#kyc bank account

Text

Why should you have an online bank account?

While keeping all your extra cash in one checking account may be easier, you are restricting your options by not taking advantage of the potential income that money may yield. A better alternative could be to select the finest savings account. You can apply online account opening to make your transaction easier. Your greatest option to increase interest and receive additional benefits may be an online high-yield savings account. Below mentioned are the reasons to have an online banking account:

No monthly fees:

Your checking and savings accounts will typically be subject to monthly maintenance fees. These fees are pointless and take money away from your hard-earned cash. Some accounts will forgo the monthly maintenance cost if you maintain a specific amount or have a particular number of monthly direct deposits.

However, you shouldn't have to worry about whether you will be able to satisfy those demands month after month. Switching because most online banks don't impose monthly fees on checking or savings accounts is sufficient.

No need to waste your time in the bank:

Visiting a bank might occasionally seem like a complete waste of time, especially if you are only depositing or opening an account. Despite significant advancements in online banking, most well-known banks continue to invest heavily in maintaining physical branches.

When you need to finish anything crucial, using an online account eliminates the need for trips or standing in lines. Instead, you do everything from the convenience of your home, sign up, make a deposit, and schedule transactions. Many offer simple mobile apps that you may access directly from your phone.

Free budgeting and savings features:

Online-only banks are far more progressive regarding their online and mobile banking services. To assist you in managing your money, many have included various useful and cost-free savings features and budgeting apps. With bank accounts open online, you can integrate credit monitoring software and budgeting programs into your account. This enables a richer banking experience to help you better manage your money.

Easy to use:

The websites or applications of traditional banks can occasionally be challenging to use, especially for smaller regional banks or credit unions. That is because their primary business isn't using Internet banking technologies. But it is the sole transaction for internet banks. Online banks typically only engage with their customers through websites and mobile applications. Signing up, making transfers, and managing your money should be simple after you open the app on your phone or the website on your computer.

They are safe:

Read reviews and compare the features of each account before selecting an online bank. Doing so confirms that they are fee-free, have competitive prices, and offer high-quality security. You can earn and save far more money with the correct bank account.

Wrapping it up:

Deposit accounts, called online savings accounts, let you maintain and build your savings without going to a bank. You can understand why you apply online account opening from the points mentioned above. The yearly percentage yield on the interest you earn from these accounts may be competitive, frequently exceeding the national average.

#premium banking#digital account opening app#digital account app#kyc bank account#account opening form online#open new bank account online#premium mobile banking

0 notes

Text

How to choose a मोबाइल बैंकिंग account without struggle

Many years ago, it was not easy to find legit मोबाइल बैंकिंग platforms or sites. It was just an impossible thing to do. However, these online banks have taken over. Additionally, most major financial institutions provide the finest online banking experience. That is definitely one thing that counts. With the many options that avail these days for you to have fun with banking, there is nothing wrong. Do not rush to choose just any bank. Do your best to choose the right bank to ensure your every need is met as it should be.

Some guidelines to help you with deciding

1. Is the online bank insured. There are different and authorized licensing bodies that when a मोबाइल बैंकिंग is linked to represents safety for you. So, you need to check to find out if that is the case. The only banks that require consideration are banks that are insured and have evidence you can verify. That is definitely one thing you need to be interested in. without the legit license, you do not need to join that online bank.

2. Check out their interest rates. The best online बैंक खाता for you should be that one that makes it possible for you to have the best interest rates. Always remember that you want a good online bank and not other stuff. You need to be ready to make the right decisions to ensure nothing goes wrong where interest rates come in. Shop around the internet to find out these interest rates and you will definitely be a happier you. If the interest rates are not checked and compared, you are the one who will end up losing.

3. No minimums and no charges or fees. If the account will require you paying fees then it is not the best. You should also do not need to be pressured to keep any minimum balance in your account all the time when you need your money.

4. Customer service should be 24/7. You should be able to get the online bank to assist you all the time. Most people do not know that the right client service experience is the best. You do not want to deal with a bank that doesn’t see your problems as a matter of concern. During or outside of normal business hours, you should be able to get the assistance you need. When you need help and there is no one available, it doesn’t help at all. That is why you need to decide precisely.

5. Any incentives. The best बैंक खाताonline should come with the finest incentives for you. These incentives will help make your use of the account exciting. Always have it in mind that the best incentives doesn’t mean the bank online is the best. However, it helps you to gain more from the bank.

You should be sure that the bank provides you with the finest mobile banking features too. This will make it very easy for you to access your bank wherever and whenever you are.

Conclusion

Understanding how the right online बैंक खाता can help you is all that matters. So, choose to check out these out to keep you on the right direction. Having the right help through tips will keep you from falling into the same ditch that others fell into. That counts much.

#kotak#Kotak811#Money Transfer App In India All Bank#Rtgs Money Transfer#Money Transfer App International#Rtgs Money Transfer App#Kyc Mobile App#Fund Transfer#Dth And Mobile Recharges#Book Flights And Hotels#Pay Credit Card Bills#Digital Banking India#Money Transfer Bank App#Premium Mobile Banking#Kyc Bank Account#Apply For Credit Cards#Payment Banks In India

1 note

·

View note

Text

A Simplified Guide for Education Loan Repayment

Education loans are beneficial for people achieving their academic dreams. But the repayment process can often filled with lots of confusions. Getting educational loan isn't that much hard as you think. With an online open savings bank account and necessary documents, you can easily apply for an educational loan. However, with a structured approach and understanding of available options, managing education loan repayments becomes manageable. If you are thinking about getting an education loan or have already got one, this guide explores actionable steps to ensure a smooth repayment journey.

Understanding Loan Terms and Conditions

Before discussing repayment, thoroughly review the terms and conditions of your education loan. Understand interest rates, repayment schedules, and any additional fees associated with the loan. Evaluate your current financial status to determine how much you can afford to repay each month. Consider factors such as income, expenses, and other financial obligations to make the best deals.

Setting Up a Zero Balance Bank Account

To streamline repayment, consider zero balance account opening app specifically dedicated to loan repayments. This account ensures that your loan payments are separated from your regular expenses, making it easier to track and manage repayments. This account will serve as the primary channel for efficiently managing your education loan payments.

Exploring Repayment Options

Familiarize yourself with the various repayment options available for education loans. These may include standard repayment plans, income-driven repayment plans, or refinancing options. Select the repayment plan that most closely matches your financial circumstances and objectives. Develop a repayment strategy based on your financial capabilities and loan terms. Determine whether you'll make fixed monthly payments or opt for a flexible repayment plan. Set realistic goals and timelines to stay on track with your repayment journey.

Automating Loan Payments

Take advantage of automatic payment options offered by lenders or banking institutions. Automating your loan payments ensures timely and consistent repayments, reducing the risk of missed deadlines and late fees. Incorporate loan repayments into your monthly budgeting process. Prioritize loan payments alongside essential expenses to ensure they're accounted for each month. As your income or expenses fluctuate, make the necessary adjustments to your budget.

Seeking Assistance if Needed

Banks provide you with a particular period called a moratorium period, which denotes the time period between your course completion and your first EMI. You may get a job immediately or not. Depending on your situation, the period will differ. If you encounter financial difficulties or anticipate challenges in meeting repayment obligations, don't hesitate to reach out to your lender. Many lenders offer assistance programs or loan modification options to help borrowers manage their loans effectively.

Monitoring Progress and Making Adjustments

Monitor your loan repayment progress regularly and make adjustments as necessary. Stay informed about your remaining balance, interest accrual, and any changes to repayment terms. Adjust your strategy if your financial situation or goals evolve over time.

Final thoughts

Education loan repayment doesn't have to be overwhelming. By following this simplified guide and leveraging available resources, you can navigate the repayment process with confidence and achieve financial freedom. Many banks offer the convenience of online open savings bank account. Take advantage of this facility to establish a designated account for loan repayments.

#kyc service#kyc for low risk customers#kyc search#bank balance#upi transaction id status check#upi transaction tracking#transaction status check#track upi transaction#upi transaction check online#check my transaction status#verify bank statement online#zero balance account opening#zero balance minor account opening online

0 notes

Text

What type of banking can one do with online banking options?

Today, everyone has started using online and mobile banking extensively. People accepted them quickly because online and mobile app banking are so convenient. Managing your bank accounts has also become simple in the modern digital age. You can now access a variety of banking services anytime, anyplace, with just a few clicks on your computer or taps on your smartphone. If you don’t have an account currently, start open mobile bank account using your bank’s official website or smartphone app. If you open a bank account online and use banking services online, you can do the following with ease:

Real-time account monitoring

Checking bank balances is one of the best features of online banking. The real-time account balance checking feature is one of the main benefits of using online and mobile app banking. The days of waiting for paper statements to show up in the mail are long gone. Regular online bank account monitoring lets you promptly detect suspicions or unapproved transactions. This enables you to take appropriate measures to fix them and save your savings money.

Notifications for pending transactions

Online bank accounts also let you check your pending transactions. This is a feature that many online banking apps and websites offer. They alert you to impending charges and deposits you forgot. Remember that the final amount posted to your account may not match the amount of pending debit card transactions. To avoid any miscommunication, you should clearly understand your bank's funds availability policy.

Automated notifications

The useful feature of automatic bank-related notifications keeps you updated on important account activities. These alerts allow you to handle your money proactively, whether through direct deposits, sizable payments, or low-balance warnings. Using online banking helps you receive bank-related alerts via text, email, or through the mobile app and tailor them to your preferences.

Quick mobile check deposits

Mobile check deposit is a super convenient option for those who would rather deposit checks online without going to a bank branch. To finish the deposit, you only need to take a picture of the check with your smartphone and adhere to the directions on the mobile banking app. Keep the physical check safe, and remember to dispose of it safely afterward.

Easy fund transfers

Online banking and mobile apps make moving money across accounts or financial organizations easy. These platforms provide safe and effective transfer choices, whether you're transferring money to pay off debt or save for the future. It is crucial to confirm the accuracy of your bank account and routing numbers to guarantee successful money transactions.

Focus on security

Finally, security is a top priority for both mobile and online banking to safeguard your private data. When handling your bank accounts digitally, you can reduce risks and feel at ease by following suggested security protocols. It is also important to use extra protections provided by your bank.

Final thoughts

In the end, you can’t deny the unmatched ease, accessibility, and security that online banking platforms offer. Online banking completely transforms the way you deal with your money. By making good use of these tools, you can simplify your banking process and maintain control over your financial situation.

#kyc verification process#kyc service#check account balance#check my bank balance#bank balance enquiry#check my account balance#check upi transaction status#upi transaction check#track upi transaction#check my transaction status#upi pay#upi application#download upi app

0 notes

Text

0 notes

Text

Is your lending platform Account Aggregator ready?

Account Aggregators are here to transform the digital lending sector as they bring absolute control for borrowers along with great convenience for lenders making it a win-win for both. Regulated and mandated by RBI, the Account Aggregation framework can be best defined as a platform collecting user’s personal financial data from Financial Information Providers (FIP) with consent and sharing it with the Financial Information Users (FIU) such as lenders making the process much faster while ensuring data is secured.

What does this mean for a User?

User-Controlled Data Sharing:

AA framework gives the users control of their data like nothing ever has. Known as an interoperable data-blind consent manager, this platform cannot read, use or sell consumer data which is encrypted by the user with digital signatures. The AA simply collects data and transfers it to FIUs who can decrypt and use the data as consented for. It equips the user to share data selectively, for a stipulated duration of time, and even withdraw the data once shared; giving the user complete visibility of when and where the data is being shared.

Simplifying Wealth Management:

Calling the AA system as your one-stop solution for managing multifarious financial assets and transactions wouldn’t be wrong. The user may consolidate all financial data across various applications to create a single touch-point through an account aggregator empowering the user in more ways than one. Along with the ease of sharing data with the service provider, the user gets a wholesome look at the portfolio and is able to closely monitor expenditure thus making wealth management simpler, faster and more secure. Consolidated data showing cash inflows through various sources can also help enhance a user’s credit scoring and underwriting.

Accelerating Lending Operations:

A consolidated system will eventually improve the efficiency of every financial operation. Registering on an AA platform via a financial entity eliminates a lot of time-consuming processes like queuing outside the bank, KYC, stamping documents et al. The lending agency can now quickly pull out borrowers’ accurate financial history, follow due diligence digitally and expedite the lending process.

Data on Fingertips:

The best part about getting on the AA framework? Consent, data-tracking, or connecting to the agency of your choice can now be managed through a simple app on the phone! Finally, feel in control? Yes, you are.

Read More: https://www.novopaybanking.com/blog/is-your-lending-platform-account-aggregator-ready

#digital lending#dasta sharing#data security#account aggregator#digital distribution solution#kyc for banking#retailers provide banking solutions#saas solutions#aeps

0 notes

Text

Manage Your Money With Best Bank Reconciliation Software - Approved

At TrustEasy, we understand that managing your finances can be a difficult and time-consuming task. That's why we've developed the best bank reconciliation software on the market. Our software helps you keep track of your income and expenses, so you can see where your money is going each month. In addition, our software makes it easy to reconcile your accounts and spot any discrepancies. As a result, you can have complete peace of mind knowing that your finances are in order. With TrustEasy, managing your money is easy! Visit us at https://trusteasy.com.au/bank-feeds-reconciliation/ to learn more!

#trust accounting#bank feeds reconciliation#tax refund in one hour#KYC for accounting firm#audit trail accounting software

0 notes

Text

Are you looking for a platform where your trading ideas can flourish? Look no further than the Stay Connected United Exchange's Community. Trade like a legend on the legendary Crypto Exchange. United exchange is a simple platform that you can use to sell and Buy Bitcoin, Ethereum, and other cryptocurrencies and store them in our secure wallets.

Bitcoin, a global cryptocurrency was invented in 2008 by an unknown person or set of people using the name Satoshi Nakamoto which was primarily invented to be used as a medium of exchange in place of the fiat currency (INR, USD etc). The developers of Bitcoin hoped it to be backed by countries.

Bitcoin enables peer-to-peer transactions. The only difference is you don’t have to pay high transaction fees, and there is no centralized authority that regulates the working of Bitcoin. It uses the SHA-256 algorithm to ensure security.

While sending and receiving the money using Bitcoin, the anonymity of the user is maintained. It allows individuals to own their own money (without dependence on banks) and aims to bring financial stability for people who live in countries with unstable currencies.

In totality, 21 million bitcoins can be mined, whereas nearly 18 million coins have been mined. Once all these coins have been mined, the supply of bitcoins will be exhausted and the prices go up in this anticipation. At the moment, one BTC costs around 43, 58,343.74 Indian Rupee (INR), which would change the very next moment.

How to buy Bitcoin at United Exchange?

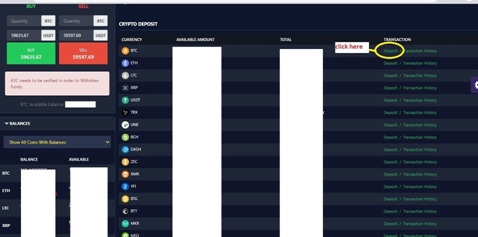

Once you have registered on our platform and completed the process of the KYC. Here are some simple methods by which you can buy Bitcoin on our platform-

Directly using your Credit card: United Exchange offers the safest route for your banking transactions, where you can buy Bitcoin directly using your Credit card. Remember to fund your account beforehand with FIAT Currencies. The process is quite short and simple. If your account has the necessary funding, all you need is to go to the deposit BTC option by click on the ‘deposits option’ on the main page and buy the desired amount of BTC.

Follow the steps written below, when you want to deposit money in BTC at United Exchange.

1. Log into your account and click on the ‘Deposit’ option on the top-left side of the screen. A page like the given below would open. Then click on ‘Deposit’ encircled in yellow.

2. A window like shown below would appear. Click on the ‘Confirm’ option.

3.After clicking on the confirm option, a new page would appear with a QR Code and a unique link, which you would copy to transfer Bitcoins.

How to store Bitcoin?

We are done buying the BTC, now the most important thing is to store. The best option is to store in “Wallets”-esp., Cold Wallets (just like the one which UE provides), which are 100 hack-proof and offline.

Now what?

There are a plenty of options available on United Exchange on what to do with your BTC. These are referred below-

Holding: You can hold BTC on UE for as long as you want, or as long as you think that the prices are going to increase. Simply store them in our ultra-safe cold wallets.

Trade: There are more than 30 crypto-currencies available at our platform, most of which are tradable with BTC. So, GO AHEAD, and trade all you want! Not to forget we charge a very minimal trading fee of only- 0.2%.

Send: Easily send anyone, anywhere around the world, which have BTC Balances in their wallets.

Enhance knowledge: Visit our website’s main page United Exchange Blogs and read extensive blogs about Crypto and all related concepts. Don’t worry! We update them regularly!!

#Buy Bitcoin#Buy Bitcoin Instantly#BTC#Buy Bitcoin In India#Crypto Exchange#Crypto Trading#Buy BTC In India#cryptocurrency#marketing#sales#bitcoin#success#investing

9 notes

·

View notes

Text

High-Risk Payment Processing Techniques: Best Practices

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In the ever-evolving realm of e-commerce, payment processing takes center stage, enabling businesses to smoothly accept credit card payments and ensure seamless customer transactions. However, for industries deemed high-risk, such as credit repair and CBD sales, navigating the payment processing landscape presents distinct challenges. In this article, we dive into the intricacies of high-risk payment processing methods and present best practices to guarantee secure and efficient transactions. Whether you're a newcomer to high-risk payment processing or looking to refine your current strategies, these insights will steer you toward favorable outcomes.

DOWNLOAD THE HIGH-RISK PAYMENT PROCESSING INFOGRAPHIC HERE

Understanding High-Risk Payment Processing

Effective navigation of the high-risk payment processing sphere necessitates a clear comprehension of high-risk industries. Sectors like credit repair and CBD sales often fall into this category due to intricate regulations and an elevated risk of chargebacks. Consequently, high-risk merchants require specialized payment processing solutions tailored to mitigate associated risks.

The Importance of Merchant Accounts

Merchant accounts form the backbone of efficient payment processing. These accounts, specifically designed for high-risk businesses, facilitate the secure transfer of funds from customers' credit cards to the merchant's bank account. Establishing a high-risk merchant account ensures seamless payment processing, enabling businesses to broaden their customer base and enhance revenue streams.

Exploring High-Risk Payment Gateways

High-risk payment gateways serve as virtual checkpoints between customers and merchants. These gateways safeguard sensitive financial information by encrypting data during transactions. When selecting a high-risk payment gateway, emphasize security features and compatibility with your business model to guarantee safe and smooth payment processing.

Tailored Solutions for Credit Repair Businesses

Credit repair merchants face unique challenges due to the industry's regulatory landscape. Obtaining a credit repair merchant account equipped with specialized payment processing solutions can aid in navigating these complexities. Implementing robust Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures ensures compliance and fosters customer trust.

CBD Sales and Payment Processing

CBD merchants operate in a market brimming with potential but also shrouded in uncertainty. Shifting regulations demand a flexible approach to CBD payment processing. Collaboration with experienced payment processors well-versed in the intricacies of CBD sales and the utilization of age verification systems can streamline transactions and bolster customer confidence.

Mitigating Chargeback Risks

Chargebacks pose a significant threat to high-risk merchants, frequently arising from disputes, fraud, or unsatisfactory service. Proactively address this issue by providing exceptional customer support, transparent refund policies, and clear product descriptions. Consistent communication can forestall chargebacks and maintain a healthy merchant-consumer relationship.

youtube

Future-Proofing High-Risk Payment Processing

Advancing technology necessitates the evolution of high-risk payment processing techniques to stay ahead of potential threats. Embrace emerging solutions like AI-driven fraud detection and biometric authentication to enhance security and streamline payment processing. Staying informed and adapting to industry trends ensures the future-proofing of payment processing strategies for high-risk merchants.

High-risk payment processing amalgamates industry knowledge, tailored solutions, and cutting-edge security measures. Whether operating in credit repair or CBD sales, a comprehensive understanding of high-risk payment processing intricacies is imperative. Leveraging specialized merchant accounts, payment gateways, and proactive chargeback prevention methods enables high-risk merchants to confidently accept credit card payments and cultivate long-term customer relationships. In an ever-evolving landscape, embracing innovative payment processing solutions guarantees a secure and prosperous future for high-risk businesses.

#high risk merchant account#high risk payment gateway#high risk payment processing#merchant processing#payment processing#credit card payment#credit card processing#accept credit cards#Youtube

17 notes

·

View notes

Text

FTX's very bad november

here are some bullet points of the key things that happened to stupid 'it turns out it was never actually a business' 40 billion dollar cryptocurrency exchange FTX this month. very funny please read more!

FTX is the 'smart, legal, pro-regulation' bitcoin exchange (a bank) beloved by athletes and US Senators alike. They are one of the five largest businesses in the crypto space, and are valued at up to $32,000,000,0000 (32B USD).

1b. FTX mints its own token, 'FT Token / FTT', which has a use-case for their advanced trading services as well as serving as a speculative asset that represents consumer trust.

2. FTX establishes a sister firm, "Alameda Research", which acted as its own market actor and research publisher. Alameda Research also have massive resources on their balance sheet.

3. When the Terra / Luna stablecoin disastrously lost its peg to the dollar earlier this year, crypto lost $60B of valuation. Everything fell, but unlike some stuff, FTT recovered.

3b. during this crisis, Alameda stepped in as a 'lender of last resort'; bailing out the liquidity-crisis-shocked crypto businesses by selling them emergency loans.

4. On November 02 (two weeks ago!) Coindesk published an exposé showing that a lot of Alameda Research's balance sheet was, basically, IOU's from FTX - the lender of last resort was a shell game.

5. at this point (i'm hazy on details!) the three FTX founders - "the Crypto King" "SBF"; Gary; and Nishad - start fighting a lot on twitter about something offline, in particular with their competitors Binance, the #1 company in the crypto space.

6. Binance sells all the FTT in its vaults. Billions of dollars' worth?

7. The market value of an FTT drops from $24 USD to $3. (an 87.5% drop in value)

8. 36 hours later, seeing FTX about to declare bankruptcy, Binance offers to buy FTX in a bailout. Binance lawyers ask to see FTX's most secret internal accounting documents.

8b. FTX provides something, which Binance aren't happy with, and Binance backs out of their offer to buy FTX.

9. a "hacker" steals between $300M-$500M USD worth of various coins and tokens from not only FTX's 'hot wallet' (actual liquid funds) but ALSO from its 'cold wallets' (which an outside hacker has no access to).

9b. in transferring these funds out of FTX and into a wallet for Tether (a stablecoin), the "hacker" doesn't have enough "TRX" to pay the gas to actually move the money. so they panic and uses TRX from their own wallet.

10. That wallet was on the Kraken ecosystem, and TRX is for the Tron Network, and both Tron and Kraken have KYC ('know your customer') ID requirements to use their systems, linking the wallet used to facilitate the theft to a driver's license and banking and contact information etc.

10b. the head of security for Kraken posts on twitter "We know the identity of the user."

11. the Bahamaian police (they spent company money on a big poly mansion on the Bahamas and so this all happens there) detain the three FTX founders

12. FTX goes from being worth $30-40 billion USD to bankrupt, nothing, goose egg, kanye voice: couldn't give a homeless guy change, its principals arrested, detained by island police as foreign billionaires, investigated by the Bahamaian money laundering authorities (lmao), investigated by America for the Tether theft (lmfao)

13. lmfao

47 notes

·

View notes

Text

From Click to Account: A Reflection on Customer Journey in Digital Bank

As a product manager for a digital bank, my journey mirrors the complexities and nuances highlighted in Adam Richardson's discussion on customer journey maps. Our mission, to open a bank account in under five minutes, isn't just a goal; it's a promise to our customers. This commitment starts with our presence on partner platforms and referrals, the initial touchpoints that introduce potential customers to our digital realm. These channels not only showcase our brand but also set the stage for the seamless experience that lies ahead.

The transition from advertisement to application download is a critical juncture in our customer’s journey. It embodies the shift from curiosity to action, a leap facilitated by our app's intuitive design and user-friendly interface. Here, the customer journey mapping becomes pivotal. By understanding each step's actions, motivations, and potential barriers, we've crafted a pathway that resonates with our users’ desires for efficiency and simplicity, ensuring that the excitement of a new banking experience is not marred by complexity.

The electronic Know Your Customer (e-KYC) process stands as a testament to our brand's promise of swift and smooth account opening. In this phase, our focus on minimizing barriers and answering customer questions preemptively comes to the forefront. By streamlining the KYC, we address common pain points and uncertainties, mirroring the framework's emphasis on clarifying the customer's journey and enhancing their experience.

Our commitment doesn’t end at account opening. Ensuring that customers can effortlessly navigate through their banking activities is paramount. This ongoing engagement reflects the 'out-of-box-experience' (OOBE) concept mentioned by Richardson, where the initial interaction with the product sets the tone for the entire customer relationship. Our dedication to a frictionless experience is our script, played out through each transaction, inquiry, and interaction within our digital banking platform.

Just as the customer journey map is an evolving blueprint, our approach to digital banking is perpetually in refinement. Drawing inspiration from the article, we recognize the non-linear nature of customer interactions and the importance of understanding each phase deeply. By continually revisiting and revising our customer journey map, we not only uphold our brand promise but also anticipate and adapt to the changing needs and expectations of our customers, ensuring a dynamic and responsive banking experience.

This iterative process, guided by insights like those shared by Richardson, enables us to maintain a clear focus on what truly matters: delivering a banking experience that is not just efficient but also empowering and engaging for our customers.

2 notes

·

View notes

Text

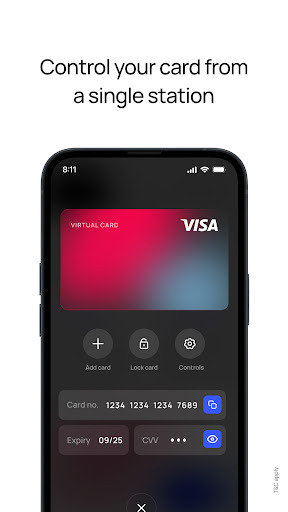

Open a zero balance savings account, scan QR & transfer money via secure UPI

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!

#kyc verification process#kyc procedure#account bank balance check#bank balance enquiry#upi transaction check online#check status of upi transaction

0 notes

Text

Open a zero balance savings account, scan QR & transfer money via secure UPI

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!

#kyc verification process#kyc service#account balance check#account bank balance check#bank balance enquiry#check balance online#check upi transaction status#track upi transaction#check upi transaction details

1 note

·

View note

Text

Buy Verified Binance Account

3 notes

·

View notes

Text

PHEMEX Exchange

Founded by former executives of Morgan Stanley in 2019, Phemex stands as a leading cryptocurrency futures exchange, facilitating the trading of diverse digital assets such as Bitcoin, Ethereum, Solana, Avalanche, Shiba Inu, and over 250 others. With a commitment to serving both professional and retail traders, Phemex offers an intuitive interface, competitive fees, tight spreads, and lightning-fast execution speeds.

Unleash the power of Phemex, the visionary platform that empowers traders worldwide. Trade a vast array of digital assets, including renowned cryptocurrencies like Bitcoin, Ethereum, and Ripple. Phemex caters to both spot and margin trading, ensuring that even the most seasoned traders have access to advanced tools and features. Experience the advantage of Phemex’s minimal fees, enabling you to maximize your profits. Available in over 180 countries, Phemex welcomes traders from around the globe to embark on an exciting journey towards financial success.

PHEMEX: Secure and Reliable?

Phemex assures safety as a regulated cryptocurrency exchange, duly registered with the US Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC). This regulatory oversight mandates stringent financial compliance, including robust anti-money laundering (AML) and countering-the-financing-of-terrorism (CFT) measures.

Rest easy knowing that Phemex provides a secure haven for buying, selling, and trading digital assets. As a testament to its credibility, the platform boasts support from industry giants like Galaxy Digital and BitMEX, cementing its position as a trusted choice in the cryptocurrency landscape. Embrace the peace of mind that comes with Phemex’s commitment to safety and the backing of renowned investors.

PHEMEX Trading Fees

Phemex stands out as the most cost-effective exchange globally, offering an unprecedented 0.025% rebate on market maker orders. Here’s how it works: when you place a limit order on Phemex and it successfully matches with another trade, Phemex will reward you with a 0.025% rebate.

Moreover, for standard market orders, Phemex imposes a mere 0.075% taker fee per trade. Take advantage of these exceptional rates and maximize your trading potential on Phemex, the ultimate destination for affordable cryptocurrency transactions. Unleash the power of low fees and embrace a rewarding trading experience with Phemex.

PHEMEX KYC Verification

Currently, Phemex sets itself apart by not mandating KYC verification for trading on their platform. This unique feature allows users to swiftly engage in cryptocurrency trading without the hassle of submitting identity verification documents. Phemex stands out as one of the few derivatives exchanges that still provide this convenience.

However, for traders dealing with substantial sums exceeding $100,000 USD, the completion of Phemex Premium membership verification becomes necessary to facilitate seamless transfers to and from their bank accounts. This added verification step ensures smooth transactions and meets the needs of large-scale traders.

Join Phemex, where trading freedom and convenience converge. Enjoy the ease of trading cryptocurrencies without the burden of KYC verification. Explore the possibilities, and if you’re a high-volume trader, unlock the full potential of Phemex by undergoing Premium membership verification. Experience a platform that caters to both small-scale and large-scale traders with efficiency and flexibility.

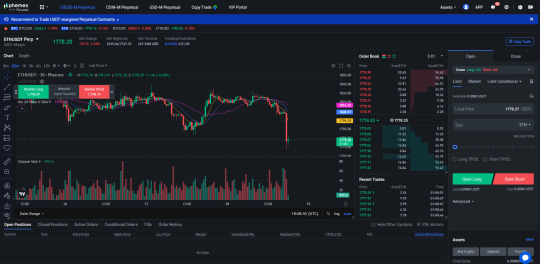

Futures and Derivatives Trading on PHEMEX

Trading ETH/USD derivatives on Phemex Futures.

Available Cryptocurrencies on PHEMEX

Phemex presents an extensive selection of top cryptocurrencies, akin to those found on renowned exchanges such as Binance or FTX. With a diverse range of over 200 digital assets, Phemex keeps pace with the ever-evolving market by promptly listing trending coins like ApeCoin (APE) or Decentraland (MANA). Discover the thrill of trading with an array of exciting options on Phemex’s platform, where opportunities abound and innovation thrives. Unleash your trading potential and explore the world of cryptocurrencies with Phemex.

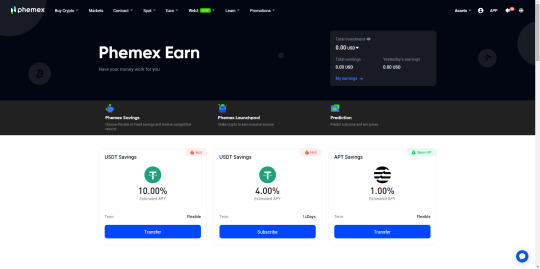

PHEMEX Earn

PHEMEX Conclusion

Discover the thriving world of Phemex, a user-friendly cryptocurrency exchange that is rapidly gaining momentum. With an impressive array of over 250 assets available for spot and futures trading, Phemex eliminates the hassle of KYC verification. Embrace the allure of low fees, abundant liquidity, and a platform tailored for both seasoned traders and beginners alike. Rest assured, Phemex prioritizes your safety, being registered with the CFTC and SEC. Unlock the potential of passive income through Phemex Earn, where staking opens doors to enticing opportunities. Join now through the provided link and seize the exclusive $180 Crypto Bonus. Don’t let this exhilarating journey pass you by.

2 notes

·

View notes

Text

Decades ago, the dominant mental image people might have had for FBO accounts was Lawyer Larry holding a settlement on behalf of Client Carla because lawyers are more like banks than regular people are like banks. The FDIC insures Carla, not Larry, even if Larry has fifty Carlas commingled in a single account and the bank only knows them as “names available on request.” (This is perhaps surprising for people who think banks need to Know Your Customers. The bank customarily adheres to its written policy about KYC for FBOs. Their regulator is OK with the policy. All of this is the normal business of banking and entirely uncontroversial.) To make Carla whole, it has to learn Carla exists first, which implies a process that cannot conclude by Next Monday.

Well that’s an edge case, right. Lawyers and FBO accounts have to be a teeny tiny percentage of all deposits and, while this would be greatly inconvenient for Carla, presumably if she is still banking through her lawyer in 2023 she is rich and sophisticated.

Let’s talk about fintech.

Many fintech products have an account structure which looks something like this sketch: a financial technology company has one or several banking relationships. It has many customers, enterprises which use it for e.g. payment services or custodying money. Those services are not formally bank accounts, but they perform a lot of feels-quite-bankish-if-you-squint to the people who rely on them to feed their families. The actual banking services are provided to those users by the banks, who are disclosed prominently on the bottom of the page and in the Terms and Conditions.

Each enterprise has their own book of users, who might number in the hundreds of thousands or millions, in a single FBO account at the bank, titled in the name of the enterprise or the name of the fintech. The true owners of the funds are known to the bank to be available in the ledgers of the fintech but the bank may have sharply limited understanding of them in real-time.

And so I ask you a rhetorical question: is this structure robust against the failure of a bank handled other-than-cleanly, such that, come the following Monday, those users receive the insurance protection which they are afforded by law? Mechanically, can that actually be done? Is our society prepared to figure that out over a weekend? Because during this past weekend, that sketch I wrote out about banks being confuddled by addition for a few hours almost certainly happened.

There are a sharply finite number of hours between Friday and Monday and we cannot conveniently extend them to cover multiparty discussions about how to get a core system to import a CSV dumped by a beleaguered data scientist from Jupyter based on a hopefully up-to-date MongoDB snapshot so that it can be provided to the FDIC agents on site.

I am very frustrated by political arguments about desert, which start with an enemies list and celebrate when the enemies suffer misfortune for their sins like using the banking system.

4 notes

·

View notes