#gstreturns

Text

#gstupdates#gst#gstindia#gstr#incometax#tax#gstreturns#gstregistration#gstcouncil#india#taxes#business#incometaxindia#gstnews#accountant#charteredaccountant#taxation#incometaxreturn#accounting#finance#gstfiling#startup#gstreturn

2 notes

·

View notes

Text

#ddhan#tax#taxes#taxconsultant#taxation#taxaccountant#taxcompliance#taxadvice#taxcredits#taxhelp#professionals#taxprofessional#taxprofessionals#gst#gstreturns#gstfiling#incometax#incometaxreturn#incometaxindia#taxfiling#gstcompliance#incometaxreturnfiling#tds#directtax#indirecttax#taxmanagement

3 notes

·

View notes

Text

1 note

·

View note

Text

Future Trends and Innovations of E-way bills:

As we gaze into the crystal ball of logistics, what does the future hold for e-way bills? One emerging trend is the integration of e-way bill systems with emerging technologies such as blockchain and artificial intelligence.

These innovations promise to enhance the efficiency and security of e-way bill management, ushering in a new era of digitized logistics. Moreover, with the advent of smart transportation solutions and IoT-enabled tracking devices, the monitoring and management of e-way bills are set to become even more streamlined and automated.

Indeed, the future of e-way bills is brimming with possibilities, poised to revolutionize the way we transport goods across borders.

#gstfiling#businesstaxes#gststructure#gstreturns#businesscompliance#businesssupport#financialhealth#taxcompliance#financialmanagement#taxregulations

0 notes

Text

Super rich and their (lol) taxes

#super rich kids#super rich#property taxes#us taxes#death and taxes game#filing taxes#taxes#tax#gst registration#gstfiling#gstreturns#gst accounting software for retail#gst#ausgov#politas#auspol#tasgov#taspol#australia#fuck neoliberals#neoliberal capitalism#anthony albanese#albanese government#class war#eat the rich#eat the fucking rich#tax avoidance#tax accountant#tax season#tax advisor & preparation

0 notes

Text

Know What is a Temporary Reference Number in GST

Registering GST for a business means getting a unique code of 15 digits. That is Temporary Reference Number (TRN).It is called a Goods and Services Tax Identification Number. GST registration is a fundamental need for business identification. It is also required for compliance verification and any tax purposes. You can track application status using Temporary Reference Number after registration.

Registration of GST is mandatory, if the aggregate value exceeds INR 40 lakhs.

"View More Information about What is a Temporary Reference Number in GST

0 notes

Text

GSTR-1 Filing/Uploading Directly Through Marg ERP

The STR-1 is a report that GST-registered businesses need to submit every month or quarter. It includes details of all their sales for that period. Marg ERP software offers a handy feature where users can easily upload their STR-1 report directly to the GST Portal. This saves time and makes the filing process much simpler. So, if you're using Marg ERP software, you can quickly and effortlessly submit your sales details to the GST Portal without any hassle.

GST Software

Know More Information:-

Give a Miss Call for Demo: +91 9999 999 364

For Support: +91-11-30969600, +91-11-66969600

Website: https://www.margcompusoft.com/

0 notes

Text

Trakintax: Simplifying Taxes and Accounting in Alwar

Find out how Trakintax simplifies taxes and accounting in Alwar effortlessly. Our platform streamlines your financial tasks for seamless management. Say goodbye to complexity and hello to efficiency with Trakintax today!

0 notes

Text

Get Your GST Registration For Your Services and Takes GST Benefits...

#Legalcy#OfficialLegalcy#LegalcyPrivateLimited#gstregistration#gst#gstupdates#incometax#gstr#gstreturns#gstindia#tax#business#startup#india#gstfiling#taxes#incometaxreturn#incometaxindia#gstcouncil#gstnews#itr#accountant#accounting#companyregistration#charteredaccountant#msme#finance#ca#gstreturn#gsttax

1 note

·

View note

Text

Benefits of GST

Learning the Goods and Services Tax (GST) course offered by AccountingMastery offers a multitude of benefits, empowering individuals with the knowledge and skills needed to excel in the dynamic field of taxation.

GST Course in Hyderabad

0 notes

Text

Parliament panel recommends below 18% GST on health insurance, micro insurance.

GST return filing in noida

#gst#incometax#tax#business#accounting#gstupdates#gstindia#ca#india#charteredaccountant#taxes#gstregistration#gstreturns#castudents#incometaxindia#incometaxreturn

0 notes

Text

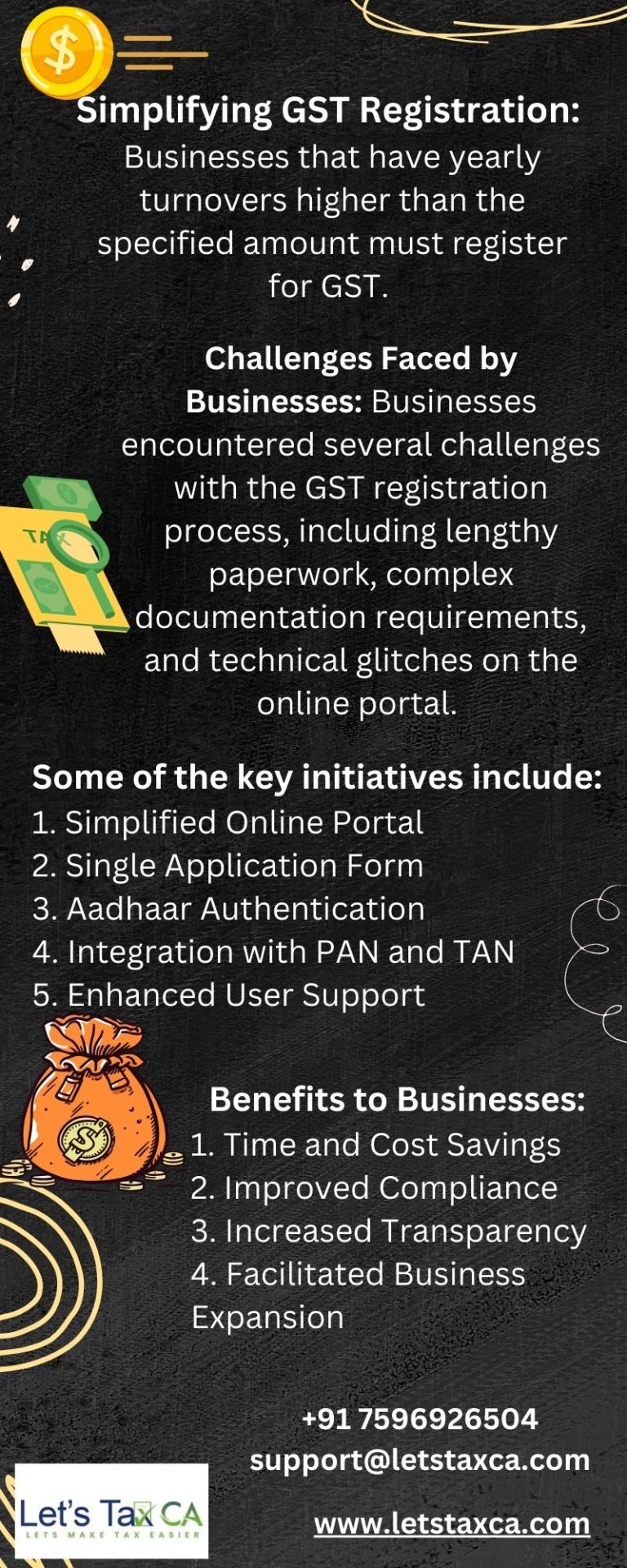

GST Registration in India

Unlock growth opportunities for your business with GST registration! Stay compliant and simplify your operations. 📝✅ #GSTRegistration #BusinessGrowth

Read more https://setupfiling.in/gst-registration/

or contact us +91 9818209246

0 notes

Text

Easy Guide to GST Registration for Your Business

#gstregistration#gstfiling#gstservices#gstapply#gst#gstconsultation#gstreturn#gstin#gstreturns#registration#gstcouncil#gstexperts#gstindia#tax#taxfiling#taxconsultants#taxes#taxation#inadvises

1 note

·

View note

Text

Did you know? Section 17(5) imposes limitations on utilizing specific GST inputs for settling GST obligations. An example of such non-eligible expenses includes membership fees incurred at clubs, health centers, or fitness facilities subject to GST charges, which cannot be claimed for GST benefits.

However, here's a valuable tip: Membership fees paid by employees to trade associations qualify as business expenses and can be utilized as GST inputs for your business. @accteezindia follow us for more such valuable tips! For GST and other tax-related queries, feel free to call or WhatsApp us +91-8860632015. Enhance your understanding of GST for maximum financial benefits! 📚💰

#accteez#accteezindia#gst#gstupdates#gstindia#gstr#gstregistration#gstcouncil#gstreturns#incometaxindia#tax#taxes#finance#accounting#accountant#club#hotel#health#fitness#tradeassociation#insta#reels#delhi#trendingreels#tips#business#startup#india

1 note

·

View note

Text

E-Way Bills in Practice:

Now that we’ve covered the theoretical aspects of e-way bills, let’s take a peek into how they work in the real world. Imagine a scenario where a manufacturer based in Gujarat needs to transport a consignment of goods to a distributor in Maharashtra.

To ensure compliance with e-way bill regulations, the manufacturer logs into the designated e-way bill portal, fills in the required details about the goods, and generates an e-way bill. This digital document accompanies the goods throughout their journey, serving as a virtual escort, guiding them safely across state borders.

At the same time, authorities can track the movement of the goods in real-time, ensuring transparency and tax compliance

#gstfiling#businesstaxes#businesscompliance#gstreturns#gststructure#businesssupport#financialhealth#financialmanagement#taxregulations#taxcompliance

0 notes

Text

GSTR-1 – Return Filing, Format, Eligibility & Rules

Learn #GSTR-1 return filing, format, eligibility, and rules. Stay compliant with GST regulations. Get expert insights for seamless tax submission.

Read Our Detailed article in the below link 👇-

https://www.mygstrefund.com/GSTR1-ReturnFiling-Format-Eligibility-Rules/

THANKS FOR READING!

We provide GST refund solutions for customers.

To know more please visit: www.mygstrefund.com

Join Our Community: community.mygstrefund.com

Contact Us: +91 9205005072

Mail- [email protected]

0 notes