#fintech launch

Text

The Magic of Fintech: A Beginner's Guide to Money Management in the Digital Age

In today's fast-paced world, managing money has become easier and more convenient, thanks to the rise of fintech. But what exactly is fintech, and how is it changing the way we handle our finances? Let's dive into the world of fintech and unravel its mysteries in simple terms!

What is Fintech?

Fintech, short for financial technology, is like having a digital piggy bank that helps you do all sorts of cool things with your money. It uses fancy technology, like computers, smartphones, and the internet, to make banking, investing, and paying for things as easy as snapping your fingers.

Blockchain in Fintech:

Ever heard of a magic chain that keeps your money safe from bad guys? That's blockchain! In fintech, blockchain technology acts like a super-strong shield, protecting your money transactions from hackers and keeping them super secure.

Financial Technology:

Imagine having a toolbox filled with gadgets that help you with money stuff. That's financial technology! It includes things like mobile banking apps, digital wallets, payment platforms, and investment apps, making money management a breeze!

Banking Fintech:

Remember the days when you had to wait in long lines at the bank? Well, with banking fintech, you can do all your banking right from your phone or computer! You can check your balance, transfer money, pay bills, and even deposit checks without ever leaving the comfort of your couch.

Fintech Brands:

Just like how you have favorite superheroes, there are fintech brands that are like the superheroes of money management! Companies like PayPal, Venmo, Cash App, and Acorns are some popular fintech brands that help millions of people manage their money every day.

Fintech Development Outsourcing:

Ever wonder how those cool fintech apps are made? Sometimes, big companies need help from outside experts to build their money magic tools. That's where fintech development outsourcing comes in! It's like hiring a team of tech wizards to bring your money dreams to life.

Fintech Startup:

Have you ever dreamed of starting your own business? Well, a fintech startup is like launching your own money adventure! Whether it's building a new payment app, creating a budgeting tool, or revolutionizing how people invest, fintech startups are the brave pioneers of money innovation.

Wrapping up

In summary, fintech is like having a magical friend who helps you manage your money smarter and faster. From digital wallets to blockchain technology, fintech is transforming the way we think about money, making it simpler, safer, and more accessible for everyone. So, whether you're a tech enthusiast, a finance whiz, or just curious about the future of money, there's something in the world of fintech for everyone to explore and enjoy!

#mobilepayment#fintechindustry#cryptocurreny trading#fintech industry#fintech#fintech startup#fintech launch#fintech news

0 notes

Text

One-stop solution to instantly launch hyper-customised financial products!

Discover the ultimate tool for instantly launching hyper-customized financial products! Our one-stop solution empowers you to create tailored offerings with ease, revolutionizing your financial ventures. Explore limitless possibilities today.

#mutual fund api#how to launch mutual funds#api for mutual funds#fintech api#mutual funds api solution

0 notes

Text

A Beginner's Guide: How to Start a Fintech Company

In the dynamic landscape of modern finance, establishing a fintech company can be both an exhilarating and challenging endeavor. As technology continues to revolutionize the financial sector, the opportunities for innovation are boundless. If you're eager to dive into the world of fintech entrepreneurship, you've come to the right place. In this comprehensive guide, we'll walk you through the fundamental steps to kickstart your journey towards launching a successful fintech startup.

Identify Your Niche:

Before delving into the intricacies of building your fintech venture, it's crucial to pinpoint your niche market. Conduct thorough market research to identify gaps or pain points in the financial industry that your startup can address. Whether it's streamlining payments, enhancing lending processes, or revolutionizing personal finance management, choose a niche where you can offer unique value.

Develop a Solid Business Plan:

A well-crafted business plan serves as the roadmap for your fintech startup. Outline your company's mission, target market, revenue model, competitive analysis, and marketing strategy. Investors and stakeholders will rely on your business plan to assess the viability and potential of your venture. Ensure that your plan is not only comprehensive but also adaptable to evolving market trends.

Embrace Cutting-Edge Technology:

At the core of every successful fintech startup lies innovative technology. Whether it's blockchain, artificial intelligence, or machine learning, integrating advanced technologies can empower your company to deliver transformative solutions. Collaborate with skilled developers and tech experts to build robust platforms that offer seamless user experiences and robust security measures.

Navigate Regulatory Compliance:

The financial industry is heavily regulated to safeguard consumer interests and maintain market stability. As a fintech entrepreneur, you must navigate complex regulatory frameworks and ensure compliance with relevant laws and regulations. Familiarize yourself with data protection laws, financial licensing requirements, and anti-money laundering regulations to avoid legal pitfalls down the road.

Forge Strategic Partnerships:

In the competitive landscape of fintech, strategic partnerships can be instrumental in accelerating your startup's growth. Collaborate with financial institutions, technology providers, and industry experts to leverage their expertise, resources, and networks. Strategic alliances can open doors to new markets, enhance product offerings, and foster innovation through knowledge sharing.

Focus on User-Centric Design:

In the digital age, user experience reigns supreme. Prioritize user-centric design principles to create intuitive and engaging fintech solutions. Conduct user testing, gather feedback, and iterate on your product design to ensure that it resonates with your target audience. By placing the needs and preferences of users at the forefront, you can cultivate a loyal customer base and drive long-term success.

Secure Funding:

Securing adequate funding is essential for fueling the growth and scalability of your fintech startup. Explore various funding options, including venture capital, angel investors, crowdfunding, and government grants. Prepare a compelling pitch deck that highlights your unique value proposition, market opportunity, and growth potential. Demonstrate a clear path to profitability and sustainable growth to attract investors.

Stay Agile and Adapt:

The fintech landscape is constantly evolving, driven by technological advancements, regulatory changes, and shifting consumer behaviors. To thrive in this fast-paced environment, embrace agility and adaptability as core principles of your startup culture. Stay attuned to market trends, monitor competitor movements, and iterate on your strategies to remain competitive and relevant.

Build Trust and Credibility:

Trust is paramount in the financial industry, and establishing credibility is essential for gaining the trust of customers, investors, and regulatory authorities. Uphold the highest standards of transparency, security, and ethical conduct in all your interactions. Invest in robust cybersecurity measures to safeguard sensitive customer data and foster trust in your brand.

Measure and Optimize Performance:

Continuously monitor key performance indicators (KPIs) to track the success and impact of your fintech startup. Analyze user engagement, conversion rates, customer retention, and financial metrics to identify areas for improvement and optimization. Leverage data analytics tools to gain actionable insights and make informed decisions that drive growth and profitability.

By following these steps and embracing innovation, determination, and strategic planning, you can embark on a rewarding journey to launch your fintech startup. Remember, success in the fintech industry requires perseverance, agility, and a relentless focus on delivering value to customers. So, roll up your sleeves, seize the opportunity, and chart a course towards building the next disruptive fintech solution.

0 notes

Text

How to Launch a Fintech [A Comprehensive Step-by-Step Guide]

Embarking on a fintech venture presents an exciting opportunity in today's tech-driven world, where financial technology is reshaping how we handle money. Whether you're a newcomer or a large company seeking adaptation, understanding the process of starting a fintech business is crucial. In this guide, we simplify the essential steps and strategies required, covering everything from generating innovative fintech ideas to navigating rules and regulations. Let's delve into the detailed process of launching a successful fintech venture.

1 note

·

View note

Text

বর্তমানে সবচেয়ে লাভজনক ব্যবসা

আমাদের মাথায় যখনই ব্যবসা করার চিন্তা আসে তখনি সবার আগে যে প্রশ্নটি ঘুরপাক খায় তা হলো, যতটা সম্ভব অল্প পুঁজিতে সবচেয়ে লাভজনক ব্যবসা কোনটি? গুগল- ইন্টারনেটে অসংখ্যবার সার্চ হয় এই প্রশ্নটি। নিজের ইচ্ছে অনুযায়ী, উদ্যোক্তা হওয়ার মনোভাবকে কাজে লাগানোর মাধ্যমে একটি স্বাধীন পেশায় নিজেকে প্রতিষ্ঠিত করার স্বপ্ন দেখতে সবারই ভালো লাগে।

ছোট পরিসরে সুপার শপ

বাংলাদেশের প্রেক্ষাপটে ছোট পরিসরে সুপার শপ একটি দারুণ লাভজনক ব্যবসায়িক আইডিয়া। এর জন্য ব্যস্ত,আবাসিক অঞ্চল খুবই গুরুত্বপূর্ণ এবং উপযুক্ত। ব্যবসায় সহায়তার জন্য এক বা দু’জন কর্মচারী নিয়োগ দিতে পারেন। ৫ থেকে ১০ লক্ষ্ টাকা পুঁজি বিনিয়োগ করে ব্যবসাটি শুরু করা যাবে। যেহেতু করোনা ভাইরাসের কারণে মানুষের ঘরে বসে কেনাকাটা করার অভ্যাস তৈরি হয়ে গেছে, তাই গতানুগতিক লাভের চেয়ে আরেকটু বেশি লাভ করতে হোম ডেলিভারির প্রসেস রাখা যেতে পারে।

অনলাইন বিজনেস

ফেসবুক, ইন্সটাগ্রাম ব্যবহার করে কোন দোকান ছাড়া একটি দারুণ ব্যবসার আইডিয়া হল অনলাইনে গার্মেন্টস আইটেম বিক্রি করা। গার্মেন্টস আইটেমের মধ্যে মেয়েদের জামা, টি-শার্ট, জিন্সের প্যান্ট, আন্ডার গার্মেন্টস ইত্যাদি রয়েছে যেগুলো অনলাইনে মার্কেটিং করে খুব সহজেই বিক্রি করা যায়।

করোনা-কালীন সময়ে অনলাইন বিজনেস সবচেয়ে বেশি জনপ্রিয়তা পেয়েছে। বিশেষ করে নারীদের জন্য এই ব্যবসা খুবই উপযোগী। খুবই কম পুঁজিতে যে কেউ ফেসবুক পেইজ, গ্রুপ বা ওয়েবসাইট তৈরি করে নিজের পণ্যের প্রচার করতে পারেন এবং ভোক্তার নিকট পৌঁছে দিতে পারেন খুব সহজেই। অনলাইনে যে কোন পণ্যের ব্যবসা করা যায়। এই সেক্টরে বর্তমানে প্রচুর উদ্যোক্তা তৈরি হচ্ছে।

অ্যাফিলিয়েট মার্কেটিং

অ্যাফিলিয়েট মার্কেটিং একটি অনলাইন ভিত্তিক ব্যবসা যেখানে কোন পুঁজি বিনিয়োগের প্রয়োজন নেই। এটি মূলত অন্য কোন কোম্পানির পণ্য নিজেই মার্কেটিং করে বিক্রি করিয়ে কোম্পানি থেকে নির্দিষ্ট পরিমাণ কমিশন পাওয়া যা আগে থেকেই নির্ধারিত থাকে।

ফ্যাশন হাউস

ফ্যাশন হাউস দিয়ে ব্যবসা শুরু করার আগে আপনাকে অবশ্যই কিছু গুরুত্বপূর্ণ বিষয় মাথায় রাখতে হবে। বাংলাদেশে এই লাভজনক এবং বেশ চাহিদা সম্পন্ন ব্যবসাটি শুরু করার জন্য একটি নিখুঁত ব্যবসায়িক পরিকল্পনা প্রয়োজন। সুপার শপ ব্যবসায়ের মতো এই বিজনেস শুরু করতে, আপনার বিনিয়োগ কোটি বা এর উপরে লাগতে পারে ,কারণ উপযুক্ত জায়গার এডভান্স অনেক বেশি পরিমানে হয়ে থাকে। তবে দোকানের অবস্থান এই ব্যবসায় সাফল্যের মূল চাবিকাঠি, তাই শুরু করার জন্য আপনাকে একটি সঠিক অবস্থান খুঁজে বের করতে হবে। পাশাপাশি যদি সোশাল মিডিয়াতে সঠিকভাবে মার্কেটিং করা যায়, তবে তা হবে আরও লাভজনক।

ফাস্ট ফুড অথবা ছোট স্কেলে রেস্তোরাঁ

বলা হয়ে থাকে, রেস্টুরেন্ট বিজনেস হলো এভারগ্রিন বিজনেস। বর্তমানে বাংলাদেশের বেশিরভাগ তরুণ উদ্যোক্তাই এই ব্যবসায় আগ্রহী। ঢাকার মত বড় শহরগুলোতে তো আছেই, এর বাইরে মফস্বল এলাকাগুলোতেও ফাস্ট ফুড বা ছোট আকারের রেস্তোরাঁয় এখন কাস্টমারের যাতায়াত অনেক বেশি। তাই যদি কেউ নির্দিষ্ট পরিমাণ পুঁজি দিয়ে লাভজনক কিছু শুরু করতে চায়, তবে রেস্টুরেন্টের কথা ভাবতে পারে। তবে এই ব্যবসায় সফলতা পেতে হলে নিখুত মনিটরিং প্রয়োজন হয় এবং সর্বোচ্চ মান ও সর্বনিম্ন মূল্য এই ব্যবসার অন্যতম মূলধন।

ব্যবহৃত পণ্য ক্রয় এবং বিক্রয়

বাংলাদেশের পাশাপাশি সারা পৃথিবীতেই ব্যবহৃত পণ্য ক্রয় এবং বিক্রয় একটি স্বল্প মূল্যের ব্যাবসায়িক ধারণা। ব্যবসাটি সহজ, আপনি ব্যবহৃত পণ্য কিনে কিছুটা মেরামত করে বিক্রি করতে পারবেন। উদাহরণস্বরূপ, একটি মোবাইল ফোন, ল্যাপটপ, কম্পিউটার, টিভি, গাড়ি, আসবাবপত্র ইত্যাদি এই ব্যবসায়ের পণ্য।

গাছ কেনা বেচা:

মানুষের শখের তালিকায় একেবারে শুরুতে আছে বাগান করা। ছাদ বাগান, বারান্দা বাগান অথবা ইনডোর গার্ডেনিং অনেকেই পছন্দ করেন। ফুল-ফল গাছ থেকে শুরু করে ছোট ছোট বাহারি গাছ যেমন খাবারে ব্যবহারের প্রয়োজন মেটায়, তেমনি পরিবেশ ও মনকে সতেজ রাখে। তাই চারাগাছের ব্যবসা বর্তমানে একটি বেশ লাভজনক। যে কেউ চাইলে অনালাইনে মার্কেটিং করে বাড়িতে বসেই শুরু করতে পারেন এই লাভজনক ব্যবসাটি।

উপরোক্ত তথ্যগুলো জানতে পেরে অনেকে উৎসাহী হলেও হয়ত তাদের মনে ব্যবসার জন্য প্রয়োজনীয় মূলধন নিয়ে চিন্তার উদয় হবে। তবে চিন্তার কোন কারন নেই। এসকল বিষয়ে তথ্য ও পরামর্শ দিতে আছে সংযোগইউ । ব্যবসার আইডিয়া, ব্যবসার লোন এবং এই বিষয়ক উপযুক্ত যেকোন তথ্য পেতে আজই সংযোগইউয়ের সাথে যুক্ত হোন

#shongjogyou#launching ceremony of shongjogyou#digital financial inclusion#digital financial services#digital financial solution#digital finance#digital financial service#finance ecosystem#access to finance#fintech startup#financial solution#financial investment#efinance solution

0 notes

Text

Every purchase you make on the #pin_network earns you rewards!

Our built-in loyalty system means you instantly receive a 1% rebate in #pin_rewards at participating #pin_partners every time you shop!

Download the app today at https://payitnow.network and start shopping with crypto today!

#pin#payitnow#pinpayments#cryptopayments#pinnetwork#makecryptosimpleandsecure#pinrewards#pinnetworkapp#binanceNZ

#rewards#lack#million#moves#project#launches#cryptocurrency#payments#defi#crypto#investment#eth#bsc#invest#btc#fintech

0 notes

Photo

Tribe ❤️ #rctribe #launch #brand #fintech #team (at Retail Capital) https://www.instagram.com/p/Ch740joM2aT/?igshid=NGJjMDIxMWI=

0 notes

Text

Intuit: “Our fraud fights racism”

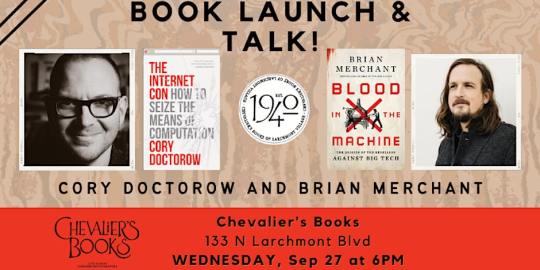

Tonight (September 27), I'll be at Chevalier's Books in Los Angeles with Brian Merchant for a joint launch for my new book The Internet Con and his new book, Blood in the Machine. On October 2, I'll be in Boise to host an event with VE Schwab.

Today's key concept is "predatory inclusion": "a process wherein lenders and financial actors offer needed services to Black households but on exploitative terms that limit or eliminate their long-term benefits":

https://journals.sagepub.com/doi/10.1177/2329496516686620

Perhaps you recall predatory inclusion from the Great Financial Crisis, when predatory subprime mortgages with deceptive teaser rates were foisted on Black homeowners (who were eligible for better mortgages), resulting in a wave of Black home theft in the foreclosure crisis:

https://prospect.org/justice/staggering-loss-black-wealth-due-subprime-scandal-continues-unabated/

Before these loans blew up, they were styled as a means of creating Black intergenerational wealth through housing speculation. They turned out to be a way to suck up Black families' savings before rendering them homeless and forcing them into houses owned by the Wall Street slumlords who bought all the housing stock the Great Financial Crisis put on the market:

https://pluralistic.net/2022/02/08/wall-street-landlords/#the-new-slumlords

That was just an update on an old con: the "home sale contract," invented by loan-sharks who capitalized on redlining to rip off Black families. Back when banks and the US government colluded to deny mortgages to Black households, sleazy lenders created the "contract loan," which worked like a mortgage, but if you were late on a single payment, the lender could seize and sell your home and not pay you a dime – even if the house was 99% paid for:

https://socialequity.duke.edu/wp-content/uploads/2019/10/Plunder-of-Black-Wealth-in-Chicago.pdf

Usurers and con-artists love to style themselves as anti-racists, seeking to "close the racial wealth gap." The payday lending industry – whose triple-digit interest rates trap poor people in revolving debt that they can never pay off – styles itself as a force for racial justice:

https://pluralistic.net/2022/01/29/planned-obsolescence/#academic-fraud

Payday lenders prey on poor people, and in America, "poor" is often a euphemism for "Black." Payday lenders disproportionately harm Black families:

https://ung.edu/student-money-management-center/money-minute/racial-wealth-gap-payday-loans.php

Payday lenders are just unlicensed banks, who deploy a layer of bullshit to claim that they don't have to play by the rules that bind the rest of the finance sector. This scam is so juicy that it spawned the fintech industry, in which a bunch of unregulated banks sprung up to claim that they were too "innovative" to be regulated:

https://pluralistic.net/2023/05/01/usury/#tech-exceptionalism

When you hear "Fintech," think "unlicensed bank." Fintech turned predatory inclusion into a booming business, recruiting Black spokespeople to claim that being the sucker at the table in the cryptocurrency casino was actually a form of racial justice:

https://www.nytimes.com/2021/07/07/business/media/cryptocurrency-seeks-the-spotlight-with-spike-lees-help.html

But not all predatory inclusion is financial. Take Facebook Basics, Meta's "poor internet for poor people" program. Facebook partnered with telcos in the Global South to rig their internet access. These "zero rating" programs charged subscribers by the byte to reach any service except Facebook and its partners. Facebook claimed that this would "bridge the digital divide," by corralling "the next billion internet users" into using its services.

The fact that this would make "Facebook" synonymous with "the internet" was just an accidental, regrettable side-effect. Naturally, this was bullshit from top to bottom, and the countries where zero-rating was permitted ended up having more expensive wireless broadband than the countries that banned it:

https://www.eff.org/deeplinks/2019/02/countries-zero-rating-have-more-expensive-wireless-broadband-countries-without-it

The predatory inclusion gambit is insultingly transparent, but that doesn't stop desperate scammers from trying it. The latest chancer is Intuit, who claim that the end of its decade-long, wildly profitable "free tax prep" scam is bad for Black people:

https://www.propublica.org/article/turbotax-intuit-black-taxpayers-irs-free-file-marketing

Some background. In nearly every rich country on Earth, the tax authorities send every taxpayer a pre-filled tax return, based on the information submitted by employers, banks, financial planners, etc. If that looks good to you, you just sign it and send it back. Otherwise, you can amend it, or just toss it in the trash and pay a tax-prep specialist to produce your own return.

But in America, taxpayers spend billions every year to send forms to the IRS that tell it things it already knows. To make this ripoff seem fair, the hyper-concentrated tax-prep industry, led by the Intuit, creators of Turbotax, pretended to create a program to provide free tax-prep to working people.

This program was called Free File, and it was a scam. The tax-prep cartel each took a different segment of Americans who were eligible for Freefile and then created an online house of mirrors that would trick those people into spending hours working on their tax-returns until they were hit with an error message falsely claiming they were ineligible for the free service and demanding hundreds of dollars to file their returns.

Intuit were world champions at this scam. They blocked their Freefile offering from search-engine crawlers and then bought ads that showed up when searchers typed "freefile" into the query box that led them to deceptively named programs that had "free" in their names but cost a fortune to use – more than you'd pay for a local CPA to file on your behalf.

The Attorneys General of nearly every US state and territory eventually sued Intuit over this, settling for $141m:

https://www.agturbotaxsettlement.com/Home/portalid/0

The FTC is still suing them over it:

https://www.ftc.gov/legal-library/browse/cases-proceedings/192-3119-intuit-inc-matter-turbotax

We have to rely on state AGs and the FTC to bring Intuit to justice because every Intuit user clicks through an agreement in which we permanently surrender our right to sue the company, no matter how many laws it breaks. For corporate criminals, binding arbitration waivers are the gift that keeps on giving:

https://pluralistic.net/2022/02/24/uber-for-arbitration/#nibbled-to-death-by-ducks

Even as the scam was running out, Intuit spent millions lobby-blitzing Congress, desperate for action that would let it continue to privately tax the nation for filling in forms that – once again – told the IRS things it already knew. They really love the idea of paying taxes on paying your taxes:

https://pluralistic.net/2023/02/20/turbotaxed/#counter-intuit

But they failed. The IRS has taken Freefile in-house, will send you a pre-completed tax return if you want it. This should be the end of the line for Intuit and other tax-prep profiteers:

https://pluralistic.net/2023/05/17/free-as-in-freefile/#tell-me-something-i-dont-know

Now we're at the end of the line for the scam, Intuit is playing the predatory inclusion card. They're conning Black newspapers like the Chicago Defender into running headlines like "IRS Free Tax Service Could Further Harm Blacks,"

https://defendernetwork.com/news/opinion/irs-free-tax-service-could-further-harm-blacks/

The only named source in that article? Intuit spokesperson Derrick Plummer. The article went out on the country's Black newswire Trice Edney, whose editor-in-chief did not respond to Propublica's Paul Kiel's questions.

Then Black Enterprise got in on the game, publishing "Critics Claim The IRS Free Tax Prep Service Could Hurt Black Americans." Once again, the only named source for the article was Plummer, who was "quoted at length." Black Enterprise declined to tell Kiel where that article came from:

https://www.blackenterprise.com/critics-claim-the-irs-free-tax-prep-service-could-hurt-black-americans/

For Intuit, placing op-eds is a tried-and-true tactic for laundering its ripoffs into respectability. Leaked internal Intuit memos detail the company's strategy of "pushing back through op-eds" to neutralize critics:

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Intuit spox Derrick Plummer did respond to Kiel's queries, denying that Intuit was paying for these op-eds, saying "with an idea as bad as the Direct File scheme we don’t have to pay anyone to talk about how terrible it is."

Meanwhile, ex-NAACP director (and No Labels co-chair) Benjamin Chavis has used his position atop the National Newspaper Publishers Association to publish op-eds against the IRS Direct File program, citing the Progressive Policy Institute, a pro-business thinktank that Intuit's internal documents describe as part of its "coalition":

https://www.documentcloud.org/documents/6483061-Intuit-TurboTax-2014-15-Encroachment-Strategy.html

Chavis's Chicago Tribune editorial claimed that Direct File could cause Black filers to miss out on tax-credits they are entitled to. This is a particularly ironic claim given Intuit's prominent role in sabotaging the Child Tax Credit, a program that lifted more Americans out of poverty than any other in history:

https://pluralistic.net/2021/06/29/three-times-is-enemy-action/#ctc

It's also an argument that can be found in Intuit's own anti-Direct File blog posts:

https://www.intuit.com/blog/innovative-thinking/taxpayer-empowerment/intuit-reinforces-its-commitment-to-fighting-for-taxpayers-rights/

The claim is that because the IRS disproportionately audits Black filers (this is true), they will screw them over in other ways. But Evelyn Smith, co-author of the study that documented the bias in auditing says this is bullshit:

https://siepr.stanford.edu/publications/working-paper/measuring-and-mitigating-racial-disparities-tax-audits

That's because these audits of Black households are triggered by the IRS's focus on Earned Income Tax Credits, a needlessly complicated program available to low-income (and hence disproportionately Black) workers. The paperwork burden that the IRS heaps on EITC recipients means that their returns contain errors that trigger audits.

As Smith told Propublica, "With free, assisted filing, we might expect EITC claimants to make fewer mistakes and face less intense audit scrutiny, which could help reduce disparities in audit rates between Black and non-Black taxpayers."

Meanwhile, the predatory inclusion talking points continue to proliferate. Nevada accountants and the state's former controller somehow coincidentally managed to publish op-eds with nearly identical wording. Phillip Austin, vice-chair of Arizon's East Valley Hispanic Chamber of Commerce, claims that free IRS tax prep "would disproportionately hurt the Hispanic community." Austin declined to tell Propublica how he came to that conclusion.

Right-wing think-tanks are pumping out a torrent of anti-Direct File disinfo. This surely has nothing to do with the fact that, for example, Center Forward has HR Block's chief lobbyist on its board:

https://thehill.com/opinion/finance/4125481-direct-e-file-wont-make-filing-taxes-any-easier-but-it-could-make-things-worse/

The whole thing reeks of bullshit and desperation. That doesn't mean that it won't succeed in killing Direct File. If there's one thing America loves, it's letting businesses charge us a tax just for dealing with our own government, from paying our taxes to camping in our national parks:

https://pluralistic.net/2022/11/30/military-industrial-park-service/#booz-allen

Interestingly, there's a MAGA version of predatory inclusion, in which corporations convince low-information right-wingers that efforts to protect them from ripoffs are "woke." These campaigns are, incredibly, even stupider than the predatory inclusion tale.

For example, there's a well-coordianted campaign to block the junk fees that the credit card cartel extracts from merchants, who then pass those charges onto us. This campaign claims that killing junk fees is woke:

https://pluralistic.net/2023/08/04/owning-the-libs/#swiper-no-swiping

How does that work? Here's the logic: Target sells Pride merch. That makes them woke. Target processes a lot of credit-card transactions, so anything that reduces card-processing fees will help Target. Therefore, paying junk fees is a way to own the libs.

No, seriously.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/09/27/predatory-inclusion/#equal-opportunity-scammers

299 notes

·

View notes

Text

11 January 2024: Crown Prince Hussein, accompanied by Princess Rajwa, attended the launch of the Jordan-Singapore Tech Alliance Forum.

Speaking at the launch, Crown Prince Hussein highlighted the forum’s importance in unifying the two countries’ efforts towards technological excellence.

He stressed Jordan’s keenness to become a rising force on the international tech scene, highlighting the importance of digital transformation and entrepreneurship in nurturing creativity and turning ideas into reality.

The similarities between tech talents in Jordan and Singapore can be a bridge that connects the two countries and enhances cooperation in service of mutual interests, the Crown Prince said at the forum, held by the Ministry of Digital Economy and Entrepreneurship and Jordan’s embassy in Singapore, in cooperation with the Singapore Business Federation and SG Tech. (Source: Petra)

His Royal Highness invited business people, experts, and CEOs to visit Jordan to learn more about the ICT and entrepreneurship sector, which is full of promising Jordanian talents.

Minister of Digital Economy and Entrepreneurship Ahmad Hanandeh said that with more than 8,000 students graduating from IT-related programmes each year, Jordan’s digital economy continues to flourish, noting that Jordanians are making an impact that is attracting businesses from around the world.

He expressed the ministry’s keenness to continue helping Singaporean companies find the perfect home for their business in Jordan, highlighting the Jordan Source programme, which is helping businesses capitalise on Jordan’s exceptional potential as a global IT and business process outsourcing hub.

The Jordan-Singapore Tech Alliance Forum saw the participation of nearly 150 representatives of tech start-ups in Singapore, in addition to six Jordanian start-ups that provide technical support to international companies in sectors like gaming, digital education, and creative industries.

During the forum, key Jordanian tech companies gave briefings on their work, and participants engaged in discussions to attract international firms to Jordan by showcasing the competitiveness of the ICT sector in the Kingdom and success stories of Jordanian start-ups.

The forum also featured a presentation on the Jordan Source programme, launched in 2021 during a ceremony attended attendance of the Crown Prince, to promote Jordan as an international hub for innovation and investment in ICT and communications.

The forum is part of a series of Jordan Source promotional tours to attract investments and build partnerships with international companies seeking to expand into the Middle East through Jordan.

On the sidelines of the forum, a memorandum of understanding between Jordan’s Institute of Banking Studies and the Singapore FinTech Association was signed.

Planning Minister Zeina Toukan, Jordan’s Ambassador to Singapore Samer Naber, and Director of the Office of the Crown Prince Zaid Baqain attended the forum.

21 notes

·

View notes

Text

Exploring Fintech: Simplifying the World of Financial Technology

In today's digital age, the term “fintech” is buzzing everywhere. But what exactly is fintech, and why is it gaining so much attention? Let's unravel the mysteries of fintech in simple terms that anyone can understand.

What is Fintech?

Fintech, short for financial technology, is all about using innovative technology to improve how we manage money. It's like having a toolbox full of smart gadgets and apps that make banking, investing, and paying for things easier and more efficient.

Fintech Technology:

Think of fintech technology as the superhero gadgets of the money world. From mobile banking apps to digital wallets and payment platforms, fintech tech helps us do things like checking our bank balance, transferring money to friends, or even investing in stocks, all from our smartphones or computers.

Fintech Management Consulting:

Ever wondered how big companies figure out the best ways to use fintech to boost their businesses? That's where fintech management consulting comes in. These experts are like financial wizards who help businesses navigate the ever-changing landscape of fintech, offering advice on everything from adopting new technologies to optimizing financial strategies.

Fintech News:

Just like we love keeping up with the latest gossip or trends, fintech news keeps us in the loop about all the exciting developments in the world of financial technology. Whether it's a new payment app, a breakthrough in blockchain technology, or updates on digital currencies like Bitcoin, fintech news keeps us informed and entertained.

Jobs in Fintech:

Interested in being part of the fintech revolution? There are plenty of cool jobs in fintech for tech-savvy folks. You could be a software developer building the next big fintech app, a data analyst crunching numbers to uncover financial insights, or a marketing guru helping fintech companies reach their audience.

Fintech Marketing Agency:

Fintech marketing agencies are like the storytellers of the fintech world. They help fintech companies spread the word about their products and services through creative marketing campaigns, social media strategies, and engaging content. Their goal? To make fintech feel less like rocket science and more like everyday magic.

Fintech Company:

Last but not least, fintech companies are the driving force behind all the fintech magic. From startups to established firms, fintech companies are on a mission to revolutionize the way we think about money. They're the ones developing cutting-edge technologies, disrupting traditional banking systems, and shaping the future of finance.

Wrapping up

In conclusion, fintech is not just about fancy apps or complicated algorithms – it's about making money management more accessible, convenient, and inclusive for everyone. So whether you're a tech enthusiast, a finance nerd, or just curious about the future of money, there's something in the world of fintech for everyone to explore and enjoy.

0 notes

Text

Difference between Direct Mutual Fund Plan vs Regular Mutual Fund Plan by Tarrakki Invest

Discover the disparities between Direct Mutual Fund Plans and Regular Mutual Fund Plans with Tarrakki Invest. Unravel the nuances to make informed investment decisions for a brighter financial future.

Visit Website : https://www.tarrakki.com

0 notes

Text

It’s easy to forget that people of African descent come from a rich legacy of community and wealth-building as the first kings and queens on the planet. In a world that stifles Black progress and seeks to recreate a Eurocentric world-view of history, the brilliance of Black business owners shines through like a diamond in the rough.

As communities of the African diaspora, from Historic Greenwood District to Cape Town, South Africa, seek to build generational wealth after decades and centuries of pillaging and persecution, a few exceptional entrepreneurs stand out. The 10 wealthiest people of African descent prove the potential that’s often locked away inside Black people everywhere.

Using data from Forbes, which tracks the net worth of the wealthiest human beings in the world, The Black Wall Street Times compiled a list of the top 10 wealthiest Black people. Out of the 10, four are American, and three are Nigerian. Additionally, two are women, and eight are men.

What lessons can we learn from their success? Let’s meet them.

10. Folorunsho Alakija — Nigerian businesswoman and philanthropist.

Alakija has an estimated net worth of $1 billion as of 2020. Alakija is the founder and executive vice chairman of Famfa Oil, one of Nigeria’s largest oil exploration companies. Entering the business world with a fashion label, Alakija rose to financial prestige by cultivating high-profile clients, including the wife of former Nigerian president Ibrahim Babangida. At 72 years old, Forbes ranks her as the 20th wealthiest person in Africa and the wealthiest woman on the continent.

I have faced many hurdles in my own life, but I have learned that with the right mindset, every challenge is a chance to create bigger and better opportunities. pic.twitter.com/KJDholX9tx— Folorunso Alakija (@alakijaofficial) March 20, 2023

9. Mohammed Ibrahim — British-Sudanese businessman and philanthropist.

Ibrahim has an estimated net worth of $1.2 billion as of 2023. Born in Sudan, he’s the founder and chairman of Celtel International, one of Africa’s largest mobile phone companies. He also established the Mo Ibrahim Foundation to support good governance in Africa. He sold Celtel International to Kuwait’s Mobile Telecommunications Company for a whopping $3.4 billion in 2005, pocketing $1.4 billion in the process.

— startupAFRICA (@startupafrimag) April 28, 2019

8. Michael Jordan — Former NBA player and American businessman.

The six-time NBA champion has stayed busy in his retirement years. He’s now a successful businessman with an estimated net worth of $2 billion as of 2023. Jordan is the majority owner of the Charlotte Hornets franchise and has several other investments in business ventures across the world.

7. Strive Masiyiwa — Zimbabwean businessman and philanthropist.

Masiyiwa has an estimated net worth of $2.1 billion as of 2023. In 1998, he overcame government opposition to launch the mobile phone network Econet Wireless Zimbabwe. He also owns stakes in fiber optic and fintech companies in several African countries. Together with his wife Tsitsi, he found HigherLife Foundation. The organization supports orphaned and low-income children in Zimbabwe, South Africa, Burundi and Lesotho.

I met Strive Masiyiwa’s Higher Life Foundation & Celebration Ministries International fact finding team that will help Joyce Banda Foundation International provide immediate & long term help to cyclone Freddy victims. Our people need urgent help. Looking forward to their support. pic.twitter.com/SvRuG7CSB0— H.E. Dr. Joyce Banda (@DrJoyceBanda) March 20, 2023

6. Oprah Winfrey — American media mogul and philanthropist.

Arguably one of the most famous Black American women, Winfrey has a net worth of $2.5 billion as of 2023. She is the founder and chairwoman of Harpo Productions, which produces television shows, films, and digital media for a variety of platforms. Beginning her career as a TV journalist, Winfrey transitioned her hit talk show into a media empire with the OWN network, reinvesting profits from movies into more ventures.

Top five

5. Patrice Motsepe — South African businessman.

In 2008, Motsepe became the first Black African billionaire and has an estimated net worth of $2.7 billion as of 2023. Motsepe is the chairman and founder of African Rainbow Minerals, a South African-based mining company. In 1997, he flippled low-producing mining shafts into a profitable enterprise. He is the owner of the Mamelodi Sundowns Football Club and was elected president of the Confederation of African Football in 2021.

This is Patrice Motsepe. He bought an unknown South African club to frustrate Orlando Pirates and Kaiser Chiefs. All the cups prize money is shared among the players. Today Mamelodi Sundows is the best football club in Africa pic.twitter.com/k2vhDRXtBo— Tolo (@021Nongwadla) March 28, 2023

4. David Steward — American businessman and philanthropist.

Steward has a net worth of $6 billion as of 2023, making him the fourth wealthiest Black person in the world. Steward is the founder and CEO of World Wide Technology, Inc., a privately held technology solutions provider. A man who once watched his car get repossessed has progressed past poverty to become owner of a company that boasts high-profile clients, such as: Citi, Verizon and the U.S. government. In 2018, Steward donated $1.3 million to the University of Missouri-St. Louis to establish the David and Thelma Steward Institute for Jazz Studies.

David Steward battled with obstacles like poverty and racism. David didn’t enjoy the best resources from his parents. However, he learnt lessons from his parents that gave him significant wealth. One such is “treating people right.”https://t.co/b1ntWaFeEX— Business Elites Africa (@ElitesAfrica) March 27, 2023

3. Mike Adenuga — Nigerian businessman and billionaire.

Adenuga has an estimated net worth of $6.1 billion as of 2023. He’s the founder and chairman of Globacom, one of Nigeria’s largest mobile phone networks. It’s the third largest operator in Nigeria, with 55 million subscribers. Adenuga also runs a profitable oil exploration company in the Niger delta. He supported himself as a college student earning an MBA in New York by moonlighting as a taxi driver. At age 26, he earned his first million dollars selling lace and soft drinks.

Mike Adenuga worked as a taxi driver to help fund his university education. A student in New York, USA, he drove a taxi to pay for his studies, even though his parents belonged to the upper middle class in Nigeria. He was born and raised in Ibadan, Oyo. pic.twitter.com/qs7CCk0CVh— Yorùbáness (@Yorubaness) March 17, 2023

2. Robert F. Smith — American businessman.

Smith a net worth of $8 billion as of 2023, making him the second wealthiest Black person in the world. He is the founder and CEO of Vista Equity Partners, a private equity firm that specializes in software, data, and technology companies. Vista is one of the most successful private equity firms, with $96 billion in assets. The persistent self-starter earned an internship at Bell Labs during college after calling the company every week for five months. As an engineer, he worked at Goodyear Tire and Kraft Foods before earning an MBA from Columbia University. In 2019, he vowed to pay the student debt for the entire graduating class of Morehouse College.

1. Aliko Dangote — Nigerian businessman.

Topping the list of the wealthiest Black person in the world with an estimated net worth of $13.7 billion as of 2023, is none other than Nigeria’s own Aliko Dangote. He’s founder and chairman of Dangote Cement, one of Africa’s leading cement producers and he’s Africa’s richest man. The company has operations in 10 countries across the Motherland, and he also boasts a newly created fertilizer company as of 2022. Once completed, Dangote Oil Refinery is expected to be one of the world’s largest, even as climate change continues to disrupt the planet.

Today we celebrate a polio-free Africa, the result of decades of vaccination, hard work, collaboration. Tomorrow we get back to work, to ensure wild polio does not come back. Together, we all can #EndPolio globally.— Aliko Dangote (@AlikoDangote) August 25, 2020

While Nigeria boasts the third and first richest Black people in the world, the list reflects a diverse array of personalities, backgrounds, and ingenuity across the African diaspora.

#Meet the Top 10 wealthiest Black people in the world in 2023#Black Entrepreneurs#Black Business#Black Money Makers#Black Economy

10 notes

·

View notes

Text

Explore the Bit Loop: The innovation of lending powered by blockchain technology

In the rapid development of financial technology, blockchain technology has become one of the powerful tools to reform traditional financial services. Bit Loop, a decentralized lending platform based on the Ethereum network, is using blockchain's smart contract technology to reshape the lending market. This article will explore in detail how Bit Loop works, its monetization model, security measures, and its unique sharing reward mechanism.

The core function and operation of Bit Loop

Smart contract applications:

The core operation of Bit Loop relies on smart contract technology, which is deployed on the Ethereum (EVM compatible) network and automatically executes all the terms of the lending agreement. Through smart contracts, Bit Loop enables automatic matching between borrowers and lenders, optimizes the liquidity of funds, and reduces transaction costs.

Decentralized lending model:

The borrowing and lending process is fully decentralized on the Bit Loop, i.e. all transactions are conducted directly between users without the need for any intermediaries. This not only increases the transparency of the transaction, but also greatly reduces the potential risk of fraud and operating expenses.

Peer-to-peer trading system:

Through the peer-to-peer flow of funds, users can send funds directly from one person's wallet to another person's wallet, ensuring the security and speed of transactions. This model provides users with more flexible and affordable borrowing options by reducing the intervention of traditional financial institutions.

The profit model of Bit Loop

Capital supply dividend:

Bit Loop may collect a percentage of the money supply from the borrower as a service fee. For example, a borrower may have to pay a 1.5% fee to obtain short-term funding, part of which goes to cover the platform's operating costs and part goes to the lender's income.

Interest income:

Lenders earn interest income by lending money to borrowers. These interest rates are usually determined by market supply and demand, and are automatically calculated and allocated through the platform's smart contracts.

Security measure

Multi-signature and anonymous supervisory node:

Bit Loop uses multi-signature technology and generated anonymous supervisory nodes to ensure the security of transactions. These technologies can effectively prevent unauthorized access and potential fraud, while enhancing the overall security of the system.

Irreversibility of smart contracts:

Smart contracts deployed on the blockchain, once launched, cannot be modified or revoked. This ensures fair and transparent operation of the platform, and even the developers of the platform cannot change the terms of the contract.

Sharing reward mechanism

Bit Loop encourages users to invite new users to join the platform through a personal sharing link. When these new users register and participate in the lending activity using the share link, the recommender will be rewarded according to the smart contract Settings. This mechanism not only increases the user base of the platform, but also provides an additional revenue stream for existing users.

conclusion

By applying the concept of decentralization to the lending market, Bit Loop provides users with a secure, transparent and efficient financial services platform. This blockchain-based lending platform not only reduces the complexity and cost of traditional banking services, but also provides more equitable and accessible financial services to users around the world. With the advancement of technology and the development of the market, Bit Loop is expected to become a leader in the field of fintech, further promoting the modernization and globalization of financial services.

#BitNest#BitNestLoop#BitNestPureContract#BitNestis the best project in the currency circle#BitNestSecurely#BitNestAutonomously#BitNestDecentralizedly#BitNestCryptographically

2 notes

·

View notes

Text

সঠিক আর্থিক সার্ভিস নির্বাচনে করনীয়

আর্থিক সার্ভিস পেতে হলে গ্রাহককে প্রথমেই আর্থিক সার্ভিস নির্বাচনে যাচাই বাছাই করার প্রয়োজন হয়ে থাকে যতক্ষন না পর্যন্ত গ্রাহক অবগত থাকেন কোন ধরনের আর্থিক সার্ভিস গ্রাহকের দরকার। এক্ষেত্রে মনে রাখা ভালো, সঠিক আর্থিক সার্ভিস যেমন আয়বর্ধকে সহায়তা করে অন্যদিকে, ভুল আর্থিক সার্ভিস আয় নিরোধোক হিসেবে কাজ করবে। আর্থিক সার্ভিস পেতে বিড়ম্বনা লেখায় আর্থিক সার্ভিস নির্বাচনের বিভ্রান্তির ব্যাপারে বিস্তারিত বলা হয় নি। আর্থিক সার্ভিস নির্বাচনের ক্ষেত্রে কিছু বিষয় জেনে সিদ্ধান্ত নেওয়া জরুরী। যেমন,

কোন ধরনের আর্থিক সার্ভিসটি দরকার?

প্রশ্নটির উত্তর নিজেই দিতে পারবেন যদি আপনি অবগত থাকেন কোন আর্থিক সার্ভিসটি আপনার জন্য যথাপোযুক্ত হবে। ধরা যাক, আপনার ঋণ দরকার। যদি ব্যবসা বাড়াতে আর্থিক সার্ভিস প্রয়োজন পড়ে তাহলে ব্যবসায় ঋণ অথবা উদ্যোক্তা ঋণ আপনার জন্য, অন্যদিকে নিজেস্ব প্রয়োজনে আছে পার্সোনাল লোন, বাড়ি নির্মান বা ক্রয়ের জন্য হোম লোন, গাড়ি ক্রয় করার জন্য কার লোন ইত্যাদি। এক্ষেত্রে বিভিন্ন খাতের ঋনের সুদের হার, ঋণ পরিশোধের সময়কাল ইত্যাদির ভিন্নতা হতে পারে।

যোগ্যতা এবং সময়কাল!

আর্থিক সার্ভিস গ্রহনের ক্ষেত্রে ব্যাংক বা যে কোন আর্থিক প্রতিষ্ঠানে নির্দিষ্ট যোগ্যতা এবং কিছু শর্ত পূরণ করতে হয়। তা ছাড়া সার্ভিস গ্রহন করা অনেকক্ষেত্রেই অসম্ভব হয়ে দাঁড়ায়। যেমন,

গ্রাহকের আয়,

আয়ের উৎস,

ঋণ পরিশোধ করার ক্ষমতা,

যথাযথ গ্যারান্টার বা জামানতকারী,

সম্পদের পরিমাণ

এসব ছাড়াও আরও কিছু শর্তাবলির উপরে নির্ভর করে থাকে আর্থিক সার্ভিসটি পাবার ক্ষেত্রে। এক্ষেত্রে গ্রাহকের সামর্থ অনুযায়ী বিবেচনা করে আর্থিক সার্ভিসটি গ্রহন করা উচিত। তা না হলে গ্রাহকের কাছে আর্থিক সেবাটি বোঝা হয়ে দাঁড়াবে।

এছাড়াও আর্থিক সার্ভিসের সময়েকাল ভেদে সার্ভিসের ভিন্নতা হতে পারে। ঋনের ক্ষেত্রে সময়কাল নির্বাচন করা গুরুত্বপূর্ন একটি বিষয়। ঋনের সময়েকালের উপরে গ্রাহকের প্রবৃদ্ধি নির্ভর করে থাকে।

নথিপত্র(ডকুমেন্টস) সংগ্রহ

আর্থিক সার্ভিসের ভিন্নতার হিসেবে ডকুমেন্টস সংগ্রহ এবং এসকল কাগজপত্রের ভিন্নতা দেখা যায়। তাই কোন ধরনের আর্থিক সার্ভিসে কী কী ডকুমেন্টস প্রয়োজন হতে পারে এ ব্যাপারে পূর্ব প্রস্তুতি নিয়ে রাখা ভালো। প্রয়োজনীয় ডকুমেন্টস জমা দেবার পরে একটি নির্দিষ্ট কার্যদিবস পরে গ্রাহকগণ আর্থিক সার্ভিসটি পেয়ে থাকেন। এর মধ্যে এইসকল ডকুমেন্টস কয়েক ধাপে ভ্যারিফিকেশন করা হয়ে থাকে। তবে বেশিরভাগ ক্ষেত্রে দেখা যায় ডকুমেন্টসের অভাবে কিংবা নির্দিষ্ট কার্যদিবসের শেষেও আর্থিক সার্ভিসটি পেতে বিলম্বনা হয়ে থাকে।

উপরোক্ত সমস্যার একটি নতুন সমাধান হচ্ছে “সংযোগইউ (SHONGJOGyou)”। সংযোগইউ হচ্ছে অনলাইন ই-ফিন্যান্স সার্ভিস প্লাটফর্ম যার মাধ্যমে ঘরে বসেই অনলাইনে ঋণ সহ যে কোন আর্থিক সার্ভিস সম্পর্কিত সকল তথ্য জানা ও গ্রহন করা যাবে। সংযোগইউর মাধ্যমে ঋণ বা যে কোন আর্থিক সার্ভিস গ্রহণের ক্ষেত্রে গ্রাহক সঠিক আর্থিক সার্ভিসসমূহ যাচাই এবং তুলনা করতে পারবে। ফলে সঠিক আর্থিক সার্ভিস গ্রহন করা যাবে আরও সহজে।

আপনার এলাকার সকল আর্থিক সার্ভিসের ব্যাপারে জানতে আজই রেজিস্ট্রেশন করুন আমাদের ওয়েবসাইটে এবং খুঁজে নিন আপনার ��ক্ষমতা অনুযায়ী উপযুক্ত আর্থিক সার্ভিসটি।

#shongjogyou#launching ceremony of shongjogyou#digital financial inclusion#digital financial service#digital financial services#digital financial solution#digital finance#access to finance#fintech startup in bangladesh#efinance solution#fintech startup#financial solution#financial investment#fintech startup revolution

0 notes

Text

The experts in phone, tablet and computer repairs, Fixonsite New Lynn is now accepting #pin_payments!

Visit https://fixonsite.nz/ to find out more

#pin#payitnow#pinpayments#cryptopayments#pinnetwork#pinpartner#pinrewards#pinnetworkapp#fixonsite

#fixed income#bsc#eth#crypto#defi#btc#fintech#payments#invest#fixer upper#fixieporn#i could fix him#introduces#stitch fix inc#coming#launches#heres#cryptocurrency

1 note

·

View note

Text

Explore the Bit Loop: The innovation of lending powered by blockchain technology

In the rapid development of financial technology, blockchain technology has become one of the powerful tools to reform traditional financial services. Bit Loop, a decentralized lending platform based on the Ethereum network, is using blockchain's smart contract technology to reshape the lending market. This article will explore in detail how Bit Loop works, its monetization model, security measures, and its unique sharing reward mechanism.

The core function and operation of Bit Loop

Smart contract applications:

The core operation of Bit Loop relies on smart contract technology, which is deployed on the Ethereum (EVM compatible) network and automatically executes all the terms of the lending agreement. Through smart contracts, Bit Loop enables automatic matching between borrowers and lenders, optimizes the liquidity of funds, and reduces transaction costs.

Decentralized lending model:

The borrowing and lending process is fully decentralized on the Bit Loop, i.e. all transactions are conducted directly between users without the need for any intermediaries. This not only increases the transparency of the transaction, but also greatly reduces the potential risk of fraud and operating expenses.

Peer-to-peer trading system:

Through the peer-to-peer flow of funds, users can send funds directly from one person's wallet to another person's wallet, ensuring the security and speed of transactions. This model provides users with more flexible and affordable borrowing options by reducing the intervention of traditional financial institutions.

The profit model of Bit Loop

Capital supply dividend:

Bit Loop may collect a percentage of the money supply from the borrower as a service fee. For example, a borrower may have to pay a 1.5% fee to obtain short-term funding, part of which goes to cover the platform's operating costs and part goes to the lender's income.

Interest income:

Lenders earn interest income by lending money to borrowers. These interest rates are usually determined by market supply and demand, and are automatically calculated and allocated through the platform's smart contracts.

Security measure

Multi-signature and anonymous supervisory node:

Bit Loop uses multi-signature technology and generated anonymous supervisory nodes to ensure the security of transactions. These technologies can effectively prevent unauthorized access and potential fraud, while enhancing the overall security of the system.

Irreversibility of smart contracts:

Smart contracts deployed on the blockchain, once launched, cannot be modified or revoked. This ensures fair and transparent operation of the platform, and even the developers of the platform cannot change the terms of the contract.

Sharing reward mechanism

Bit Loop encourages users to invite new users to join the platform through a personal sharing link. When these new users register and participate in the lending activity using the share link, the recommender will be rewarded according to the smart contract Settings. This mechanism not only increases the user base of the platform, but also provides an additional revenue stream for existing users.

conclusion

By applying the concept of decentralization to the lending market, Bit Loop provides users with a secure, transparent and efficient financial services platform. This blockchain-based lending platform not only reduces the complexity and cost of traditional banking services, but also provides more equitable and accessible financial services to users around the world. With the advancement of technology and the development of the market, Bit Loop is expected to become a leader in the field of fintech, further promoting the modernization and globalization of financial services.

#BitNest#BitNestLoop#BitNestPureContract#BitNestis the best project in the currency circle#BitNestSecurely#BitNestAutonomously#BitNestDecentralizedly#BitNestCryptographically

3 notes

·

View notes