#gsttax

Text

Uncover Potential Savings with a Thorough GST Audit

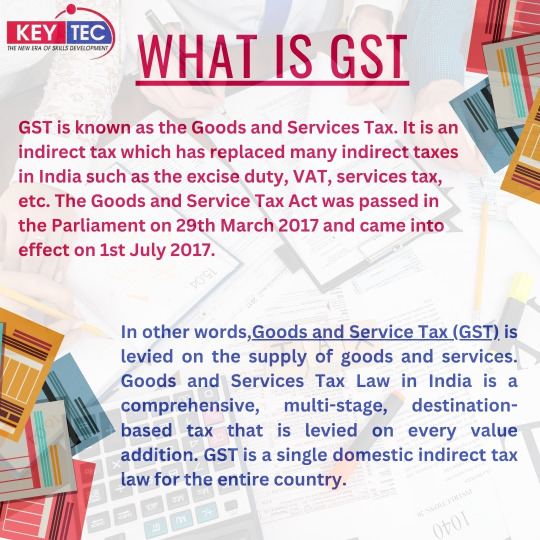

In today's complex business landscape, tax compliance is of paramount importance for companies of all sizes. One area that requires special attention is Goods and Services Tax (GST) compliance. To ensure businesses meet their obligations and maximize their financial benefits, conducting a thorough GST audit is crucial.

Understanding the GST Audit

A GST audit is an in-depth examination of a company's financial records, transactions, and GST filings. Its purpose is to ensure that a business accurately and appropriately complies with GST laws and regulations. The audit process evaluates the correctness of GST returns, the accuracy of input and output tax calculations, proper maintenance of records, and adherence to compliance timelines.

Navigating Tax Compliance

Navigating tax compliance can be a daunting task for businesses due to the evolving nature of GST laws, frequent amendments, and stringent reporting requirements. However, a thorough GST audit can simplify the process and provide several benefits:

Identify Errors and Discrepancies: During a GST audit, experts scrutinize financial records and GST filings to identify any errors, discrepancies, or non-compliance issues. This helps rectify mistakes and ensures accurate reporting, minimizing the risk of penalties or legal consequences.

Enhanced Compliance: By conducting a GST audit, businesses can evaluate their compliance with GST laws and regulations. This proactive approach ensures adherence to tax requirements, reducing the likelihood of errors and non-compliance issues in the future.

Uncover Potential Savings: A comprehensive GST audit goes beyond mere compliance. It helps identify potential savings opportunities by reviewing input tax credits, exemption claims, and other tax benefits. Uncovering these savings can significantly improve a company's financial position and profitability.

Optimize Input Tax Credits: One of the primary benefits of a GST audit is the optimization of input tax credits. By scrutinizing the eligibility and accuracy of claimed input tax credits, businesses can ensure they are capturing all eligible credits. This leads to reduced tax liabilities and increased cash flow.

Mitigate Risk: In a rapidly changing tax environment, businesses face the risk of non-compliance due to unintentional errors or lack of awareness. A thorough GST audit helps mitigate this risk by identifying potential compliance gaps and providing recommendations for corrective action.

Conclusion

In the realm of tax compliance, a comprehensive GST audit serves as a valuable tool for businesses. By conducting regular audits, companies can navigate the complexities of GST laws, identify errors, enhance compliance, and uncover potential savings. The benefits of a thorough GST audit extend beyond mere compliance, allowing businesses to optimize their financial position and drive sustainable growth. Embracing a proactive approach to tax compliance through GST audits enables businesses to confidently navigate the ever-changing tax landscape while uncovering potential savings along the way. At IPPC Group, we follow a comprehensive audit approach, leaving no stone unturned. We thoroughly review your financial records, transactions, and GST filings to identify any errors, discrepancies, or non-compliance issues. Our in-depth analysis allows us to provide you with actionable insights to rectify mistakes and improve your compliance posture. Contact us for GST audit services.

0 notes

Text

To know more visit our website.

Follow us for more.

#gst#gsttax#financialservices#fileitr#finance#infographic#company#financialfreedom#entrepreneur#business#fintech#financialplanning

0 notes

Text

#gstfiling#gst#gstregistration#gstr#incometax#gstindia#gstupdates#tax#business#gstreturns#gsttax#india#incometaxindia#gstnews#startup#itr#taxes#companyregistration#gstsoftware#gstcouncil#gstreturn#dsc#b#incometaxreturn#smallbusiness#gstbilling#gstaccountingsoftware#company#class#billingsoftware

1 note

·

View note

Text

Is the GST really beneficial for India?

To comprehend the way GST is affecting the Indian economy, and how it has affected the general Indian economy, we have to know what GST is applicable to and what its kinds. We will also examine the different consequences of GST.

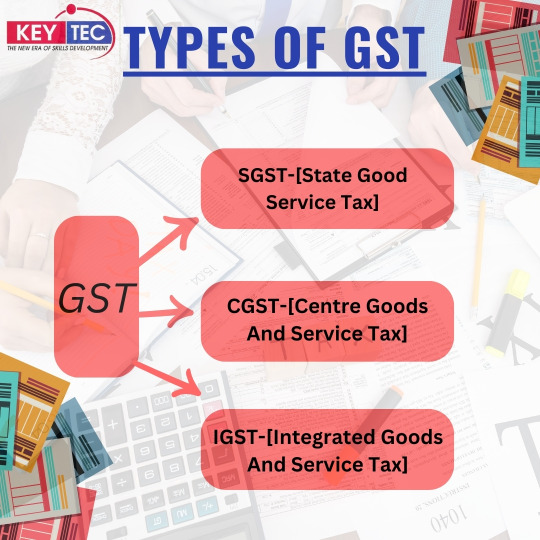

GST is imposed at each step of the production and sales of services and products across India. GST is charged at the time that the products or services are used. There are three categories of GSTtax -

CGST (Central Goods and Services Tax) is a tax imposed by the Central Government on the interstate sale of services and goods.

It is a tax referred to as SGST (State Goods and Services Tax) is a tax imposed from State Governments State Government on sales within the state.

IGST (Integrated Tax on Goods and Tax on Services) is charged when a shipment of products and services is made from one State to the other. The tax collected is split between government officials from the Central State Government as well as by the Central State Government.

Get your company registration in India. We provide the Fastest company registration services for Pvt.

Ltd, Llp, Partnership affordable price.

2 notes

·

View notes

Text

#gsttax - 15% · #gst - 14% · #gstr - 9% · #tax - 9% · #gstindia - 9% · #gstfiling - 8% · #incometax - 8% · #taxes - 8% ...

#institute #keytec

0 notes

Text

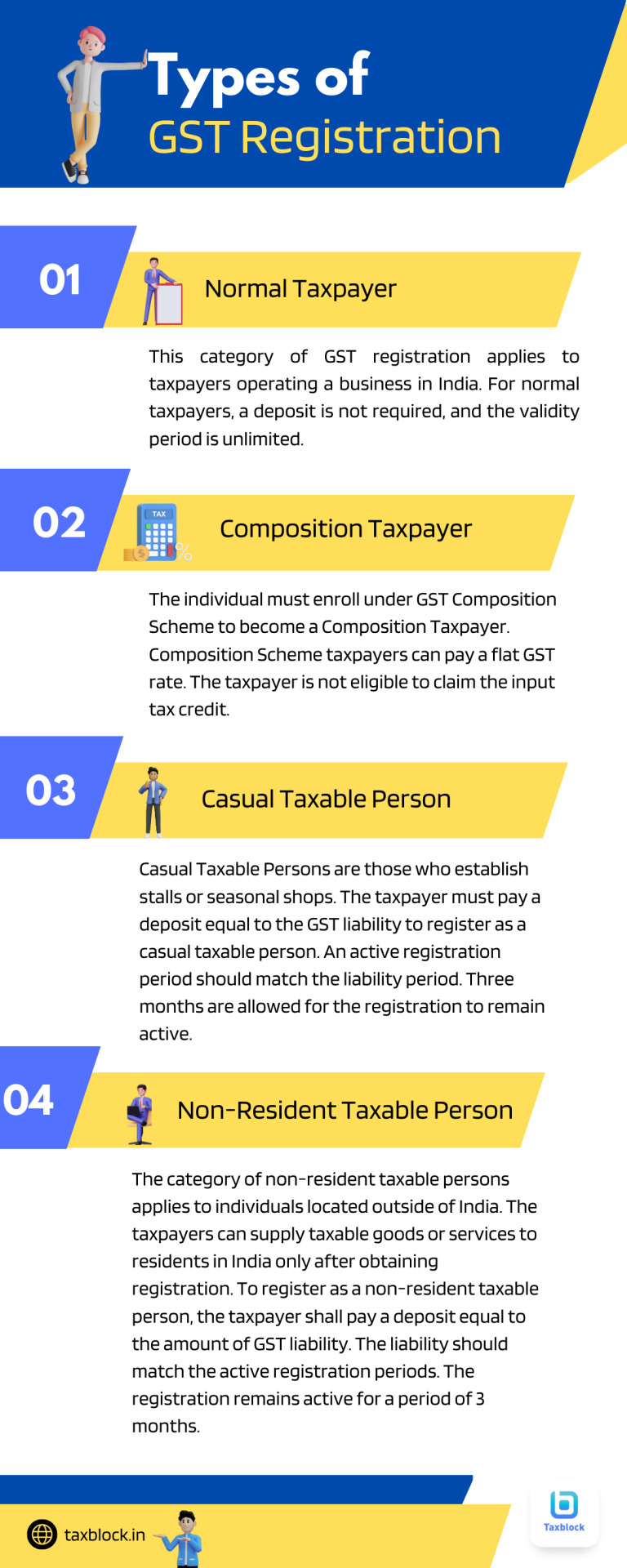

GST Registration

File your GST application & get your GSTIN number online with Tax Rupees Rs.799. Complete your GST registration process in less than 5 working days.

#gst#incometax#gsttax#business#taxrupees

0 notes

Link

0 notes

Photo

GST Related All Services Available here.... #gst #gstregistrationrequireddocuments #gstregistrationservices #gstregistrationindia #gstregistration #gsttax #gstfile (at Allahabad, India) https://www.instagram.com/p/CbpTWphBPOc/?utm_medium=tumblr

#gst#gstregistrationrequireddocuments#gstregistrationservices#gstregistrationindia#gstregistration#gsttax#gstfile

0 notes

Link

0 notes

Photo

Tally में GST Automatic Tax कैसे Calculate करे? पूरी जानकारी के लिए हमारे ब्लॉग पर जाए। @tally_ashraf @tally_digital_class #gsttax #tallyerp9 #GstAutmaticTax #Technicalcubetally https://www.instagram.com/p/B6hwX79gCPT/?igshid=277hmr2j54f3

0 notes

Video

youtube

CrestPMS | Invoices

This video will give you brief idea about how Invoices section work. If you have any query, write us at [email protected]

1 note

·

View note

Text

buy gst ebook

Biggest E book on Indirect tax

To make law more clear, we provide you with the elaborative interpretation of law in this GST E-Book.

contact - 9810156227

0 notes

Text

#gsttax - 15% · #gst - 14% · #gstr - 9% · #tax - 9% · #gstindia - 9% · #gstfiling - 8% · #incometax - 8% · #taxes - 8% ...

#instituite#keytec

0 notes

Link

0 notes