browse by way of the article, which fits via varied forms of checks and the expiration pointers for every. Transactions are restricted as much as $2,500 per transaction, $5,000 every day .

Typically, sure but be taught extra in regards to the course of and benefits associated to opening a bank account for a young person. Find out more about bank's particular eligibility necessities when opening a model new bank account. Make positive you could have the needed documentation so as to open a checking account. Transferring cash between HSBC and different monetary establishments is straightforward. If you’re going to mail the money, a cash order is a more secure various to cash or a verify, since it may be traced and canceled if it will get lost or stolen. You can even get the Wise card, which you ought to use to pay for items and services all round the world.

This influences which products we write about and the place and how the product appears on a web page. Here is a list of our companions and here is how we make money. At NerdWallet, our content material goes through a rigorous editorial review process. We have such confidence in our correct and helpful content material that we let exterior specialists inspect our work. She beforehand labored as an editor, a author and a analysis analyst in industries starting from health care to market research.

0 notes

Text

The Way To Transfer Cash From One Financial Institution To Another

For a world transfer, a third-party bank might facilitate the transaction. International wire transfers are also typically carried out using the Society for Worldwide Interbank Financial Telecommunication network. This just isn't an exhaustive listing, as many credit score unions and banks additionally supply related providers at no cost. As lengthy as you’ve confirmed the recipient, a bank wire switch is likely the safest method to transfer money from one financial institution to another. An online transfer by way of your bank’s web site is another very safe choice. To keep away from being scammed, pay attention to frequent schemes and solely switch money if you have a reliable reason for doing so and you understand the recipient.

Debit card purchases, ATM withdrawals, checks and ACH transfers can all trigger overdrafts. Each financial institution has its personal charge structure for funds transfers with different establishments. Businesses additionally usually incur charges from their payment processor, just like they do with bank card payments. Because clients typically initiate the transaction, it’s potential they may ship the wrong quantity. There are methods to work round this—for example, Stripe holds customers’ bank transfers and allows companies to reconcile discrepancies for as much as ninety days, typically. But you’ll nonetheless need to commit additional time and sources to overpayment or underpayment points whenever you accept bank transfers from prospects.

youtube

Overdraft fees can put a dent in your pockets if you’re not cautious. Here are a quantity of methods to protect your self in opposition to overdraft fees. Read on to study why we selected each financial institution, compare professionals and cons and access individual financial institution evaluations.

Tips On How To Get Overdraft Charges Refunded

This is to help avoid sending money to a scammer and reduce the possibility of fraud. Before you make a bank transfer you should all the time double-check that you've the required credit in your account. If you do not have the stability needed to satisfy the cost you may go overdrawn and be charged by your financial institution. If you are making a transfer in individual within the branch and are unsure whether or not you manage to pay for, ask the bank teller to check earlier than processing the transfer. Domestic wire transfers are processed in real time and are normally delivered inside one business day.

Keep in thoughts that firms may cost a payment for both sending and receiving wire transfers, and charges may improve if you’re sending the money to someone exterior the united states

Peggy James is an professional in accounting, corporate finance, and personal finance.

Date of request On a enterprise day - before 1am Eastern time Date switch will be made Same day.

Depending on the circumstances of your transfer, your funds could be received within minutes or up to a number of working days.

You can even ship wire transfers by way of money-transfer providers, which frequently have lower fees than traditional banks. Western Union, MoneyGram and Wise are examples of cash switch providers. This technique is easiest if each bank accounts are in your name. To transfer funds to someone else, you could need to make use of a third-party payment supplier or a wire transfer.

Up to 4.60% APY on checking and financial savings account balances may be yours if you set up direct deposit or by depositing $5,000 or more each 30 days. Members without direct deposit earn 1.20% APY on financial savings balances. Discover Bank presents a cash again checking account, a high-yield financial savings account, a money market account and CDs with phrases from three months to 10 years. The cellular app is extremely rated on the App Store and Google Play. For mobile transactions funds might be paid to receiver’s mWallet account supplier for credit score to account tied to receiver’s cell quantity. Additional third-party charges could apply, together with SMS and account over-limit and cash-out charges.

Select The Quickest Cost Possibility

Apply for a mortgage or refinance your mortgage with Chase. View today’s mortgage charges or calculate what you can afford with our mortgage calculator. Open a financial savings account or open a Certificate of Deposit and start saving your money. Learn extra about what second chance banking is and the significance of a second likelihood bank account.

This virtual account number automates reconciliation and prevents businesses from exposing their real account particulars to customers. Pay for your money transfer through credit/debit card1, or along with your bank account. It’s easy to register and switch cash to another bank account through our cell app or in particular person today. To transfer money to somebody else’s bank account, you’ll need to have their details handy. Enter your recipient’s details to transfer money on to their checking account. To enable non-Wells Fargo accounts for Transfers, further security measures are required.

With financial institution to financial institution transfers, you probably can easily transfer cash between your U.S. HSBC deposit accounts and your accounts at other U.S. monetary establishments – together with banks and credit unions. There are many ways to do this, together with utilizing your bank’s web site or cellular app, a private verify, a cashier’s verify, a wire switch or an ACH transaction. There are professionals and cons to each methodology, and a few come with transfer charges. Check along with your financial institution to see which technique might be finest for you based on these issues.

ACH stands for Automated Clearing House, a network run by the National Automated Clearing House Association that enables banks and other financial institutions to send and obtain money. Nacha is an independent organization owned by a big group of banks, credit score unions, and fee processing firms. While bank-to-bank transfers are dependable, they aren’t the quickest approach to transfer money internationally. https://zil.us/bank-transfer/ why millions of individuals worldwide select to transfer money with Western Union.

While checks are getting much less and less common these days, there are tons of banks nonetheless accepting them. Once you’re all arrange, you can start holding a steadiness in dozens of currencies — sending your money all around the world. If your financial institution is in another a part of town, or you've a jam-packed schedule, this may be a difficulty. You and your recipient could be registered with the service and easily transfer the cash between your accounts. You'll learn all about sending money throughout the US and in addition the method to save when sending cash abroad with Wise.

Check your account for transfer charges deducted out of your account. Your financial institution could deduct a payment for sending the switch, and the receiving bank may deduct a charge. The Wells Fargo Active Cash could be a wonderful alternative on your balance transfer. Besides a beneficiant intro provide, the cardboard provides ongoing worth through cash-back rewards. Still, ensure to do the maths to see if the provide is an efficient match for you — and don't forget to suppose about different cards too. A stability transfer frees up the credit restrict in your old card.

If you don’t have that data, get these numbers from a examine, from that account's on-line banking account, or from a representative at your financial institution. It additionally features its own savings account and offers cryptocurrency investments. To decide which secure payment technique suits your wants, study in regards to the six options beneath, including how they work, how a lot they value and which situations they’re useful for. Money switch apps are cheap and handy choices for paying household and pals. Bankrate follows a strict editorial coverage, so you probably can trust that we’re placing your pursuits first. Our award-winning editors and reporters create sincere and correct content material that can help you make the best monetary selections.

It is possible that the money you would possibly save is being made up through the change rate you are offered. A financial institution switch, additionally called a wire transfer, is a approach to ship money from one checking account to a different anyplace in the world. Bank redirects are used in some online fee situations.

Send cash on the go, at the grocery store, the gym, or from wherever you might be with the Western Union® app. Browse through the article, which matches by way of various forms of checks and the expiration tips for each. Transactions are limited up to $2,500 per transaction, $5,000 every day .

Checking Accounts

Typically, yes but be taught more about the course of and advantages associated to opening a bank account for a teenager. Find out more about financial institution's specific eligibility necessities when opening a new checking account. Make positive you have the needed documentation so as to open a checking account. Transferring cash between HSBC and other monetary establishments is easy. If you’re going to mail the cash, a money order is a safer alternative to cash or a examine, since it might be traced and canceled if it will get lost or stolen. You also can get the Wise card, which you need to use to pay for items and companies all over the world.

This influences which merchandise we write about and the place and how the product appears on a page. Here is an inventory of our partners and here is how we generate income. At NerdWallet, our content goes via a rigorous editorial evaluation course of. We have such confidence in our accurate and helpful content that we let outside specialists examine our work. She previously worked as an editor, a author and a analysis analyst in industries starting from health care to market analysis.

1 note

·

View note

Text

“Unveiling the Untold: Inside Chime’s Revolutionary Banking Transformation”

“Discover the groundbreaking strategies that propelled Chime to the forefront of digital banking. Dive deep into the untold story behind Chime’s unprecedented success and learn how they revolutionized the banking industry. Uncover exclusive insights and unlock the secrets to driving engagement, attracting traffic, and skyrocketing views with Chime’s innovative approach”.

Chime Online Banking:

Revolutionizing Your Financial Game

Hey there, folks! If you’re tired of getting slapped with hefty fees every time you make a simple transaction, then buckle up because I’ve got something to say about it. Chime Online Banking is here to shake things up in the world of finance, and let me tell you, it’s about time!

The Frustration Ends Here

Ever felt like your traditional bank is out to get you? Well, you’re not alone. With hidden fees lurking around every corner and overdraft charges hitting you when you least expect it, it’s enough to make anyone see red. But fear not, because Chime is here to change the game.

Say Goodbye to Fees

One of the things I love most about Chime is its commitment to transparency. No more sneaky fees or surprise charges draining your hard-earned cash. With Chime, what you see is what you get, and let me tell you, it’s a breath of fresh air.

Banking Made Simple

Gone are the days of waiting in long lines at the bank or dealing with confusing paperwork. Chime makes banking simple and hassle-free, with everything you need right at your fingertips. From mobile check deposit to instant notifications, managing your money has never been easier.

Join the Revolution

So, what are you waiting for? Join the millions of people who have already made the switch to Chime and take back control of your finances today. Trust me, once you go Chime, you’ll never look back.

Chime Credit Card:

The Chime Credit Builder is a secured credit card offered by Chime, a financial technology company. Here are key points about the Chime Credit Builder:

Secured Credit Card: The Chime Credit Builder Visa® Credit Card is a secured credit card designed to help individuals build or rebuild their credit history.

No Annual Fee or Interest: This card has no annual fee and no interest charges, making it a cost-effective option for those looking to improve their credit without incurring additional expenses.

Security Deposit: To open an account, users are required to make a security deposit, which determines their credit limit. The amount deposited becomes the available credit limit for the card.

Build Credit History: By using the Chime Credit Builder responsibly, such as making on-time payments, users can build a positive credit history over time.

Regular Credit Card Use: The Chime Credit Builder Visa® Credit Card can be used like a regular credit card for everyday purchases, such as groceries, gas, or online shopping.

No Interest: Chime Credit Builder does not charge interest, making it a suitable option for those looking to avoid interest payments while building their credit history.

No Credit Check: Chime doesn’t require a credit check to open a Credit Builder account, making it accessible to individuals with limited or poor credit history.

No Monthly Fees:

Enjoy banking without worrying about monthly charges or hidden fees, allowing you to keep more of your hard-earned money.

High-Yield Savings Account: Grow your savings faster with Chime’s high-yield savings account, helping you reach your financial goals sooner.

Fee-Free Overdraft: Get fee-free overdraft protection up to $200, providing peace of mind and preventing unexpected charges.

Mobile Banking App: Access your account anytime, anywhere with the Chime mobile app, enabling you to check balances, deposit checks, and send money effortlessly.

Secure Credit Card: Chime offers a secured credit card option with no minimum-security deposit required, helping you build credit responsibly.

60,000+ Fee-Free ATMs: Access your money conveniently with a vast network of fee-free ATMs nationwide, making it easy to withdraw cash when needed.

ACH Payment Processing: Easily process ACH payments for seamless transactions and convenient bill payments.

Alerts and Notifications: Stay informed about your account activity with real-time alerts and notifications, ensuring you’re always in control of your finances.

User-Friendly Interface: Enjoy a user-friendly online and mobile banking experience, making it simple to manage your finances with ease.

Cash Management: Effectively manage your cash flow with Chime’s cash management features, allowing you to optimize your financial resources.

Chime Online Banking provides a comprehensive suite of features and benefits designed to simplify your banking experience and help you achieve your financial goals.

Love Always,

Maria D.C Santiago

#ChimeRevolution

#BankingWithoutFees

#SayNoToHiddenCharges

#SimplifyYourFinances

#ChimeInnovation

#TransparentBanking

#EasyMoneyManagement

#JoinTheChimeMovement

#FinancialFreedomWithChime

#NoMoreBankingBS

0 notes

Text

The Flare Account® - Online Banking & Savings

Prepaid Debit Card: Ace Flare offers a prepaid debit card that can be used for everyday purchases, online shopping, and ATM withdrawals. This card provides a convenient alternative to traditional banking services, especially for individuals who may not have access to a traditional bank account.

High-Yield Savings Account: In addition to the prepaid debit card, Ace Flare provides users with the option to open a high-yield savings account. This account allows you to earn interest on your savings while keeping your funds easily accessible.

Direct Deposit: Ace Flare allows you to set up direct deposit, enabling you to have your paychecks, government benefits, or tax refunds deposited directly into your account. This feature eliminates the need for paper checks and provides faster access to your funds.

Mobile Check Deposit: With the Ace Flare mobile app, you can conveniently deposit checks using your smartphone. Simply take a photo of the front and back of the check, and the funds will be deposited into your account, saving you a trip to the bank.

Budgeting Tools: Ace Flare offers budgeting tools and features that help you track your spending, set financial goals, and stay on top of your expenses. These tools provide valuable insights into your financial habits and help you make informed decisions to achieve your financial objectives.

Rewards Program: Ace Flare has a rewards program that allows you to earn cashback on qualifying purchases. By using your Ace Flare prepaid debit card for everyday expenses, you can accumulate rewards that can be redeemed for future purchases.

Customer Support: Ace Flare prides itself on providing excellent customer support. If you have any questions, concerns, or need assistance with your account, you can reach out to their customer service team via phone, email, or the support section of their website.

It's important to note that while Ace Flare offers a range of convenient and beneficial features, it's always recommended to carefully review the terms and conditions, including any associated fees, before opening an account.

Ace Flare Login provides you with a gateway to take advantage of these features and manage your finances effectively. Whether you're looking for a reliable prepaid debit card, a high-yield savings account, or user-friendly budgeting tools, Ace Flare offers a comprehensive solution to meet your financial needs.

0 notes

Text

Best ways to get more returns from online savings accounts

For most people, a savings account is the first bank account they open. And in most banks, you can do certain things to yield a higher interest for the money you put into your savings account. Normally, savings money will yield different interest rates depending on the bank. But when you have an online open saving account, you get returns in a number of other ways. Even today, not many people can make full use of a savings account because they don’t know how to use one. So, here are some suggestions that help you earn higher returns from your savings account.

Choose an account with a high-interest rate.

The best method to get the most out of your savings account is to open one with a bank that gives more appealing interest rates. After all, you will always receive greater profits if the interest rate is higher.

Before selecting the best bank, compare savings rates online. You can enhance the interest you receive on the money you have saved over time by even a small rise in the savings account interest rate.

Make use of the rewards offered on bank debit cards

You can earn good if you have a savings account that is also linked to a debit card. Well-known banks provide debit cardholders with a profusion of incentives, bonuses, and other privileges.

For example, when you purchase items from co-brands or shop online, you might be able to take advantage of discounts. When you online open saving account, certain bank debit cards even offer free insurance coverage. So, over time, you will be able to save a huge sum of money with the help of all these perks and rewards.

Set saving goals

One of the main reasons most people find it difficult to reach their financial goals of saving money is a lack of discipline. So, how can someone develop the self-control to save money? Decide how much money you want to save and how long you want to save it for.

Do not forget to create short-term savings goals that are reasonable and should be neither extremely difficult nor extremely easy to attain. This also holds true for long-term money savings goals. This is because a goal that is too simple will encourage you to procrastinate, but a goal that is too hard will deter you from continuing.

Try to open two or more savings accounts.

Creating two or more savings accounts will enable you to handle your money more simply and to benefit from additional advantages. This is due to the possibility that managing just one savings account can make it difficult for you to prevent money from being wasted.

The majority of people have connected their primary savings accounts to their online wallets and use online payment apps to pay different expenses. So, it's beneficial to have a second savings account that you use to deposit any money that you don't end up spending each month.

Final thoughts

So, if you are ready, use your bank’s mobile banking app and online open saving bank account to enjoy the benefits of an online savings account and mobile banking.

#0 account opening bank#account online opening#bank online application#bank saving account open#digital account opening#digital savings account#free online bank account#instant account#instant saving account#instant account opening#online account opening#online bank accounts opening#online bank opening account#online banking account open

0 notes

Text

Creating a Passive Income Stream: A Guide to Financial Assets

In the quest for financial independence, passive income has become a key objective for many individuals. The allure of earning money without the need to actively work for it each day is compelling. Passive income can come from various sources, and in this guide, we will explore a range of financial assets that can contribute to building a passive income stream.

Dividend Stocks: These are shares of companies that pay out a portion of their earnings to shareholders. Investing in dividend stocks can provide a regular income stream, and if chosen wisely, these stocks can also appreciate in value over time.

Here are the main indicators to consider:

Dividend Yield: This is the ratio of a company's annual dividends compared to its share price. It's expressed as a percentage and helps investors understand how much they can earn from dividends relative to the stock price.

Dividend Payout Ratio: This ratio measures the proportion of earnings paid out as dividends to shareholders. It's calculated by dividing the annual dividends per share by the earnings per share. A lower payout ratio may indicate that the company has room to grow its dividends, while a higher ratio could suggest a ceiling to growth or potential sustainability issues.

Dividend Coverage Ratio: This ratio assesses a company's ability to pay dividends based on its net income. It's the inverse of the dividend payout ratio and provides a buffer indicator; the higher the coverage ratio, the more secure the dividend payment.

Free Cash Flow to Equity (FCFE): Free cash flow to equity reflects the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. It's an important measure because it shows how much cash is available to be returned to shareholders in the form of dividends.

Net Debt to EBITDA: This ratio compares a company's total debt minus cash and cash equivalents to its earnings before interest, taxes, depreciation, and amortization. It gives investors an idea of how many years it would take for a company to pay back its debt if net debt and EBITDA are held constant. A lower ratio suggests a company is less burdened by debt and potentially in a better position to pay dividends.

Real Estate Investment Trusts (REITs): REITs are companies that own, operate, or finance income-generating real estate. They offer a way to invest in real estate without the need to directly manage properties, and they typically distribute at least 90% of their taxable income to shareholders in the form of dividends.

Bonds and Bond Funds: Bonds are debt securities issued by corporations or governments. Bond funds invest in a diversified portfolio of bonds and can provide regular interest payments, making them a stable passive income source.

Peer-to-Peer Lending: This involves lending money to individuals or businesses through online platforms. Investors can earn interest on the loans they provide, which can be a lucrative source of passive income.

The advantages of P2P lending platforms include the potential for higher returns for investors and more accessible loans for borrowers. Additionally, loans can be secured, providing some level of recourse should a borrower default. Some platforms also offer provision funds as a safety net for investors.

However, it's important to note that P2P lending is not without its risks. Investors' capital is at risk, and there may be charges if funds need to be withdrawn quickly. Returns can also be lower than expected if loans are repaid early.

For those considering P2P lending, whether as a borrower or an investor, it's crucial to conduct thorough research and understand the terms and conditions of the platform being used. It's also wise to diversify investments across different loans and platforms to mitigate risk.

High-Yield Savings Accounts and CDs: These are bank accounts that offer higher interest rates than regular savings accounts. Certificates of Deposit (CDs) are time-bound deposits that typically offer a fixed interest rate for the term of the CD.

Money Market Funds: These funds invest in short-term debt securities and can offer higher returns than traditional savings accounts, with relatively low risk.

Rental Properties: Owning rental real estate can provide a steady stream of income. However, it requires an upfront investment and can involve ongoing management responsibilities unless a property manager is employed.

Asset Sharing: This can include renting out a room, parking space, or even your car. It's a way to make money from assets you already own.

Asset Building: This involves creating something that can generate income over time, such as writing a book, developing an online course, or creating a blog with affiliate marketing.

Digital Products: Selling digital products like e-books, online courses, or stock photography can provide passive income. Once created, these products can be sold repeatedly without much additional effort.

Automated Businesses: Some businesses can be automated to a degree that they require minimal ongoing effort. This might include drop-shipping stores or websites with automated services.

It's crucial to understand that although these assets offer passive income potential, they typically demand an initial investment of time, money, or both. Furthermore, ongoing management or monitoring might be required to sustain and expand these income sources. Like any investment, there's inherent risk, so thorough research and diversification are essential to minimize potential losses.

Passive income can significantly contribute to achieving financial independence, but it's not a shortcut to instant wealth. It demands foresight, perseverance, and astute investment decisions. By examining the aforementioned options and identifying the right combination that aligns with your financial objectives and risk tolerance, you can construct a resilient passive income stream that bolsters your long-term financial security.

For comprehensive insights into each passive income avenue, consider delving into financial advisories and investment platforms offering customized guidance and opportunities. Remember, the cornerstone of successful passive income lies in establishing a coherent strategy and adapting it as you gain experience and cultivate your investments. Here's to prosperous investing!

0 notes

Text

How is using an online bank account helpful for you?

Most individuals have been using online banking for the last few years. There are many wonderful advantages to using an app or website for banking. Digital banking is any banking done online through a mobile application or website. It eliminates the need for clients to physically visit a branch by enabling them to conduct banking transactions and access banking services remotely. Because digital banking is so convenient and useful, it has grown in popularity recently. In today's fast-paced world, most people prefer instant bank account opening online. This post explains how using an online bank account is helpful for you:

Bank on your phone or tablet

Starting an online banking account does not require sitting at a computer; you can do it from your phone or tablet. Most bank websites are mobile-friendly, making accessing the internet on your preferred device simple. Furthermore, assistance is typically well-marked and offers live chat or a phone line to the department you require, so you don't have to worry about losing out on the in-person interaction.

Pay bills and make payments

The days of filling out long papers and sending checks to pay bills are long gone. You may use your bank's website to pay all your bills and make payments, which is one of the main advantages of online banking. In addition to sending money to friends and family, you can set up standing orders and direct debits. That is as convenient as it gets.

Minimize unnecessary costs with low-fee online accounts

More customers choose to new bank accounts open online because of their fee-friendly approach, which typically offers accounts with lower costs compared to traditional banks. Access to accounts with few or no fees is one advantage of using an online bank, including several high-yield savings accounts.

However, while comparing accounts from different online banks, thoroughly review the charge schedules like any other bank account. To save money, look for accounts with low or no fees for services like overdrafts, ATM usage, and monthly maintenance. You should also fulfill any other account requirements.

Control

Real-time access to managing and transferring money as needed and having self-serve control over your funds are two other important advantages of digital banking. There are typically no time limits on when you can carry out banking operations, such as depositing checks or transferring money between accounts, with mobile banking apps and websites, in contrast to traditional banking establishments. Also, navigating daily transactions is becoming simpler.

Keep on top of your finances

You will find it much easier to stay on top of your finances if you use online banking. In addition to checking your balance and seeing your transactions easily, you will also be able to view past payments to ensure they were made on time. You may also flag any unauthorized purchases more easily, allowing you to act quickly if you become aware of them.

Wrapping it up As a result, the above detailed are about how using online bank account helpful for you. Banks employ various technologies to guarantee that online banking is secure. Online and mobile banking systems can assist you with everyday banking duties, improve your financial management, and, in certain situations, link you to a group of like-minded people after new bank accounts open.

#best savings account#ebanking#instant online bank account opening#safe mobile banking#instant open bank account#manage bank account online#digital banking

0 notes

Text

Why should you have an online bank account?

While keeping all your extra cash in one checking account may be easier, you are restricting your options by not taking advantage of the potential income that money may yield. A better alternative could be to select the finest savings account. You can apply online account opening to make your transaction easier. Your greatest option to increase interest and receive additional benefits may be an online high-yield savings account. Below mentioned are the reasons to have an online banking account:

No monthly fees:

Your checking and savings accounts will typically be subject to monthly maintenance fees. These fees are pointless and take money away from your hard-earned cash. Some accounts will forgo the monthly maintenance cost if you maintain a specific amount or have a particular number of monthly direct deposits.

However, you shouldn't have to worry about whether you will be able to satisfy those demands month after month. Switching because most online banks don't impose monthly fees on checking or savings accounts is sufficient.

No need to waste your time in the bank:

Visiting a bank might occasionally seem like a complete waste of time, especially if you are only depositing or opening an account. Despite significant advancements in online banking, most well-known banks continue to invest heavily in maintaining physical branches.

When you need to finish anything crucial, using an online account eliminates the need for trips or standing in lines. Instead, you do everything from the convenience of your home, sign up, make a deposit, and schedule transactions. Many offer simple mobile apps that you may access directly from your phone.

Free budgeting and savings features:

Online-only banks are far more progressive regarding their online and mobile banking services. To assist you in managing your money, many have included various useful and cost-free savings features and budgeting apps. With bank accounts open online, you can integrate credit monitoring software and budgeting programs into your account. This enables a richer banking experience to help you better manage your money.

Easy to use:

The websites or applications of traditional banks can occasionally be challenging to use, especially for smaller regional banks or credit unions. That is because their primary business isn't using Internet banking technologies. But it is the sole transaction for internet banks. Online banks typically only engage with their customers through websites and mobile applications. Signing up, making transfers, and managing your money should be simple after you open the app on your phone or the website on your computer.

They are safe:

Read reviews and compare the features of each account before selecting an online bank. Doing so confirms that they are fee-free, have competitive prices, and offer high-quality security. You can earn and save far more money with the correct bank account.

Wrapping it up:

Deposit accounts, called online savings accounts, let you maintain and build your savings without going to a bank. You can understand why you apply online account opening from the points mentioned above. The yearly percentage yield on the interest you earn from these accounts may be competitive, frequently exceeding the national average.

#premium banking#digital account opening app#digital account app#kyc bank account#account opening form online#open new bank account online#premium mobile banking

0 notes