#digital financial inclusion

Text

Feeling the heartache, spreading love and hope!

Feeling the heartache, spreading love and hope: The world comes together to mourn and aid those impacted by the recent earthquake in Turkey, as we stand united in support of our brothers and sisters.

#shongjogyou#help for turkey#digital financial inclusion#digital financial services#digital financial solution#digital financial service#digital finance#fintech startup#financial inclusion#financial solution#financial investment#access to finance#fintech startup in bangladesh#fintech startup revolution#startup for investment in bangladesh#turkey earthquake

0 notes

Link

In the Southern and Eastern Mediterranean countries, where youth make up half of the population, youth are critical to long-term development. They will be able to play their full role as the engine of inclusive growth resulting from digital financial inclusion. To attain improved financial inclusion rates in the region, efforts must be reproduced and multiplied while learning from each other's experiences. This is required to improve the resilience of the youth population, which has been disproportionately affected by the COVID-19 problem.

Today, this article will highlight why youth digital financial inclusion is essential, its challenges, and how they can be eradicated. So let’s get started.

Why Digital Financial Inclusion Is Important

When it comes to young people, financial inclusion is critical in broadening the range of opportunities available to them to improve their current and future lives. Youth can invest in their education to boost their employability and future professional prospects by using formal financial services. It allows people to gain their autonomy in society (housing, future planning) and become active socioeconomic agents in their country. Furthermore, having access to financial services and goods allows young people to start their businesses and contribute to new jobs.

Read more: https://www.emeriobanque.com/blogs/advancing-the-digital-financial-inclusion

0 notes

Text

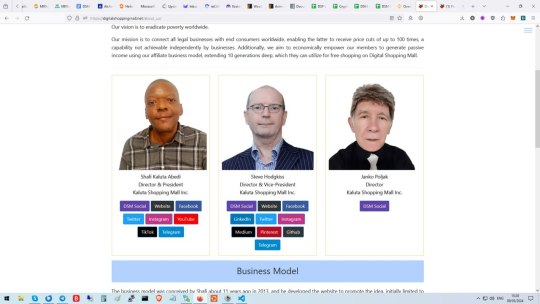

Digital Shopping Mall's "About Us " page and way forward

https://social.digitalshoppingmall.net/content/perma?id=14815&cd1=4&cd2=4

#digital shopping mall#DSM#Kaluta Shopping Mall#KSM#Poverty eradication#financial security#financial inclusion#price revolution#passive income#recommendation commissions#ad revenue share work from home

0 notes

Text

Unlock Financial Opportunities with Prefr Loans – A Comprehensive Guide

Unlocking Financial Opportunities: A Deep Dive into Prefr Loans

In the ever-evolving realm of financial services, Prefr stands tall as a reliable and accessible provider of credit solutions. Let’s embark on a comprehensive journey to explore the various facets of Prefr loans, understanding why this NBFC (Non-Banking Financial Company) is not just a lender but a financial ally.

Prefr Loans: A…

View On WordPress

#Prefr Loans#NBFC#Salaried Professionals#Self-Employed Entrepreneurs#Loan Flexibility#Repayment Tenure#Competitive Interest Rates#Transparent Processing Fee#Net Take-Home#Age Criteria#Digital Process#Responsible Borrowing#Credit Solutions#Prefr Features#Financial Solutions#Financial Empowerment#cibil score#personal finance#Financial Inclusion#loan application

0 notes

Text

Payments Possible Through UPI in These Countries, Not Just in India

Payments Possible Through UPI in These Countries, Not Just in India

The Unified Payments Interface (UPI), a groundbreaking digital payment system that has transformed the way financial transactions are conducted in India, is now extending its reach beyond the nation’s borders. This expansion marks a significant milestone in the global adoption of India’s innovative payment infrastructure,…

View On WordPress

#cross-border transactions#digital innovation#digital payments#financial inclusion#financial integration.#global adoption#innovative payment infrastructure#mobile banking#NPCI#UPI

0 notes

Text

Islamic Financial Innovations and Technologies: Catalysts for Inflation Control and Production’s Growth

Introduction:

In recent years, Islamic financial innovations and technologies have emerged as key players in shaping economic landscapes. Beyond their traditional role in banking and finance, these innovations are now being recognized for their potential in controlling inflation and fostering production growth. This article explores the distinctive features of Islamic financial solutions and…

View On WordPress

#islamicfinance islamicbanking islamiceconomics system#digital banking#Financial Inclusion#innovation#Islamic Finance

0 notes

Text

"RUPAY: Transforming India's Payment Landscape with a Homegrown Touch"

Title: Unveiling RUPAY: India’s Homegrown Payment System

Introduction:

In the dynamic landscape of digital transactions, India has witnessed a significant transformation in its payment ecosystem. Among the various players, RUPAY has emerged as a prominent and homegrown payment system that has been making waves across the country. In this blog post, we’ll explore what RUPAY is, its origin, and…

View On WordPress

#Financial inclusion in India#Indigenous card payment network#Low-cost digital transactions#National Payments Corporation of India (NPCI)#RUPAY India

0 notes

Text

1 note

·

View note

Text

A Section 8 Microfinance Company, under the Companies Act, 2013, is a non-profit organization that is established with the objective of promoting commerce, art, science, sports, education, research, social welfare, religion, charity, protection of environment, or any such other object. It aims to utilize its profits or income, if any, solely for the promotion of the specified objects. This legal structure is particularly well-suited for entities that aim to carry out charitable or non-profit activities. Read More

#financial inclusion#microfinance#non banking financial company#financial inclusion meaning#financial inclusion banking awareness#company registration in india 2022#microfinance company#company registration#what is the job of field officer in microfinance company#microfinance company me field officer ka kam kya hota h#digital financial services#how to get job in microfinance#inclusive banking and microfinance#inclusion#miro finance company#what is microfinance

0 notes

Text

Sustainable Options For Investors

The world of finance can be a complex and daunting one, especially for beginner investors. With numerous investment options and institutions vying for your attention, it's crucial to make informed choices. In recent years, sustainable finance practices have gained prominence, and not just in traditional banks. Non-banking institutions have also taken up the mantle of responsible investing. Today, we will explore sustainable finance practices in non-banking institutions, offering insights for individuals seeking to align their investments with their ethical values.

What Is Sustainable Finance

Before delving into the practices of non-banking institutions, it's essential to grasp the concept of sustainable finance. Sustainable finance, often referred to as ESG (Environmental, Social, and Governance) investing, involves considering environmental, social, and governance factors when making investment decisions.

ESG investing prioritizes investments that contribute positively to the environment, society, and governance. It's a conscious choice to support businesses that not only generate profits but also strive to make a positive impact on the world. Non-banking institutions have recognized the growing demand for ESG investments and are incorporating these principles into their services.

Non-Banking Institutions Embracing Sustainability

Non-banking institutions encompass a wide range of entities, including mutual funds, insurance companies, and asset management firms. Many of these organizations are adopting sustainable finance practices, offering individuals a diverse set of options for responsible investing.

1. Sustainable Mutual Funds

Mutual funds are a popular choice for many investors, and sustainable mutual funds have gained traction. These funds invest in companies that adhere to ESG principles. By choosing such funds, you can contribute to the growth of businesses that prioritize sustainability and social responsibility.

Also Read: NBFC Partnerships In The Digital Age

2. Ethical Insurance Products

Insurance companies now offer ethical insurance products, such as policies that promote clean energy, support community development, or protect the environment. These options allow you to insure your assets while making a positive impact.

3. Responsible Asset Management

Asset management firms are increasingly incorporating ESG factors into their investment strategies. By entrusting your funds to these firms, you can be confident that your investments are aligned with your values.

4. Green Bonds

Non-banking institutions also issue green bonds to fund environmentally-friendly projects. These bonds provide a unique investment avenue for those looking to support green initiatives while earning a return on their investment.

Key Considerations For Beginner Investors

As a beginner investor, the world of sustainable finance may seem overwhelming. Here are some key considerations to help you navigate this landscape effectively:

1. Define Your Values

Determine what sustainability means to you. Is it supporting clean energy, promoting gender diversity, or advocating for responsible governance? Identifying your values will guide your investment choices.

2. Research Thoroughly

Understand the financial products and services offered by non-banking institutions. Compare the options available and assess their alignment with your values.

3. Diversify Your Portfolio

While sustainability is important, it's equally crucial to diversify your investments. Spread your investments across different asset classes and industries to manage risk effectively.

4. Risk Assessment

Assess the risk associated with sustainable investments. Like any other investment, ESG investments carry their own set of risks. Understand these risks and evaluate your risk tolerance.

Also Read: How Digital Platforms Drive Financial Inclusion

5. Seek Professional Guidance

If you're unsure about sustainable finance practices, consider consulting a financial advisor. They can help you navigate the nuances of ESG investing and make informed decisions.

6. Stay Informed

Stay up-to-date with the latest developments in sustainable finance. Non-banking institutions continually evolve their offerings, and being informed will help you make timely and well-informed choices.

Conclusion

In the world of finance, the options for responsible investing have expanded beyond traditional banks. Non-banking institutions now play a significant role in promoting sustainable finance practices. As a beginner investor, it's essential to understand the principles of ESG investing, define your values, and conduct thorough research to align your investments with your ethical beliefs. With a thoughtful approach and a commitment to sustainability, you can make a positive impact on the world while growing your wealth.

0 notes

Text

Fintech in Bangladesh

Bangladesh is still trailing behind other affluent countries when it comes to employing technology to automate and digitalize banking transactions. Bangladesh’s financial institutions have been chastised for a lack of effort to enhance financial inclusion, inadequate customer service facilities, a lack of information technology (IT) risk management, and inefficient operations due to the use of suboptimal technology. Financial institutions in Bangladesh are still battling to recruit and retain consumers as the world shifts to increasingly digital forms of transactions. It’s past time for the United States to catch up.

Customers can now obtain banking services from anywhere thanks to technological advancements. It’s a technology that improves and replaces existing systems. Everything from money transactions to server management is covered. Fintech can provide you with simple transactions or smart management systems.

Mobile Financial Services (MFS), like bKash, Nagad, Rocket, SureCash, Trust Axiata Pay (TAP), and Upay, are very popular and loved by the people of Bangladesh nowadays. These institutions cater to around 35 million people with an annual credit of over USD 7 billion. They have done an incredible job to successfully bring a vast majority of people under the umbrella of digital financial services. So let’s dive into what is next for Fintech in Bangladesh and how it can improve the financial landscape. Most of the information is taken from some research firm, some news paper besides some fintech companies websites.

Digital banking has the potential to transform the lives of people who work in the informal economy. MFS and Agent banking are important components of the financial inclusion plan because they provide low-income and disadvantaged persons with low-cost access to financial services. MFS transactions have increased by roughly 30% year over year, while deposits have increased by 108.38% year over year in agency banking until March.

It’s no surprise that Big Data, Machine Learning, and Artificial Intelligence are driving many business decisions in the modern age. Financial services in many countries use big data to screen potential clients. The system can do extensive background checks in a flash. All these can help to reduce and prevent money loss for loaners who can assess the viability of a loan or investment. The whole system is intuitive, smooth, and easy to use and most of all, it gives accurate results and predictions.

For financial institutions in Bangladesh, this technology is crucial. The percentage of bad loans and poor investments is staggering with 11.4% of recipients defaulting. In the first quarter of 2021, defaulted loans accounted for 8.07% of total outstanding loans. Fintech which assists in digitally retrieving customer data and calculating expected loss can help reduce that percentage by a significant amount. They can not only reduce time but also improve customer satisfaction.

Fintech in BangladeshFinancial institutes in Bangladesh are far behind in cyber security and risk management. Recently, 147 public and private organizations – including banks and non-bank financial institutions (NBFIs), came under cyber attacks. Bangladesh Bank itself has often faced cyber-attacks which led them to lose millions of dollars.

Integrating artificial intelligence and machine learning for fraud detection, blockchain systems, and regulatory technologies (RegTech) with financial services, will help build a secure system. E-KYC can also help in preventing money laundering activities by enhancing customer identification and authentication processes.

Fintech-enabled payment processing can help bring more cash transactions under the formal sector, thereby mitigating malpractices, improving transparency, and providing better fund protection for customers. Digital payments can also reduce the amount of money to be printed, thus reducing the risks of counterfeit money. It can also help financial institutions maintain consistency in their operations and reduce the risks of error.

Bangladesh’s financial markets where stocks, bonds, etc. are sold could see a significant transformation by leveraging Fintech. Starting from financial advisory, domestic and international online trading platforms to using technology to improve regulation in stock exchanges, the potential for Fintech in Bangladesh is massive. Wealth management, for example, has been one of the financial services that have been disrupted in a big way by FinTech. With the implementation of big data, artificial intelligence, blockchain, and other supportive technologies like RegTech, the financial markets will work more efficiently and securely.

Fintech companies in Bangladesh should be encouraged to help create accessible and affordable consumer credit products such as peer-to-peer (P2P) lending platforms, crowdfunding platforms, and alternative credit scoring apps. Insurance companies in Bangladesh should widely accept insurance in their operations for wider availability of insurance products, increased accountability, and transparency.

No matter how you slice it, the future is with Fintech. The technology has enormous potential for growth, innovation, and cost savings. There are lots of untapped opportunities in Bangladesh. Innovation in financial services should go hand in hand with growth as the country graduates to a developing nation. Out of 83 countries, Bangladesh ranked 78th on the Global Fintech index 2021; declining 17 points since last year. This slow adaptation of technology may hinder the country’s growth. (Source: Dhaka Tribune). It is time for the Bangladeshi financial landscape to adopt Fintech. We should leverage our younger population, a growing number of mobile subscribers, and millions of internet users to boost more Fintech disruption and adaptation. To achieve sustainable growth, it is essential for financial institutions and the government to prioritize Fintech going forward.

Fintech in Bangladesh has totally changed the financial landscape. There have been several growing fintech companies in Bangladesh over the years. Since the pandemic has inspired people into cashless transactions, fintech companies in Bangladesh have welcomed this opportunity to make a meaningful and noteworthy impact in Bangladesh.

SHONGJOGyou has become the first most convenient and comfortable financial technology in Bangladesh to bring all important financial needs under one roof. It is a complete financial communication platform, which allows you to do all banking, loan, insurance, and investment in one online platform. SHONGJOGyou is also an excellent digital financial platform for investment.

#shongjogyou#fintech startup in bangladesh#fintech startup revolution#fintech revolution#fintech startup#digital financial inclusion#digital financial solution#digital financial services#digital finance#digital financial service#efinance solution#access to finance#doorstep finance#financial inclusion#financial investment#financial solution

0 notes

Text

Examining Cryptocurrency's Future Impact

Cryptocurrency, a digital marvel that has taken the financial world by storm, has been creating quite a buzz lately. No, it's not the plot of a sci-fi movie; it's very much real and shaping the future of finance. In this article, let’s delve into the potential impact of cryptocurrency on our financial landscape.

The Rise of Digital Gold

Cryptocurrency, with Bitcoin leading the charge, has often been referred to as "digital gold." Why, you ask? Well, it shares some striking similarities with the shiny metal. Just like gold, cryptocurrencies are decentralized and aren't tied to any government or central authority. They are limited in supply, making them a store of value in the long run. As more people recognize the benefits of decentralized currency, we're likely to see the rise of digital gold as a formidable investment and wealth preservation option.

Also Read: The Risks And Rewards Of Hedge Fund Strategies

Financial Inclusion for All

Cryptocurrency has the power to bring financial services to the unbanked and underbanked populations across the globe. In many parts of the world, people lack access to traditional banking services, but they often have access to the internet and smartphones. Cryptocurrency can bridge this gap, enabling anyone with an internet connection to participate in the global economy. This inclusive nature could potentially lift millions out of poverty and provide a lifeline to those without access to traditional banking.

Smart Contracts and Beyond

Cryptocurrency isn't just about being a digital alternative to paper money; it's also about innovation. One of the most intriguing aspects of cryptocurrencies is the use of smart contracts. These self-executing contracts with the terms of the agreement directly written into code have the potential to revolutionize various industries, including law, real estate, and supply chain management. Smart contracts eliminate the need for intermediaries, reducing costs and increasing efficiency. This could redefine how we conduct business transactions in the future.

Environmental Concerns and Solutions

The environmental impact of cryptocurrency, particularly Bitcoin, has raised some valid concerns. The energy-intensive process of mining cryptocurrencies has been criticized for its carbon footprint. However, the crypto community is actively exploring greener alternatives, such as proof-of-stake and eco-friendly mining practices. As the industry matures, it's likely that we'll see a shift toward more sustainable and environmentally friendly blockchain technologies.

Regulatory Challenges

While the decentralized nature of cryptocurrencies is one of their key strengths, it also poses a challenge when it comes to regulation. Governments and financial institutions around the world are grappling with how to integrate cryptocurrencies into existing regulatory frameworks. Striking the right balance between fostering innovation and protecting consumers is no easy task, but it's essential for the continued growth of the cryptocurrency space.

The Evolution of Traditional Banking

Cryptocurrency is forcing traditional banks to adapt. As cryptocurrencies gain prominence, banks are exploring ways to incorporate them into their services. Some banks are offering crypto custody services, while others are looking into the development of their own digital currencies. This evolution in banking not only benefits consumers but also ensures that the banking industry remains relevant in the digital age.

Also Read: The Role of Bots, Assistants, AIs in Customer Communication

Conclusion

Cryptocurrency's future is one of innovation, inclusion, and adaptation. While challenges exist, the transformative potential of digital currencies in finance is undeniable. The world of cryptocurrency is evolving rapidly, and it's a journey well worth following.

0 notes

Text

https://social.digitalshoppingmall.net/content/perma?id=14630&cd1=4&cd2=4

#Kaluta Shopping Mall#KSM#Digital Shopping Mall#DSM#Poverty eradication#financial inclusion#financial security#economic empowerment#moneyless economy#currency-less economy#price revolution#shopping revolution

0 notes

Text

Empowering Micro Enterprises: MSME Minister Launches Rs 20 Lakh Scheme for GST-Exempted Units Under CGTMSE

Transformative Initiative for Informal Micro Enterprises (IMEs)

In a groundbreaking move, MSME Minister Narayan Rane has introduced a revolutionary scheme specifically designed for Informal Micro Enterprises (IMEs), with the aim of bolstering their access to credit facilities and alleviating financial constraints. Launched under the esteemed Credit Guarantee Fund Trust for Micro and Small…

View On WordPress

#MSME Minister#Narayan Rane#Rs 20 Lakh Scheme#GST-Exempted Micro Units#CGTMSE#Financial Inclusivity#Formalization Drive#Udyam Portal#Digital Ecosystem#MSE Sector#Priority Sector Lending#Credit Facilities#Financial Support#Collateral-free Loans#economic growth#government initiatives

0 notes

Text

E-NACH's Impact on Digital Finance

The world of finance is undergoing a digital revolution, and at the heart of this transformation lies Electronic National Automated Clearing House, or E-NACH for short. E-NACH is quietly reshaping the way financial transactions are conducted in India, making them more efficient, secure, and convenient. In this article, let’s dive straight into the impact of E-NACH on digital finance.

The Rise of E-NACH

So, what exactly is E-NACH? In simple terms, it's an electronic method of verifying and processing recurring payments, often used for services like loan EMI payments, insurance premiums, and utility bills. Instead of the traditional paper-based system, E-NACH relies on the power of digital technology to streamline these transactions.

Also Read: Emerging Trends in the NBFC Sector

Enhanced Convenience

For consumers, E-NACH translates to enhanced convenience. No more standing in long queues or filling out cumbersome forms to pay your bills. With E-NACH, your recurring payments are automated, ensuring that you never miss a due date. This not only saves time but also eliminates the stress of remembering multiple payment deadlines.

Streamlined Verification Process

One of the most significant impacts of E-NACH is the simplification of the verification process. In the past, banks and financial institutions had to rely on physical documents and signatures, leading to delays and errors. With E-NACH, the verification process is not only faster but also more accurate. It reduces the chances of fraud and ensures that transactions are processed swiftly.

Cost-Efficiency

From a business perspective, E-NACH brings cost-efficiency to the forefront. Traditional methods of payment processing involve significant paperwork and manual labor. E-NACH automates these processes, reducing operational costs and the risk of human errors. This cost-saving benefit can be passed on to consumers in the form of lower transaction fees or better deals on financial products.

Financial Inclusion

E-NACH is also contributing to the cause of financial inclusion in India. It's helping individuals who were previously excluded from the formal financial system to access services like loans and insurance. On this, Abhay Bhutada explains that E-NACH makes lending accessible to a wider range of smartphone users.

Security and Transparency

In today's digital age, security is paramount. E-NACH is designed with robust security measures in place, ensuring the protection of sensitive financial information. Additionally, the transparency offered by digital transactions allows consumers to track their payments and monitor their financial activities more effectively.

Also Read: Investor's Playbook on Taxation Strategies

ConclusionE-NACH is revolutionizing digital finance in India. It simplifies verification processes, enhances convenience, reduces costs, promotes financial inclusion, and ensures security and transparency. Ganesh Ram, CEO of MF Utilities India, adds that E-NACH also plays a crucial role rise in SIPs. As more businesses and individuals embrace this technology, we can expect a financial landscape that is not only more efficient but also more accessible to all.

0 notes